First Trust Natural Gas ETF

Latest First Trust Natural Gas ETF News and Updates

How Much Natural Gas Could Fall Next Week

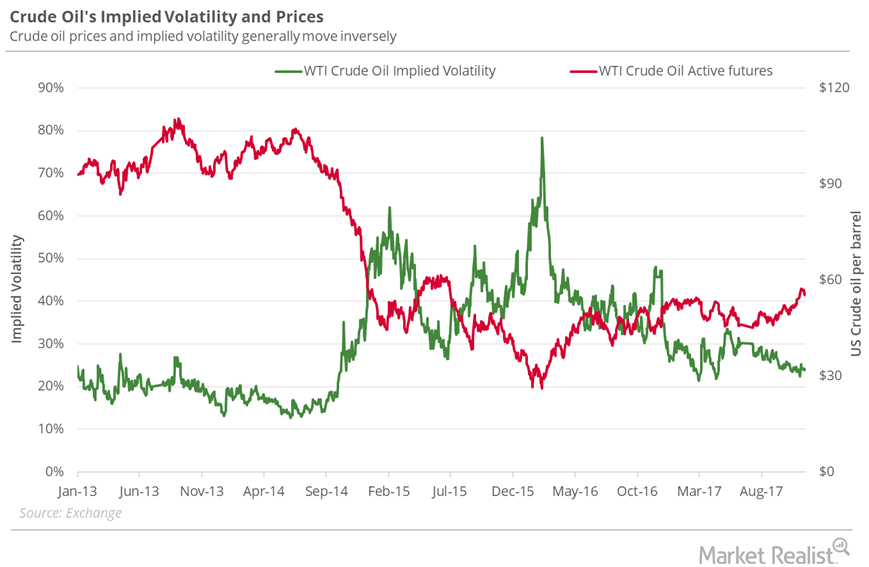

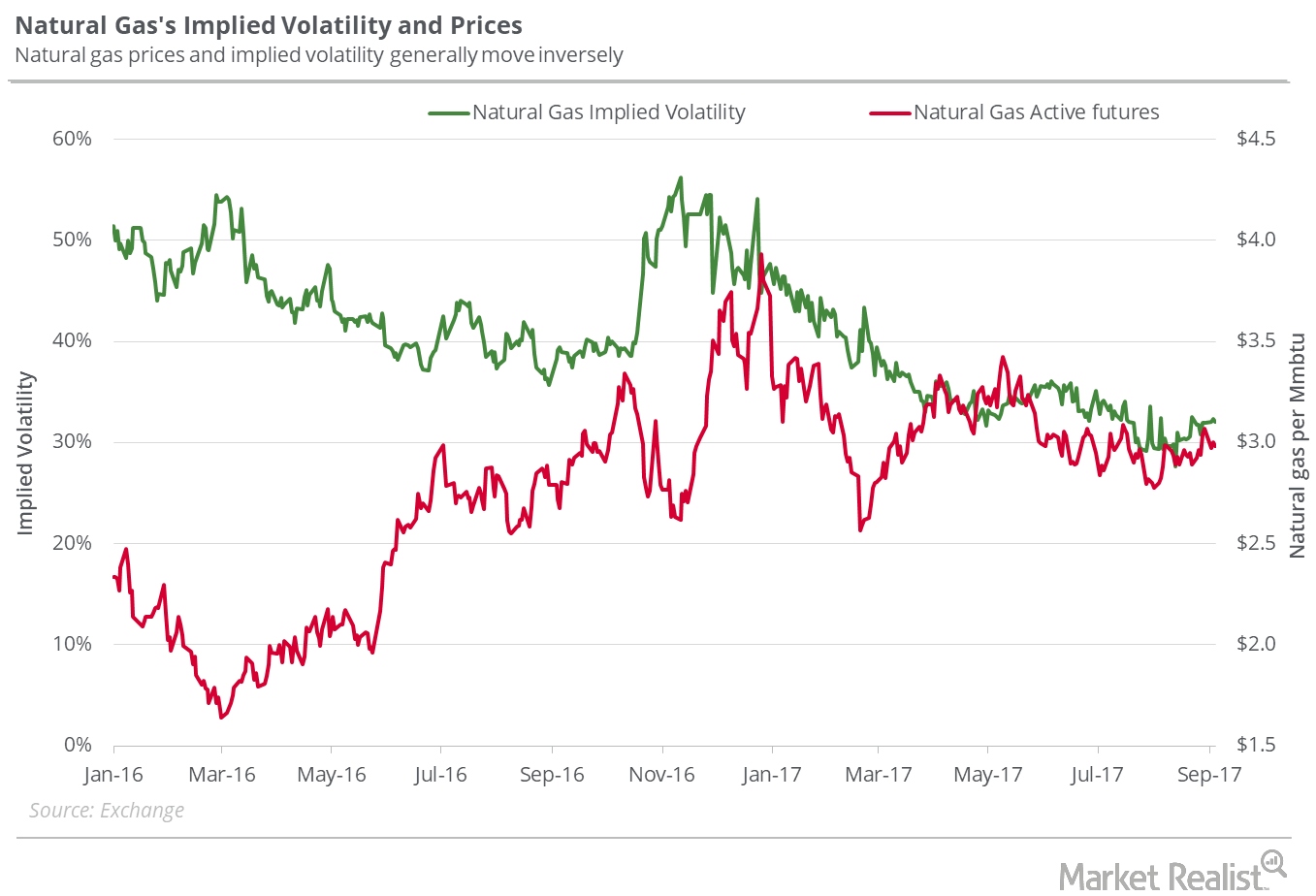

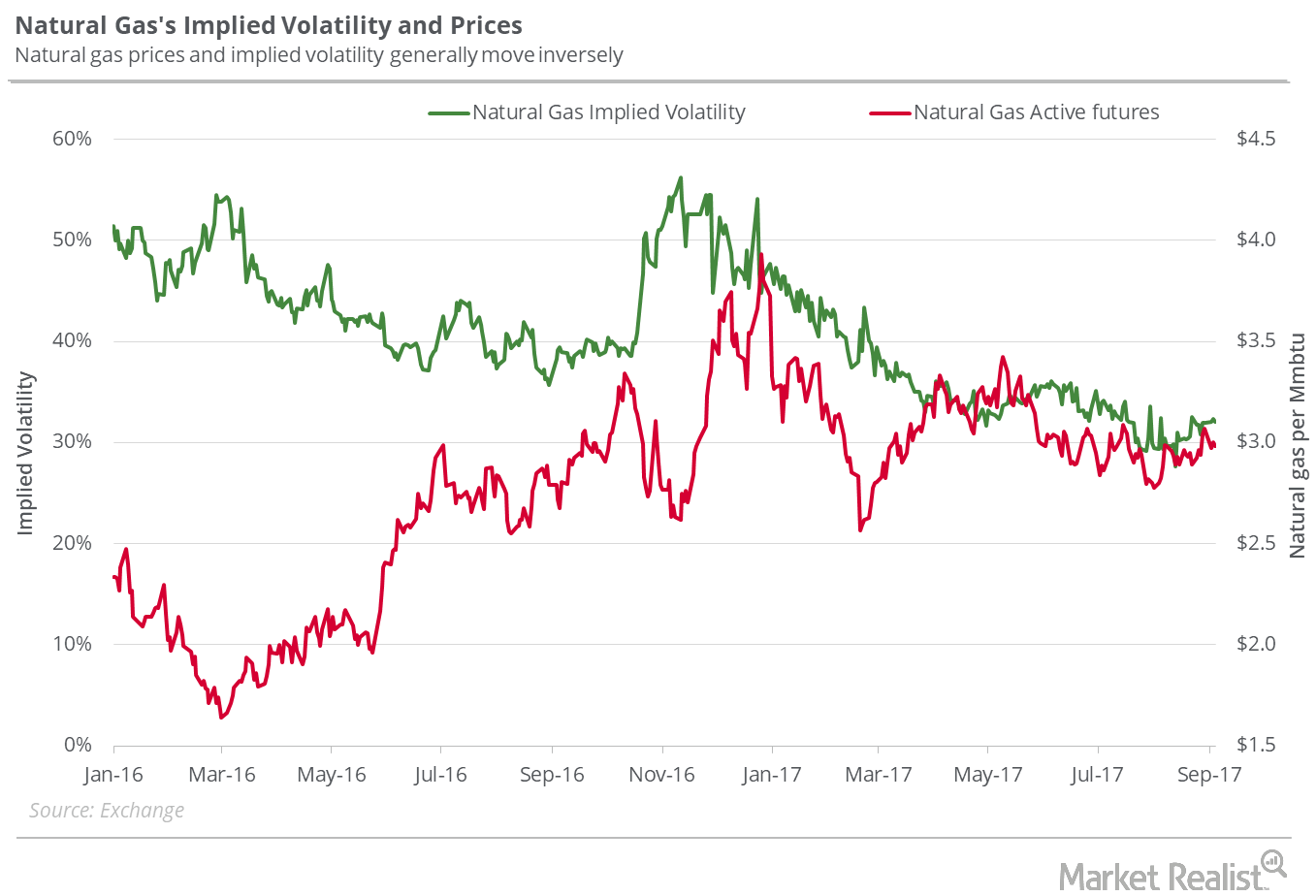

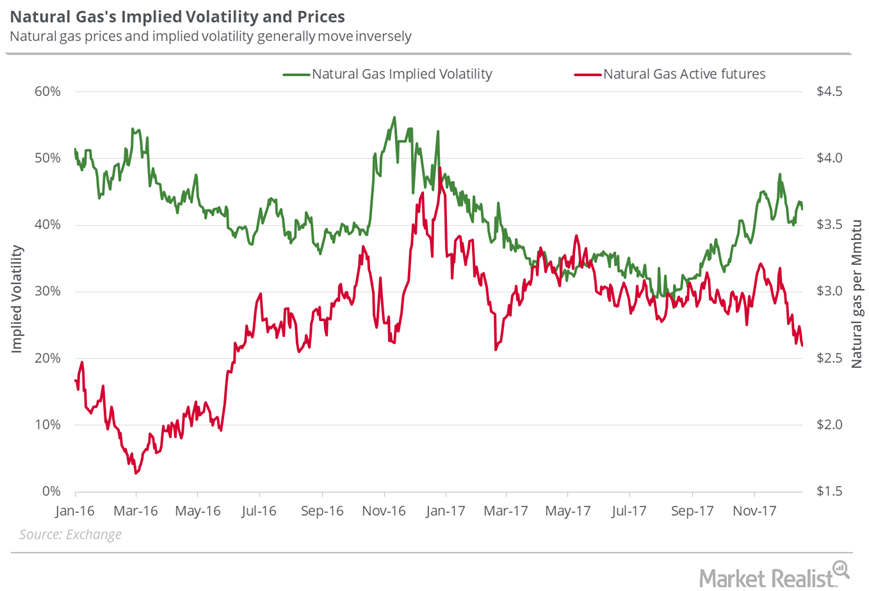

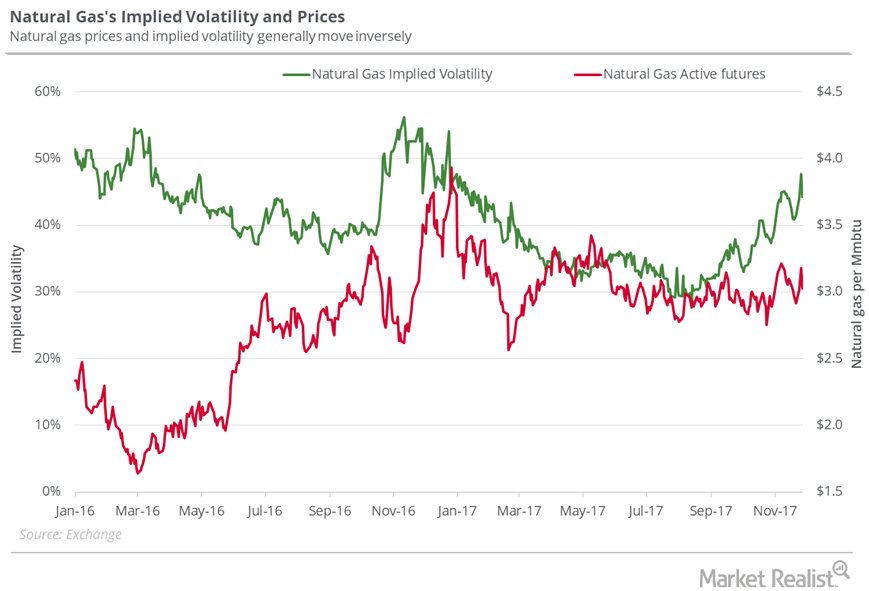

