Sue Goodridge

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Sue Goodridge

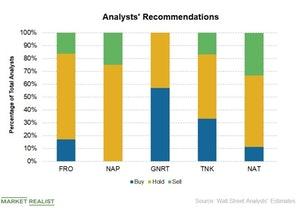

Analysts’ Recommendations for Crude Tanker Stocks

In Week 28, analysts made no target price revisions or recommendation changes for crude tanker companies.

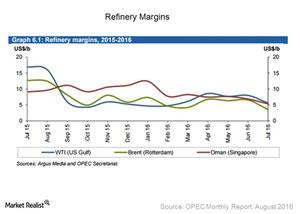

Oil Supply and Refinery Margins Concern Crude Tankers

Refinery margins have fallen throughout most of the world. US Gulf refinery margins for WTI crude lost more than $2 compared to last month’s level.

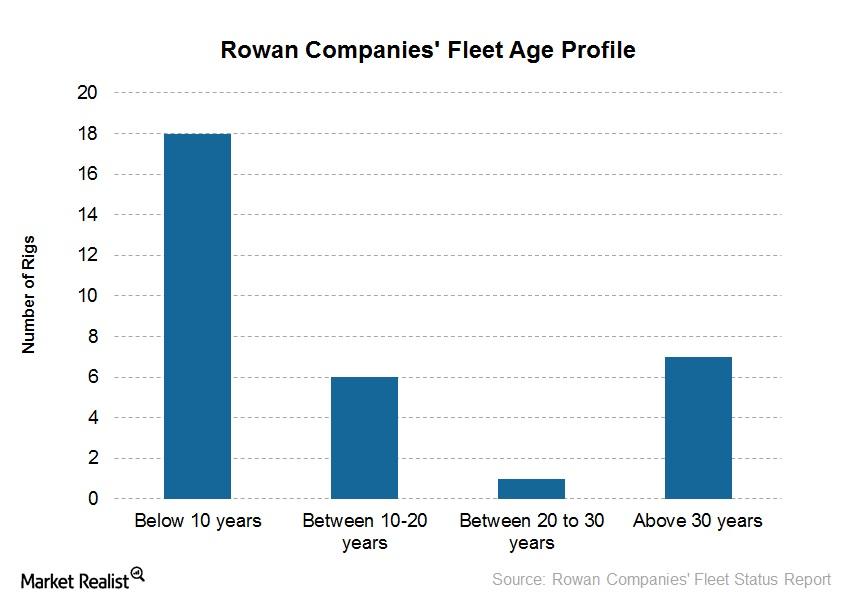

Analyzing Rowan’s Rig Scrapping and Stacking Activity in 3Q15

Offshore drilling (XLE) (IYE) is a capital-intensive industry requiring a large amount of money to keep rigs active and well-maintained.

Seadrill Stock Rose 98% in Week 20

The offshore drilling industry made headlines last week, especially Seadrill (SDRL), which reached a 52-week high of $0.73.

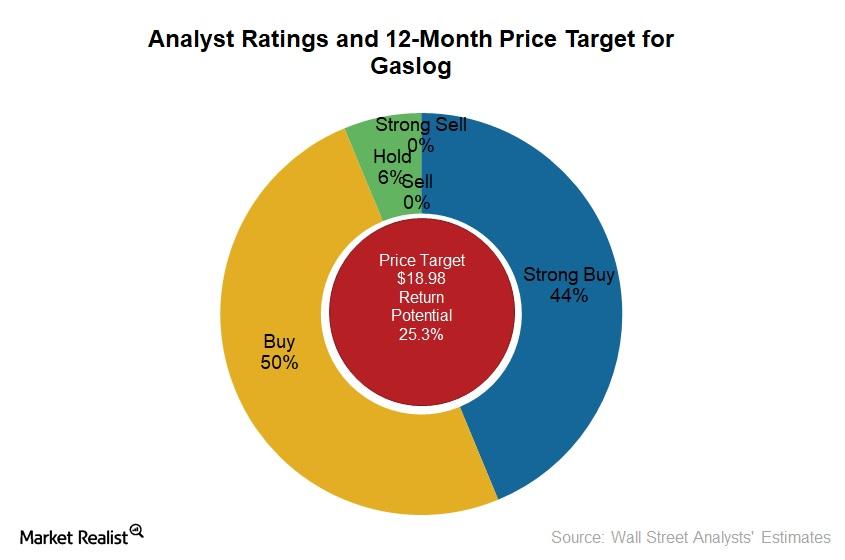

Morgan Stanley Upgrades GasLog

In June 2017, Morgan Stanley upgraded GasLog (GLOG) to “overweight” from “equal weight.”

How Offshore Drilling Stocks Performed Last Week

Most offshore drilling stocks traded in the green in the week ended July 13. The best performer during the week was Noble.

