International Paper Co

Latest International Paper Co News and Updates

WestRock Made Key Changes to Its Management

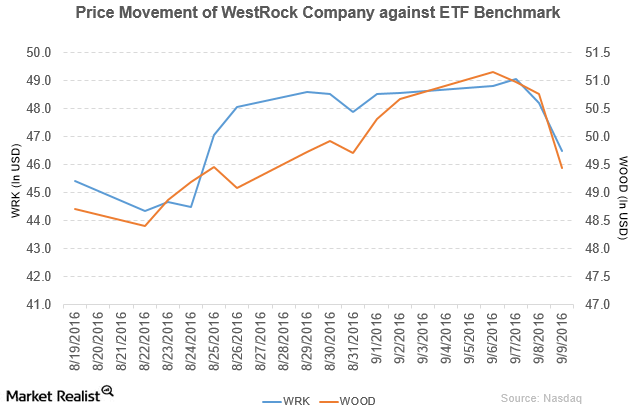

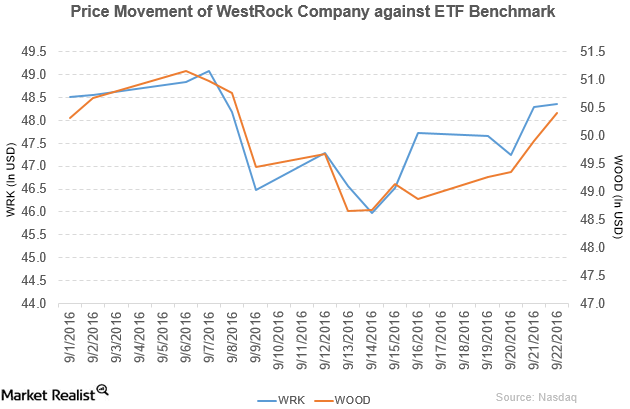

WestRock (WRK) fell 4.2% to close at $46.49 per share during the first week of September 2016.

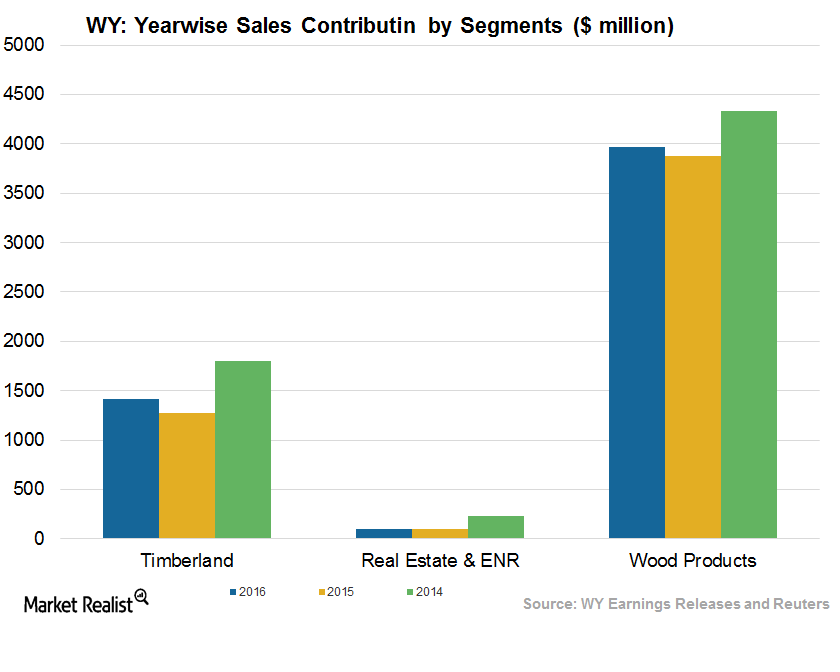

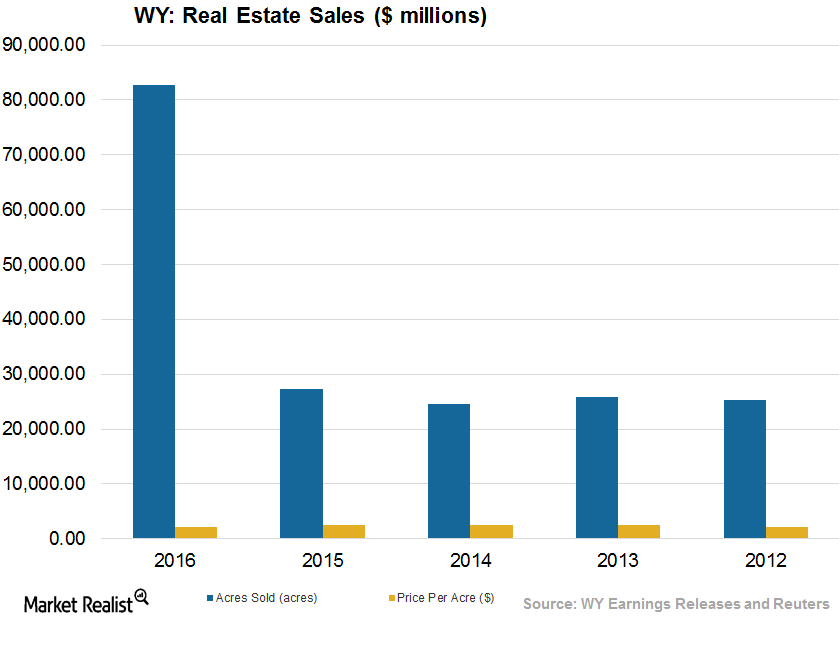

Understanding Weyerhaeuser’s Divestiture Policy

Weyerhaeuser (WY) has undertaken several divestiture policies in order to dispose of its underperforming and non-core businesses.

How Weyerhaeuser Fared in 2Q17: The Details

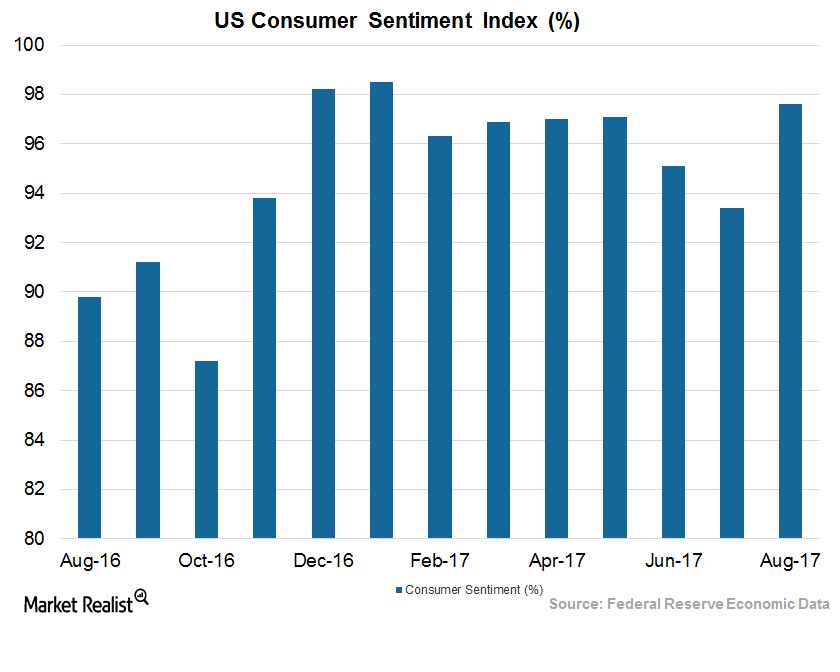

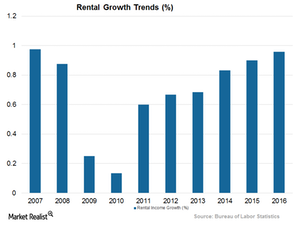

The growing economy has helped REITs including Weyerhaeuser (WY), Rayonier (RYN), Resolute Forests Products (RFP), and International Paper (IP) reap higher profits.

