United States 12 Month Oil ETF

Latest United States 12 Month Oil ETF News and Updates

Oddly Enough, You Can Buy Unclaimed Mail and Large Packages — Here’s How

Although buying unclaimed mail may sound odd and unethical, it happens. Want to know how to buy unclaimed mail? Keep reading to find out.

Are Oil’s Supply Concerns Rising?

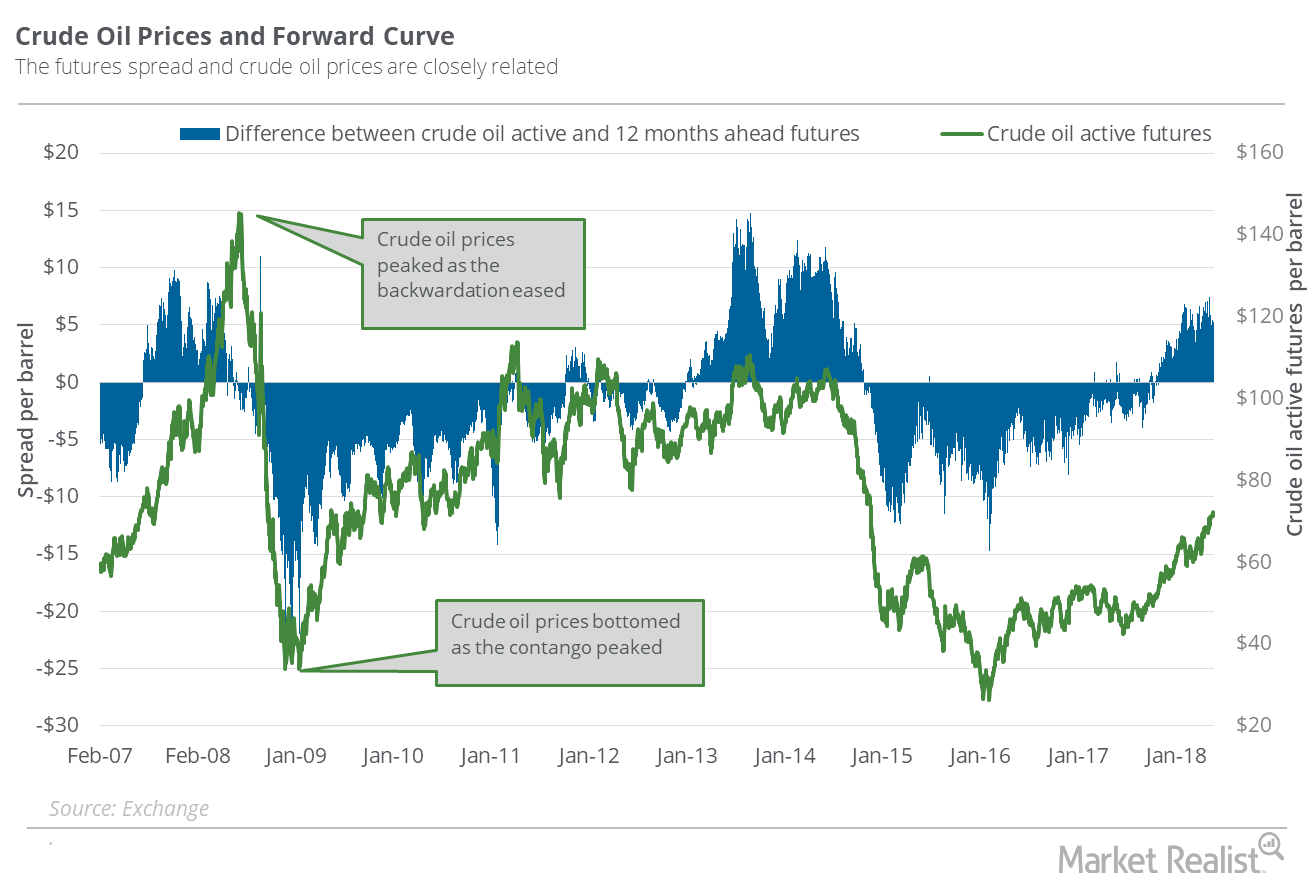

On May 21, US crude oil July futures closed $5.97 above the July 2019 futures contract. On May 14–21, US crude oil July futures rose 1.9%.

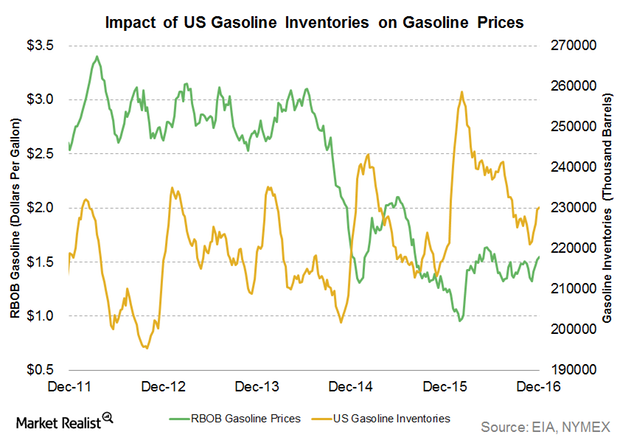

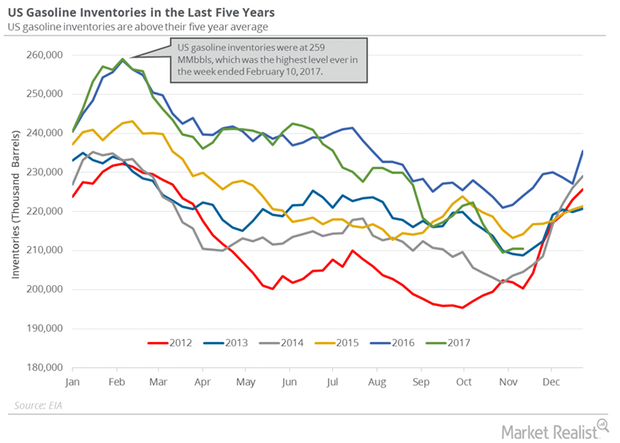

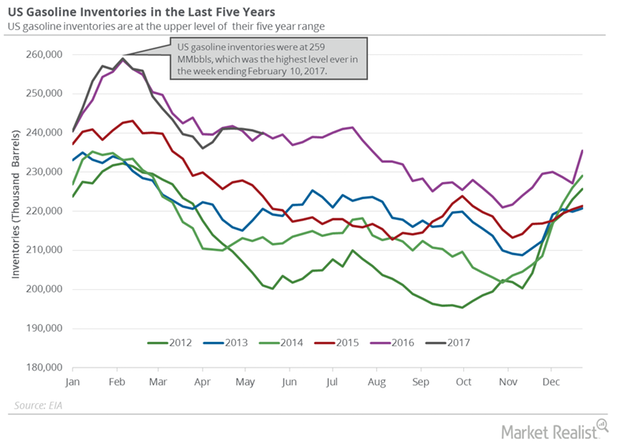

Will Gasoline Inventories Impact Gasoline and Crude Oil Prices?

The API released its weekly inventory report on December 28, 2016. It estimates that US gasoline inventories fell by 2.8 MMbbls from December 16–23, 2016.

