Baxter International Inc

Latest Baxter International Inc News and Updates

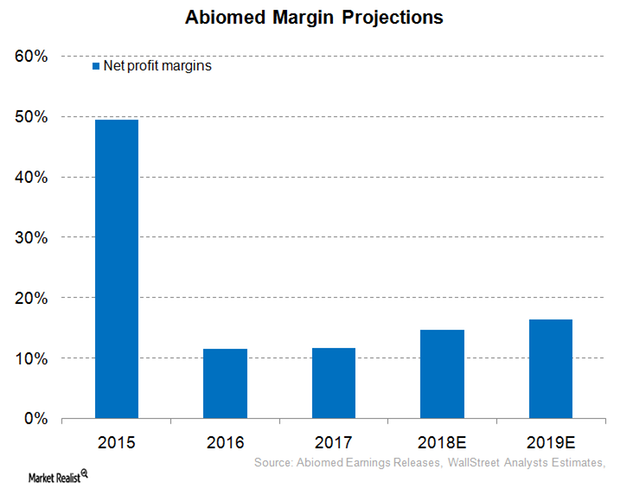

Inside Abiomed’s Profit Margin Expectations for Fiscal 2018

For fiscal 2018 (ended March 31, 2018), Abiomed (ABMD) has projected that its operating margins will be in the range of 22%–24%.

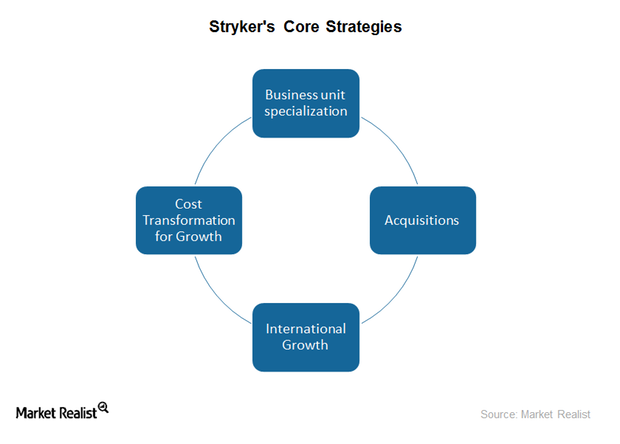

How Are Stryker’s Core Strategies Working Toward Its Growth?

Stryker (SYK) registered strong 3Q16 earnings on October 27, 2016. The company’s reported earnings exceeded analysts’ estimates.

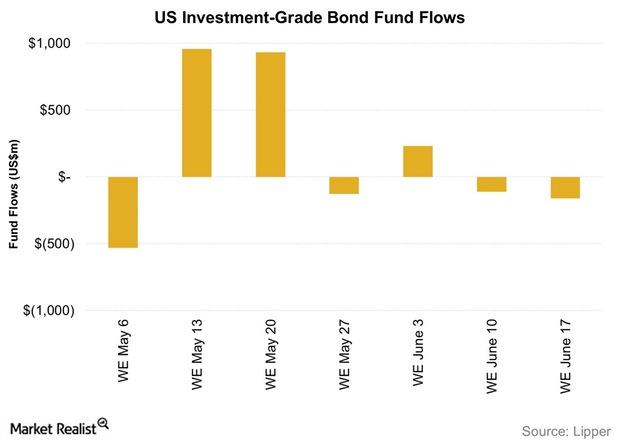

Investment-Grade Bond Funds Saw Outflows Last Week

Flows into investment-grade bond funds (LQD) were negative in the week ending June 17. This was the second consecutive week witnessing outflows.

S&P 500 Index Nears Record High amid Earnings Season

The S&P 500 Index, represented by the SPDR S&P 500 ETF (SPY), rose 0.3% on October 23, nearing the all-time high it saw in July.