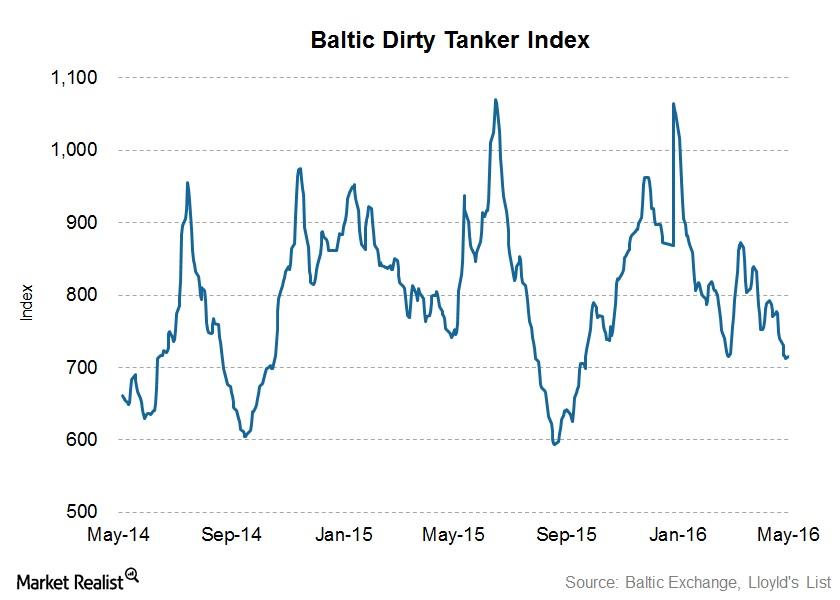

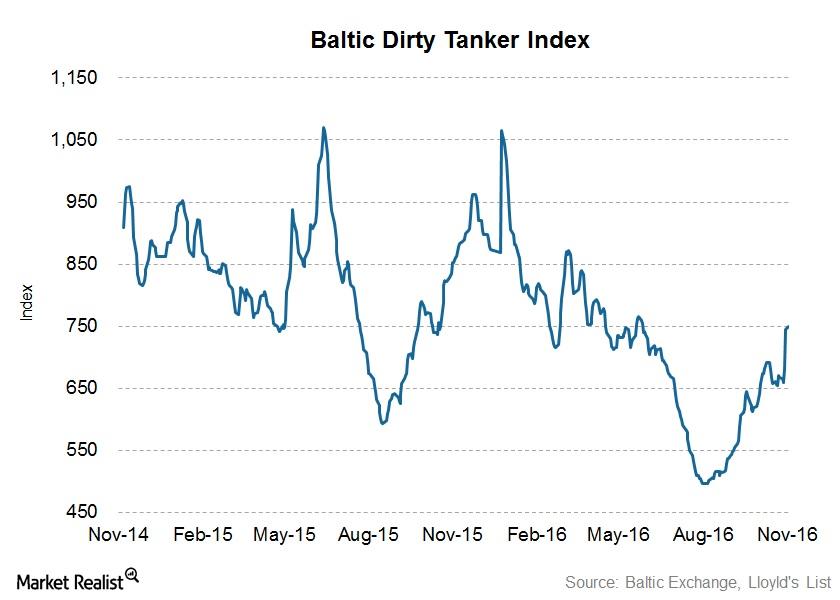

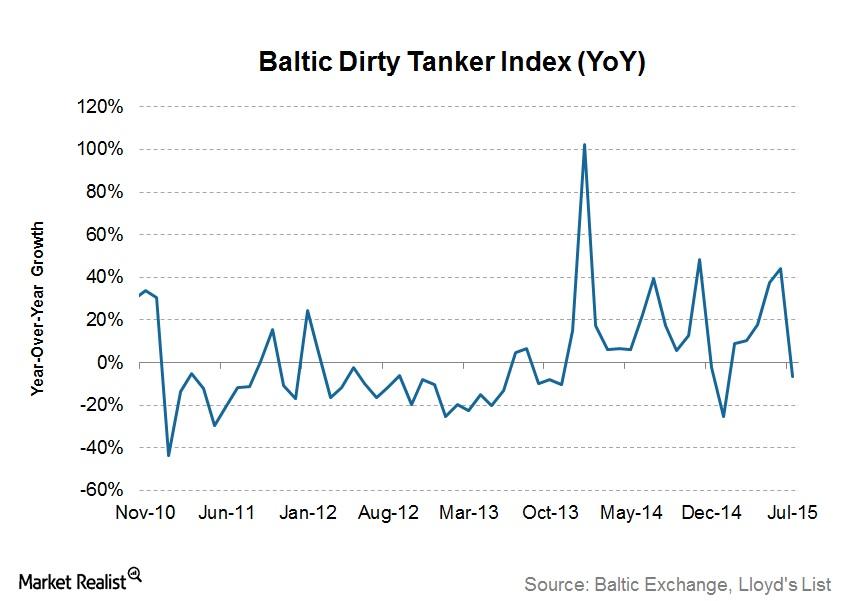

BDTI, Crude Tanker Stock Prices Inch Higher in Week 22

The BDTI stood at 739 on June 7, 2016. For the week ending June 3 (Week 22), the BDTI rose to 759 from 735 at the beginning of the week.

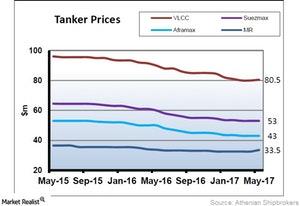

VLCC Prices Rose First Time in 2017

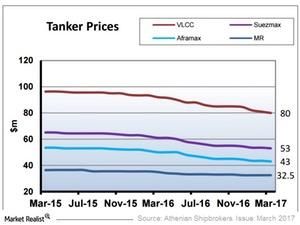

Newbuild VLCC (very large crude carrier) prices rose in May 2017, and this is the first time we’ve seen a rise in prices this year.

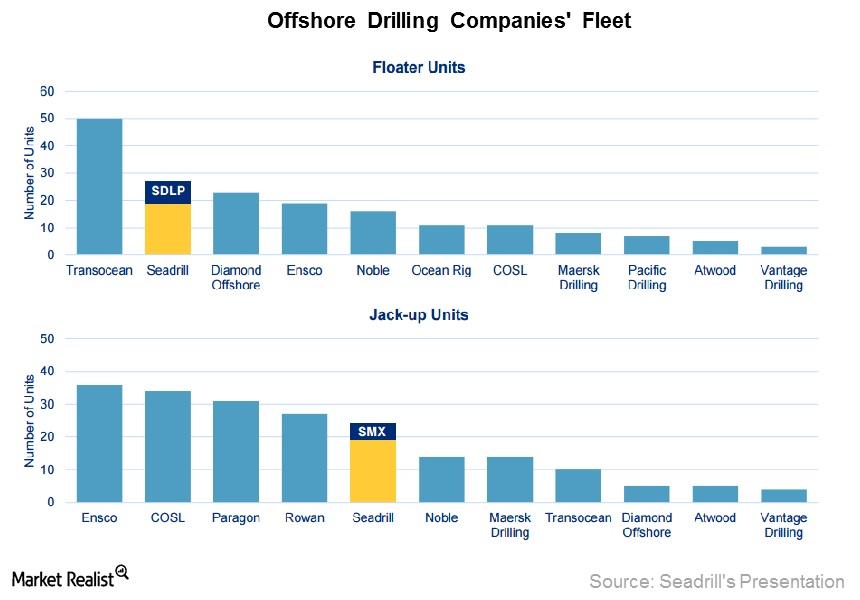

A Review of Floaters and Jack-Up Fleets for Offshore Drillers

Seadrill and Diamond Offshore have more than 20 floaters in their fleets. Ensco and Rowan Companies have more jack-ups in their fleets than peers have.

