Russell 2000

Latest Russell 2000 News and Updates

MPC, TSO, VLO, PSX: Which Refining Stock Is Trading at a Premium?

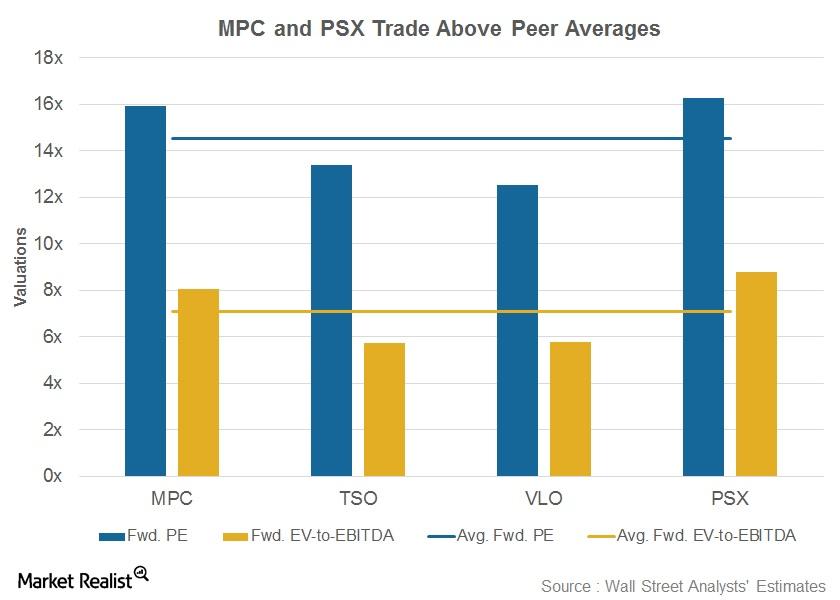

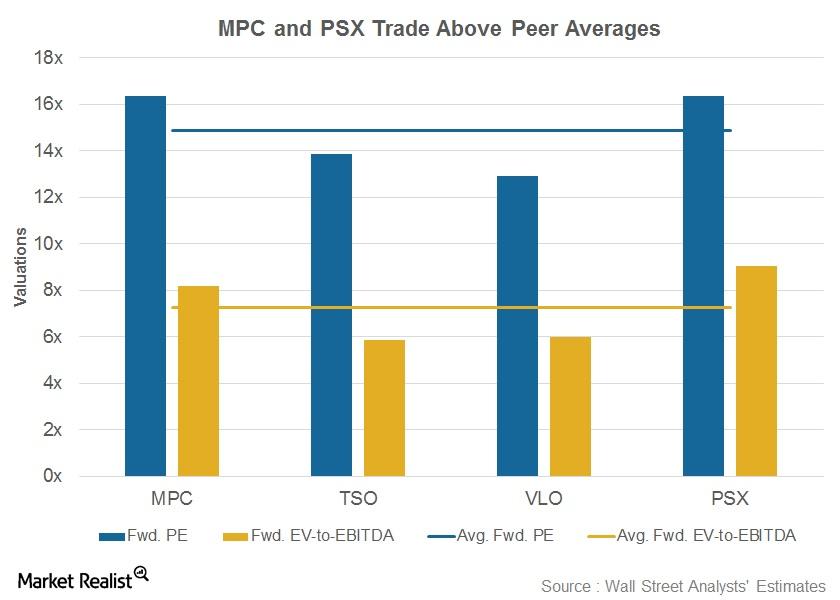

Now, let’s look at the forward valuations of Marathon Petroleum (MPC), Tesoro (TSO), Valero Energy (VLO), and Phillips 66 (PSX).

