Domino's Pizza Inc

Latest Domino's Pizza Inc News and Updates

Domino’s Didn’t Take Off in Italy, Franchiser Closes Restaurants

Domino's, which had opened around 33 restaurants in Italy, has closed all of its locations. The franchise owner discovered that Italians prefer local pizza.

Domino’s to Use Nuro Robot Vehicles for Pizza Delivery in Houston

Nuro announced a partnership with Dominos. The company will use Nuro's R2 robot vehicles to deliver pizzas in Houston.

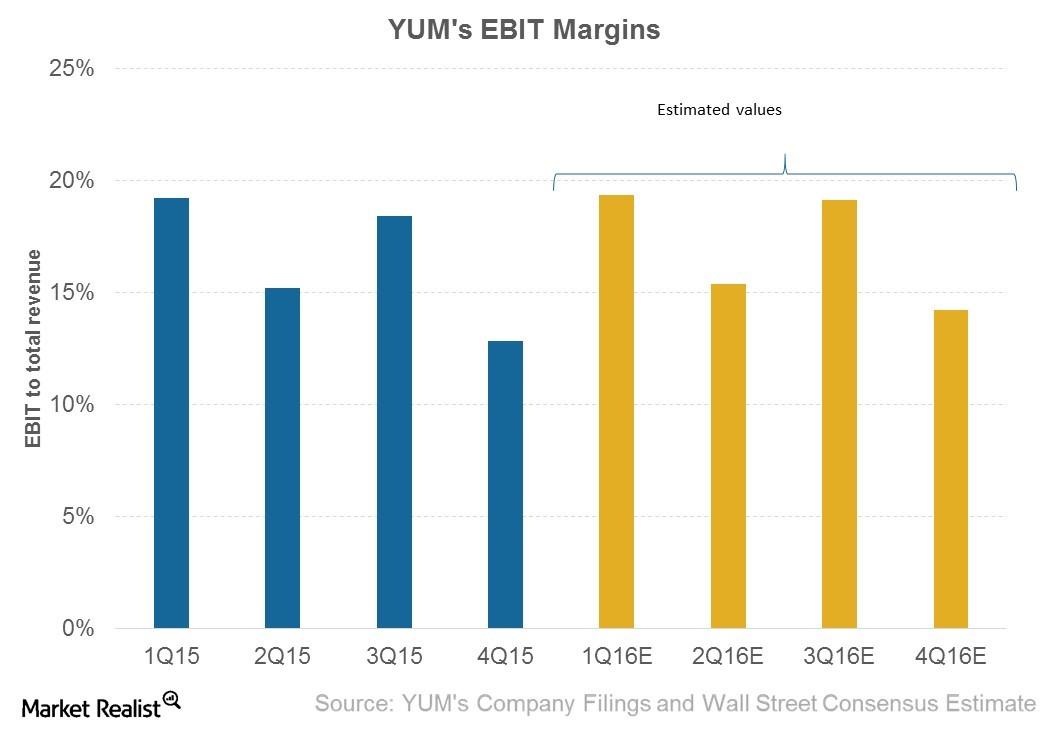

Could Yum! Brands’ Margins Increase in 1Q16?

With positive same-store sales growth expected in all three of YUM’s divisions, analysts are expecting the leverage to improve the company’s margins.

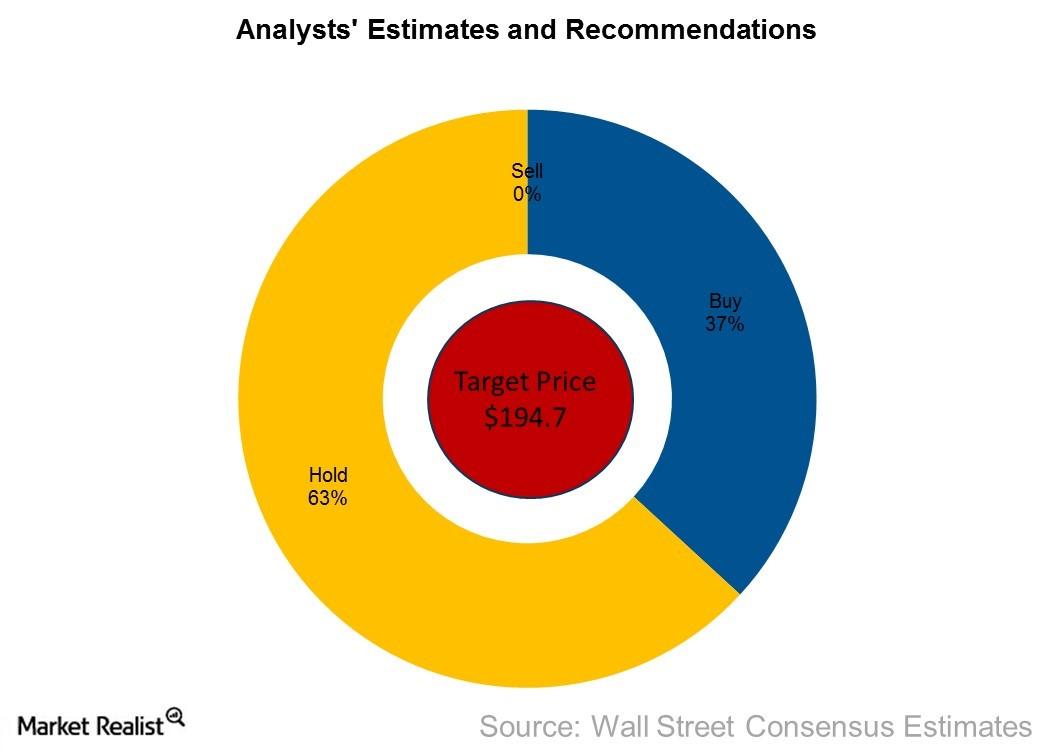

Why Analysts Say ‘Hold’ for Domino’s Stock ahead of Q1 Earnings

As of April 21, 2017, Domino’s Pizza (DPZ) was trading at $179.3. Domino’s stock price might have factored in the estimates we discussed in our previous articles.

