iShares 20+ Year Treasury Bond

Latest iShares 20+ Year Treasury Bond News and Updates

Gundlach Discussed the Fed, Trade Deal, and Gold

Gundlach thinks that we’ve already seen a bottom in interest rates for 2019. US Treasury yields have been hitting lows in 2019.

The Dollar Is Strengthening: How Will It Affect Markets?

The US Dollar Index, which measures the strength of the dollar against a basket of other currencies, has risen 2.2% in the past month.

Can the US-China Trade War Spiral into a Crude Oil War?

Although the US doesn’t export much crude oil to China, the additional supply of cheap Iranian oil could pressure both Brent and WTI crude prices.

Is the Market Worried about an Overheating US Economy?

Federal Reserve Chair Jerome Powell’s speech did little to assuage investors’ concerns regarding the overheating of the US economy.

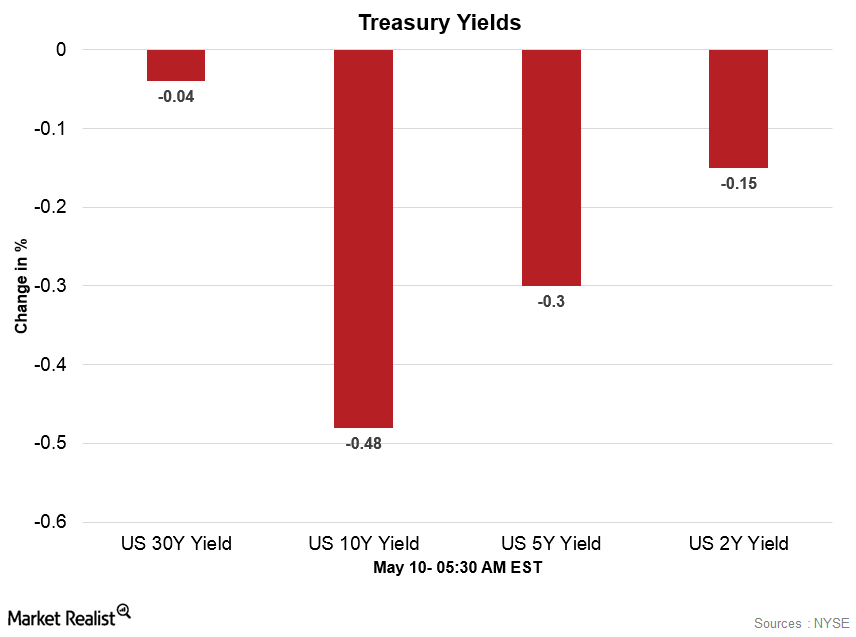

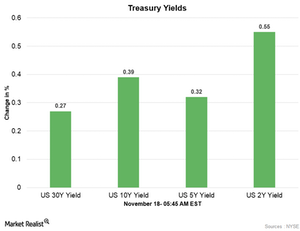

US Dollar Index and Treasury Yields in the Early Hours

The US Dollar Index started Thursday on a mixed note and traded with weakness in the early hours.

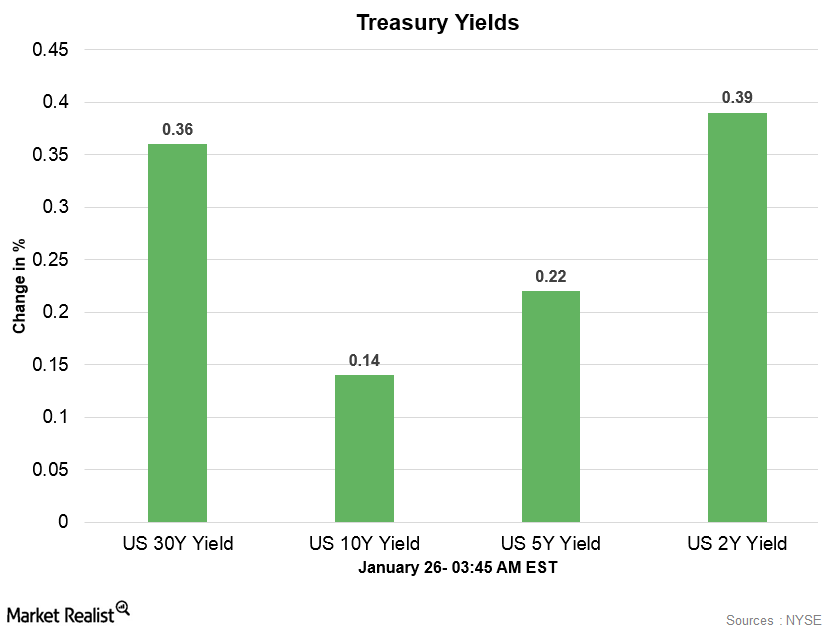

US Dollar Index and Treasury Yields Early on January 26

The US Dollar Index started this week on a weaker note. At 3:35 AM EST on January 26, the US Dollar Index was trading at 88.83—a drop of 0.62%.

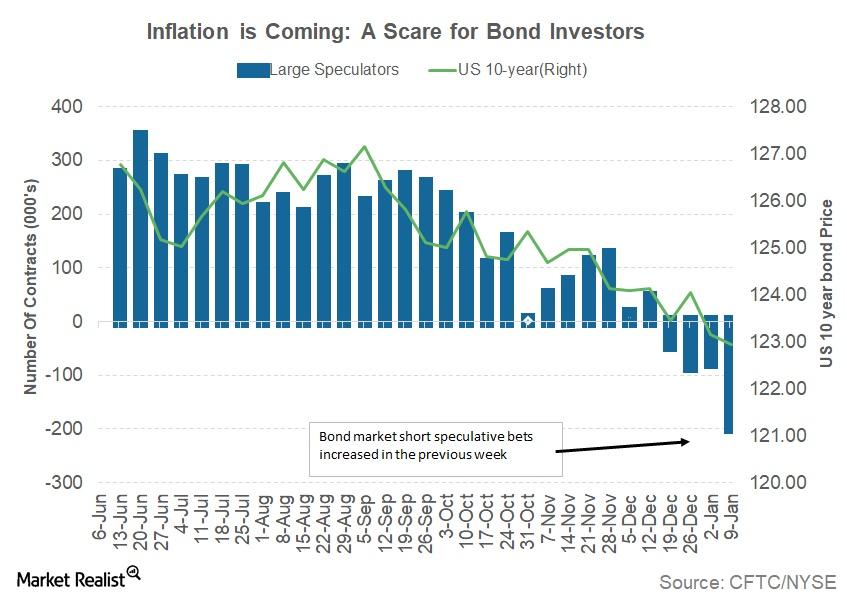

Why Bill Miller Thinks Bond Bull Market May Be Coming to an End

Bill Miller said, “Bonds, in my opinion, have entered a bear market, but one that is likely to be benign for the next year or so.”

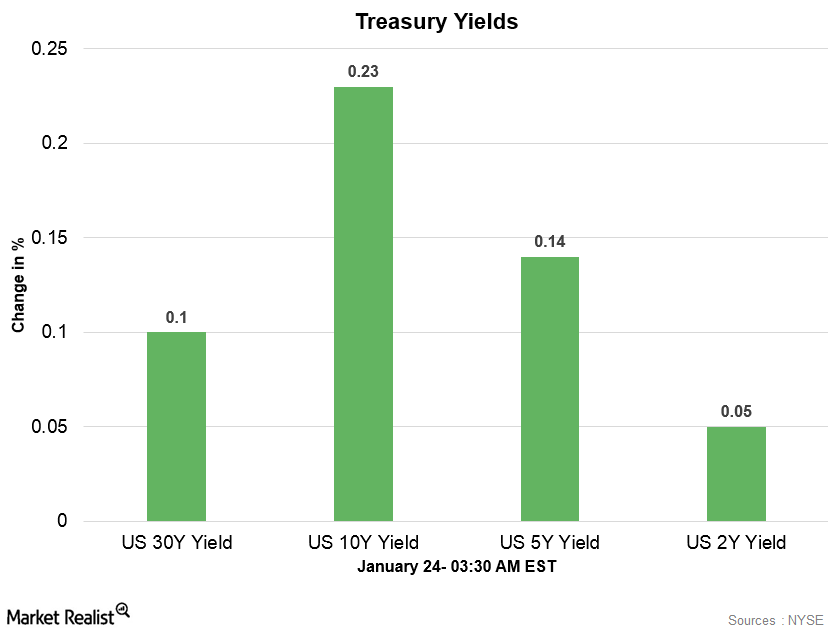

US Dollar Index and Treasury Yields Are Mixed in the Early Hours

On January 24, 2018, the US Dollar Index opened the day lower and traded at fresh three-year low price levels in the early hours.

