PowerShares Dynamic Food & Beverage ETF

Latest PowerShares Dynamic Food & Beverage ETF News and Updates

Opportunities and risks that Dunkin’ Brands investors must know

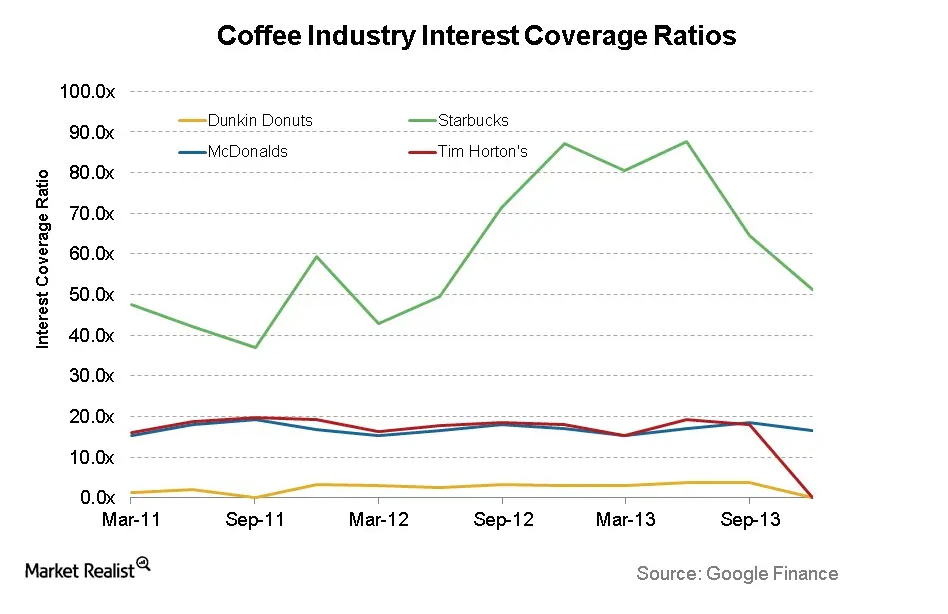

It’s no big secret that Dunkin’ Donuts has the highest relative leverage in the industry. Leverage comes with a number of risks— a substantial risk is the interest paid on debt.

Understanding Starbucks’ cost structure and operating expenses

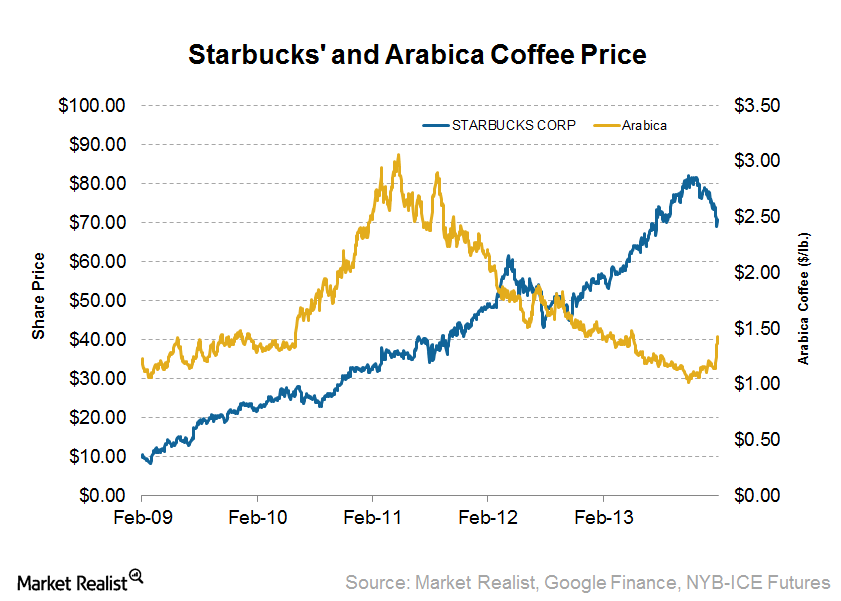

Starbucks’ main cost driver is its price per pound of coffee beans. The two most consumed coffee beans are Arabica and Robusta blends.

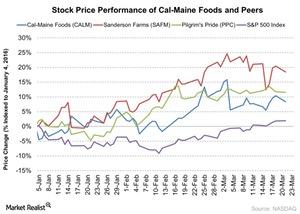

Analyzing the Expectations for Cal-Maine Foods in Fiscal 3Q16

Cal-Maine Foods will report its fiscal 3Q16 results on March 28. Cal-Maine’s stock has gained 2% since its last quarter earnings release on December 23, 2015.

Why high valuation and coffee prices drove Starbucks down ~13%

As store count grew over the past few years, Starbucks’ forward P/E valuation metric also expanded. What used to be just 17x gradually grew to roughly 27x, a 58% based solely on expansion in the valuations.

McDonald’s Global Presence and the Three-Legged Stool

McDonald’s, the world’s largest fast food chain, has over 38,000 restaurants across 120 countries. In 2018, it had approximately $21.0 billion in sales.Consumer Why Dunkin’ Brands is a unique player in a maturing industry

Dunkin’ Donuts’ main competitor on the coffee sales front is Starbucks, which sells coffee from its company-owned fleet of retail locations.

Must-Know: McDonald’s Has Got Tough Competition

McDonald’s (MCD) competition includes large international and national food chains as well as regional and local retailers of food products.

