General Mills Inc

Latest General Mills Inc News and Updates

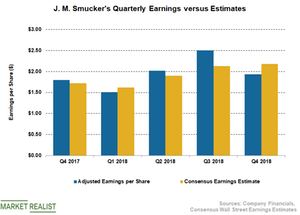

Why J.M. Smucker Missed Q4 Earnings Estimate

J.M. Smucker (SJM) reported weaker-than-expected fiscal Q4 earnings.

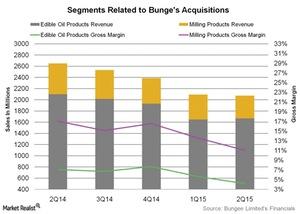

Will Bunge’s Acquisitions Help Revive Its Segment Margins?

Bunge North America, the North American operating segment of Bunge Limited (BG), announced that it had acquired Whole Harvest Foods.

Here’s How Wall Street Reacted to General Mills’ Q2 2019 Results

Most analysts lowered their target prices on General Mills stock following the release of its results for the second quarter of fiscal 2019.

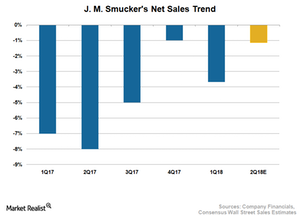

Behind J.M. Smucker’s Waning Sales

J.M. Smucker (SJM) has continued to disappoint on the sales front this year, having posted declines in sales for the past several quarters.

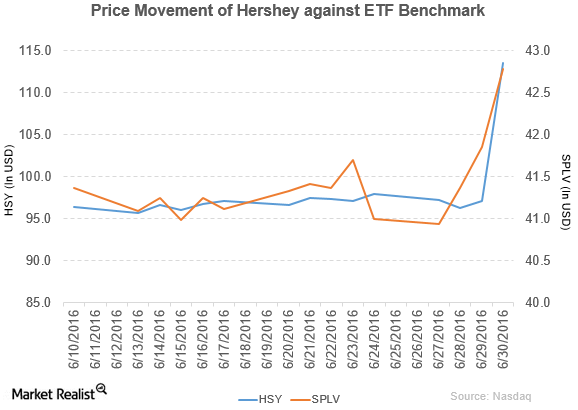

Why Did Hershey’s Stock Rise on June 30?

The Hershey Company (HSY) has a market cap of $24.2 billion. Its stock rose by 16.8% to close at $113.49 per share on June 30, 2016.

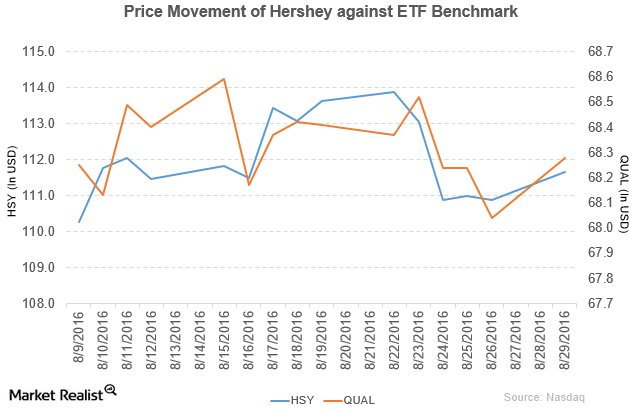

The Hershey Company Shows Mixed Price Movement on August 29

The Hershey Company (HSY) has a market cap of $23.8 billion. It rose by 0.71% to close at $111.67 per share on August 29, 2016.

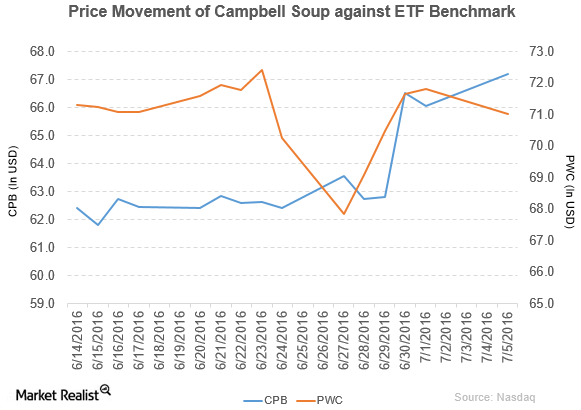

Campbell Soup’s Efforts to Make GMO Labeling Mandatory

Campbell Soup Company (CPB) has a market cap of $20.9 billion. Its stock rose by 1.7% to close at $67.19 per share on July 5, 2016.

