Anglogold Ashanti Ltd

Latest Anglogold Ashanti Ltd News and Updates

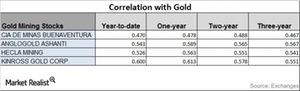

Volatility for Precious Metal Miners: Movement Going Forward

The ETFS Physical Swiss Gold (SGOL) and the ETFS Physical Silver (SIVR) have risen 8.5% and 4.1%, respectively, on a year-to-date basis as of May 18, 2017.

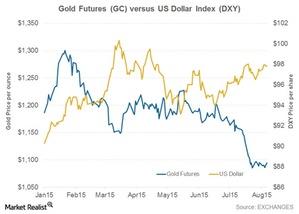

Will the Dollar Get Burned by Another Rate Hike?

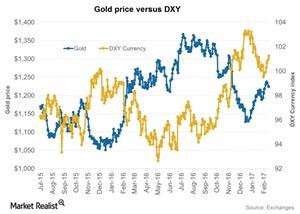

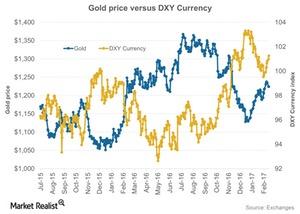

While the US dollar has seen a decline in 2017, the increased possibility of a Fed rate hike in June could give the currency some breathing room.

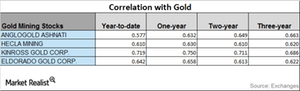

How Miners’ Correlations to Gold Are Trending

As global tumult grips markets and investors turn to mining stocks as safe havens, it’s crucial to understand which stocks are closely tied to precious metals.

Understanding the Fall in the US Dollar and How Precious Metal Reacted

All four precious metals witnessed a rise in price on Monday, March 20, as the US dollar slipped to its six-week low.

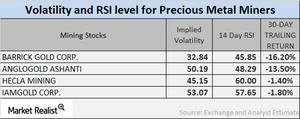

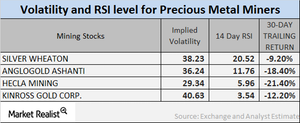

Analyzing Mining Stocks’ Volatility

As of March 15, the volatilities of Silver Wheaton, AngloGold Ashanti, Hecla Mining, and Kinross Gold were 38.2%, 36.2%, 29.3%, and 40.6%, respectively.

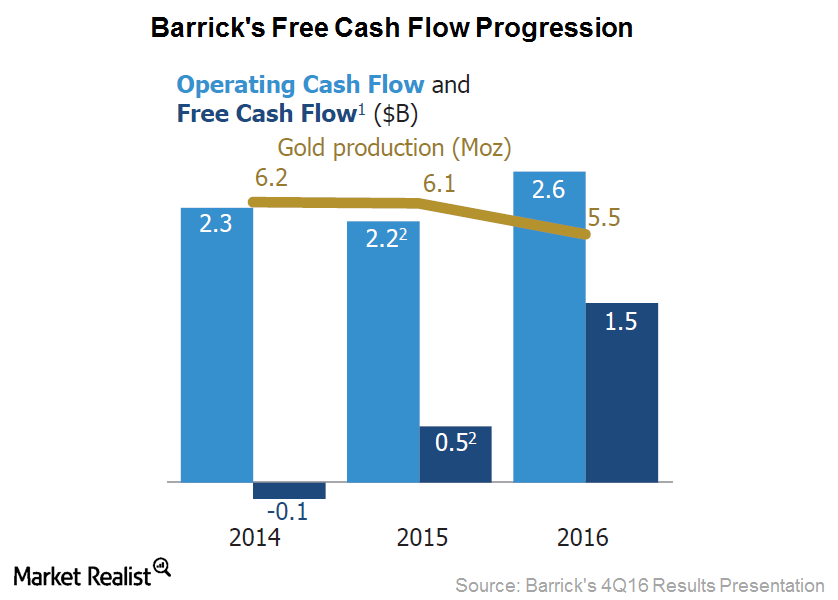

This Is Barrick Gold’s Focus: To Improve Free Cash Flow

Barrick Gold’s (ABX) management has defined value creation for shareholders in terms of FCF (free cash flow) per share.

Reading the Volatility Numbers for Mining Stocks

It’s important to monitor the implied volatilities and RSI levels of large mining stocks, particularly in the wake of the changes in precious metal prices.

What’s the Correlation between Mining Stocks and Gold?

Mining companies that have high correlations with gold include Agnico Eagle Mines (AEM), Alacer Gold (ASR), Alamos Gold (AGI), and AngloGold Ashanti (AU).