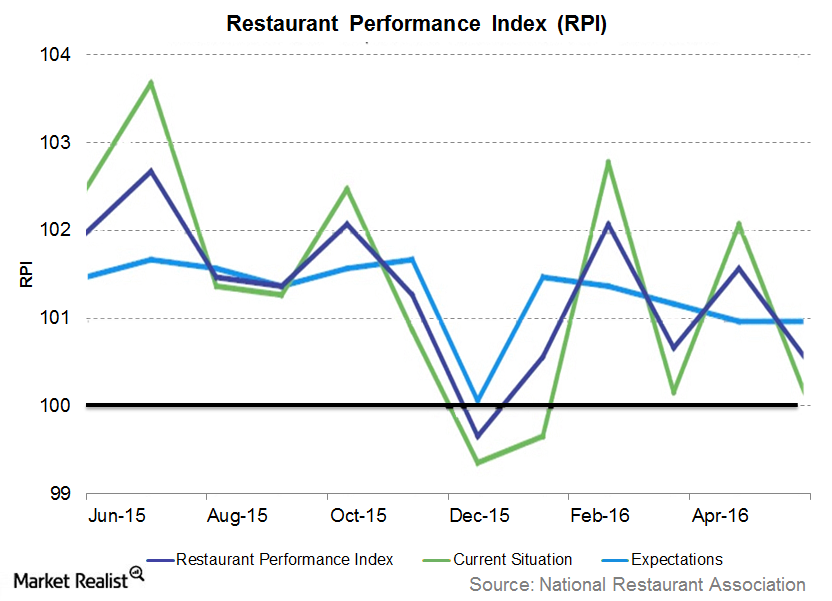

Investing in Restaurant Stocks: Tailwinds and Challenges

You could consider investing in restaurant stocks, given the solid fundamentals in the sector and the macroeconomic tailwinds favoring the industry.Consumer Starbucks revenues: Why customers are willing to pay a premium

Starbucks’ revenue mix is weighted in favor of beverages. This should come as no shock, considering the firm’s roots trace back to a single coffee shop at Pike’s Place Market in Seattle.Consumer Must-know: Chipotle Mexican Grill’s 3 key risks

Chipotle Mexican Grill (CMG) is exposed to three primary risks: price risk, interest rate risk, and currency risk.Consumer Key restaurant industry formats: The casual dining business

Contrary to fast food restaurants, casual dining restaurants have a relaxed and casual ambiance with a lot of seating. They offer full table service and may also have a wine menu or full bar service.

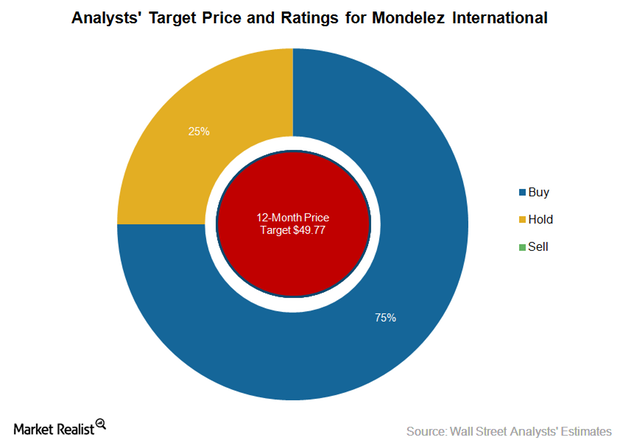

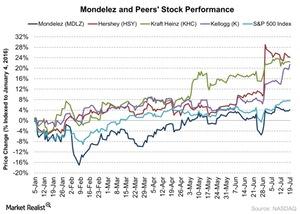

Mondelēz’s Stock: Why Do Most Analysts Rate It a ‘Buy’?

Current recommendations As of January 30, 15 of 20 analysts covering Mondelēz International’s stock had a “buy” rating. Five analysts had a “hold” recommendation, and there were no “sell” recommendations. On January 5, 2017, Berenberg Bank initiated coverage on Mondelēz International’s stock with a “buy” rating and a price target of $51. Consensus “buy” rating […]

How McDonald’s Wages and Major Costs Stack Up

McDonald’s performance is sensitive to any changes in price levels—be it food, labor, or rent. So how much does it cost for McDonald’s to generate revenue?

McDonald’s Supply Chain: A Must-Know for Investors

With over 38,000 restaurants, McDonald’s doesn’t make any of its products. Instead, it contracts with suppliers to meet its massive requirements.Consumer Why it’s important to understand Noodles and Co.

Noodles & Company (or NDLS) was founded in 1995. It’s a fast-casual restaurant chain that serves classic noodle and pasta dishes.

McDonald’s Menu Struggles to Shed Its Junk Food Rep

Despite health-related controversies, fast food companies such as McDonald’s maintain that they provide consumers with choice and convenience.

