Agnico Eagle Mines Ltd

Latest Agnico Eagle Mines Ltd News and Updates

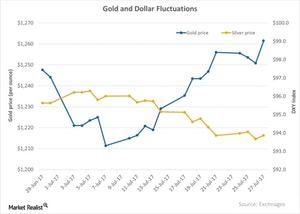

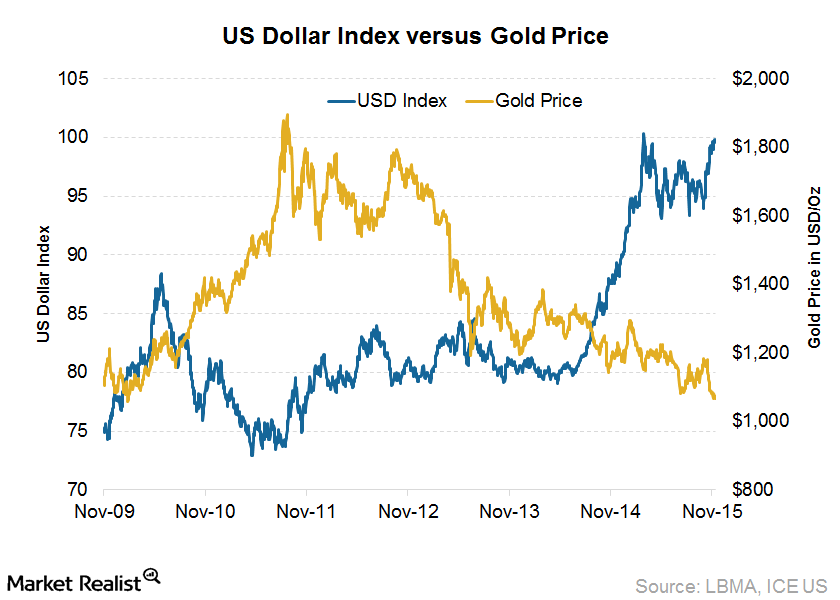

How the US Dollar Affected Gold

The US dollar has been on a downward swing over the past week.

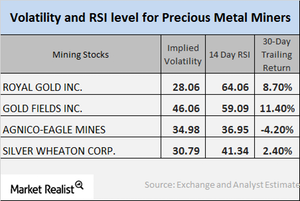

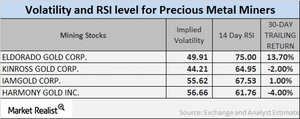

Unpacking the Technical Indicators for Mining Stocks

Mining stocks have bounced back from the choppy markets we’ve seen over the past month. On July 20, most mining stocks saw upward movements in their prices.

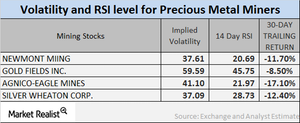

How Has Miners’ Volatility Trended in July?

Mining stocks have bounced back from the choppy markets seen over the past week.

Why Mining Stocks’ Relative Strength Levels Keep Falling

In this article, we’ll take a look at the variables that determine how attractive particular mining stocks or shares are or could become.

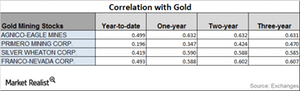

How Are the Correlations of Mining Stocks Moving?

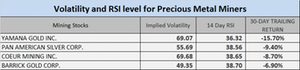

Fears surrounding a potential upcoming interest rate hike took over precious metals recently, and they fell at the beginning of May 2017.

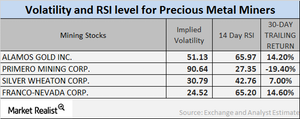

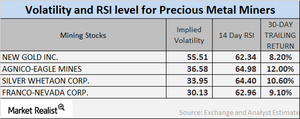

Analyzing the Volatility of Mining Stocks

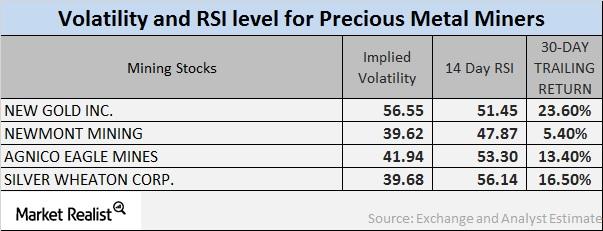

As of April 6, 2017, the volatilities of New Gold (NGD), Agnico Eagle (AEM), Silver Wheaton (SLW), and Franco-Nevada (FNV) were 55.5%, 36.6%, 34%, and 30.1%, respectively.

