Brent Nyitray, CFA, MBA

Brent Nyitray has 18+ years of experience in the investment industry, primarily focused on the Real Estate Sector at a variety of hedge funds, including Elliot Management and Dellacamera Capital Management. Until 2004, Brent was a Managing Director at Bear Stearns, responsible for the European Risk Arbitrage trading desk in London. Brent earned an MBA in 1994 from the Simon Graduate School of Business with a 3.9 GPA. He was formerly a US Naval Officer.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Brent Nyitray, CFA, MBA

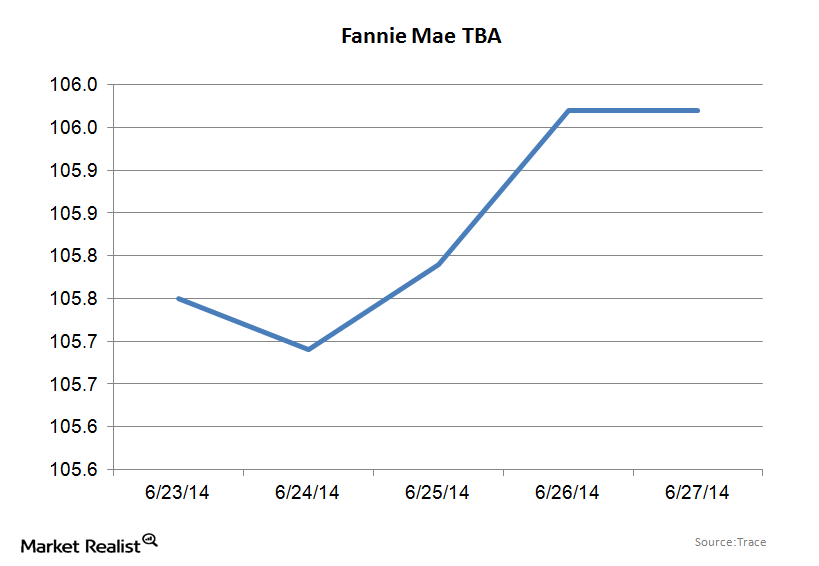

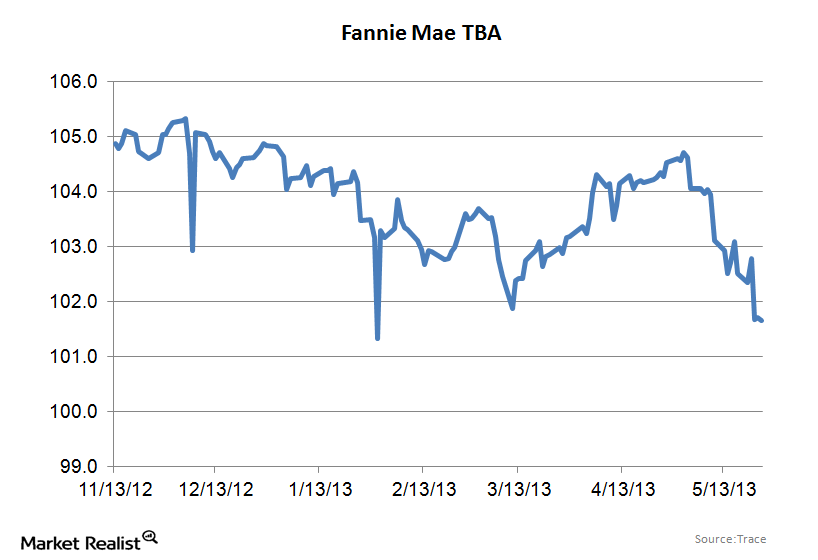

Why Fannie Mae securities rallied with bonds about 1/4

The main action driving TBAs specifically seems to be out of Washington, between the Fed purchases and the government’s policies to drive origination.

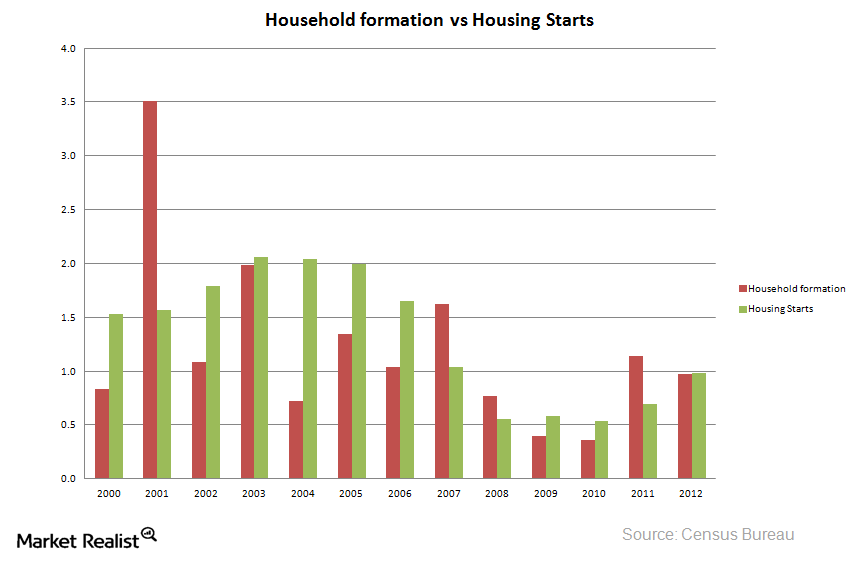

Why household formation drives homebuilder demand (Part 2)

Continued from Part 1 The state of the first-time homebuyer The first-time homebuyer has been in a difficult position post-crisis. Many college students graduated with high levels of student loan debt and grim job prospects. Given the harsh job market, many graduates decided to return to school, moved in with their parents, or moved in […]

