PowerShares DWA Energy Momentum ETF

Latest PowerShares DWA Energy Momentum ETF News and Updates

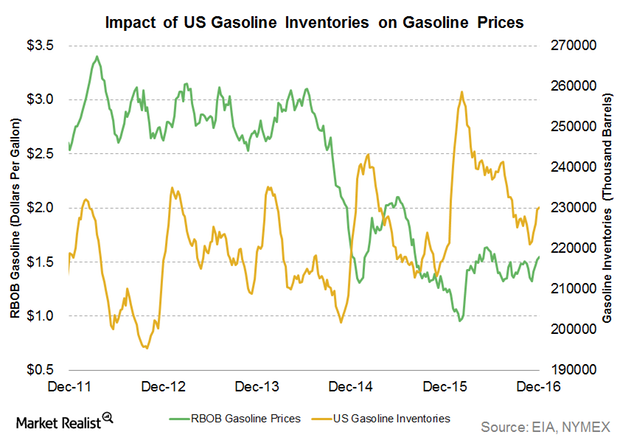

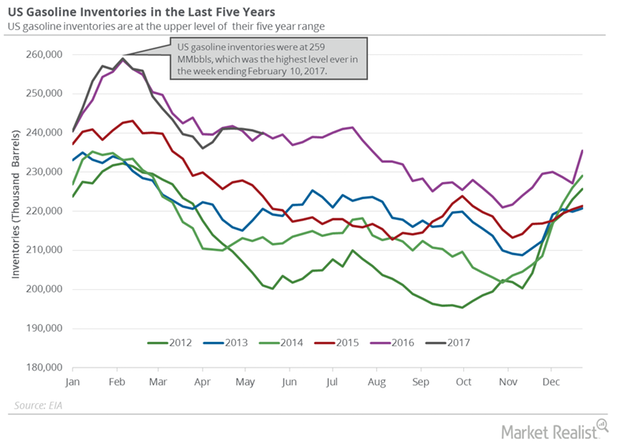

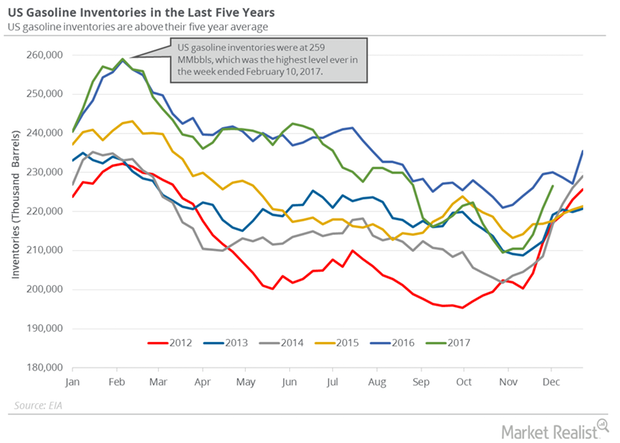

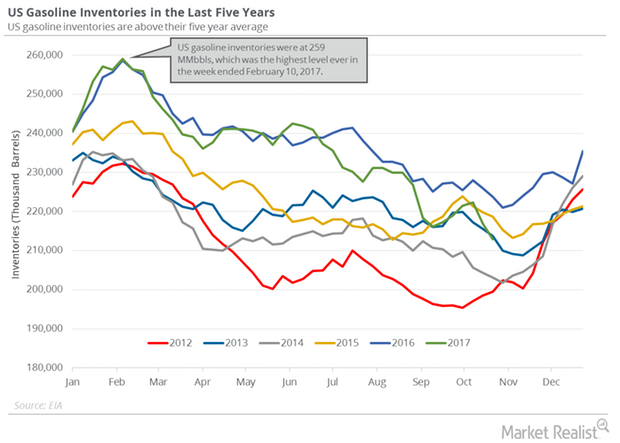

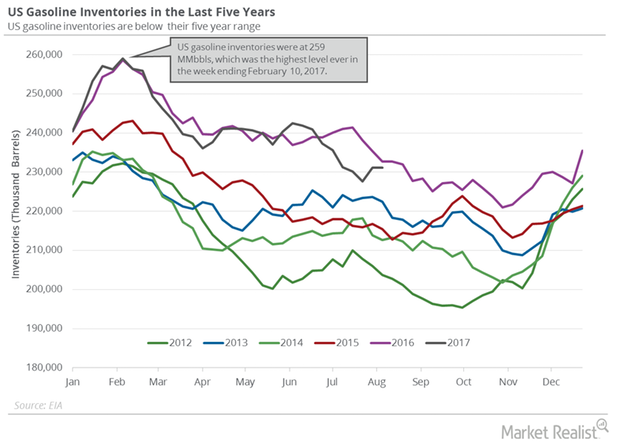

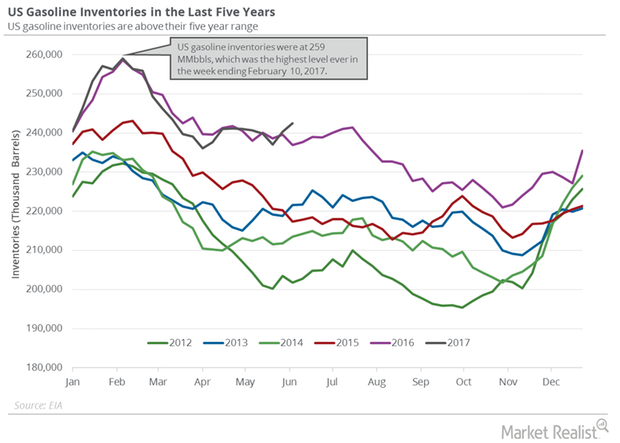

Will Gasoline Inventories Impact Gasoline and Crude Oil Prices?

The API released its weekly inventory report on December 28, 2016. It estimates that US gasoline inventories fell by 2.8 MMbbls from December 16–23, 2016.

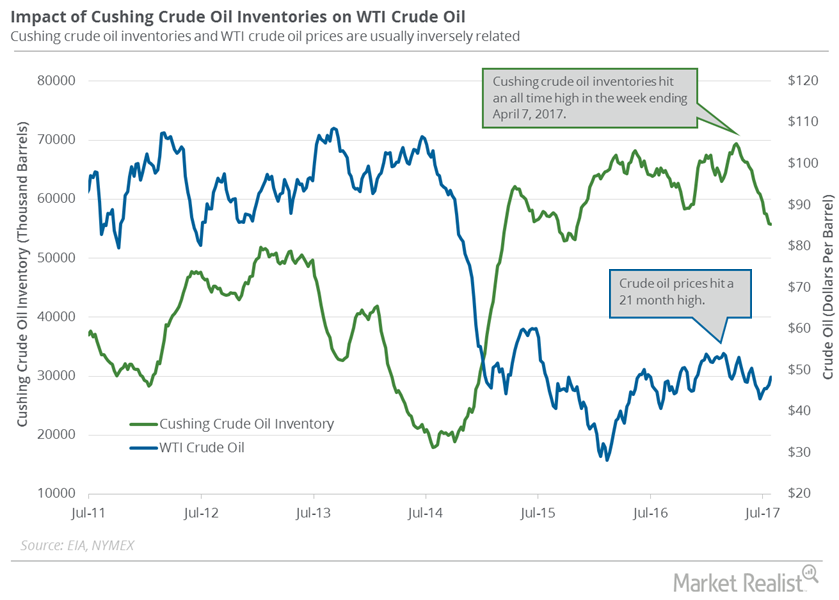

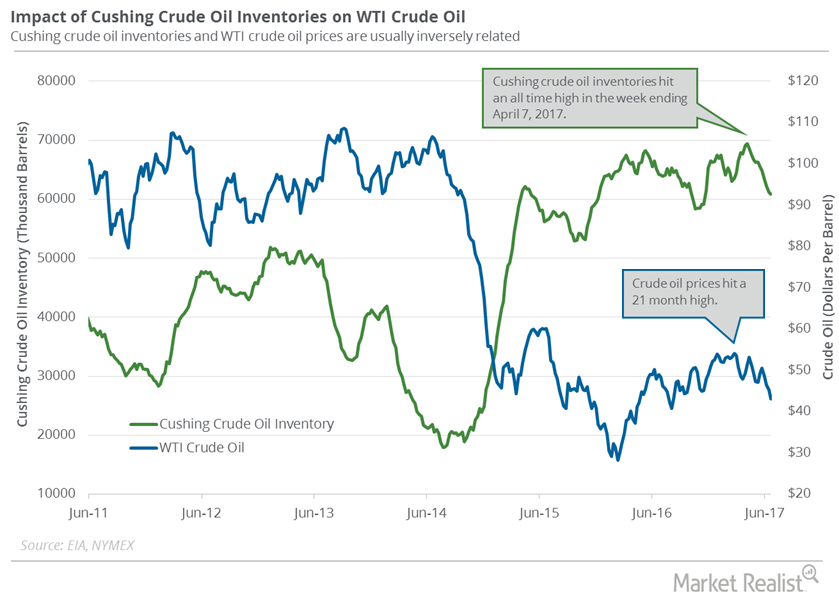

Cushing Inventories Rise for the First Time in 12 Weeks

Cushing is the largest crude oil storage hub in the United States. A market survey estimates that Cushing inventories fell from August 4 to August 11.

