Amit Singh

Amit Singh has been working with Market Realist since 2017. He has over eight years of strong experience (both sell-side and buy-side) in analyzing financial reports and filings as well as identifying strategic investment opportunities. Over the years, Amit has covered various industries and geographies, with a primary focus on consumer staples and the consumer discretionary sector.

Amit’s background spans evaluating company portfolios, building complex financial models, writing financial articles, and identifying the overall financial worth of companies. He has a post-graduate diploma in finance.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Amit Singh

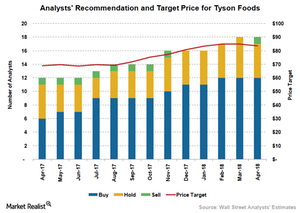

What Analysts Recommend for Tyson Foods

Of the 18 analysts covering Tyson Foods, 67.0% recommend a “buy” on its stock.

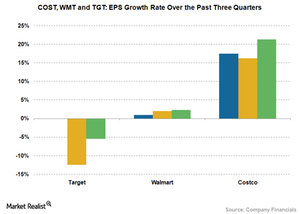

Costco, Walmart, and Target: Comparing Earnings Growth

Costco (COST) continues to impress with its high earnings growth rate despite its continued focus on prices amid increased competition from Amazon (AMZN).

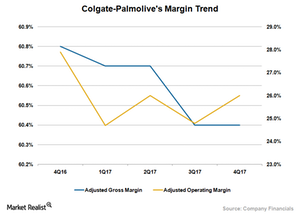

Will Colgate-Palmolive Stock Recover?

Colgate-Palmolive (CL) stock is down about 9.6% on a YTD (year-to-date) basis as of March 26, 2018.

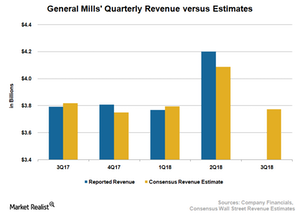

Will General Mills Sustain Its Sales Momentum in Q3?

Analysts expect General Mills (GIS) to report sales of $3.8 billion in fiscal 3Q18, reflecting a marginal decline of 0.5% on a YoY (year-over-year) basis.

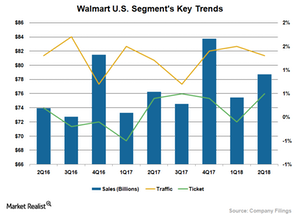

Walmart’s US Segment Is a Key Revenue Driver

During fiscal 4Q18, Walmart’s US segment reported sales of $86.6 billion, up 3.4% on a year-over-year basis.

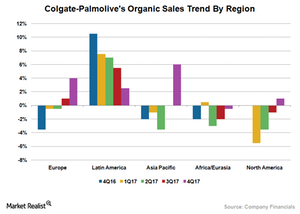

Analyzing Colgate-Palmolive’s Regional Sales in 4Q17

Colgate-Palmolive (CL) witnessed improved volumes across several regions thanks to the improvement in volumes driven by new products supported by increased advertising.

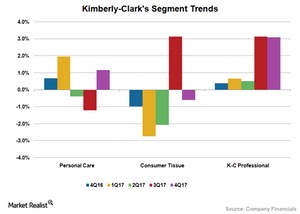

Kimberly-Clark: Segment Performances in 4Q17

Kimberly-Clark’s (KMB) Personal Care segment returned to growth in 4Q17. The segment’s top line increased 1.2% to $2.3 billion.

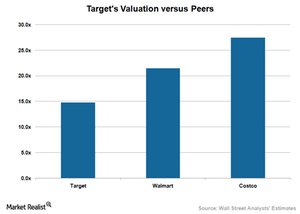

Target’s Valuation Compared to Its Peers

Target (TGT) stock was trading at a forward PE ratio of 14.8x on January 9, 2018, which seems compelling when compared to the peer group average of 24.5x.

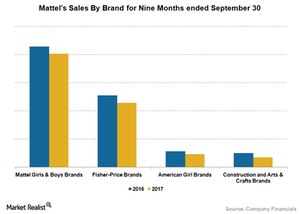

Mattel’s Year-to-Date Sales by Brand

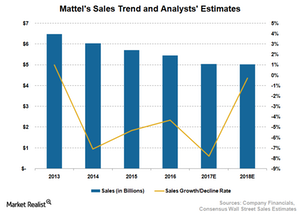

As you can see in the graph below, Mattel’s (MAT) sales declined across all its brands for the nine-month period that ended on September 30, 2017.

