Coeur Mining Inc

Latest Coeur Mining Inc News and Updates

Is Silver More Valuable as a Precious Metal or an Industrial Metal?

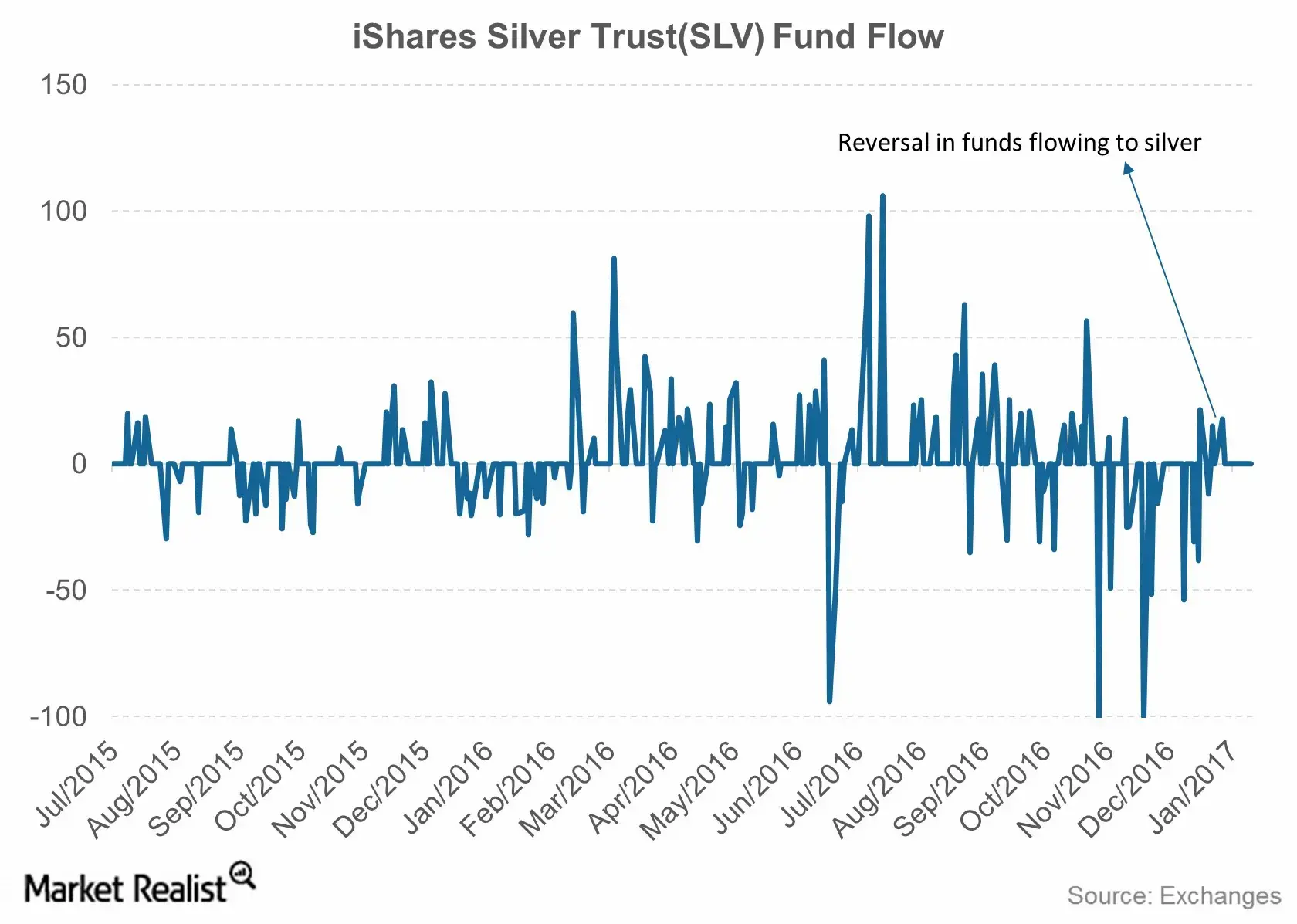

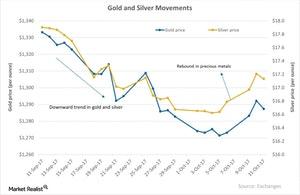

Silver has been falling over the past few years, despite surging demand for its industrial use. Fundamentally, silver seems to be strong due to rising demand and a year-over-year shortfall in its supply.

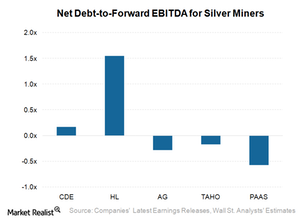

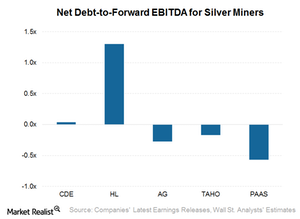

Behind Silver Miners’ Debt Repayment Capacities

Silver companies try to maintain an optimal level of debt-to-equity to lower their costs of capital and maintain an optimum level of risk-reward for shareholders.