How Are Mining Stocks Performing at the Start of April 2017?

As of April 4, 2017, the volatilities of New Gold (NGD), Agnico Eagle Mines (AEM), Silver Wheaton (SLW), and Randgold Resources (GOLD) were 51.5%, 35.4%, 61.7%, and 54.1%, respectively.

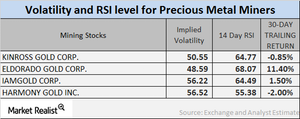

Understanding Mining Stock Volatility in March

Now that mining companies have begun witnessing revivals from their losses earlier this year, it becomes crucial to examine the volatility figures and RSI.

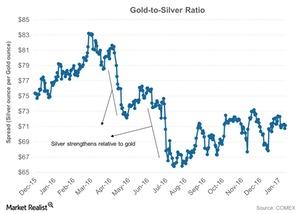

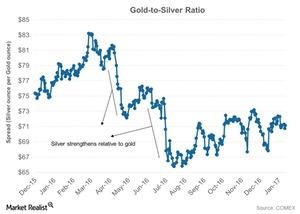

Where Is the Gold-Silver Ratio Headed?

When analyzing the precious metals market, it’s important to take a look at the relationship between gold and silver.

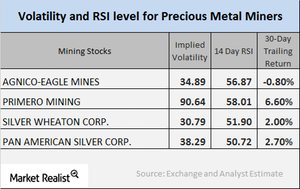

Are Miners Rebounding from Last Week’s Slump?

Monitoring the implied volatilities of large mining stocks is important. We should also watch their RSI (relative strength index) levels, particularly in the wake of changing precious metals prices.

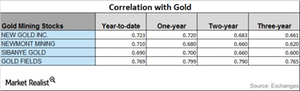

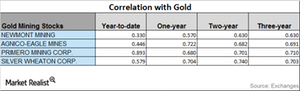

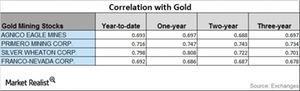

Mining Stocks: An Upward or Downward Correlation to Gold?

Agnico-Eagle Mines has the highest correlation to gold year-to-date. Primero Mining is the least correlated to gold.

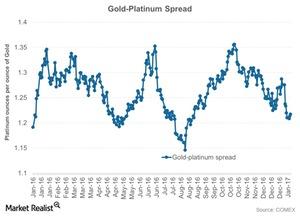

A Look at the Gold-Platinum Ratio

The demand for platinum has been very fragile over the past few years due to concerns about sales of diesel-based vehicles.

Reading the Ups and Downs of the Gold-Silver Spread

The gold-silver spread was trading at 68.5 on February 23, 2017. The spread suggests that it took 68.5 ounces of silver to buy a single ounce of gold.

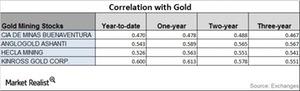

Mining Stocks and Gold Prices: Reading the Correlation

It’s important to understand which mining stocks have overperformed and underperformed precious metals.

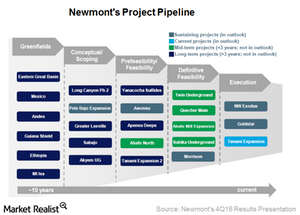

Newmont Mining: How’s the Project Pipeline Looking?

Newmont Mining (NEM) approved funding for its Northwest Exodus project in June 2016, and the project is now under construction.

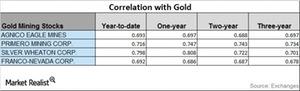

Analyzing the Correlations of Precious Metals Mining Stocks

Mining companies that have high correlations with gold include B2Gold (BTG), Royal Gold (RGLD), Agnico Eagle Mines (AEM), and Primero Mining (PPP).

Inside Gold’s Upward and Downward Correlation Trends

Precious metal prices have risen due to uncertainty since Donald Trump won the US presidential election.

How Are Mining Stocks Reacting in 2017?

The rate hike phenomenon in December 2016 played negatively for precious metals.

