Invesco CurrencyShares Euro Trust

Latest Invesco CurrencyShares Euro Trust News and Updates

Have We Seen a Short-Term Bottom for the Dollar?

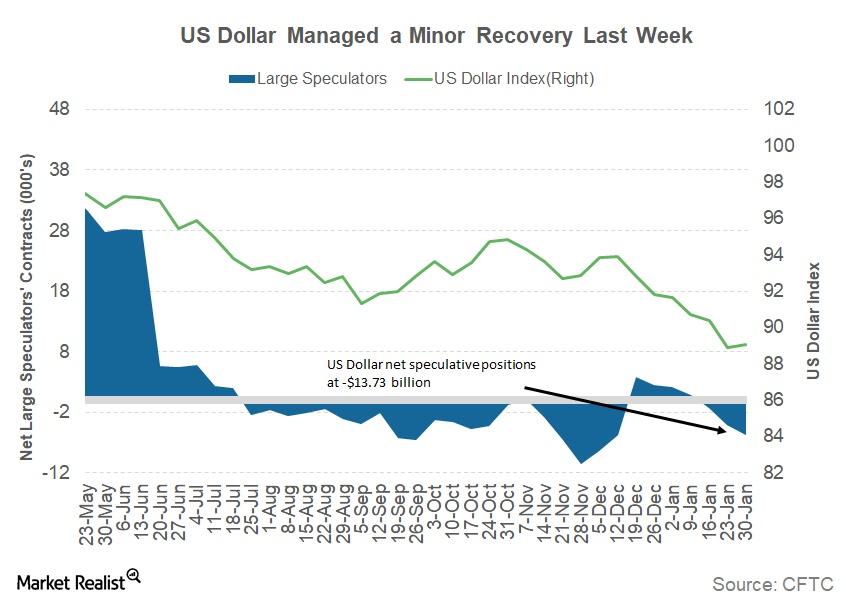

The US Dollar Index (UUP) managed to close in positive territory in the week ended February 8, 2018, after posting seven consecutive weekly losses.

Euro Reaches 23-Month Peak: Could It Climb Higher?

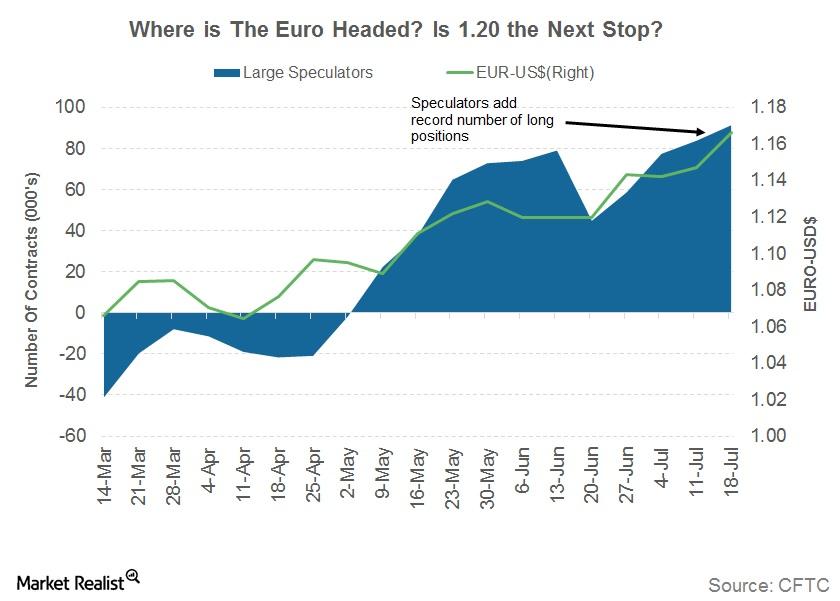

Euro rallies to a 23-month peak Last week, the euro (FXE) closed at 1.17, appreciating by 1.7% against the US dollar (UUP). The currency has appreciated by more than 10% against the US dollar this year, making it one of the strongest developed market currencies. Improving economic conditions and a stable political climate turned the […]

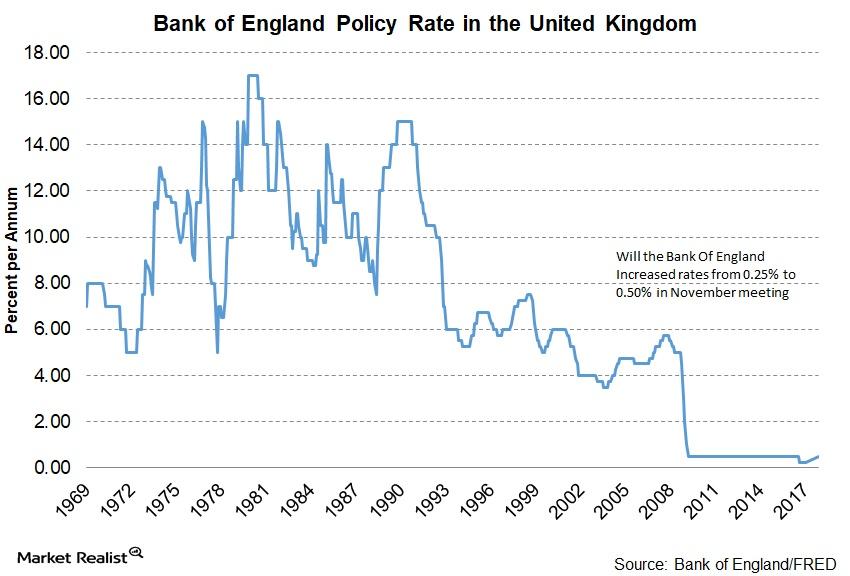

Bank of England Raises Interest Rate to 0.50%

The BOE (Bank of England) in its November meeting increased its benchmark interest rates from 0.25% to 0.50%.

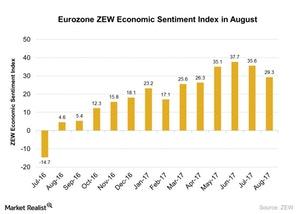

Eurozone ZEW Economic Sentiment Fell after a Year

According to a report by the Centre for European Economic Research (ZEW), the Eurozone ZEW Economic Sentiment Index fell to 29.3 in August.

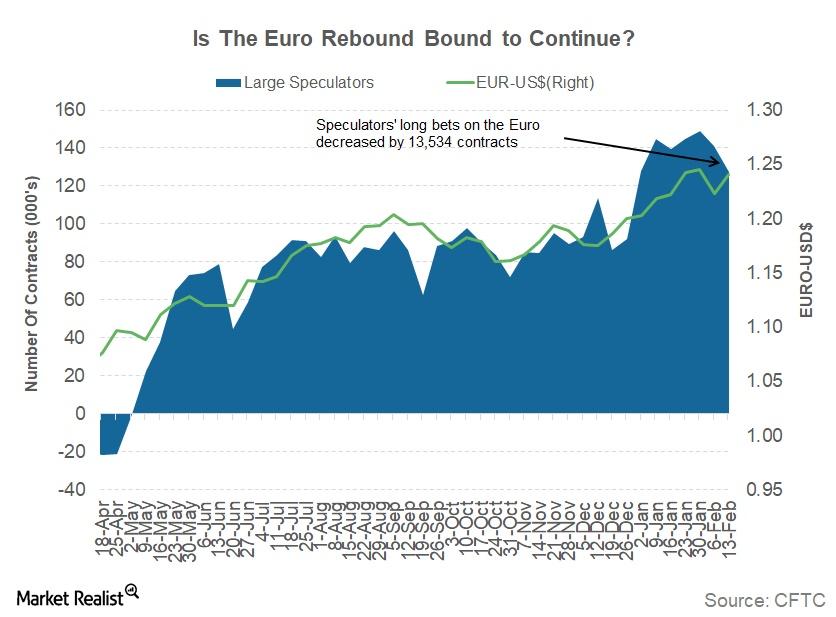

What to Expect from the Euro This Week

The euro-dollar (FXE) exchange rate closed the week ending February 16 at 1.24, an appreciation of 1.4% against the US dollar (UUP).

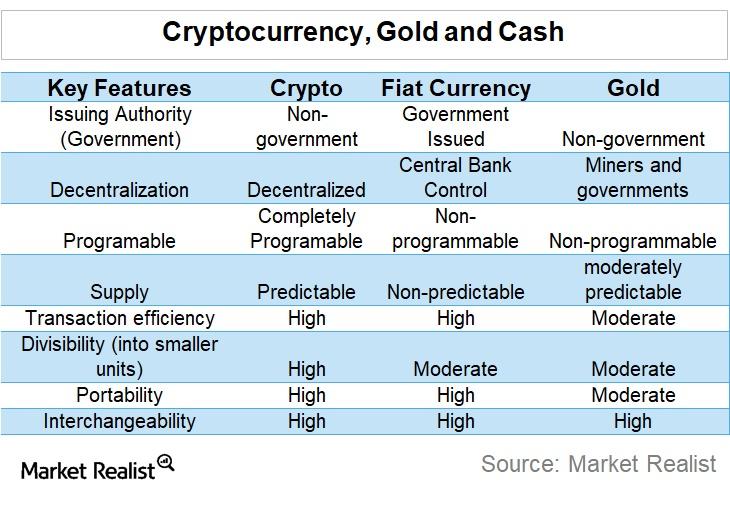

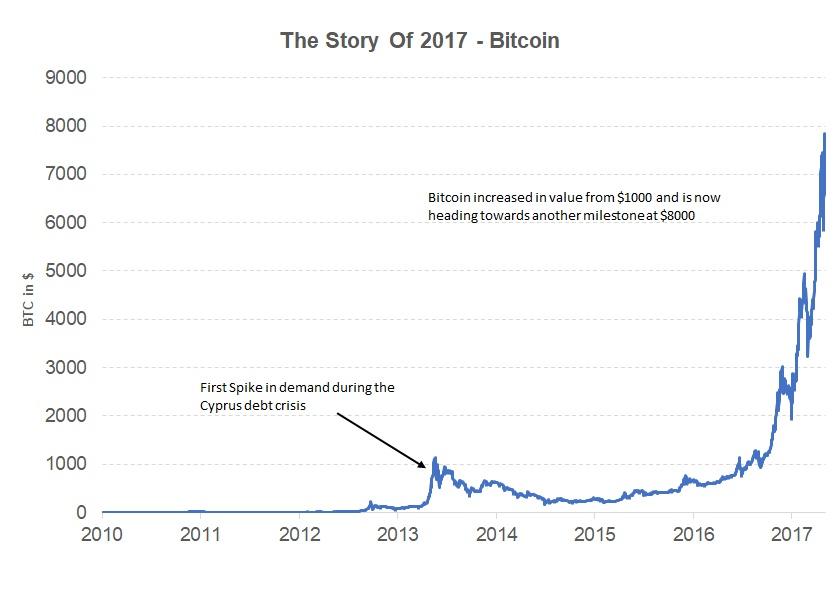

Is Bitcoin a Bubble?

