Anglogold Ashanti Ltd

Latest Anglogold Ashanti Ltd News and Updates

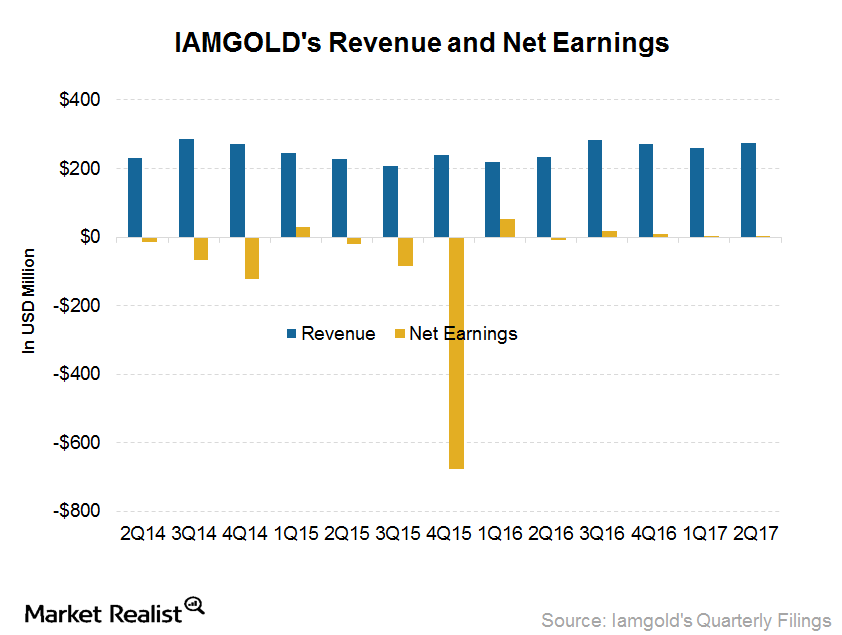

Understanding IAMGOLD’s 2Q17 Earnings Highlights

IAMGOLD’s (IAG) 2Q17 production was 223,000 ounces of gold—growth of 26,000 ounces or 13% year-over-year (or YoY).

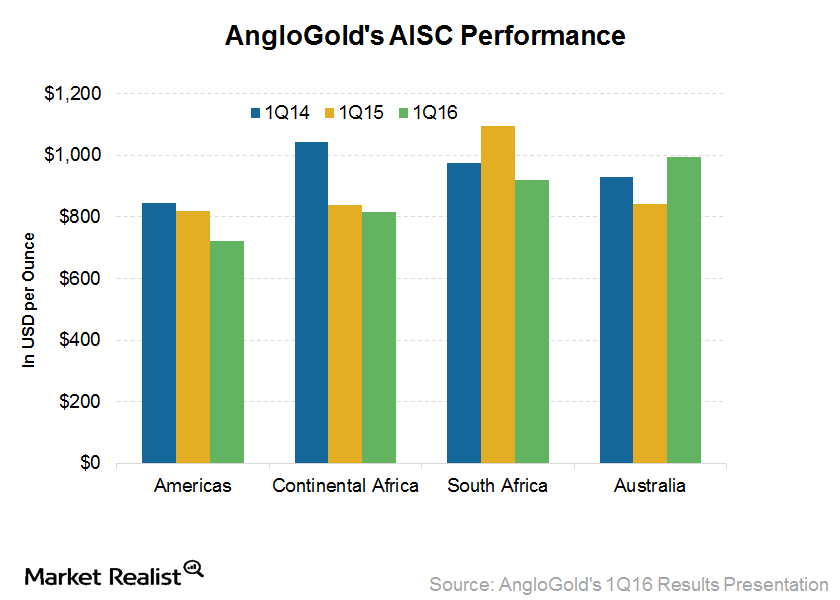

How Did AngloGold Reduce Its Costs despite Lower Production?

AngloGold Ashanti that for the last three years, its management’s focus has been on the widening of its margins on a sustainable basis.

