Vanguard Growth ETF

Latest Vanguard Growth ETF News and Updates

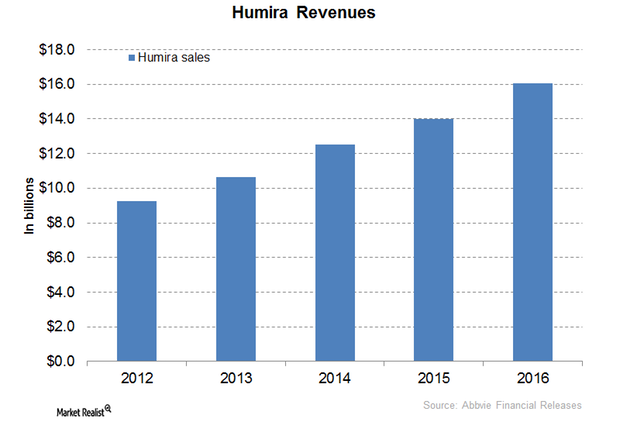

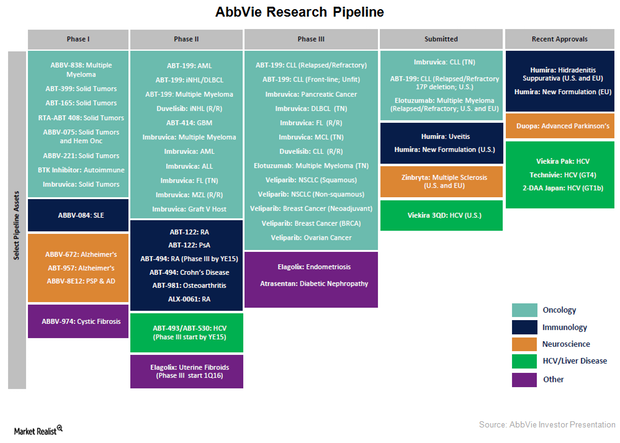

Humira May Continue to Drive AbbVie’s Revenue Growth

In 2016, AbbVie’s (ABBV) drug Humira reported revenue of ~$16.0 billion, which reflected a ~15% year-over-year (or YoY) rise.

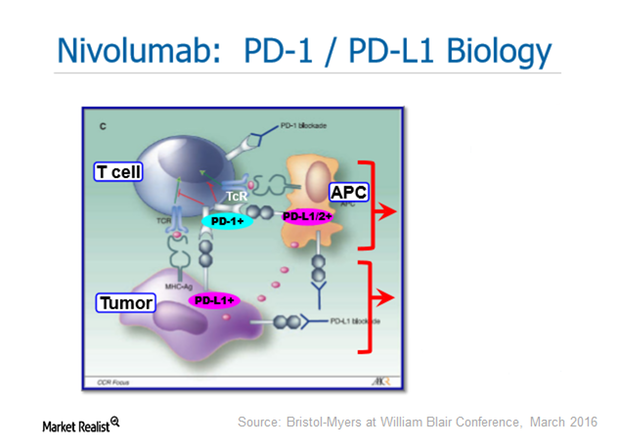

Brace Yourself: AstraZeneca Could Be a Fourth Entrant into the PD-1/PD-L1 Drug Class

The PD-1 (programmed death-1)/PD-L1 (programmed death-ligand 1) class consists of Bristol-Myers Squibb’s Opdivo, Merck’s Keytruda, and Roche’s Tecentriq.

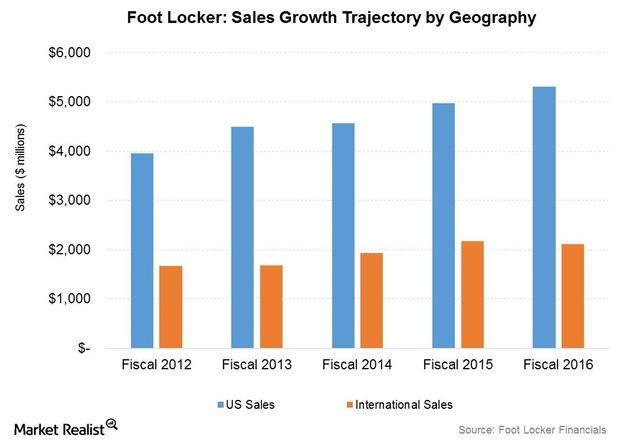

Fleet of Foot? Foot Locker’s Fastest-Growing Sales Segments

In fiscal 2016, Foot Locker made $5.3 billion in US sales, representing 71.6% of its total revenue. In contrast, international revenue came in at $2.1 billion.