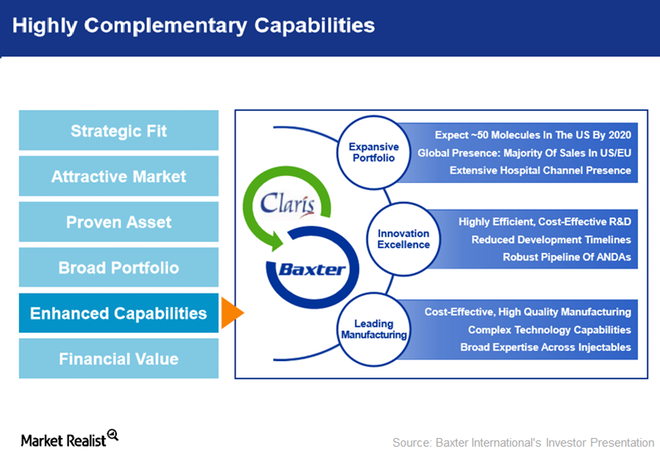

Effect of Claris Injectables Acquisition on Baxter’s 2017 Growth

On July 27, 2017, Baxter International (BAX) completed the acquisition of Claris Injectables, which is expected to help expand and strengthen Baxter’s core capabilities.

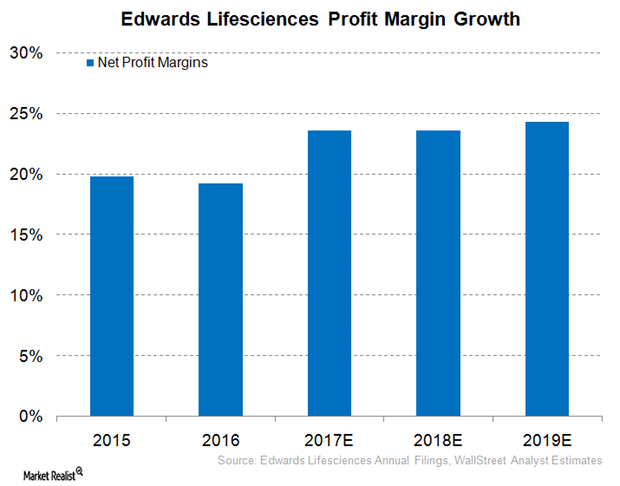

Can Edwards Lifesciences See Robust Net Profit Margin in 2017?

In its 2Q17 earnings conference call, Edwards Lifesciences (EW) projected 2017 adjusted EPS to fall to $3.65–$3.85, which is higher than the previous $3.43–$3.55.

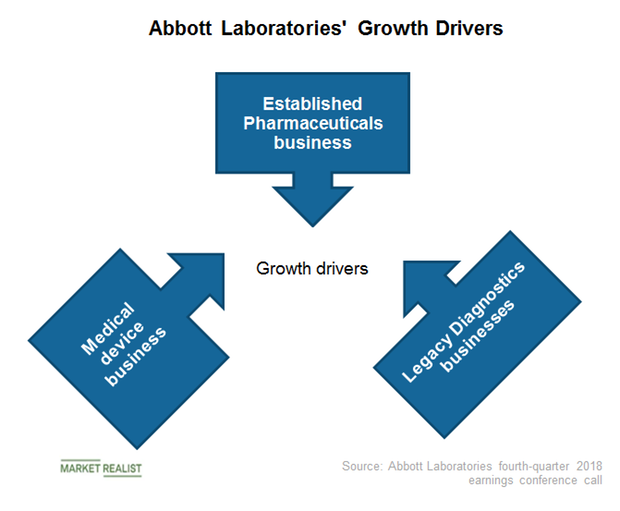

What Are Abbott Laboratories’ Key Growth Drivers in 2019?

On its fourth-quarter earnings call, Abbott forecast that its Established Pharmaceuticals segment would grow in the mid- to high single digits YoY in the first quarter.

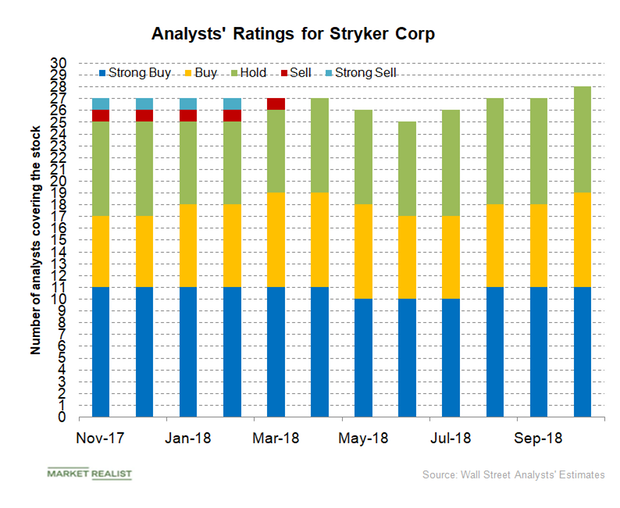

What Analysts Recommend for Stryker Stock

Of the total 28 analysts covering Stryker (SYK) in October 2018, 19 analysts have given the stock a “buy” or higher rating, and nine analysts have given Stryker a “hold” rating.