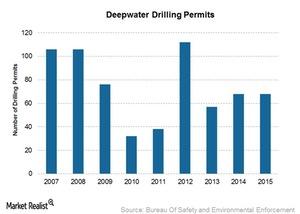

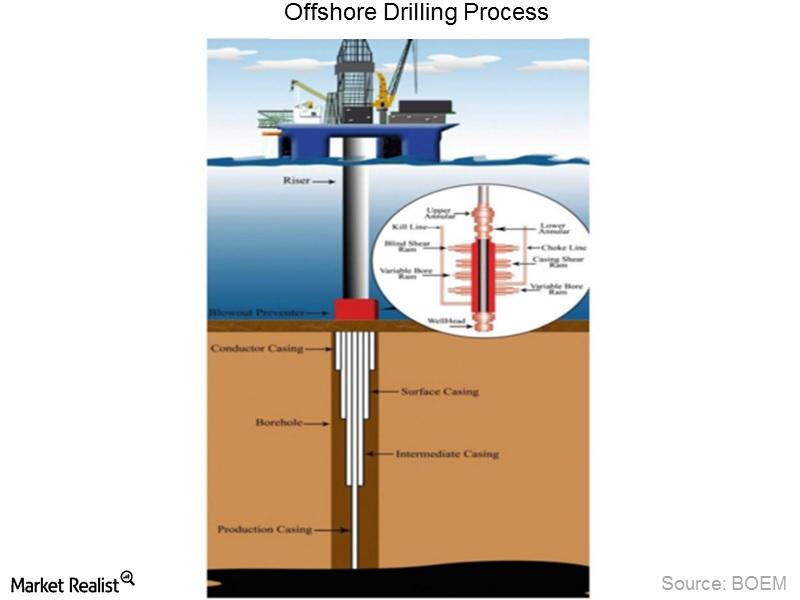

The 2010 Gulf Oil Spill Tragedy and Its Aftermath across the Industry

The marine oil spill in April 2010 was the worst environmental disaster in US history, causing millions of barrels of oil gushed into the Gulf.

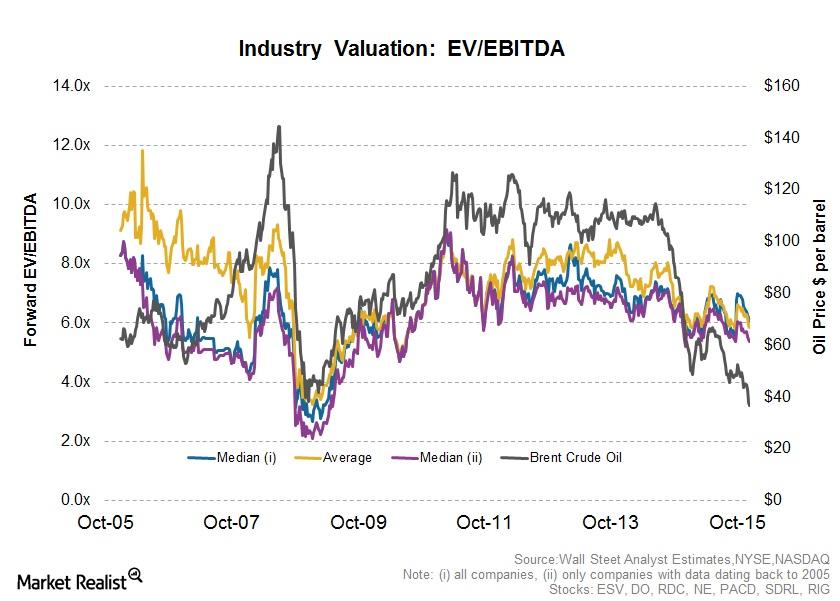

How to Interpret Valuation Multiples in the Offshore Drilling Industry

Offshore drilling companies are capital-intensive and have varying degrees of financial leverage. Thus, we use the EV-to-EBITDA multiple as a valuation.

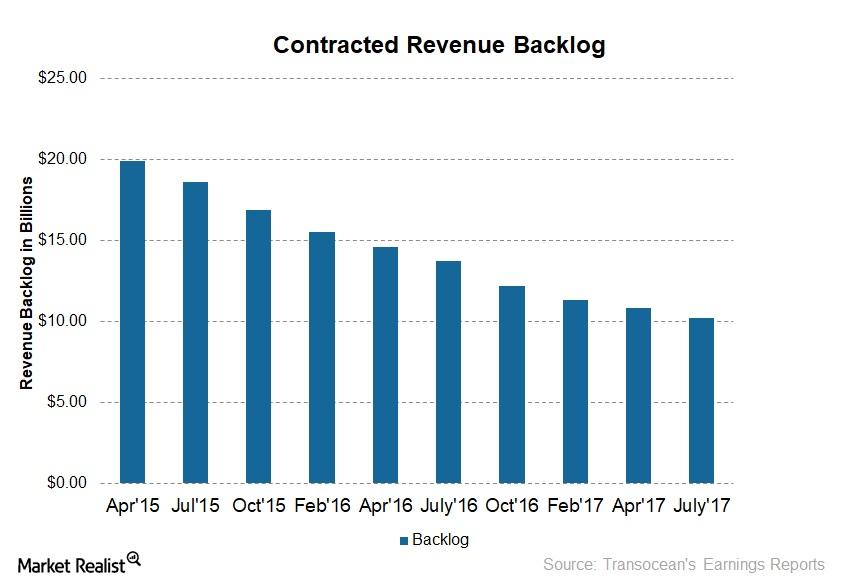

Transocean Secured New Contracts

As of July 25, 2017, Transocean (RIG) had a backlog of $10.2 billion—compared to $10.8 billion in April 2017.