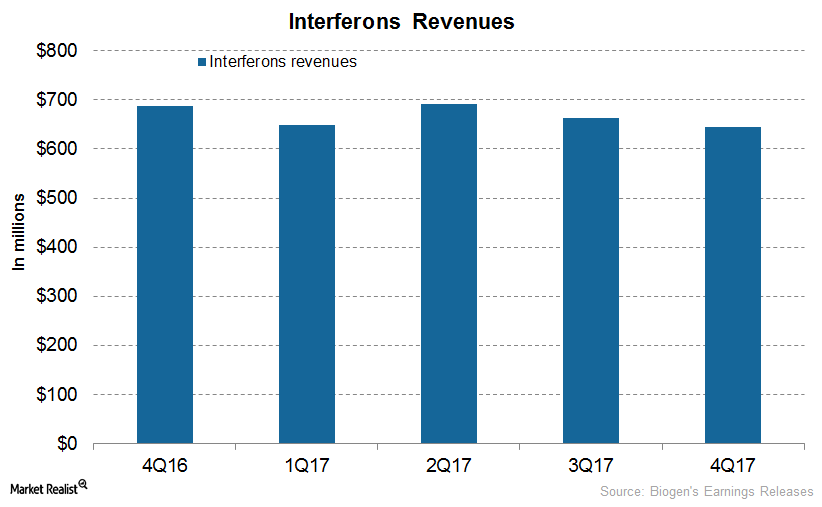

How Biogen’s Biosimilars and Interferons Performed in 4Q17

In 4Q17, Biogen’s (BIIB) interferons generated revenues of $645 million, which reflected a 6% decline YoY and a 3% decline on a quarter-over-quarter basis.

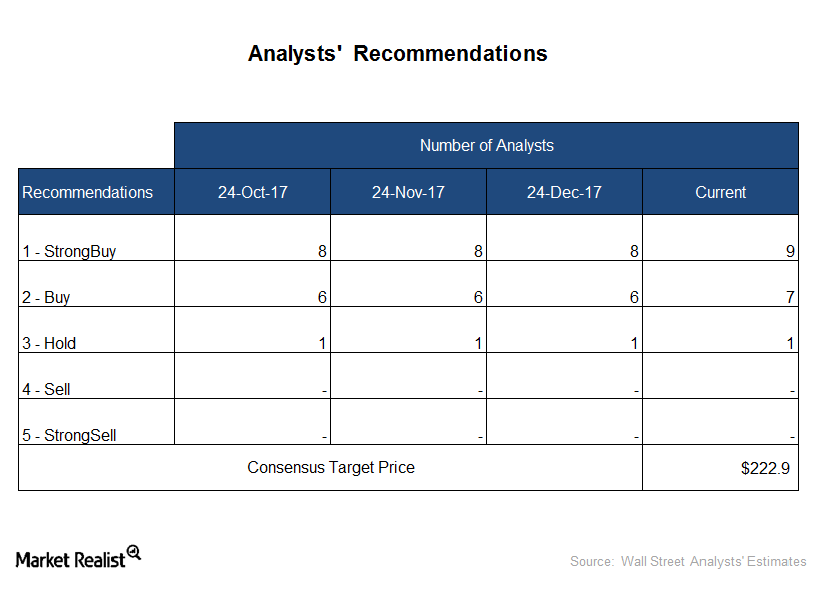

Analyst Ratings for Thermo Fisher Scientific before 4Q17 Results

Thermo Fisher Scientific (TMO) will announce its 4Q17 and fiscal 2017 results on January 31, 2018. It has launched some innovative products and entered into strategic collaborations and partnerships.

