Shire PLC

Latest Shire PLC News and Updates

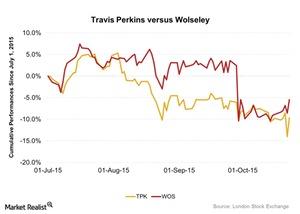

Travis Perkins Rebounded, Led EWU by 5.09%

Travis Perkins was at the top of the iShares MSCI United Kingdom ETF on October 23, 2015, as analysts showed positivity toward the construction industry.

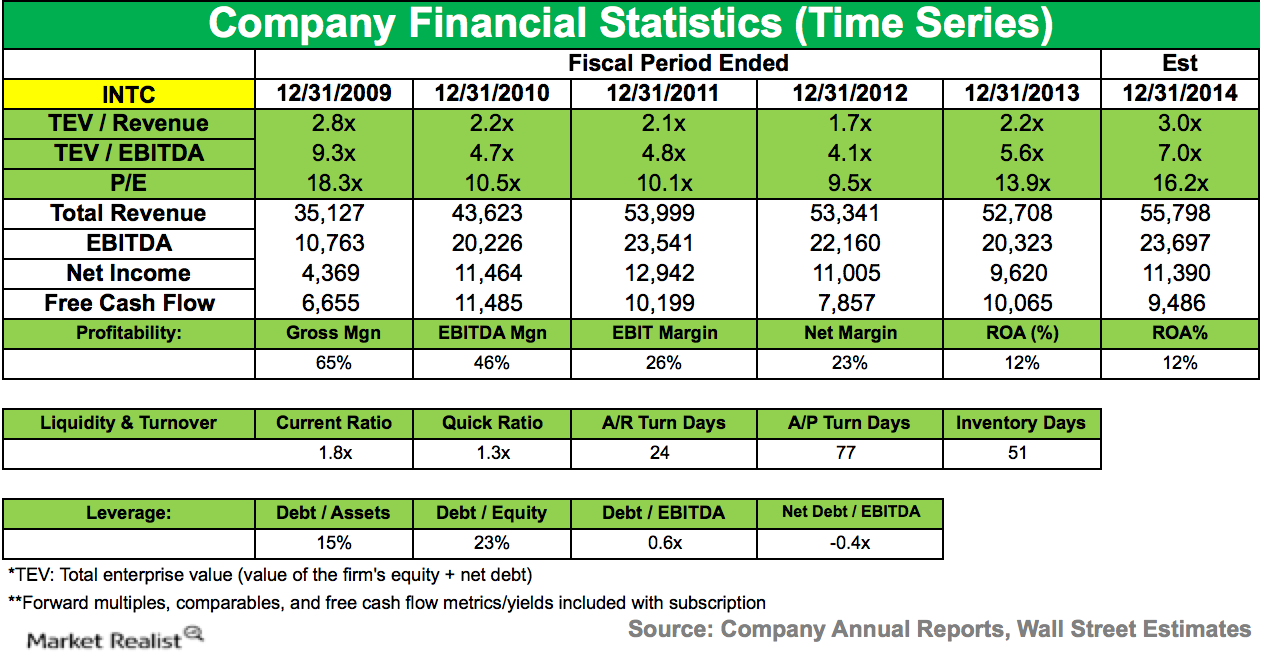

AQR Capital increases stake in Intel

Intel generated ~$5.7 billion in cash from operations. The company paid quarterly dividends of $1.1 billion and repurchased 122 million shares for $4.2 billion.

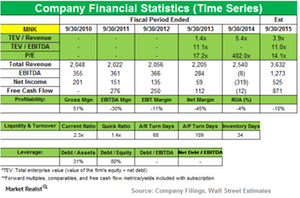

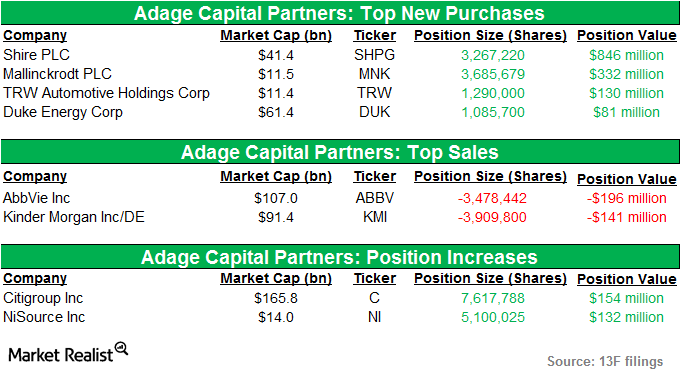

Adage Capital adds a new position in Mallinckrodt

Adage Capital added a new position in Mallinckrodt Plc (MNK) in the third quarter of 2014. The position accounted for 0.82% of the fund’s total portfolio.