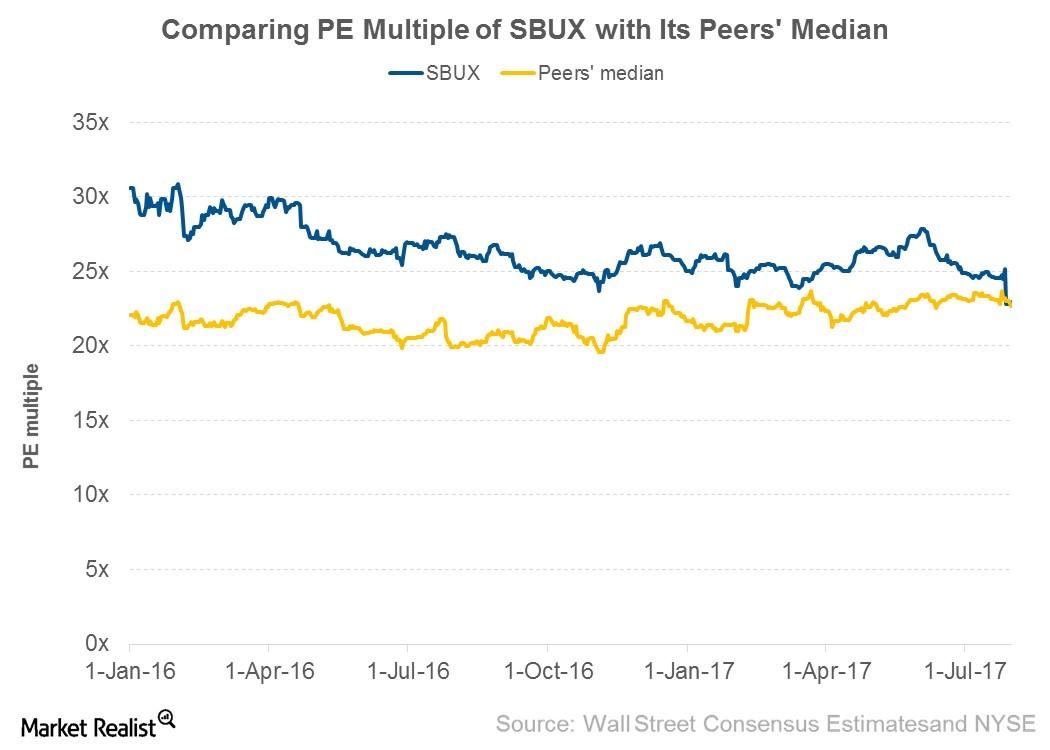

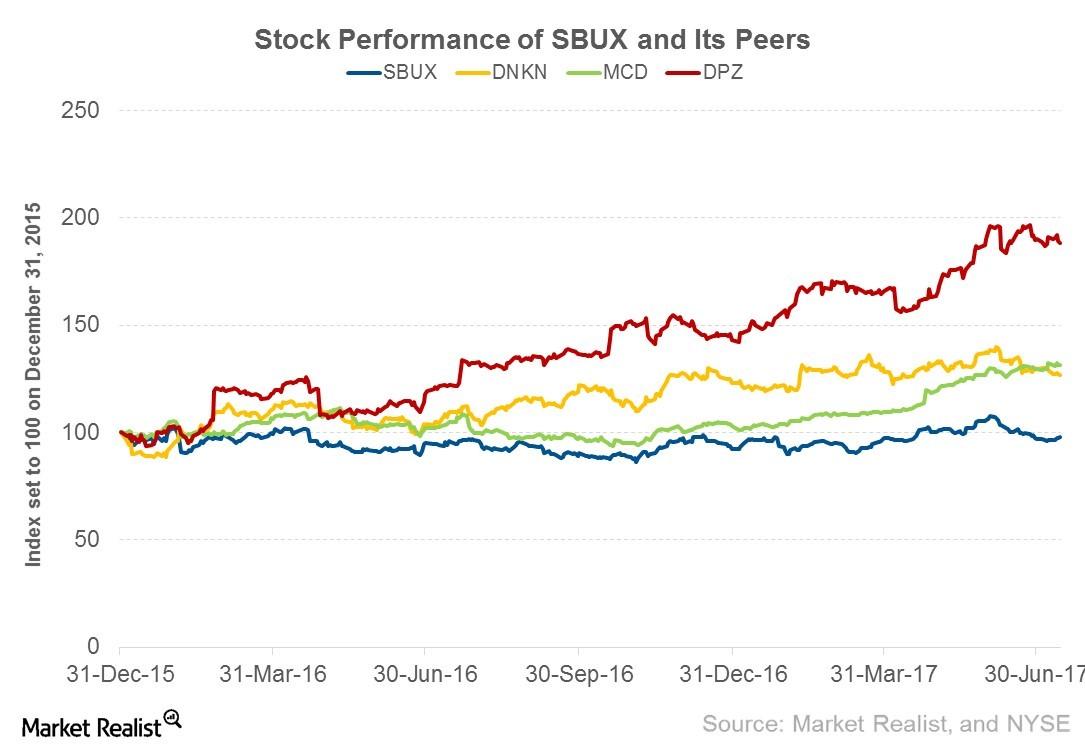

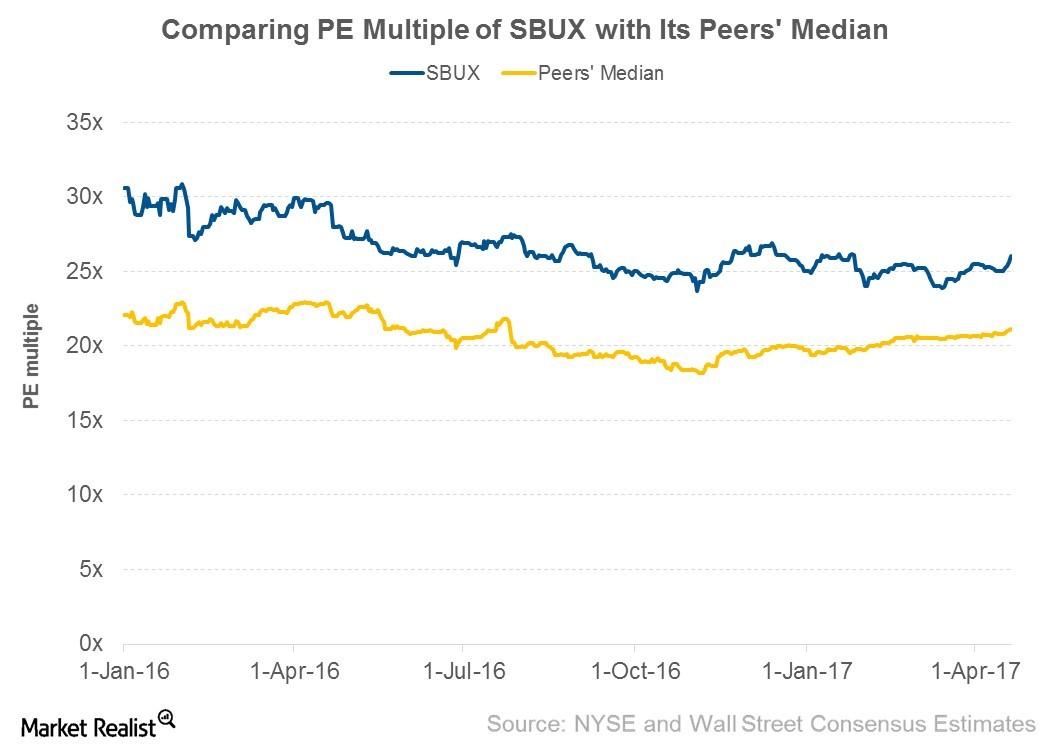

Weak Fiscal 3Q17 Sales Lower Starbucks’s Valuation Multiple

Valuation multiple We’ve used the forward PE (price-to-earnings) multiple for our analysis, due to its high visibility in Starbucks’s (SBUX) earnings. The forward PE multiple is calculated by dividing a company’s stock price by analysts’ earnings estimates for the next four quarters. Starbucks’s forward PE multiple Starbucks’ lower-than-expected SSSG (same-store sales growth) in fiscal 3Q17, lowering of […]

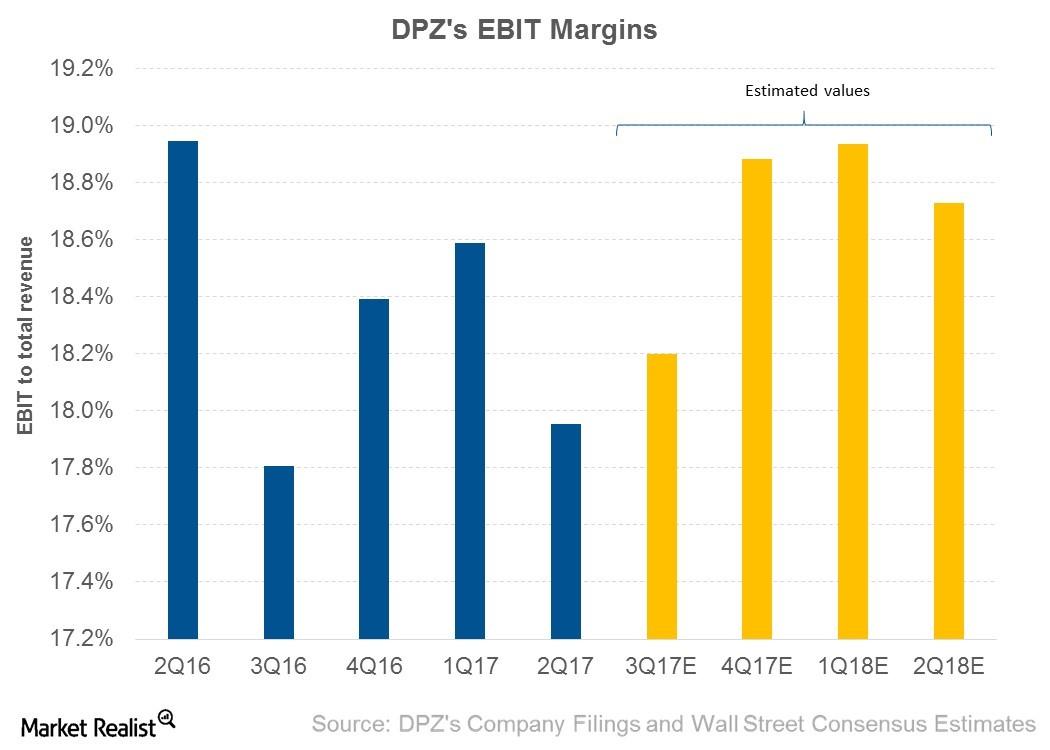

Why Did Domino’s EBIT Margin Decline in 2Q17?

For 2Q17, Domino’s (DPZ) posted EBIT (earnings before interest and tax) of $113.27 million, which represents an EBIT margin of 18.0%, compared with 18.9% in 2Q16.

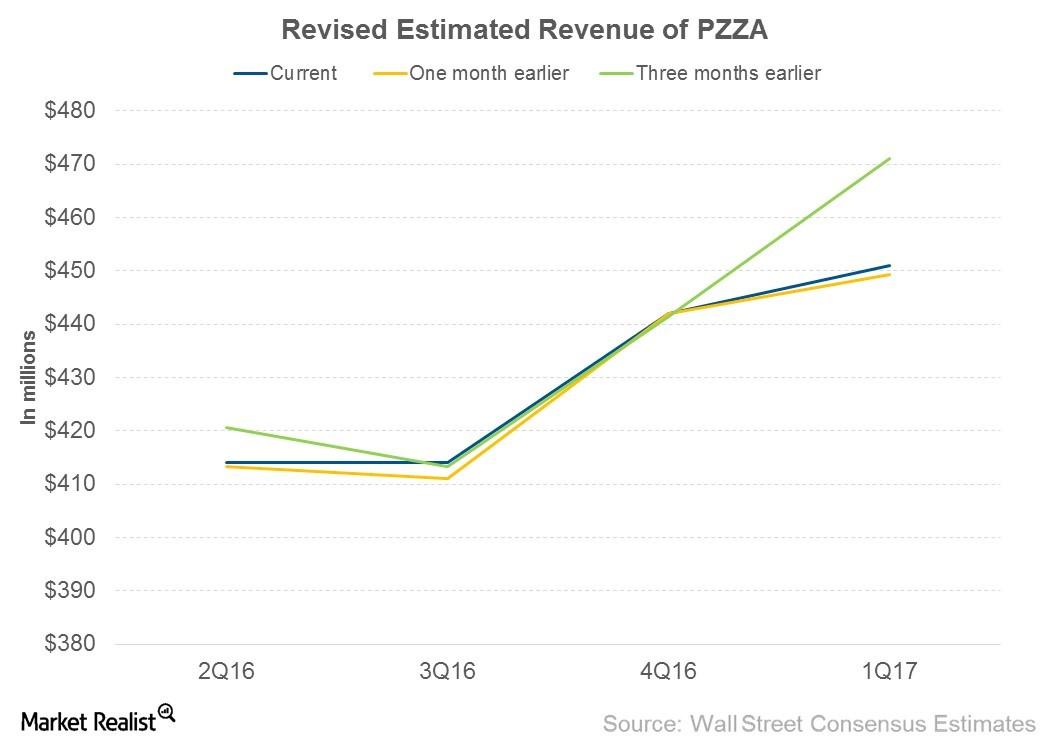

Why Have Analysts Raised their Revenue Estimates for Papa John’s?

In 1Q16, PZZA’s domestic company-owned restaurants generated nearly 48% of Papa John’s revenue, while domestic commissaries and others generated 39.4%.

