VanEck Vectors Gold Miners ETF

Latest VanEck Vectors Gold Miners ETF News and Updates

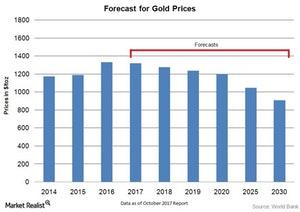

Gold’s Outlook for 2018

Looking ahead for 2018, industry analysts stated in a Bloomberg article that they expect gold to perform better early in the year led, by the “January effect.”

How Mining Stocks Have Performed in January So Far

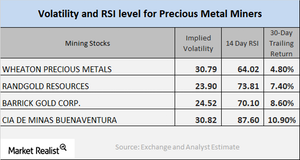

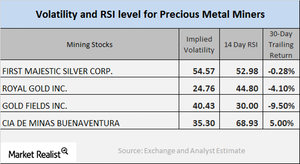

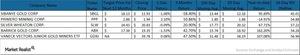

SLW, GOLD, ABX, and BVN have call implied volatilities of 30.8%, 23.9%, 24.5%, and 30.8%, respectively.

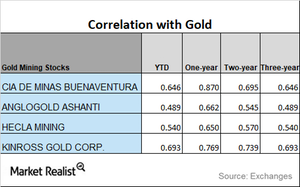

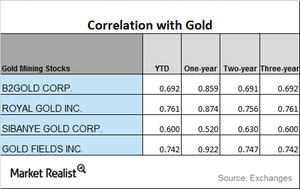

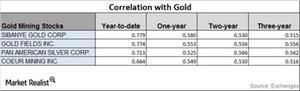

The Correlation Trends of Miners in 2017

If we look at the YTD correlations of the select mining shares to gold, there has been a reasonable fall. On a YTD basis, Sibanye Gold has the least correlation to gold.

How Turbulence in the Market Has Moved Precious Metals

Often, gold, silver, platinum, and palladium react to the overall risk in the market.

A Correlation Study of Miners in December 2017

If we look at the YTD (year-to-date) correlations of the select mining shares to gold, there has been a reasonable fall.

The Tax Reform Bill’s Impact on Precious Metals

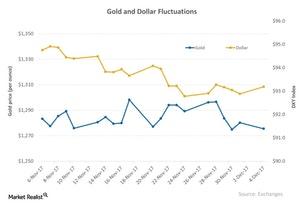

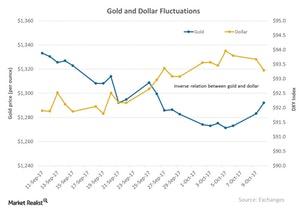

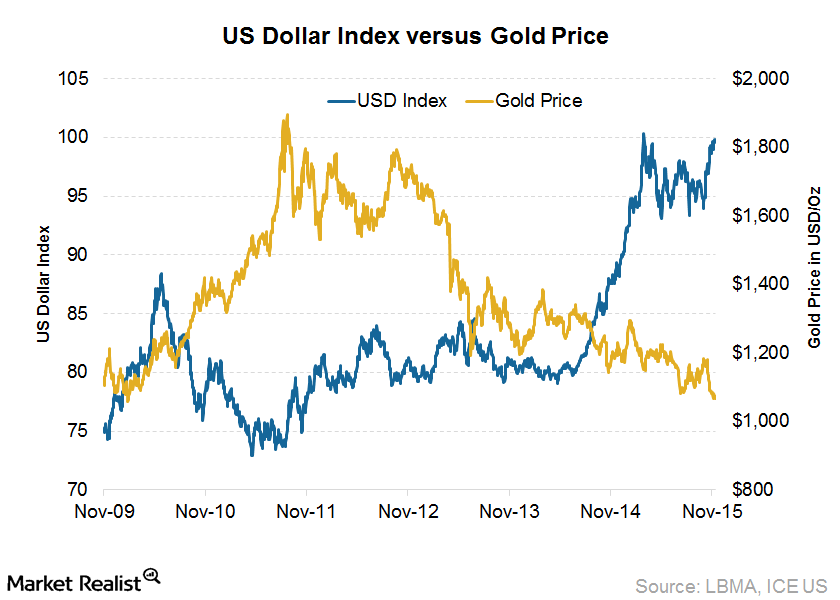

All four precious metals saw a down day on Monday, December 4, 2017, after the US dollar, in which the four metals are priced, rose $0.39%, propelled by the Senate passing its tax reform bill.