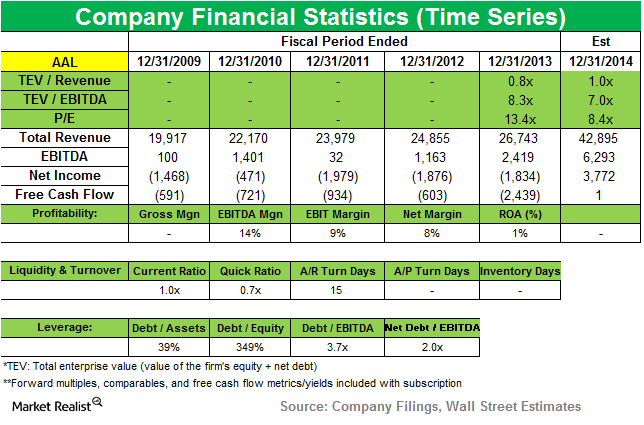

American Airlines gets significantly lower position in Appaloosa

Appaloosa Management significantly lowered its position in American Airlines (AAL) in the third quarter that ended in September 2014. The position accounts for 3.81% of the fund’s total third-quarter portfolio.

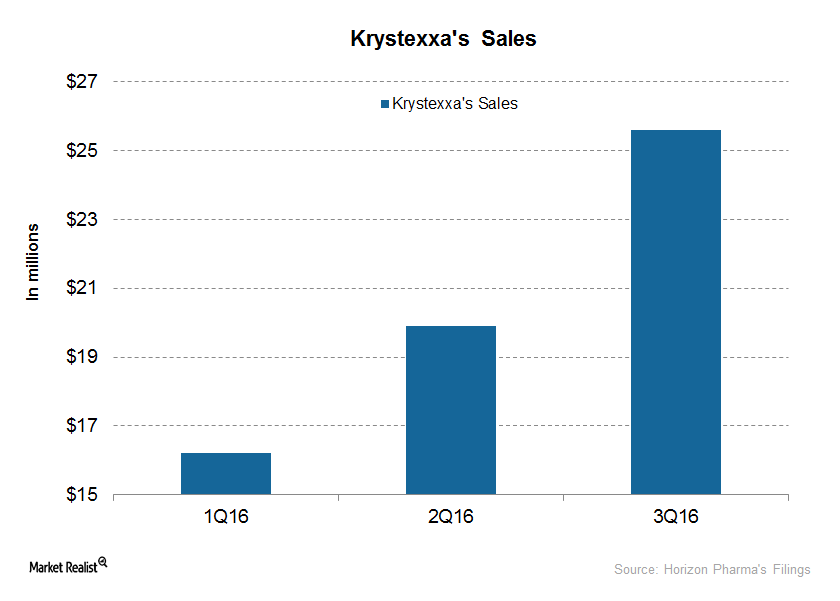

Revenue Drivers for Krystexxa, Horizon’s Orphan Biologic Drug

Horizon plans to drive Krystexxa through increased awareness and outreach, investing in its marketing and medical education as well as commercial infrastructure.

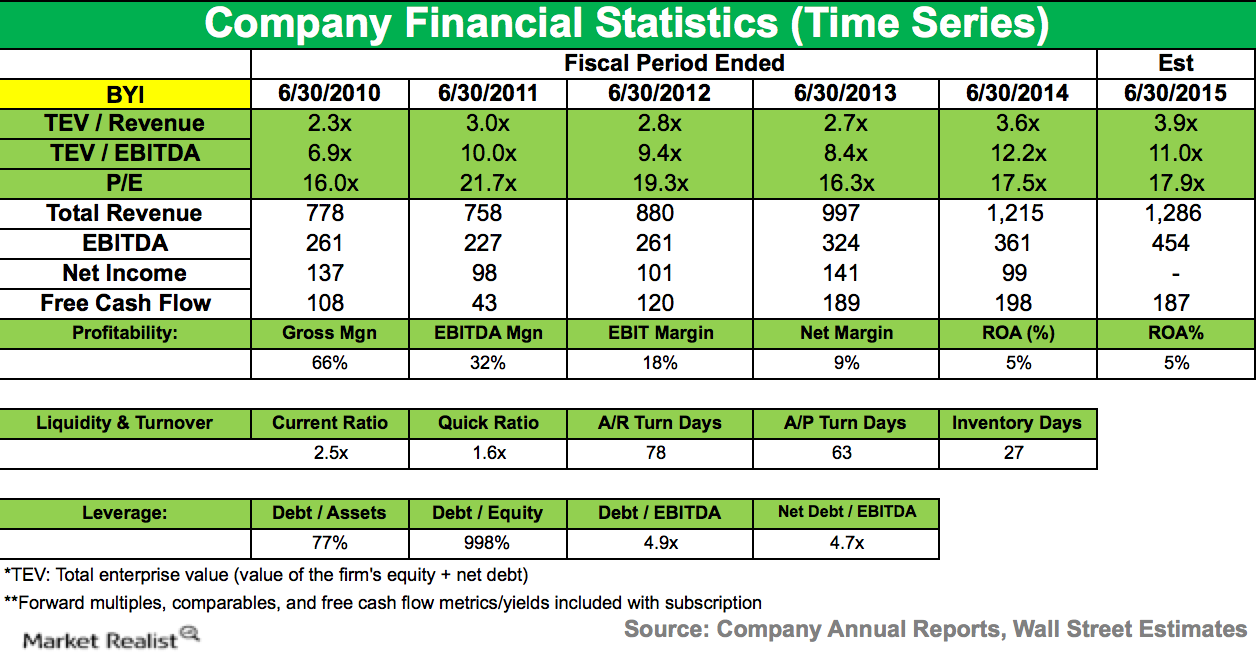

AQR Capital initiated position in Bally Technologies Inc.