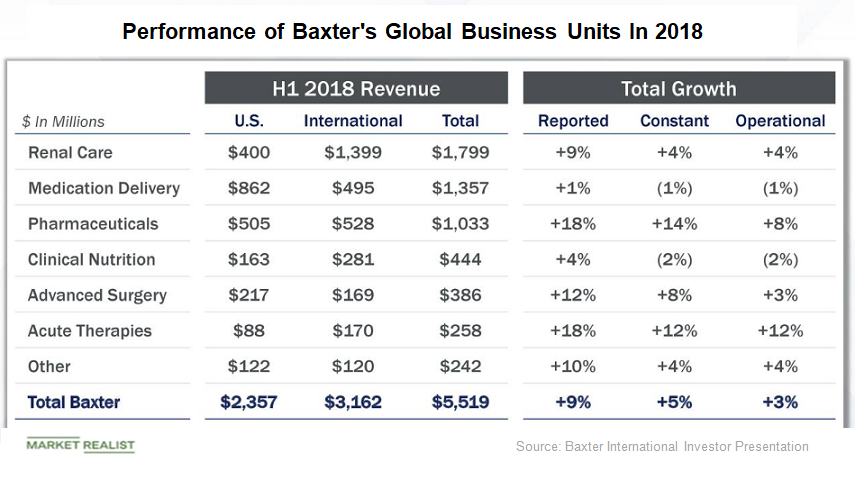

Baxter’s Global Business Units Continue to Deliver

Baxter International’s (BAX) global business units delivered strong performances in the second quarter.

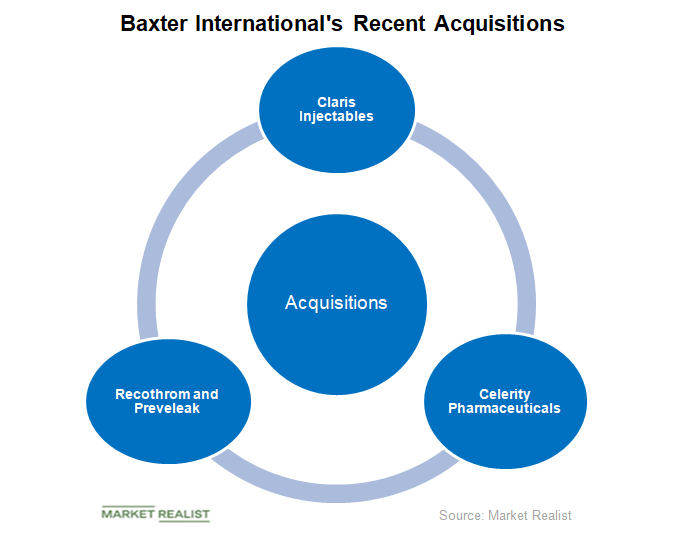

A Close Look at Baxter International’s Acquisitions

Sales from Baxter International’s (BAX) Acute Therapies rose 22%, from $106 million in Q1 2017 to $129 million in Q1 2018.

Baxter International Completes Its Mallinckrodt Assets Buy

Baxter (BAX) announced the completion of its acquisition of Recothrom and Preveleak assets from Mallinckrodt for $185.0 million.

Chart in Focus: Baxter International’s Intralipid 20% Recall

On October 5, 2017, Baxter International (BAX) announced the voluntary recall of a shipment from a lot of Intralipid 20% IV Fat Emulsion, 100 mL. This lot was distributed from August 11 to August 31, 2017.