The price of bitcoin (SOXL) (SOXX) has risen 69,278.6% over the last five years. On the other hand, in the last seven days, it has plummeted 27% to $12,466.

Is Bitcoin Ready to Replace Real Currency?

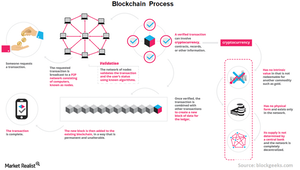

Despite the higher number of transactions that need to be updated regularly by users, the transaction capacity is intentionally kept very low by the bitcoin founders.

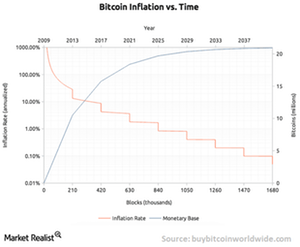

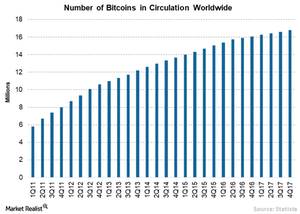

Why the Number of Bitcoins Is Limited

The founders of bitcoin have set a limit of 21 million bitcoins that can be mined over a period of time. Of those, 16.8 million are already in circulation.

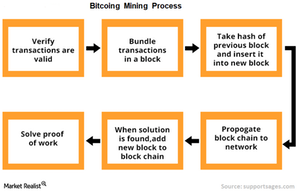

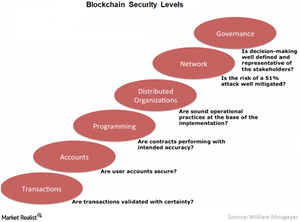

How Blockchain Technology Could Reduce Criminal Activities

Before updating data on a blockchain, users must agree about the veracity of the transaction through a process called consensus.

How Digital Assets Could Generate Income

Blockchain technology holds a lot of promise due to its many advantages such as transparency, faster transactions at lower costs, and a reliable system.

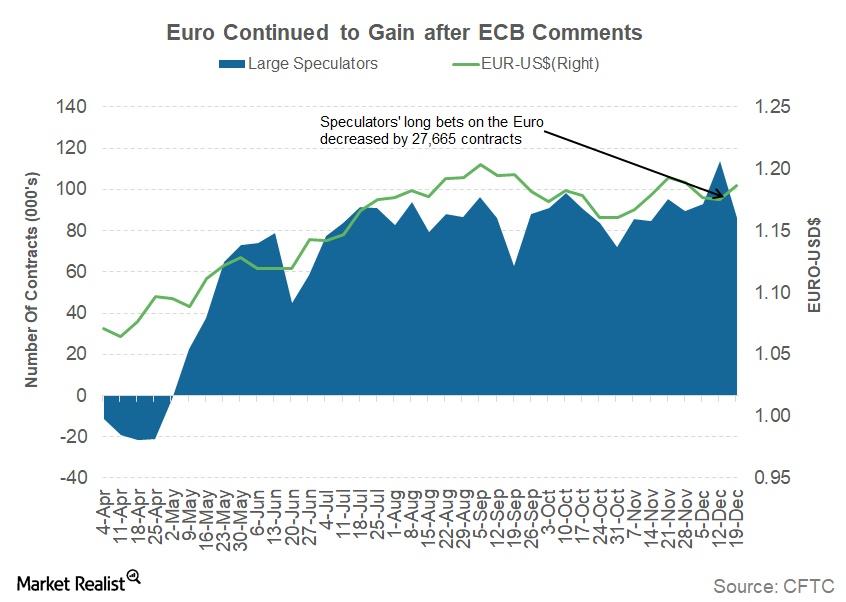

Politics and Central Bank Comments Could Drive the Euro Higher

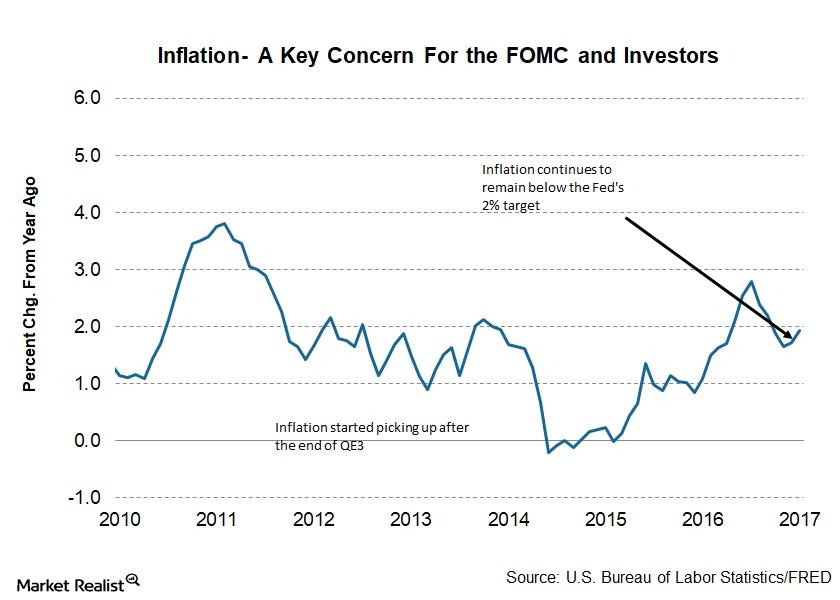

The Eurozone’s inflation data published on January 17 indicated that prices increased 1.4% in December 2017, which is still below the long-term average.

