Vanguard Small-Cap ETF

Latest Vanguard Small-Cap ETF News and Updates

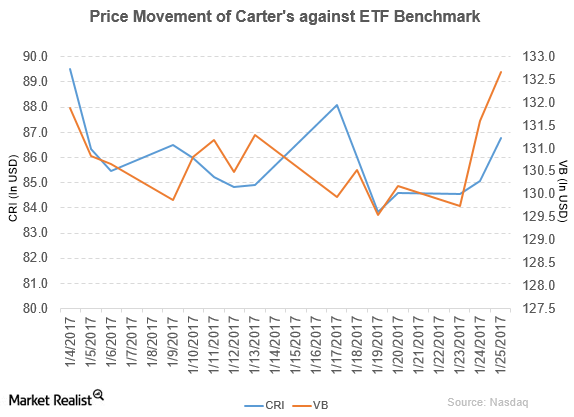

Morgan Stanley Rated Carter’s as ‘Overweight’

On January 25, 2017, Morgan Stanley initiated the coverage of Carter’s with “overweight” rating. It set the stock’s price target at $103.0 per share.

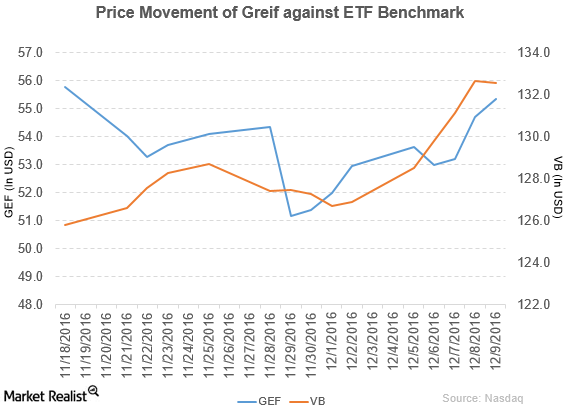

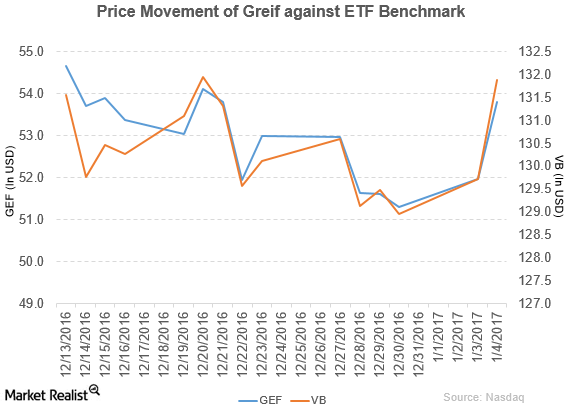

How Did Greif Perform in Fiscal 4Q16?

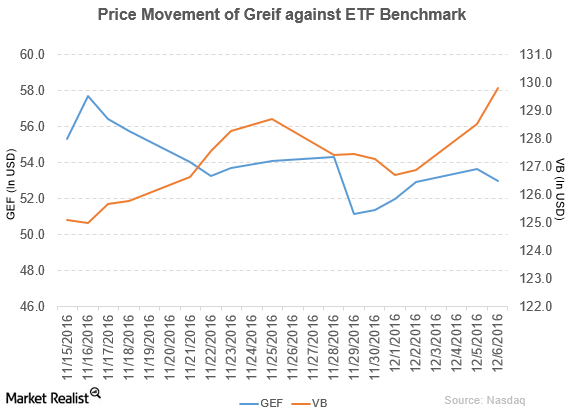

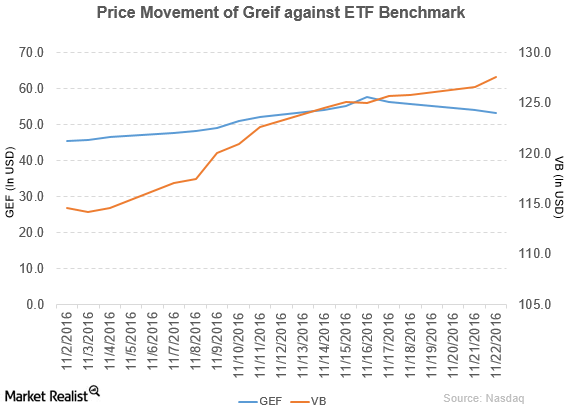

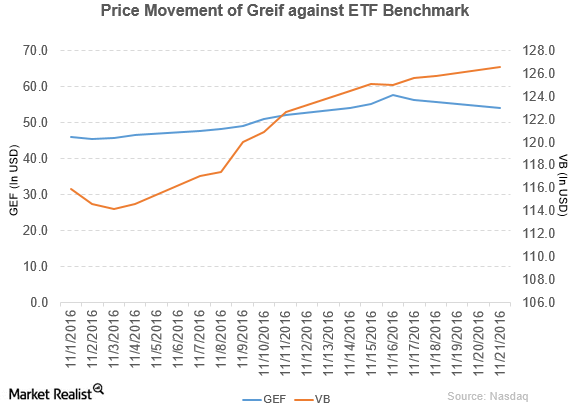

Greif (GEF) rose 4.6% to close at $55.35 per share during the first week of December 2016.

