VanEck Vectors Gold Miners ETF

Latest VanEck Vectors Gold Miners ETF News and Updates

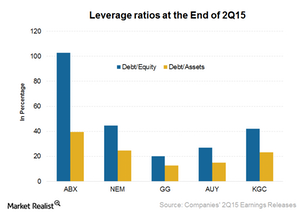

Comp: Analyzing the Financial Leverage for Gold Miners

Barrick Gold’s (ABX) financial leverage is among the highest in the industry. Barrick has a high debt-to-assets ratio of 40%.

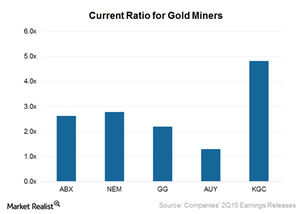

Comp: Importance of Looking at Gold Miners’ Liquidity Profile

In a weaker commodity price environment, a company’s short-term liquidity might come under more pressure. It could be forced to take drastic measures.

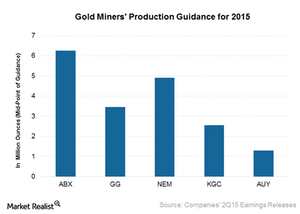

Comp: Which Gold Miners Expect Production Growth Going Forward?

Yamana Gold (AUY) expects higher gold production in the second half of the year compared to the first half of the year. It’s expected to be more than 15% higher.

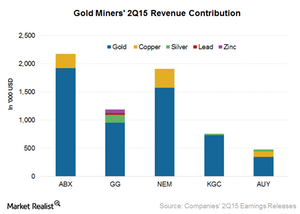

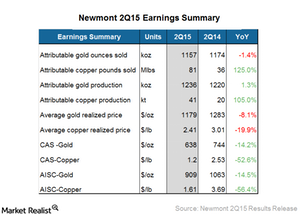

Comp: Do Gold Miners with an Exposure to Copper Face Downside?

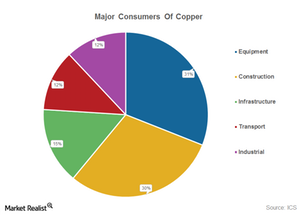

Newmont Mining (NEM) has exposure to gold and copper. In 2Q15, it generated 18% of its revenue from copper. The rest of its revenue was from gold sales.

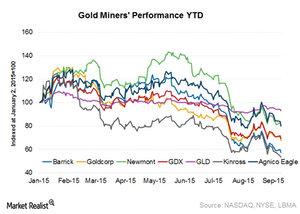

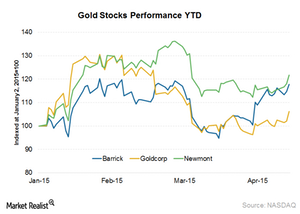

Comparative Analysis: How Have Gold Miners Performed This Year?

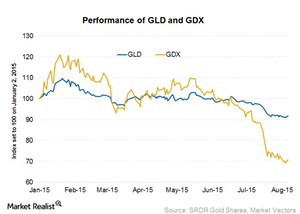

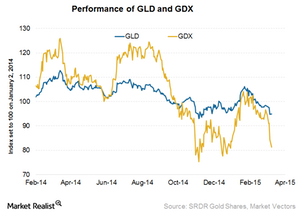

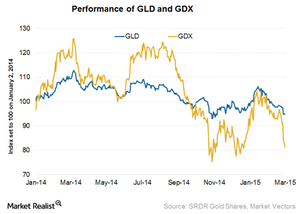

Gold prices, as tracked by the SPDR Gold Trust (GLD), have significantly outperformed the VanEck Vectors Gold Miners Index (GDX) since 2008.

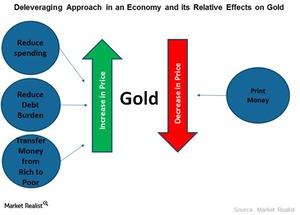

Reviewing an Economy and Its Effect on Gold Prices

Deleveraging can affect gold and other bullion prices, as well as exchange-traded funds such as the iShares Gold Trust ETF (IAU) and the iShares Silver Trust ETF (SLV).

