VanEck Vectors Gold Miners ETF

Latest VanEck Vectors Gold Miners ETF News and Updates

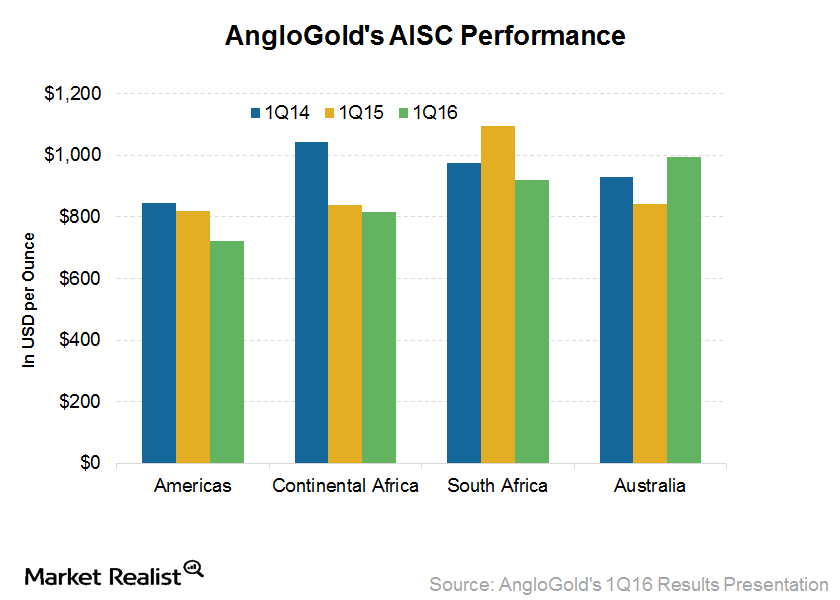

How Did AngloGold Reduce Its Costs despite Lower Production?

AngloGold Ashanti that for the last three years, its management’s focus has been on the widening of its margins on a sustainable basis.

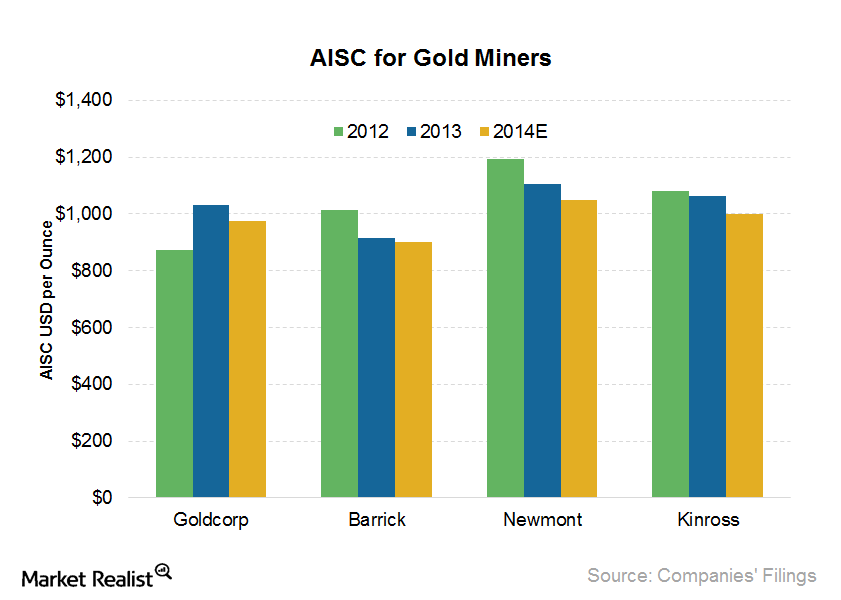

Goldcorp’s cost reduction compared to its peers

Goldcorp’s (GG) all-in sustaining costs (or AISC) are falling. In 2013, its AISC was $1,031 per ounce. It expects the AISC to be in the range of $950–$1,000 for 2014.

