ArcelorMittal SA

Latest ArcelorMittal SA News and Updates

What to Expect from U.S. Steel Corporation’s 4Q17 Shipments

U.S. Steel Corporation’s 4Q17 European shipments could be higher—compared to the sequential quarter. Steel demand tends to be slow in the third quarter.

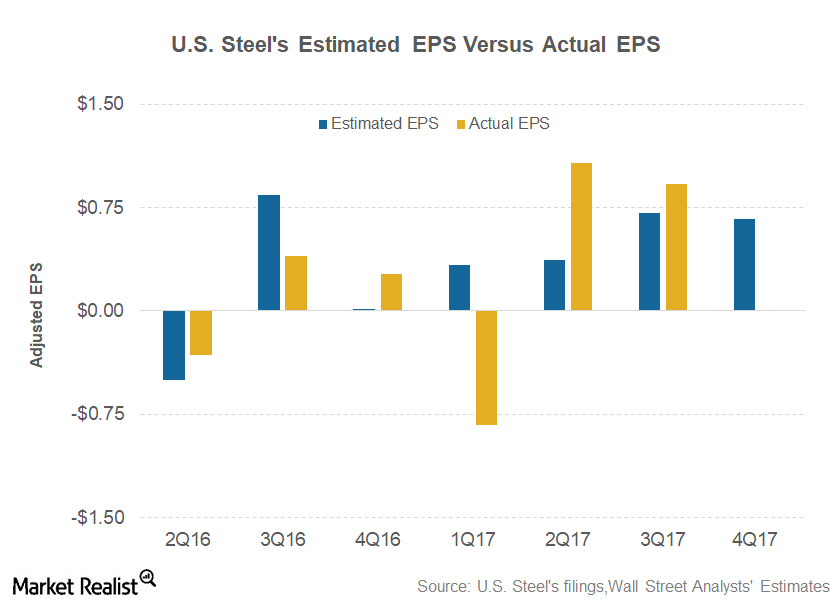

Can U.S. Steel Corporation Continue to Fly High?

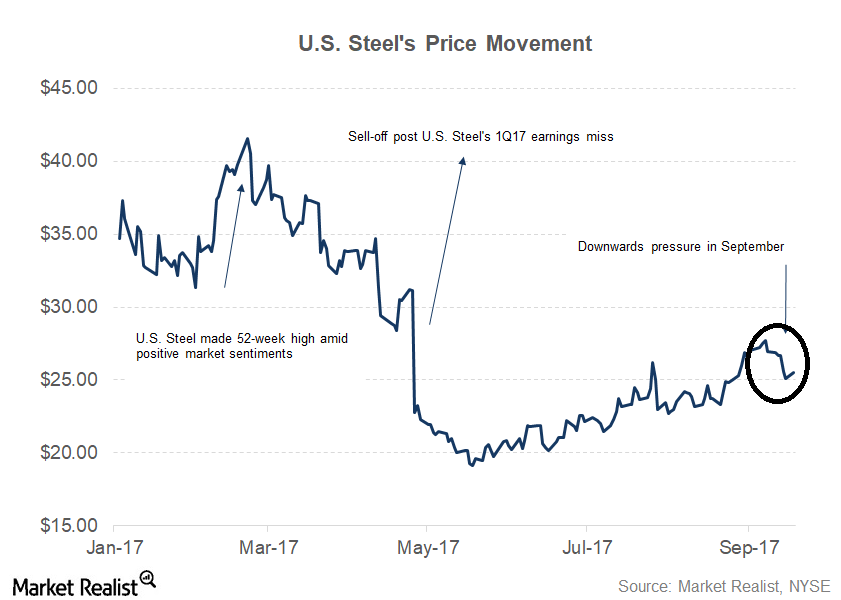

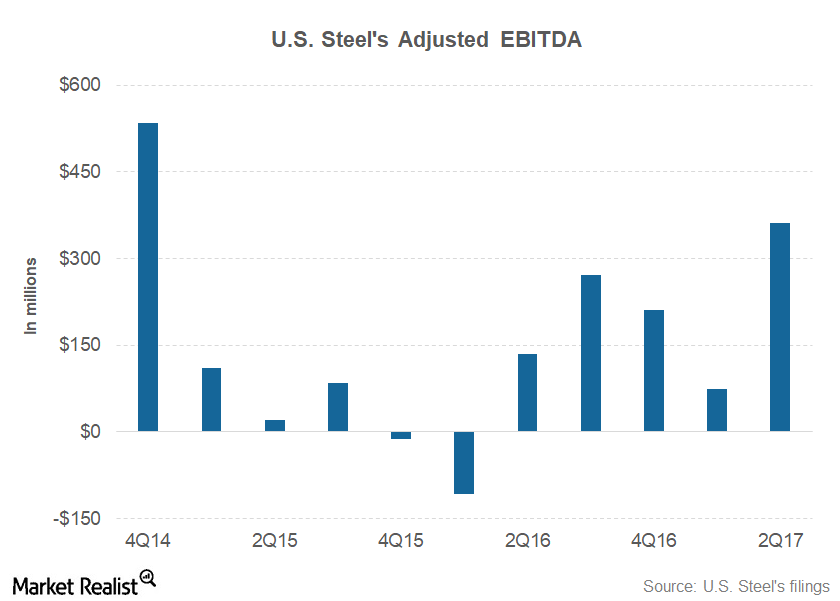

U.S. Steel Corporation (X) is scheduled to release its 4Q17 financial results on January 31, 2018. U.S. Steel Corporation closed 2017 with gains of 6.6%.