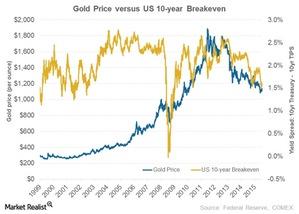

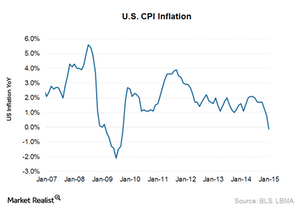

Inflation and Its Relationship to Gold Prices

Gold is a traditional hedge against inflation. Conditions that represent inflation include rising property prices, a rising stock market, and increasing asset values.

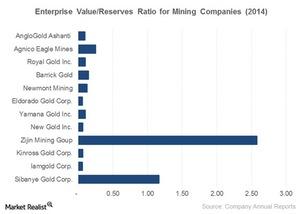

Analyzing the EV-to-Reserves Ratio for Tracking Miners

The EV-to-reserves ratio is good for the mining industry. “Enterprise value” reflects the company’s total value. “Reserves” refers to geologic reserves that the business owns.

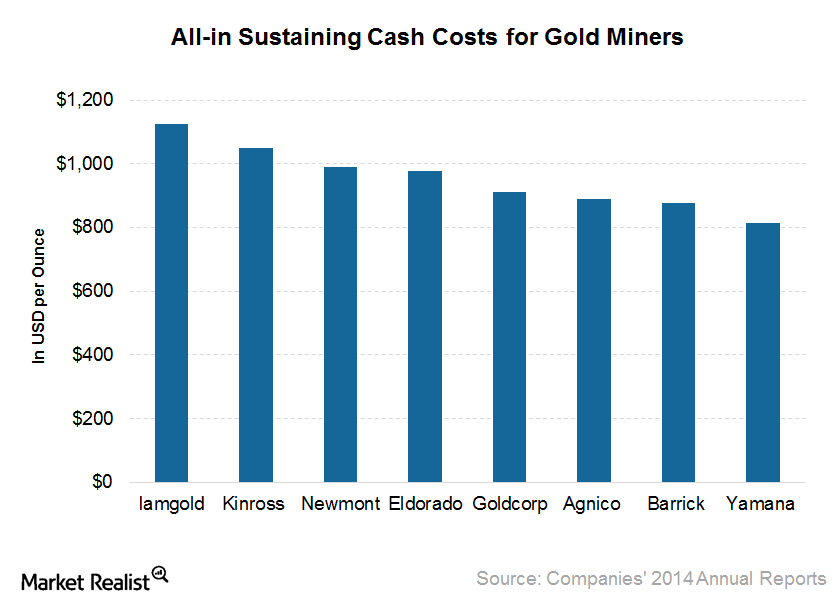

At What Cost Are Gold Miners Digging Out Gold This Year?

The average AISC for eight significant gold miners for 2015, as guided, is $950 per ounce compared to $900 per ounce for 1Q15.

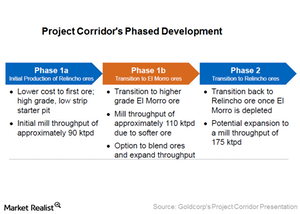

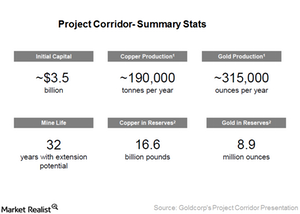

Goldcorp Forms Project Corridor Joint Venture with Teck Resources

The combined project will be a 50:50 joint venture between Goldcorp and Teck with the interim name of Project Corridor.

Goldcorp Acquires New Gold’s 30% Interest in the El Morro Project

On August 27, Goldcorp (GG) announced that it has entered into an agreement with New Gold (NGD) to acquire its 30% interest in the El Morro gold-copper project in Chile.

