Agnico Eagle Mines Ltd

Latest Agnico Eagle Mines Ltd News and Updates

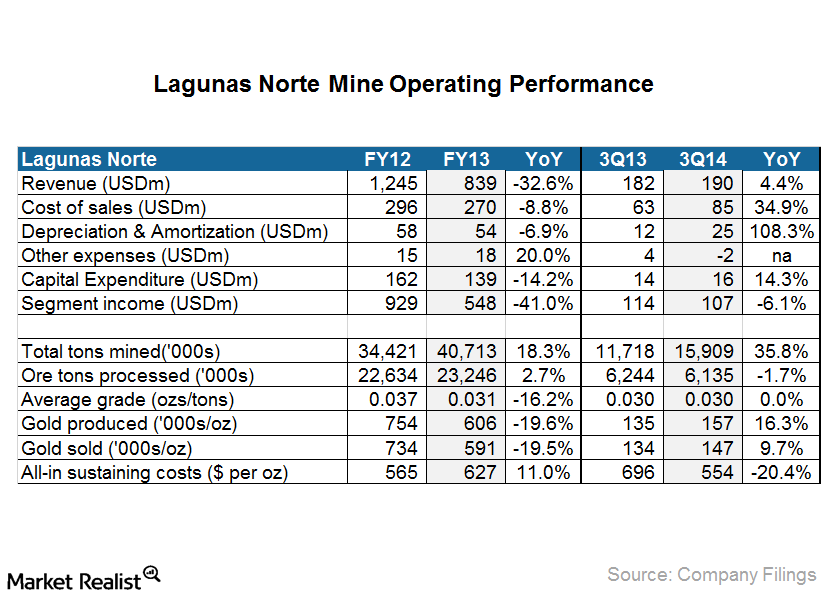

Materials Lagunas Norte: Increasing Barrick’s cost per unit

Lower ore grade increases the amount of waste stripping required—in order to extract some volume of ore—as a result of mining more tons of waste.

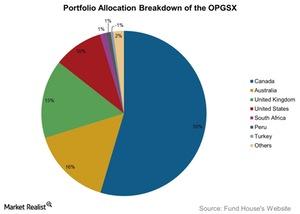

An Overview of OPGSX’s Precious Metal Holdings

OPGSX may also invest up to one-fifth of its portfolio directly into gold or silver bullion and other precious metals.

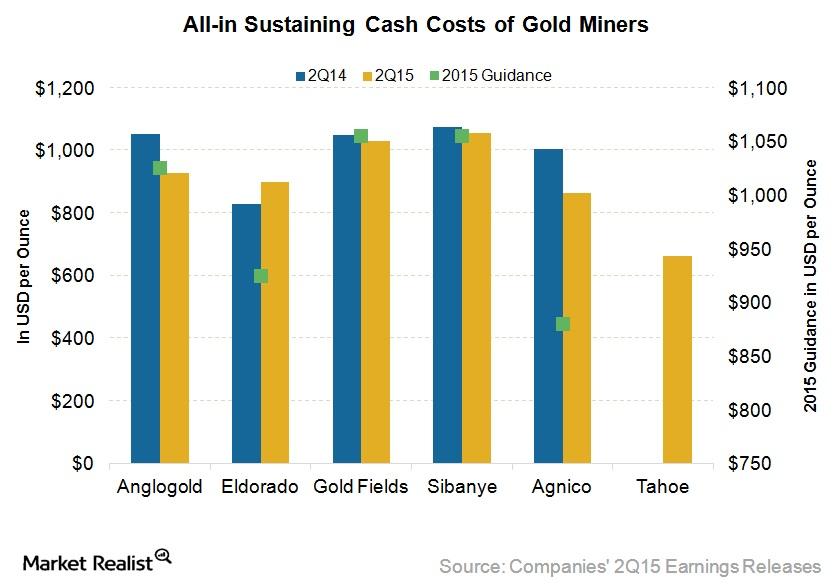

Which Intermediate Gold Miners Have Cost Advantages in 2H15?

All-in sustaining costs make up a comprehensive and important cost metric for gold mining companies. A lower AISC is better for gold miners.

