SPDR® S&P Oil & Gas Explor & Prodtn ETF

Latest SPDR® S&P Oil & Gas Explor & Prodtn ETF News and Updates

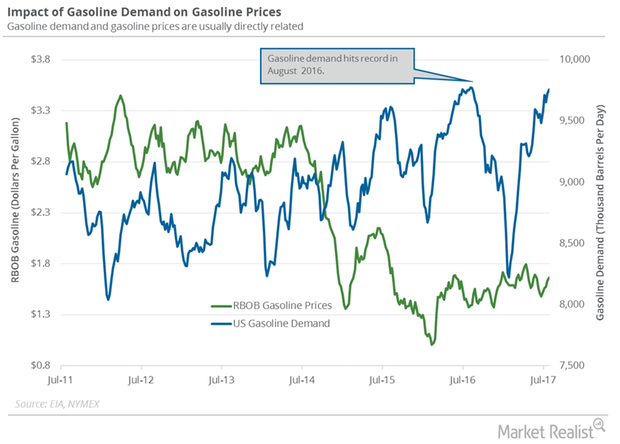

US Gasoline Demand Hit a Record: What’s Next?

The EIA estimates that weekly US gasoline demand rose by 21,000 bpd (barrels per day) to 9,842,000 bpd on July 21–28, 2017. It’s the highest level ever.

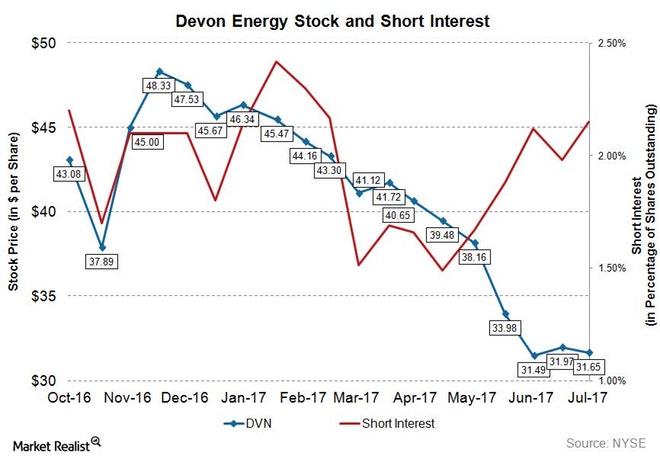

Chart of the Week: What’s the Short Interest in Devon Energy?

As of July 14, 2017, short interest in Devon Energy (DVN) is ~11.3 million shares, while its average daily volume is ~6.2 million shares.

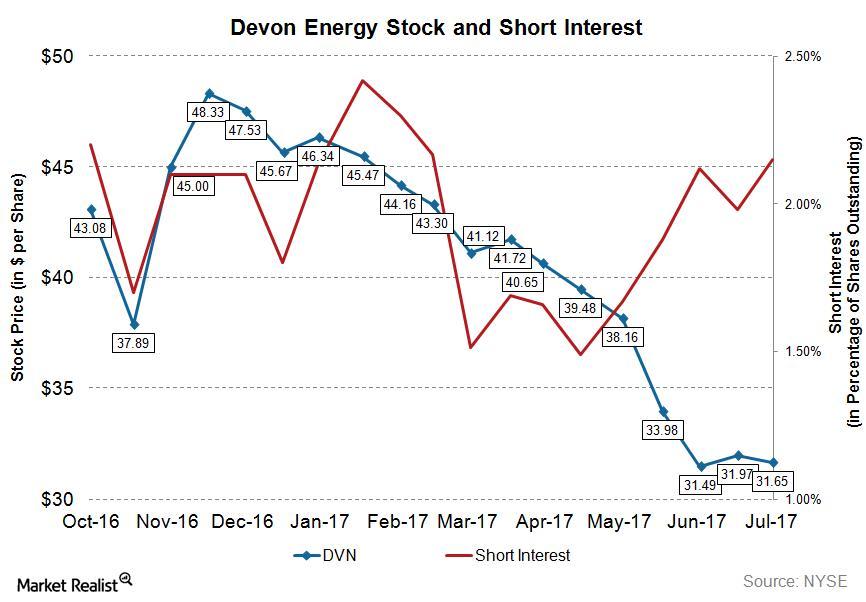

Short Interest in Devon Energy Stock

As of July 14, 2017, Devon Energy’s (DVN) short interest stood at ~11.31 million, while its average daily volume is ~6.21 million.

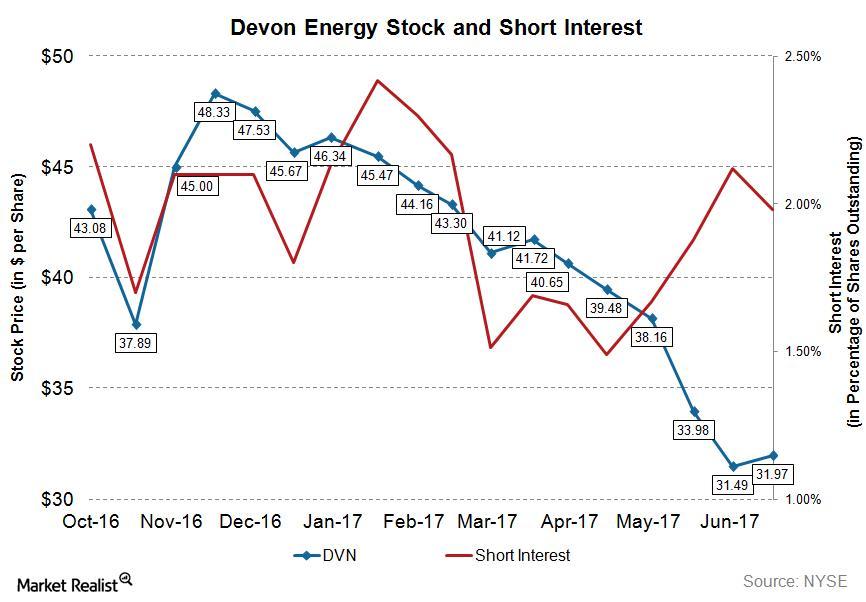

Analyzing Short Interest in Devon Energy Stock

As of June 30, 2017, Devon Energy’s (DVN) total shares shorted (or short interest) stood at ~10.4 million, whereas its average daily volume was ~5.9 million.