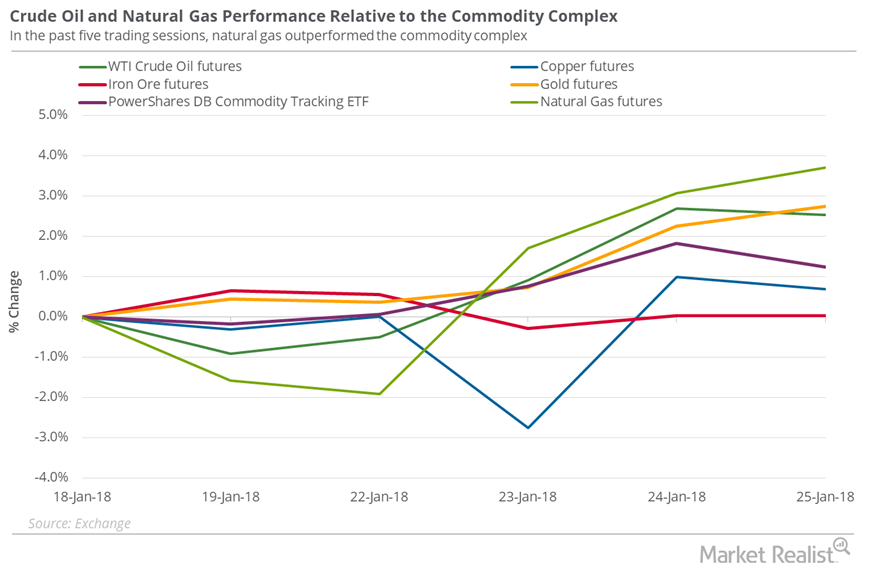

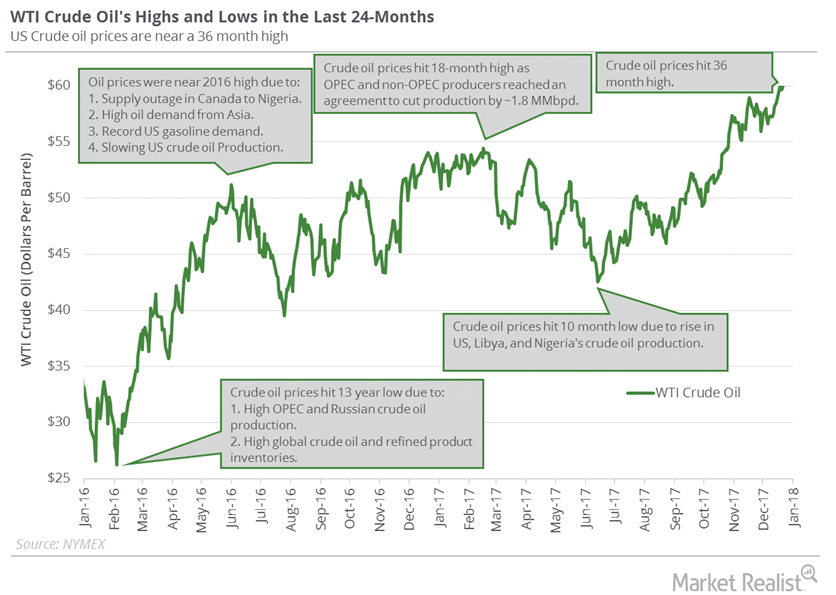

Why Oil Prices Could Increase More

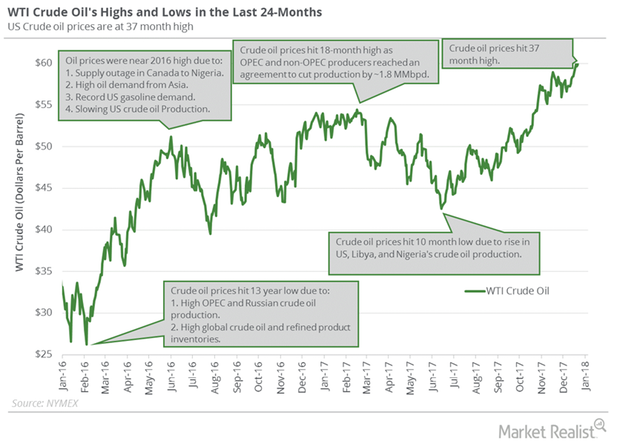

On January 22, 2018, US crude oil active futures were 3.1%, 7.8%, 15.8%, and 23.7% above their 20-day, 50-day, 100-day, and 200-day moving averages.

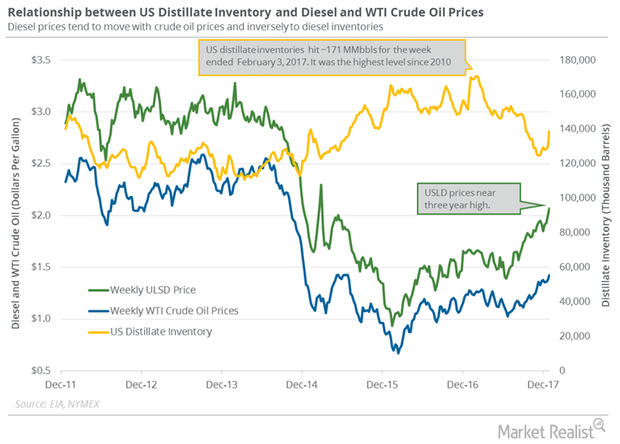

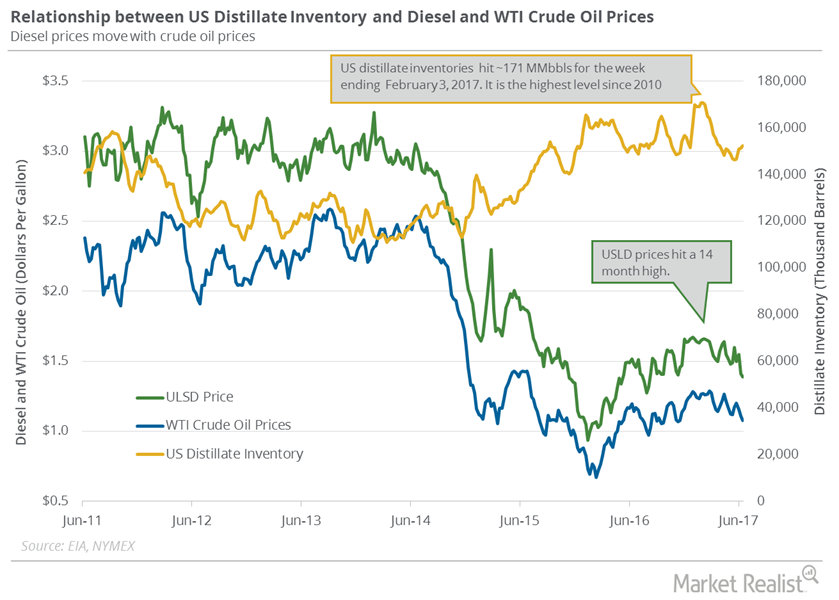

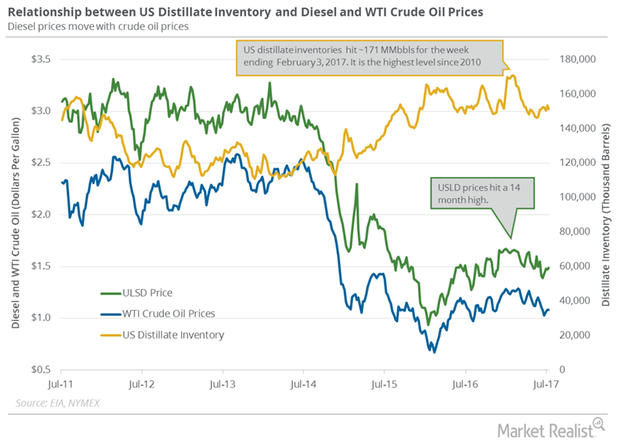

US Distillate Inventories Rose for the Sixth Time in 7 Weeks

US distillate inventories increased for the sixth time in the last seven weeks. The inventories rose ~11% in the last seven weeks.

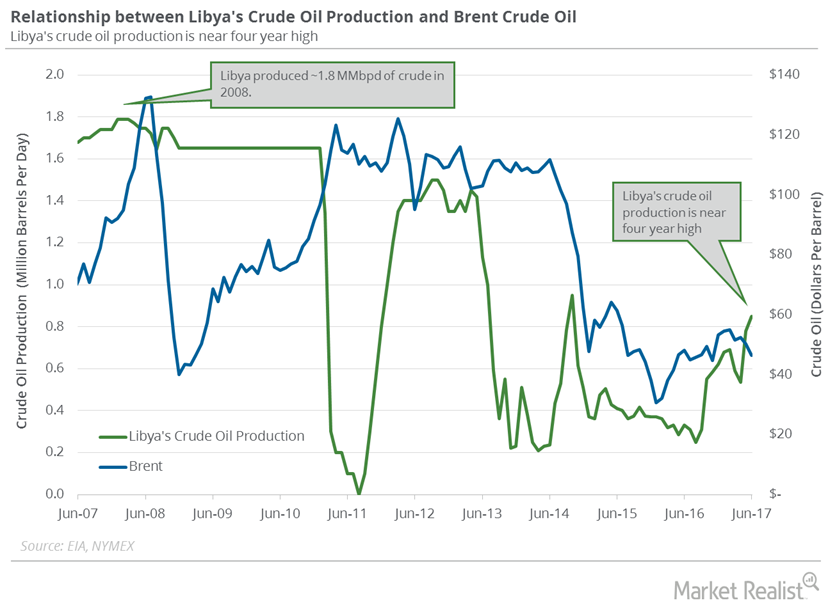

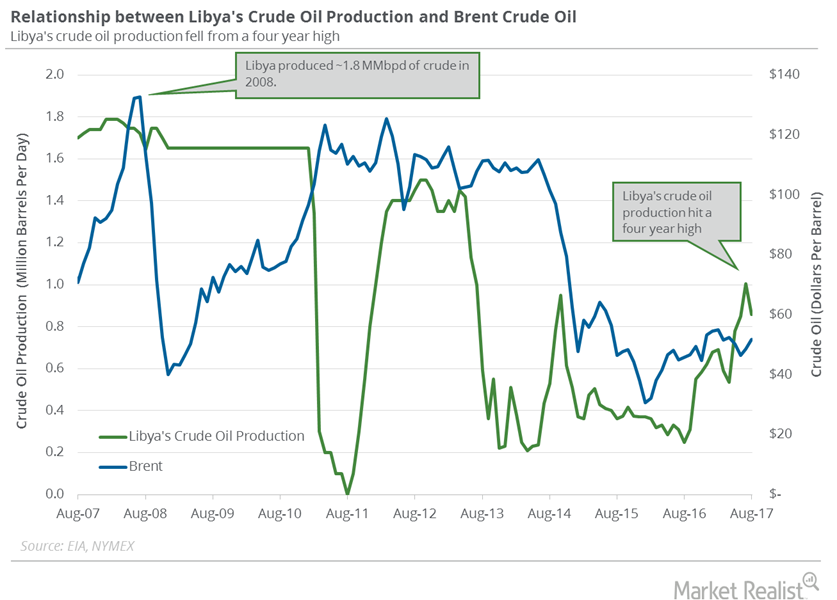

Libya’s Crude Oil Production: Bears Could Control Oil Prices

Libya’s crude oil production was at 1,030,000 bpd in July 2017. Production has risen ~60% from its levels in January 2017.

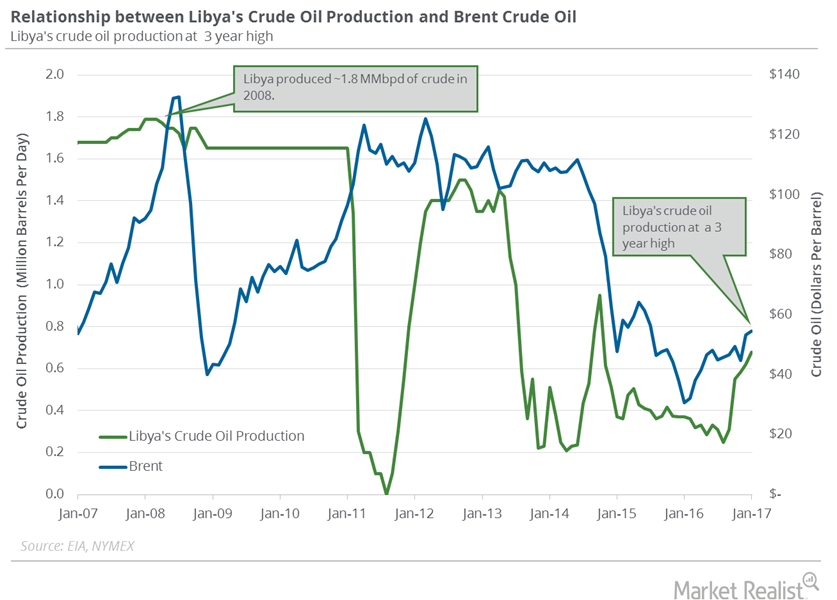

Analyzing Libya’s Crude Oil Production

A Reuters survey estimates that Libya’s crude oil production fell by ~20,000 bpd (barrels per day) to 670,000 bpd in February 2017—compared to January 2017.

