PowerShares Dynamic Large Cap Growth ETF

Latest PowerShares Dynamic Large Cap Growth ETF News and Updates

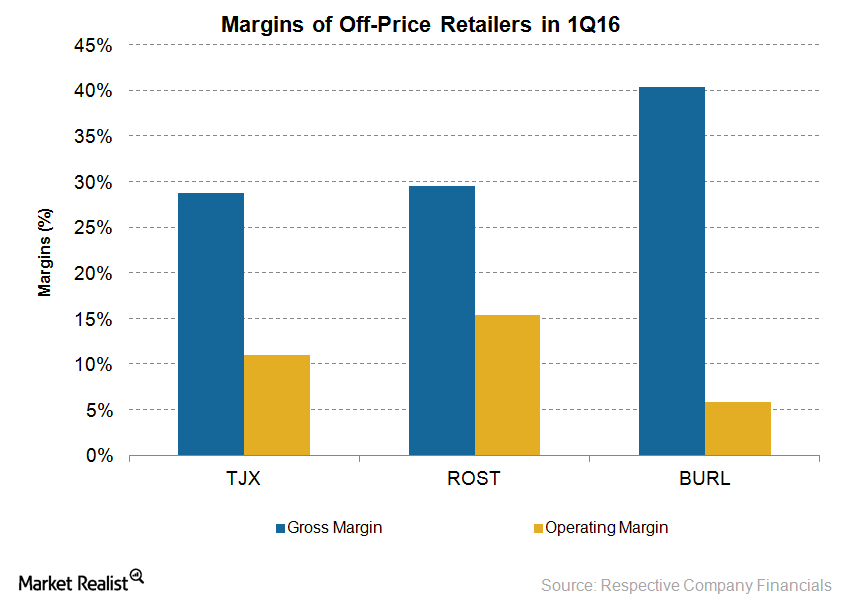

Which Off-Price Retailer Is Operating at the Highest Margins?

Major off-price retailers have strong margins supported by lean operating models, efficient inventory management, and strong vendor relationships.

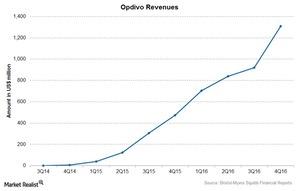

A Look at Opdivo’s Performance in 2016

Bristol-Myers Squibb’s (BMY) latest drug, Opdivo, was the seventh drug to be approved by the FDA for the treatment of melanoma.

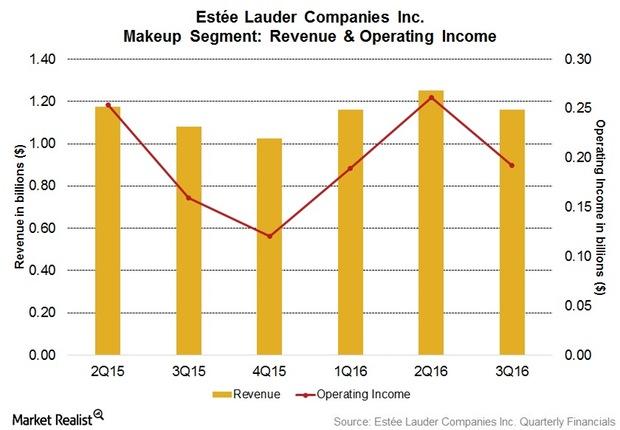

Estée Lauder’s Makeup Segment Boosted Its Operating Income

Estée Lauder’s makeup segment’s net revenue rose 7.3% in reported terms and 11% in constant currency terms to $1.2 billion in fiscal 3Q16.

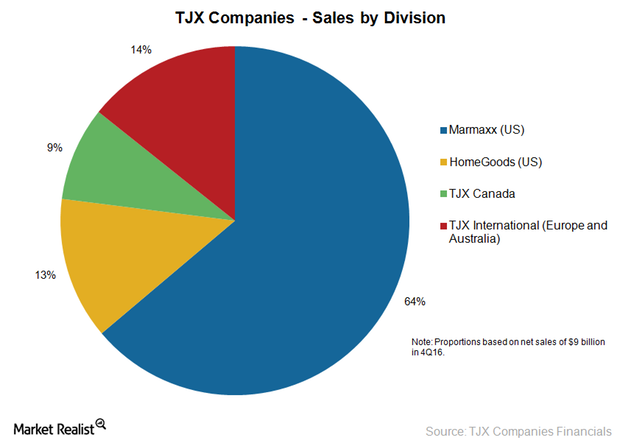

TJX Companies’ US Business in Fiscal 4Q16

The US business of TJX Companies consists of 1,156 T.J. Maxx stores, 1,007 Marshalls stores, 526 HomeGoods stores, and eight Sierra Trading Post stores.

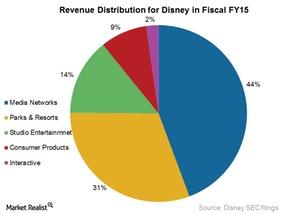

Assessing Disney’s Business Segment Performance in Fiscal 2015

Disney’s (DIS) Media Networks segment was the biggest contributor to its revenue, at 44% or $52.5 billion, in fiscal 2015.

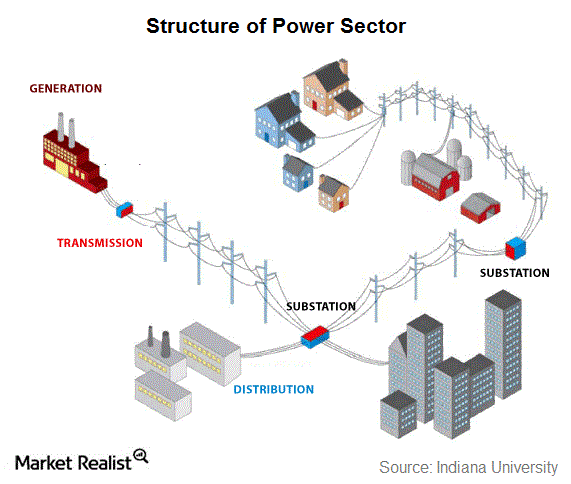

Understanding the structure of the global power sector

While the power sector differs country by country, the operational structure of the sector across the world is pretty much the same.