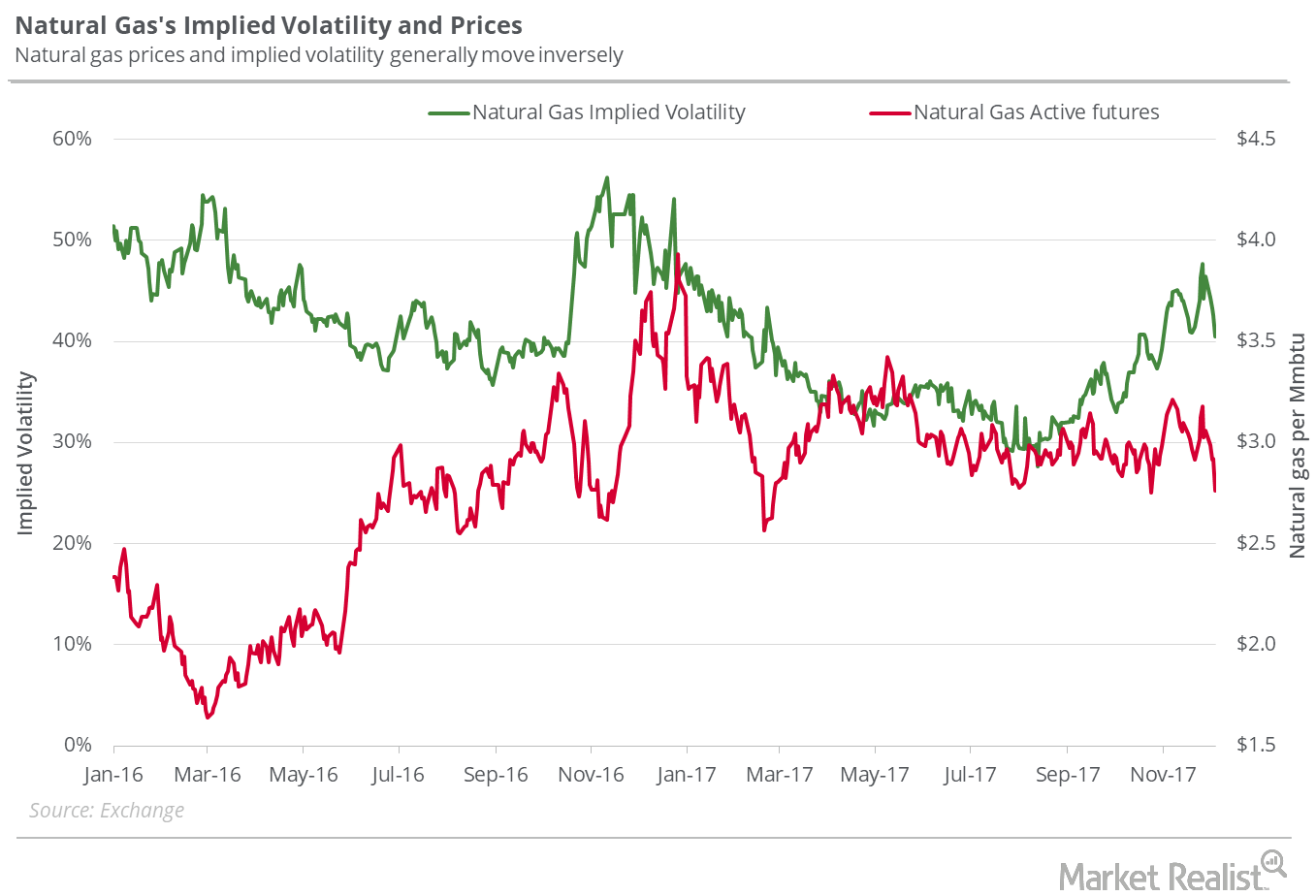

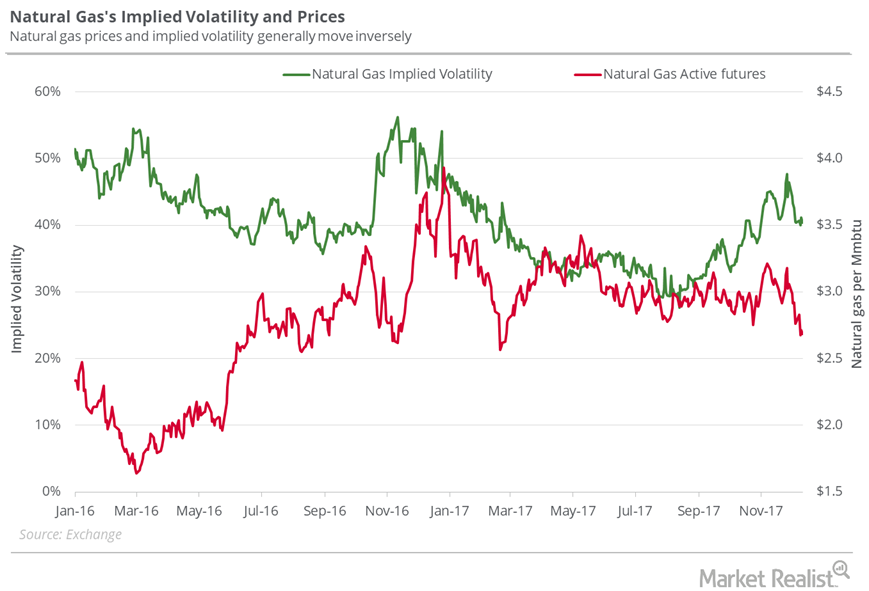

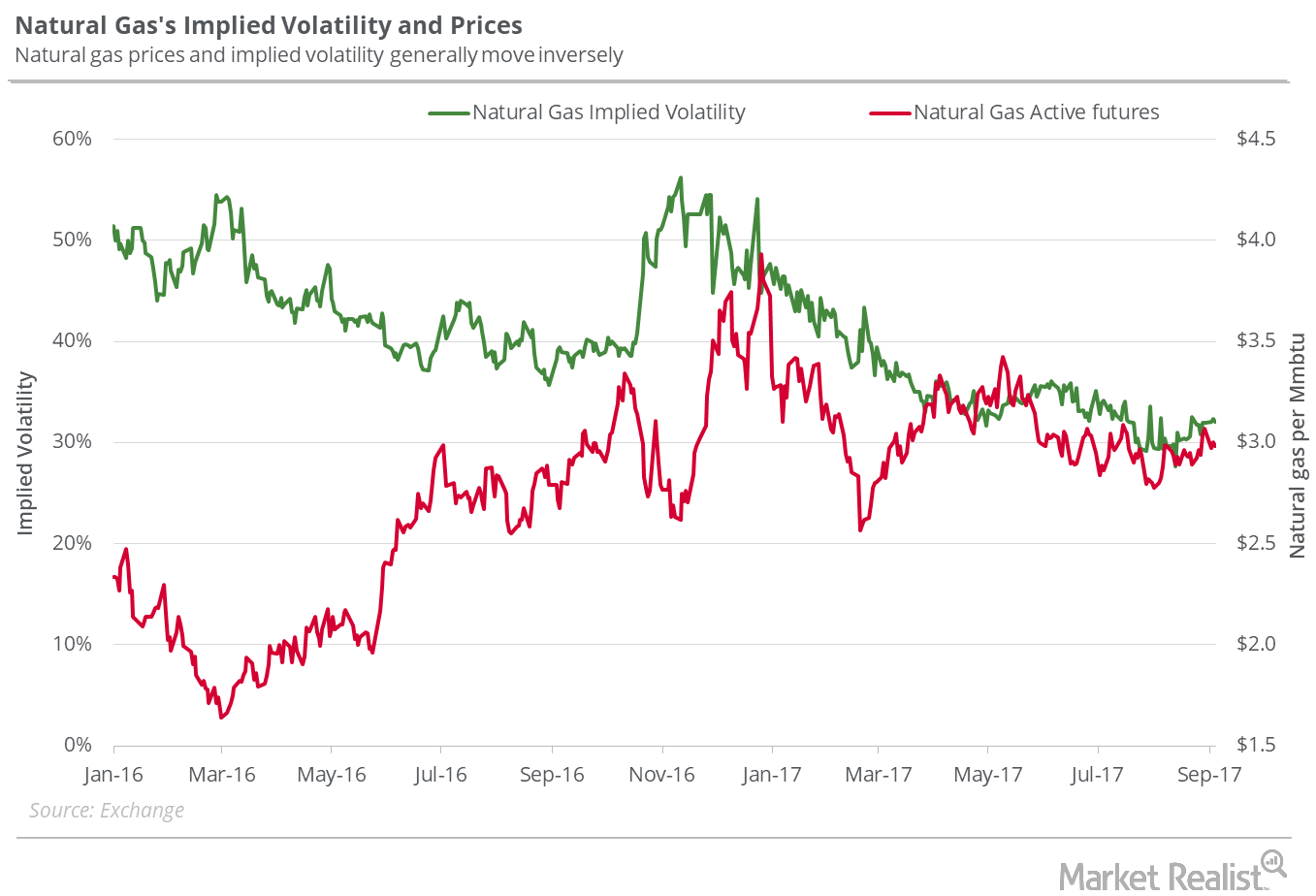

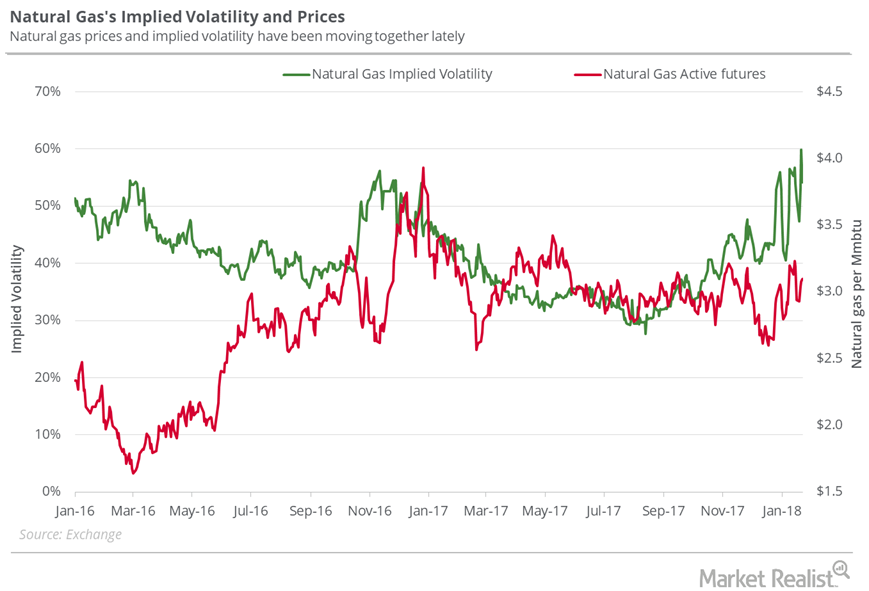

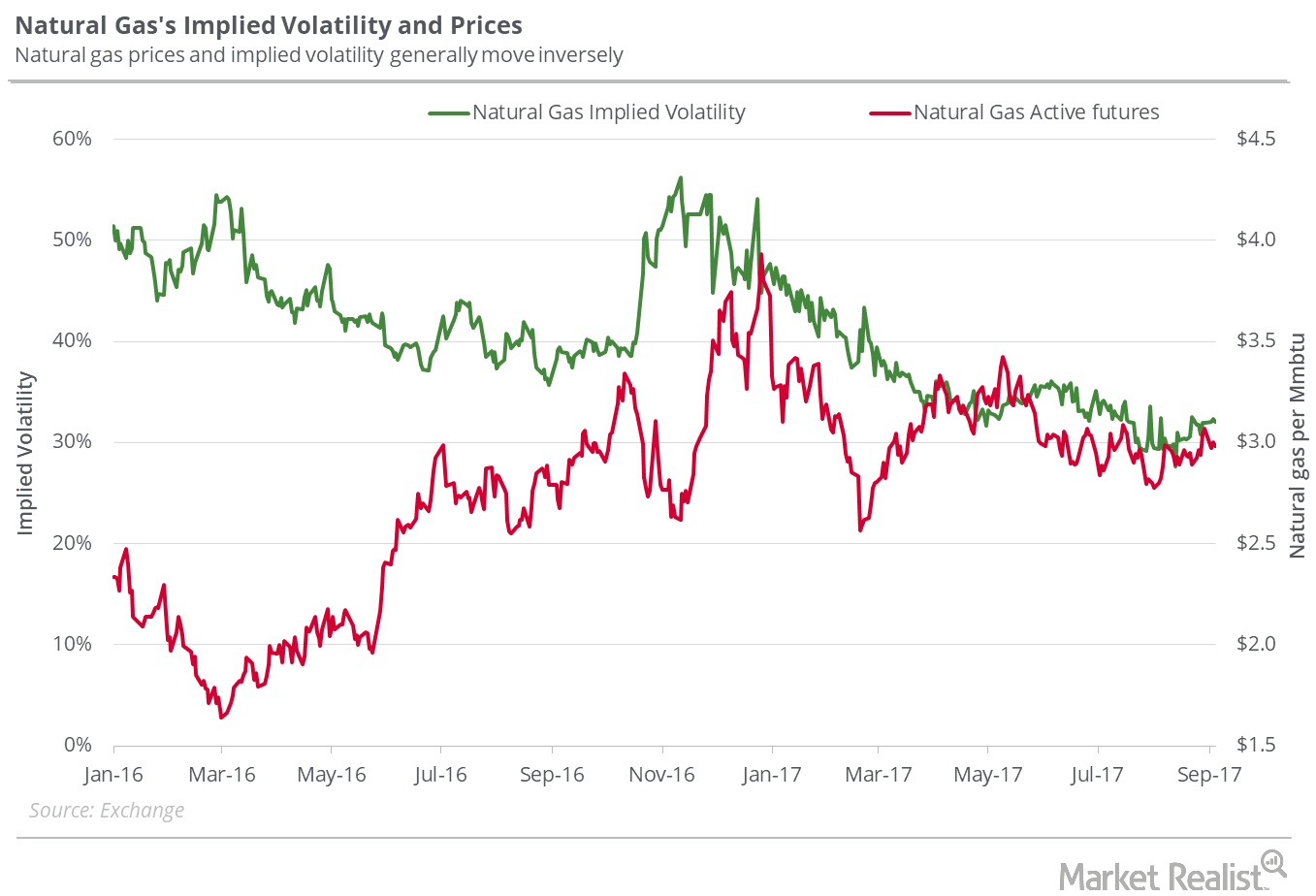

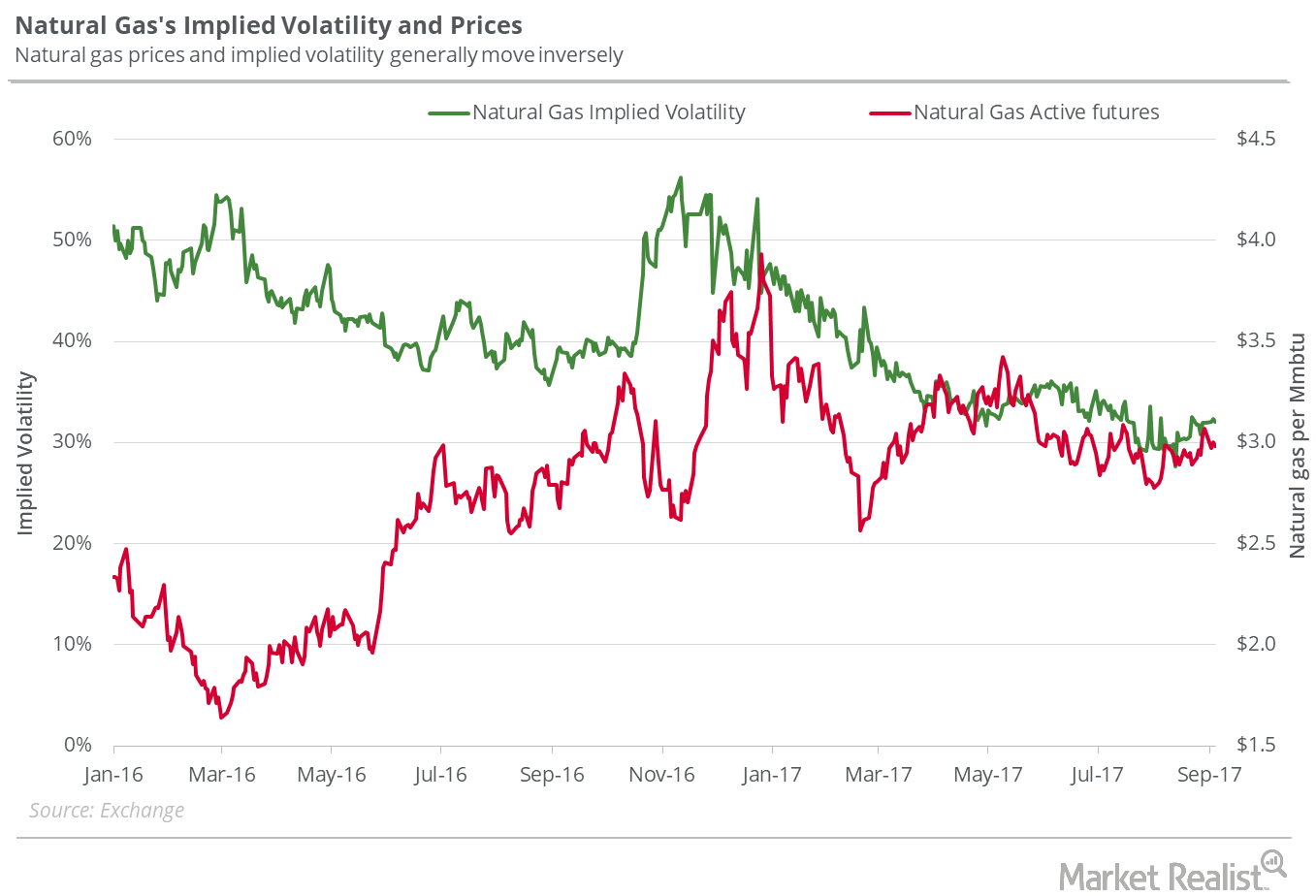

On November 16, 2017, the implied volatility of natural gas was 44%—6.4% above its 15-day average.