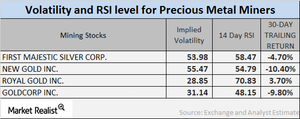

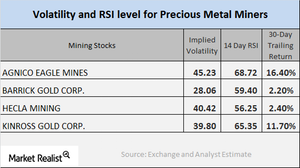

How Mining Stock Volatility Numbers Are Moving Now

First Majestic, New Gold, Agnico, and Silver Wheaton now have RSI scores of 60.5, 56.2, 57.6, 59.6, respectively.

Which Gold Stocks Do Analysts Love and Hate?

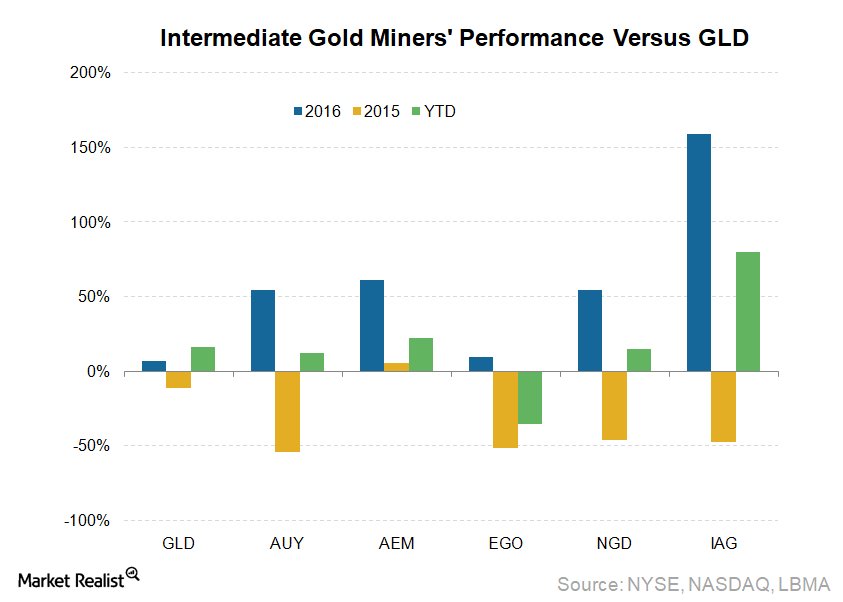

Gold price’s reversal this year has created opportunities in gold stocks. The SPDR Gold Shares ETF (GLD) had gained 11% year-to-date as of Friday.

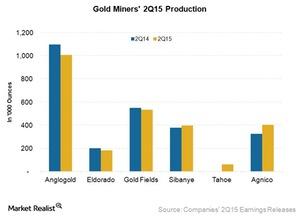

Evaluating Gold Production for Intermediate Gold Miners in 2Q15

Gold production is an important metric for gold miners, because miners generally try to increase gold production in order to reduce costs amid low prices.

Gold Prices Soar: Which Stocks Do Analysts Favor?

Kirkland Lake is first among analysts’ favorite gold stocks with 91% “buy” and 9% “hold” ratings. The target price implies a potential upside of 16%.