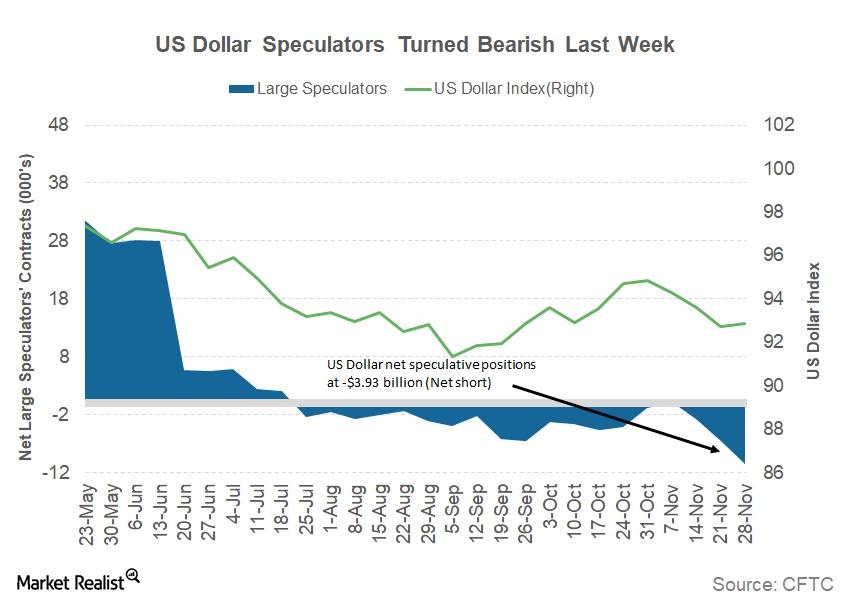

How the US Dollar Could React to a US Government Shutdown

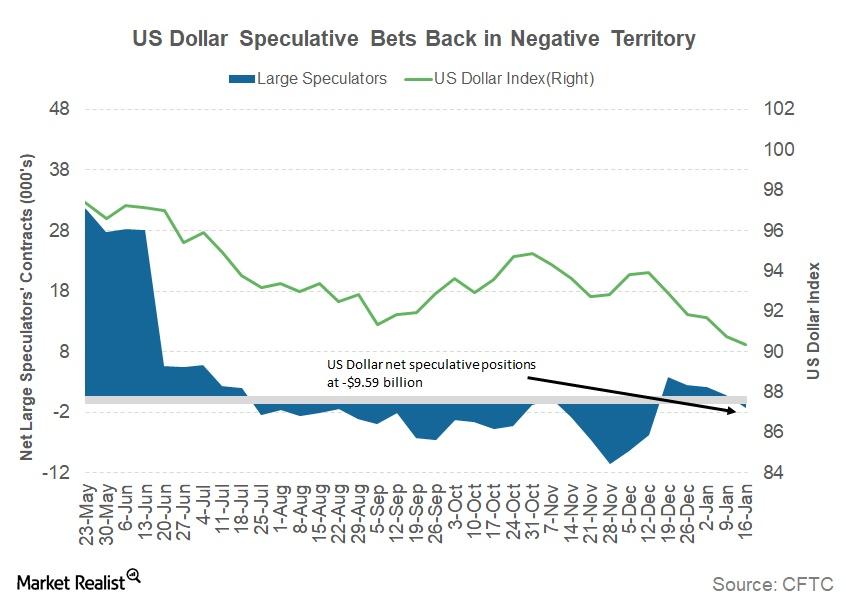

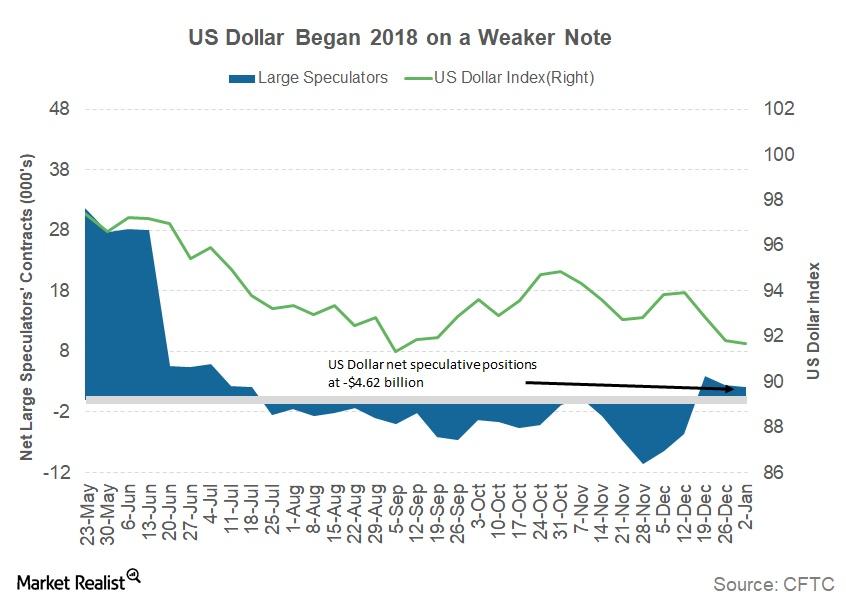

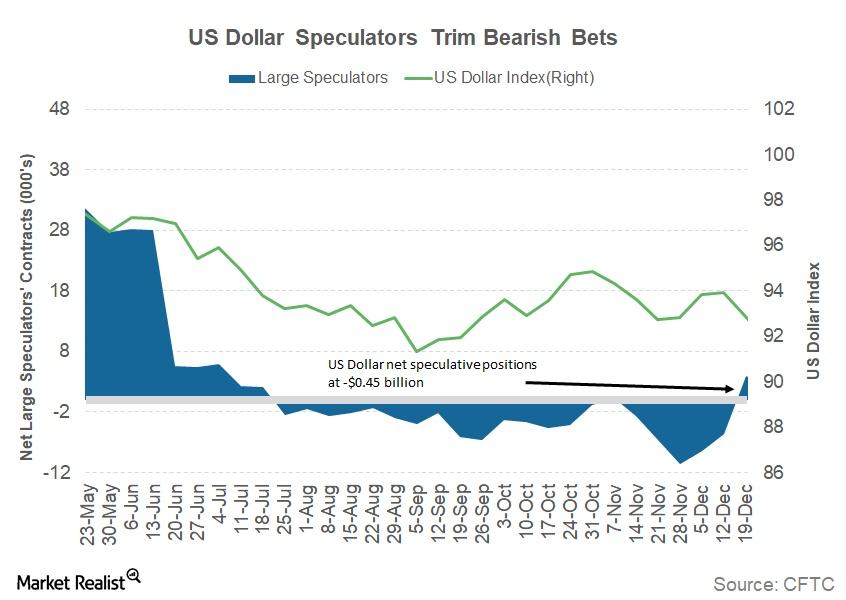

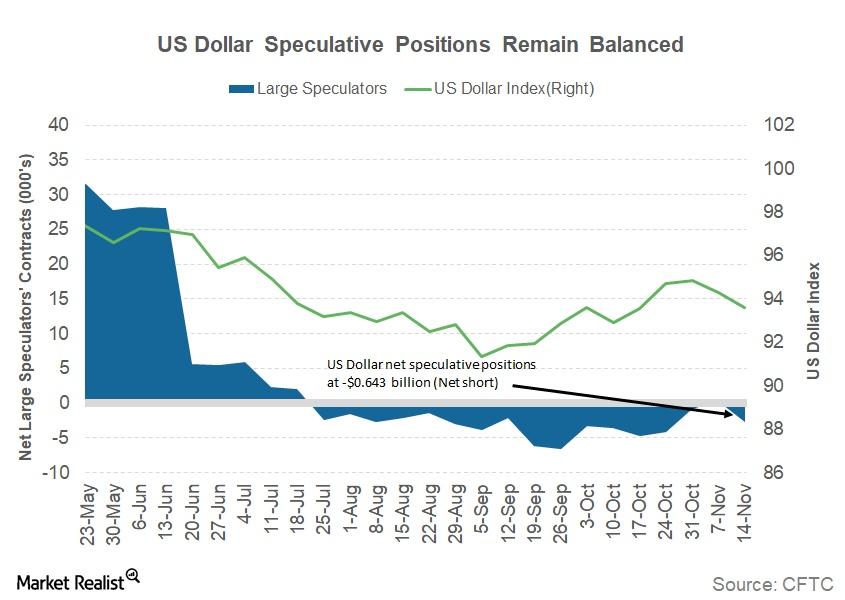

According to the January 19 Commitment of Traders report, released by the Chicago Futures Trading Commission, large speculators have turned bearish on the US dollar.

What Factors Are Driving the Euro Higher?

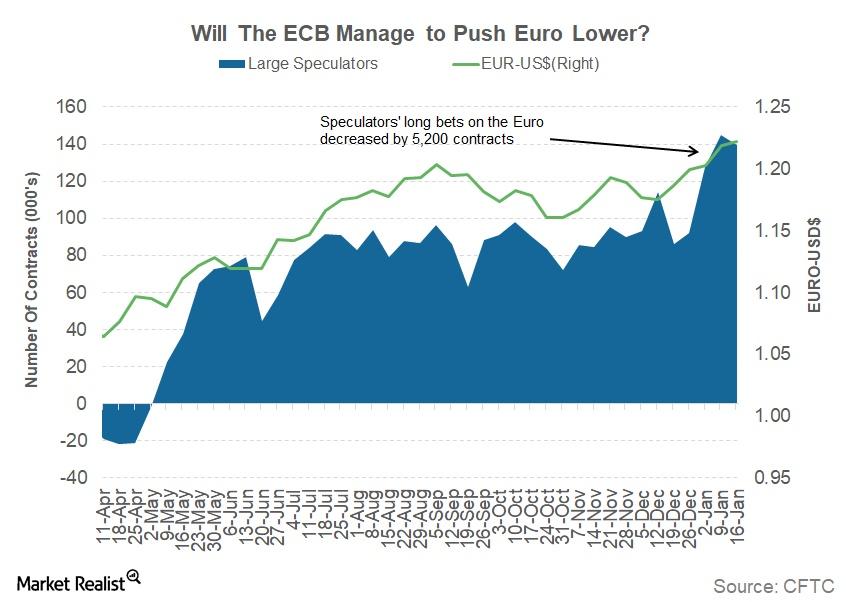

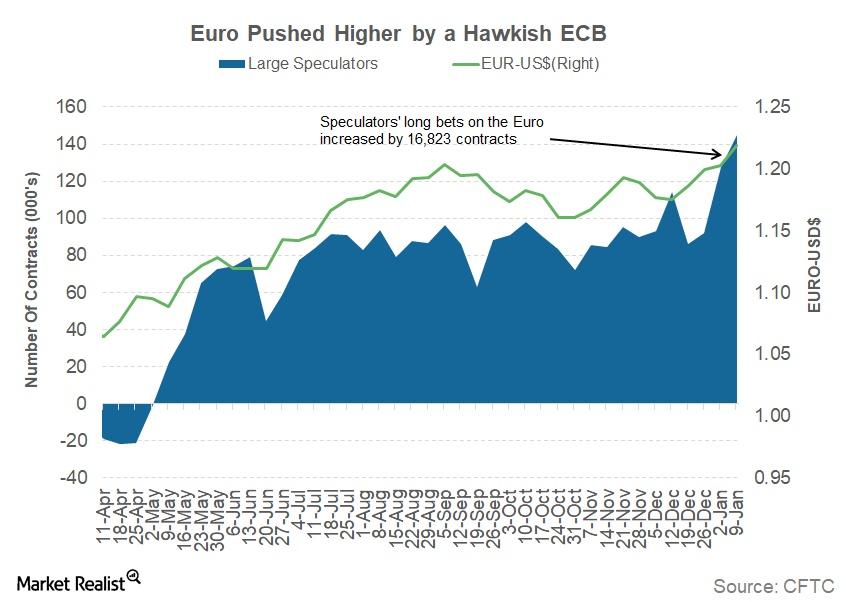

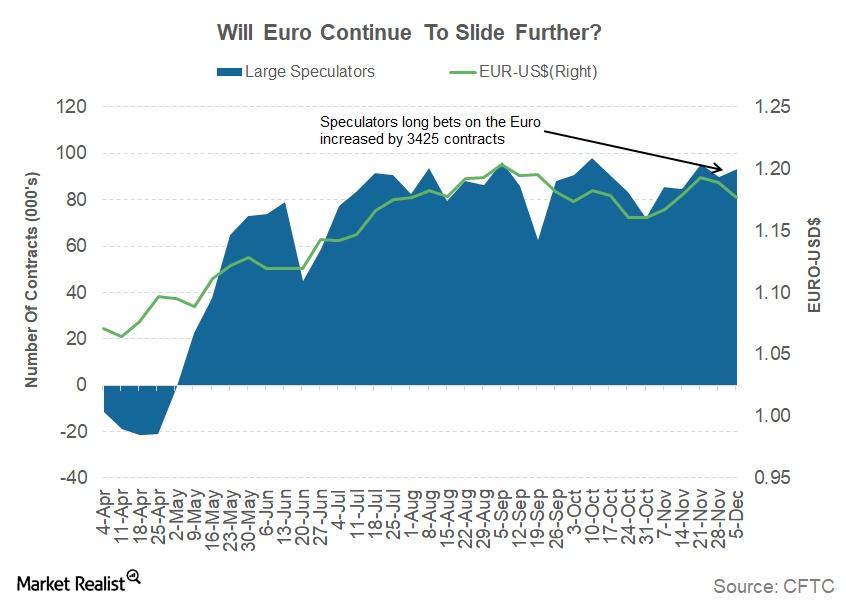

According to the January 12 Commitment of Traders report, speculators increased their long euro positions by 16,823 contracts last week.

