First Trust Natural Gas ETF

Latest First Trust Natural Gas ETF News and Updates

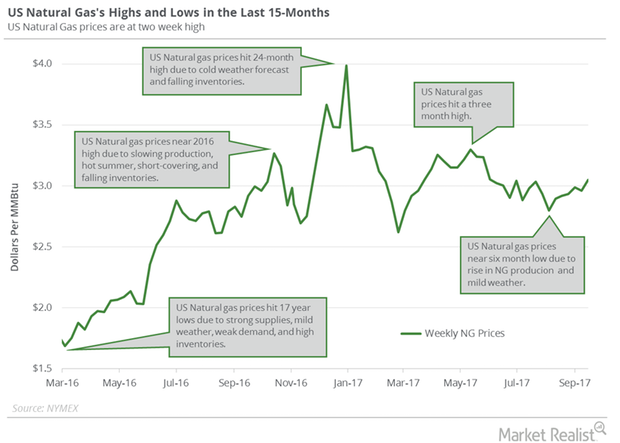

Why US Natural Gas Futures Hit a 2-Week High

US natural gas (DGAZ)(UGAZ)(UNG) futures contracts for October delivery rose 0.32% to $3.07 per MMBtu (million British thermal units) on Thursday, September 14.

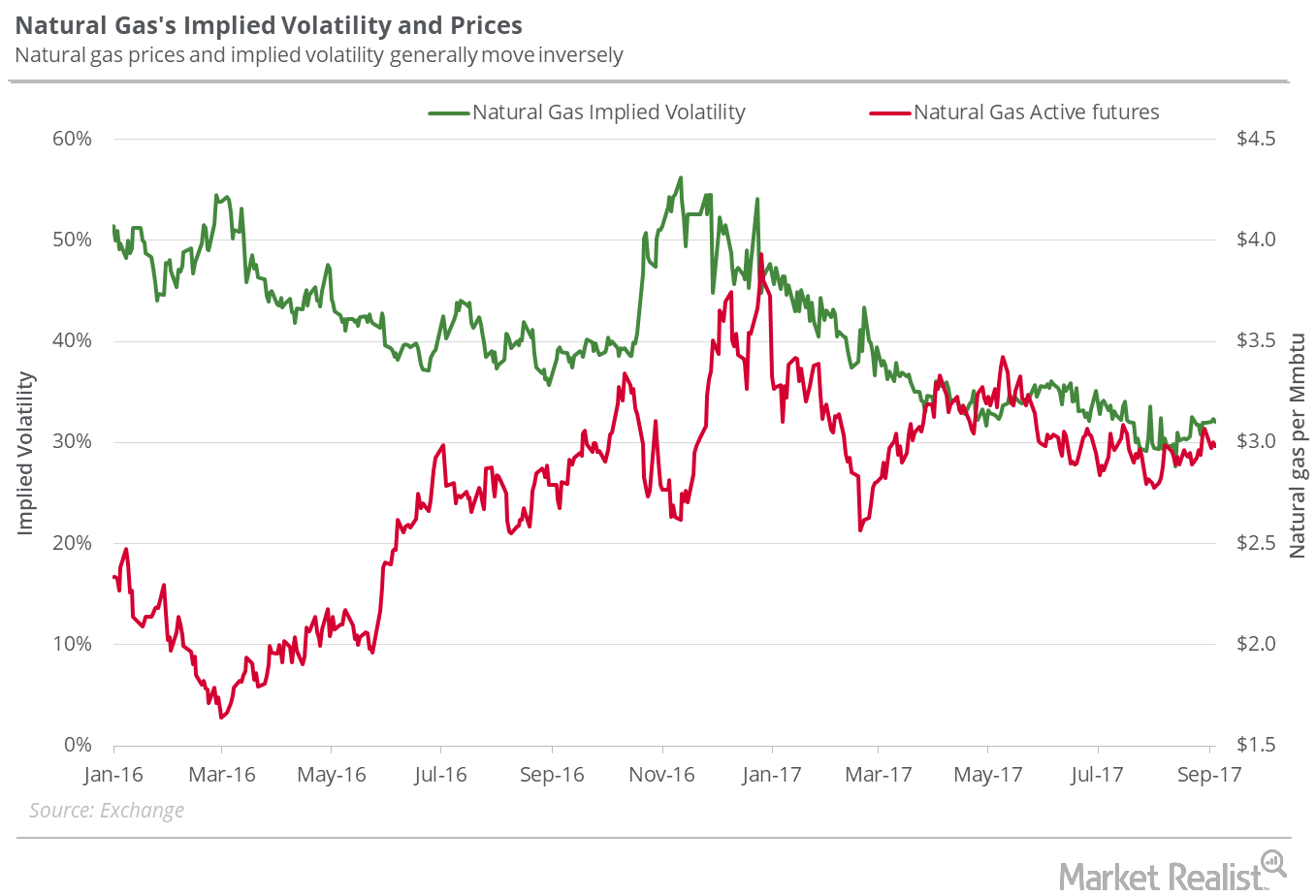

Is Natural Gas a Good Short for Bears at $3?

On September 13, natural gas October futures closed at $3.058 per MMBtu (million British thermal units). The same day, natural gas prices rose 1.9%.

Natural Gas Could Regain the $3 Mark Next Week