AQR Capital initiated a position in Bally Technologies during the third quarter of 2014 that accounts for 0.22% of the fund’s 3Q14 portfolio.

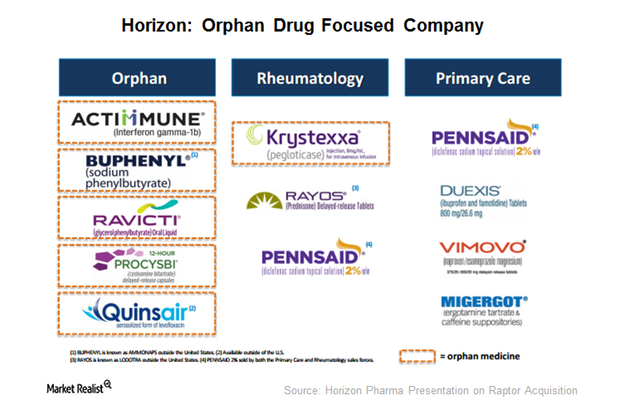

Buy Allows Horizon to Further Expand into Orphan Drug Space

Through the acquisition of Raptor Pharmaceuticals, Horizon Pharma (HZNP) will gain access to Procysbi and Quinsair and expand in the orphan drug space.

A key overview of Adage Capital’s holdings in 3Q14

Adage Capital’s US long portfolio grew from $38.69 billion in 2Q14 to $40.2 billion in 3Q14. The portfolio comprised around 699 stocks.

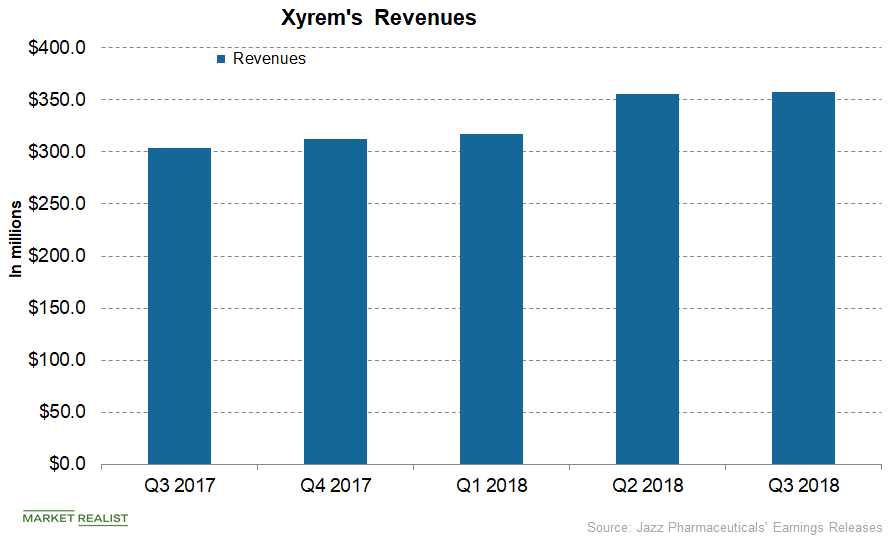

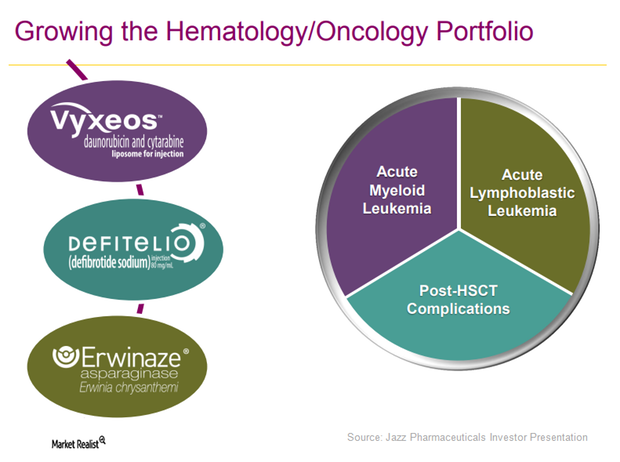

Jazz Pharmaceuticals: How Are Xyrem and Erwinaze Positioned?

Jazz Pharmaceuticals’ Xyrem generated revenues of $357.3 million in the third quarter—compared to $303.9 million in the third quarter of 2017.