Will Libya and Iran Swing Crude Oil Prices?

Market surveys project that Libya’s crude oil production is near 1 MMbpd—the highest level in three years. High production could pressure crude oil prices.

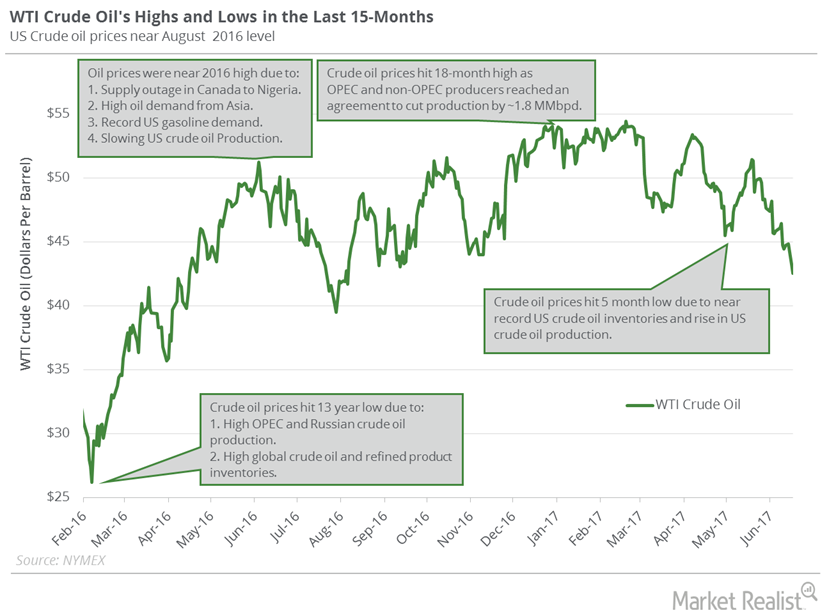

US Crude Oil Prices Could Be Range Bound Next Week

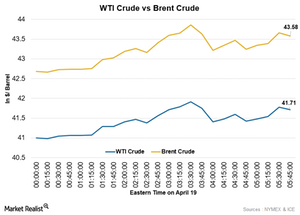

August WTI (West Texas Intermediate) crude oil (XOP) (VDE) (RYE) futures contracts rose 0.5% and closed at $42.74 per barrel on June 22, 2017.

Crude Oil Is Stable amid Lower Inventory Levels

After falling to five-week low price levels on May 2, crude oil prices are stable in the early hours on May 3. The market opened higher on Wednesday.

