Steve Ariel

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Steve Ariel

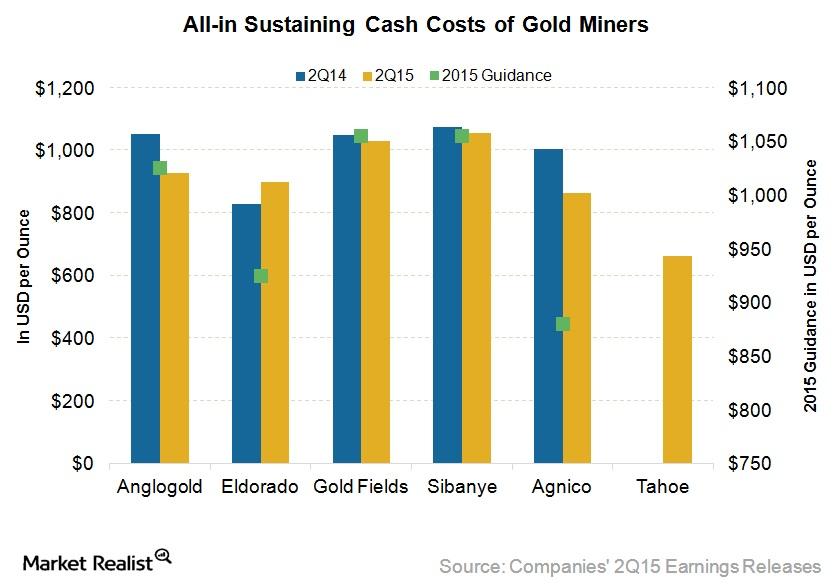

Which Intermediate Gold Miners Have Cost Advantages in 2H15?

All-in sustaining costs make up a comprehensive and important cost metric for gold mining companies. A lower AISC is better for gold miners.

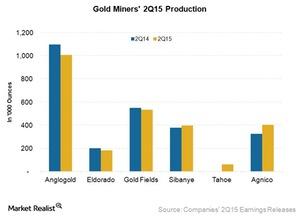

Evaluating Gold Production for Intermediate Gold Miners in 2Q15

Gold production is an important metric for gold miners, because miners generally try to increase gold production in order to reduce costs amid low prices.

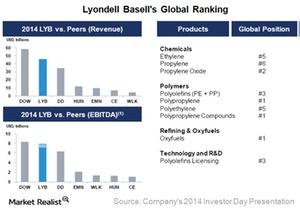

What Are LyondellBasell’s Global Rankings?

LyondellBasell (LYB) is the leading global producer of olefins and polyolefins.

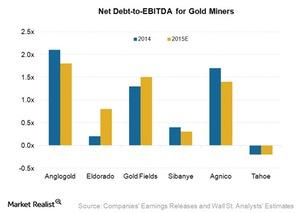

Net Debt-to-EBITDA Expectations for Intermediate Gold Miners in 2015

In 2015, the average net debt-to-EBITDA ratio of the six intermediate gold miners we’ve been evaluating in this series is 0.9x—a similar level to 2014.

An Overview of Gold Miner Performance in 2015

Gold miners’ stocks have underperformed most of the market indices and gold itself. GDX has significantly underperformed GLD since 2008.

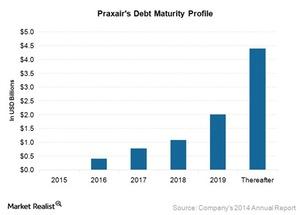

Does Praxair Have a Sustainable Debt Maturity Profile?

Praxair’s total debt has increased significantly, rising from $6.6 billion in 2011 to $9.3 billion in 2014.

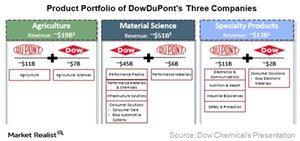

DowDuPont Will Spin Off into 3 Independent Public Companies

After the merger, DowDuPont will spin off into three independent and public companies—agriculture, material science, and specialty products.

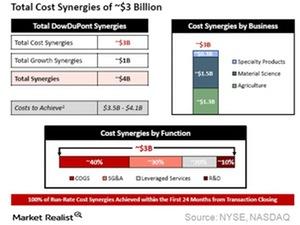

Will the Dow Chemical and DuPont Merger Have Operational Synergy?

With corporate changes, the combined company is expected to generate total cost savings of $3 billion over the next two years after the merger.

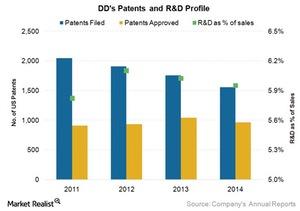

DuPont’s Research and Development Spending Compared to Its Peers’

DuPont is a technology and research and development driven company. It spent an average of 6% of its revenues on R&D activities during the 2011–2014 period.

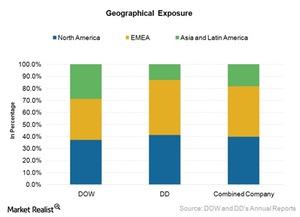

Will the Merger Have Geographical Synergy for the New Company?

After the merger, the merged entity is expected to have a better geographical presence than its individual global presence.