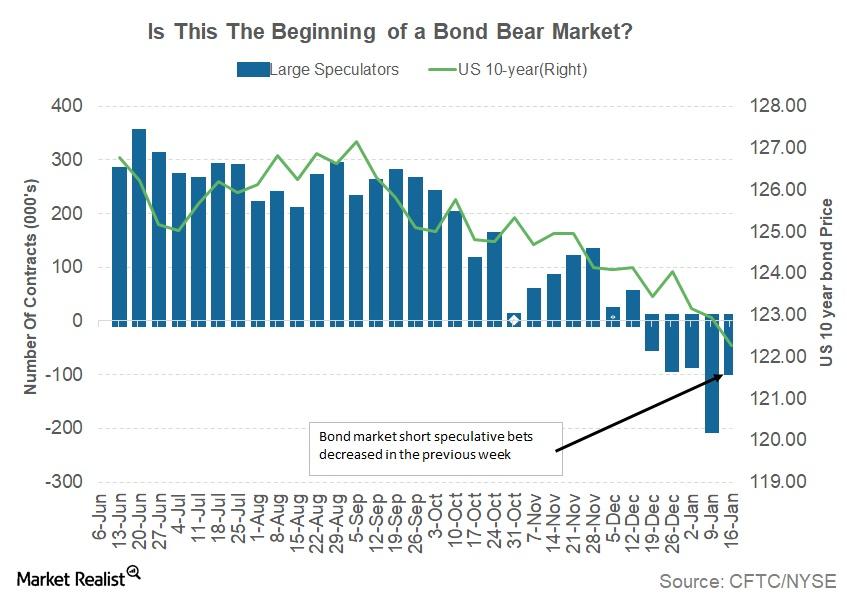

Are Bond Yields Set to Move Higher this Week?

The US Treasury is not able to issue any more debt until the debt ceiling is raised, which could increase the volatility in the bond markets.

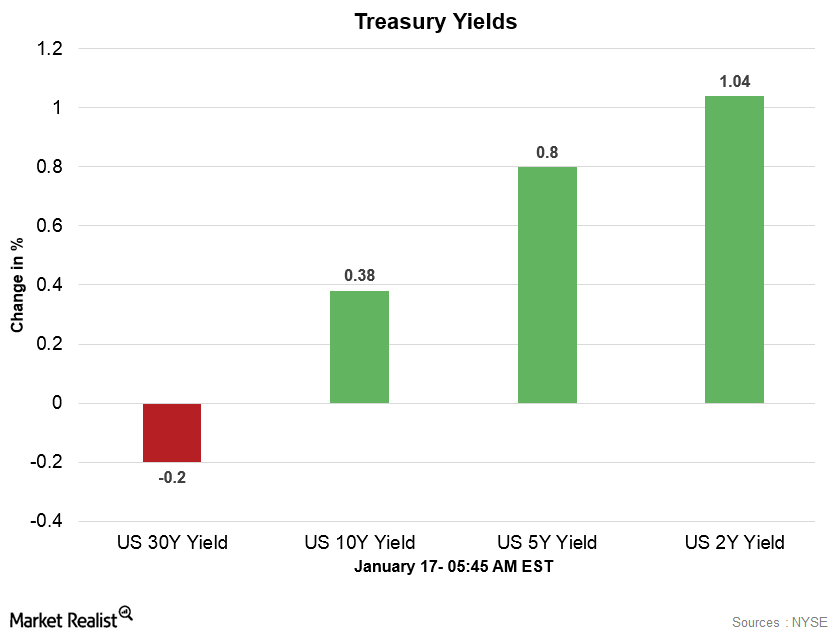

US Dollar Index and Treasury Yields on January 17

The US Dollar Index is trading above opening prices with stability. At 5:30 AM EST on January 17, the US Dollar Index was trading at 90.6.

Why the US Bond Market Moved Lower Last Week

The core CPI of 0.3% pushed the annual number up by 0.1% to 1.8%.

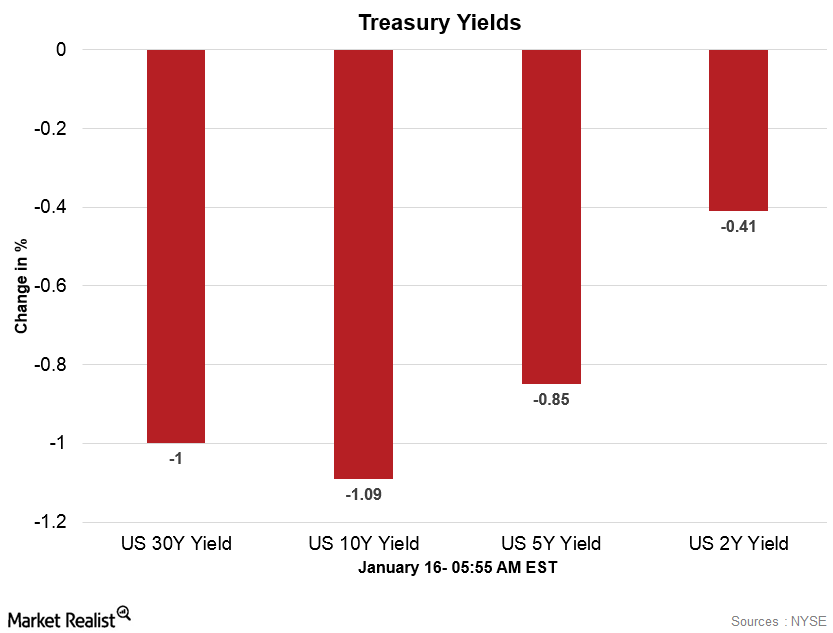

US Dollar Index Regained Strength Early on January 16

After falling for four consecutive trading weeks, the US Dollar Index started this week on a weaker note by falling to three-year low price levels.

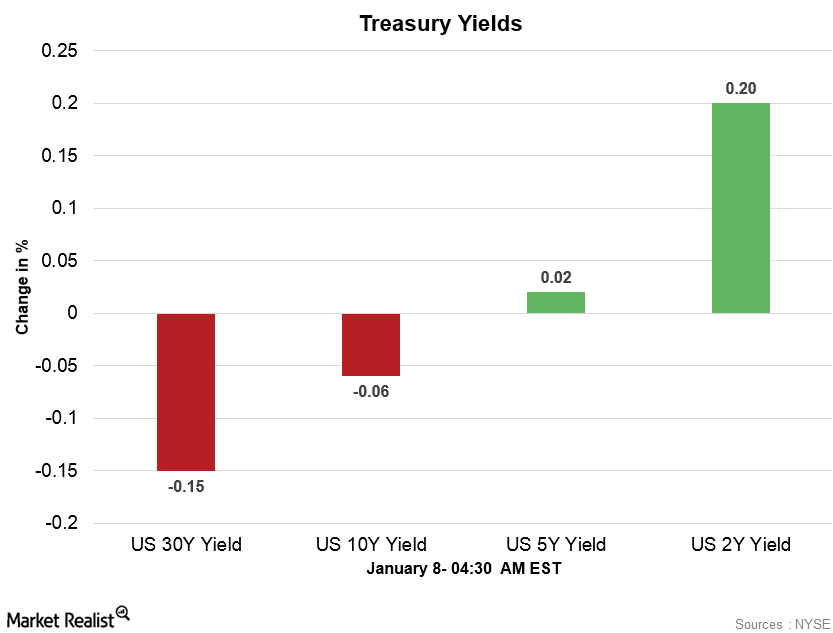

US Dollar Index and Treasury Yields Early on January 8

The US Dollar Index opened January 8 on a stronger note and traded at one-week high price levels in the early hours.

