NCI Inc

Latest NCI Inc News and Updates

Royal Caribbean operates the world’s largest contemporary cruise brand

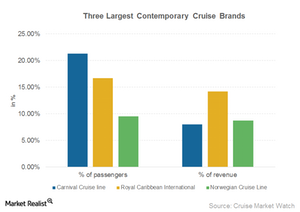

Royal Caribbean International is a global brand offered by Royal Caribbean (RCL). It’s one of the world’s three largest contemporary brands.

Marketing contributes to Royal Caribbean’s growing customer base

Royal Caribbean (RCL) offers all cruise company services, including pre- and post-hotel stay arrangements and air transportation.

Does Norwegian Cruise Have Enough Cash to Survive?

Norwegian Cruise Line stock fell 2.8 percent in the pre-market trading session today at 8:40 a.m. ET. The CDC extended a no sail order through September.

What Should You Do with Carnival Stock Right Now?

Carnival stock rose 2.4% in today’s pre-market trading session at 5:52 AM ET. The company will suspend its cruises in North America until September 30.

Before You Buy Norwegian Cruise Stock, Read This

On Wednesday, Norwegian Cruise stock fell 8.4% and closed at $19.20. The company extended the suspension of global voyages until September 30.

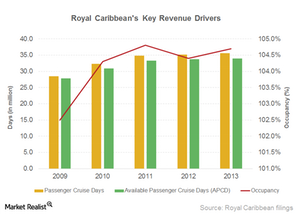

Key metrics to measure Royal Caribbean’s revenue performance

Now let’s look at certain key operating metrics used in the cruising industry to evaluate operational performance.

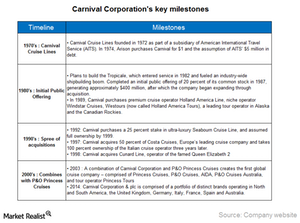

Carnival: Strong Brands Help Develop Market Niche

Carnival is among the most profitable and financially strong leisure travel companies in the world. It provides leisure travel to all major cruise destinations across the globe.

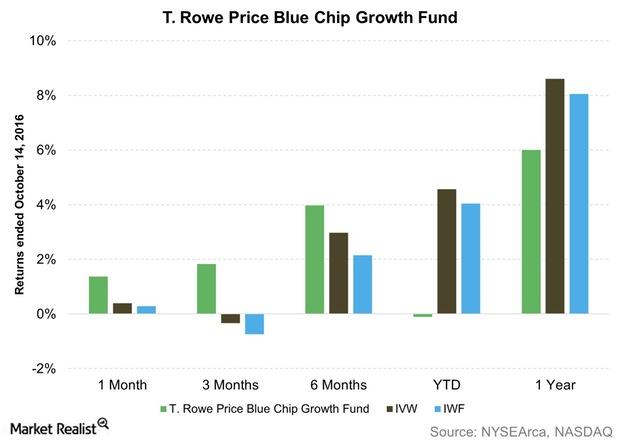

Why the T. Rowe Price Blue Chip Growth Fund Has Had a Rough 2016

TRBCX has had quite a poor run in 2016 so far. The fund places in the bottom three in the YTD period among the 12 funds in this review.

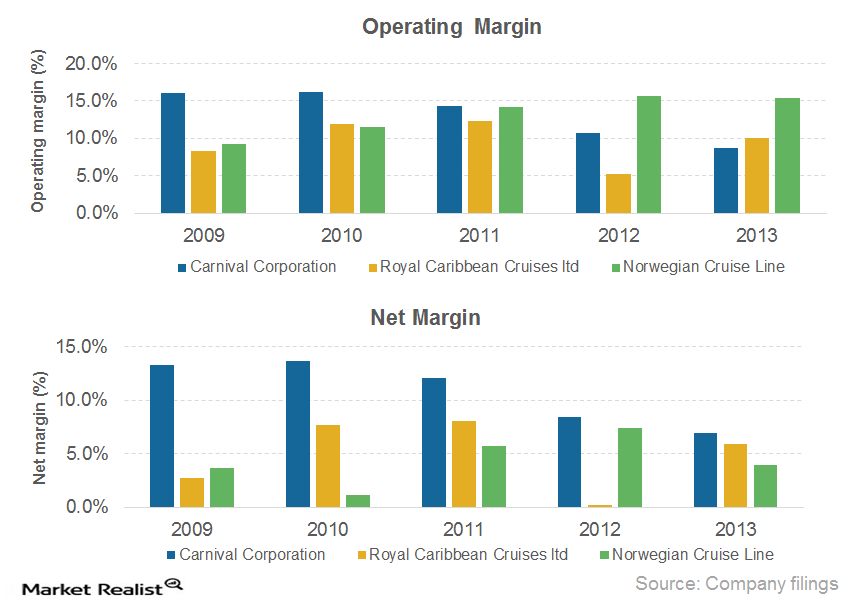

Comparing the major cruise lines’ operating and net margins

Among the three major competitors in the cruise industry, Royal Caribbean (RCL) had the highest operating margin in 2013.

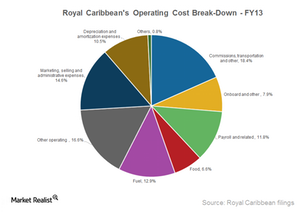

Breaking down Royal Caribbean’s operating costs

Costs directly related to operating a cruise ship comprise ~74% of Royal Caribbean’s (RCL) total operating costs.

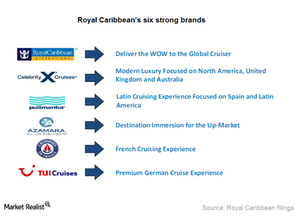

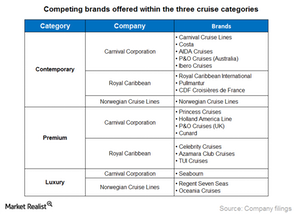

Royal Caribbean tailors brands for specific international markets

Apart from operating the largest contemporary global brand, Royal Caribbean offers five additional brands targeting specific markets.