Will Natural Gas Prices Fall to $2.8 Next Week?

On November 2, 2017, natural gas’s (GASL) (GASX) implied volatility was 38.2%, 1.8% below its 15-day average.

How the Inventory Spread Could Boost Natural Gas Prices

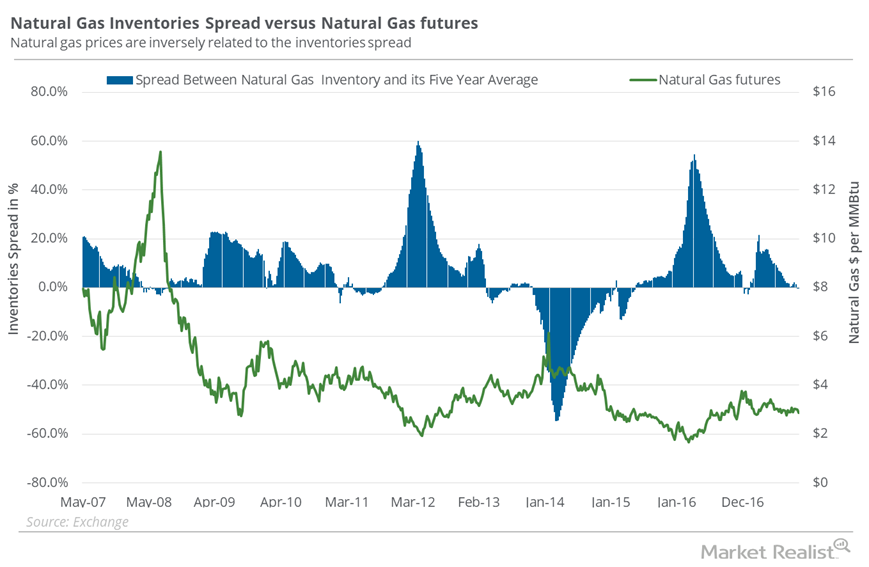

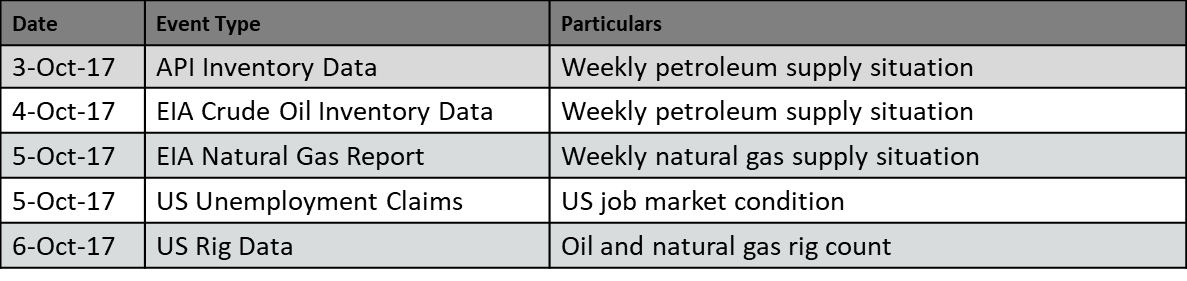

In the week ended October 6, natural gas inventories rose by 87 Bcf (billion cubic feet) to 3,595 Bcf—13 Bcf more than the market expected inventories to rise.

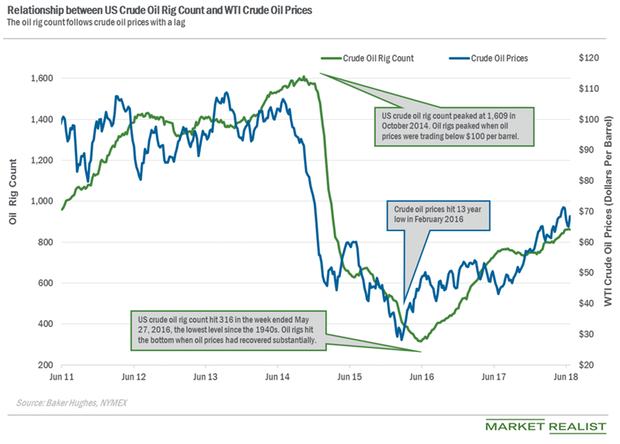

Will the Oil Rig Count Increase Natural Gas Downside Risk?

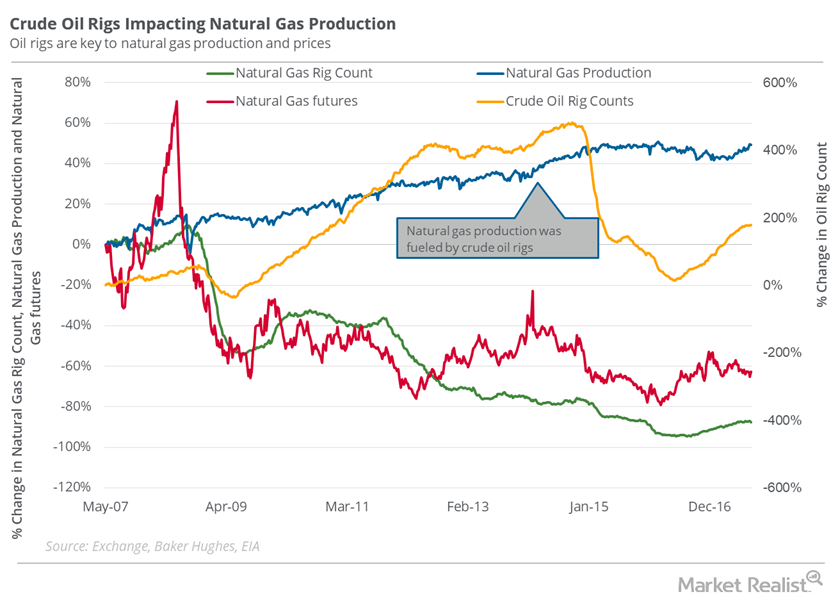

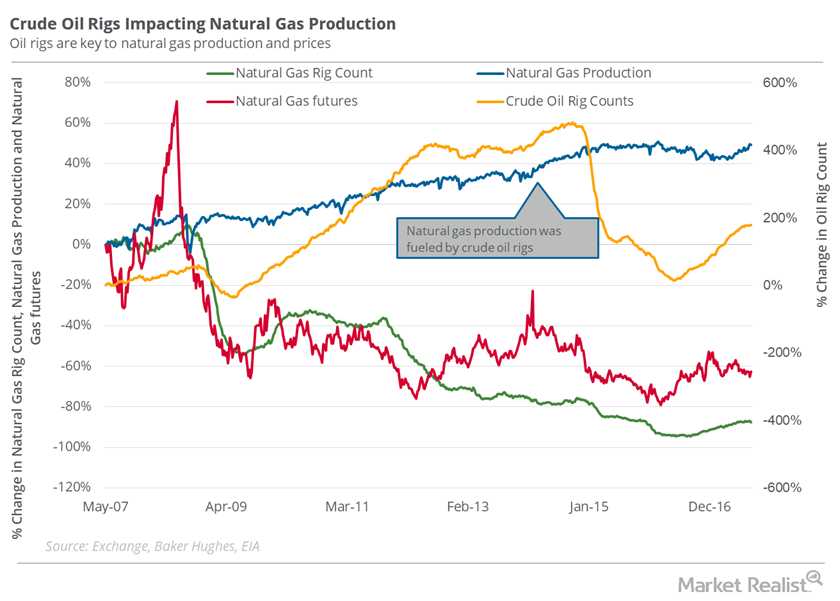

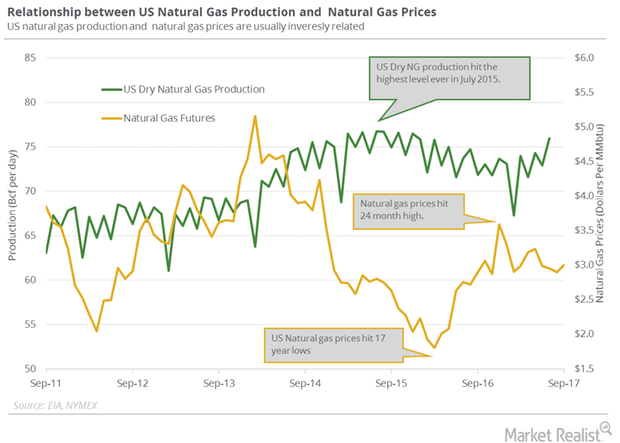

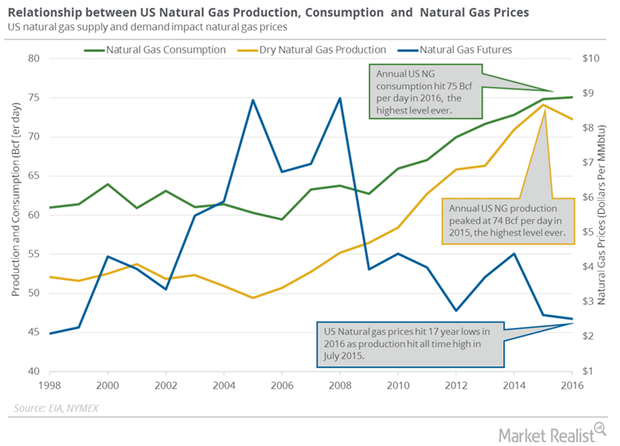

Since 2008, the natural gas rig count has fallen ~89% from its record high. But the fall was unable to stop the rise in natural gas supplies.

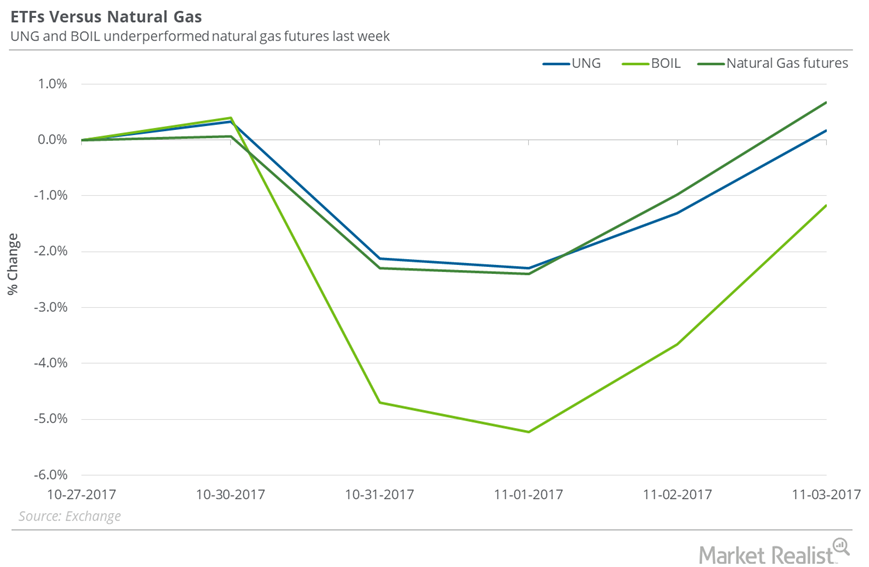

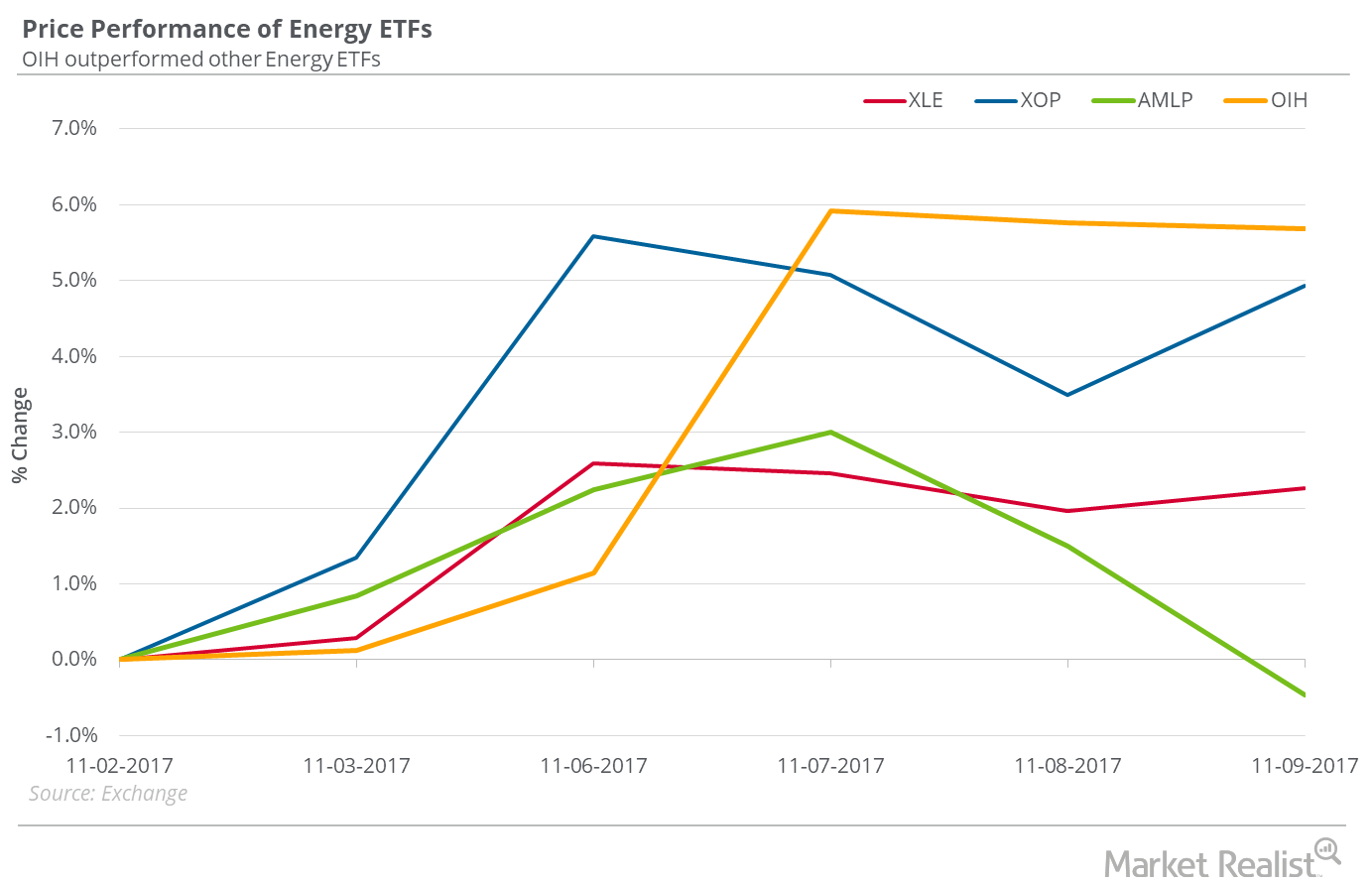

How Natural Gas ETFs Fared Last Week

Between October 27 and November 3, 2017, the United States Natural Gas Fund LP (UNG) rose just 0.2%, and natural gas December futures rose 0.7%.