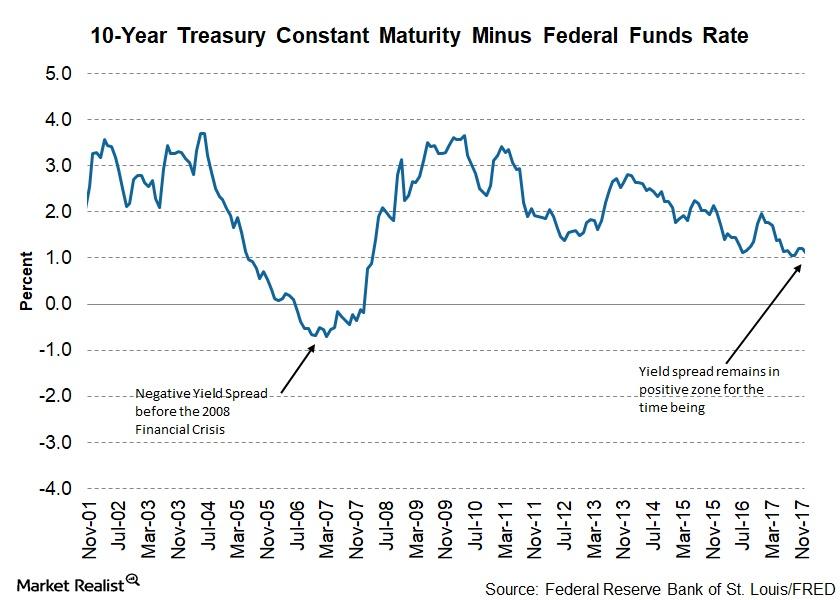

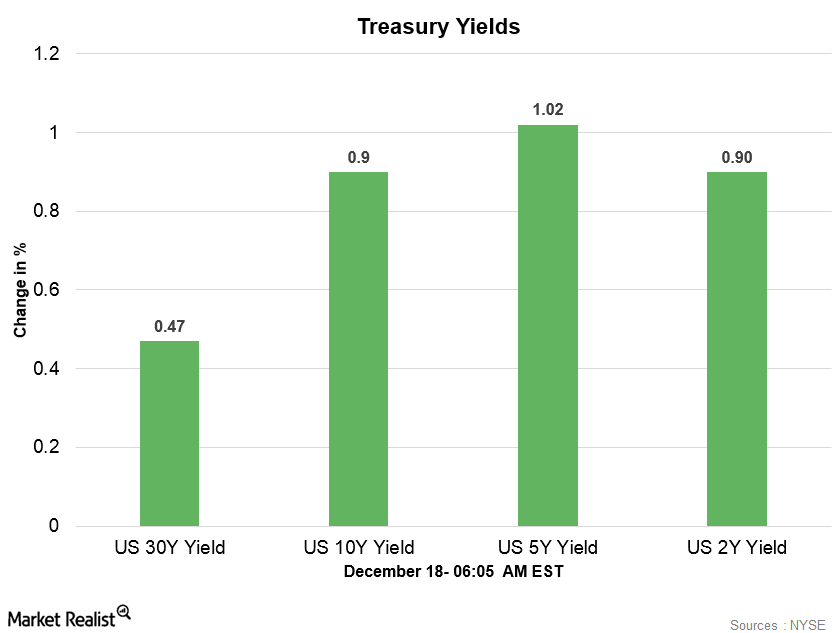

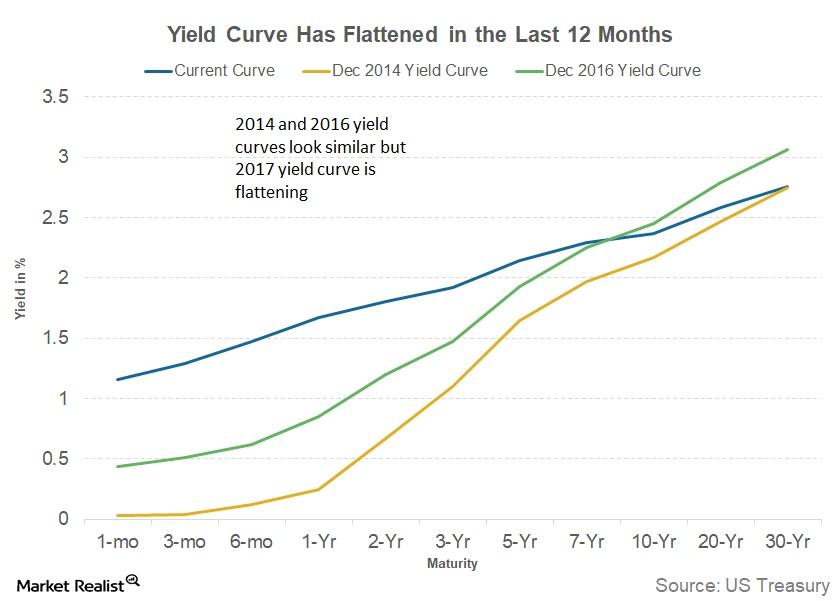

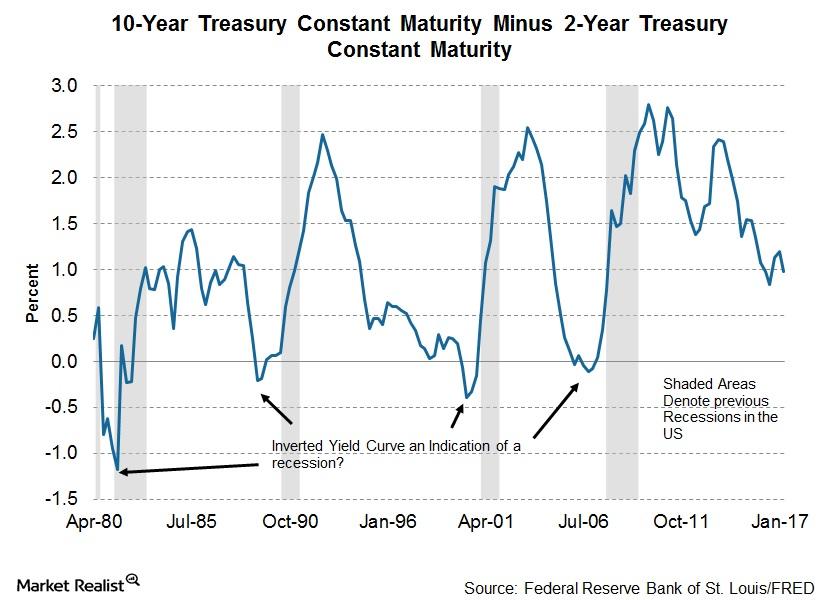

Analyzing the Yield Curve’s Ongoing Flatness

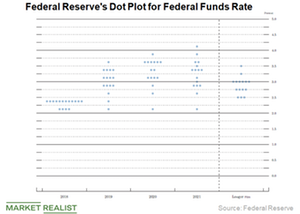

A December rate hike and a flattening yield curve The Fed rolled out another rate hike at its final meeting of 2017. The target range for the federal funds rate was increased by 0.25% to 1.25%–1.50%, and the Fed has signaled three more rate hikes in 2018. Two members dissented to the rate hike due to lower […]

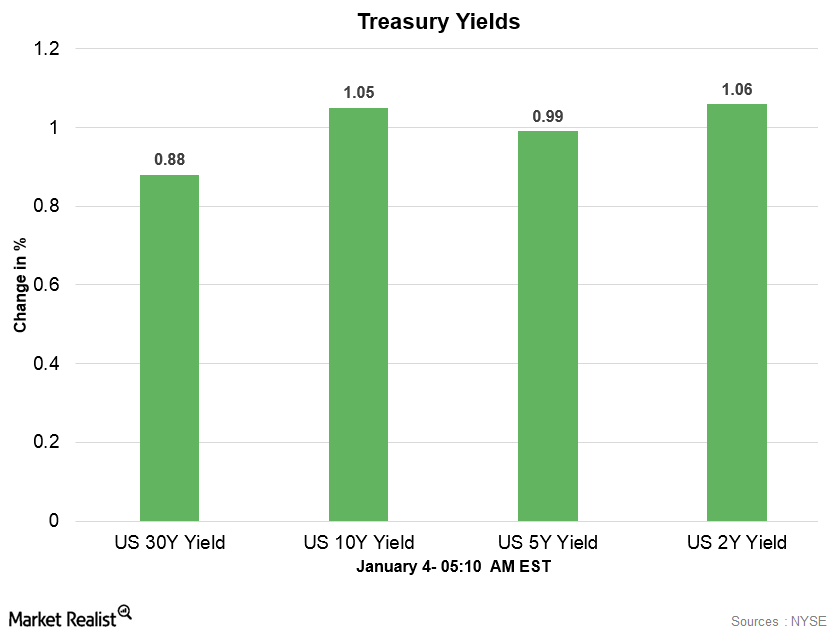

US Dollar Index and Treasury Yields Early on January 4

After falling for two consecutive trading weeks, the US Dollar Index started this week on a weaker note and traded with mixed sentiment.

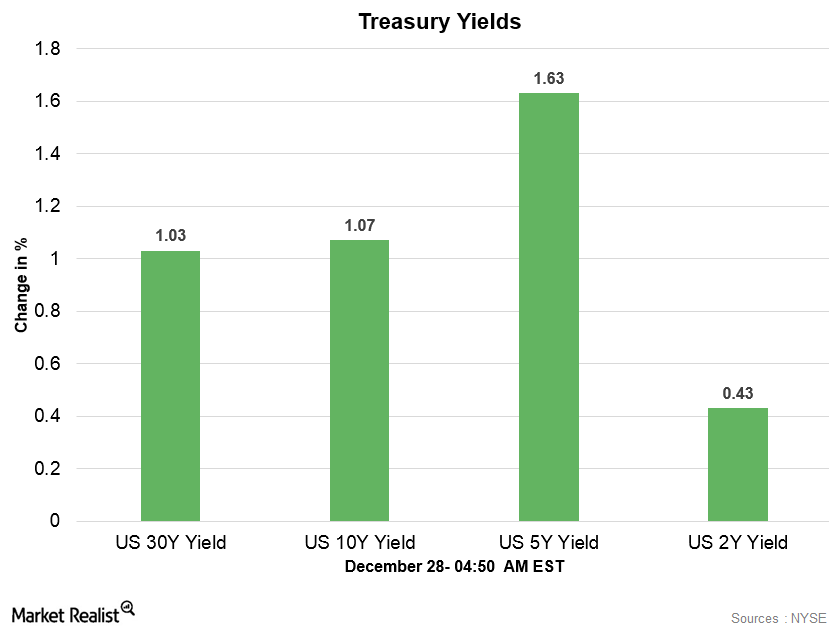

How the US Dollar Index and Treasury Yields Performed on December 28

The US Dollar Index broke its three-week-long gaining steak this week and fell to three-week low price levels on Wednesday.

US Dollar Index and Treasury Yields Are Stable in the Early Hours

After gaining for three trading weeks, the US Dollar Index started this week on a weaker note and fell in the first four trading days of the week.

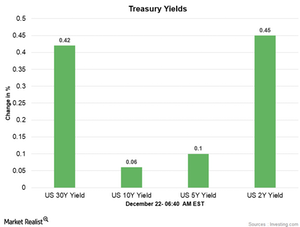

US Dollar Index and Treasury Yields Rose in the Early Hours

After gaining for three consecutive trading weeks, the US Dollar Index started this week on a mixed note.