In the next seven days, natural gas October futures could close between $2.85 and $3.11 per MMBtu (million British thermal units).

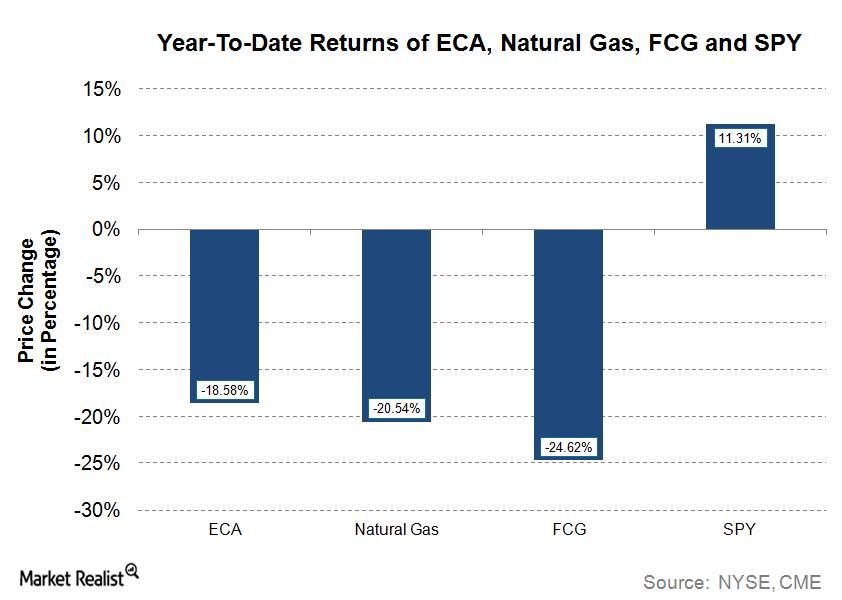

How Encana Stock Has Performed This Year

Year-to-date, Encana’s (ECA) stock has fallen ~19% to $9.53. The stock is trading below its 50-week and 200-week moving averages.

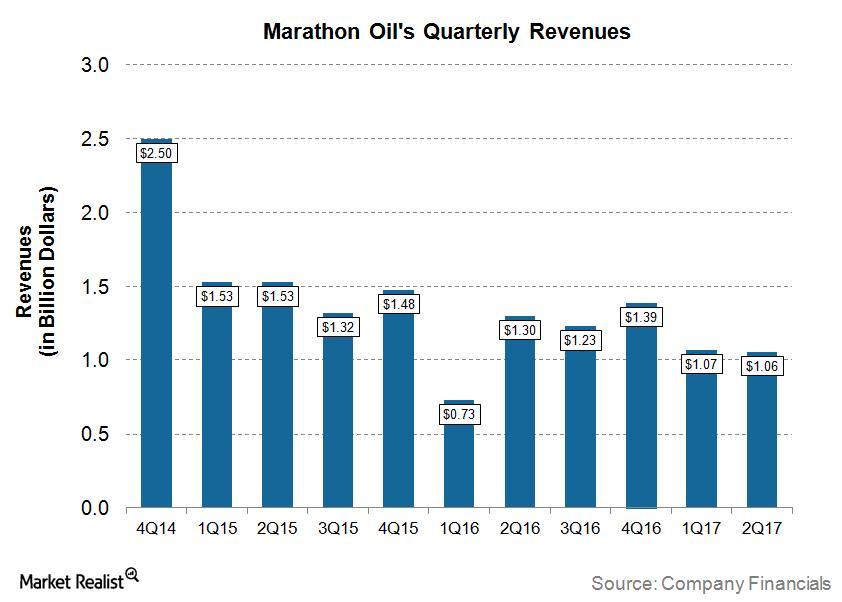

Analyzing Marathon Oil’s 2Q17 Revenues

For 2Q17, Marathon Oil (MRO) reported revenues of ~$1.06 billion, which was higher than Wall Street analysts’ consensus for revenues of ~$1.02 billion.

