Coeur Mining Inc

Latest Coeur Mining Inc News and Updates

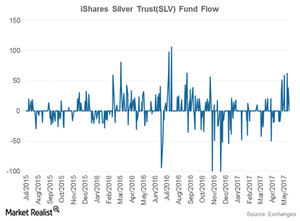

Reading the Fund Flows of the iShares Silver Trust

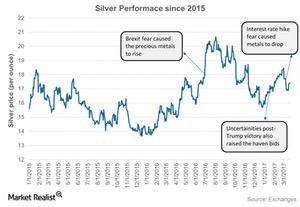

Over the past year, silver has been very volatile compared to the other three precious metals. Silver was the highest among precious metals in mid-April 2017.

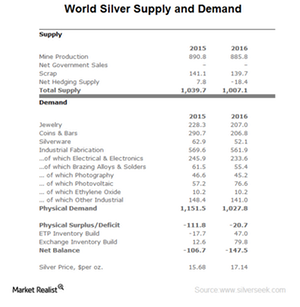

Analyzing Silver’s Fundamentals

When analyzing the performance of a metal, investors should look at its fundamentals. In this series, we’ll look at various metrics for silver and other precious metals.

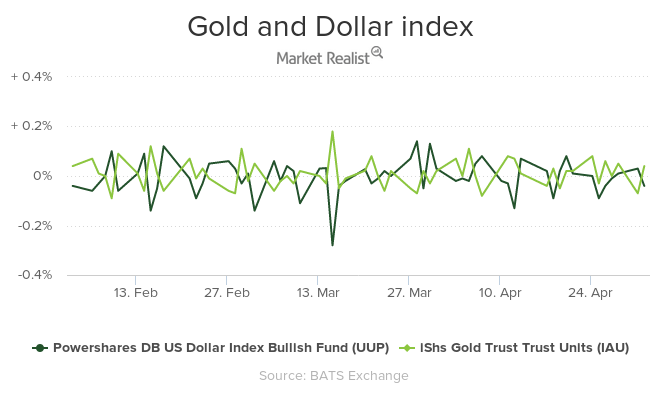

Global Tremors, the Dollar, and Gold in Early May

Geopolitical risks had been playing on haven bids for precious metals, but now, we may be seeing to be a temporary respite—however brief—from global worries.

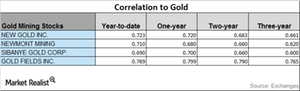

How Is Gold Fields’ Correlation with Gold Trending?

Turbulence in markets due to the viability of the Trump Administration, the upcoming French elections, and the Brexit vote caused precious metals to rise.

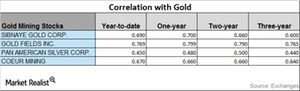

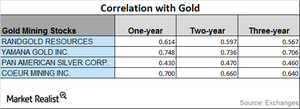

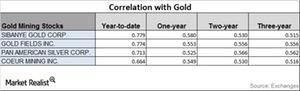

How Did Mining Stocks Correlate with Gold in March 2017?

Yamana’s correlation with gold has increased from a three-year correlation of ~0.74 to a one-year correlation of ~0.80.

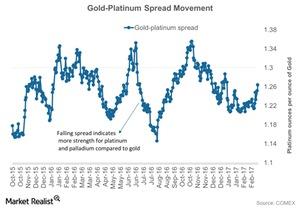

Where’s the Platinum Spread Headed in 2017?

Among the four precious metals, platinum has been the worst-performing precious metal and has seen a year-to-date rise of only 5.8%.

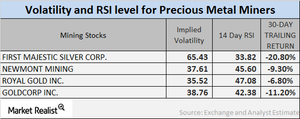

Mining Stock RSI levels: What the Indicators Suggest

NUGT and AGQ have seen YTD rises of 18.6% and 27.5%, respectively. But the volatility of such mining funds can be higher than that of precious metals.

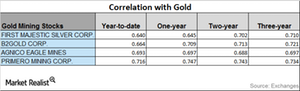

Analyzing the Correlation between Silver Prices and Miners

Mining funds such as the iShares MSCI Global Gold Min (RING) and the leveraged ProShares Ultra Gold (AGQ) have also seen significant correlations with their respective precious metals.