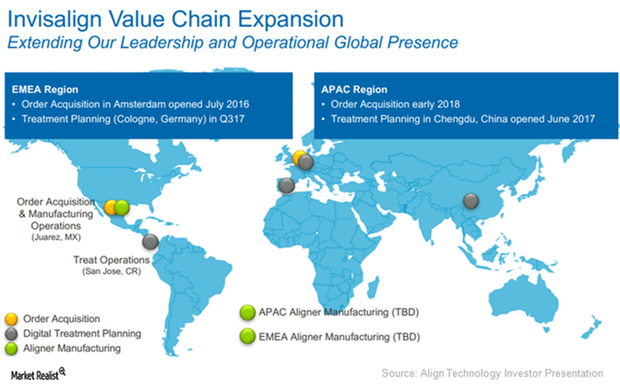

Align Technology’s Customer Acquisition Strategy Driving Market Growth

In 3Q17, Align Technology trained nearly 1,000 doctors in China.

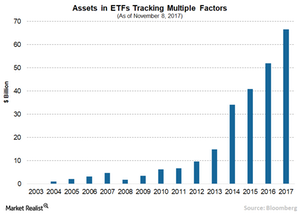

Can Smart Beta Go Wrong?

The smart beta approach aims to benefit from market inefficiencies to deliver higher risk-adjusted returns and improve diversification.

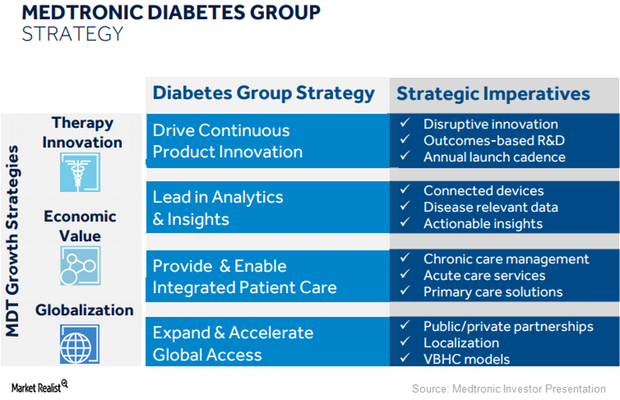

What’s Medtronic’s Long-Term Growth Strategy for Its Diabetes Business?

Medtronic (MDT) expects its diabetes business to witness a temporary sequential drop in revenues in 2Q18 and then return back to growth in the second half of fiscal 2018.

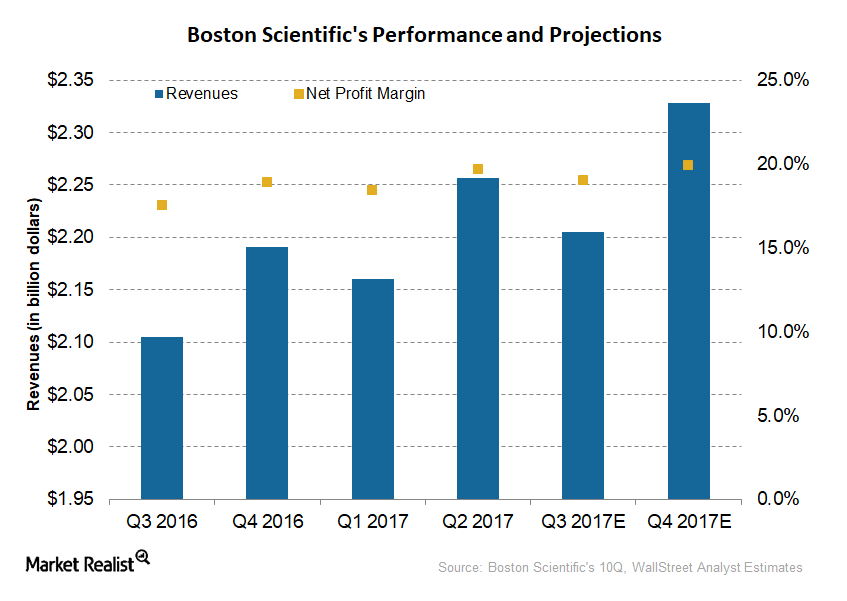

Boston Scientific’s Updated 2017 Guidance

Boston Scientific (BSX) expects to register 2017 revenues of $8.9 billion–$9.0 billion compared to its previous guidance of $8.8 billion–$8.9 billion.

