Prologis Inc

Latest Prologis Inc News and Updates

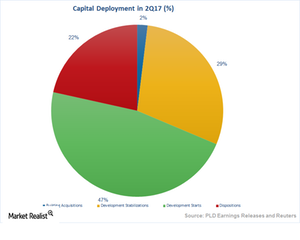

How Prologis Boosted Top-Line Growth in 2Q17

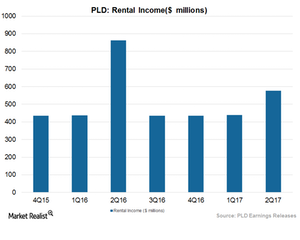

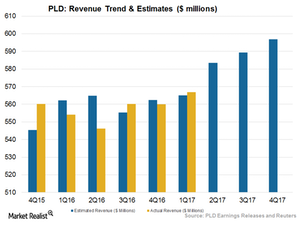

Prologis’s (PLD) upbeat top-line and bottom-line results in 2Q17 were driven by higher-than-expected rent growth and net operating income.

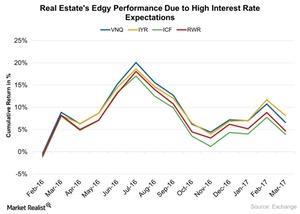

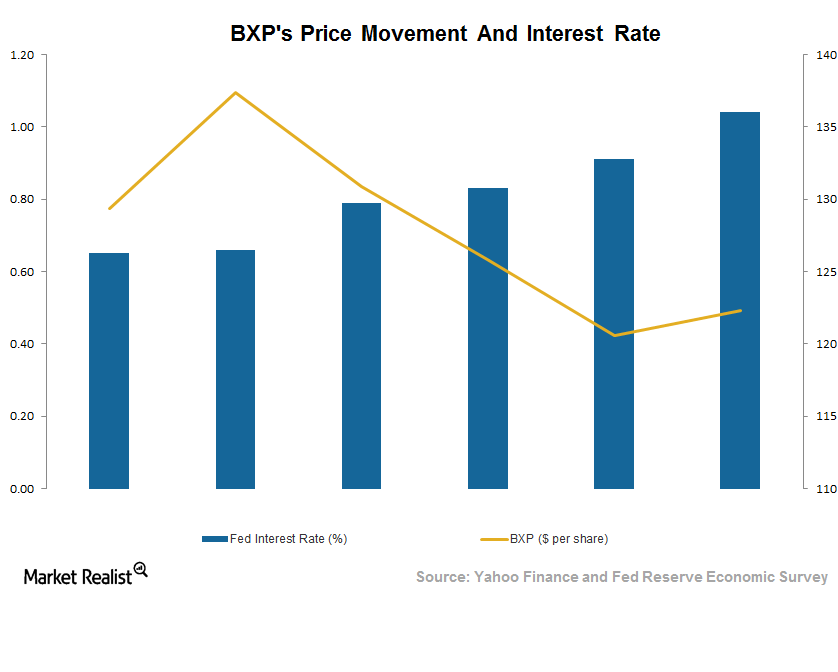

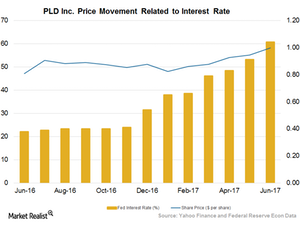

The Real Estate Reaction: Gauging the Impact of the Fed’s Rate Hikes

The rising interest rate is expected to boost the economy in the long run, but it could severely impact sectors like real estate.