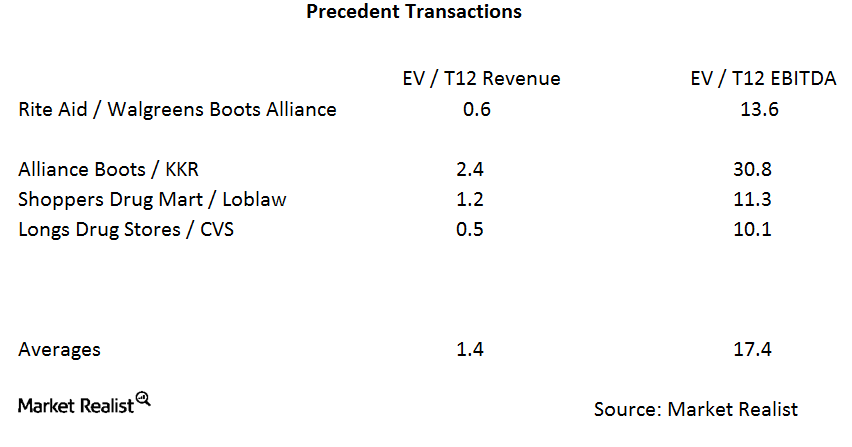

Could the Rite Aid–Walgreens Merger Get Competitive?

In the Rite Aid–Walgreens merger, Walgreens is paying about 0.6x trailing-12-month revenues and 13.6x trailing-12-month EBITDA.

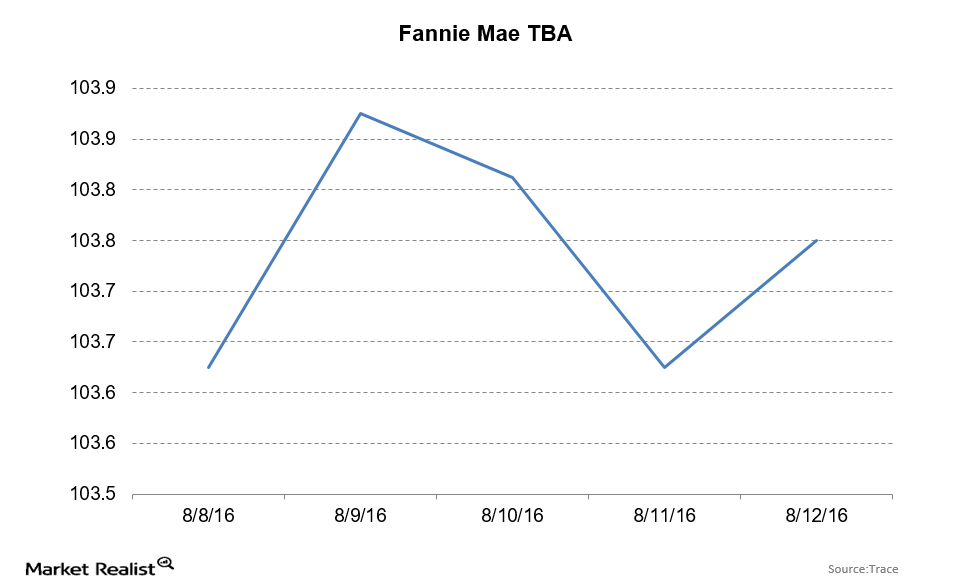

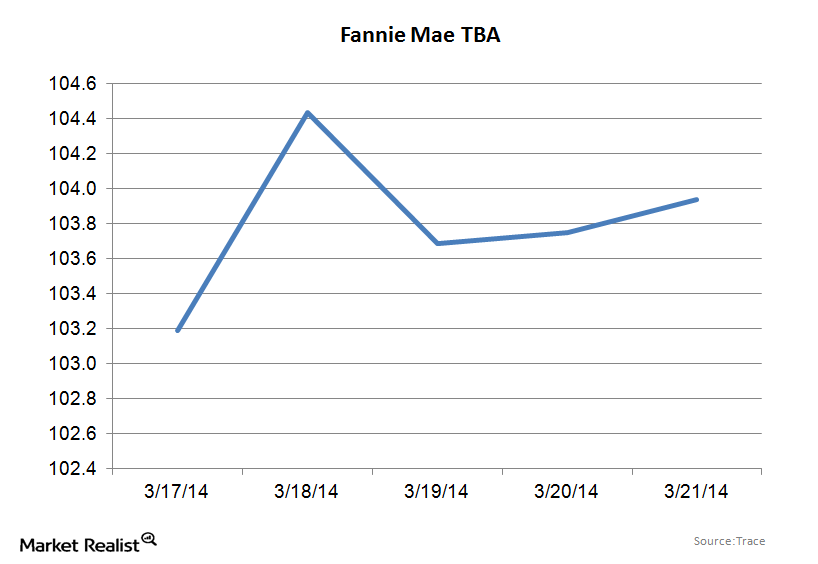

Fannie Mae TBAs Rise with the Bond Market

For the week ending August 12, 2016, Fannie Mae TBAs ended at 103 24/32—up 4 ticks for the week. The ten-year bond yield fell by 8 basis points to 1.51%.