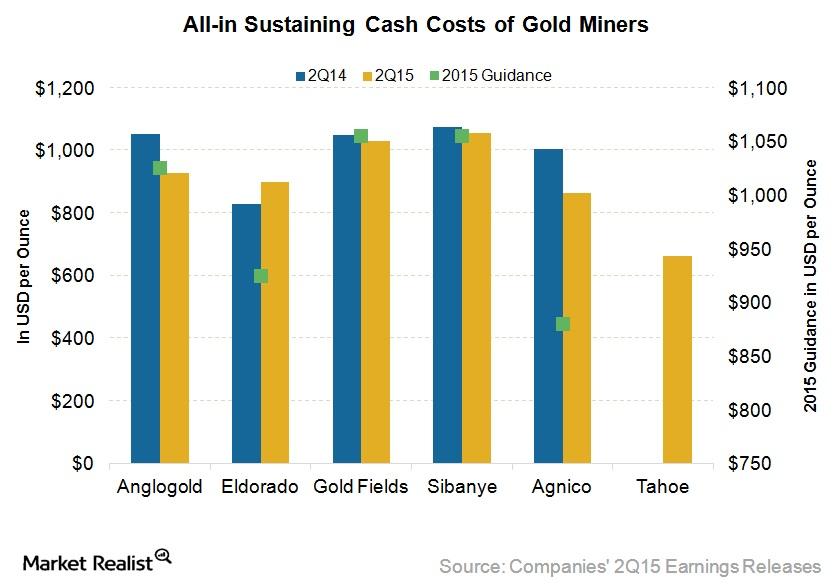

Which Intermediate Gold Miners Have Cost Advantages in 2H15?

All-in sustaining costs make up a comprehensive and important cost metric for gold mining companies. A lower AISC is better for gold miners.

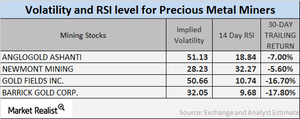

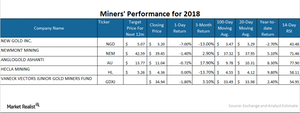

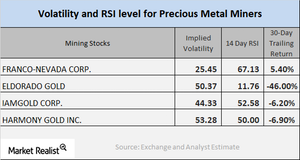

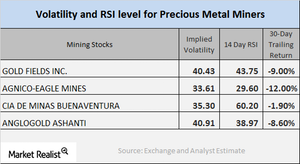

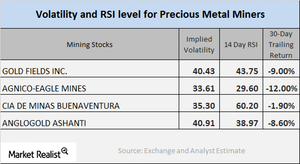

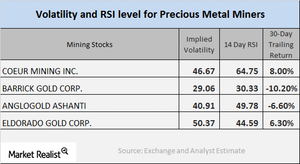

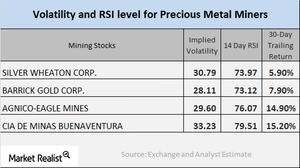

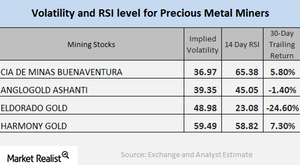

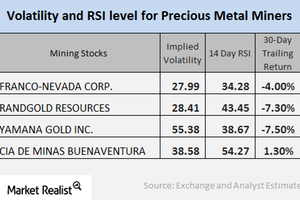

What Falling Miner RSI Levels Suggest

The RSI levels of our four select mining giants have all increased lately due to their higher stock prices.

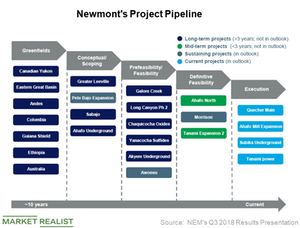

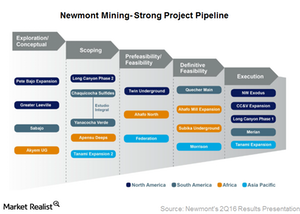

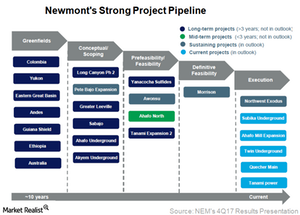

Newmont’s Project Pipeline Remains Strong: What’s the Upside?

