SPDR® S&P Homebuilders ETF

Latest SPDR® S&P Homebuilders ETF News and Updates

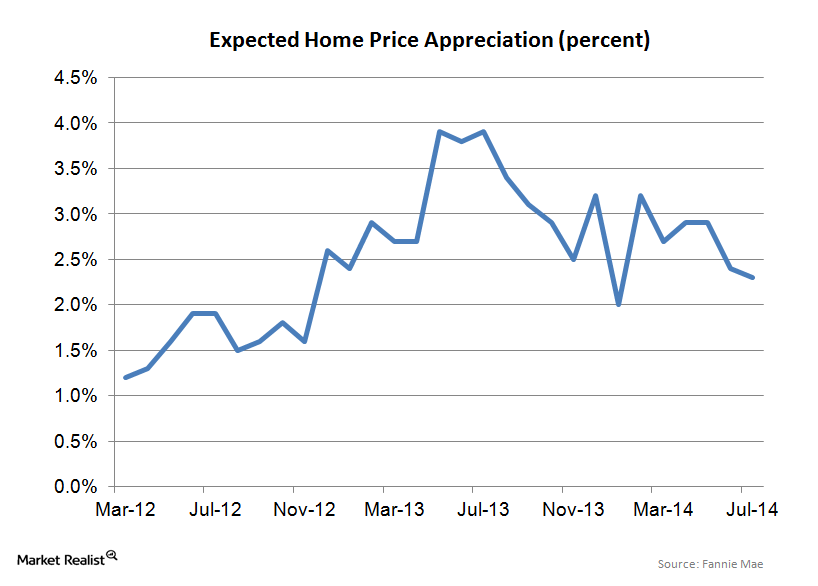

Consumers are tempering their home price appreciation expectations

The 2.3% home price expectation is much lower than the 6%–7% forecast we’re seeing out of the National Association of Realtors and the mid single-digit forecast we’re seeing from most Wall Street professionals.

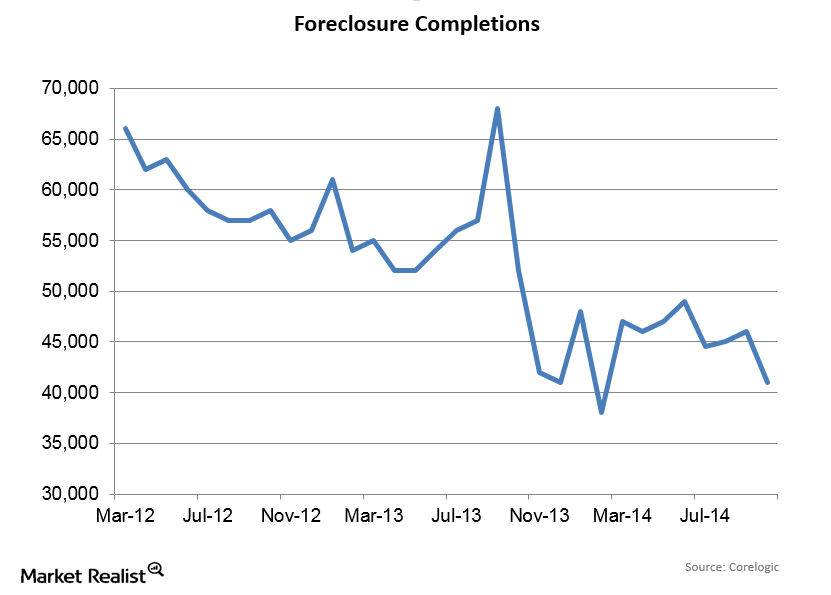

Foreclosure Completions Drop In October

Since foreclosures represent a process that may or may not wind up with the bank owning the home, foreclosure completions are a better indicator of foreclosure activity than foreclosure starts.

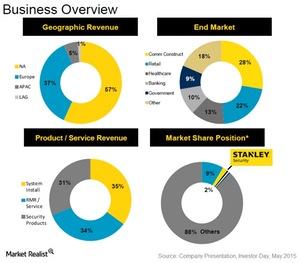

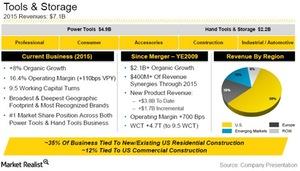

What You Should Know about Stanley Security’s Business Mix

The Stanley Security business saw a steady decline in the last four years with sales falling from $2.4 billion in 2012 to ~$2.1 billion in 2015.

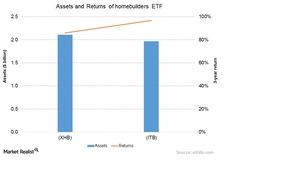

Why you should invest in homebuilder ETFs like XHB and ITB

ETFs present another investment avenue. Apart from pure homebuilder ETFs, there are many other ETFs that offer exposure to homebuilders.

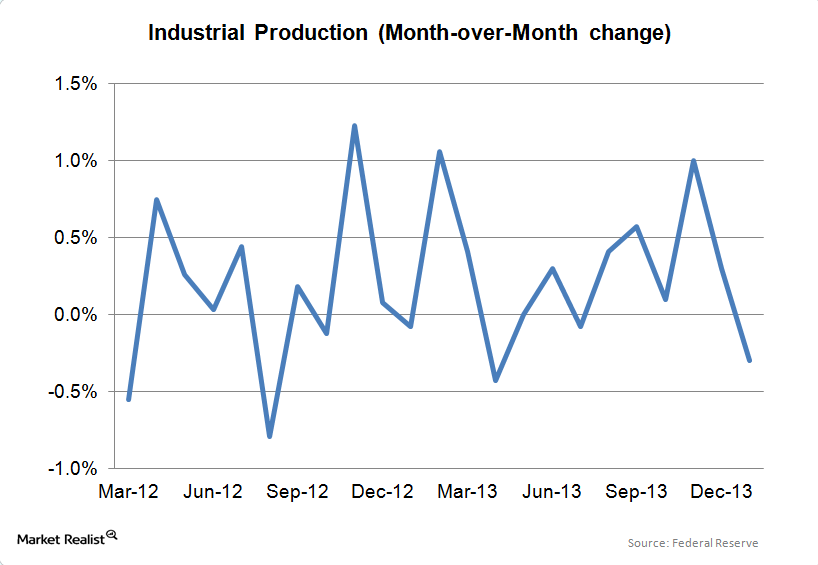

A decline in manufacturing causes industrial production to fall

Up until January, industrial production and manufacturing production had been accelerating, so it is premature to draw any major conclusions from one disappointing report.