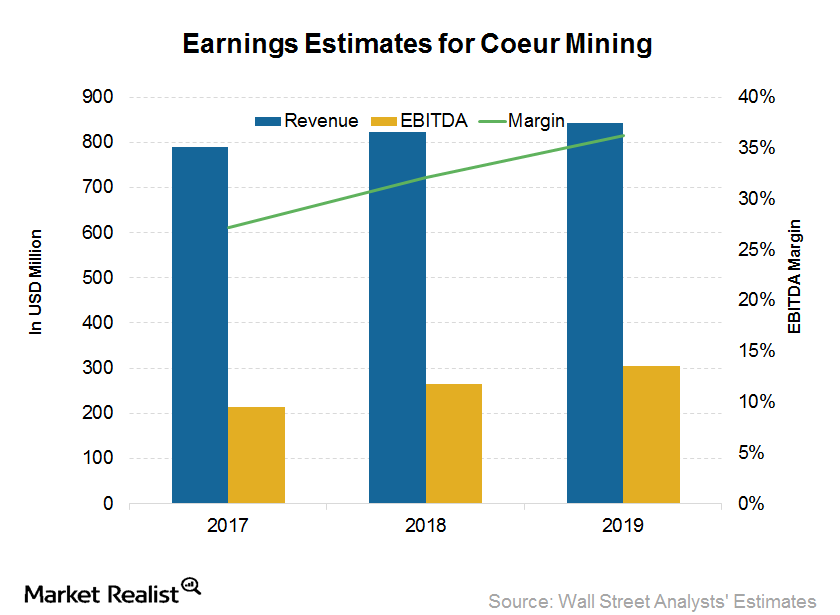

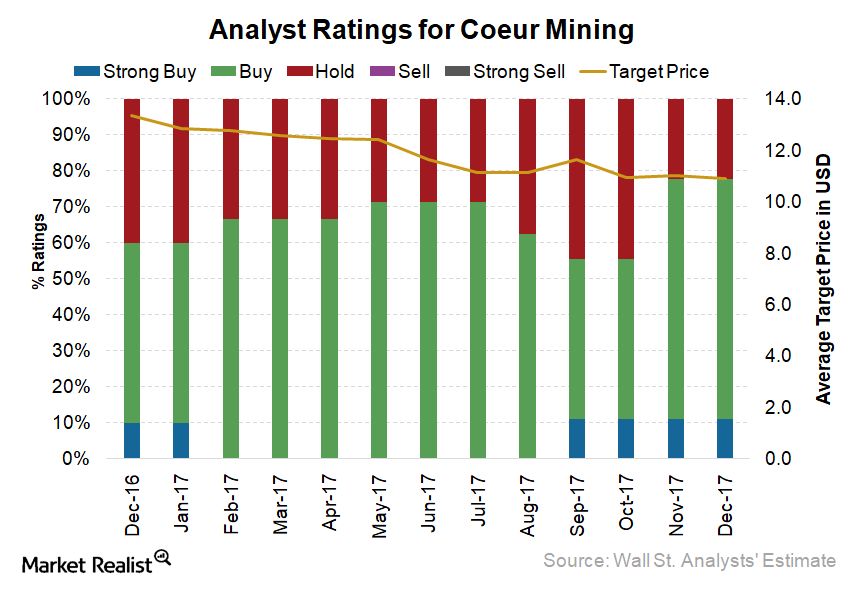

Analysts Are Optimistic about Coeur Mining

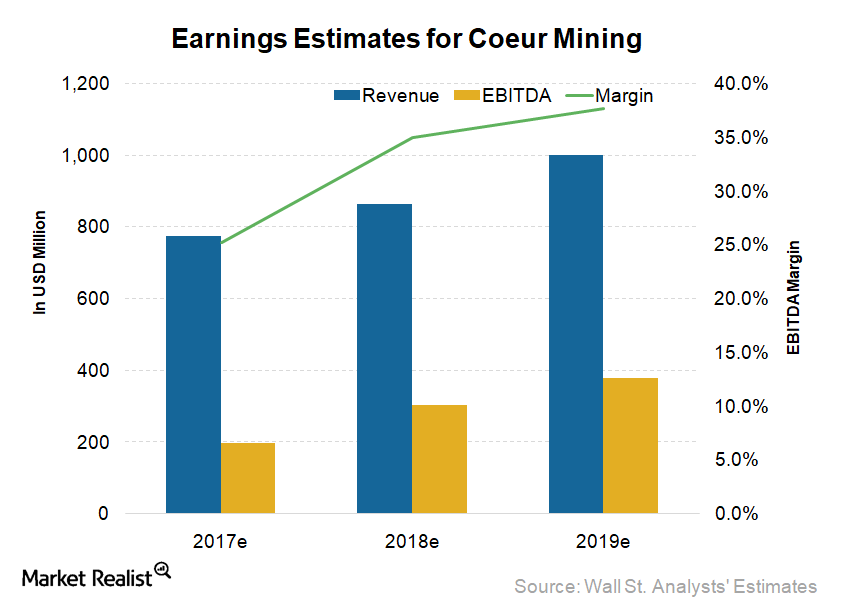

Market sentiment for Coeur Mining Coeur Mining (CDE) is a high-cost producer compared with peers (RING) (SIL). While it has initiated several measures to bring down its costs in the last few years, they remain high. Higher costs make CDE more leveraged to gold and silver prices than other low-cost producers such as Barrick Gold (ABX) […]