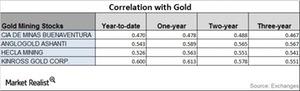

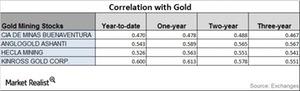

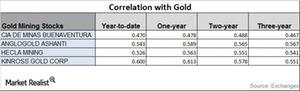

Analyzing Mining Stocks’ Correlation in 2016

Mining companies that have high correlations with gold include Buenaventura (BVN), AngloGold Ashanti (AU), Hecla Mining (HL), and Kinross Gold (KGC).

Reading the Correlation of the Mining Stocks

Mining stocks and gold Although precious metals were doing well at the beginning of 2016, it’s important to know which mining stocks overperformed and underperformed precious metals. Precious metal prices have been falling since Donald Trump won the US presidential election on November 8, 2016. As a result, mining stocks have also been falling. Mining […]

Which Mining Stocks Have Highest Correlation to Gold?

Mining companies that have high correlations with gold include Cia de Minas Buenaventura (BVN), AngloGold Ashanti (AU), Hecla Mining (HL), and Kinross Gold (KGC).

Rising Volatility Continues to Affect Miners’ Stocks

The precious metals price correction that happened on September 2, 2016, extended to September 6. How did equities and funds respond?

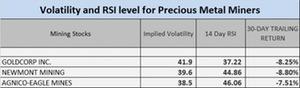

Unemployment Remains a Major Concern for South Africa

South Africa’s unemployment rate was as high as 25% in 2015. The high unemployment rate has been a serious issue in the country for several years now.