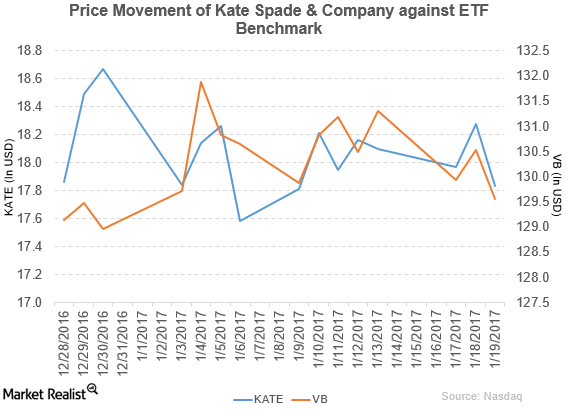

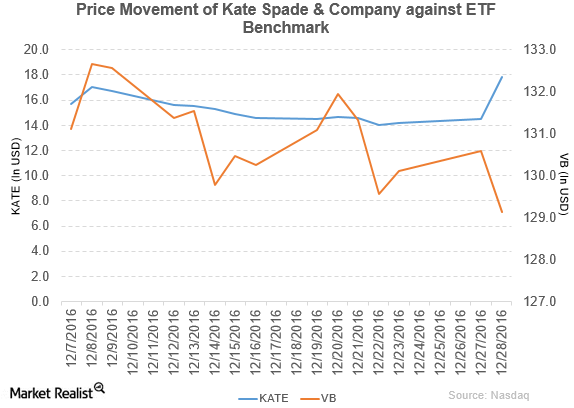

Bank of America/Merrill Lynch Downgrades Kate Spade to ‘Neutral’

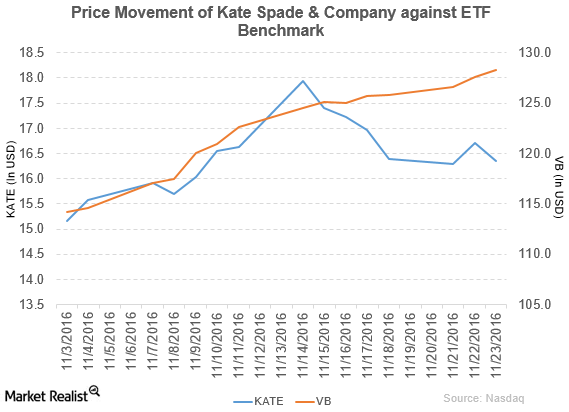

Kate Spade (KATE) reported fiscal 3Q16 net sales of $316.5 million—a rise of 14.1% compared to net sales of $277.3 million in fiscal 3Q15.

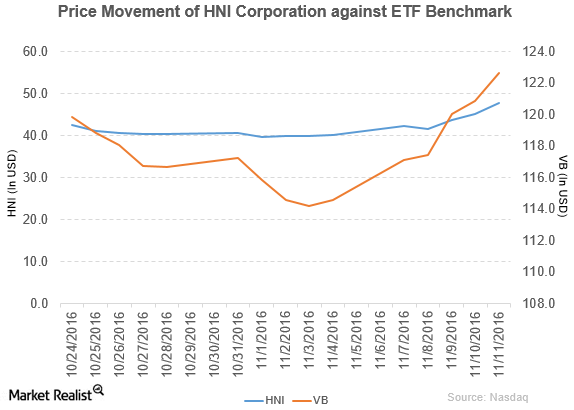

HNI Corporation Declared a Dividend of $0.28 Per Share

HNI Corporation (HNI) rose 19.0% to close at $47.83 per share during the second week of November 2016.

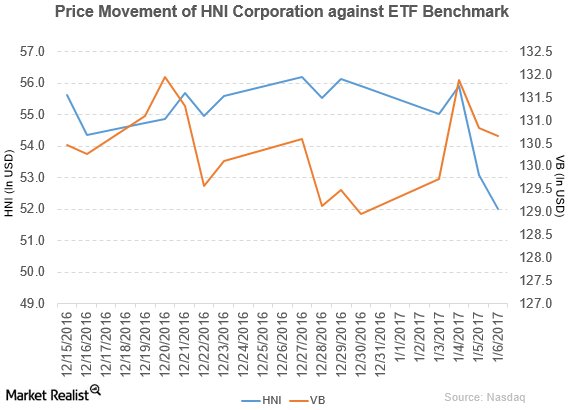

Sidoti Rated HNI Corporation as ‘Neutral’

HNI Corporation fell 2.1% to close at $51.99 per share on January 6. Its weekly, monthly, and YTD movements were -7.4%, -3.2%, and -7.0%, respectively.

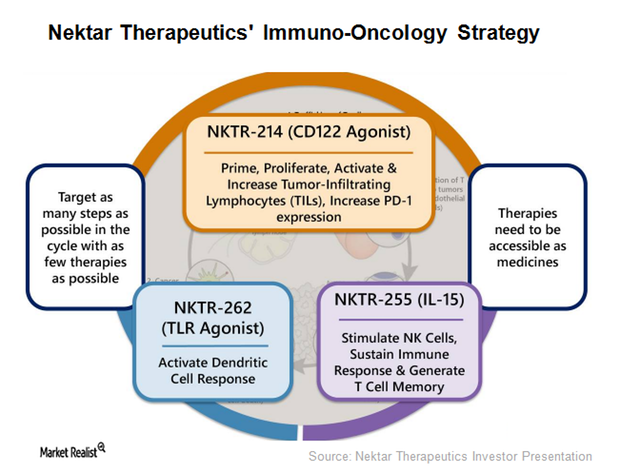

A Deeper Look at Nektar Therapeutics’ Licensing Agreements

License and collaboration agreements Nektar Therapeutics (NKTR) has entered into a number of licensing and collaboration agreements for research, development, and commercialization with various healthcare companies, including Eli Lilly (LLY), AstraZeneca (AZN), and Amgen (AMGN). Under these agreements, Nektar is entitled to receive license fees, milestone payments, royalties, and payments for manufacturing and supplying Nektar’s […]