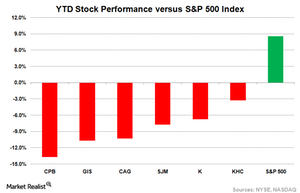

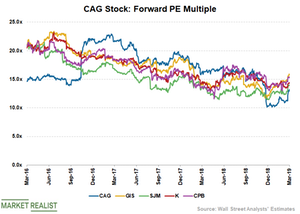

Why Food Stocks Aren’t Cooking

So far this year, food stocks have largely disappointed investors, and the outlook for the rest of the year appears no better. Stock prices for food manufacturers have been on a downtrend, underperforming the S&P 500 Index (SPX-INDEX) on a YTD (year-to-date) basis, as the graph below shows. As of July 3, Campbell Soup (CPB), General Mills (GIS), Conagra Brands (CAG), J. M. Smucker (SJM), Kellogg (K), and Kraft Heinz (KHC) have fallen 13.7%, 10.7%, 10.2%, 7.7%, 6.7%, and 3.3%, respectively, YTD. The S&P 500 Index has returned 8.5% during the same period.

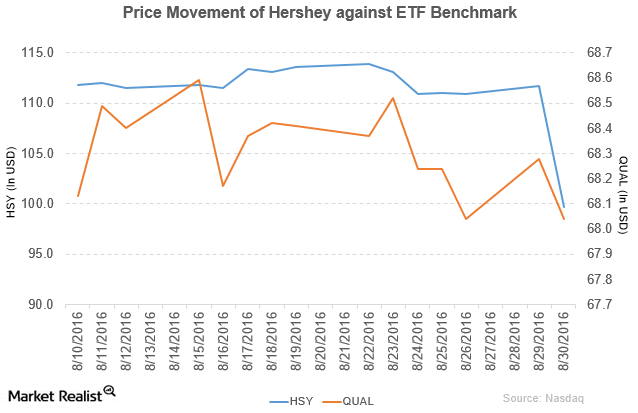

Why Did Hershey Fall by 10.8% on August 30?

The Hershey Company (HSY) has a market cap of $21.3 billion. It fell by 10.8% to close at $99.65 per share on August 30, 2016.

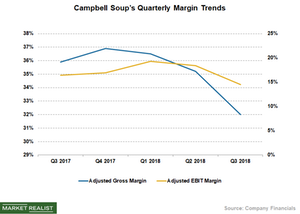

Campbell Soup’s Margins Could Continue to Contract

The Campbell Soup Company (CPB) continued to report sluggish margins as higher-than-expected inflation in commodities and transportation costs remained a drag.

How General Mills’ Segments Performed in Q4

In fiscal 2019’s fourth quarter, General Mills’ (GIS) North American Retail net sales fell 2% YoY (year-over-year) to $2.34 billion, and organic sales fell 2% due to lower pricing.

What Analysts’ Price Target Indicates for J.M. Smucker Stock

Wall Street has a price target of $114.54 per share on the J.M. Smucker Company (SJM), implying a potential downside of 5.6% based on its closing price of $121.31 on June 24.

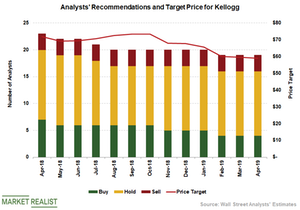

Kellogg: Analysts Recommend a ‘Hold’

Most of the analysts covering Kellogg continue to maintain a neutral outlook on the stock, which reflects near-term pressure on its earnings.

These Consumer Staples Stocks Marked Stellar Gains in Q1

The Consumer Staples Select Sector SPDR ETF (XLP) rose 10.5% in the first quarter of 2019.

Analyzing Conagra Brands’ Growth Drivers

Conagra Brands (CAG) shares have risen 21.1% since the company reported its third-quarter earnings on March 21.

Why General Mills’ Sales Growth Rate Could Decelerate

General Mills (GIS) posted stronger-than-expected sales during the third quarter of fiscal 2019.

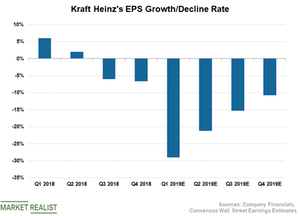

Why Kraft Heinz’s EPS Could See a Double-Digit Decline in 2019

Kraft Heinz’s (KHC) bottom line has remained under pressure in the past two quarters and disappointed investors.