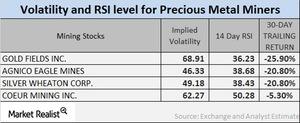

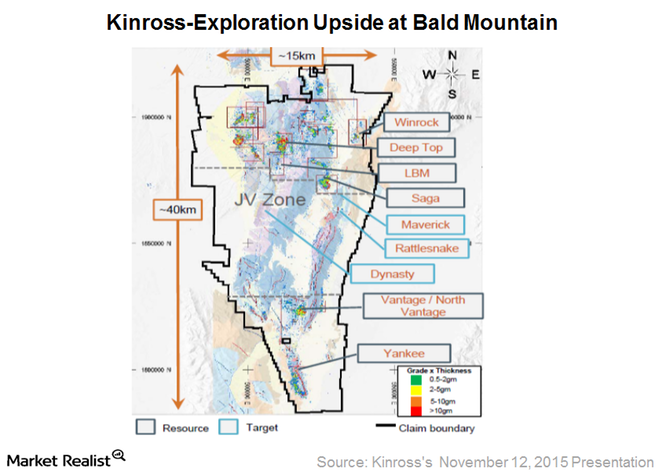

Reading the Volatility and RSI Levels for Miners

Precious metal mining stocks are known to closely track the performance of their respective precious metals. Mining stocks often show more volatility than metals.

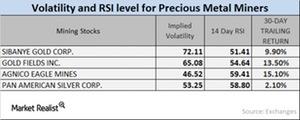

Volatility among the Miners in 2017

Sibanye Gold, Gold Fields, Agnico-Eagle Mines, and Pan American Silver had RSI levels of 51.4, 54.6, 59.4, and 58.8, respectively.

What’s the Correlation between Mining Stocks and Gold?

Mining companies that have high correlations with gold include Agnico Eagle Mines (AEM), Alacer Gold (ASR), Alamos Gold (AGI), and AngloGold Ashanti (AU).

What Are Miners’ Volatility and RSI Levels?

Precious-metal-based funds such as the ProShares Ultra Silver (AGQ) and the Direxion Daily Gold Miners (NUGT) have seen a revival in their price during the last month.

Reading the RSI Levels and Volatilities of Mining Companies

Many of the fluctuations in precious metals have been determined by the Federal Reserve’s interest rate stance. These variations play on precious metals funds.

Fed’s Hawkish Stance: Why It Impacted Precious Metals

Last week was rough for precious metals. Gold, silver, platinum, and palladium all fell. Gold had the biggest weekly fall in about three years.

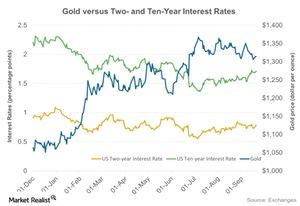

How Bald Mountain Is a Positive for Kinross Gold

Kinross Gold (KGC) acquired 100% of the Bald Mountain gold mine and the remaining 50% of the Round Mountain gold mine in Nevada from Barrick Gold (ABX) in November 2015.

Why Mining Stocks Are Rising post-Brexit

Friday was important. Gold rose to a two-year high due to additional haven bids on the Brexit referendum.

How Much Can Brexit Affect the Precious Metals?

Brexit could send jitters around the globe, and investors may jump to safe-haven assets such as gold and silver, which have risen 21.2% and 25.6%, respectively, on a YTD (year-to-date) basis.

Why Have Newmont and Agnico Outperformed?

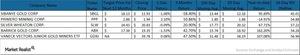

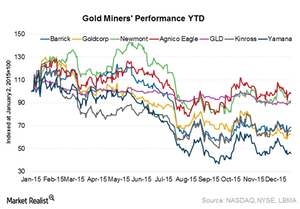

In this series, we’ll look at various factors that are affecting gold miners like Barrick Gold, Newmont Mining, Goldcorp, Yamana Gold, Agnico Eagle Mines, and Kinross Gold.

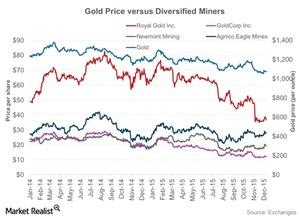

How Gold Prices Impact Diversified Miners

The term “diversified miners” refers to mining companies that are not into streamlined gold or silver mining, but also mine base metals.