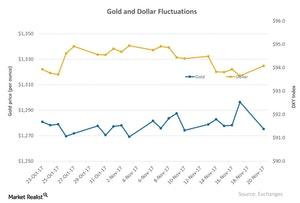

How the Higher Dollar Has Affected Precious Metals

Precious metal slump All four precious metals saw a down day on Monday, November 20. Gold fell 1.6% to $1,275.30 per ounce, after touching a one-month high on Friday, November 17. The fall in precious metals was most likely due to the rise in the US dollar. The US Dollar Index rose 0.45% on Monday. Gold, silver, platinum, […]

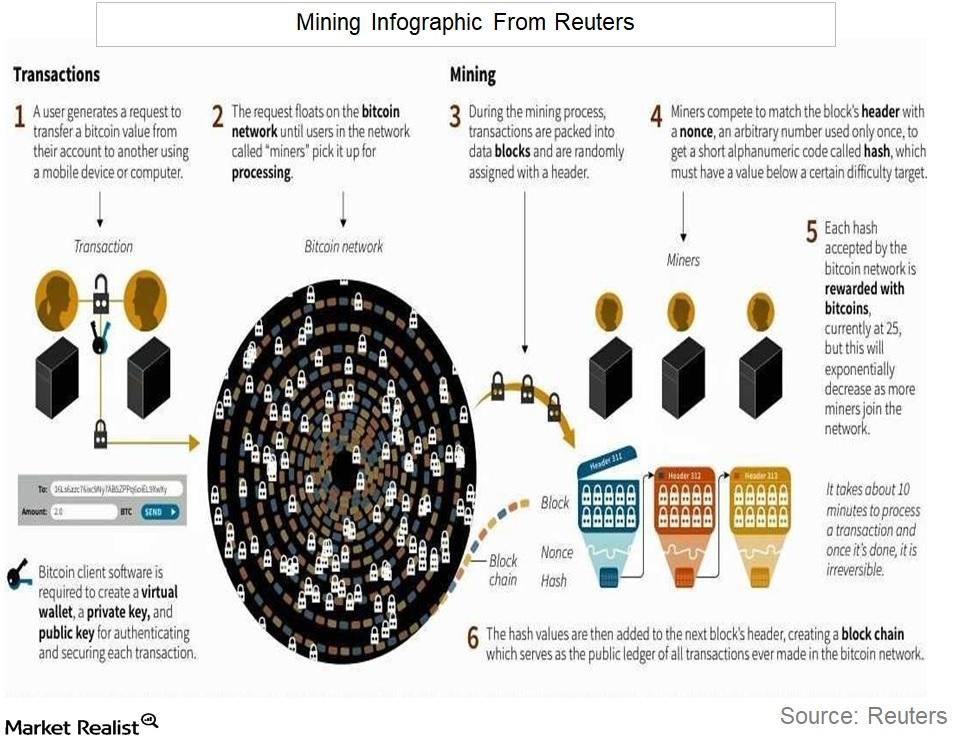

How Bitcoins Are Created Today

In the bitcoin world, mining involves investing a lot of capital in computer hardware and competing with fellow miners to solve a complex mathematical problem.

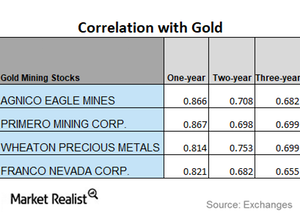

Mining Stocks: Analyzing Correlation Trends

Mining stocks’ performance usually depends on precious metals’ performance. However, the two can deviate. Correlation analysis can give investors some perspective on how mining stocks relate to gold and silver.