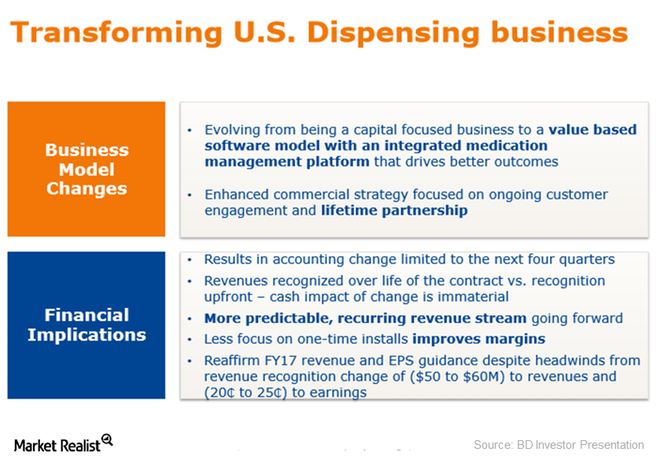

Headwind for Becton Dickinson: US Dispensing Business

Becton Dickinson (BDX) is the leading player in the US dispensing business. Its Pyxis system sales contribute significantly to the company’s total revenues.

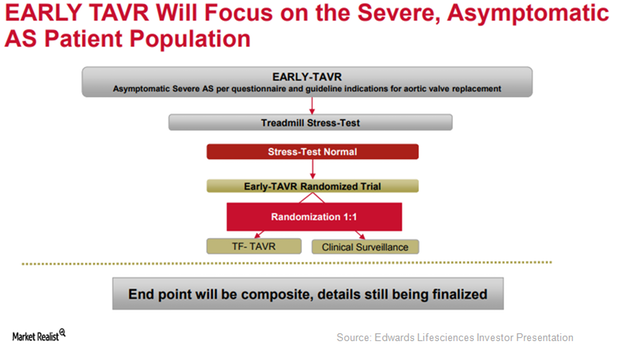

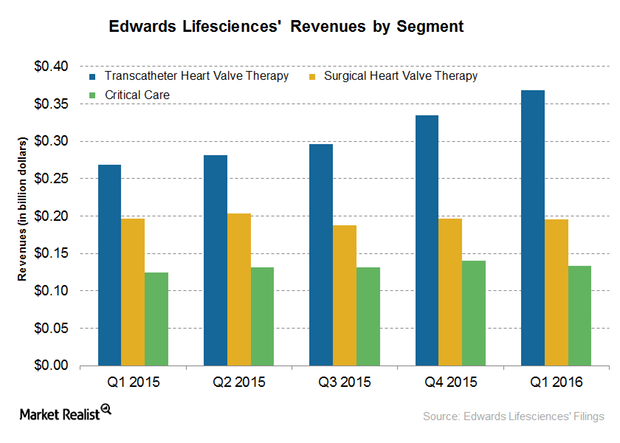

Edwards Lifesciences Focuses on Indication Expansion of SAPIEN 3 in 2017

To further expand the label of its transcatheter heart valve (or THV), SAPIEN 3, Edwards Lifesciences (EW) is currently involved in enrolling patients in its EARLY-TAVR trial.

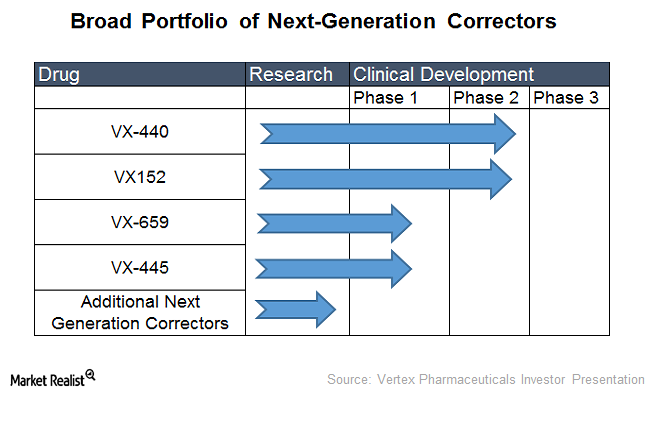

Inside Vertex Pharmaceuticals’ Clinical Pipeline

In March 2017, Vertex Pharmaceuticals (VRTX) announced promising results from two phase-3 clinical trials, Evolve and Expand.