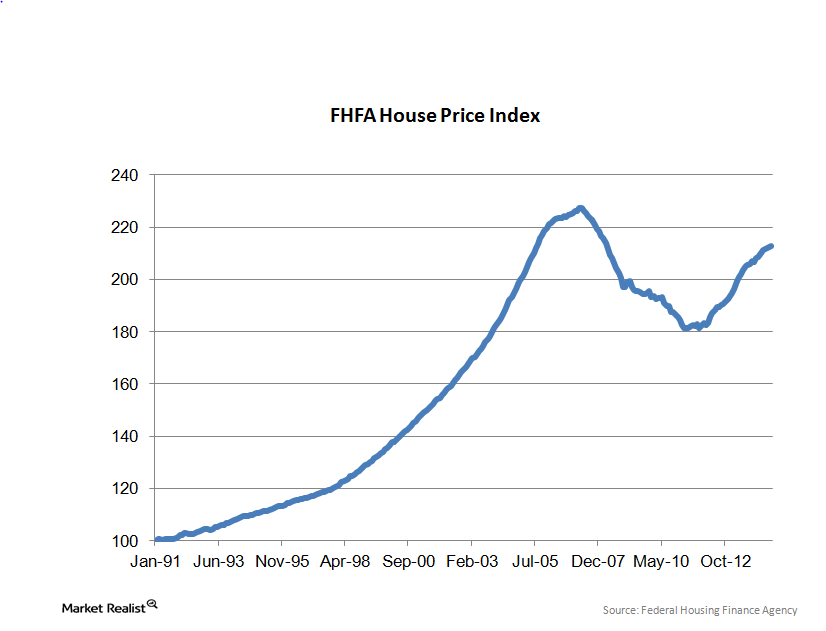

Must-know: Why home-price appreciation is leveling off

In July, home prices increased 0.1% month-over-month. They’re up 4.4% year-over-year (or YoY). Prices are now within 6.5% of their April 2007 peak. They correspond to the levels in July 2005. Real estate values drive consumer confidence and spending. They have an enormous impact on the economy.

What’s Stanley Black & Decker’s Market Position?

Stanley Black & Decker (SWK) has a stupendous record of launching at least 1,000 products every year at an average of three products a day.

A Brief Overview of Honeywell Automation and Control Solutions

Honeywell (HON) provides control solutions for various residential and industrial applications through the Honeywell Automation and Control Solutions–ACS unit.

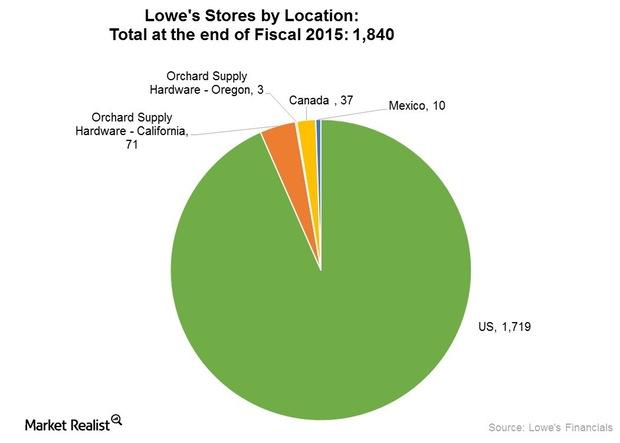

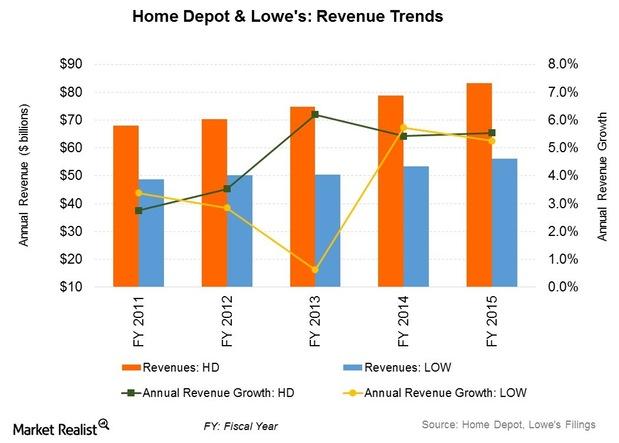

Why Lowe’s Bought Orchard Supply and Is Eyeing Smaller Stores

Lowe’s is also experimenting with the idea of rolling out other smaller format stores like City Center stores in other under-penetrated and high-density urban areas in the US.

What Are Stanley Black & Decker’s Business Segments?

Stanley Black & Decker (SWK) markets its products through three business segments: Global Tools & Storage, Security, and Industrials.

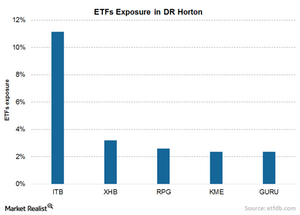

How to Invest in D.R. Horton through ETFs

D.R. Horton sees allocation in major homebuilding sector-specific ETFs like the iShares Dow Jones US Home Construction Index Fund (ITB).

Lowe’s Retail and Pro Customers: Who Accounts for More Sales?

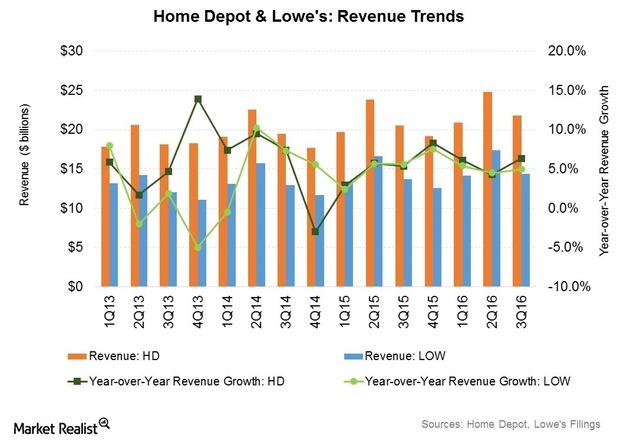

The retail customer accounts for about 70% of Lowe’s sales. However, retail customers account for about two-thirds of Home Depot’s (HD) customer base.Financials Why we need to relook at the consumer in this week’s releases

This week is full of indicators, with most of them being measures of national-level economic activity.

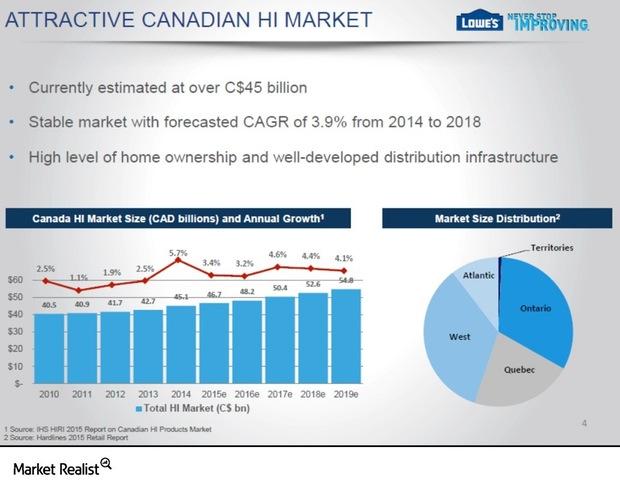

Market Share Play: Lowe’s Bid to Gain Scale in Canada with Rona

The Rona (RON.TO) acquisition should give Lowe’s (LOW) a market-leading position in Canada’s home improvement market, estimated at over $45 billion Canadian.