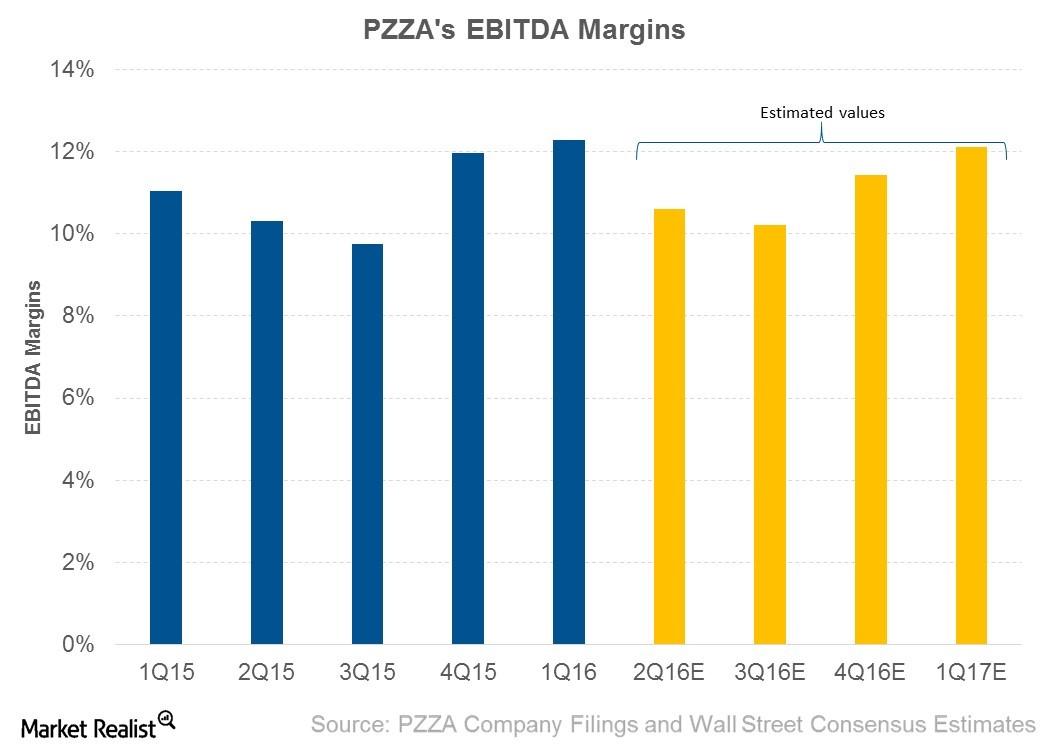

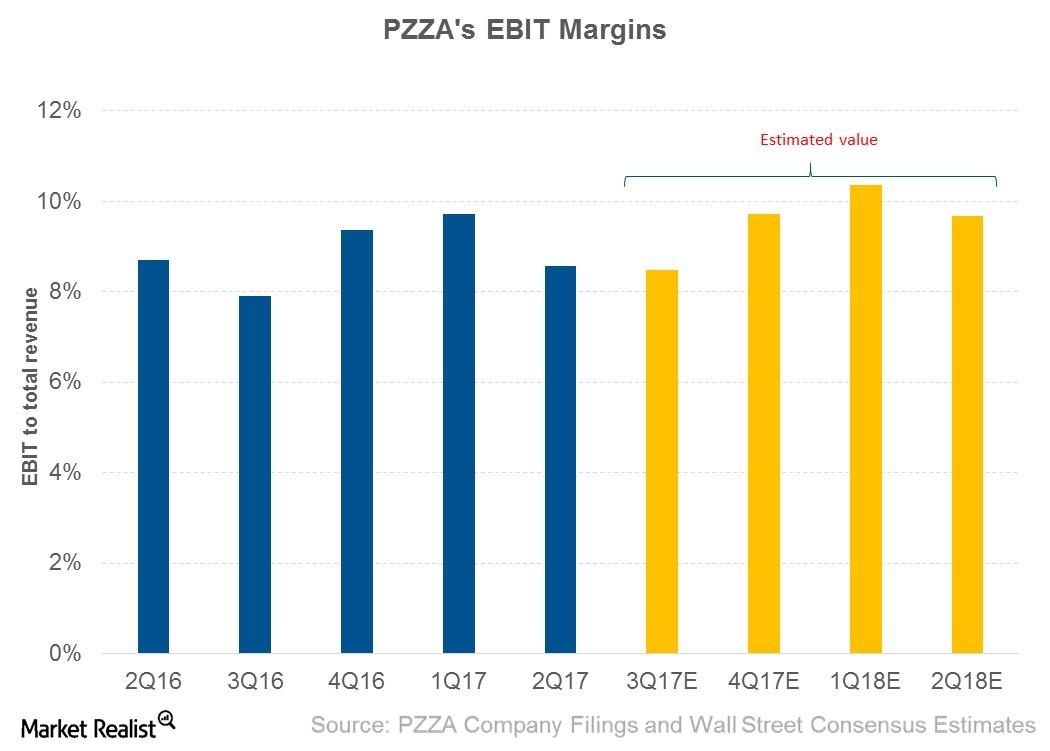

Why Are Analysts Expecting Papa John’s EBITDA Margins to Expand in 2Q16?

Analysts expect Papa John’s (PZZA) to post EBITDA of $43.9 million in 2Q16. This represents an EBITDA margin of 10.6%, compared to 10.3% in 2Q15.

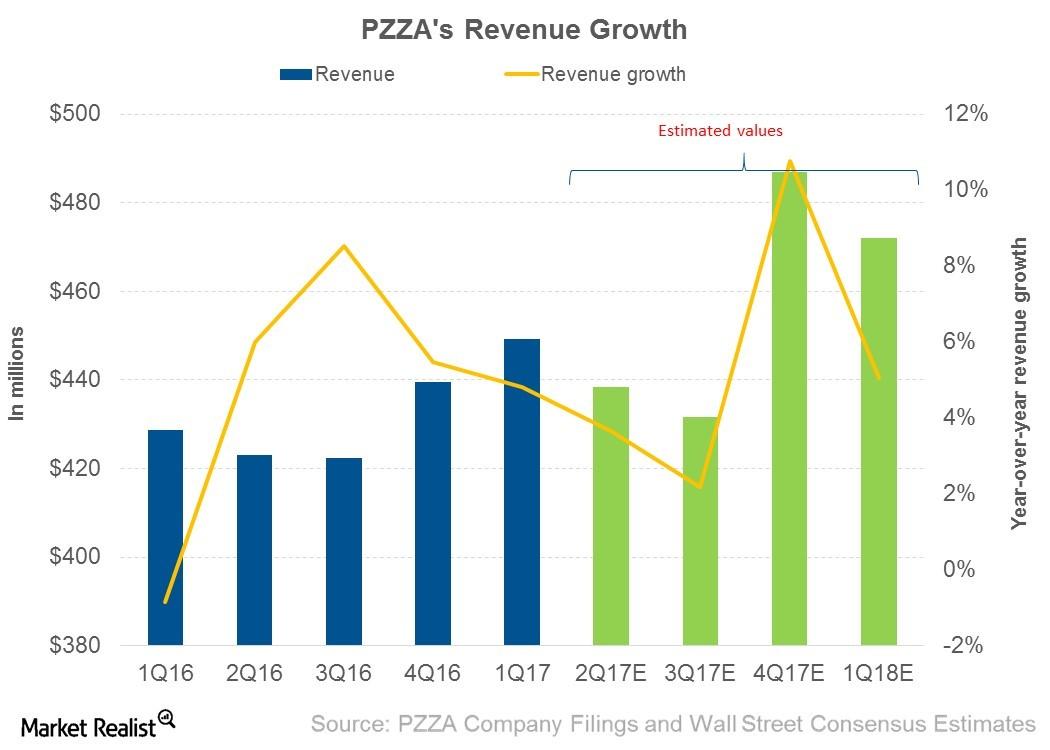

Papa John’s Revenue Estimates for the Next 4 Quarters

For the next four quarters, analysts expect Papa John’s (PZZA) to post revenue of $1.83 billion, which represents growth of 5.5%.

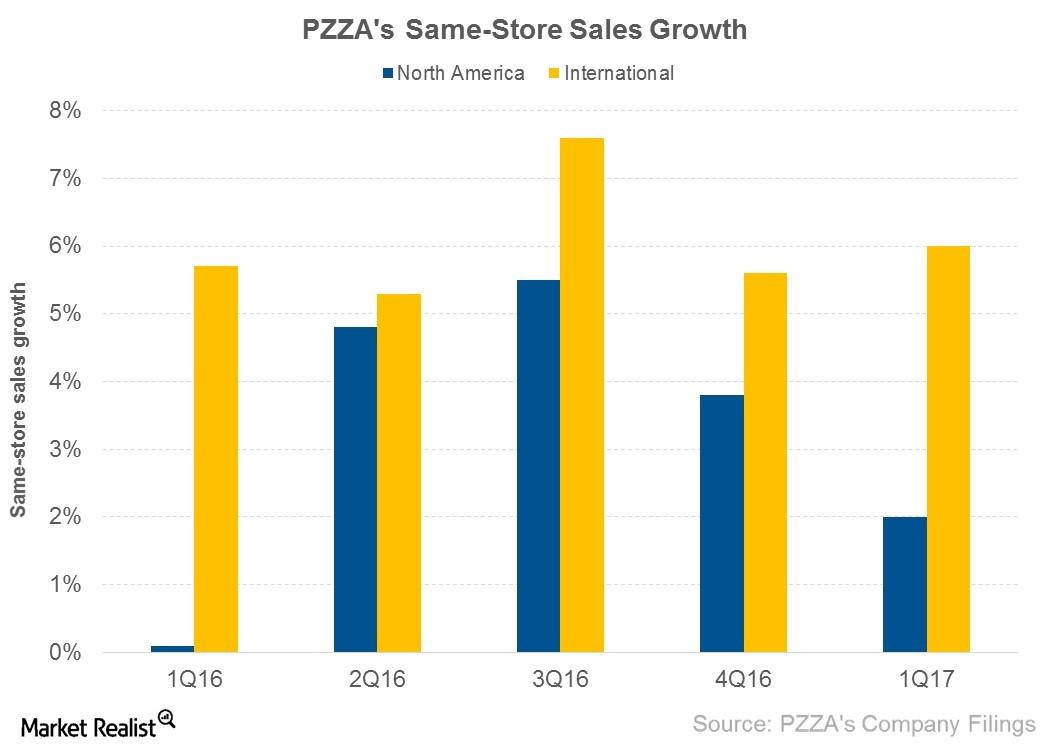

Factors That Drove Papa John’s Same-Store Sales Growth in 1Q17

In 1Q17, Papa John’s (PZZA) restaurants in North America posted SSSG of 2%. Company-owned restaurants posted SSSG of 3%, and franchised restaurants posted SSSG of 1.7%.