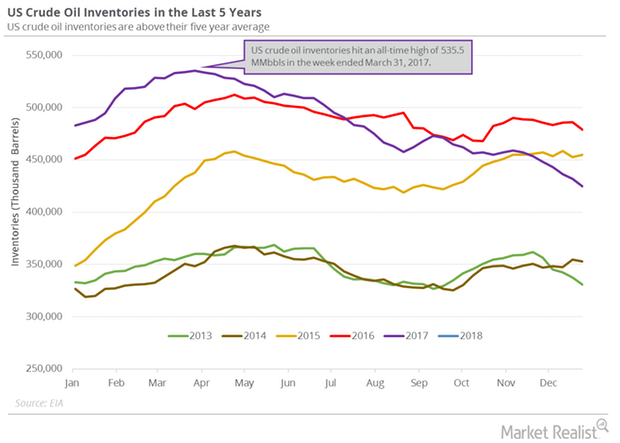

US Crude Oil Inventory Report Might Disappoint Traders

An unexpected increase in US oil inventories pressured WTI oil (USO) (UCO) prices in post-settlement trade on November 28, 2017.

Why Oil Prices Could Lose Momentum

On January 25, 2018, US crude oil’s (USO) (USL) March 2018 futures fell 0.2% and settled at $65.51 per barrel.

What to Expect from Libya’s Crude Oil Production in September

The EIA estimates that Libya’s crude oil production fell by 145,000 bpd (barrels per day) to 860,000 bpd in August 2017—compared to the previous month.

Why Is the Risk in Oil Prices Rising?

On December 5, 2017, US crude oil (USO) (USL) January 2018 futures rose 0.3%. The API’s oil inventory data might have supported oil prices on the same day.

Does the Natural Gas Fall Relate to Oil’s Decline?

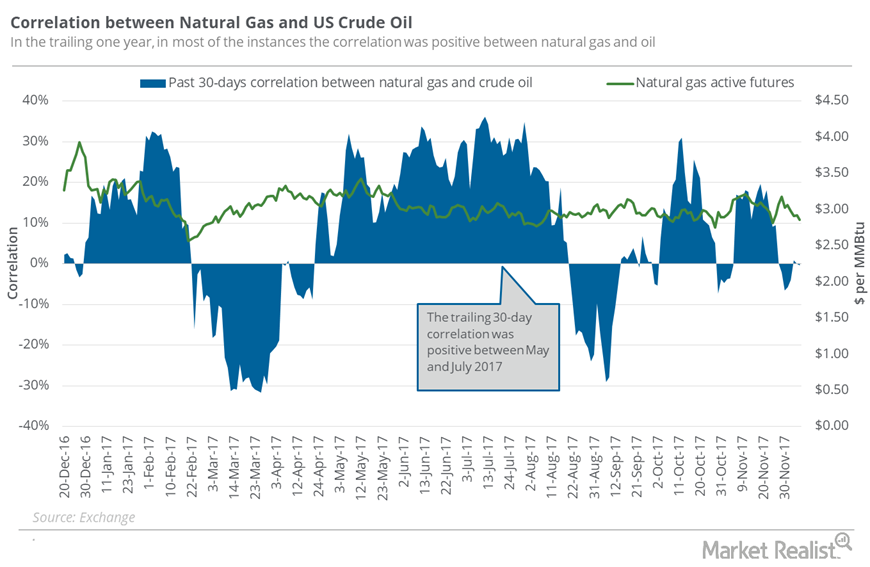

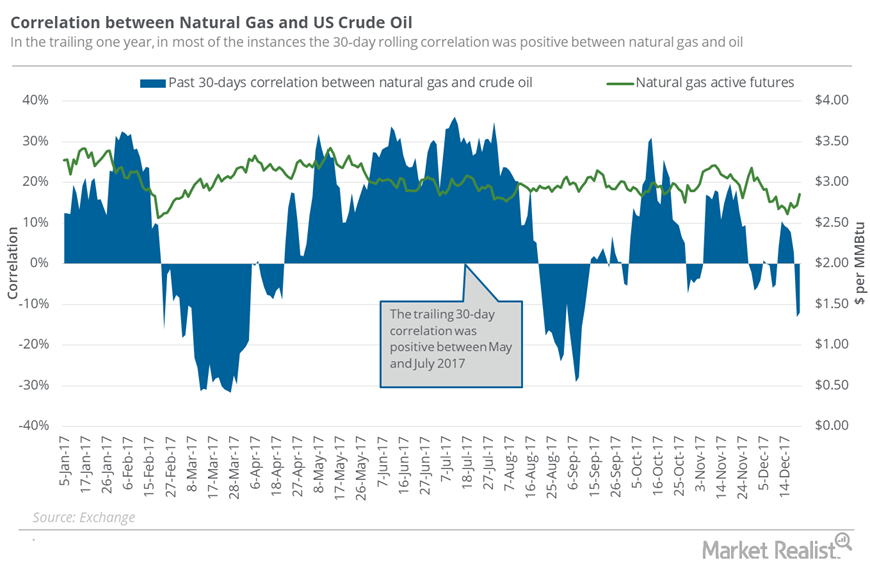

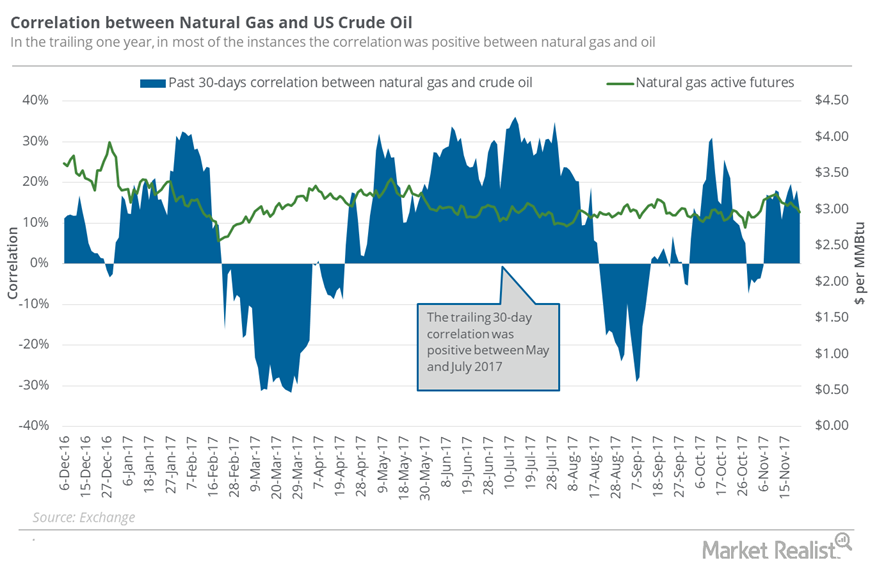

Between November 29 and December 6, natural gas (GASL)(GASX)(FCG) January 2018 futures had a correlation of -1.6% with US crude oil January futures.

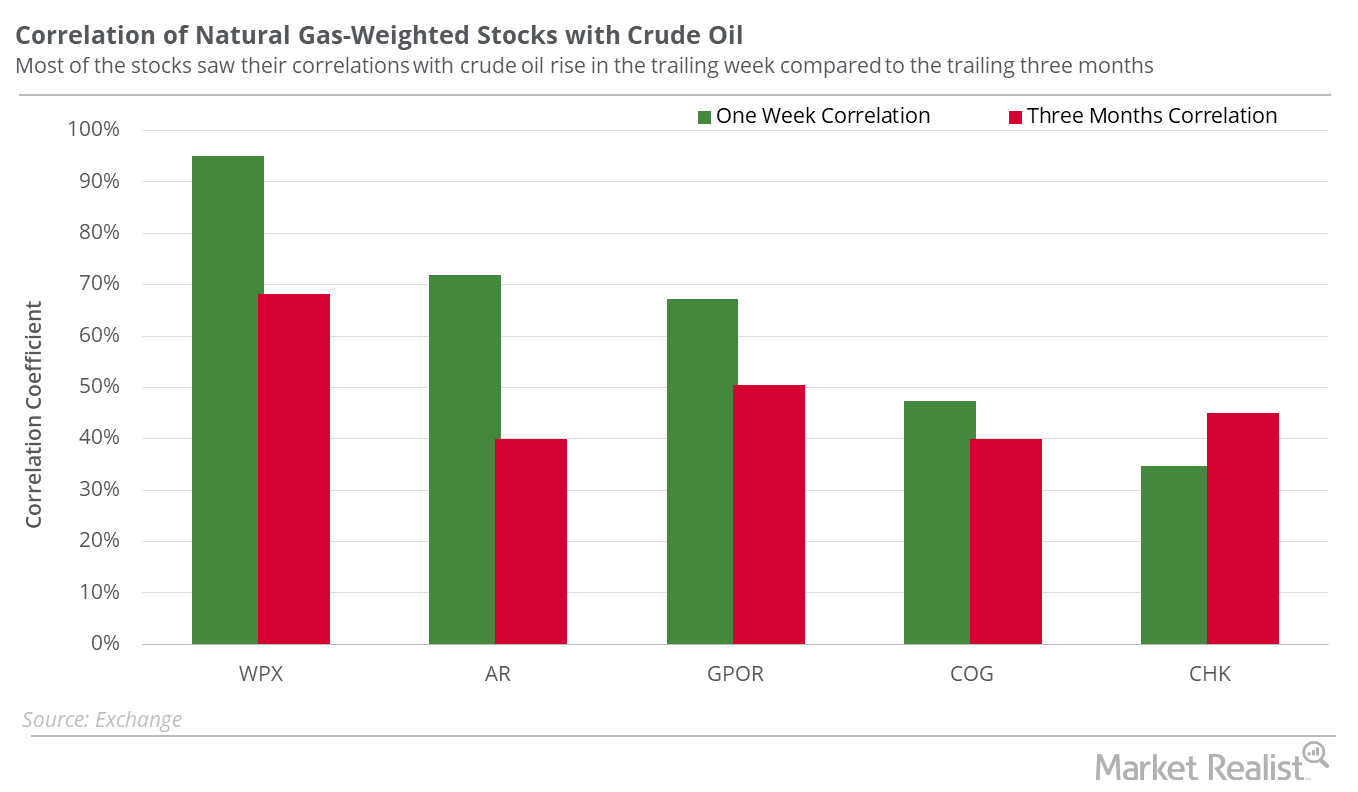

Which Natural Gas–Weighted Stocks Could Follow Oil?