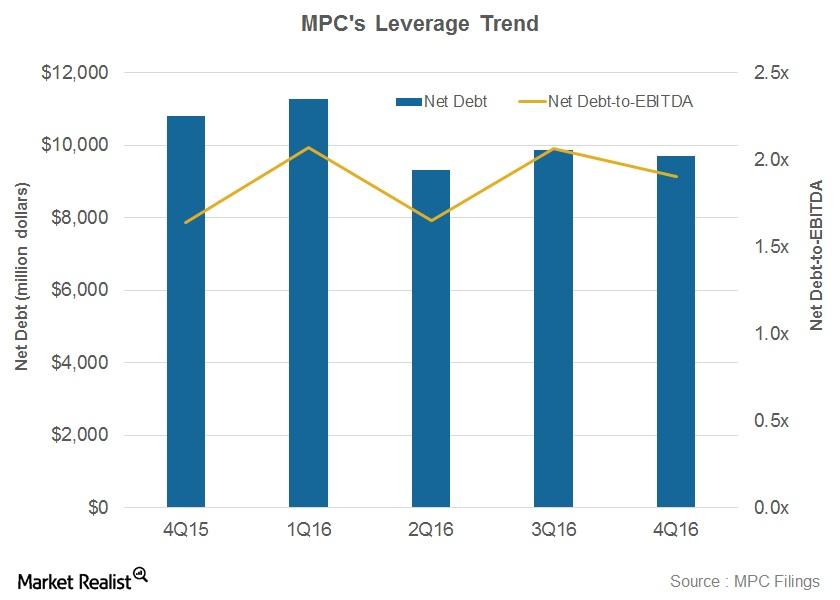

Marathon Petroleum’s Debt Is Lower than Industry Averages

Marathon Petroluem’s net debt-to-EBITDA ratio stood at 1.9x in 4Q16. It’s lower than the average industry ratio of 2.8x.

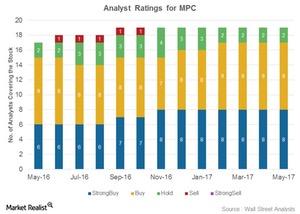

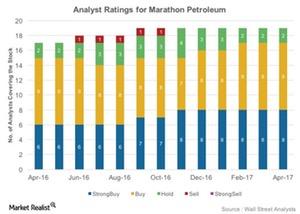

Why Most Analysts Are Calling Marathon Petroleum a ‘Buy’

Marathon Petroleum (MPC) has been rated by 19 Wall Street analysts. Seventeen analysts (or 89%) have rated it as a “buy” so far in May 2017.

Comparing MPC’s, TSO’s, VLO’s, and PSX’s Valuation

Average valuation multiples Earlier, we discussed refining stocks’ performance in 1Q17 and compared their dividend yields. In this part, we’ll look at Marathon Petroleum’s (MPC), Tesoro’s (TSO), Valero Energy’s (VLO), and Phillips 66’s (PSX) forward valuation. The average forward EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiples and average forward PE […]

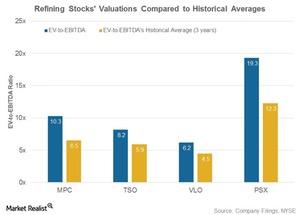

How Refining Stocks’ Historical Valuation Compares

Refining stocks’ valuation In this part, we’ll compare refining stocks’ EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) ratios with their three-year averages. Marathon Petroleum (MPC), Valero Energy (VLO), Phillips 66 (PSX), and Tesoro (TSO) are trading higher than their historical valuation. MPC was trading at a 10.3x EV-to-EBITDA ratio in 1Q17, compared […]

Understanding Valero’s Stock Performance Prior to the 1Q17 Results

Since February 2017, downstream stocks have been hit by volatile crack conditions and changing inventory levels. VLO has also witnessed volatility in its stock price.

How Refining Stocks’ Valuations Compare to Historical Averages

In this article, we’ll look at refining stocks’ EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) ratios compared to their three-year historical averages.

These Refining Stocks Are Trading at a Premium

PSX is trading at 9x its forward EV-to-EBITDA ratio and at 16.4x its forward PE ratio, which is above the peer averages.

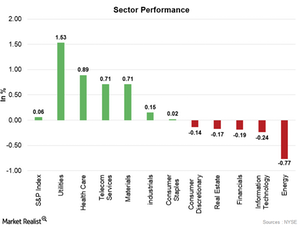

How Did the S&P 500, NASDAQ, and Dow Perform on January 25?

On January 25, six out of the S&P 500’s 11 major sectors moved higher. Strength in the utilities and health care sectors pushed the market higher.