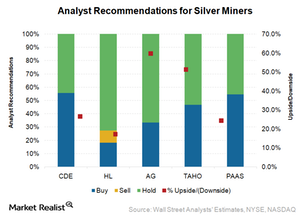

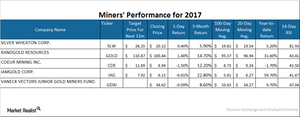

How the Ratings and Potential Upsides for Silver Miners Look Today

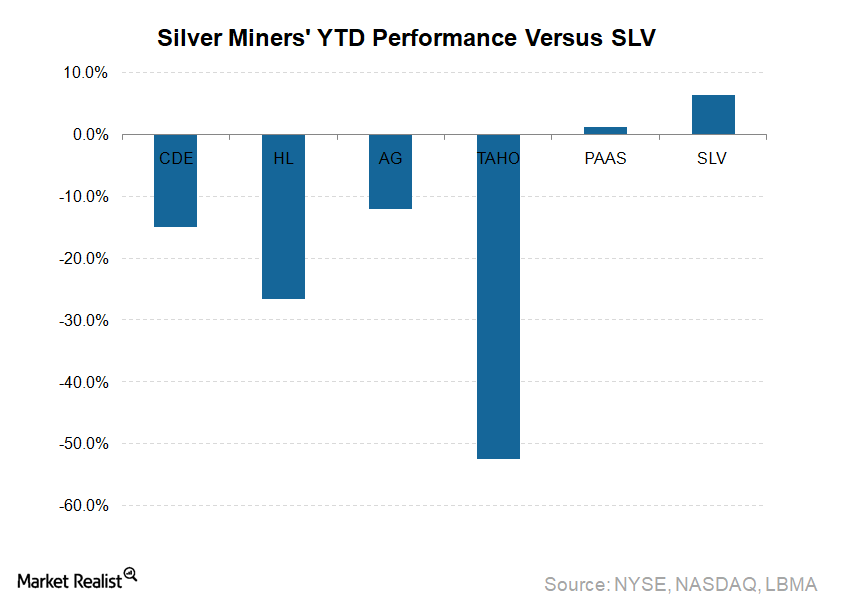

The performances of precious metal miners with substantial exposure to silver have been disappointing in 2017. As a group, they’ve returned just 0.9% YTD.

The Market Sentiment for Coeur Mining as 4Q17 Begins

CDE stock has risen 2.6% year-to-date. However, during the same period, silver prices gained 4.7% and the Global X Silver Miners ETF (SIL) rose 5.5%.

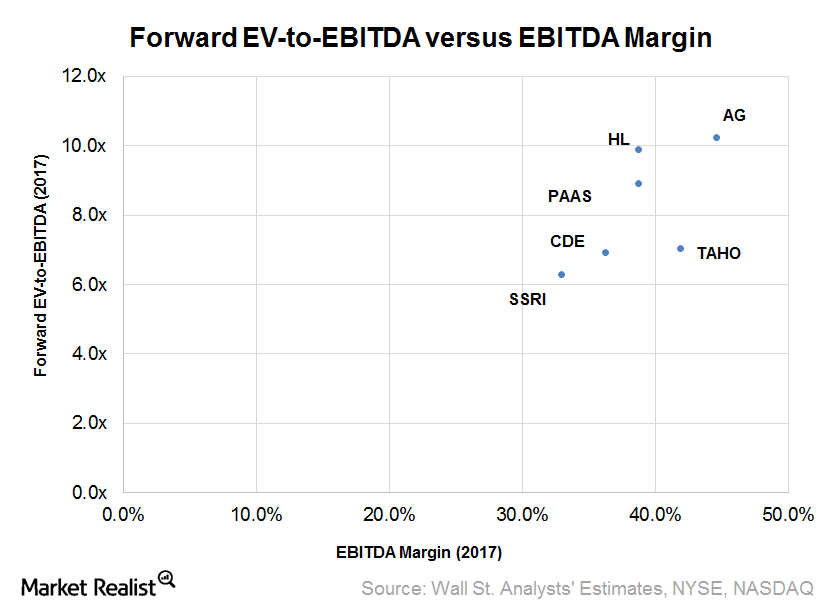

Analyzing Silver Miners’ Relative Valuations

Precious metals miners with substantial exposure to silver are usually classified as silver miners.