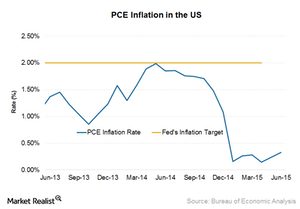

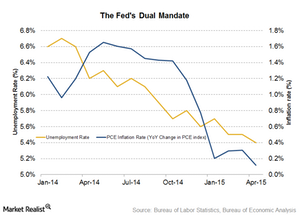

Inflation Rates: How They’re Related to Precious Metals

With the looming fears of inflation reaching its target 2% level, the Fed is likely waiting for assertions from the economy.

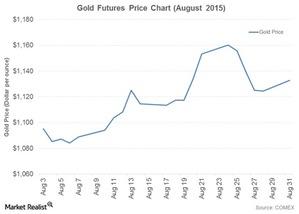

China’s Falling Stock Market Pushes Gold Upward

The turnaround from the direction that gold was headed during the last month has also supported silver prices. Silver fell marginally by 0.68% last month.

Gold Is Resilient to the Fed’s Likely Questionable Liftoff Move

With the confusing reviews from the Fed on Wednesday, gold on COMEX rose 2.20% on August 20 and closed at $1,153.20 per ounce. Silver for September expiry also rose.

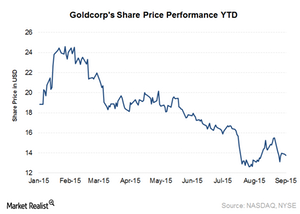

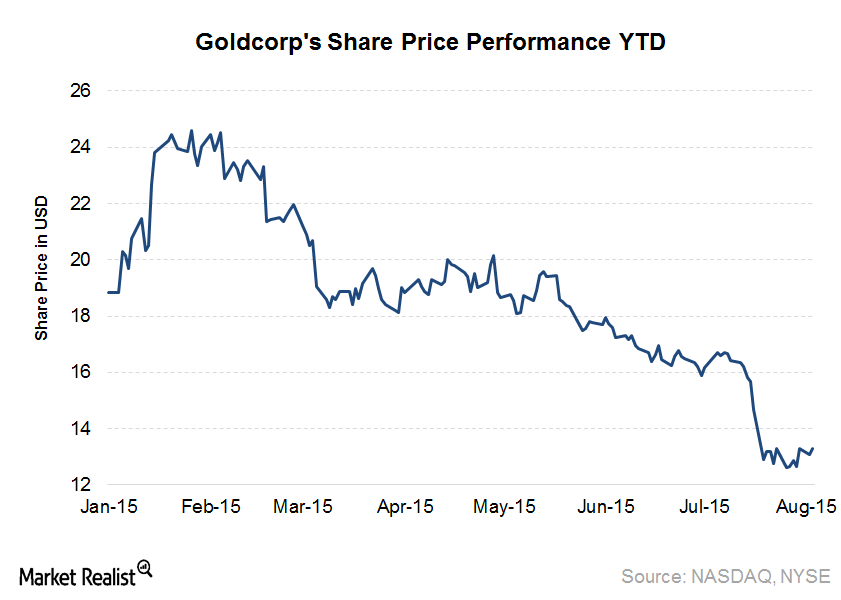

Is the Market Excited about Goldcorp’s Recent Moves?

Goldcorp (GG) announced on August 27 that it has bought the remaining 30% stake of El Morro from New Gold (NGD).

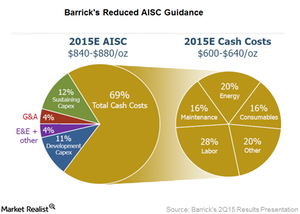

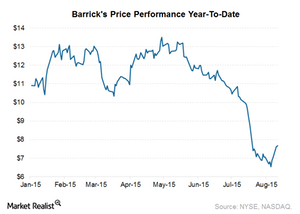

Current Gold Prices Push Barrick Gold to Go for a Leaner Look

Barrick Gold (ABX) is focused on reducing operating expenses. The company’s all-in sustaining costs to produce gold in 2Q15 totaled $895 per ounce. In 1Q15, costs came in at $927 per ounce.