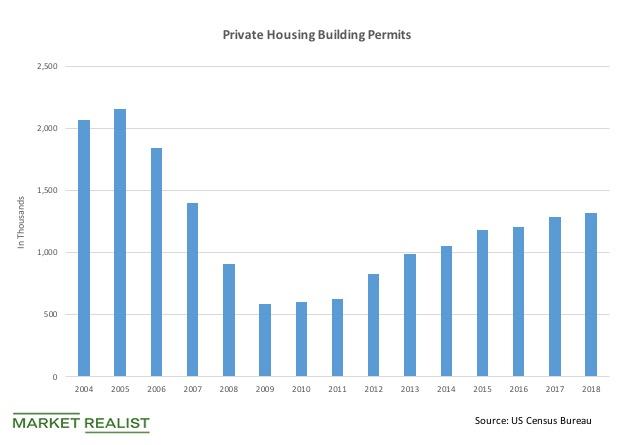

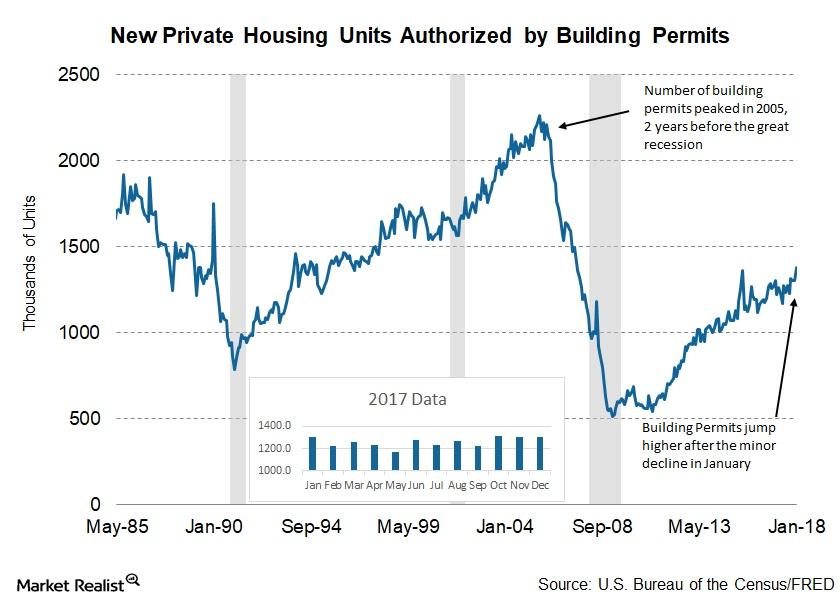

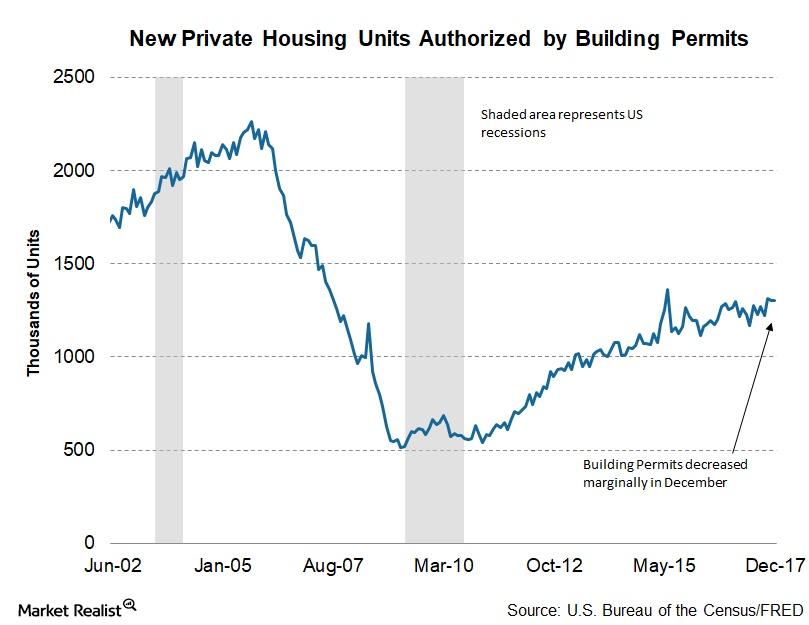

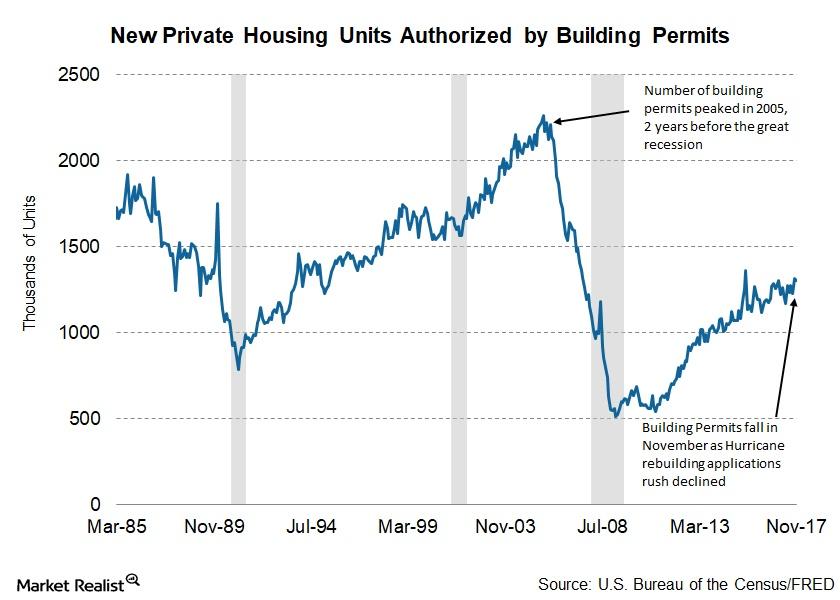

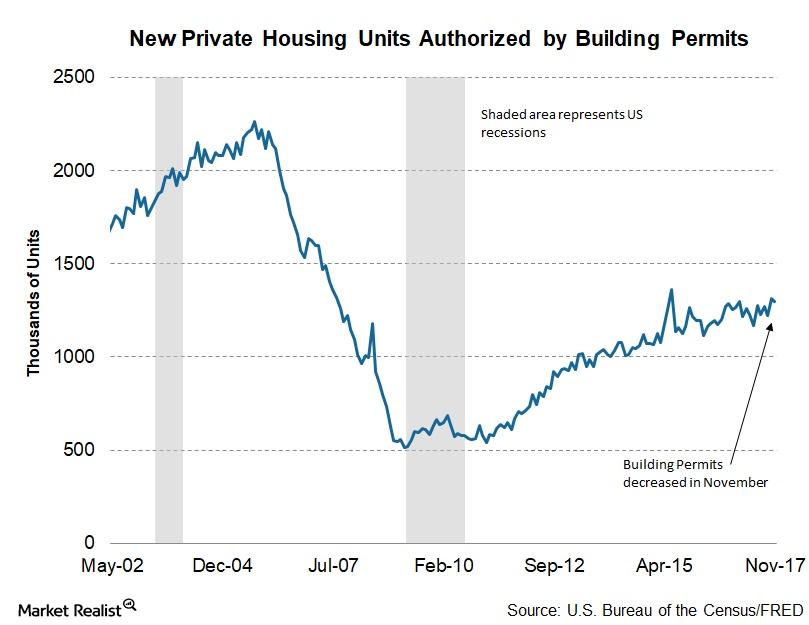

How Building Permits and the Housing Market Can Predict Trends

When real estate developers or REITs like AvalonBay (AVB) are confident about the economy, they build more in anticipation of future demand from consumers.