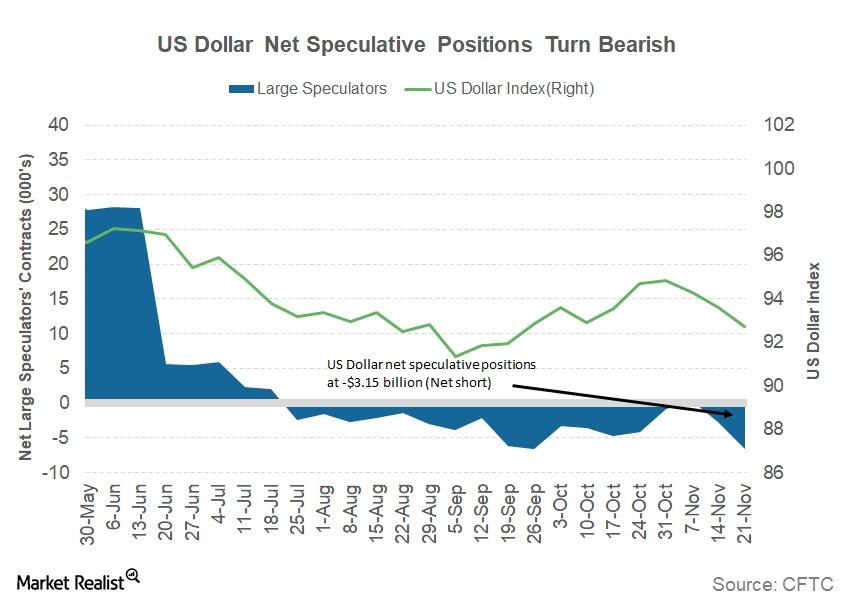

Why the US Dollar Is Losing Its Appeal

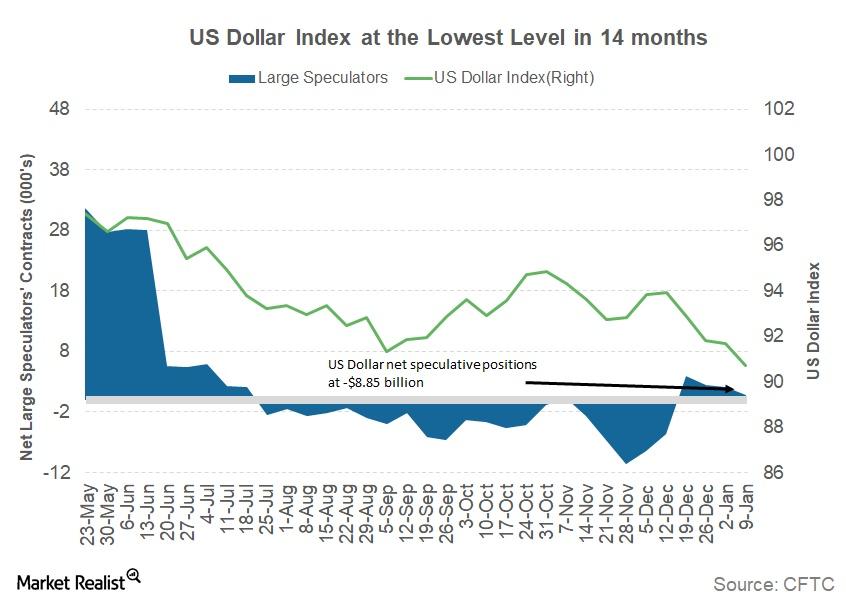

The US Dollar Index (UUP) continued its decline, posting a fourth consecutive weekly loss during the week ended January 12.

Factors That Are Driving the Euro Higher

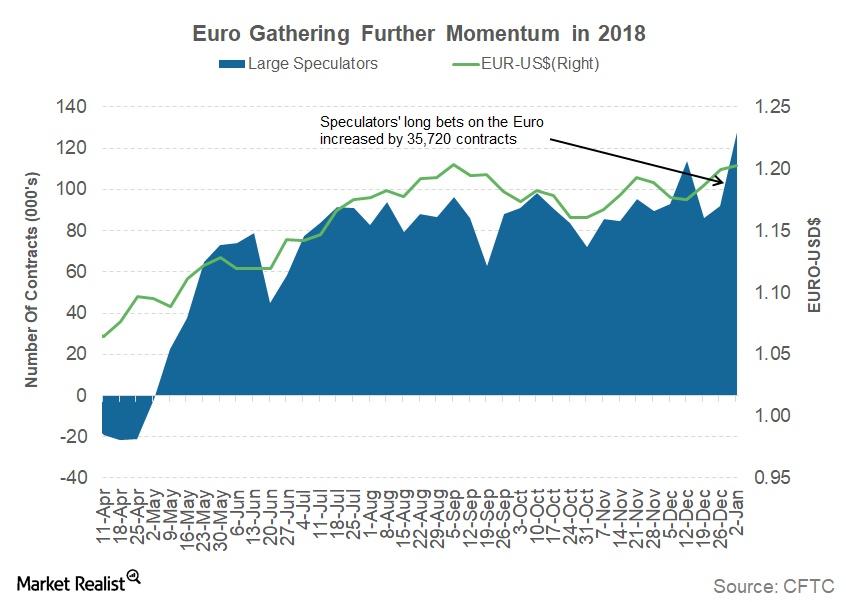

The euro appreciated 0.27% against the US dollar (UUP) after posting double-digit gains against the US dollar in 2017.

Why the US Dollar Began 2018 with Losses

The US Dollar index (UUP) began 2018 on a negative note, posting losses against most of the major currencies.

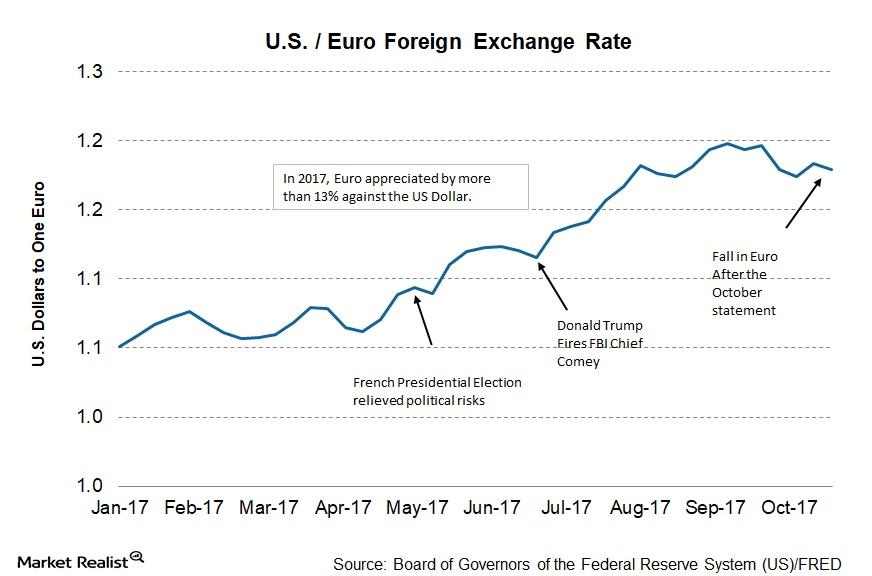

What to Make of the Surprising Gains in the Euro in 2017

The euro–dollar (FXE) pair closed 2017 at 1.1998. It appreciated by 13% against the US dollar and posted close to 10% gains against the other major global currencies.

How Could the US Dollar Fare in 2018?

The US dollar’s long-term outlook looks marginally better in 2018 than in 2017.

Here’s What Drove the Euro Higher Last Week

The euro (FXE) closed the week ended December 22, 2017, at 1.1864, appreciating 0.94% against the dollar (UUP).

Can the US Dollar Gain Back Lost Ground This Week?

The US Dollar index (UUP) failed to capitalize last week on the optimism from Congress passing the US tax reform bill.

What Drove the Euro Higher Last Week?