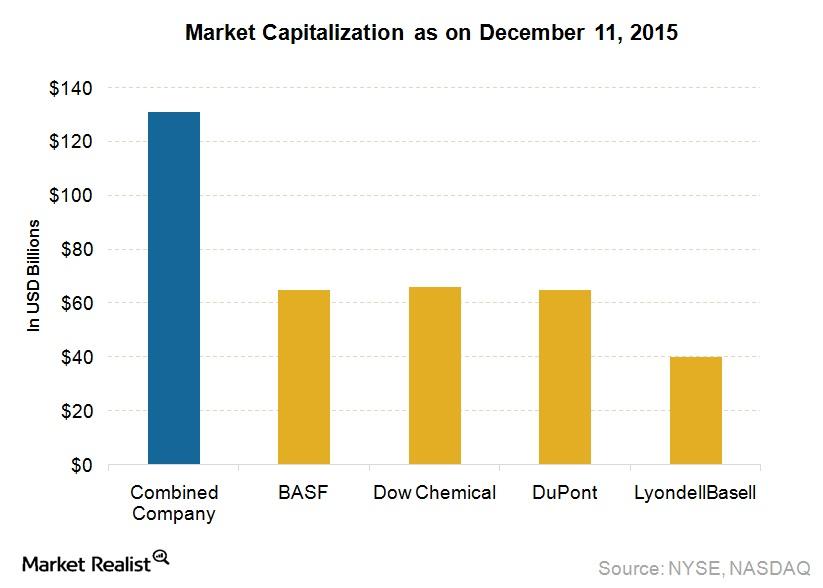

Analyzing the US Chemical Industry’s Biggest Merger

Dow Chemical (DOW) and DuPont (DD) are the world’s leading chemical companies. They announced that they will merge to form the world’s largest chemical company.

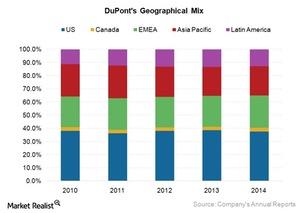

How Is DuPont’s Geographical Sales Exposure and Global Presence?

DuPont is a global company with operations in more than 90 countries. In 2014, the company’s North America region contributed 41% to its total revenue.

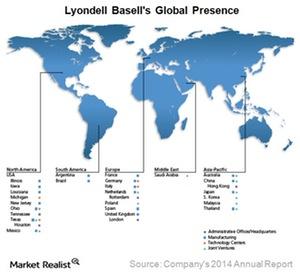

How Does LyondellBasell’s Geographical Exposure Compare to Peers?

LyondellBasell (LYB) has a presence throughout the world. However, the company generates around 50% of its revenue from the United States.

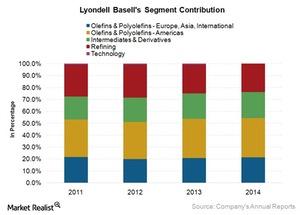

LyondellBasell: A Leading Manufacturer of Olefins and Polyolefins

LyondellBasell is one of the world’s leading producers of olefins and polyolefins. After Dow Chemical, LYB is the second largest company by revenue and EBITDA in the US.

What Will Drive Dow Chemical’s Future Growth?

The Dow Chemical Company has significantly changed its business model to improve its earnings profile and returns to shareholders.

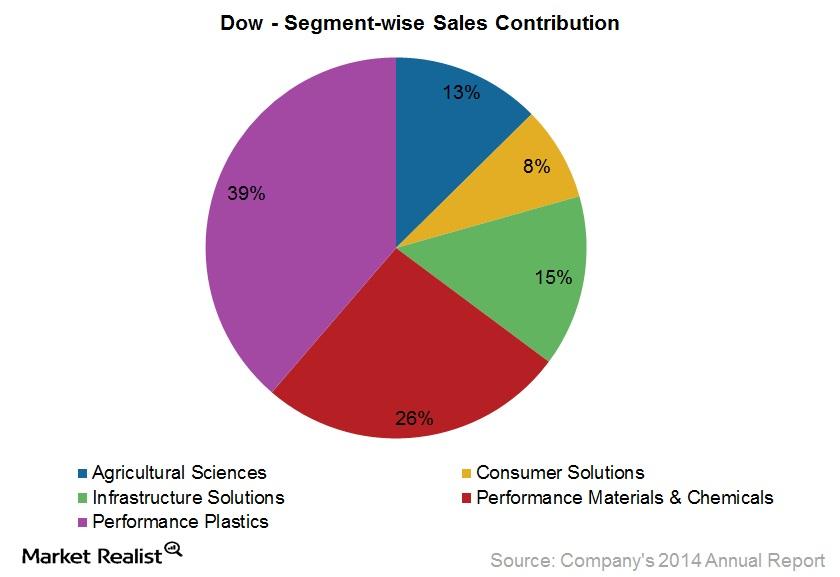

Understanding Dow’s Largest Segment, Performance Plastics

Dow’s Performance Plastics segment contributed 39% and 46% to Dow’s total revenue and EBITDA, respectively, in 2014.

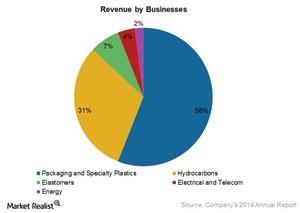

Dow: Largest Chemical Company in the United States

The Dow Chemical Company is the largest chemical company in the United States by revenue.

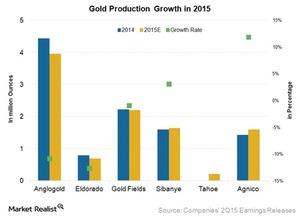

Why Growth in Gold Production Is Important for Gold Miners

Future gold production growth is important because the gold market is forward-looking, making future gold production a key driver of gold miners’ revenue.

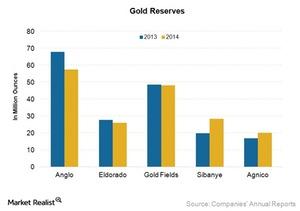

Assessing the Importance of Gold Reserves for Future Growth

Gold reserve growth is a key revenue driver for miners. It’s thus important for gold miners to continue replacing every ounce of gold they produce and sell.