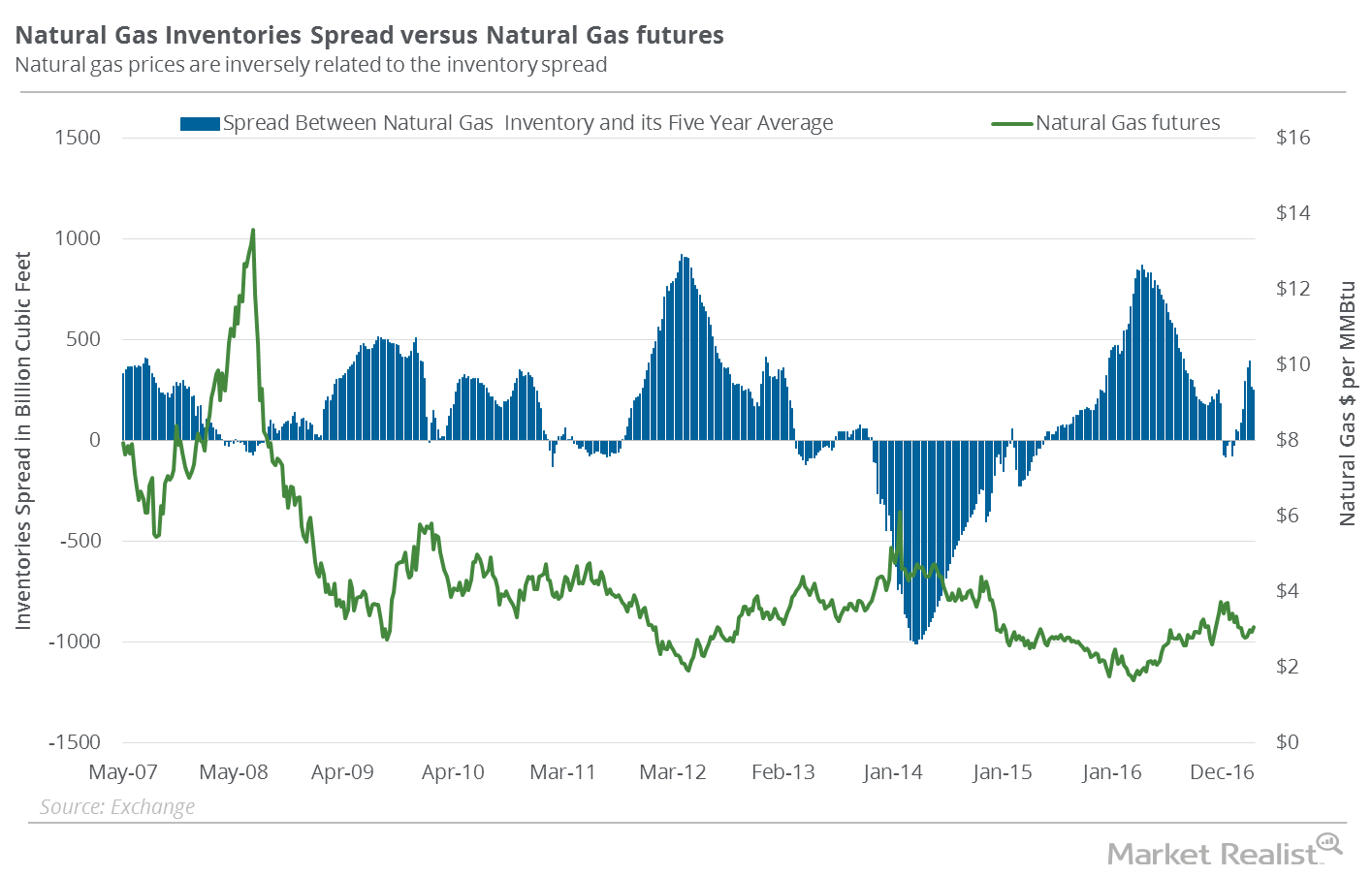

Can the Natural Gas Inventories Spread Rescue Natural Gas Bulls?