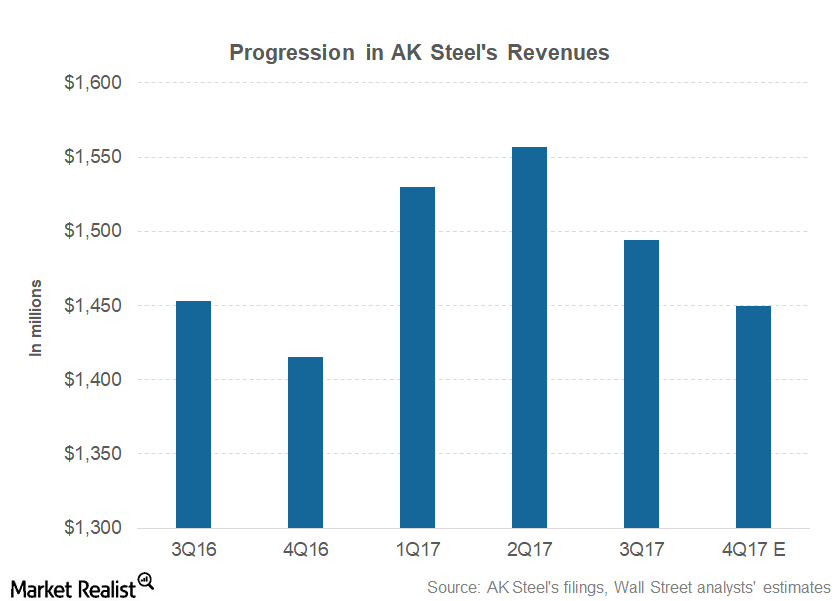

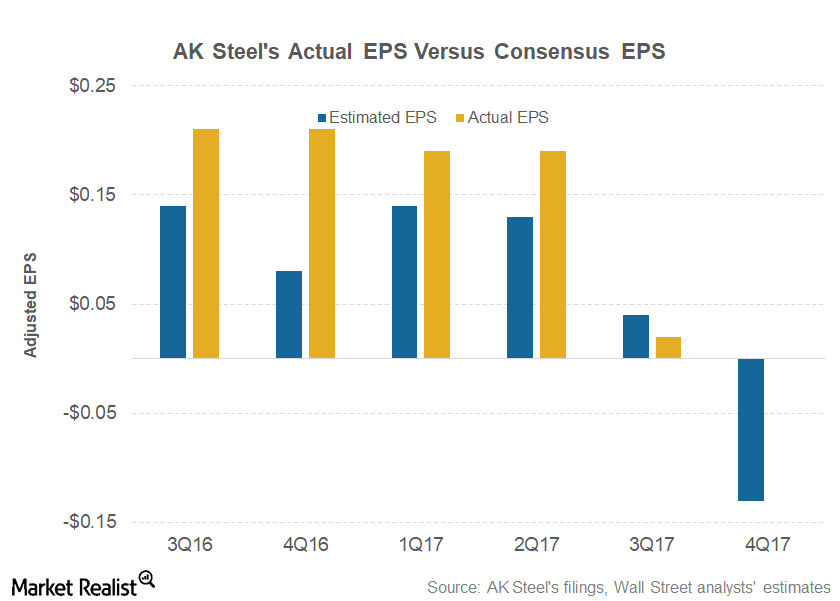

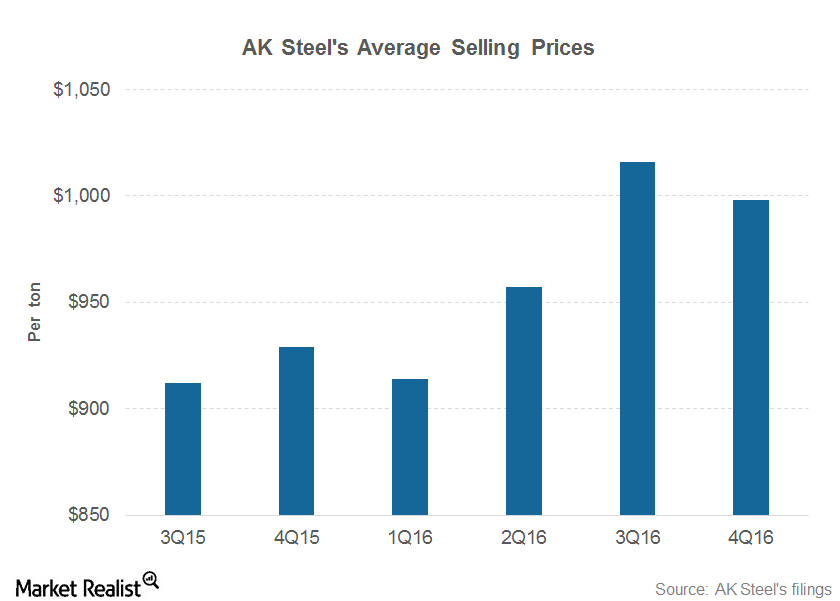

What Could Drive AK Steel’s 4Q17 Financial Performance

AK Steel’s 4Q17 financial performance AK Steel’s (AKS) 4Q17 earnings results are expected on January 30. In this article, we’ll see what analysts are projecting for AK Steel’s 4Q17 revenue. We’ll also look at what could drive AK Steel’s 4Q17 financial performance. According to analyst estimates compiled by Thomson Reuters, AK Steel is expected to post […]

Could AK Steel’s 4Q17 Results Keep Investors’ Optimism Alive?

AK Steel (AKS) is scheduled to release its 4Q17 earnings results on January 30, 2018.

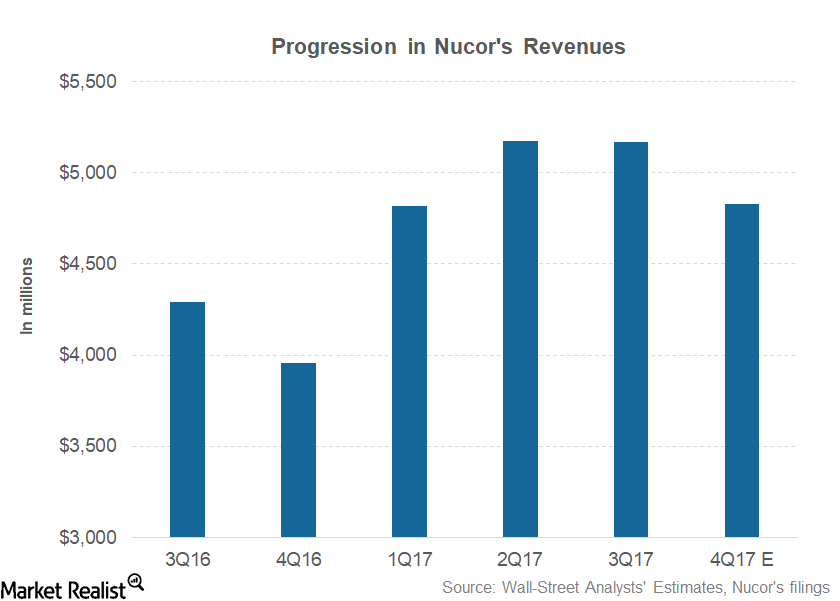

Nucor’s 4Q17 Earnings: What’s the Word on Wall Street?

Nucor (NUE), the leading US-based steel producer, is expected to release its 4Q17 earnings on January 30. Analysts polled by Thomson Reuters expect Nucor to post 4Q17 revenues of ~$4.8 billion.

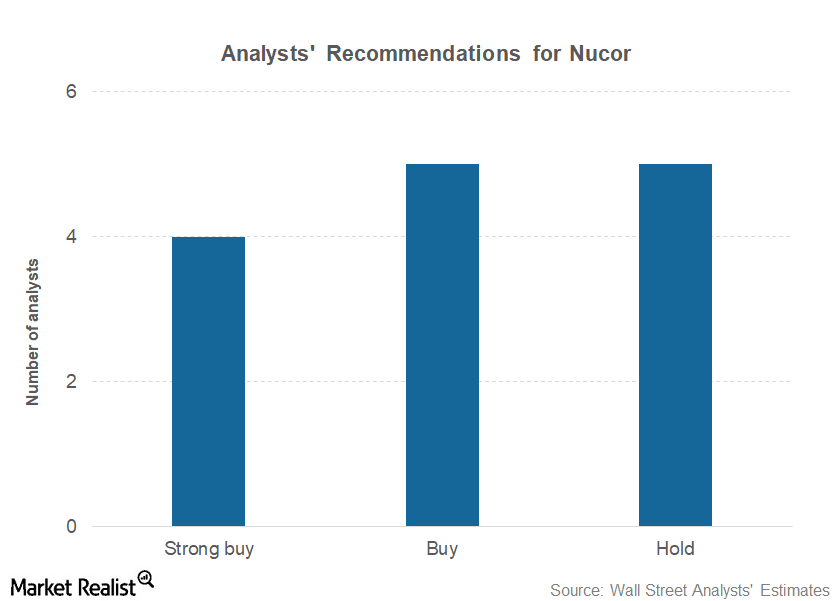

Nucor: What Analysts Expect This Earnings Season

Nucor received a “strong buy” rating from four analysts, while five analysts have a “buy” rating on the stock and five analysts have a “hold” rating.

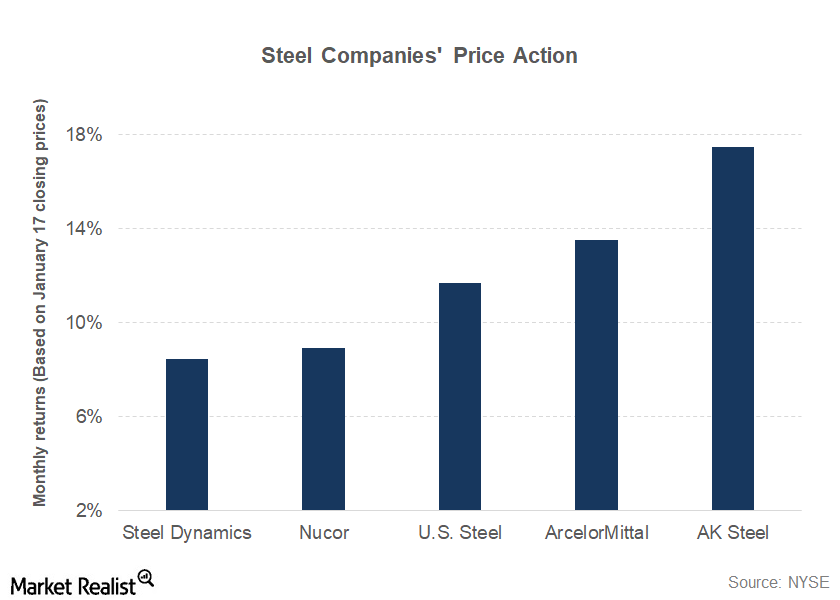

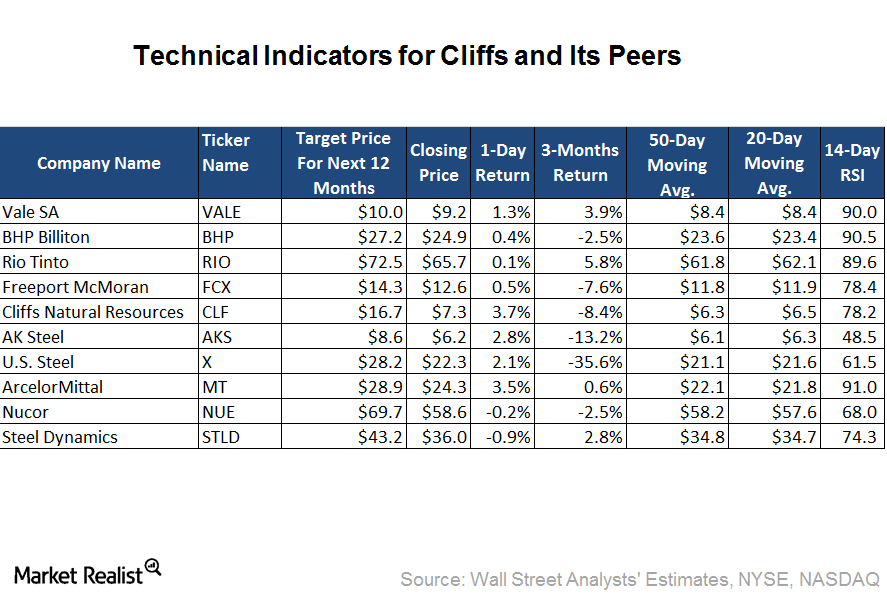

How Markets See US Steel Stocks before 4Q17 Earnings

Steel Dynamics will release its 4Q17 financial results on January 22, 2018. AK Steel and Nucor are scheduled to release their 4Q17 earnings on January 30.