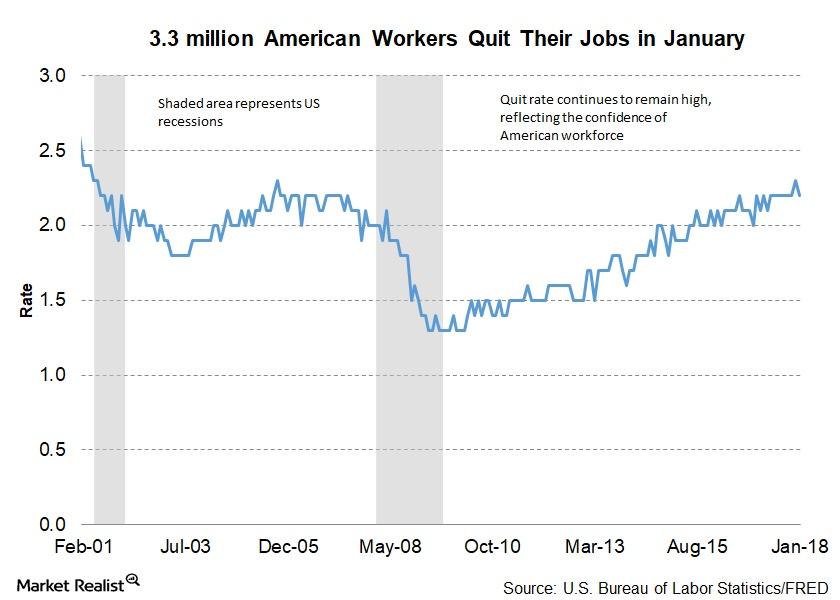

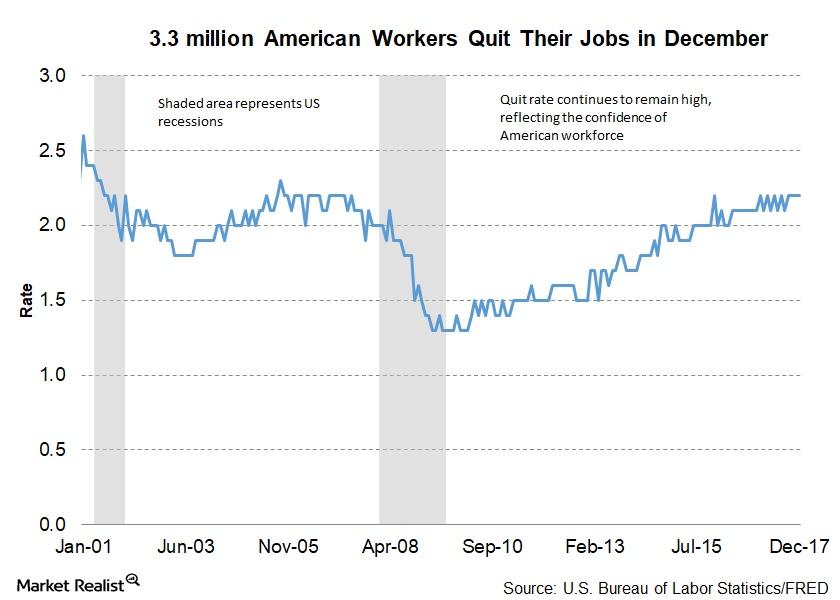

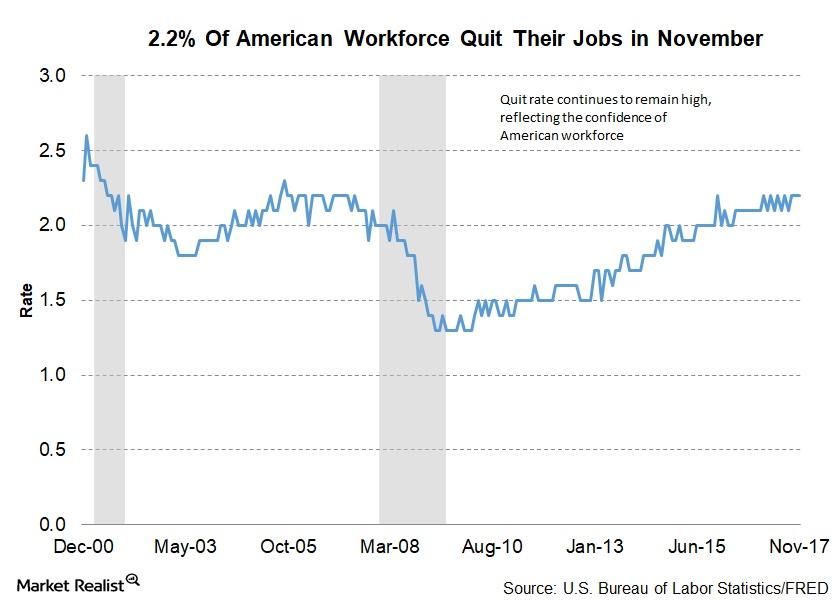

Why the US Workforce’s Quit Rate Has Remained High

January’s JOLTS (Job Openings and Labor Turnover Survey) data, which contains information about job openings and total separations, was reported on March 16.