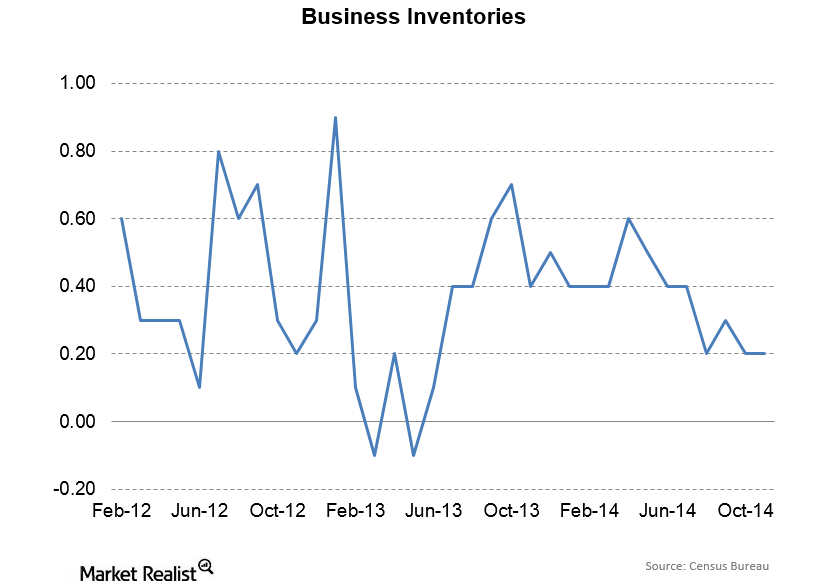

Inventories Spike In November, Portending Weak December Sales

Sales fell 0.2% in November. Inventories increased 0.2%. Interestingly, the inventory build was with the retailers, not the manufacturers.

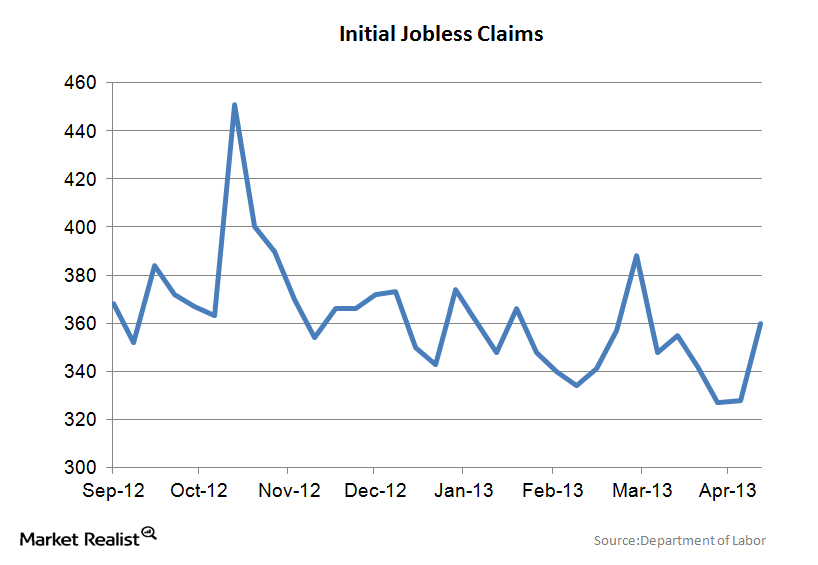

Initial jobless claims jump

Initial jobless claims rose to an annualized rate of 360,000 for the week ended May 10th Initial jobless claims are one of the few labor market indicators that are released every week. Unemployment is a profound driver of economic growth, and persistent unemployment has been the Achille’s heel of this recovery. While it seems like […]

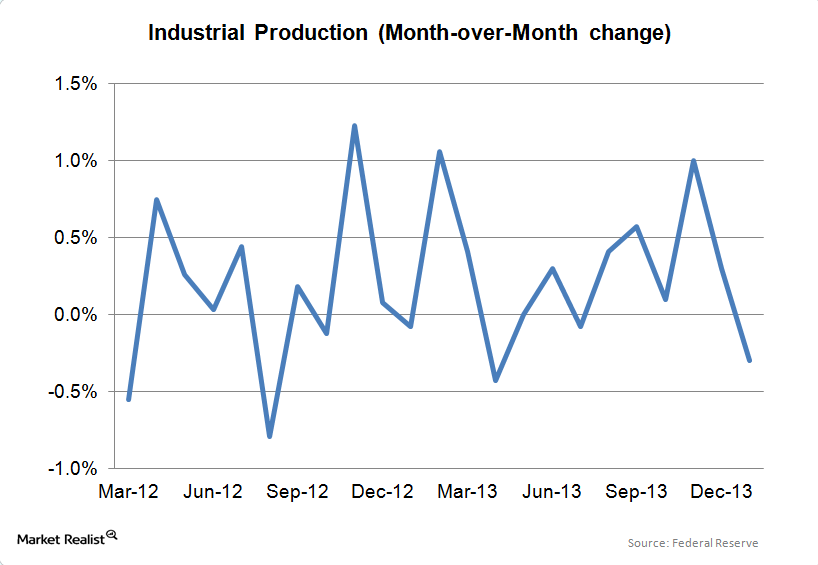

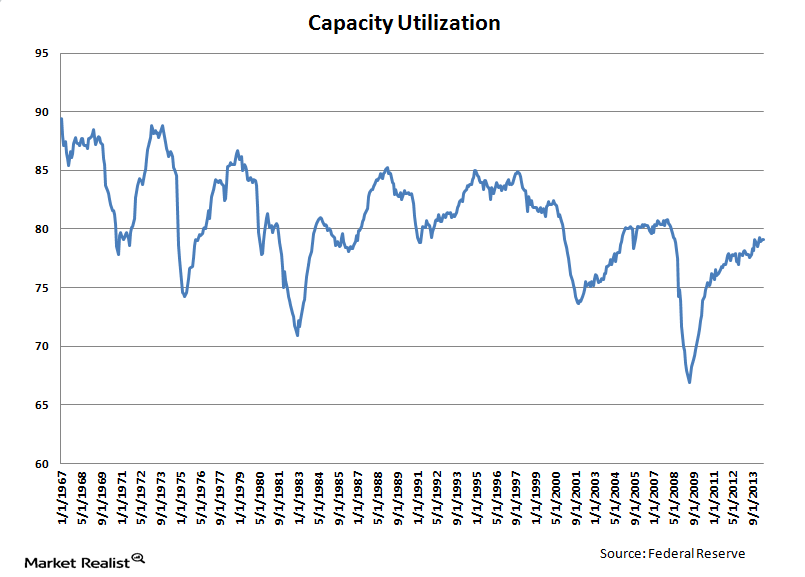

A rebound in capacity utilization helps office REITs like SL Green

While most people don’t think of industrial data affecting office REITs, it does influence the top-line growth of commercial REITs like SL Green (SLG).

