Robert Karr

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Robert Karr

Prospect Capital’s Higher Leverage Could Impact Returns in 2017

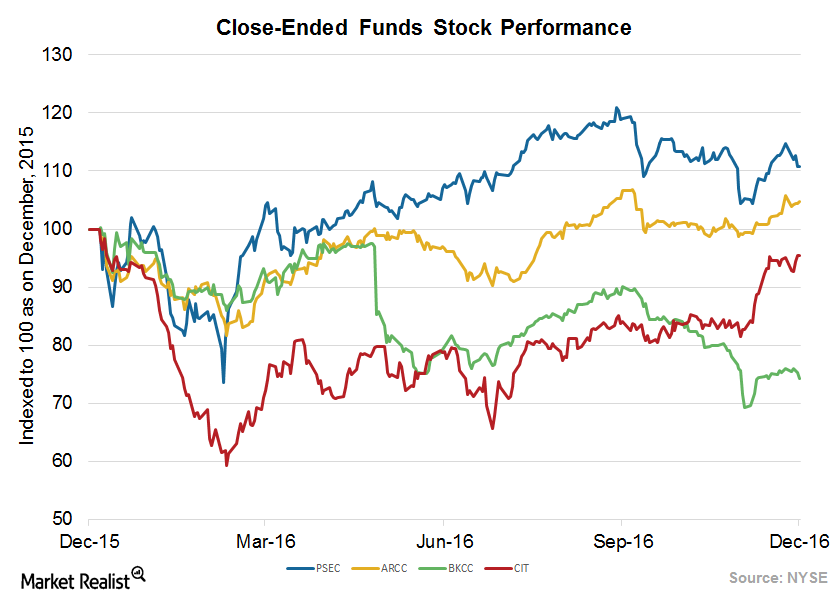

Since the Fed increased interest rates in December 2016, Prospect Capital (PSEC) could see some pressure on its cost of capital in 2017.

Prospect Capital’s Performance to Rise Marginally in 2017

In this series, we’ll look at Prospect Capital’s expected performance, deployments, portfolio strategy, yields, balance sheet strength, dividends, and valuations.

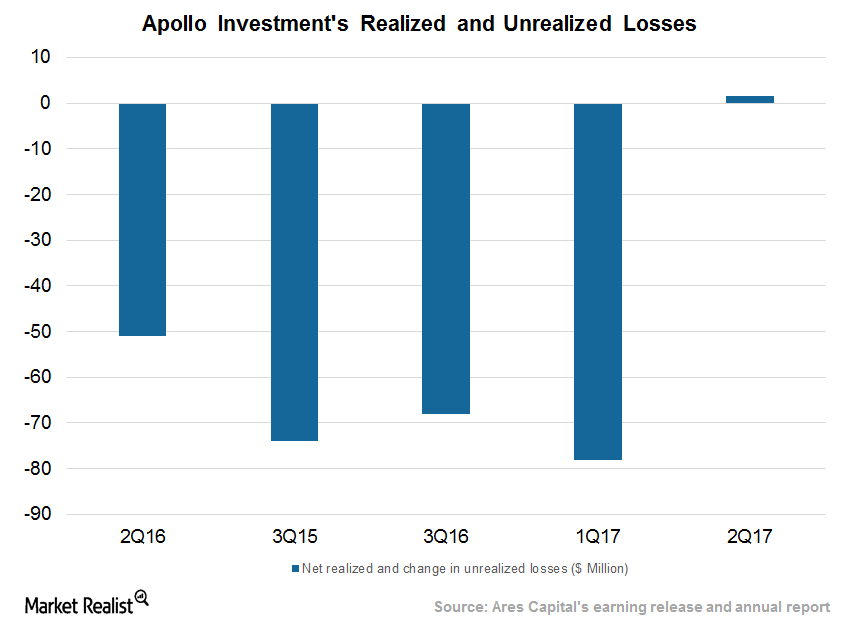

Apollo Investments Sees Gains and Reversal on Portfolio

Apollo Investment’s (AINV) realized and unrealized gains stood at $1.6 million in fiscal 2Q17 compared to realized losses of $42.6 million in fiscal 1Q16.

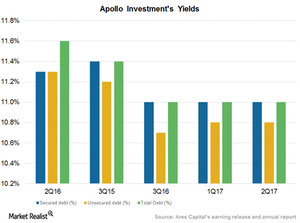

Apollo Investment’s Yields Stabilize, Reduced Exposure in Energy

At the end of fiscal 2Q17, Apollo Investment’s (AINV) oil and gas investments represented 9.7% of its total portfolio, or $246 million.

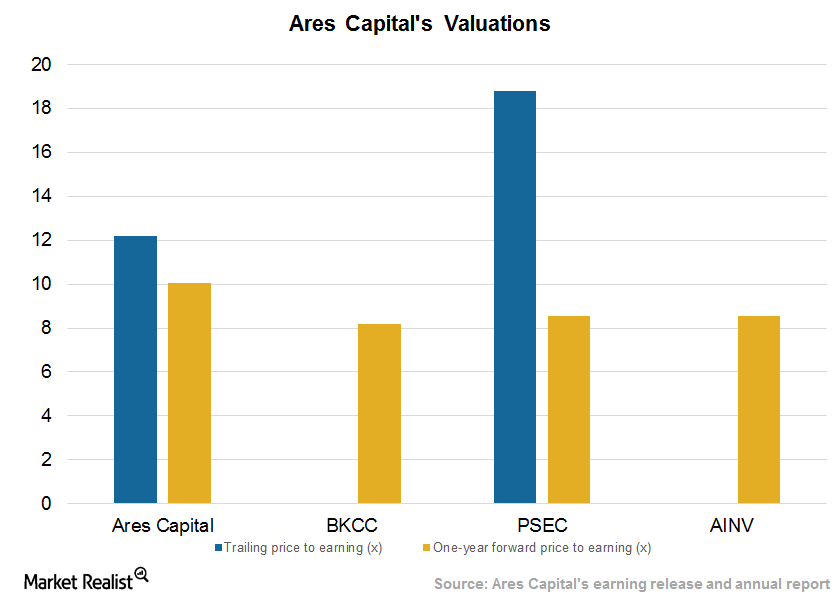

AINV’s Valuation Fair, Stock Can Rise on Earnings Surprise

Currently, Apollo Investment (AINV) is trading at 8.5x on a one-year forward earnings basis. Its peers are trading at 8.8x.

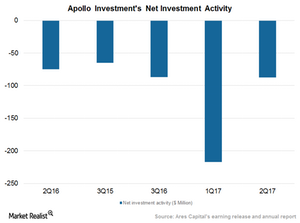

Apollo Investment’s Net Exits Trend Expected to Reverse in 2017

Apollo Investment’s (AINV) total portfolio stood at ~$2.6 billion in fiscal 2Q17 compared to ~$3.2 billion in fiscal 2Q16.

