Economist warns the 'American dream' could be over due to $38.5 trillion national debt

While Americans have been focusing on tariffs and rising costs of everything from groceries to housing and healthcare, there's a bigger threat few are talking about. The United States entered 2026 with a massive national debt of $38.5 trillion, and the country's fiscal liabilities are at a historically high level. This is suffocating the elusive American Dream, according to Kurt Couchman, a senior fellow in fiscal policy at Americans for Prosperity. The economist told Fortune that the debt crisis could even push the country into all-out depression if no action is taken. Similar views were shared by BlackRock CEO Larry Fink, who expressed that the mounting national debt could soon affect the markets as well, in a separate interview.

The K-shaped economy has already bolstered the claims about the "death" of the American Dream. With rising wealth inequality, stagnant wages, and declining social services, the middle class is struggling with flat incomes and higher costs, making upward mobility harder. Meanwhile, the rising cost of retirement, raising children, and even owning a car has led many to believe that having $5 million in the bank is the only way to come close to living the American Dream, per Fortune.

While many blame inflation, deindustrialisation, wages, and more, according to Couchman, the symptoms trickle back to the vast sum the U.S. owes to its debtors. The problem isn't just the mounting debt, but the interest the government pays on it. Interest outlays have gone up by a whopping 15% to $355 billion in Q1 fiscal 2026 (Oct.-Dec. 2025), and the average interest rate hovers at 3.32%, the highest since 2009, Reuters reported. This has led experts like the founder of Bridgewater Associates, Ray Dalio, to warn that interest payments will one day squeeze out all the government investment that's needed for economic prosperity.

Last month, in a Congressional testimony, Couchman told the House Judiciary Subcommittee on the Constitution and Limited Government that “the growing debt risks a bond market reckoning with potentially dire consequences for the American people. The actions of their representatives in Congress will determine whether the conditions of the American Dream—peace, freedom, and prosperity—survive, or if the future is decline.” The economist, who previously worked in government affairs positions in the Committee for a Responsible Federal Budget, further told Fortune in a phone interview that the affordability crisis was largely a result of an "explosion" in monetary supply at the beginning of the pandemic.

“We’ve already experienced the inflationary aspects of excessive federal spending and debt. We’re now at the point where if you look at [the Congressional Budget Office], World Bank, and [International Monetary Fund] and others, they say that once the debt burden surpasses a certain threshold of GDP, it starts to slow the economic growth," he explained. The report added that it isn't the amount of debt that is worrying, but the debt-to-GDP ratio. Couchman warned that if this ratio is too far out of balance, economic growth can be hampered by excessive interest payments.

In an interview with CNBC's “Squawk on the Street,” the CEO of BlackRock, the world's largest asset manager, expressed that markets continue to obsess over the Federal Reserve, but they don't discuss fiscal discipline, especially when the national debt keeps creeping higher. Suggesting that the pattern of unsettling numbers isn't likely to change, he argues that the U.S. Treasury market, which is the global benchmark, could take a hit as international investors will soon start questioning America’s fiscal trajectory. However, Fink suggested that if the country keeps up its pace of GDP growth and keeps it up at 3% for the next 10 to 15 years, the debt-to-GDP ratio will shrink, despite how large the deficits may seem.

More on Market Realist:

Even Americans earning over $100,000 a year are starting to lose faith in US economy

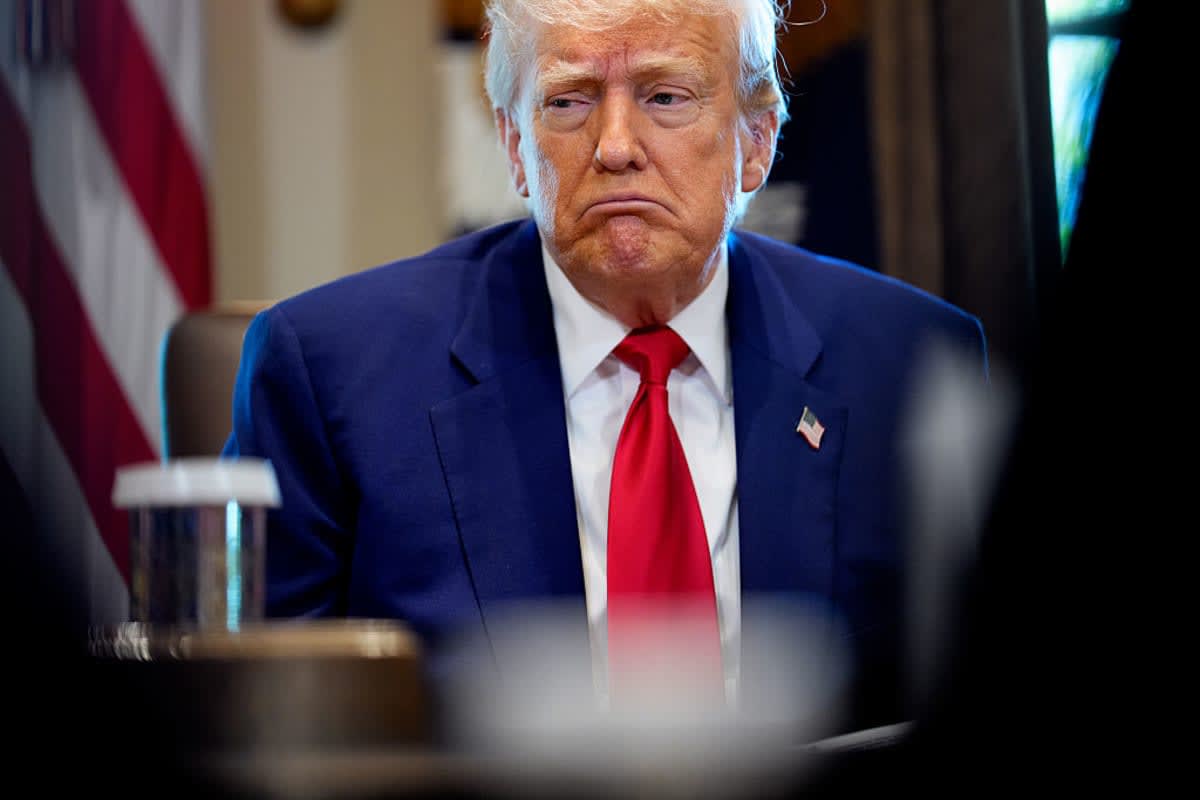

Analysts warn Trump's proposed defense budget will cause a major problem for US economy

Trump's bid to control US Fed might lead to 'fiscal dominance' — and that's not good news