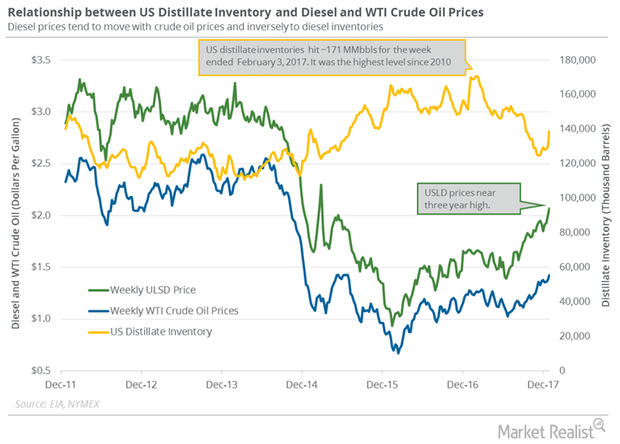

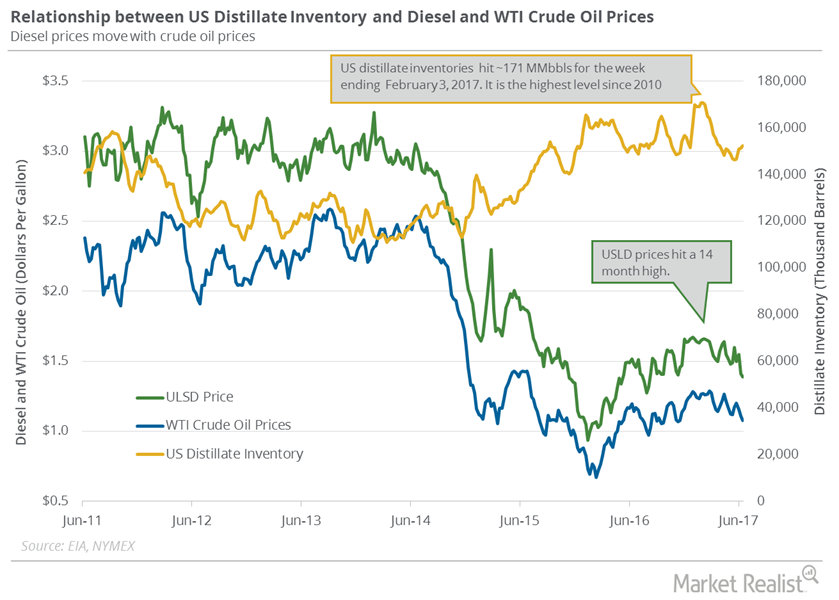

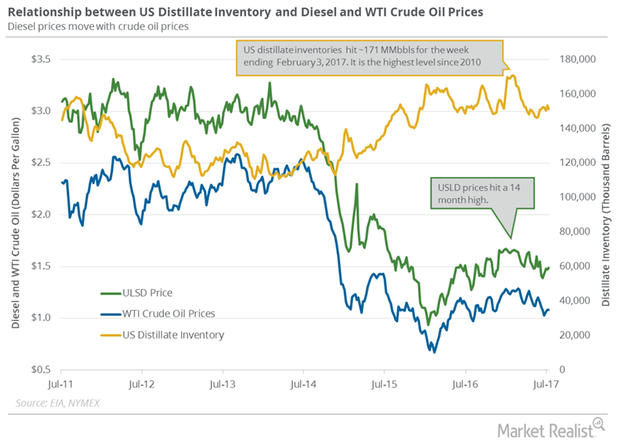

US Distillate Inventories Rose for the Sixth Time in 7 Weeks

US distillate inventories increased for the sixth time in the last seven weeks. The inventories rose ~11% in the last seven weeks.

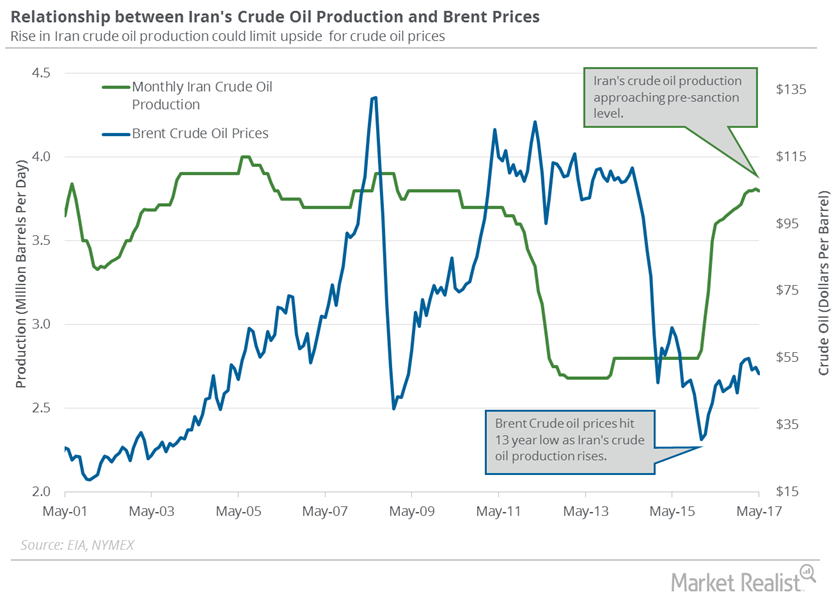

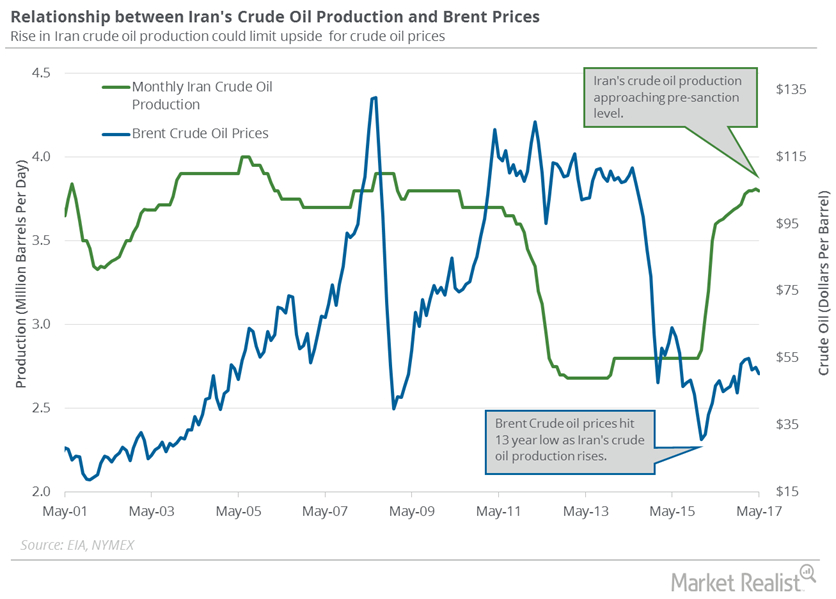

Iran’s Crude Oil Exports Could Impact Crude Oil Prices

The rise in crude oil export capacity suggests that Iran’s getting ready for a massive increase in crude oil production in 2018.