How Silver Prices Are Influencing Major Silver Miners

Mining companies like First Majestic Silver (AG), Silver Wheaton (SLW), Pan American Silver (PASS), Coeur Mining (CDE), and Hecla Mining (HL) are primarily into silver exploration.

What Put Coeur Mining in 2nd Place?

Right now, of the nine Wall Street analysts covering CDE stock, according to Thomson Reuters, 78% recommend a “buy,” while 22% recommend a “hold.”

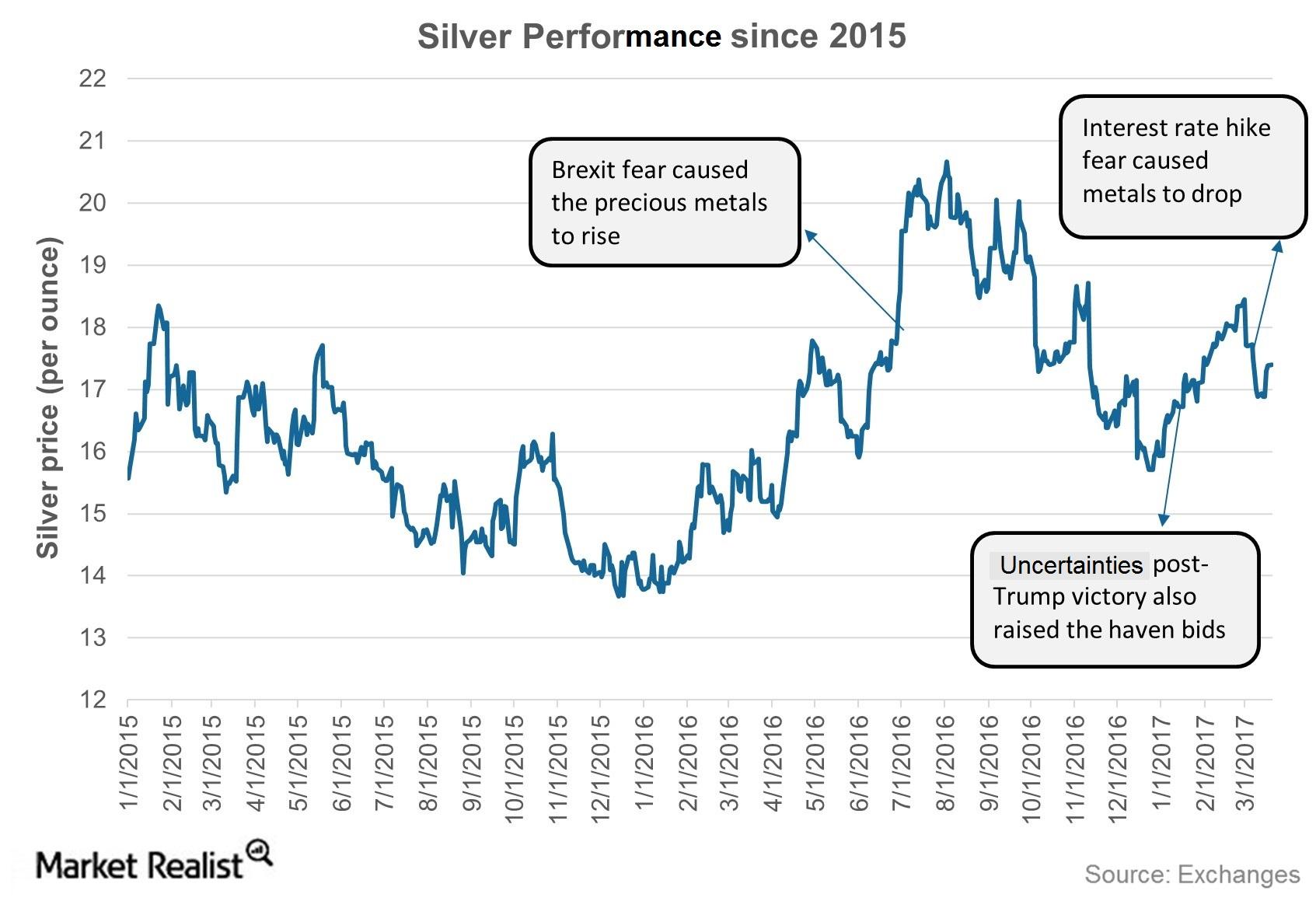

What’s the Impact of Interest Rates on Precious Metals?

Monetary policies have been crucial in determining the movement in precious metals.

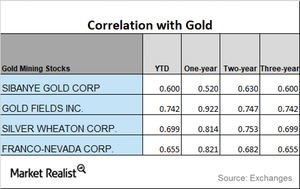

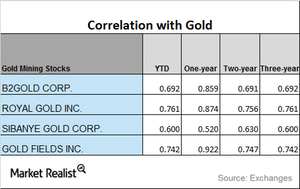

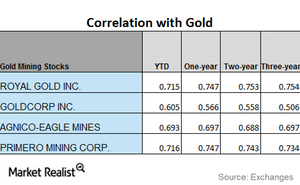

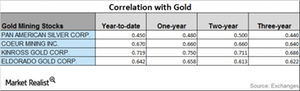

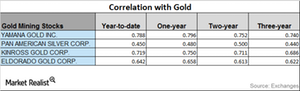

Comparing Mining Stocks’ Correlation with Gold

Mining stocks tend to move with gold prices. In this part, we’ll analyze the correlation between gold and four mining stocks.