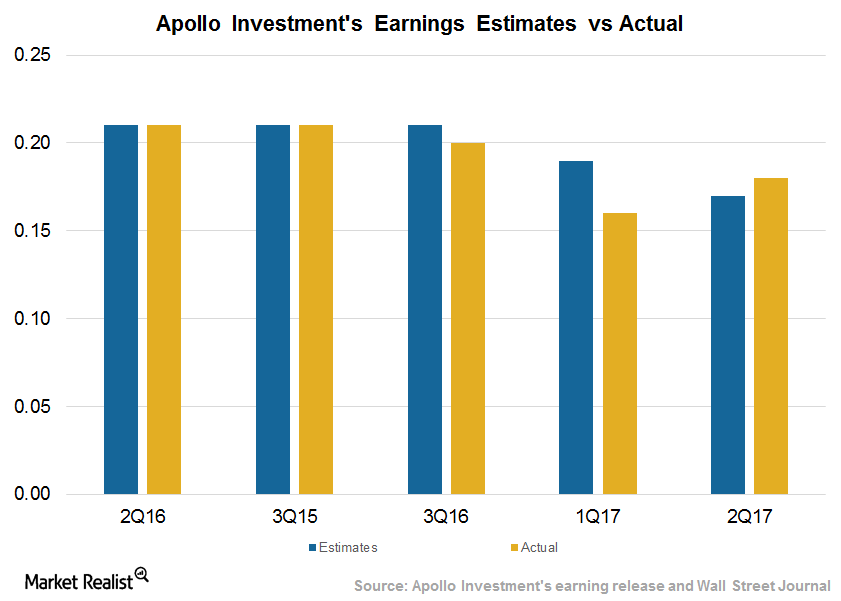

Apollo Investment Improved Bottom Line on Select Investments

Apollo Investment (AINV) posted earnings per share of $0.18 in fiscal 2Q17, compared to analyst estimates of $0.17. In this series, we’ll study AINV’s performance, yields, capital deployment, portfolio, dividends, and valuations.

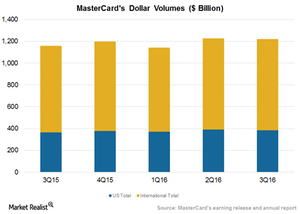

Will Payment Processors Keep Seeing the US Dollar Impact in 2017?

Payment processors are now seeing improved performances on increased spending, new technologies, expansion into global markets, and the stable US dollar.

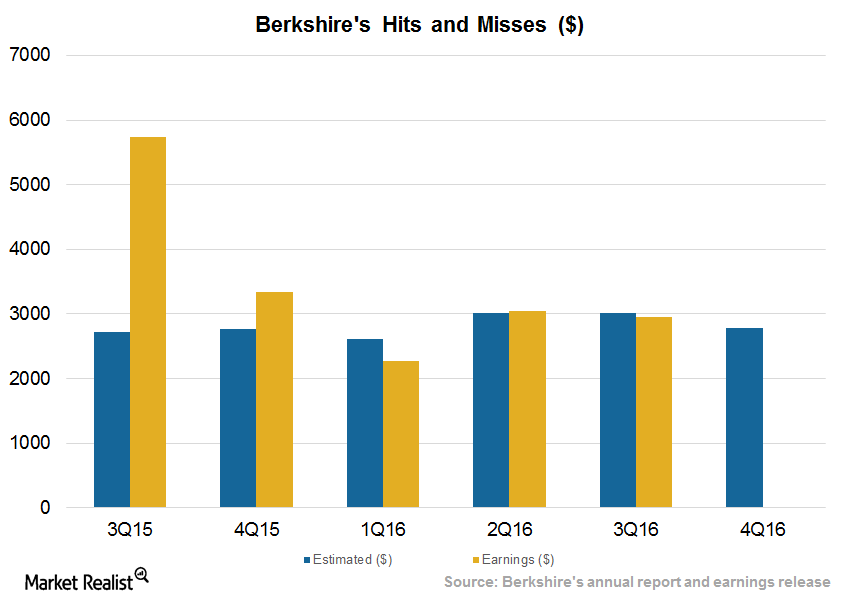

What to Expect from Berkshire Hathaway’s Earnings

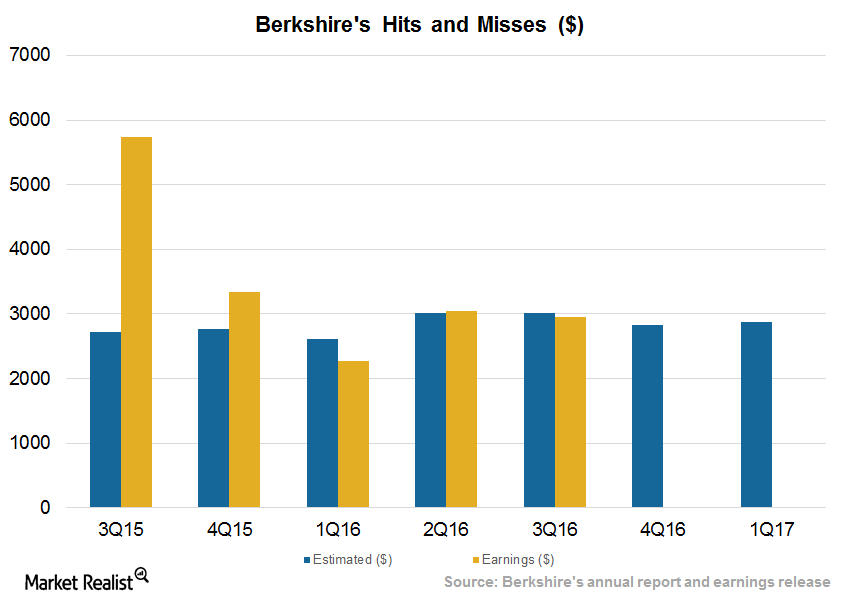

Berkshire Hathaway (BRK-B) is expected to post EPS (earnings per share) of $2,829 per share in 4Q16 and $2,880 in 1Q17.

Blackstone and KKR Deployments Rise in 2016 on Valuations

Blackstone Group (BX), the world’s largest alternative manager, invested $2.9 billion during the September 2016 quarter.

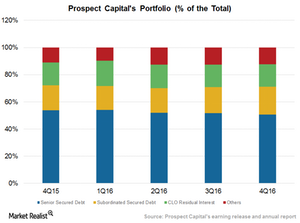

Apollo, BlackRock Target Less Risk, Unlike Ares, Prospect

Over the past few years, closed-end funds (PSP) have deployed funds in middle market companies with better credit ratings.

Closed-End Funds Are Affected by Originations, Rates

Closed-end managers deploy money in middle market companies engaged in businesses across sectors by raising capital through share issuances.

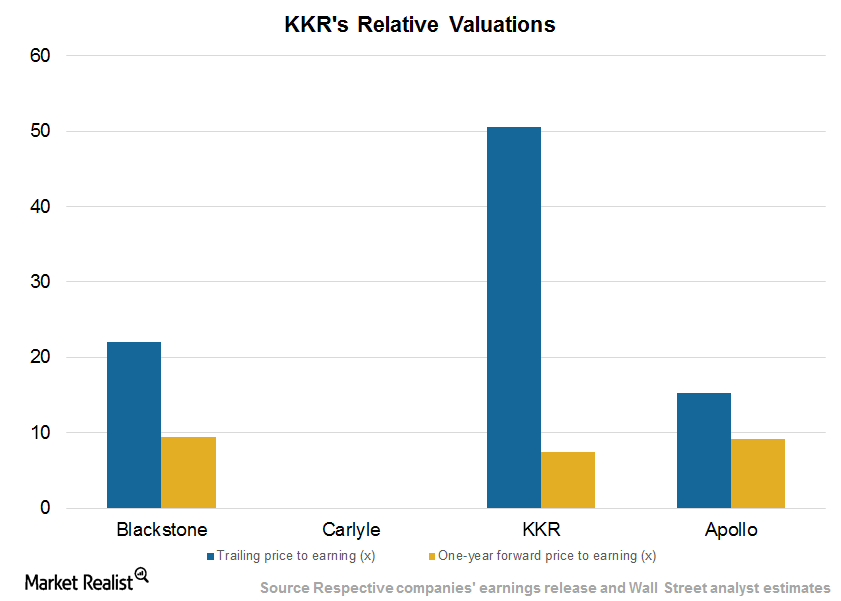

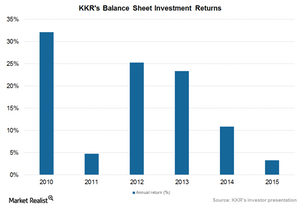

KKR Valuations Fair amid Volatile Performance and Capital Raises

KKR & Company (KKR) expects to post EPS (earnings per share) of $0.41 in 3Q16, reflecting a subdued performance compared to its 3Q15 numbers.