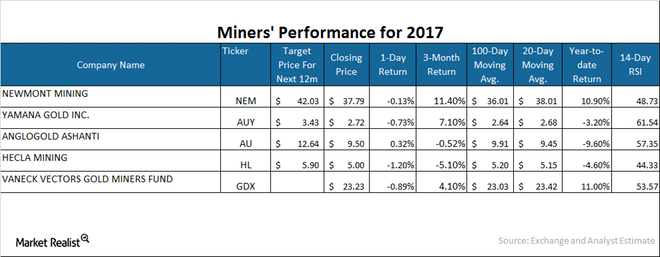

How Gold Companies Have Performed in 2017

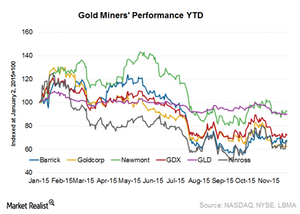

Gold stock indices also traded near their highs for the year, but then followed the gold price lower. During September the NYSE Arca Gold Miners Index (GDMNTR) retreated 6.5%.

A Look at the Correlation Trends for Miners

Franco-Nevada and Silver Wheaton have seen an upward trend in their correlations with gold.

A Brief Correlation Study of Mining Stocks as of October 23

The iShares MSCI Global Gold Min (RING) and the VanEck Vectors Gold Miners (GDX) have fallen 1.3% and 1.4%, respectively, on a five-day-trailing basis.

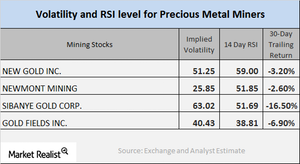

How Mining Stocks Are Reacting as of October 17

Despite the overall downturn among precious metals on Tuesday, October 17, precious metal mining stocks witnessed a mixed reaction that day.

Reading the Drop in Precious Metals on Monday, October 16

After the rise we saw on Friday, October 13, precious metals had a down day on Monday, October 16.

Relative Strength Index Indicators of Mining Shares in October

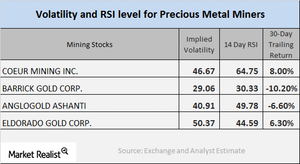

On October 11, 2017, Randgold Resources, Pan American Silver, Barrick Gold, and Kinross Gold had implied volatility readings of 25.0%, 34.0%, 29.1%, and 41.6%, respectively.

How Miners Correlate to Gold

Mining funds that have a strong relationship to precious metals are the Global X Silver Miners (SIL) and the VanEck Vectors Gold Miners (GDX).

How Mining Stocks Are Performing

The precious metals continued rising on Wednesday, and gold also witnessed a rebound.

Precious Metals and Companies That Mine Them

Precious metal miners got a boost on Tuesday, October 3, 2017, despite the marginal fall of precious metals.