Why Mattel’s Sales Could Keep Falling in the Near Term

Toy makers in the United States (SPY) are facing near-term disruptions affecting their top-line performance. Toys “R” US, one of the leading distribution partners for US toy companies, filed for bankruptcy.

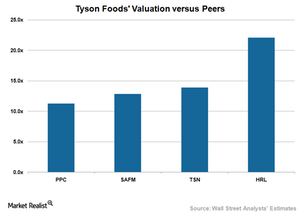

How Tyson Foods Compares with Its Peers in Valuation

As of December 22, 2017, Tyson Foods (TSN) stock was trading at a 12-month forward PE (price-to-earnings) multiple of 13.9x, which could seem attractive to investors.

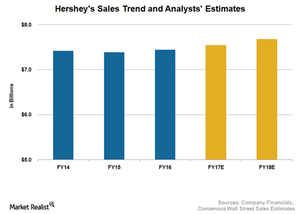

Hershey to Acquire Amplify Snack Brands for $1.6 Billion

The Hershey Company (HSY) is one of the few food companies in the United States (SPY) that have managed to improve sales despite the challenging landscape.

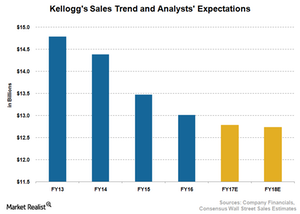

Why Analysts Expect Kellogg’s Sales to Fall

Kellogg (K) estimates a 3% decline in its top line for fiscal 2017, reflecting weakness in the cereal category and challenges in several markets.

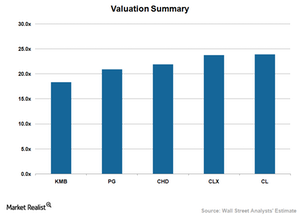

How PG, KMB, CL, CLX, and CHD Compare on Valuation

As of November 24, 2017, Colgate-Palmolive (CL) stock was trading at a forward PE multiple of 24.0x, which is higher than its peers.

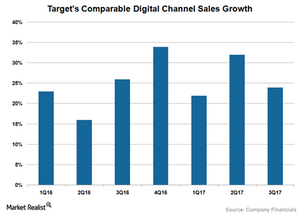

Target’s Growth Initiatives Are on Track

Target announced several customer-friendly initiatives that are resulting in higher sales. The company ramped up its delivery mechanism.

Here’s What’s Driving Walmart’s Sales Growth

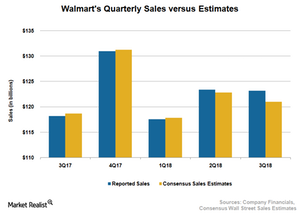

Walmart (WMT) reported sales of $123.2 billion in fiscal 3Q18, which easily exceeded analysts’ expectation of $121 billion, rose 4.2% YoY (year-over-year).

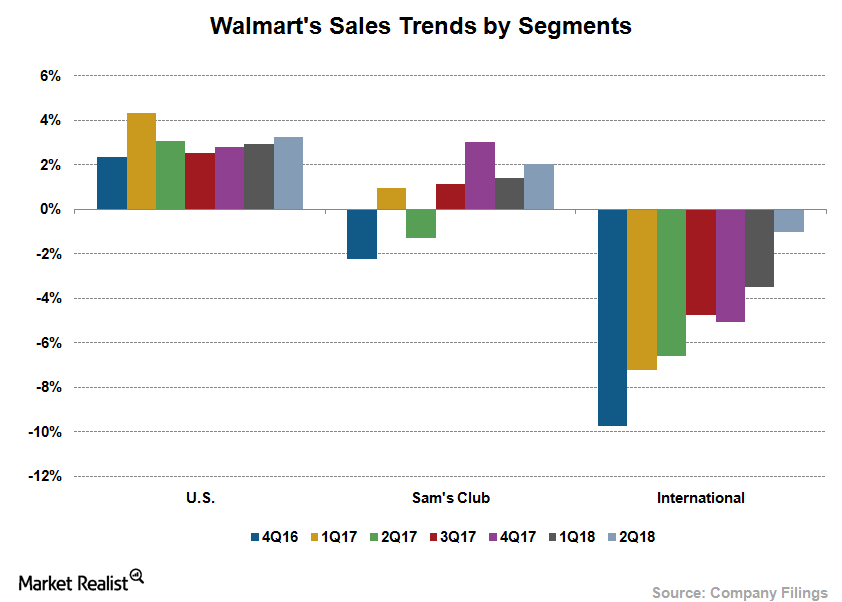

Walmart: Segments’ Sales Trends in Fiscal 2018

During the last reported quarter, the Walmart U.S. segment’s sales rose 3.3% year-over-year to $78.7 billion, reflecting a 1.8% increase in comps.