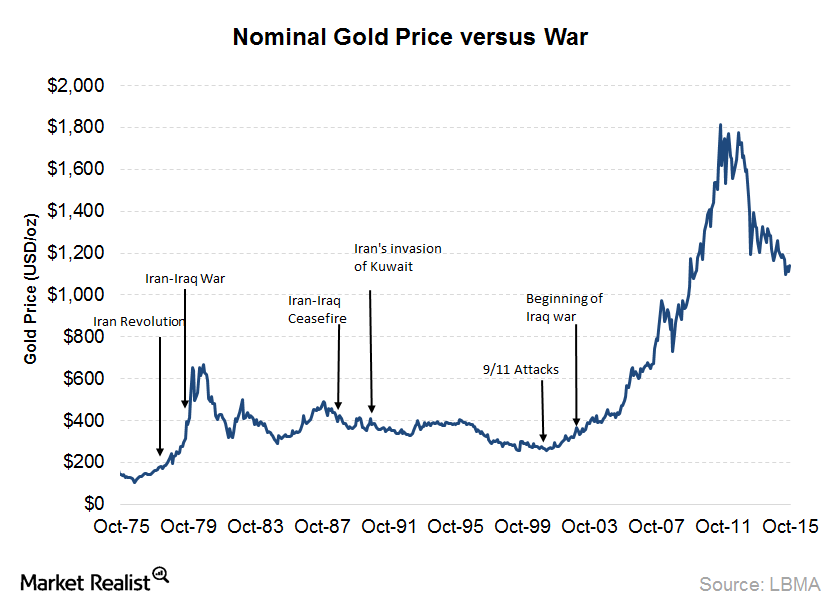

How the Threat of War Affects Gold Prices

Gold’s safe haven appeal might lead investors to gold and other precious metals in terms of heightened geopolitical tensions and war.

Why the Strong US Dollar Outlook Means Pressure for Gold Prices

Tracked by the Federal Reserve, the weekly US Dollar Index (UUP) measures the value of the dollar compared to its six significant trading partners.

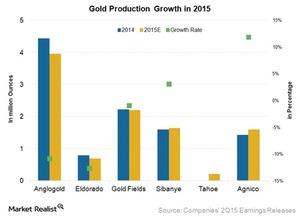

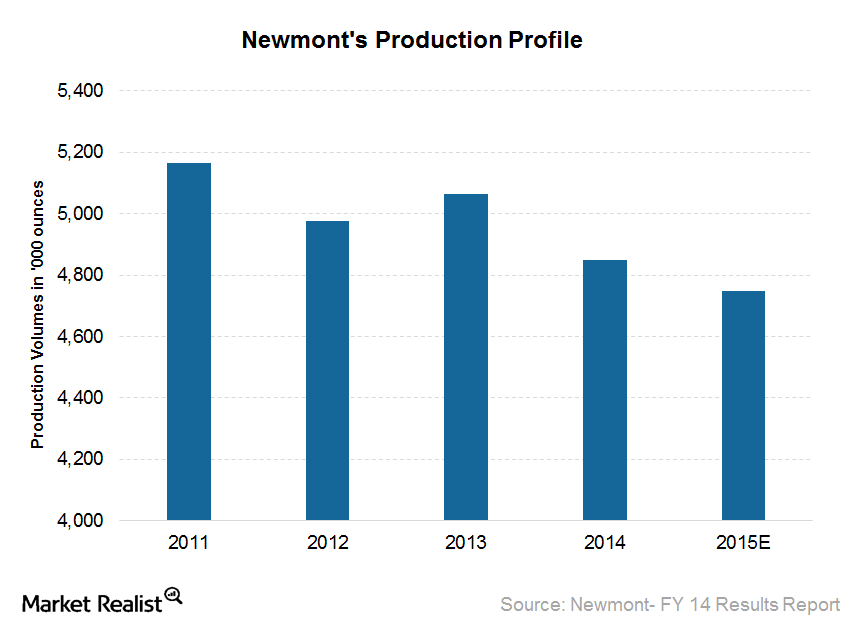

Why Growth in Gold Production Is Important for Gold Miners

Future gold production growth is important because the gold market is forward-looking, making future gold production a key driver of gold miners’ revenue.

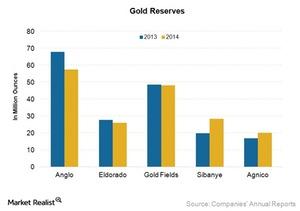

Assessing the Importance of Gold Reserves for Future Growth

Gold reserve growth is a key revenue driver for miners. It’s thus important for gold miners to continue replacing every ounce of gold they produce and sell.

Did Strong Data Push Gold Prices South?

Gold prices don’t seem to have caught up with interest rate expectations, which have gone from 1.5% at the start of the year to about 0.5% today. The loosening monetary policy has probably worked in favor of gold.