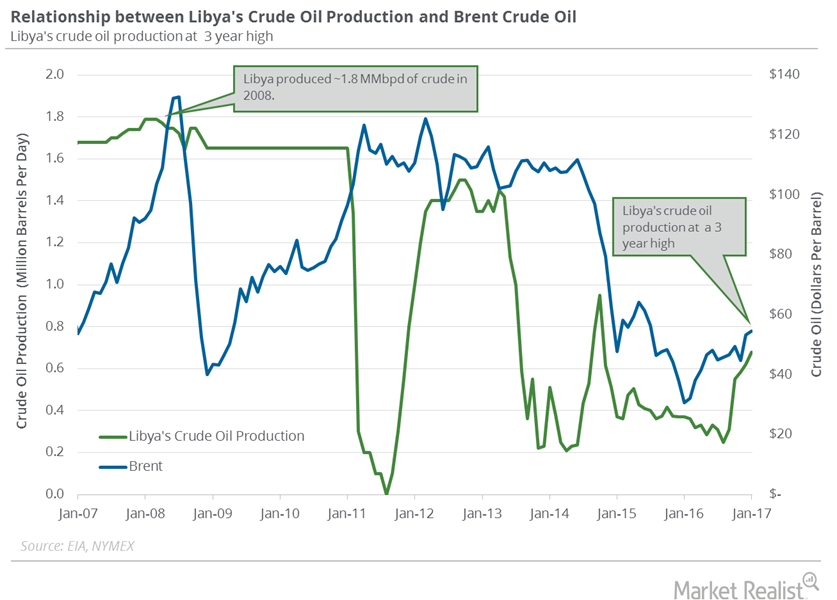

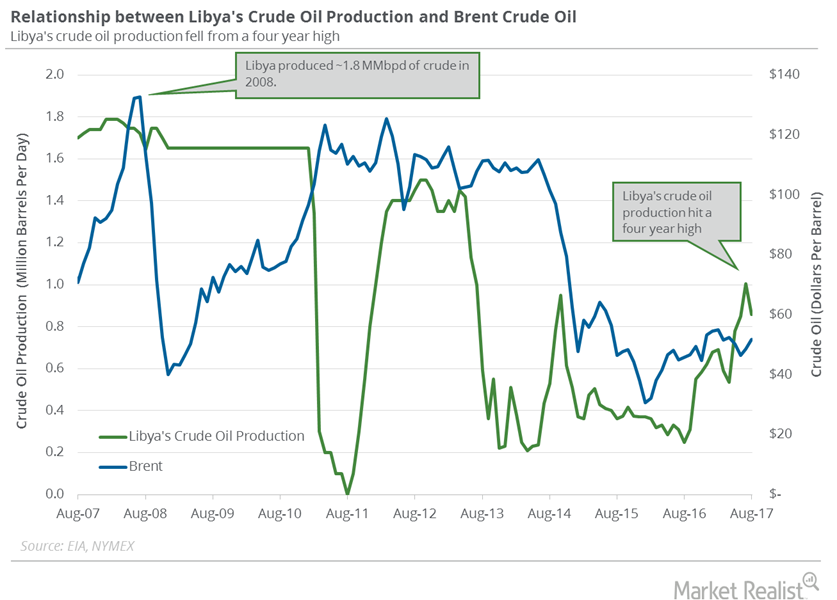

Analyzing Libya’s Crude Oil Production

A Reuters survey estimates that Libya’s crude oil production fell by ~20,000 bpd (barrels per day) to 670,000 bpd in February 2017—compared to January 2017.

Why Did Crude Oil Prices Rise?

On February 9, 2017, US crude oil futures contracts for March delivery closed at $53.00 per barrel—an ~1.3% rise compared to the previous trading session.

Cushing Inventories Have Fallen 10% in the Last 10 Weeks

Cushing crude oil inventories have fallen 10% in the last ten weeks. A better-than-expected fall in Cushing inventories could support US crude oil prices.

Will US Crude Oil Prices Outperform in 2H17?

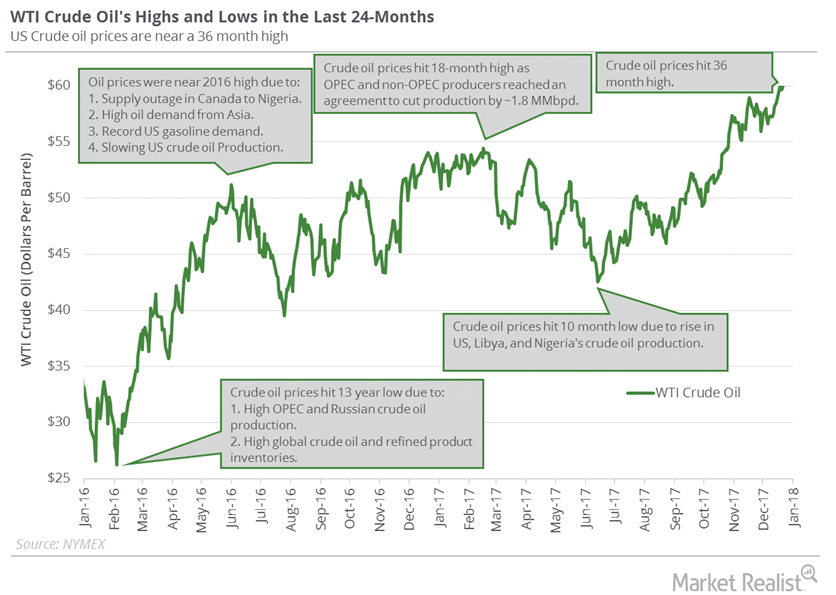

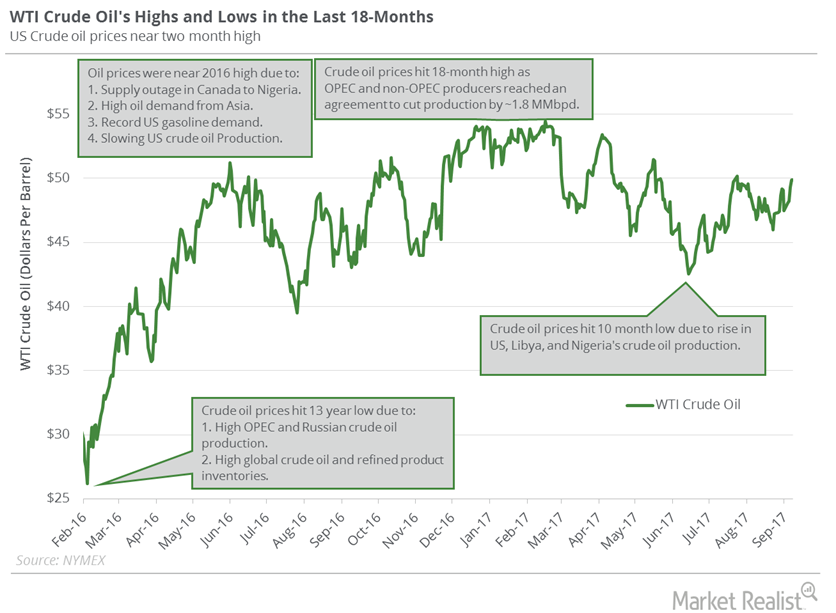

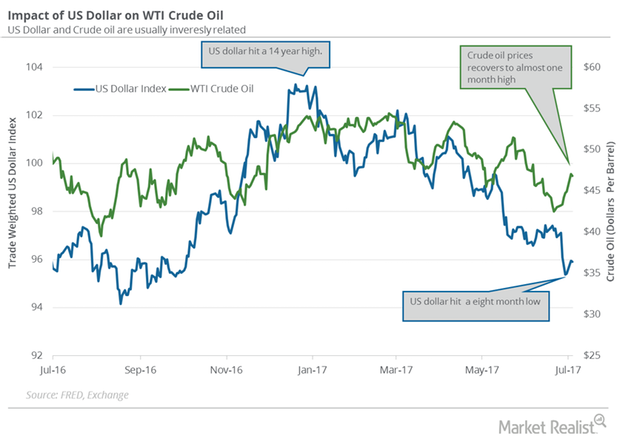

WTI crude oil (BNO) (PXI) (UCO) (XOP) prices have fallen 18% year-to-date. They have fallen 7% in the past year due to bearish drivers.

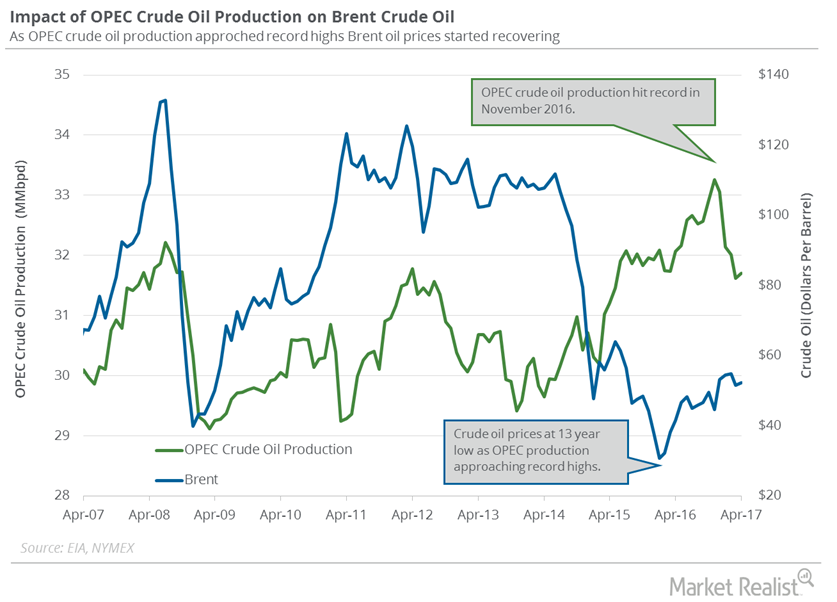

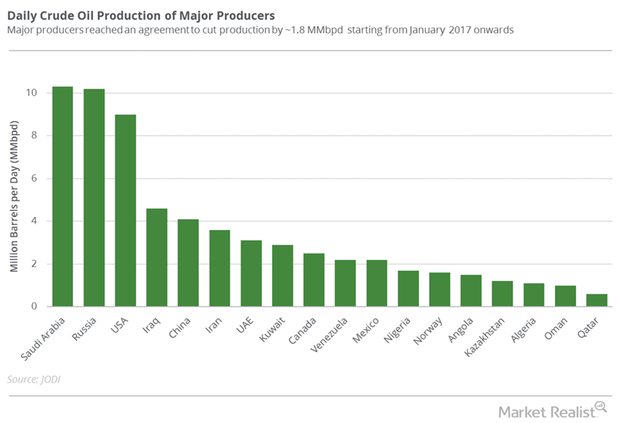

OPEC’s Crude Oil Production: Key for Crude Oil Traders?