How Did Greif Perform in Fiscal 4Q16?

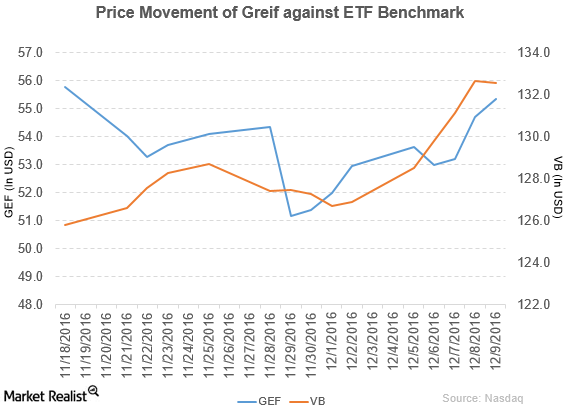

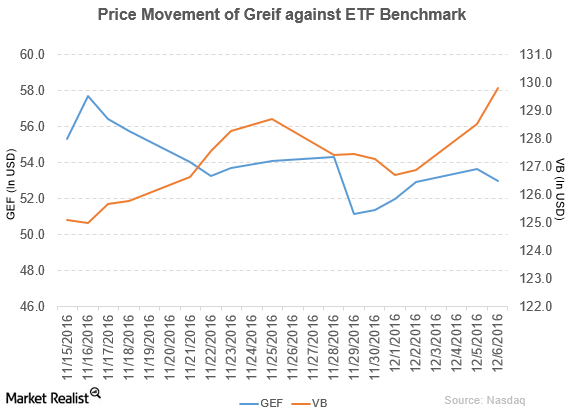

Greif (GEF) rose 4.6% to close at $55.35 per share during the first week of December 2016.Consumer Berkshire Hathaway buys a new stake in Verizon Communications

Berkshire Hathaway took a new position in Verizon Communications (VZ) last quarter. The position accounts for 2.04% of the fund’s portfolio.

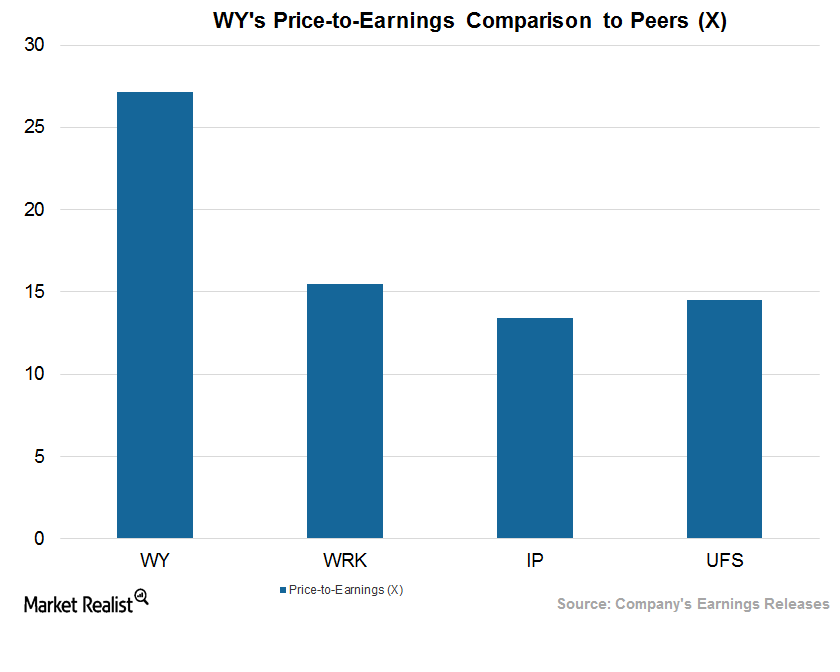

How Weyerhaeuser Compares with Peers

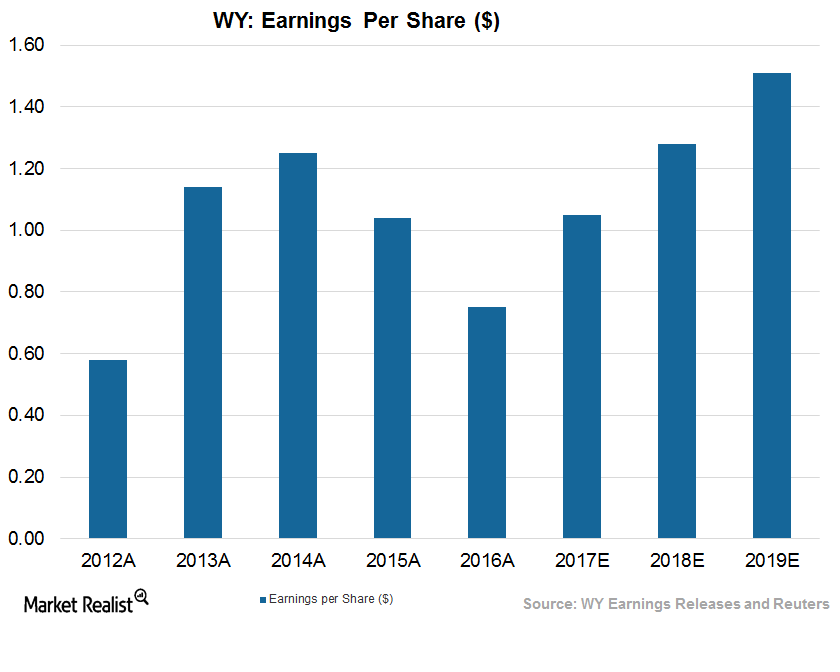

The expected performance of timberland REIT Weyerhaeuser (WY) for the rest 2017 and in 2018 can be best understood by its valuation multiples.

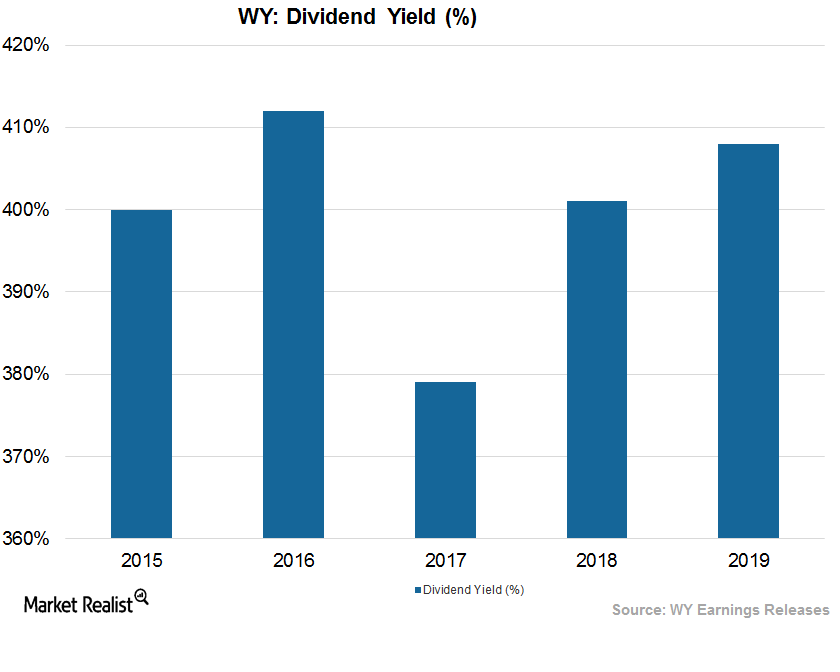

How Weyerhaeuser Treats Its Shareholders

REITs (real estate investment trusts) usually provide generous returns to their shareholders in the form of dividends or share buybacks.