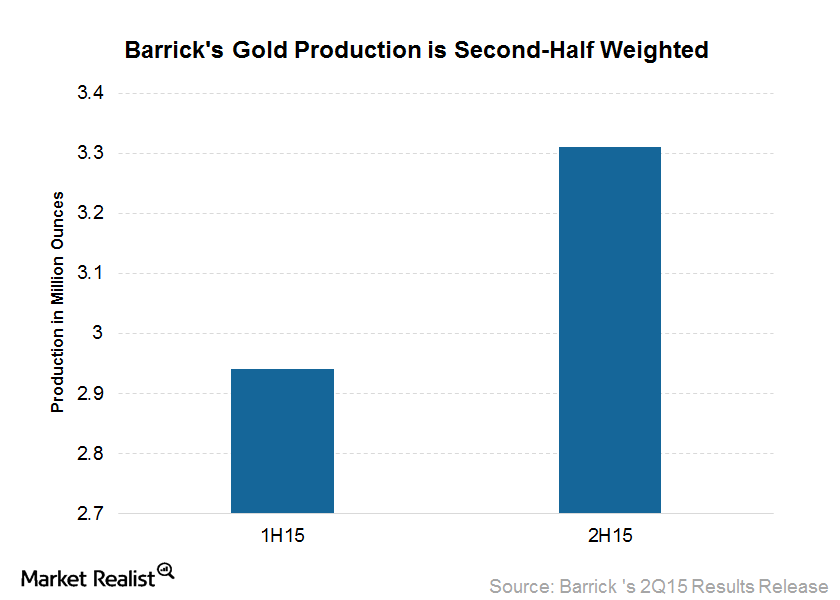

Barrick Gold Weights 2015 Production toward the 2nd Half

Barrick has reduced its 2015 gold production guidance to 6.1 million to 6.4 million ounces from 6.2 million to 6.6 million ounces.

Investors Are Excited about Barrick Gold’s 2Q15 Results, but Why?

In this series, we’ll analyze Barrick Gold’s 2Q15 results. Barrick stock reacted positively to its earnings report, its improved cost guidance, and its progress toward reducing its debt.

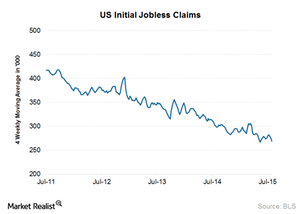

US Employment Report: Will It Keep the Hopes of a Rate Hike Going?

Since the current set of data were better than the market expectations, the market’s hopes for a September rate hike are still on.

Could PCE Inflation Inspire Action at the Next Fed Meeting?

The BEA released the PCE inflation index for June on August 3, 2015. PCE inflation rose 0.30%—a pace that hasn’t been seen since December 2014.

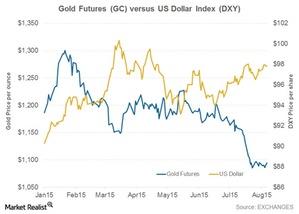

Key Indicators Are Pointing to Gold Prices

Gold prices have been steadily falling since the last week of June. As of August 11, gold prices (GLD) have fallen by 4.40% in a month.

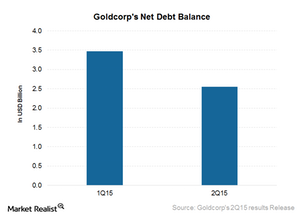

Goldcorp’s FCF Growth Could Strengthen Its Balance Sheet

Goldcorp has the strongest balance sheet in its peer group. Goldcorp’s liquidity is also comfortable at $3.2 billion, including $940 million in cash and cash equivalents.