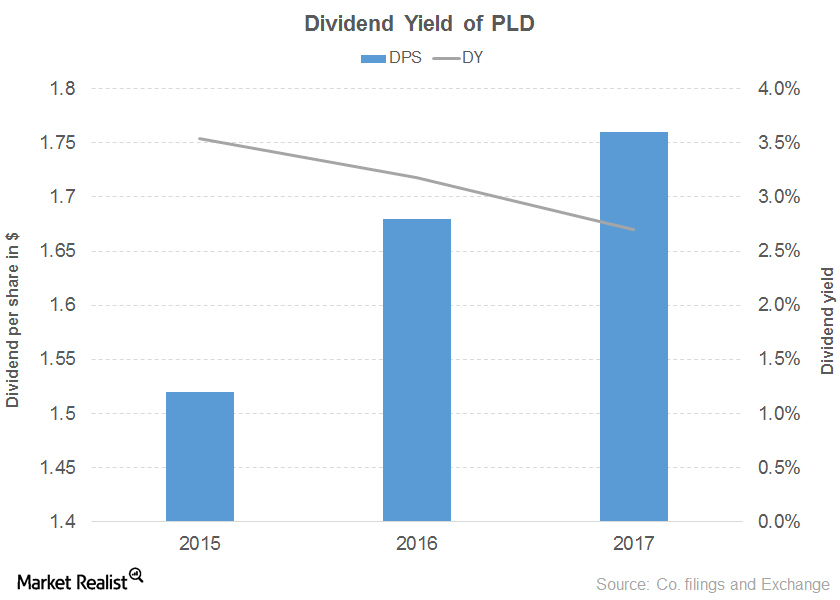

Why Prologis Has a Downward Sloping Dividend Yield Curve

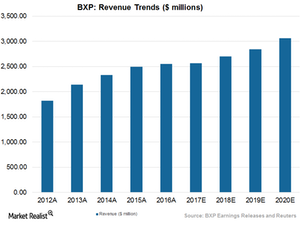

Prologis has noted a 15.0% rise in revenue in the first half of 2017, driven by every segment. Operating income rose 61.0% despite higher expenses.

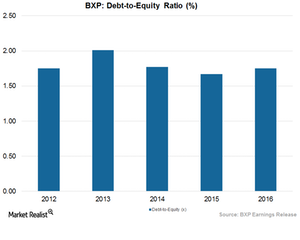

What’s Boston Properties’ Balance Sheet Position?

REITs depend on equity and debt for their working capital.

How Boston Property Is Flourishing despite Rising Interest Rates

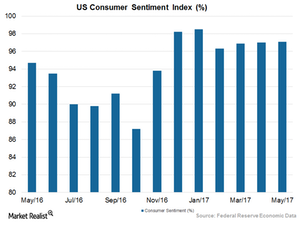

Although it is a common belief that high interest rates are usually bad for REITs like Boston Properties (BXP), Simon Property (SPG), Prologis (PLD), and Vornado Realty Trust (VNO), we find that REITs have continued in their growth trajectory in the past few months.

Can Boston Properties Flourish amid Higher Interest Rates?

REITs have flourished for a considerable period in a record-low-interest-rate environment because they depend on debt and equity for their working capital.

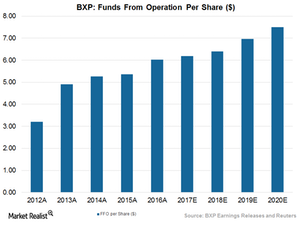

What Lies Ahead for Boston Properties in 2017?

Boston Properties raised its EPS (earnings per share) outlook for 2017 to a range of $2.72 to $2.77 per share.

How Did Boston Properties Fare in 1H17?

The growing economy has acted as a boon to REITs, and with the help of their strategic initiatives, these REITs have been able to take advantage of the opportunity and report higher revenue and profits.

Why Boston Properties Could Be Strong Enough to Combat Headwinds

Boston Properties’ recent upbeat results came on the back of higher leasing activity as well as strong occupancy levels, which led to revenue growth.