KKR Maintains Dividends, Continues with Repurchases in 3Q

As of October 2016, KKR has bought back 31.5 million common units for $457 million of its announced $500 million share repurchase program in December 2015.

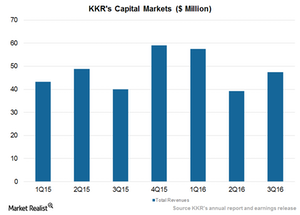

KKR Capital Markets Manages Higher Revenues on Deal Making

KKR’s Capital Markets and Principal Activities segment saw revenues of $47 million in 3Q16, as compared to $40 million in 3Q15 and $39 million in 2Q16.

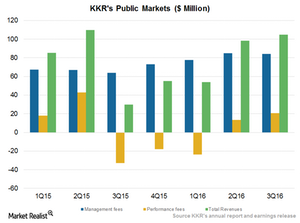

KKR Public Markets’ Performance Rises on Improved Credit Pricing

In 3Q16, KKR’s Public Markets segment reported total revenues of $84 million in 3Q16, as compared to $64 million in 3Q15.

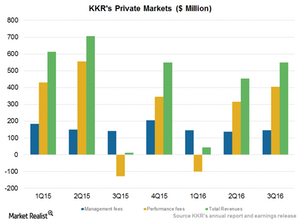

KKR Private Markets Segment Rises on Performance Fees in 3Q

In 3Q16, KKR’s Private Markets segment reported revenues of $549 million in 3Q16, as compared to $12 million in 3Q15 and $453 million in 2Q16.

E*TRADE Bank Saw Continued Expansion, Supported Broking

E*TRADE’s bank offers its clients FDIC insurance on a certain amount of deposits. It deploys funds primarily in low-risk securities.

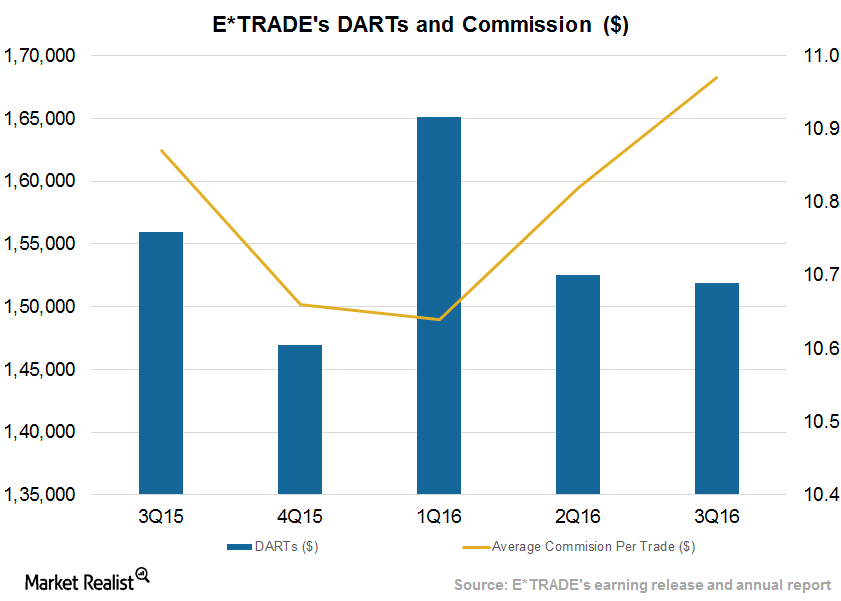

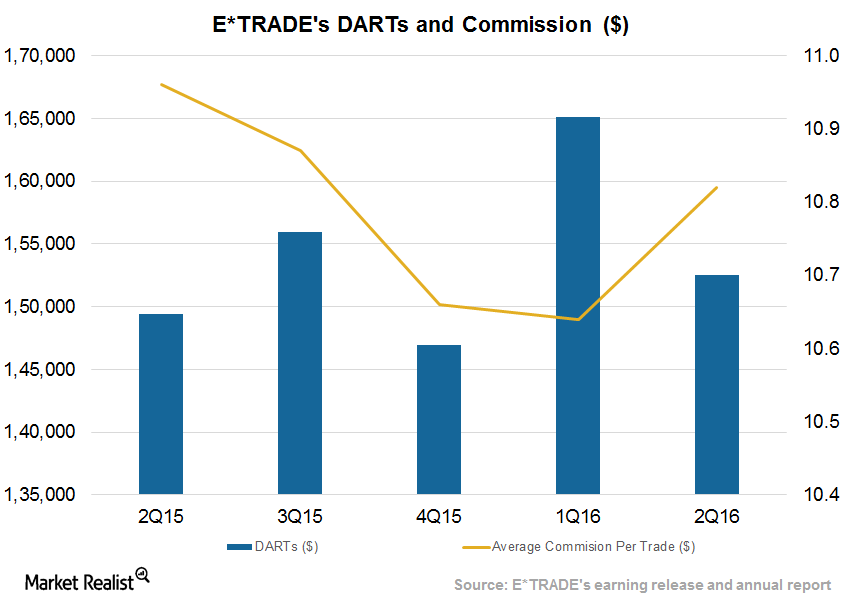

E*TRADE Saw Subdued DARTs amid Mixed Volatility in 3Q16

E*TRADE Financial reported DARTs (daily average revenue trades) of ~151,905 during 3Q16. It included 6,500 DARTs from the OptionsHouse acquisition.

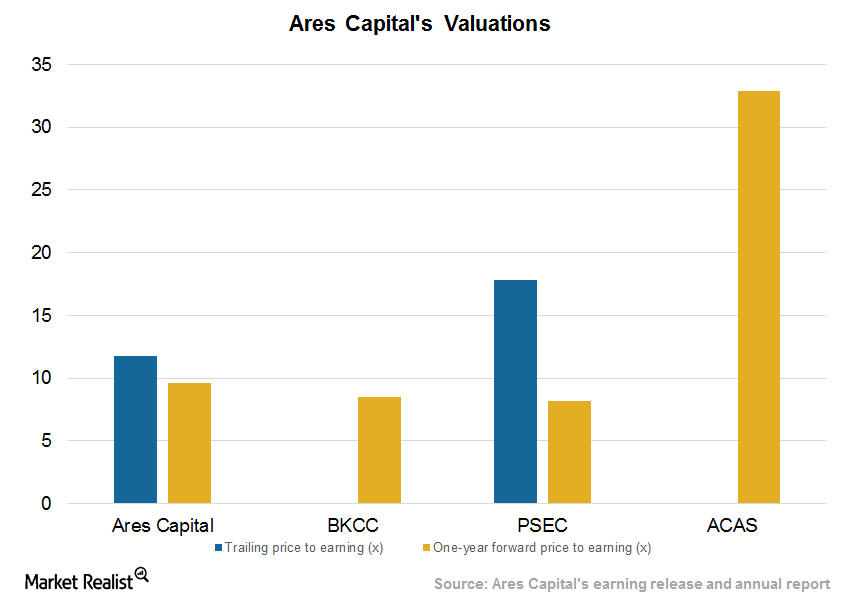

Ares Capital Stock and Valuations Rise on Strong Performance

Ares Capital (ARCC) stock has risen ~1.6% over the past six months. The company saw a strong performance in 3Q16 on higher deployment, yields, and lower expenses.