A Bloomberg survey estimates that OPEC’s crude oil production rose by 315,000 bpd to 32.21 MMbpd in May 2017—compared to the previous month.

What to Expect from Libya’s Crude Oil Production in September

The EIA estimates that Libya’s crude oil production fell by 145,000 bpd (barrels per day) to 860,000 bpd in August 2017—compared to the previous month.

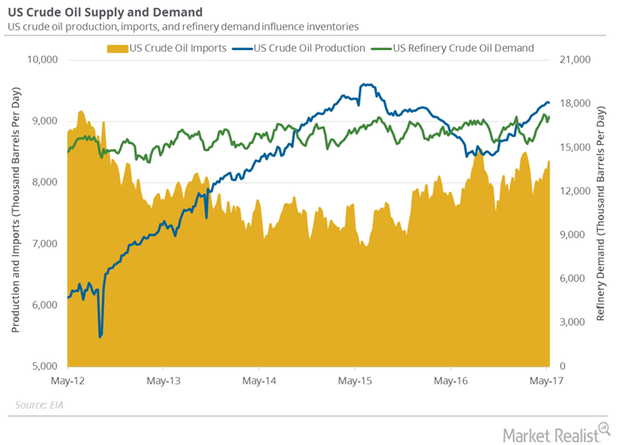

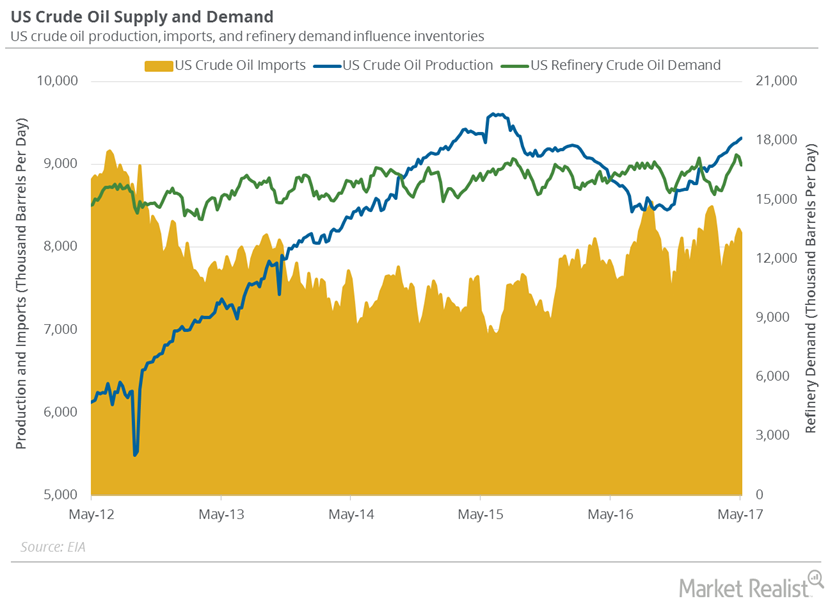

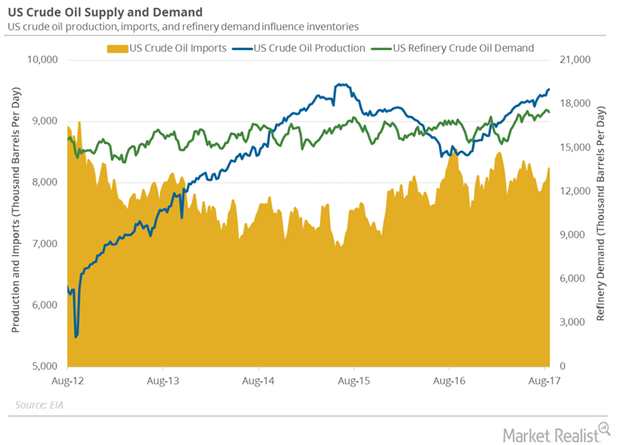

US Refinery Demand Impacts Crude Oil Inventories

US refineries operated at 93.4% of their operable capacity in the week ending May 5, 2017. The rise in refinery demand is bullish for crude oil prices.

US Gasoline Inventories Fell Less, Pressured Gasoline Prices

The EIA released its weekly crude oil report on May 24, 2017. US gasoline inventories fell by 0.8 MMbbls to 239.9 MMbbls on May 12–19, 2017.

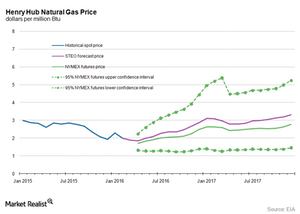

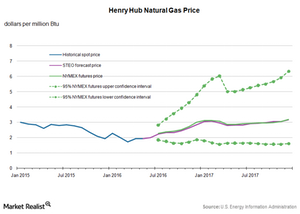

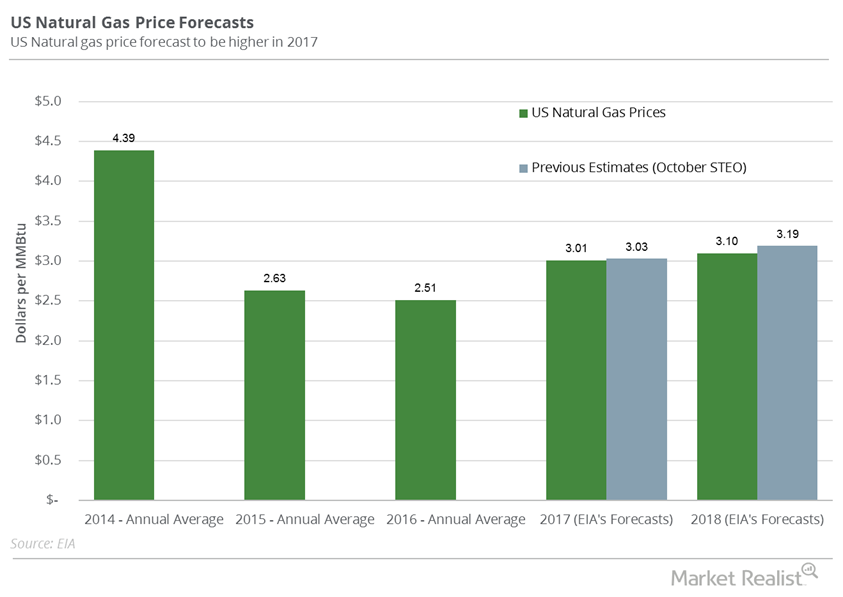

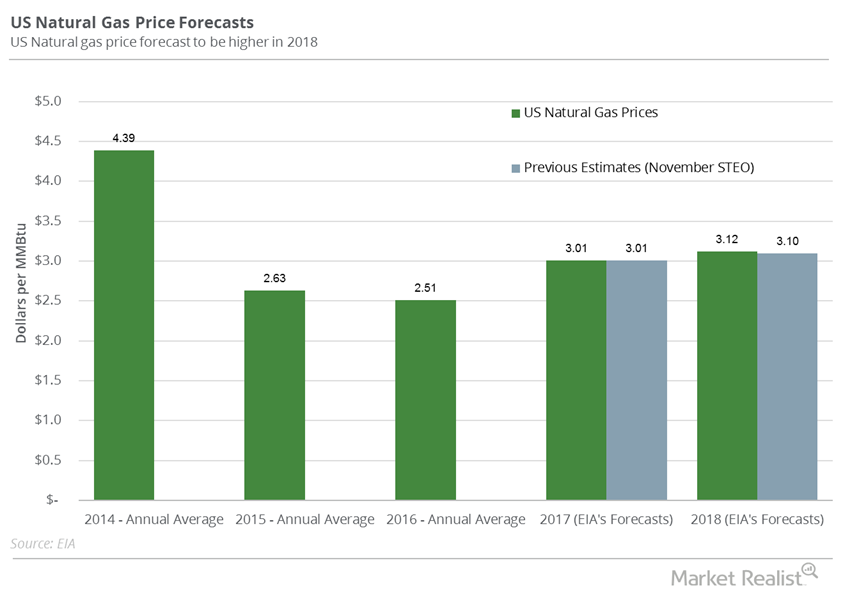

What’s the Long-Term US Natural Gas Price Forecast?