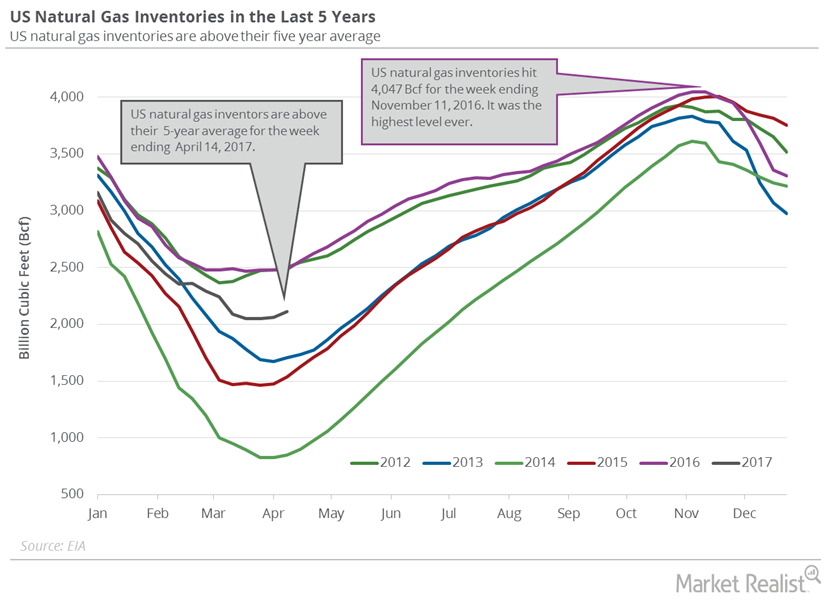

In the week ended June 23, 2017, natural gas inventories were at 2,816 Bcf (billion cubic feet)—46 Bcf more compared to the week earlier.

US Natural Gas Inventories Pressure Prices

The EIA reported that US natural gas inventories rose by 54 Bcf to 2,115 Bcf on April 7–14, 2017. Inventories rose 2.6% week-over-week but fell 14.8% YoY.

