Energy Transfer LP

Latest Energy Transfer LP News and Updates

Will Energy Transfer Equity Build on Last Week’s Gains This Week?

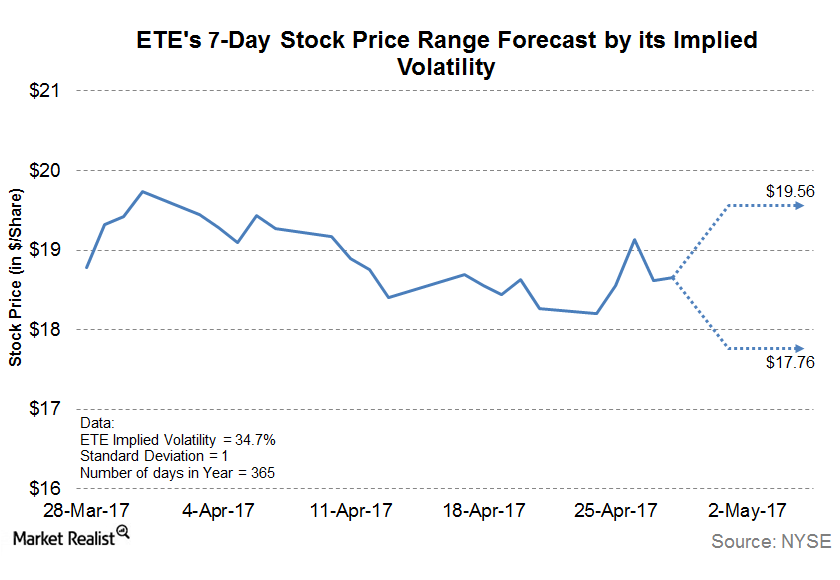

Energy Transfer Equity (ETE) recently went below its 50-day simple moving average driven by the decline in the last two trading sessions of last week.

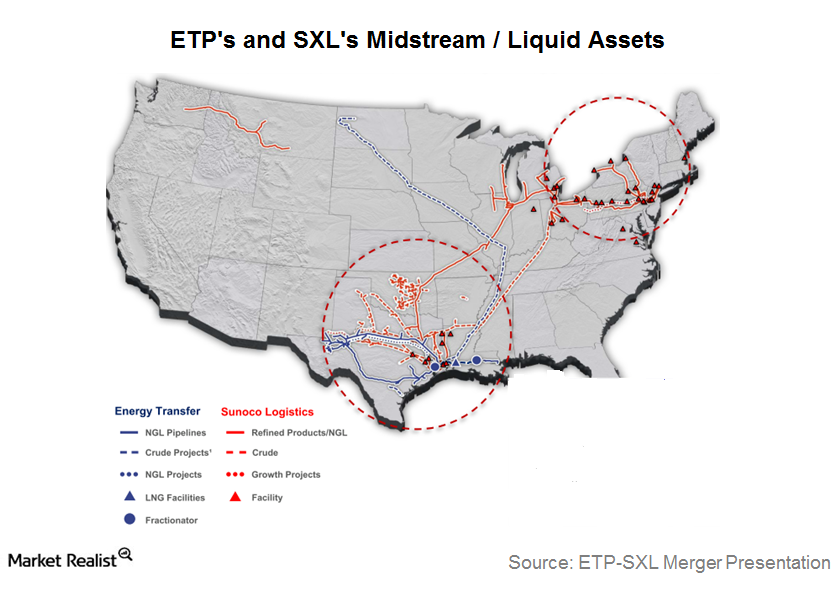

How Sunoco Logistics Could Benefit from Liquids Integration

SXL has remained bullish on its NGL growth story, which has been supported by strong NGL supply growth from the liquids-rich Marcellus and Utica Shales.

What Might Cap Rising Crude Oil Prices?

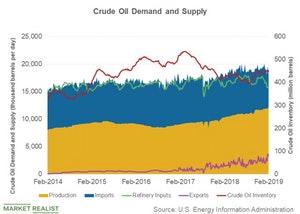

The US crude oil (USO) supply includes domestic production and imports. The supply gets consumed as inputs to refineries and exports.

Analyzing Cheniere Energy’s Commodity Price Exposure

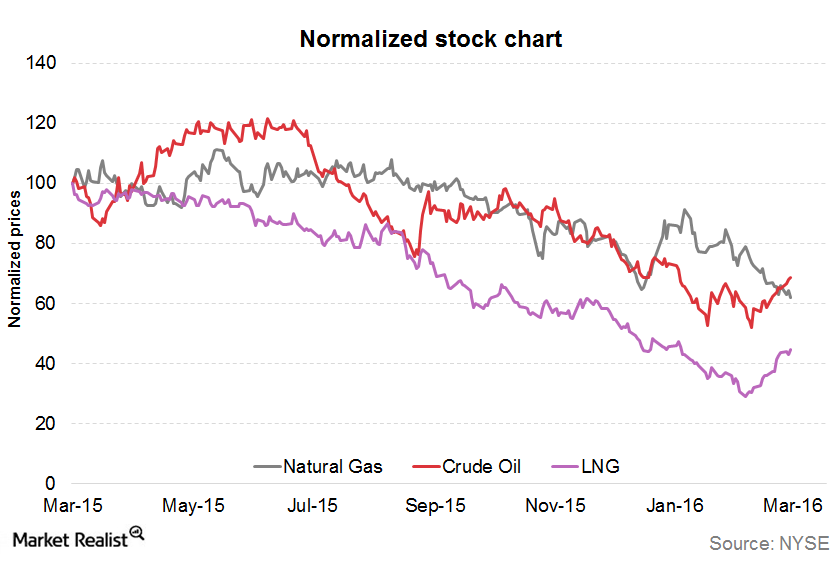

The correlation between Cheniere Energy’s stock price and crude oil (USO) resulted in a correlation coefficient of 0.87 during the past year.

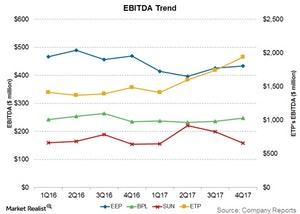

Why Energy Transfer Partners’ Earnings Are on the Rise

Energy Transfer Partners (ETP) reported adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) of $1.9 billion in 4Q17.

