iShares 20+ Year Treasury Bond

Latest iShares 20+ Year Treasury Bond News and Updates

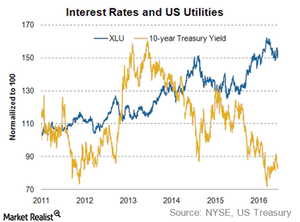

Understanding How Higher Interest Rates Impede Utilities

The near-zero interest rate environment has resulted in a low cost of debt, which has motivated more new debt issuances by utilities.

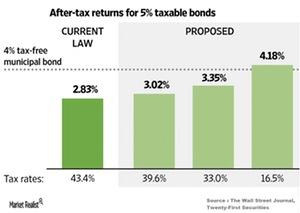

Tax Reform Is Full of Unknowns

President-elect Donald Trump’s tax reforms could bring cheers from taxpayers, but the tax bracket changes may not be well received by muni bond investors.

Richard Bernstein: Be Safe on Your Quest for Safety

After expressing his thoughts on the Baby Boomer generation’s having become risk-averse, Richard Bernstein moved on to the topic of the safety of “safe” investments.

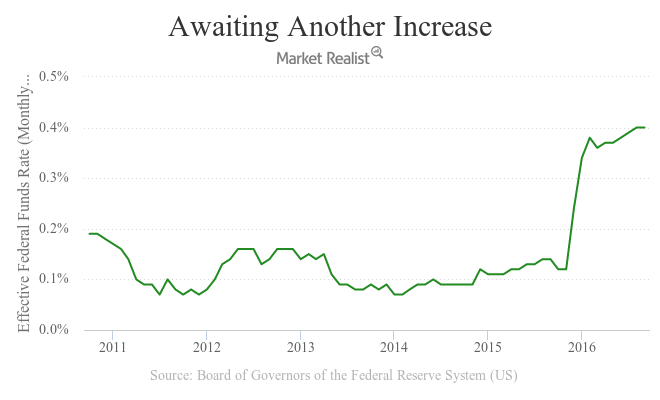

How Delayed Monetary Accommodation Can Cause a Recession

Retracting monetary accommodation on time is crucial as well. This was the chief reason why three dissents took place in the September FOMC.

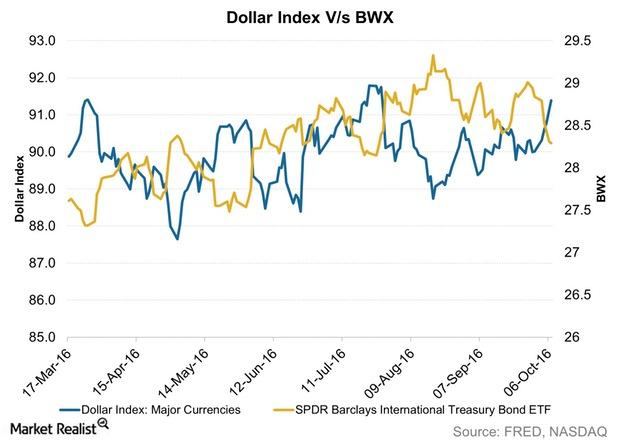

How Does a Strong Dollar Impact International Bonds?

When we talk about the relationship between the US dollar and bonds and how currency movements impact bonds, we’re essentially talking about international bonds.

Why Did Treasury Bonds Record a Fall in Yield?

The yield on US ten-year Treasury securities fell below the 1.6% mark for the first time on September 26, 2016 due to a rise in demand.