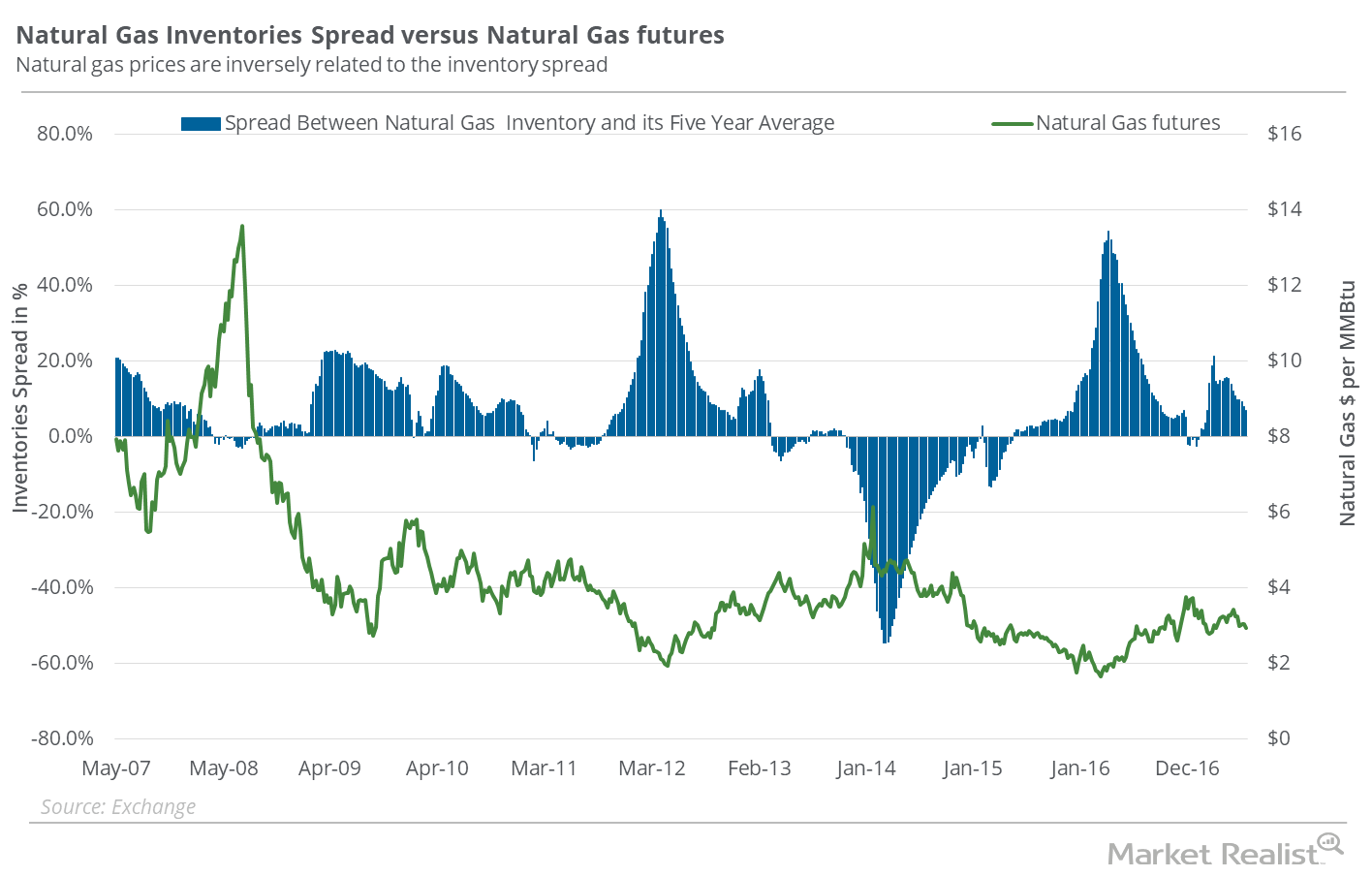

Inventories Spread: Why Natural Gas Uptrend Could Be at Risk

According to data from the EIA (U.S. Energy Information Administration) released on March 30, 2017, natural gas inventories fell by 43 Bcf (billion cubic feet) during the week ending March 24, 2017.