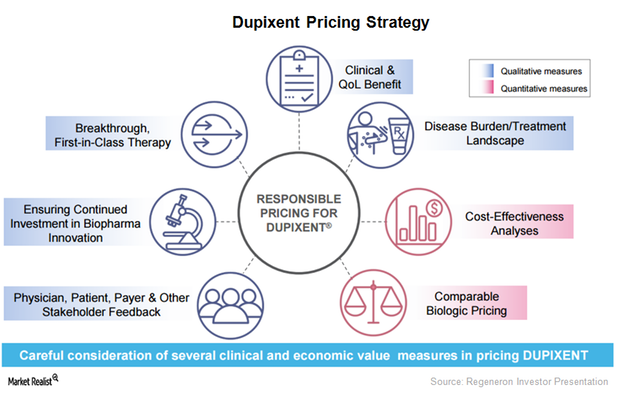

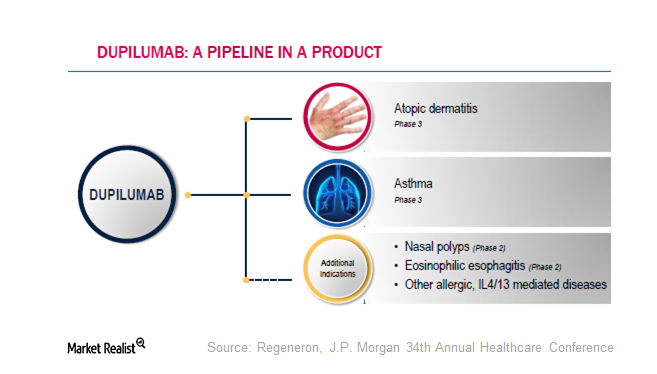

Dupixent May Be a Major Growth Driver for Regeneron in 2017

After Dupixent’s commercial launch, Regeneron has been involved in creating awareness for the drug among physicians who have been treating AD patients.

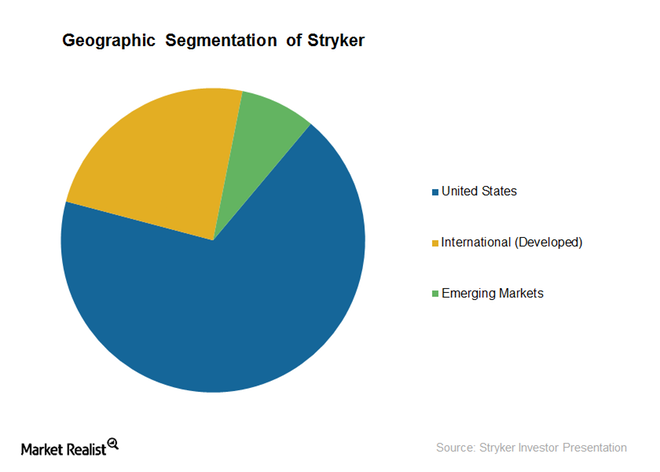

How Stryker Plans to Capture the International Markets

Most of Stryker’s emerging market sales are from China. However, Europe and emerging markets sales have witnessed high growth in recent quarters.

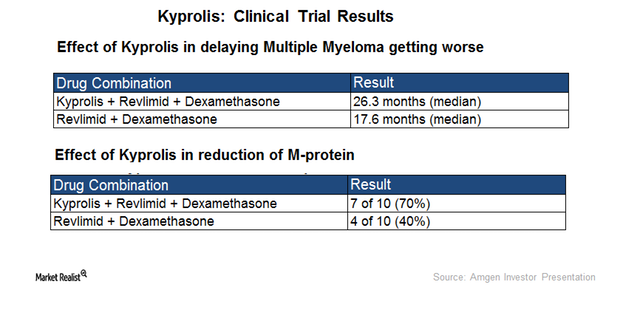

Kyprolis Could Significantly Drive Amgen’s Revenue Growth in 2017

Amgen’s (AMGN) Kyprolis has gained considerable market share in second-line multiple myeloma (or MM) indication since its launch in 2012.