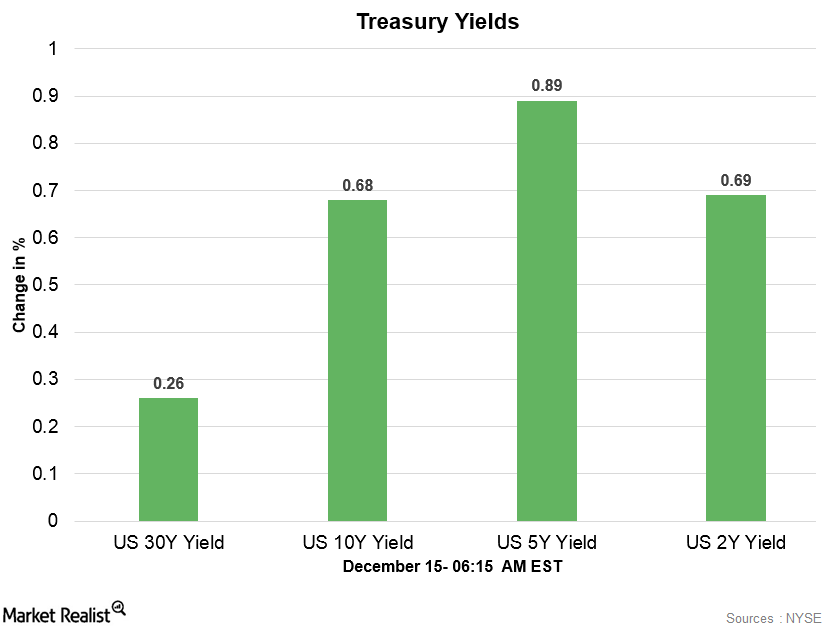

US Dollar Index is Weak in the Early Hours on December 15

The US Dollar Index traded with strength for two weeks and started this week on a mixed note amid the dented market sentiment.

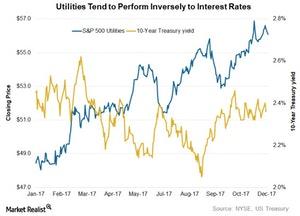

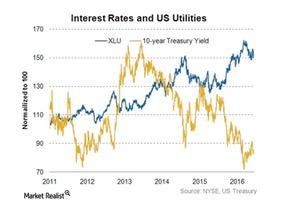

Utilities Tend to Have Inverse Relationship with Interest Rates

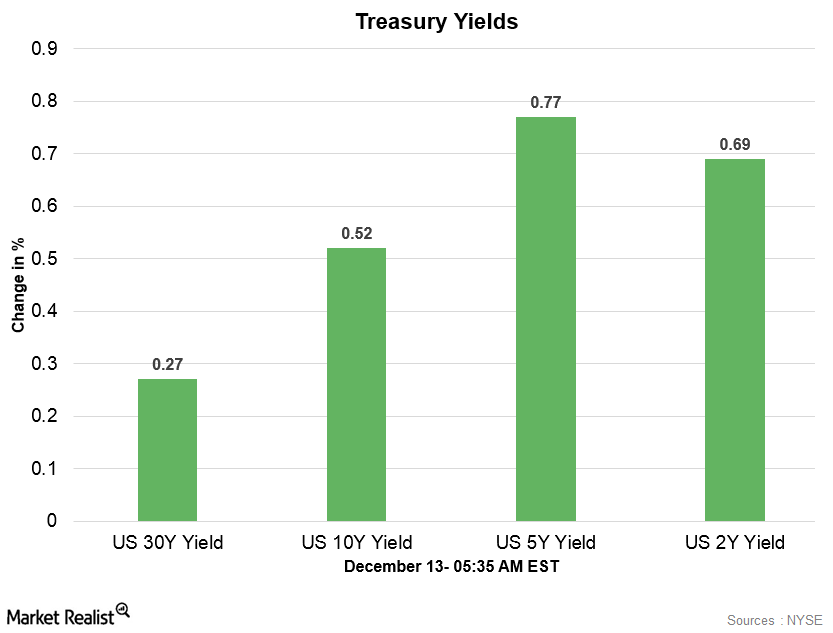

On December 13, 2017, ten-year Treasury yields fell to 2.4%. The ten-year Treasury yields (TLT) reported a yearly high of 2.6% prior to the first rate hike in March 2017.

US Dollar Index Is Weak Early on December 13

In the early hours on Wednesday, the US Dollar Index is weak and trading below the opening prices. At 3:50 AM EST, it was trading at 94—a fall of 0.11%.

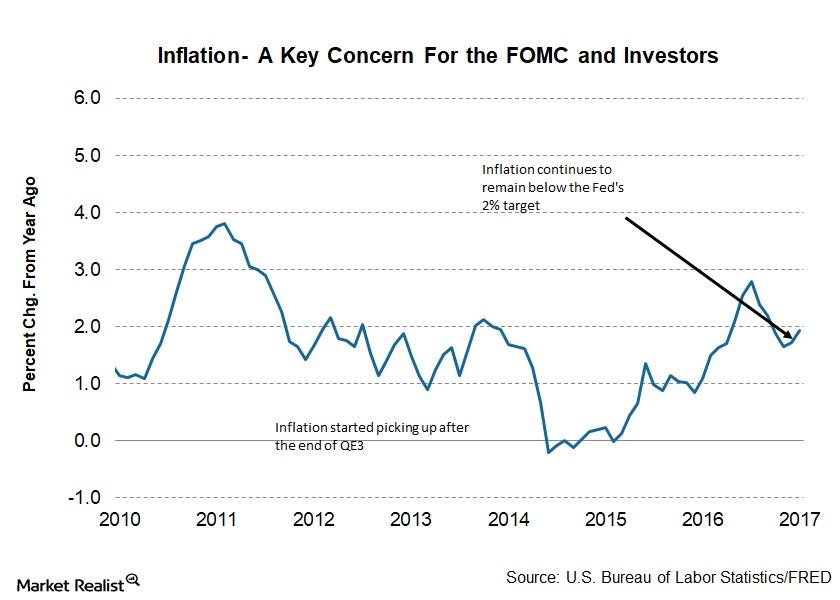

The Primary Cause of Yield Curve Flattening

Interest rates and inflation The pace of interest rate hikes and inflation rate growth have a profound influence on the US yield curve. The US Fed has been communicating its intent to increase interest rates from the current ultra-low level to a target rate of 2.5% over the next few years. The conditions required for […]

What Leads to Yield Curves Flattening

Factors leading to yield curves flattening There are multiple factors that can affect the shape of yield curves. Bonds (BND) with different maturities react differently to changes in economic conditions and expectations. For example, when the US Fed announces an interest rate hike, short-term bonds (SHY), which are to the left side of a yield curve, react […]

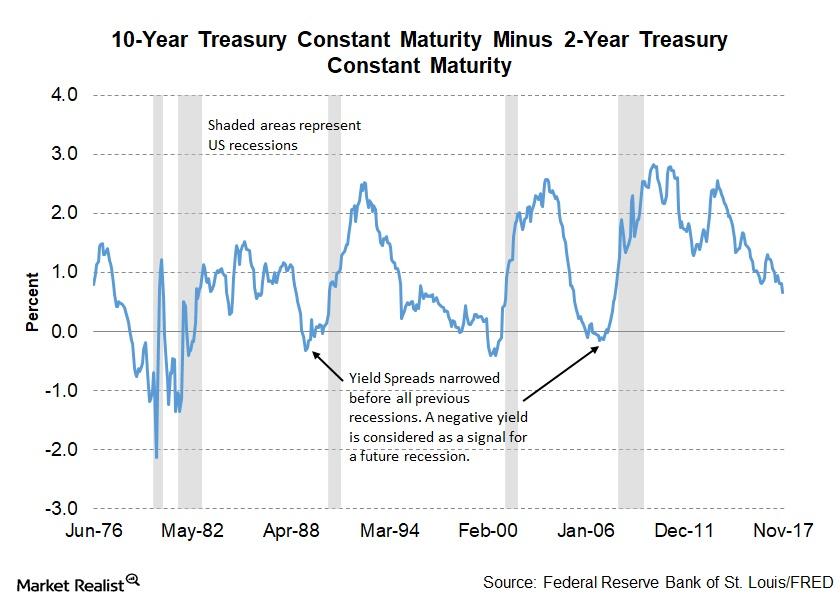

Assessing the Risk of a Flattening Yield Curve

St. Louis Fed president and CEO James Bullard gave a presentation at a regional economic briefing on December 1. Throughout this series, we’ll analyze Bullard’s take on the risks of an inverted yield curve.

US Dollar Index and Treasury Yields Are Stable

The US Dollar Index started this week on a stronger note by rebounding on Monday. The US Dollar Index opened Tuesday on a stable note.

US Dollar Index and Treasury Yields Are Strong

The US Dollar Index broke its three-week losing streak last week and regained stability. The US Dollar Index opened higher on Monday.

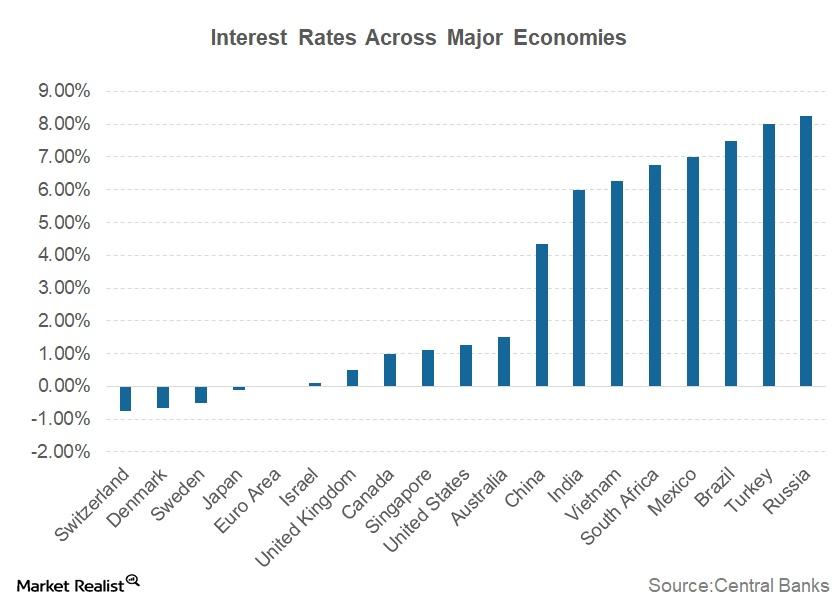

The Problem with the Current Interest Rates

With global economies progressing toward normalcy or the “new normal,” as Williams called it, central banks are moving toward normalizing policy by signaling interest rate hikes.