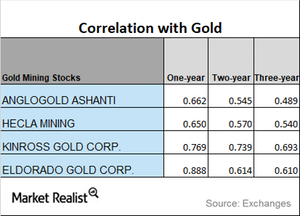

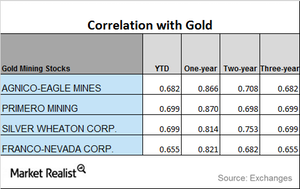

Analyzing Miners’ Correlations with Gold in January 2018

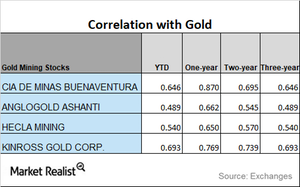

In this part of the series, we’ll analyze the correlations of the movements of a group of mining stocks with gold.

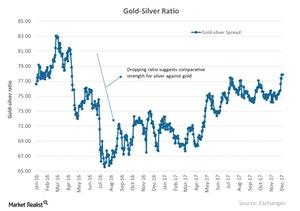

A Brief Analysis of the Gold-Silver Spread in January 2018

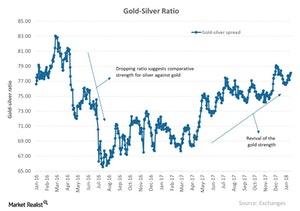

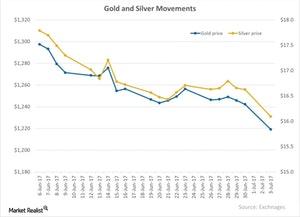

A quick look at the relationship between the two core precious metals, gold and silver, could also be helpful in the analysis of the overall precious metals market.

A Quick Look at the Precious Metals Revival, Miners’ Performances

Precious metals prices shot up on January 19, 2018, with concerns looming over the shutdown the of the US government.

How Are Miners’ Correlations to Gold Trending?

Mining stocks tend to take their cues from gold.

A Brief Analysis of Silver Miners in January 2018

The target prices of the four miners we’re covering in this part are higher than their current trading prices, which could lead to an optimistic outlook on their prices.

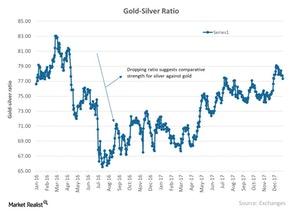

Reading the Recent Gold-Silver Spread

Among these spreads, the gold-silver spread is the most talked about because it measures the number of silver ounces it takes to buy a single ounce of gold.

A Look at the Gold Spreads at the End of 2017

A gold-silver spread of 77.3 suggests that it requires almost 78 ounces of silver to buy a single ounce of gold.

A Quick Look at the Performance of Silver Miners in December 2017

Coeur Mining and Hecla Mining have seen a loss in their prices on a year-to-date basis, falling 17.9% and 24.0%, respectively.

Where Are Miners’ Correlations with Gold Headed?

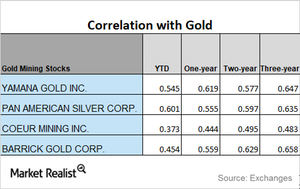

In this article, we’ll aim to study the correlations of Yamana Gold (AUY), Pan American Silver (PAAS), Coeur Mining (CDE), and Barrick Gold (ABX) with gold.

Miners’ Correlation with Gold

Correlation analysis A correlation study of mining stocks to precious metals is important. It gives insights about miners’ potential price movement. Although the mining shares are essentially part of the market’s equity segment, they’re more coordinated with metals’ movement. Gold is the most dominant precious metals. We’ll discuss how Yamana Gold (AUY), Pan American Silver (PAAS), Coeur […]

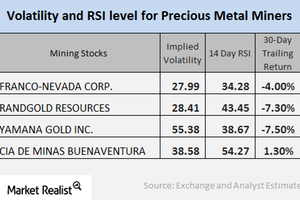

Analyzing Mining Stocks’ Technical Indicators

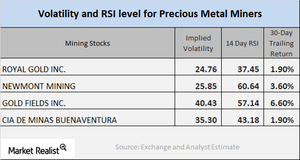

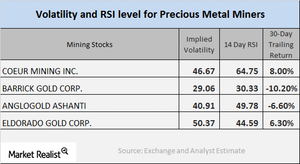

Gold Fields, Coeur Mining, Hecla Mining, and IamGold have call implied volatilities of 40.4%, 46.7%, 33.6%, and 44.3%, respectively.