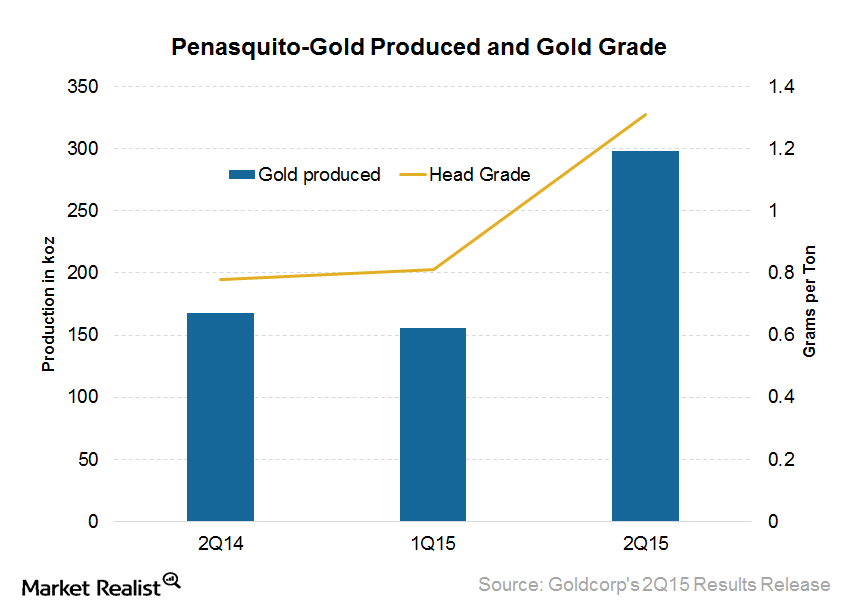

Peñasquito Helps Achieve Record Quarterly Production for Goldcorp

The Peñasquito mine contains gold, silver, lead, and zinc. It achieved its first commercial production in 2010, on schedule and on budget.

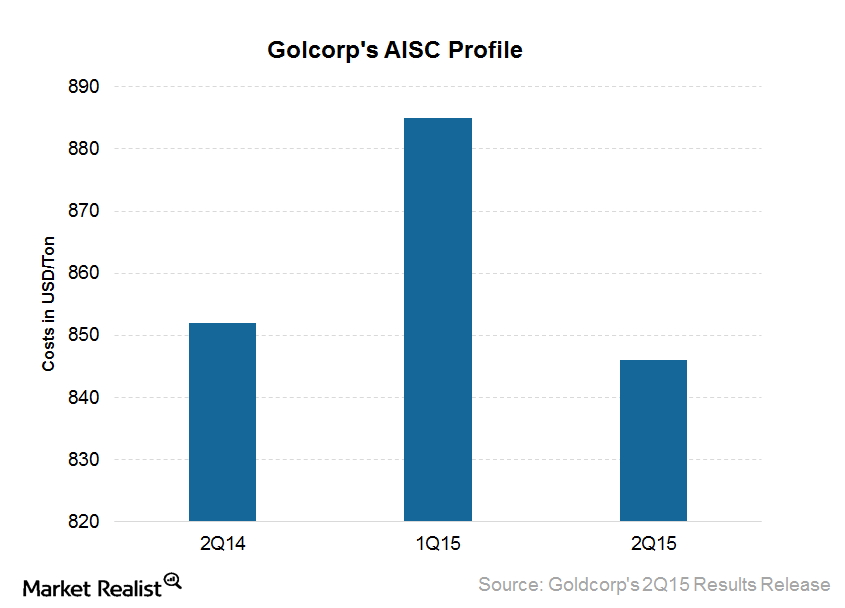

Improved Cost Outlook Bodes Well for Goldcorp’s Future

Goldcorp reported a strong reduction in all-in sustaining costs (or AISC) for 2Q15. AISC came in at $846 per ounce, compared with $885 per ounce in 1Q15 and $852 in 2Q14.

Do Falling Gold Prices Mean More Mergers Are in the Cards?

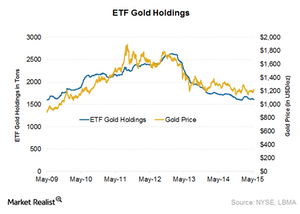

Gold touched its lowest level on July 24. Its price fell to $1,073.70. Miner ETFs have suffered more than gold prices themselves.

