Assessing the Importance of Gold Reserves for Future Growth

Gold reserve growth is a key revenue driver for miners. It’s thus important for gold miners to continue replacing every ounce of gold they produce and sell.

Oct. 29 2015, Published 3:08 p.m. ET

Gold reserves for future revenue

Gold reserve growth is one of the key revenue drivers for gold miners. Thus, it is very important for gold miners to continue replacing every ounce of gold they produce and sell from their mines. But gold mines have limited lives and limited reserves. So to increase their gold reserves, gold miners have to either discover new mines (organic growth) or acquire mines from peers (inorganic growth).

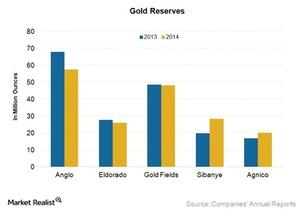

As the above graph shows, Agnico Eagle Mines (AEM) and Sibanye Gold (SBGL) increased their gold reserves in 2014 through inorganic growth. Anglogold Ashanti (AU), Eldorado Gold Corporation (EGO), and Gold Fields (GFI) reported lower gold reserves in 2014 primarily due to depleting mines.

Higher gold reserves due to inorganic growth

Agnico Eagle’s gold reserves increased by 18% in 2014 to 20.0 million ounces from 16.9 million ounces in 2013. This gold reserve growth was largely driven by the company’s acquisition of the Canadian Malartic mine (50% interest and 4.3 million ounces of gold reserve).

With inorganic growth, Sibanye Gold increased its gold reserve by a whopping 44% in 2014, to 28.4 million ounces from 19.7 million ounces in 2013. Sibanye acquired the Cooke mine (stock deal) and the Wits gold mine ($407 million cash deal) in 2013. The company’s growth in reserves was also supported by increased gold reserves at its Kloof 4 and Driefontein 5 shaft mines.

Lower gold reserves due to depleting mines

Anglogold saw a drastic decline in its gold reserves as it fell by 15%, from 67.9 million ounces in 2013 to 57.5 million ounces in 2014. This was due to depletions (around 4.9 million ounces), asset sales, and changes in gold price assumptions.

Gold Fields reported a marginal decline of 1% in gold reserves during the same period, from 48.6 million ounces in 2013 to 48.1 million ounces in 2014, due to challenges at its South Deep mine. To increase its gold reserves, the company has invested in brownfield exploration in Australia and is looking for valuable acquisitions.

Eldorado’s gold reserve decreased by 6%, to 25.9 million ounces in 2014 from 27.7 million ounces in 2013, primarily due to the depletion of its mines.

Agnico Eagle, Sibanye Gold, Anglogold (AU), Eldorado (EGO), and Gold Fields (GFI) have assumed gold prices of $1,150, $1,190, $1,600, 1,300, and $1,300, respectively, to calculate their gold reserves. Anglogold could see declines in its gold reserves in 2015 due to asset sales and higher leverage. Agnico Eagle’s gold reserves could increase further due to favorable development at its Creston Mascota and La India mines.

The VanEck Vectors Gold Miners Index (GDX) invests in gold mining companies, so investors can get exposure to gold or specific gold miners by investing in GDX. Agnico Eagle and Anglogold, for example, together account around 10% of the fund’s holdings.

Continue to the next part of this series for a discussion of how financial leverage affects gold miners in 2015.