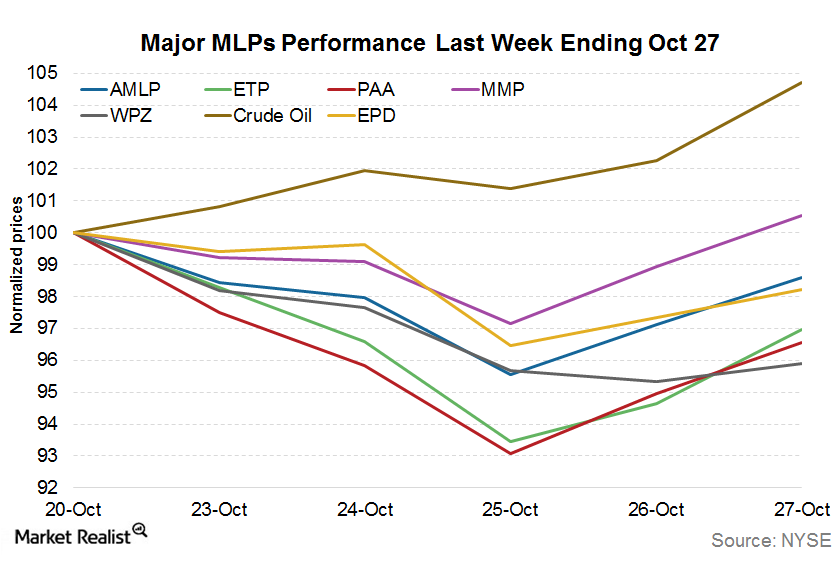

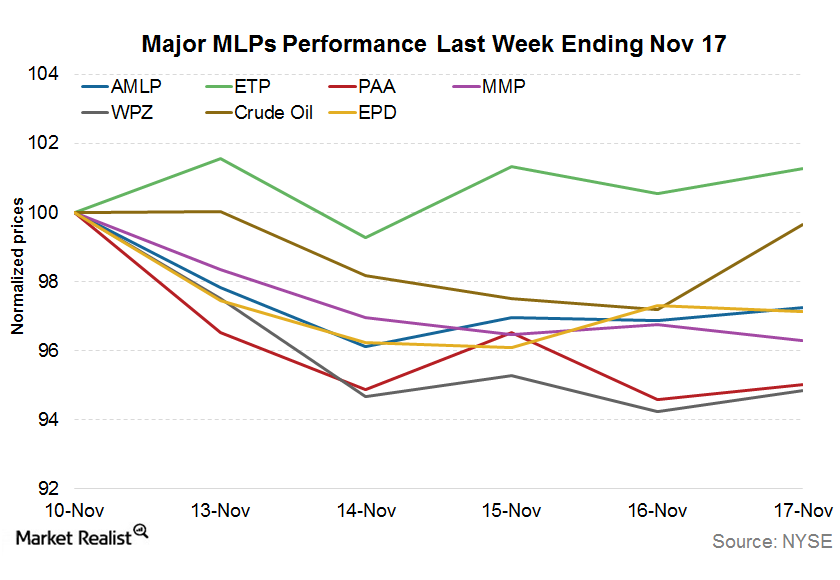

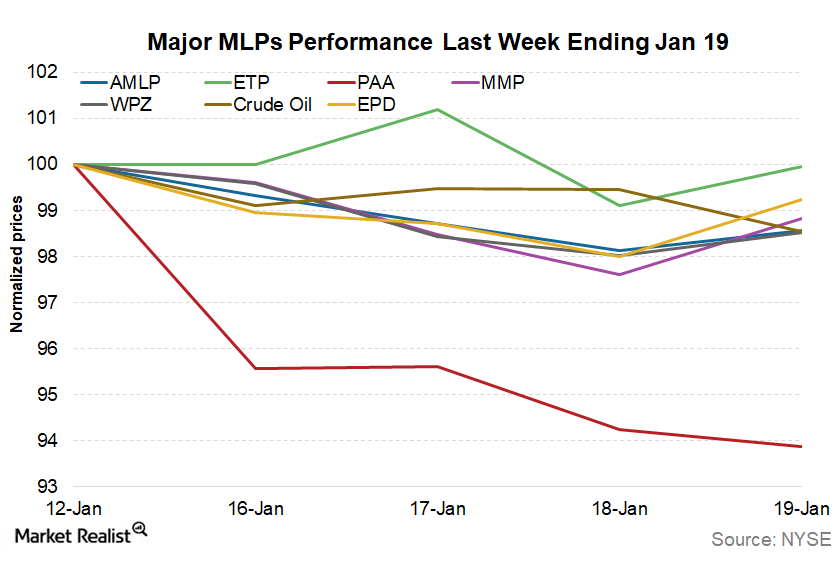

Why MLPs’ Sluggishness Continued Last Week

MLPs’ sluggishness continued last week despite strong crude oil. The Alerian MLP Index (^AMZ), which tracks the performance of 50 energy MLPs, fell 1.2% last week.

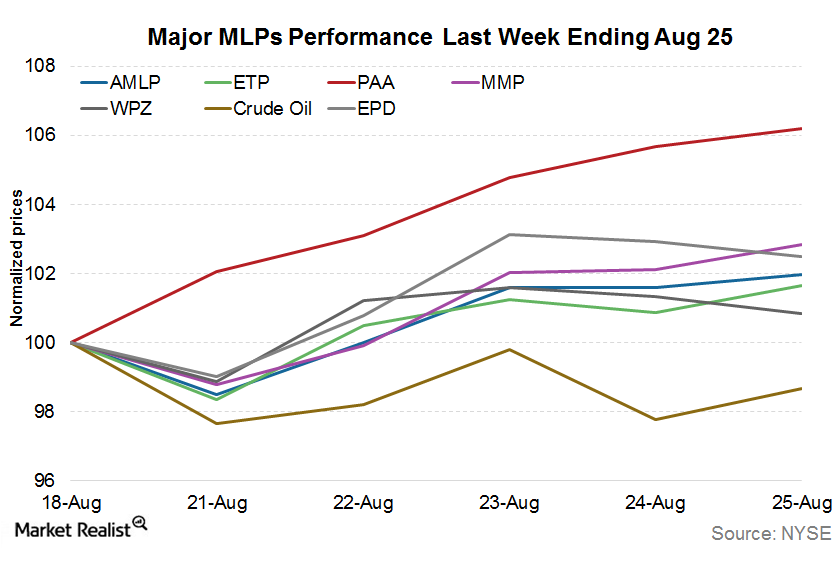

MLPs Recovered Slightly in the Week Ending August 25

MLPs recovered slightly in the week ending August 25—possibly due to an overcorrection in the first three weeks of the month.

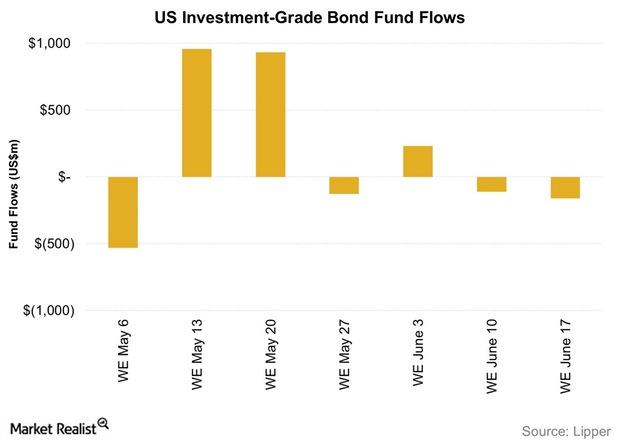

Investment-Grade Bond Funds Saw Outflows Last Week

Flows into investment-grade bond funds (LQD) were negative in the week ending June 17. This was the second consecutive week witnessing outflows.

Why MLPs Saw a New 52-Week Low Last Week

MLPs went through some carnage last week. The Alerian MLP Index (^AMZ), which tracks the performance of 50 energy MLPs, saw a new 52-week low of 258.45.

Introducing the UBS ETRACS Alerian MLP Infrastructure ETN AMZIX

The UBS ETRACS 1x Monthly Short Alerian MLP Infrastructure Total Return Index ETN (MLPS) tracks the Alerian MLP Infrastructure Total Return Index (AMZIX).

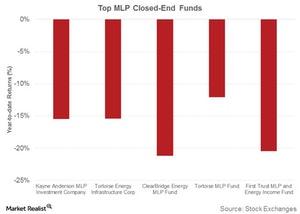

Analyzing the Top MLP Closed-End Funds in 1Q18

NTG invests primarily in MLPs and their affiliates. The fund has ~$1 billion of assets under management. NTG focuses on natural gas infrastructure MLPs.