WPX Energy had the lowest correlation with natural gas prices in the past five trading sessions. Southwestern Energy had among the highest correlations.

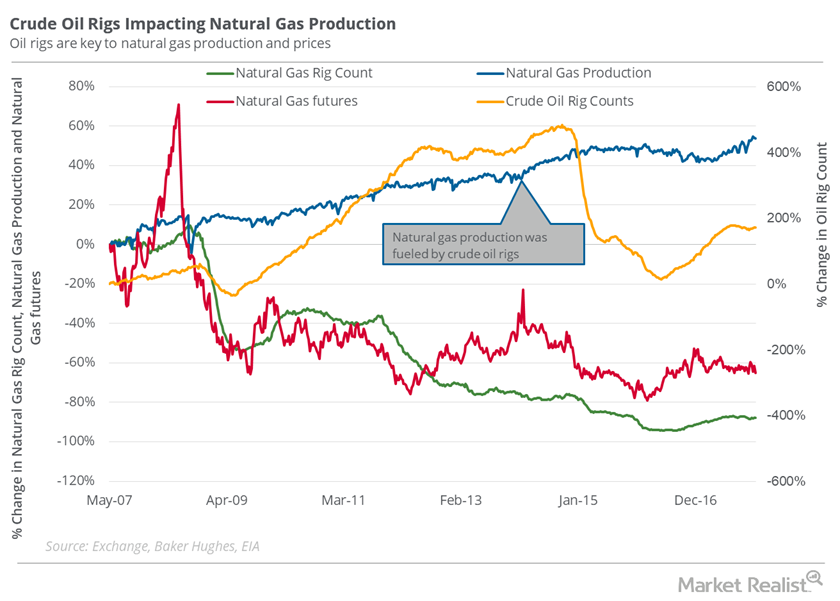

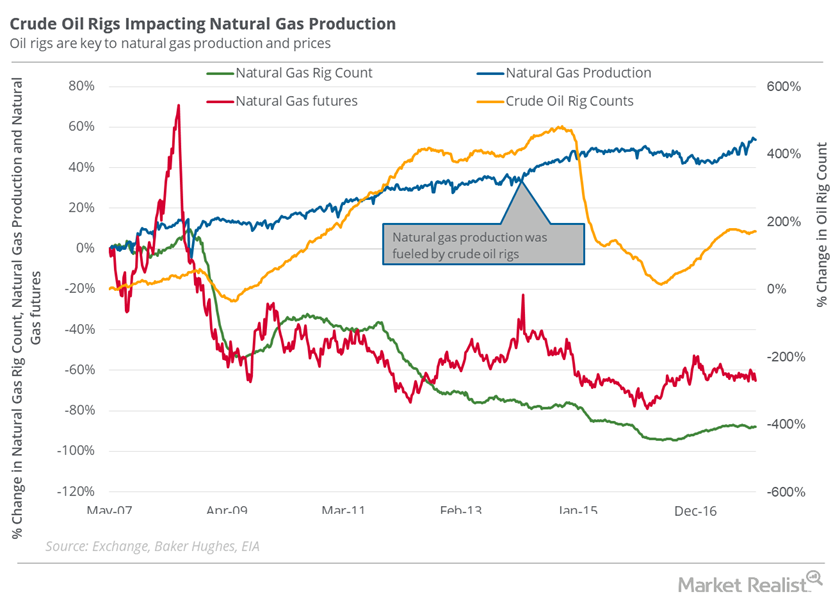

Natural Gas Traders Should Stay Cautious of Oil Rigs

On December 29, the natural gas rig count was 88.7% below its record high of 1,606 in 2008. However, natural gas supplies have risen drastically since 2008.

US Gasoline Inventories Fell Less, Pressured Gasoline Prices

The EIA released its weekly crude oil report on May 24, 2017. US gasoline inventories fell by 0.8 MMbbls to 239.9 MMbbls on May 12–19, 2017.

Why Oil Traders Should Stay Cautious after OPEC Meeting

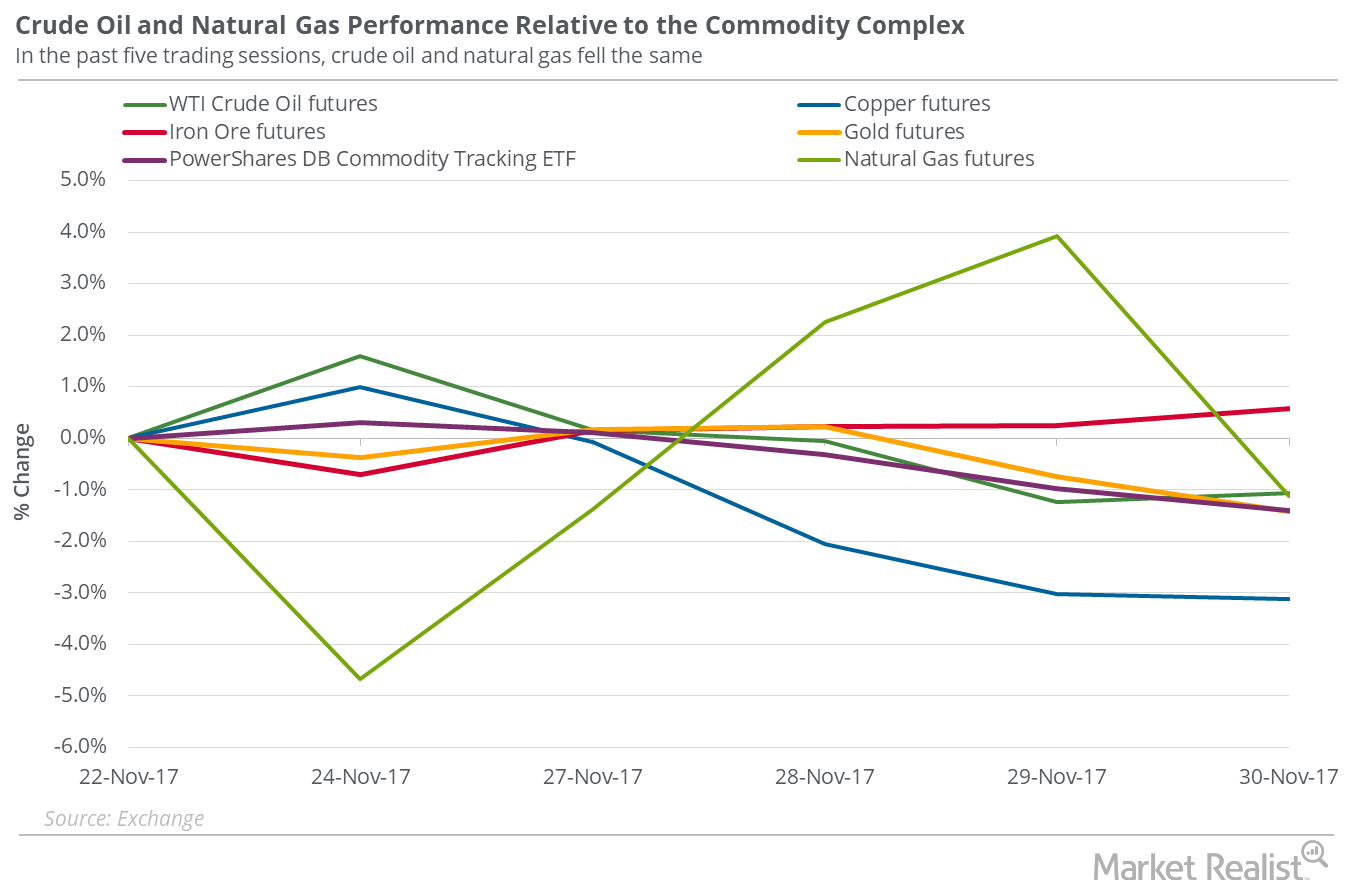

On November 30, 2017, US crude oil (USO) (USL) active futures rose just 0.2% and closed at $57.4 per barrel.

Will Non-OPEC Oil Supply Dominate Oil Prices in 2018?