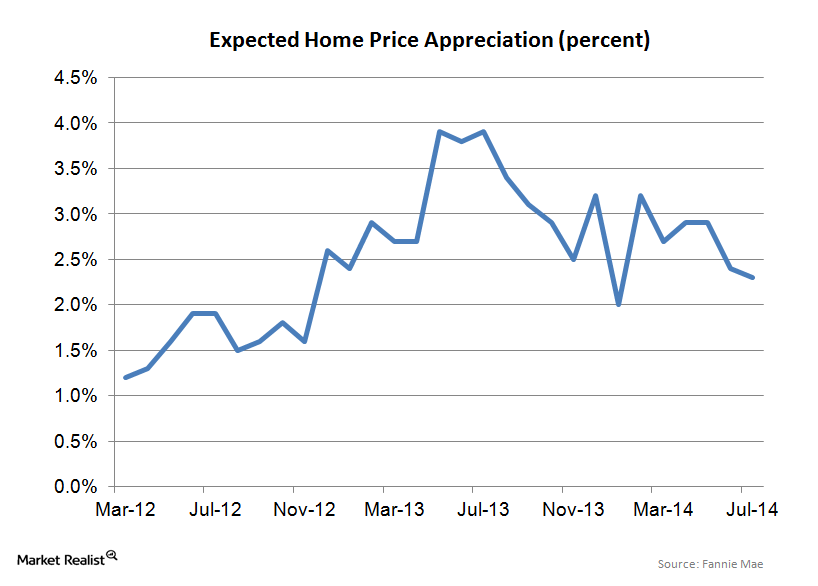

Consumers are tempering their home price appreciation expectations

The 2.3% home price expectation is much lower than the 6%–7% forecast we’re seeing out of the National Association of Realtors and the mid single-digit forecast we’re seeing from most Wall Street professionals.

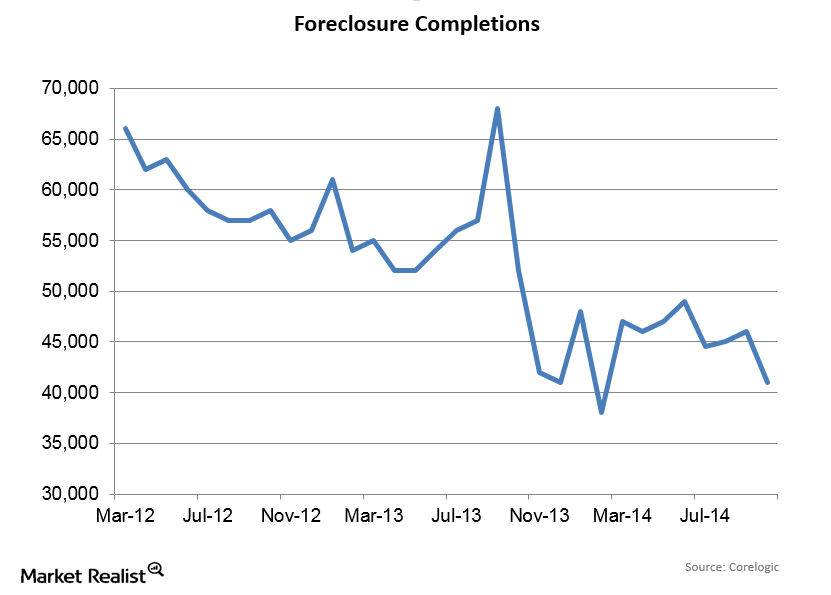

Foreclosure Completions Drop In October

Since foreclosures represent a process that may or may not wind up with the bank owning the home, foreclosure completions are a better indicator of foreclosure activity than foreclosure starts.

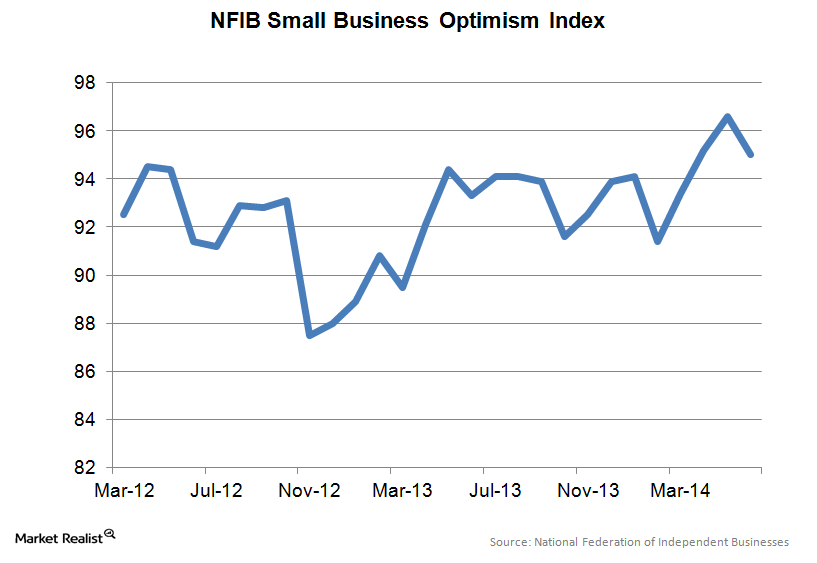

Why small business optimism continues to recover slowly

Small business accounts for roughly half of the U.S. gross domestic product (or GDP) and jobs.