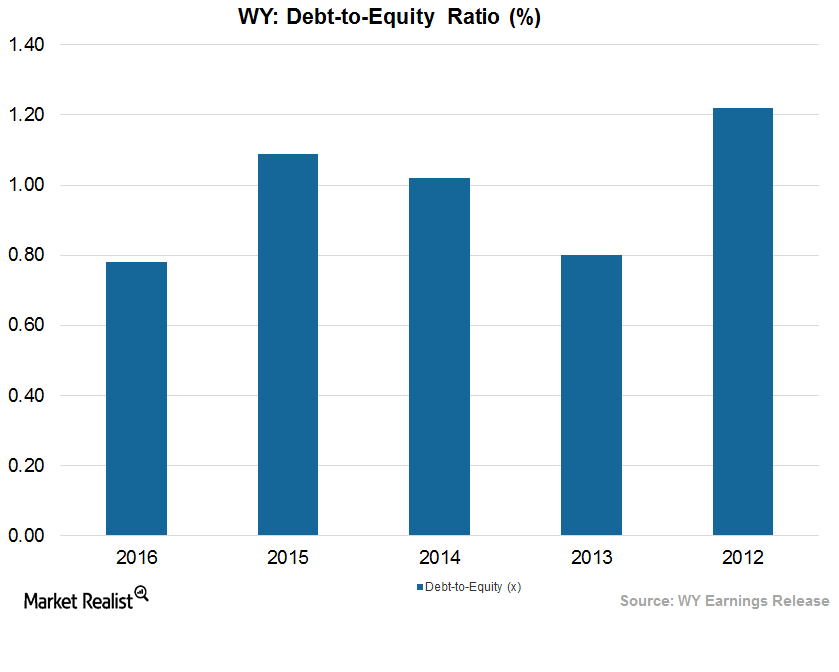

Is Weyerhaeuser Maintaining a Strong Balance Sheet?

REITs (real estate investment trusts) depend mostly on debt for their day-to-day functioning and working capital.

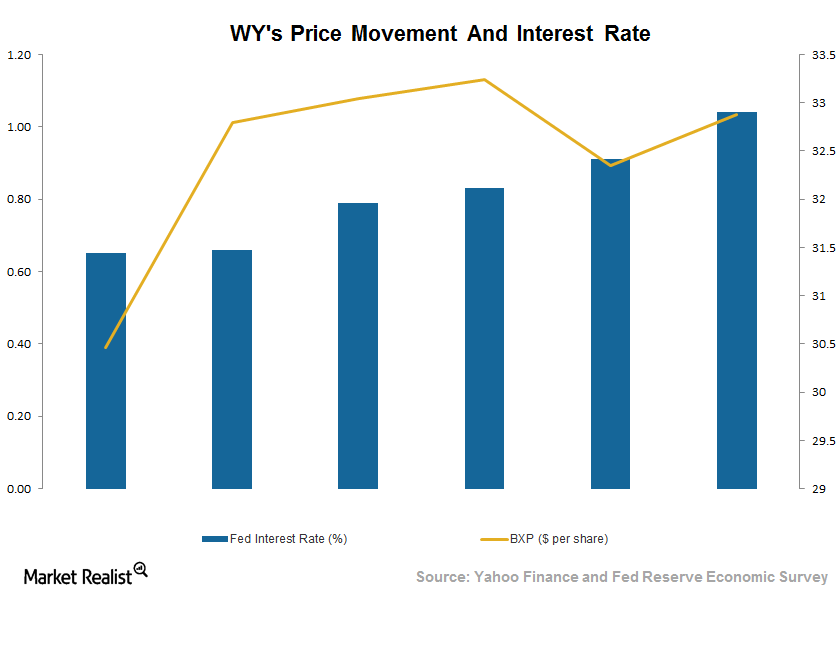

How Weyerhaeuser and REITs Can Fight the Interest Headwind

After thriving for a long time in a low interest rate environment, REITs (real estate investment trusts) are now facing a high interest rate.

How the Rising Interest Rate Affects REITs like Weyerhaeuser

REITs (real estate investment trusts) depend on debt and equity for their working capital, and so they’re directly impacted by the Fed’s interest rate policy.

Inside the Weyerhaeuser-Plum Creek Merger

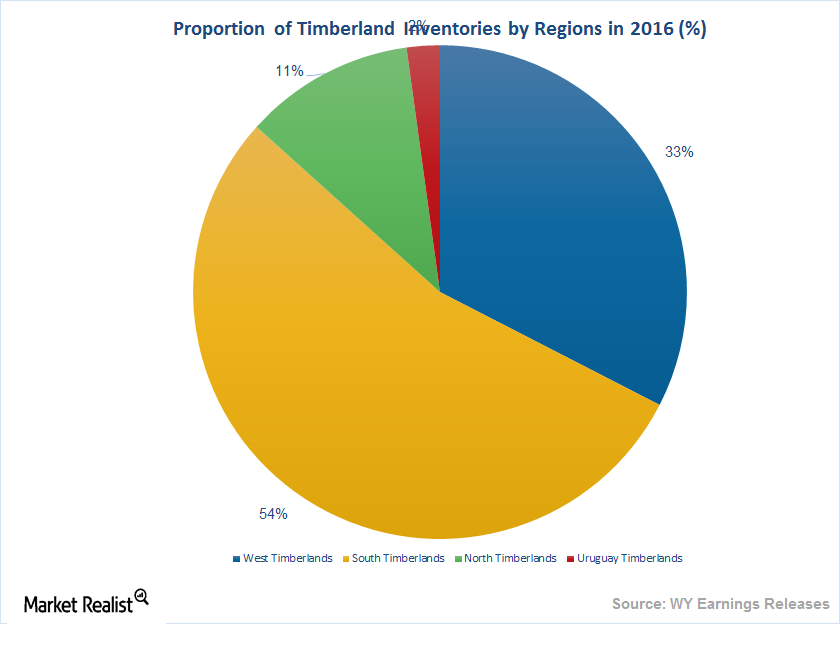

Timberland REIT (real estate investment trust) Weyerhaeuser (WY) owns almost 13.1 million acres of timberlands across the US.