In its March Short-Term Energy Outlook report, the EIA forecast that the US natural gas supply-demand balance could average around 2.9 Bcf per day in 2016.

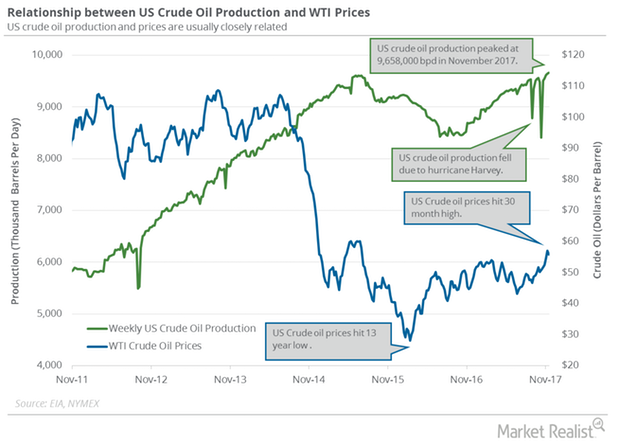

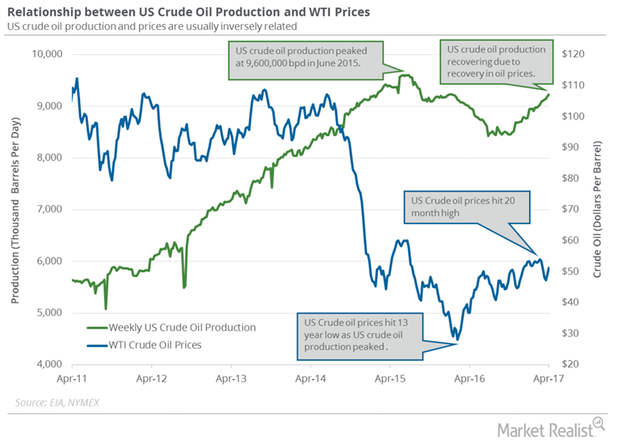

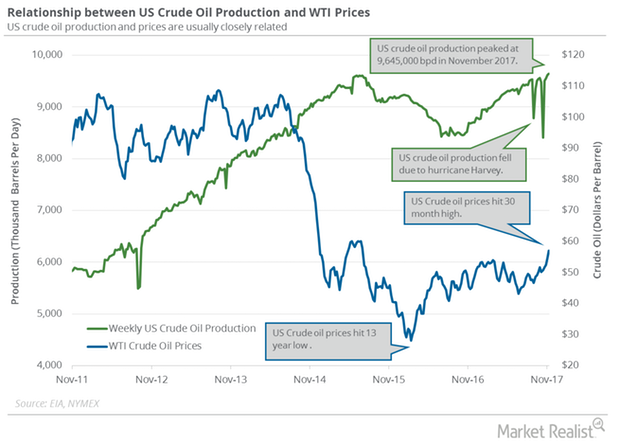

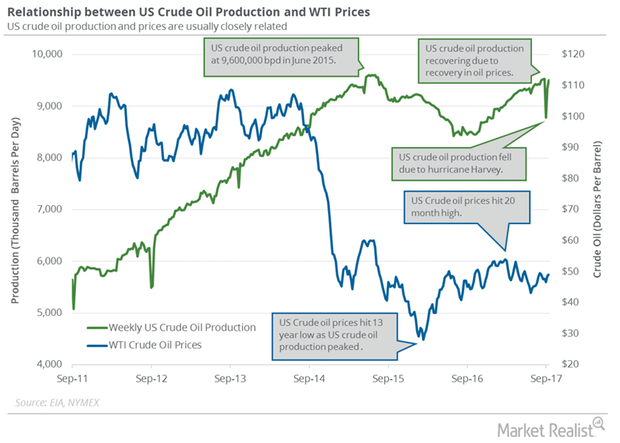

Why US Crude Oil Production Could Hit a Record High in 2018

US crude oil production According to the EIA (U.S. Energy Information Administration), US crude oil production rose 13,000 bpd (barrels per day) to 9,658,000 bpd between November 10 and 17, 2017. Production, which rose for the fifth straight week, has been pressuring oil (SCO) prices in the last few weeks. Production has risen 977,000 bpd (11.3%) year-over-year. Any […]