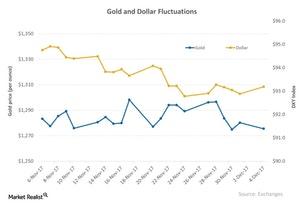

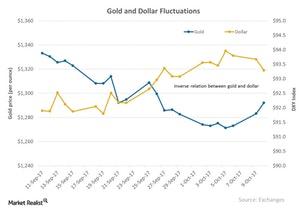

The Tax Reform Bill’s Impact on Precious Metals

All four precious metals saw a down day on Monday, December 4, 2017, after the US dollar, in which the four metals are priced, rose $0.39%, propelled by the Senate passing its tax reform bill.

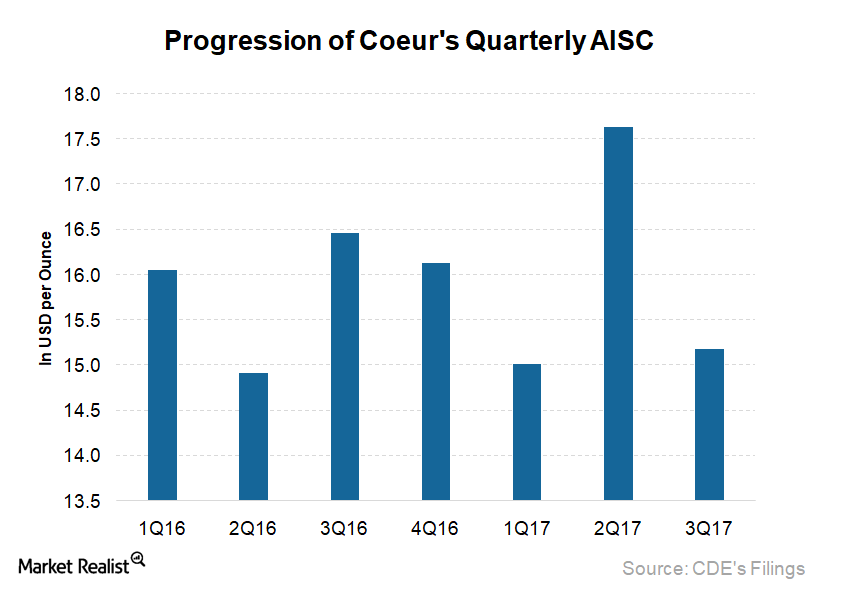

Coeur Mining: What Could Lead to Cost Improvement in 2018

Coeur Mining (CDE) reported AISC (all-in sustaining costs) of $15.18 per ounce for 3Q17.

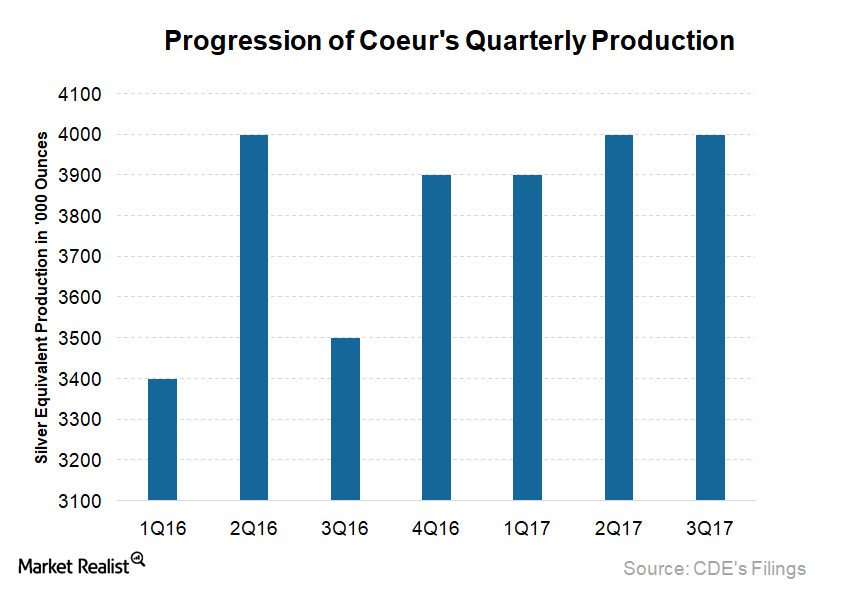

Why Coeur Mining Lowered Its Production Guidance

Coeur Mining (CDE) achieved silver equivalent ounces of 9.5 million for 3Q17. That is comprised of silver production of 4 million ounces and 93,293 ounces of gold.

What Factors Could Drive Coeur Mining Stock in 2018?

Coeur Mining (CDE) was one of the stocks to gain significantly in 2016, rising ~270%. The situation in 2017 has reversed completely.