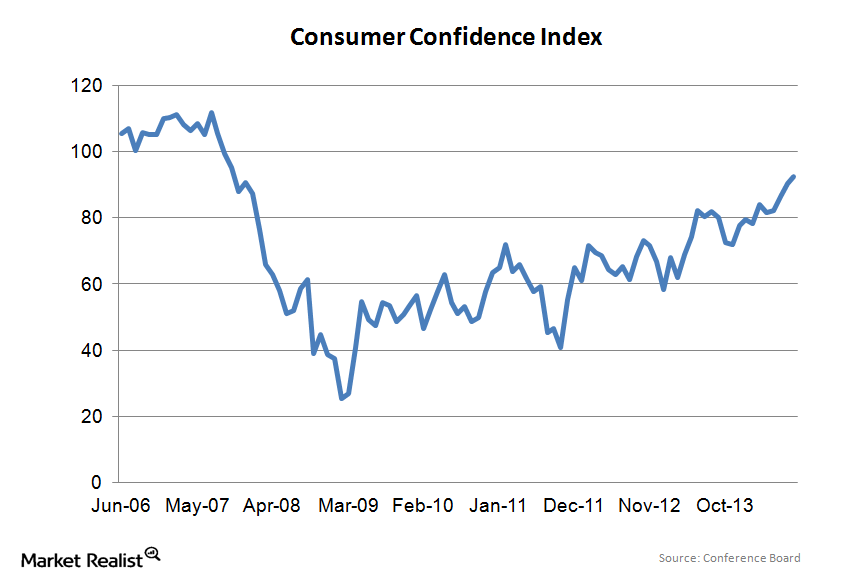

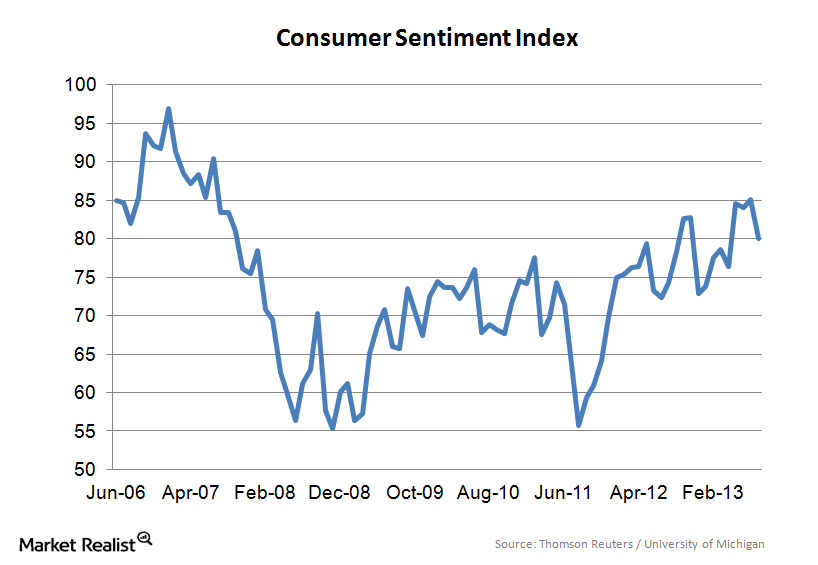

Why rising asset prices are driving consumer confidence higher

The CCI is one of the oldest consumer surveys, originally started as a mail-in survey in 1967. It asks respondents whether certain conditions are positive, negative, or neutral.