Newmont Mining is poised to overtake Barrick Gold as the world’s largest gold producer in 2018.

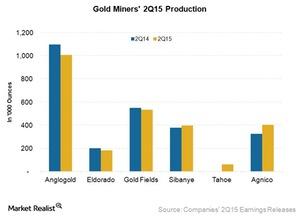

Evaluating Gold Production for Intermediate Gold Miners in 2Q15

Gold production is an important metric for gold miners, because miners generally try to increase gold production in order to reduce costs amid low prices.

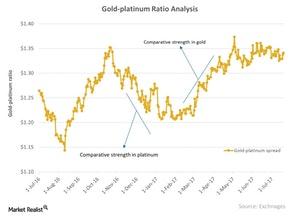

Platinum Touched Its Six-and-a-Half-Year Low in 2015

As automobile catalysts comprise ~44% of the demand for platinum, the Volkswagen scandal curbed the demand for diesel-fueled cars that use platinum as a catalyst. This pulled down the already depressed platinum and comparatively strengthened palladium.

Why Are Gold ETFs Losing Their Allure?

With declining gold prices, the most famous gold ETF, the SPDR Gold Shares ETF (GLD), has also lost its allure. It’s trading at lower volume.

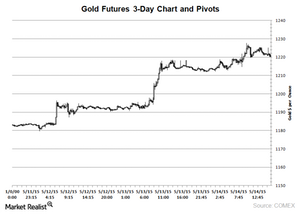

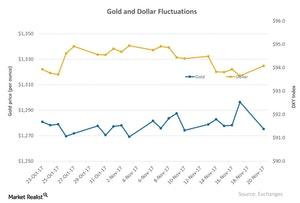

Gold Prices Extend Rally on Depreciating Dollar

This is the fifth up day for gold prices in the last ten days. Prices increased by 0.72% more on the average up days than on the average down days over the last ten trading sessions.

Newmont’s Project Pipeline: On Track and On Budget

Newmont Mining (NEM) has five projects in final stages, all of which will start production either this year or next.

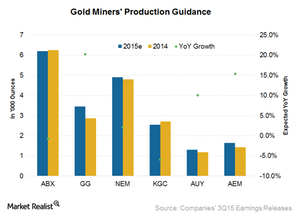

As Good as Gold: Analyzing Gold Miners’ Production Growth

In 3Q15, Goldcorp (GG) posted record gold production of 922,200 ounces—2% growth quarter-over-quarter and 42% growth year-over-year.

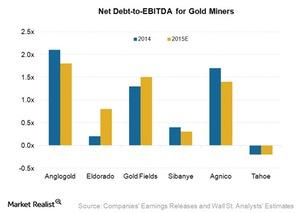

Net Debt-to-EBITDA Expectations for Intermediate Gold Miners in 2015

In 2015, the average net debt-to-EBITDA ratio of the six intermediate gold miners we’ve been evaluating in this series is 0.9x—a similar level to 2014.

An Overview of Gold Miner Performance in 2015

Gold miners’ stocks have underperformed most of the market indices and gold itself. GDX has significantly underperformed GLD since 2008.

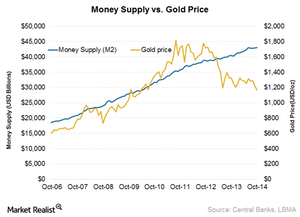

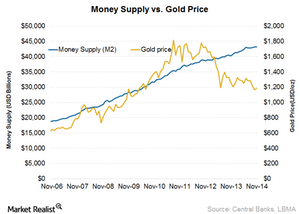

Price of gold relates to growth of global money supply

When money supply growth is used to prop up the financial and economic system instead of fuel strong economic growth, the price of gold relates to growth of the money supply.