Why the Rebound in Building Permits Is Positive for the US Economy

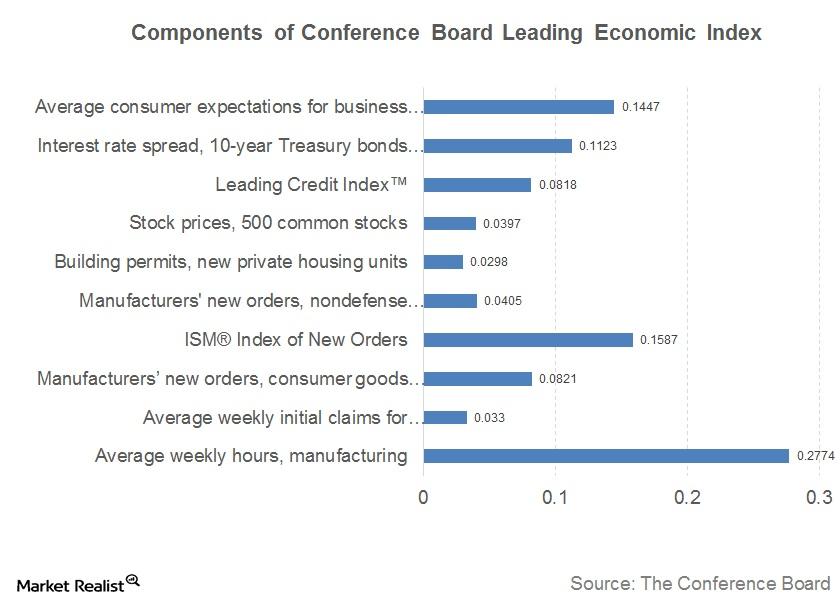

The Conference Board uses the number of building permits issued as one of the key constituents of its LEI (Leading Economic Index) model.

Why Quit Rate Indicates a Strong US Employment Market

As per the latest JOLTS report, total separations for December were 5.2 million, which is 3.6% of the total workforce.

Why Building Permits Didn’t Change in December

For 2017, 1,263,400 housing units have been authorized by building permits—a 4.7% increase from 1,206,600 housing units in 2016.

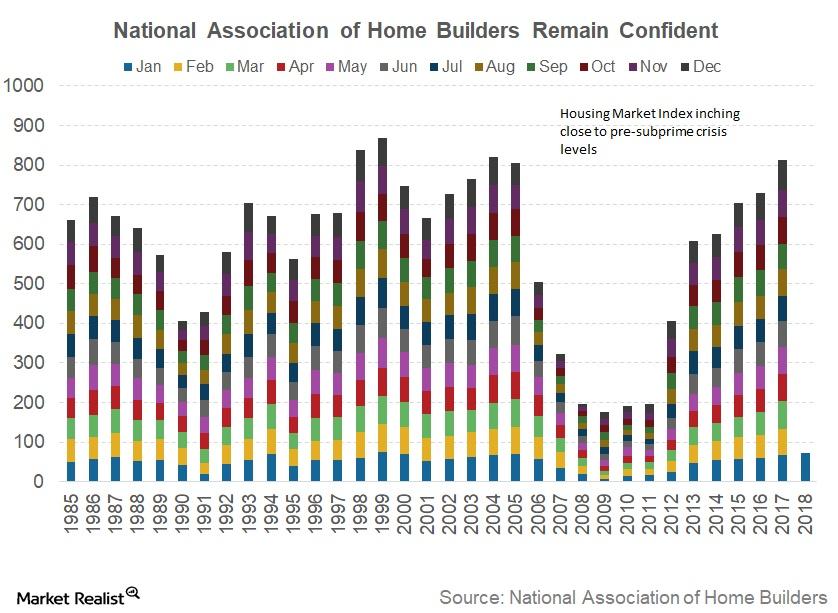

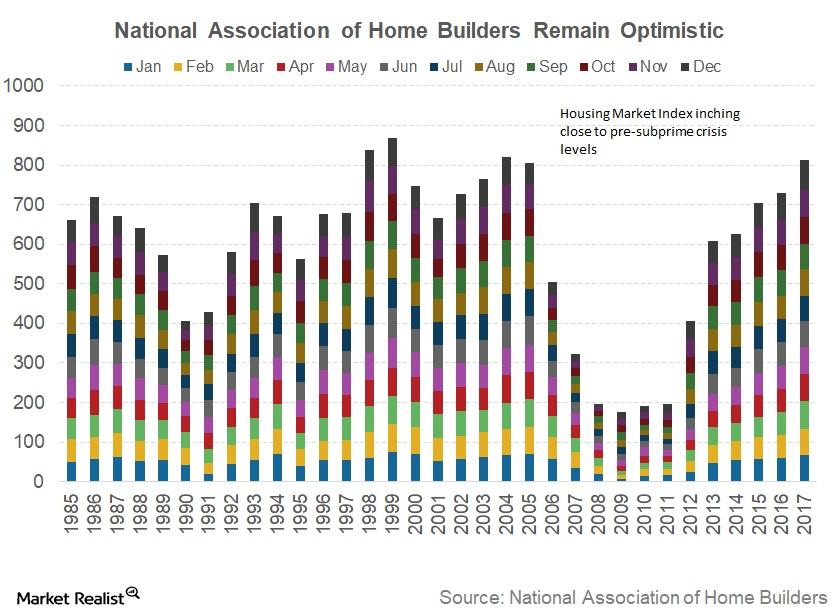

How Confident Are Homebuilders at the Beginning of 2018?

Comments from NAHB members indicated that homebuilders are optimistic about the future demand and projected increased activity in the housing sector.

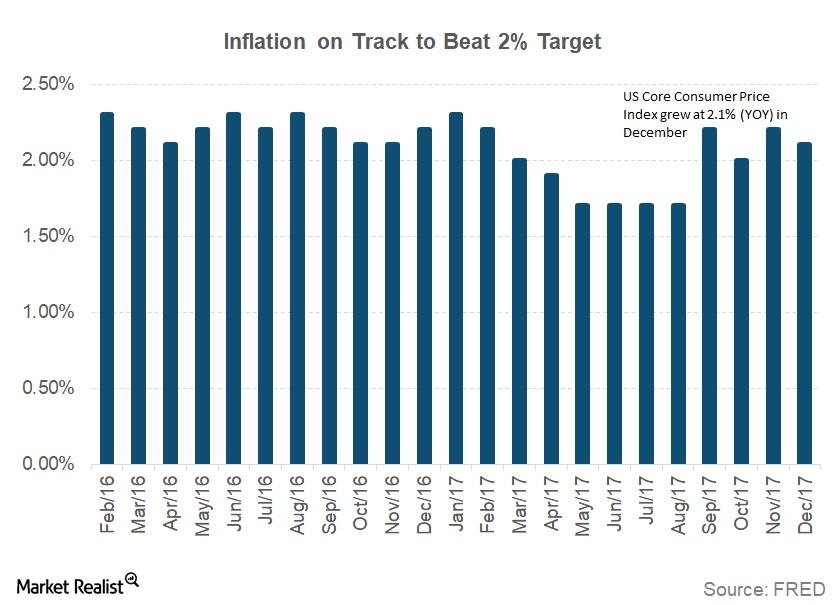

Why Did the Consumer Price Index Rise in December?