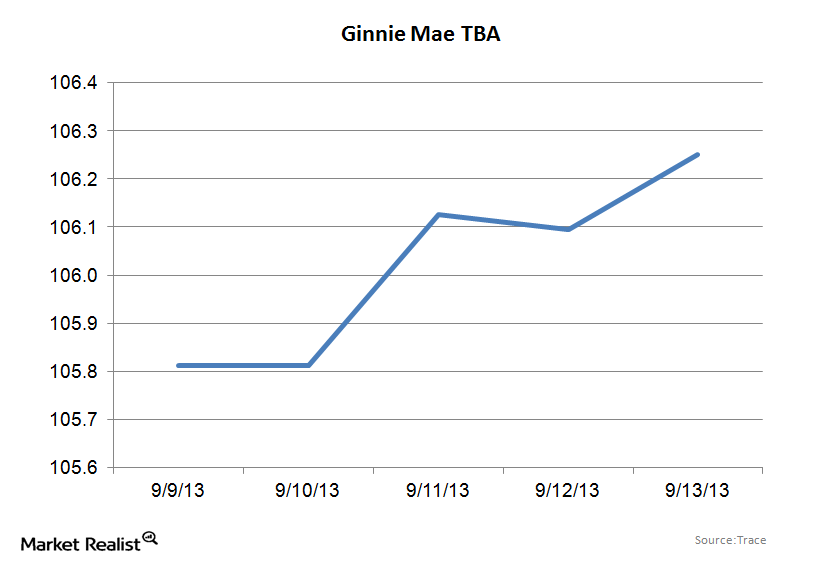

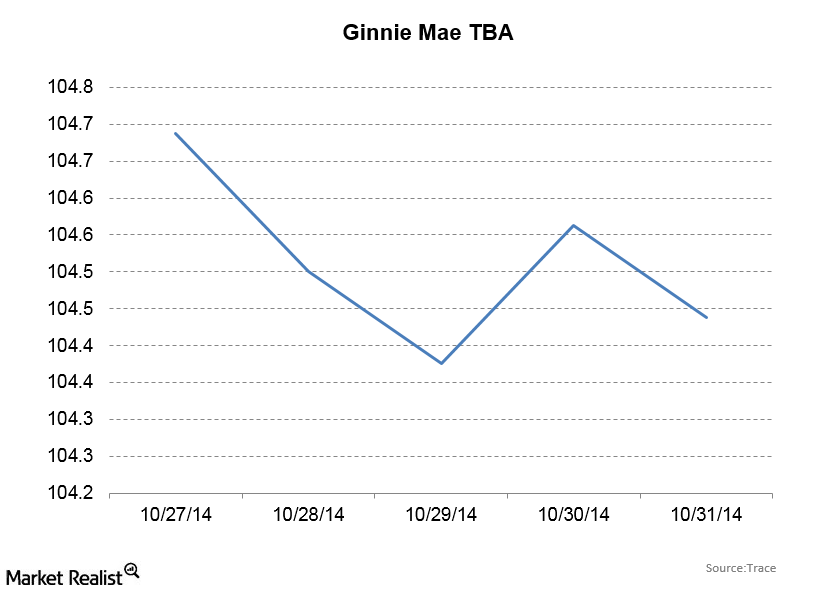

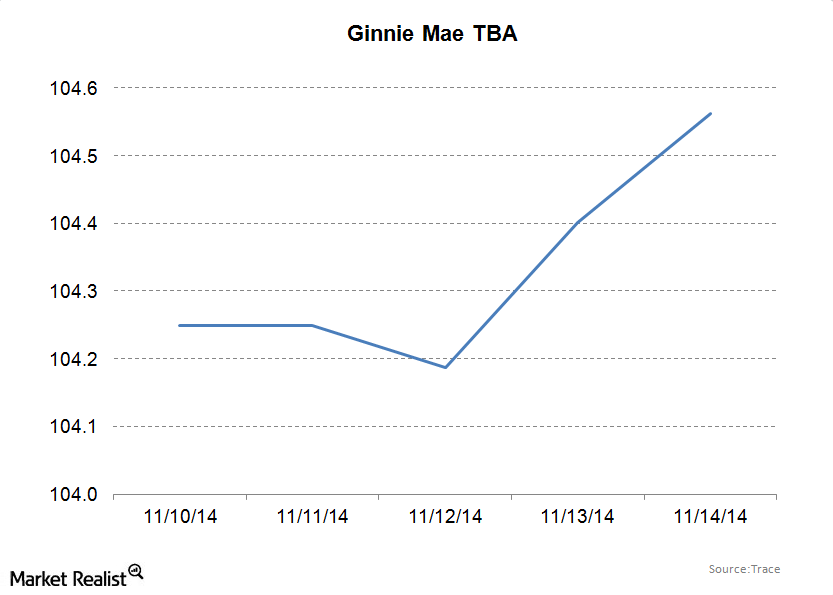

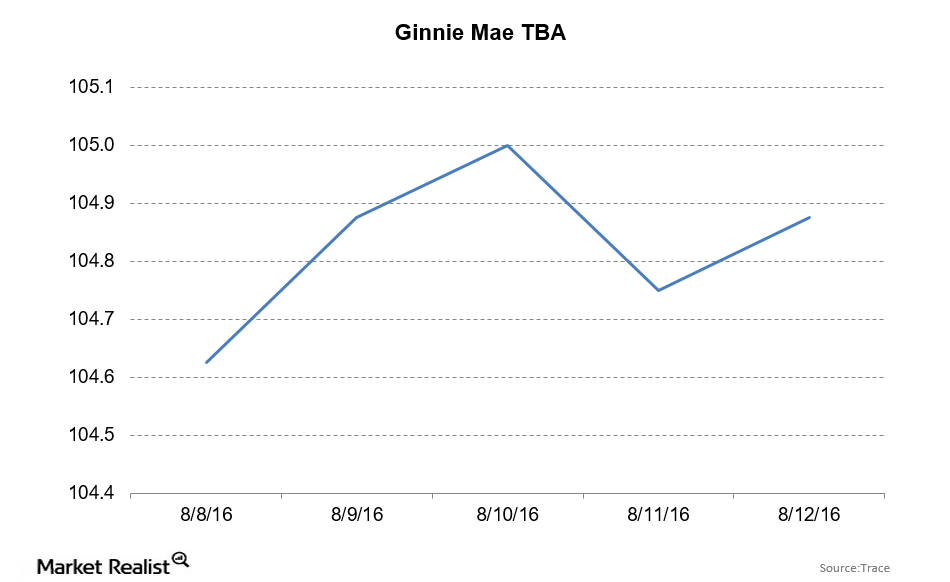

Ginnie Mae TBAs rally before the Fed meeting

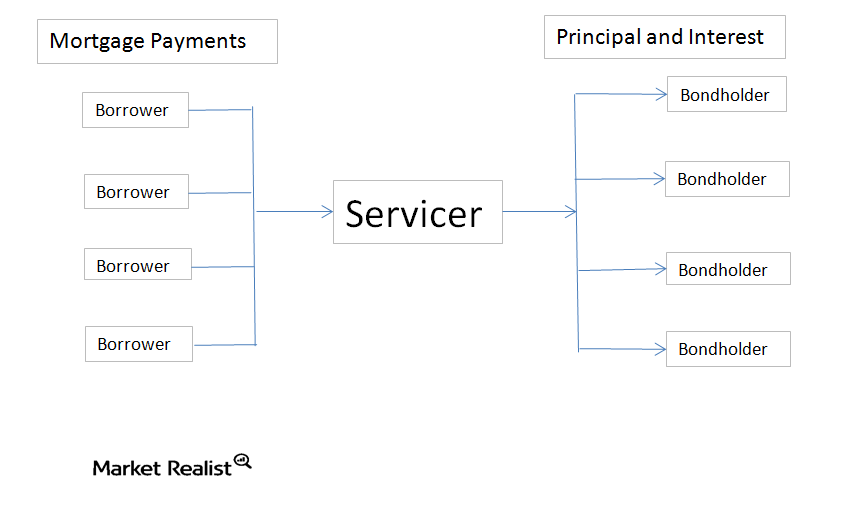

Mortgage-backed securities are the starting point for all mortgage market pricing and the investment of choice for mortgage REITs When the Federal Reserve talks about buying mortgage-backed securities, it’s referring to the To-Be-Announced (also know as the TBA) market. The TBA market allows loan originators to take individual loans and turn them into a homogeneous product […]

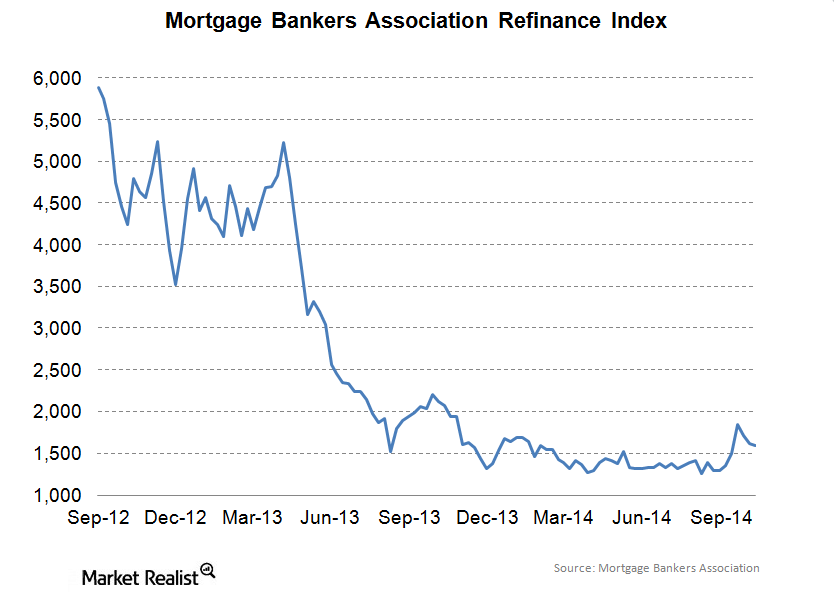