Did Kraft Heinz’s Underperformance Ring an Alarm Bell?

Shares of Kraft Heinz (KHC) crashed more than 27% on Friday, February 22, as weaker-than-expected fourth-quarter results and sluggish guidance upset investors.

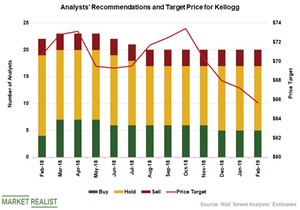

Kellogg Stock: Analysts’ Recommendations

Analysts continue to suggest a “hold” rating on Kellogg (K) stock. Analysts’ target price shows a downward trend.

Could McCormick’s Improving Fundamentals Boost Its Stock?

McCormick (MKC) has seen double-digit sales and earnings growth over the past couple of quarters.

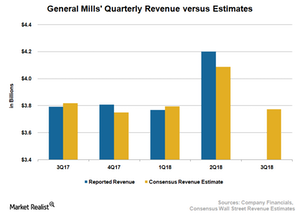

Will General Mills Sustain Its Sales Momentum in Q3?

Analysts expect General Mills (GIS) to report sales of $3.8 billion in fiscal 3Q18, reflecting a marginal decline of 0.5% on a YoY (year-over-year) basis.

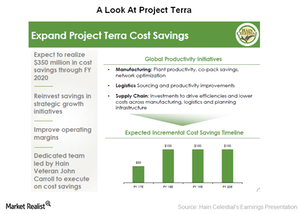

Hain Celestial’s SKU Optimization and Project Terra Efforts

Hain Celestial has undertaken a massive SKU optimization program. In fiscal 4Q17, the company stated that it had streamlined 20% of its US inventory.

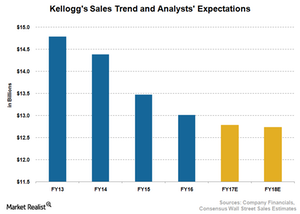

Why Analysts Expect Kellogg’s Sales to Fall

Kellogg (K) estimates a 3% decline in its top line for fiscal 2017, reflecting weakness in the cereal category and challenges in several markets.

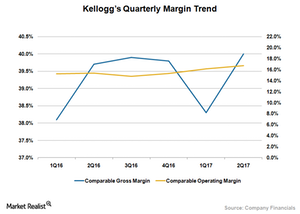

Why Kellogg’s 3Q17 Profit Margins Could Improve

Kellogg (K) posted improved profit margins despite lower sales, thanks to the company’s focus on efficiency and initiatives to reduce costs.

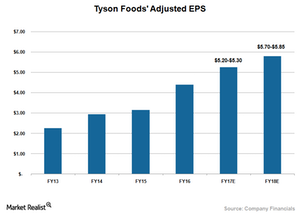

Tyson Foods Raises Fiscal 2017 Guidance

Tyson Foods (TSN) stock jumped about 8% on September 29, 2017, after the company raised its fiscal 2017 EPS (earnings per share) guidance.

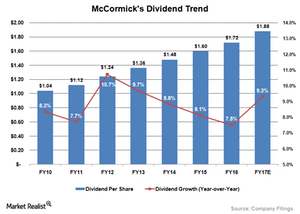

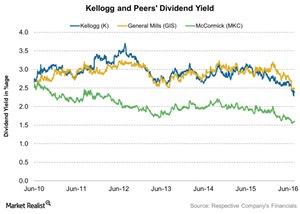

A Look at McCormick’s Strong Dividend History

In the past three fiscal years, McCormick has returned more than $1.0 billion to its shareholders in the form of dividends and share buybacks.

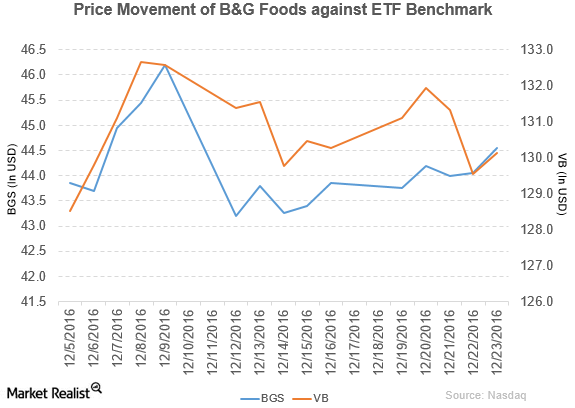

Citigroup Gives B&G Foods a ‘Neutral’ Rating

B&G Foods (BGS) rose 1.6% to close at $44.55 per share during the third week of December 2016.