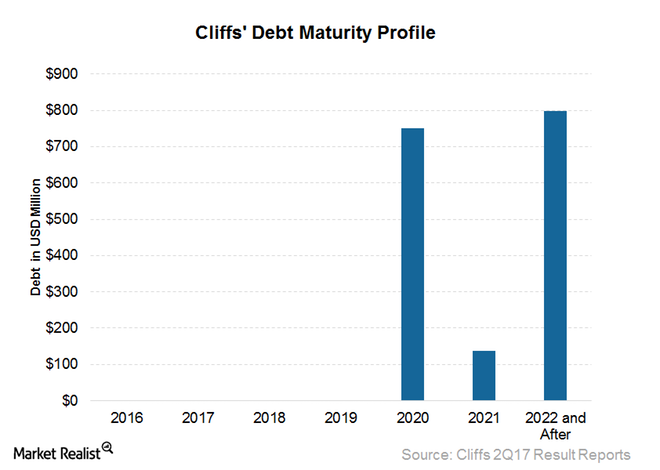

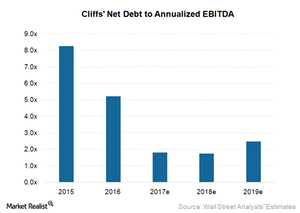

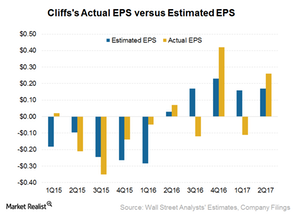

Why Analysts Project Lower Net Debt for Cliffs in 2017

Although investors are still concerned about Cleveland-Cliffs’ (CLF) debt, it has come a long way with respect to debt levels.

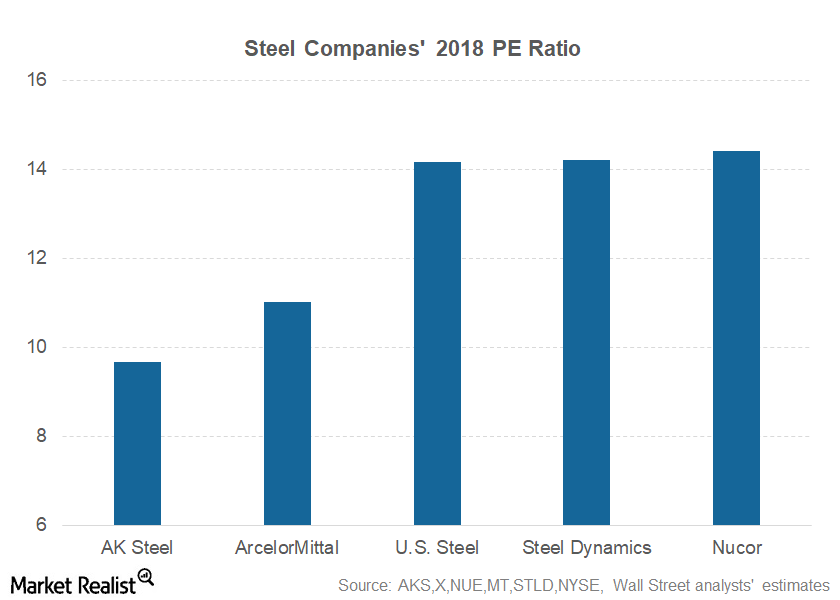

How Steel Companies’ PE Ratios Stack Up

AK Steel (AKS) has the lowest forward PE multiple of 9.7 among our select group of steel stocks.

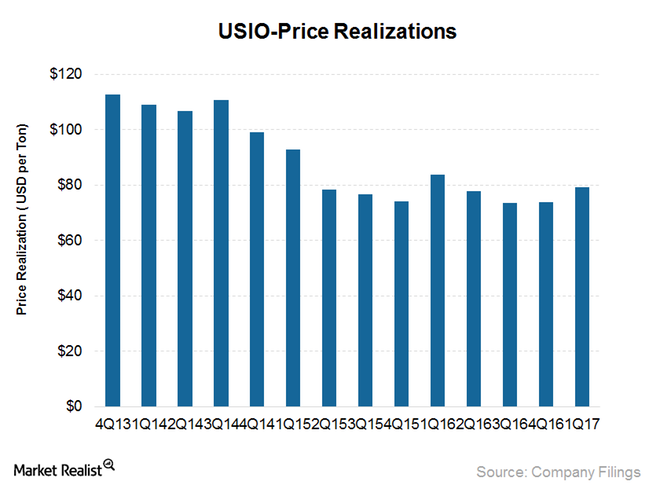

Can Cleveland-Cliffs’ Realized Prices in the US Recover in 2018?

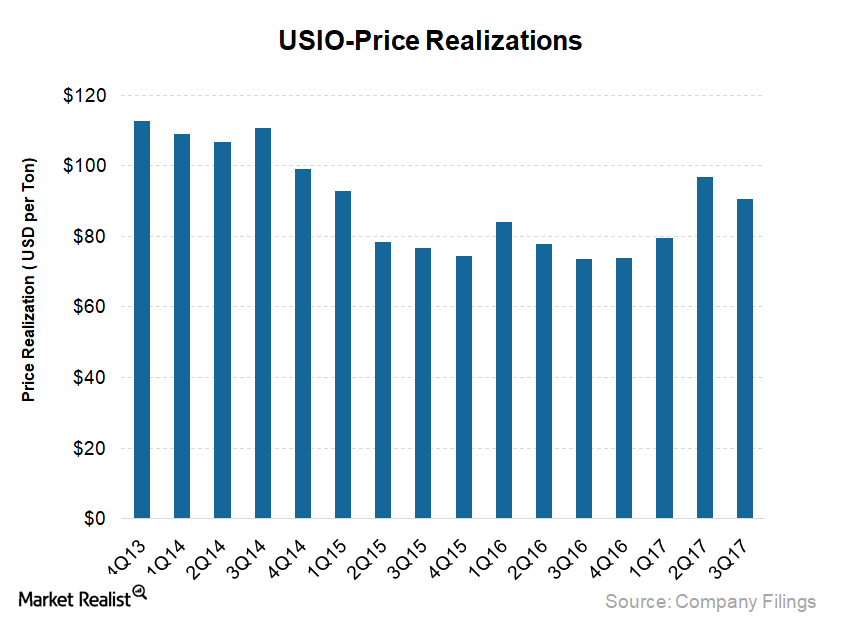

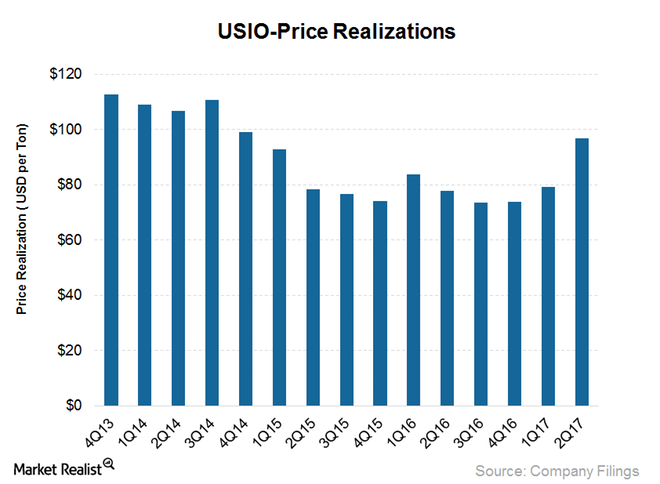

For 3Q17, Cleveland-Cliffs reported average realized prices came in at $90.50 per ton.

Factors Driving Analysts’ Forecast of a Drop in CLF’s Net Debt in 2017

According to consensus estimates, CLF’s net debt should fall 42% by the end of 2017 compared to 2016.

Can Cleveland-Cliffs’ Realized Prices in the US See an Uptick in 3Q17?

Cleveland-Cliffs’ (CLF) average realized prices increased 24% year-over-year and 22% quarter-over-quarter to $97 per ton in 2Q17.