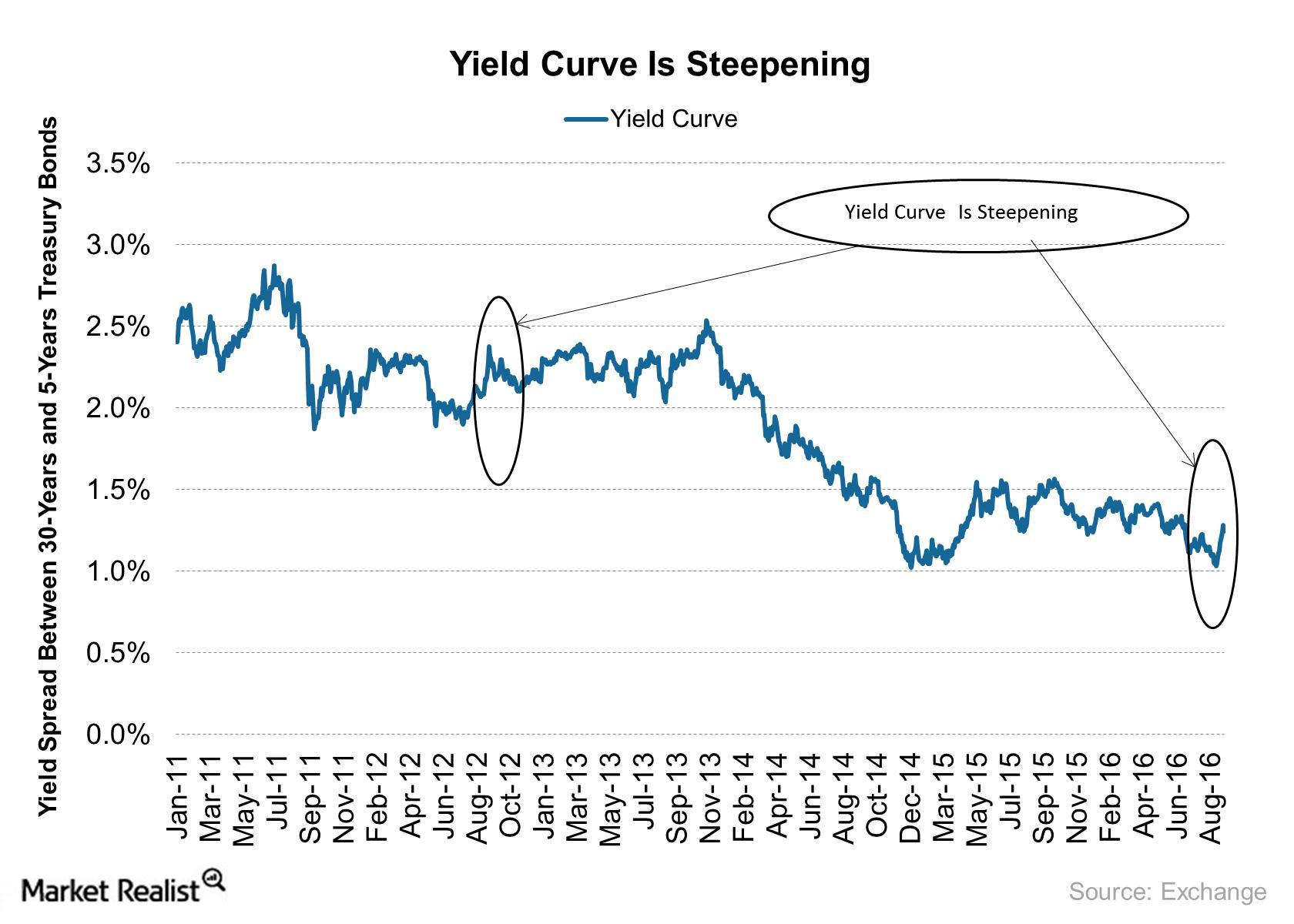

Yield Curve Is Steepening: What Does It Indicate for the Market?

In this series, we’ll compare yields across various developed markets (EFA) (VEA). We’ll also look at how a steepening yield curve affects the financial sector (XLF).

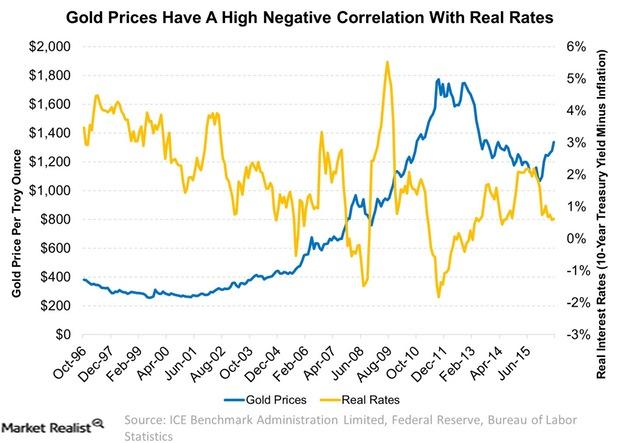

How the Fed’s Shifting Stance on Rates Affects Gold

The Fed’s Shifting Stance on Rates The summer doldrums came late this year for gold and gold stocks. Now that the U.K. Brexit decision is old news, the markets are again obsessed with the Federal Reserve’s (the “Fed”) shifting stance on rate decisions. Although the Fed’s tone had been dovish on rate increases following the […]

How Holding Duration Is Risky during Rising Inflation

Moving on to the fixed income space, the Janus team sees holding duration in portfolios as a risk.

