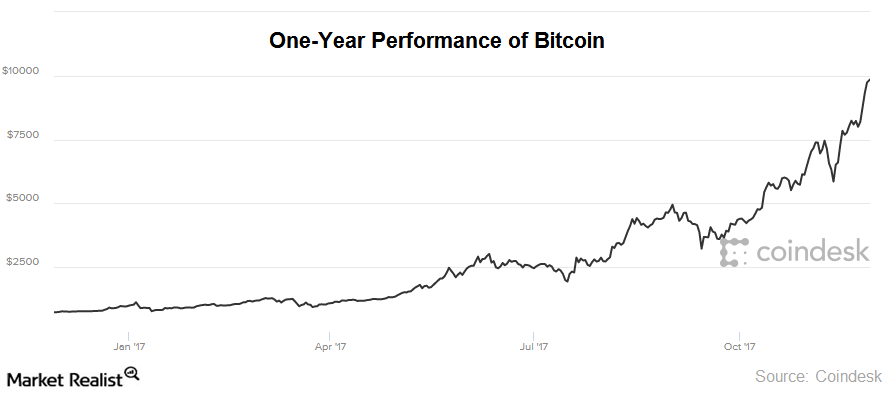

Why Gorman Doesn’t Think Bitcoin Deserves So Much Attention

James Gorman thinks that investment in bitcoin could be risky.

The latest on hedge funds, exchange traded funds (ETFs), mutual funds and top fund managers like Cathie Wood's Ark Invest.

© Copyright 2026 Market Realist. Market Realist is a registered trademark. All Rights Reserved. People may receive compensation for some links to products and services on this website. Offers may be subject to change without notice.