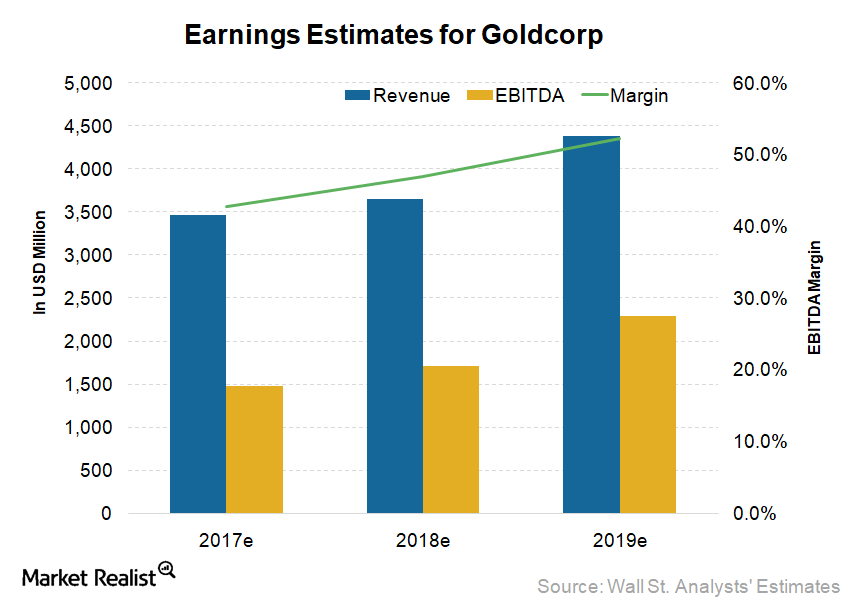

Do Goldcorp’s Earnings Estimates Reflect Analysts’ Increasing Optimism?

Goldcorp (GG) has given negative returns in 2017. Its stock has lost 6.1% of its value as compared to a gain of 12.8% in the iShares Gold Trust (GLD) and 11.1% in the VanEck Vectors Gold Miners ETF (GDX).

Why Are Gold ETFs Losing Their Allure?

With declining gold prices, the most famous gold ETF, the SPDR Gold Shares ETF (GLD), has also lost its allure. It’s trading at lower volume.

Which Gold Miners Are Ray Dalio and John Paulson Betting On?

Hedge funds increased their net positions in the SPDR Gold Shares ETF during the first quarter.

Lagunas Norte: AISC down due to lower sustaining capex

All-in sustaining costs (or AISC) came in at $554 per ounce, a reduction of $142 per ounce from the same period last year. The reduction was mainly due to lower sustaining capital expenditure (or capex).

Must Know: An Overview of Kinross Gold Corp.

In this series, we’ll analyze the various business aspects of Kinross Gold. We’ll also look at various key drivers that impact Kinross’s investors.

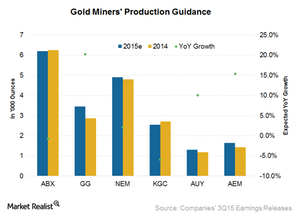

As Good as Gold: Analyzing Gold Miners’ Production Growth

In 3Q15, Goldcorp (GG) posted record gold production of 922,200 ounces—2% growth quarter-over-quarter and 42% growth year-over-year.

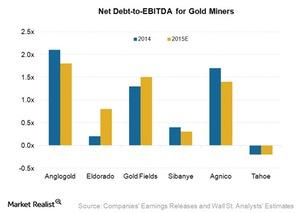

Net Debt-to-EBITDA Expectations for Intermediate Gold Miners in 2015

In 2015, the average net debt-to-EBITDA ratio of the six intermediate gold miners we’ve been evaluating in this series is 0.9x—a similar level to 2014.

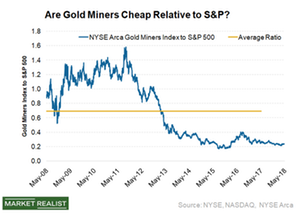

An Overview of Gold Miner Performance in 2015

Gold miners’ stocks have underperformed most of the market indices and gold itself. GDX has significantly underperformed GLD since 2008.

Why Are Intermediate Gold Miners so Exuberant?

Intermediate gold miners are smaller than senior gold miners in terms of production and market capitalization, but they are still generally liquid.