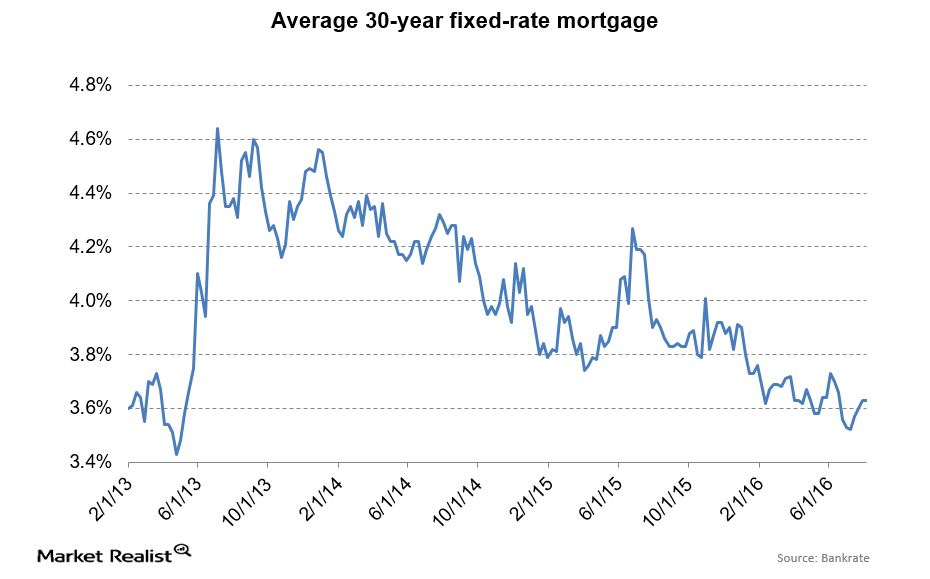

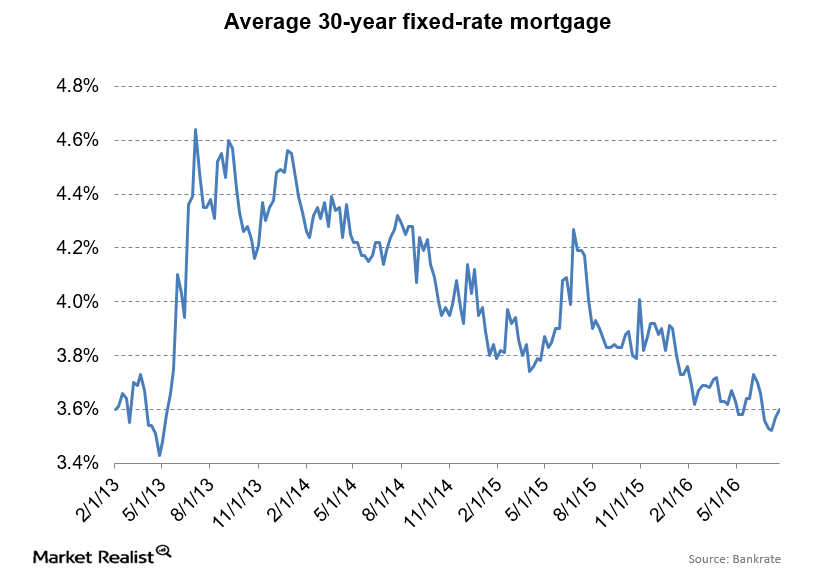

Mortgage Rates Didn’t Move despite a Volatile Bond Market

Lately, mortgage rates and bond yields have shown a weak correlation. Treasury yields have fallen in the past month, while mortgage rates have been steady.

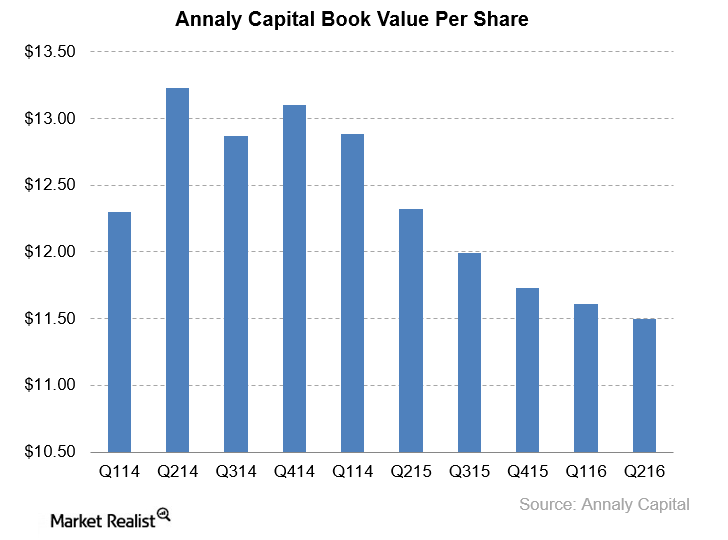

How’s Annaly Capitalizing on Commercial Real Estate?

By investing in commercial real estate, Annaly Capital is increasing its returns. At the same time, it’s taking on credit risk.

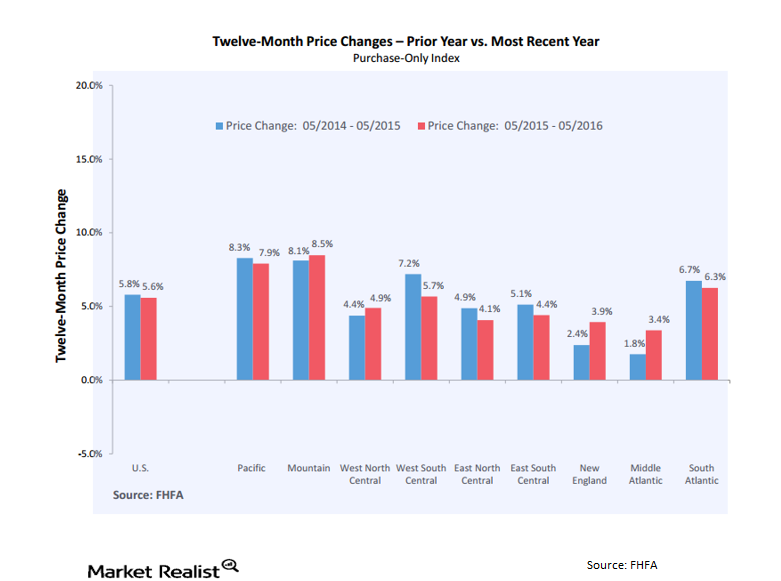

Real Estate Market Hot in the West, Cold in the Northeast

Home prices in the Pacific and Mountain states have outperformed prices in the rest of the country over the past two years.