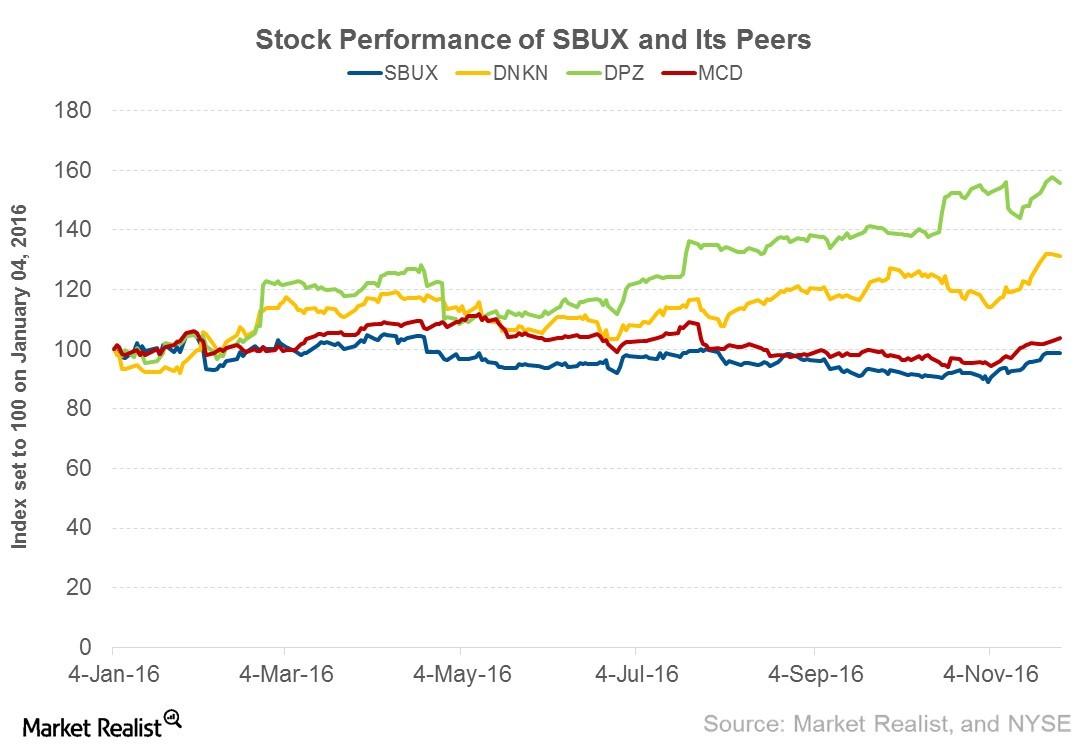

Why Analysts Are Recommending “Buy” for Starbucks

Target price On January 13, 2017, Starbucks (SBUX) was trading at $57.85. The company’s share price may already have been factored into the estimates we’ve discussed in this series. In this article, we’ll look at analysts’ recommendations and estimated target prices for the stock over the next 12 months. Despite Starbucks posting strong 4Q16 earnings […]

Why Papa John’s Earnings Margin Narrowed in 2Q17

Performance in 2Q17 In 2Q17, Papa John’s International (PZZA) posted EBIT (earnings before interest and tax) of $37.2 million, which represents an EBIT margin of 8.6%. In comparison, the company posted an EBIT margin of 8.7% in 2Q16. Why Papa John’s margins narrowed Papa John’s EBIT margins were impacted by a rise in the cost of […]

Why Investors Are Confident in YUM ahead of Its 3Q16 Results

Yum! Brands develops, operates, franchises, and licenses the Pizza Hut, KFC, and Taco Bell brands. It’s set to announce its 3Q16 results on October 5, 2016.

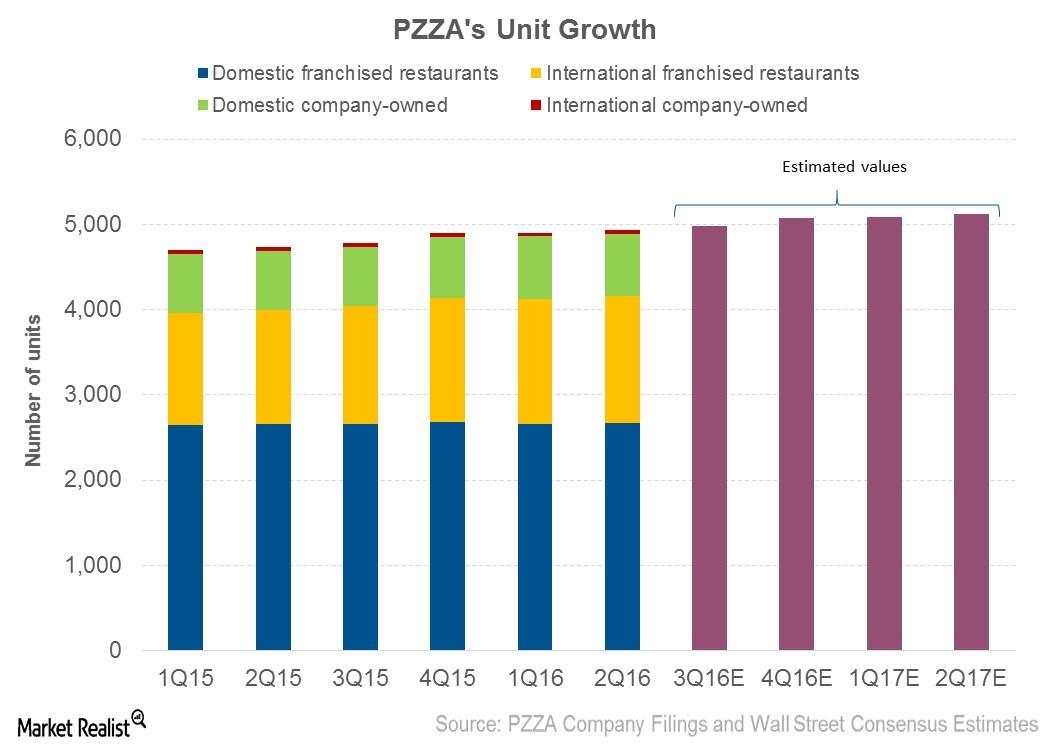

Franchising Dominates Papa John’s Expansion Plans

With 42 units added in the first two quarters of 2016, Papa John’s has maintained its 2016 guidance for unit growth at 180–200 units.