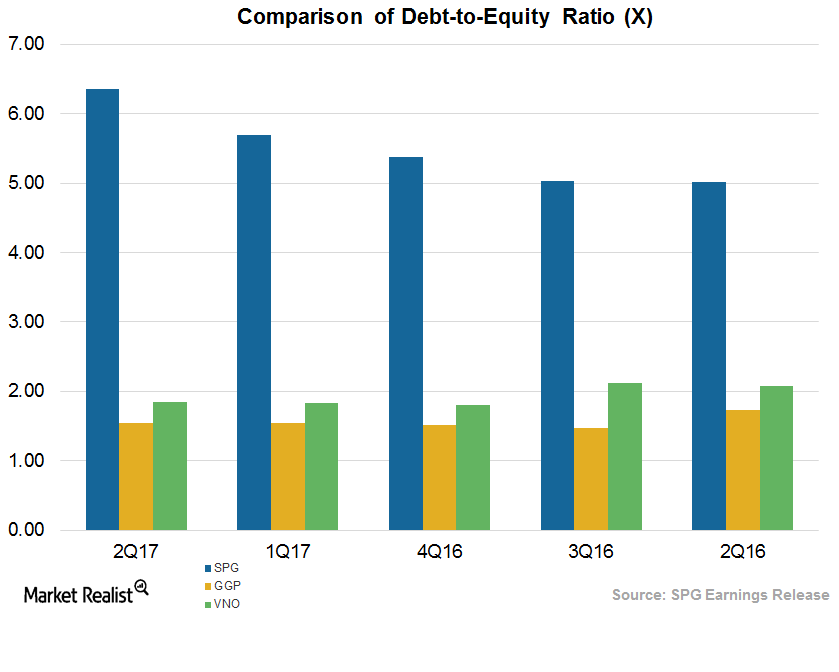

Commercial REITs Have Higher Debt-to-Equity Ratios

GGP’s (GGP) debt-to-equity was 1.55x for 2Q17, which was higher than the industrial mean of 1.07x. As of 2Q17, GGP had $2.0 billion of liquidity.

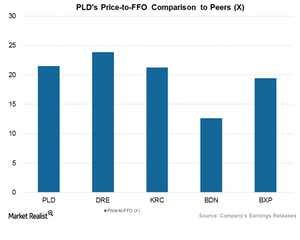

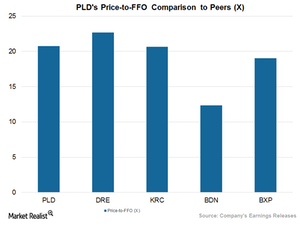

How Prologis Stacks Up against Peers after 2Q17 Earnings

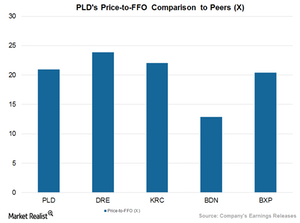

The price-to-FFO multiple is the best way to evaluate Prologis (PLD).

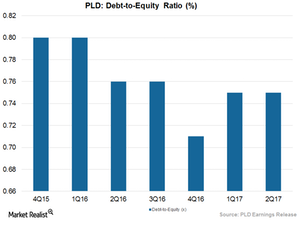

How Prologis Improved Its Balance Sheet

Prologis maintained a debt-to-equity ratio of 0.75x for 2Q17, which was lower than the industrial mean of 1.07x.

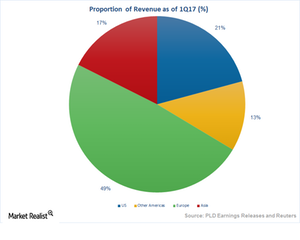

Robust US Business Growth Helped Prologis in 2Q17

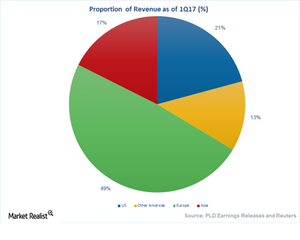

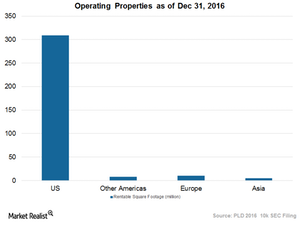

Prologis’s (PLD) properties are spread across the globe. This geographical diversity ensures that the company gets the optimum value from the retail and supply chains in different parts of the world.

Prologis’s Strong 2Q17 Results Backed by Rent Growth

Prologis (PLD) reported better-than-expected 2Q17 top-line and bottom-line results.

Where Does Prologis Stand after 2Q Earnings?