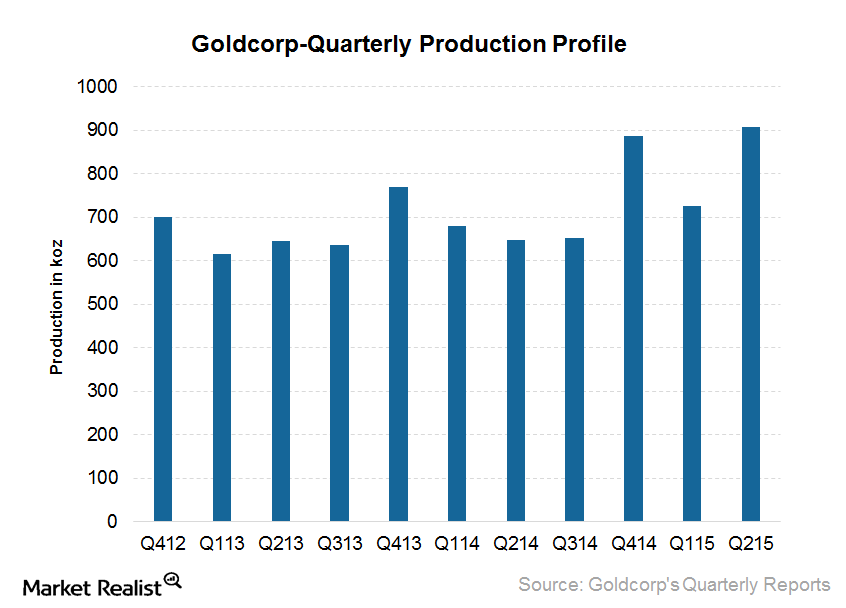

Goldcorp’s Production Growth Starts to Deliver in 2Q15

In 2Q15, Goldcorp achieved record gold production of 908,000 ounces. The Peñasquito mine in Mexico posted a record 298,000 ounces—33% of total gold production.

How Goldcorp Beat Estimates in Its 2Q15 Earnings

Goldcorp announced its 2Q15 results on July 30. The company’s gold production showed very strong growth at 25.3% quarter-over-quarter.

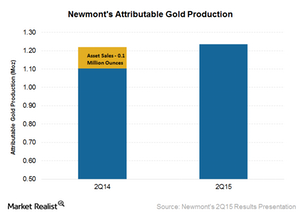

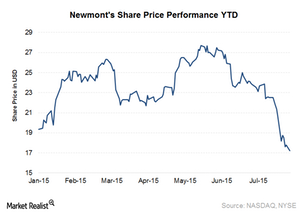

Newmont Reports Strong Gold Production in 2Q15

Newmont Mining’s (NEM) attributable gold production for 2Q15 was 1.24 million ounces. This is higher by 0.2 million ounces compared to the same quarter last year.

Newmont Mining Reports Solid 2Q15 Results

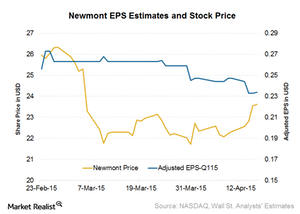

Newmont Mining (NEM) announced its 2Q15 results on July 22. It reported adjusted EPS of $0.26 and adjusted EBITDA of $692 million.

Key Highlights of Newmont’s 2Q15 Earnings

In its 2Q15 earnings release, Newmont Mining (NEM) reported net income attributable to shareholders of $131 million, or $0.26 per share. This compares to $101 million, or $0.20 per share, in 2Q14.

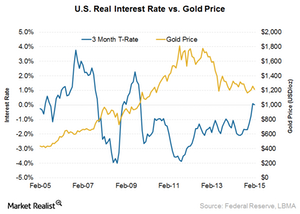

Rate Hike Expectations: How They Shape the Price of Gold

An interest rate hike by the Fed will lead to pressure on the price of gold. When alternative investments are attractive due to an increase in the interest rate, money flows from gold.

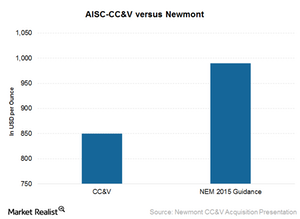

Newmont Mining’s Acquisition Makes Strategic Sense

The CC&V mine acquisition will help Newmont achieve a lower-cost profile. The mine’s cost attributable to sales and all-in sustaining costs are lower than Newmont’s current averages.