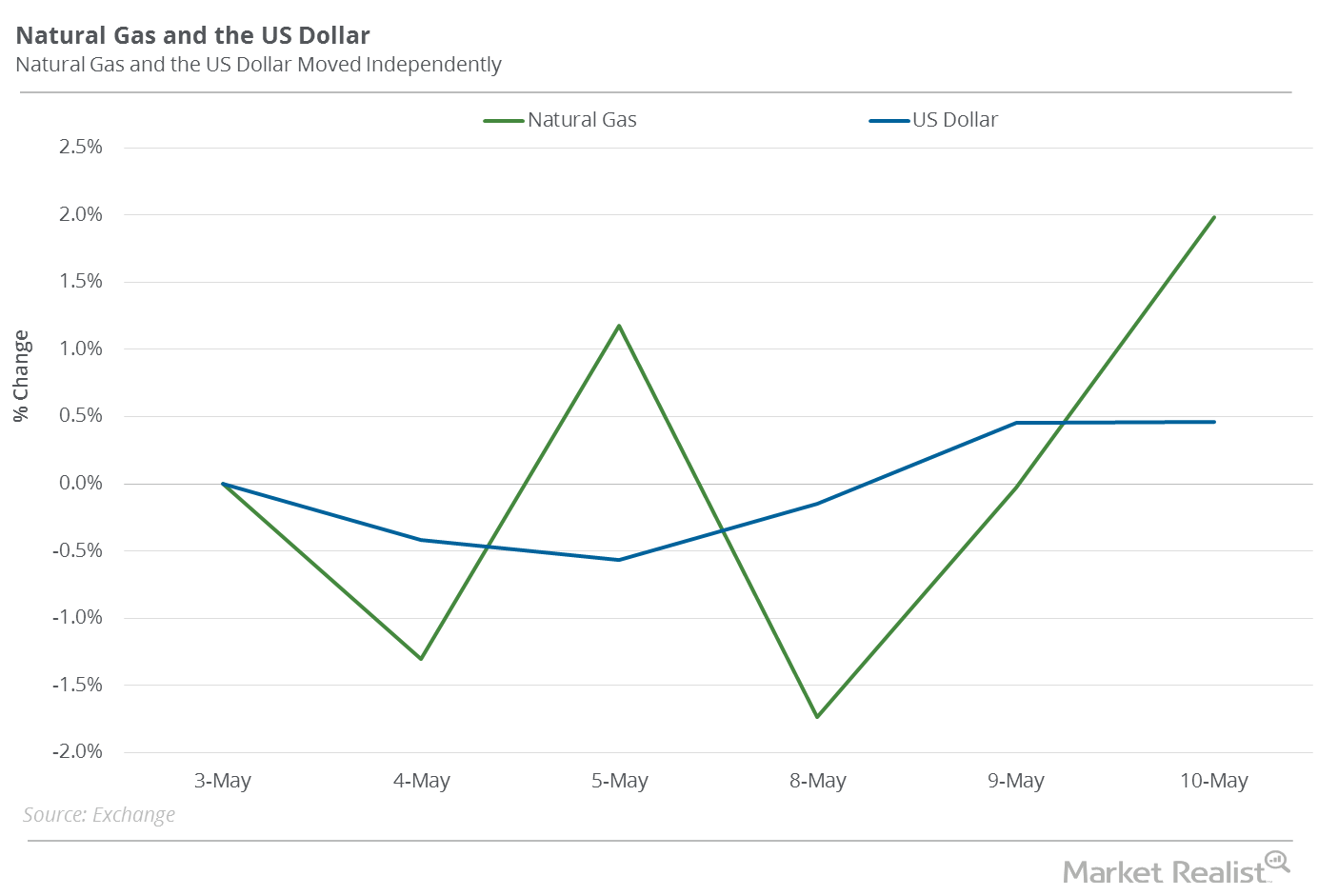

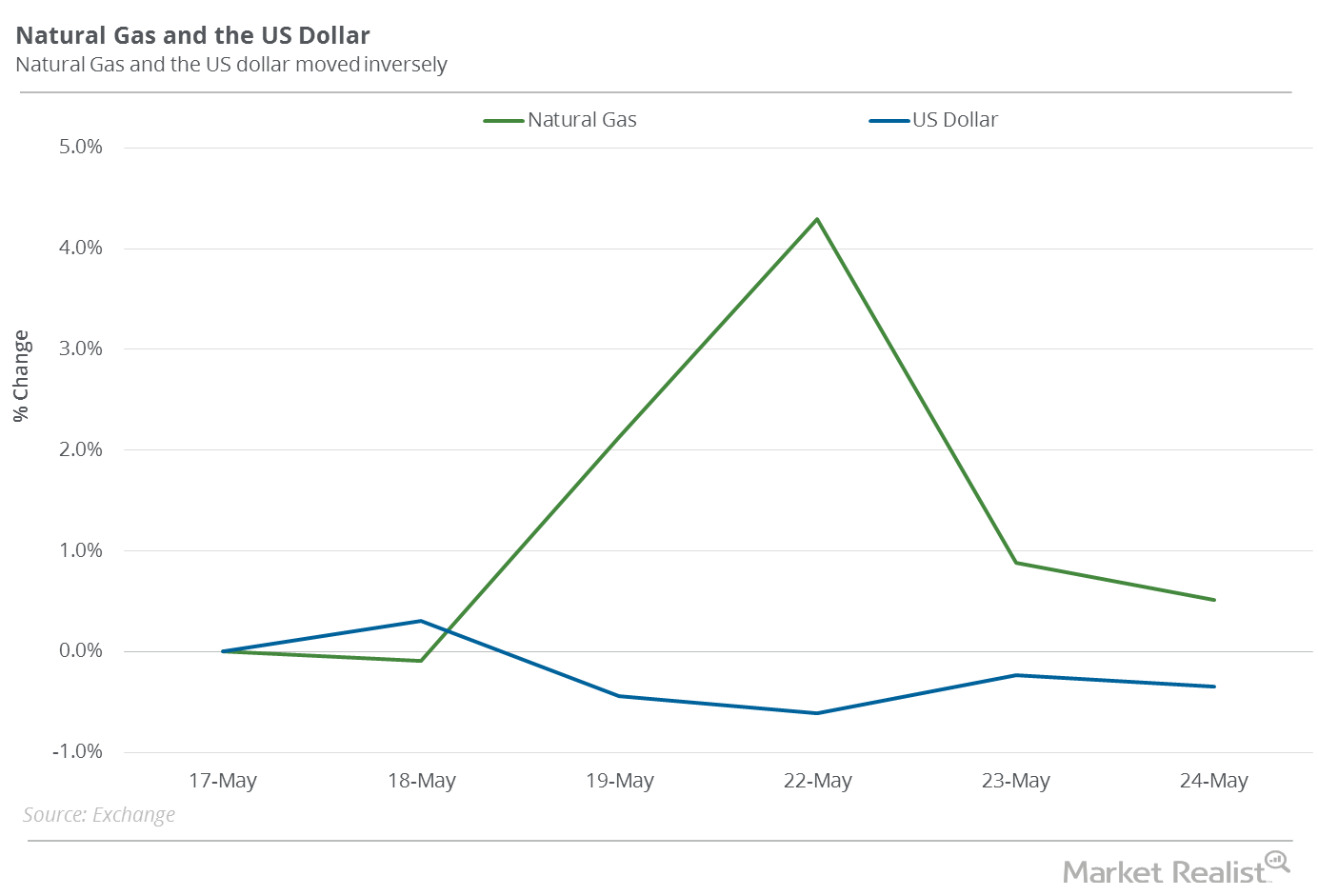

Natural Gas Prices Are Impacted by the US Dollar

Between May 3 and May 10, 2017, natural gas (GASX) (FCG) (GASL) June futures rose 2%. The US dollar (UUP) (UDN) (USDU) rose 0.5% during that period.

Will US Crude Oil Futures Rise above $50 per Barrel This week?

September US crude oil prices are on a rollercoaster ride in 2017 due to bullish and bearish drivers. US crude oil prices are near a two-month high.

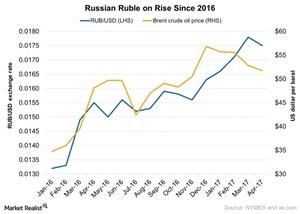

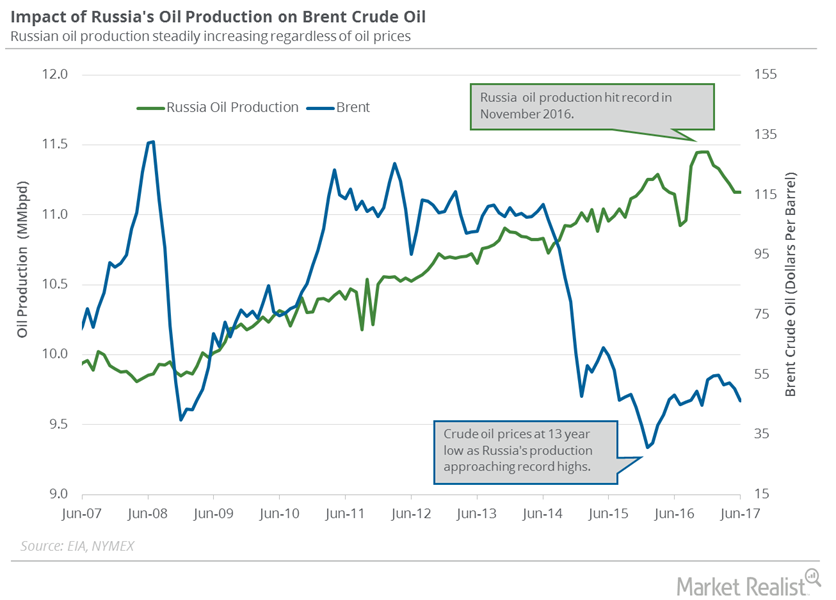

Why the Ruble Is on the Rise

The recovery of oil prices in the latter half of 2016 has helped the Russian ruble to appreciate along with improved exports.

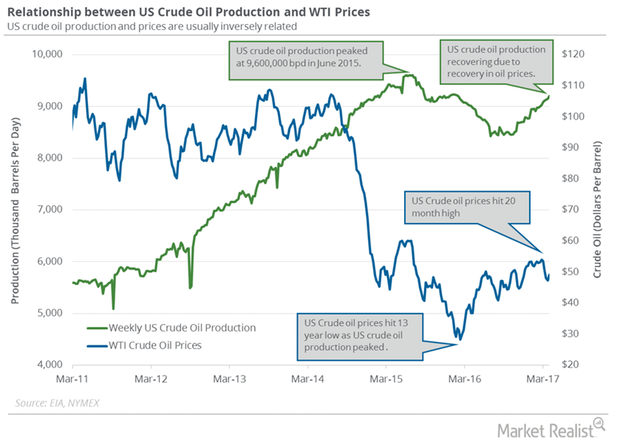

Why US Crude Oil Output Hit a High from January 2016

US crude oil output is at the highest level since January 25, 2016. The rise in crude oil output is the biggest bearish driver for crude oil prices in 2017.

Geopolitical Tension Could Drive Brent and US Crude Oil Futures

Brent crude oil futures fell 0.7% to $49.61 per barrel on July 4, 2017. August WTI crude oil (XLE) (XOP) (PXI) futures contracts rose in electronic trading.

Fall in US Refinery Demand and Imports Impacted Inventories

US refineries operated at 91.5% of their operable capacity in the week ending May 5, 2017. The US refinery demand fell for the second consecutive week.

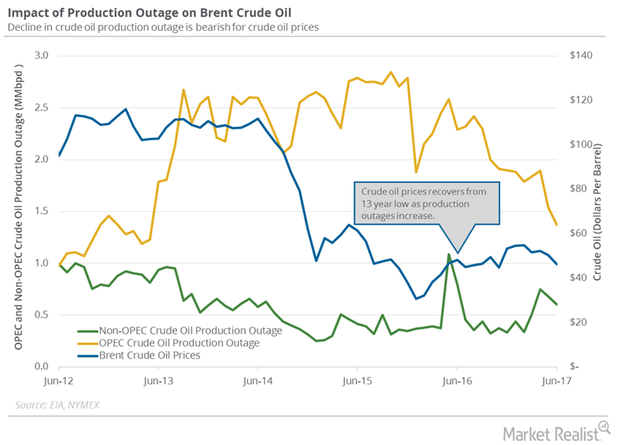

Global Crude Oil Supply Outages Near 5-Year Low

The US Energy Information Administration estimates that global crude oil supply outages fell by 247,000 bpd (barrels per day) to 2.0 MMbpd (million barrels per day) in June 2017.