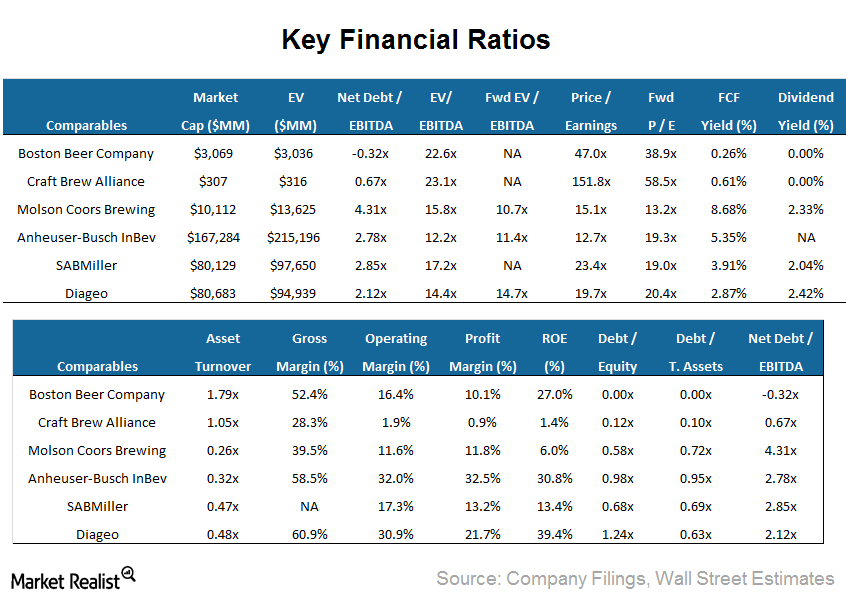

Boston Beer Company: An introduction to better beer business

Boston Beer Company Inc. (SAM) is the largest craft brewer in the United States, having sold ~2.7 million barrels of proprietary core brand products.

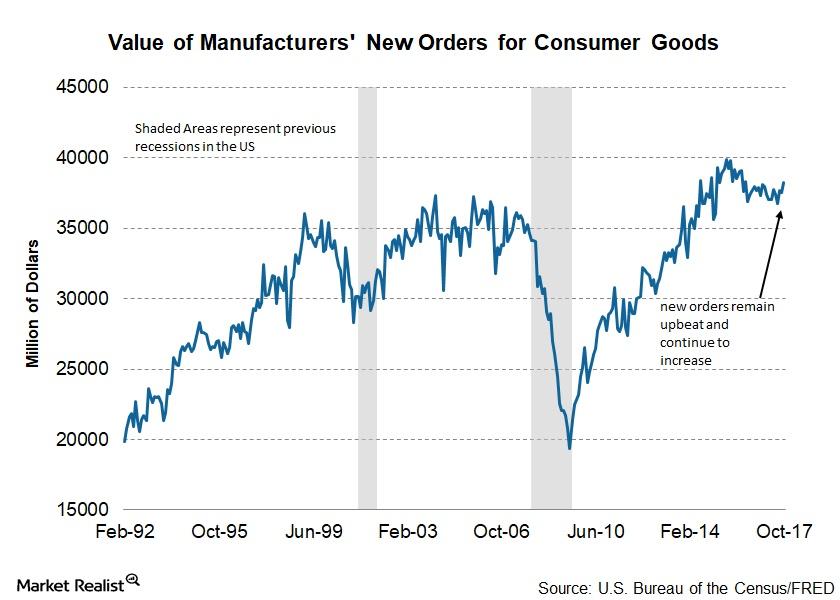

What Rising Consumer Goods and Material Orders Signal

Manufacturers’ new orders for consumer goods and materials New orders for consumer goods and materials give investors an insight into the demand for goods and form an important constituent of the Conference Board LEI (Leading Economic Index). Changes to demand in the consumer goods sector impact the performance of FMCG (fast moving consumer goods) companies, which include large retailers such […]

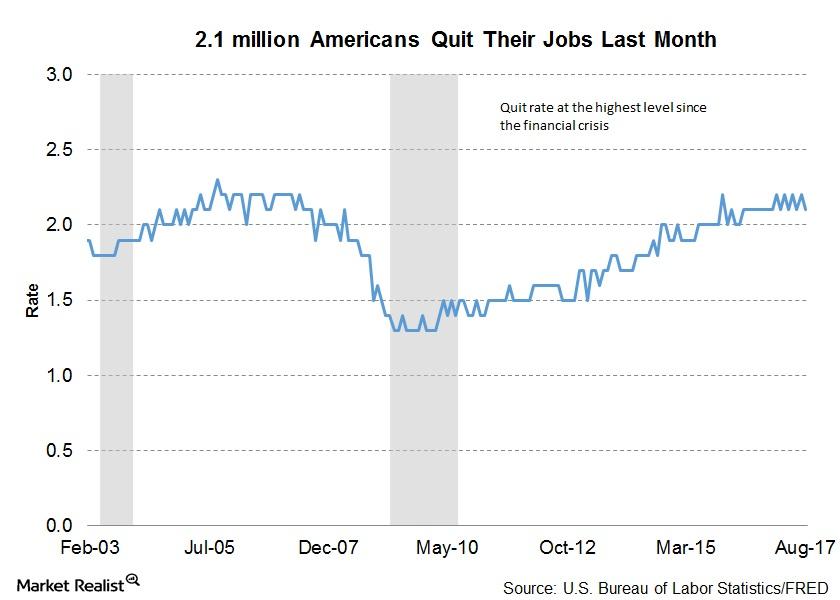

How Many Americans Quit Their Jobs in August?

As per the latest JOLTS report, about 2.1 million Americans quit their jobs voluntarily in August, which was a decrease of 70,000 from the previous reading.