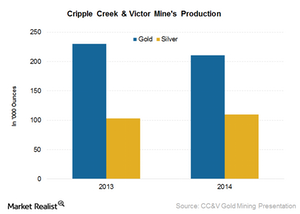

Newmont Mining Acquires Cripple Creek from AngloGold

The Cripple Creek & Victor mine is located near Colorado Springs, Colorado. It’s and open-pit mine that has been operational since 1995.

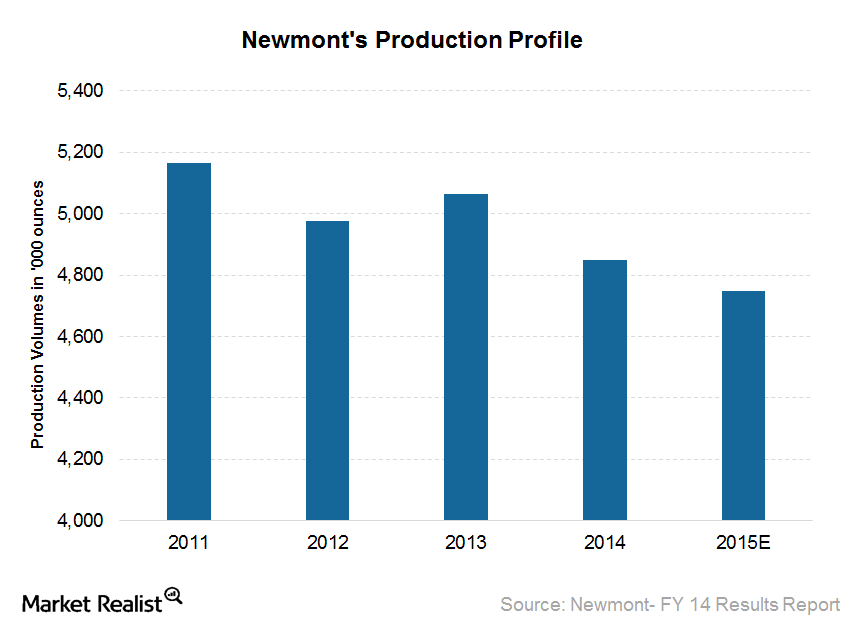

Newmont Mining Asset Optimization Efforts Encourage Analysts

Newmont Mining is the world’s second-largest gold producer. In this series, we’ll analyze various steps taken by Newmont toward asset optimization.

Gold ETF Holdings Fall to 4-Month Low Led by the SPDR Gold Trust

Gold ETF holdings reached a peak of 1,679.8 tons on February 24. In January and early February, gold holdings surged because of the Swiss National Bank’s decision to remove the euro cap.

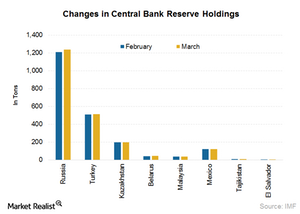

Russia on Gold Buying Spree, El Salvador Surprises with Sell-Off

After a break of two months, Russia resumed its gold buying spree in March, buying close to 30 tons of gold. Since 2005, Russia’s gold reserves have nearly tripled.

What Were Newmont’s Key Events Since Its Last Earnings Release?

Investors should be aware of two key events for Newmont Mining (NEM): the go ahead for Long Canyon Phase 1 and the renewal of the contract at Batu Hijau.

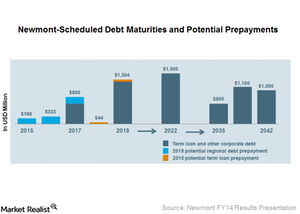

Key Updates Investors Should Look for in Newmont’s 1Q15 Results

Newmont stated during its 4Q14 earnings call that it is analyzing potential opportunities to pay its liabilities in advance.

What Are Market Expectations for Newmont in 1Q15?

Analysts’ sales estimate for Newmont is $1.93 billion for 1Q15 compared to $1.80 billion in 4Q14.

What Do Declining US Real Interest Rates Mean for Gold?

Gold is used as an investment alternative because investors perceive it as a way to protect money’s purchasing power.