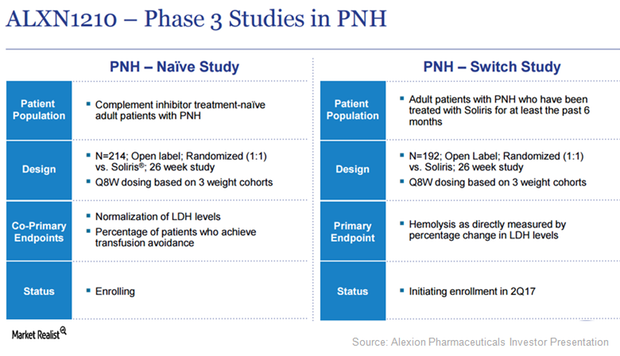

ALXN1210 Is Expected to Boost Alexion Pharmaceuticals’ Revenue

Alexion Pharmaceuticals has planned five clinical trials in 2017 to test the potential of investigational next-generation C5 antibody, ALXN1210, as a treatment option for complement-mediated diseases.

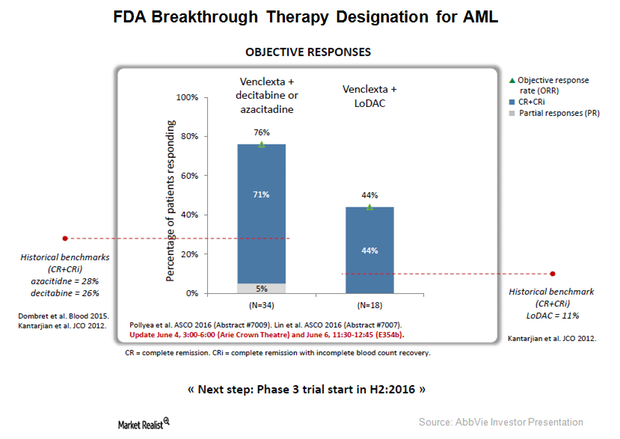

Acute Myeloid Leukemia: Growth Opportuny for AbbVie’s Venclexta?

AbbVie’s (ABBV) Venclexta has been granted FDA breakthrough therapy designation as a first line therapy for patients with acute myeloid leukemia who are ineligible for high-dose chemotherapy.

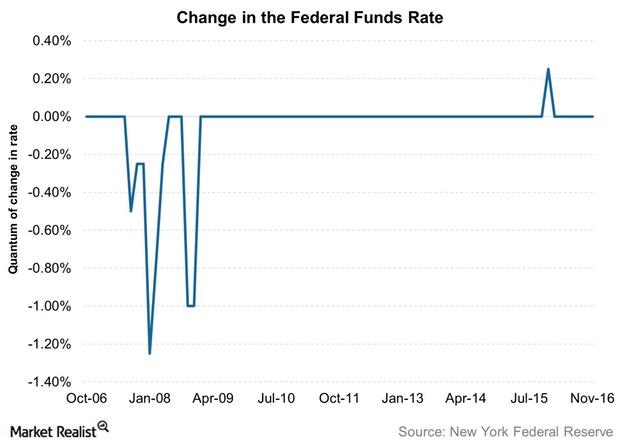

How the Next President Could Shape US Monetary Policy

The Federal Reserve’s second last meeting of 2016 is now over, leaving only one meeting left in which the central bank can enact a rate hike.

Why Were Fed Policymakers Worried about Clear Communication?

The credibility of the Federal Reserve was a concern raised by some policymakers at the September FOMC (Federal Open Market Committee) meeting.

Regeneron’s Dupilumab: How Much Potential Does It Hold?

Dupilumab has a breakthrough therapy designation from the FDA for the indication of moderate-to-severe atopic dermatitis in adults.

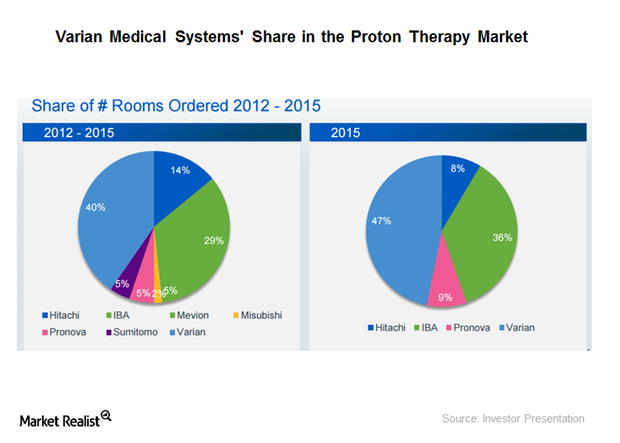

How Is Varian Positioned in the Particle Therapy Business?