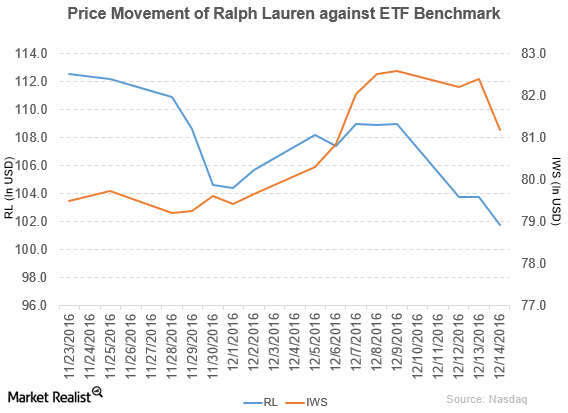

Ralph Lauren Declares a Dividend

Ralph Lauren declared a regular quarterly dividend of $0.50 per share on its common stock. The dividend will be paid on January 13, 2017, to shareholders.

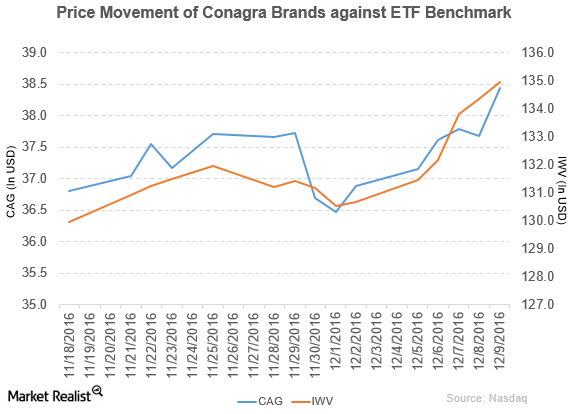

Conagra Brands Declares a Dividend and a New Board Appointment

Conagra Brands (CAG) rose 4.2% to close at $38.44 per share during the first week of December 2016.

B&G Foods Acquired Victoria Fine Foods for $70 Million

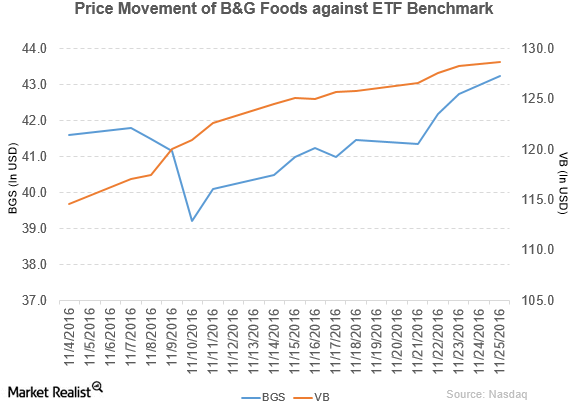

B&G Foods (BGS) declared a quarterly cash dividend of $0.47 per share on its common stock. This dividend will be paid on January 30, 2017, to shareholders of record on December 30, 2016.

B&G Foods Acquired ACH Food Companies’ Business

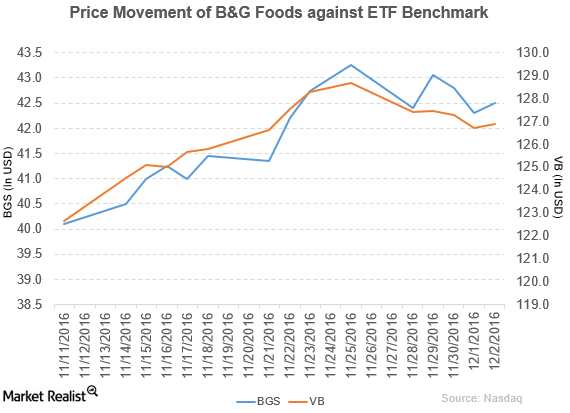

B&G Foods (BGS) rose 5.5% to close at $43.25 per share during the fourth week of November 2016.