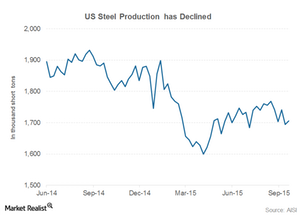

How the US Steel Industry’s Supply and Demand Looks before 4Q17

Steel stocks have recouped some of their losses in the last two trading sessions. However, U.S. Steel Corporation (X) and AK Steel (AKS) have lost 5.3% and 4.1%, respectively, month-to-date based on their September 27 closing prices.

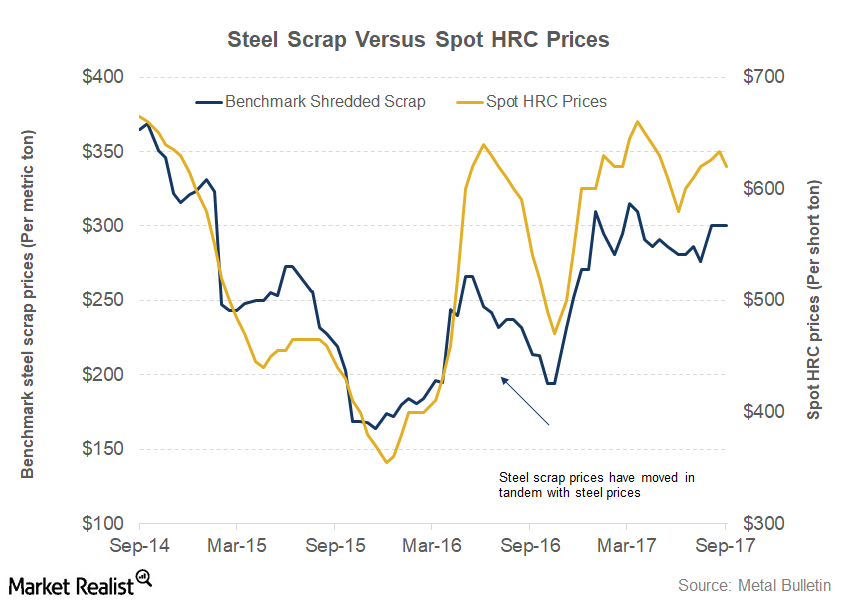

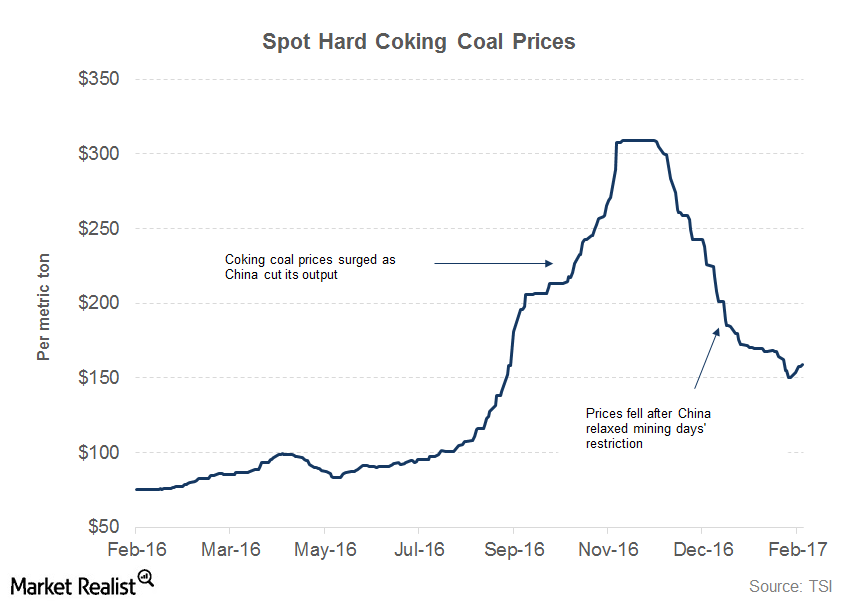

US Steel Producers Are Complaining about Higher Input Costs

Steel production is raw material–intensive in nature. Iron ore, steel scrap, and coking coal are the key raw materials that go into steel production.

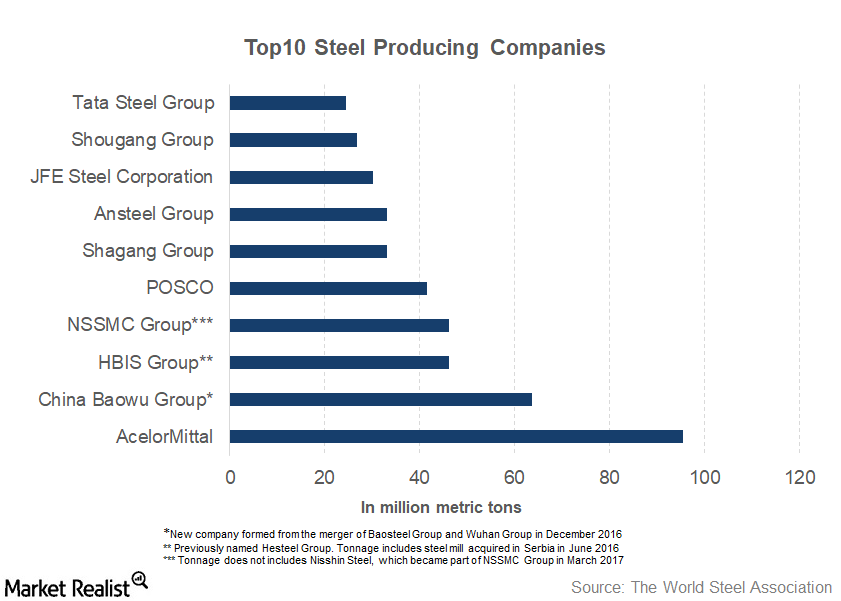

Size Matters: Which Are the Top 10 Steel-Producing Companies?

In this series, we’ll look at the top ten companies in the global steel industry based on steel production, steel consumption, and steel imports.

Impact on CLF: Will the Trump Administration Listen to US Steelmakers?

The American steel industry has written to President Donald Trump requesting that he restrict steel imports immediately.

A Comparative Analysis of Steel Companies’ Leverage

Steel companies have high sensitivity to steel prices and their earnings tend to be volatile. Spot steel prices have been volatile in the last few years.

Cliffs Natural Resources: What Will Drive Performance after 2Q17?

The 2Q17 earnings season for US-based steel companies is now over. Cliffs Natural Resources (CLF) released its 2Q17 results on July 27, 2017, before the market opened.

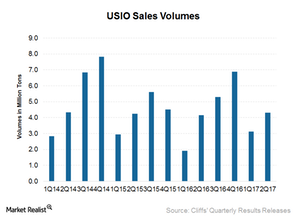

What Could Drive Cliffs Natural Resources’ US Volumes in 2H17

US iron ore (or USIO) is the main driver for Cliffs Natural Resources’ (CLF) top and bottom lines. The top line, in turn, is driven by volumes and realized prices.

Key Highlights from Cliffs Natural Resources’ 2Q17 Results

Cliffs Natural Resources (CLF) achieved revenues of $569 million for 2Q17, an increase of 15% year-over-year (or YoY).

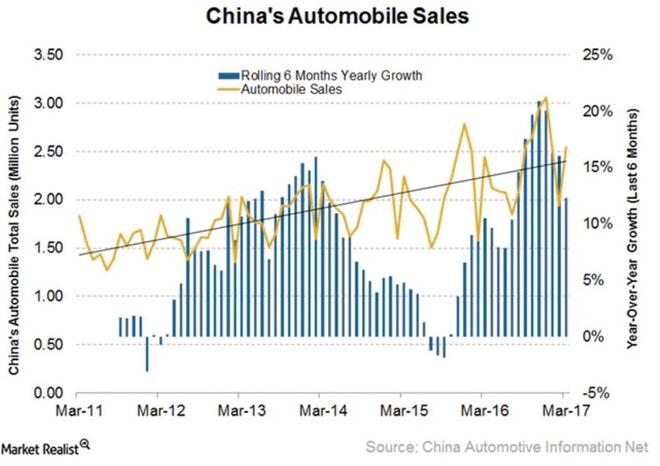

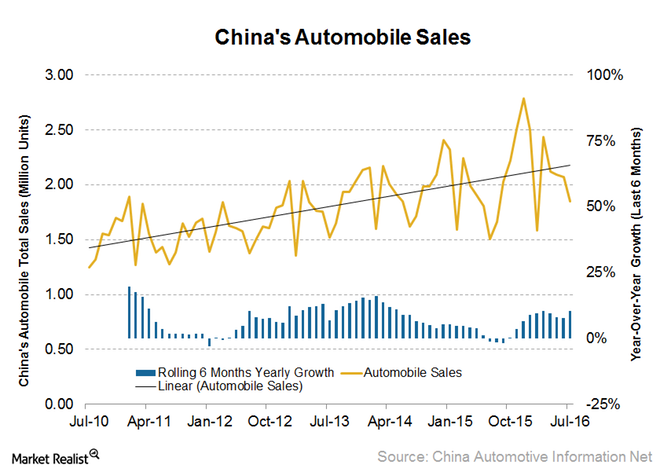

China’s Auto Sales Rebounded in June: Gauging Iron Ore’s Impact

Since China’s automobile industry is the second-largest consumer of steel after the real estate sector, it’s important to track its developments.