Where Natural Gas Prices Could Go Next Week

On September 21, 2017, natural gas implied volatility was 35.1%, or 5.1% above the 15-day average.

Are Natural Gas Supplies Overtaking Demand?

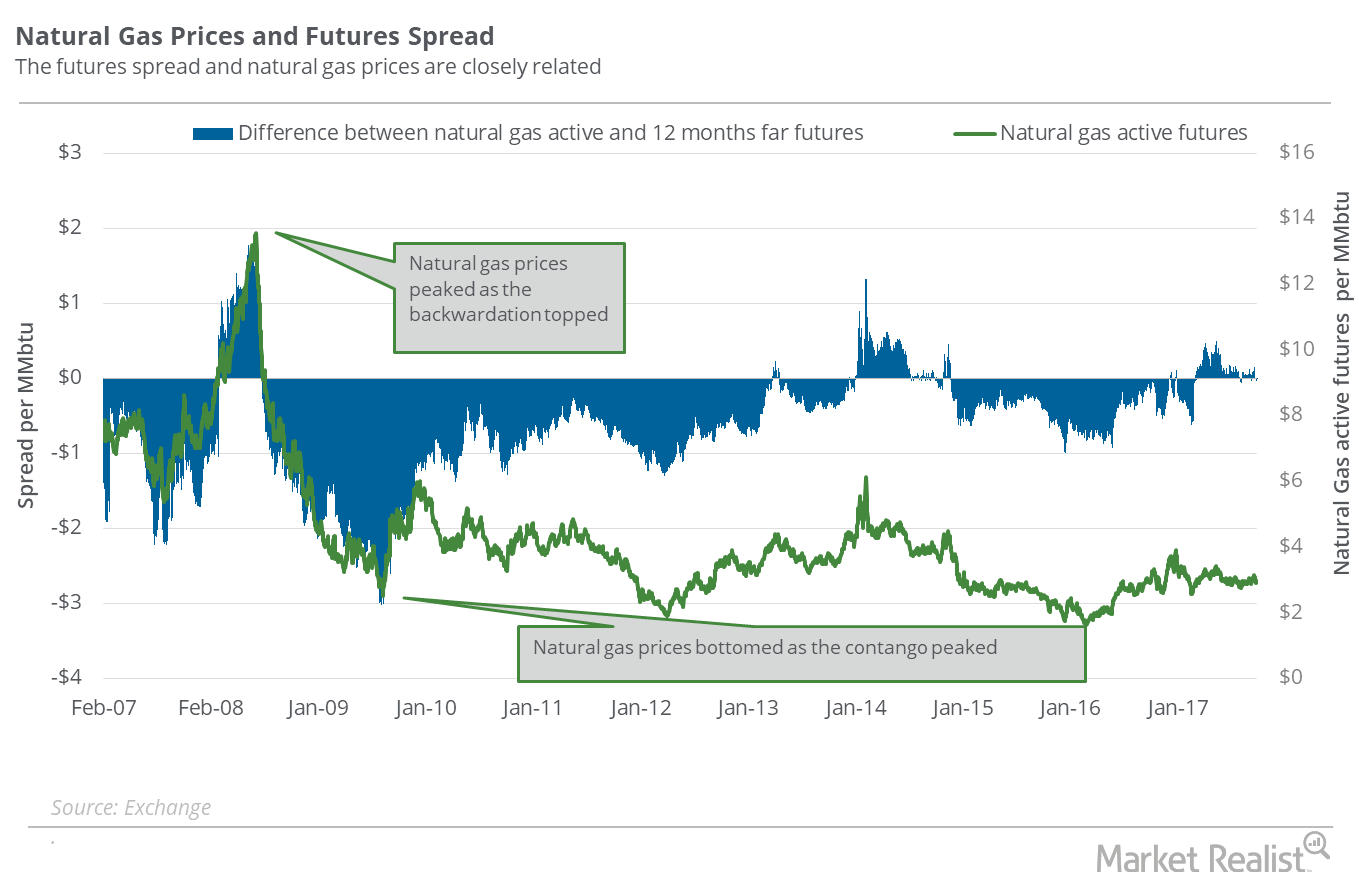

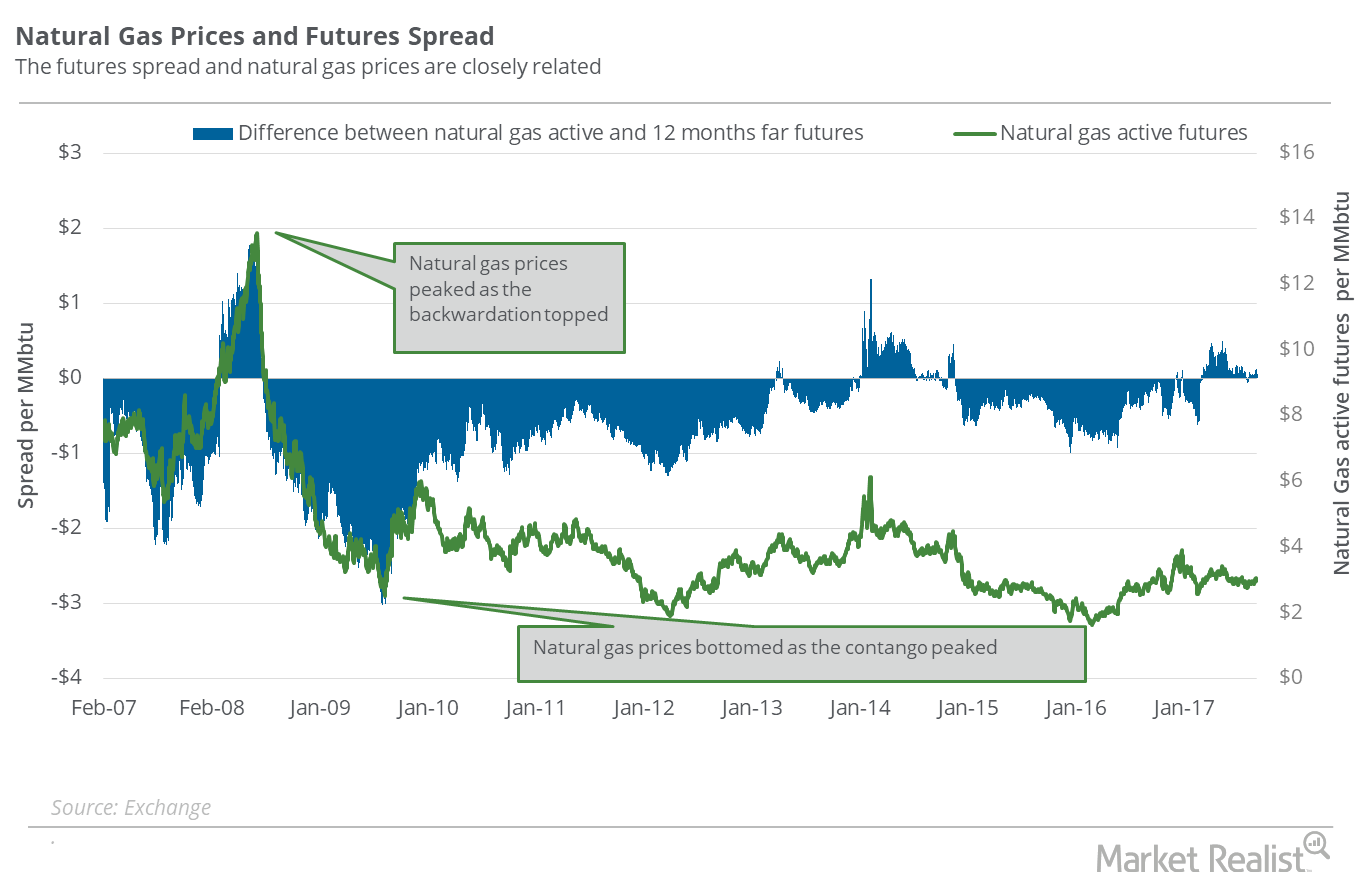

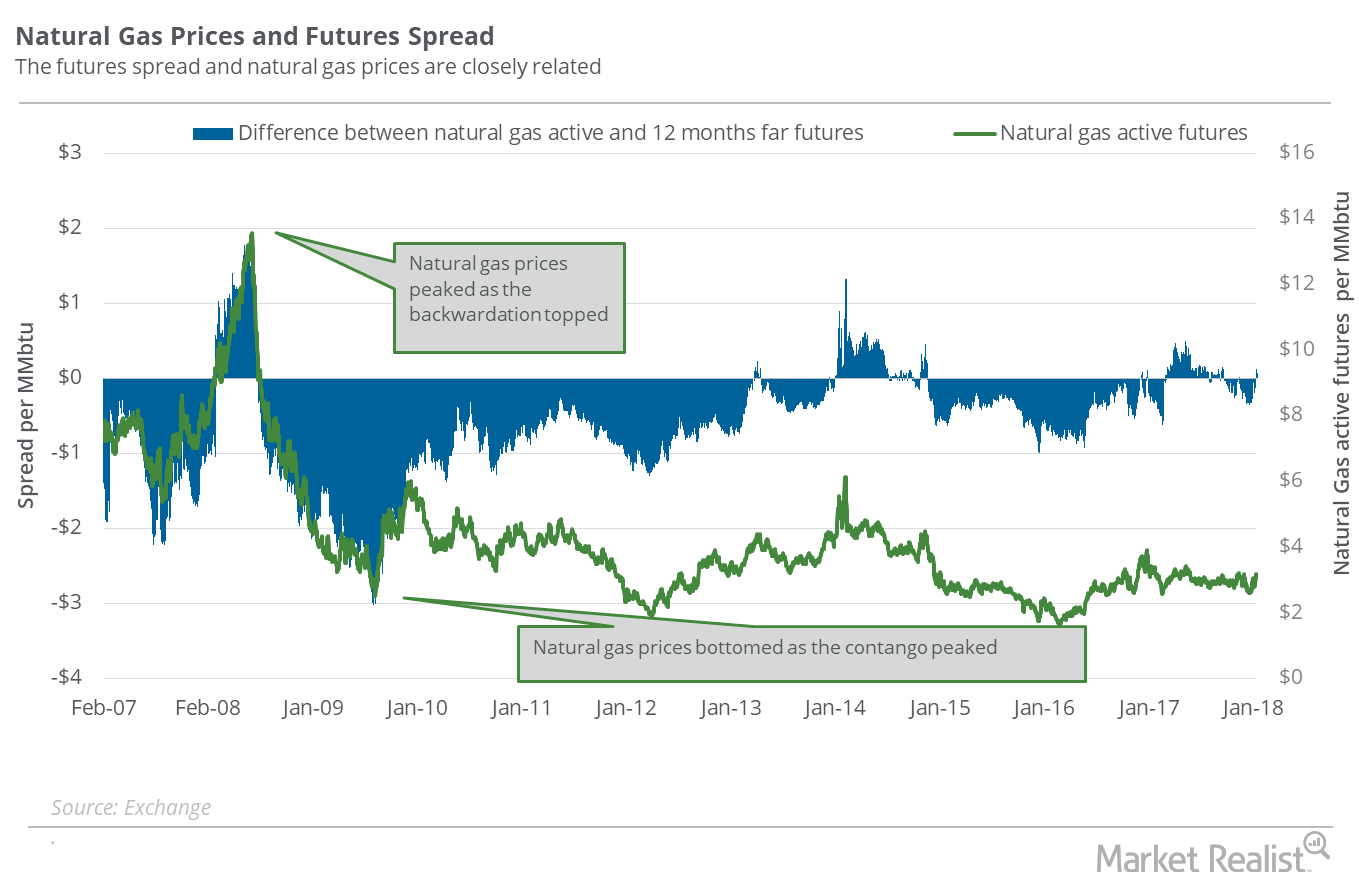

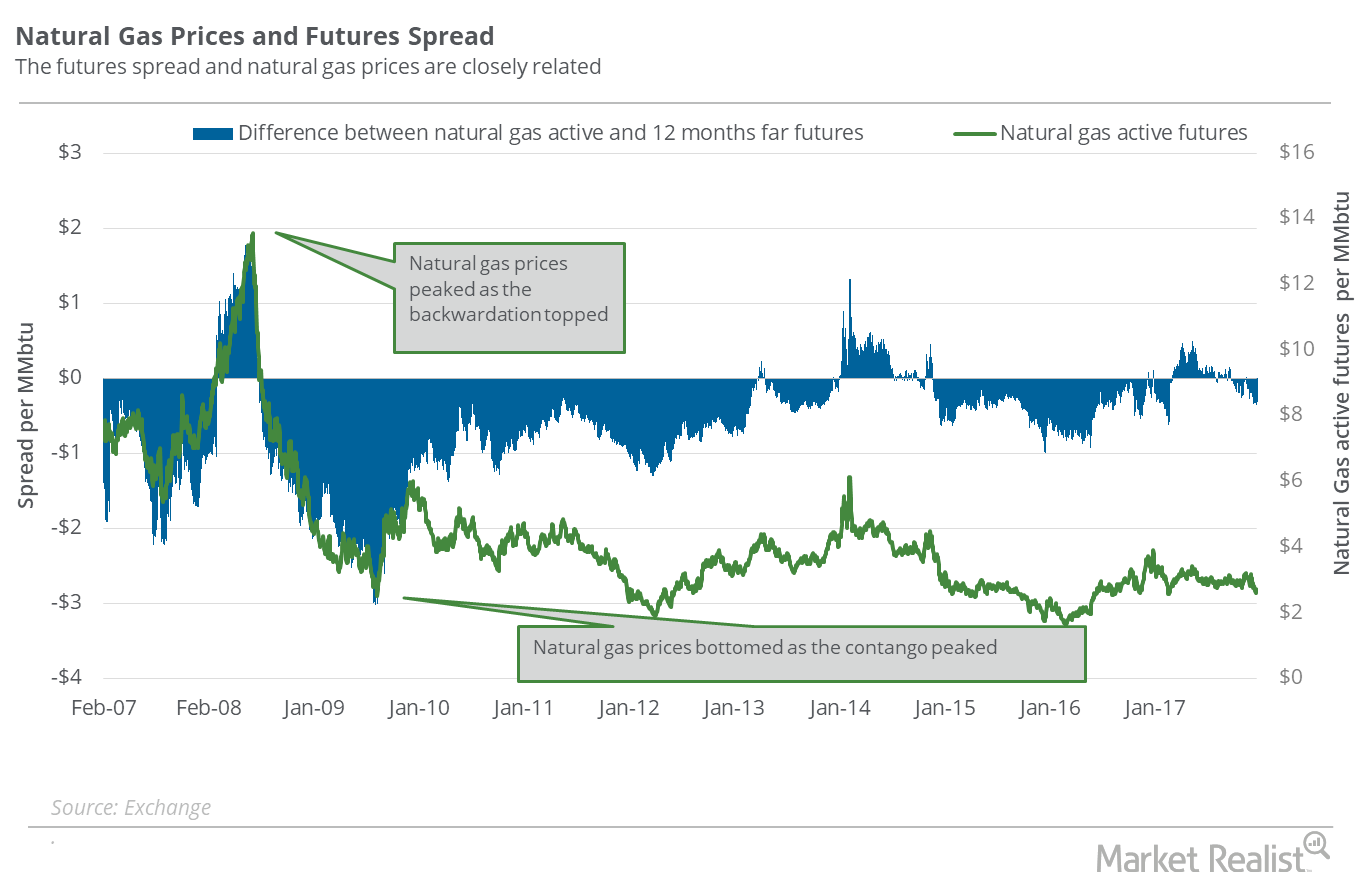

Futures spread On September 27, 2017, natural gas (FCG) (GASL) (BOIL) 2018 November futures traded $0.04 lower than November 2017 futures. That is, the futures spread was at a discount of $0.04. On September 20, 2017, the futures spread was at a discount of $0.10. Between September 20 and 27, 2017, natural gas November futures […]

Could Natural Gas Reach a New 2017 Low Next Week?

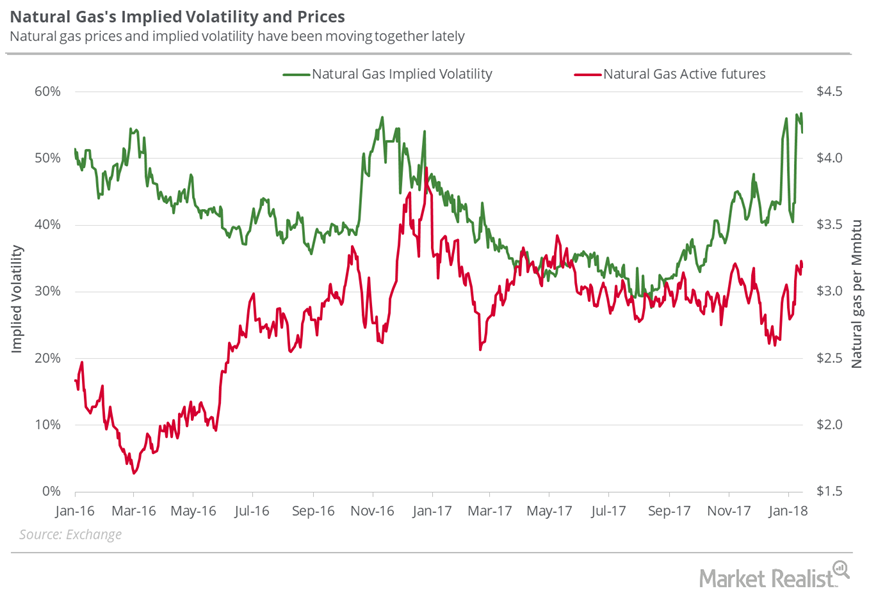

Implied volatility On December 21, 2017, natural gas futures’ implied volatility was 42.4%. In the last trading session, their implied volatility was on par with the 15-day average. Supply-glut concerns pushed natural gas (UNG) (BOIL) futures to a 17-year low on March 3, 2016, with an implied volatility of 53.8%. From this multiyear low, natural gas prices […]

Can Natural Gas Stay above $3 Next Week?

On November 30, 2017, natural gas’s implied volatility was 44.3%, about 1% above its 15-day average.

Futures Spread: Is the Natural Gas Market Turning Bullish?

On September 20, 2017, natural gas (FCG) (BOIL) October 2018 futures closed $0.10 below its October 2017 futures.

Hedge Funds’ Net Long Positions in US Natural Gas

Hedge funds decreased their net bullish positions in US natural gas futures and options 1.9% to 186,799 on June 12–19.