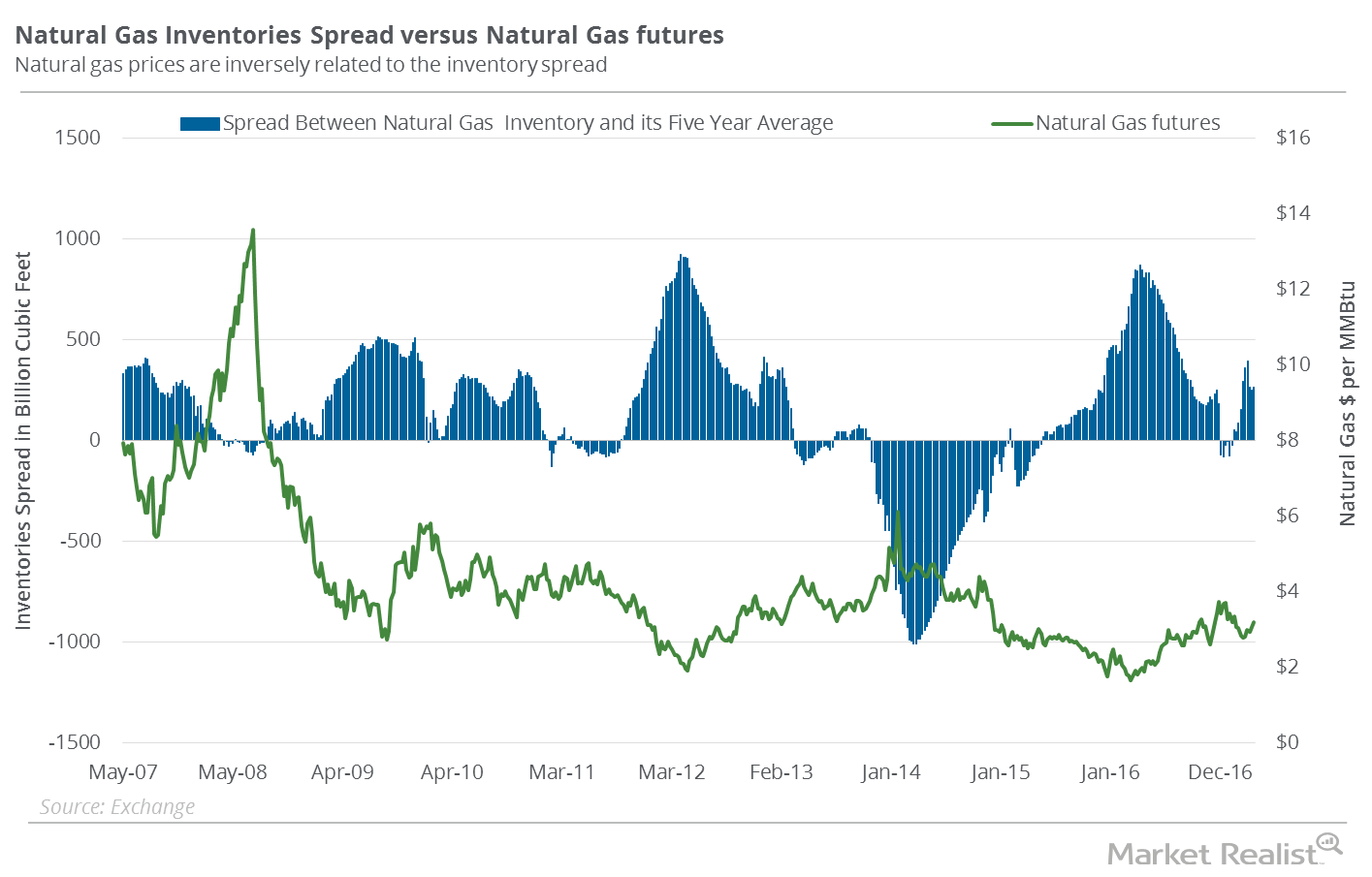

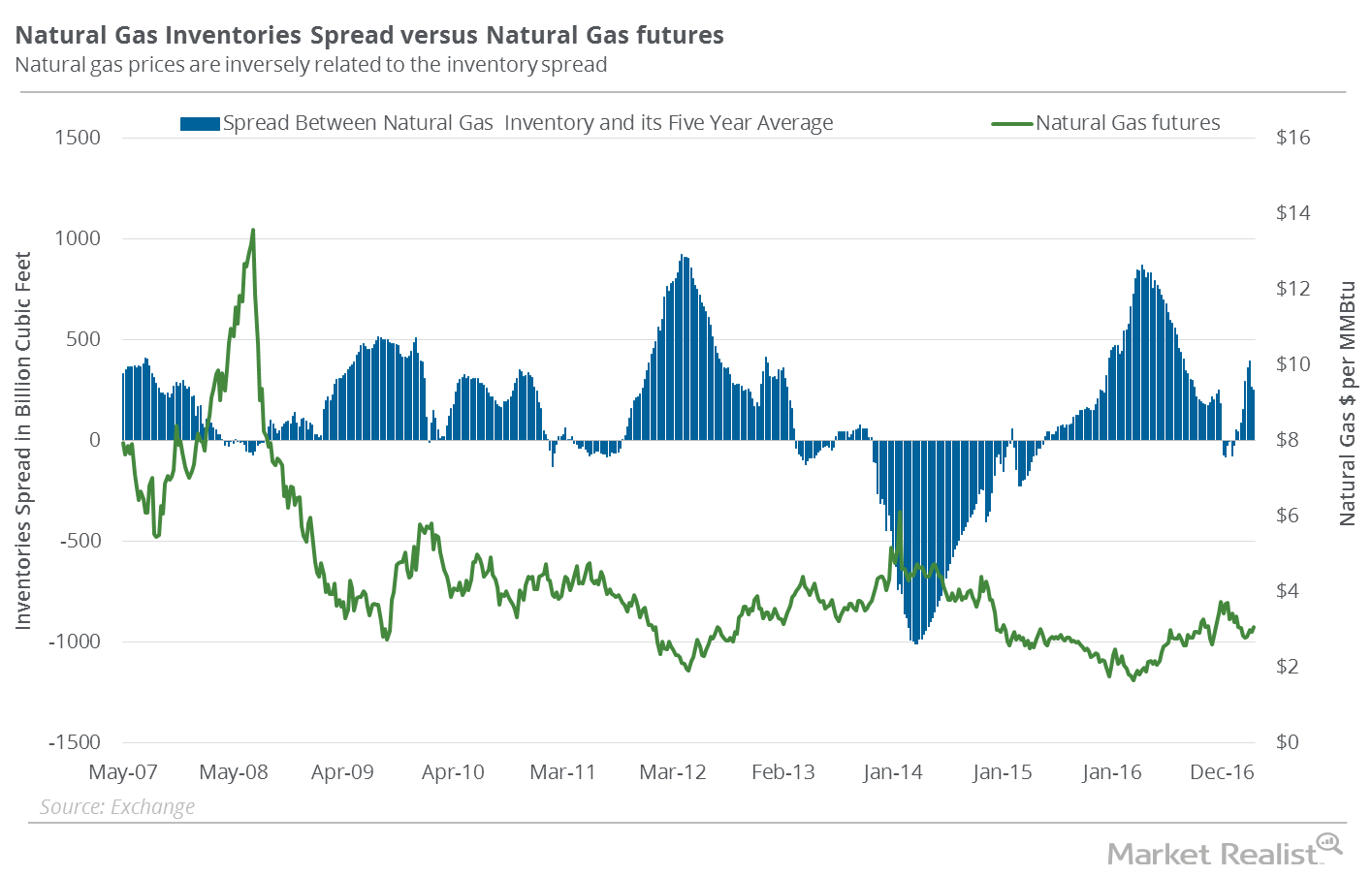

Inventories Spread: Will Natural Gas Prices Fall Again?

Natural gas (GASX) (FCG) (GASL) inventories rose by ten Bcf (billion cubic feet) during the week ending April 7, 2017.

Inventories Spread: Why Natural Gas Uptrend Could Be at Risk

According to data from the EIA (U.S. Energy Information Administration) released on March 30, 2017, natural gas inventories fell by 43 Bcf (billion cubic feet) during the week ending March 24, 2017.

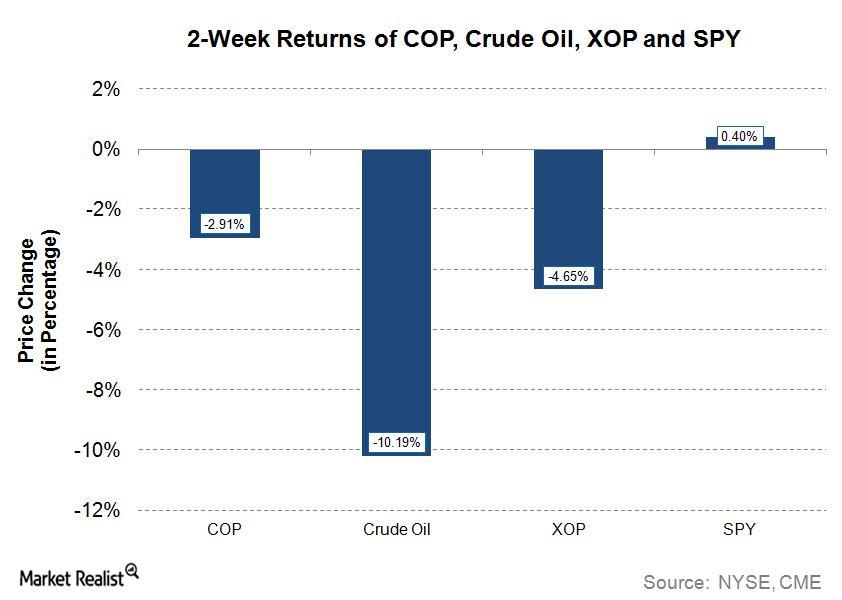

Why ConocoPhillips Stock Is Outperforming Crude Oil and Peers

In the last two weeks, the stock of ConocoPhillips (COP), a crude oil (USO) and natural gas (UNG) producer, has outperformed crude oil prices.