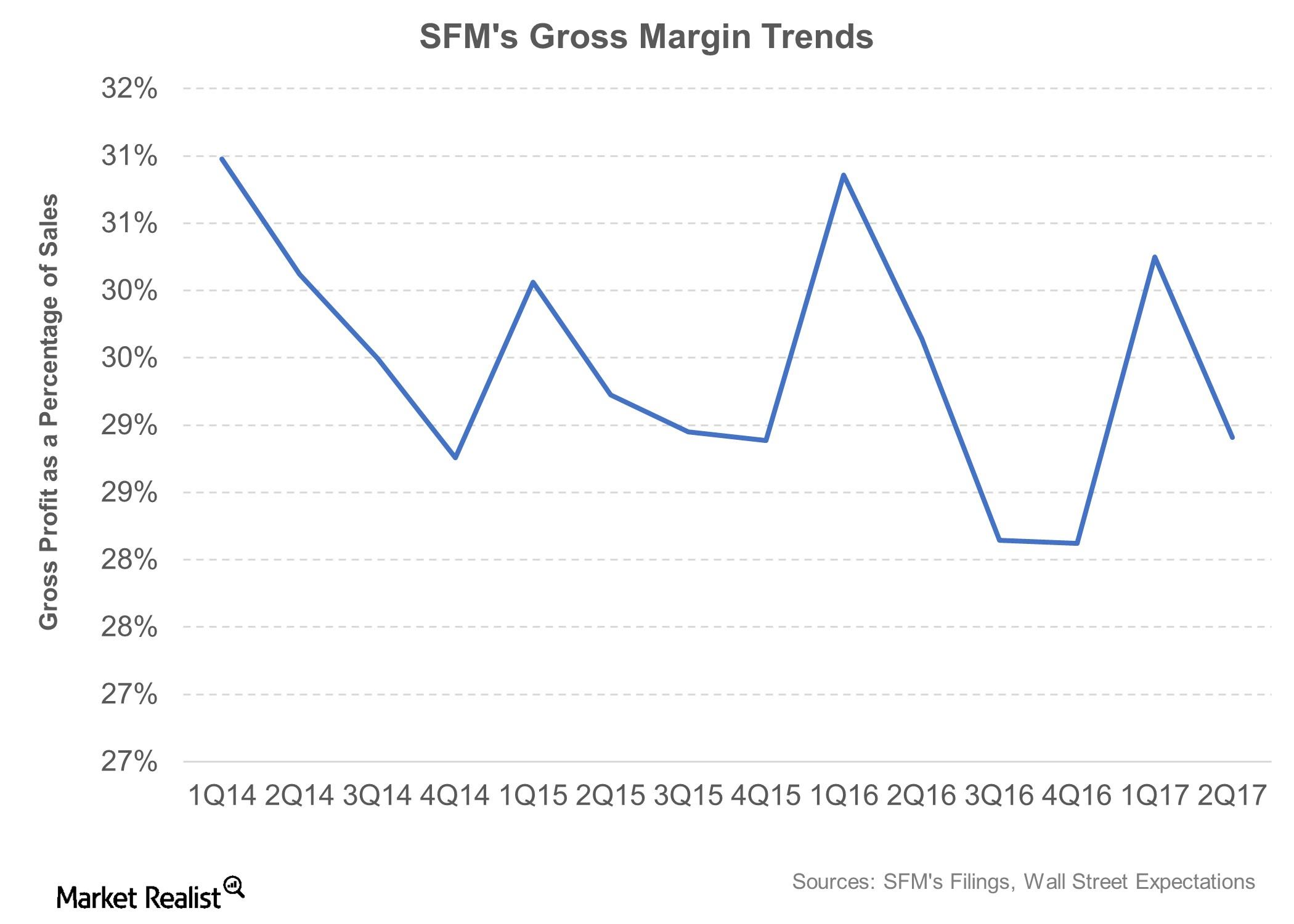

Sprouts Farmers Market’s 2Q17 Earnings Rose 16%

SFM’s top line is expected to grow 13%–14% based on its sales comp growth of 1.5%–2.0% and 32 new store openings.