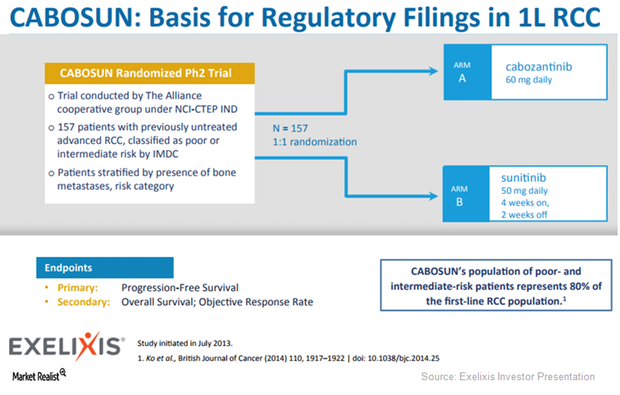

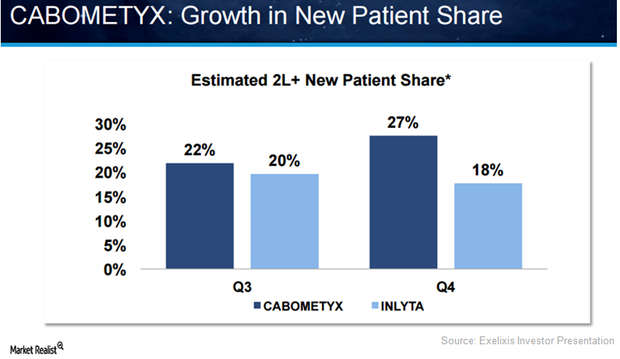

Behind Exelixis’s Cabometyx Strategy for 2018

Exelixis (EXEL) expects the FDA’s approval for Cabometyx for first-line RCC (renal cell carcinoma) to be a major revenue driver.

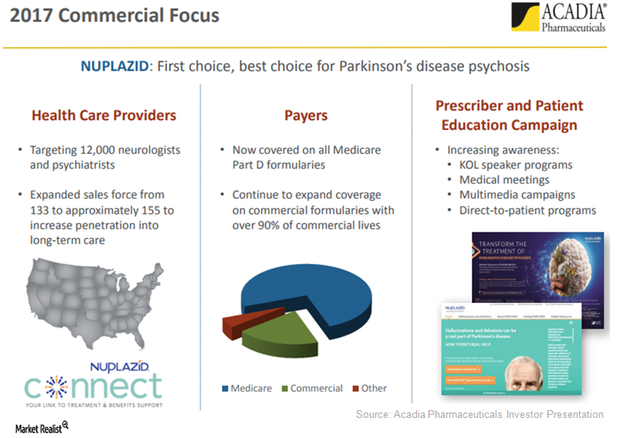

Nuplazid Sees Increasing Physician Intent to Prescribe in 2017

Acadia Pharmaceuticals’ (ACAD) commercial teams have been carrying out promotional efforts to create awareness for Nuplazid among physicians with the intent to have them prescribe the drug.

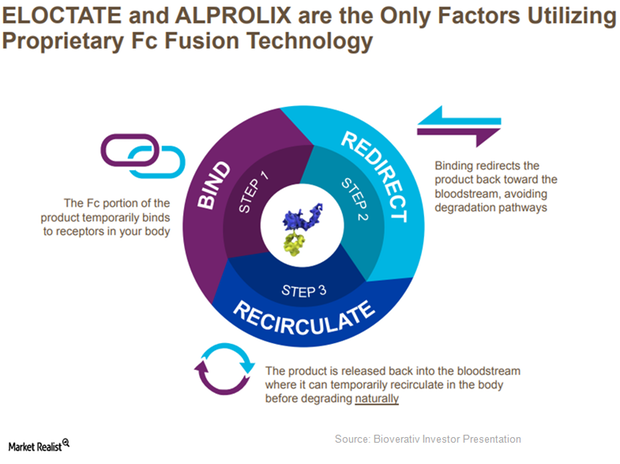

Alprolix and Eloctate Increasingly Used for Prophylaxis in 2017

Since demand from the target population for prophylaxis is rising rapidly, Bioverativ’s Alprolix and Eloctate are expected to see solid demand trends in 2017.

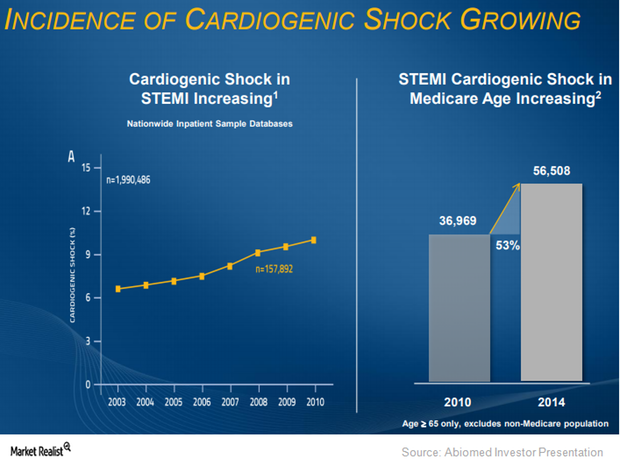

Where Abiomed Plans to Expand Impella CP’s Label

About 40% of patients succumb to heart failure within five years. Abiomed believes that it is reperfusion injuries that cause these problems.