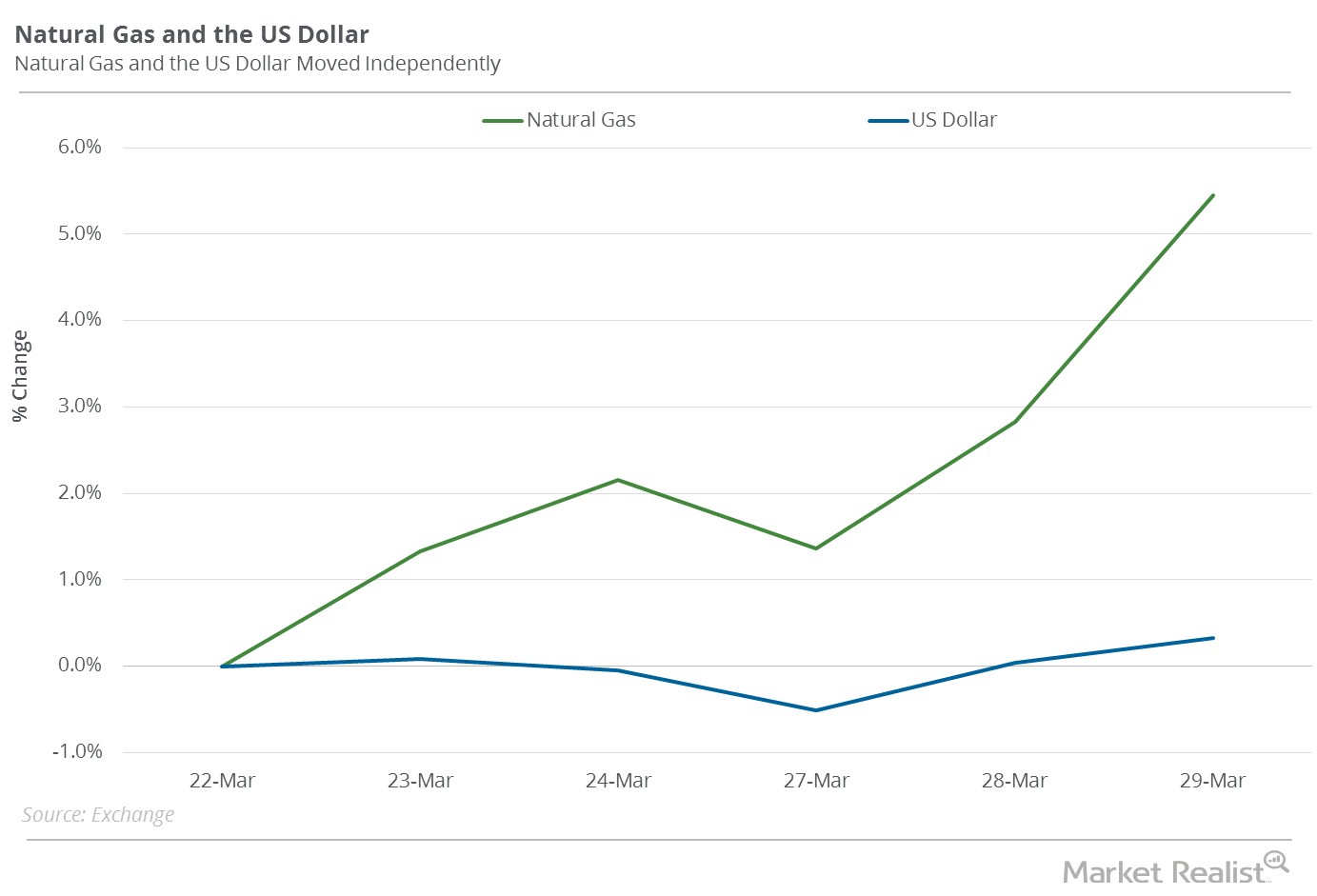

US Dollar Could Impact Natural Gas Prices

Between March 22 and March 29, 2017, natural gas (GASX) (FCG) (GASL) May futures rose 5.4%. The US dollar rose 0.3% during that period.