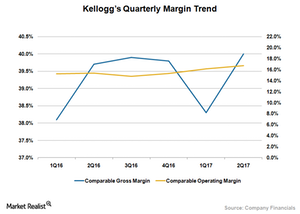

Why Kellogg’s 3Q17 Profit Margins Could Improve

Kellogg (K) posted improved profit margins despite lower sales, thanks to the company’s focus on efficiency and initiatives to reduce costs.

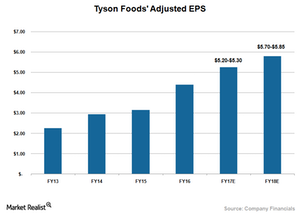

Tyson Foods Raises Fiscal 2017 Guidance

Tyson Foods (TSN) stock jumped about 8% on September 29, 2017, after the company raised its fiscal 2017 EPS (earnings per share) guidance.

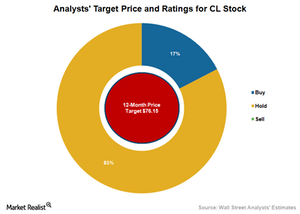

What Analysts Recommend for Colgate-Palmolive

The majority of analysts providing recommendations on Colgate-Palmolive (CL) stock maintain a neutral outlook.

How Walmart Has an Edge Over Competition

As competition heats up in the grocery business, Walmart (WMT) is leveraging its strong retail presence, which gives the company an edge over the competition.

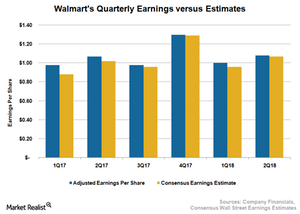

Walmart Beats Fiscal 2Q18 Bottom-Line Analyst Estimates

Walmart (WMT) reported its fiscal 2Q18 results on August 17. Walmart’s adjusted earnings per share of $1.08 beat Wall Street’s estimate and increased 1% year-over-year.

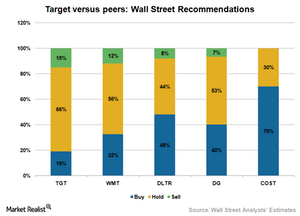

What Analysts Think of Target Stock

The majority of analysts covering Target (TGT) are neutral on the stock. Analysts’ consensus rating on TGT was 2.9 on a scale of 1.0 (strong buy) to 5.0 (strong sell).

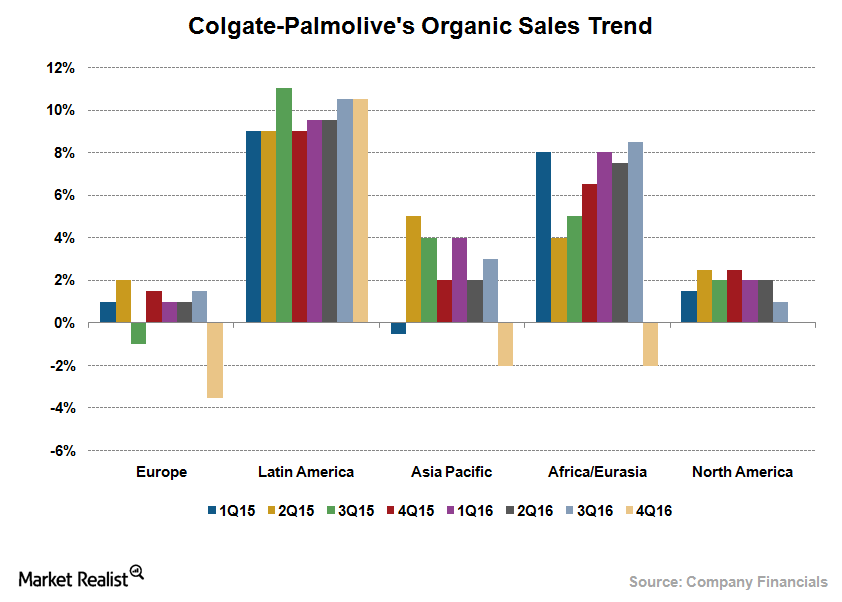

Colgate-Palmolive’s Regional Trends Are Now Headed This Way

CL’s organic sales in its North American segment remained flat in 4Q16. Volume gains in toothpaste were offset by a fall in toothbrushes and liquid hand soap.