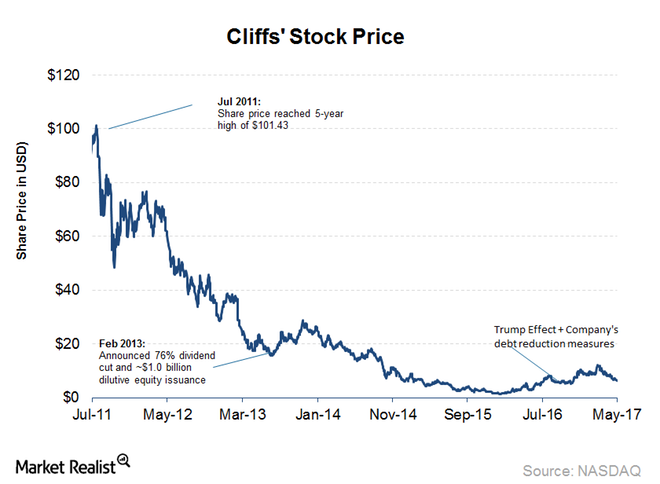

CLF and Peers in Overbought Territory: What Triggered It?

Based on its June 12, 2017, closing price, Cliffs Natural Resources is trading 15.2% and 11.9% higher than its 50-day and 20-day moving averages, respectively.

Can CLF’s Realized Prices See an Uptick in the US Segment?

Compared to 1Q16, Cliffs Natural Resources’ average realized prices fell 5% year-over-year to $79.30 per ton in 1Q17.

Why US Steel Bears Could Have a Valid Point

US steel prices have held their ground in 2017 and have built on last year’s gains. However, the bears (SDS) also have some valid points. Let’s discuss them in perspective.

Key Updates Markets Are Waiting for in U.S. Steel’s 1Q17 Call

In this article, we’ll analyze the key updates the markets are waiting for in U.S. Steel’s 1Q17 earnings call.

Can AK Steel Regain Its Lost Mojo in 1Q17?

Previously, we looked at AK Steel’s (AKS) 1Q17 earnings estimates. In this article, we’ll look at some key updates the markets could be anticipating in the company’s 1Q17 earnings call.

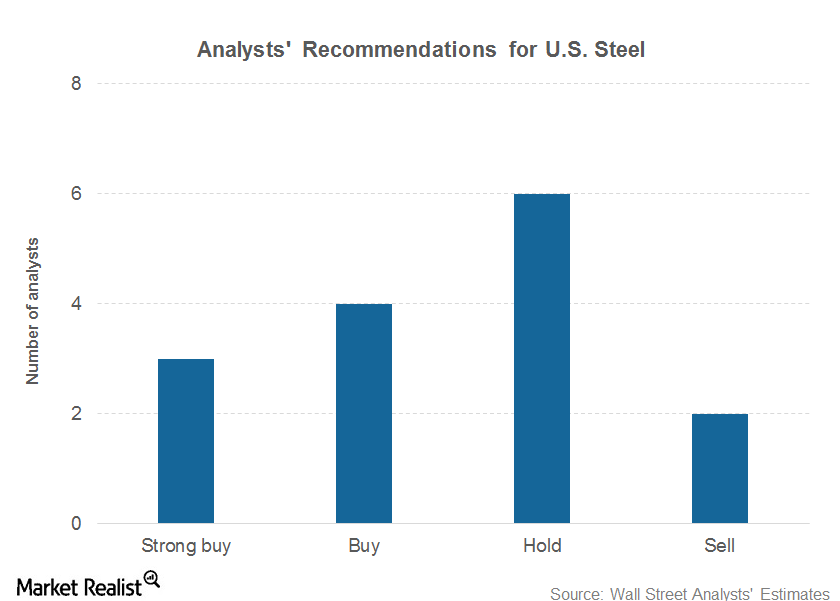

Analysts Might Take a Fresh Look at U.S. Steel Corporation

U.S. Steel Corporation will release its 1Q17 earnings on April 24 after the market closes. The company’s earnings conference call will be on April 25.

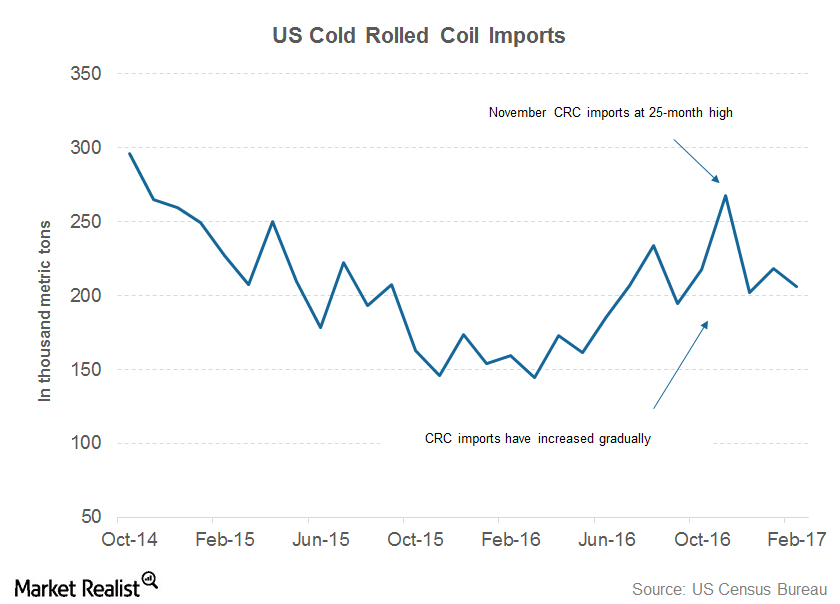

What the Divergence in Flat Rolled Steel Imports Tells Us

In this article, we’ll look at February 2017’s flat rolled steel imports and study whether there’s a divergence in the imports of these products.

How Raw Material Prices Could Impact U.S. Steel’s Performance

ArcelorMittal’s mining operations generated an operating income of $203 million in 4Q16, almost double what they generated in 3Q16.

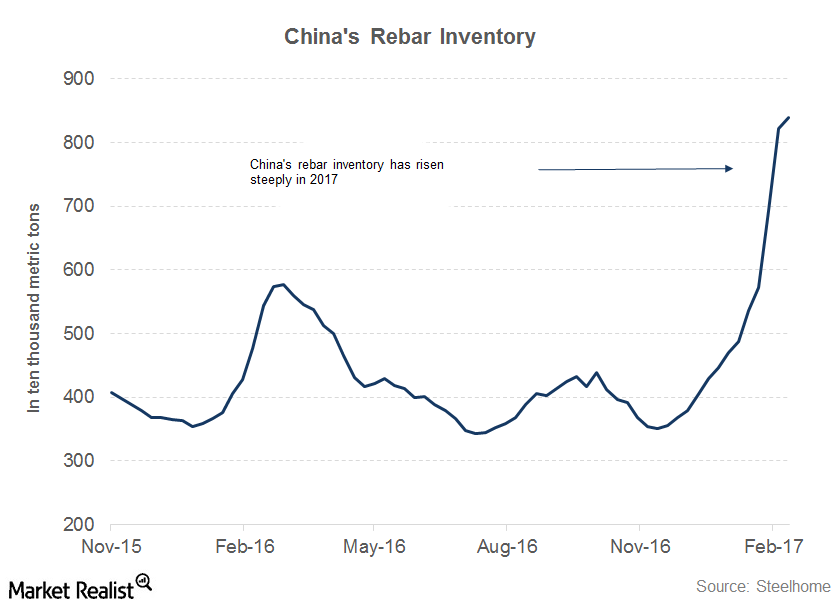

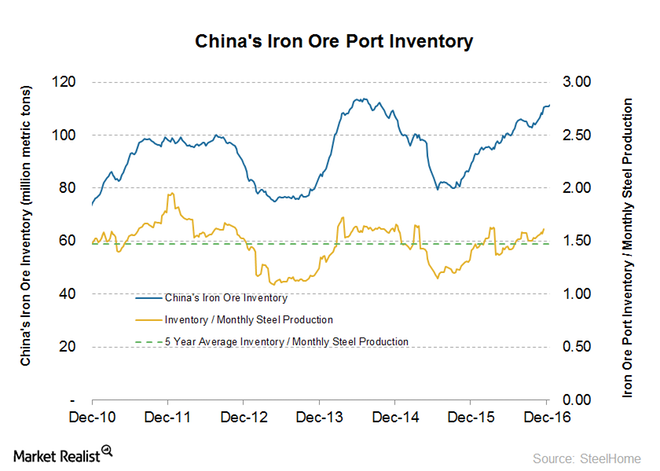

Are Rising Chinese Steel Inventories a Risk for Steel Investors?