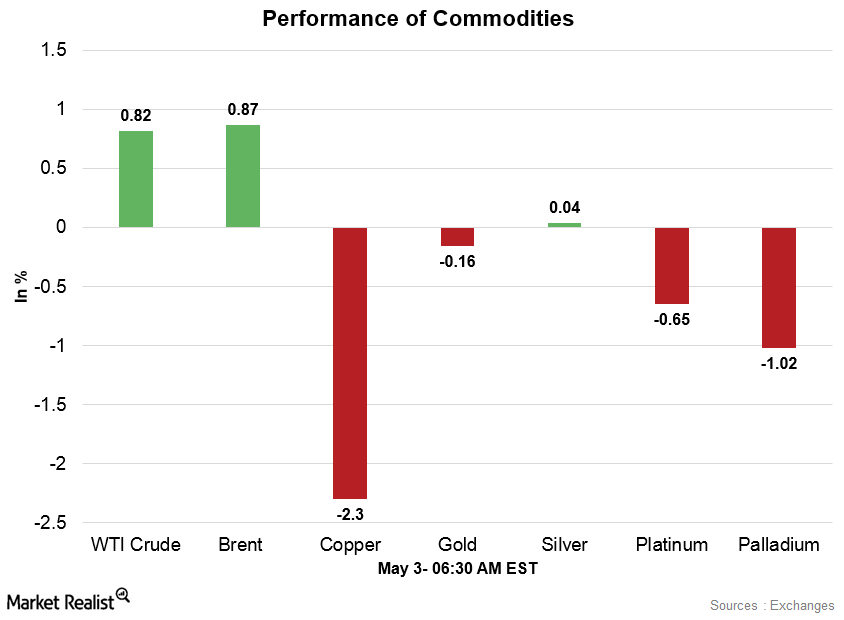

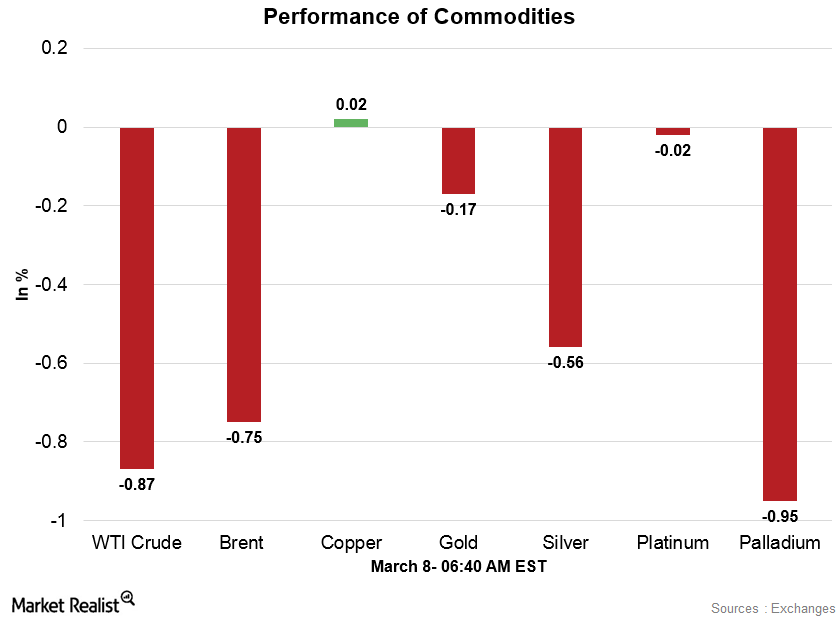

Commodities Are Weaker amid the Firmer Dollar

Gold (GLD) and silver (SLW) are weaker in the early hours due to the firmer dollar and expectations of a US interest rate hike in the Fed’s March meeting.