Global money supply and its link to gold

The gold price increase kept pace with the global money supply until recently. The relationship between the two appears to have broken.Materials Are Analysts Optimistic about Miners?

Despite the ongoing slump in the precious metals market, it seems that there could be hope going forward.

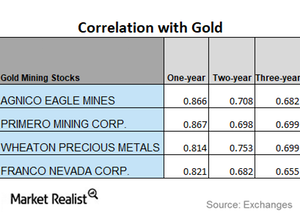

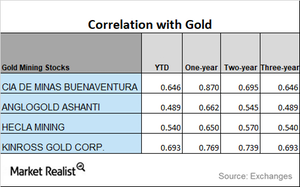

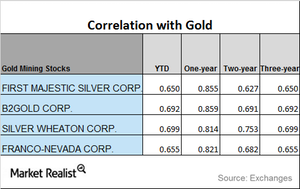

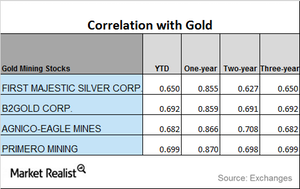

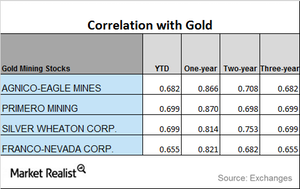

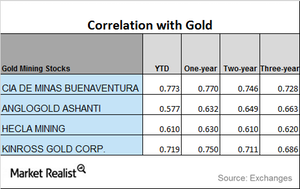

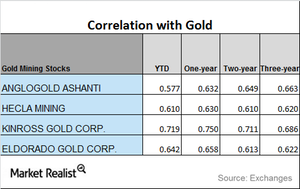

Comparing Mining Stocks’ Correlation with Gold

Mining stocks tend to move with gold prices. In this part, we’ll analyze the correlation between gold and four mining stocks.

Newmont Mining’s Project Pipeline Is as Strong as It Gets

Newmont Mining’s (NEM) has one of the best project pipelines in the sector (GDX)(GDXJ)—stronger than Kinross Gold (KGC), Barrick Gold (ABX), and AngloGold Ashanti (AU).

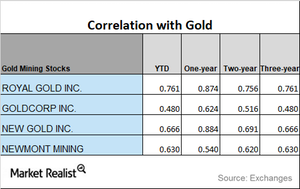

Analyzing Miners’ Correlations with Gold in January 2018

In this part of the series, we’ll analyze the correlations of the movements of a group of mining stocks with gold.

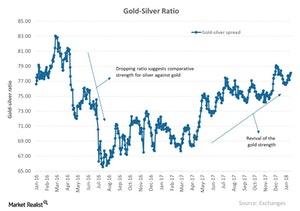

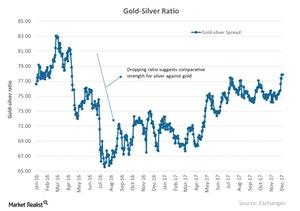

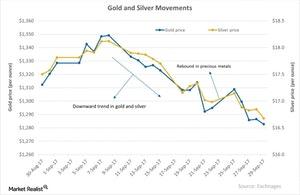

A Brief Analysis of the Gold-Silver Spread in January 2018

A quick look at the relationship between the two core precious metals, gold and silver, could also be helpful in the analysis of the overall precious metals market.

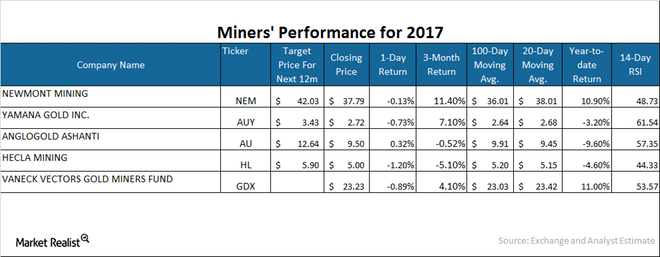

What Miners’ Moving Averages Indicate

NGD and HL are both trading below their longer-term 100-day moving averages.