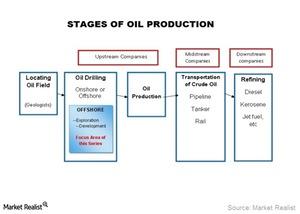

Extracting the Basics: An Introduction to Offshore Drilling

Oil is one of the most important and most frequently traded commodities, and offshore drilling is an integral part of the oil industry.

Floating Storage and Regasification Units: Updates and Outlook

In this article, we’ll look at Golar’s prospects and progress with regards to its FSRU (floating storage and regasification unit) business stream.

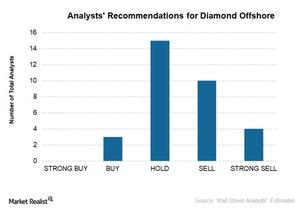

Jefferies Revises Target Prices for Diamond Offshore, Noble

Article focus In this article, we’ll discuss analysts’ target price revisions for offshore drilling companies in Week 8 of 2018 (ended February 23). Revisions in Week 8 Jefferies revised its target prices for two offshore drillers. On February 21, 2018, it reduced the target price for Transocean (RIG) to $12 from 413 and maintained a […]

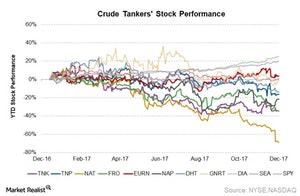

Crude Tanker Stocks and the BDTI Index in Week 39

In week 39, the week ending September 29, the BDTI rose to 776 from 772. In week 38, the index rose by 28 points. It rose for the fifth consecutive week.

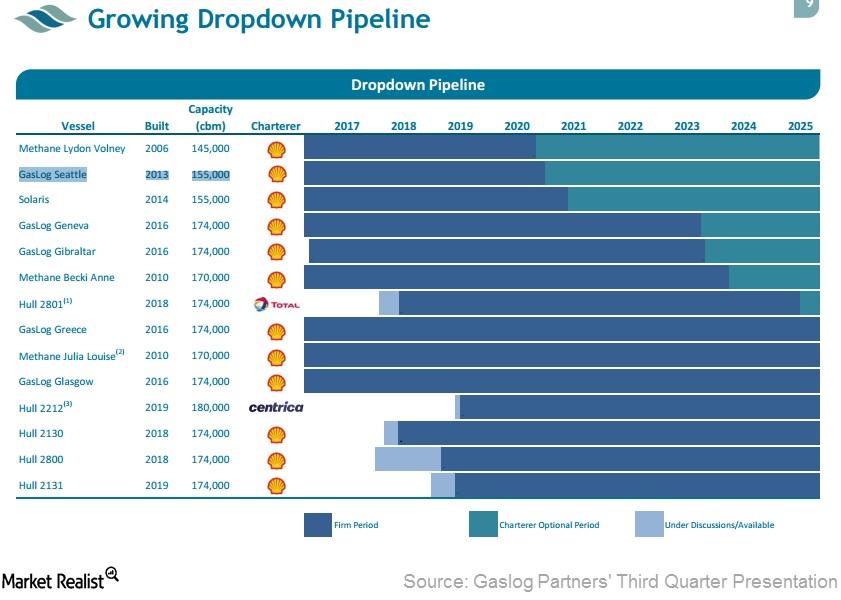

What Are GasLog Partners’ Asset Dropdown and Dropdown Options?

GasLog, GasLog Partners’ general partner (or GP), has entered into a seven-year time charter contract with Total, which will commence in mid-2018.

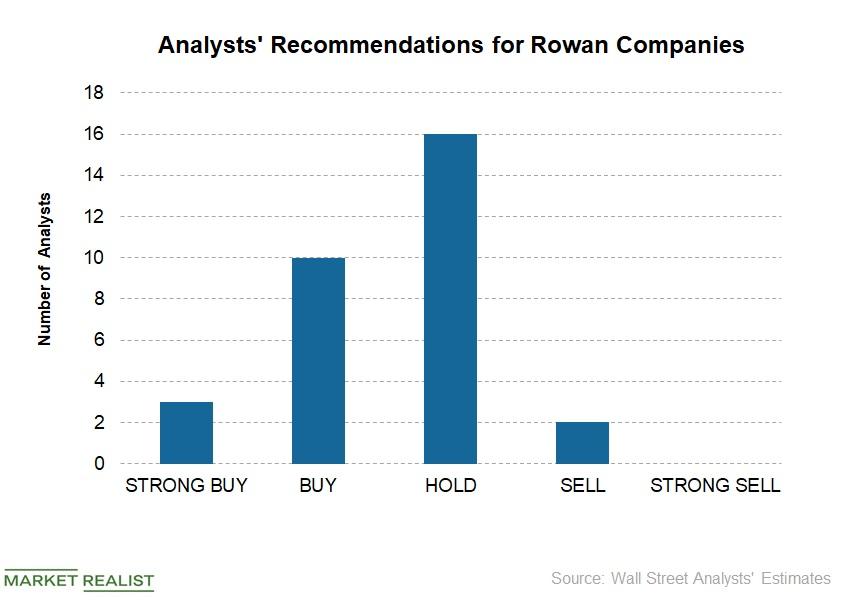

Wells Fargo Upgrades Rowan Companies to ‘Outperform’