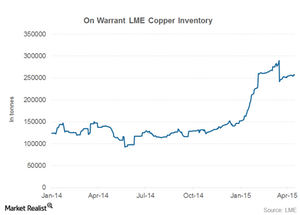

London Metal Exchange Copper Inventory Sees On-Warrant Stock Dip

A declining on-warrant copper inventory means that more metal is being booked for delivery. This is generally associated with stronger demand.

Newmont Will Release 1Q15 Results on April 24

Newmont Mining is the world’s second largest gold producer. It’s the only gold company included in the S&P 500 Index and Fortune 500.

Key Indicators Impacting Gold Price Performance

Gold prices are holding steady in April. The SPDR Gold Trust ETF traded at $115.43 on April 15, almost flat when compared with April 1’s value of $115.60.

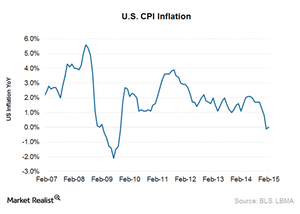

US CPI Inflation Sees Marginal Uptick in February

Gold usually has a direct relationship to inflation. Gold demand increases during periods of high inflation and falls when inflation is low.

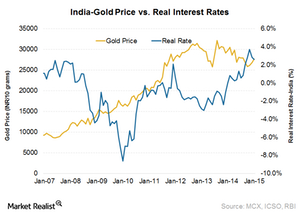

India’s rising real interest rate is negative for gold

India’s real interest rate has moved up rapidly in the last few months due to declining inflation.

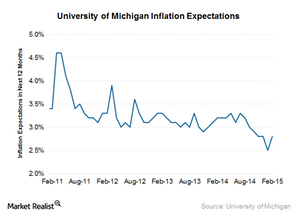

What do US inflation expectations mean?

In 2014, inflation expectations were 2.8% to 3.3%. In January 2015, expectations dropped to 2.5%, the lowest since September 2010.

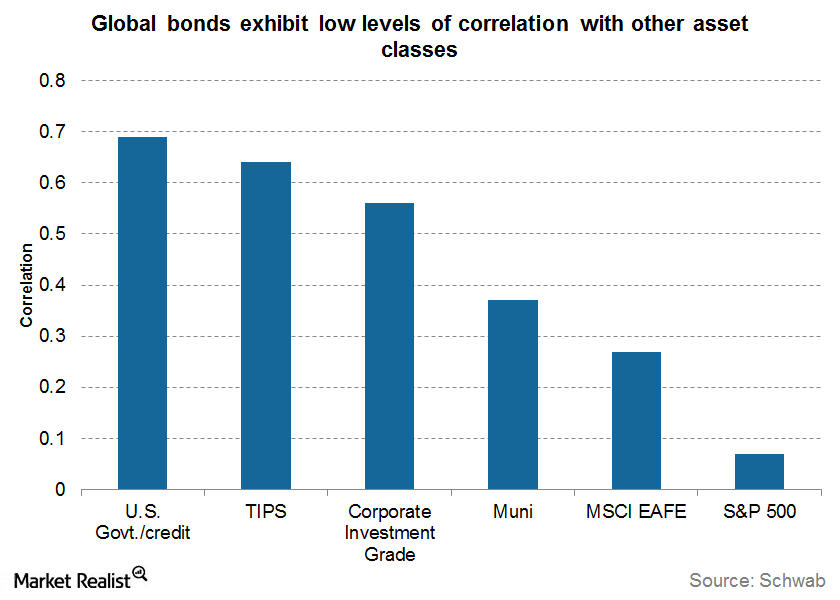

Cushion Volatility With Bonds

High yield bonds are becoming increasingly correlated with the S&P 500 and might increase your risk exposure instead of giving diversification benefits.

US inflation rate hits negative for the first time since 2009

The US Consumer Price Index reading for the month of January was -0.1%. This is the first negative US inflation reading since October 2009.

Why tracking gold indicators is important for investors

In this series, we’ll look at some gold indicators investors can track to get a sense of what direction the price of gold will take.

Must Know: Major Consumers Of Copper

Because of its excellent heat transfer capabilities, copper is also widely used in producing heat exchange equipment and other uses in extreme environments.