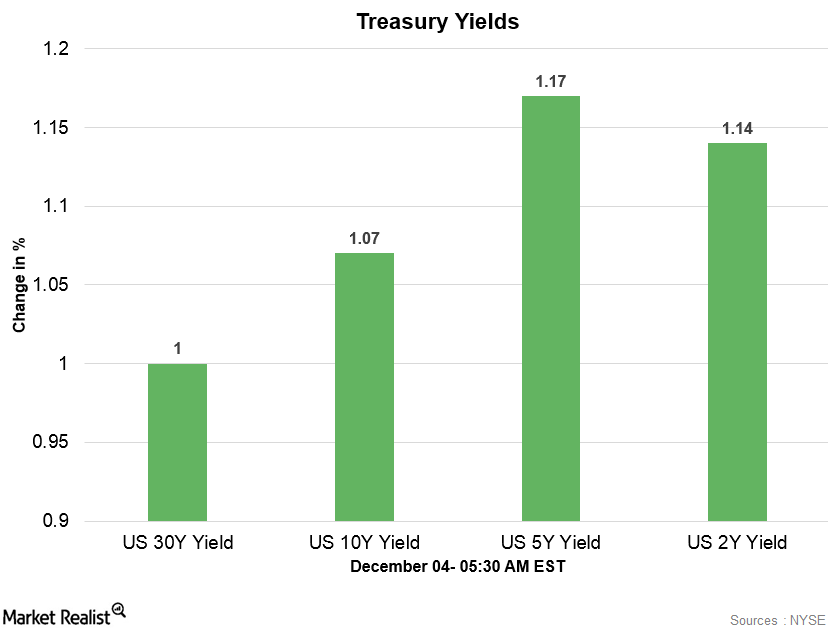

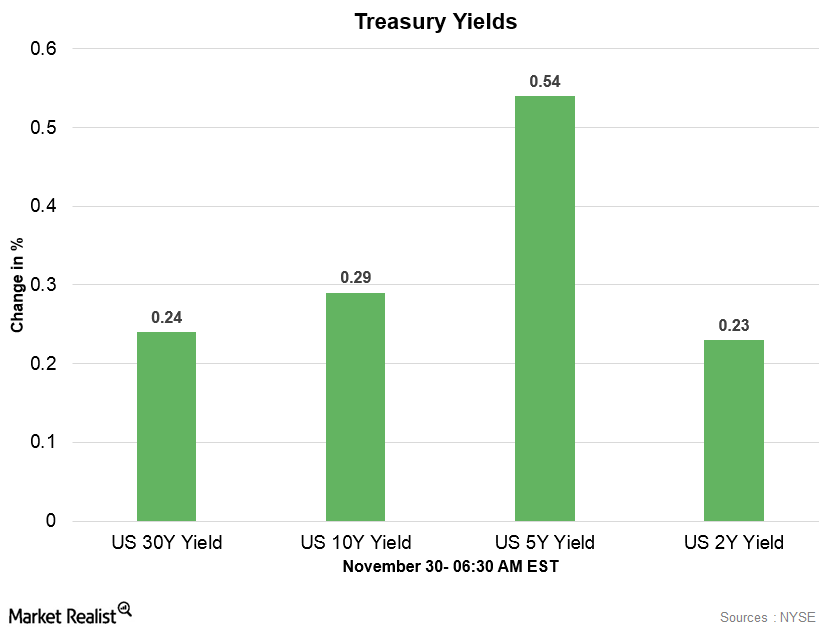

US Dollar Index and Treasury Yields Are Strong on November 30

In the early hours on November 30, the US Dollar Index is trading with strength above opening prices.

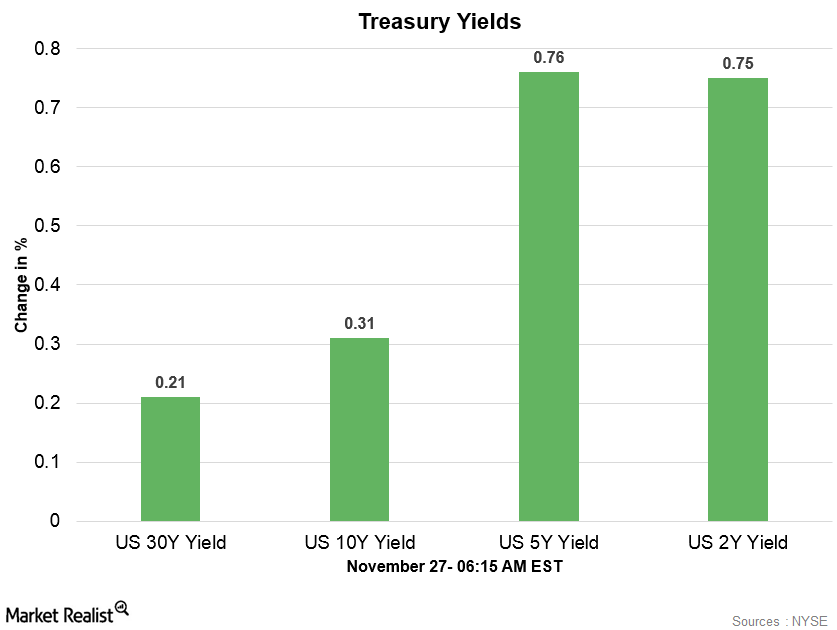

US Dollar Index Is Weak in the Early Hours on November 27

The US Dollar Index started this week on a weaker note and traded below the opening prices in the early hours on Monday.

US Dollar Index Weak in The Early Hours of November 23

US Dollar Index The US Dollar Index has been weak for two consecutive trading weeks, and started this week on a mixed note. The index lost strength as the week progressed and fell to four-week lows on Wednesday. The US Dollar Index opened the day with weakness on Thursday. Market sentiment Market sentiment towards the US Dollar Index was […]

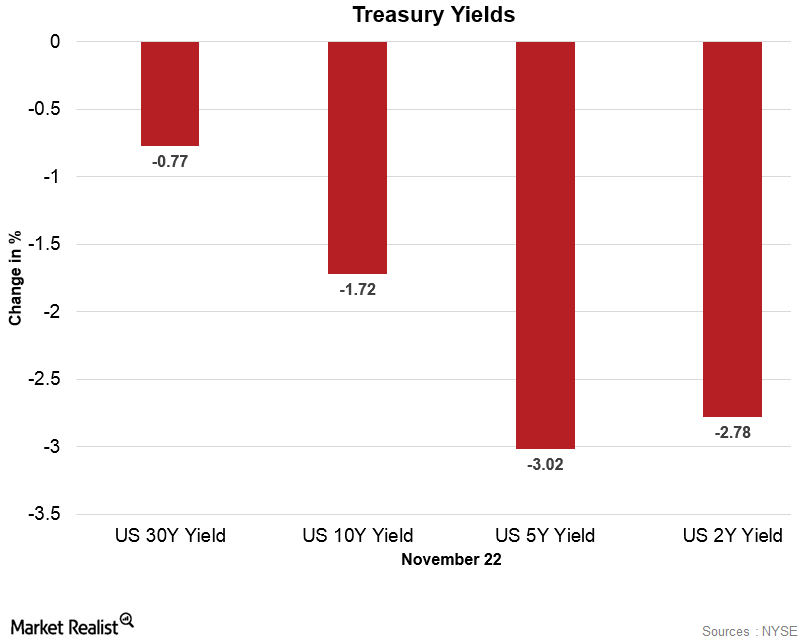

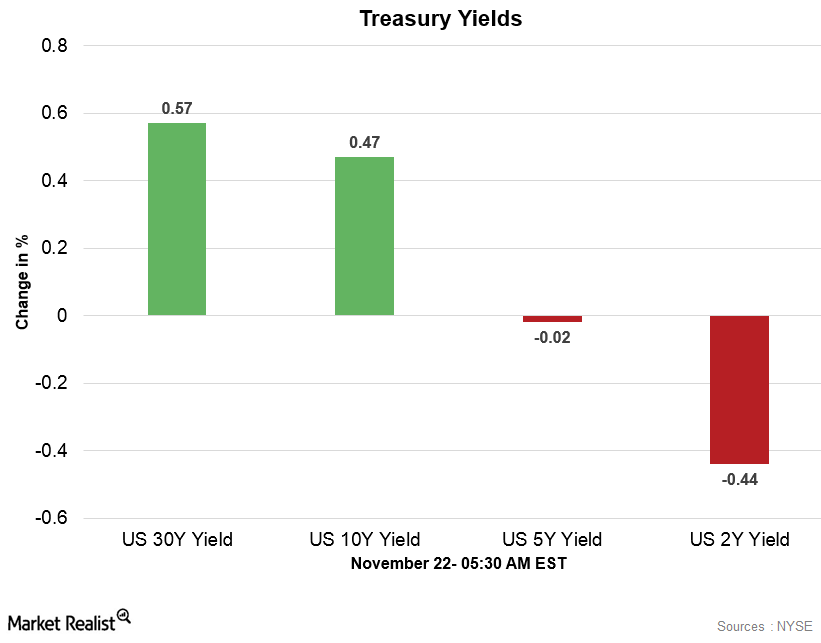

US Dollar Index Consolidates in the Early Hours

In the early hours on November 22, the US Dollar Index is trading with weakness below the opening prices.