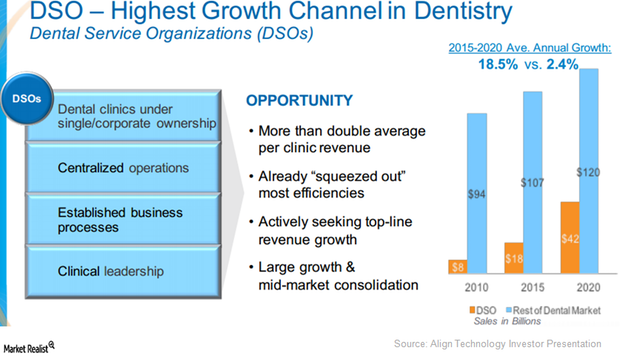

These Are Align Technologies Key Demand Drivers in North America

In 1Q17, Align Technology (ALGN) has started selling its new product Invisalign Go in North America, which involves a few DSOs (dental service organizations).

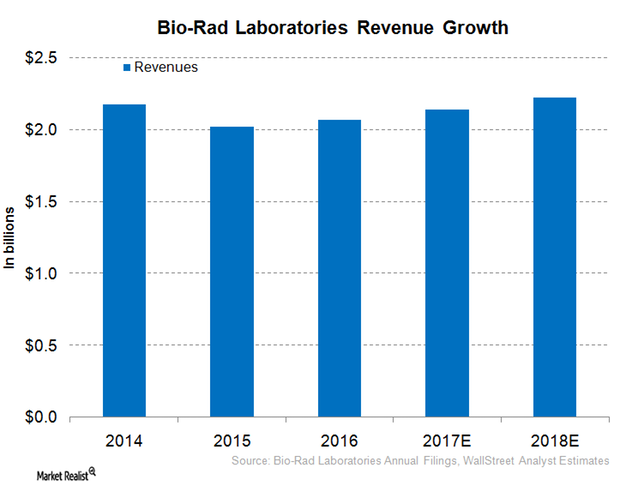

Inside Bio-Rad Laboratories’ Robust Revenue Growth Projection for 2017

On March 13, 2017, Bio-Rad Laboratories (BIO) provided a long-term, currency-neutral revenue growth target of around 3%–5%.

Behind Exelixis’s Successful Commercial Launch of Cabometyx in 2016

Launched in the US in 2Q16, Exelixis’s (EXEL) Cabometyx managed to fetch revenues of $31.2 million and $44.7 million in 3Q16 and 4Q16, respectively.

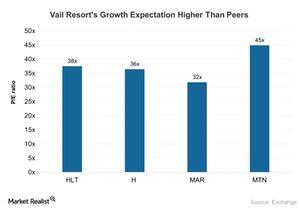

Vail Resorts: Exceptional Takes Time, According to Baron

Baron Capital began investing in Vail Resorts in 1997, and it owns a ~15%–20% stake in the company. According to Ron Baron, this investment has returned ~50%–75%.

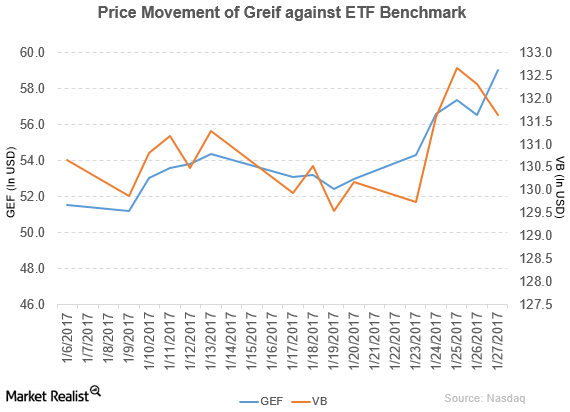

Bank of America/Merrill Lynch Upgrades Greif to a ‘Buy’

In fiscal 2016, Greif (GEF) reported net sales of $3.3 billion, a fall of 8.1% year-over-year.

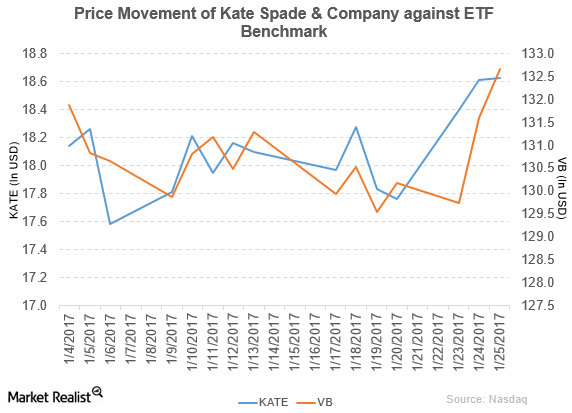

Telsey Downgraded Kate Spade & Company to ‘Market Perform’

On January 25, 2017, Telsey downgraded Kate Spade’s rating to “market perform” from “outperform.” It reported fiscal 3Q16 net sales of $316.5 million.