What to Expect from Natural Gas Next Week

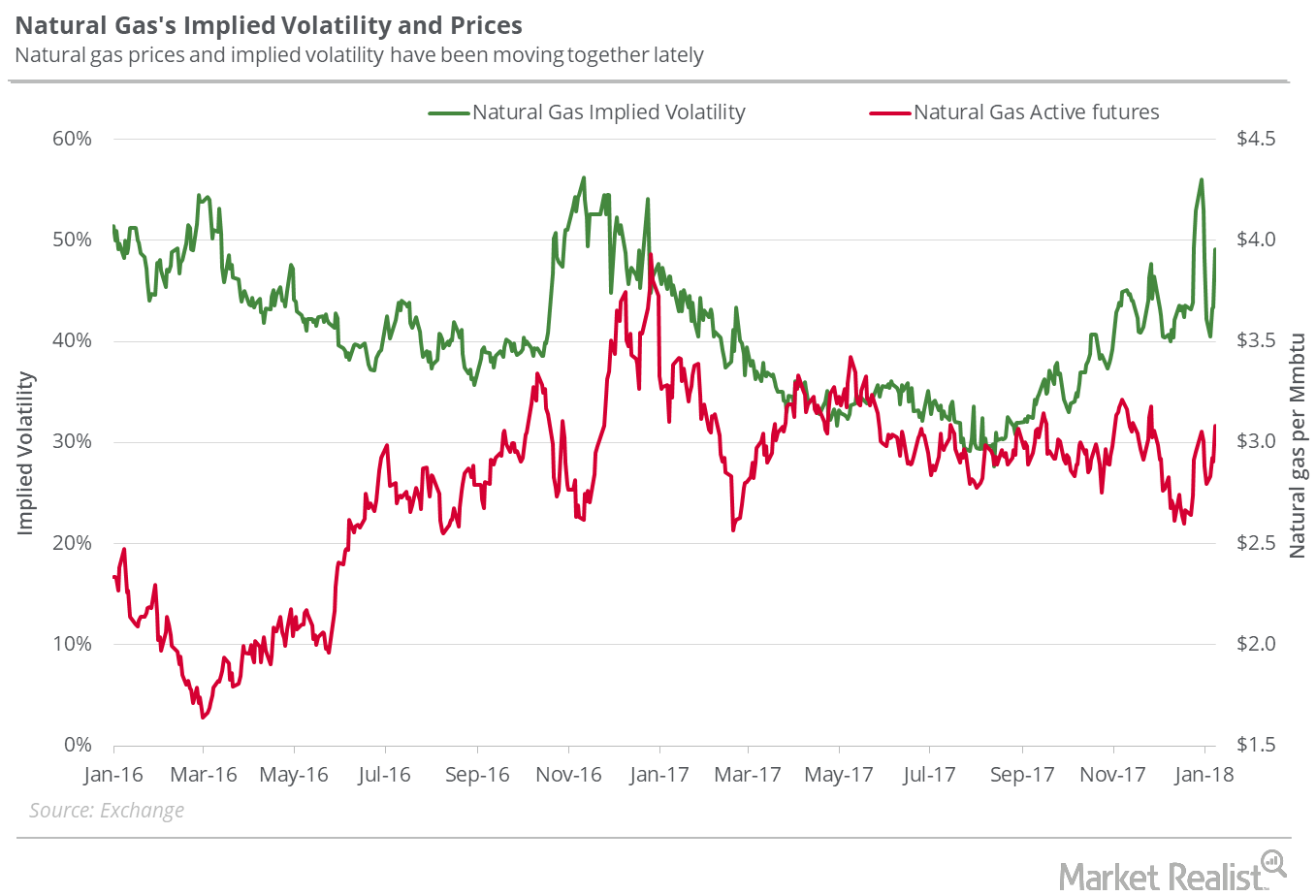

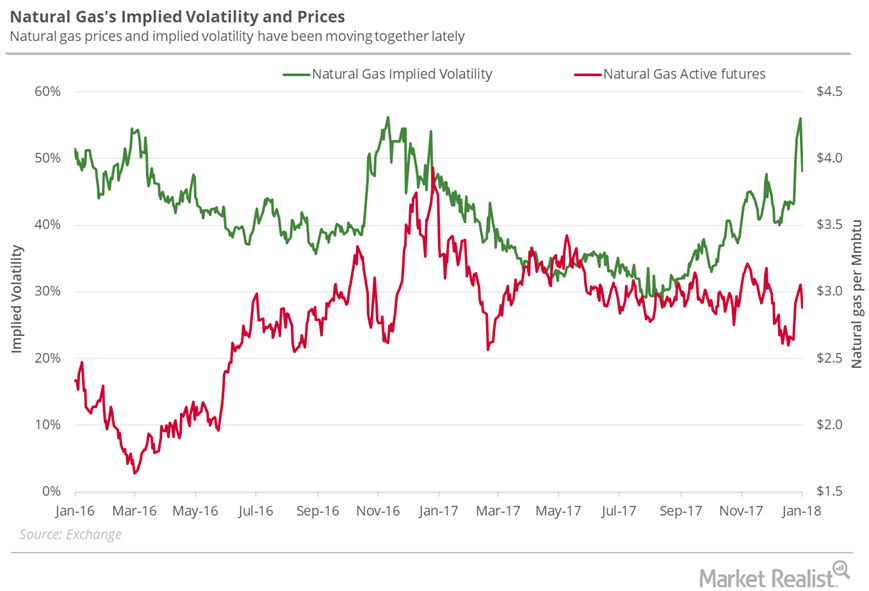

On January 18, 2018, natural gas’s implied volatility was 53.9%, 10.2% above its 15-day average.

How Hedge Funds Feel about Natural Gas Right Now

On September 29, the CFTC (U.S. Commodity Futures Trading Commission) is slated to release its weekly “Commitment of Traders” report.

Could La Niña Save Natural Gas Bulls?

On October 4, 2017, natural gas (UNG) November futures closed at $2.94 per MMBtu (million British thermal units), a rise of 1.6% from the last trading session.

US Natural Gas Consumption Could Help the Prices

US natural gas consumption fell 0.17% to 57.1 Bcf/d (billion cubic feet per day) on October 12–18, 2017. It rose 3.1% from the same period in 2016.

Possibilities for Natural Gas Prices Next Week

On December 7, 2017, natural gas’s implied volatility was 40.5% or ~7.5% less than its 15-day average. On November 29, the implied volatility rose to 47.7%.

Could Oil Rig Count Stop Natural Gas Fall?

In the week ended October 6, 2017, the natural gas rig count fell by two to 187.

Could Natural Gas Hit a New 2017 Low Next Week?

On December 14, 2017, the implied volatility of natural gas futures was 40.4%. It was ~5.9% below its 15-day average.

Will Natural Gas Reclaim $3 Next Week?

On October 12, 2017, natural gas implied volatility was 35.9%, 1.7% above its 15-day average.

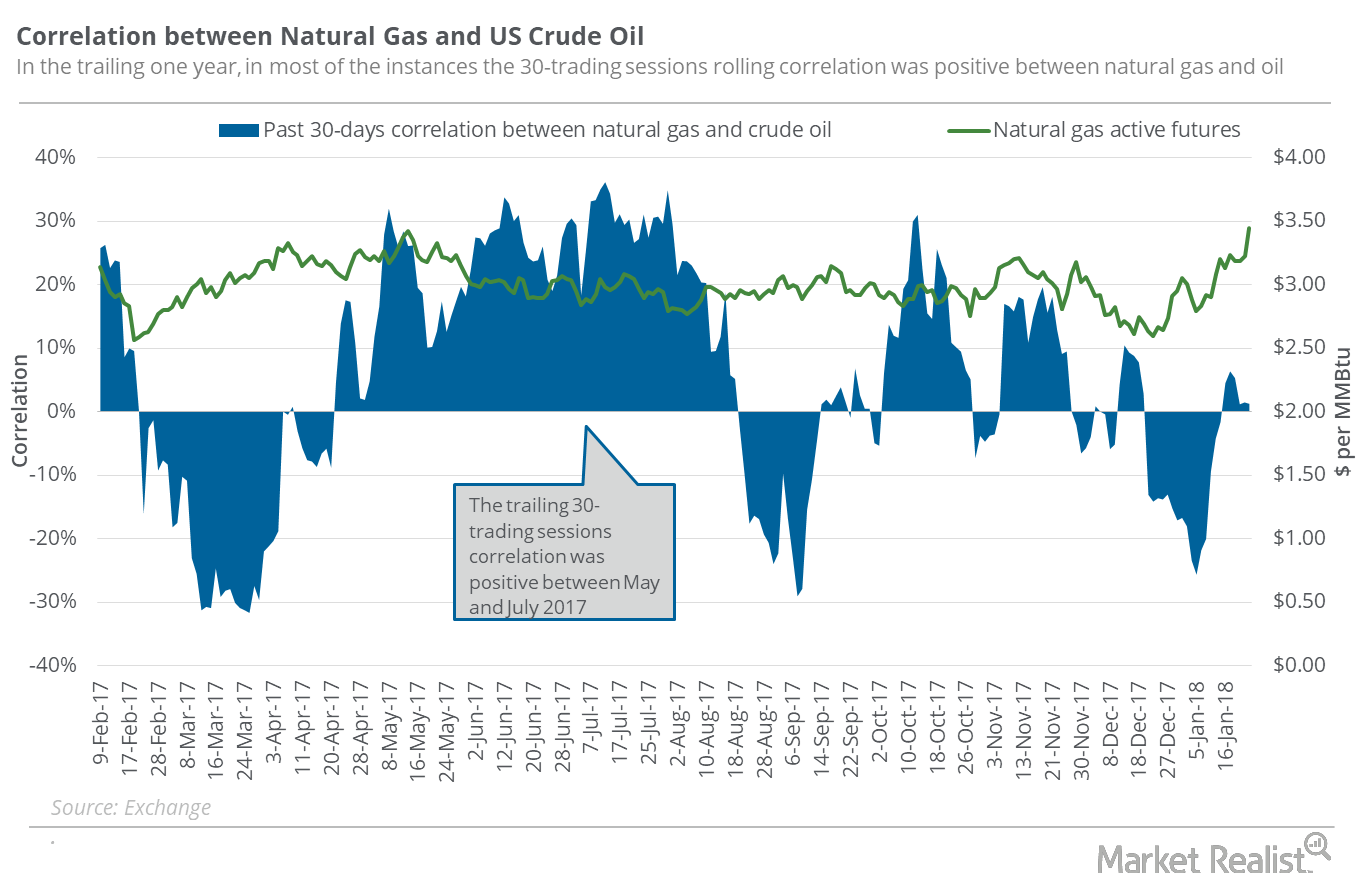

How Closely Is Natural Gas Tracking Oil?