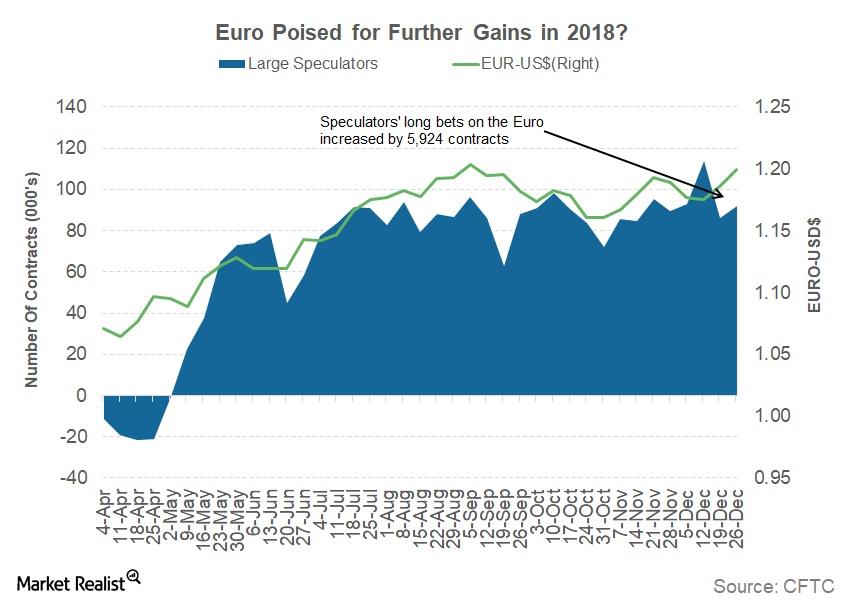

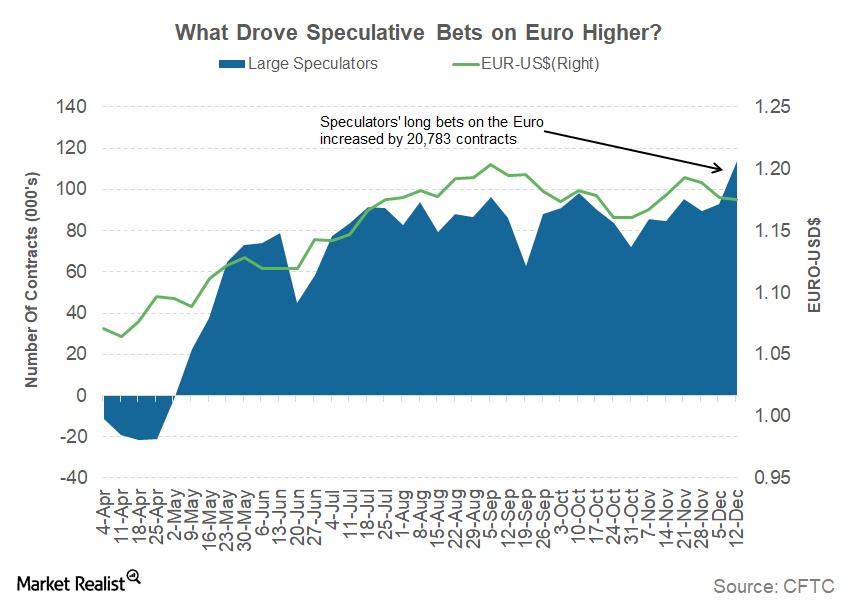

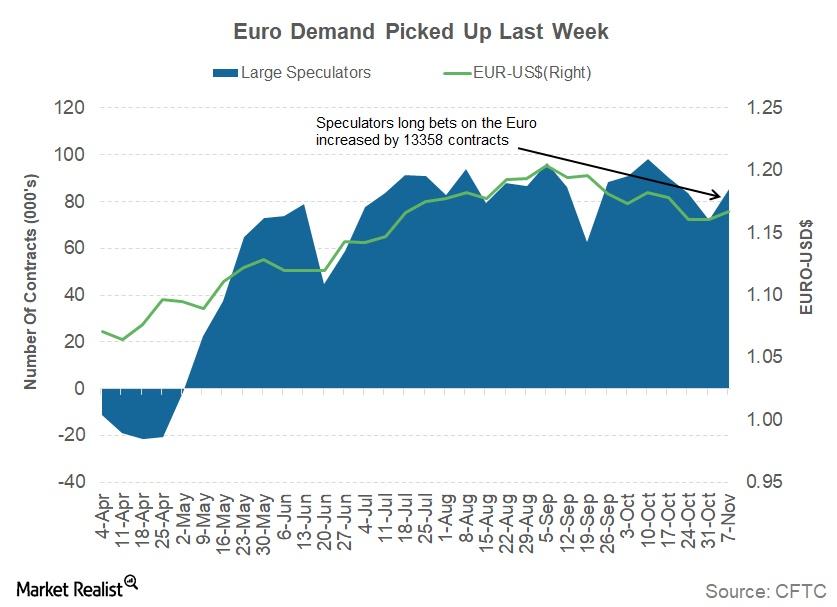

The total net speculative bullish positions on the euro (EUFX) increased from 93,106 contracts to 113,889 contracts in the previous week.

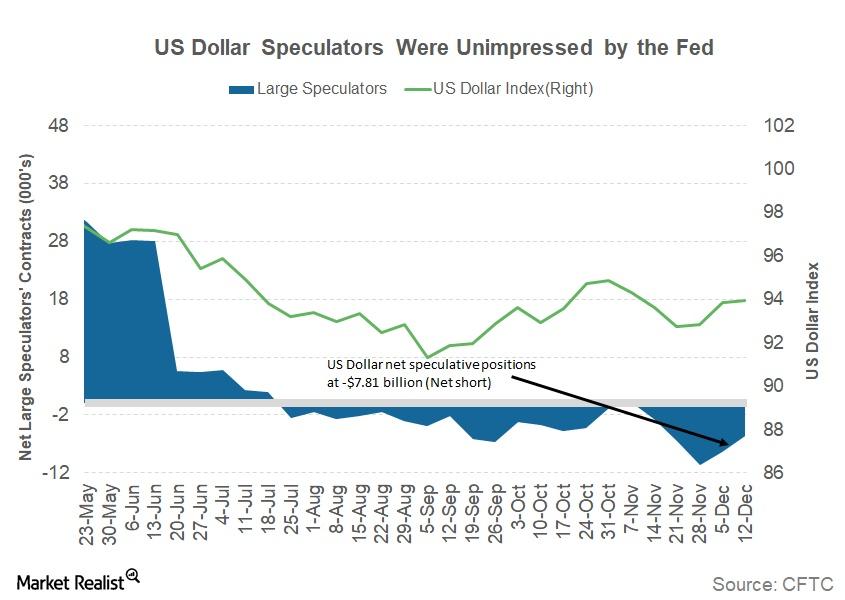

Why the US Dollar Resisted the Fed’s Latest Rate Hike

According to Reuters, the US dollar (USDU) net short positions increased to ~-$7.8 billion during the week ended December 15 compared to ~-$4.3 billion in the previous week.

Will the US Dollar Surge Higher after FOMC Meeting?

The US Dollar Index (UUP) continued its ascent against the other major currencies as investors positioned for a rate hike from the Fed and reacted to the increased possibility of tax reforms by the end of this year.

Why the Euro Continued to Fall Last Week

The euro-dollar (FXE) closed the week ending December 8 at 1.18, depreciating by 1.1% against the US dollar (UUP).

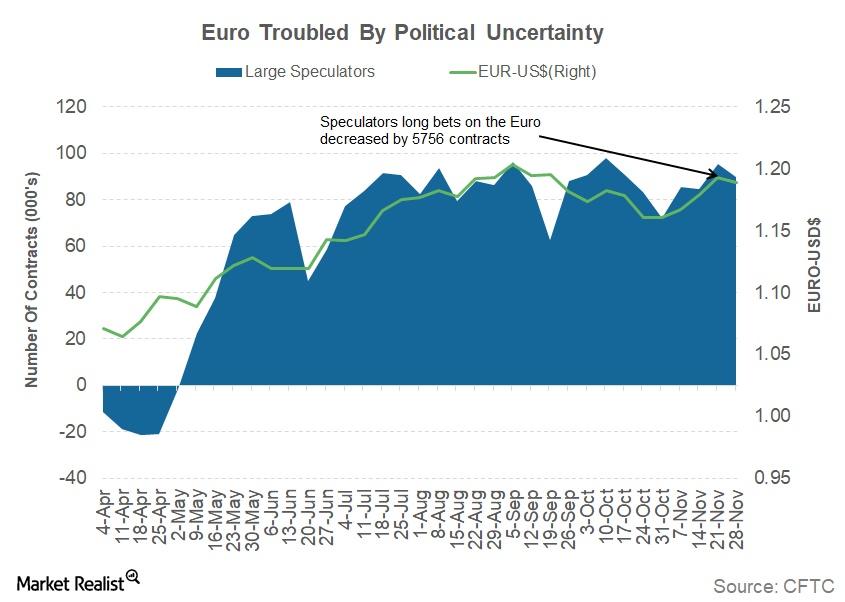

Are Politics Holding the Euro Back?

The euro-dollar (FXE) closed the week ending December 1 at 1.19, depreciating by 0.33% against the US dollar (UUP).

Will the US Dollar Surge on Tax Reform News?

The US Dollar Index (UUP) managed to close the week ending December 1 in positive territory with a gain of 0.14%.

Reasons behind a 3rd Weekly Loss for the US Dollar

The US Dollar Index (UUP) had another bad week as traders offloaded long dollar positions amid tax reform uncertainty last week.

How Bitcoin Differs from Other Currencies

Bitcoin has been rallying for the past year, with some proponents advocating that it could replace fiat currencies in the future.

What Drove the Euro Higher against the Dollar Last Week?

The euro-dollar (FXE) closed the week ending November 17 at 1.2, appreciating by 1.1% against the US dollar (UUP).

Could US Dollar Recover This Week?

The US Dollar Index (UUP) continued to struggle as the fate of US tax reform remains uncertain.

How Did Bitcoin Come to Be?

The idea behind bitcoin is simple: to create a new platform for transactions that are independent of central banks and involve minimal transaction costs.

How Euro Managed to Bounce Back Last Week

The euro-dollar (FXE) pair closed the week ending November 10 at 1.2, appreciating 0.48% against the US dollar (UUP).

Will US Dollar Survive Tax Reform Uncertainty?

The US Dollar Index (UUP) lost steam last week after posting three consecutive weekly gains.