EIA Raises Estimates for US Crude Oil Production in 2018

The EIA (U.S. Energy Information Administration) reported that US crude oil production rose by 36,000 bpd (barrels per day) to 9,235,000 bpd between March 31 and April 7, 2017.

Natural Gas Prices Are Trading above Key Moving Averages

US natural gas inventories are 25% higher than their five-year average. High natural gas inventories could also limit the upside for US natural gas prices.

US Distillate Inventories Rose for the Fourth Straight Week

US distillate inventories rose by 1.1 MMbbls to 152.5 MMbbls on June 9–16, 2017. US distillate inventories rose for the fourth consecutive week.

Hedge Funds: Bullish or Bearish on Natural Gas?

Aegent Energy Advisors predicts that US natural gas prices might not exceed $3.18 per MMBtu by December 2017.

Will US Natural Gas Futures End 2017 on a Low Note?

January US natural gas (UGAZ) futures contracts were below their 100-day, 50-day, and 20-day moving averages on December 21, 2017.

Recent Fall in the US Dollar: Crucial for Natural Gas?

Natural gas (GASX) (FCG) (GASL) July futures rose 0.5% on May 17–May 24, 2017. During this period, the US dollar (UUP) (UDN) (USDU) fell 0.3%.

Crude Oil Futures: Next Important Resistance Level

WTI crude oil (UCO) futures closed at $62.01 per barrel on January 4, 2018—the highest level since December 2014. WTI prices rose ~12.4% in 2017.

US Distillate Inventories Fell for the Fourth Time in 5 Weeks

The EIA reported that US distillate inventories fell by 1.9 MMbbls (million barrels) to 149.5 MMbbls on July 14–21, 2017.

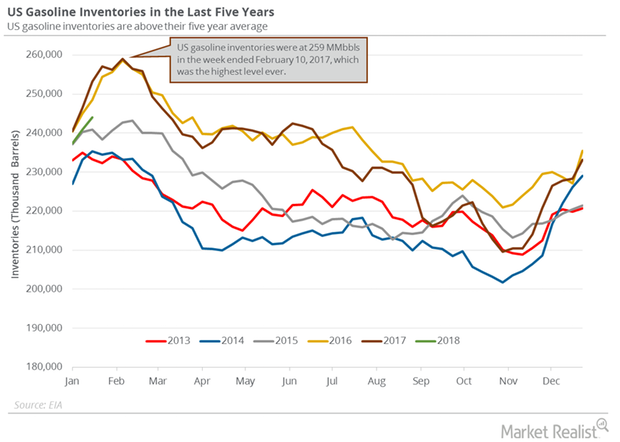

US Gasoline Inventories Could Threaten Crude Oil Prices

According to the EIA, US gasoline inventories increased by 3.1 MMbbls (million barrels) to 244 MMbbls on January 12–19, 2018.

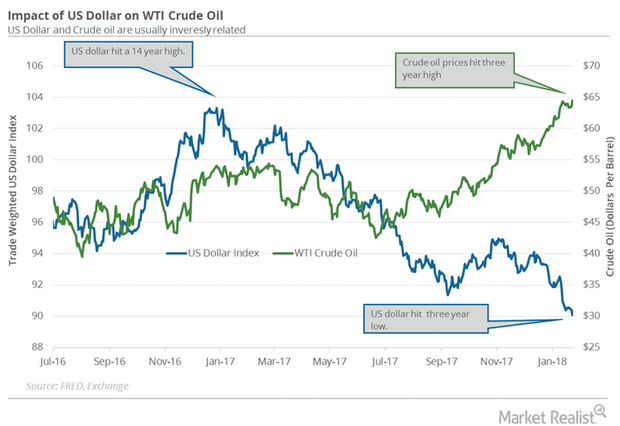

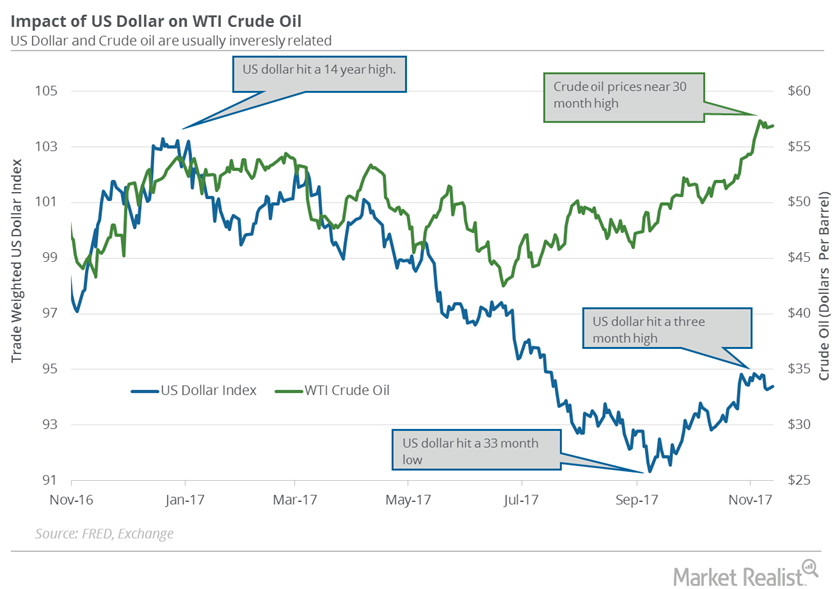

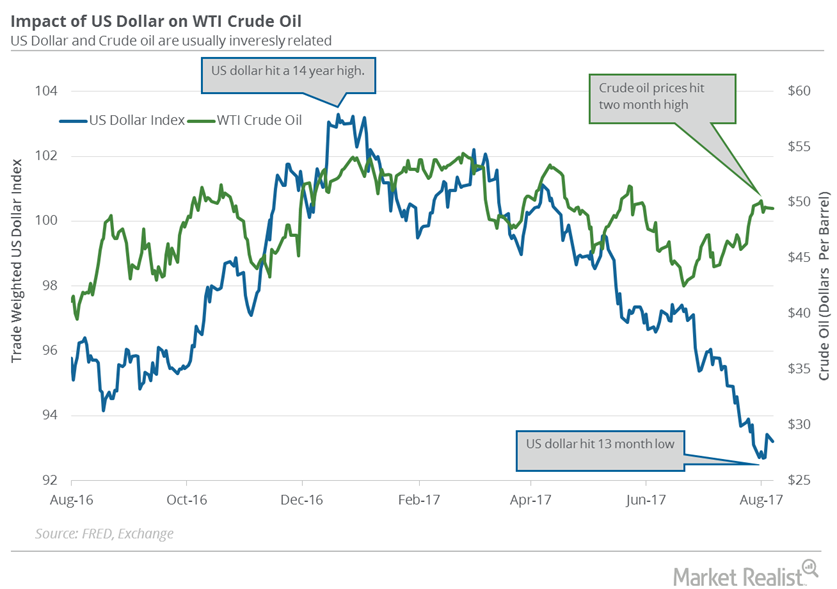

US Dollar Hit a 3-Year Low: Is It Bullish for Crude Oil?

The US Dollar Index (UUP) fell 0.34% to 90.09 on January 23—the lowest level since December 2014. The fall supported crude oil prices on January 23, 2018.

Analyzing the API’s Gasoline and Distillate Inventories

On December 19, 2017, the API released its crude oil inventory report. US gasoline inventories rose by 2 MMbbls (million barrels) on December 8–15, 2017.

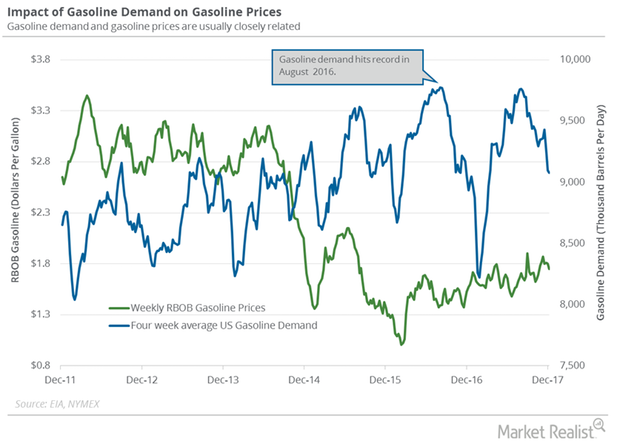

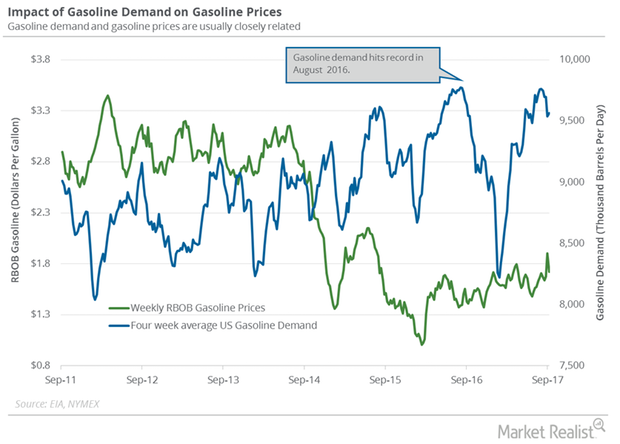

US Gasoline’s Demand Trend Is Changing

The EIA estimates that four-week average US gasoline demand fell by 21,000 bpd (barrels per day) to 9.1 MMbpd on December 1–8, 2017.