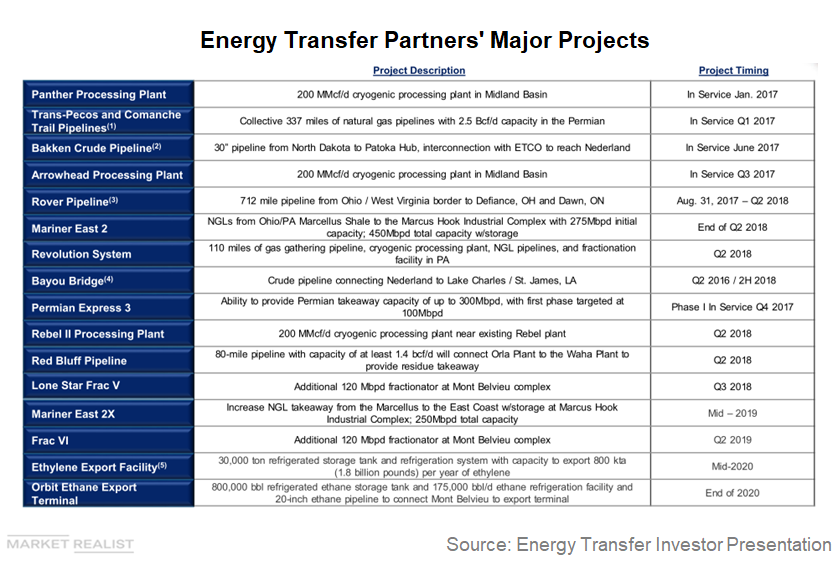

A Quick Update on Energy Transfer Partners’ Major Projects

Energy Transfer Partners remains optimistic about its recently announced projects despite the rise in global trade tensions.

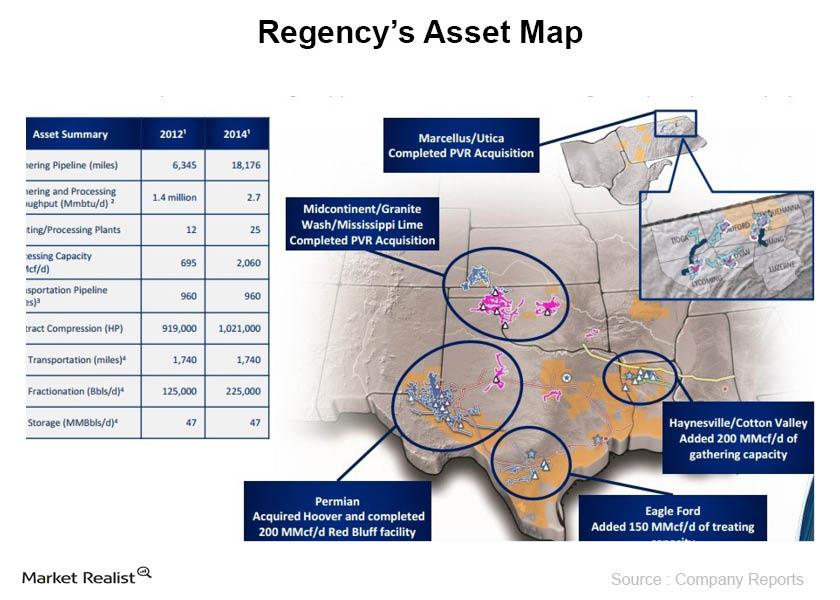

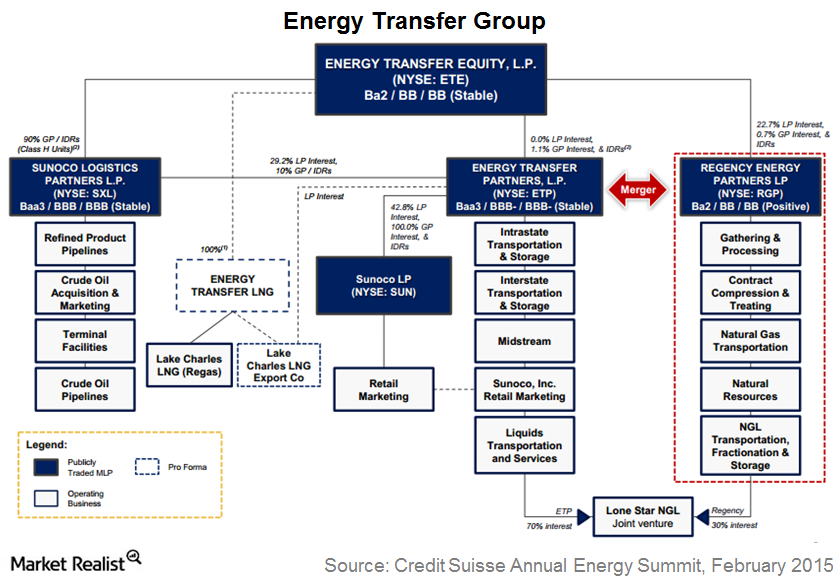

Overview: Regency Energy Partners

Regency Energy Partners L.P. (RGP) is a midstream operator of natural gas pipelines, gathering systems, and processing facilities.

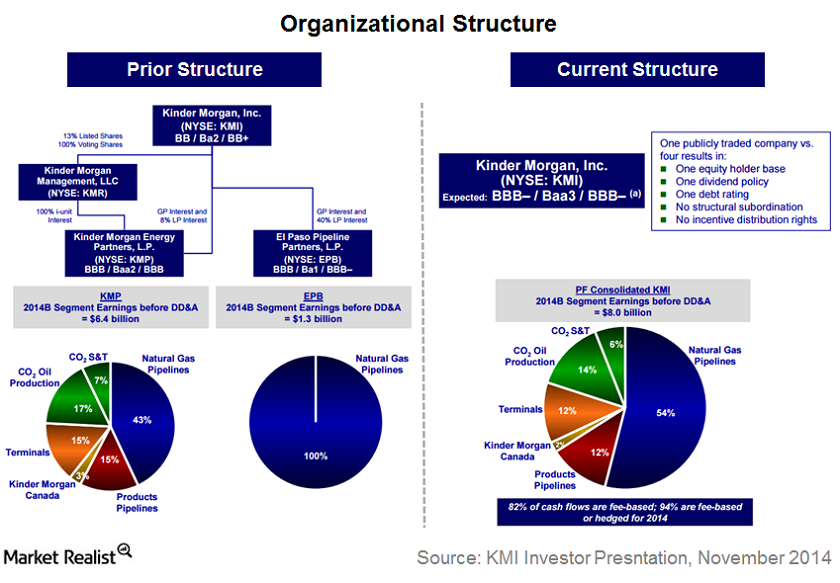

Kinder Morgan Consolidation: What It Means for the MLP Market

On November 26, 2014, Kinder Morgan acquired all of its equity interests in Kinder Morgan Partners, El Paso, and Kinder Morgan Management.

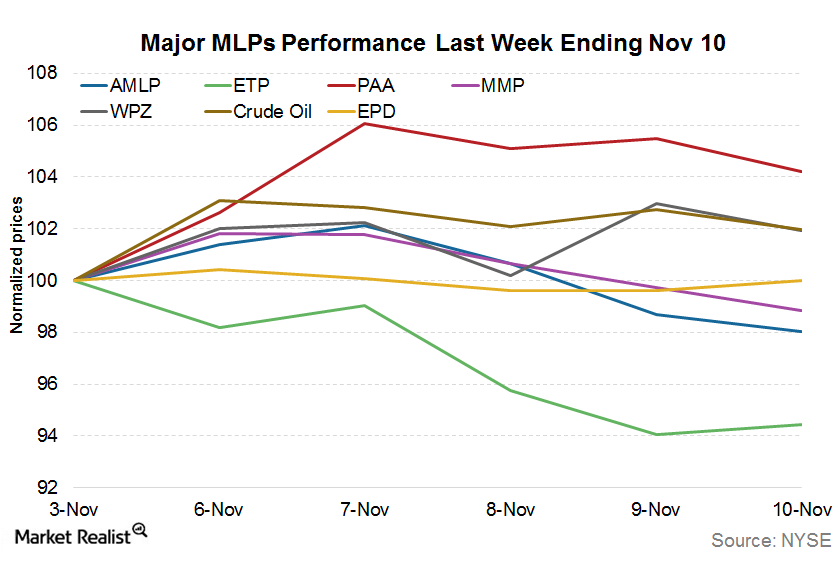

What’s behind MLP Performances for the Week Ended November 10?