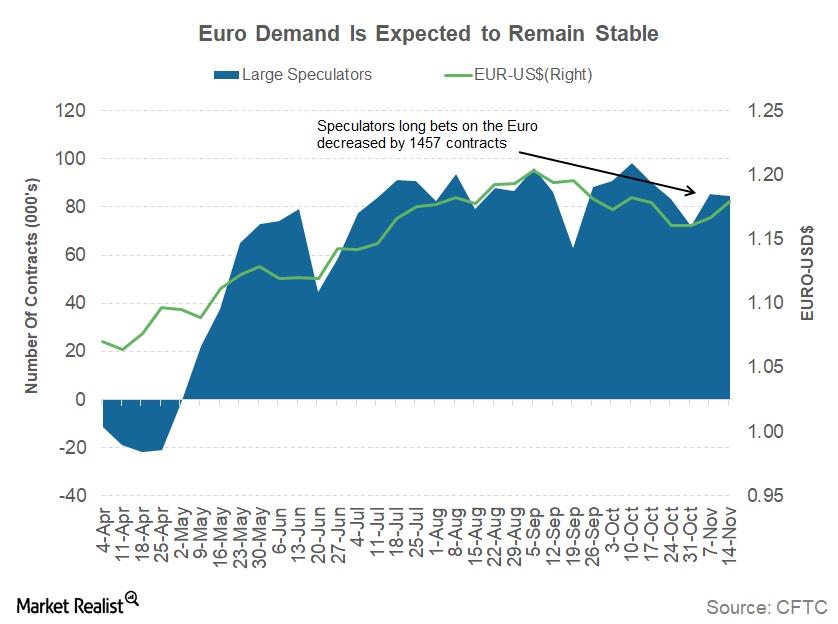

Why the Euro Is Likely to Remain Quiet this Week

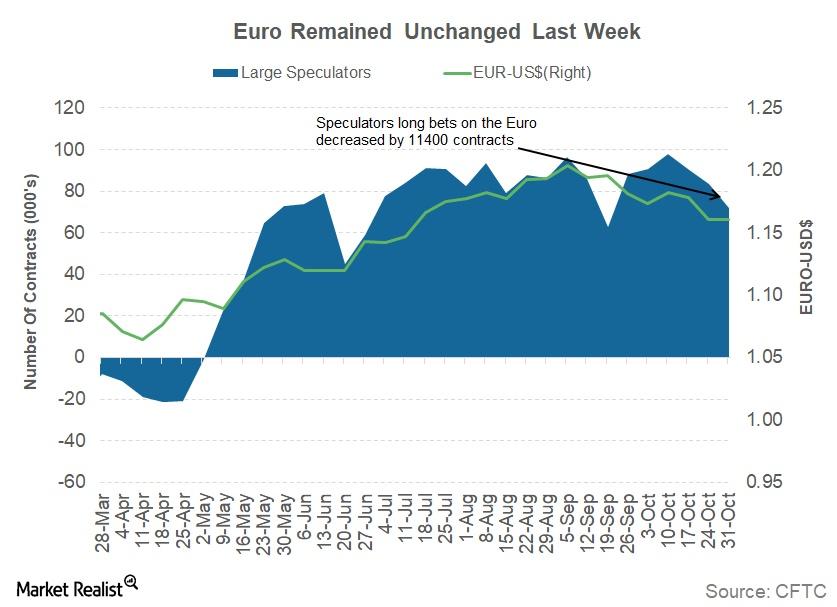

The euro-dollar pair (FXE) closed the week ending November 3 at 1.1609 against the US dollar (UUP). Worries about a possible escalation of tensions in Spain’s Catalonia region proved futile.

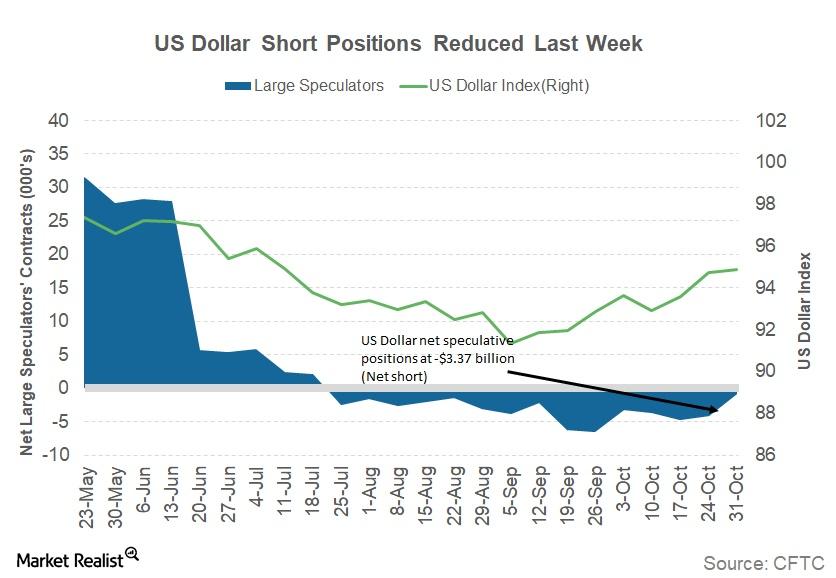

US Dollar Survived Dovish FOMC Statement, Lackluster Jobs Report

The US dollar index (UUP) remained supported last week despite a dovish FOMC statement and a lower-than-expected rise in monthly non-farm payrolls.

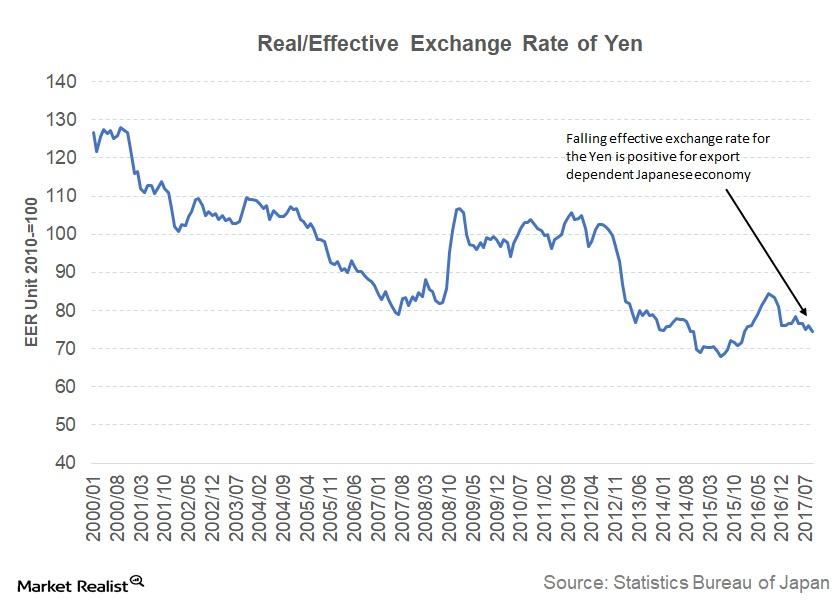

Japanese Yen Is Expected to Depreciate More

Since the Japanese election results, the Japanese yen has depreciated. The Bank of Japan is expected to continue the accommodative policy.

Eurozone Inflation Is Improving: Why Is ECB Still Dovish?

On a year-over-year basis, the Eurozone Inflation (VGK) (IEV) (EZU) Index stood at 1.5% in September 2017, the same as in August 2017.

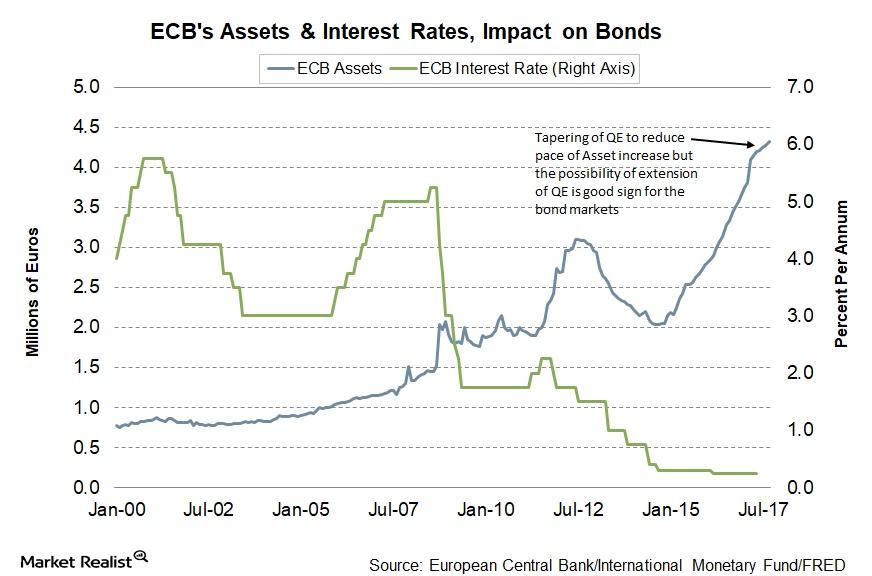

Analyzing the European Central Bank’s October Statement

The reduction to the ECB’s bond-buying program will likely have a mixed impact on the bond markets of countries in the European Union.

Why the ECB Isn’t Worried about the Appreciating Euro

In the ECB’s (European Central Bank) October policy meeting, the ECB didn’t explicitly talk about the appreciating euro.

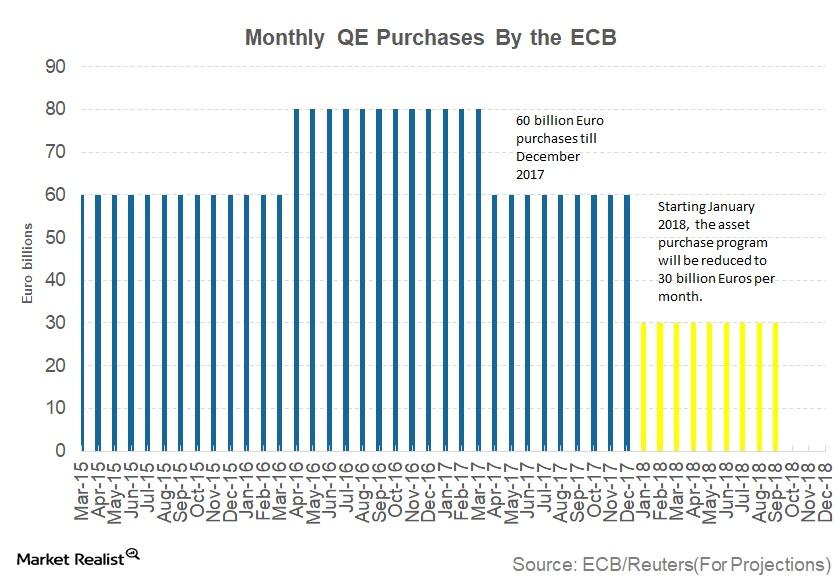

Update from the European Central Bank’s October Policy Statement

In the ECB’s (European Central Bank) October policy meeting, its laid out its plans for the QE (quantitative easing) program.