A Look at WhiteWave Foods’ 3Q16 Performance

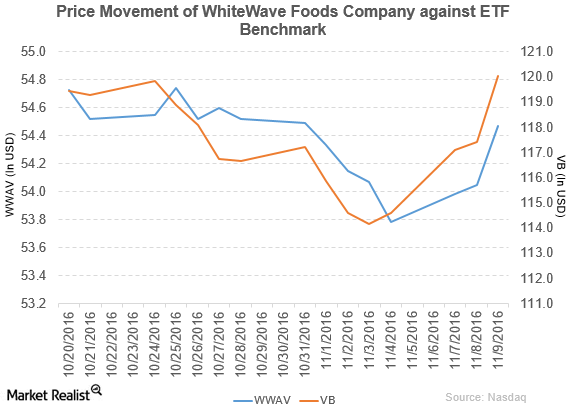

Price movement WhiteWave Foods (WWAV) has a market cap of $9.7 billion. It rose 0.78% to close at $54.47 per share on November 9, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 0.59%, 1.7%, and 40.0%, respectively, on the same day. WWAV is trading 0.37% above its 20-day moving average, 0.44% […]

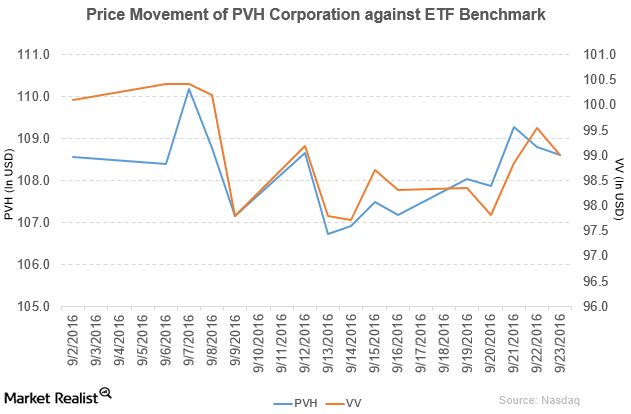

Judith Amanda Sourry Knox Joins PVH’s Board of Directors

PVH Corporation (PVH) rose 1.3% to close at $108.60 per share during the third week of September 2016.

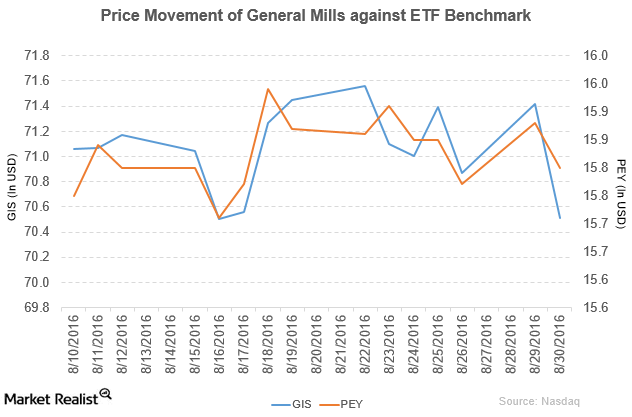

General Mills Made Key Changes in Its Management

General Mills (GIS) has a market cap of $42.6 billion. It fell by 1.3% to close at $70.51 per share on August 30, 2016.

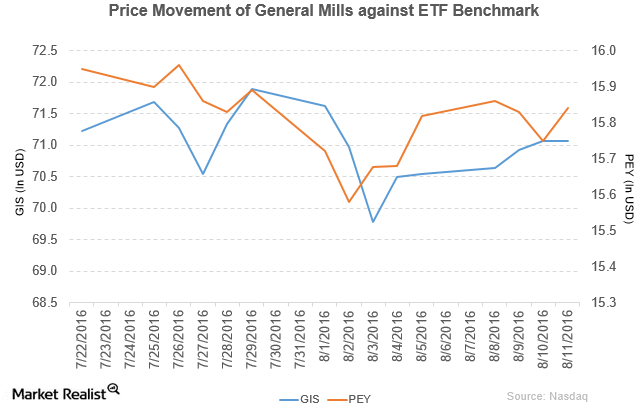

General Mills Rose by Just 0.01% on August 11: Why?

General Mills (GIS) has a market cap of $42.7 billion. It rose by 0.01% to close at $71.07 per share on August 11, 2016.

What Do Analysts Recommend for Kellogg after Fiscal 2Q16 Results?