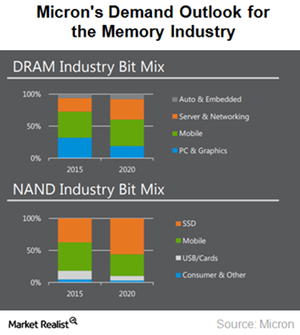

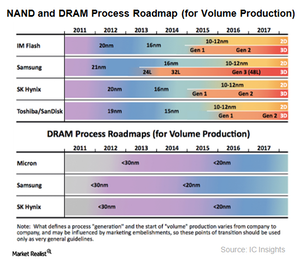

The Cloud Server Market—Micron Technology’s Next Big Opportunity

On the DRAM front, Sanjay Mehrotra stated that average capacity per server increased to ~145 GB in 2017, and it is expected to increase to ~350 GB by 2021.

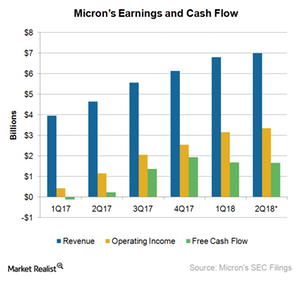

The State of Micron’s Cash Flow in Fiscal 2018

To become cost-competitive, Micron is increasing its capex from $5.0 billion in fiscal 2017 to $7.5 billion in fiscal 2018.

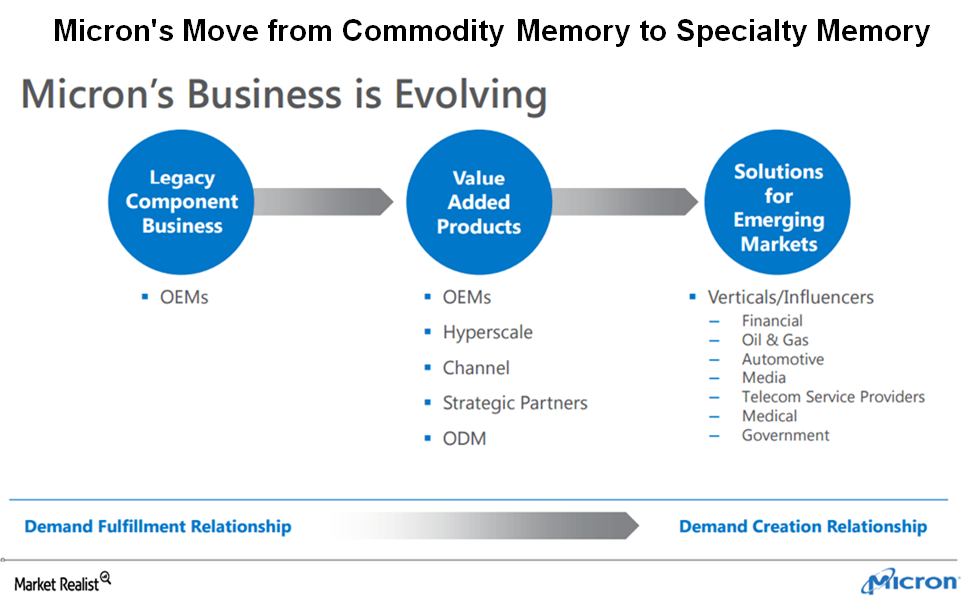

Micron’s Strategy to Survive a Memory Downturn

In fiscal 1Q18, Micron introduced its 32 GB NVDIMMN (nonvolatile dual in-line memory module), which is a combination of its DRAM and NAND products.

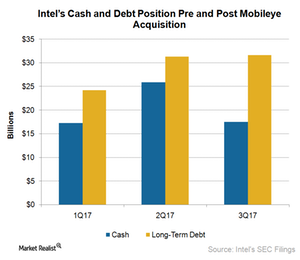

How Did the Mobileye Acquisition Impact Intel’s Balance Sheet?

Intel (INTC) is increasing its earnings through spending discipline and by focusing its expenses on projects with high ROI (return on investment).