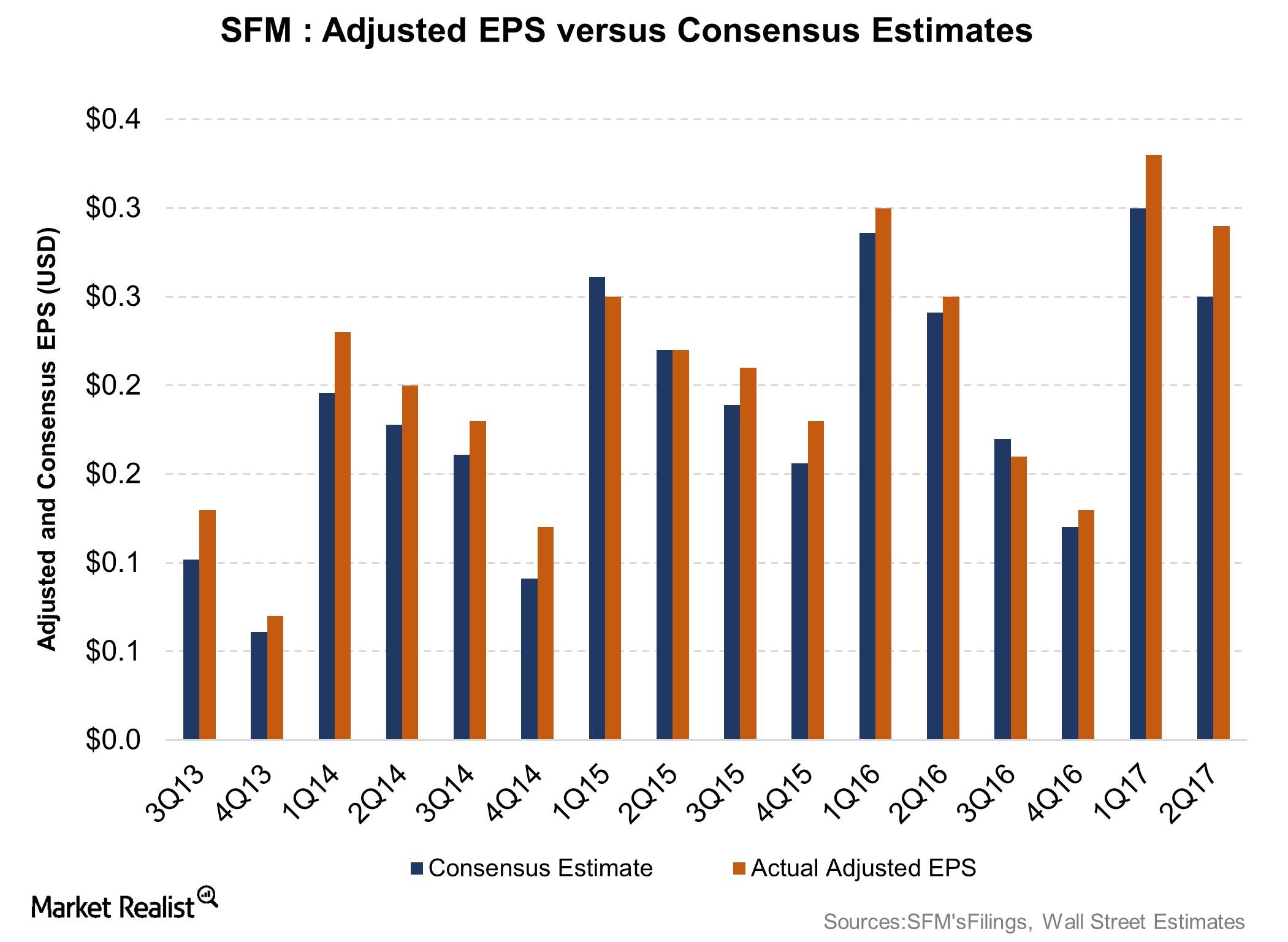

Sprouts Farmers Market’s 2Q17 Earnings Beat: Top, Bottom Lines Up

Phoenix, Arizona–based Sprouts Farmers Market (SFM) reported its 2Q17 results on August 3. Total sales for SFM increased 15% year-over-year to $1.2 billion, $17.0 million more than consensus estimates.