The average broker target price for Kellogg for the next 12 months has risen to $83.93 from $79. This is 1.4% higher than the closing price of $82.71 on August 5.

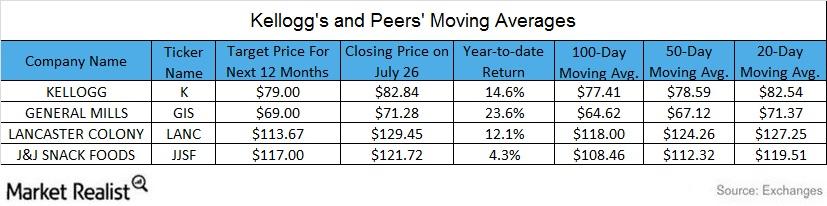

Key Moving Averages: Analyzing Kellogg versus Its Peers

Kellogg closed at $82.84 on July 26. It’s trading 7.0%, 5.4%, and 0.4% above its 100-day, 50-day, and 20-day moving averages. It has appreciated ~15% in 2016.

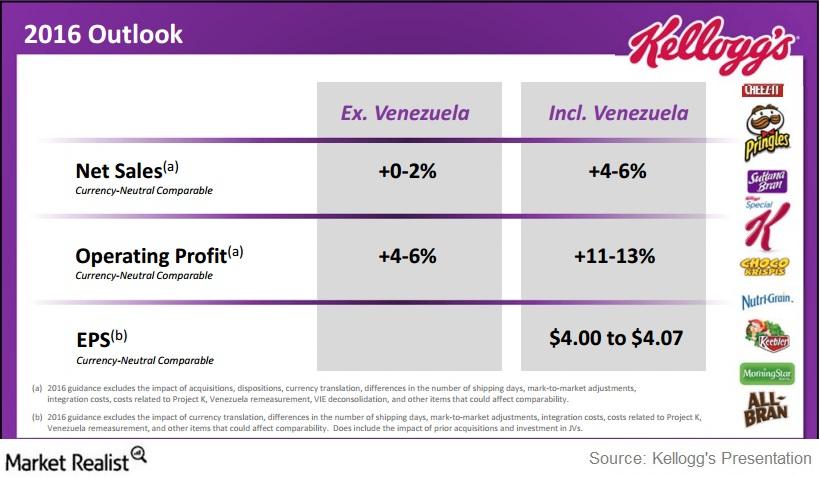

What’s Kellogg’s Updated Guidance for Fiscal 2016?

Kellogg (K) updated its fiscal 2016 guidance for currency-neutral comparable net sales, operating profit, and earnings per share.

How Much Did Kellogg Return to Shareholders?

Kellogg announced a quarterly dividend of $0.50 per share on its common stock—paid on June 15 to shareowners of record at the close of business on June 1.

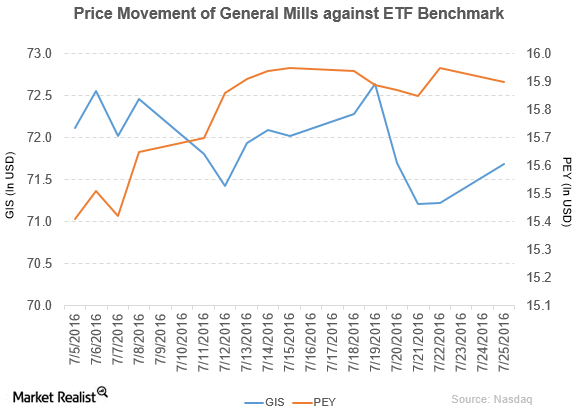

Why Did General Mills Expand the Recall of Its Products?

General Mills rose by 0.66% to close at $71.69 per share on July 25. The stock’s weekly, monthly, and YTD price movements were -0.82%, 8.1%, and 27.1%.

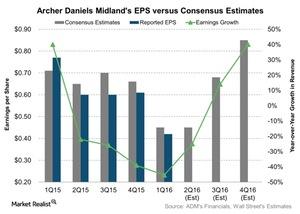

What Could Cast a Shadow over Archer Daniels Midland’s 2Q16 EPS?

Analysts expect Archer Daniels Midland’s adjusted EPS in 2Q16 to be $0.45—compared to $0.60 in 2Q15. It represents a massive decline of 25%.