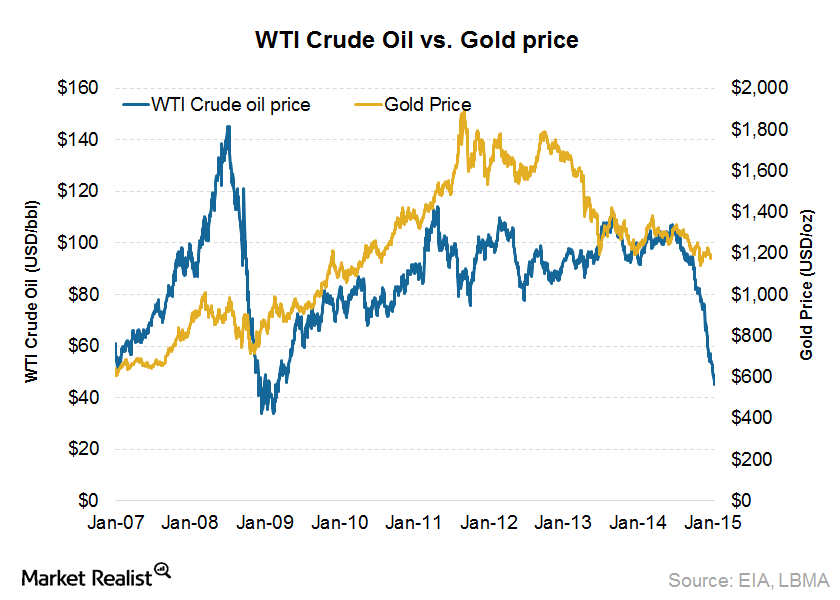

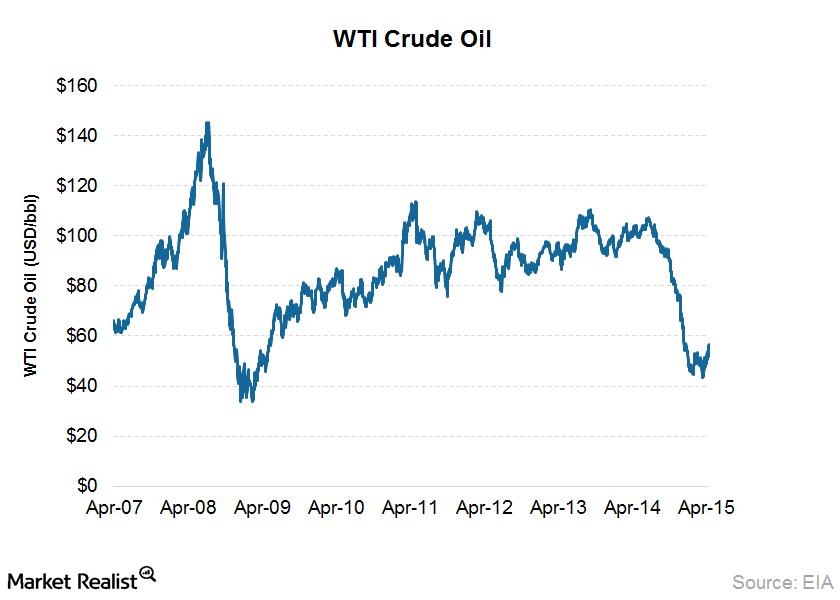

Low crude oil prices impact gold

Cheaper oil means lower inflation. This means gold should be affected negatively since it’s usually considered a hedge against inflation.

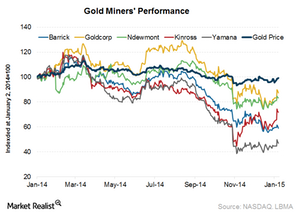

Assessing variables that drive the outlook for gold prices

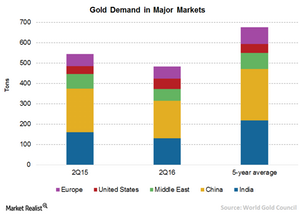

Physical buying from China and India should support the demand for gold. But a rate hike by the Fed could be the catalyst that could take gold down.

