What are Carnival Corporation’s revenue sources?

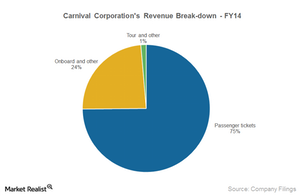

Carnival Corporation (CCL) derives revenue from the following three sources: passenger tickets, onboard or other activities, and tours.

Jan. 14 2015, Updated 12:37 p.m. ET

Carnival’s revenue sources

Carnival Corporation (CCL) derives revenue from the following three sources: passenger tickets, onboard or other activities, and tours.

Passenger ticket revenue

Passenger ticket revenue comprised ~75% of Carnival Corporation’s total revenue in 2014. This includes revenue from the sale of air and other transportation to and from airports. Cruising provides transportation to various destinations, but it also provides accommodations, a wide choice of food, and daily entertainment options that are supposed to be more cost-effective than land-based vacations.

Activities and facilities onboard include nightclubs, lounges, bars, theatrical shows, movies, swimming pools, libraries, health clubs, and a variety of sports. These activities as well as government fees and taxes are included in the ticket price. Royal Caribbean Cruises Ltd. (RCL) and Norwegian Cruise Line (NCLH), Carnival Corporation’s (CCL) competitors, also derive more than 70% of their revenue from passenger cruise tickets.

Onboard and other activities

Revenue from other onboard activities that aren’t part of the ticket price are categorized as the onboard or other segment. This includes revenue from the sale of liquor and some nonalcoholic beverages, short excursions, casino gaming, gift shop sales, laundry services, full-service spas, and dining options. The company either offers these directly or earns a fee on their sales. In 2014, revenue from these services and products comprised 24% of the total revenue.

Tours

Carnival Corporation (CCL) owns and operates 11 hotels or lodges, 300 motor coaches, and 20 glass-domed railcars under Holland America Princess Alaska Tours, a leading tour company. The tour and others segment revenue comprised 1% of the total revenue in 2014 and included revenue from hotel and transportation operations and from one ship the company owns and charters under a long-term lease.

The cruising industry is a growing industry, and investors can gain exposure to stocks in the industry through ETFs such as the PowerShares Dynamic Leisure and Entertainment Portfolio (PEJ), the PowerShares Dynamic Large Cap Growth Portfolio (PWB), and the Consumer Discretionary Select Sector SPDR Fund (XLY).