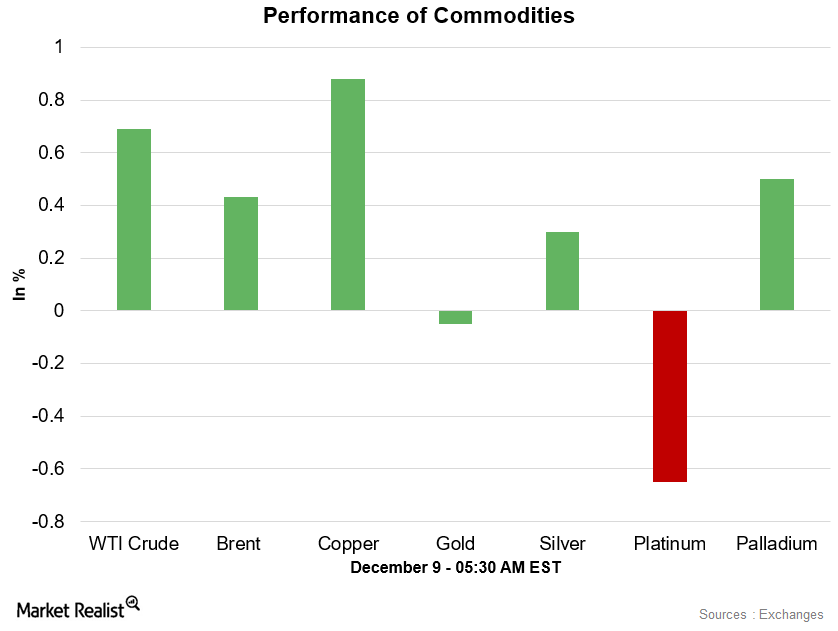

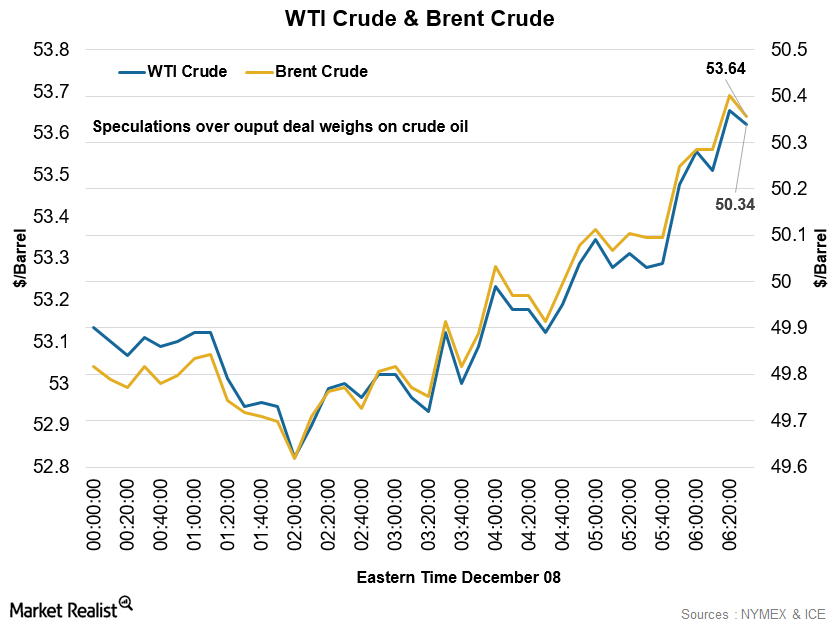

Crude Oil and Copper Are Stable, Gold Is Weaker on December 9

At 5:00 AM EST on December 9, the WTI crude oil futures contract for January 2017 delivery was trading at $51.21 per barrel—a rise of ~0.71%.

China’s Trade Data and the Weaker Dollar Support Commodities

Copper prices are stable in the early hours on December 8. China’s upbeat trade balance data are supporting the sentiment in the copper market.

Early Morning Update: Crude Oil Fell, Metals Were Mixed

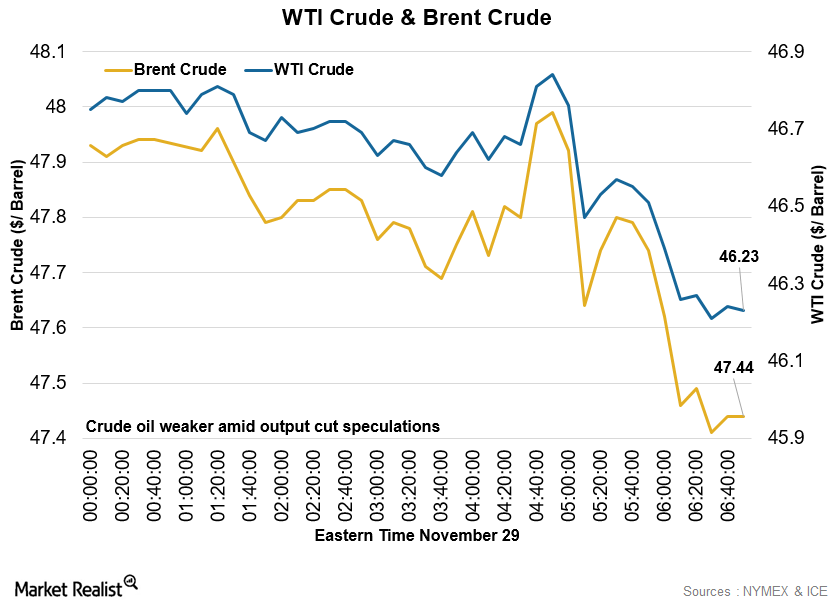

Crude oil prices are weaker early on November 29 amid speculations about the supply cuts. Russia confirmed that it wouldn’t attend OPEC’s meeting.

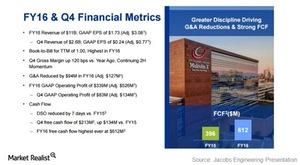

Jacobs Engineering Posts the Highest Annual Free Cash Flows

Jacobs Engineering Group declared its 4Q16 and fiscal 2016 results on November 22. It reported adjusted EPS (earnings per share) of $0.77.

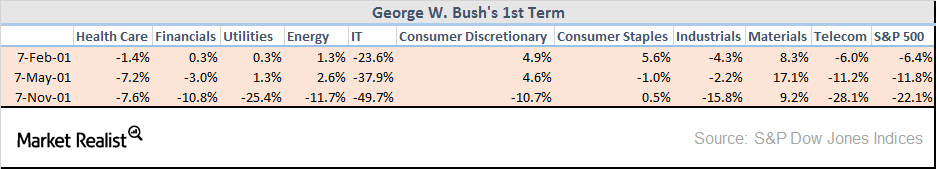

Which Sectors to Invest in If Donald Trump Wins

When Republican George H.W. Bush was elected president, the S&P 500 rose 8.5% three months after the election. It had a return of 11.2% six months after the election.

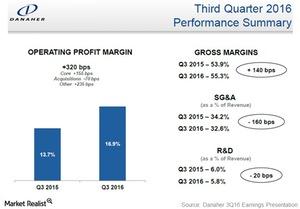

With Phenomenex, Danaher Has an Attractive Consumables Asset

On October 12, Danaher announced its an agreement to acquire Phenomenex, a privately held manufacturer of separation and purification consumables.

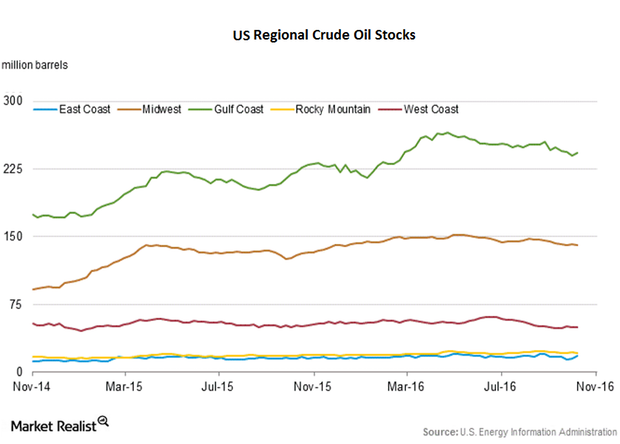

Analyzing US Crude Oil Inventories by Region: The Latest

The EIA divides the United States into five storage regions. Let’s assess the changes in crude oil inventories for these regions between September 30 and October 7.