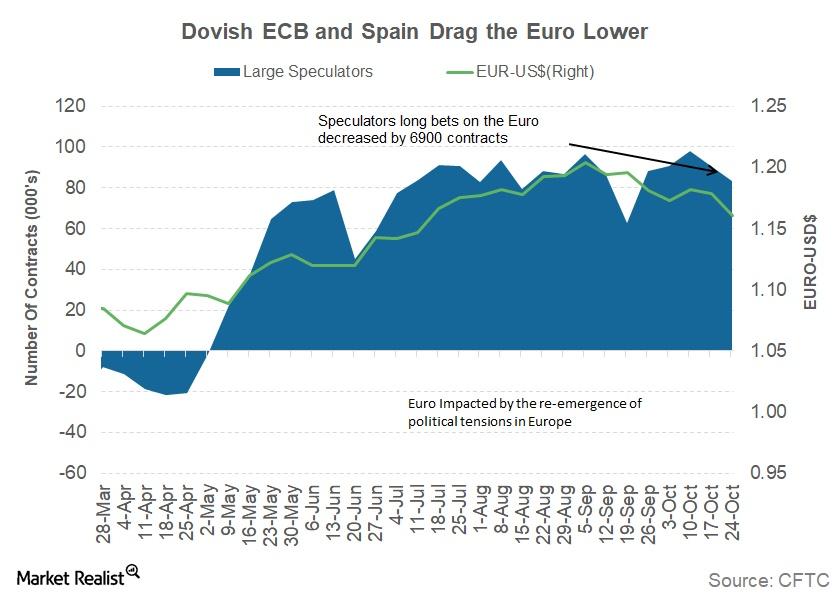

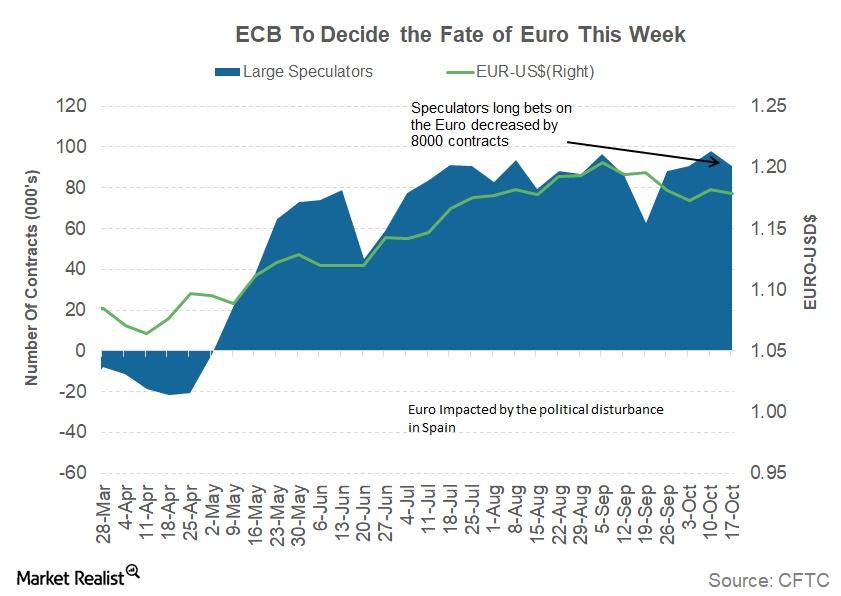

How Political Drama and ECB’s Dovish Statement Affected the Euro

The euro-dollar (FXE) pair closed the week ending October 27 at 1.16 against the US dollar (UUP).

How the US Dollar Could React to November FOMC Meeting

The US Dollar Index (UUP) continued its ascent last week.

Why the Euro’s Troubles Could Continue This Week

The euro-dollar (FXE) closed the week ending October 20 at 1.179 against the US dollar (UUP).

What to Expect from the US Dollar This Week

The US Dollar Index (UUP) has bounced back from the shallow low that it saw the previous week.

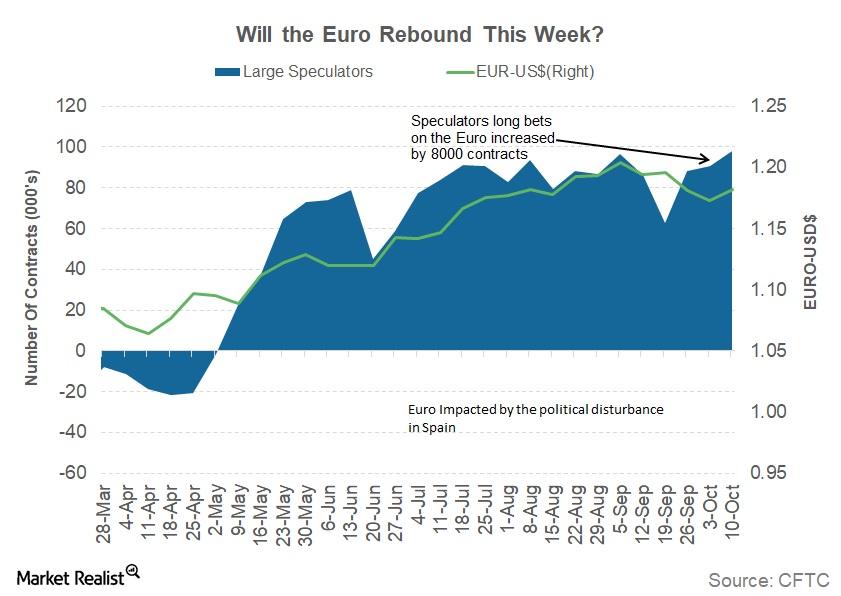

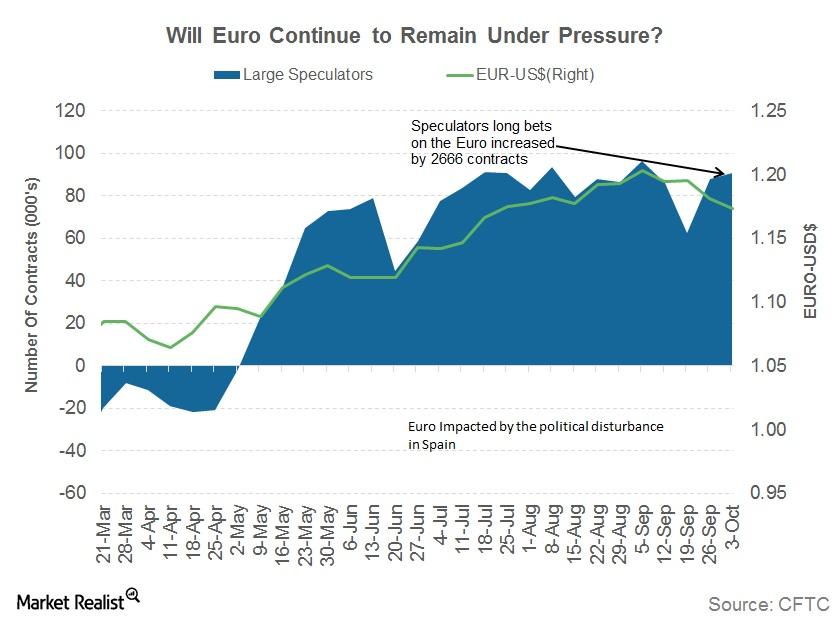

Will the Euro Regain Its Momentum this Week?

The euro-dollar (FXE) pair closed the week ending October 13 at 1.1822 against the US dollar (UUP). The shared currency managed to rebound from an 11-week low the week before, affected by political turmoil in Spain.

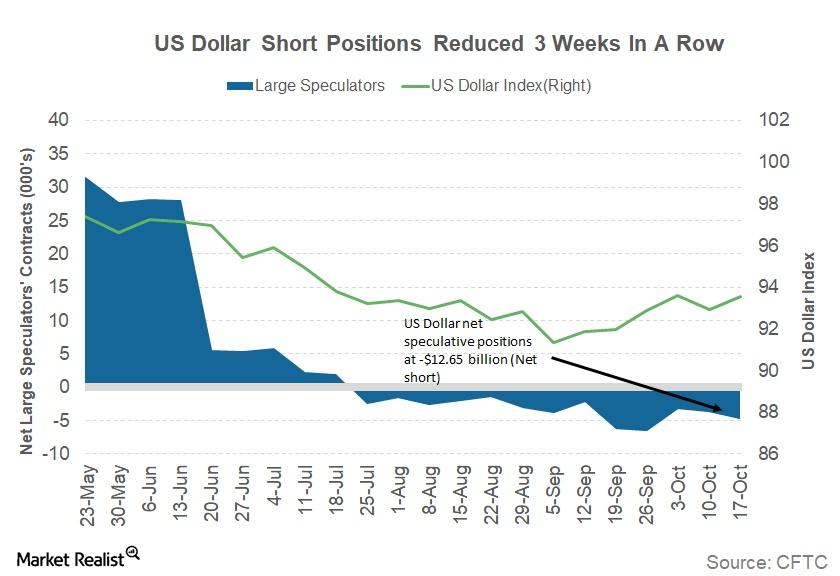

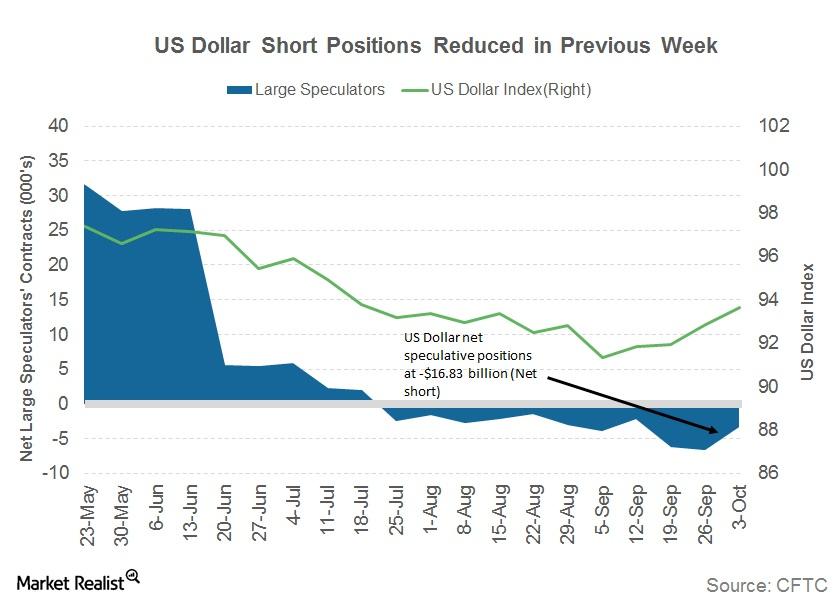

Has the US Dollar Rally Ended for Now?