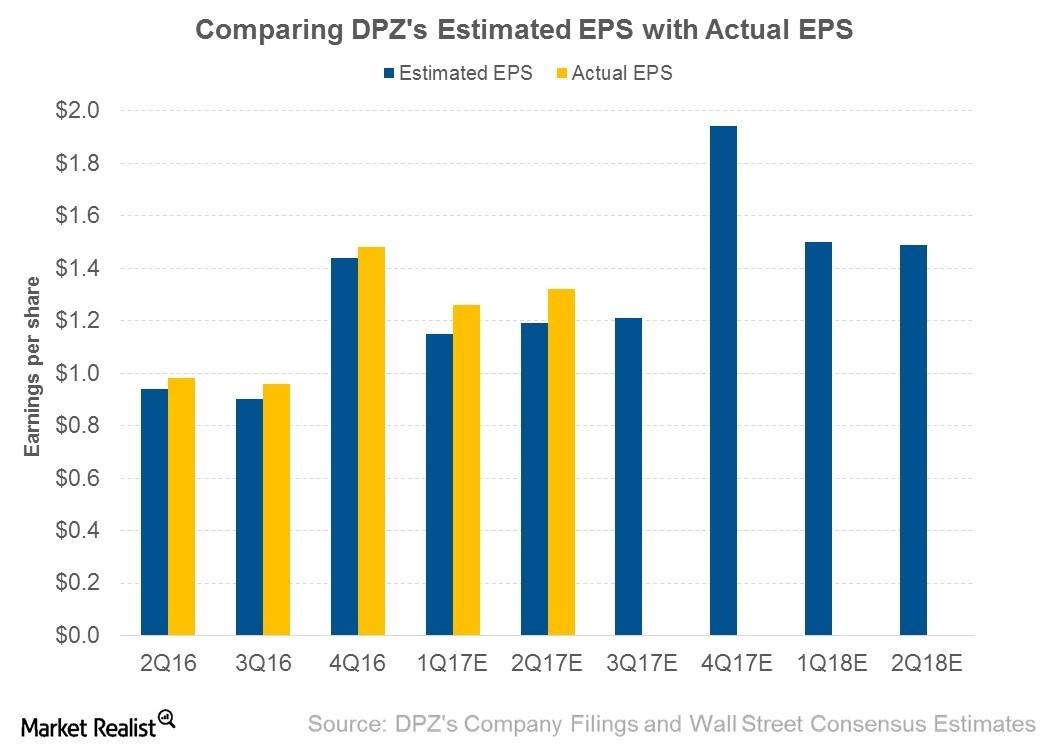

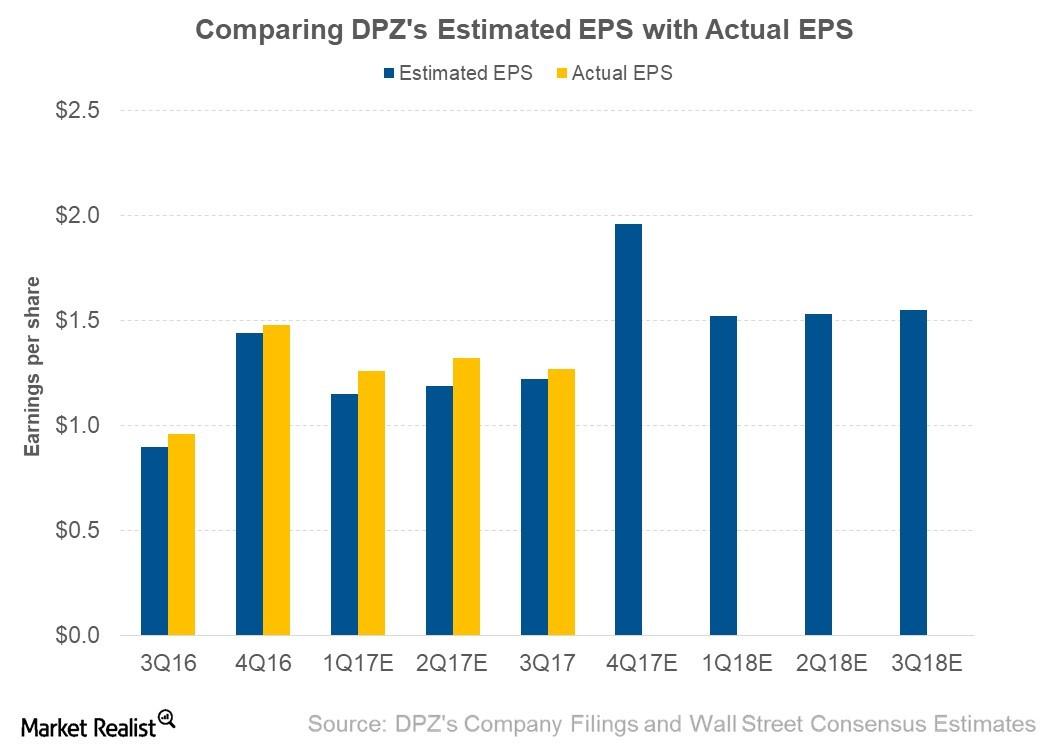

Could Domino’s Earnings Rise in the Next 4 Quarters?

Earnings expectations For the next four quarters, analysts expect Domino’s Pizza (DPZ) to post EPS (earnings per share) of $6.14, which represents a growth of 22.3% from the EPS of $5.02 seen in the four quarters prior. EPS growth Domino’s EPS growth is expected to be driven by higher revenue, EBIT (earnings before interest and tax) […]

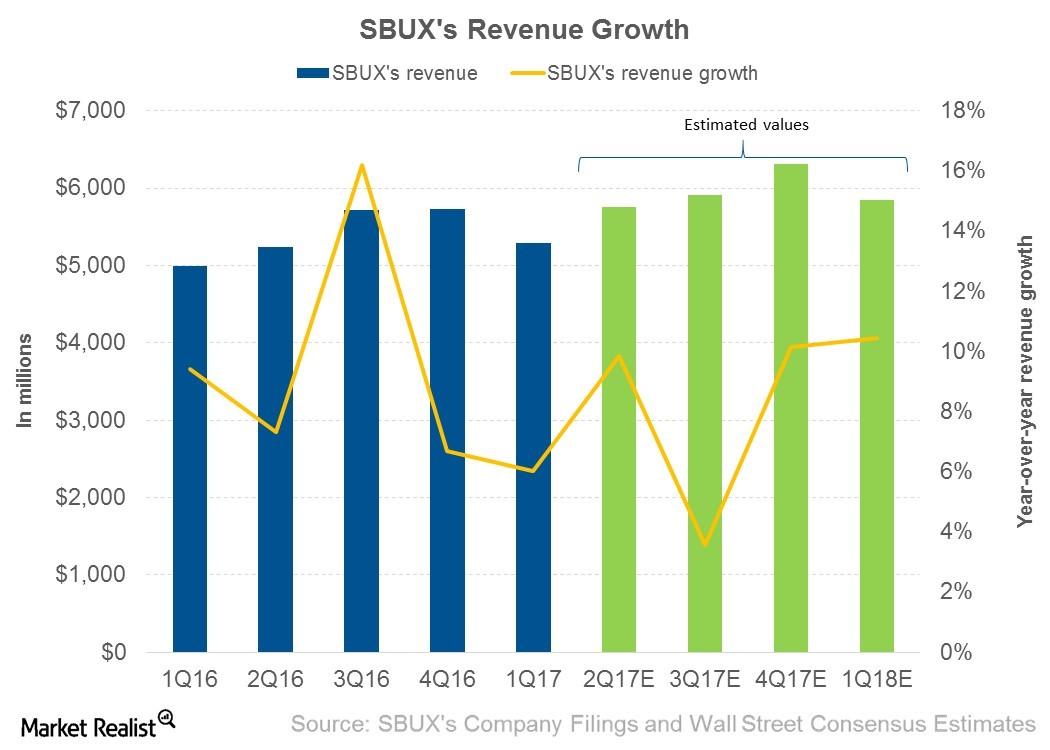

Why Investors Weren’t Impressed by Starbucks’s Fiscal 2Q17

Starbucks (SBUX) posted its fiscal 2Q17 earnings after the market closed on April 27, 2017. Its EPS was $0.45 on revenues of $5.3 billion.

What to Expect from Starbucks’s Revenue in Next 4 Quarters

In the next four quarters, analysts are expecting Starbucks (SBUX) to post revenue of $23.8 billion, which represents an increase of 8.4% from $22.0 billion in the corresponding quarters of the previous year.

This Likely Drove Domino’s 3Q17 EPS

For 3Q17, Domino’s Pizza (DPZ) posted adjusted EPS (earnings per share) of $1.27, which represents a 32.3% YoY (year-over-year) rise from $0.96 in 3Q16.

An In-Depth Overview of Panera Bread

Panera Bread is a limited-service fast-casual restaurant company. In July 2017, JAB acquired Panera in a $7.5 billion deal and took it private.

Domino’s Stock Jumps 21% Since Last Earnings Release

Year-to-date, Domino’s stock is up 8.7%, as of February 20. It has rocketed 21% since the company’s last earnings release in October 2014.

What’s Behind the Decline in Starbucks Stock Price

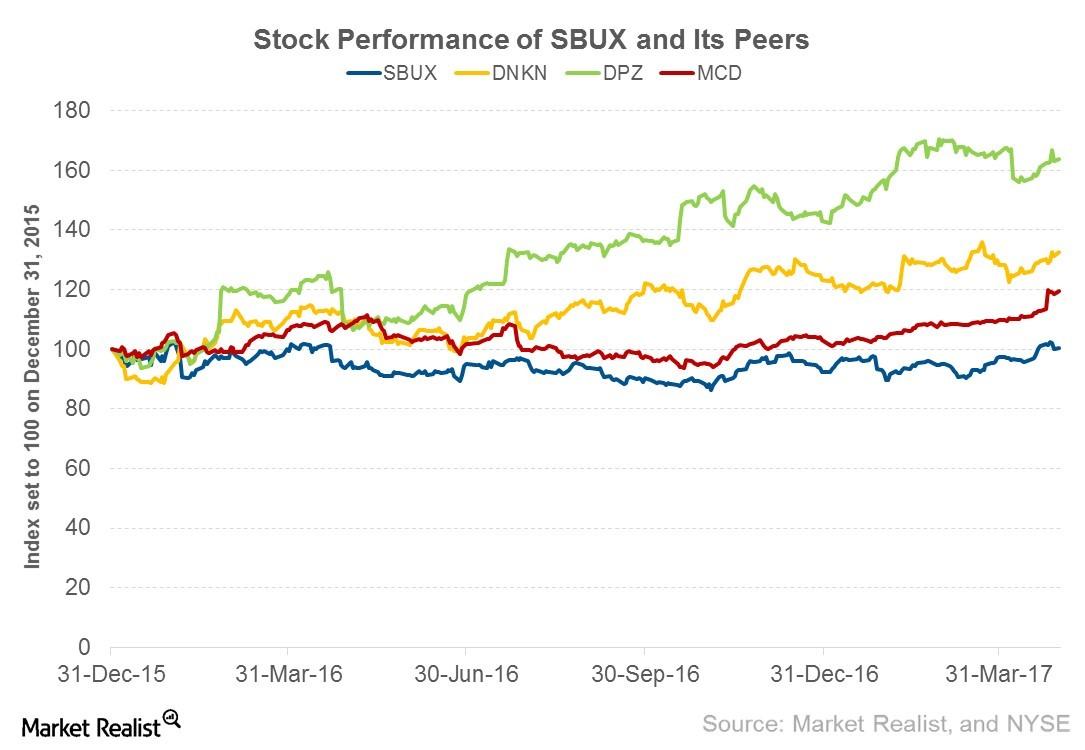

After posting its fiscal 2Q17 earnings on April 27, 2017, Starbucks (SBUX) stock rose 5.3% to reach $64.57 on June 2, 2017. The aggressive expansion plans in the CAP (China and Asia-Pacific) region and its implementation of technological advancements led Starbucks stock price to rise. However, since then, the stock has seen downward momentum.Consumer Why Yum! Brands’ division in India has been successful

Yum! Brands’ (YUM) division in India includes its businesses in India, Nepal, Bangladesh, and Sri Lanka. As of June 2014, the company had 714 restaurant units in India.Consumer Domino’s management guidance on food costs, capex, and more

Management anticipates the effective tax rate to be in the range of 37% to 38% for the “foreseeable future.” Corporate tax rates in the U.S. are high, and force some companies to move their headquarters to countries offering lower tax rates.

Will Starbucks’s Fiscal 3Q17 Earnings Boost Its Stock Price?

Starbucks (SBUX) is scheduled to announce its fiscal 3Q17 earnings after the market closes on July 27, 2017. Starbucks’ fiscal 3Q17 extends from April 3, 2017.

An Investor’s Guide to Chipotle and Its Customers

Chipotle Mexican Grill (CMG) operates more than 1,700 fast-casual restaurants. Here’s everything you need to know about the business.