With higher steel production and subdued demand, one would expect a tsunami of Chinese steel exports, but this wasn’t the case last month. So what did China want with so much steel?

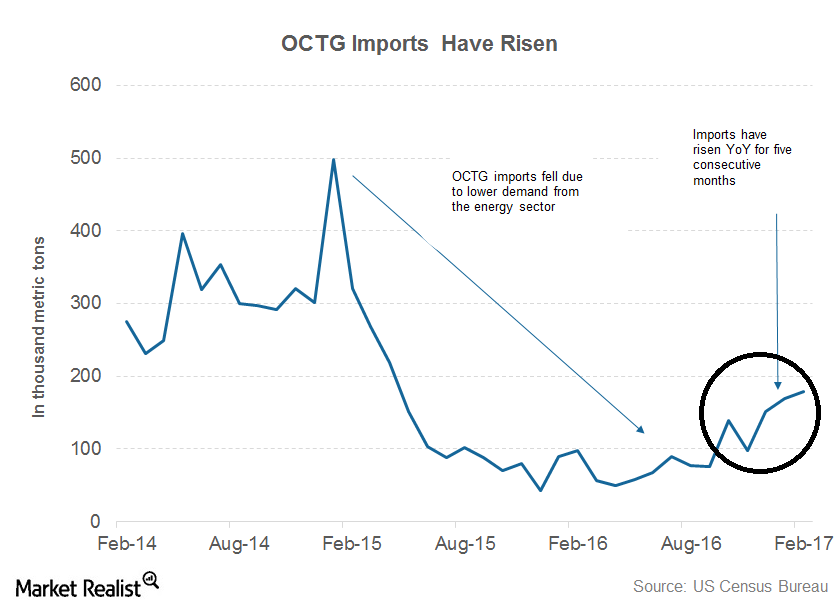

What Rising OCTG Imports Mean for U.S. Steel

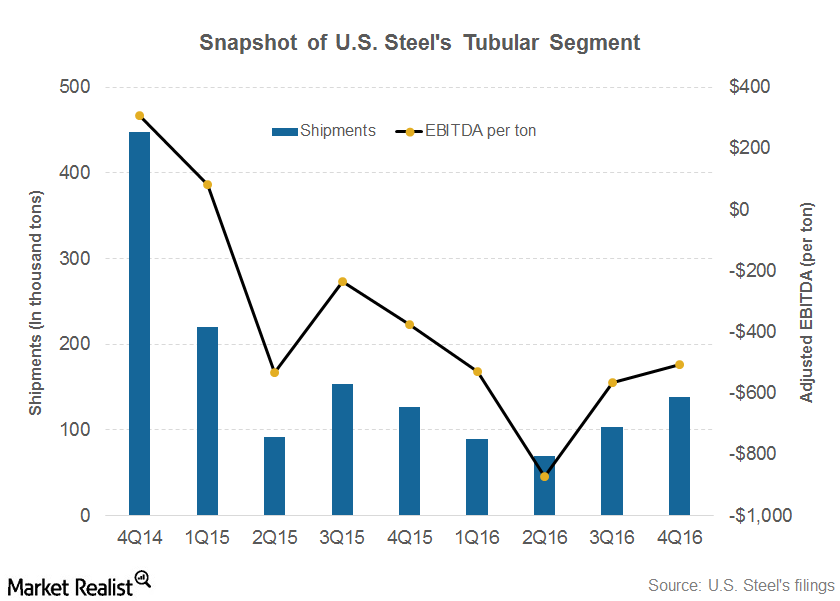

U.S. Steel Corporation has three segments: Flat Rolled, Europe, and Tubular. The company’s Tubular segment produces OCTG (oil country tubular goods) that are used in the energy sector.

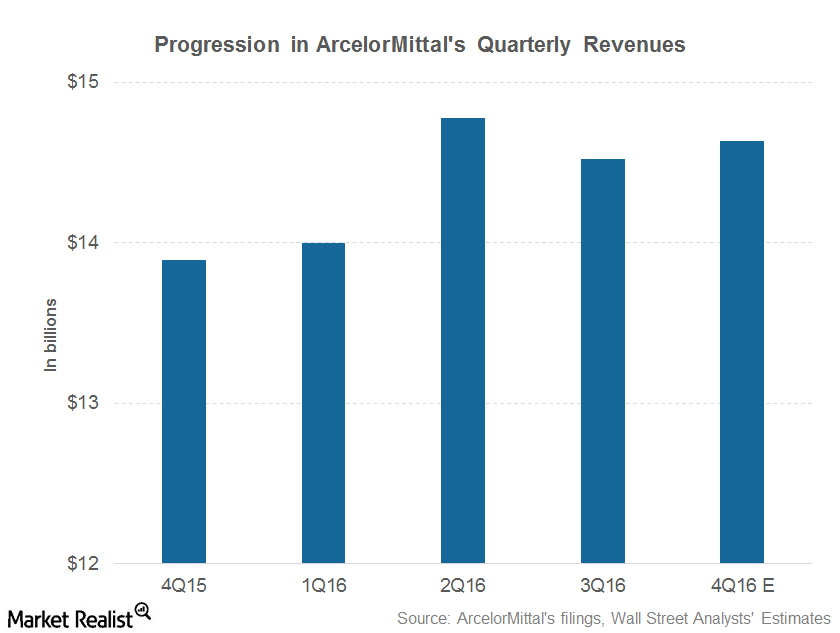

ArcelorMittal’s Expected 4Q16 Revenues: The Word on Wall Street

Analysts expect ArcelorMittal (MT) to post revenues of $14.6 billion in 4Q16. The company posted revenues of $14.5 billion in 3Q16 and $13.9 billion in 4Q15.

What Could Affect Iron Ore Prices in 2017?

Chinese demand is the key driver of iron ore prices, as the country accounts for more than two-thirds of seaborne demand (CLF) (BHP).

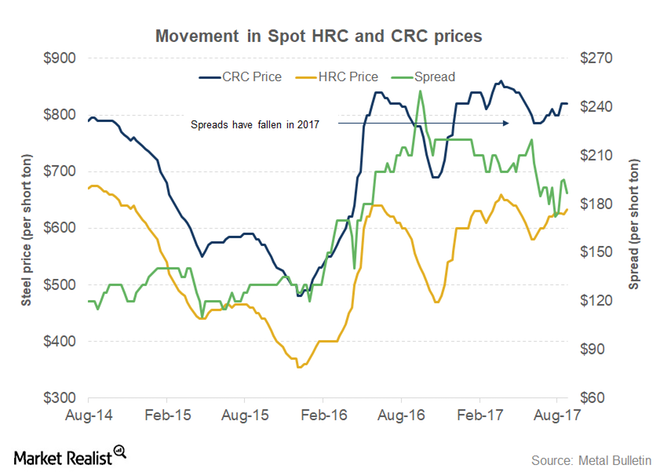

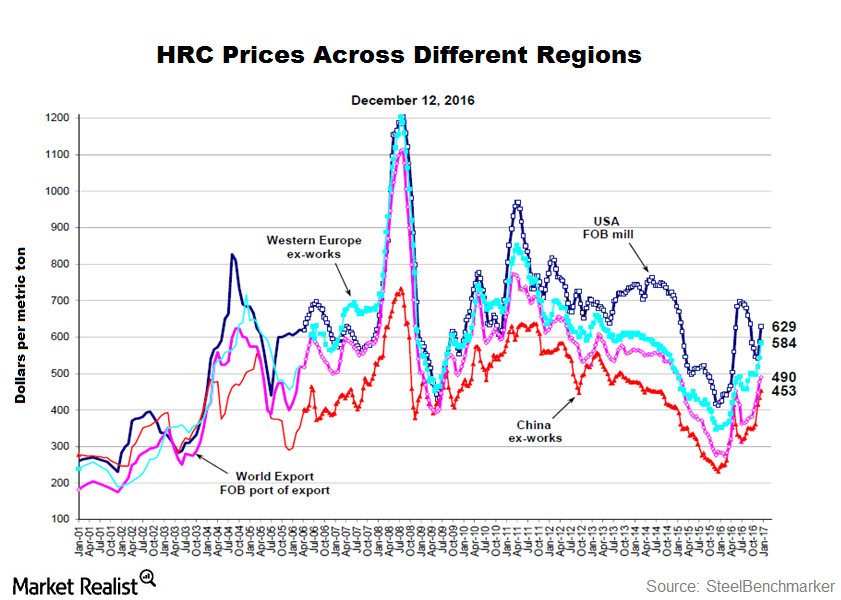

Why U.S. Steel Investors Should Look at Steel Price Spreads

The United States is the largest steel importer globally. Steel companies such as U.S. Steel Corporation frequently blame steel imports for the US steel industry’s woes.