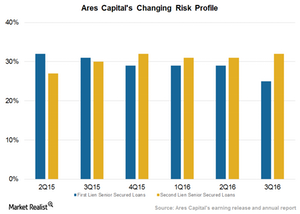

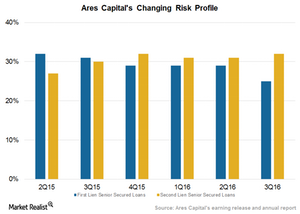

Ares Capital Second Lien Preference Evident in Portfolio Changes

Ares Capital (ARCC) has consistently enhanced its exposure to second lien debt in a bid to generate higher yields.

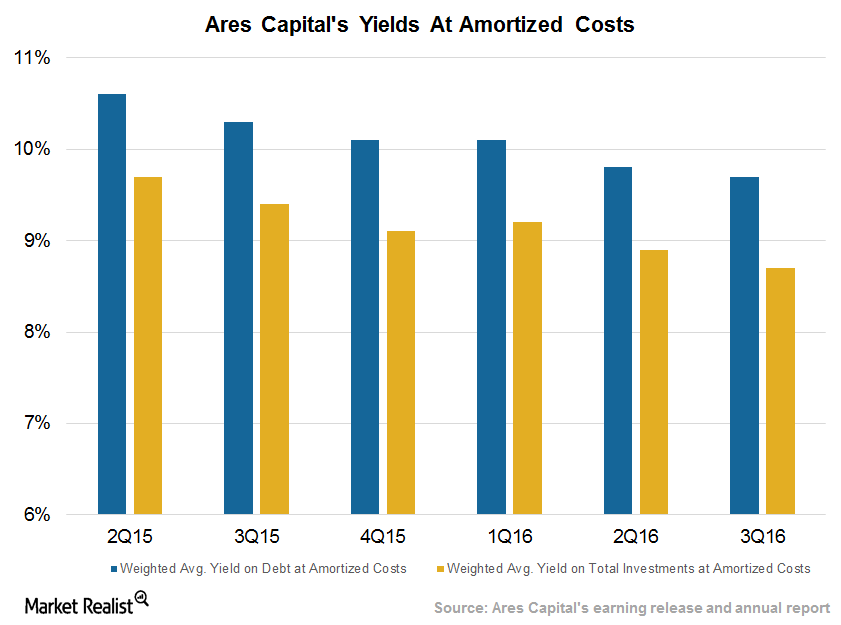

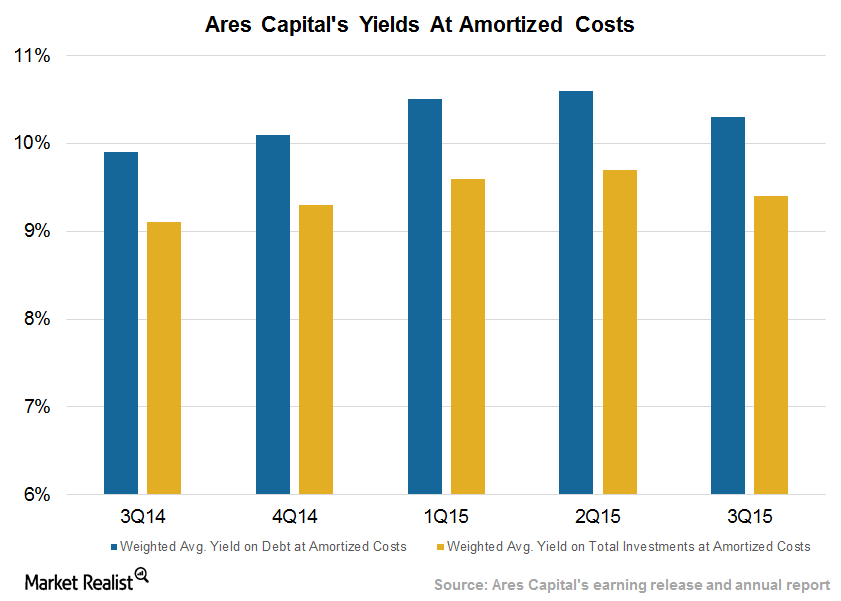

Ares Capital’s Yields and Credit Statistics Fell in 3Q16

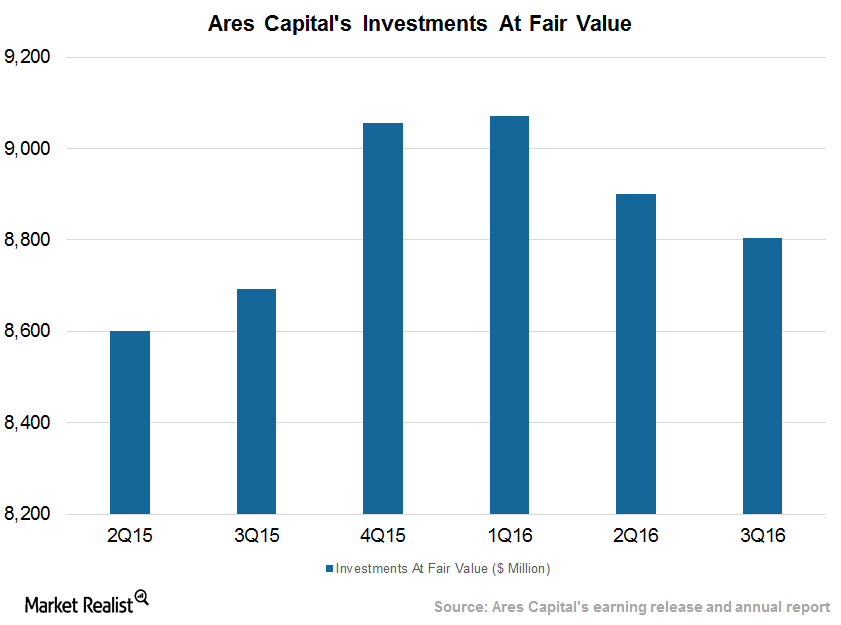

Ares Capital’s (ARCC) portfolio totaled $8.8 billion at fair value as of September 30, 2016.

Ares Capital Enhances Originations in 3Q16

By the end of September 2016, Ares Capital (ARCC) had a diversified portfolio of 215 companies totaling $8.8 billion at fair value.

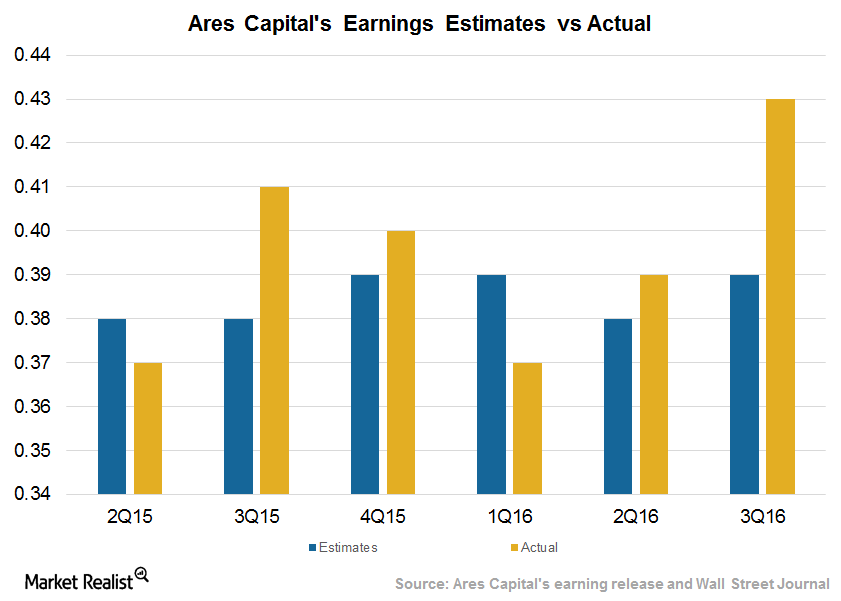

Ares Capital’s Performance Improves amid ACAS Acquisition News

Ares Capital (ARCC) posted EPS (earnings per share) of $0.43, beating Wall Street analysts’ estimate of $0.39 in 3Q16.