Of the total 95 MLPs, 62 ended last week in the red, 30 ended in the green, and the remaining three ended flat. Energy Transfer Partners (ETP) fell 5.5%.

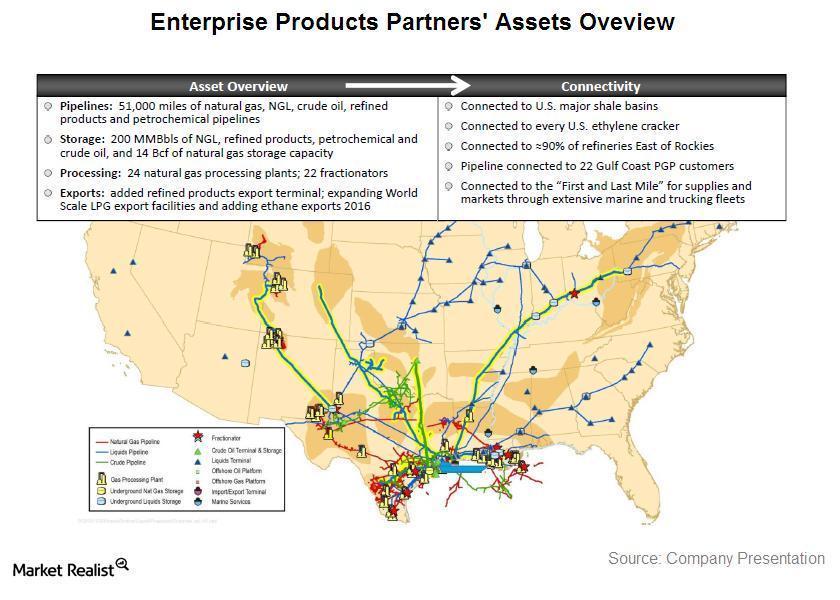

Why Enterprise Products Partners is important to investors

EPD is a leading midstream service provider in the natural gas, natural gas liquids (or NGLs), crude oil, petrochemicals, and refined products sectors.

These Midstream Players Have Created Maximum Wealth for Investors

In this series, we’ll look at the historical outliers in midstream energy, which have generated massive wealth amid turbulent times.

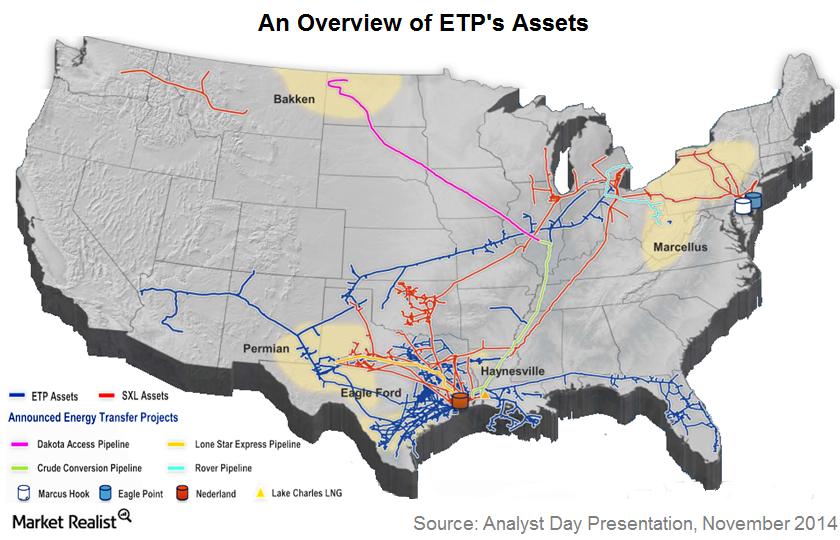

A Review of Energy Transfer Partners’ Business Segments

ETP operates primarily through its six business segments by leveraging its huge asset base.

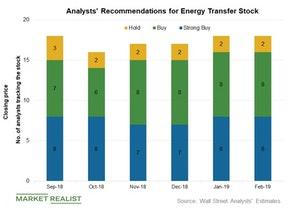

How Will Energy Transfer Stock Perform in 2020?

Energy Transfer (ET) stock had a weak run despite strong earnings growth in 2019. Here’s a look into how analysts think ET will perform in 2020.

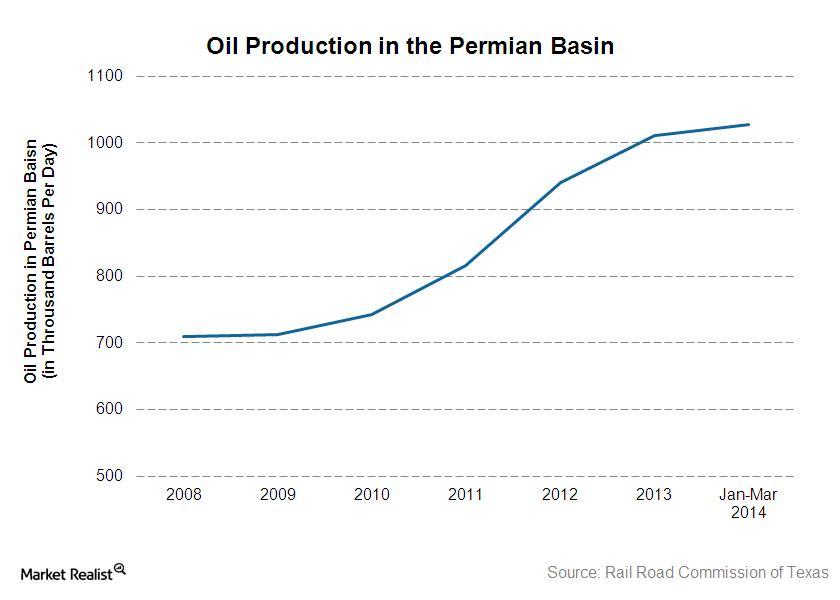

Why oil and natural gas production in the Permian should increase

According to the Energy Information Administration’s short-term energy outlook published in June 2014, crude oil production will average 8.4 million barrels per day in 2014.

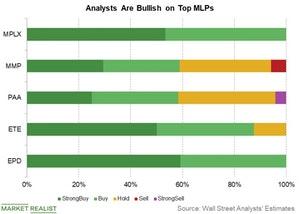

EPD, ETE, PAA, and MMP: What Do Analysts Recommend?

All of the analysts surveyed by Reuters covering Enterprise Products Partners (EPD) and MPLX (MPLX) rated the stocks as “buy.”

ET, EPD, and KMI: Analysts’ Views and Target Prices

According to analysts’ estimates, Energy Transfer (ET) stock has a median target price of $21.24—compared to its current market price of $14.82.

Natural Gas Prices: What to Expect in 2019

The EIA expects US natural gas prices to average $2.89 per MMBtu in 2019. For 2020, the forecast is $2.92 per MMBtu.

Enbridge’s Line 3 Replacement Project Gets Delayed

On March 1, after the markets closed, Enbridge announced that it received a timeline for the permits for its Line 3 Replacement project.

Is Energy Transfer Partners Exploring a C Corporation Structure?