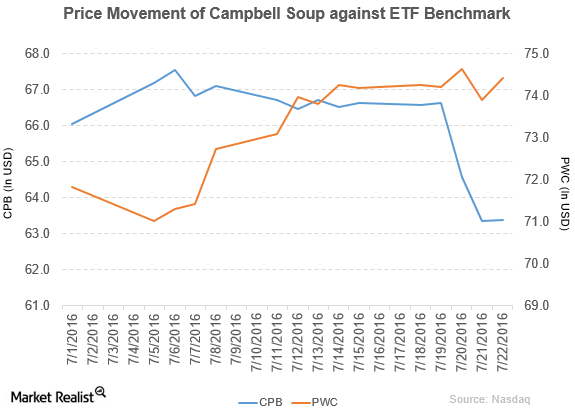

Campbell Soup Announces Its Target and Strategies

Campbell Soup fell by 4.9% to close at $63.38 per share in the third week of July. Its weekly, monthly, and YTD price movements were -4.9%, 1.7%, and 22.5%.

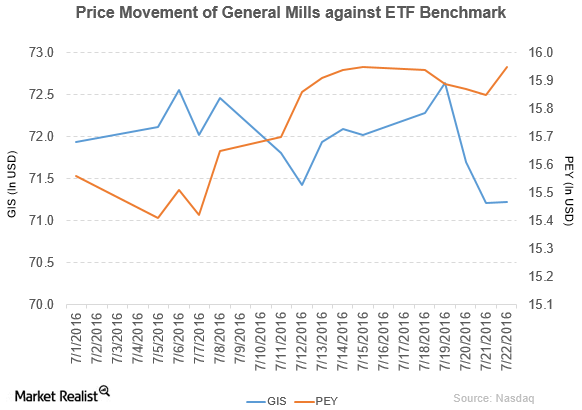

General Mills Announces Restructuring Plans

General Mills fell by 1.1% to close at $71.22 per share in the third week of July. Its weekly, monthly, and YTD price movements were -1.1%, 8.0%, and 26.2%.

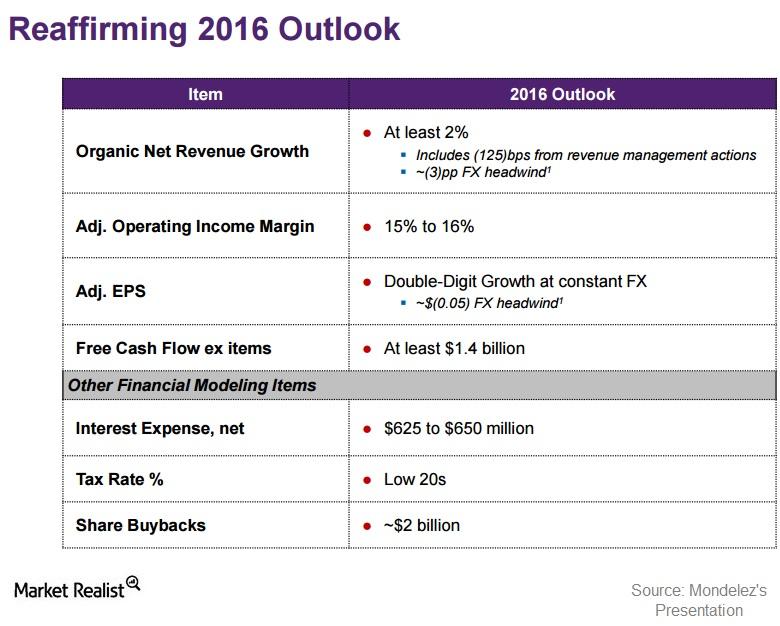

Mondelez’s Revenue Expectations for Rest of Fiscal 2016

In its fiscal 1Q16, Mondelez International (MDLZ) reaffirmed the fiscal 2016 outlook it announced during its 4Q15 results.

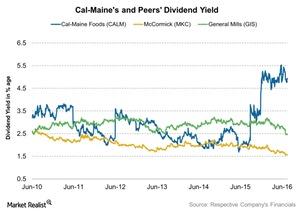

How Much Did Cal-Maine Return to Shareholders in Fiscal 2016?

Cal-Maine Foods has a dividend yield of 4.0% as of July 18, 2016. Management raised the dividend at a CAGR (compound annual growth rate) of 15.3% over five years.