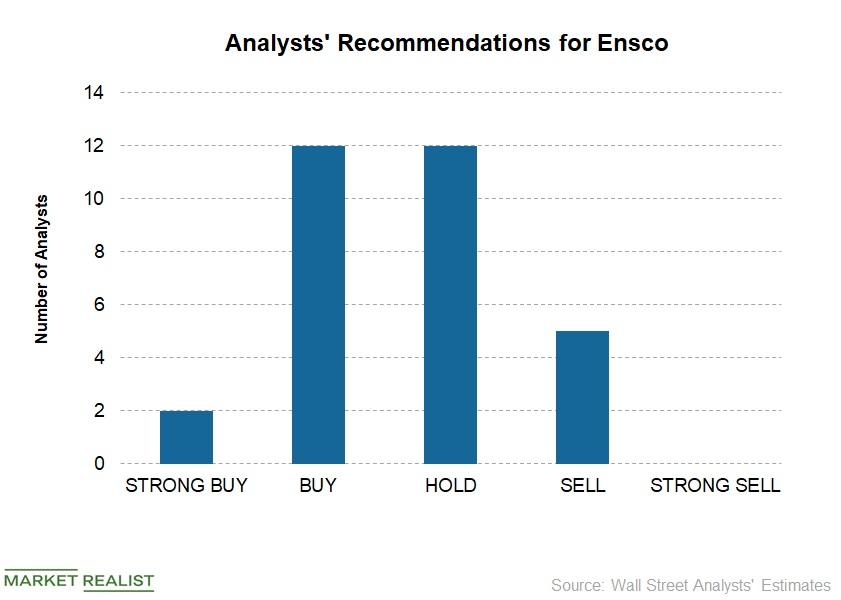

RDC’s analyst recommendations Analysts’ consensus rating for Rowan (RDC) is 2.6, which means a “hold.” Peers Transocean (RIG), Diamond Offshore (DO), Noble (NE), and Ensco (ESV) also have “hold” ratings. Of the 31 analysts covering Rowan (RDC), 39% recommend “buy” or some equivalent, 55% recommend “hold,” and 6% recommend “sell.” Among the top offshore drilling stocks […]

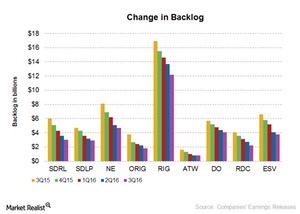

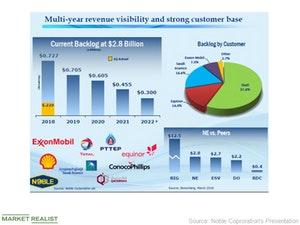

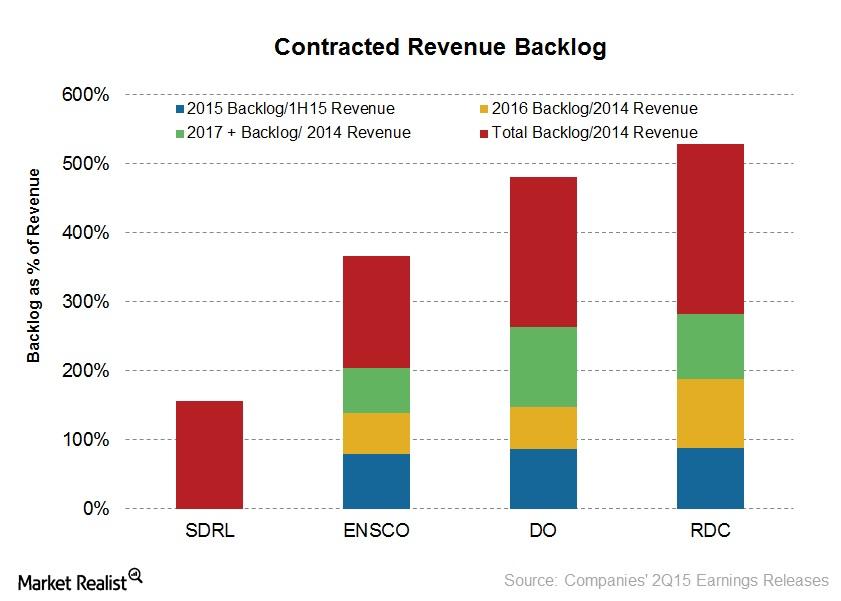

Offshore Drillers: How Their Backlogs Are Rapidly Declining

The offshore drilling industry has had low day rates and few or no new drilling contracts in the past year. Companies are alive mostly due to their earlier contracts.

China’s June Data Impact the Crude Tanker Industry

China (FXI) released its key economic data for June—import and export data, auto sales data, and the manufacturing index.

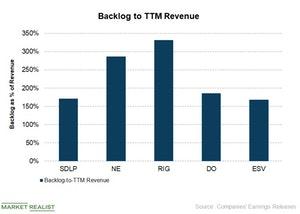

Transocean Has the Highest Backlog among Its Peers

In the last part of this series, we saw which offshore drillers had the highest and lowest falls in their backlogs. In this article, we’ll compare offshore drillers’ backlogs versus their revenues.

Jefferies Revises Ratings and Target Prices for Offshore Drillers

In Week 25, which ended June 22, Jefferies downgraded one offshore driller and revised the target prices for others.

Analyzing Noble’s June Fleet Status Report

On June 7, Noble (NE) released its June fleet status report. Most of the offshore drilling companies don’t publish a monthly fleet status report.

China’s April Trade Data and the Crude Oil Tanker Industry

China, which has the second-largest economy in the world, has a significant impact on the crude tanker industry.

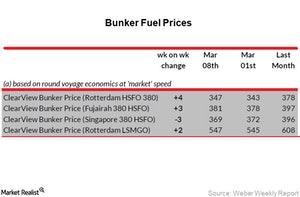

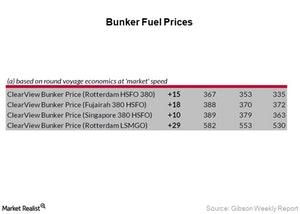

Analyzing Bunker Fuel Prices in Week 12

On March 22, 2018, the average bunker fuel price was $423 per ton—compared to $413 per ton on March 15.