A Look at Miners’ Correlation Trends

AngloGold Ashanti has seen the highest correlation to gold in the past year, while Eldorado Gold has seen the lowest correlation.

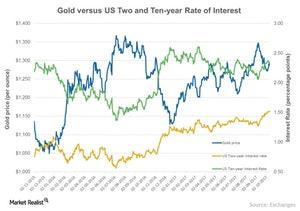

Interest Rate versus Gold: Interest Rate Wins Again

Gold is a non-yield bearing asset that reacts negatively to rises in the interest rate.

A Look at the Gold Spreads at the End of 2017

A gold-silver spread of 77.3 suggests that it requires almost 78 ounces of silver to buy a single ounce of gold.

What Direction Is the Correlation of Miners Headed?

On a year-to-date basis, AngloGold has seen the highest correlation to gold, while Cia De Minas has the lowest year-to-date correlation.

A Correlation Study of Miners in December 2017

If we look at the YTD (year-to-date) correlations of the select mining shares to gold, there has been a reasonable fall.

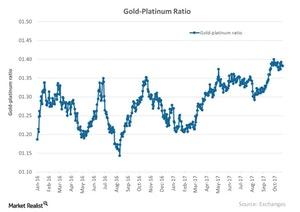

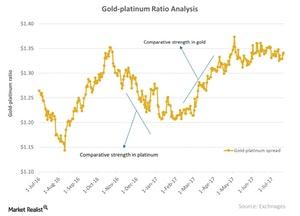

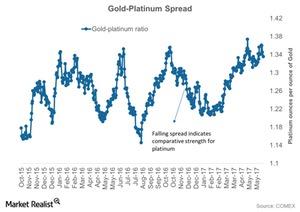

Insight into the Platinum Markets in November 2017

The gold-platinum ratio was ~1.4 on November 22, 2017.

How the Higher Dollar Has Affected Precious Metals

Precious metal slump All four precious metals saw a down day on Monday, November 20. Gold fell 1.6% to $1,275.30 per ounce, after touching a one-month high on Friday, November 17. The fall in precious metals was most likely due to the rise in the US dollar. The US Dollar Index rose 0.45% on Monday. Gold, silver, platinum, […]

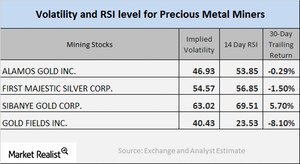

A Quick Look at Miners’ Technical Details

As of November 16, 2017, Alamos Gold, First Majestic Silver, Sibanye Gold, and AngloGold Ashanti had call-implied volatilities of 46.9%, 54.6%, 63%, and 40.9%, respectively.

What’s the Directional Trend in Key Miners’ Correlation?

AngloGold Ashanti has had the lowest correlation with gold this year, while Gold Fields has had the highest correlation with gold.

Analyzing the Correlation of Mining Stocks to Gold

Kinross Gold’s correlation has risen from a three-year correlation of 0.69 to a one-year correlation of 0.77, which suggests that Kinross has moved in the same direction as gold 77% of the time.

Behind the Correlations of Key Miners Today

On a YTD (year-to-date) basis, the correlations of the above mining stocks appear to be weak when compared with last year.

The Importance of Knowing the Technicals of Mining Stocks

On October 30, 2017, ABX, AU, KGC, and IAG had call implied volatilities of 29.1%, 40.9%, 41.6%, and 44.3%, respectively.

How Gold Companies Have Performed in 2017

Gold stock indices also traded near their highs for the year, but then followed the gold price lower. During September the NYSE Arca Gold Miners Index (GDMNTR) retreated 6.5%.