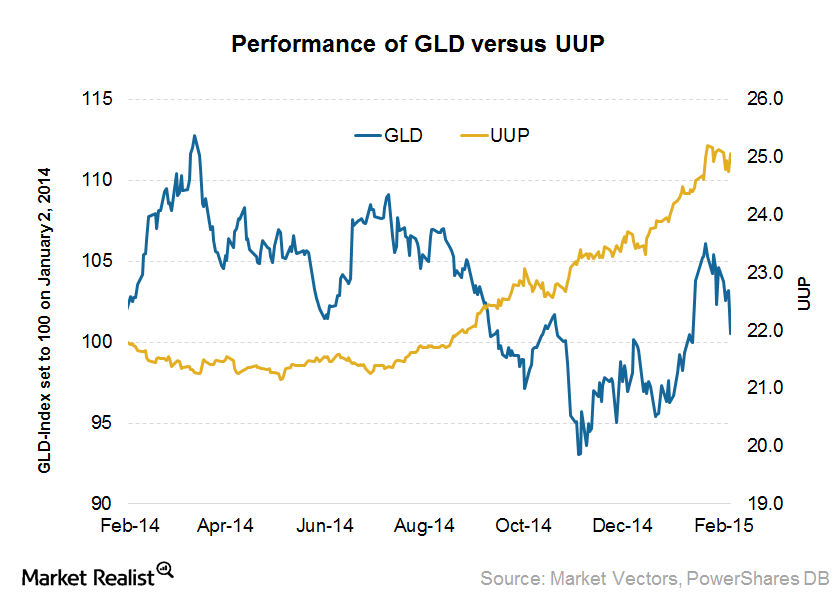

Investing in gold? Watch the US Dollar Index

Tracked by the Federal Reserve, the weekly US Dollar Index measures the value of the dollar compared to the currencies of its significant trading partners.Financials GG’s merger and acquisition strategy is different than its peers

Although every gold miner talks about only doing merger and acquisition (or M&A) strategies that are in shareholders’ best interests, GG sticks to its strategy—unlike most of its peers.Materials Key things to look out for when you invest in junior gold stocks

The junior mining space is very risky, given very limited options in terms of mines and their involvement in early stages. So it’s very important to identify the right junior stock.

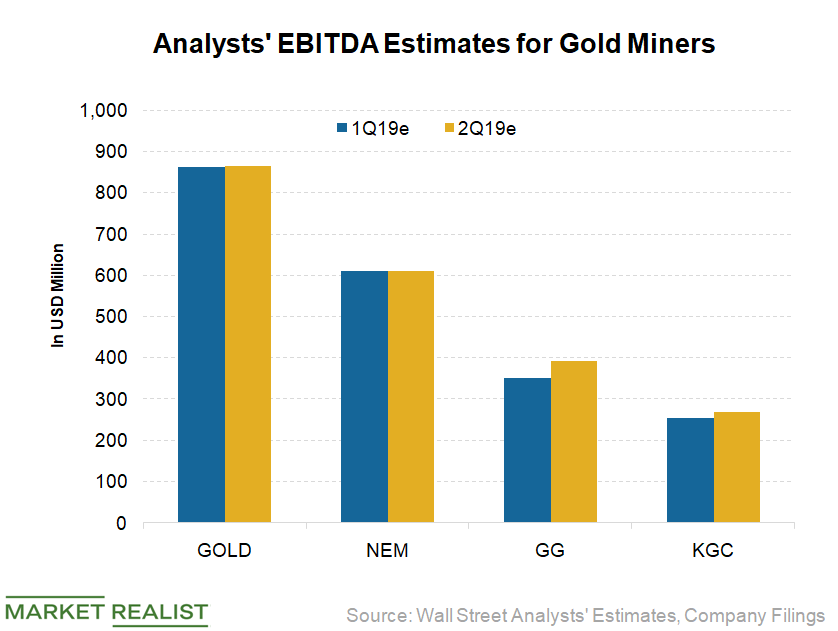

Which Gold Stocks Could Beat Analysts’ Earnings Expectations in Q1?

Many gold miners (RING) are set to release their first-quarter results shortly. Analysts expect Barrick Gold’s (GOLD) EBITDA to rise 6.2% YoY (year-over-year) in the first quarter.