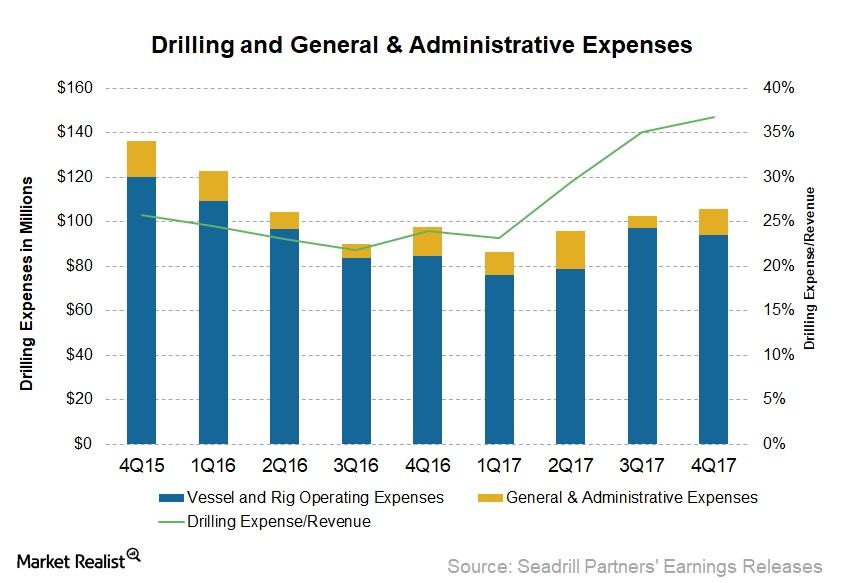

A Look at Seadrill Partners’ Cost Performance in 4Q17

Seadrill Partners’ (SDLP) vessel and rig operating expenses fell 3% to $94 million in 4Q17 compared to $96.9 million in 3Q17.

Euronav and Gener8 Maritime Partners’ Merger

On December 21, 2017, Euronav (EURN) and Gener8 Maritime Partners (GNRT) announced a stock-for-stock merger.

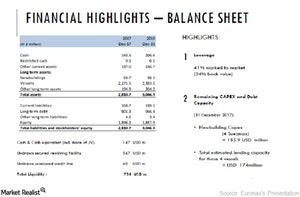

Analyzing Euronav’s Balance Sheet on December 31

Euronav had a liquidity of $754 million at the end of the fourth quarter. Euronav has been working to strengthen its liquidity position.

China’s December Trade Data Impact the Crude Tanker Industry

China (FXI) released key economic data for December 2017—import and export data, auto sales data, and the manufacturing index.

Oil Price Reach 3-Year High: What about Bunker Fuel Prices?

On January 4, 2018, the average bunker fuel price was $431 per ton—compared to $413 per ton on December 21, 2017.

What Current Tanker Prices Tell Us about the Tanker Industry

Newbuild vessel prices fell in March 2017. We saw in our last month’s series that newbuild vessel prices also fell in February.

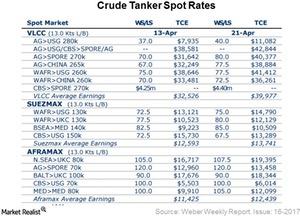

VLCC, Suezmax, and Aframax Rates Rose in Week 16

According to the Weber Weekly Report, VLCC rates on the benchmark route rose from $32,439 per day on April 13, 2017, to $38,884 per day on April 21, 2017.

Crude Tanker Stocks Rose during Election Week

The BDTI (Baltic Dirty Tanker Index) was at 740 on November 14, 2016. The BDTI tracks shipping rates for crude oil (DBO) on representative routes.

