How the Fed’s Shifting Stance on Rates Affects Gold

The Fed’s Shifting Stance on Rates The summer doldrums came late this year for gold and gold stocks. Now that the U.K. Brexit decision is old news, the markets are again obsessed with the Federal Reserve’s (the “Fed”) shifting stance on rate decisions. Although the Fed’s tone had been dovish on rate increases following the […]

Sept. 21 2016, Updated 1:04 p.m. ET

The Fed’s Shifting Stance on Rates

The summer doldrums came late this year for gold and gold stocks. Now that the U.K. Brexit decision is old news, the markets are again obsessed with the Federal Reserve’s (the “Fed”) shifting stance on rate decisions. Although the Fed’s tone had been dovish on rate increases following the August 18 release of the Federal Open Market Committee (or FOMC) minutes from its July 27 meeting, sentiment changed markedly just a week later following the Federal Reserve Bank of Kansas City’s annual symposium in Jackson Hole on August 26.

The selling pressure actually started on August 24 ahead of the Jackson Hole meeting, when unusually heavy selling occurred in the gold futures market. We continue to be amazed (in a negative way) at the inconsistent shifts in the Fed’s guidance, its lack of leadership, and the damage this uncertainty seems to be causing to the economy. A speech by Federal Reserve Chairwoman Janet Yellen, followed by comments in the press by Vice Chairman Stanley Fischer, convinced the markets that a rate increase is now possible at the next Fed meeting on September 21. As a result, the U.S. dollar strengthened while gold, and especially gold shares, took a tumble.

Market Realist – Higher interest rates could be a possible headwind for gold

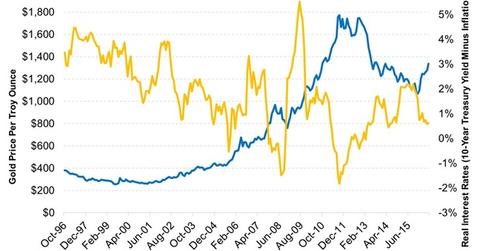

The graph above compares gold (GLD)(OUNZ) prices with real interest rates over the last 20 years. The graph suggests that the two move in opposite directions. Over the last 20 years, the two have had a strongly negative correlation of -0.62.

If interest rates are high, investors prefer to invest in bank deposits or Treasuries (TLT). On the other hand, lower interest rates mean that investors have more of an incentive to invest in gold. Meanwhile, gold is a good hedge against inflation, like other commodities, which is why real interest rates are one of the major drivers of gold prices.

The Fed suddenly became hawkish at the Jackson Hole meeting on August 24, causing gold prices to fall by 2.0%. Although higher interest rates might cause gold prices to fall further, this effect has been taken into consideration. In the next part, we’ll discuss how a Fed rate hike in 2016 might actually support gold prices.