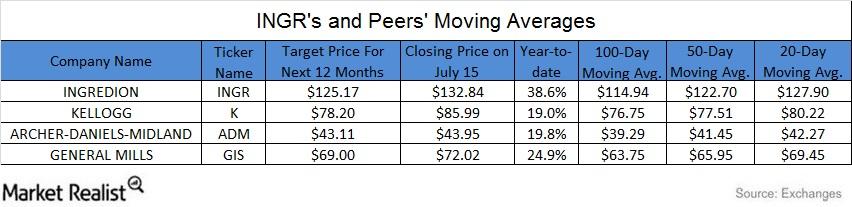

How Does Ingredion Compare to Peers on Key Moving Averages?

On July 15, 2016, Ingredion (INGR) closed at $132.84. It traded 15.6% above its 100-day moving average, 8.3% above its 50-day moving average, and 3.9% above its 20-day moving average.

How Has Mead Johnson Grown through Innovation?

Mead Johnson (MJN) participated and discussed some key strategies in the Deutsche Bank Global Consumer Conference held last month.

Why Are Analysts So Positive about General Mills?

About 64% of analysts rate General Mills a “hold,” 18% rate it a “sell,” and 18% rate it a “buy.”

General Mills Declared Increased Dividend in Fiscal 4Q16

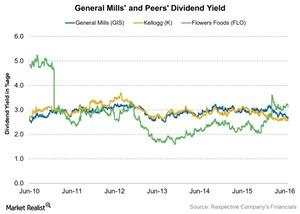

With its fiscal 4Q16 earnings release, the General Mills board approved a quarterly dividend of $0.48 per share. It will be paid on August 1, 2016.

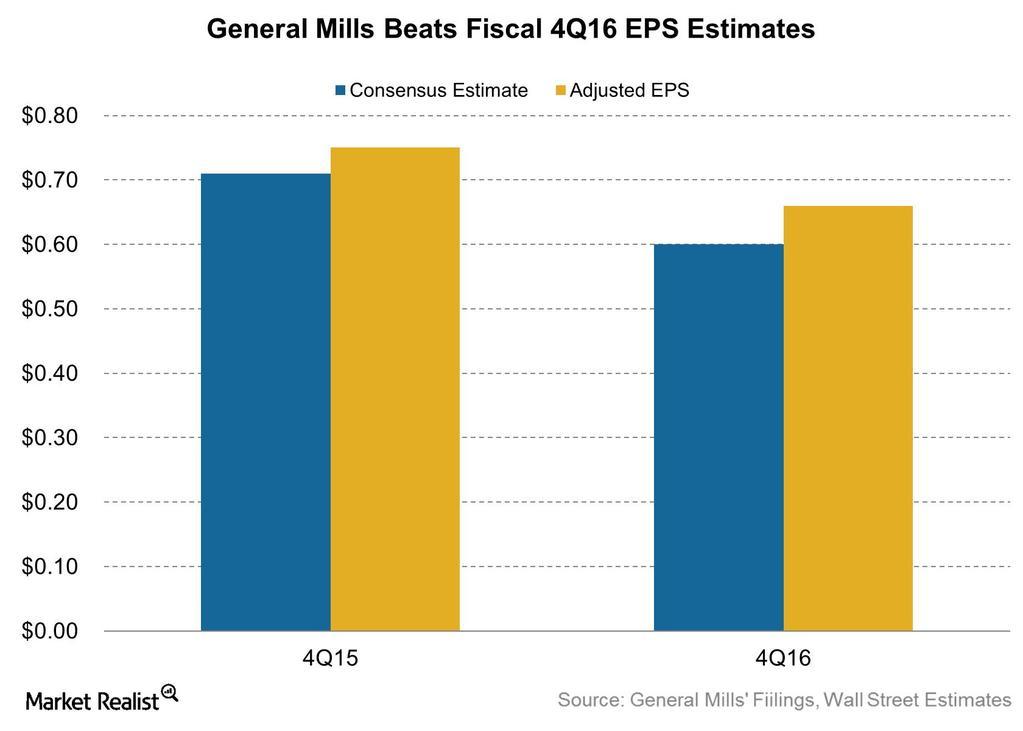

Why Did General Mills’ Earnings Fall in Fiscal 4Q16?

General Mills’ (GIS) fiscal 4Q16 earnings beat estimates by 10%. Adjusted EPS, however, declined 12% compared to fiscal 4Q15.