According to the December CPI report released by the U.S. Bureau of Labor Statistics on January 12, consumer prices in December increased 0.1%.

How Many Americans Quit Their Jobs in November?

As per the latest JOLTS report, about 3.2 million American workers quit their jobs voluntarily in November.

Building Permits Fall in November: Should We Worry?

Building permits and the economy The number of building permits issued each month is a constituent of the Conference Board LEI (Leading Economic Index). The construction and housing industry (PKB) is a major job provider in the economy, and changes in activity in the sector affect employment conditions and aggregate demand. A higher number of building permits is a leading […]

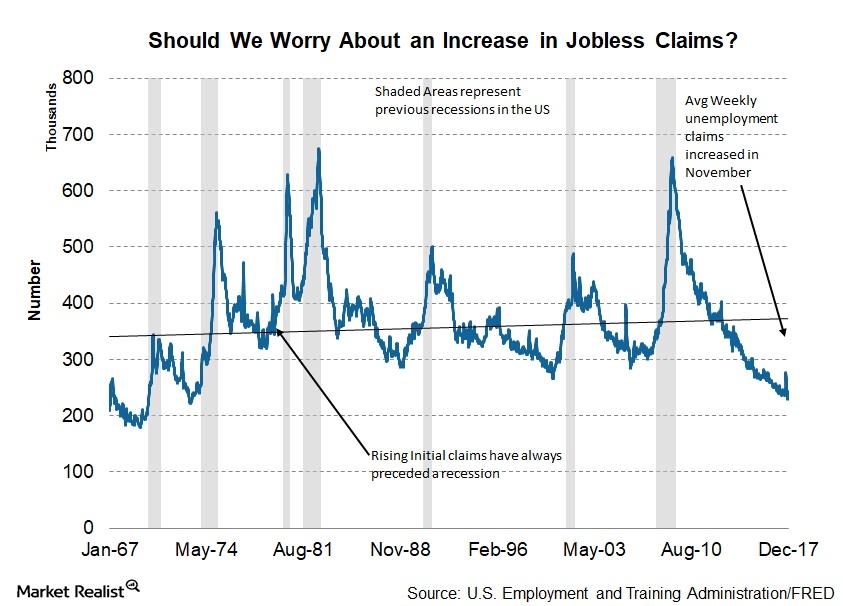

Should We Worry about Rising Unemployment Claims?

Average weekly claims and the economy Average weekly unemployment claims are a constituent of the Conference Board LEI (Leading Economic Index). Claims have a 3% weight in the LEI. Weekly unemployment claims, if adjusted for seasonality, give investors a clear understanding of changes in the employment market. Though the Bureau of Labor Statistics releases a monthly […]

Housing Market: Builders’ Confidence Reaches an 18-Year High

For November, the NAHB Housing Market Index was reported as 74—an increase of five from October and an 18-year high.

Should Investors Be Concerned about Fewer Building Permits?

In November 2017, housing units (XHB) authorized by building permits were at a seasonally adjusted rate of 1.298 million—a decrease of 1.4% from October.

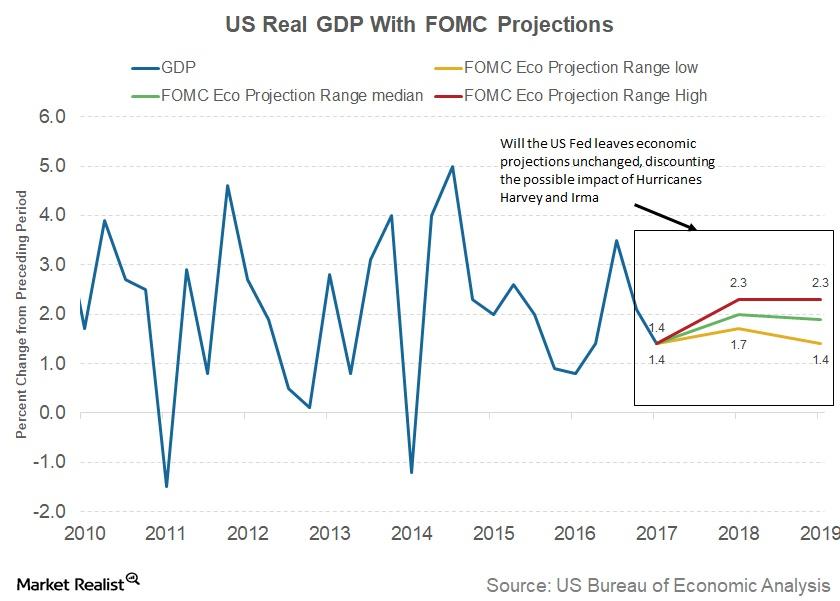

The FOMC’s View on the US Economy

At the November meeting, the FOMC staff review indicated that US labor market conditions continued to strengthen and that the US economy continued to expand at a solid pace.

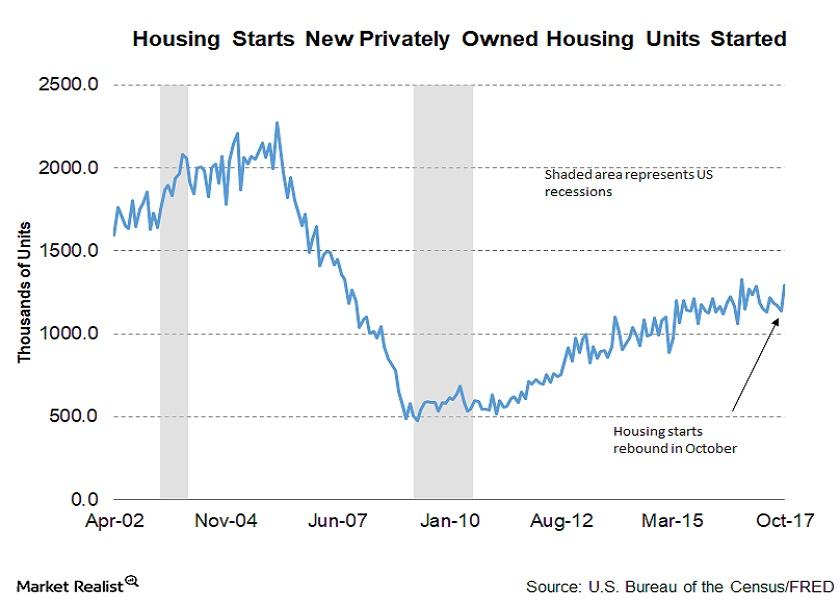

Analyzing Housing Starts in October 2017

In October 2017, housing starts rebounded sharply from the slump in September. October housing starts beat the market’s expectations.