Management Changes at Baxter International: What You Should Know

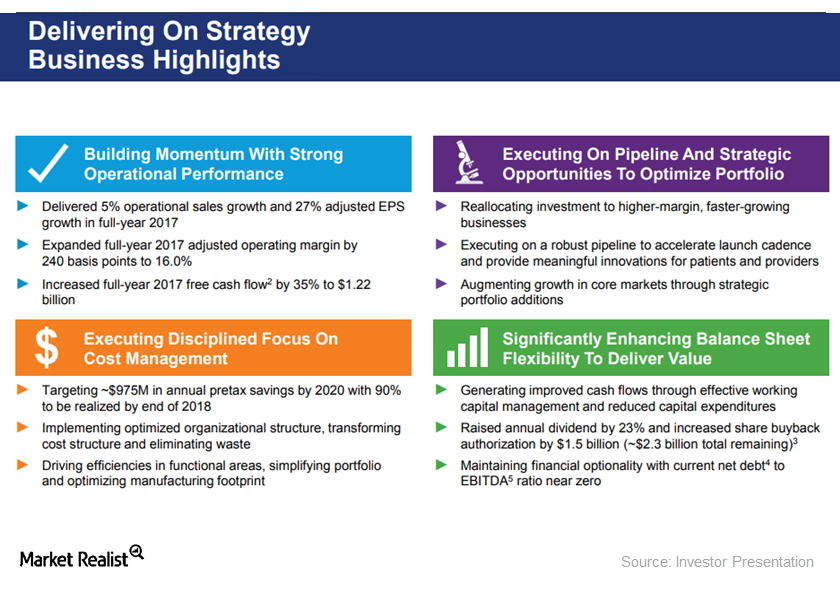

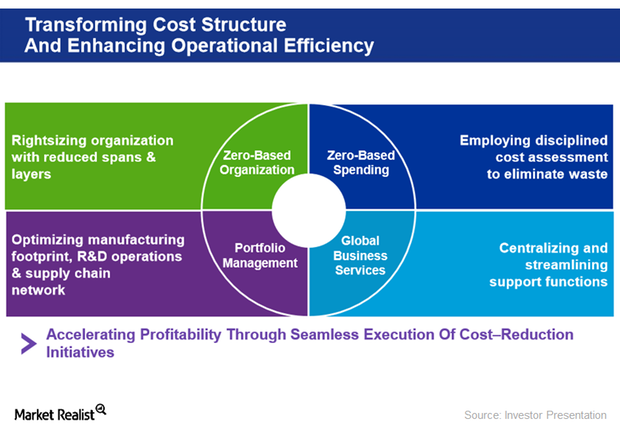

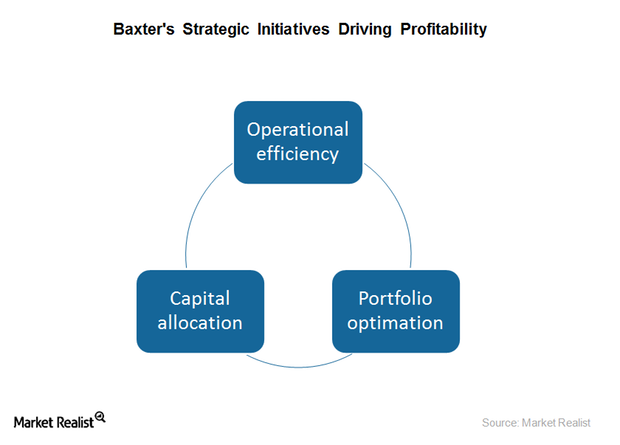

Baxter International (BAX) has been going through a cost transformation and reorganization process for some time. The initiative includes some leadership and management changes.

Inside Baxter International’s Stock Price Performance

On September 7, 2017, BAX stock closed at $62.84 per share. It has a 50-day moving average of $61.15 and a 200-day moving average of $57.14.