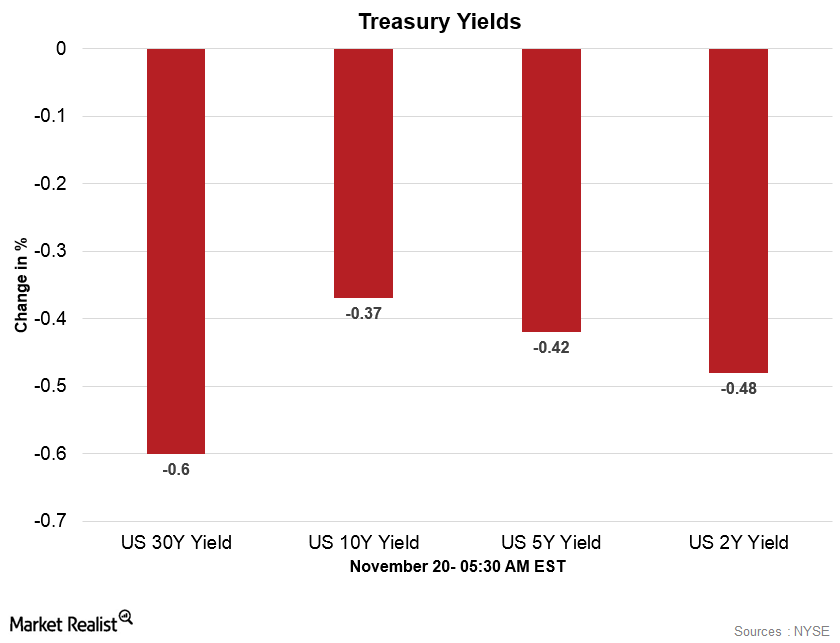

US Dollar Index is Stable in the Early Hours on November 20

The US Dollar Index opened on a stronger note on November 20. However, the dollar lost strength as the day progressed.

US Dollar Index Is Weak in the Early Hours on November 17

The US Dollar Index started Friday on a weaker note and traded below the opening prices with weakness in the morning session.

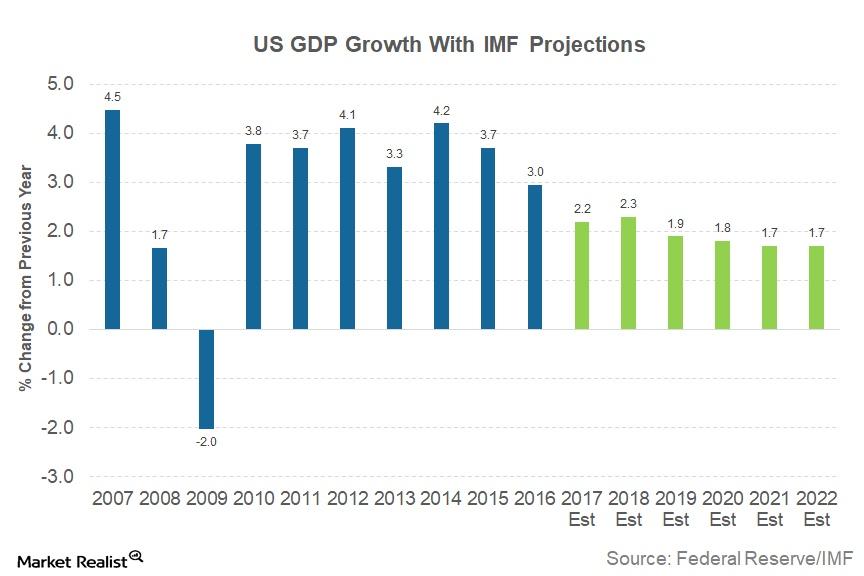

IMF: Why US Economic Growth Could Slow

The International Monetary Fund (or IMF), in its “World Economic Outlook” (or WEO) released in October, upgraded the economic forecast for the United Statess for 2017.

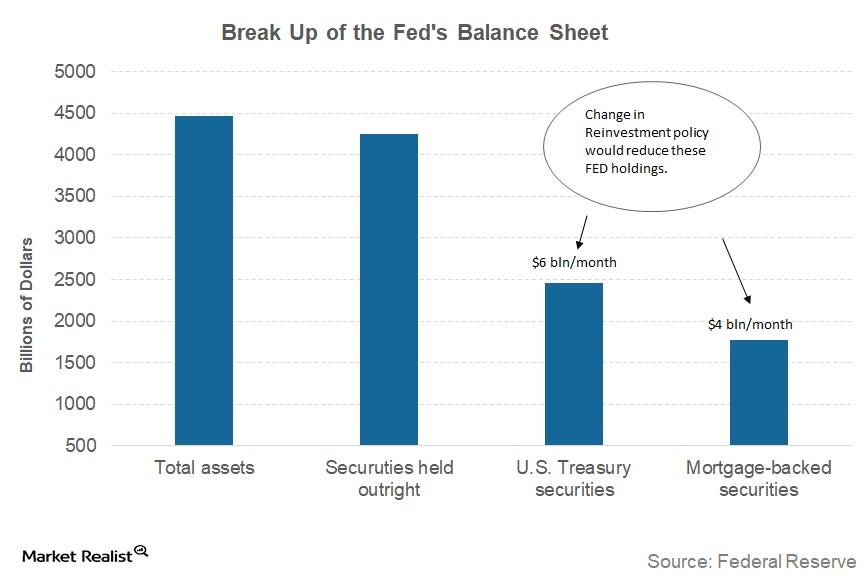

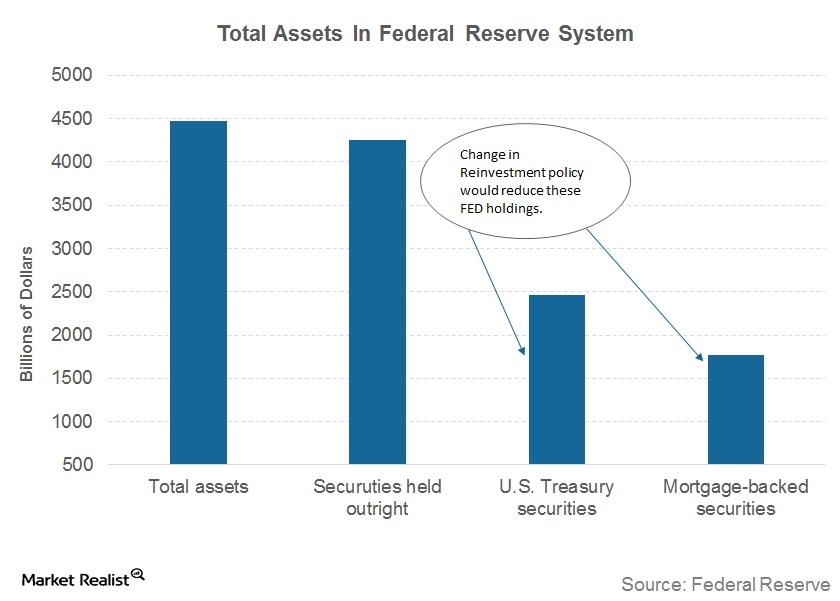

Janet Yellen Balance Sheet Strategy a Closer Look

Fed Chair Janet Yellen, in her speech at the 2017 Herbert Stein Memorial Lecture, offered some more insight into the Fed’s balance sheet reducing strategy.

Will Tax Cuts Bump Up Treasury Yields?

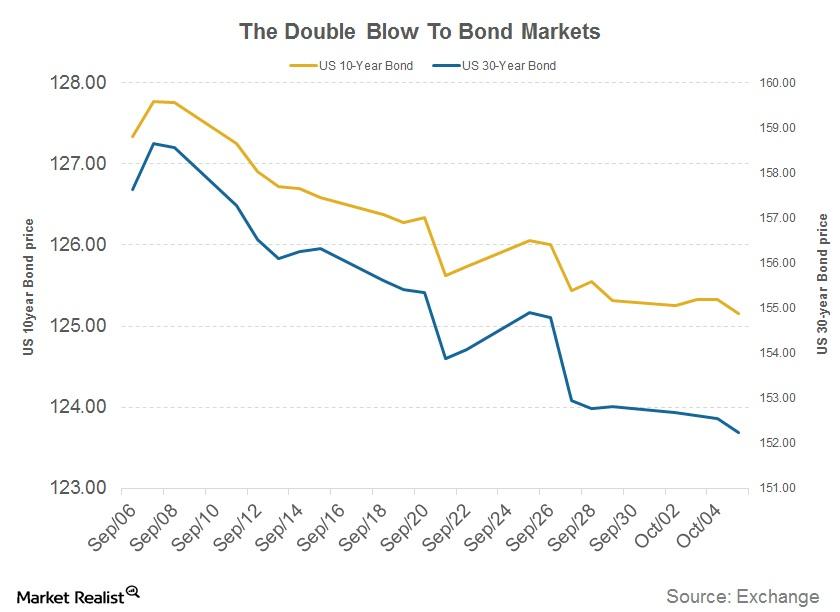

Since early September, US ten-year and longer-dated paper has been falling. Rates for the US government ten-year bond jumped from 2.04% on September 7 all the way to 2.36% on October 10.