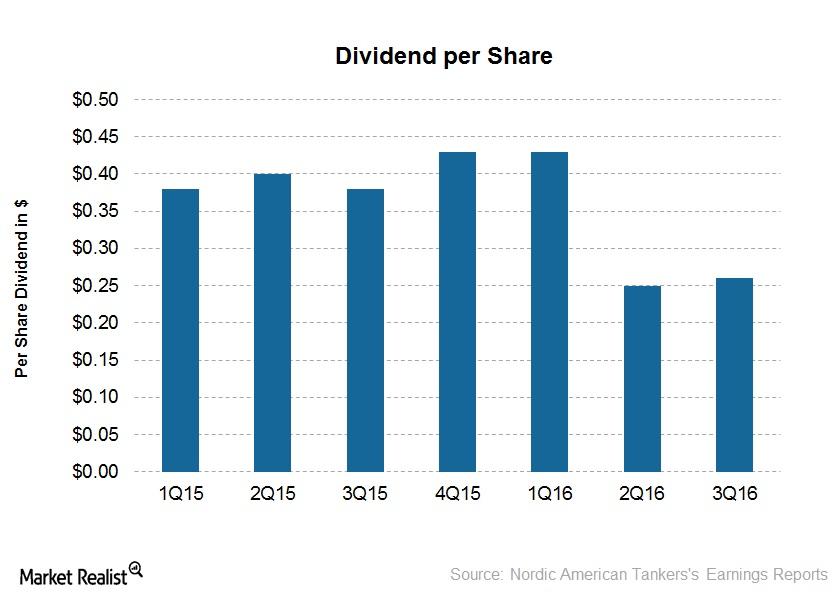

Nordic American Tankers’ Long Dividend History Continued

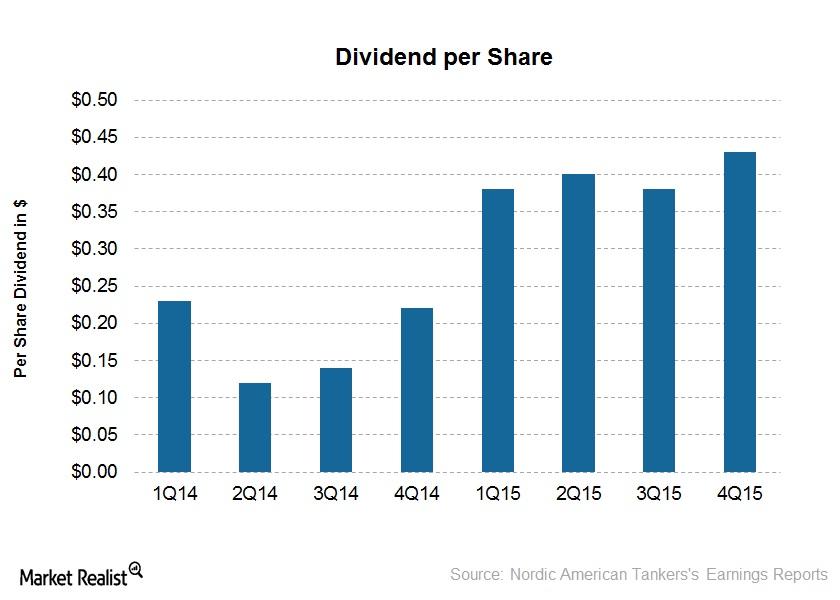

Nordic American Tankers has a long history of paying dividends—77 consecutive quarters to date. It declared a cash dividend of $0.26 per share on October 27.

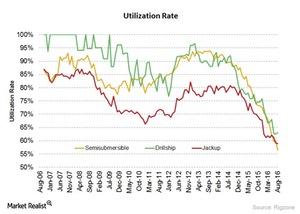

How Are Offshore Drilling Rig Utilization Rates Trending?

The rig utilization rate has drastically fallen compared to its historical rates. The utilization rate is an important indicator to gauge demand and activity in the offshore drilling industry.

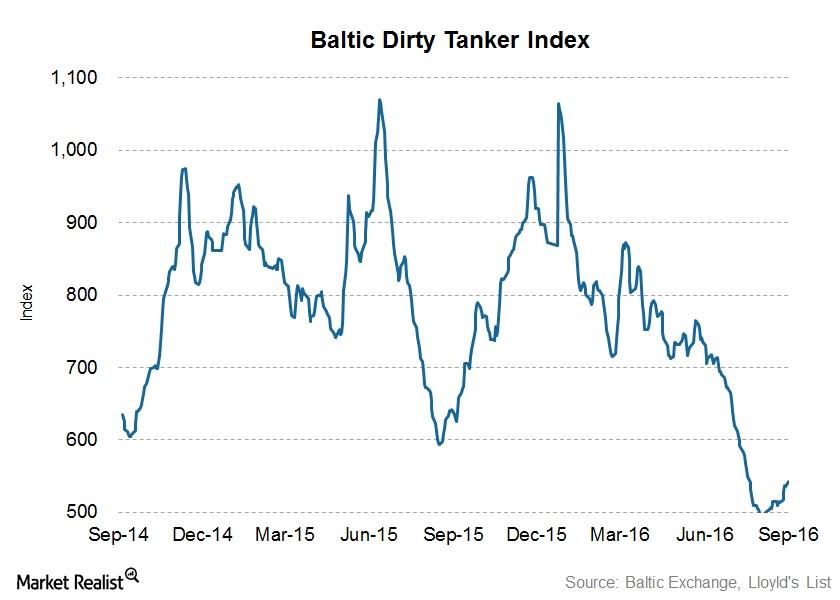

Performance of Baltic Dirty Tanker Index in Focus

The BDTI (Baltic Dirty Tanker Index) stood at 554 on September 12, 2016. For the week ended September 9 (Week 36), the BDTI rose to 542 from 516 at the beginning of the week.

NAT’s Dividends: 74 Straight Quarters of Payouts to Investors

Nordic American Tankers’ (NAT) dividend yield has ranged from 6.3%–10.36% in the past four quarters. NAT had a dividend yield of 14.17% as of February 11, 2016, one of the highest dividend yields in the industry.

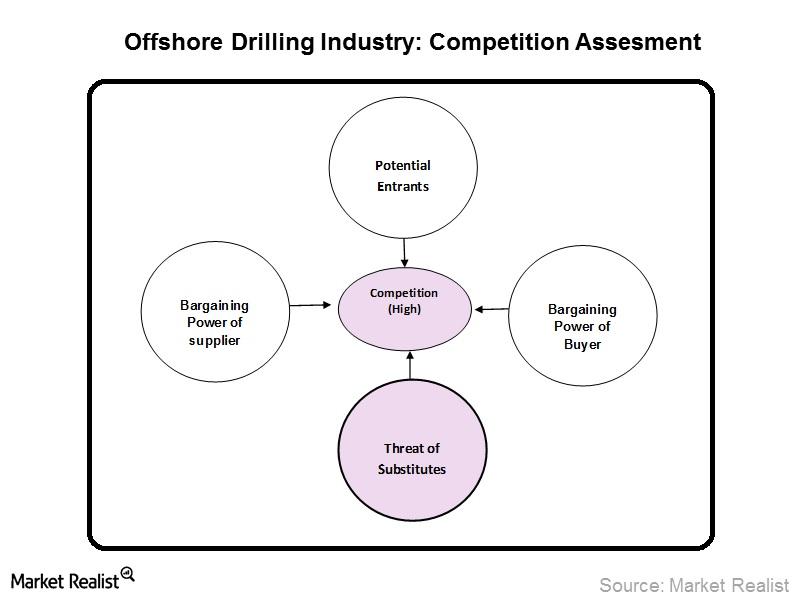

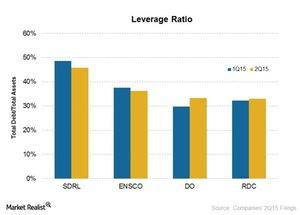

The Intense Competition in the Offshore Drilling Industry

The offshore drilling industry has a high degree of financial and operating leverage, which forces participants to engage in price competition.