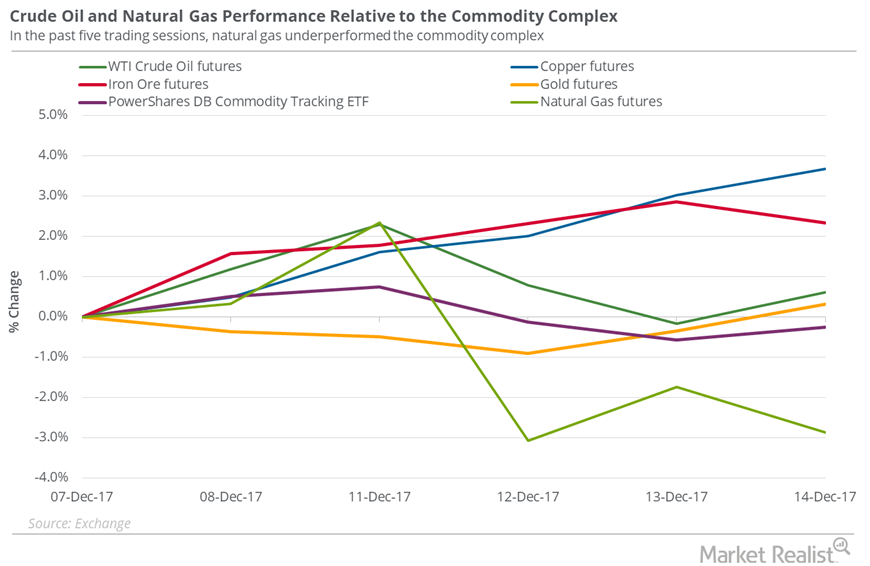

On December 14, 2017, US crude oil (USO) (USL) January 2018 futures rose 0.8% and closed at $57.04 per barrel.

Will US Crude Oil Futures Rise above $50 per Barrel This week?

September US crude oil prices are on a rollercoaster ride in 2017 due to bullish and bearish drivers. US crude oil prices are near a two-month high.

US Dollar near 9-Month High: Is It Bearish for Crude Oil Prices?

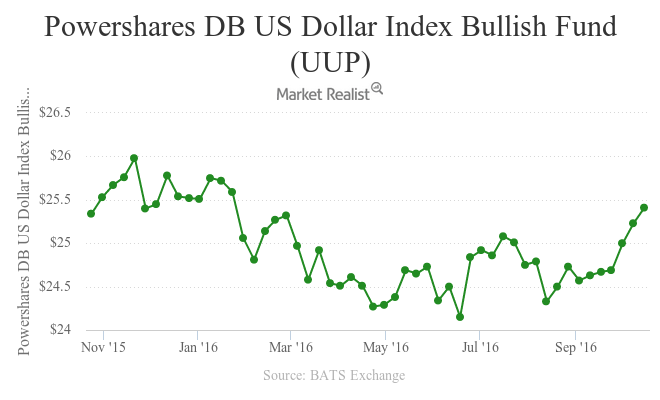

December WTI crude oil futures contracts rose on October 21, 2016, due to expectations of OPEC and Russia reaching an agreement to cap production.

Is Natural Gas Moving with Oil Prices?

The correlation between natural gas (GASL)(GASX)(FCG) active futures with US crude oil active futures was 99.8% between December 12 and December 19.

Is It Worth Risking Long Trades in Oil?

On November 24–December 1, 2017, US crude oil (USO) (USL) January futures fell 1%. On December 1, US crude oil January futures closed at $58.36 per barrel.

What’s Holding US Crude Oil below $60?

On December 11, US crude oil January 2018 futures rose 1.1%. The 2% rise in Brent crude oil prices could have supported the gain in US crude oil prices.

What to Watch when Oil’s at a 3-Year High

From January 5 to January 12, 2018, US crude oil February futures rose 4.7%. On January 12, US crude oil futures closed at $64.3 per barrel, their highest closing price since December 8, 2014.

Why Oil Prices Have Been Relatively Flat

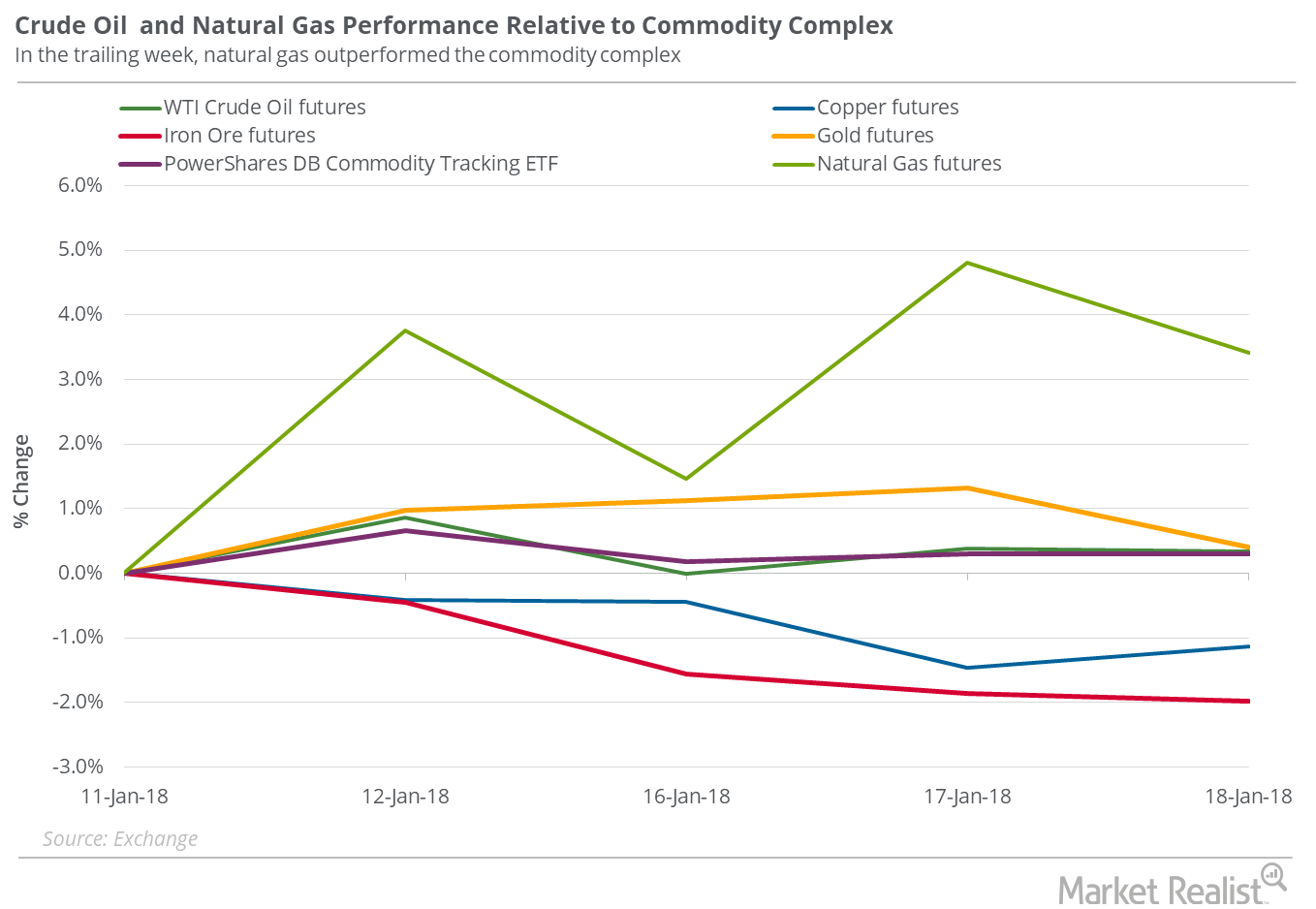

On January 18, 2018, US crude oil (USO) (USL) March 2018 futures were almost unchanged at $63.89 per barrel.

Will Crude Oil Futures and S&P 500 Move in the Same Direction?

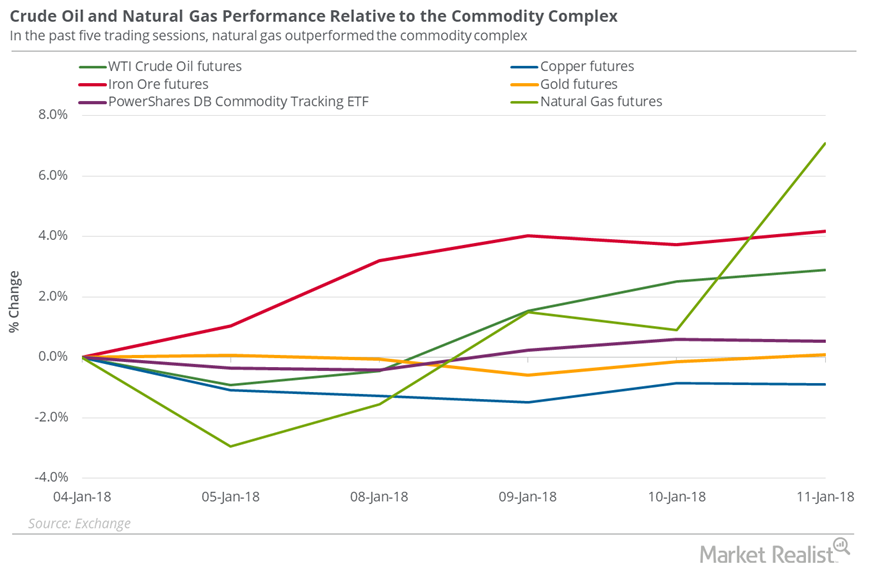

February US crude oil (UWT) (USL) futures contracts rose 0.5% to $61.73 per barrel on January 8. Prices are near the highest level since December 2014.

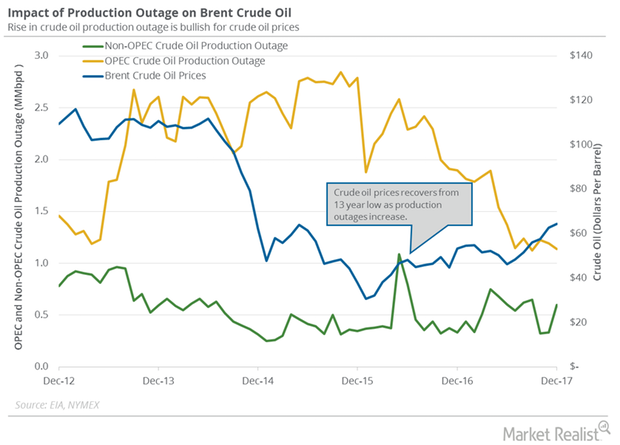

Global Crude Oil Supply Outages Are near a 4-Month High

Global crude oil supply outages increased by 208,000 bpd (barrels per day) to 1,738,000 bpd in December 2017—compared to the previous month.