Tracking the Conference Board Leading Economic Index

In this series, we’ll analyze each component of the Conference Board Leading Economic Index and understand its implications for the consumer discretionary (XLY), industrial (XLI), and housing (XHB) sectors and the overall market (SPY).

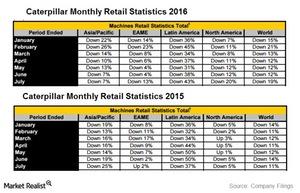

Investors Shouldn’t Expect Near-Term Optimism from Caterpillar

Caterpillar (CAT) released its retail statistics for July on a three-month rolling basis on August 18. However, Caterpillar’s retail sales fell in July.

How Stanley Black & Decker Came to Be

Stanley Black & Decker (SWK), a Fortune 500 company, is the world’s leading tool company. It provides a wide array of products to the construction (XHB) and automobile (FSAVX) end markets.

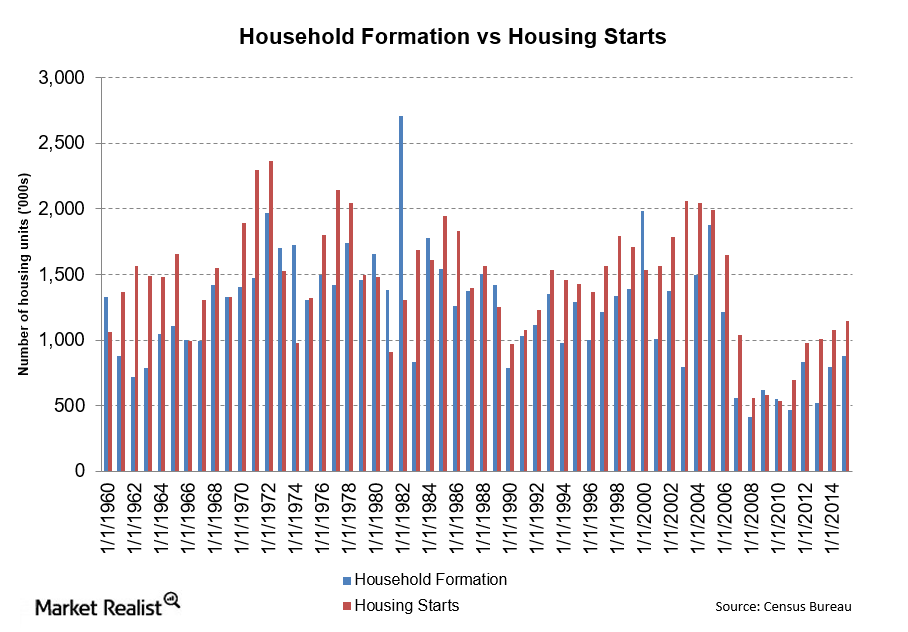

Limited Supply: Analyzing Housing Starts and Household Formations

There was a big fall in household formation in 2008. In 2005, household formation peaked at 1.9 million. By 2008, that number was just over 400 million.

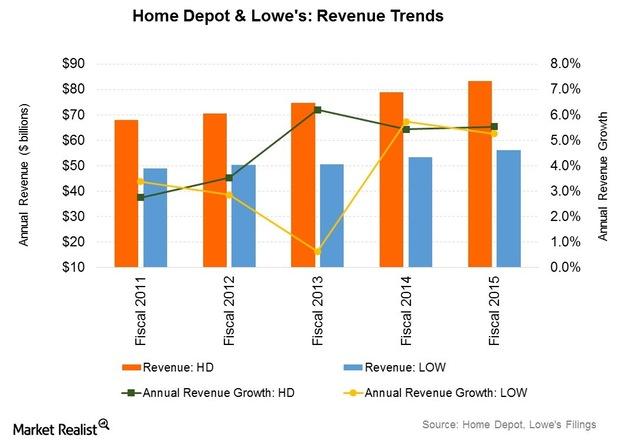

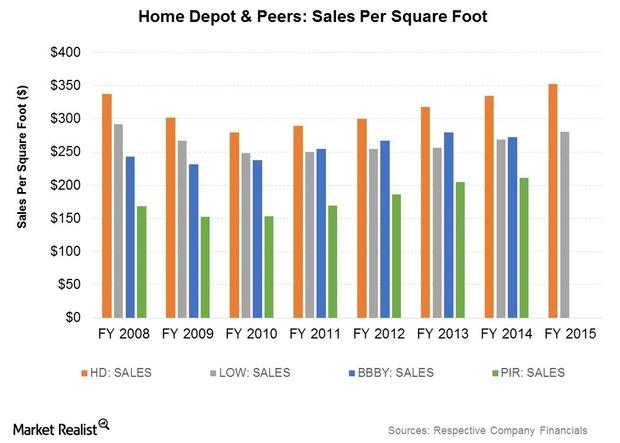

Why Same-Store Sales Surged for Home Depot and Lowe’s

Home Depot’s same-store sales grew 5.1% overall, marking the 18th straight quarter of positive comps for the retailer.

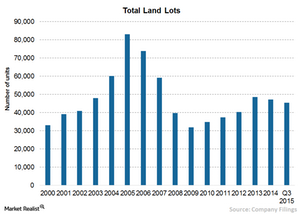

Understanding Toll Brothers’ Land Acquisition Strategy

Toll Brothers’ use of land option agreements reduces financial risks associated with long-term land holdings. The land acquisition strategy of other homebuilders also involves option contracts.

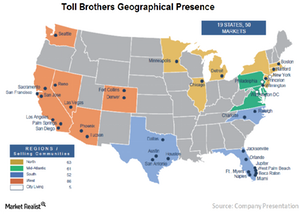

A Geographic Overview of Toll Brothers’ Homebuilding Operation

Toll Brothers (TOL) has a very geographically diverse homebuilding operation in the United States. The company has a presence in 50 markets, spanning 19 states as well as the District of Columbia.