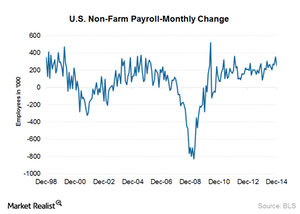

How US labor conditions impact gold investors

It’s important to keep an eye on labor conditions since they offer a look at the future direction of gold prices and ultimately gold-backed ETFs.Materials Lagunas Norte: Increasing Barrick’s cost per unit

Lower ore grade increases the amount of waste stripping required—in order to extract some volume of ore—as a result of mining more tons of waste.

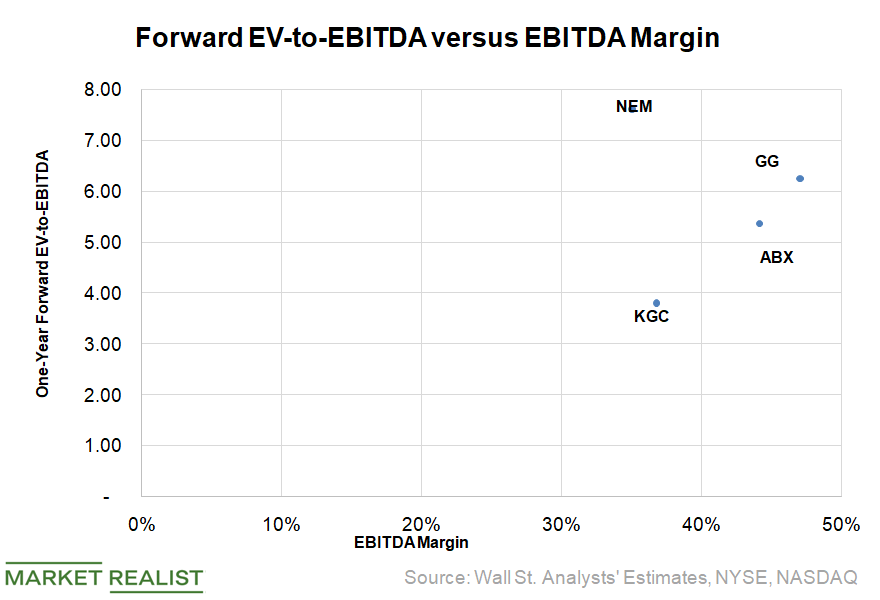

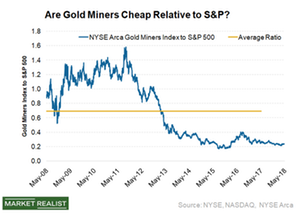

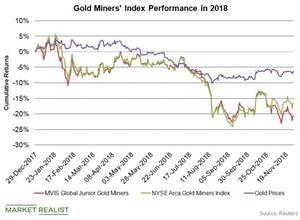

Which Gold Miners Could Offer Valuation Upsides after Q2 2018?

The average ratio of the NYSE Arca Gold Miners Index and the S&P 500 Index (SPY) is 0.18 compared to the ten-year average of 0.68.Materials Why an increase in real interest rates makes gold lose its sheen

Gold doesn’t give any returns besides appreciation. Appreciation doesn’t always happen. As a result, gold has to compete against assets that yield something. When the return on the alternate assets begins to rise, the demand for gold falls. In a scenario where the real interest rates are rising continuously, the demand for gold—as an investment—will start falling.