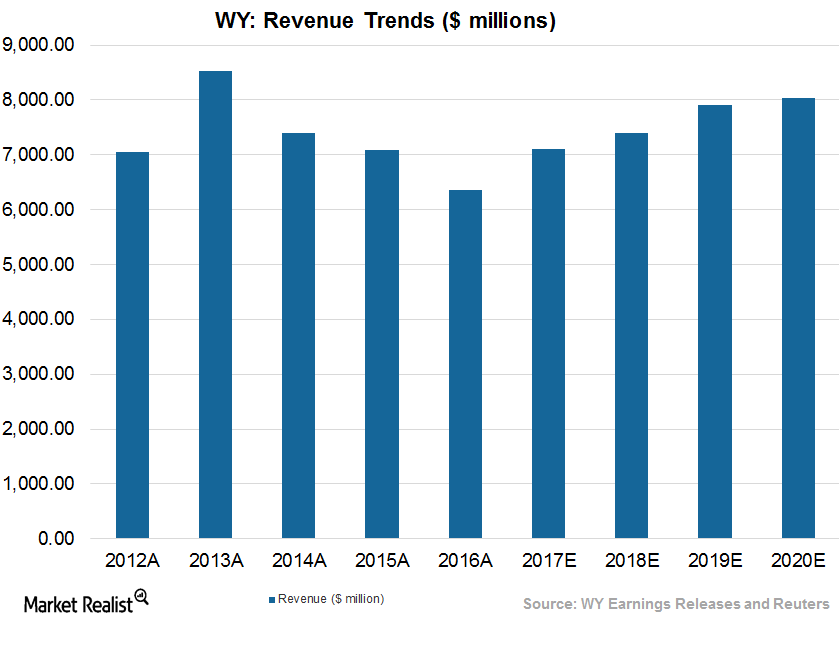

What Lies ahead for Weyerhaeuser in 2017?

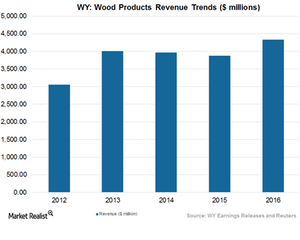

Timberland REIT (real estate investment trust) Weyerhaeuser (WY) expects to continue its growth trajectory for the rest of 2017.

What Strong Wood Means for Weyerhaeuser’s Momentum

Timberland REIT (real estate investment trust) Weyerhaeuser (WY) has been able to use the opportunities of the booming housing sector to its advantage.

Behind Weyerhaeuser’s Growth Trajectory

Timberland REIT (real estate investment trust) Weyerhaeuser (WY) reported upbeat earnings results for 2Q17, backed by higher sales and prudent cost management.

How Weyerhaeuser and Timberland REITs Came through the Fire

Timberland REITs (real estate investment trusts) in the US don’t seem to be in doubt about their continued growth momentum in the near future.

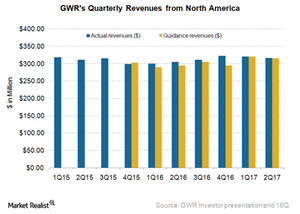

Genesee & Wyoming’s North American Revenues in 2Q17

In 2Q17, GWR’s North American revenues were $315.7 million, a 3.6% rise from $304.6 million in the same quarter last year.

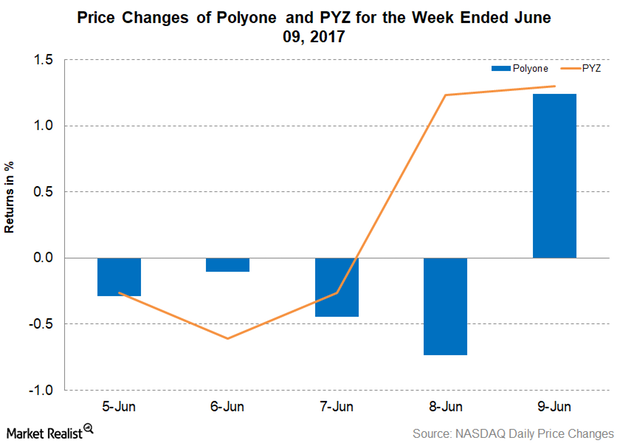

PolyOne Acquired Rutland Holding Company

On June 8, 2017, PolyOne (POL) announced that it acquired Rutland Holding Company. The acquisition will help PolyOne expand its portfolio.

WestRock Company Declared Dividend of $0.40 per Share

WestRock (WRK) reported fiscal 1Q17 net sales of $3.45 billion, a fall of 0.7% compared to net sales of $3.47 billion in fiscal 1Q16.

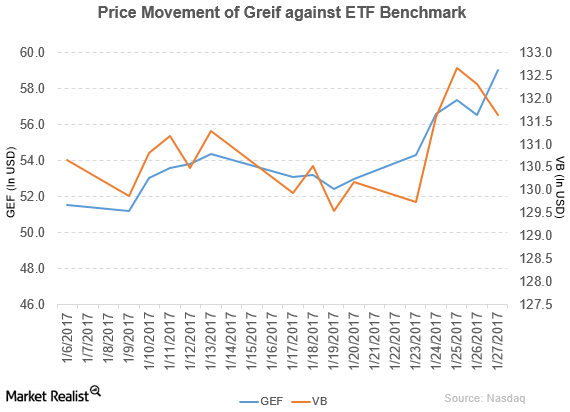

Bank of America/Merrill Lynch Upgrades Greif to a ‘Buy’

In fiscal 2016, Greif (GEF) reported net sales of $3.3 billion, a fall of 8.1% year-over-year.

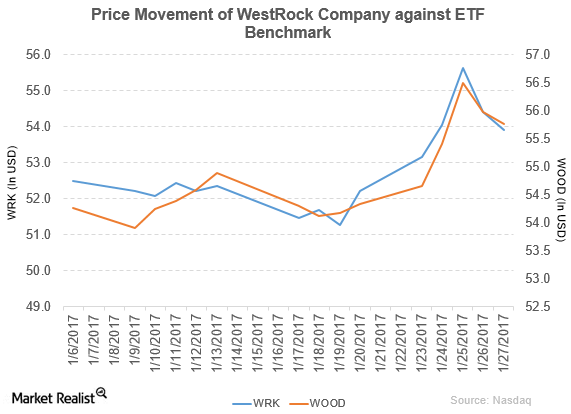

What’s the Latest News on WestRock Company?

WestRock Company (WRK) has a market cap of $13.4 billion. It rose 1.8% to close at $53.16 per share on January 23, 2017.

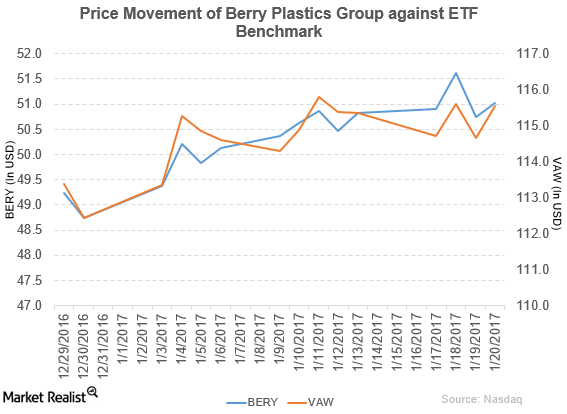

Berry Plastics Acquired AEP Industries

In fiscal 2016, BERY reported net sales of $6.5 billion, a rise of 32.9% year-over-year.