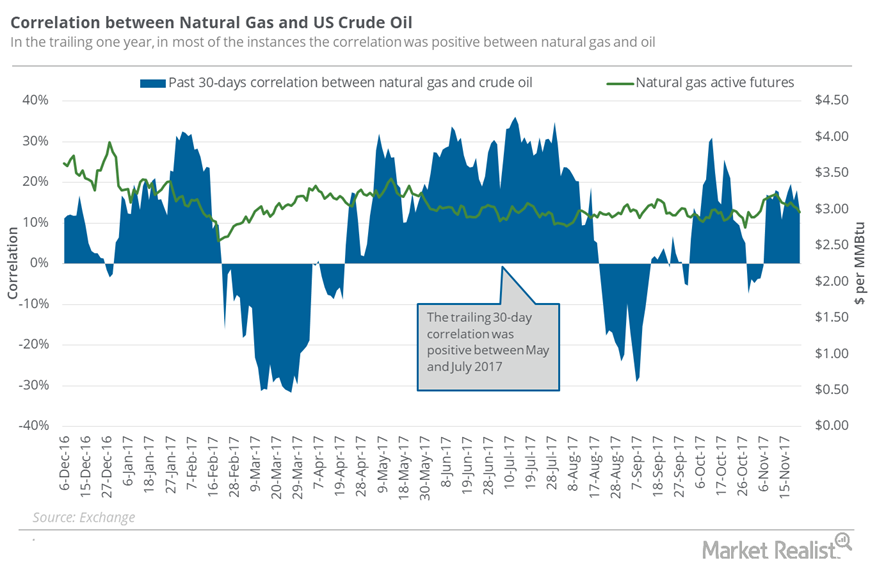

Between November 15 and 22, natural gas (UNG)(FCG) January futures had a correlation of 52.5% with US crude oil January futures.

Natural Gas Could Reach the $3.4 Mark Next Week

On November 9, 2017, natural gas had an implied volatility of 43.5%—9.4% more than its 15-day average. Natural gas active futures settled at $3.2 per MMBtu.

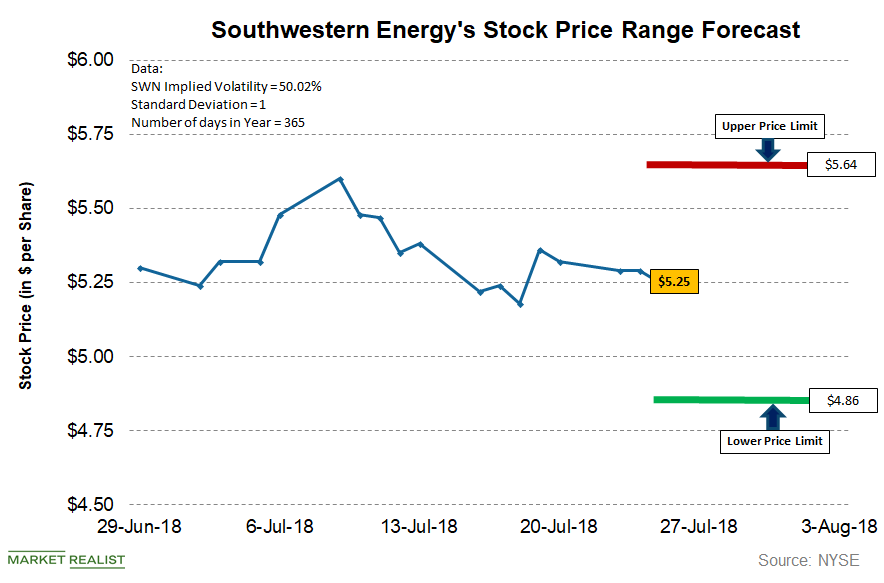

What’s the Forecast for Southwestern Energy Stock?

As of July 25, Southwestern Energy (SWN) had an implied volatility of ~50.0%, which is lower when compared with its implied volatility of ~50.9% at the end of the second quarter of 2018.

Where Could Natural Gas Prices Close Next Week?

On January 25, 2018, natural gas’s implied volatility was at 54.8%, 8% above its 15-day average.

Does Natural Gas’s Rise Depend on Crude Oil?

Between January 16 and January 23, 2018, natural gas (GASL) (UNG) (FCG) had a correlation of 84.6% with US crude oil (OIIL) (USL) (DBO) active futures.

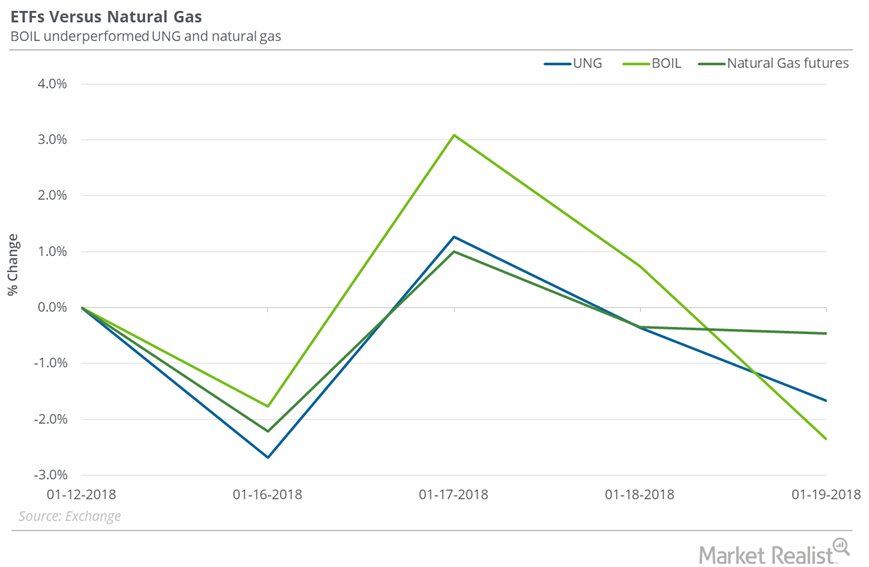

How Natural Gas ETFs Performed Last Week

Between January 12 and January 19, 2018, the United States Natural Gas ETF (UNG), an ETF that has exposure to natural gas futures, fell 1.7%.

Natural Gas Market Could Be Pricing In a Supply Deficit

On January 16, 2018, the gap between natural gas’s February 2018 futures and February 2019 futures was $0.07, or the futures spread.

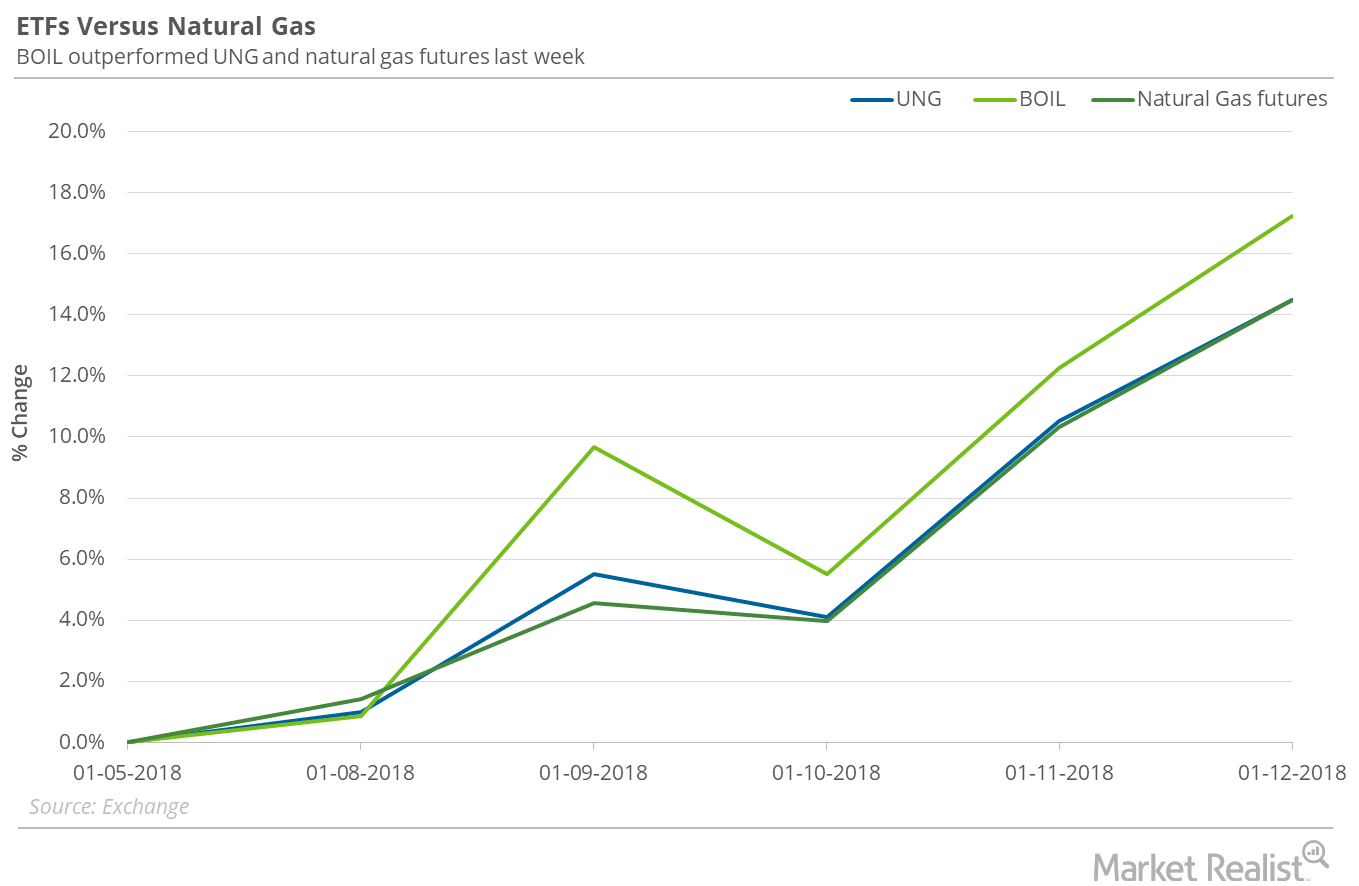

How Natural Gas ETFs Are Reacting to Spike in Natural Gas

Between January 5 and January 12, 2018, the United States Natural Gas ETF (UNG), which holds positions in active natural gas futures, gained 14.5%.

Is $3.30 Possible for Natural Gas Next Week?

On January 11, 2018, natural gas’s implied volatility was 49.1%. That’s 7% above its 15-day average.

Possible Downside in Natural Gas Next Week

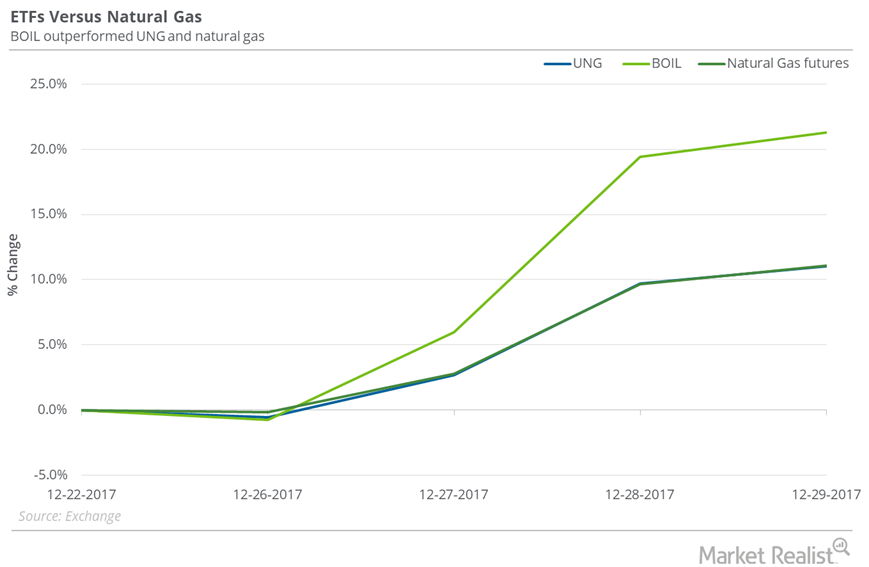

On December 21, 2017, natural gas prices closed at the lowest closing level since February 23, 2017. Since that day, natural gas futures have risen 11.1%.

Natural Gas ETFs to Watch in 2018

On December 29, 2017, the closing prices of natural gas futures contracts between March 2018 and May 2018 were progressively lower.

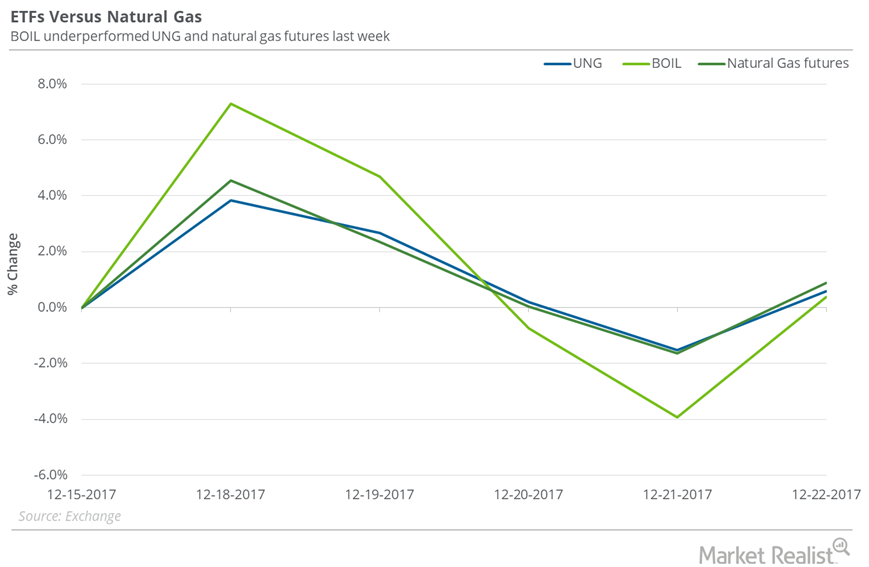

Natural Gas Returns and Natural Gas ETFs

From December 15–22, 2017, the United States Natural Gas Fund (UNG) rose 0.6%.