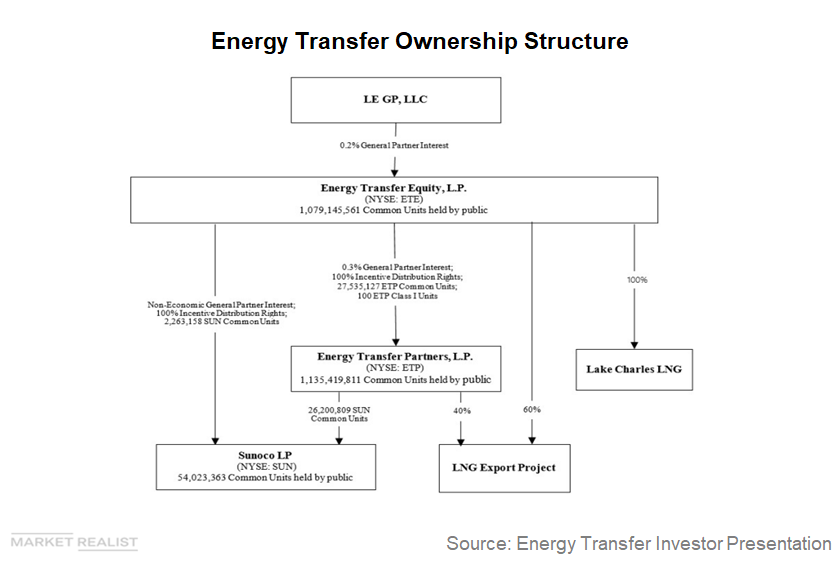

High leverage and a complex capital structure have been a drag on Energy Transfer Partners’ market performance.

Why MLPs Underperformed the Energy Sector Last Week

MLPs underperformed the energy sector and the broader US markets last week. Let’s take a look.

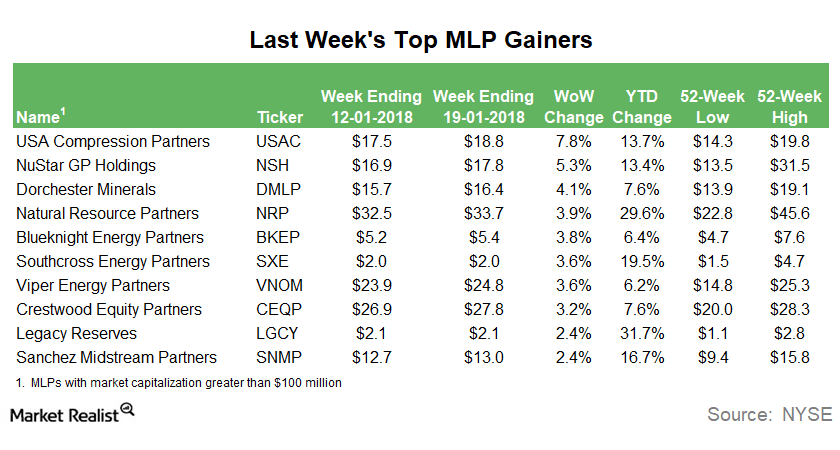

Why USAC Was the Top MLP Last Week

USA Compression Partners (USAC), a midstream MLP involved in natural gas contract compression services, was the top MLP gainer last week with WoW (week-over-week) gains of 7.8%.

MLPs Cool Off after a Strong 2-Week Rally

MLPs (master limited partnerships) cooled off last week, which ended on January 19, after two weeks of a strong rally.

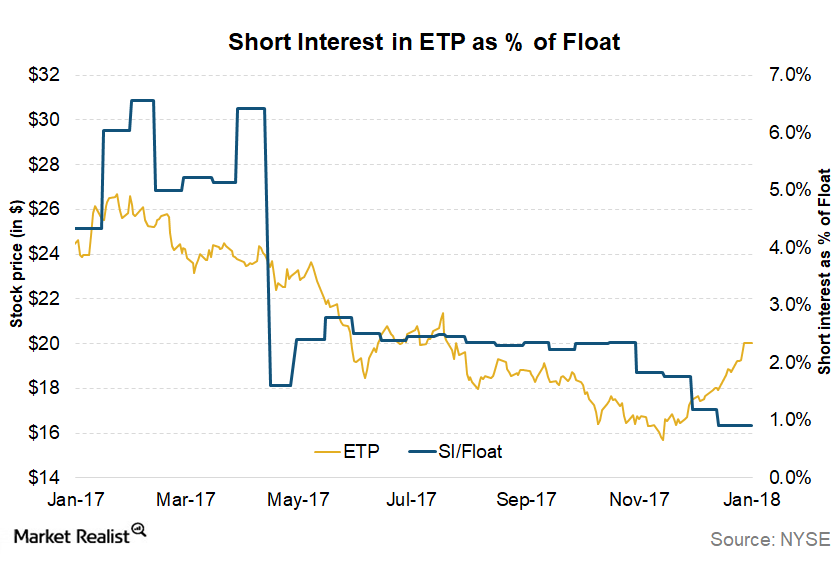

How USAC Deal Could Boost ETP’s Market Performance

Energy Transfer Partners (ETP) had a strong start to the year with a rise of ~6.5% in 2018 YTD (year-to-date).

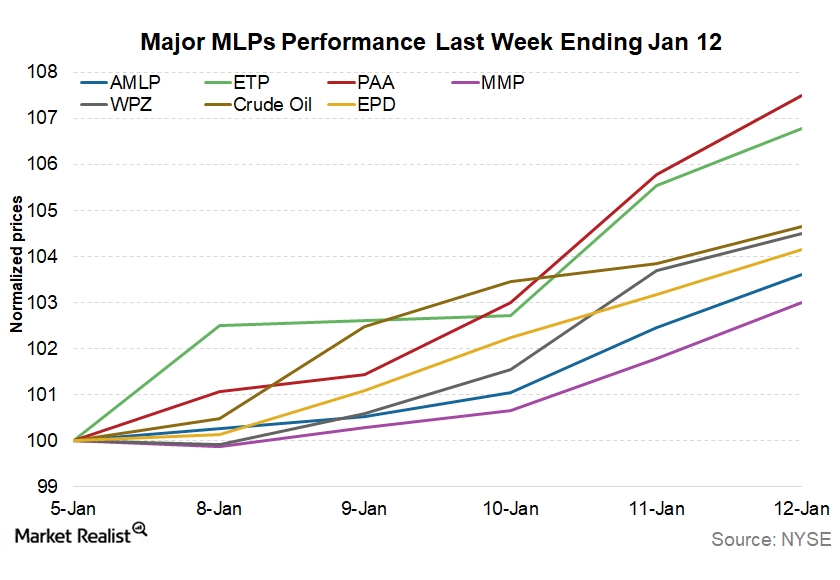

MLPs Continue to Outperform Broader US Markets in 2018

MLPs maintained their winning streak in the second week of 2018. The Alerian MLP Index (^AMZ) rose 4.6% last week and ended at 300.5.