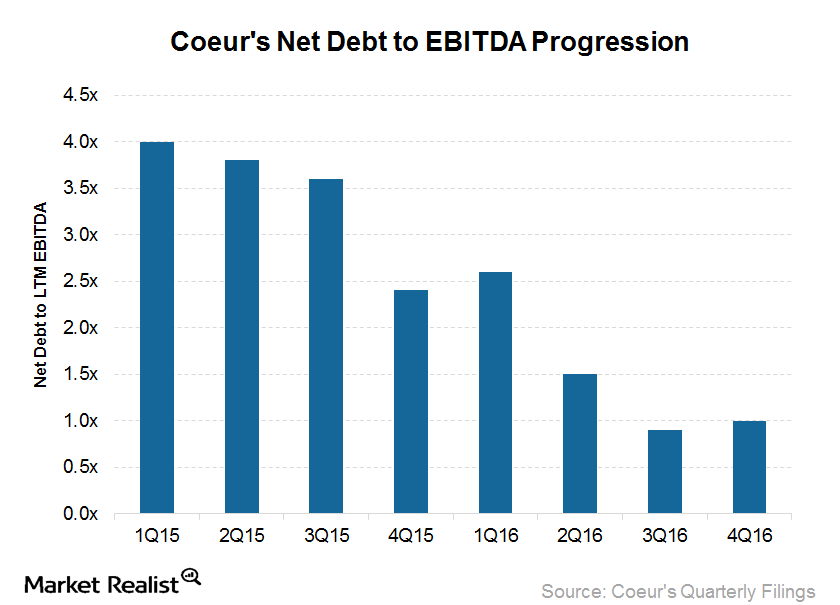

Coeur’s Financial Leverage Improves: A Word of Caution

Coeur Mining (CDE) ended 2016 with an outstanding debt of $210.9 million. That’s 57.0% less than at the end of 2015.

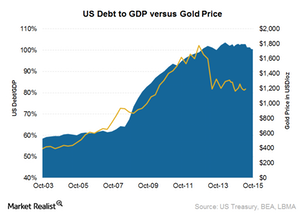

How Big Is the US Debt Compared to Other Nations?

Japan leads the nations with its rising debt-to-GDP ratio. The United States is in seventh place.

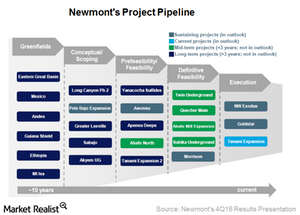

Newmont Mining: How’s the Project Pipeline Looking?

Newmont Mining (NEM) approved funding for its Northwest Exodus project in June 2016, and the project is now under construction.