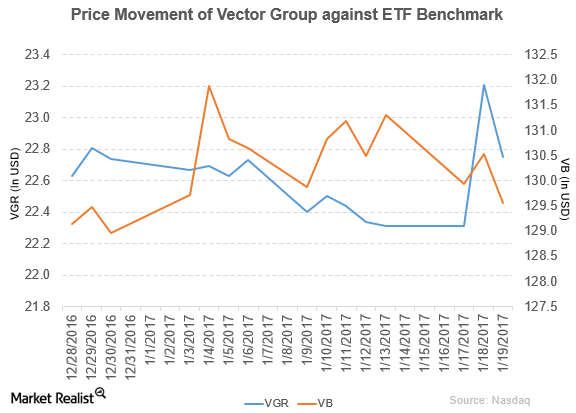

Moody’s Rated Vector Group’s Secured Notes

Vector Group (VGR) has a market cap of 2.9 billion. It fell 2.0% to close at $22.75 per share on January 19, 2017.

Robert W. Baird Upgrades Greif to ‘Outperform’

Greif (GEF) has a market cap of $3.0 billion. It rose 3.5% to close at $53.80 per share on January 4, 2017.

Why Did Kate Spade Stock Rise on December 28?

Kate Spade (KATE) rose more than 23.0% on December 28, 2016, after the report that the company is planning to sell its businesses with the help of investment banker.

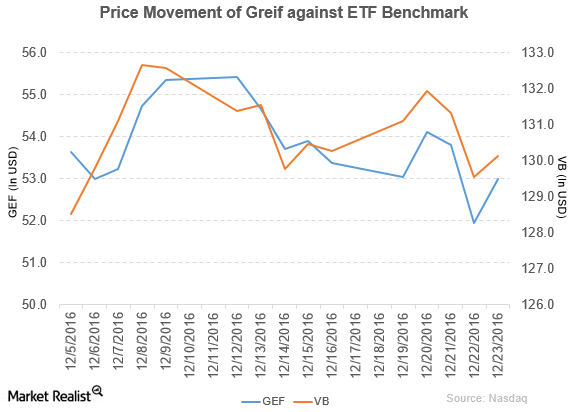

BMO Capital Downgrades Greif to ‘Underperform’

Greif (GEF) fell 0.69% to close at $53 per share during the third week of December 2016.

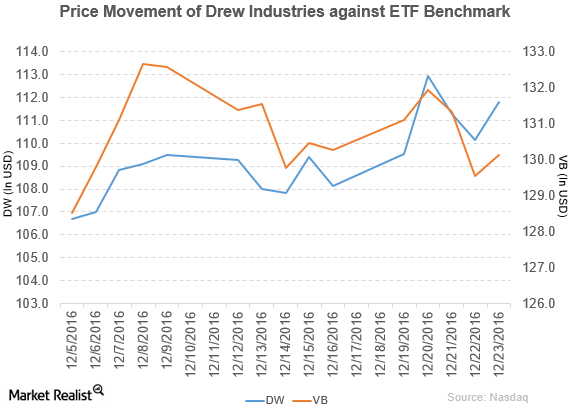

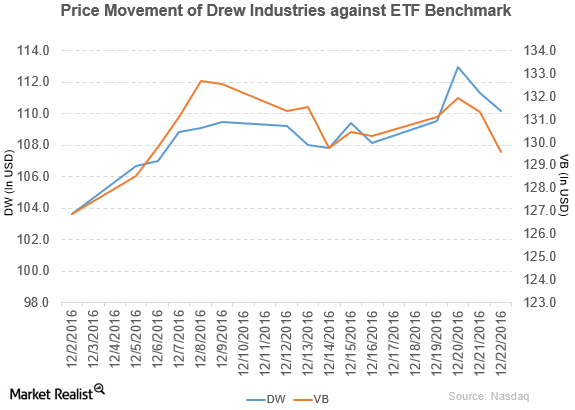

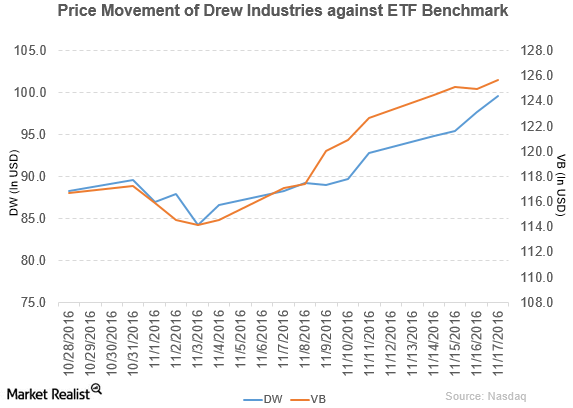

Drew Industries Announces Change of Name and Ticker Symbol

Drew Industries (DW) rose 3.4% to close at $111.80 per share during the third week of December 2016.