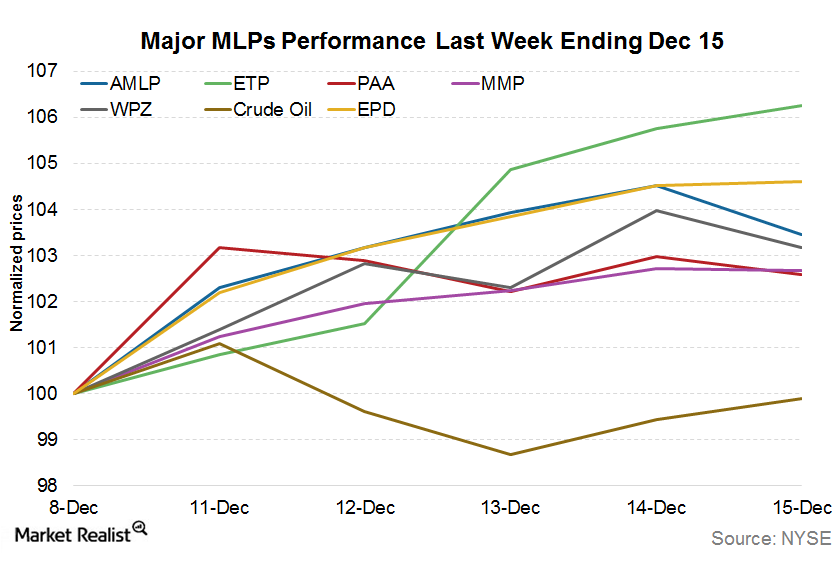

What Drove MLPs in the Week Ending December 15?

MLPs were strong in the week ending December 15, 2017. The Alerian MLP Index (^AMZ) had a strong start last week although it fell slightly on Friday.

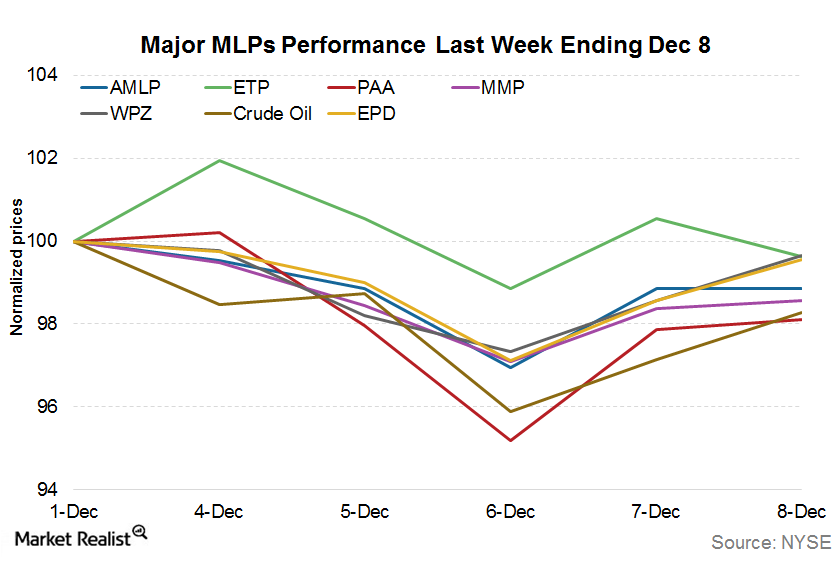

What’s Been Impacting MLP Performances as of December 8?

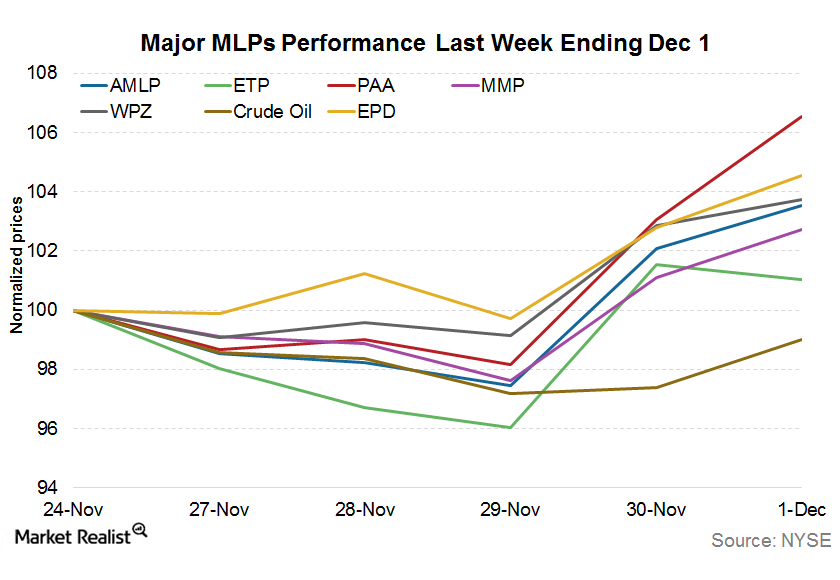

Most MLPs (master limited partnerships) closed the week ended December 1 in the red, after seeing some gains earlier in the week.

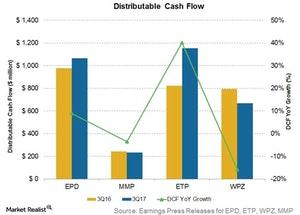

What’s behind ETP’s Strong Distributable Cash Flow Growth?

Energy Transfer Partners’ DCF rose 27.5% YoY to $1,049 million in 3Q17 compared to $823 million in 3Q16.

Understanding the Slight Recovery among MLPs Last Week

MLPs (master limited partnerships) recovered slightly last week (ended December 1, 2017), after three weeks of sluggishness.

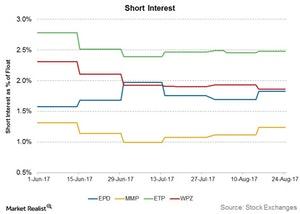

Short Interest in Enterprise Products and Magellan Rose Recently

The short interest as a percentage of float in Enterprise Products Partners’ (EPD) stock is 1.8%—higher than the 1.7% in mid-August.