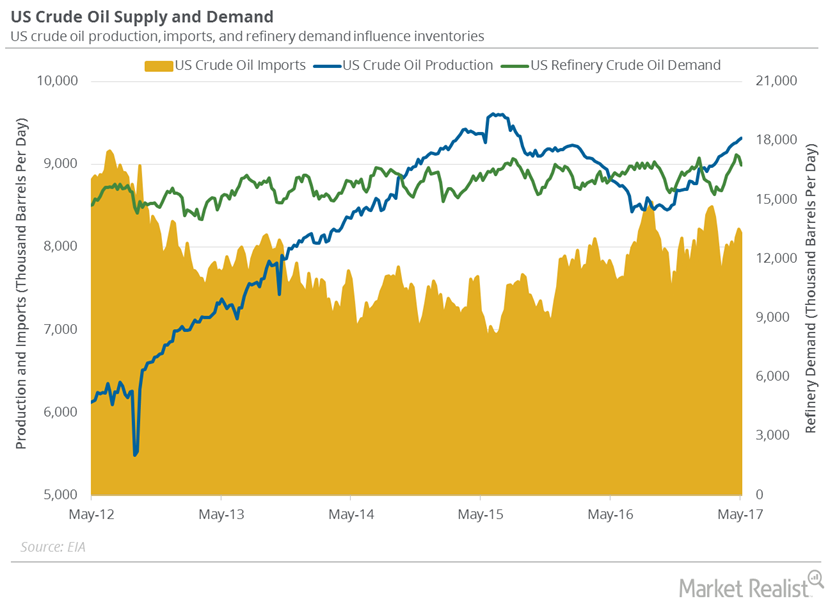

Fall in US Refinery Demand and Imports Impacted Inventories

US refineries operated at 91.5% of their operable capacity in the week ending May 5, 2017. The US refinery demand fell for the second consecutive week.

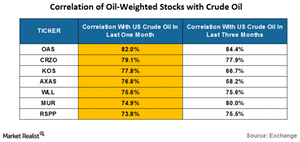

Crude Oil’s Comeback: Analyzing Oil-Weighted Stocks

On August 15, 2016, US crude oil (USO) (OIIL) (USL) (SCO) contracts for September delivery closed at $45.74 per barrel—2.8% above its previous closing price.

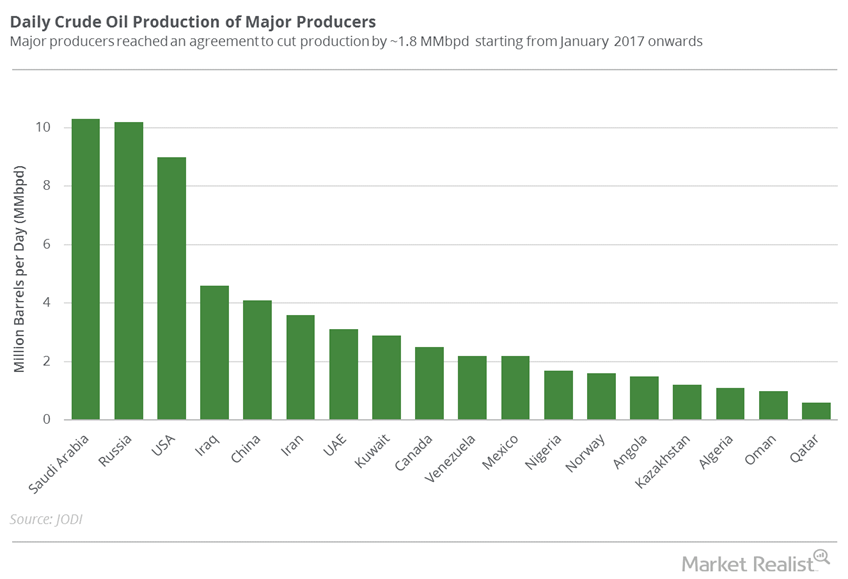

Chart of the Week: Crude Oil Production of Global Majors

Crude oil (OIIL) (DBO) (USL) prices fell on June 5, 2017, due to geopolitical tensions.

A Look at the Rig Count and Natural Gas

On December 15, 2017, the natural gas rig count was 88.6% lower than its record high in 2008.

Why Oil Prices Could Move Higher

On January 12, 2018, US crude oil (USO) (USL) February 2018 futures gained 0.8% and settled at $64.3 per barrel—a three-year high.

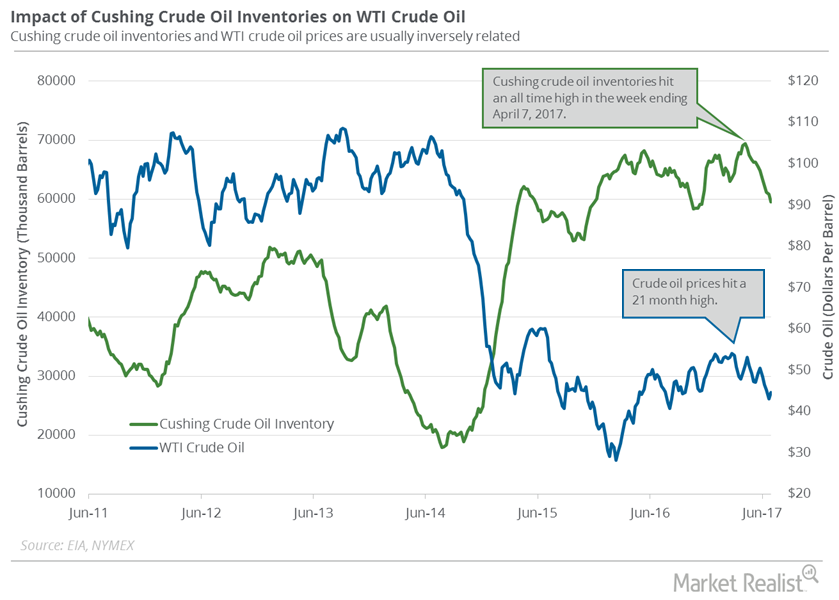

Cushing Inventories: Lowest Level since November 2016

Cushing inventories could have fallen on June 30–July 7, 2017. Crude oil inventories at Cushing have fallen for the seventh straight week.

Will Crude Oil Futures Rise or Fall This Week?

WTI crude oil (SCO) futures settled at $64.30 per barrel on January 12, 2018—the highest level since December 2014.

US Distillate Inventories Rose for the Fourth Straight Week

US distillate inventories rose by 1.1 MMbbls to 152.5 MMbbls on June 9–16, 2017. US distillate inventories rose for the fourth consecutive week.

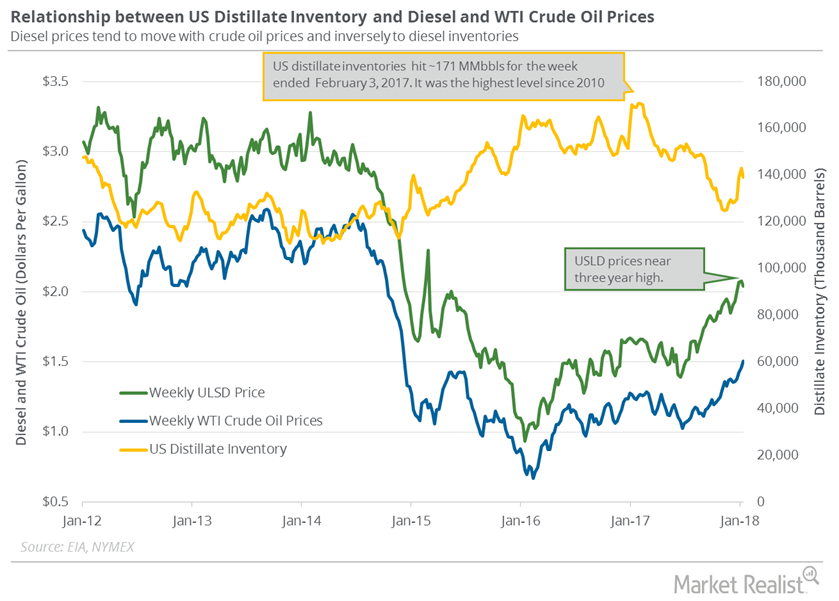

US Distillate Inventories Fell for the Third Time in 10 Weeks

US distillate inventories fell by 3.8 MMbbls or 2.7% to 139.2 MMbbls on January 5–12, 2018. The inventories fell by 29.9 MMbbls or 18% from a year ago.

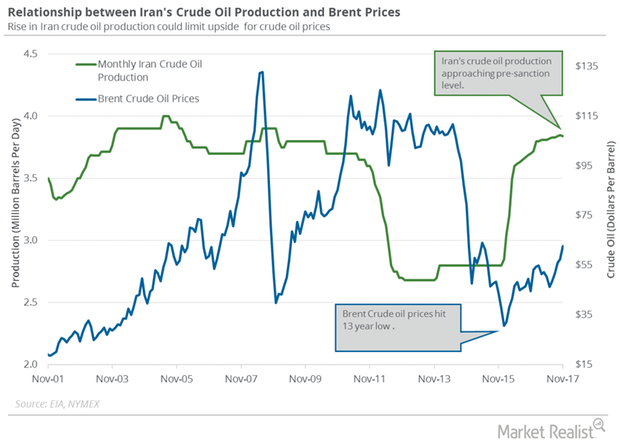

Are Supply Concerns Pushing Oil Higher?

On January 11, 2018, US crude oil’s (USO) (USL) February 2018 futures gained 0.4% and settled at $63.80 per barrel, a new three-year high.

Hedge Funds: Bullish or Bearish on Natural Gas?