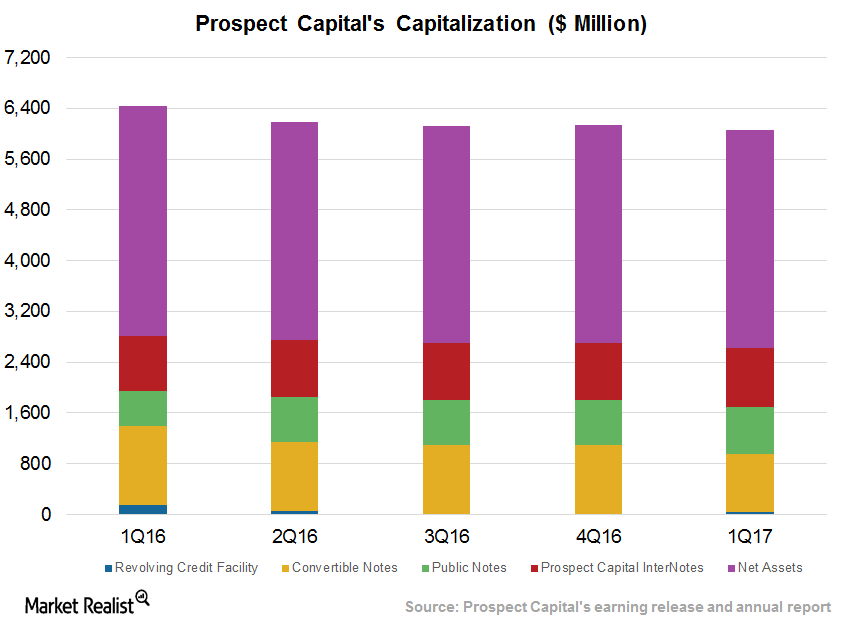

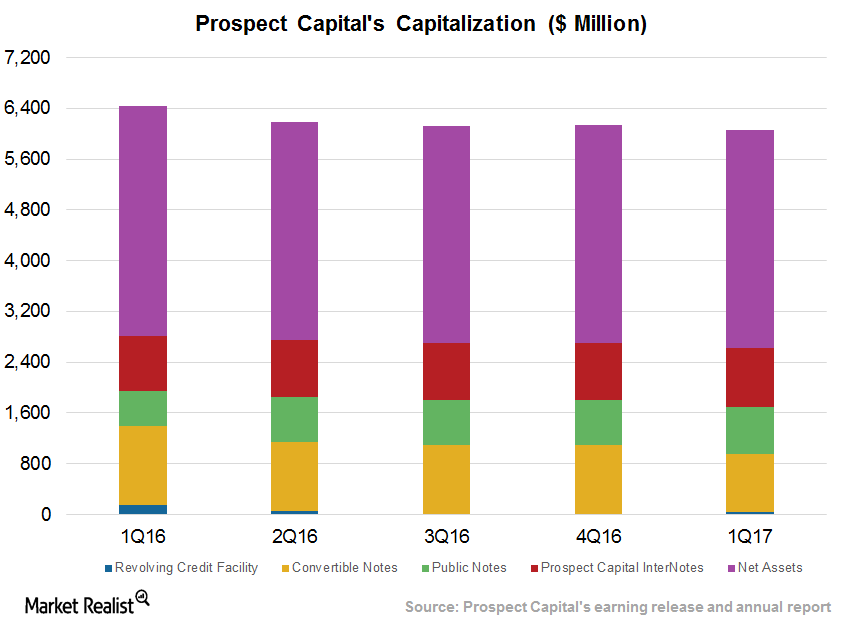

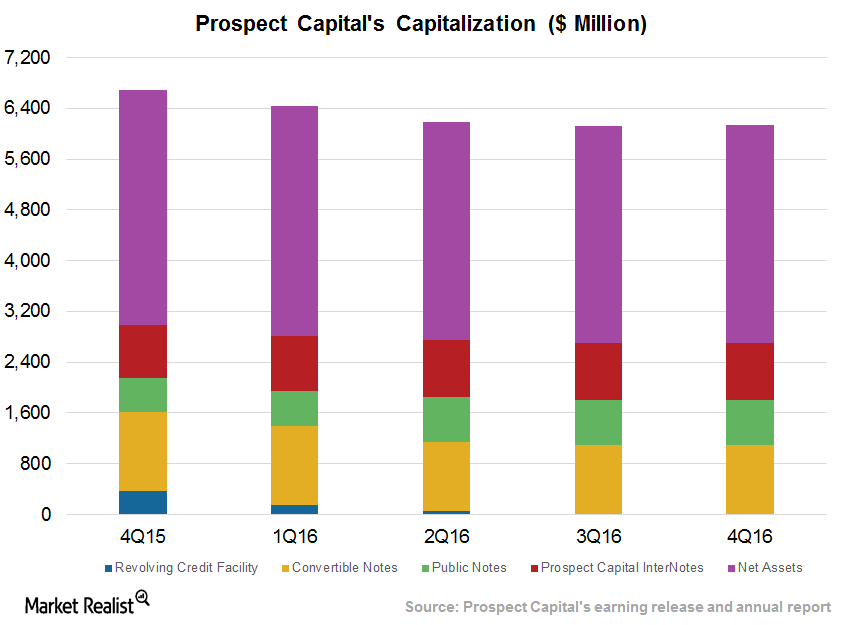

Prospect’s Leverage Rises on Higher Origination in Fiscal 1Q17

Prospect Capital has been operating at higher leverage to take advantage of low rates. But the Fed is expected to raise interest rates in calendar 4Q16.

Buffett’s Berkshire Misses Estimates amid Volatile Environment

Berkshire Hathaway reported its third quarter earnings on November 5, 2016. The company missed analysts’ operating earnings per share estimates of $3,022 with reported EPS of $2,951.

PSEC Reduces Leverage amid Low Originations, Potential Rate Hike

Prospect Capital (PSEC) has used the low interest rate environment to its advantage by deploying higher leverage over the past couple of years.

Prospect Could See Higher Originations in Fiscal 1Q17

In fiscal 4Q16, Prospect Capital (PSEC) made $294 million in investments, a substantial rise compared to its investments of $23 million in fiscal 3Q16.

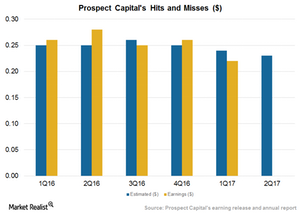

What to Expect of Prospect Capital’s Earnings in Fiscal 1Q17

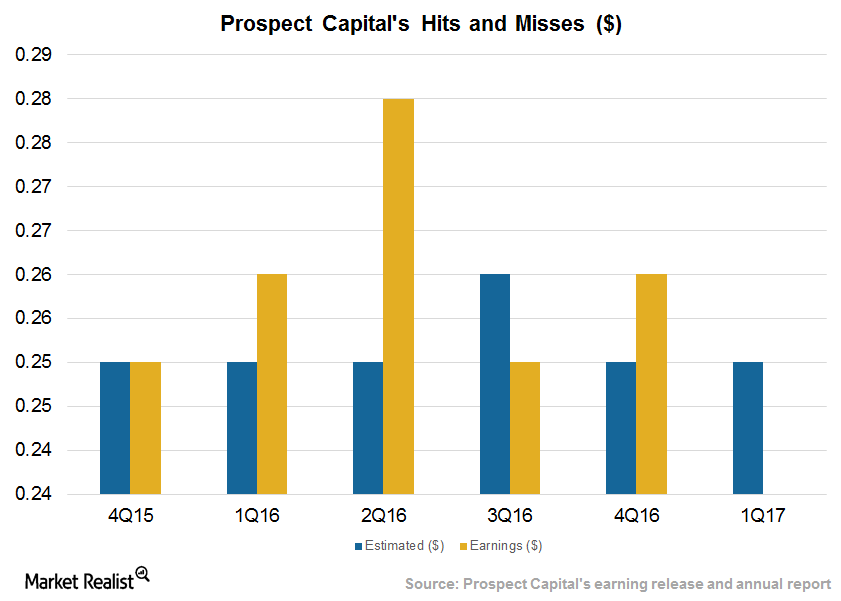

Prospect Capital (PSEC) is expected to post earnings per share (or EPS) of $0.24 in fiscal 1Q17, a fall of $0.01 compared to estimates.