A Double Blow for Bond Markets?

The announcement of the GOP tax reform plan added to the pressure on bond markets.

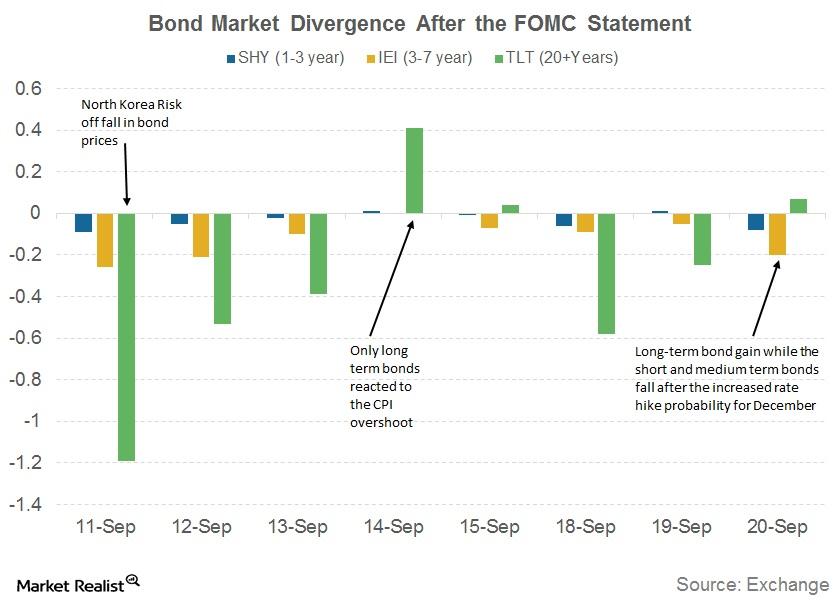

Why Maturity Bonds Reacted Differently to the Fed’s September Statement

The Fed’s balance sheet has $4.4 trillion in bond market securities, and it intends not to reinvest a small portion of the maturing securities every month.

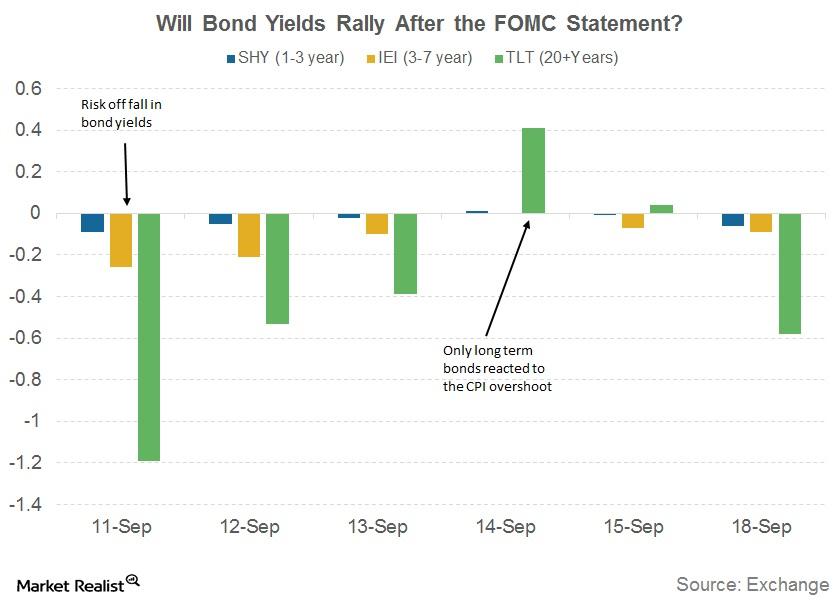

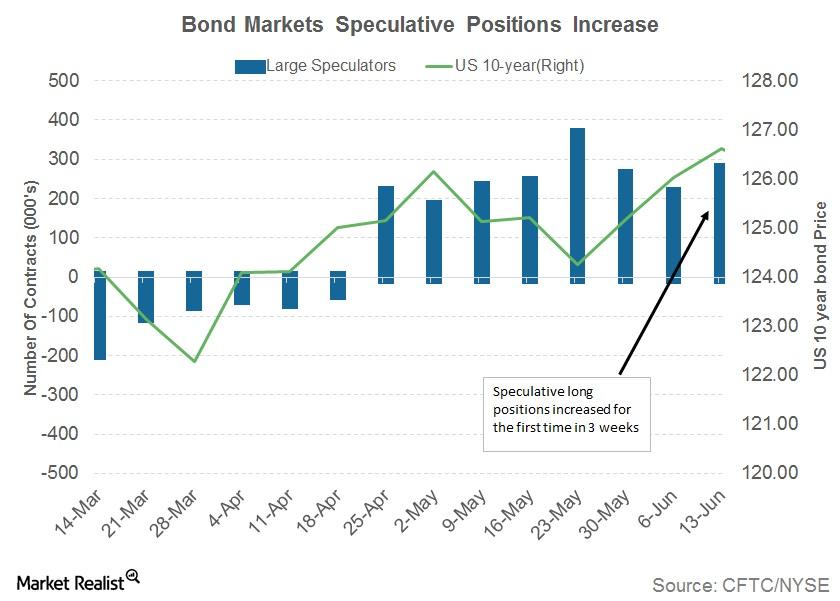

Will US Bond Yields Rally after the FOMC Statement?

The bond markets are the most impacted asset class by any changes to the Federal interest rates.

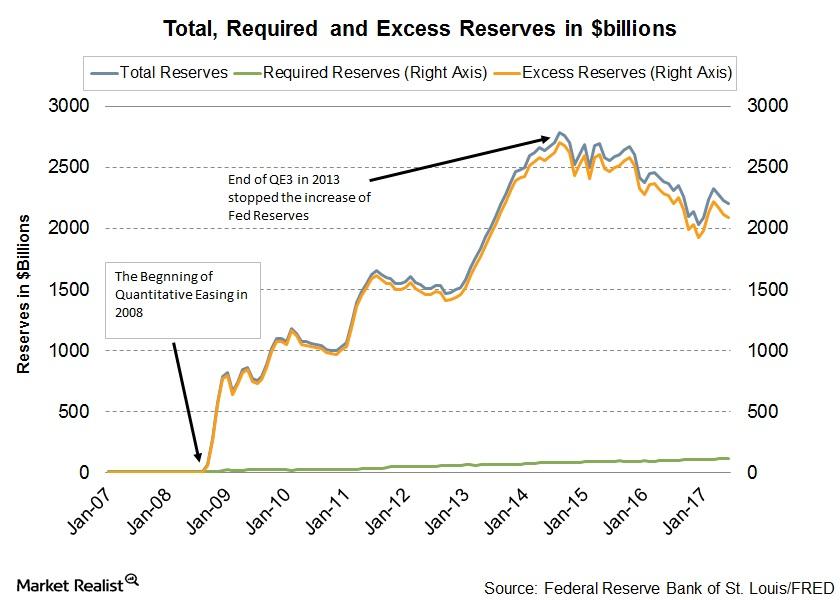

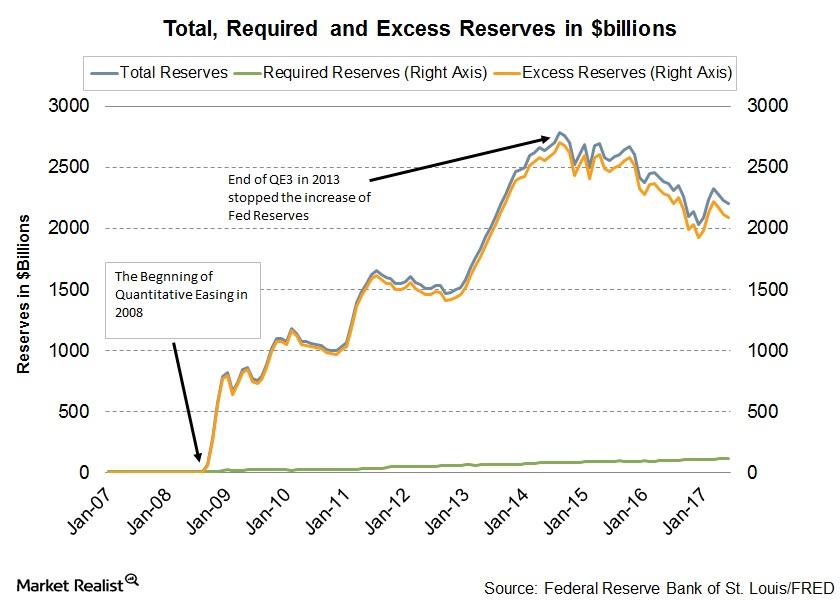

Markets Are Confident on Fed Balance Sheet Trimming Announcement

In its efforts to revive the US economy from the Great Recession, the US Fed started purchasing US government-backed securities in 2008.