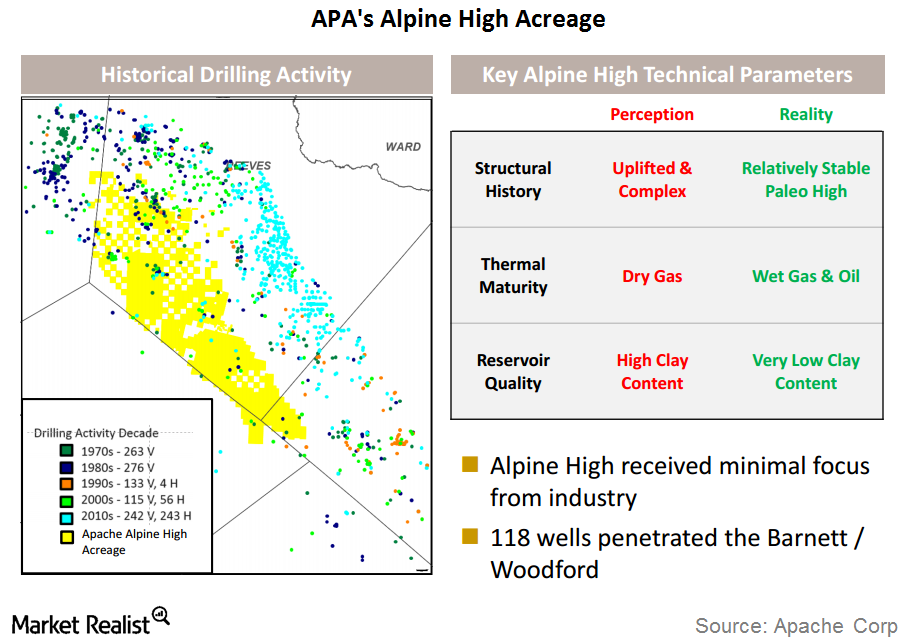

Apache Announces a New Oil and Gas Discovery

On September 7, 2016, Apache (APA) announced a new resource play, Alpine High, in the Delaware Basin of Texas.

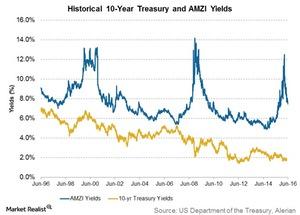

Analyzing the 10-Year Treasury and MLP Yields Spread

Generally, MLP yields move in the same direction as Treasury yields in the long term. MLP yields trade at a spread over Treasuries.

Why Did Oil Prices Rise This Morning?

Oil prices rose early today because of the oil workers’ strike in Kuwait. Here’s what you need to know.

Understanding Dover Corporation’s Corporate Profile and History

Dover Corporation (DOV) is a machinery manufacturer that operates in four diverse segments: Energy, Engineered Systems, Fluids, and Refrigeration & Food Equipment.

The Importance of Specialty Chemicals in the Oil Industry

Specialty oilfield chemicals are used in the oil and gas industry to improve well performance by making exploration and production more efficient.

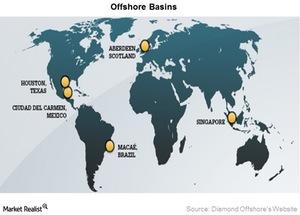

How Geography and Climate Impact Offshore Oil Rig Choices

The majority of offshore operations occur in six key locations worldwide that differ widely in terms of water depth, weather conditions, and remoteness.

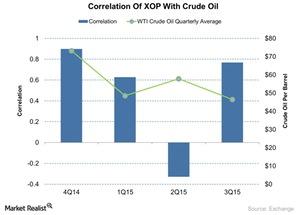

An Analysis of the Correlation between XOP and Crude Oil

Here we’ll present the results of a quarterly correlation analysis between crude oil and the SPDR S&P Oil & Gas Exploration & Production ETF (XOP).

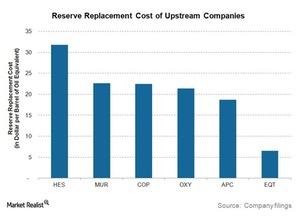

Weighing the Reserve Replacement Cost Metric of Upstream Energy Companies

The Reserve Replacement Cost metric gives us the cost incurred by an upstream company by considering the per-barrel-of-oil equivalent of a new reserve.

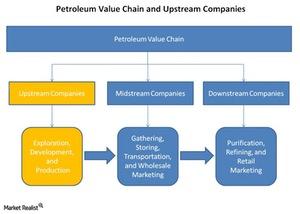

Where Do Upstream Energy Companies Sit along the Petroleum Value Chain?

Upstream energy companies are the starting point of the petroleum value chain and are involved in exploration, appraisal, development, and production.

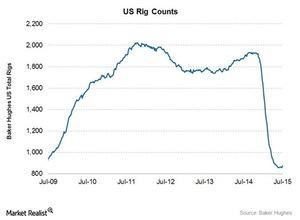

Biggest US Rig Count Rise in a Year: What Does It Change?

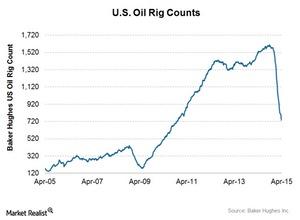

Despite recent rises, at 876, the US rig count is still at its lowest level since January 2003. In September 2014, the average rig count came close to the record, reaching 1,931.

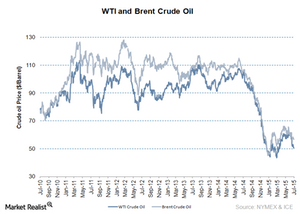

Brent and WTI Crude Oil Prices Widen in the Depressed Oil Market

August WTI crude oil futures contracts fell by $0.74 and closed at $50.15 per barrel on July 20. Brent fell by $0.45 and settled at $56.65 at the close of trade.

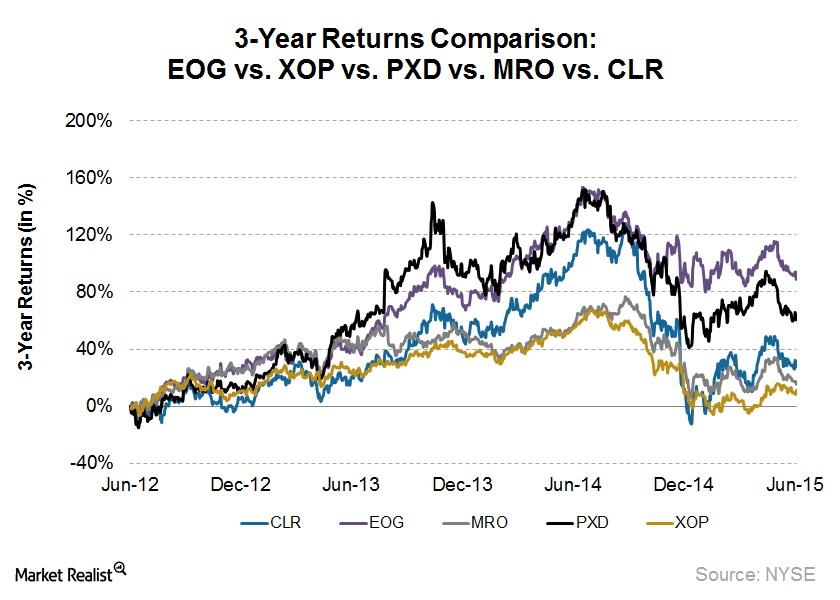

EOG and Pioneer: The Best Upstream Stocks in the Past 3 Years

Of the top American upstream stocks, EOG Resources has been the outperformer since June 2012, returning 93%. During the same period, Pioneer Natural Resources (PXD) returned 61%.