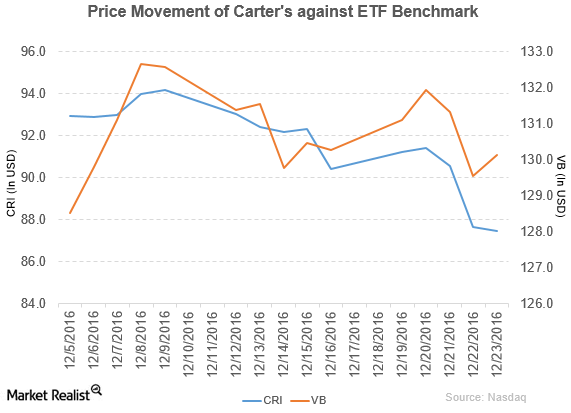

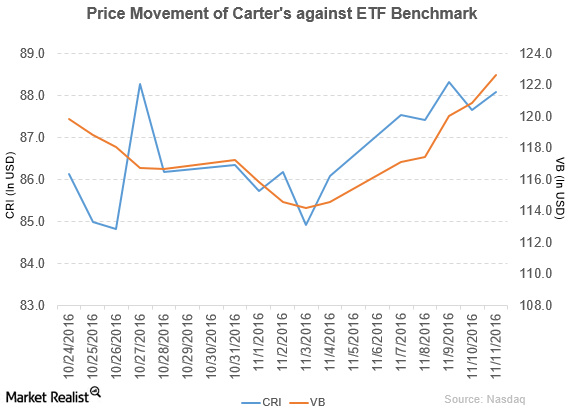

Citigroup Upgrades Carter’s to a ‘Buy’

Carter’s (CRI) fell 3.3% to close at $87.48 per share during the third week of December 2016.

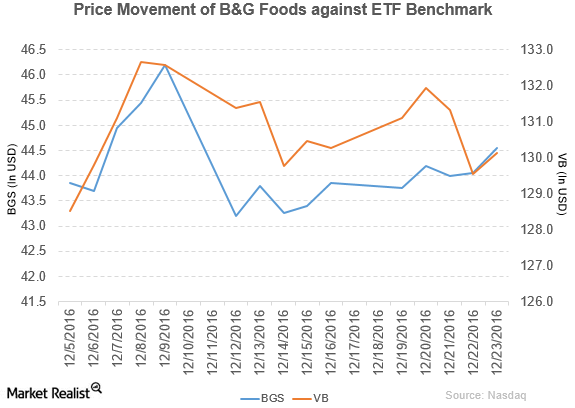

Citigroup Gives B&G Foods a ‘Neutral’ Rating

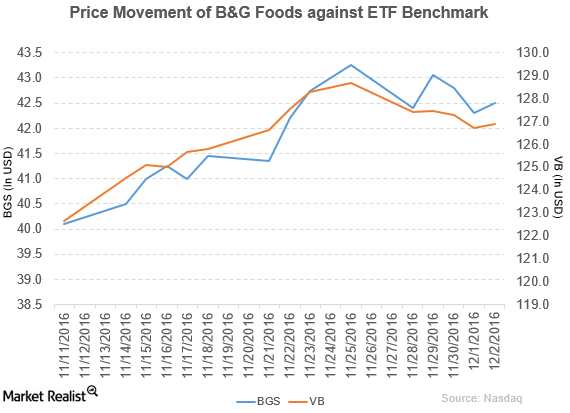

B&G Foods (BGS) rose 1.6% to close at $44.55 per share during the third week of December 2016.

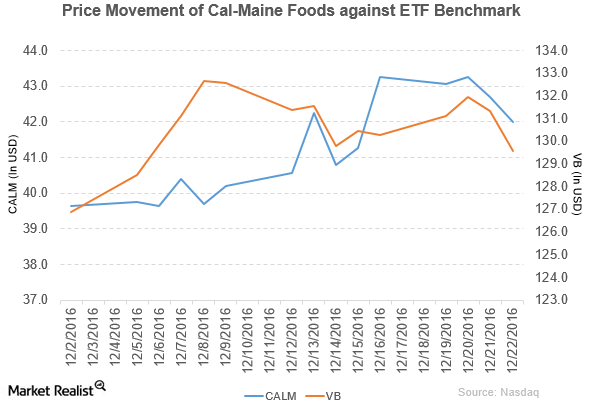

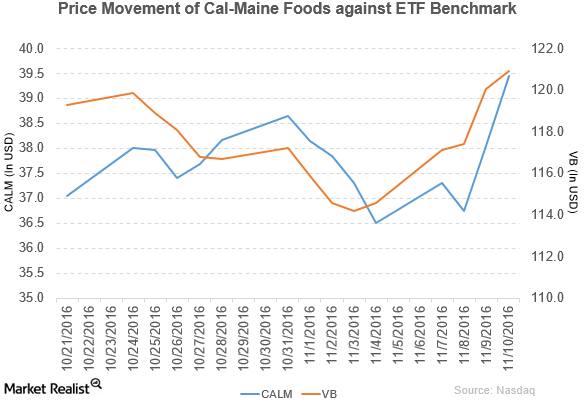

Understanding Cal-Maine Foods’ Performance in Fiscal 2Q17

Cal-Maine Foods (CALM) has a market cap of $1.9 billion. It fell 1.6% to close at $42.00 per share on December 22, 2016.

Why Sidoti Rated Drew Industries a ‘Buy’

Drew Industries (DW) has a market cap of $2.7 billion. It fell 1.0% to close at $110.15 per share on December 22, 2016.