Robert W. Baird Upgrades Greif to ‘Outperform’

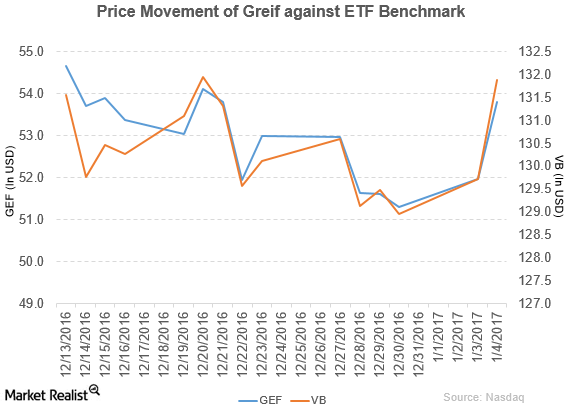

Greif (GEF) has a market cap of $3.0 billion. It rose 3.5% to close at $53.80 per share on January 4, 2017.

BMO Capital Downgrades Greif to ‘Underperform’

Greif (GEF) fell 0.69% to close at $53 per share during the third week of December 2016.

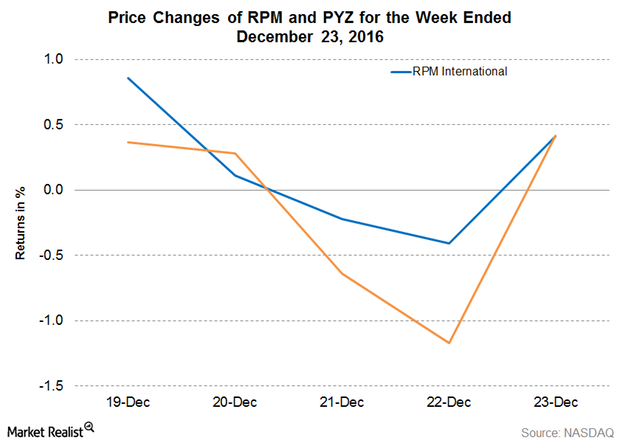

RPM International to Acquire SPS Group

On December 21, RPM announced that it has entered an agreement to acquire SPS Group.

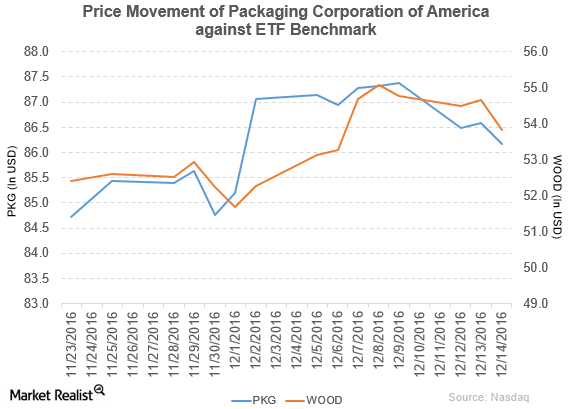

Packaging Corporation of America Declares Dividend of $0.63 Per Share

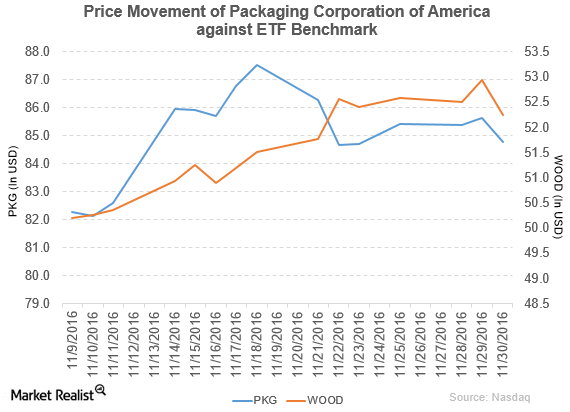

PKG fell 0.50% to close at $86.16 per share on December 14. The stock’s weekly, monthly, and YTD price movements were -1.3%, 0.22%, and 40.3%.

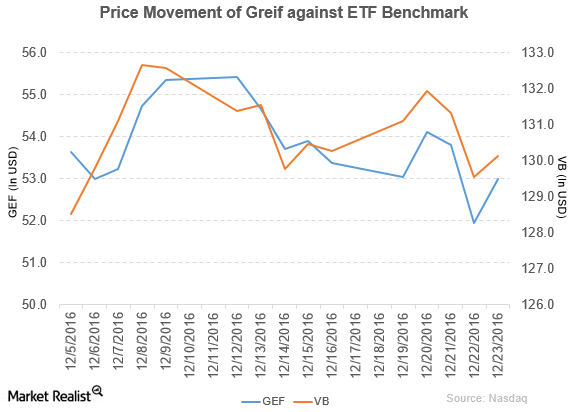

Greif Declared Quarterly Dividends

Greif (GEF) has a market cap of $2.8 billion. It fell 1.2% to close at $52.98 per share on December 6, 2016.

Packaging Corporation of America Acquires Columbus Container

Packaging Corporation of America’s (PKG) capital spending fell 12.8%, and its cash balance rose 49.7% between 3Q15 and 3Q16.

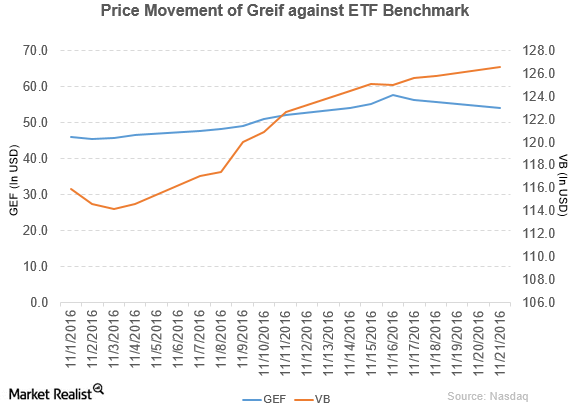

Bank of America/Merrill Lynch Downgrades Greif to ‘Neutral’

Greif reported 3Q16 net sales of $845.0 million, a fall of 9.1% compared to its net sales of $930.0 million in 3Q15.

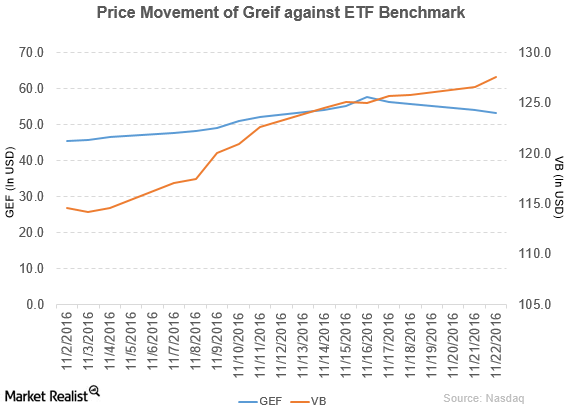

Wells Fargo Downgrades Greif to ‘Market Perform’

Greif (GEF) has a market cap of $2.9 billion. It fell 3.2% to close at $54.02 per share on November 21, 2016.

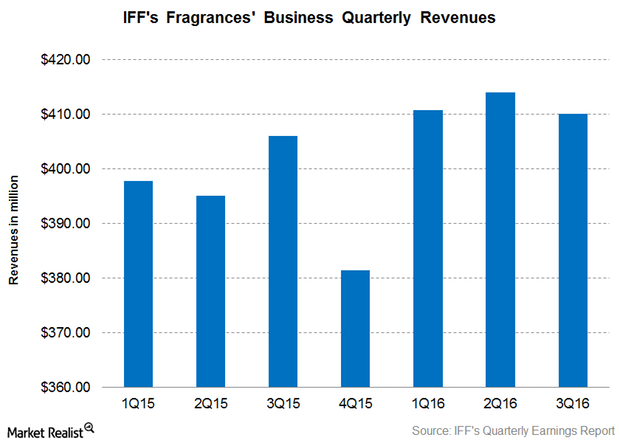

How Did IFF’s Fragrances Segment Perform in 3Q16?