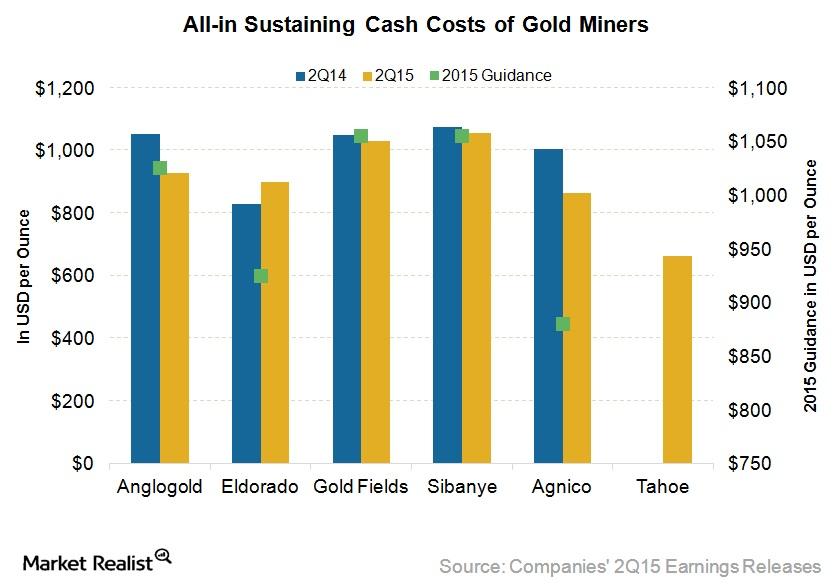

Which Intermediate Gold Miners Have Cost Advantages in 2H15?

All-in sustaining costs make up a comprehensive and important cost metric for gold mining companies. A lower AISC is better for gold miners.

Which Gold Stocks Do Analysts Love and Hate?

Gold price’s reversal this year has created opportunities in gold stocks. The SPDR Gold Shares ETF (GLD) had gained 11% year-to-date as of Friday.

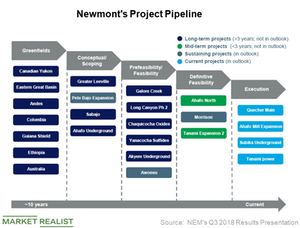

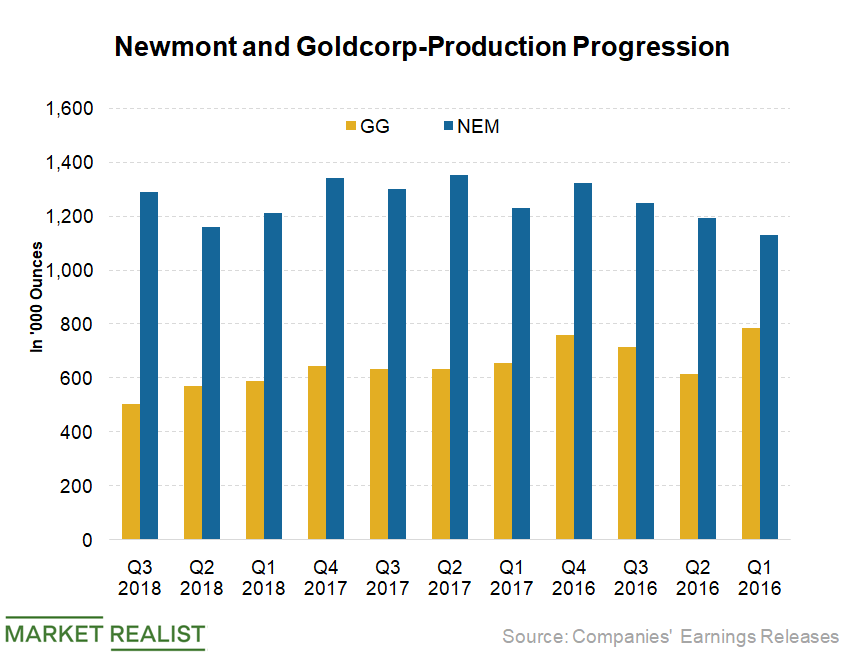

Newmont’s Project Pipeline Remains Strong: What’s the Upside?

Newmont Mining is poised to overtake Barrick Gold as the world’s largest gold producer in 2018.

How Silver Prices Are Influencing Major Silver Miners

Mining companies like First Majestic Silver (AG), Silver Wheaton (SLW), Pan American Silver (PASS), Coeur Mining (CDE), and Hecla Mining (HL) are primarily into silver exploration.

Can Management Changes Break Gold’s Price Ceiling?