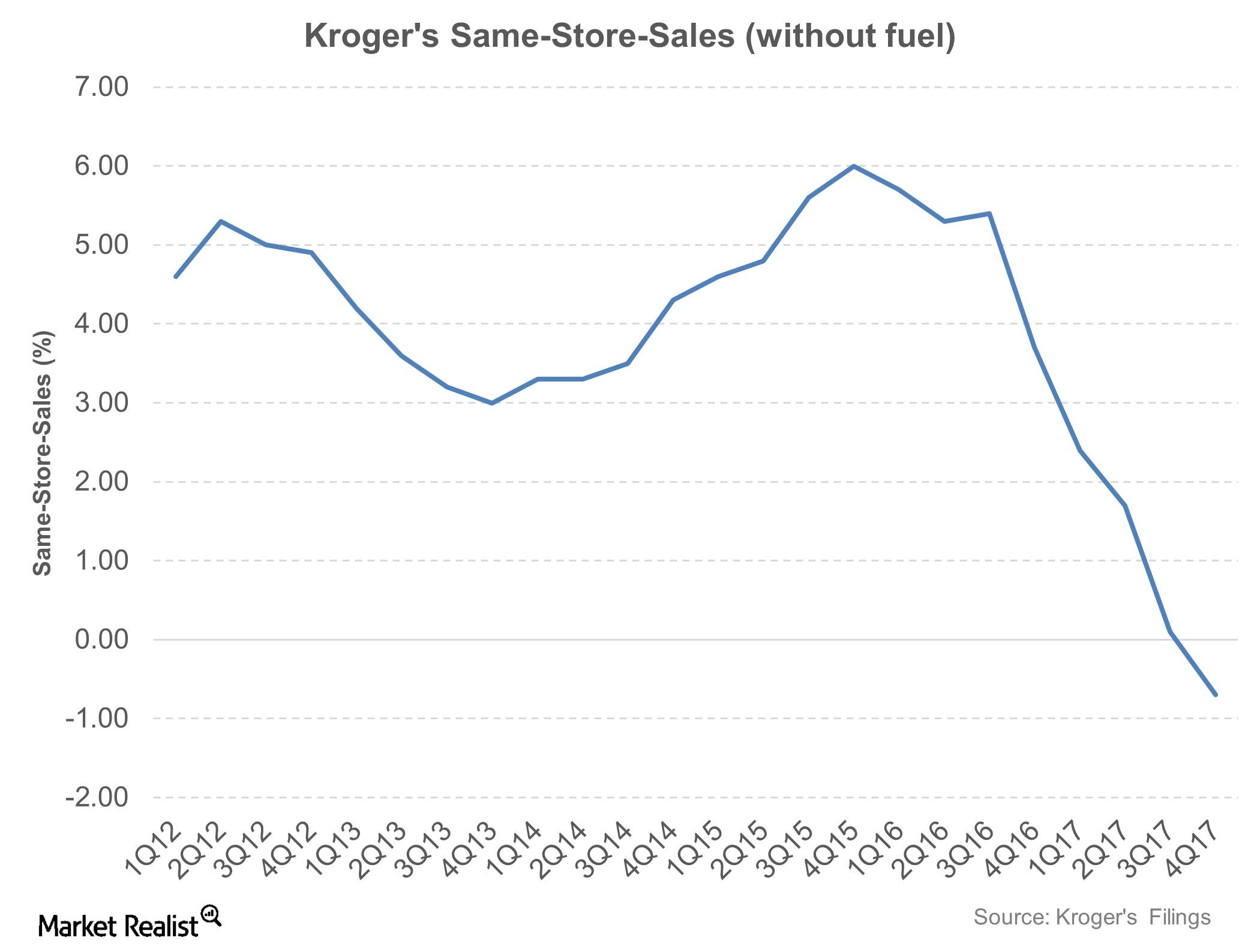

What’s Eating Kroger’s Sales Comps?

Kroger (KR) has done reasonably well lately, having survived an intensely competitive retailing environment over the past few years.

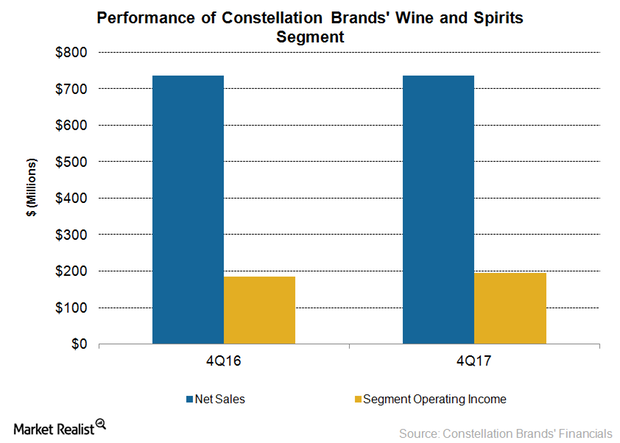

What Impacted Constellation Brands’ 4Q Wine and Spirits Sales?

In the full-year fiscal 2017, Constellation Brands’ Wine and Spirits segment’s sales rose 6.0% to $3.1 billion.

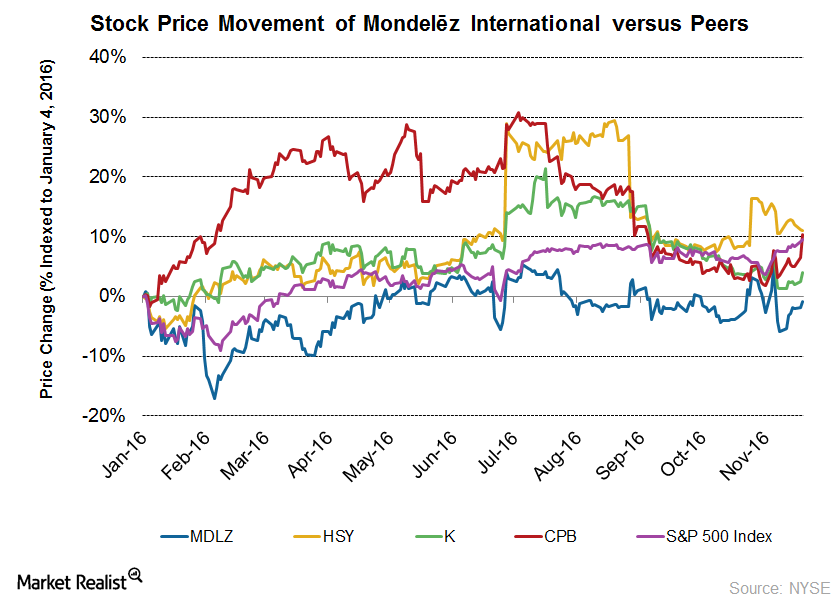

Why Has Mondelēz International Been Rising for Two Months?

Mondelēz International’s (MDLZ) stock rose 3.6% to $44.32 per share on October 26, 2016, after the announcement of the company’s 3Q16 results.

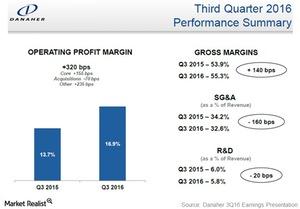

With Phenomenex, Danaher Has an Attractive Consumables Asset

On October 12, Danaher announced its an agreement to acquire Phenomenex, a privately held manufacturer of separation and purification consumables.

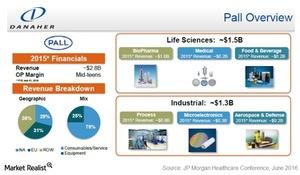

Pall Acquisition Gave Birth to Danaher’s Filtration Business

Danaher’s filtration business came into existence through the acquisition of Pall in 2015.

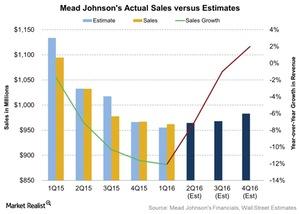

What Will Hurt Mead Johnson’s 2Q16 Revenue?