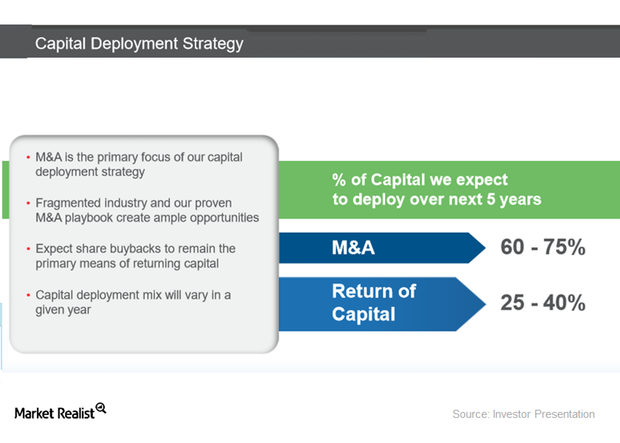

Understanding Thermo Fisher’s Capital Deployment Strategy

Thermo Fisher Scientific expects to deploy 60%–75% of its capital toward M&As (mergers and acquisitions).

Understanding Thermo Fisher’s Growth Strategy

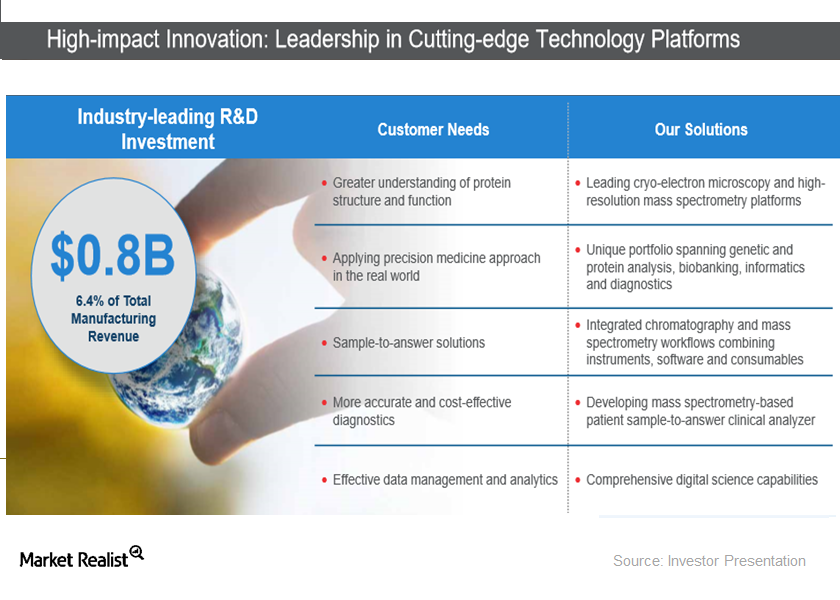

Thermo Fisher Scientific (TMO) has always focused on innovation as a key growth strategy.

Baxter International’s Recent Product Launches and Partnerships

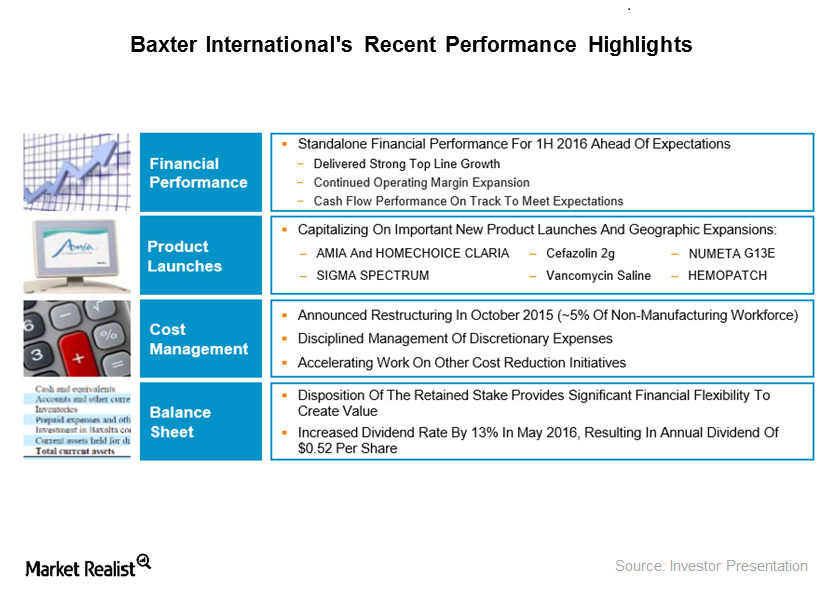

Baxter International’s R&D investments were around $150 million in 2Q16, which represents a YoY (year-over-year) increase of around 1%.