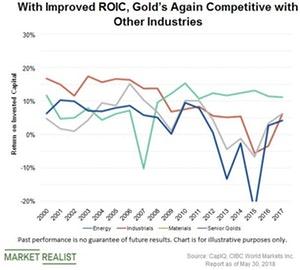

The gold mining industry is on a track to reverse its traditional method of mining to generate better shareholder returns.Materials Must-know: Why US debt to GDP and gold price move together

Debt to gross domestic product (or GDP) is the ratio that shows how much a country owes versus how much it earns. Investors use this ratio to measure a country’s ability to make future payments on its debt. This impacts the country’s borrowing costs and government bond yields.

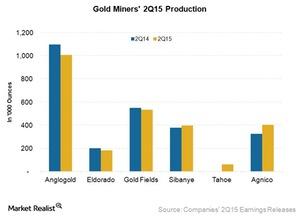

Evaluating Gold Production for Intermediate Gold Miners in 2Q15

Gold production is an important metric for gold miners, because miners generally try to increase gold production in order to reduce costs amid low prices.

Platinum Touched Its Six-and-a-Half-Year Low in 2015

As automobile catalysts comprise ~44% of the demand for platinum, the Volkswagen scandal curbed the demand for diesel-fueled cars that use platinum as a catalyst. This pulled down the already depressed platinum and comparatively strengthened palladium.

Gold Prices Soar: Which Stocks Do Analysts Favor?

Kirkland Lake is first among analysts’ favorite gold stocks with 91% “buy” and 9% “hold” ratings. The target price implies a potential upside of 16%.

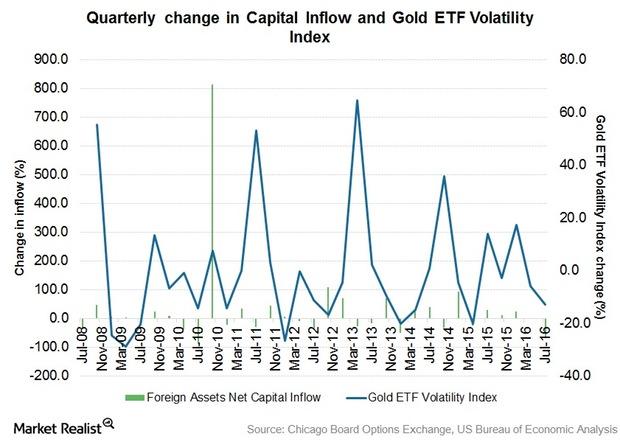

Why Are Gold ETFs Losing Their Allure?

With declining gold prices, the most famous gold ETF, the SPDR Gold Shares ETF (GLD), has also lost its allure. It’s trading at lower volume.

Foreign Exchange and Fuel Tailwinds Could Help Newmont in 1Q15

Investors should watch out for any tailwinds or headwinds that could impact Newmont’s costs in 1Q15.

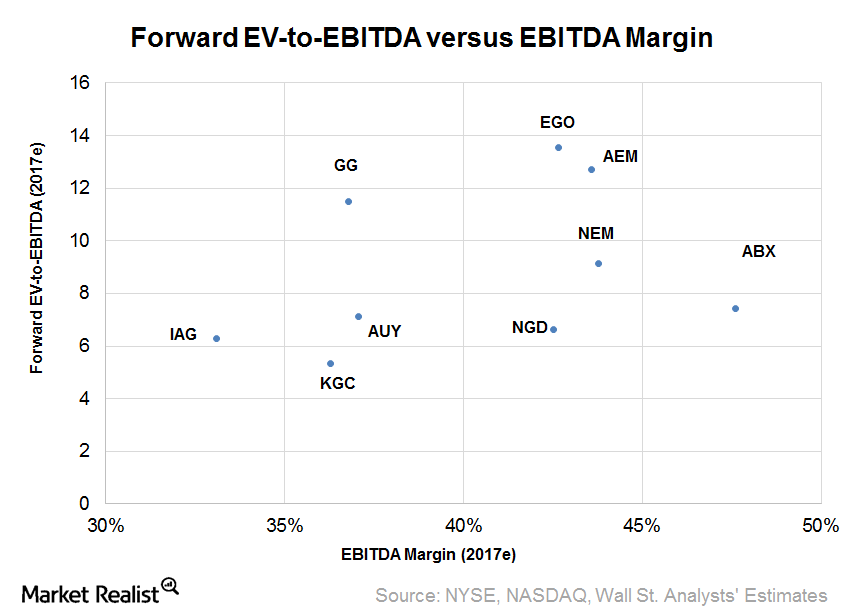

Valuations in Gold: Where’s the Upside among Miners Today?