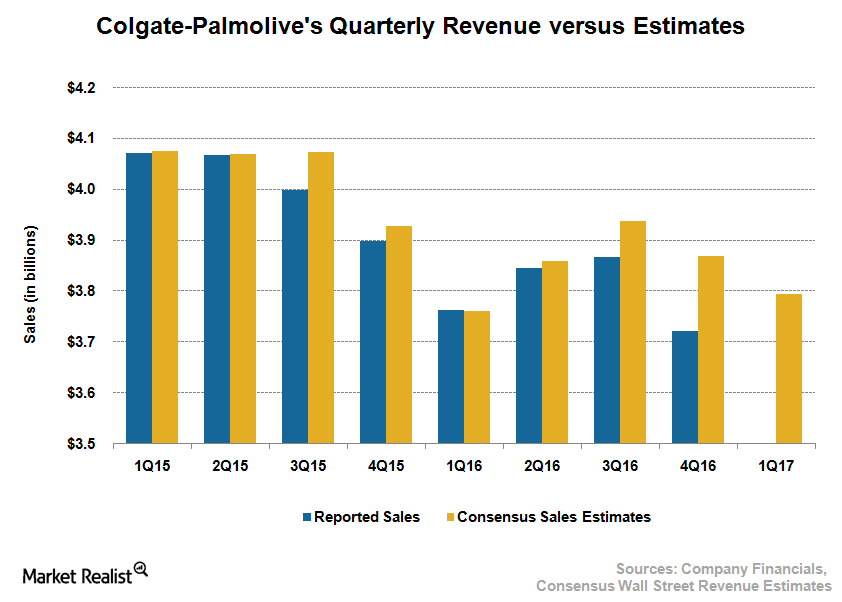

Colgate-Palmolive’s Sales Growth: Understanding Analyst Expectations

Analysts expect Colgate-Palmolive (CL) to post revenue of $3.8 billion in 1Q17, which would represent a YoY (year-over-year) growth of 0.8%.

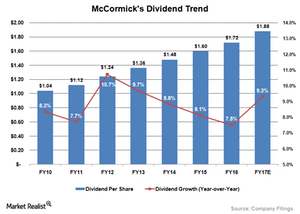

A Look at McCormick’s Strong Dividend History

In the past three fiscal years, McCormick has returned more than $1.0 billion to its shareholders in the form of dividends and share buybacks.

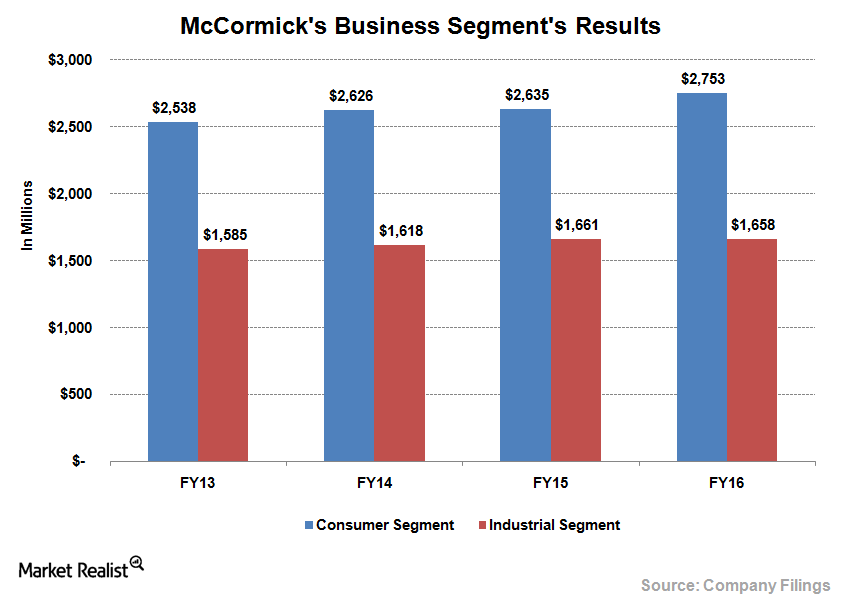

A Look at McCormick’s Strategic Initiatives

McCormick’s (MKC) strategic acquisitions have been one of the key components of the company’s sales and margin growth.

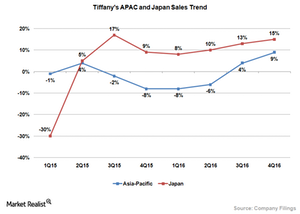

Why Tiffany’s Growth Story May Take Place in Asia

Tiffany’s international operations are vital to top-line growth. In fiscal 2016, US sales accounted for 42.3% of overall sales, while other countries made up 42.6%.