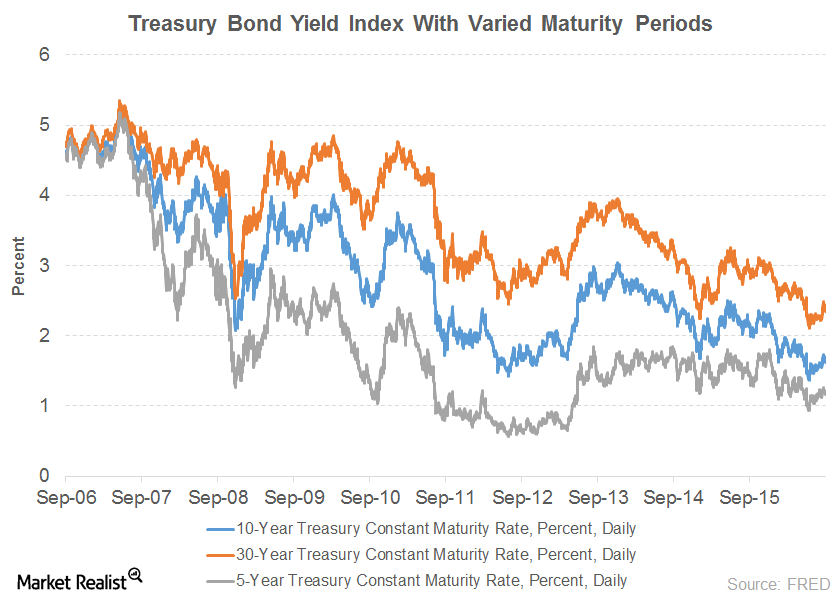

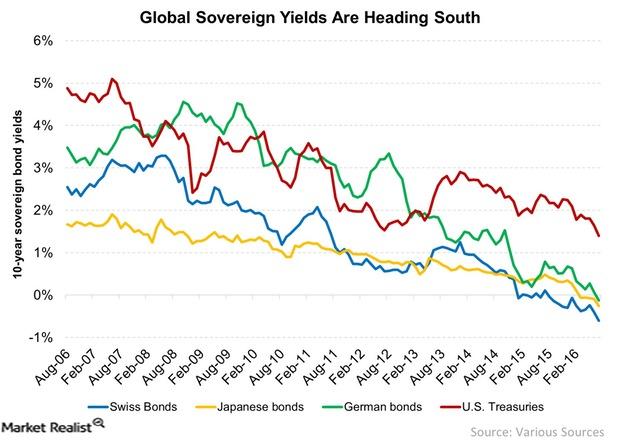

Low Yields: The Reason Lies outside the United States

The reason for low yields lies outside the United States. Global yields have been heading south over the last ten years.

Mortgage Rates Rise with the Bond Market

Lately, mortgage rates and bond yields have shown a weak correlation. Treasury yields have fallen over the past month, while mortgage rates have been steady.

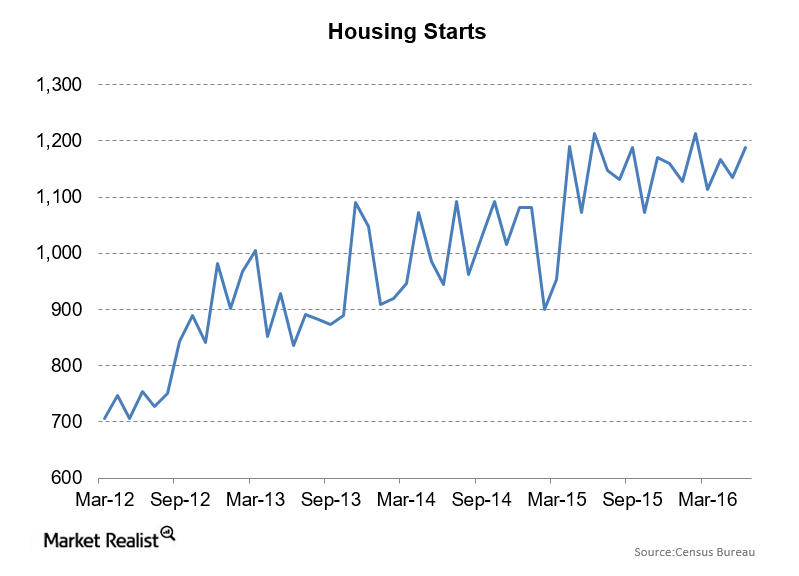

Why Do Housing Starts Remain Muted?

Housing starts and building permits came in around 1.2 million—towards the top end of a narrow range over the past year.

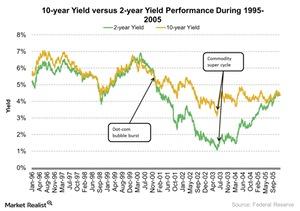

How Might Yields React to a Dot-Com Bubble Situation?

During the 1999–2002 dot-com bubble crisis, the US 2-Year Treasury yield fell by 74%. It made a high of 6.9% in May 2000 and a low of 1.8% in September 2002.

Richard Bernstein Discusses the Risk of Seeking Safety

In his July 2016 Insights newsletter, Richard Bernstein stated, “Safe investments are safe until everyone wants them.”