Among senior gold miners, Goldcorp is trading at the highest multiple of 10.3x—a premium of 31% compared to the peer average.

Which Gold Miners Are Ray Dalio and John Paulson Betting On?

Hedge funds increased their net positions in the SPDR Gold Shares ETF during the first quarter.

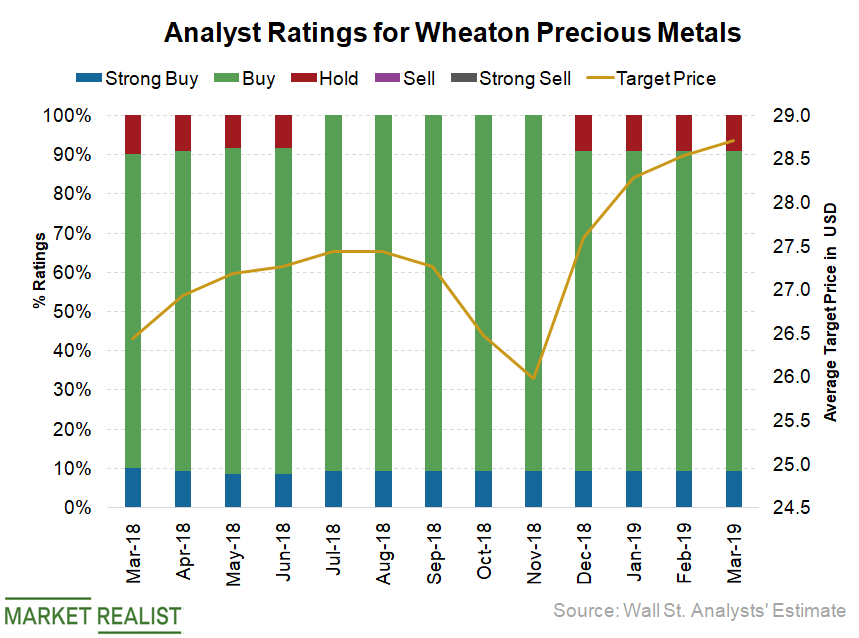

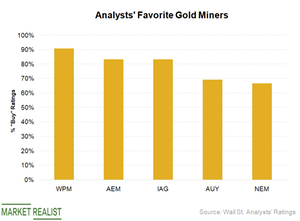

Why Wheaton Precious Metals Is Still Analysts’ Top Gold Bet

Among major gold (GLD)(IAU) mining and gold streaming companies (GOAU), Wheaton Precious Metals (WPM) is analysts’ favorite and has received the most “buy” recommendations at 91%.