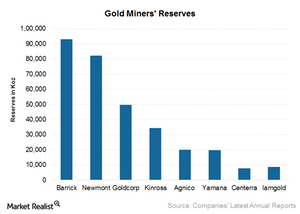

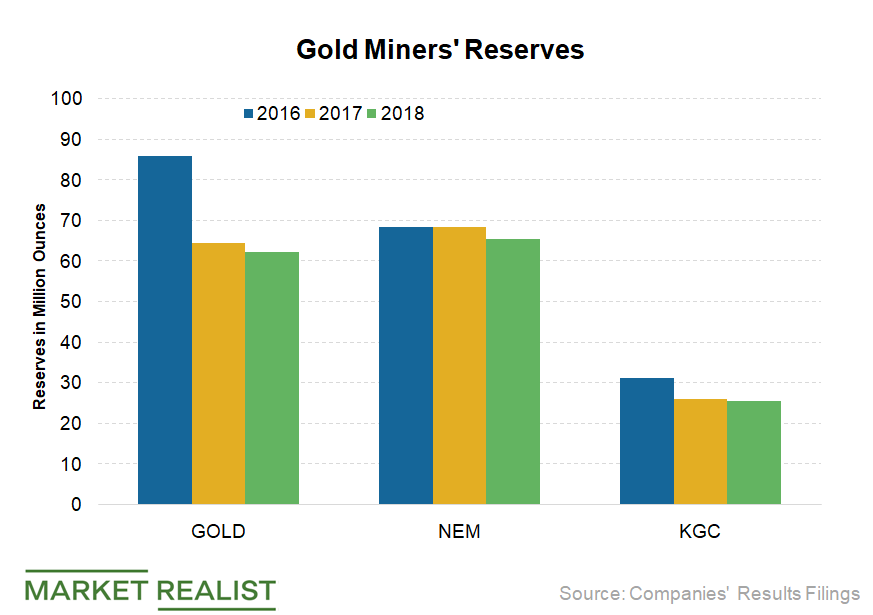

Why Did Barrick Gold’s Reserves Fall in 2018?

At the end of 2018, Barrick Gold (GOLD) reported mineral reserves of 64.5 million ounces—a decline of 3.4% YoY.Miscellaneous How Is the Dollar Affecting Precious Metals?

Besides ongoing geopolitical concerns, a crucial factor that gold keeps looking to for directional moves is the US dollar.

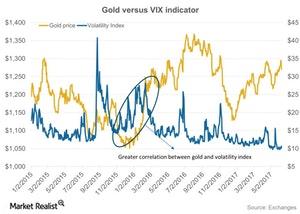

How Is the Volatility Index Impacting Gold?

Another critical factor that has been affecting the price movement of precious metals is overall market volatility.

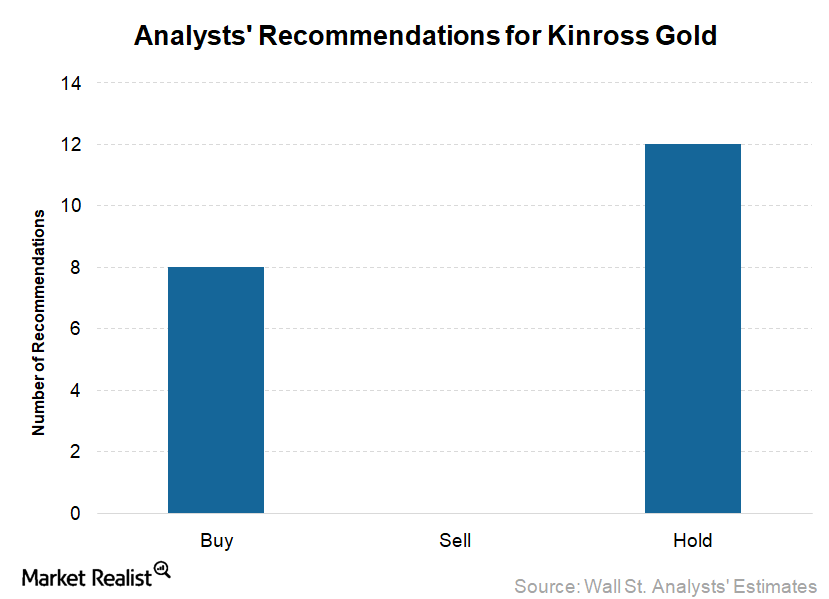

A Look at Recent Analyst Ratings for Kinross Gold

None of the analysts covering Kinross Gold (KGC) recommended a “sell” rating on the stock. 40% of them have “buy” ratings, while 60% suggest a “hold” for the stock.

Mining Stocks Follow Precious Metals: Technical Insights

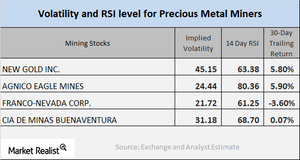

New Gold, Agnico-Eagle Mines, Franco-Nevada, and Cia de Minas Buenaventura have call-implied volatilities of 45.2%, 24.4%, 21.7%, and 31.2%, respectively.