Why Medtronic Is Diversifying beyond Medical Devices

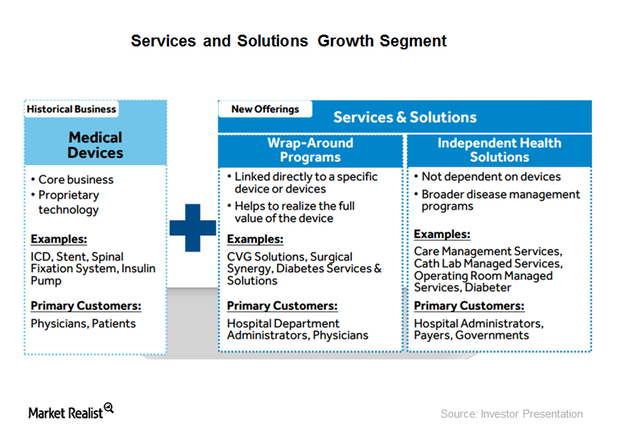

Medtronic established a services and solutions growth vector as one of its core strategies. It contributed ~20 basis points to Medtronic’s growth in 3Q16.

How Baxter’s Biosciences Spin-off into Baxalta Improved Its Valuation

On July 1, 2015, Baxter separated its Biosciences division into a new entity named Baxalta in an effort to divest risky segments and streamline operations.

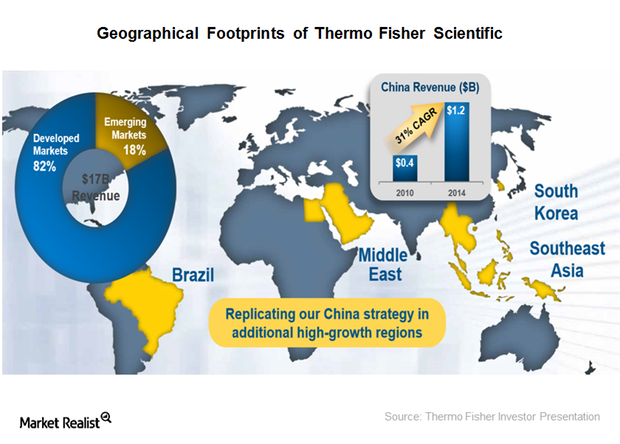

The Geographic Strategy of Thermo Fisher Scientific

Thermo Fisher Scientific is a global company, but the majority of its revenues are generated from the developed markets. The US is its largest market, generating ~48% of the company’s total revenues.

Thermo Fisher Scientific’s Laboratory Products and Services Segment

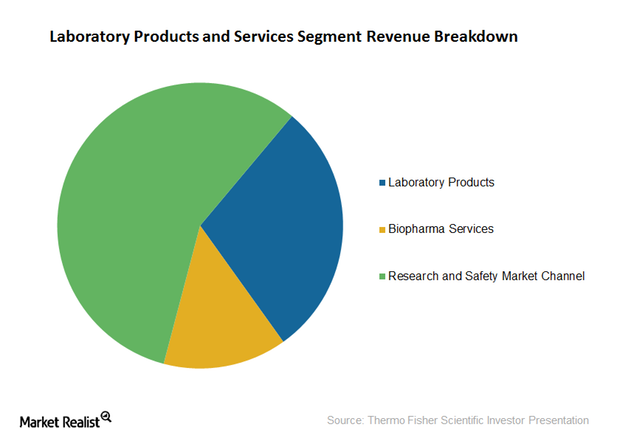

Thermo Fisher Scientific’s Laboratory Products and Services segment earned revenues of approximately $6.6 billion in 2014, representing organic growth of around 5%.