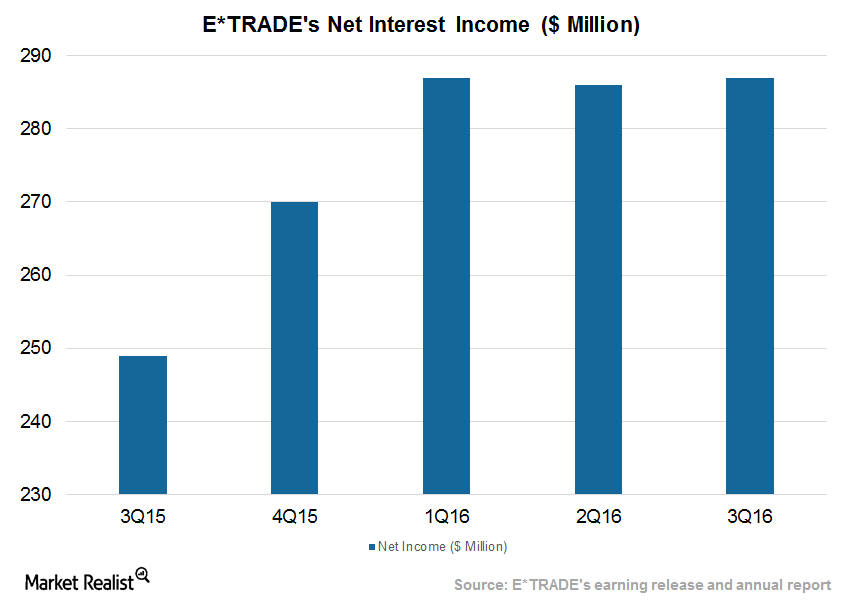

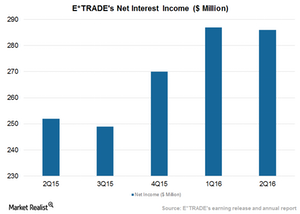

Assets, Rates to Have Pushed E*TRADE’s Bank Revenues Higher in 3Q16

E*TRADE Financial (ETFC) operates the federally chartered savings bank E*TRADE Bank. This structure has been deployed by many major brokers in the US.

How Volatility Affects E*TRADE’s DARTs

E*TRADE Financial reported DARTs (daily average revenue trades) of ~153,000 in 2Q16. The company’s DARTs fell 8% from the previous quarter and rose 2% YoY.

Alternatives Are Sitting on Record Capital, Making Investments

In 2015, fund managers took advantage of lower valuations and the availability of a record dry powder in order to make fresh investments at lower valuations.

International Use to Boost Visa’s Fiscal 4Q16 Processed Transactions

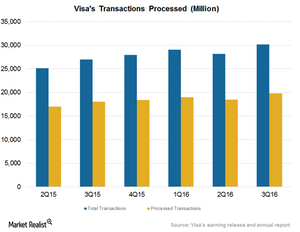

Visa (V) reported total transactions of $30.2 billion in fiscal 3Q16, compared to $27 billion in fiscal 3Q15—a growth of 11.8% year-over-year.

PNC Financials’ Non-Interest Income Ratio Continues to Expand

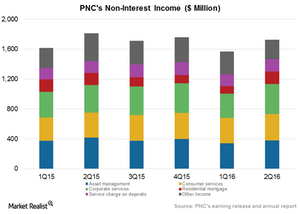

PNC Financial’s non-interest income for 2Q16 increased by 10% over the previous quarter, mainly due to higher fee income growth.

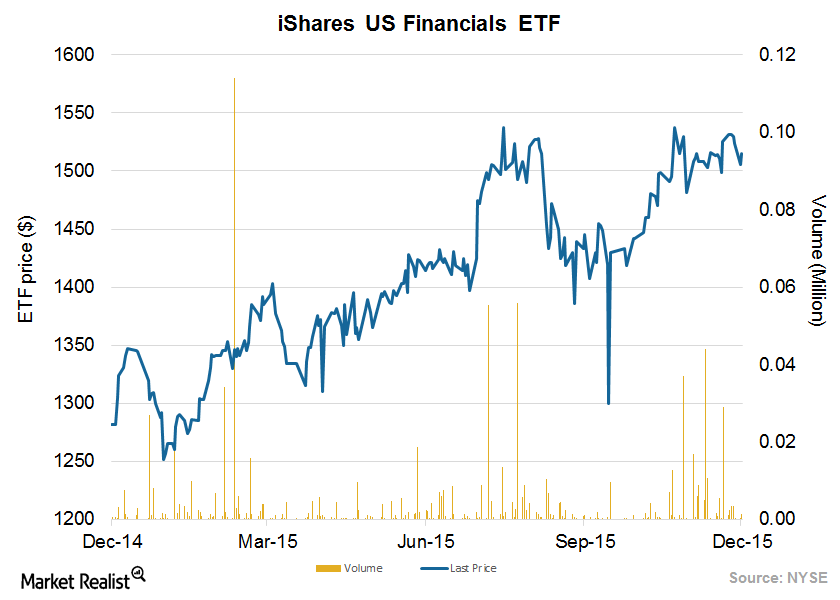

Rising Interest Rates, Banks, and Insurance Companies

Banking stocks are expected to benefit from higher interest rates, but not immediately. Also, rising interest rates would be countered by higher existing liquidity.

American Express Is Focusing on Its Global Commercial Services

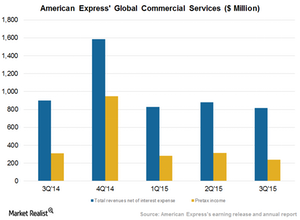

American Express’s Global Commercial Services’ total revenues net of interest expense fell by 9% to $817 million in 3Q15, forming 10% of its total revenues.

Ares Capital’s 3Q15 Investment Performance, Senior Secured Loans

Ares Capital’s (ARCC) portfolio totaled $8.7 billion at fair value as of September 30, 2015. Its total assets stood at $9.2 billion.