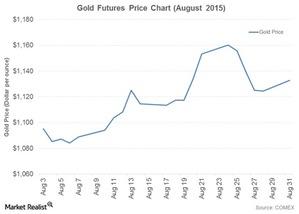

Gold Is Resilient to the Fed’s Likely Questionable Liftoff Move

With the confusing reviews from the Fed on Wednesday, gold on COMEX rose 2.20% on August 20 and closed at $1,153.20 per ounce. Silver for September expiry also rose.

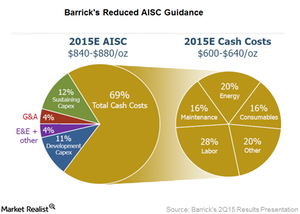

Current Gold Prices Push Barrick Gold to Go for a Leaner Look

Barrick Gold (ABX) is focused on reducing operating expenses. The company’s all-in sustaining costs to produce gold in 2Q15 totaled $895 per ounce. In 1Q15, costs came in at $927 per ounce.

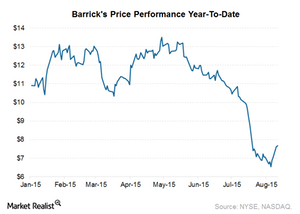

Investors Are Excited about Barrick Gold’s 2Q15 Results, but Why?

In this series, we’ll analyze Barrick Gold’s 2Q15 results. Barrick stock reacted positively to its earnings report, its improved cost guidance, and its progress toward reducing its debt.

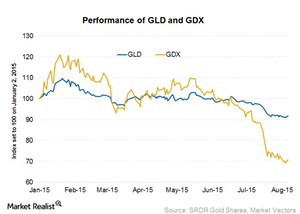

Key Indicators Are Pointing to Gold Prices

Gold prices have been steadily falling since the last week of June. As of August 11, gold prices (GLD) have fallen by 4.40% in a month.

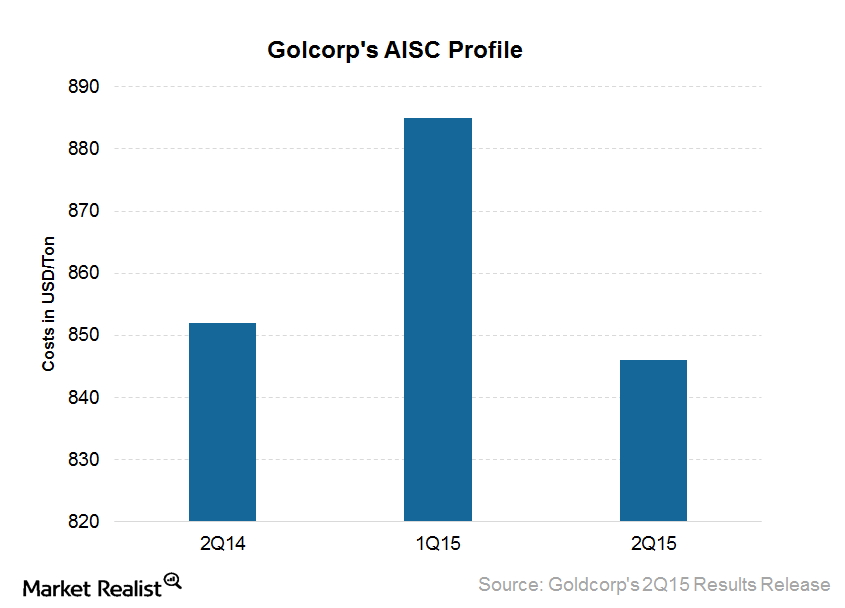

Improved Cost Outlook Bodes Well for Goldcorp’s Future

Goldcorp reported a strong reduction in all-in sustaining costs (or AISC) for 2Q15. AISC came in at $846 per ounce, compared with $885 per ounce in 1Q15 and $852 in 2Q14.

What Were Newmont’s Key Events Since Its Last Earnings Release?

Investors should be aware of two key events for Newmont Mining (NEM): the go ahead for Long Canyon Phase 1 and the renewal of the contract at Batu Hijau.

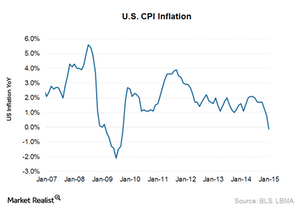

US CPI Inflation Sees Marginal Uptick in February

Gold usually has a direct relationship to inflation. Gold demand increases during periods of high inflation and falls when inflation is low.

US inflation rate hits negative for the first time since 2009

The US Consumer Price Index reading for the month of January was -0.1%. This is the first negative US inflation reading since October 2009.