What Mining Stocks’ Implied Volatility Tells Us

As of October 24, 2017, Silver Wheaton (SLW), Yamana Gold (AUY), Barrick Gold (ABX), and AngloGold Ashanti (AU) had implied volatility readings of 30.8%, 48.4%, 29.1%, and 40.9%, respectively.

How Key Mining Stocks Are Correlated with Gold in October 2017

The PowerShares DB Gold Fund (DGL) and the Vaneck Merk Gold Trust (OUNZ) have risen 12.1% and 12.95, respectively, year-to-date, taking strong cues from gold.

A Brief New Look at the Technical Indicators of Mining Stocks

The Physical Silver Shares (SIVR) and Physical Swiss Gold Shares (SGOL) witnessed rises on Friday, October 16, climbing 0.98% and 0.81%, respectively.

Behind the Recent Correlation Movements of Precious Metals

Among these four miners, AngloGold has the lowest correlation with gold so far this year, while Coeur Mining has the highest correlation YTD.

Mining Stocks Today: Your Technical Updates

On October 5, Gold Fields, Agnico-Eagle, Cia De Minas Buenaventura, and AngloGold had implied volatility readings of 40.4%, 33.6%, 35.3%, and 40.9%, respectively.

Precious Metals and Companies That Mine Them

Precious metal miners got a boost on Tuesday, October 3, 2017, despite the marginal fall of precious metals.

Precious Metals in September: A Review

The negative sentiment toward gold prevailed on Friday, September 29, the last trading day of the month. Gold futures for November expiration fell 0.3%.

Reading Miners’ Gold Correlation Trends

Correlation trends On September 26, precious metals and mining stocks fell. Analyzing mining stocks’ correlation with gold is important since it can give some idea of future stock movement. In our analysis, we’ll focus on Buenaventura (BVN), AngloGold Ashanti (AU), Hecla Mining (HL), and Kinross Gold (KGC). Mining funds track precious metals and their price movements. Whereas the Global […]

How Gold and Platinum Are Moving in Tandem

Like silver, platinum has industrial uses and has seen growing demand in China.

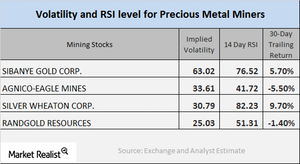

Analyzing the RSI Movements of Precious Metals

The price movement in precious metals is often closely traced by mining stocks. Before investors opt for mining stocks, they should analyze a few of the crucial technical details.

Reading Miners’ Correlation Trends

Mining stocks Before investors park their money in mining stocks, it’s crucial for them to compare miners’ performance with gold. In this part of the series, we’ll analyze the correlations of AngloGold Ashanti (AU), Hecla Mining (HL), Kinross Gold (KGC), and Eldorado Gold (EGO) with gold. The VanEck Vectors Junior Gold Miners ETF (GDXJ) and the […]

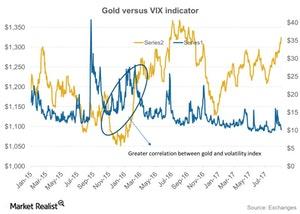

How Gold Is Coping amid Market Turmoil

Precious metals have maintained upward movement over the past month as geopolitical tensions hover.

Platinum Market: Reading the Gold-Platinum Ratio

When reading the platinum market, it’s important to look at the relative performance of platinum and gold by using the gold-platinum ratio.

What Miners’ Technical Indicators Suggest

Most of the miners have seen an upswing in their prices over the past week.

Have Miners’ Relative Strength Levels Revived?

In this article, we’ll look at some important technical indicators for Coeur Mining (CDE), Barrick Gold (ABX), Buenaventura (BVN), and AngloGold Ashanti (AU).

Gold-Platinum Ratio: Is Platinum a Long-Term ‘Buy’?

When reading the platinum market, it’s important to analyze the comparative performance of platinum and gold by using the gold-platinum ratio or spread.