US Crude Oil Rig Count Down for 19 Straight Weeks

US crude oil rig count decreased by 26 for the week ended April 17 down from 760 to 734. The number of oil rigs is now at its lowest level since December 3, 2010.

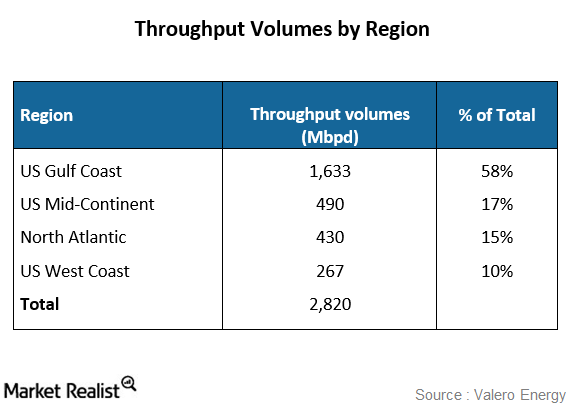

Analyzing Valero Energy’s operational performance in 4Q 2014

Valero Energy’s (VLO) refining segment’s throughput volumes increased by 41,000 barrels a day compared to the previous year’s fourth quarter.

Russia’s sovereign credit rating downgraded to junk

Russia’s sovereign credit rating now stands on par with countries such as Turkey and Indonesia. The oil price crisis isn’t helping matters.

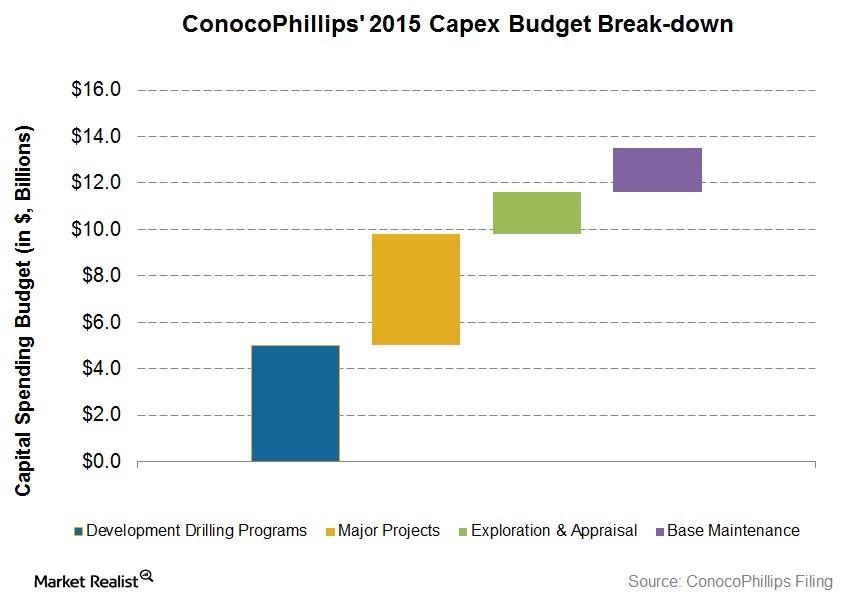

A key analysis of ConocoPhillips’ capex breakdown for 2015

ConocoPhillips’ capex breakdown for 2015 includes major projects, development drilling, exploration and appraisal, and base maintenance.

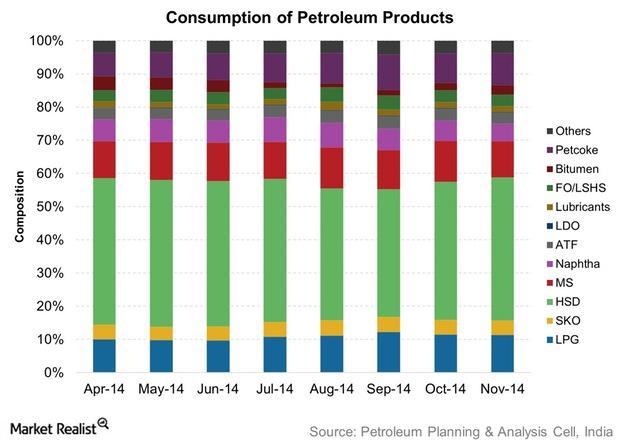

Analyzing India’s oil consumption

In India, the consumption of oil products saw steady growth over the years. The CAGR (compound annual growth rate) for the ten years ending in March 2014 is above 3.5%.

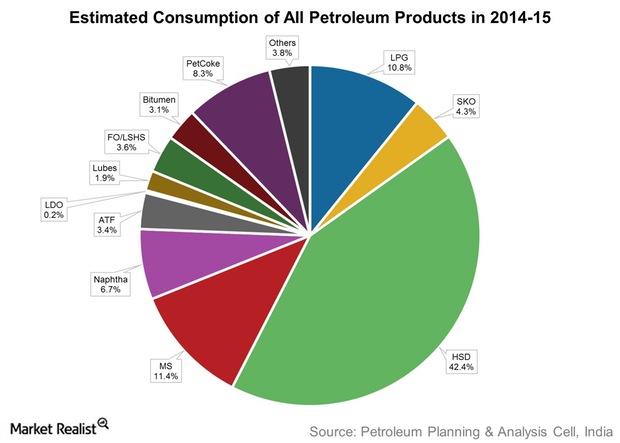

What products does India produce and consume?

Before moving on to India’s petroleum consumption, production, and refining, it would be beneficial to take a look at the various products that India produces and consumes.