Yield for Yields! Where Can You Find Yields Today?

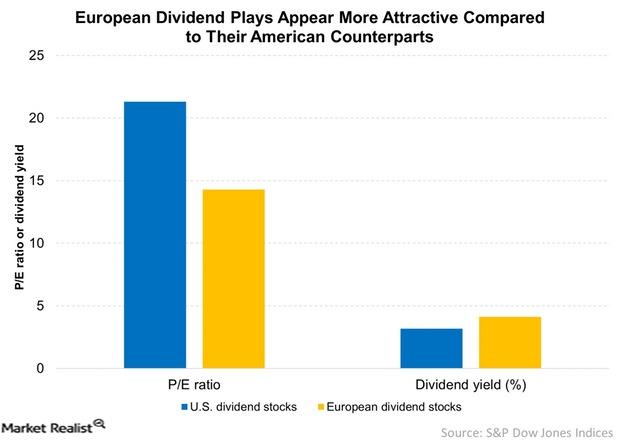

Not only are European stocks cheaper than American ones, they also offer more attractive dividend yields.

How Does a Rate Hike Impact Insurance Stocks?

Interest rates are a key performance driver for life insurance companies, affecting their margins, hedging costs, and product sales.

Why Is the Median Income to Median Home Price Ratio Elevated?

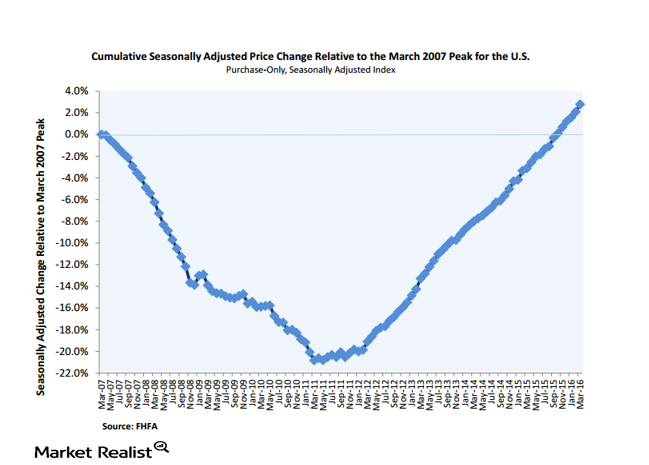

The recent 5.5% year-over-year gain for home prices has put the FHFA House Price Index about 3% above its April 2007 level.

The Effect of an Interest Rate Reversal on Insurance Companies

Interest rates are a key performance driver for life insurance companies. They affect their margins, hedging costs, and product sales.

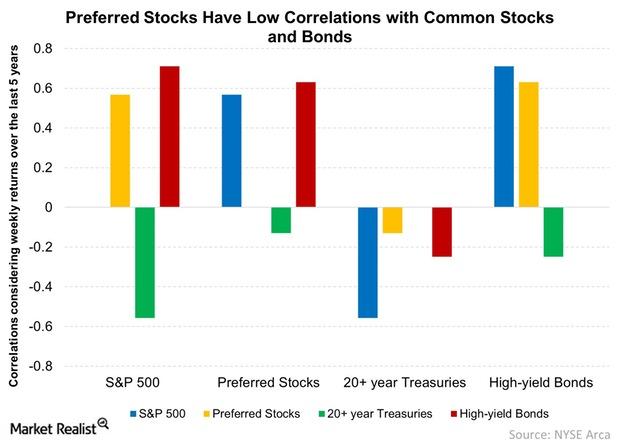

When Are Preferred Shares Appropriate for Your Portfolio?

Treasuries (TLO) add ballast to a stock-centric portfolio while providing low yields.

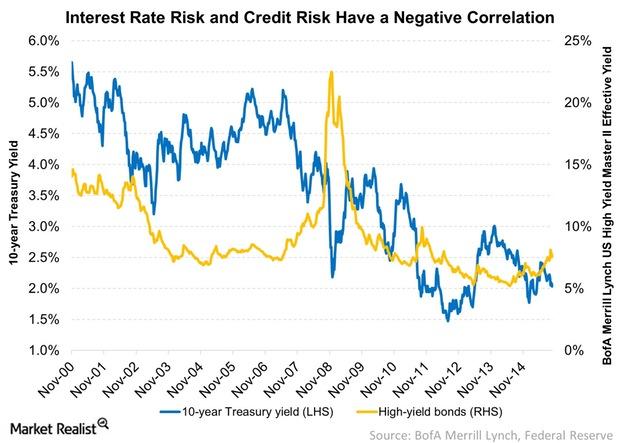

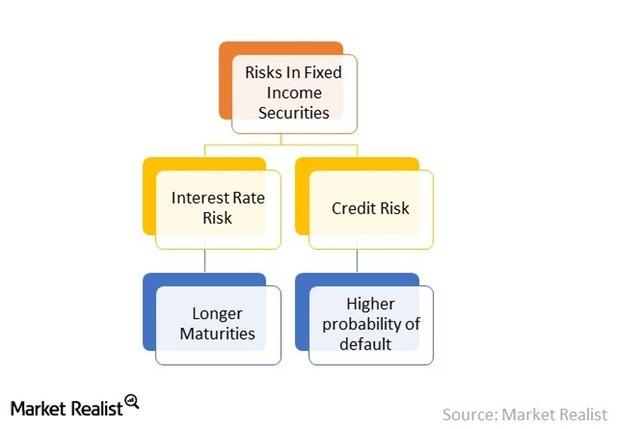

Credit Risk and Interest Rate Risk Have a Negative Correlation

Credit markets tend to improve when the economy is improving. The possibility of a default on corporate bonds (LQD) drops, thus causing their yields to fall.

