B&G Foods Acquired Victoria Fine Foods for $70 Million

B&G Foods (BGS) declared a quarterly cash dividend of $0.47 per share on its common stock. This dividend will be paid on January 30, 2017, to shareholders of record on December 30, 2016.

Dec. 6 2016, Updated 8:07 a.m. ET

Price movement

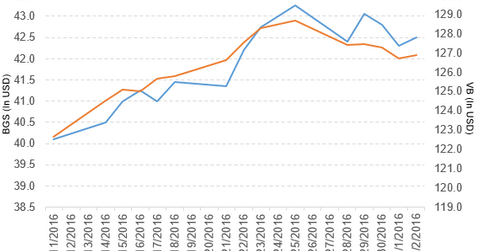

B&G Foods (BGS) has a market cap of $2.8 billion. It rose 0.47% to close at $42.50 per share on December 2, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -1.7%, 1.1%, and 25.0%, respectively, on the same day.

BGS is trading 2.2% above its 20-day moving average, 6.1% below its 50-day moving average, and 0.34% below its 200-day moving average.

Related ETF and peers

The Vanguard Small-Cap ETF (VB) invests 0.11% of its holdings in BGS. The YTD price movement of VB was 15.9% on December 2.

The market caps of BGS’s competitors are as follows:

Latest news on BGS

In a press release on December 2, 2016, B&G Foods reported, “B&G Foods, Inc. (BGS) announced that effective today it has acquired Victoria Fine Foods Holding Company and Victoria Fine Foods, LLC from Huron Capital Partners and certain other sellers for approximately $70.0 million in cash, subject to a customary working capital adjustment.”

The report continued, “B&G Foods projects that after it fully integrates the Victoria brand, the brand will generate on an annualized basis net sales of approximately $41.0 million and adjusted EBITDA of approximately $9.0 million.”

The press release added, “B&G Foods funded the acquisition and related fees and expenses with cash on hand and additional revolving loans under its existing credit facility.”

Performance of B&G Foods in 3Q16

B&G Foods reported 3Q16 net sales of $318.2 million, a rise of 49.2% compared to its net sales of $213.3 million in 3Q15. The company’s gross profit margin and operating margin rose 270 basis points and 240 basis points, respectively, in 3Q16 compared to 3Q15.

BGS’s net income and EPS (earnings per share) rose to $32.4 million and $0.50, respectively, in 3Q16, compared to $19.8 million and $0.34, respectively, in fiscal 3Q15. It reported adjusted EPS of $0.56 in 3Q16, a rise of 43.6% compared to 3Q15.

BGS’s inventories and trade accounts receivable rose 9.1% and 30.0%, respectively, in 3Q16 compared to 4Q15. It reported cash and cash equivalents of $240.6 million in 3Q16, compared to $5.2 million in 4Q15.

Quarterly dividend

B&G Foods (BGS) declared a quarterly cash dividend of $0.47 per share on its common stock. This dividend will be paid on January 30, 2017, to shareholders of record on December 30, 2016.

Projections

B&G Foods made the following projections for 2016:

- net sales in the range of $1.38 billion–$1.40 billion

- adjusted EBITDA[1. earnings before interest, tax, depreciation, and amortization] in the range of $322.0 million–$328.0 million

- adjusted EPS in the range of $2.11–$2.17

In the final part of this series, we’ll discuss Sonoco Products (SON).