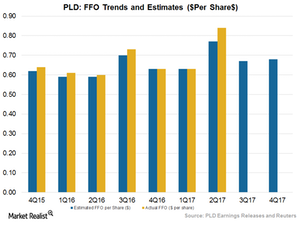

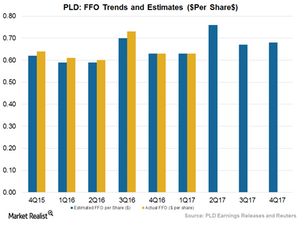

Prologis (PLD) reported core funds from operation (or FFO) of $0.84 per share in 2Q17, which surpassed Wall Street’s estimates of $0.77 by a remarkable 9.1%.

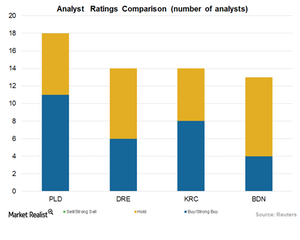

Prologis: What Analysts Recommend for the Stock

Analysts have assigned Prologis stock a mean price target of $58.47, which is 2.1% higher than its current price of $57.28.

Where Does Prologis Stand among Its Peers?

In terms of price-to-FFO multiple, PLD trades at par with most of its peers except Brandywine Realty Trust (BDN).

Will Prologis Be Able to Turn Macro Issues to Its Advantage?

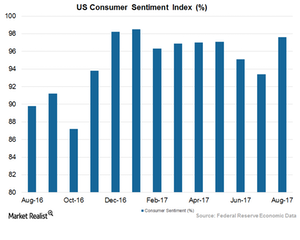

In addition to Prologis’s strategic initiatives such as acquisitions, dispositions, and project development activities, several macroeconomic factors also impact performance.

The Factors behind Prologis’s Expected 2Q17 Upbeat Results

Wall Street expects Prologis to report adjusted FFO (funds from operations) of $0.76, a 27.3% rise year-over-year.

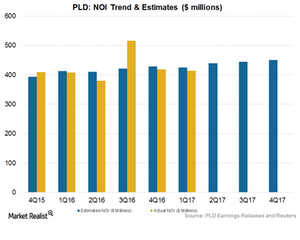

Can Prologis’s Cost Reductions Drive Net Operating Income Higher?

According to Wall Street analysts, Prologis (PLD) is expected to report NOI (net operating income) of $440.2 million in 2Q17.

Prologis’s Main Revenue Drivers in 2Q17

Prologis (PLD) is expected to see higher revenue growth as well as higher margins for 2Q17.

Will Prologis Ride High on Its Top Line in 2Q17?

Analysts expect Prologis (PLD) to report revenue of $583.5 million for 2Q17 when it releases its earnings on July 18, 2017.

What’s in Store for Prologis in 2Q17?

Prologis (PLD) is scheduled to report its fiscal 2Q17 earnings on July 18. 2017. Analysts expect it to report adjusted FFO (funds from operations) of $0.76.

Understanding Prologis’s Multiples Next to Those of Peers

Prologis’s price-to-FFO multiple is now 20.95x, which means that it has been returning consistent capital value and reliable dividend yields to investors.

Why Prologis’s Business Model Promises Consistent Profitability

Prologis is expected to achieve a growth rate of 6%, 5.8%, 9.1% and 8.7%, respectively, in AFFO (adjusted funds from operations) over the next four quarters.

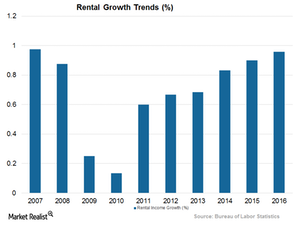

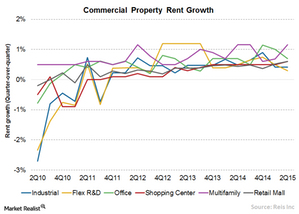

The Rise in Commercial Property Rent Is Beneficial to REITs

Rent increased 0.4% for industrial properties in 2Q15, which was unchanged from the previous quarter, but lower than the 0.5% 2Q14 growth.