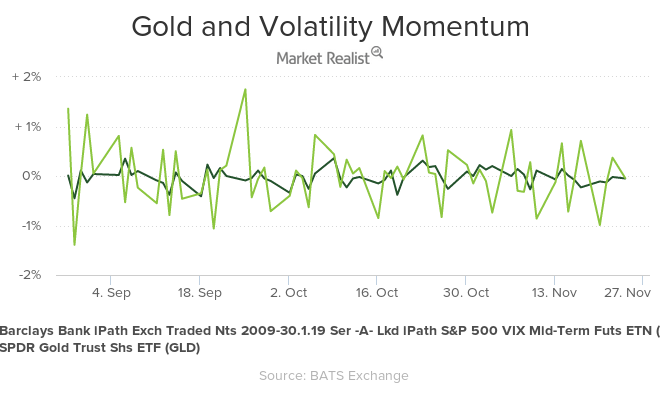

An Update on the Precious Metals as November Comes to an End

The US stock markets were closed on Thursday, November 23, 2017, for Thanksgiving, and the next day (Black Friday) was quite slow for precious metals. Gold played in a narrow range that day.

The Directional Correlation Move of Mining Stocks in 2017

If we look at the one-year correlation of miners, Barrick Gold has the lowest correlation with gold, while Yamana has the highest.

A Quick Look at Miners’ Recent Performance

Precious metal miners saw mixed performance on Tuesday, November 14. Gold and silver saw an up-day while platinum and palladium were low.

Mining Stocks: Analyzing Correlation Trends

Mining stocks’ performance usually depends on precious metals’ performance. However, the two can deviate. Correlation analysis can give investors some perspective on how mining stocks relate to gold and silver.

Yield Changes for Precious Metals: What Could Be the Impact?

If we look beyond the dollar influence on precious metals, we can analyze how the probability of an interest rate hike could influence precious metals and their miners.

A Brief Analysis of Mining Stock Correlations with Gold

The iShares MSCI Global Gold Min (RING) and the Sprott Gold Miners (SGDM) rose with metals on Monday, climbing 1.2% and 0.83%, respectively.

Silver Mining Stock Technicals as of Last Week

AG, CDE, and HL have shown YTD losses of 12%,16%, and 9.2%, respectively. The silver-based Global X Silver Miners Fund (SIL) has a YTD loss of 0.31%.

Mining Shares’ Directional Move in October

Most of the mining shares saw a downside move in the price on October 19, 2017, but gold and silver had an up day.

Which Elements Impact Precious Metals?

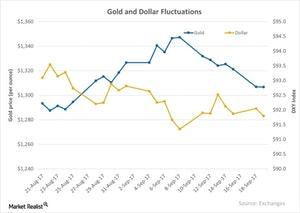

Gold fell for the third consecutive day on October 18, 2017, as the US dollar regained strength. However, October 19 was an up day for gold and silver.

Behind the Recent Correlation Movements of Precious Metals

Among these four miners, AngloGold has the lowest correlation with gold so far this year, while Coeur Mining has the highest correlation YTD.

The Reaction of Precious Metals on October 11

The last few days have seen a rise in precious metal prices. However, on Wednesday, October 11, 2017, the prices of these loved metals fell.

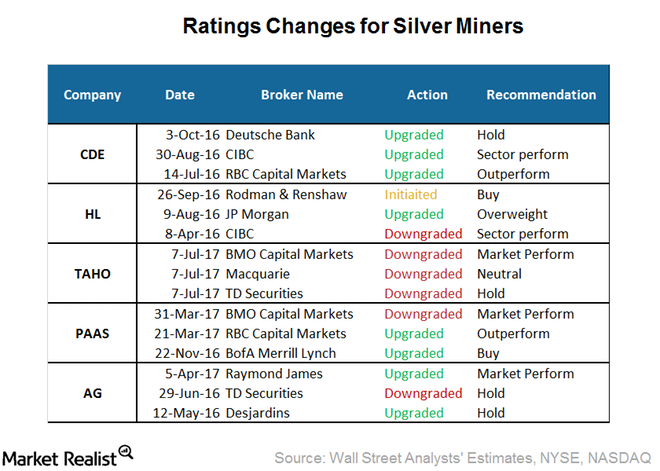

Behind the Recent Analyst Rating Changes for Silver Miners

After the Guatemalan government’s decision to suspend Tahoe Resources’ (TAHO) license, the company saw several downgrades.