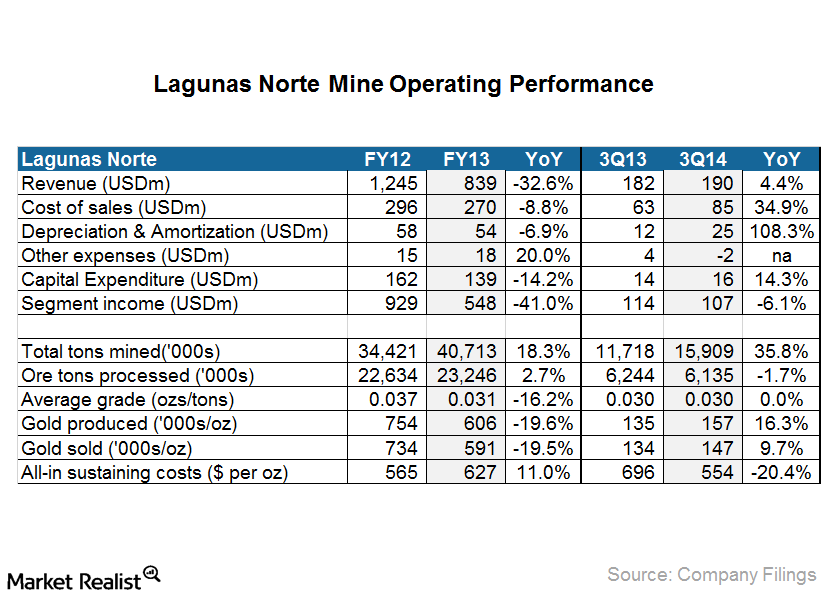

Lagunas Norte: AISC down due to lower sustaining capex

All-in sustaining costs (or AISC) came in at $554 per ounce, a reduction of $142 per ounce from the same period last year. The reduction was mainly due to lower sustaining capital expenditure (or capex).

Must Know: An Overview of Kinross Gold Corp.

In this series, we’ll analyze the various business aspects of Kinross Gold. We’ll also look at various key drivers that impact Kinross’s investors.Materials Why gold and the US dollar have an inverse relationship

Gold and the U.S. dollar were associated when the gold standard was being used. During this time, the value of a unit of currency was tied to the specific amount of gold. The gold standard was used from 1900 to 1971. The separation was made in 1971. The U.S. dollar and gold were freed. They could be valued based on supply and demand.

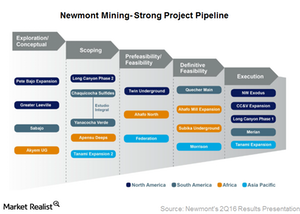

Newmont’s Project Pipeline: On Track and On Budget

Newmont Mining (NEM) has five projects in final stages, all of which will start production either this year or next.

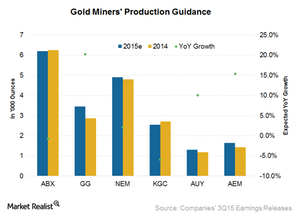

As Good as Gold: Analyzing Gold Miners’ Production Growth

In 3Q15, Goldcorp (GG) posted record gold production of 922,200 ounces—2% growth quarter-over-quarter and 42% growth year-over-year.

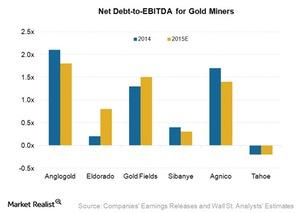

Net Debt-to-EBITDA Expectations for Intermediate Gold Miners in 2015

In 2015, the average net debt-to-EBITDA ratio of the six intermediate gold miners we’ve been evaluating in this series is 0.9x—a similar level to 2014.

An Overview of Gold Miner Performance in 2015

Gold miners’ stocks have underperformed most of the market indices and gold itself. GDX has significantly underperformed GLD since 2008.

Why Gold ETFs See Robust Net Inflows against Actively Managed Gold Funds

One of the dominant financial trends of the past decade has been a move by investors out of actively managed funds and into passively managed index funds or exchange traded funds (ETFs).

The Re-Emergence of Seasonal Gold Demand Trends

With selling pressure removed, normal gold demand trends may re-emerge Historically, there is a seasonal pattern to gold prices dependent on physical demand trends. Often, there is weakness in the summer when jewelry demand, primarily from China and India, is low and trading volumes decline. Seasonal strength often occurs from August to January, beginning with […]

How Gold Stocks Have Performed This Year

Gold and gold miners didn’t start off the year on a good note.

Goldman Sachs and Gundlach See Upside in Gold Prices

Gundlach is bullish on gold. He expects the metal to reach new highs. His bullishness for gold also stems from his bearishness for the US dollar.

Gold Prices: Undervaluation, Smart Money Piles Up

Since March, gold prices are on a tear due to uncertainty surrounding COVID-19. The SPDR Gold Shares has seen gains of 16.2% since March 18.