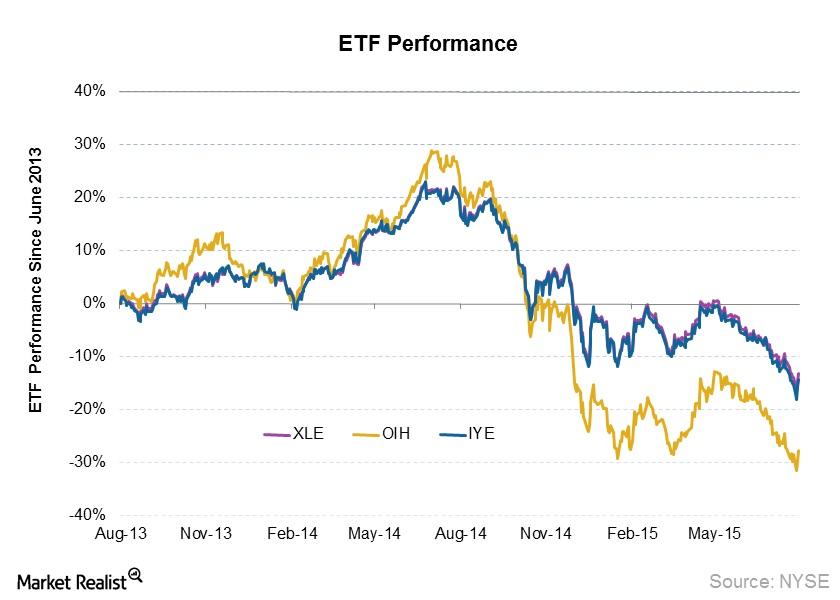

ETF Exposure in the Offshore Drilling Space

Among the biggest ETFs in the offshore drilling space, investors can choose between ETFs like OIH, XLE, and IYE for exposure to offshore drilling.

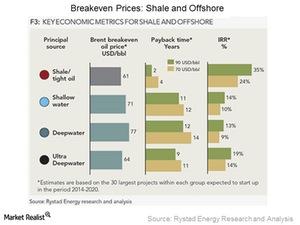

How Offshore and Onshore Drilling Perform when Oil Prices Tumble

Unconventional sources of onshore drilling have started gaining popularity in recent years, but the crude from these sources are costly to produce.

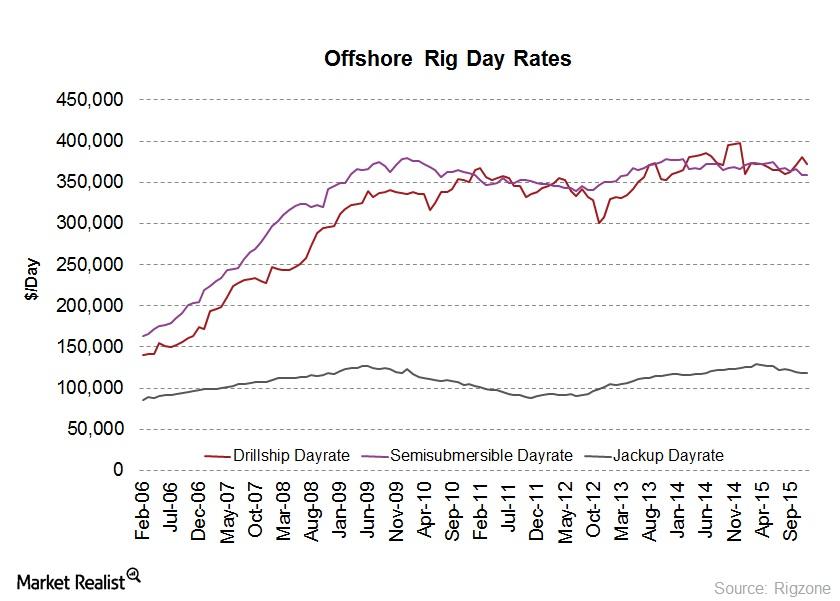

Day Rates and Lifelines of Offshore Drilling Companies

Even in the same category of rigs, different water depth capabilities cause offshore drilling day rates differ. Day rates are also impacted by region.

How Geography and Climate Impact Offshore Oil Rig Choices

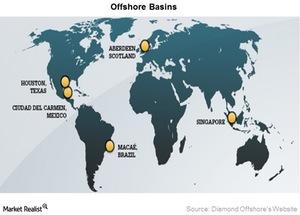

The majority of offshore operations occur in six key locations worldwide that differ widely in terms of water depth, weather conditions, and remoteness.

Getting to Know the Types and Characteristics of Offshore Rigs

Jack-ups, followed by semisubmersibles, drill most of the existing offshore wells today, and drillships come in third place in terms of rigs in operation.

Why the Offshore Drilling Process Is so Complex and Costly

The offshore drilling process requires complex machinery and large crews. At every stage, things that can go wrong, so each stage requires special care.

Rowan Companies Has Highest Backlog among its Peers

Overall, Rowan Companies (RDC) has a comparatively stronger backlog. Higher backlogs are associated with stable revenues in the short to midterm, which reduces risk for investors.

Which Offshore Driller Is the Most Leveraged?

As the above chart shows, Seadrill (SDRL) has the highest leverage, with a debt-to-asset ratio of 46%. Ensco (ESV) has the second highest ratio at 36%.

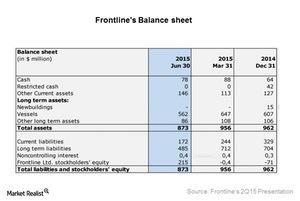

Restructuring Frontline’s Balance Sheet

Fontline’s balance sheet restructuring has improved its solvency ratios.

Free Fall of Baltic Dirty Tanker Index: Something to Worry About?

On July 1, the Baltic Dirty Tanker Index was at 952 points, the highest in July. Then the index took a free fall and hit 752 points on July 31 and 673 on August 12.

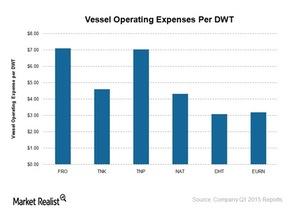

Comparing Tanker Companies’ Operating Expenses per DWT

Vessel operating expenses mainly include crewing, repair and maintenance, and insurance expense, but not fuel cost (DBO).