Varian Medical Systems (VAR) had gross orders value of $310 million in 2015.

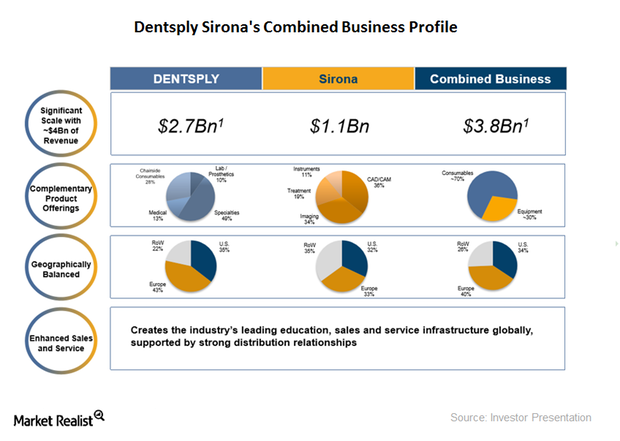

Introducing Dentsply Sirona, a Leading Dental Products Manufacturer

Dentsply Sirona (XRAY) is the largest manufacturer of dental equipment and technologies in the world. The company was formed in February 2016.

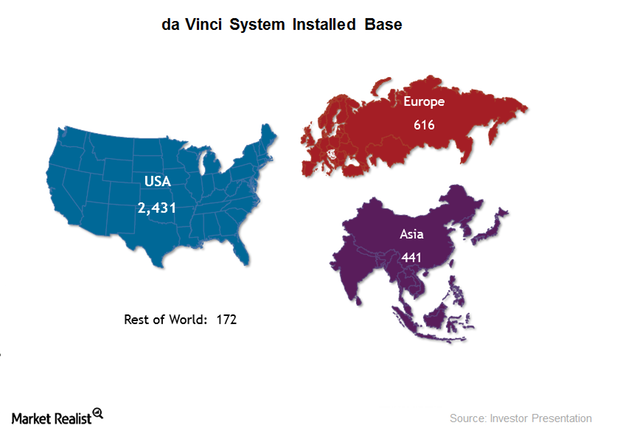

Exploring Intuitive Surgical’s Sales Model

Intuitive Surgical follows a diversified sales strategy and doesn’t generate more than 10% of its revenue through any one customer.

How Did Edwards Lifesciences’ Critical Care Segment Fare in 1Q16?

Edwards Lifesciences (EW) reported ~$697 million in total revenue in 1Q16. Of that, ~$134 million was contributed by the company’s Critical Care segment.

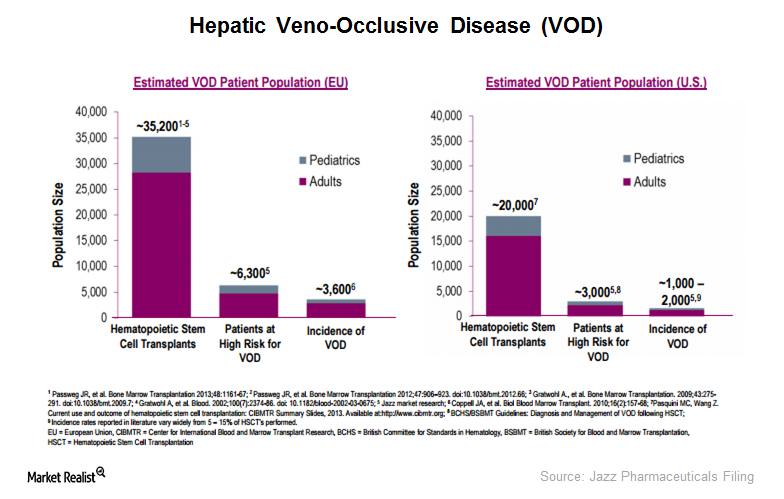

Defitelio: Volume and Pricing Challenges

Jazz Pharmaceuticals’ Defitelio is the first and only approved treatment that increases survival in VOD patients with multi-organ dysfunction (or MOD).