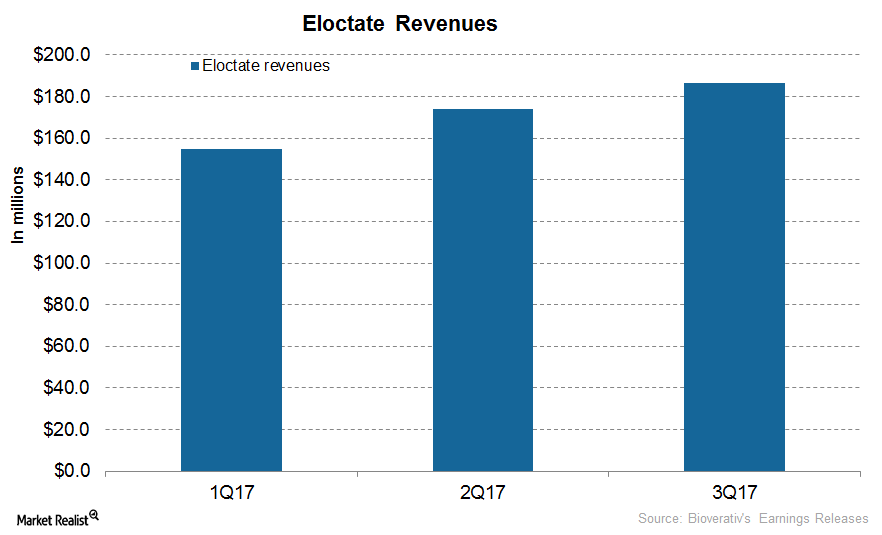

How Is Bioverativ’s Eloctate Positioned Now?

In 3Q17, Bioverativ’s (BIVV) Eloctate generated revenue of $186.3 million, reflecting a 41% rise on a year-over-year (or YoY) basis.

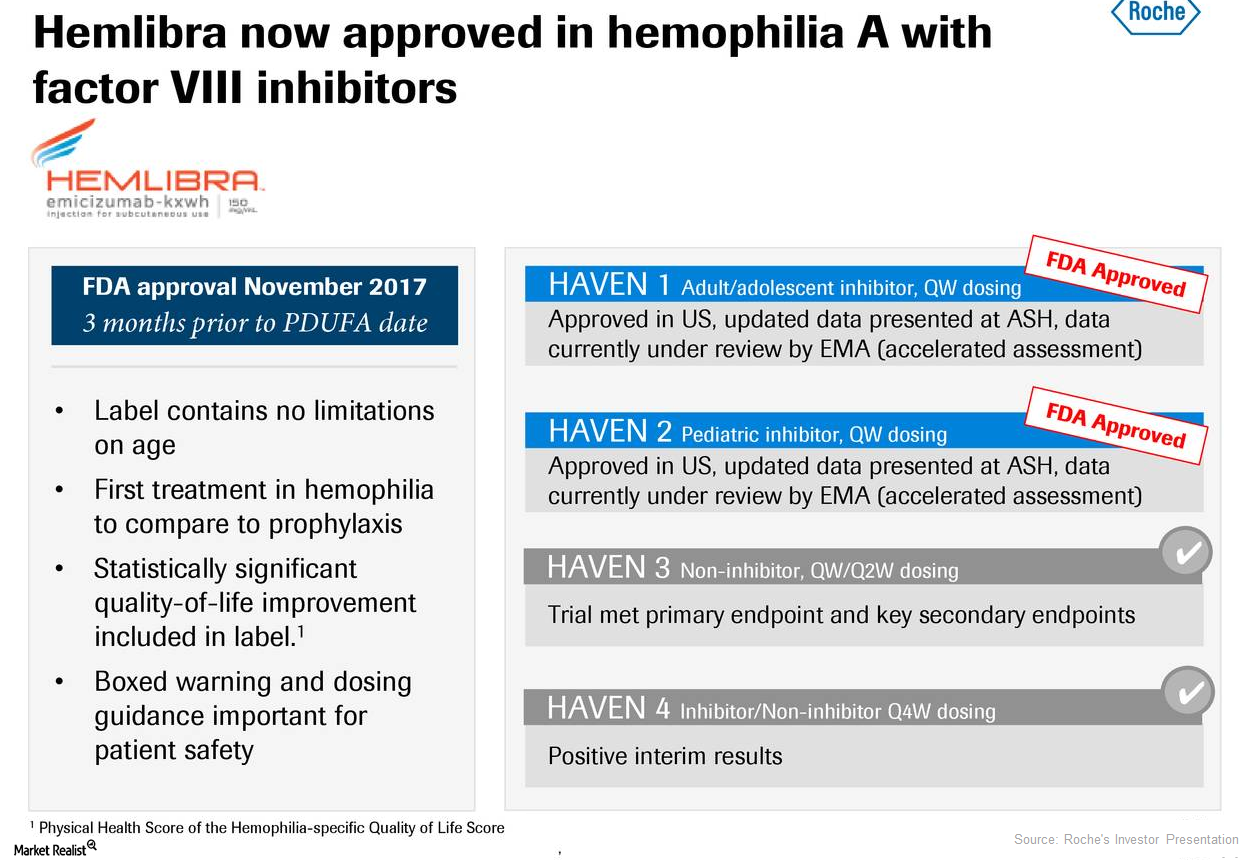

How Is Roche’s Hemlibra Positioned for 2018?