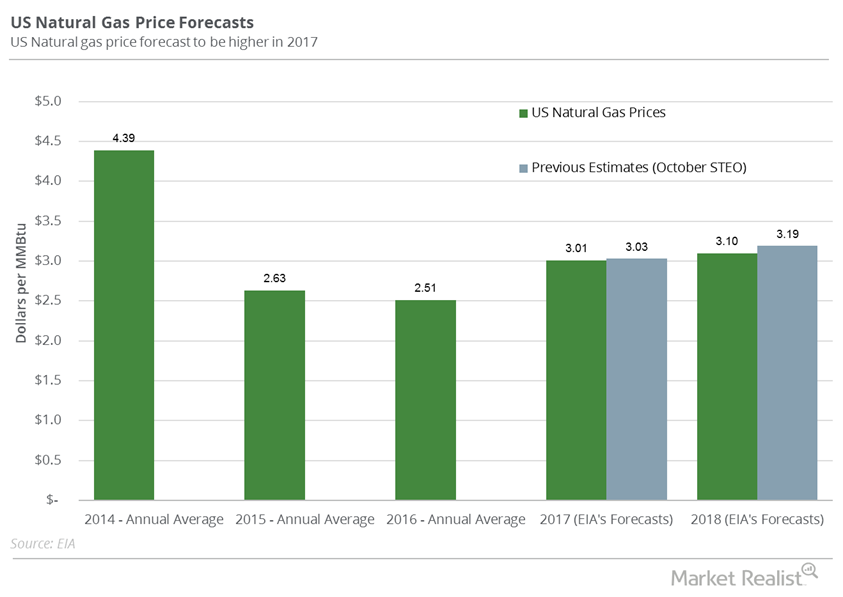

Aegent Energy Advisors predicts that US natural gas prices might not exceed $3.18 per MMBtu by December 2017.

Is Oil Set to Make Record Highs in 2018?

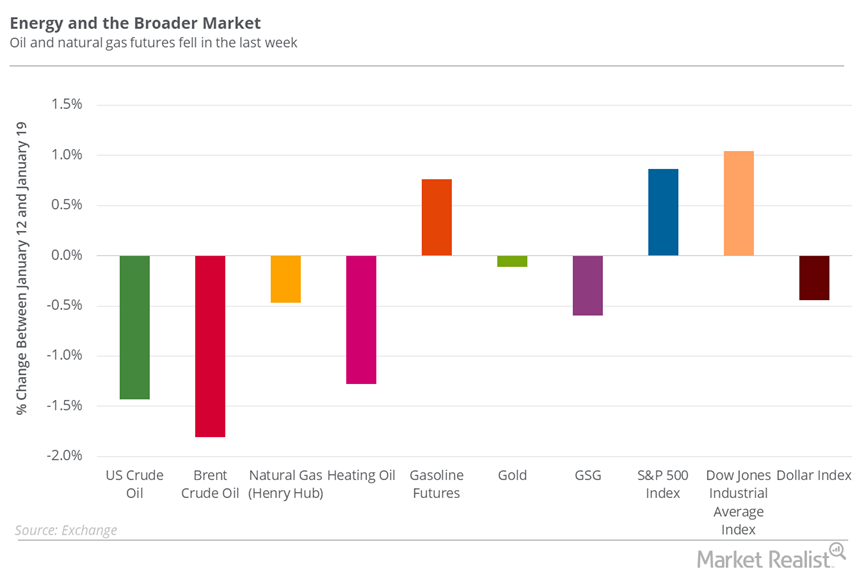

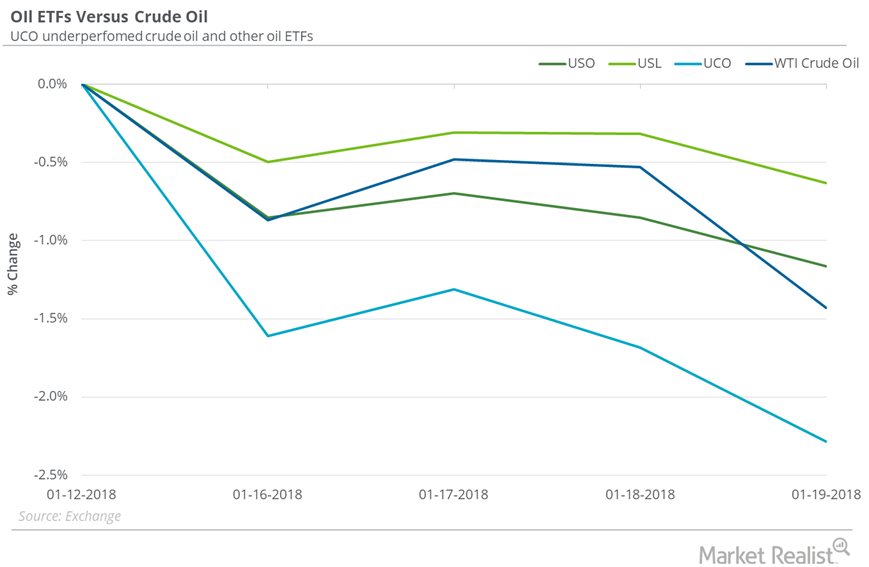

Between January 12 and January 19, 2018, US crude oil (USO) (USL) March futures fell 1.4%.

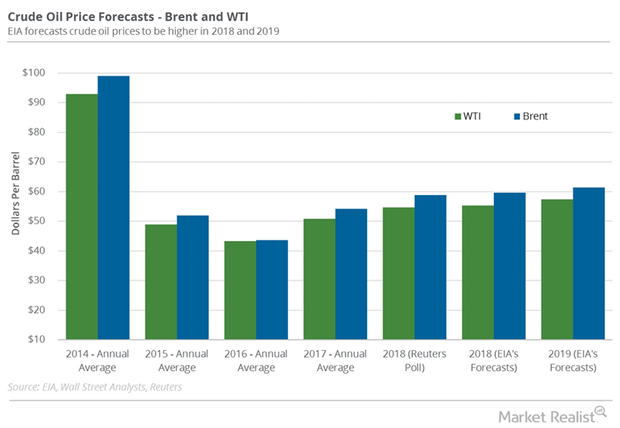

What Could Impact Oil Prices in 2018?

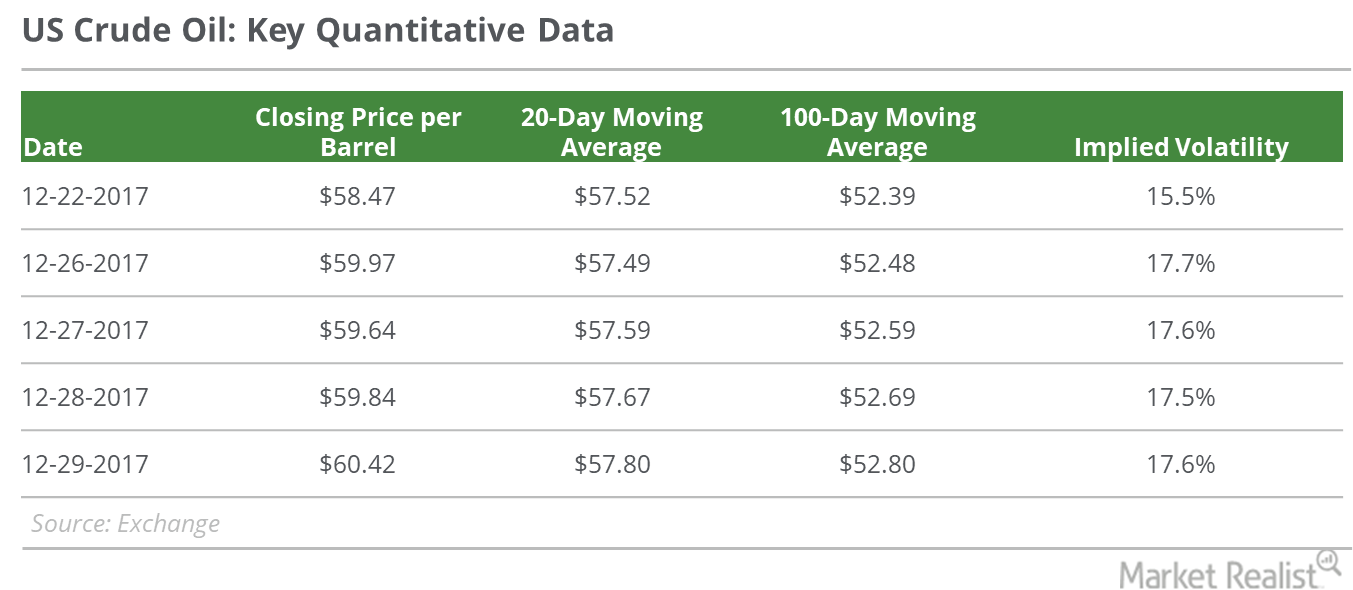

On December 29, 2017, US crude oil’s (USO) (USL) February 2018 futures rose 1% and closed at the 2017 highest closing price of $60.42 per barrel.

Crude Oil Futures: Next Important Resistance Level

WTI crude oil (UCO) futures closed at $62.01 per barrel on January 4, 2018—the highest level since December 2014. WTI prices rose ~12.4% in 2017.

How Closely Is Natural Gas Tracking Oil?

Between November 15 and 22, natural gas (UNG)(FCG) January futures had a correlation of 52.5% with US crude oil January futures.

US Distillate Inventories Fell for the Fourth Time in 5 Weeks

The EIA reported that US distillate inventories fell by 1.9 MMbbls (million barrels) to 149.5 MMbbls on July 14–21, 2017.