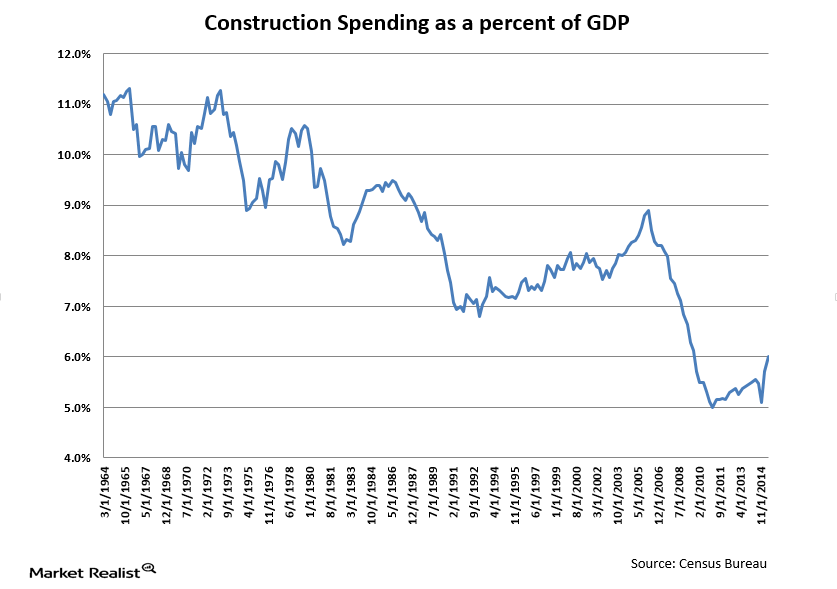

The Importance of Construction Spending to GDP

Historically, construction spending has led economies out of recessions. This didn’t happen in the most recent recession, however, because of the overhang from the real estate bubble.

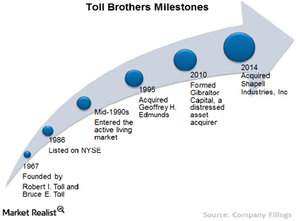

Investing in Toll Brothers: A Must-Know Company Overview

Toll Brothers is primarily engaged in the development of attached and detached homes in luxury residential communities. It’s a dominant player in the luxury segment with very few comparable competitors.

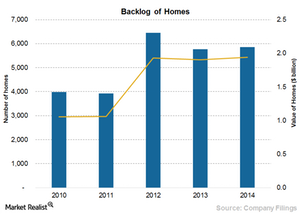

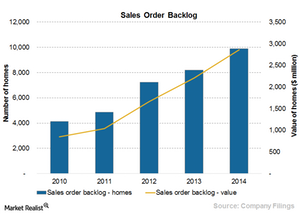

Why PulteGroup Saw a Modest Rise in Sales Order Backlog in 2014

Sales order backlog represents homes under contract but not closed or delivered. For orders in backlog, the company receives a customer contract and deposit, which may or may not be refundable.

Understanding PulteGroup’s Land Acquisition Strategy

PulteGroup (PHM) mainly acquires land to complete sales of housing units within 24 to 36 months from the date of opening a community.

What Is PulteGroup’s Market Segmentation Strategy?

The move-up buyers in Pulte Homes communities tend to place more premium on location and amenities.

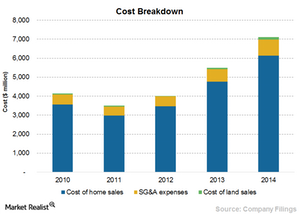

What Was D.R. Horton’s Cost Structure Breakdown in 2014?

Cost of homes sold is the highest of the company’s costs at 78.1%, followed by SG&A at 10.6%, and cost of land sold at 1.6%.

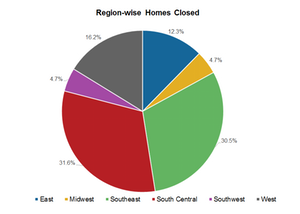

What Is D.R. Horton’s Market Segmentation Strategy?

As part of its market segmentation strategy, D.R. Horton launched a variety of different brands, including D.R. Horton, America’s Builder, Express Homes, and Emerald Home.

D.R. Horton’s Huge Sales Order Backlog Ensures Sustainable Growth

Pretty much all of the homes in D.R. Horton’s sales order backlog at the end of fiscal 2014 are likely to close in fiscal 2015, which will boost the company’s revenues.

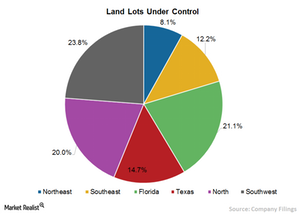

Understanding D.R. Horton’s Land Acquisition Strategy

D.R. Horton directly acquires almost all of its land and lot positions. The company has initiated few joint ventures for land acquisitions.

An Overview of D.R. Horton’s Homebuilding Segment

The homebuilding segment of D.R. Horton, which mainly focuses on single-family attached and detached homes, is divided into six divisions.

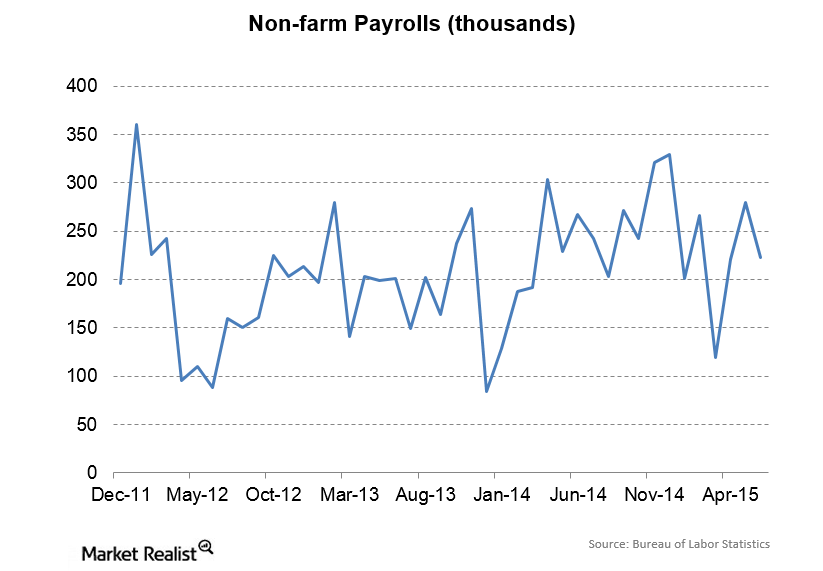

June Payrolls Increase

Private payrolls increased by 223,000 in June, while government jobs growth was flat and manufacturing employment barely increased.

Home Depot’s Target Market and Customer Base

Home Depot invests considerable sums in providing a superior customer experience. Its co-founders say “the customer has a bill of rights at The Home Depot.”

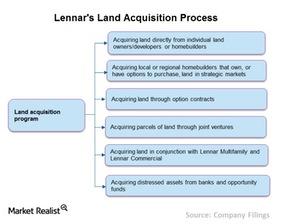

Lennar’s Diversified Land Acquisition Process

Lennar’s land acquisition process includes acquiring land from individual land owners, developers, or homebuilders. Lennar also creates JVs to acquire land.

Home Improvement Retail: A Two-Horse Race for Supremacy

The home improvement industry is highly concentrated, particularly in the consumer market. The degree of concentration is growing.

Market Segmentation in Lennar Corporation

Lennar’s market segmentation is primarily first-time, move-up, and active adult homebuyers in areas ranging from urban infill to golf course communities.