Roche’s (RHHBY) Hemlibra is used for the prevention and reduction of the frequency of bleeding episodes in individuals with hemophilia A with factor VIII inhibitors.

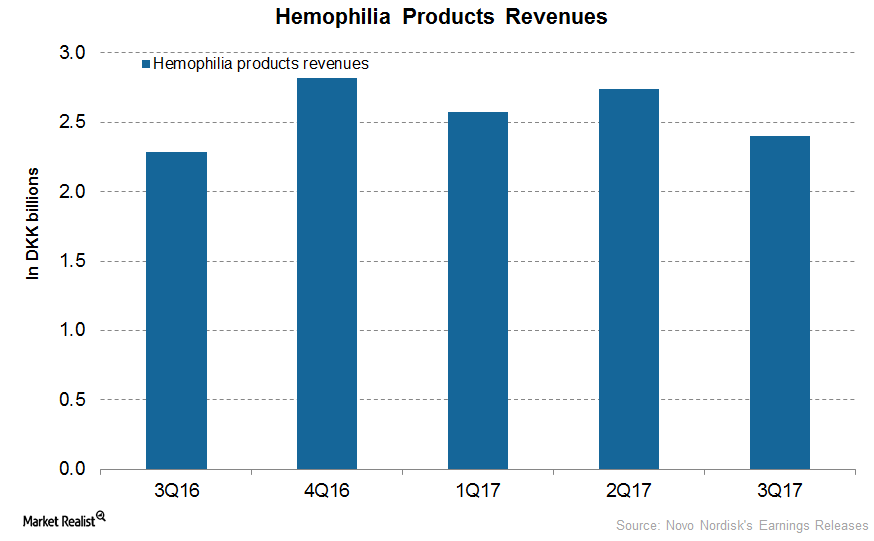

How Novo Nordisk’s Biopharmaceuticals Segment Performed in 3Q17

In 3Q17, Novo Nordisk’s (NVO) hemophilia segment reported revenues of 2.4 billion Danish krone (or DKK), a ~10% increase on a YoY basis.

How Are Bioverativ’s Key Drugs Positioned after 2Q17?

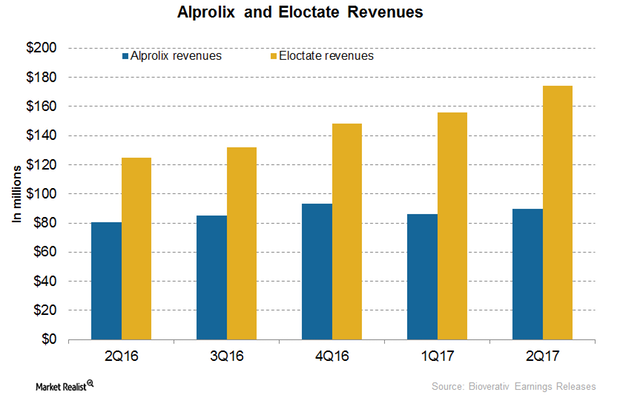

In 2Q17, Bioverativ’s Alprolix generated revenues of ~$89.7 million, which represents ~12% growth YoY (year-over-year) and ~4% growth sequentially.

Erwinaze Sales May Remain Flat in 2017

Erwinaze saw net sales worth $49 million in 2Q17, almost flat compared to the drug’s revenues of $50 million in 2Q16.

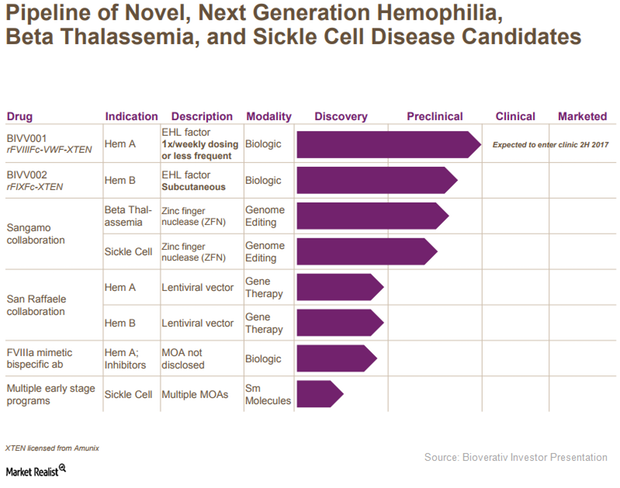

Bioverativ’s Research Pipeline May Boost Future Revenues

Bioverativ (BIVV) plans to improve compliance rates for hemophilia patients further by launching therapies with lower dosage frequency.