A Look at Opportunities and Challenges in NVIDIA’s GPU Business

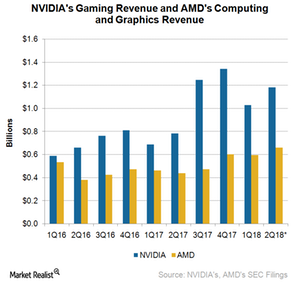

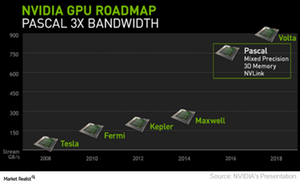

NVIDIA (NVDA) has become NVIDIA because of its most advanced GeForce GPUs (graphics processing units), which are superior in the PC (personal computer) gaming market in terms of performance.

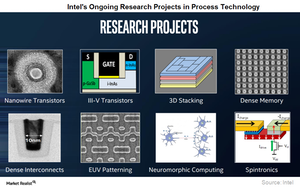

Intel Sees Future in Neuromorphic Chips and Quantum Computing

Intel taps neuromorphic processors Intel (INTC), a leader in the data processor market, is set to secure its position in the cloud computing space with its new Nervana NNP (Neural Network Processor), which it developed in conjunction with Facebook (FB). Now, it is tapping offline, on-device computing to compete with more energy-efficient ARM processors in […]

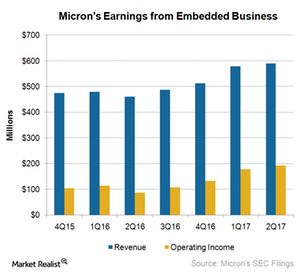

What’s the Role of Embedded Business in Micron’s Future Growth?

Micron’s EBU revenue rose 19% sequentially to $700 million in fiscal 3Q17 driven by high demand for its products across consumer, industrial, and automotive markets.

NVIDIA Seeks to Continue Its Strong Gaming Revenue Growth in Fiscal 2018

NVIDIA’s gaming revenues rose 49% year-over-year to ~$1.0 billion in fiscal 1Q18, driven by strong demand for Pascal GPUs.

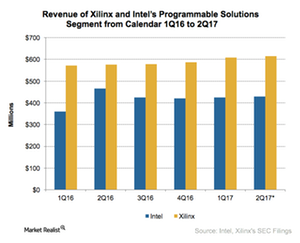

What’s Going on in Intel’s Programmable Solutions Group?

Intel is offering a full spectrum of AI solutions and several accelerators. The company’s journey in accelerated computing began with its acquisition of Altera in 2015.

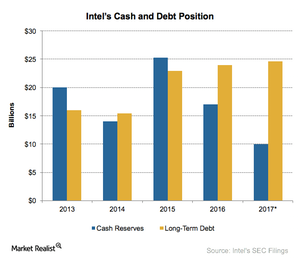

Should Investors Be Concerned about Intel’s Leverage?

Intel has long-term debt of $24 billion against cash reserves of $17 billion, resulting in net debt of $7 billion.

Micron Doubts That China Could Sustain in the Memory Market

According to Micron’s Ernest Maddock, even if China succeeds in securing legitimate IP, it would still fail in the memory market.

Speculation about NVIDIA’s Volta Gaming Graphic Processing Unit

NVIDIA’s product strategy NVIDIA (NVDA) has officially unveiled its next-generation Volta architecture. Whenever the company develops a new architecture, it first launches it on the Tesla GPU (graphic processing unit) platform for data centers because it commands a higher price than other platforms. Then it launches the architecture on the GeForce gaming platform, as its […]