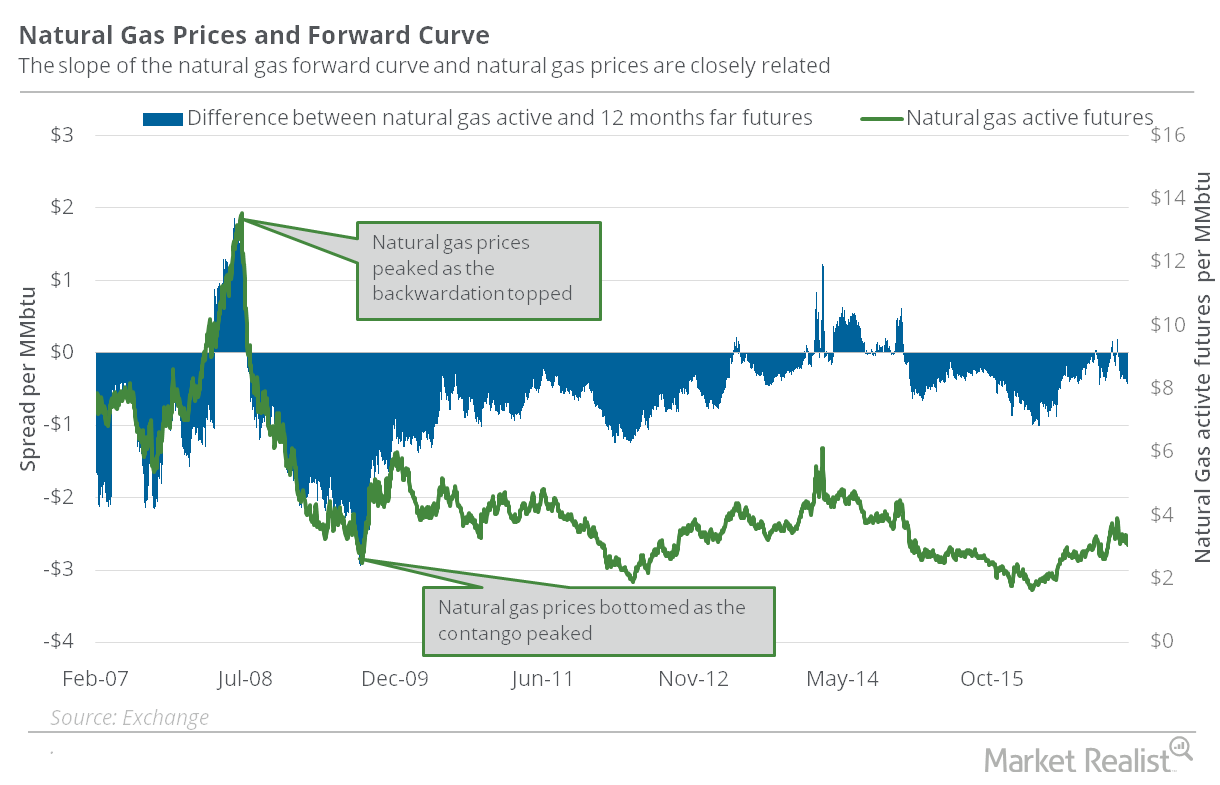

What Contango Could Mean for Natural Gas Traders

Active natural gas futures are currently trading at a discount of $0.56 to the futures contracts 12 months ahead. The situation is called “contango.”

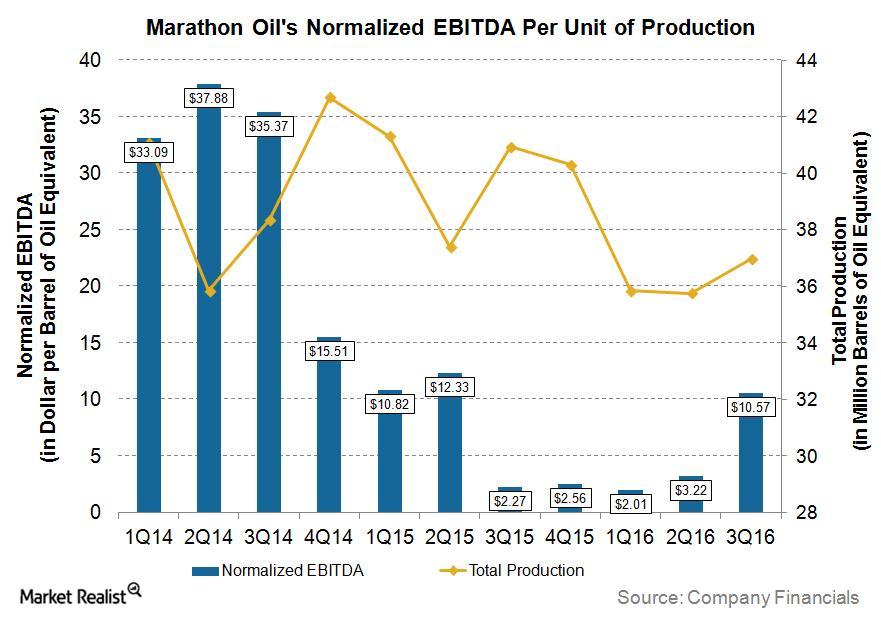

Understanding Marathon Oil’s EBITDA Normalized to Production

In 3Q16, Marathon Oil (MRO) reported normalized EBITDA per unit of production of ~$10.57 per boe, which was ~366% higher than in 3Q15.

Why the Weather Could Mean Trouble for Natural Gas Bulls

The weather forecast for September 26 to October 2 indicates that temperatures in the US could remain lower than the five-year average for the period.

How Could the Weather Impact Natural Gas Prices?

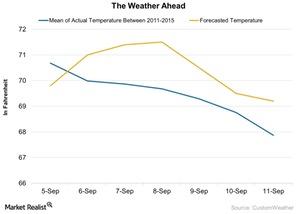

Weather forecasts for September 5–11 indicate that temperatures in the United States could remain higher than the five-year average for the same period, except on September 5.

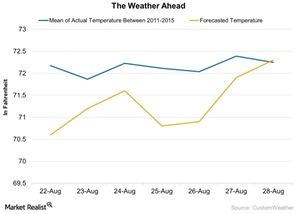

How Will Weather Affect Natural Gas Prices This Week?