How Gold Mining Industry Has Revived Itself

The last ten years have been a roller coaster ride for the gold (GLD) (GDXJ) (GDX) mining industry.

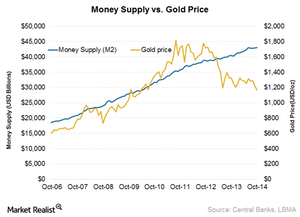

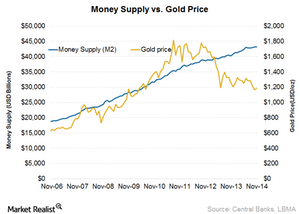

Price of gold relates to growth of global money supply

When money supply growth is used to prop up the financial and economic system instead of fuel strong economic growth, the price of gold relates to growth of the money supply.Financials GG’s merger and acquisition strategy is different than its peers

Although every gold miner talks about only doing merger and acquisition (or M&A) strategies that are in shareholders’ best interests, GG sticks to its strategy—unlike most of its peers.Materials Key things to look out for when you invest in junior gold stocks

The junior mining space is very risky, given very limited options in terms of mines and their involvement in early stages. So it’s very important to identify the right junior stock.

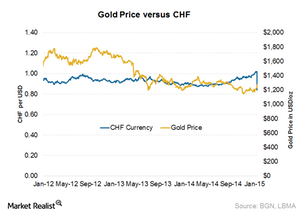

Why the Swiss National Bank removed the cap against the euro

A cap was put in place to stop the currency’s appreciation. An appreciating local currency is detrimental to exporters.

Global money supply and its link to gold

The gold price increase kept pace with the global money supply until recently. The relationship between the two appears to have broken.

China’s De-Dollarization amid Trade War: Gold’s Upside?

China continued buying gold for the tenth consecutive month in September. The country also continued its de-dollarization bid.

Trump, Trade War, Powell: More Upside for Gold Prices?

Gold hit a fresh six-year high on Friday as trade tensions between the US and China escalated. The SPDR Gold Shares ETF (GLD) closed up 2%.

What Synergies Does Newmont Expect from Merger with Goldcorp?

Increased shareholder returns were the main motivation behind the Newmont Mining and Goldcorp merger.

Why Jeffrey Gundlach Likes Gold

During DoubleLine’s investor webcast on June 13, Jeffrey Gundlach said, “I am certainly long gold.” His call on gold is based on his expectation that the US dollar (UUP) will finish lower this year.

The Five Gold Stocks Wall Street Is Loving Lately

Gold miners usually act as a leveraged play on gold prices. In 2018, the VanEck Vectors Gold Miners ETF (GDX) fell 9.3%, amplifying the 1.9% fall in gold prices (GLD).

Which Senior Gold Miners Are Analysts Loving Lately and Why?

In this series, we’ll consider recommendations, target prices, estimates, and potential upsides and downsides for senior gold miners.

How Do Gold Miners’ Leverage Ratios Look?

Barrick has reduced its debt more than 57% in the last four years from $13.4 billion at the end of 2014 to $5.7 billion at the end of 2018.

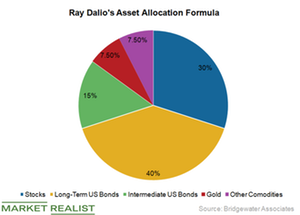

Buffett versus Dalio on Gold: Whose Advice Should You Take?

When it comes to investing in stocks, Berkshire Hathway’s (BRK.A) chair, Warren Buffett, and Bridgewater’s founder, Ray Dalio, have similar advice.

Can Newmont Mining Outperform Its Peers in 2019?

Newmont Mining (NEM) reported its fourth-quarter earnings results before the market opened on February 21.

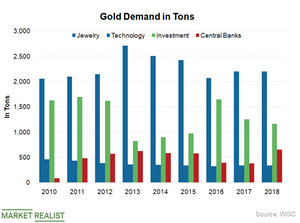

Central Banks Purchased the Most Gold in 50 Years in 2018

According to the gold demand trend released by the World Gold Council on January 31, annual gold demand increased by 4% in 2018.