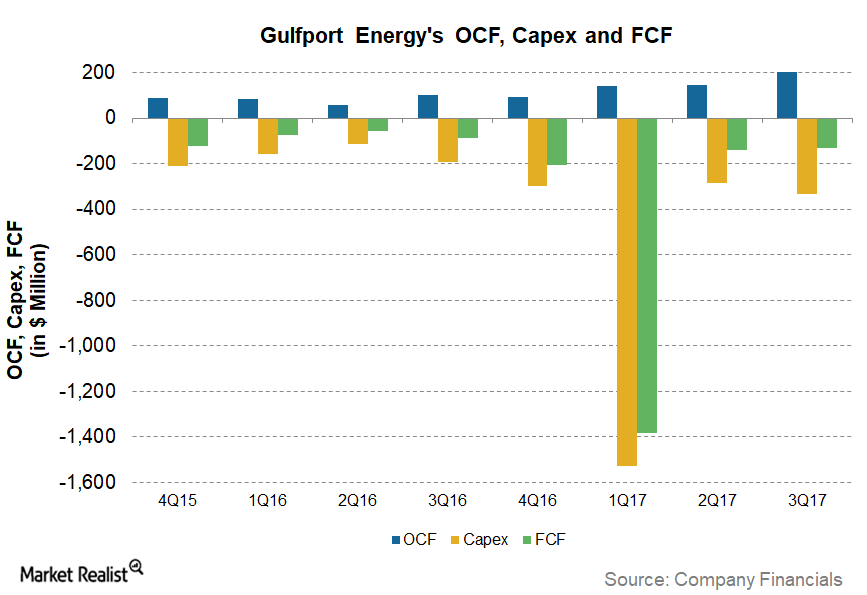

Is Gulfport Energy’s Normalized Free Cash Flow Trending Up?

For 9M17 (the first nine months of 2017), Gulfport Energy (GPOR) had normalized FCF (free cash flow) of -336%, the fourth lowest among the upstream producers we have been tracking.

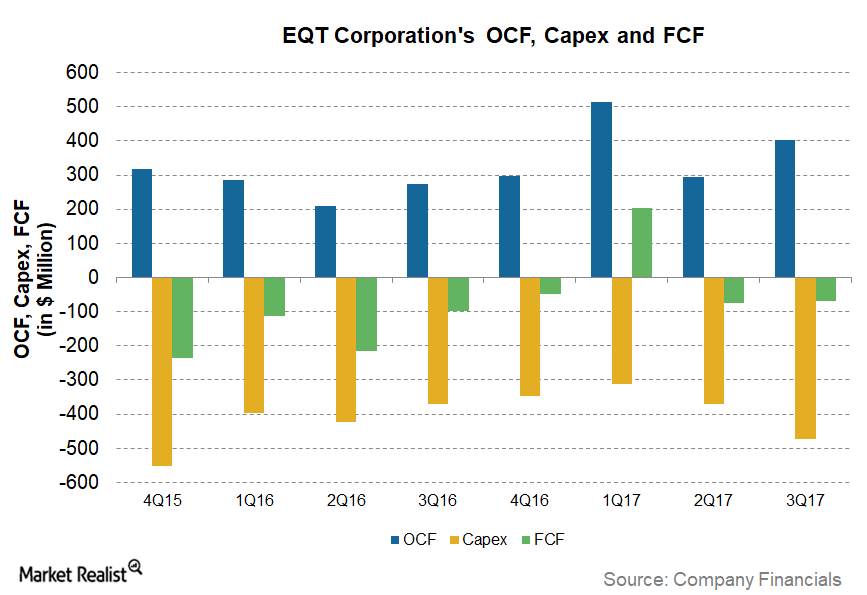

Why EQT’s Normalized Free Cash Flow Is Improving

As we saw in part one of this series, EQT (EQT) had normalized free cash flows of ~5% in the first nine months of 2017, the fifth highest among crude oil (USO) and natural gas (UNG) (UGAZ) producers we have been tracking.

Natural Gas: Have Oversupply Concerns Eased?

On December 19, natural gas (UNG)(BOIL)(FCG) January 2018 futures closed $0.31 below its January 2019 futures.

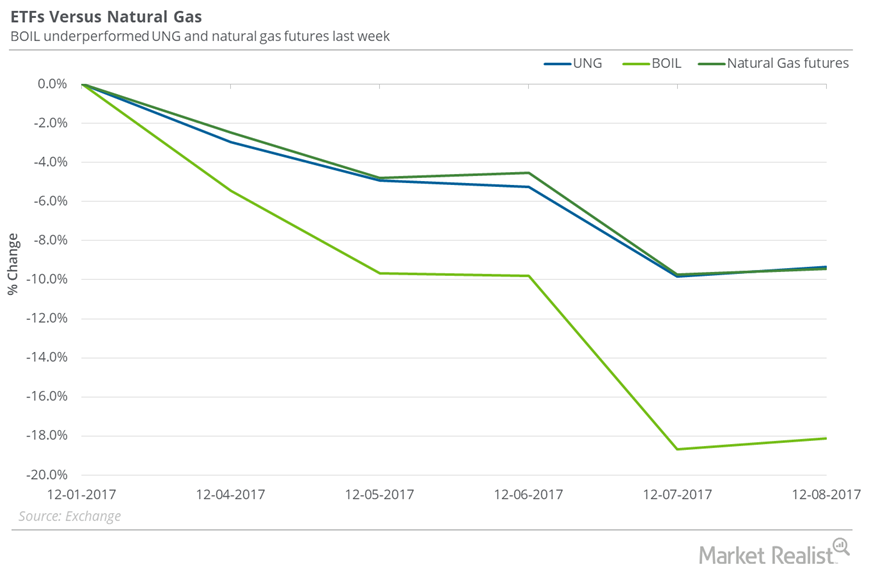

Natural Gas: Fall Impacts Natural Gas ETFs

On December 1–8, 2017, the United States Natural Gas Fund (UNG), which holds near-month natural gas futures contracts, fell 9.3%.

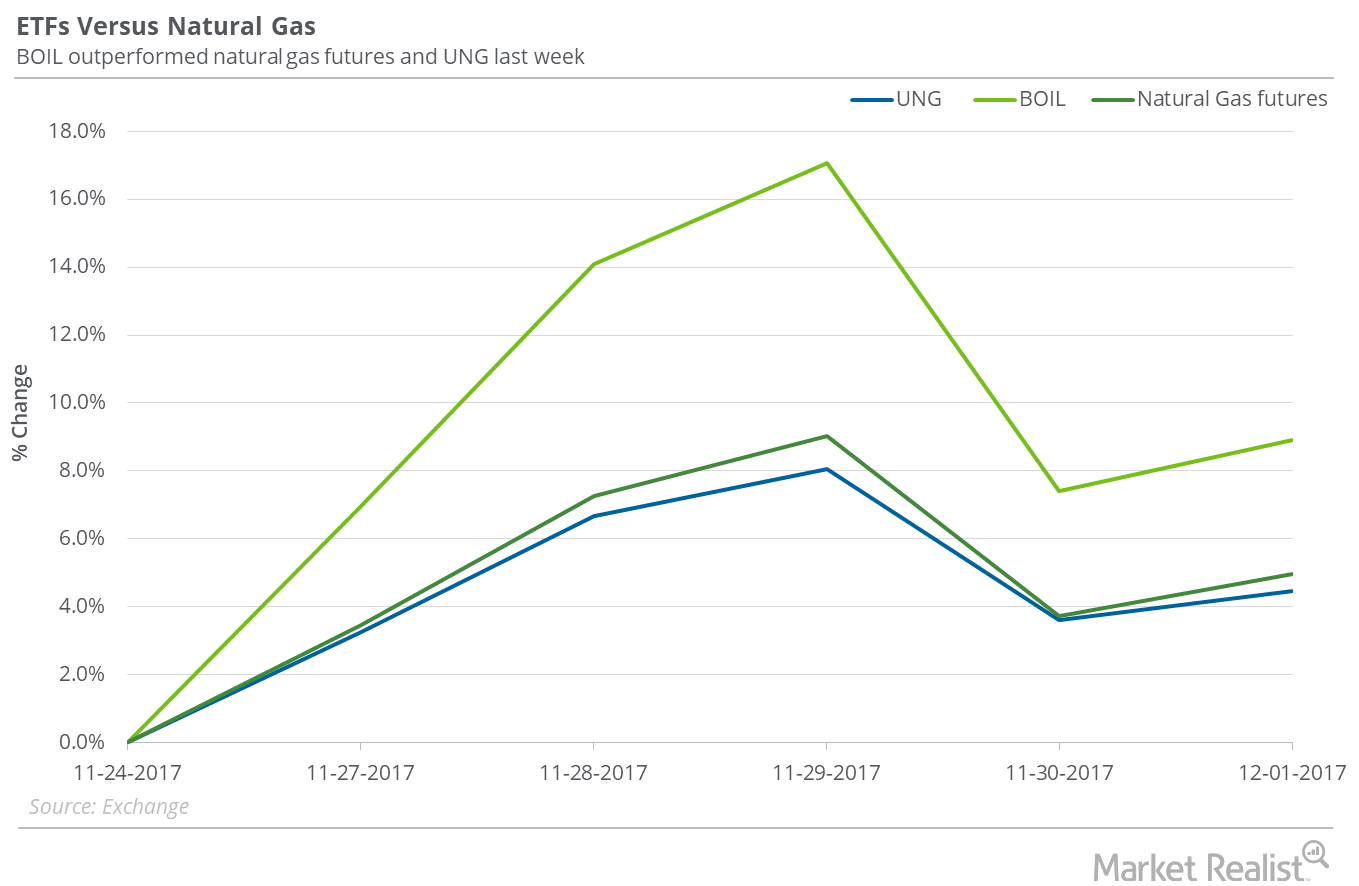

Rise in Natural Gas Impacts Natural Gas ETFs

On November 24–December 1, 2017, the United States Natural Gas Fund (UNG), that follows near-month natural gas futures contracts, rose 4.5%.

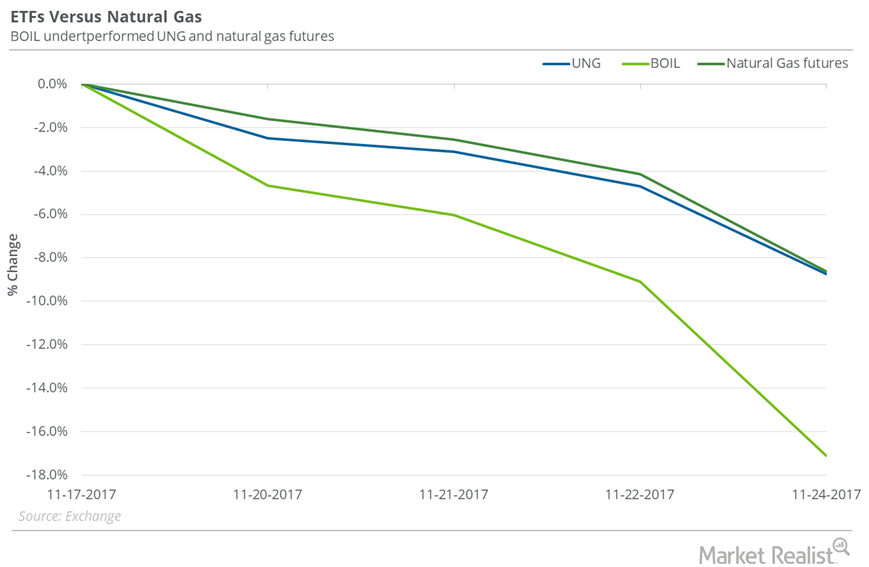

How Are Natural Gas ETFs Adjusting to Fall in Natural Gas Prices?

Between November 17 and November 24, 2017, the United States Natural Gas Fund LP (UNG) fell 8.8%.

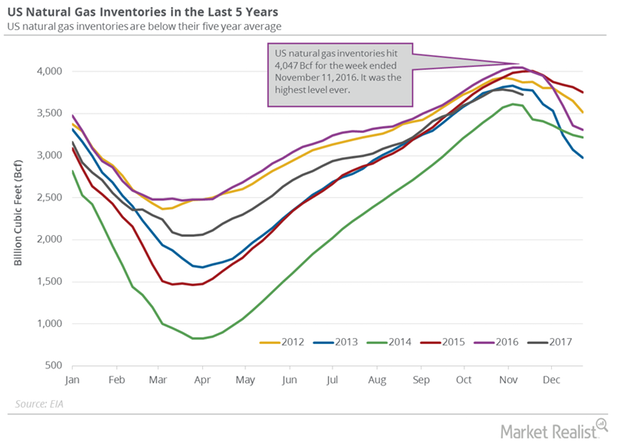

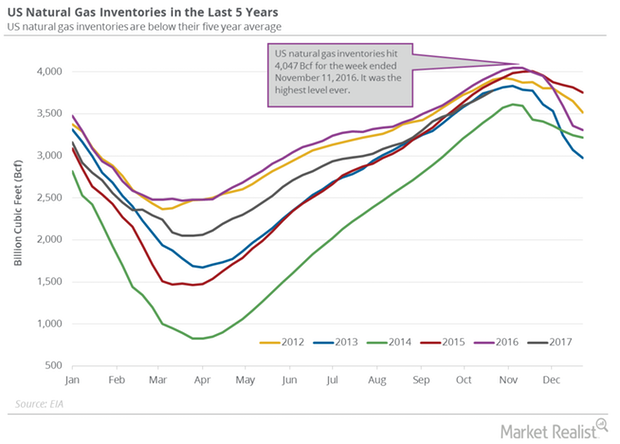

US Natural Gas Inventories Have Fallen 8% from Last Year

The EIA estimated that US natural gas inventories fell by 46 Bcf (billion cubic feet) or 1.2% to 3,726 Bcf on November 10–17, 2017.

Are Natural Gas ETFs Doing Any Better than Natural Gas?