The End Of Quantitative Easing Could Make Mortgage REITs Vulnerable

Big agency REITs like Annaly (NLY) and American Capital Agency (AGNC) took the chance to deleverage their balance sheets after the warning in the spring of 2013.

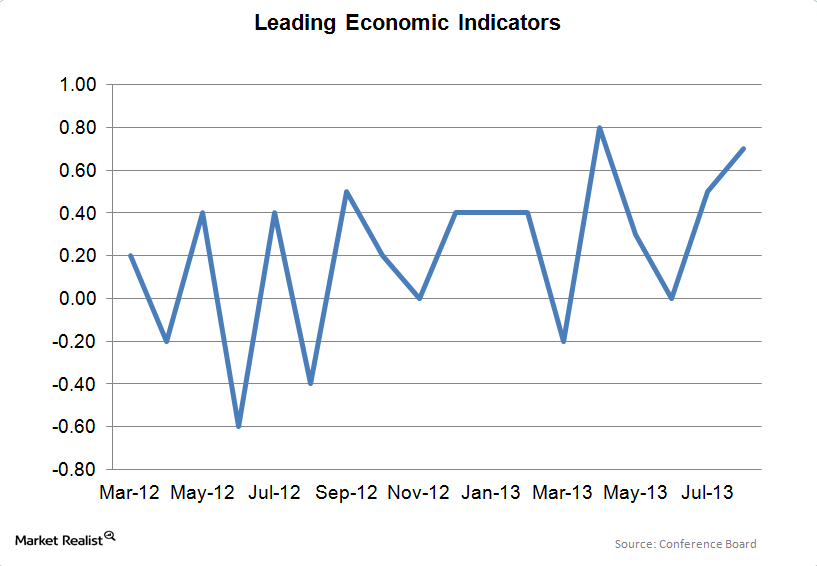

Jump in leading economic indicators shows an improving economy

After increasing by 0.5 in July, the Index of Leading Economic Indicators rose by 0.2 to end at +0.7. Overall, the index indicates an economy that’s slowly mending.

Ginnie Mae securities shake off the end of quantitative easing

The ten-year bond sold off, with yields increasing from 2.27% to 2.34%. Ginnie Mae TBAs bucked the trend, rising from 104 20/32 to 104 25/32.