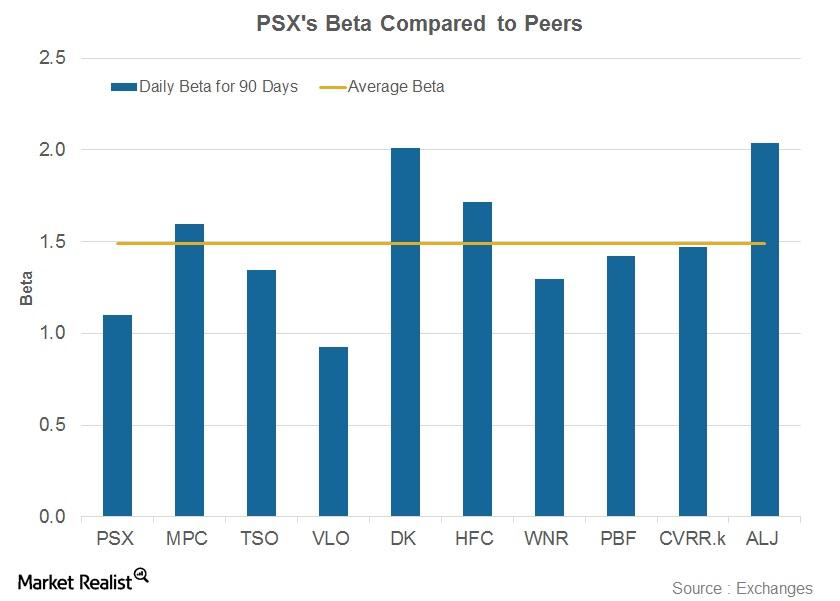

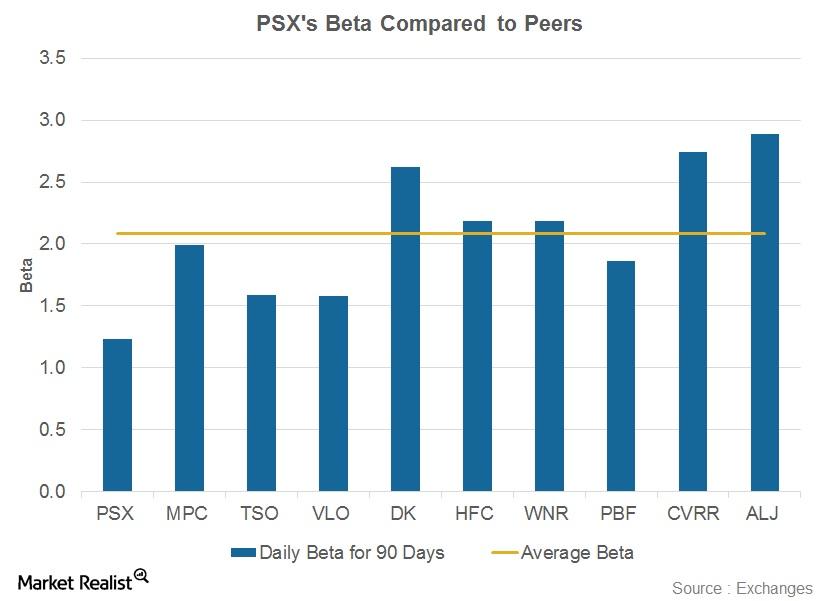

Phillips 66’s Beta: Does It Imply the Company Is Less Volatile?

Phillips 66’s 90-day daily beta stands at 1.1, which is below its peer average of 1.5.

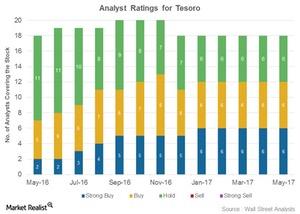

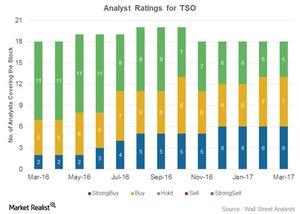

How Analysts Rated Tesoro on Its 1Q17 Earnings Day

Tesoro (TSO) has been rated by 18 analysts. Of those, 12 have assigned the stock a “buy” or “strong buy” rating.