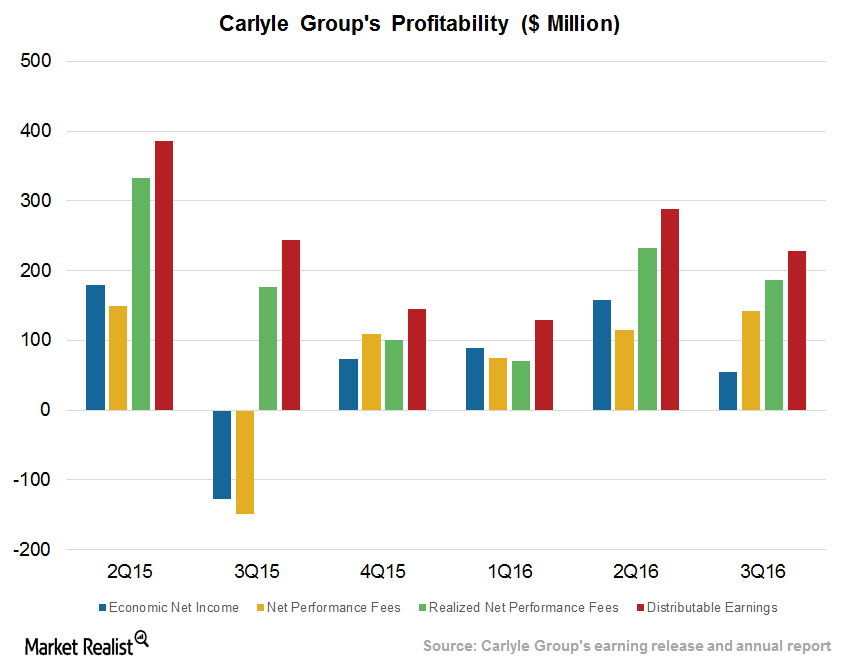

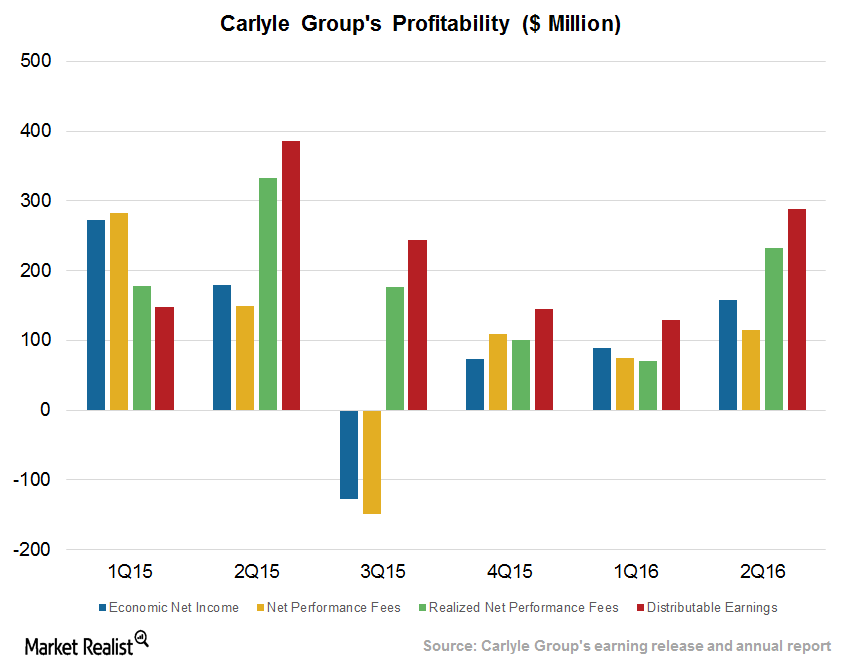

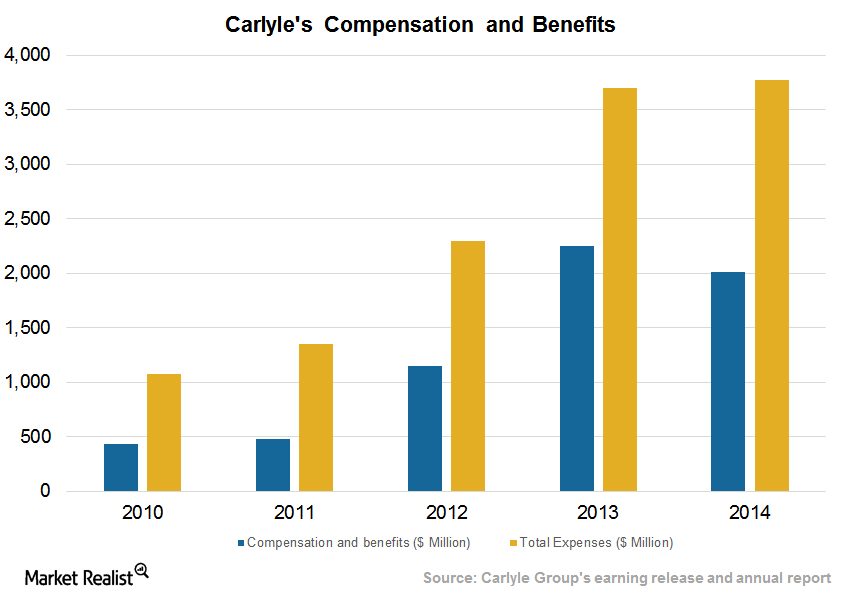

The Carlyle Group Provides Healthy Compensation to Retain Talent

The Carlyle Group’s (CG) private equity business derives value from the effective management of its operating companies as well as the returns generated for its unitholders or limited partners.

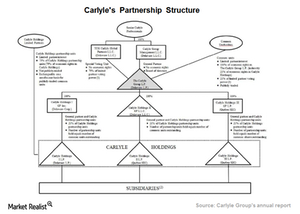

Understanding the Carlyle Group Partnership Structure

The Carlyle Group (CG) raises funds and investment commitments using a partnership structure, also known as an investment vehicle.

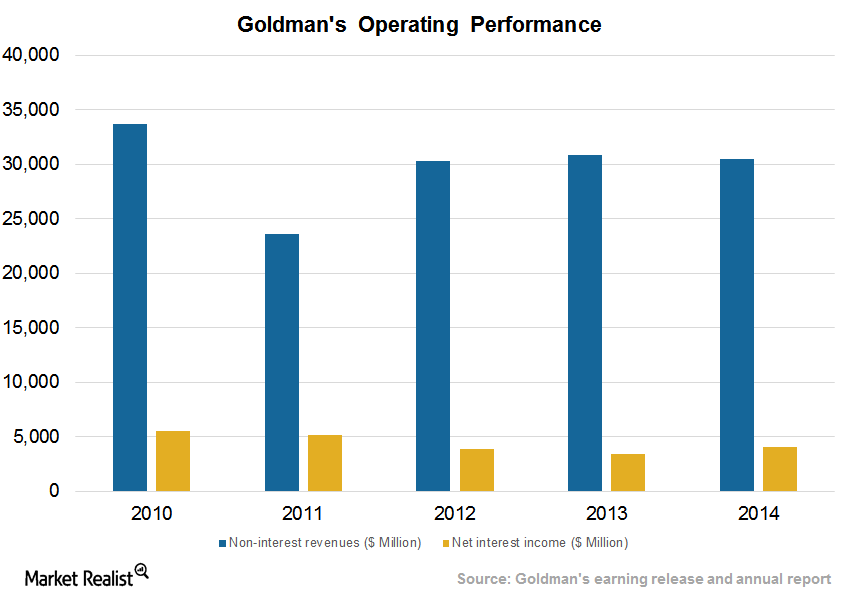

Goldman Sachs’ Revenue Model

Goldman Sachs engages in asset management, investment banking, wealth management, institutional sales, and trading activities across asset classes as well as regions.

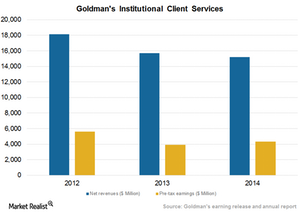

Goldman Sachs’ Institutional Client Services Posts Highest Profit

Goldman Sachs’ major services in the division include offerings related to interest rate products, credit products, mortgages, currencies, and commodities.