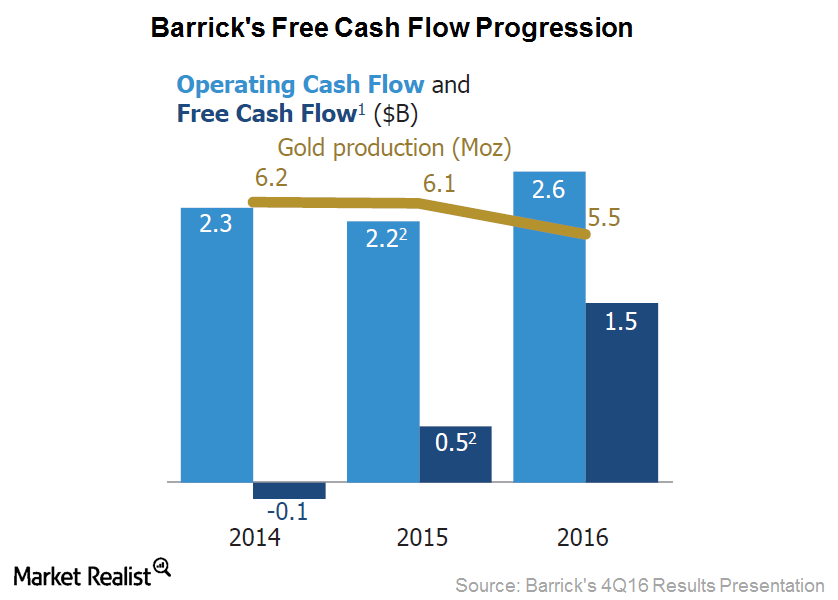

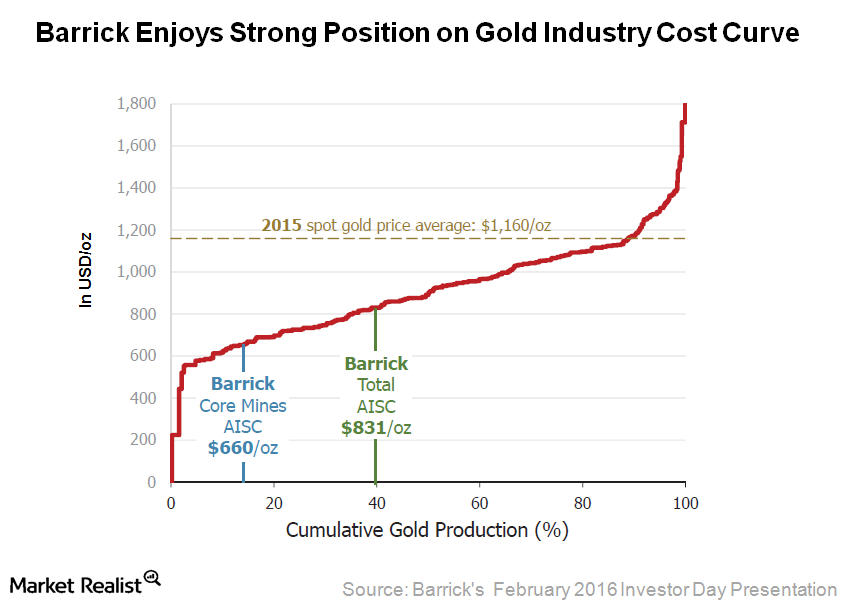

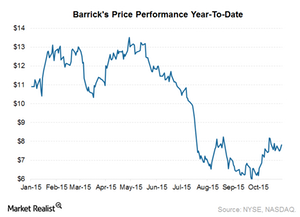

This Is Barrick Gold’s Focus: To Improve Free Cash Flow

Barrick Gold’s (ABX) management has defined value creation for shareholders in terms of FCF (free cash flow) per share.

How Miners’ Correlations Are Moving

Precious metals prices have risen from the ten-month lows they saw in December 2016. As a result, most mining stocks have also risen substantially.

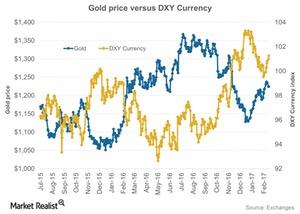

Why Gold and the US Dollar Are Moving in Opposite Directions

Gold prices tumbled on Tuesday, February 14, as the US dollar rose after the US Federal Reserve chair, Janet Yellen, seemed optimistic about raising interest rates.

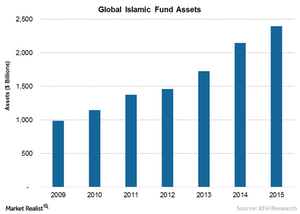

Will the Shari’ah Standard on Gold Be a Game-Changer?

In December, the AAOIFI and the WGC (World Gold Council) issued, for the first time, Shari’ah standard to deal with the use of gold (GDX) (GDXJ) as an investment in the Islamic finance industry.

Gold Prices Recover amid Sell-Off

Demand for Gold Withstood Recent Selloff Despite the drop in the gold price in October, demand for gold bullion-backed exchange traded products (ETPs) held firm. Inflows have no doubt slowed down compared to earlier in the year (0.4% increase in holdings in October compared to 12% and 6% increases in February and June respectively), but […]

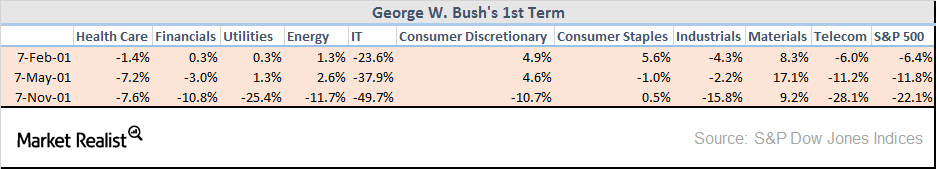

Which Sectors to Invest in If Donald Trump Wins

When Republican George H.W. Bush was elected president, the S&P 500 rose 8.5% three months after the election. It had a return of 11.2% six months after the election.