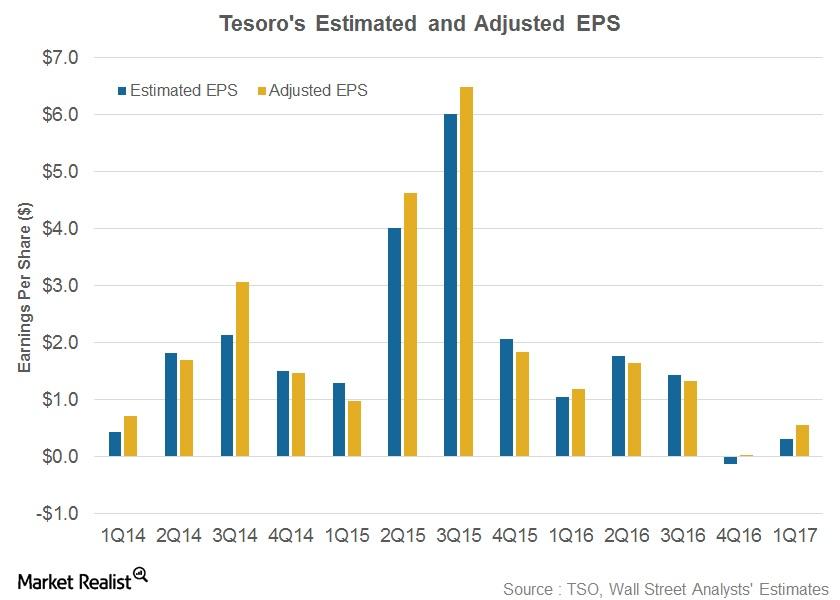

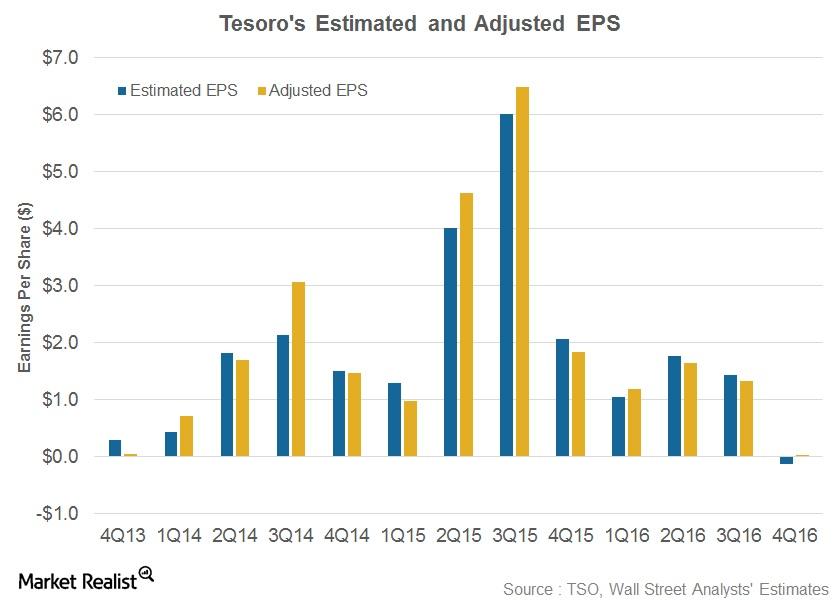

Tesoro Beats 1Q17 Earnings

Tesoro (TSO) posted its 1Q17 results on May 8, 2017. Revenues missed analysts’ estimate, but adjusted EPS of $0.55 surpassed the estimate of $0.31.

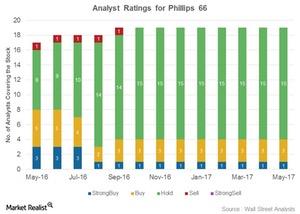

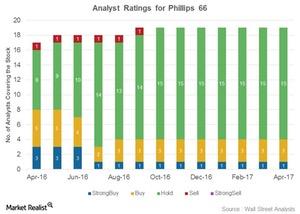

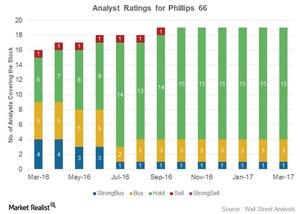

Analysts’ Ratings for Phillips 66 after Its 1Q17 Earnings

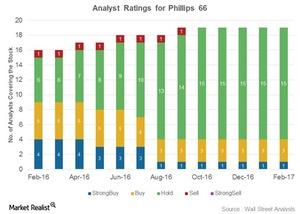

After its earnings, Phillips 66 was rated by 19 analysts. Four analysts gave it a “buy,” 15 gave it a “hold,” and no analysts gave it a “sell.”

Where Do Analysts Ratings for Tesoro Stand Pre-Earnings?

In this series, we’ve examined Tesoro’s (TSO) 1Q17 estimates, refining margin outlook, and stock performance ahead of its earnings release expected on May 8, 2017.

How Are Analysts Rating Phillips 66 before Its 1Q17 Earnings?

Phillips 66 has been rated by 19 analysts. Of those, four (or 21.0%) have given it a “buy” or “strong buy” rating.

Marathon Petroleum on the Street: What’s Changed among Analysts?