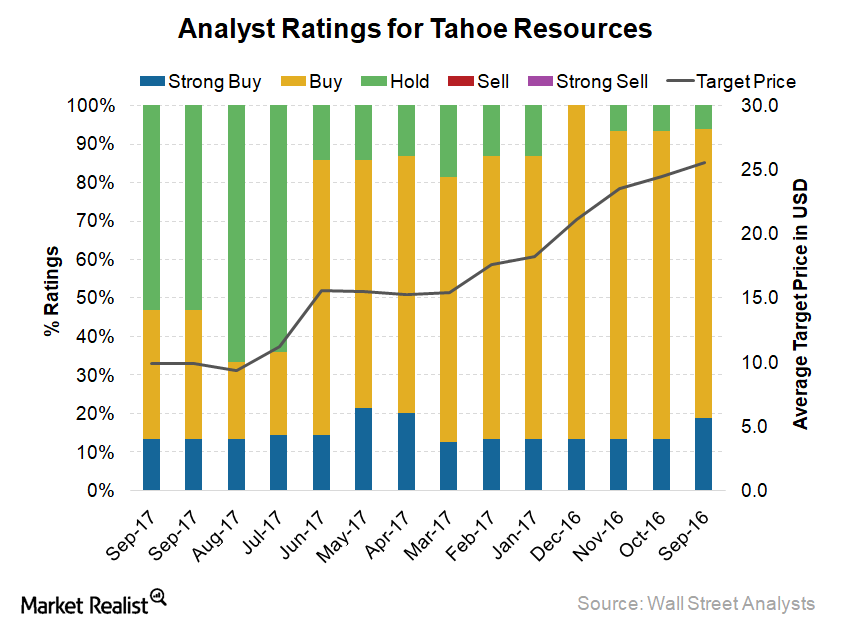

How Do Analysts View Tahoe Resources despite Its Underperformance?

Tahoe Resources (TAHO) stock has lost 44.1% of its value year-to-date until the end of September.

Precious Metals and Companies That Mine Them

Precious metal miners got a boost on Tuesday, October 3, 2017, despite the marginal fall of precious metals.

The Latest in Correlation Trends between Mining Stocks and Gold

Among the four miners that we’re analyzing here, Sibanye Gold has the lowest correlation with gold on a one-year basis, while Gold Fields has the highest.

Precious Metals, Miners and the Scaling Dollar

Later in the day on September 20, after rising gold prices fell on the US Federal Reserve’s indication of one more interest rate hike in 2017.

Miners Followed Precious Metals Downhill on September 18

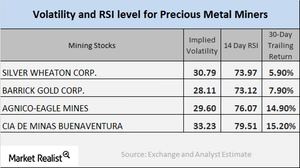

On September 18, Coeur Mining, Barrick Gold, Kinross Gold, and Eldorado Gold had volatilities of 42.3%, 26.4%, 40.8%, and 50.1%, respectively.

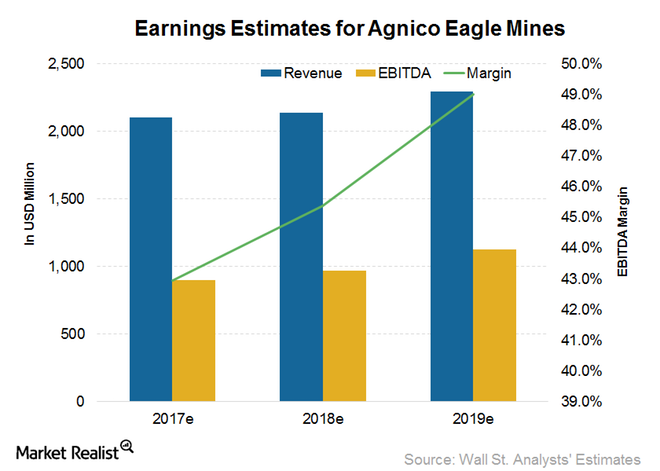

How Analysts Estimate Agnico Eagle Mines’ Earnings in 2017 and Beyond

Despite just 0.7% expected growth in revenues for 2017, Agnico Eagle Mine’s EBITDA is expected to grow 5.6% YoY in 2017.

The Correlation Analysis of Miners through August 2017

Silver Wheaton has a three-year correlation of ~0.70 with gold and a year-to-date correlation of ~0.80.

Have Miners’ Relative Strength Levels Revived?

In this article, we’ll look at some important technical indicators for Coeur Mining (CDE), Barrick Gold (ABX), Buenaventura (BVN), and AngloGold Ashanti (AU).

How Precious Metals’ Slump Dragged Mining Shares and Funds Lower

Gold tumbled to an eight-week low on July 3, 2017. Gold futures for August delivery fell almost 1.9% to settle at $1,219.2 per ounce.

These Mining Companies Are Showing an Uptrend Correlation with Gold

When we try to interpret the performance of precious metals, it’s crucial to study the impact of metal price variations on mining shares.

Insight into the Silver Market in June 2017

Silver has seen a five-day trailing loss of 2.6%, while gold and platinum fell 1.7% and 1.9%, respectively.

Barrick Gold’s and Other Miners’ Correlation with Gold

Metal stocks As we study the impact of global variables on precious metals and the mining sector, we should also analyze the relationship between mining stocks and gold. Correlational analysis can help us compare price movement in mining stocks and the metal. In this part of our series, we’ll examine New Gold’s (NGD), Newmont’s (NEM), Coeur […]

How Silver Miners Rank Based on Debt Repayment Capacity

Coeur Mining (CDE) has a net debt-to-forward-EBITDA ratio of 0.40x, which seems comfortable. Hecla Mining’s (HL) ratio is slightly higher at 1.3x.