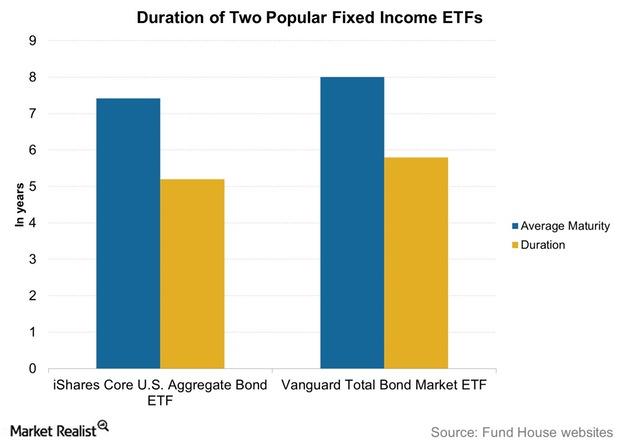

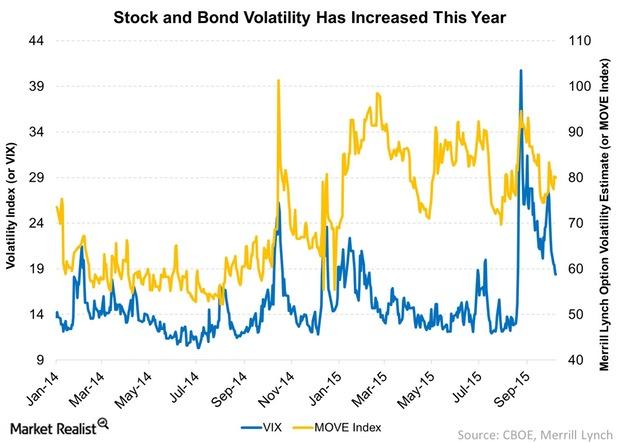

Higher Volatility: You Need to Rethink Your Portfolio Strategy

Higher volatility calls for you to rethink your strategy. After being calm for most of 2014, both bonds (AGG)(BND) and stocks have experienced volatility this year.

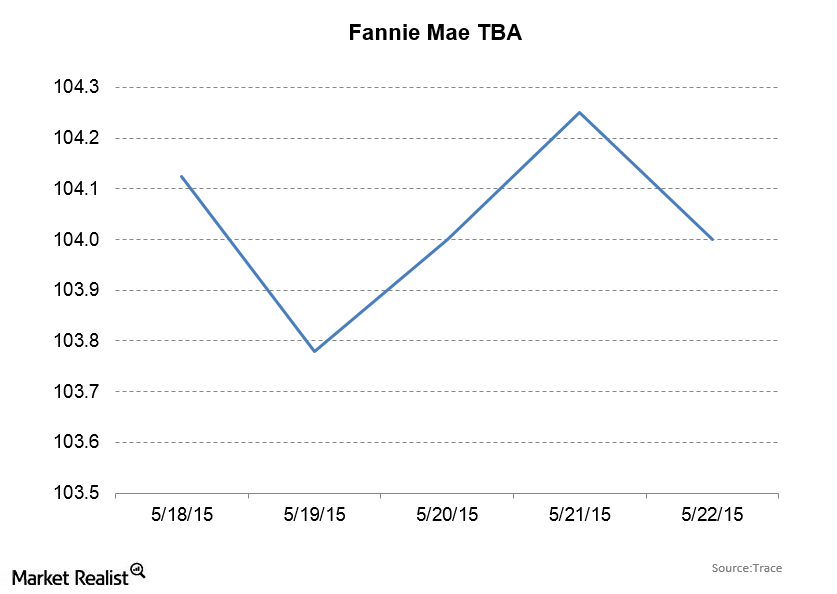

REIT Outlook: Fannie Mae Securities Close at 104 1/32

Fannie Mae TBAs started the week at 104 15/32 and gave up 7/16 to close at 104 1/32. The ten-year bond yield increased by 7 basis points.

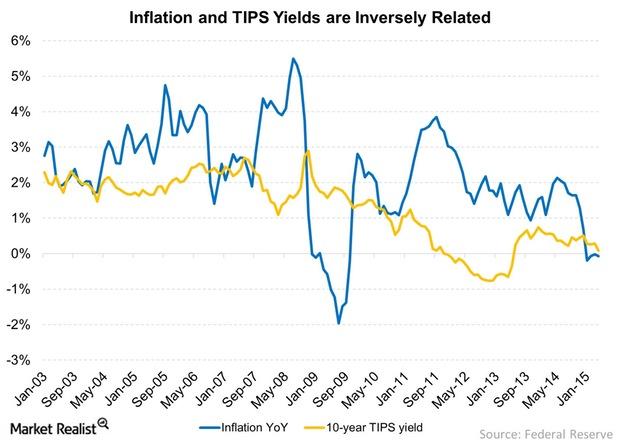

The Impact of Rising Interest Rates on TIPS

With interest rates likely to go up by the end of the year, TIPS with shorter maturities look more attractive.