The US Dollar Index (UUP) turned lower again in last week after a surprise rally following the October jobs report on October 6.

A Look at the Catalonia-Troubled Euro This Week

It’s possible that political pressures could keep the euro under pressure as the economic calendar remains light in the Eurozone.

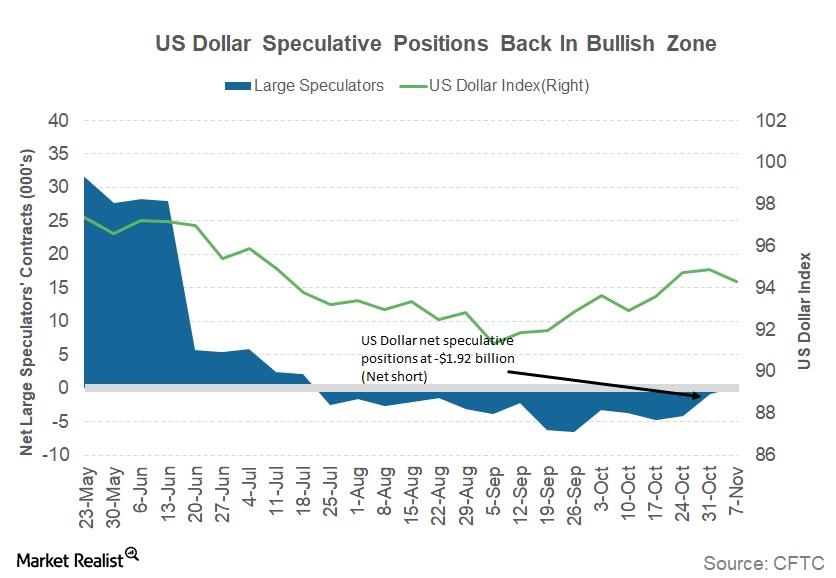

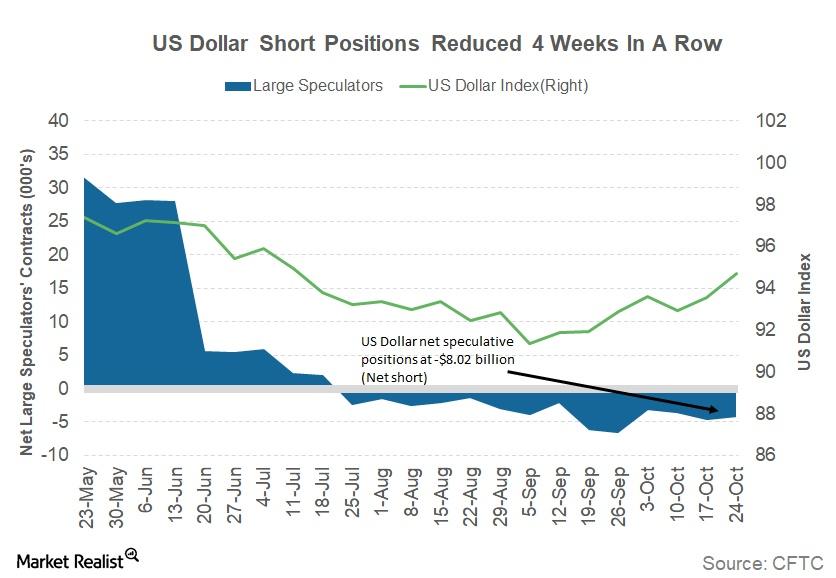

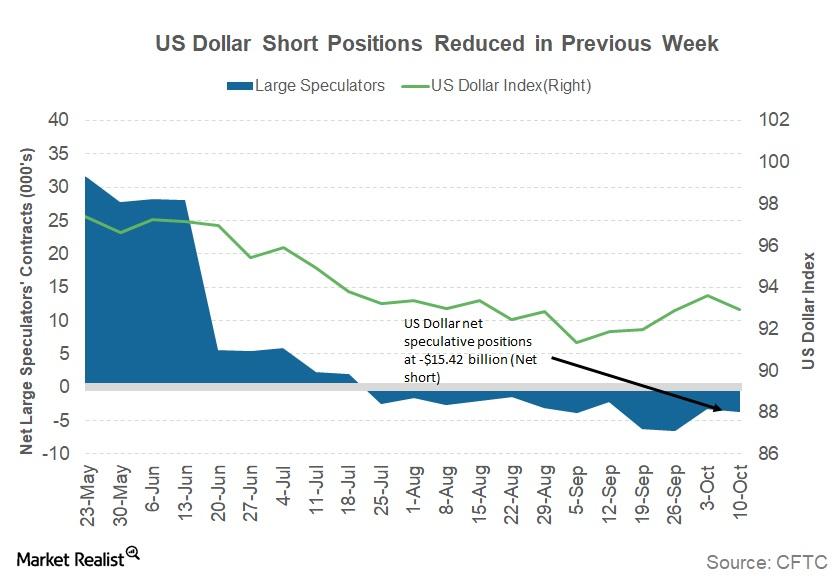

Are Investors Positioning for a US Dollar Rally?

The US Dollar Index (UUP) closed at 93.64 last week, a gain of 0.82% and the fourth consecutive weekly rise. The dollar didn’t react to a loss of 33,000 jobs in September.

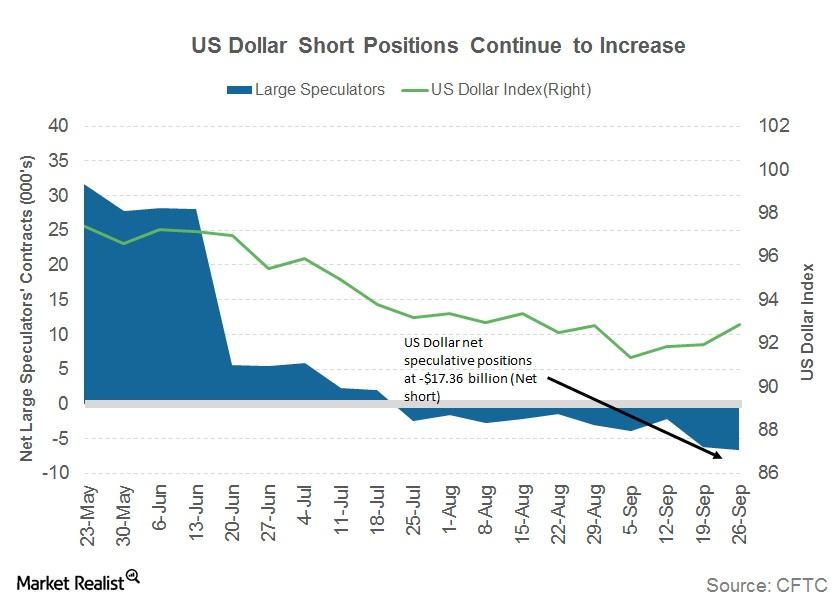

Why Speculators Continue to Bet against the US Dollar

The US Dollar Index (UUP) continued its rally last week, closing at 92.88 and posting a gain of 0.99% for the week.

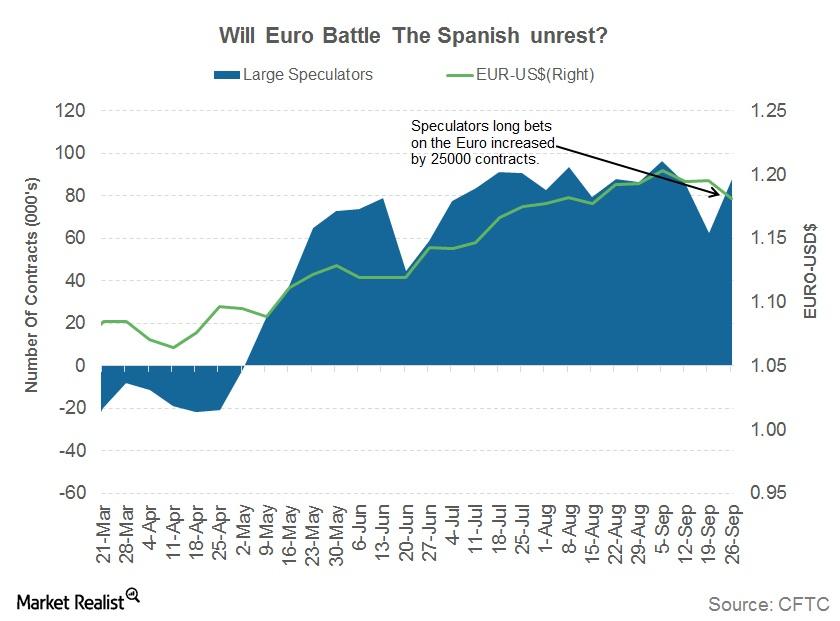

Will Spanish Unrest Drag the Euro Lower?

The euro-dollar (FXE) closed the week ending September 29 at 1.1814 against the US dollar (UUP). German election results had a minor negative impact on the shared currency.