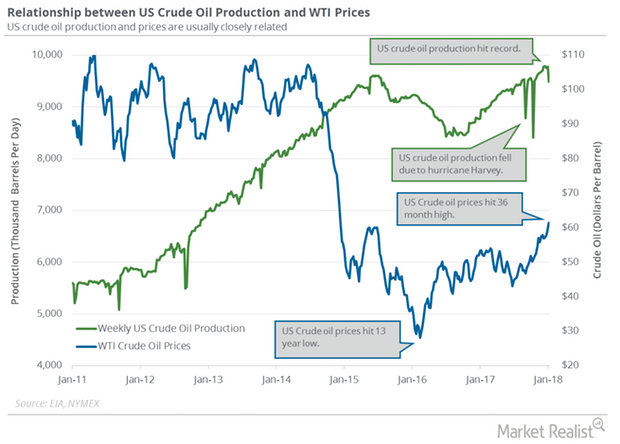

Will US Oil Production Pressure Crude Oil Futures?

February WTI crude oil futures contracts fell 0.9% to $63.73 per barrel on January 16. Brent oil futures fell 1.6% to $69.15 per barrel on the same day.

US Crude Oil Production Fell and Boosted Oil Futures

US crude oil production fell by 290,000 bpd (barrels per day) or 3% to 9,492,000 bpd between December 29, 2017, and January 5, 2018.

Traders Could Start Booking a Profit in Crude Oil Futures

On January 16, 2018, Goldman Sachs said that crude oil prices could exceed its forecast in the coming months.

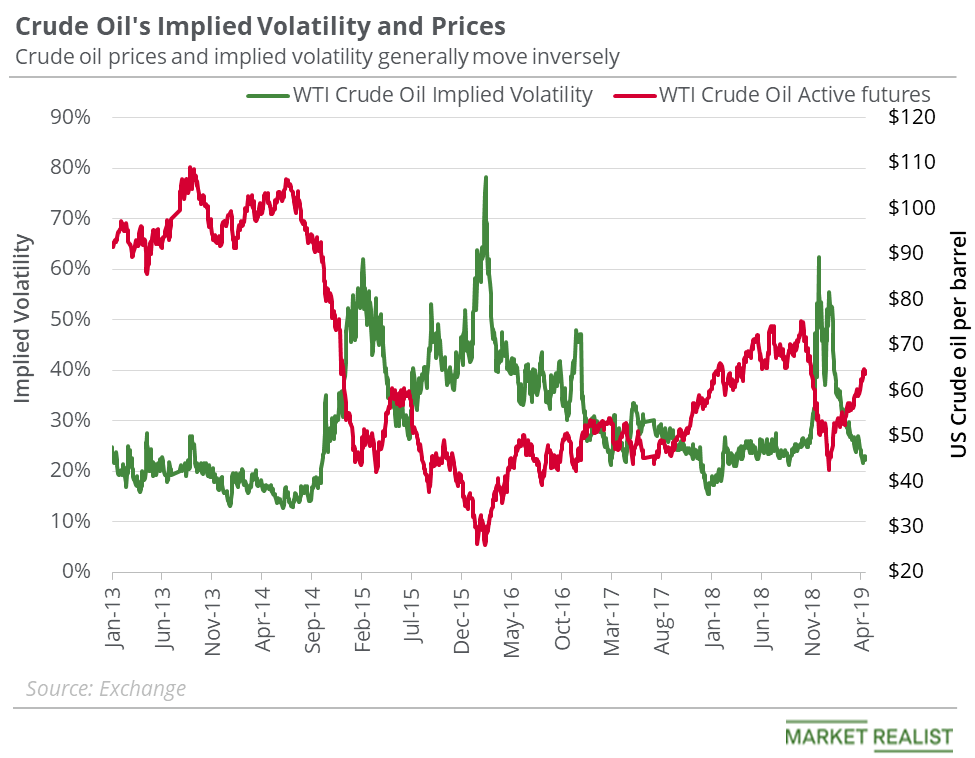

Oil Prices: Implied Volatility Suggests Upside Is Intact

On June 27, US crude oil’s implied volatility was 33.7%—12.7% below its 15-day average. Lower implied volatility might support oil prices.

Crude Oil’s Implied Volatility and Price Forecast

On April 17, US crude oil’s implied volatility was 22.1%, which is 5.5% below its 15-day average.

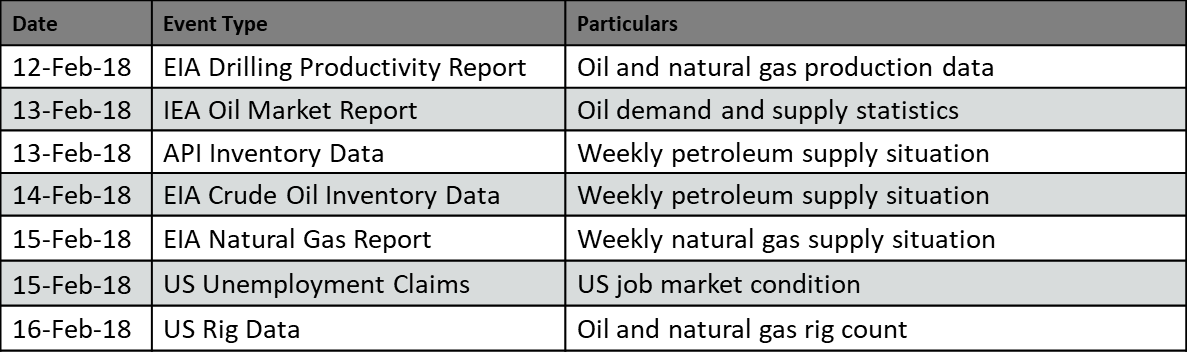

Key Events That Could Steer Oil and Gas Prices This Week

The EIA’s (U.S. Energy Information Administration) Drilling Productivity Report is scheduled for release on February 12, 2018.

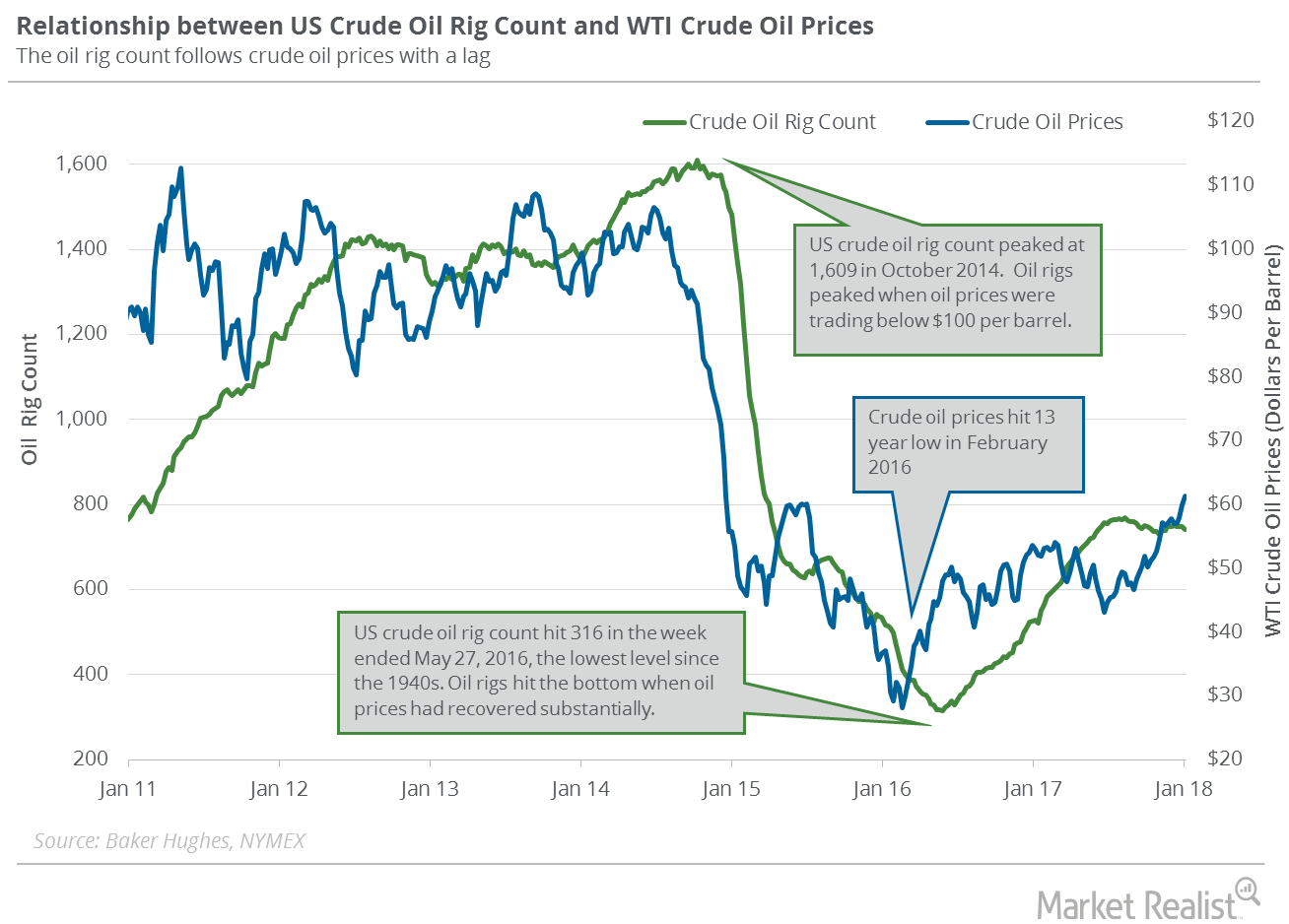

Are US Crude Oil Rigs Indicating a Slowdown in Oil Production?

On January 19, 2018, Baker Hughes released its weekly US crude oil rigs report. US crude oil rigs decreased by five to 747 on January 12–19, 2018.

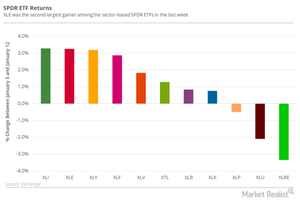

Are Oil ETFs Outperforming Oil?

Between January 12 and January 19, 2018, the United States Oil ETF (USO) fell 1.2%.