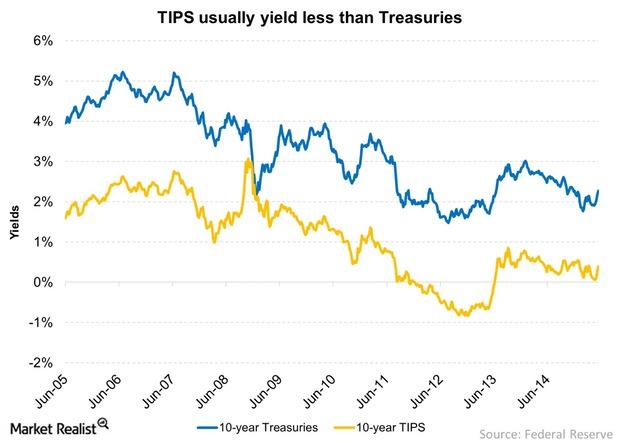

Comparing Treasury Inflation-Protected Securities and Treasuries

Yields on TIPS remain close to 0%, making them unattractive for some. However, considering that inflation rates could go up and remain there, these securities look attractive.

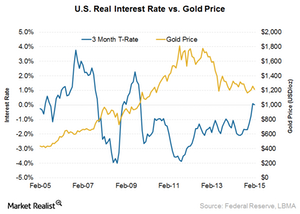

What Do Declining US Real Interest Rates Mean for Gold?

Gold is used as an investment alternative because investors perceive it as a way to protect money’s purchasing power.

The Must-Know Risks of Fixed Income Investing

There are no free lunches. The risks involved in fixed income investing are two-fold.

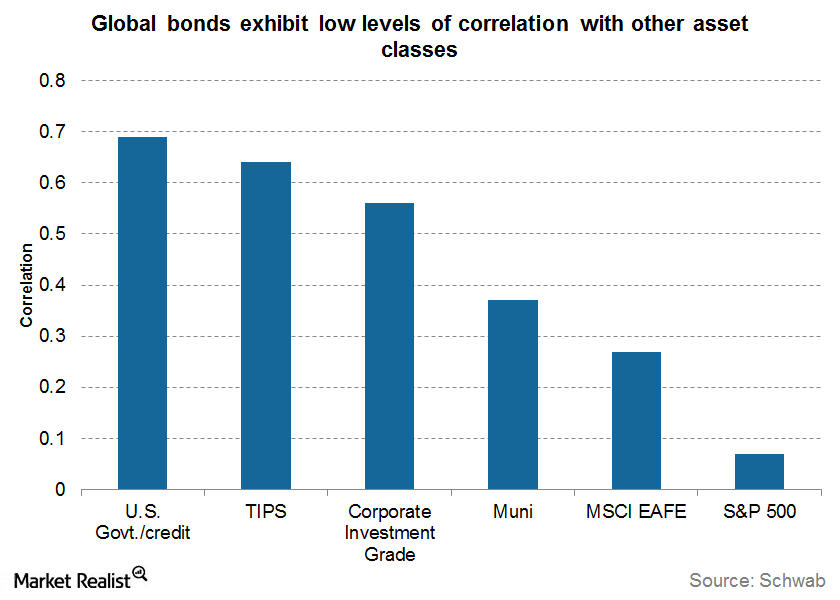

Cushion Volatility With Bonds

High yield bonds are becoming increasingly correlated with the S&P 500 and might increase your risk exposure instead of giving diversification benefits.

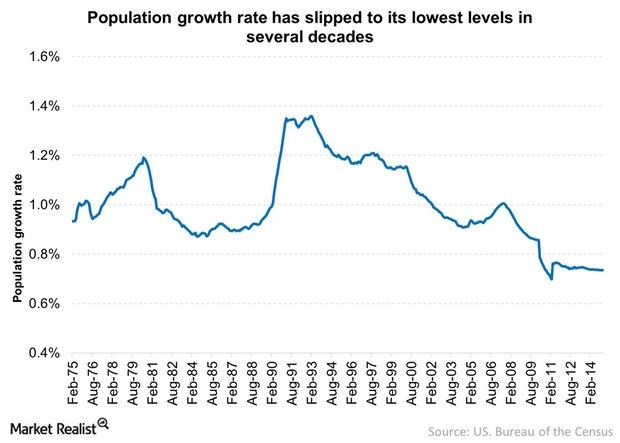

Job Creation Isn’t Matching Population Growth

Job creation isn’t matching population growth. The population growth has been dipping over the last two decades. Currently, it’s 0.7% per year.

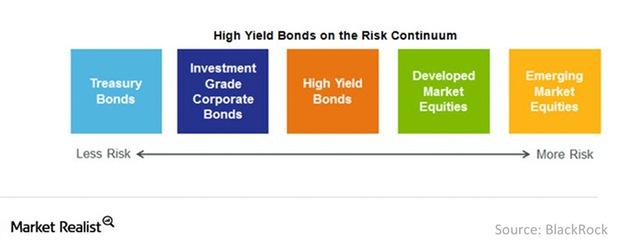

Where Are High Yield Bonds On The Risk Continuum?