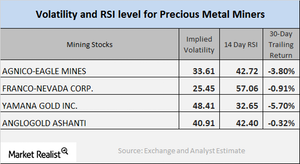

What Mining Stocks’ Indicators at the End of December Tell Us

Agnico, Randgold, Yamana, and Barrick have call implied volatilities of 24.3%, 21.1%, 38.8%, and 22.8%, respectively.

The Revival of Miners and Technical Indicators on December 20

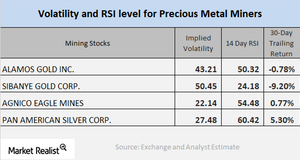

Alamos Gold, Sibanye Gold, Agnico Eagle Mines, and Pan American Silver have call-implied volatilities of 43.2%, 50.5%, 22.1%, and 27.5%, respectively.

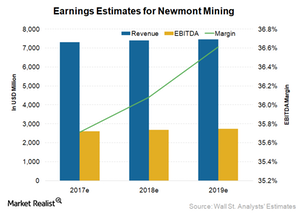

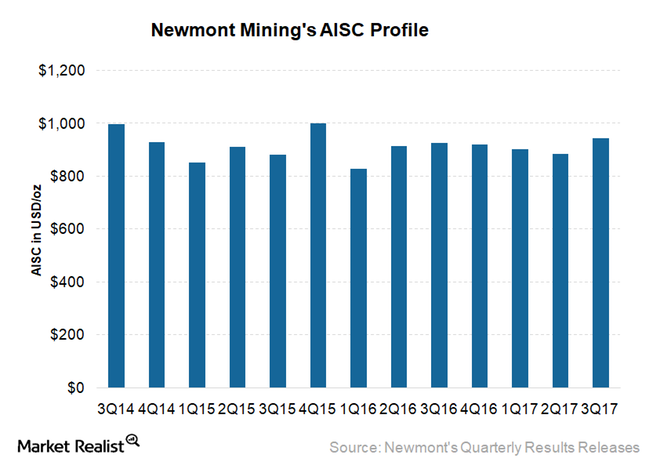

These Factors Are Driving Analysts’ Estimates for Newmont Mining

Newmont Mining’s mean consensus revenue for 2017 is $7.3 billion. This implies year-over-year (or YoY) growth of 8.1%.

Investors Might See a Bump in Newmont’s Costs in 2018 before Improving

Newmont Mining (NEM) is expecting its newest mines to add production at just $750 per ounce.

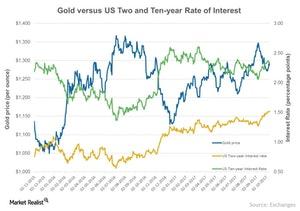

How Eager Are Precious Metals to Hear the Fed’s Decision?

Gold, silver, and platinum all had a down day on Tuesday, December 13, mainly due to speculations over the Federal Reserve’s pending interest rate decision.

Rate Hike Could Move Precious Metals and Miners

Investors have their eyes set on the interest rates. A rise in the interest rates causes the demand for precious metals to fall.

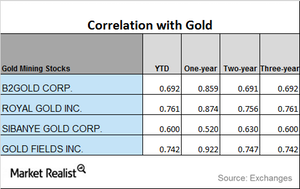

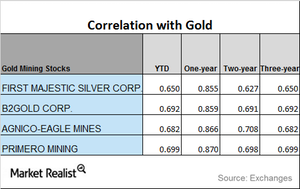

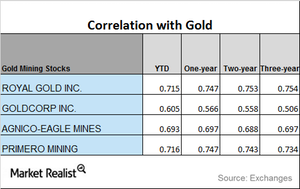

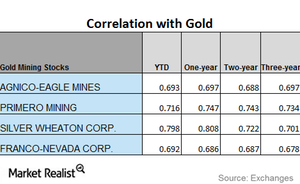

What Are Miners’ Correlation Trends?

Gold is the most dominant among the four precious metals. It’s important that investors analyze how miners are moving compared to precious metals.