What Factors Are Supporting Steel Prices?

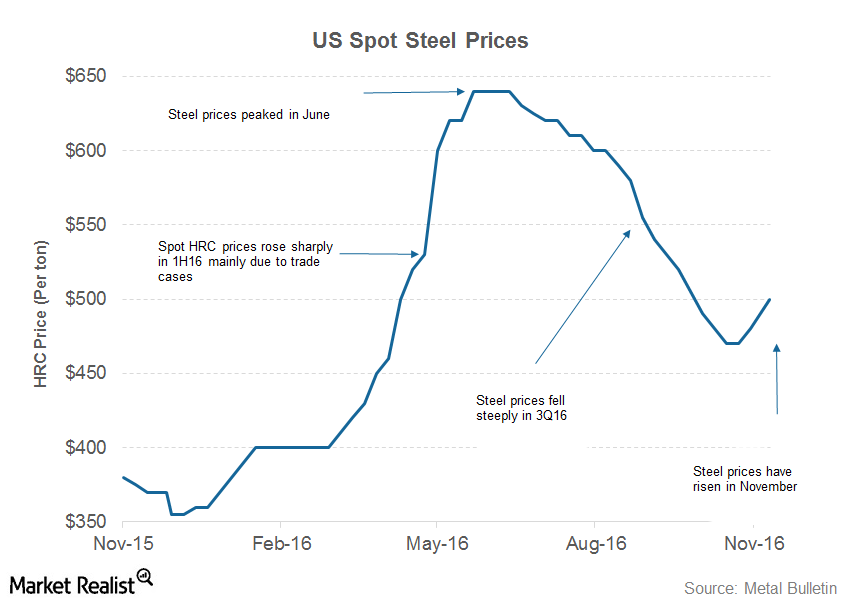

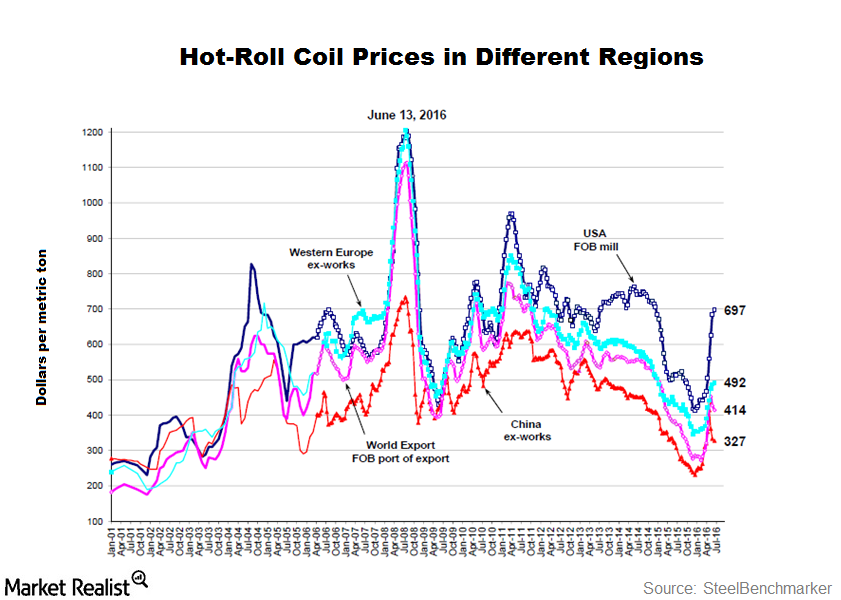

According to data compiled by Metal Bulletin, spot HRC (hot rolled coil) prices rose from $380 per short ton to $640 per short ton between January 2016 and June 2016.

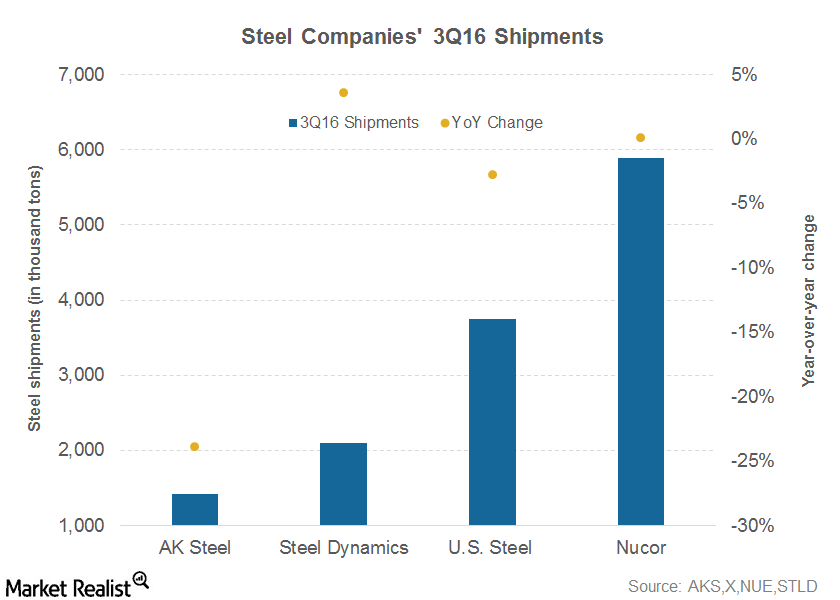

Revenue Miss Was a Hallmark of Steel Companies’ 3Q16 Earnings

One of the key features of steel companies’ 3Q16 financial performance was lower-than-expected revenues.

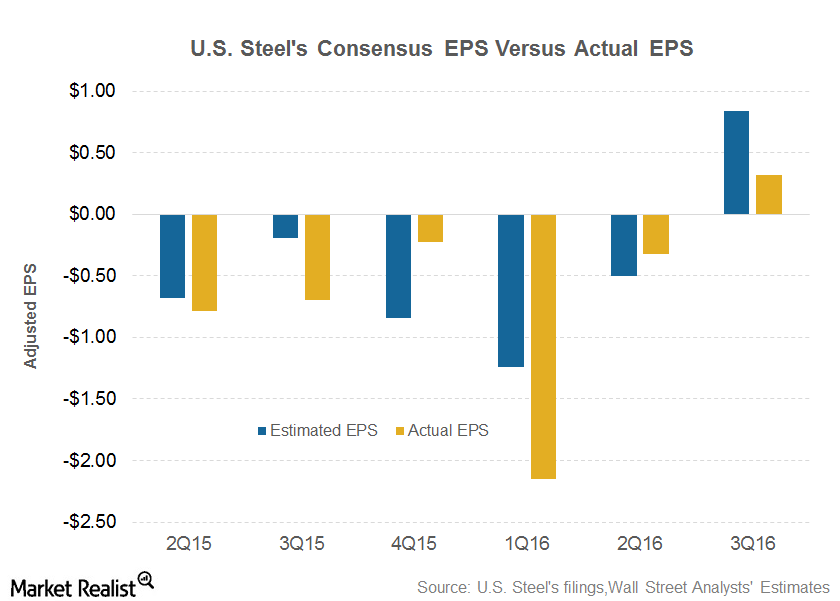

U.S. Steel Bulls Left Heartbroken After 3Q16 Earnings Miss

U.S. Steel Corporation (X) released its 3Q16 financial results on November 1 after the market closed, and it held its earnings conference call on November 2.

The Outlook for China’s Automobile Sales and Why It Matters

China’s passenger car sales rose 26% year-over-year in August. This is the fourth consecutive month that car sales have risen in the double digits.

What’s Driving the Record Spread Between HRC and CRC Prices?

US Spot hot rolled coil prices have risen in the ballpark of $200 per short ton in 2016. Spot cold rolled coil prices have risen by ~$300 per short ton.

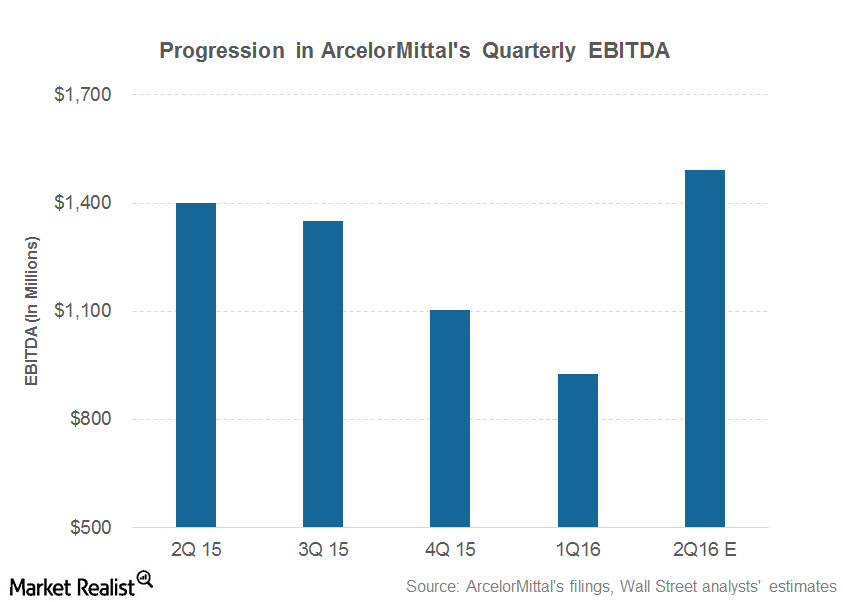

Are ArcelorMittal’s 2Q16 Earnings Estimates a Little Aggressive?