AbbVie’s Late-Stage Research Pipeline Could Boost Future Revenues

In partnership with Bristol-Myers Squibb, AbbVie is exploring elotuzumab to treat relapsed refractory multiple myeloma. The drug also received a breakthrough therapy designation from the FDA on May 19, 2014.

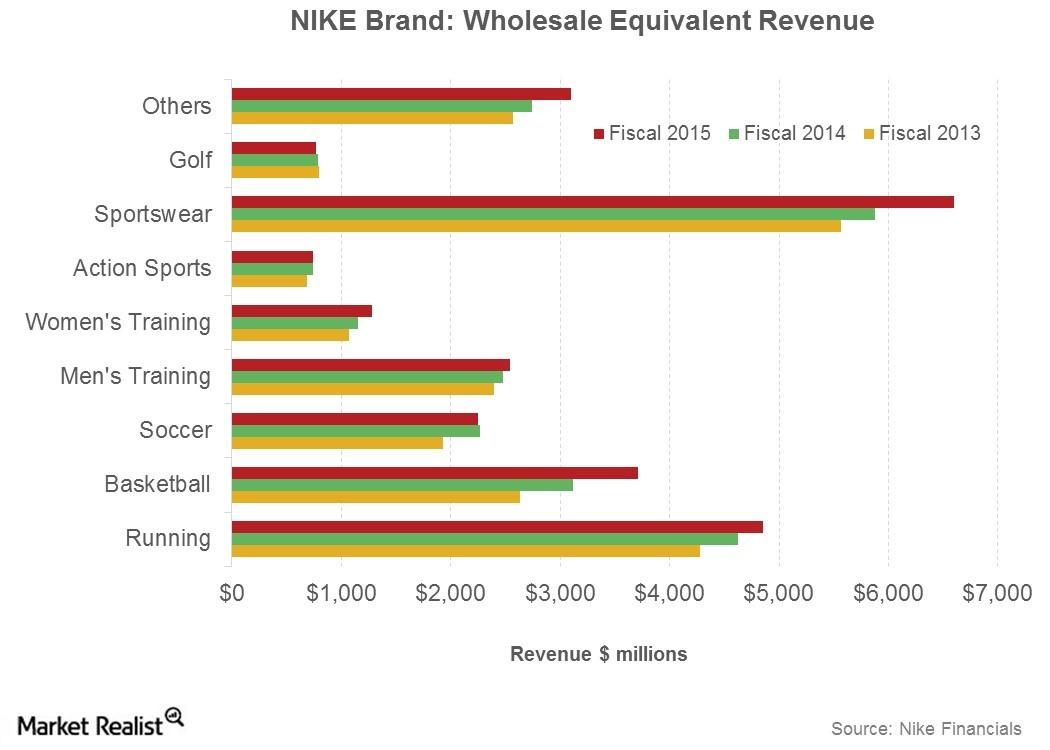

Future Sales Drivers for Nike’s Integrated Marketplace Model

Nike is expecting sales through wholesalers to grow at a mid- to high-single compounded annual growth rate over the next five years through fiscal 2020.

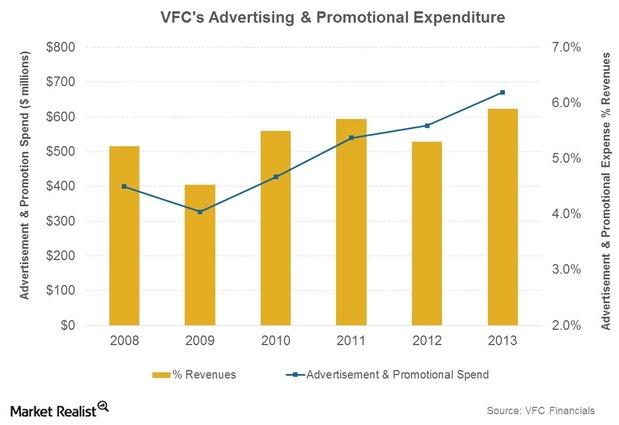

Discovering VF Corp.’s Marketing Edge

VFC’s marketing dollars are designed to get the most returns from its stores, other retailers (wholesale customers), and its e-commerce websites.Technology & Communications Why is the NASDAQ heavily weighted towards technology stocks?

The NASDAQ’s upstart image and all-electronic trading platform have attracted more technology-based companies. Many of these companies didn’t qualify to list on the NYSE when they originally went public.