Of the 19 analysts covering MPC, 17 (89%) analysts have assigned “buy” or “strong buy” ratings, while two (11%) have assigned “hold” ratings.

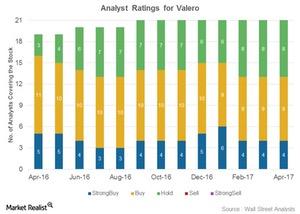

Analyst Ratings for Valero: Why the ‘Hold’ Ratings?

VLO’s mean price target of $72 per share implies around a 10% gain from its current level.

Why Most Analysts’ Ratings for Tesoro Are ‘Buys’

Thirteen out of the 18 analysts covering Tesoro (TSO) have rated it as a “buy” so far in March 2017. Another five analysts have rated TSO as a “hold.”

Phillips 66’s Beta: Does It Imply That PSX Is Less Volatile?

Phillips 66’s (PSX) 90-day beta stood at 1.2 on March 16, 2017, below its peer average of 2.1.

Could Intel Make the Mobileye Integration a Success?

Intel is looking to mitigate the integration risk by integrating its Automated Driving Group with Mobileye instead of integrating Mobileye into its business.

Why the Majority of Analysts Rate Phillips 66 as a ‘Hold’

Fifteen out of the 19 analysts covering Phillips 66 (PSX) rated it as a “hold” in March 2017. Another four analysts rated PSX as a “buy” or a “strong buy.”

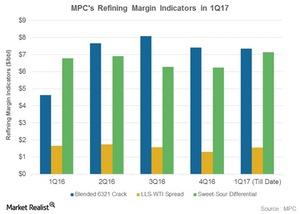

Could Marathon Petroleum’s Refining Earnings Rise in 1Q17?

Marathon Petroleum’s refining earnings are impacted by the blended LLS 6-3-2-1 crack, the sweet-sour differential, and the LLS-WTI spread.

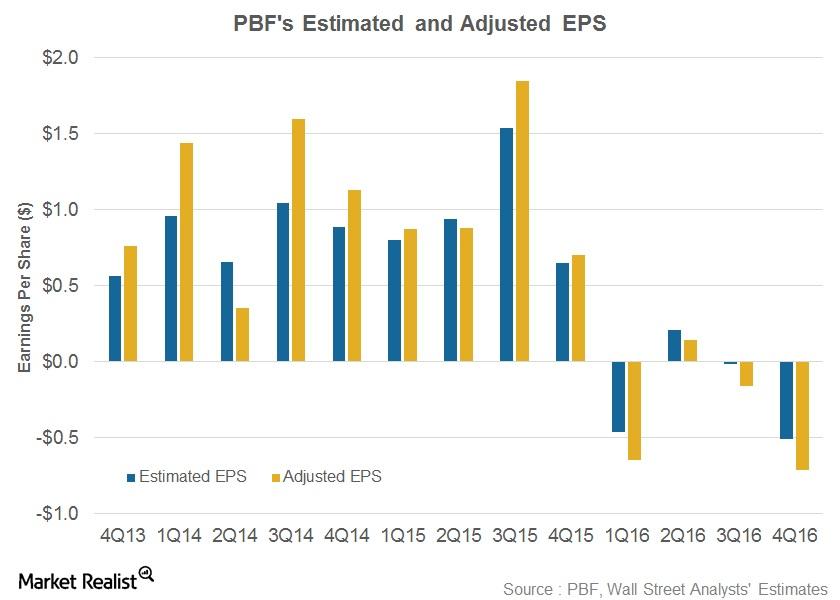

PBF Energy’s 4Q16 Results: Earnings Take a Nosedive

PBF Energy (PBF) released its 4Q16 results on February 16, 2017. The earnings results weren’t very encouraging for this petroleum refiner.

Tesoro Stayed Positive despite the Fall in Its 4Q16 Earnings

Tesoro (TSO) posted its 4Q16 results on February 6, 2017. It reported revenues of $6.6 billion, which missed Wall Street analysts’ estimates.

Phillips 66’s Recommendations: What the Analysts Are Saying Now

After its 4Q16 results, four of 19 analysts assigned “buy” or “strong buy” recommendations to Phillip’s 66 stock, while 15 assigned “holds.”