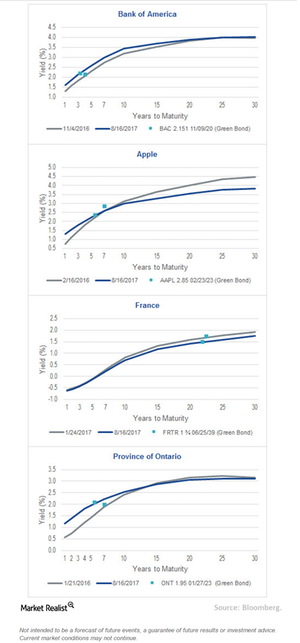

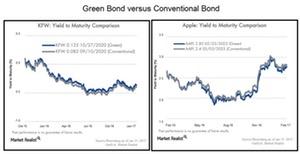

Does the Green Bond Premium Exist?

Despite the rapid rise in issuance, demand for green bonds continues to outshine supply. The excess demand for green bonds has led to higher returns.

Could the Fed Announce Balance Sheet Shrinking in September?

The Fed, in its efforts to normalize policy, announced that it is starting the balance sheet unwinding program soon.

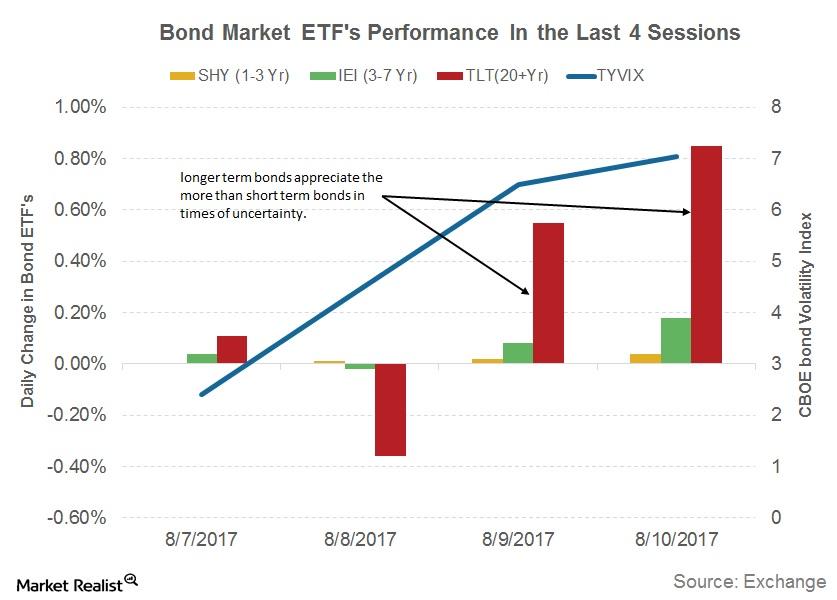

Will Bond Yields Continue to Fall amid Geopolitical Tensions?

Bonds, especially U.S. Treasuries (GOVT), are considered one of the safest assets in which to park your funds in times of uncertainty.

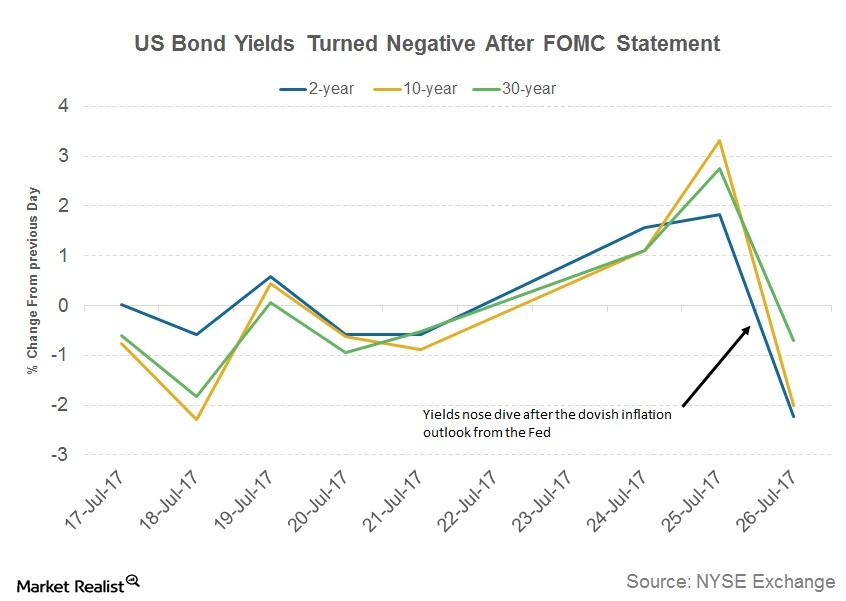

Why Bond Prices Rose after the FOMC’s Statement

US government bonds gained after the FOMC (Federal Open Market Committee) indicated in its July 2017 statement that near-term inflation could remain below its 2% target.

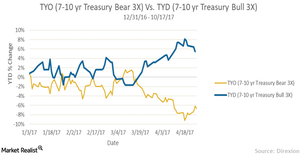

Is a Flattening Yield Curve a Sign of an Impending Recession?

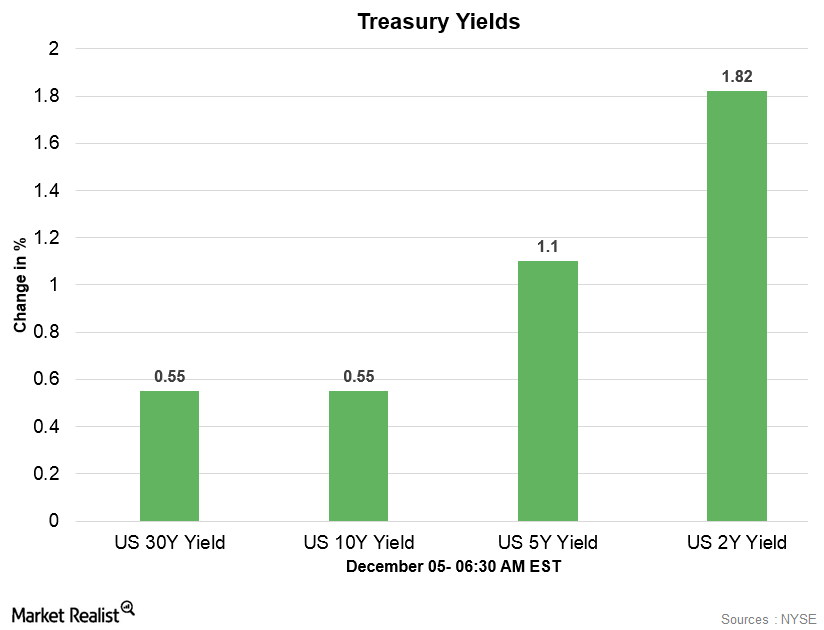

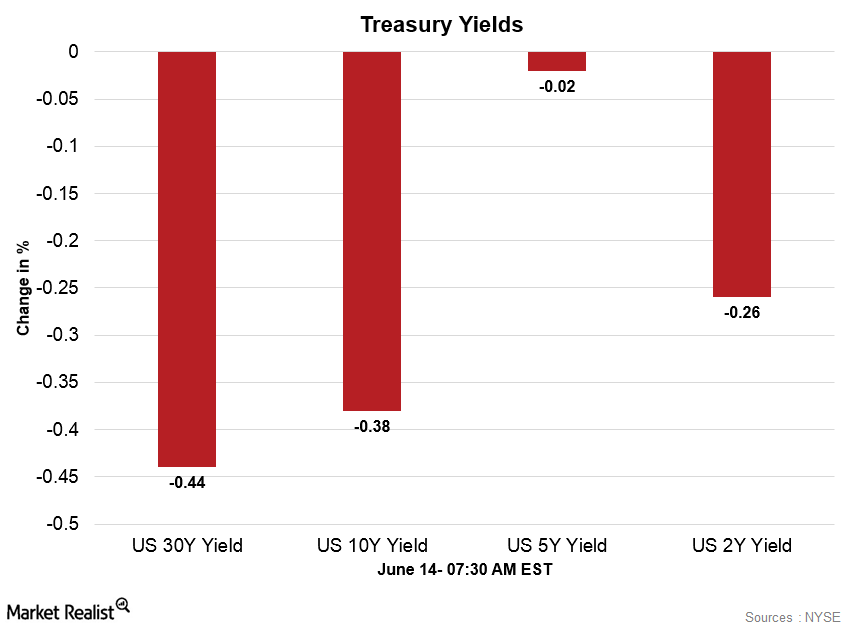

Yields in the shorter timeframe such as the two-year yield (SHY) and T-notes (SCHO) are rising more than the ten-year or the 30-year (TLT) yields.

What Does Rise in US Interest Rates Mean for Bond Markets?

US Treasuries (GOVT) had a mixed response to the FOMC statement and the Fed’s interest rate hike.

US Dollar and US Treasuries Are Slightly Weaker

In the early hours on Wednesday, the US Dollar Index is slightly weaker. At 5:45 AM EST on June 14, the US Dollar Index was trading at 96.99—0.01% higher.

Inside the Fed’s Balance Sheet (The Biggest in the World)

The Fed has started the rate normalization process only recently and has a long way to go before the rates come back to pre-Lehman-collapse levels.

Green Bonds and Conventional Bonds: What’s the Difference?

There isn’t much difference between a conventional bond and a green bond (GRNB), also known as a climate bond. Both have similar risk-return profiles.

How Higher Interest Rates Can Impact Utilities

Treasury yields (TLT) become more attractive when interest rates rise, making utilities (XLU) less competitive in terms of yields.