Analysts are expecting Mead Johnson’s revenue to be $964 million for 2Q16. That’s a fall of 7% compared to 2Q15 revenues of $1.0 billion.

Did Oreo Cookies, Trident Gum Sales Boost Mondelez’s 2Q Earnings?

Mondelez International (MDLZ), maker of Cadbury chocolates and Oreo cookies, is all set to report its fiscal 2Q16 earnings results on July 27 before the market opens.

Why Are So Many Analysts Rating B&G Foods a ‘Hold’?

Approximately 78% of analysts rate B&G Foods a “hold,” and 22% rate it a “buy.” None of the analysts rate it a “sell.”

What Are Wall Street Analysts’ Recommendations for ConAgra?

The average broker target price for ConAgra has risen slightly to $50.60 from $50.27. This 5% higher than ConAgra’s closing price of $47.91 on June 23.

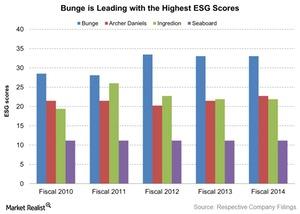

How Is Bunge’s Environmental, Social, and Governance Score?

Bunge (BG) has had the highest ESG score among its peers for the last five years.

Why Papa John’s Leads the Pack in Technology Implementation

Papa John’s was first to introduce online ordering at all of its US delivery restaurants in 2001 as well as first to introduce SMS text ordering in 2007.Consumer Must-know: Starbucks’ key value metrics—same-store sales

Same-store sales are one of the important drivers in the restaurant industry. Same-store sales directly drives the revenues. It measures the percentage change in the revenues generated by existing restaurant locations over the same period last year.Consumer Must-know: Key metrics in McDonalds’ quarterly earnings

McDonald’s reported flat global comparable sales and negative comparable guest count for 2Q14, which is concerning from a long-term income growth perspective.Consumer Why marketing and advertising are so important for restaurants

Mainstream channels of marketing—like radio, TV, and print ads—are still common. But many restaurant chains have also used social media to increase their brand presence.Consumer Important pros and cons of the company-operated restaurant model

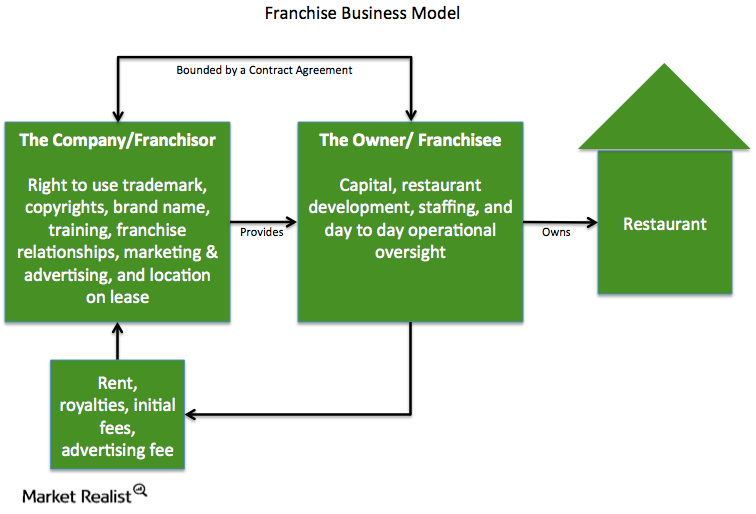

In the last part of this series, we looked at the franchise model. Let’s now take a look at the company-operated restaurant model.

Important pros and cons of the franchise restaurant model

The most common business models in the restaurant industry are for franchised and company-operated restaurants. Let’s look at the franchise model in closer detail.Consumer Overview: Assessing the restaurant industry business model

Restaurants are simple businesses. Because we have to eat every day, people often think the restaurant industry is a safe one to invest in.

Why food will become more important to Starbucks’ future growth

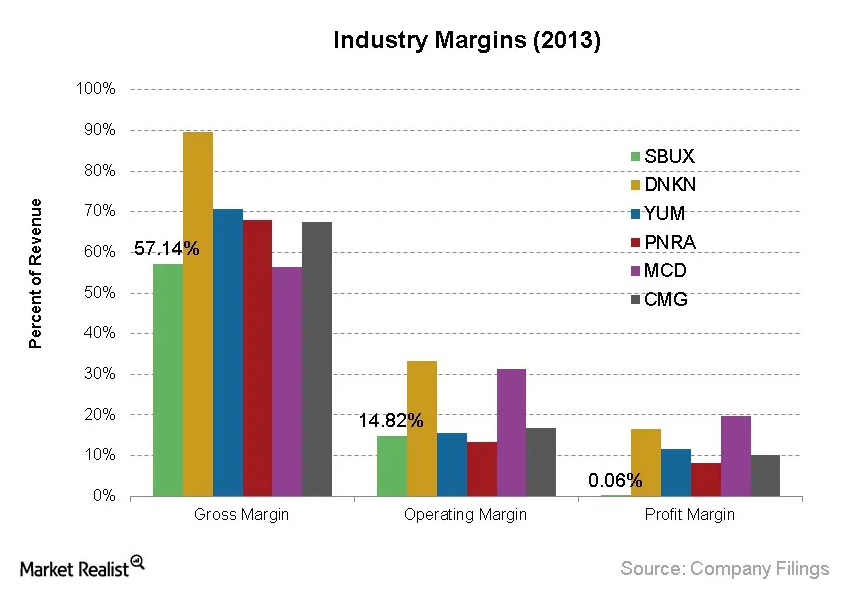

As a primary coffee retailer, food has been a relatively minor part of Starbucks Corp.’s (SBUX) focus in the past. But lately, Starbucks has been expanding its product offerings for food.Consumer An industry advantage: Dunkin’ Brands’ operating costs are dieting