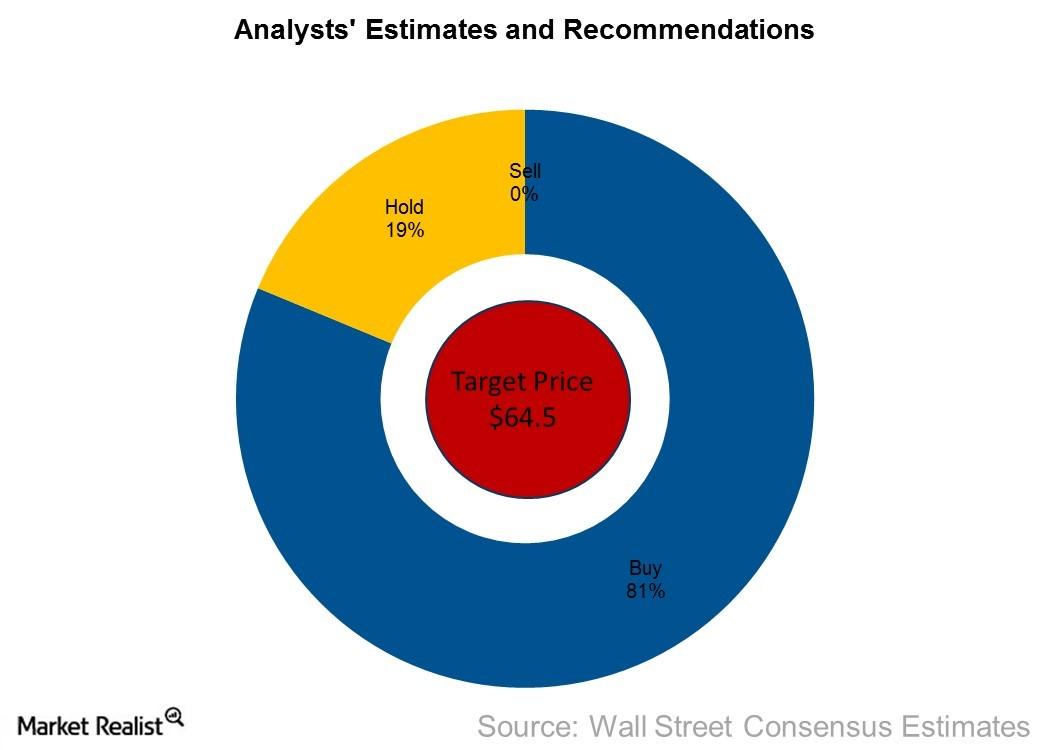

Wedbush Initiated Coverage on Papa John’s with a ‘Buy’ Rating

On Wednesday, Nick Setyan of Wedbush initiated his coverage on Papa John’s with a “buy” rating. He also gave a target price of $95.

Must-Know: McDonald’s Has Got Tough Competition

McDonald’s (MCD) competition includes large international and national food chains as well as regional and local retailers of food products.

How Much Upside Is Left in Starbucks’s Stock Price?

Starbucks’s (SBUX) share price has been soaring since it announced its fiscal 4Q16 results on November 3, 2016. Let’s explore why.

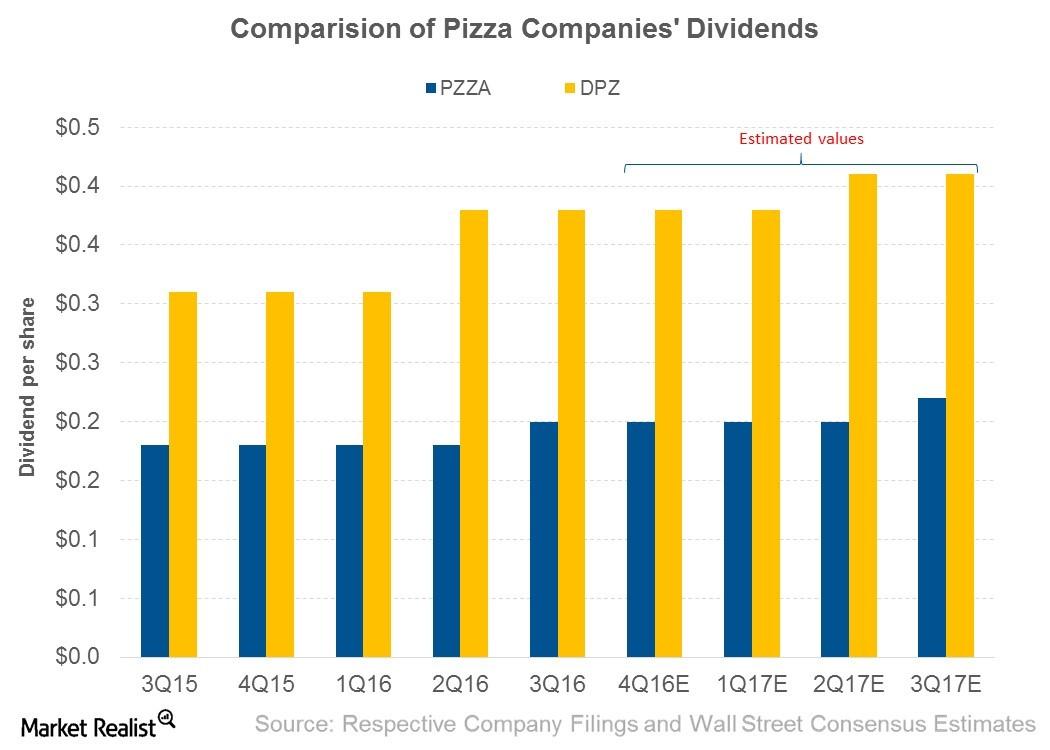

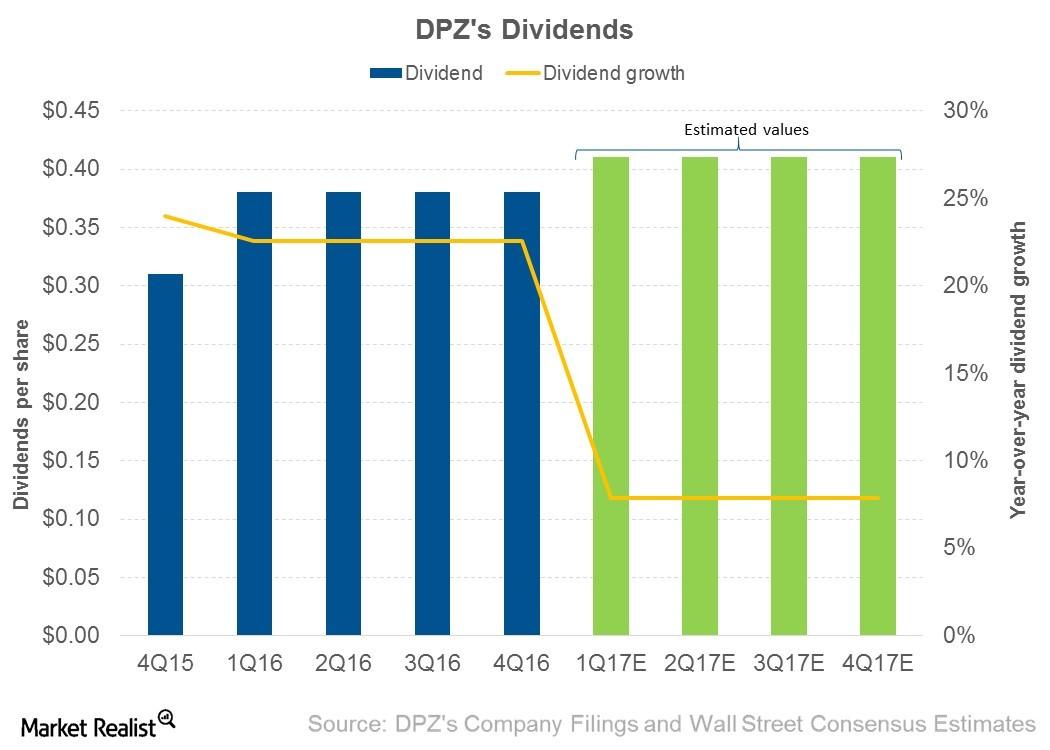

Comparing Domino’s and Papa John’s Dividend Policies

Importance of dividends Dividends help smooth out return volatility for shareholders. Both Domino’s Pizza (DPZ) and Papa John’s (PZZA) have a strong history of returning cash to shareholders. . 3Q16 dividends In 3Q16, Domino’s Pizza paid dividends of $0.38, which represents a growth of 22.6% from $0.31 in fiscal 3Q15. For the next four quarters, […]

Investors Should Consider Domino’s Pizza before Its Q2 Earnings

Domino’s Pizza (NYSE:DPZ) will likely report its second-quarter earnings on July 16. Should you buy the stock before its earnings?

Domino’s Pizza Stock Rises following Positive Business Update

Domino’s Pizza announced that in the first two months of the second quarter, its US SSSG grew by 14.0%, while its international SSSG rose by 1.0%.

Domino’s Pizza’s Q1 Results Might Drive Its Stock Price

The COVID-19 outbreak has created a meltdown in the global financial markets. However, Domino’s Pizza (NYSE:DPZ) has continued its impressive performance.

Is Domino’s Pizza a Safe Bet amid the Lockdown?

President Trump extended the lockdown to April 30 amid the COVID-19 pandemic. Will Domino’s Pizza (NYSE:DPZ) benefit from the extension?

Domino’s Pizza Withdraws Its Guidance, Stock Falls

Domino’s Pizza (NYSE:DPZ) stock fell in the pre-market session on March 31. The restaurant chain pulled its guidance due to the coronavirus outbreak.

Domino’s Pizza Stock Rose Due to Earnings Beat

Today, Domino’s Pizza reported its fourth-quarter earnings. The company reported revenues of $1.15 billion, which beat analysts’ estimates of $1.13 billion.Consumer Why Domino’s stockholders’ deficit may be manageable

Domino’s stockholders’ deficit is a result of the company’s recapitalization efforts in 2007 and 2012. This deficit is funded with debt, which can burden a company with interest payments, resulting in a margin squeeze or a loss.

Domino’s Stock Bounced Back despite Weak Q3

Domino’s reported a disappointing third-quarter financial performance on Tuesday. Domino’s stock pared the initial losses and closed about 5% higher.

Domino’s Stock Falls on Weak Q2 Sales

Lower-than-expected Q2 sales caused Domino’s stock to fall approximately 7.0% in today’s pre-market trading.