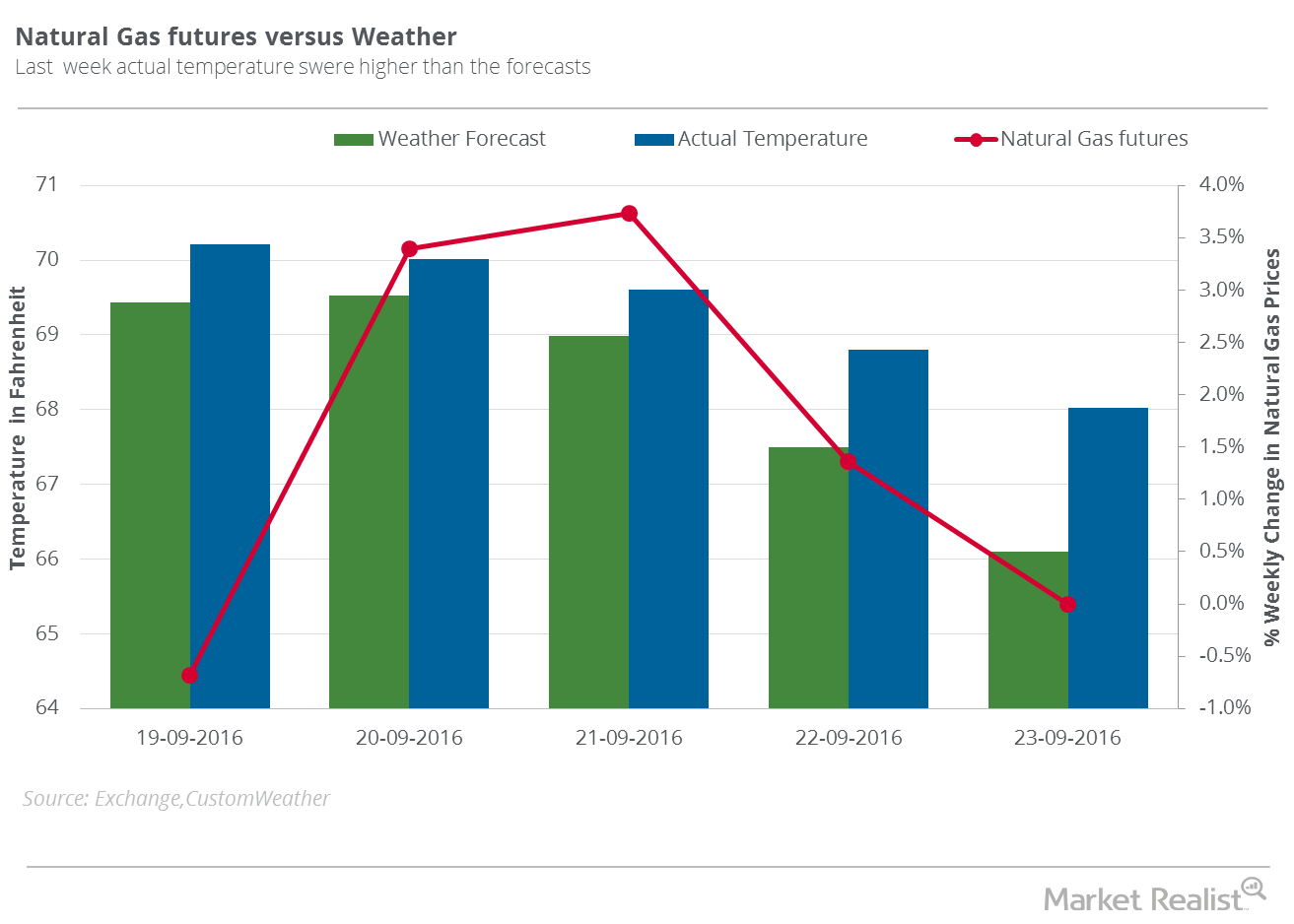

Lower temperatures decrease the use of natural gas (UNG) (DGAZ) (BOIL) (FCG) (UGAZ) (GASL) for cooling purposes during the summer.

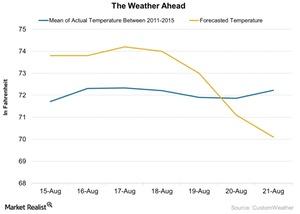

How Will the Weather Impact Natural Gas This Week?

In the week ending August 12, temperatures were higher than the forecast for the week. Natural gas futures fell 6.7% for the week ending on August 12.

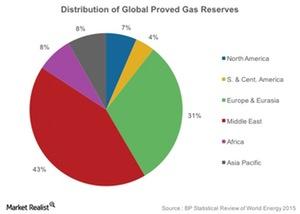

A Vital Resource: Which Region Has the Most Natural Gas Reserves?

Total global natural gas reserves stand at 6,606 trillion cubic feet, of which 43% are in the Middle East.