Dunkin’ Brands has a very low capital requirement relative to the rest of the coffee retail industry. This is due to its business model, centered around establishing franchises across the world.Consumer Must-know: Dunkin’ Brands is innovating the supply chain

Dunkin’ Brands Group doesn’t typically supply products to its franchises. Revenues derive from royalty fees as opposed to product distribution.Consumer Must-know risks: Why Starbucks should hedge its shrubs

Starbucks indicates that it uses derivative contracts to hedge commodity price risks. These contracts typically don’t have a lifespan longer than five years.Consumer A Starbucks on every corner: A guide to the SBUX business model

This business model has allowed Starbucks to be the first coffee firm to put retail locations in each of the BRIC nations and many more.Consumer Business overview: Why Starbucks deserves your attention

Starbucks began in 1971 as a single coffee shop in Seattle. Today, it’s the world largest coffee retailer, with over 19,000 locations in more than 60 countries (as of FY2013 end).

Is craft better? Boston Beer Company’s high-quality ingredients

The four main ingredients that Boston Beer Company uses are malt, hops, yeast, and apples. Malts, hops, and yeast are part of most beer-making processes.

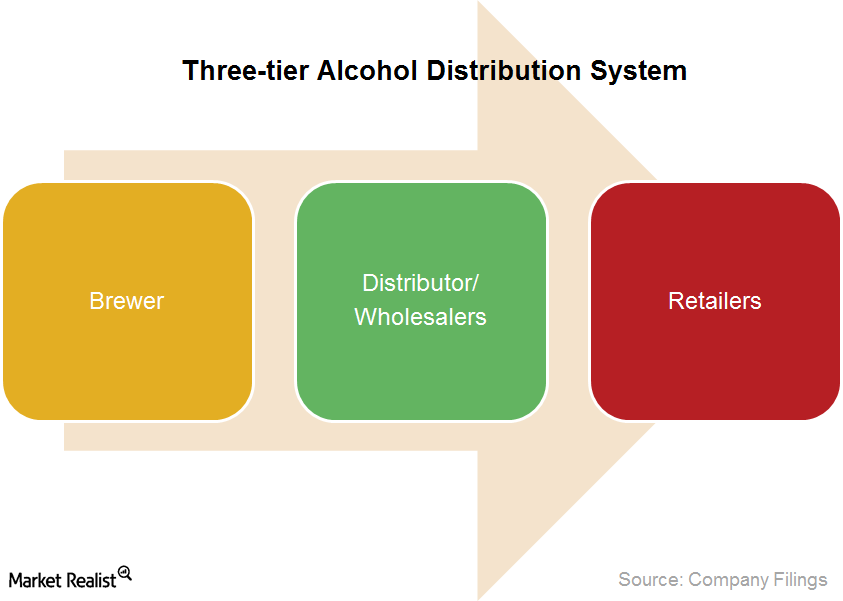

Why Boston Beer Company and peers’ beer distribution is important

Like other brewers in the United States, Boston Beer Company (SAM) sells its products to distributors and wholesalers, which in turn sell to retailers.

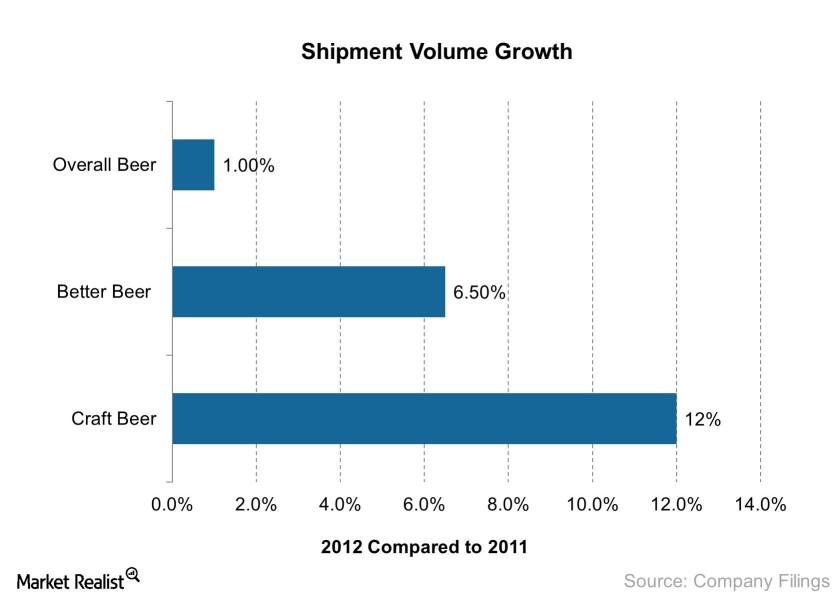

The rise of craft beer: Boston Beer Company and Samuel Adams

Craft beer consumption is on the rise, as drinkers are going for more premium products these days. Boston Beer Company (SAM) stands to benefit.