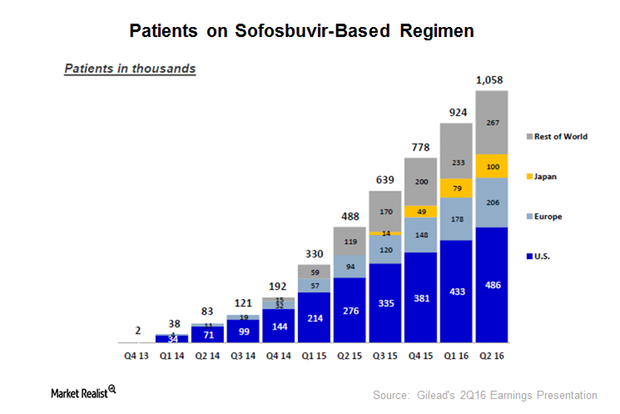

How Gilead Dominates the HCV Space

In January 2012, Gilead Sciences (GILD) acquired Pharmasset and got access to sofosbuvir. In December 2013, the FDA approved sofosbuvir under the brand name Sovaldi.

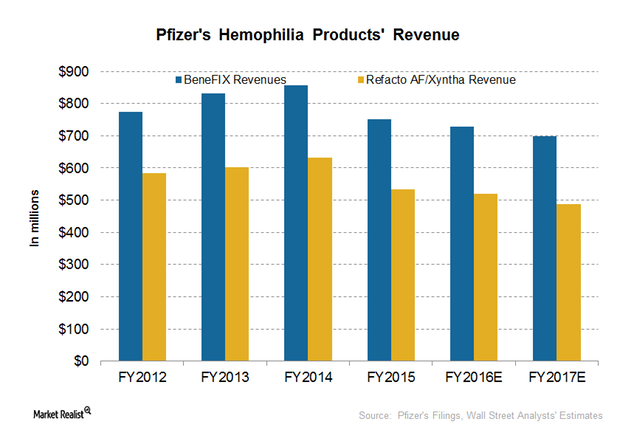

Why Are Revenues from Pfizer’s Rare Disease Portfolio Falling?

BeneFIX, the major contributor to Pfizer’s (PFE) Rare Disease portfolio, is indicated for hemophilia B. During the first six months, the drug earned $367 million.

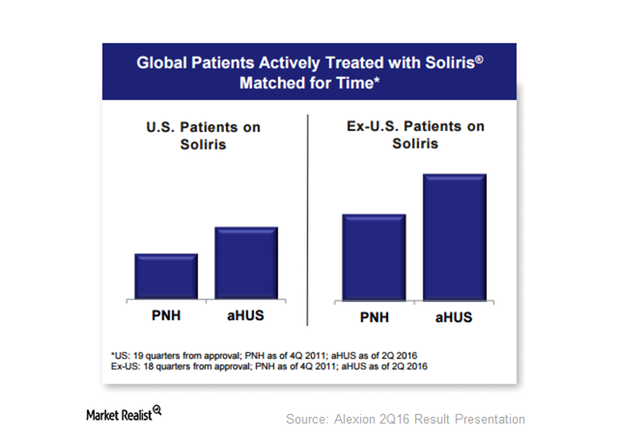

How Significant Is Alexion’s Opportunity with Soliris?

Alexion (ALXN) has been serving the atypical hemolytic uremic syndrome, or aHUS, market for the past five years.

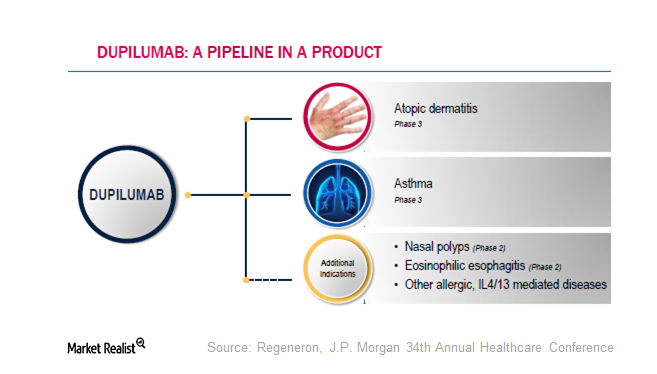

Regeneron’s Dupilumab: How Much Potential Does It Hold?

Dupilumab has a breakthrough therapy designation from the FDA for the indication of moderate-to-severe atopic dermatitis in adults.