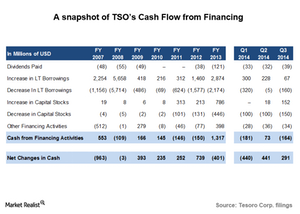

Tesoro’s cash flow from financing activities

Tesoro’s activities at the cash flow from financing level have been both a source and a destination for Tesoro’s cash over the years.

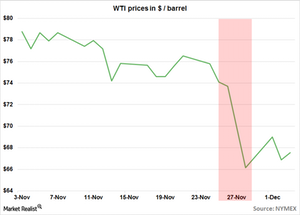

Why the bottom fell out of crude oil

Oil markets had been watching what OPEC would do in its November 27 meeting. Crude oil fell ~30% since June. It decided to stay production levels. Crude oil dropped ~10% after the news.

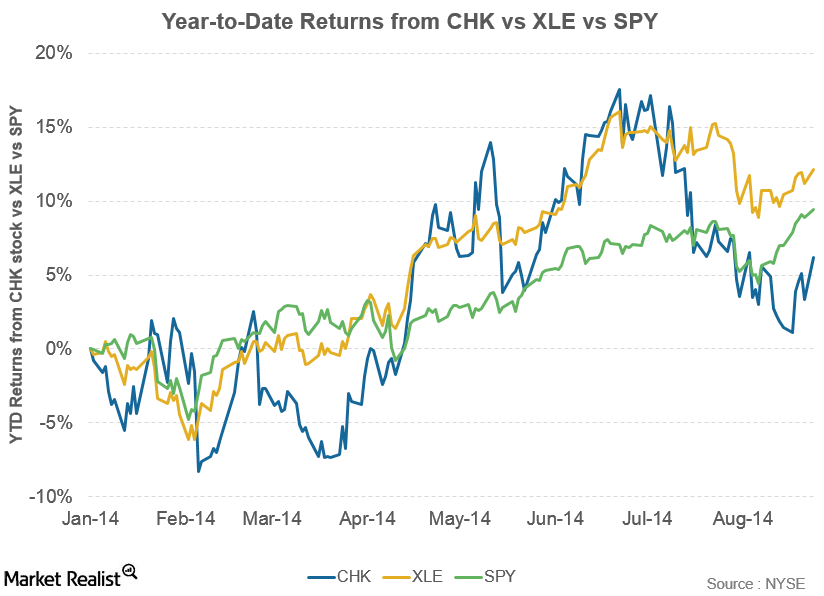

An investor’s must-read introduction to Chesapeake Energy

Chesapeake Energy (CHK) is an eminent energy exploration and production company in the U.S. Its operations span across the Marcellus, Utica, Niobrara, Mississippian Lime, Eagle Ford, Barnett, and Haynesville shales.

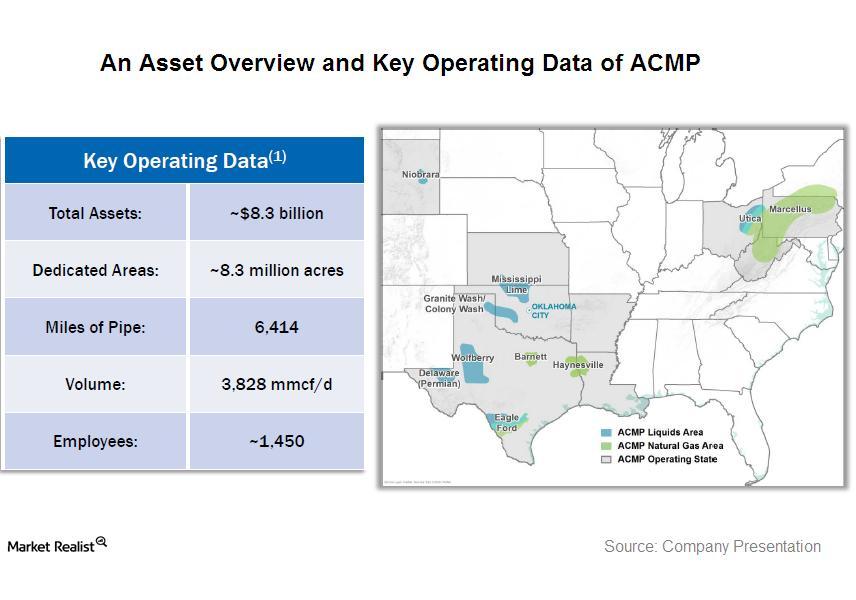

An introduction to Access Midstream Partners’ business and assets

Access Midstream Partners is a master limited partnership, which owns, operates, develops and acquires natural gas, NGLs, and oil gathering systems and other midstream energy assets.

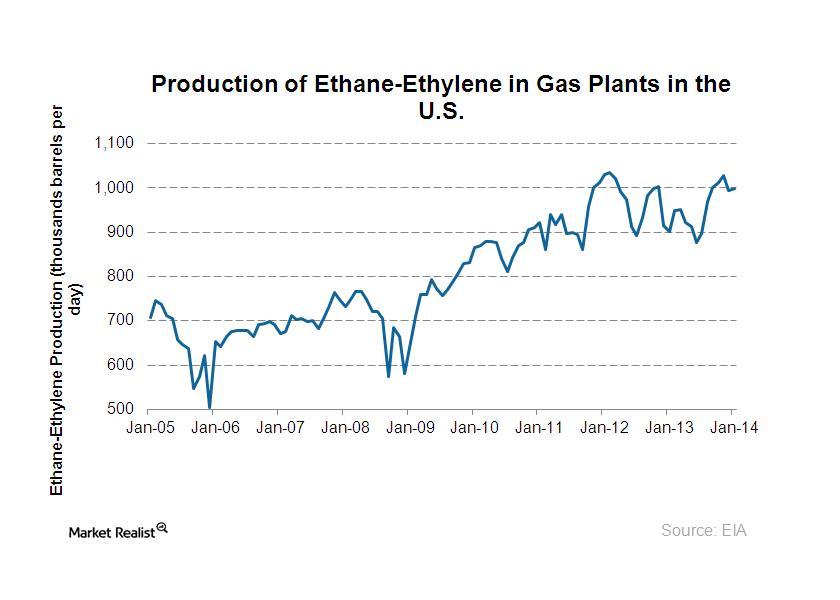

Why ethane production has increased a lot over the past few years

Ethane is the largest component of the natural gas liquids stream, and the increased wet gas production caused a large increase in ethane production.