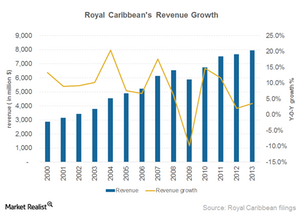

A closer look at Royal Caribbean’s revenue sources and growth

Royal Caribbean (RCL) derives revenue from two sources: passenger ticket revenue and onboard and other revenue.

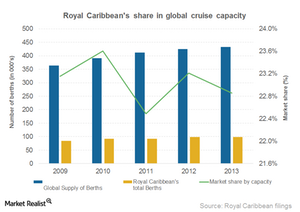

Overview: Royal Caribbean Cruises, the 2nd largest cruise operator

Royal Caribbean Cruises, founded in 1968 and headquartered in Miami, Florida, is the world’s second largest cruise company.

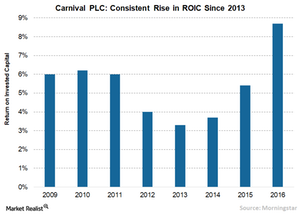

Carnival stays competitive with strong financial position

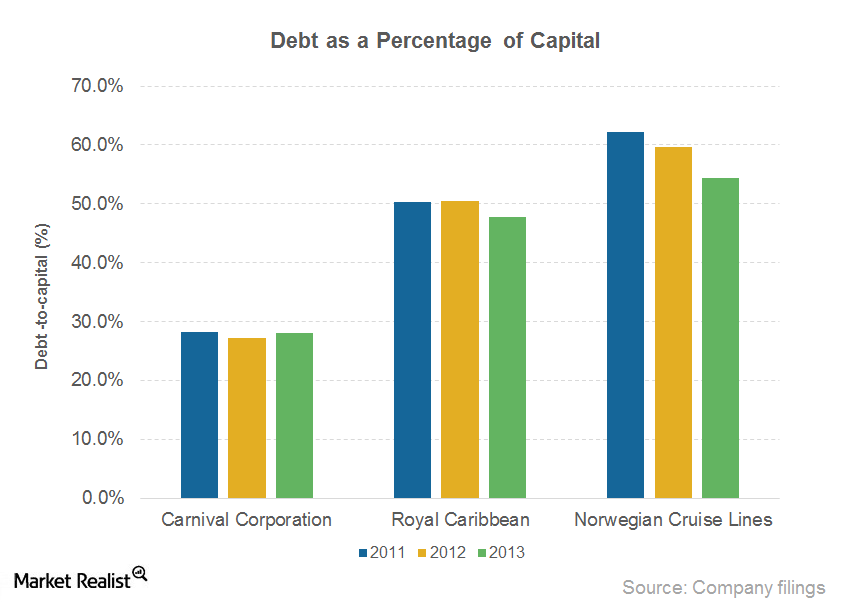

Carnival has a stronger financial position than its peers. It maintained a very low debt-to-capital ratio of 28% in 2013 and just 27% in 2014.

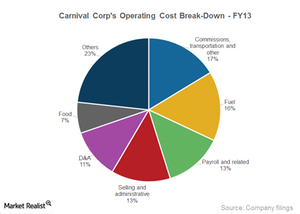

A key overview of Carnival’s costs and profitability

Carnival’s operating profit increased to $1,792 million in 2014, from $1,352 million in 2013. Its operating margin increased to 11.3%, from 8.7% in 2013.

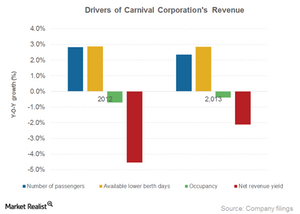

Key drivers of Carnival’s revenue growth

The growth of demand was the key driver of Carnival Corporation’s revenue growth in 2014. The number of passengers increased by 5% in 2014.

Carnival’s contemporary, premium, and luxury cruises

Cruise categories Cruise liners have been successfully providing a wide range of products and services at various price points to suit preferences of passengers from different age groups. Service levels and pricing differ by brand, category of the ship, cabins, season, duration, and itinerary. We can categorize cruise brands into these three categories: contemporary, premium, […]

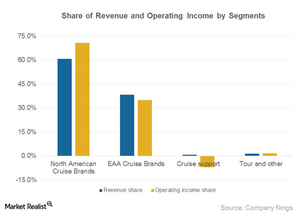

Two segments make up 98% of Carnival Corporation’s revenue

Two of Carnival Corporation’s (CCL) operating segments comprise almost 98% of the company’s revenue. Carnival also reports a Cruise Support segment and a Tour segment.

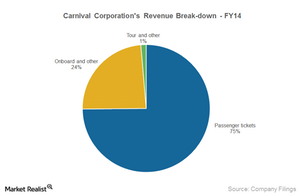

What are Carnival Corporation’s revenue sources?

Carnival Corporation (CCL) derives revenue from the following three sources: passenger tickets, onboard or other activities, and tours.

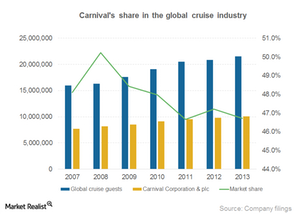

Carnival boasts largest market share of cruise passengers

The number of Carnival’s cruise passengers has increased at a six-year CAGR of 4.6%. It has the largest market share of cruise passengers at ~47%.

A key overview of Carnival, the world’s largest cruise company

Carnival Corporation (CCL), the largest cruise company in the world, operates 101 cruise ships and has a global market share of ~47%.