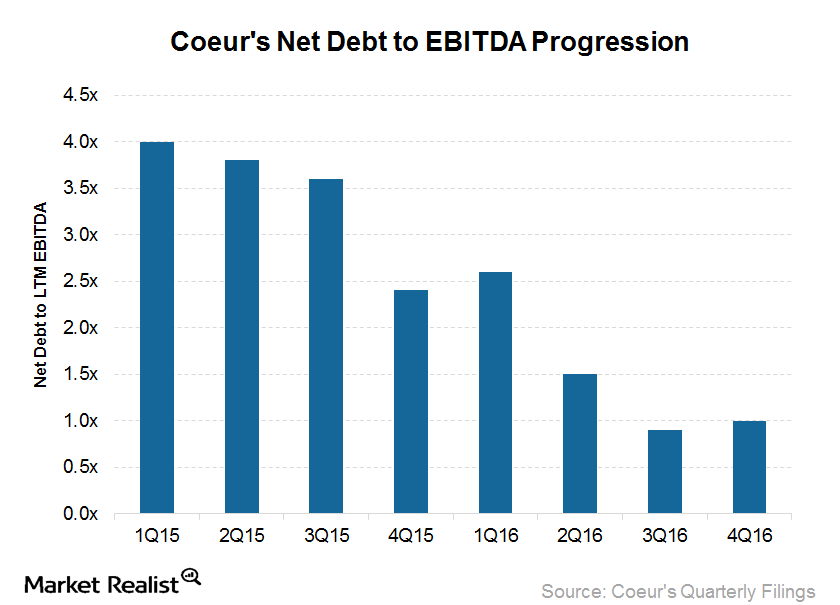

Coeur’s Financial Leverage Improves: A Word of Caution

Coeur Mining (CDE) ended 2016 with an outstanding debt of $210.9 million. That’s 57.0% less than at the end of 2015.

These Factors Have Been Driving Silver Prices

Silver has performed slightly better than gold and platinum on a year-to-date basis.

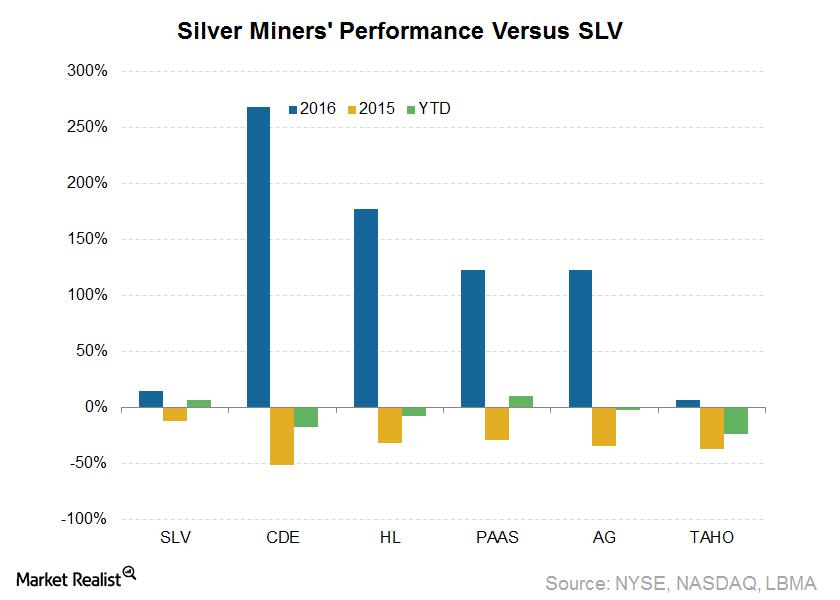

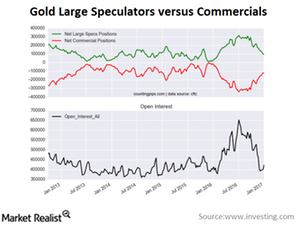

Looking at Silver Miners after the Federal Reserve’s Rate Hike

Silver miners (SIL) are usually a levered play on gold. Notably, silver has outperformed gold year-to-date.

Analyzing the Upward-Downward Correlation of Precious Metals

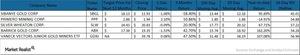

Mining companies with high correlations to gold include Randgold Resources (GOLD), Yamana Gold (AUY), Pan American Silver (PAAS), and Coeur Mining (CDE).

Reading the Correlation Movement of Mining Stocks

Sibanye Gold has the closest correlation to gold on a YTD basis among the four miners under review.

How Miners’ Correlations Are Moving

Precious metals prices have risen from the ten-month lows they saw in December 2016. As a result, most mining stocks have also risen substantially.

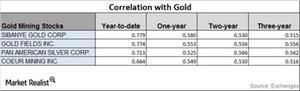

Reading Speculators’and Hedgers’ Positions in Gold

Large speculators and traders continued to reduce their bullish net positions in gold futures markets last week for the eighth consecutive week.

What’s in Store for Silver Miners after the Fed’s Rate Hike?

Silver miners have shown a significant correlation to gold prices, at 0.84 from the start of 2013 to December 14, 2016.

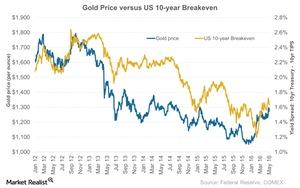

Will Gold Keep a Close Watch on Inflation Numbers?

Donald Trump’s recent victory is shining a light on the possibility of a rise in inflation and how such a rise could work for gold.

Are Inflation Concerns Likely to Boost Gold’s Performance?

The difference between yields on ten-year US notes and similar-maturity TIPS, a gauge of price expectations, expanded to as much as 1.7% last Tuesday.

What Do Analysts Think about Coeur Mining?

Of the ten analysts covering Coeur Mining, 50% have given the stock a “buy” recommendation. The average target price is $14.20 compared to its current price of $15.90.

Why Mining Stocks Are Rising post-Brexit

Friday was important. Gold rose to a two-year high due to additional haven bids on the Brexit referendum.