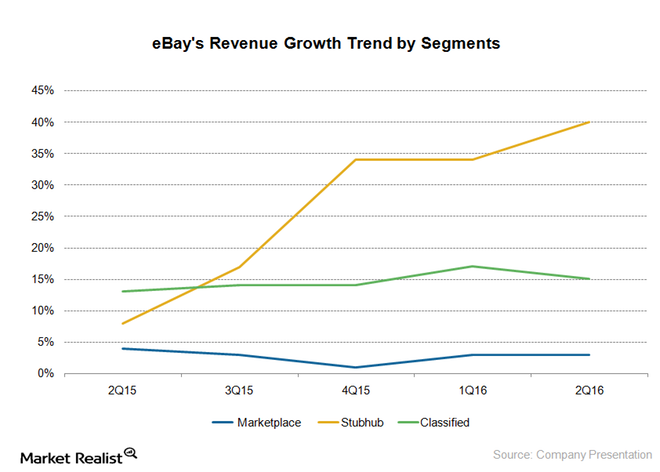

Behind eBay’s Key Revenue Drivers

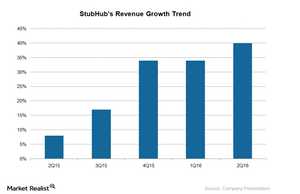

StubHub is eBay’s fastest-growing business segment, a key driver behind the company’s turnaround story, and the largest ticket marketplace in the US.

Why eBay’s StubHub Is the New Growth Engine

StubHub is eBay’s (EBAY) fastest-growing business. The unit generated $1.1 billion by gross merchandise volume, a rise of 35% year-over-year in 2Q16.

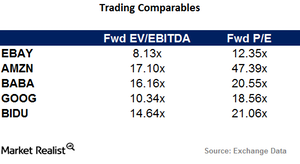

How Amazon Compares to Its Peers

In this part of the series, we’ll discuss why investors shouldn’t worry about Amazon’s (AMZN) lofty valuations compared to those of its peers.

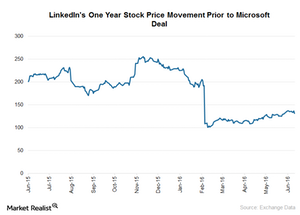

How Did LinkedIn’s Growth and Earnings Quality Look before Deal?

Microsoft (MSFT) announced the acquisition of LinkedIn (LNKD) for $26.2 billion in cash on June 13, 2016.

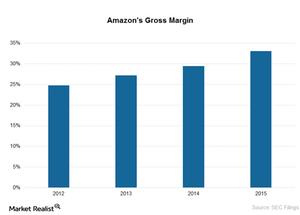

How Amazon’s Marketplace Is Driving Its Gross Margins

The growing number of third-party sellers on Amazon Marketplace is one of the key factors driving the company’s expansion in its gross margin.

How Amazon Web Services Has Expanded Globally

Amazon (AMZN) currently dominates the cloud infrastructure space. AWS (Amazon Web Services) is used by more than 1 million customers.

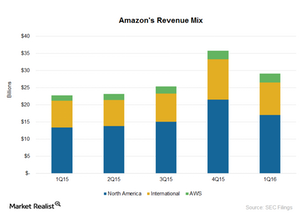

How Amazon Has Consistently Grown Its Revenue

In the last five years, Amazon’s revenue has risen at a compound annual growth rate of 22% thanks to its flourishing e-commerce sales.

What Are Amazon’s Revenue and Profitability Drivers?

Amazon’s other services, which were developed to support its core retail business, have now become its revenue and profitability drivers.

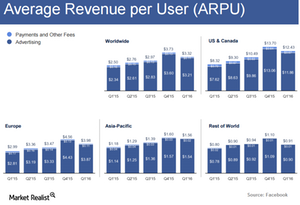

How Is Facebook’s Average Revenue per User Trending?

Average revenue per user (or ARPU) is a key metric for Internet companies, as it helps in analyzing how well a company can monetize its user base.

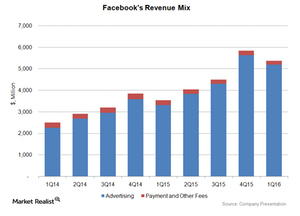

What Are Facebook’s Main Revenue Streams?

Facebook has a history of posting strong double-digit revenue growth with its mobile advertising segment acting as the primary catalyst.