Analyzing Trends in Mining Stocks’ Correlation

Gold remains the most dominant among the four precious metals. It’s crucial that investors analyze how the miners are moving versus precious metals.

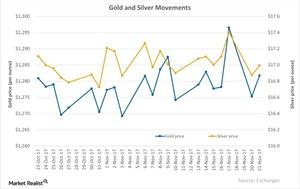

What Led to the Recent Rebound in Precious Metals?

After a substantial slump on Monday, gold futures for December delivery rose 0.5% on Tuesday and closed at $1,281.7 per ounce.

A Brief Analysis of Mining Stocks in November 2017

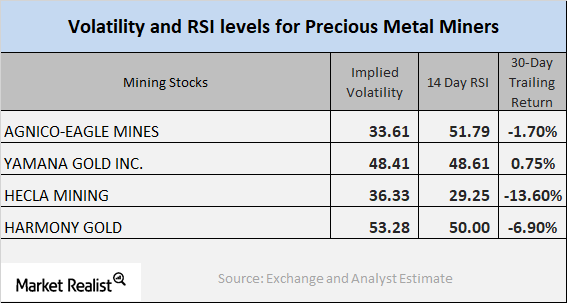

On November 7, Agnico-Eagle Mines (AEM), Yamana Gold (AUY), Hecla Mining (HL), and Harmony Gold (HMY) had implied volatility readings of 33.6%, 48.4%, 36.3%, and 53.3%, respectively.

Reading the Correlation Movements of Precious Metal Miners with Gold

The iShares MSCI Global Gold Min (RING) and the VanEck Vectors Junior Gold Miners (GDXJ) fell 2.6% and 1.5%, respectively, on October 26.

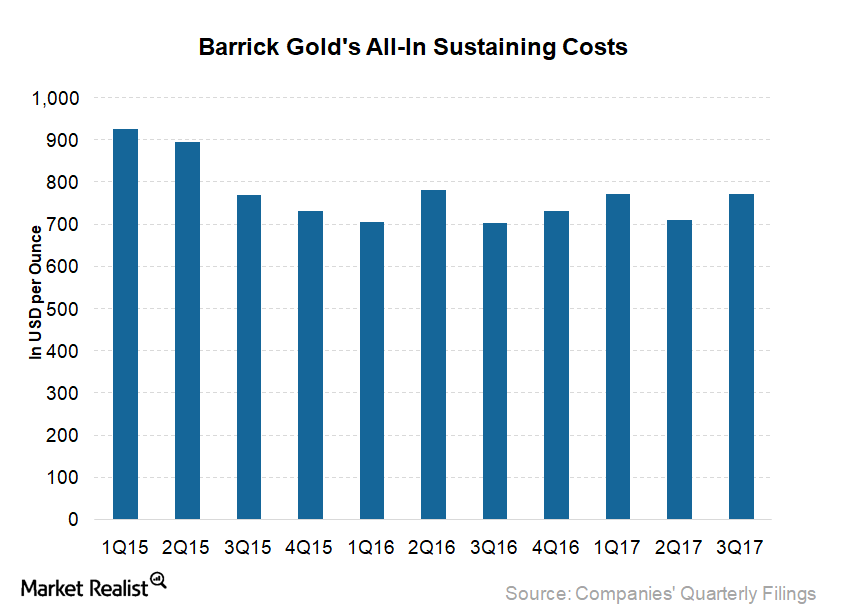

Is Barrick Gold behind in Achieving Its Unit Cost Target?

Barrick Gold (ABX) reported AISC (all-in sustaining costs) of $772 per ounce in 3Q17, which is 10% higher year-over-year and 9% higher sequentially.

A Technical Analysis of Mining Shares in October

When investors look at mining stocks, it’s important that they do a technical analysis of the stocks.

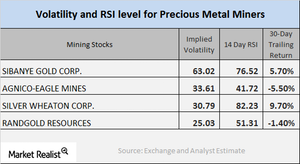

Mining Shares: RSI Numbers and Implied Volatility

As of October 19, Sibanye Gold, Agnico Eagle Mines, Silver Wheaton, and Randgold Resources had implied volatility readings of 63%, 33.6%, 30.8%, and 25%.