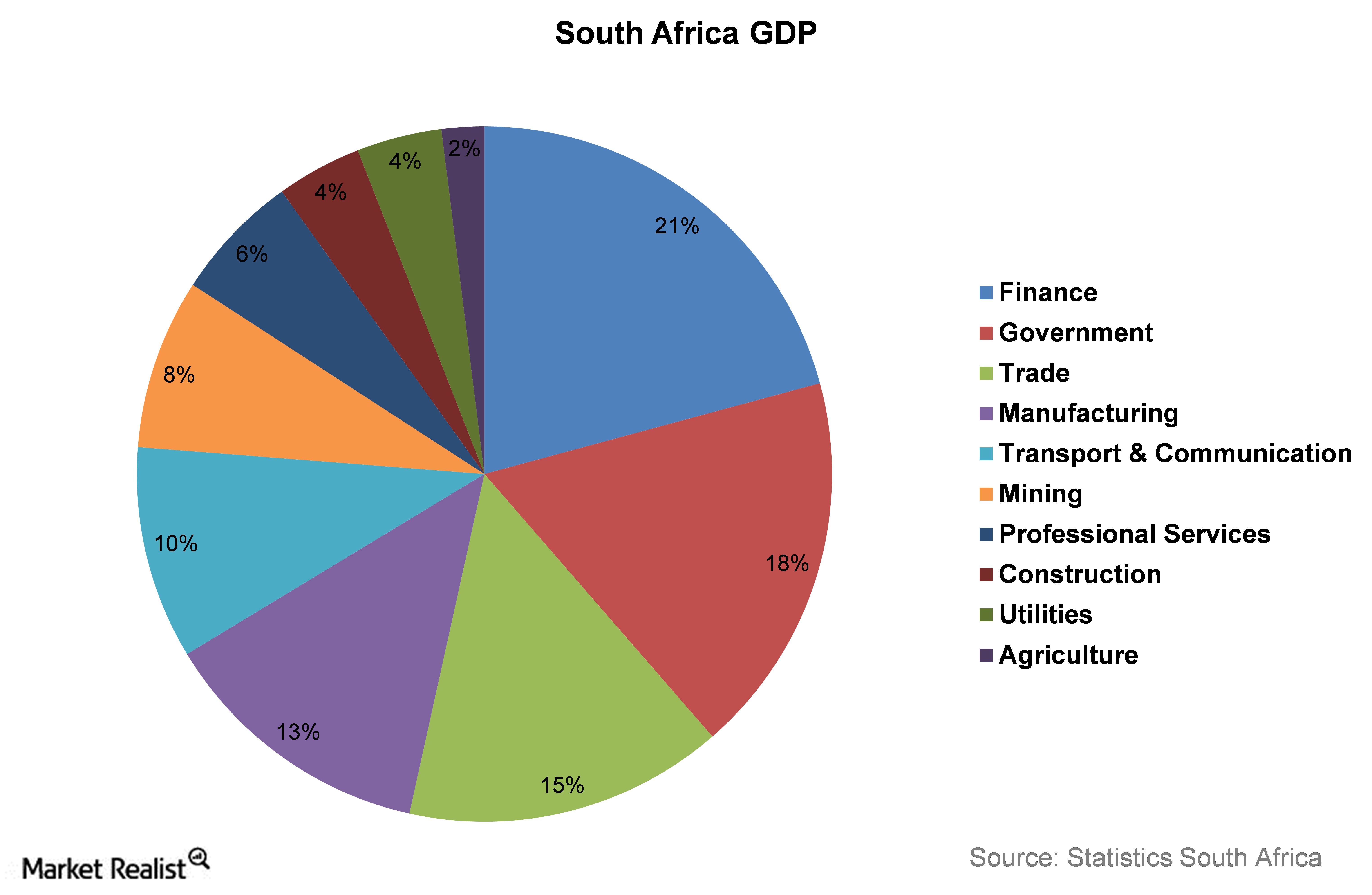

An Overview of the South African Economy’s Structure

The finance sector here consists of finance, real estate, and business services. The South African economy depends heavily on the manufacturing sector.

Intermediate Gold Miners Fell in 2015 and Beyond

From the start of 2015 to January 8, 2016, the prices of gold (GLD) have fallen by 7% and the VanEck Vectors Gold Miners Index (GDX) has fallen by 23%.

How the Gold Price Is Influencing Pure Gold Miners

In the precious metals mining industry, there are some stocks that to an extent follow the price and market sentiment of the precious metals.

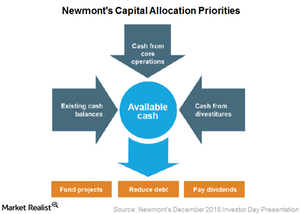

How Will Newmont’s Capital Allocation Priorities Look Like?

Newmont Mining outlined its capital allocation priorities. Management mentioned that they aim to fund their projects through cash generated from core operations.

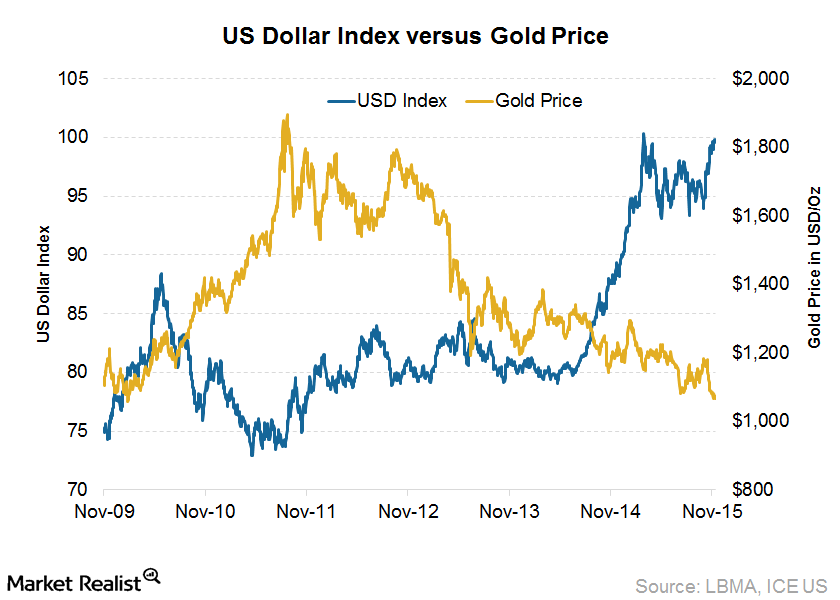

Why the Strong US Dollar Outlook Means Pressure for Gold Prices

Tracked by the Federal Reserve, the weekly US Dollar Index (UUP) measures the value of the dollar compared to its six significant trading partners.