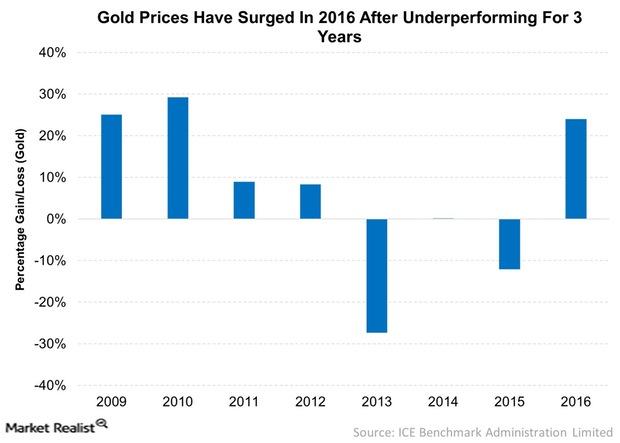

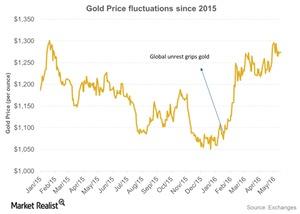

Gold Prices Moving North after 3 Years of Underperformance

This year, gold prices had risen by 24% as of September 19. Gold prices fell in August due to the Fed’s hawkish stance.

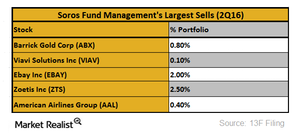

Why Did Soros Fund Management Reduce Its Holdings in Barrick Gold?

Billionaire investor George Soros, who said in April 2016 that gold was the only asset that could outperform in the current market environment, is now getting out of gold.

Why Mining Stocks Are Rising post-Brexit

Friday was important. Gold rose to a two-year high due to additional haven bids on the Brexit referendum.

Why Is JPMorgan Chase Positive on Gold?

After seeing three straight years of losses, gold (GLD) performed extremely well at the beginning of 2016.

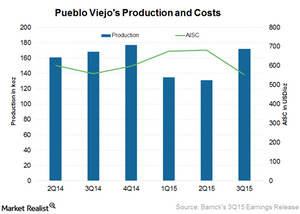

Barrick’s Focus on Costs Places It Favorably on Gold’s Cost Curve

Barrick Gold achieved all-in sustaining costs of $831 per ounce for 2015. This AISC was below the 40th percentile of the global industry cost curve.

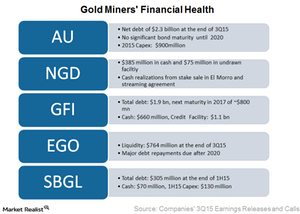

Which Intermediate Gold Miners Could Run into Financial Concerns?

Eldorado Gold is well placed financially. It had a liquidity of $763.8 million, including $388.8 million in cash, cash equivalents, and term deposits.

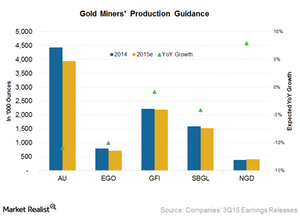

Decelerating Production Growth for Some Intermediate Gold Miners

New Gold produced 123,000 ounces in 3Q15. It has guided for a production toward the higher end of the guidance range of 390,000–410,000 ounces for 2015.

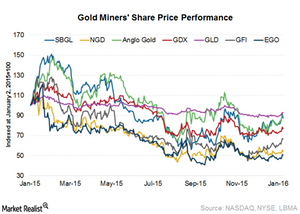

Intermediate Gold Miners Fell in 2015 and Beyond

From the start of 2015 to January 8, 2016, the prices of gold (GLD) have fallen by 7% and the VanEck Vectors Gold Miners Index (GDX) has fallen by 23%.

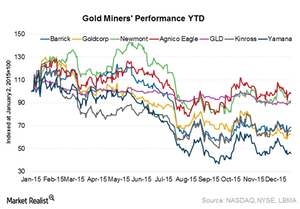

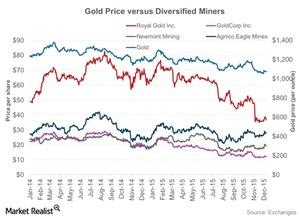

Why Have Newmont and Agnico Outperformed?