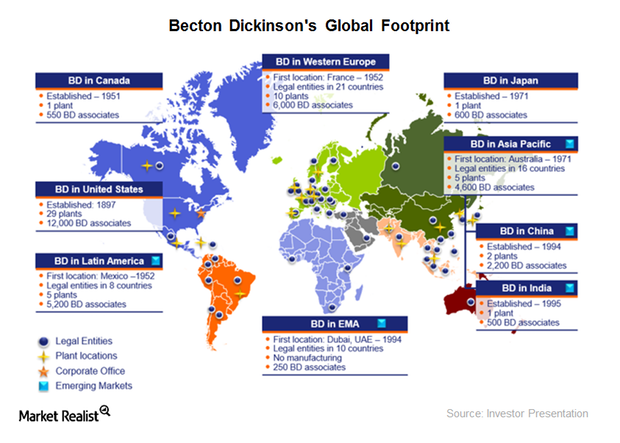

Analyzing Becton, Dickinson and Company’s Geographic Strategy

Becton, Dickinson and Company (BDX), or BD, has operations across the globe, with more than 50% of its 2015 revenues coming from international markets.

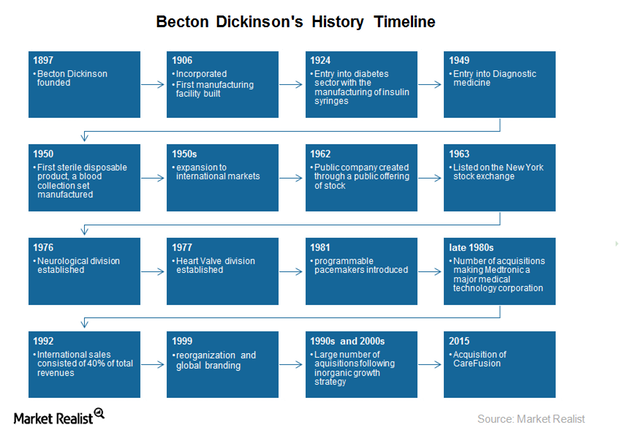

Becton, Dickinson and Company: A Leading Global Medical Device Company

Becton, Dickinson and Company, or BD, headquartered in Franklin Lakes, New Jersey, is one of the leading medical technology companies in the United States.

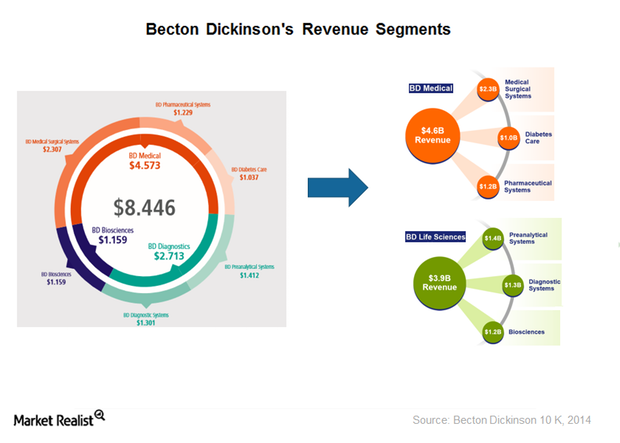

An Overview of Becton, Dickinson and Company’s Business Model

On October 1, 2015, BD underwent organizational restructuring to better align its business model to the strategic vision and goals of the company.

A Must-Read Overview of the Medical Device Industry

The US medical device market is projected to grow at a compound annual growth rate of 6.1% between 2014 and 2017.

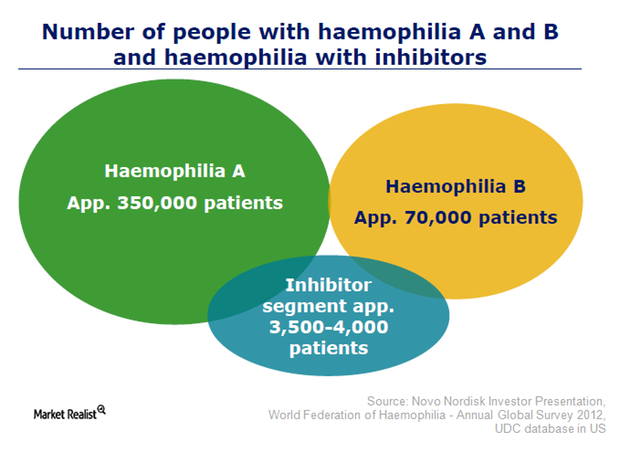

Novo Nordisk Plans to Pursue Leadership in Hemophilia Market

Novo Nordisk is pursuing leadership in the hemophilia market with its new drugs as well as a few investigational hemophilia drugs in its late-stage research pipeline.