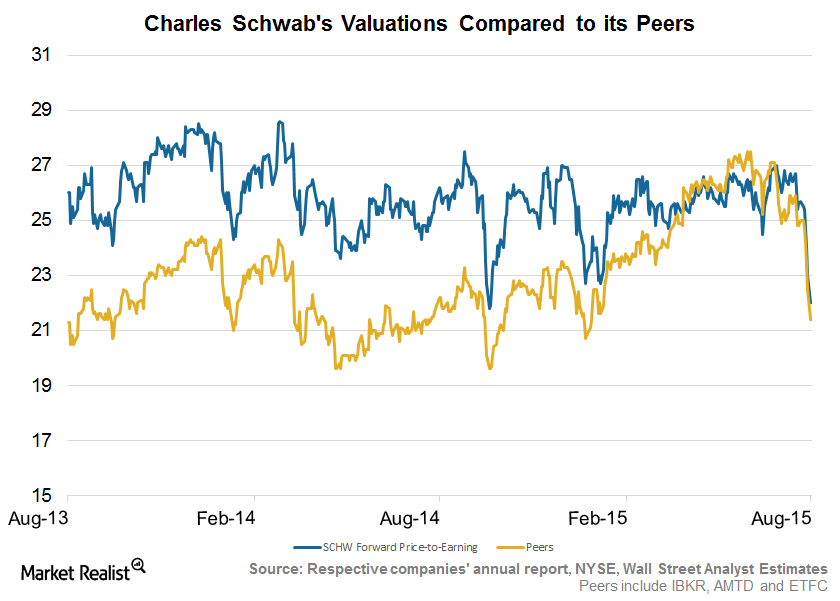

Charles Schwab Trading at Multiyear Low Valuations

Charles Schwab’s valuations declined significantly over the past month mainly due to macro factors such as China’s slowing economy and a weaker domestic economy.

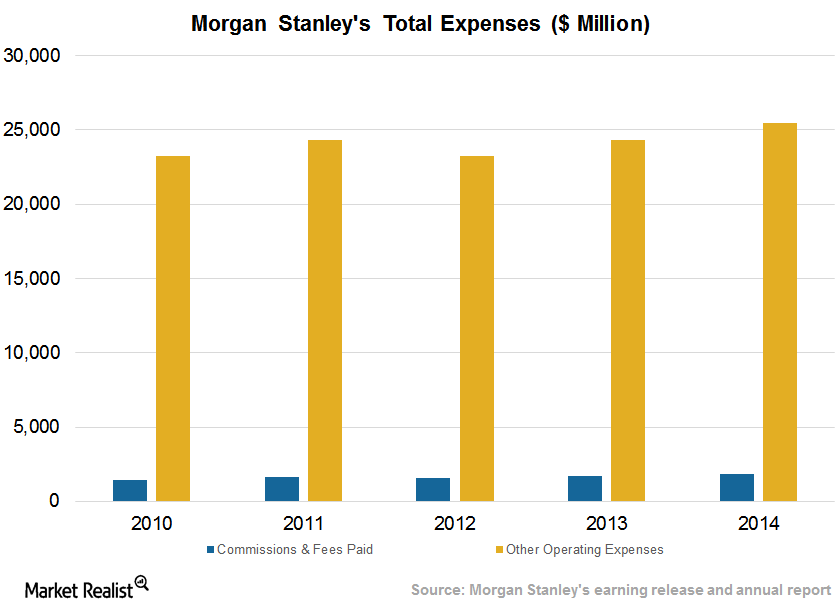

Morgan Stanley’s Careful Attention to Compensation Expenses

Morgan Stanley divides its non-interest expenses into compensation and non-compensation. It’s compensation expenses (and benefits) are ~80% of this class.

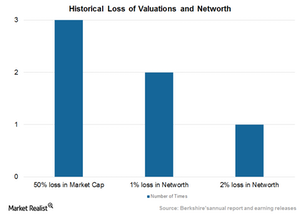

Warren Buffet’s 50-Year Vision for Berkshire Hathaway

Berkshire Hathaway has doubled its earnings and balance sheet potential since the financial crisis of 2007.

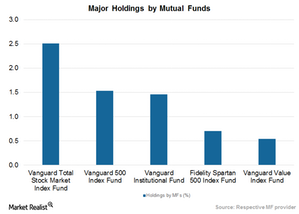

Mutual Funds Own 18% of Berkshire Hathaway

Major mutual funds prefer Berkshire Hathaway (BRK-B) over private equity firms and asset managers like Blackstone (BX) and BlackRock (BLK).

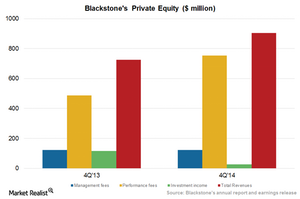

Blackstone’s Dominant Performance in Private Equity Space

Blackstone (BX) generated revenues of $2.7 billion and economic income of $1.8 billion for the year, backed by strong performance of BCP V and BCP VI.

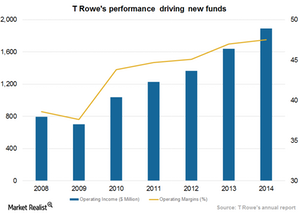

T. Rowe Price Group: It Takes Seed Capital to Build New Funds

The length of time seed capital is held in a portfolio depends on various factors such as how long it takes to generate cash flow from unrelated investors.

KKR Capstone: An institutionalized process of creating value

KKR has institutionalized the process of creating value in its portfolio companies through KKR Capstone.

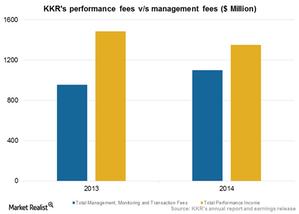

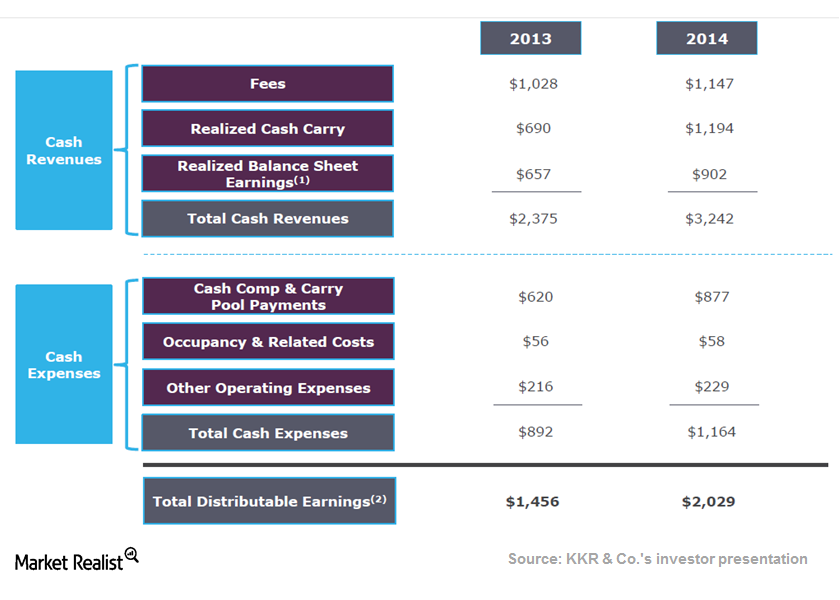

What does KKR’s revenue model look like?

KKR has a diverse revenue model, making fees for providing investment management to its funds, investment vehicles, managed accounts, and finance companies.

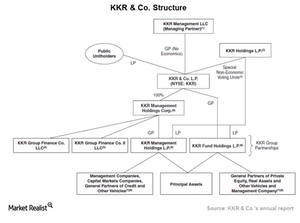

How KKR structures its investment vehicles

KKR structures its investment vehicles as a partnership or combination of domestic and overseas partnerships that contribute capital toward the fund.