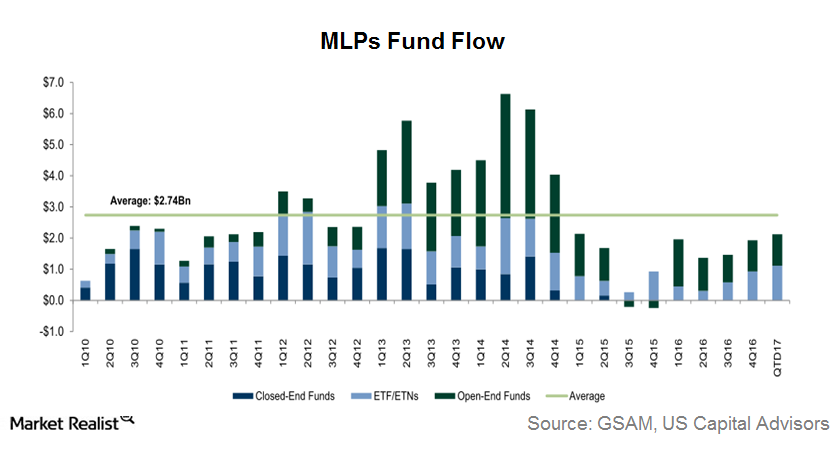

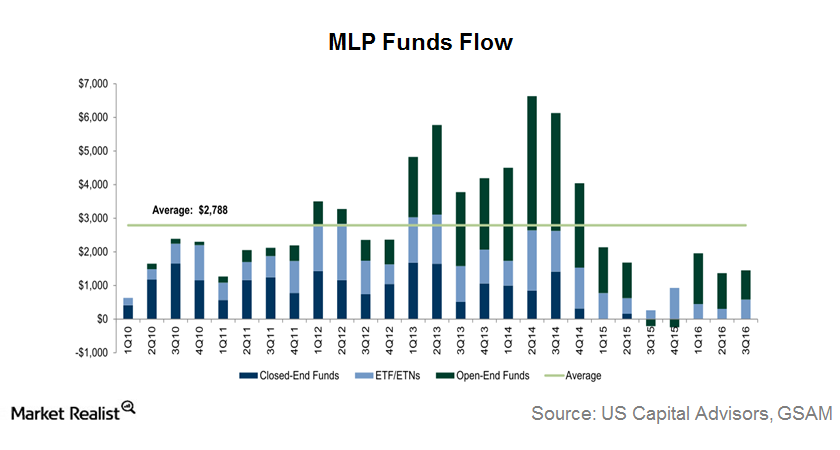

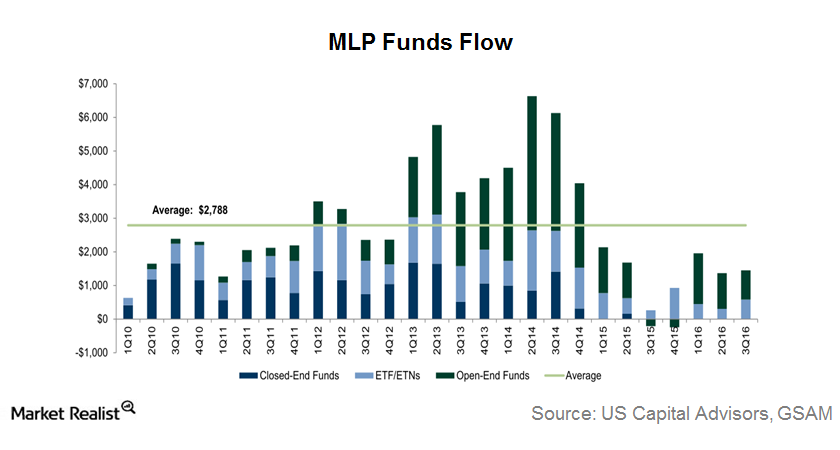

How MLP Funds’ Capital Inflow Improved in 1Q17

MLP funds’ capital inflow has recovered slightly in recent quarters compared to the second half of 2015.

Why Institutional Investors Seem Bullish on MLPs in 2017

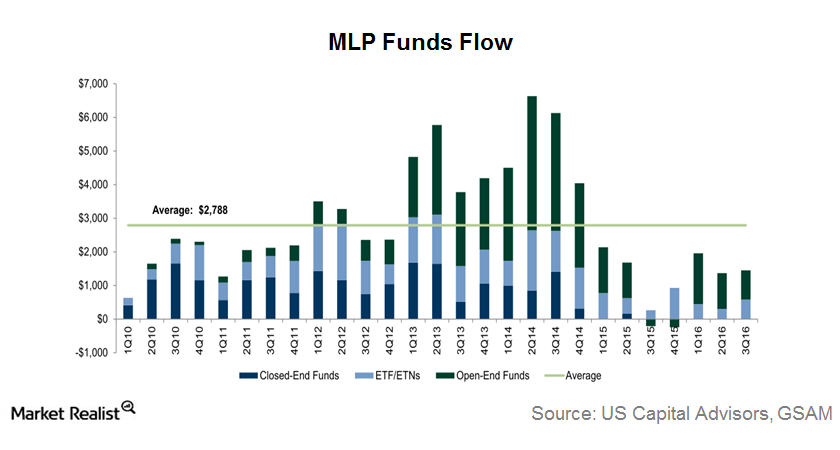

MLP funds’ capital inflow recovered slightly in 2016 compared to their levels during the second half of 2015.

What Does the MLP Funds Market Look Like?

MLP funds’ capital inflows have recovered slightly in 2016 compared to 2H15. However, their overall capital inflow is still lower than their seven-year average.

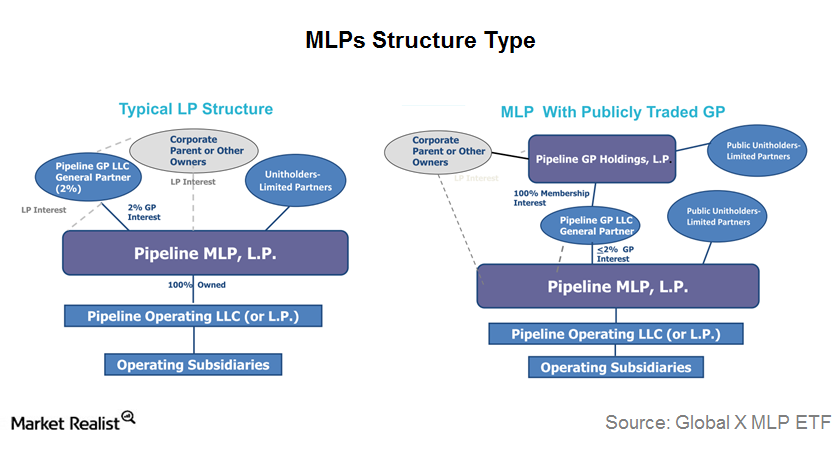

Do MLPs Benefit from the LP-GP Model?

MLPs generally have an LP-GP (limited partner and general partner) model structure in which the LP is a publicly traded entity and owns the majority of the operating assets.

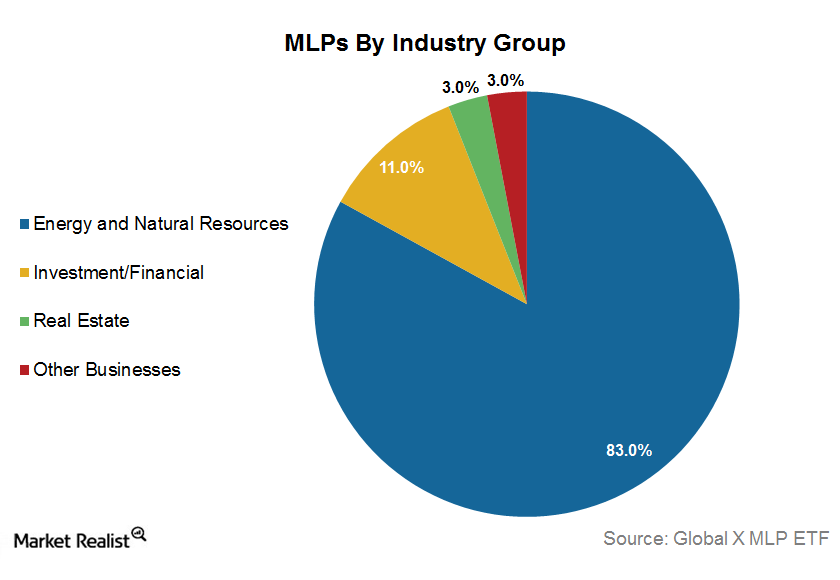

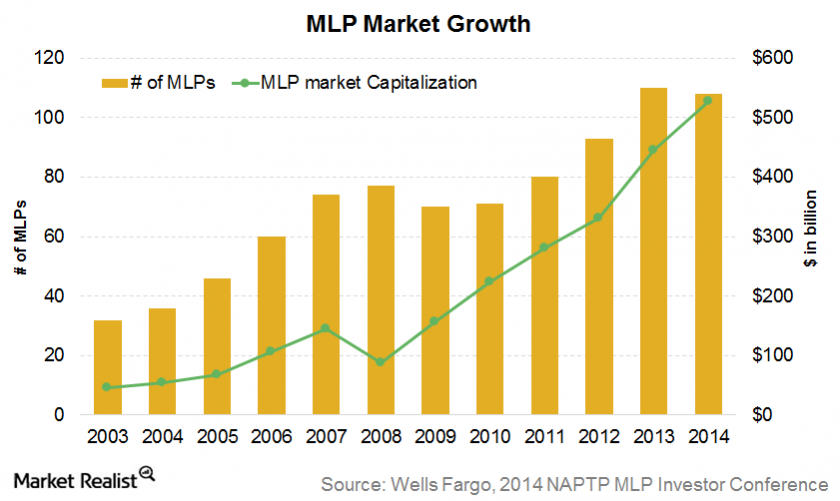

What You Should Know about Master Limited Partnerships

The number of MLPs has risen from a mere 32 in 2003 to 117 as of November 2016. 83% of total MLPs are energy and natural resources–related.