Domino’s Stock Rises after J.P. Morgan’s Upgrade

Today, J.P. Morgan upgraded Domino’s Pizza (DPZ) from “neutral” to “overweight” while keeping its 12-month price target at $270.

Will 2018 Be a Good Year for Pizza Companies?

All major pizza companies have announced their 4Q17 earnings, so it’s time to compare their performance.

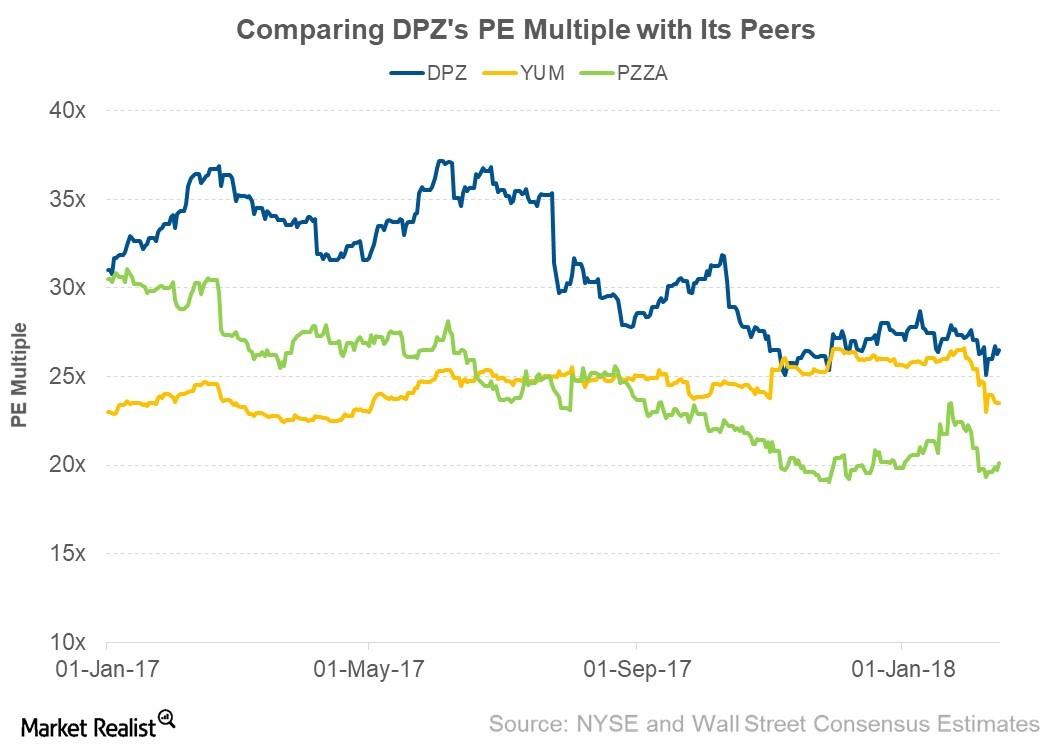

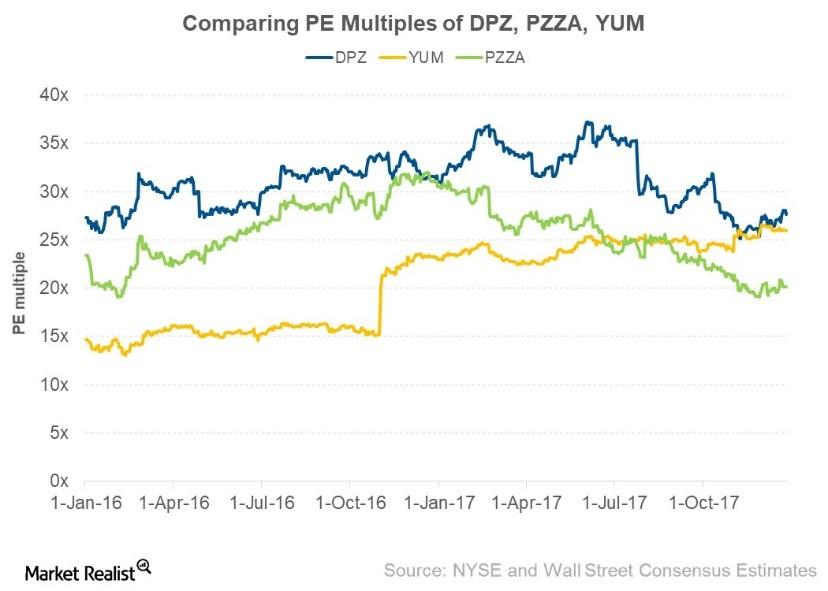

Domino’s Valuation Multiple Compared to Its Peers

As of February 14, 2018, Domino’s was trading at a forward PE multiple of 26.5x compared to 31.8% before the announcement of its 3Q17 earnings.

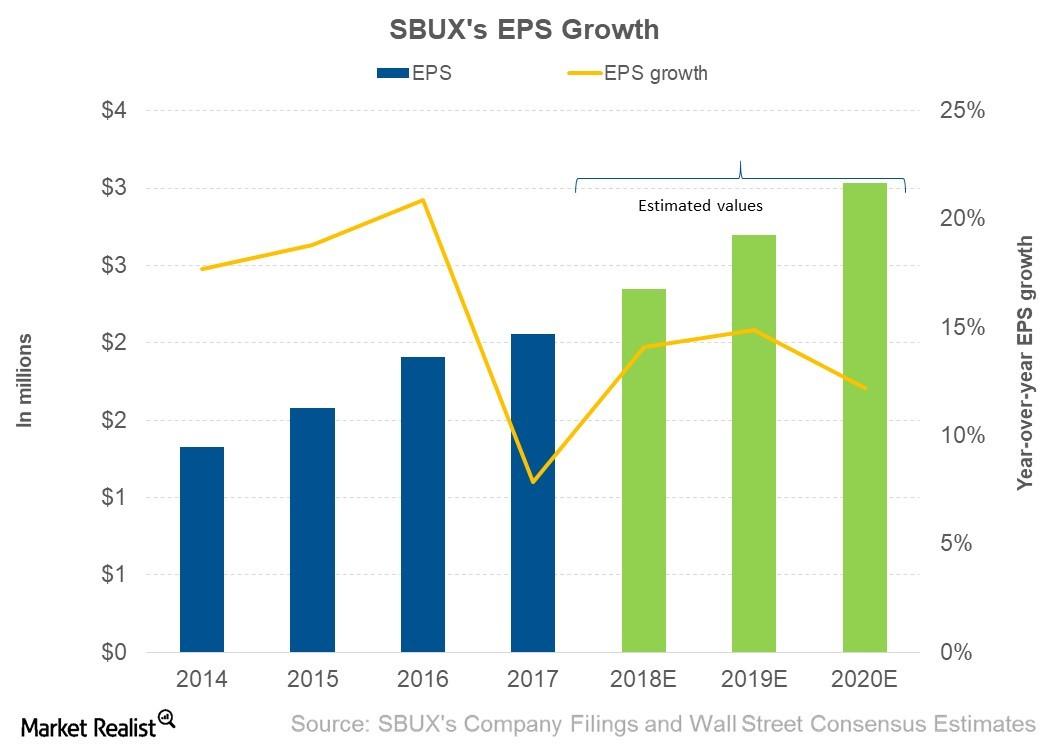

What Drove Starbucks’s Earnings per Share in Fiscal 2017?

In fiscal 2017, Starbucks (SBUX) posted adjusted EPS (earnings per share) of $2.06, which represents growth of 7.9% from its $1.91 in fiscal 2016.

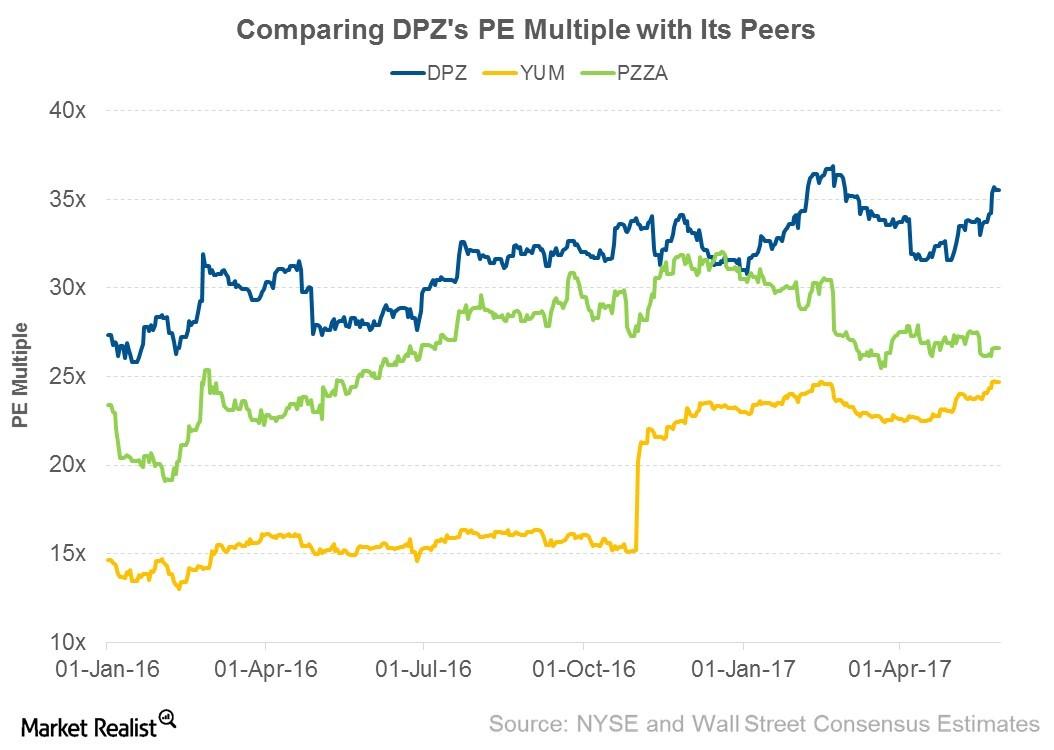

How Do Pizza Companies’ Valuation Multiples Compare?

Due to the high visibility of their earnings, we’ve opted to use the forward PE (price-to-earnings) multiple for our valuation analysis of the pizza companies in this series.