Crude Oil Prices Are Positive before OPEC’s Meeting

US crude oil futures for January delivery rose 0.3% to $57.47 per barrel at 1:10 AM EST on November 30, 2017. Prices rose ahead of OPEC’s meeting.

US Crude Oil Production: Bearish Driver for Oil Prices

The EIA estimates that US crude oil production rose by 25,000 bpd (barrels per day) or 0.3% to 9,645,000 bpd on November 3–10, 2017.

US Dollar Could Pressure Crude Oil Futures This Week

The US Dollar Index rose 0.13% to 94.4 on November 13, 2017. It limited the upside for US crude oil (UWT) (DWT) prices on the same day.

US Gasoline Inventories Fell 18%, Bullish for Crude Oil

The EIA (U.S. Energy Information Administration) estimates that US gasoline inventories fell by 4,020,000 barrels to 212.8 MMbbls on October 20–27, 2017.

US Crude Oil Production Near 4-Week High: Another Bearish Factor

The EIA (U.S. Energy Information Administration) estimates that US crude oil production rose by 157,000 bpd (barrels per day), or 1.7%, to 9,510,000 bpd between September 8, 2017, and September 15, 2017.

US Gasoline Demand Could Fall in 2018

The EIA estimates that weekly US gasoline demand rose by 456,000 bpd (barrels per day) to 9.6 MMbpd (million barrels per day) on September 1–8, 2017.

Will US Crude Oil Futures Break $50 per Barrel?

Let’s track some important events for crude oil and natural gas traders between September 18 and September 22.

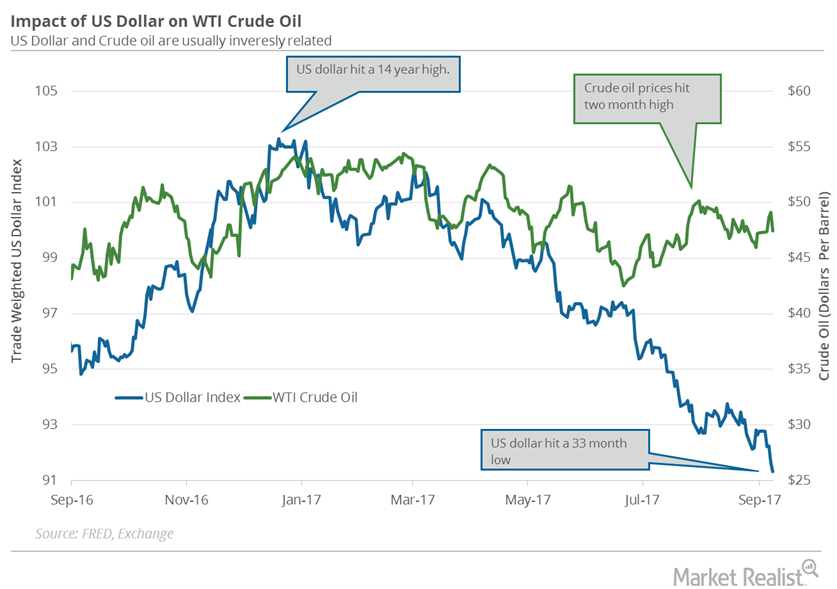

Why the US Dollar Hit a 33-Month Low

The US Dollar Index fell 0.34% to 91.33 on September 8—the lowest level in the last 33 months. Prices fell due to the following factors.…

How Tropical Storm Harvey Impacts US Crude Oil and Gasoline Prices

WTI (West Texas Intermediate) crude oil (SCO)(BNO)(PXI) futures contracts for October delivery rose 0.4% and were trading at $46.8 per barrel in electronic trading at 2:05 AM EST on August 29.

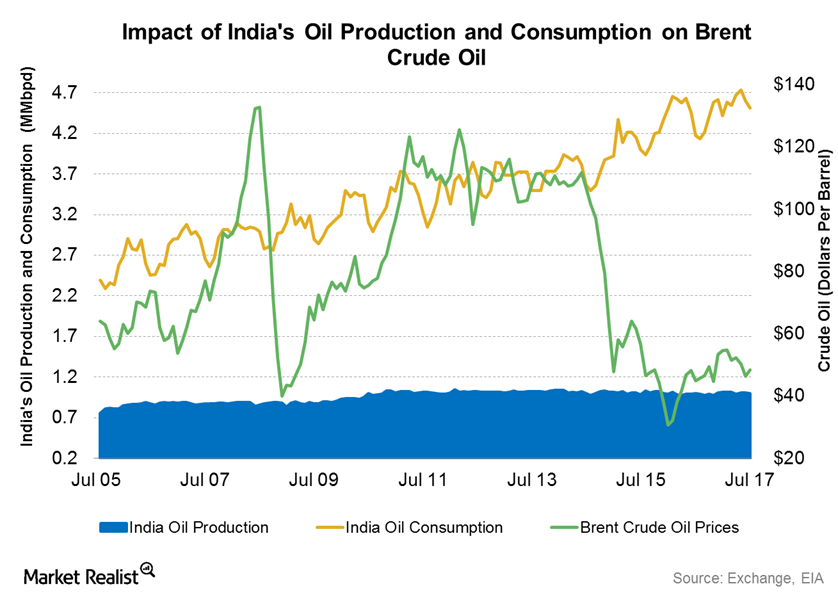

How India’s Crude Oil Imports, Production, Demand Impact Prices

India’s Petroleum Planning and Analysis Cell estimated that the country’s crude oil imports rose 0.60% to 4.2 MMbpd in July 2017 from July 2016.

US Gasoline Inventories Pressured Gasoline and Crude Oil Futures

The EIA reported that US gasoline inventories rose by 22,000 barrels or 0.1% to 231.1 MMbbls (million barrels) on August 4–11, 2017.

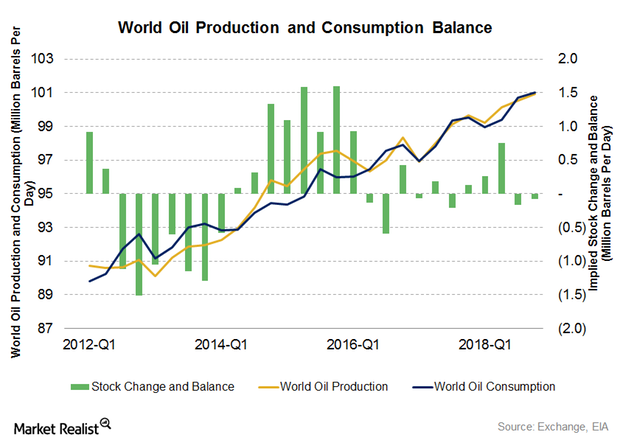

Will Global Oil Consumption Beat Production?

WTI (West Texas Intermediate) crude oil (PXI)(USL)(SCO) futures contracts for September delivery fell 0.1% and were trading at $48.78 per barrel in electronic trading at 2:00 AM EST on August 14, 2017.

Russia’s Crude Oil Production Was Flat Again

The Russian Energy Ministry estimates that Russia’s crude oil production was flat at 10.95 MMbpd in July 2017—compared to the previous month.

US Dollar Recovers from a 13-Month Low

The US Dollar Index rose 0.77% to 93.7 on August 4, 2017. The US dollar rose due to the better-than-expected rise in US unemployment data.

Will the US Dollar Continue Its Bearish Momentum This Week?

August 2017 West Texas Intermediate crude oil futures contracts fell 0.5% and were trading at $46.83 per barrel in electronic trade at 1:45 AM EST on July 4, 2017.

Analyzing Iran’s Crude Oil Production and Export Plans

Iran’s crude oil production is at a seven-year high. Iran was able to scale up production after the US lifted sanctions on the country in January 2016.

Analyzing US Gasoline Inventories and Gasoline Demand

US gasoline inventories rose by 2.1 MMbbls to 242.3 MMbbls on June 2–9, 2017. Inventories rose 0.9% week-over-week and 2.3% year-over-year.