How Much Have MLP Fund Inflows Improved in 2016?

MLP funds’ capital inflows have recovered in 2016 from levels in 2H15. But overall capital inflows are lower than the seven-year average of $2.8 billion.

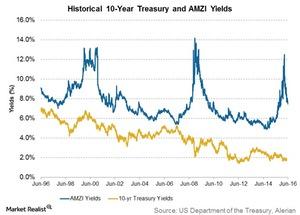

Analyzing the 10-Year Treasury and MLP Yields Spread

Generally, MLP yields move in the same direction as Treasury yields in the long term. MLP yields trade at a spread over Treasuries.

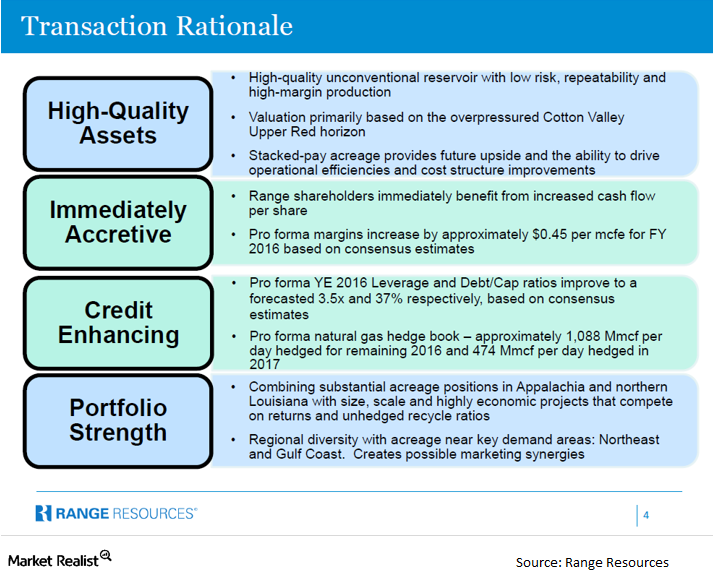

Rationale for the Memorial Resource-Range Resources Transaction

Range Resources is growing its portfolio in the Southeast US. Natural gas exports seem to be a promising growth area. The deal will enhance its credit profile.

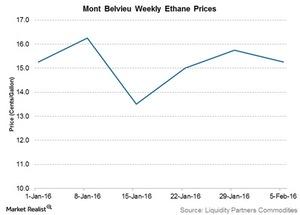

Ethane Prices Fall 3%: Impact on MLPs

Mont Belvieu ethane prices fell 3% to $0.15 per gallon in the week ending February 5, 2016. Ethane prices had risen 5% to $0.16 per gallon in the previous week.

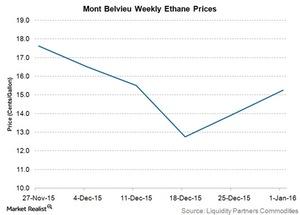

Ethane Prices Rose, Benefiting MLPs

Mont Belvieu ethane prices rose 9% to $0.15 per gallon in the week ended January 1, 2016, from $0.14 per gallon in the previous week.

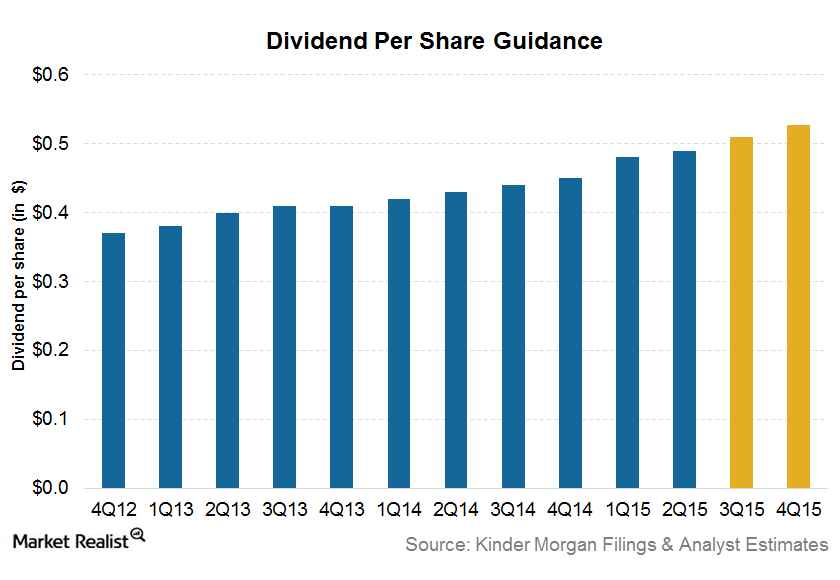

Kinder Morgan’s Outlook for the Rest of 2015

According to Wall Street analysts’ consensus outlook, Kinder Morgan’s (KMI) dividend is expected to grow by ~15.3% year-over-year by the end of 2015.

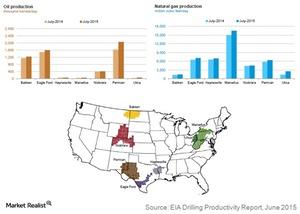

Must-Know: The 7 Regions for Oil and Gas Production in the US

The EIA (Energy Information Administration) monitors seven key tight oil and gas regions in the US.

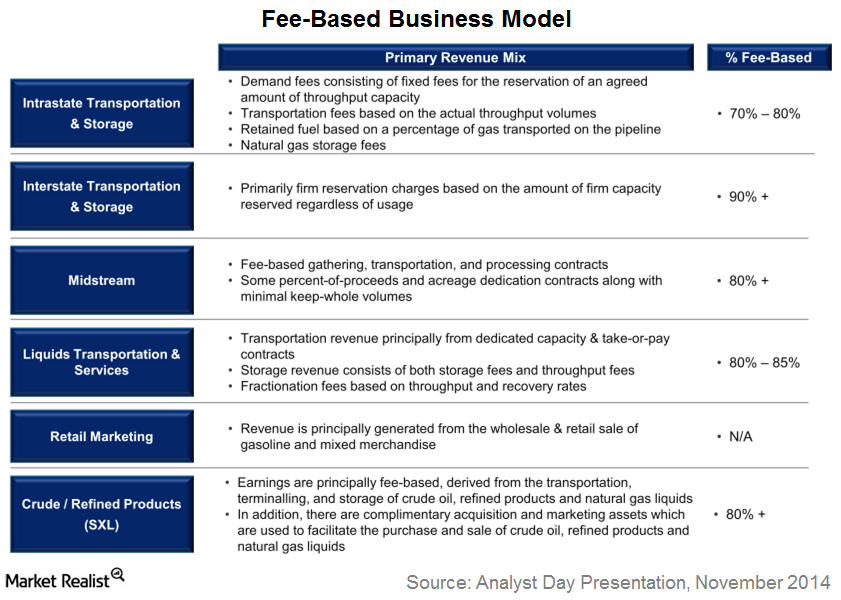

Energy Transfer Partners’ Fee-Based Model Drives Performance

Considering the rock solid performance of ETP during the slump in energy prices, it is clear that ETP has more fee-based contracts.

A Must-Know Overview of Energy Transfer Partners

Energy Transfer Partners (ETP) is one of the largest publicly traded master limited partnerships in the US in terms of equity market capitalization.

What Investors Need to Know about MLPs

MLPs are engaged in the production, transportation, storage, and processing of natural resources like oil, natural gas, and NGLs. They’re public companies.