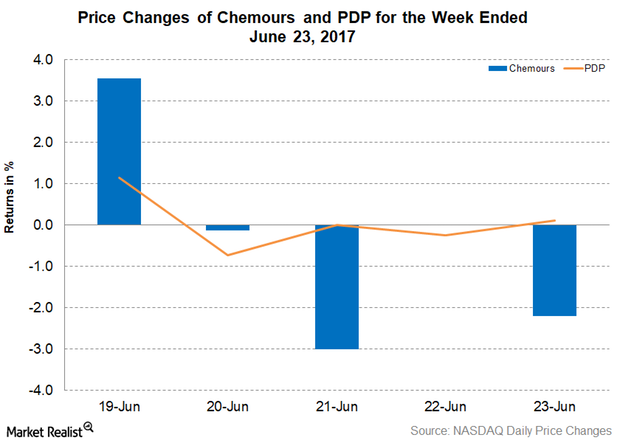

Chemours to Take New Measures to Eliminate Waste in Fayetteville

Chemours stock fell 1.9% for the week and closed at $36.0. CC stock has been in a downward trend since May.

How Domino’s Pizza’s Valuation Multiple Compares to Its Peers

Domino’s better-than-expected SSSG and earnings in 1Q17 appear to have increased investor confidence, leading to rises in DPZ stock and its PE multiple.

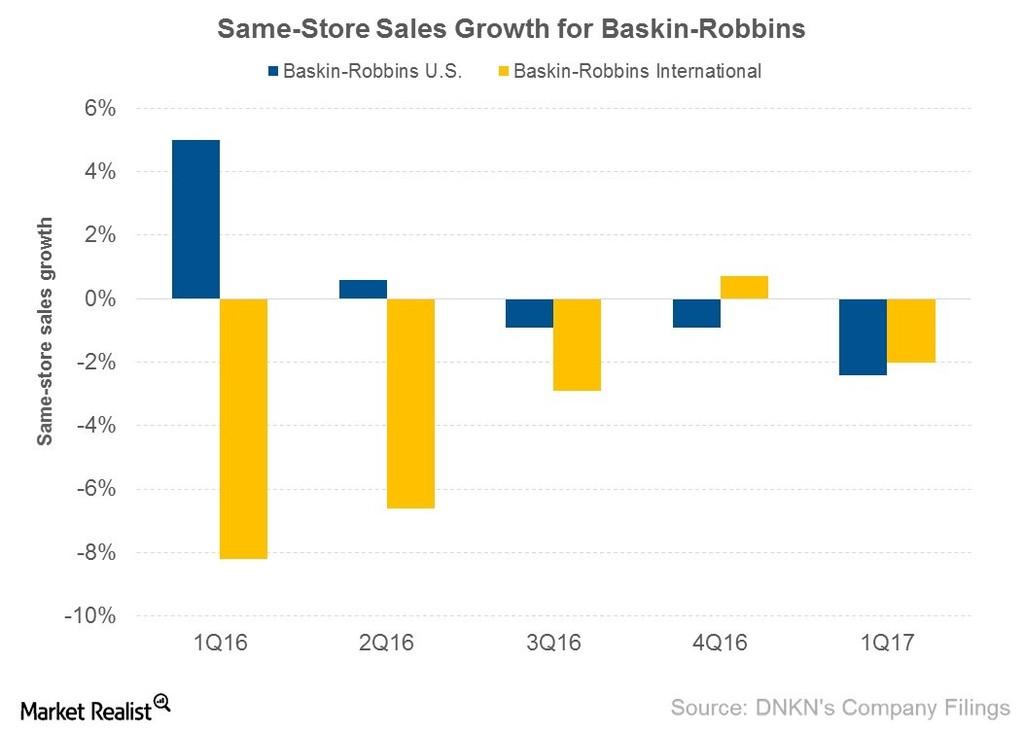

Why Baskin-Robbins Had Negative Same-Store Sales Growth in 1Q17

In 1Q17, Baskin-Robbins, which operates under the umbrella of Dunkin’ Brands (DNKN), had SSSG of -2.4% in the United States and -2.0% in international markets.

How Starbucks’s Valuation Compares to Peers

For the next four quarters, analysts are expecting Starbucks to post EPS growth of 12.8%.

Why Domino’s Dividend Policy Is Important

In 2016, Domino’s Pizza (DPZ) paid dividends of $1.52—growth of 22.5% from $1.24 in 2015. In 2017, analysts expect its dividends to rise 7.9% to $1.64.

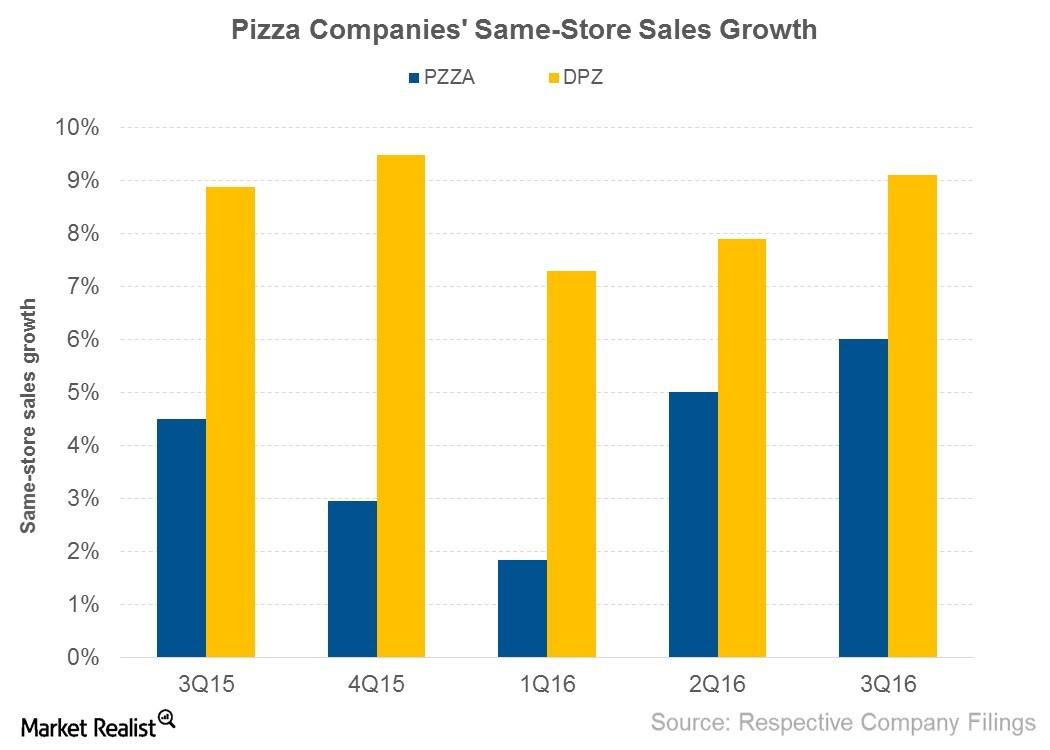

What Drove Domino’s and Papa John’s Same-Store Sales in 3Q16?

Same-store sales growth SSSG (same-store sales growth), which is expressed as a percentage, is a measure of revenue growth in existing stores over a certain period. SSSG is driven by ticket size and traffic. It’s an important metric for investors to monitor, as it increases a company’s revenue without increasing capital investment, and it’s a […]

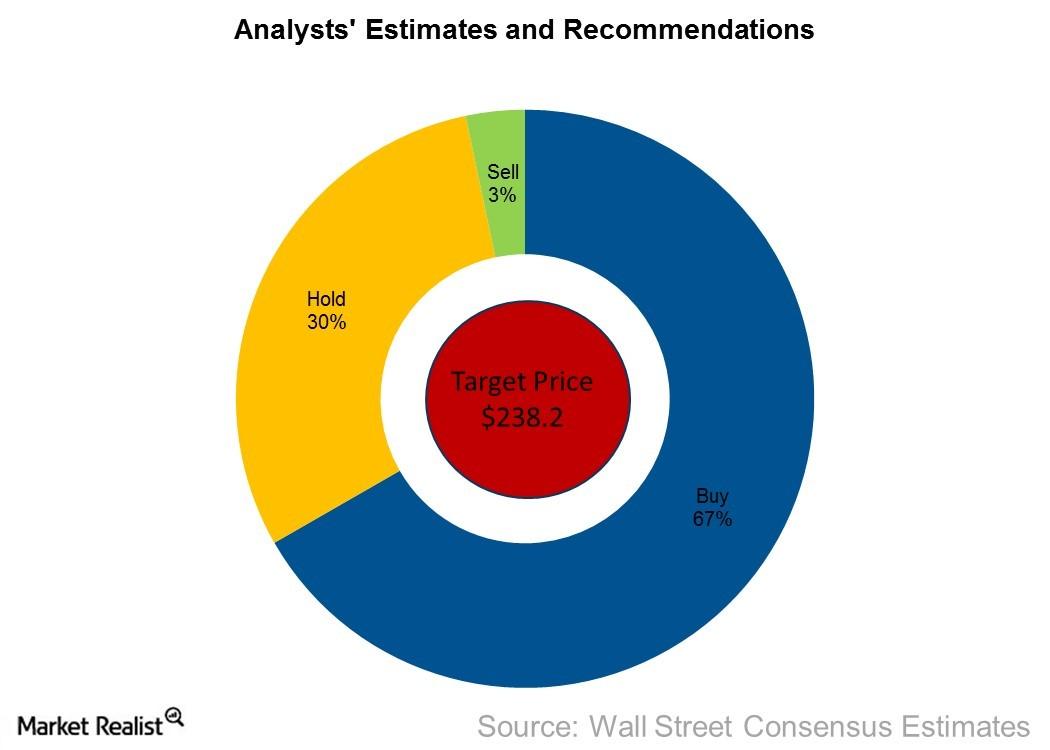

What Are Analysts’ Recommendations for Panera Bread?

Despite the recent fall in Panera’s share prices, analysts are still maintaining their price target of $238.2 for the next year—a return potential of 18.5%.