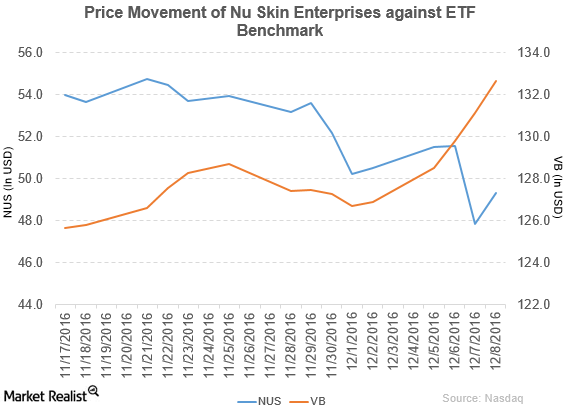

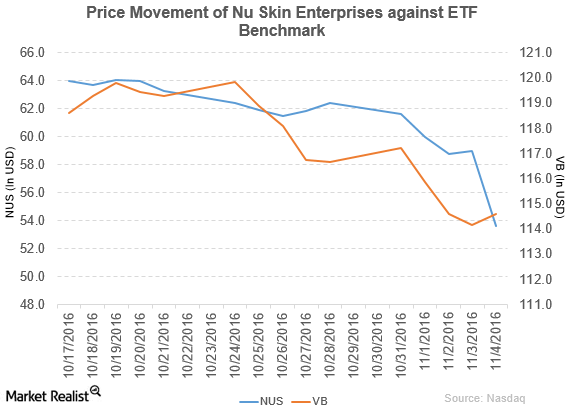

Sidoti Upgrades Nu Skin Enterprises to ‘Buy’

Price movement Nu Skin Enterprises (NUS) has a market cap of $2.7 billion. It rose 3.1% to close at $49.32 per share on December 8, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -1.8%, -7.9%, and 34.7%, respectively, on the same day. NUS is trading 6.3% below its 20-day moving average, […]

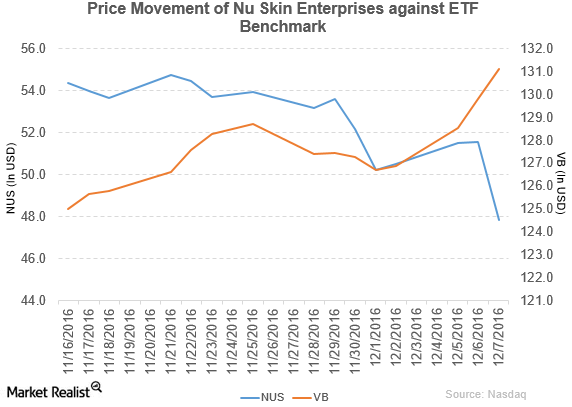

Nu Skin Enterprises Made Changes in Its Management

Nu Skin Enterprises (NUS) has a market cap of $2.6 billion. It fell 7.2% to close at $47.85 per share on December 7, 2016.

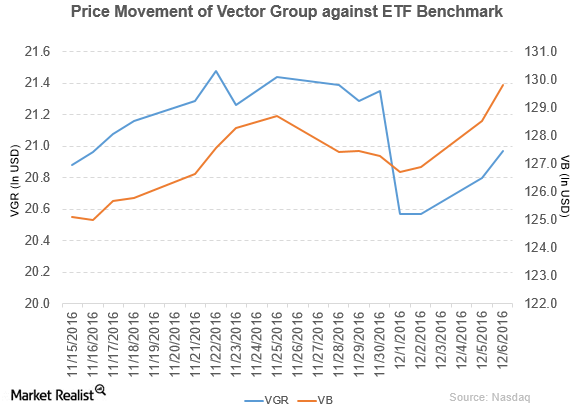

Vector Group Declares Dividend of $0.40 per Share

Vector Group (VGR) has a market cap of $2.7 billion. Its stock rose 0.82% to close at $20.97 per share on December 6, 2016.

Greif Declared Quarterly Dividends

Greif (GEF) has a market cap of $2.8 billion. It fell 1.2% to close at $52.98 per share on December 6, 2016.

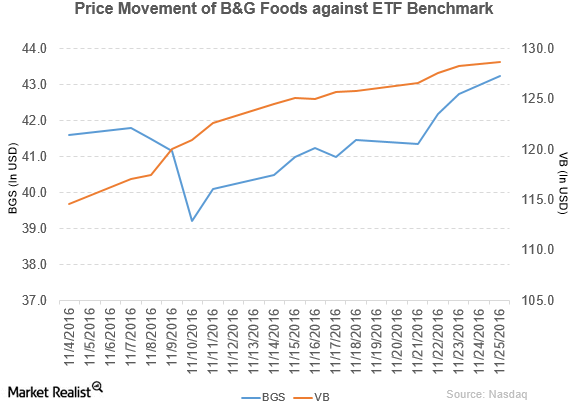

B&G Foods Acquired Victoria Fine Foods for $70 Million

B&G Foods (BGS) declared a quarterly cash dividend of $0.47 per share on its common stock. This dividend will be paid on January 30, 2017, to shareholders of record on December 30, 2016.

B&G Foods Acquired ACH Food Companies’ Business

B&G Foods (BGS) rose 5.5% to close at $43.25 per share during the fourth week of November 2016.

Wolfe Research Downgraded Kate Spade to ‘Peer Perform’

On November 23, 2016, Wolfe Research downgraded Kate Spade & Company’s rating to “peer perform” from “outperform.”

Bank of America/Merrill Lynch Downgrades Greif to ‘Neutral’

Greif reported 3Q16 net sales of $845.0 million, a fall of 9.1% compared to its net sales of $930.0 million in 3Q15.