ArcelorMittal (MT) posted adjusted EBITDA of $927 million in 1Q16 and ~$1.4 million in 2Q15.

How Fallen Angels Could Reward Investors

Fallen angel bonds—high-yield bonds originally issued with investment grade credit ratings—are generally known for offering potential value. A big source of this value has been the tendency of fallen angels to be oversold below what may be considered fair value, leading to a downgrade to high yield. A less obvious source of value for fallen angels […]

Could Brexit Shake the European Steel Industry?

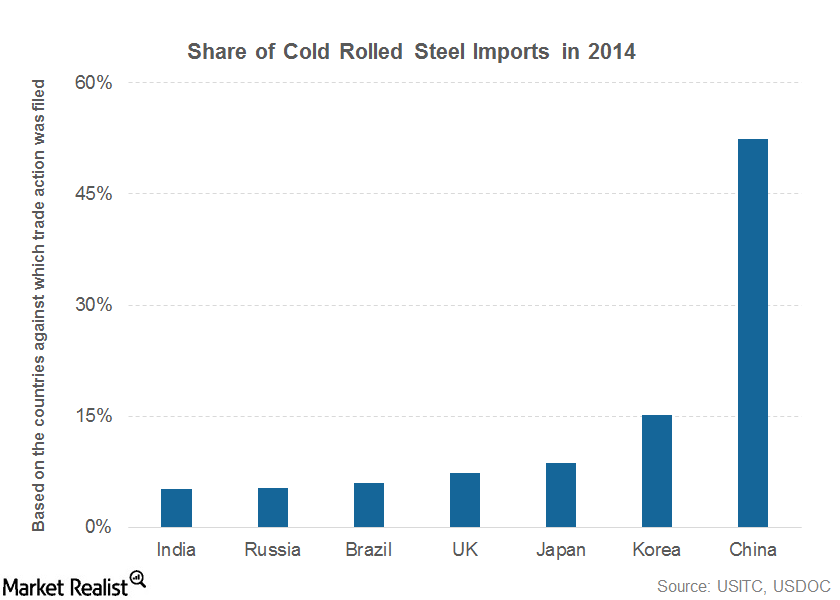

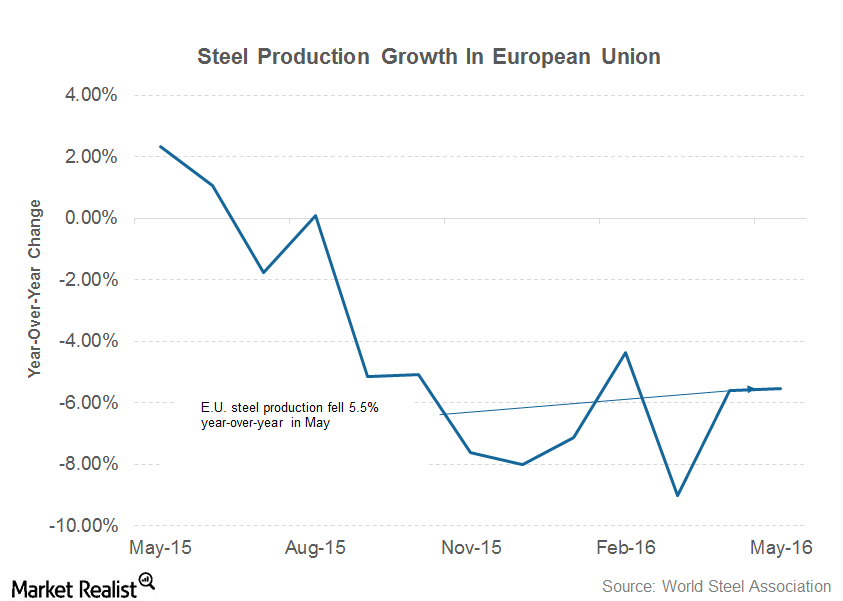

The EU hasn’t been able to act decisively against higher Chinese steel imports. European steel production has fallen much steeper this year.

Brexit or No Brexit, the European Steel Industry Is in Shambles

In May, ~14.5 million metric tons of steel were produced in the European Union. That was a YoY decline of 5.5%.

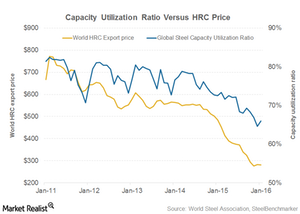

Will Global Overcapacity Weigh Heavy on Steel Prices?

The excess global steel capacity will take a lot of time to balance out. The capacity closures in China, if they happen at all, will be gradual.

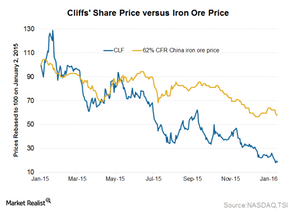

What to Look for in Cliffs Natural Resources’ 4Q15 Results

In its 4Q15 earnings release on January 27, 2016, Cliffs Natural Resources (CLF) may provide a further update on its venture into a direct reduced iron business.

Is there More Downside to Cliffs’s USIO Division Volume Guidance?

In its 2Q15 results, Cliffs Natural Resources (CLF) downgraded its volume guidance for the USIO division for 2015, from 20.5 million tons to 19 million tons.

Cliffs to Announce 3Q15 Results on October 29

Cliffs Natural Resources (CLF) will release its 3Q15 results before the US market opens on October 29, 2015. A conference call will occur at 10:00 AM ET on October 29.

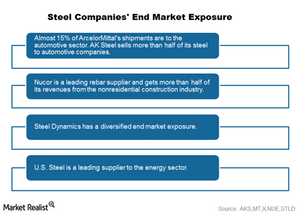

The Importance of Diversified End Market Exposure

Steel companies’ product portfolios and end market exposures can have significant impacts on company performance.

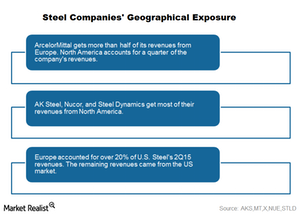

How Geographical Exposure Varies Between Steel Companies

A look at the geographical exposure of different steel companies, which are exposed to the overall economic activity of the regions in which they operate.

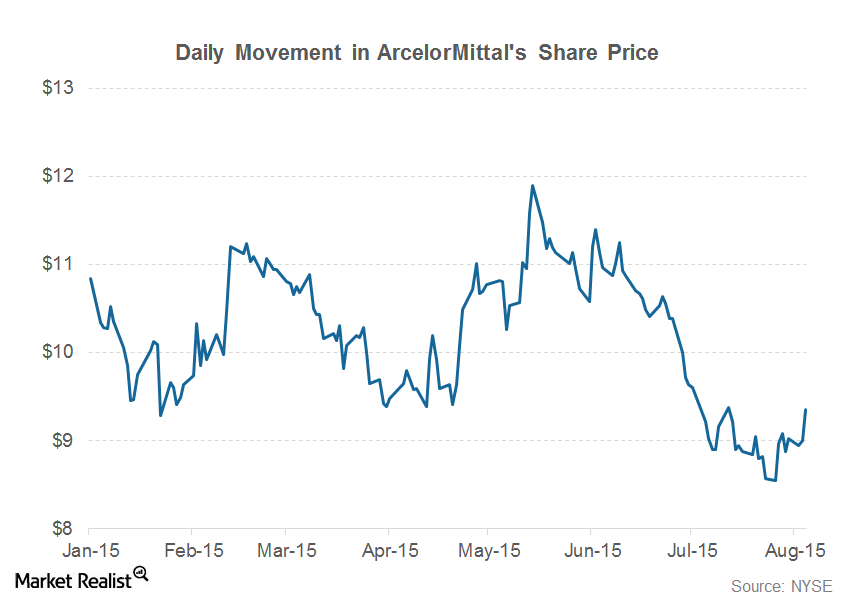

ArcelorMittal’s 2Q15 Earnings: Key Investor Takeaways

ArcelorMittal (MT) released its 2Q15 earnings on July 31. It reported net earnings of $0.2 billion in 2Q15 compared to a loss of $0.7 billion in 1Q15.