IFF’s Fragrances segment reported revenues of ~$410.1 million in 3Q16, as compared to $406 million in 3Q15, implying a 1.0% YoY rise.

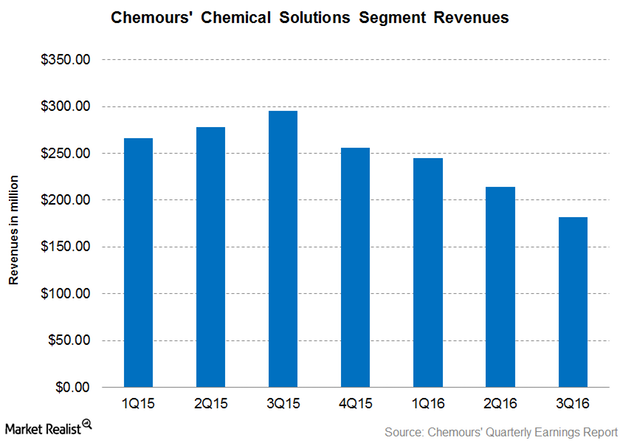

Why Did the Chemours Chemical Solutions Segment’s Revenue Dip in 3Q16?

Chemours’ Chemical Solutions segment reported revenue of $182 million in 3Q16, as compared to $295 million in 3Q15, implying a revenue fall of 38.2% YoY.

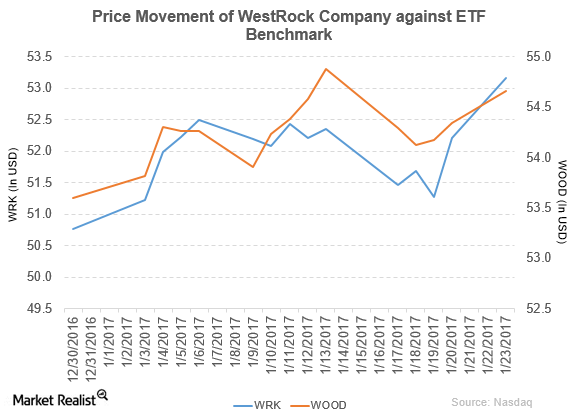

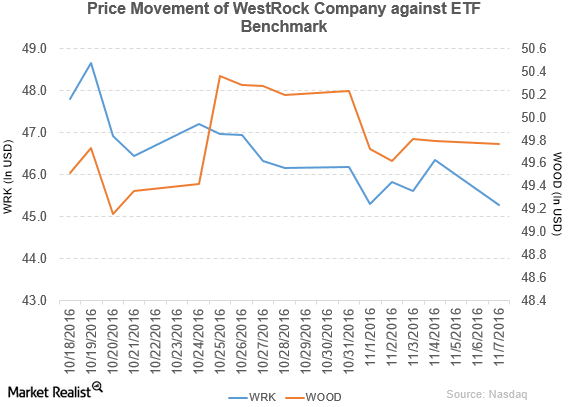

A Look at WestRock’s 4Q16 Performance

Price movement WestRock (WRK) has a market cap of $11.4 billion. It fell 2.3% to close at $45.27 per share on November 7, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -2.0%, -2.7%, and 2.2%, respectively, on the same day. WRK is trading 2.7% below its 20-day moving average, 4.2% below […]

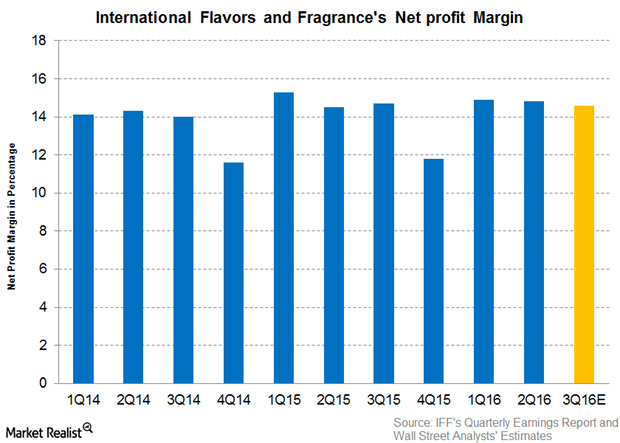

Can IFF Surprise Analysts with a Higher Net Profit Margin?

Wall Street analysts are expecting International Flavors and Fragrances (IFF) to post a net profit margin of 14.6% in 3Q16, compared to 14.7% in 2Q16.

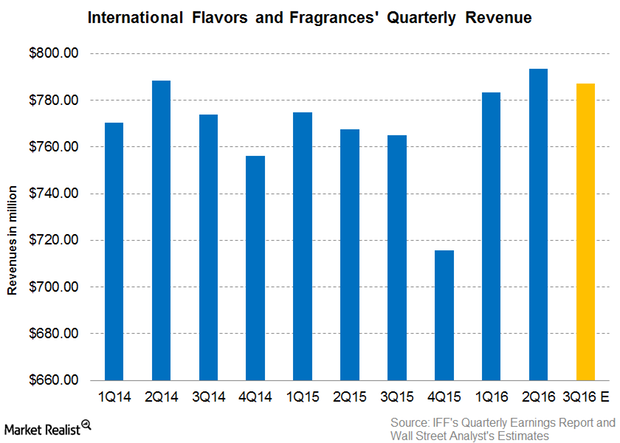

Can IFF Break the Jinx of the $700 Million Revenue Range?

Analysts are expecting International Flavors and Fragrances to post revenue of $787.20 in 3Q16, implying a 2.9% rise in its projected revenue on a year-over-year basis.

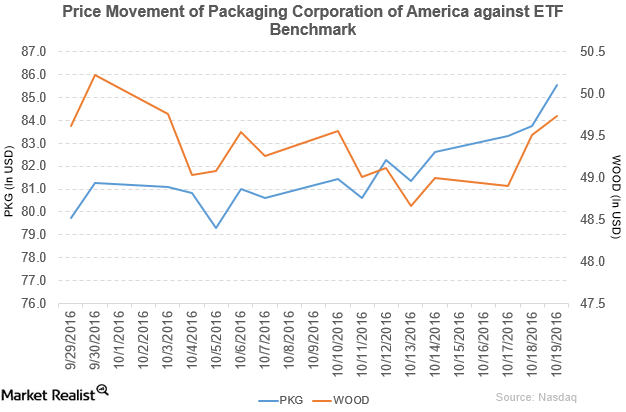

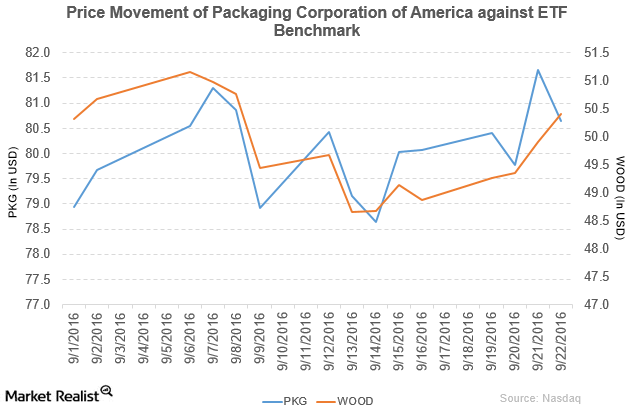

How Has Packaging Corporation of America Performed in 3Q16?