Wells Fargo Downgrades Greif to ‘Market Perform’

Greif (GEF) has a market cap of $2.9 billion. It fell 3.2% to close at $54.02 per share on November 21, 2016.

Drew Industries Declares Dividend of $0.50 Per Share

Drew Industries rose 1.9% to close at $99.60 per share on November 17. The stock’s weekly, monthly, and YTD price movements were 11.0%, 7.4%, and 65.5%.

Carter’s Declares Dividend of $0.33 Per Share

Price movement Carter’s (CRI) has a market cap of $4.4 billion. It rose 0.48% to close at $88.09 per share on November 11, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 2.3%, 0.92%, and -0.06%, respectively, on the same day. CRI is trading 2.0% above its 20-day moving average, 2.1% below […]

Goldman Sachs Rated Cal-Maine Foods as ‘Neutral’

Cal-Maine Foods (CALM) reported fiscal 1Q17 net sales of $239.8 million, a fall of 60.7% compared to its net sales of $609.9 million in fiscal 1Q16.

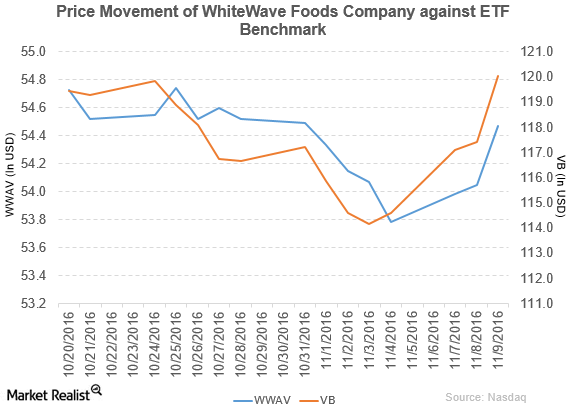

A Look at WhiteWave Foods’ 3Q16 Performance

Price movement WhiteWave Foods (WWAV) has a market cap of $9.7 billion. It rose 0.78% to close at $54.47 per share on November 9, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 0.59%, 1.7%, and 40.0%, respectively, on the same day. WWAV is trading 0.37% above its 20-day moving average, 0.44% […]

Nu Skin Enterprises Declares Its 3Q16 Results and Quarterly Dividend

Nu Skin Enterprises (NUS) has a market cap of $3.0 billion. It fell by 9.1% to close at $53.61 per share on November 4, 2016.

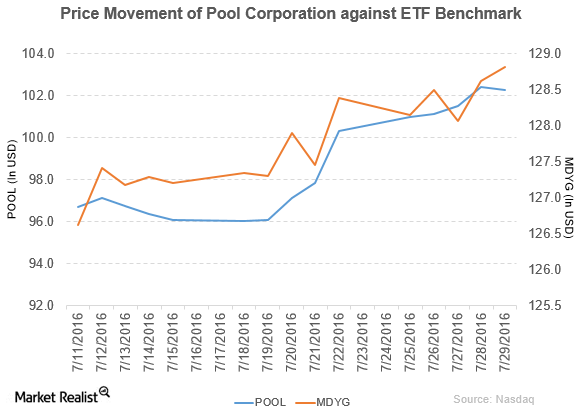

Pool Corporation Declares a Dividend of $0.31 Per Share

Pool Corporation (POOL) has a market capitalization of $4.2 billion. It fell by 0.13% to close at $102.28 per share on July 29, 2016.

Pool Corporation’s Top and Bottom Lines Rose in 2Q16

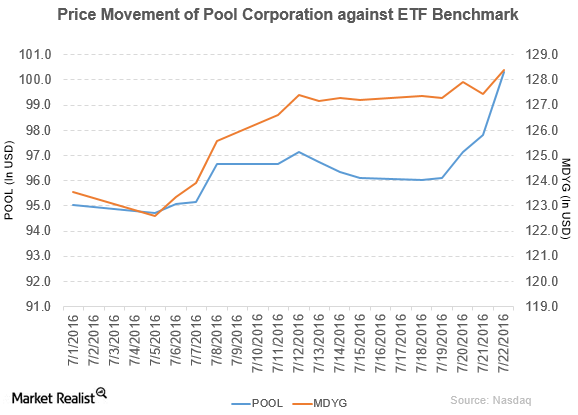

POOL rose by 4.4% to close at $100.32 per share during the third week of July. Its weekly, monthly, and YTD price movements were 4.4%, 11.5%, and 25.0%.

Johnson Rice Downgrades Pool Corporation to ‘Accumulate’

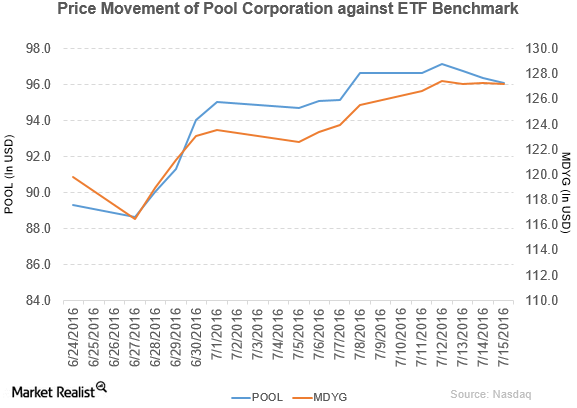

Pool Corporation fell by 0.27% to close at $96.10 per share on July 15. Its weekly, monthly, and YTD price movements were -0.59%, 6.6%, and 19.8%.