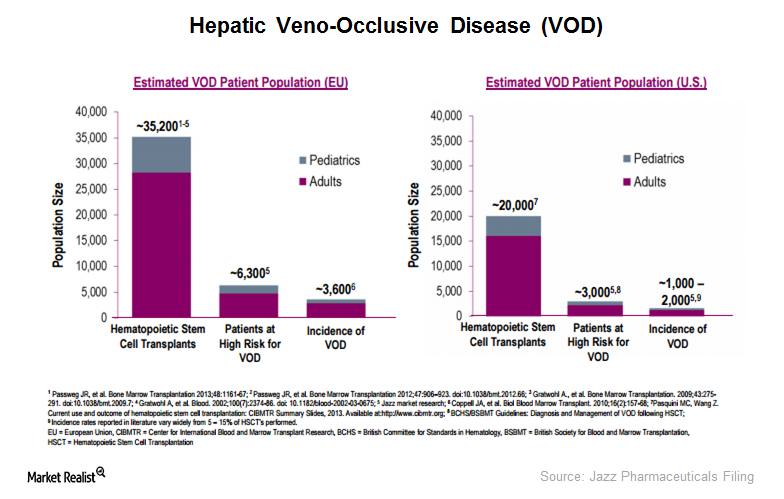

Defitelio: Volume and Pricing Challenges

Jazz Pharmaceuticals’ Defitelio is the first and only approved treatment that increases survival in VOD patients with multi-organ dysfunction (or MOD).

What’s Happening with a Generic Version of Vyvanse?

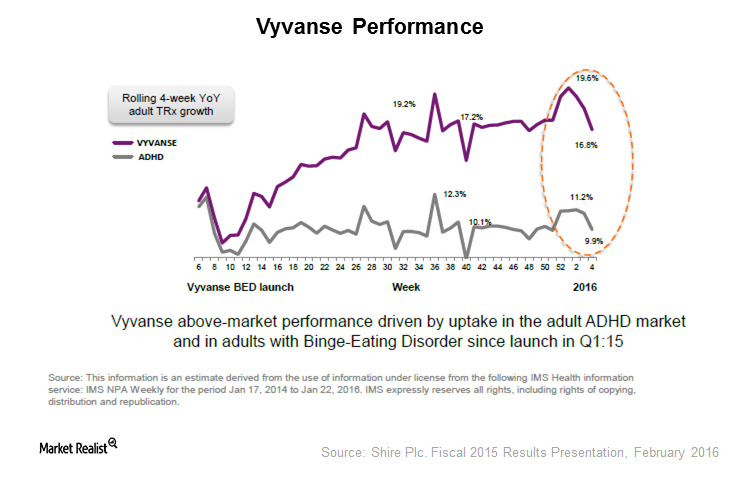

Vyvanse, Shire’s (SHPH) key drug, earned $1.7 billion in 2015, a 21% annual growth. Analysts expect Vyvanse to add $1.9 billion and $2.1 billion to Shire’s top line in 2016 and 2017.

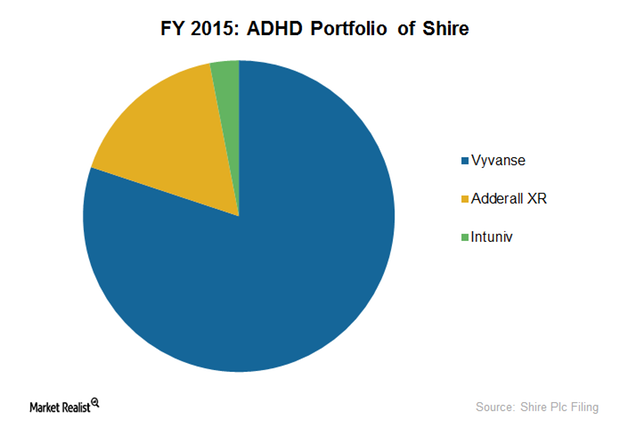

How Vyvanse Could Fuel Shire’s ADHD Portfolio Sales

Vyvanse is Shire’s leading ADHD drug, constituting 80% of the company’s ADHD portfolio. In fiscal 2015, Vyvanse earned the company $1.7 billion.

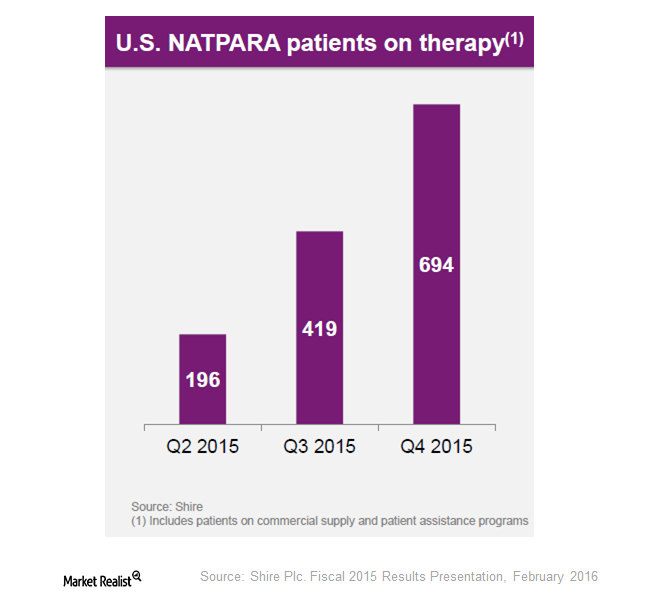

Shire’s Acquisition Gives It Natpara and Gattex

Gattex is the first and only analog of glucagon-like peptide-2 (or GLP-2) indicated for short bowel syndrome. The drug is known as Gattex in the United States and Revestive in Europe.