Price movement Packaging Corporation of America (PKG) has a market cap of $8.0 billion. It rose 2.1% to close at $85.54 per share on October 19, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 4.0%, 7.2%, and 39.3%, respectively, on the same day. PKG is trading 5.1% above its 20-day moving […]

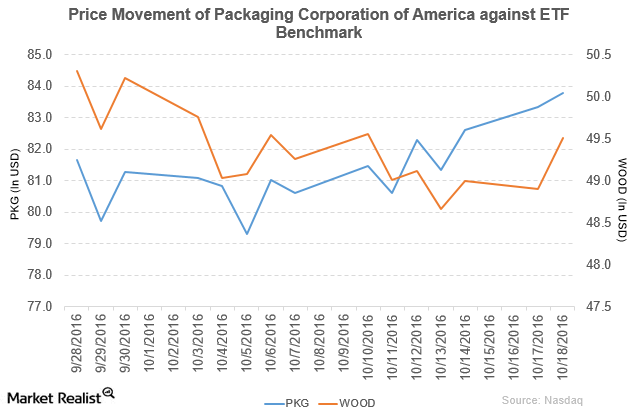

Bank of America Merrill Lynch Upgrades PKG to a ‘Buy’

Price movement Packaging Corporation of America (PKG) has a market cap of $7.8 billion. It rose 0.53% to close at $83.77 per share on October 18, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 3.9%, 4.2%, and 36.4%, respectively, on the same day. PKG is trading 3.2% above its 20-day moving […]

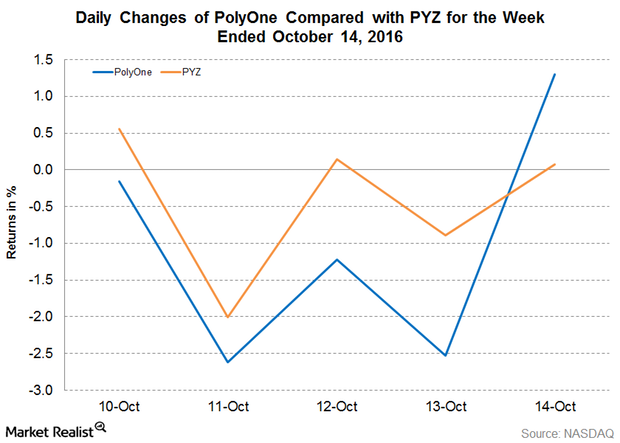

PolyOne Will Manufacture Specialty Materials in India

On October 12, 2016, PolyOne (POL) announced that it would produce specialty engineered materials at its existing facility in Pune, India.

Why Is Andrews & Springer Investigating Packaging Corporation of America?

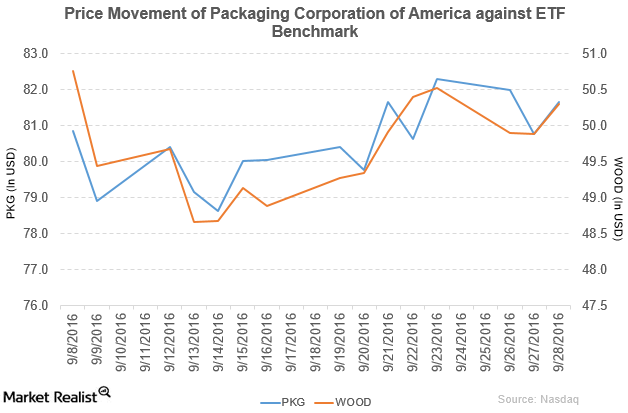

PKG rose 1.1% to close at $81.66 per share on September 28. Its weekly, monthly, and YTD price movements were 0.0%, 4.3%, and 32.9%.

Deutsche Bank Upgrades Packaging Corporation of America to a ‘Buy’

Price movement Packaging Corporation of America (PKG) has a market cap of $7.8 billion. It rose 2.1% to close at $82.29 per share on September 23, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 2.8%, 9.1%, and 34.0%, respectively, on the same day. PKG is trading 3.6% above its 20-day moving […]

Goldman Sachs Rated WestRock Company as ‘Neutral’

WestRock (WRK) reported fiscal 3Q16 net sales of $3.6 billion, a rise of 44.0% compared to net sales of $2.5 billion in fiscal 3Q15.

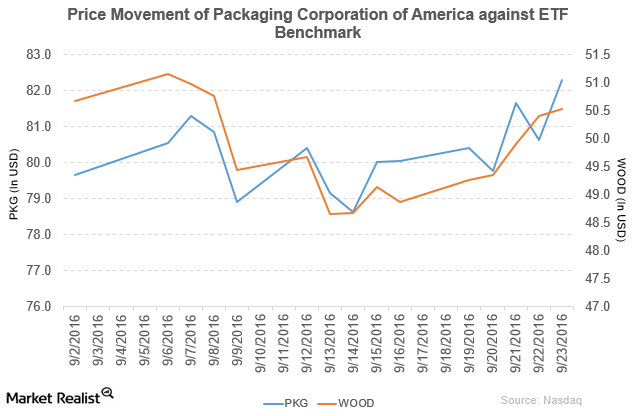

Goldman Sachs Rated Packaging Corporation of America as ‘Sell’

Packaging Corporation of America (PKG) has a market cap of $7.6 billion. It fell 1.3% to close at $80.64 per share on September 22, 2016.

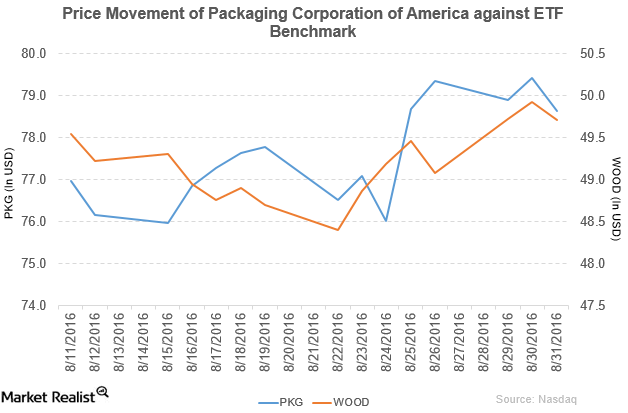

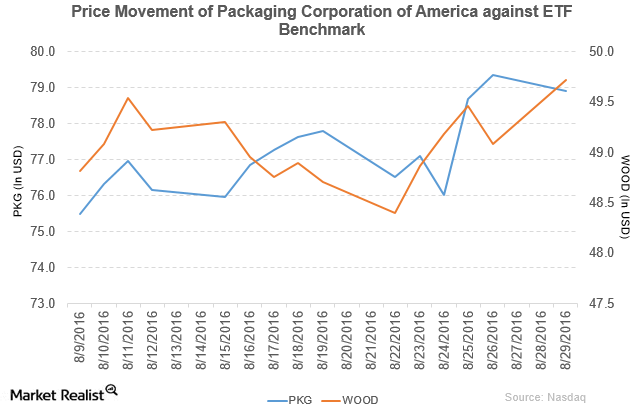

PKG Declares Dividend of $0.63 Per Share

Packaging Corporation of America (PKG) has a market cap of $7.4 billion. It fell by 0.99% to close at $78.63 per share on August 31, 2016.