In this series, we’ll look at various factors that are affecting gold miners like Barrick Gold, Newmont Mining, Goldcorp, Yamana Gold, Agnico Eagle Mines, and Kinross Gold.

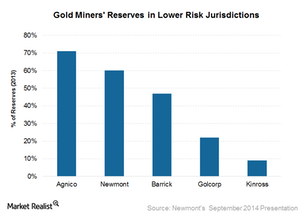

Gold Miners Are Cutting Down on Risky Geographical Exposure

While gold miners (GDX) are trying hard to limit their exposure to safe jurisdictions, it’s important to look at their geographic exposure and the implications it could have on their future prospects.

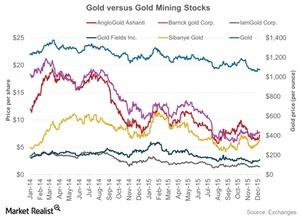

How the Gold Price Is Influencing Pure Gold Miners

In the precious metals mining industry, there are some stocks that to an extent follow the price and market sentiment of the precious metals.

How Gold Prices Impact Diversified Miners

The term “diversified miners” refers to mining companies that are not into streamlined gold or silver mining, but also mine base metals.

2015 Has Been Hard on Mining Companies

2015 has been tough for miners, especially due to the price rout in the commodities market. The commodities market has fallen about 24.3% since the start of the year.

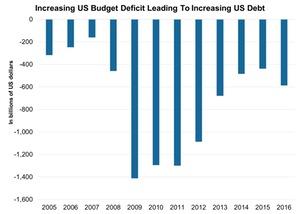

Could Rising Government Debt Mean Long-Term Upside for Gold?

If you expect this positive correlation to resume, then gold would seem very cheap at its current levels, suggesting an upside in gold prices in the long term.

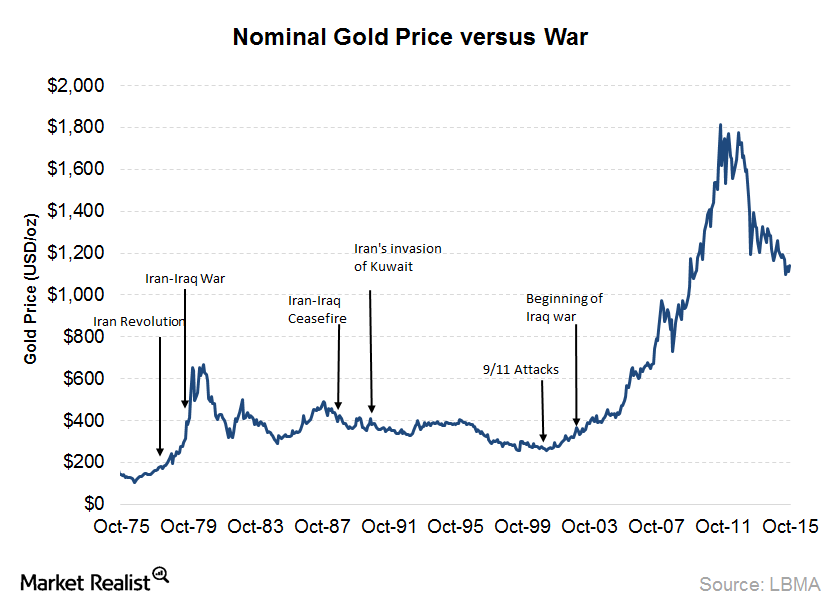

How the Threat of War Affects Gold Prices

Gold’s safe haven appeal might lead investors to gold and other precious metals in terms of heightened geopolitical tensions and war.