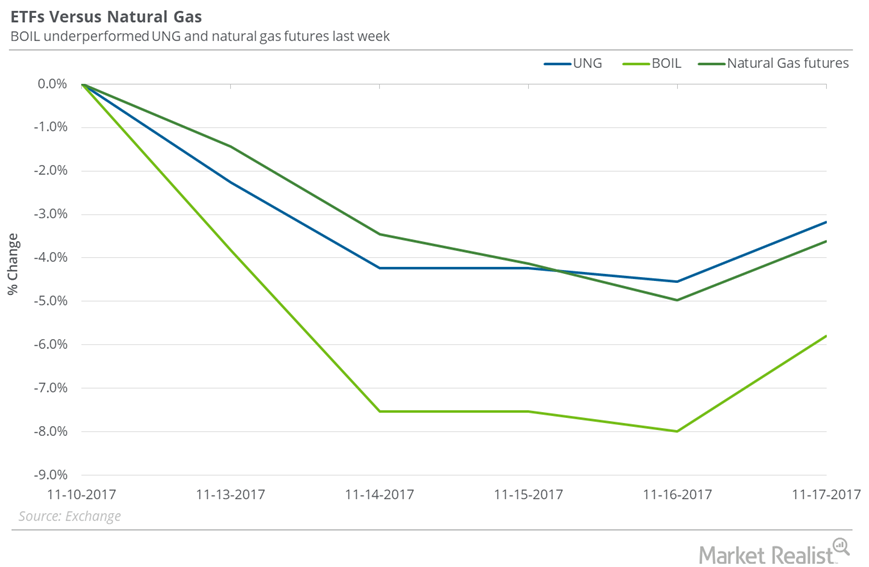

Between November 10 and November 17, the United States Natural Gas Fund LP (UNG) fell 3.2% while natural gas active futures fell 3.6%.

Did Natural Gas ETFs Outperform Natural Gas Last Week?

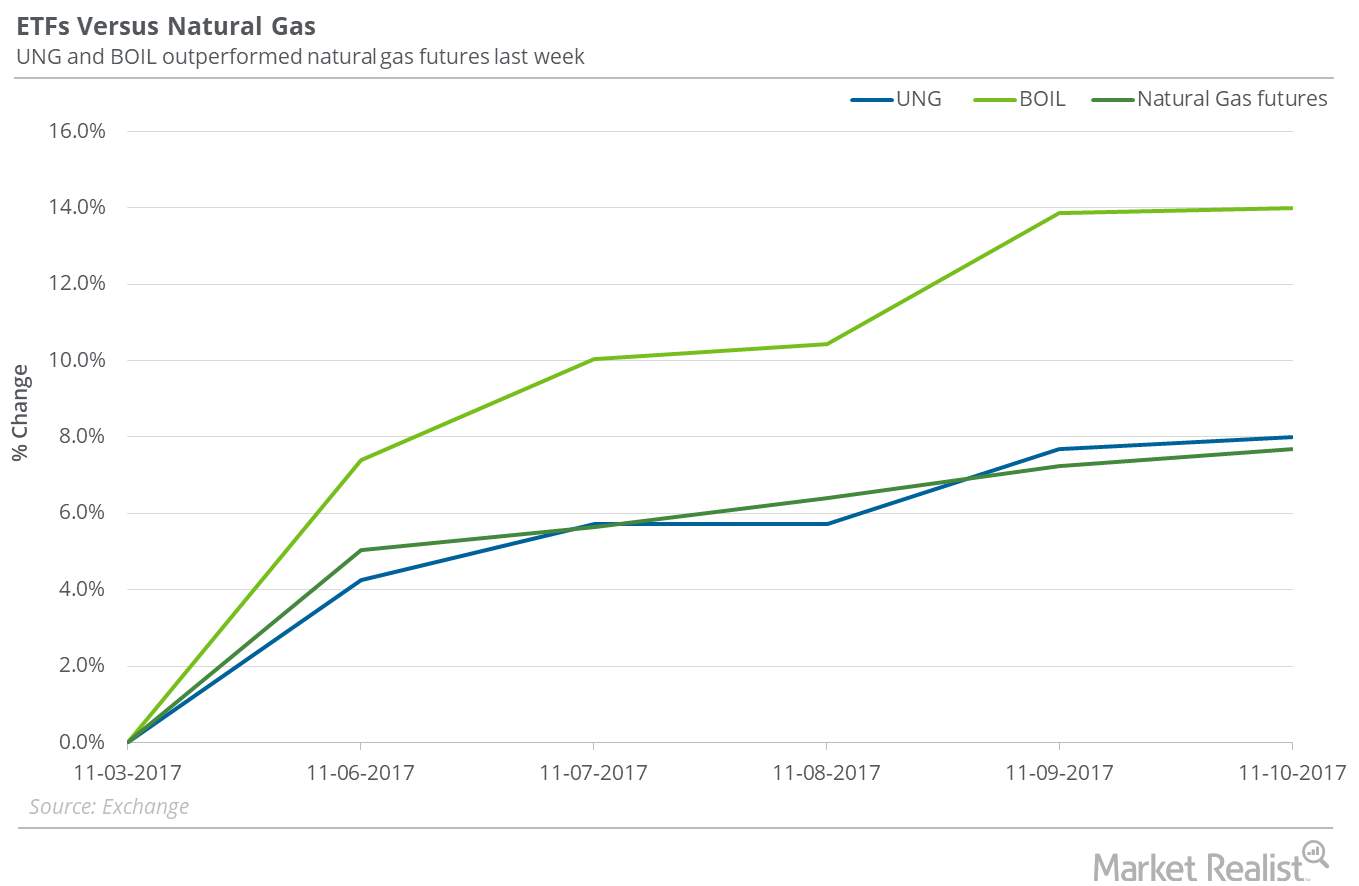

Between November 3 and November 10, 2017, the United States Natural Gas Fund LP (UNG) rose 8%, only 30 basis points above the gain in natural gas December futures.

US Natural Gas Inventories Could Help Natural Gas Futures

The EIA reported that US natural gas inventories rose by 65 Bcf (billion cubic feet) to 3,775 Bcf on October 20–27, 2017.

Natural Gas versus Natural Gas ETFs Last Week

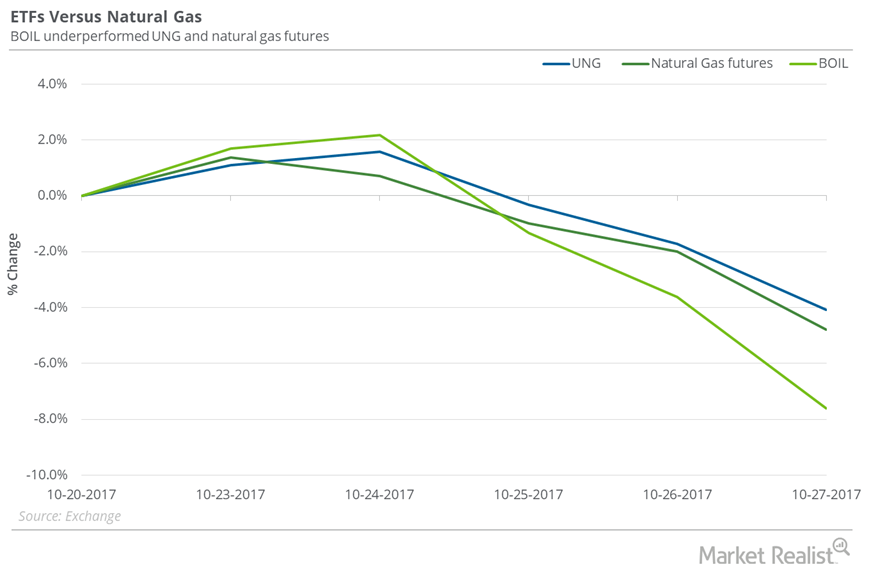

On October 20–27, natural gas (FCG) (GASL) (GASX) December futures fell 4.8%. During this period, the United States Natural Gas Fund LP (UNG) fell 4.1%.

How Is US Natural Gas Production and Consumption Trending?

PointLogic estimates that weekly US dry natural gas production rose by 0.9 Bcf (billion cubic feet) per day to 74.6 Bcf per day between October 19 and October 25, 2017.

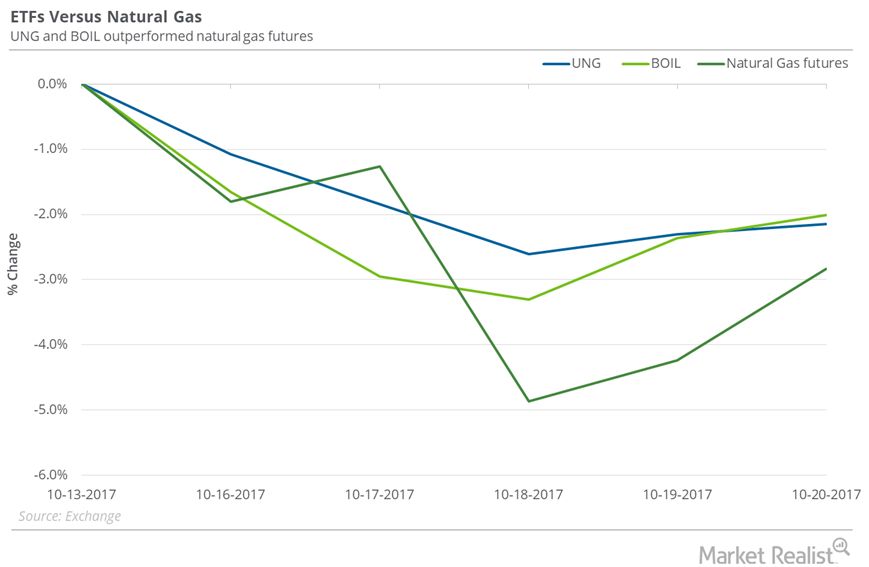

Where Natural Gas ETFs Stood next to Natural Gas Last Week

Between October 13 and October 20, 2017, the United States Natural Gas Fund LP (UNG) fell 2.2%, and natural gas November futures fell 2.8%.

Will Natural Gas Fall to $2.7 Levels Next Week?

On October 19, 2017, natural gas futures’ implied volatility was 38.8%, 9.6% above its 15-day average.

The Smell of Natural Gas: Ripe for a Pullback?

On October 18, natural gas November futures closed at $2.85 per MMBtu (million British thermal units)—3.6% below the last trading session’s closing price.

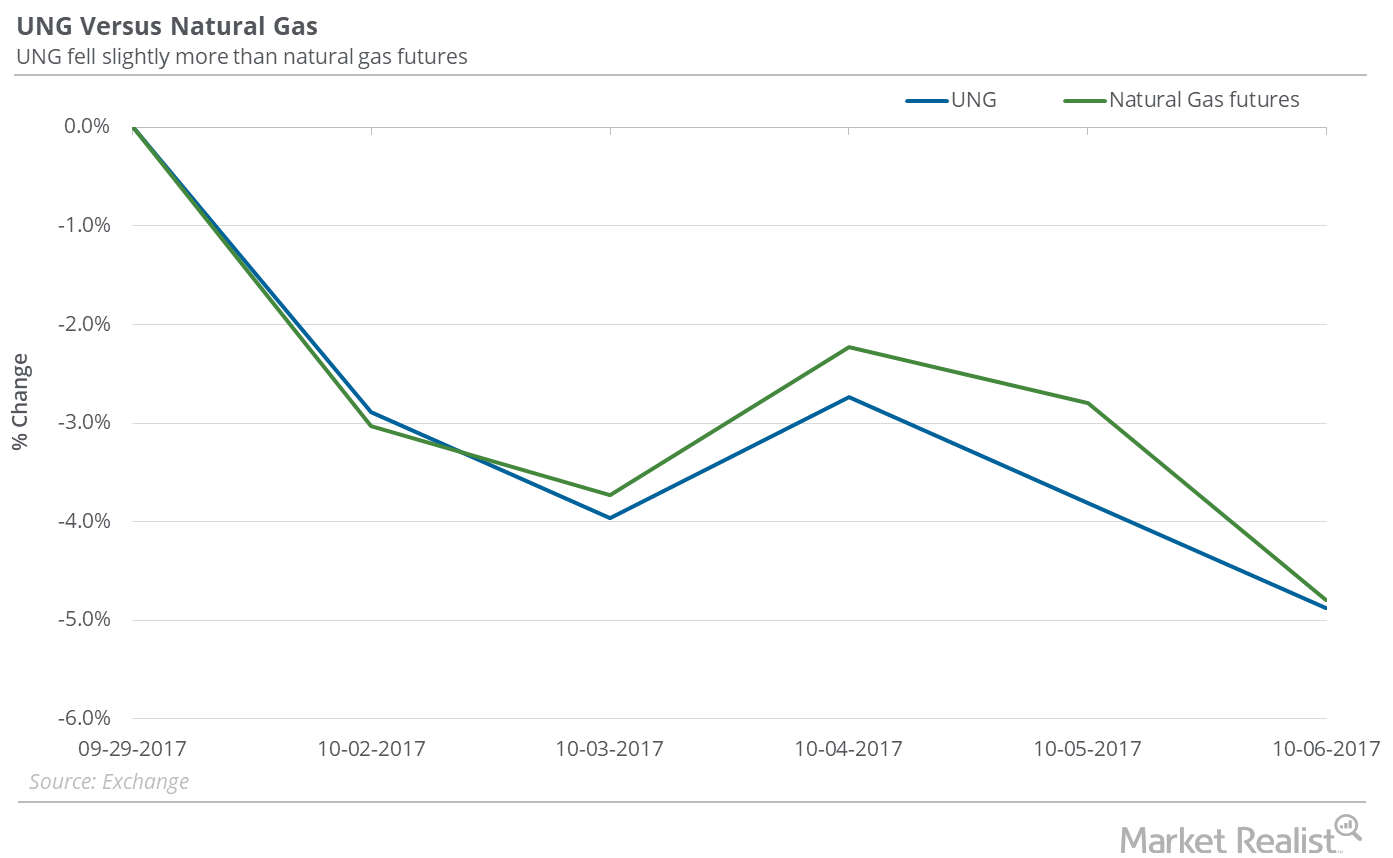

Did UNG Outperform Natural Gas in the Week Ended October 6?

Between September 29 and October 6, 2017, the United States Natural Gas Fund ETF (UNG) fell 4.9%, while natural gas (BOIL) (GASX) November futures fell 4.8%.

Could Natural Gas Fall below the $2.8 Mark Next Week?

On October 5, 2017, the implied volatility of US natural gas active futures was at 33.1%, or 7.3% below the 15-day average.

How UNG Fared Compared to Natural Gas Last Week

On September 22–29, 2017, the United States Natural Gas Fund LP (UNG) rose 0.2%, while natural gas (BOIL) November futures fell 0.5%.

Will US Natural Gas Consumption Outweigh Production?

PointLogic estimates that weekly US natural gas consumption fell 6.6% to 52 Bcf per day from September 7 to 13. Consumption fell 13% year-over-year.