The Baxalta–Shire merger: Basics of Shire Pharmaceuticals

Shire is a biopharmaceutical company that focuses on rare diseases. Shire is best known for its treatments in ADHD, and the market here is quite large.

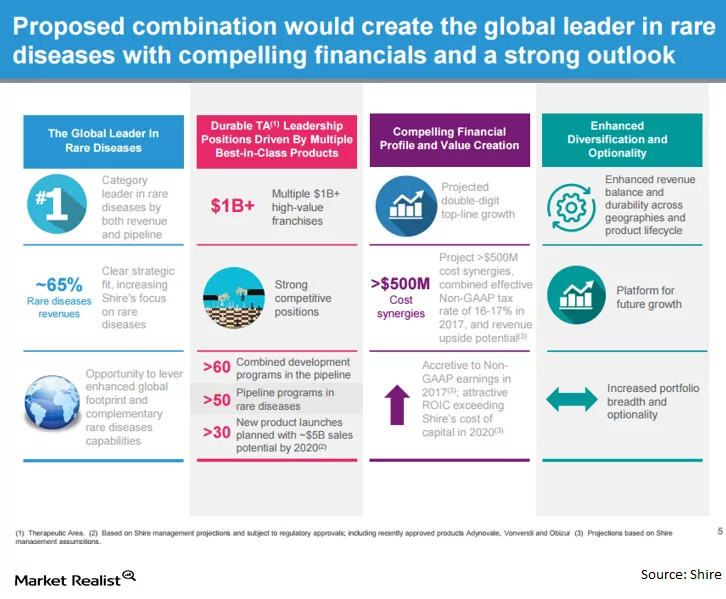

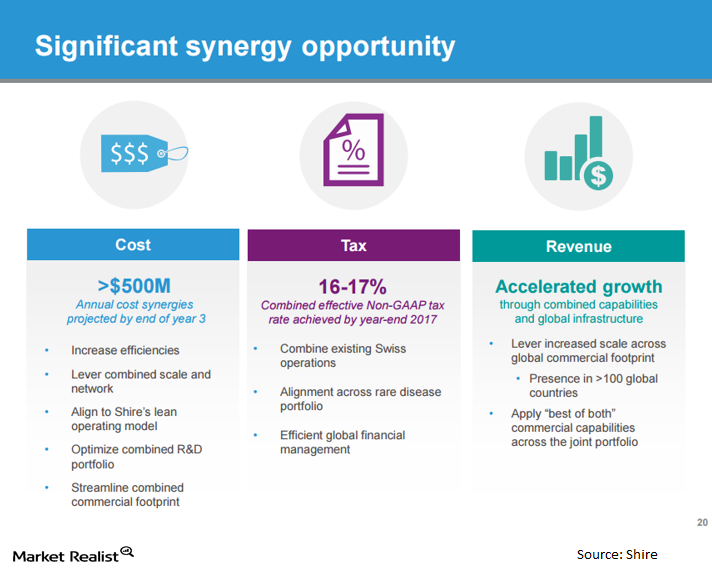

Growth and Synergies Drive the Baxalta–Shire Merger

The Baxalta–Shire merger could create the top platform for rare diseases in the world. Baxalta brings Advate, a treatment for hemophilia, a rare blood disease.

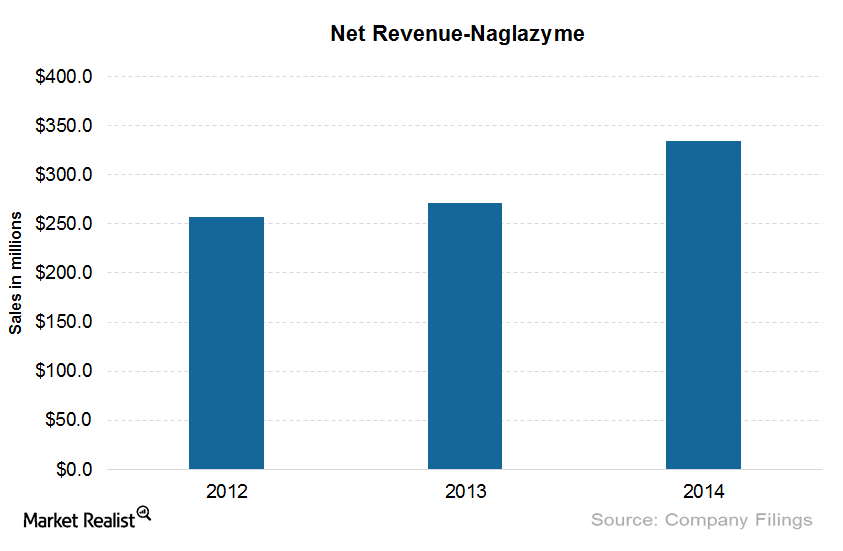

Naglazyme: One of the Costliest Drugs in the United States

The wholesale cost per patient for Naglazyme is around $485,747 per year. The drug has been effective in improving walking and stair-climbing capacity.