Packaging Corporation of America Completes Acquisition of TimBar

Packaging Corporation of America (PKG) has a market cap of $7.4 billion. It fell by 0.57% to close at $78.91 per share on August 29, 2016.

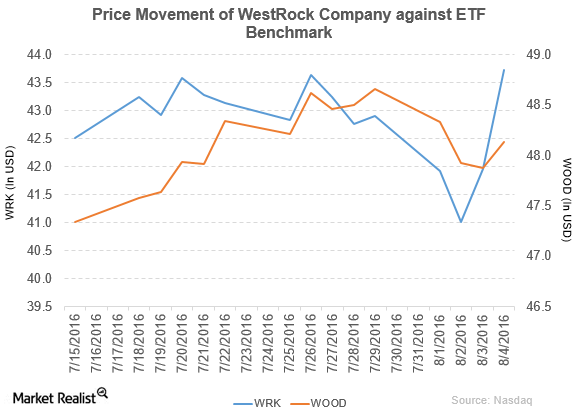

How Did WestRock’s 3Q16 Earnings Turn Out?

WestRock (WRK) has a market cap of $11.0 billion. It rose by 4.2% to close at $43.72 per share on August 4, 2016.

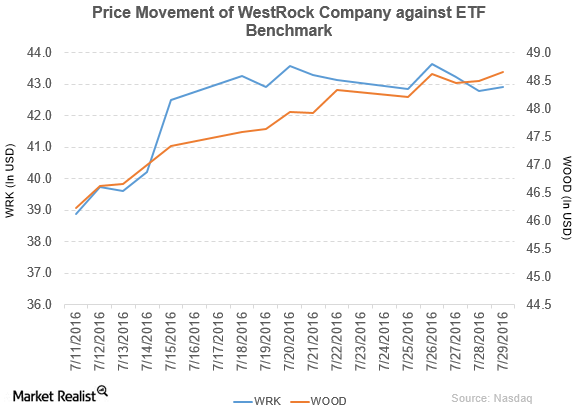

WestRock Declares a Dividend of $0.375 Per Share

WestRock Company (WRK) has a market capitalization of $10.9 billion. It rose by 0.33% to close at $42.91 per share on July 29, 2016.

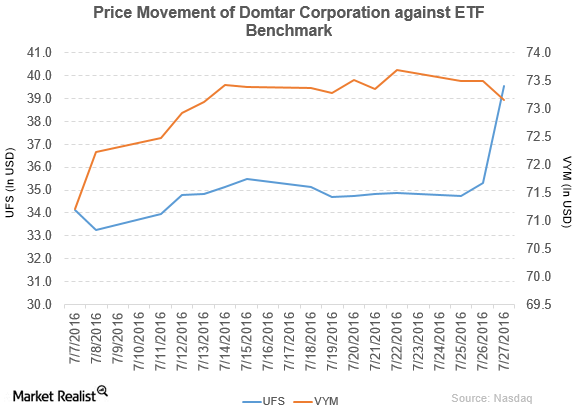

How Did Domtar Perform in 2Q16?

Domtar (UFS) has a market cap of $2.5 billion. It rose by 11.9% to close at $39.53 per share on July 27, 2016.

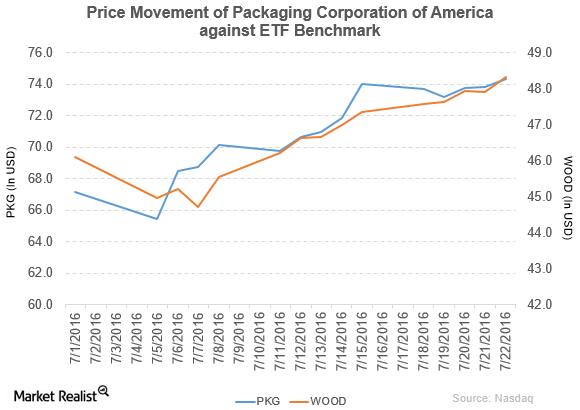

Deutsche Bank Downgrades Packaging Corporation of America

Packaging Corporation of America (PKG) has a market cap of $7.0 billion. It rose by 0.72% to close at $74.34 per share on July 22, 2016.

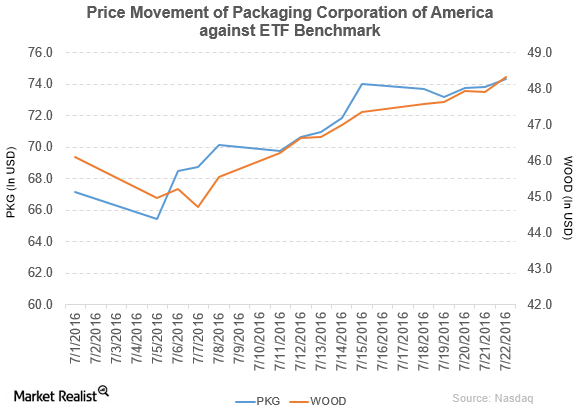

How Packaging Corporation of America Performed in 2Q16

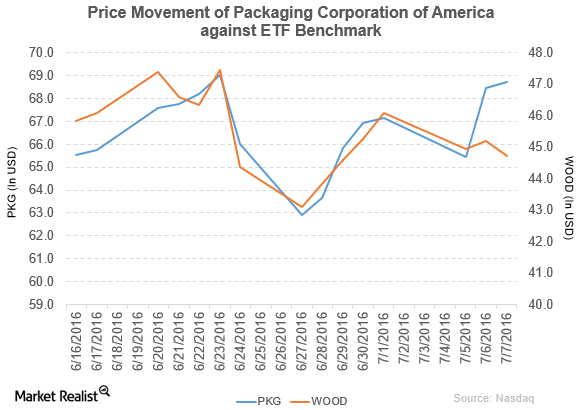

Packaging Corporation of America rose by 0.42% in the third week of July. Its weekly, monthly, and YTD price movements were 0.42%, 9.0%, and 20.1%.

Buckingham Research Downgrades Packaging Corporation of America to ‘Neutral’

Its net income and EPS (earnings per share) rose to $102.6 million and $1.09, respectively, in 1Q16, as compared to $89.6 million and $0.92, respectively, in 1Q15.

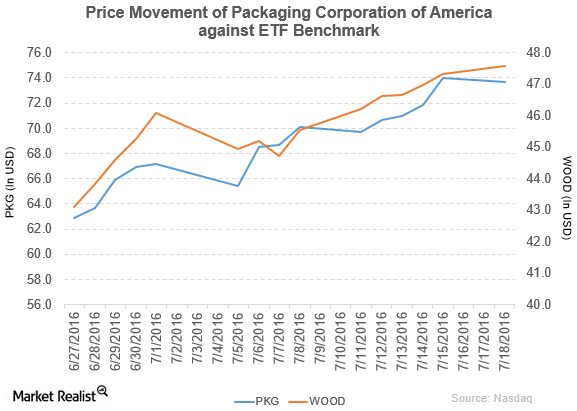

Moody’s Says PKG’s TimBar Acquisition Is Credit Positive

Packaging Corporation of America rose by 0.34% to close at $68.71 per share on July 7. Its weekly, monthly, and YTD movements were 4.3%, -2.6%, and 11.0%.