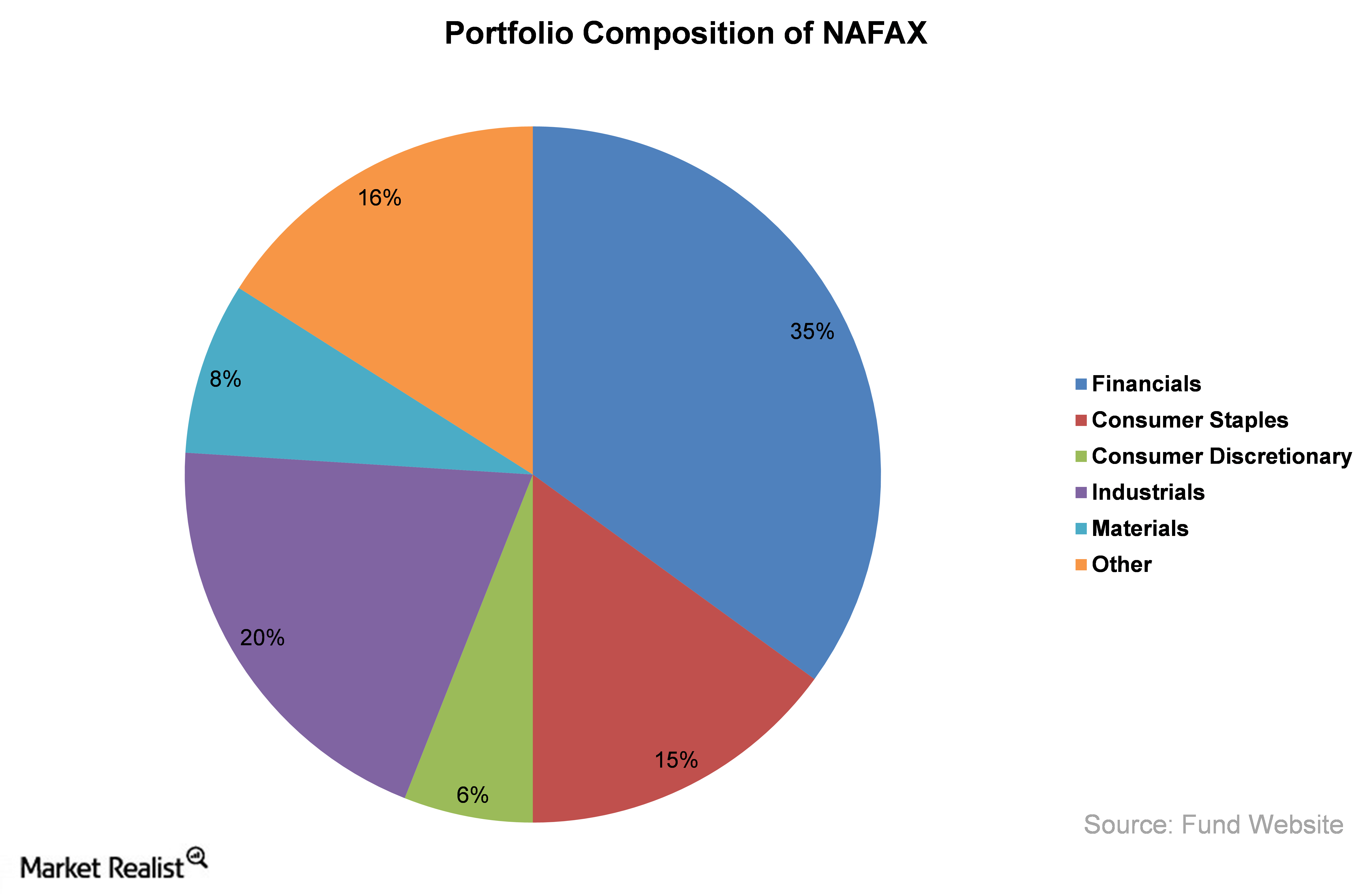

The Nile Pan Africa A Fund: Negative Returns for 5 Years

The Nile Pan Africa A Fund (NAFAX) invests at least 80% of its portfolio in the stocks of Africa-based companies. The majority of the fund’s exposure is in South Africa.

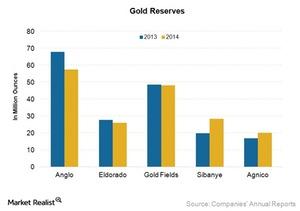

Assessing the Importance of Gold Reserves for Future Growth

Gold reserve growth is a key revenue driver for miners. It’s thus important for gold miners to continue replacing every ounce of gold they produce and sell.

China’s Falling Stock Market Pushes Gold Upward

The turnaround from the direction that gold was headed during the last month has also supported silver prices. Silver fell marginally by 0.68% last month.

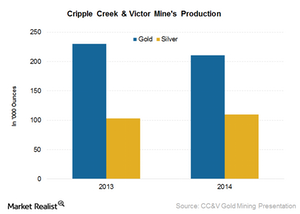

Newmont Mining Acquires Cripple Creek from AngloGold

The Cripple Creek & Victor mine is located near Colorado Springs, Colorado. It’s and open-pit mine that has been operational since 1995.

Newmont Mining Asset Optimization Efforts Encourage Analysts

Newmont Mining is the world’s second-largest gold producer. In this series, we’ll analyze various steps taken by Newmont toward asset optimization.

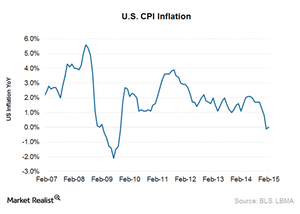

US CPI Inflation Sees Marginal Uptick in February

Gold usually has a direct relationship to inflation. Gold demand increases during periods of high inflation and falls when inflation is low.