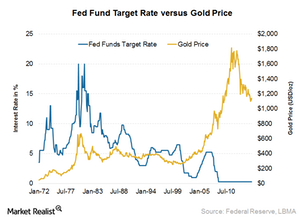

How the Fed Interest Rate Hike Is Expected to Affect Gold Prices

The Fed rate hike has been a major driver for gold prices since mid-2015. Higher interest rates usually diminish gold’s appeal due to its non–interest yielding nature.

Why the Strong US Dollar Outlook Means Pressure for Gold Prices

Tracked by the Federal Reserve, the weekly US Dollar Index (UUP) measures the value of the dollar compared to its six significant trading partners.

What Can You Learn from the Recent Gold Price Swings?

After getting a good start to the year—driven by strong demand from Asia, the Greek crisis, and the Swiss currency cap removal—gold prices started pulling back in April.

Barrick: What Will Drive Increased Recoveries for Pueblo Viejo?

The Pueblo Viejo mine is a joint venture between Barrick Gold Corporation (ABX) at 60% and Goldcorp (GG) at 40%.

Must-Read Notes on Barrick Gold’s 3Q15 Earnings and Conference

Barrick Gold (ABX) reported its 3Q15 results on October 28 after market hours and held its conference call the next day. Its results beat market expectations.

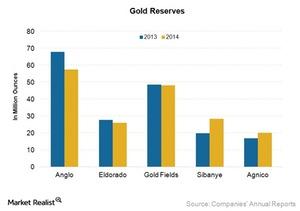

Assessing the Importance of Gold Reserves for Future Growth

Gold reserve growth is a key revenue driver for miners. It’s thus important for gold miners to continue replacing every ounce of gold they produce and sell.

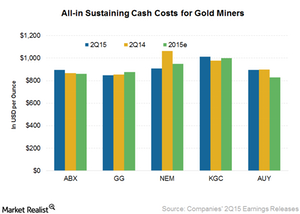

Comp: How Are Gold Miners Progressing on the Cost-Cutting Front?

For 2Q15, Newmont has been the most successful YoY in cost cutting. It had a reduction of 14.50%—mainly due to a rise in productivity and efficiency improvements.

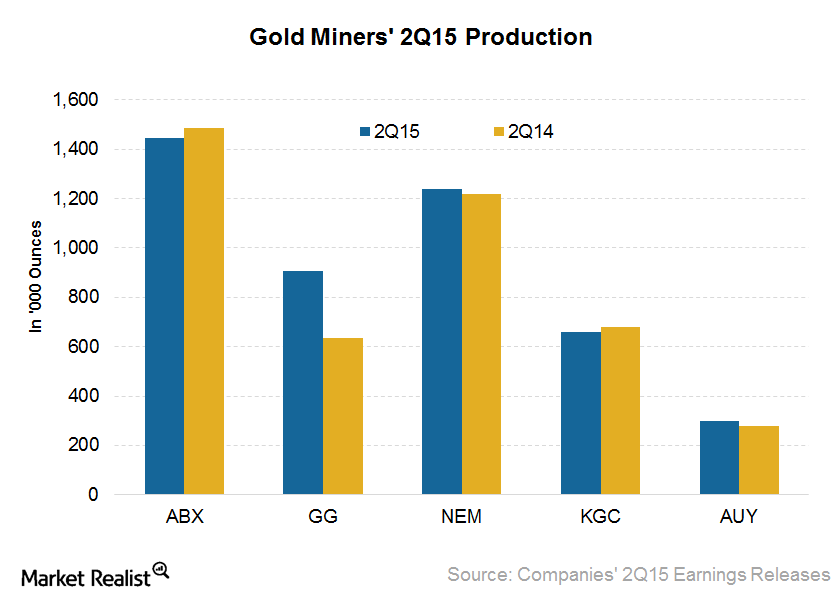

Comp: A Look at Gold Miners’ 2Q15 Production Profile

Gold miners’ (GDX) production profile is very important for investors. According to the WGC, gold mine production rose by 3% YoY to 786.6 tons in 2Q15.