High yield bonds (HYG), which are usually issued by mid- and small-cap companies, are considered riskier than investment grade corporate bonds.

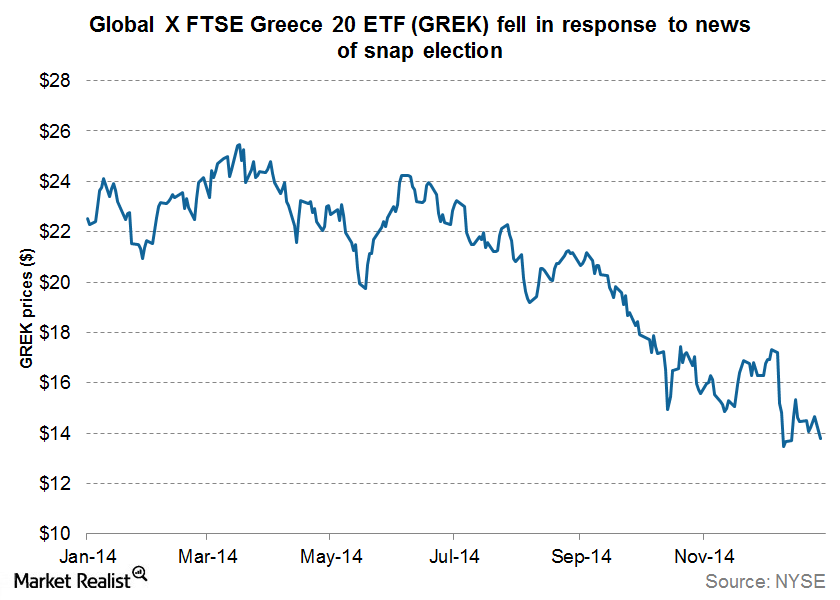

Is Greek Political Instability A Tragedy In The Making?

It’s indeed déjà vu as a fresh round of worry over Greek political instability engulfs the Eurozone (EZU).

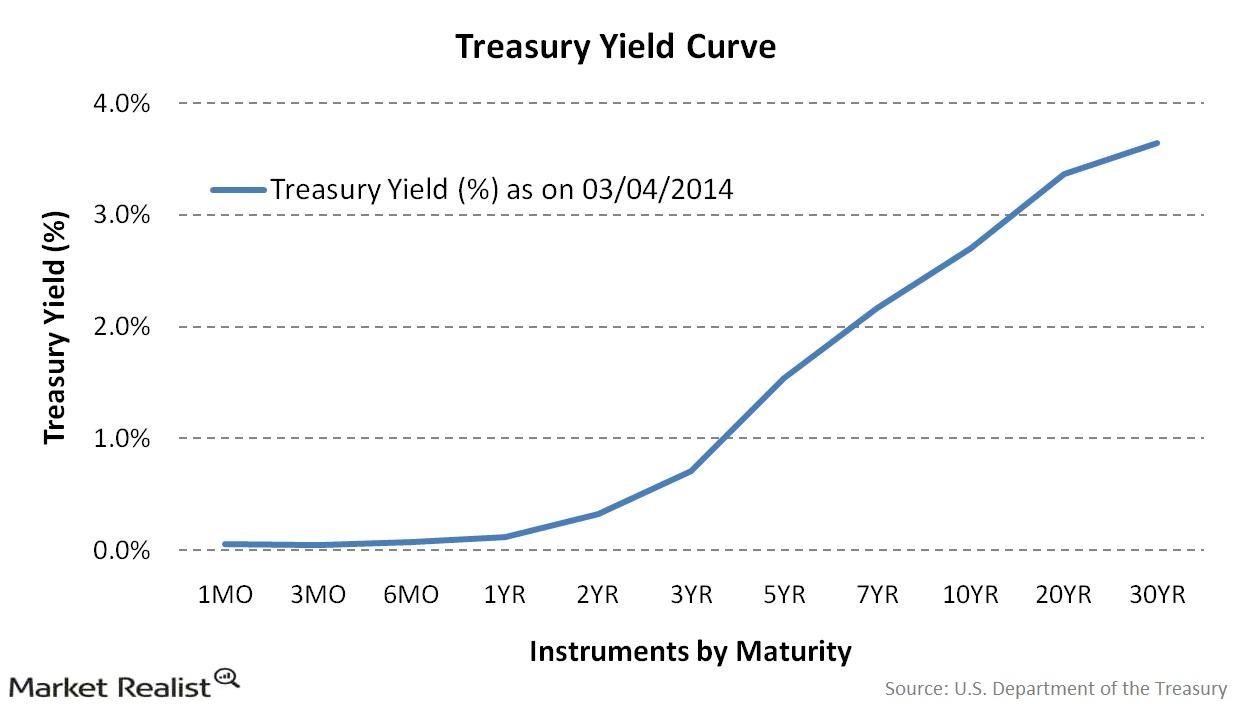

The yield curve: An indicator of the monetary policy implications

Intelligent investors have an opportunity to earn profits and avoid losses, if they understand how the yield curve may move when the Fed acts.