A Brief New Look at the Technical Indicators of Mining Stocks

The Physical Silver Shares (SIVR) and Physical Swiss Gold Shares (SGOL) witnessed rises on Friday, October 16, climbing 0.98% and 0.81%, respectively.

A Correlation Analysis of Some Important Miners

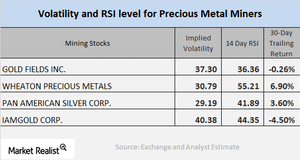

Among the miners that we’re looking at in this part of the series, Sibanye Gold has the lowest correlation to gold on a YTD basis, while Gold Fields has the highest correlation to gold.

How Miners Correlate to Gold

Mining funds that have a strong relationship to precious metals are the Global X Silver Miners (SIL) and the VanEck Vectors Gold Miners (GDX).

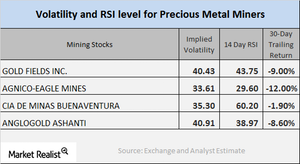

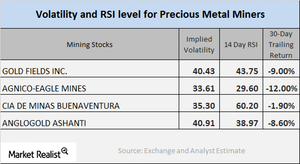

Mining Stocks Today: Your Technical Updates

On October 5, Gold Fields, Agnico-Eagle, Cia De Minas Buenaventura, and AngloGold had implied volatility readings of 40.4%, 33.6%, 35.3%, and 40.9%, respectively.

How Mining Stocks Are Performing

The precious metals continued rising on Wednesday, and gold also witnessed a rebound.

Could North Korea Be Affecting Precious Metal Prices?

North Korean tensions Like the US dollar, global tensions can be responsible for precious metal price fluctuations. North Korea has interpreted US president Donald Trump’s comments as a declaration of war, stating that Pyongyang has the right to take countermeasures, including shooting down US bombers outside of its airspace. The ongoing unrest in the Korean peninsula has led to a global […]

Reading the Correlation of Mining Shares

Monday, September 25, 2017, was a day of revival for mining shares as tensions in North Korea resurfaced.

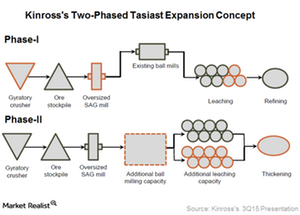

Why the Tasiast Expansion Is Key to Kinross Gold’s Potential

The Tasiast Phase One expansion is expected to increase mill throughput capacity from 8,000 tons per day to 12,000 tons per day.

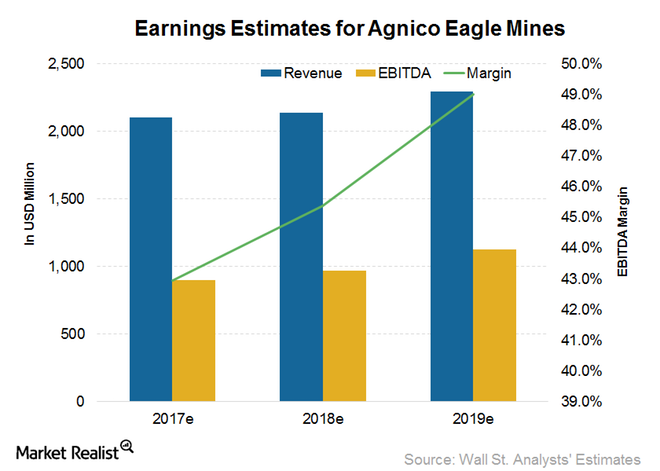

How Analysts Estimate Agnico Eagle Mines’ Earnings in 2017 and Beyond

Despite just 0.7% expected growth in revenues for 2017, Agnico Eagle Mine’s EBITDA is expected to grow 5.6% YoY in 2017.

Analyzing the Miners’ Crucial Indicators in September

On September 11, 2017, Agnico-Eagle, Barrick Gold, Hecla Mining, and Kinross had volatilities of 45.2%, 28.1%, 40.4%, and 39.8%, respectively.

Miners: Correlation Trends in August 2017

Silver Wheaton has the highest correlation with gold, while Franco-Nevada has the lowest correlation.