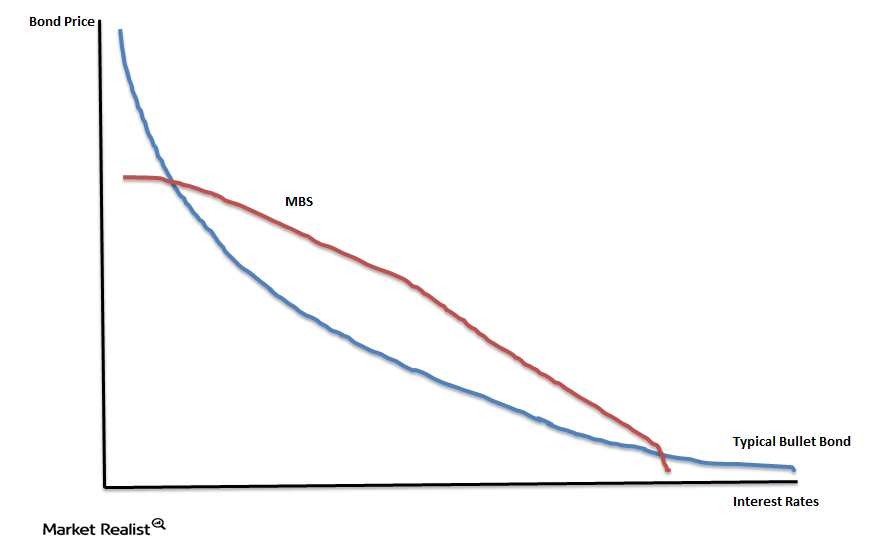

Primer on mortgage backed securities, Part 3

Continued from Primer on mortgage backed securities, Part 2. Basic mortgage backed securities: Fannie Mae, Freddie Mac, and Ginnie Mae Most mortgage backed securities are agency securites, which means they are associated with government guaranteed loans. Fannie Mae and Freddie Mac are government sponsored entities (GSE’s) and do not carry an explicit government guarantee like Ginnie Mae mortgages do. […]

Mortgage servicing rights increase in value as interest rates rise

Mortgage servicing rights are one of the few financial assets that increase in value as rates rise Most mortgage REITs are exposed to changes in interest rates, and are usually long-duration, which means that the value of their portfolio decreases in value as interest rates rise. Good examples of these types of REITs would be […]

A decline in manufacturing causes industrial production to fall

Up until January, industrial production and manufacturing production had been accelerating, so it is premature to draw any major conclusions from one disappointing report.

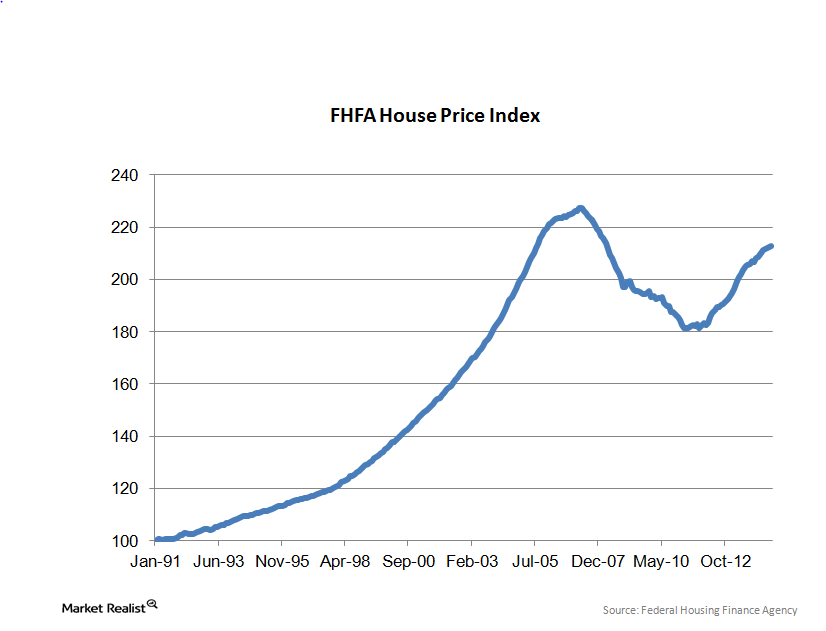

Must-know: Why home-price appreciation is leveling off

In July, home prices increased 0.1% month-over-month. They’re up 4.4% year-over-year (or YoY). Prices are now within 6.5% of their April 2007 peak. They correspond to the levels in July 2005. Real estate values drive consumer confidence and spending. They have an enormous impact on the economy.

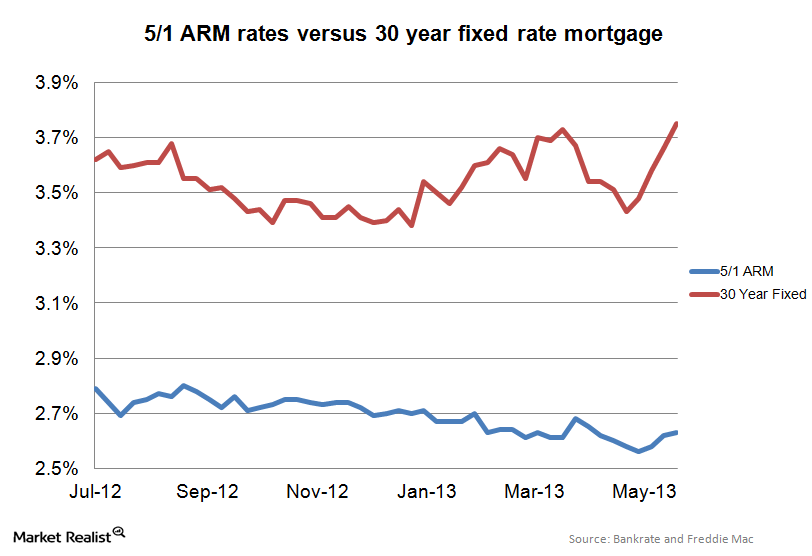

Spread between 5/1 ARMs and 30-year fixed rate mortgages blows out

The spread between the 30-year fixed rate mortgage and the 5/1 ARM changes over time After the financial crisis, Adjustable Rate Mortgages (ARM) got somewhat of a dirty name. Lenders were criticized for using the low “teaser” rate on mortgages to evaluate whether the buyer could afford the home; many borrowers were unable to afford […]

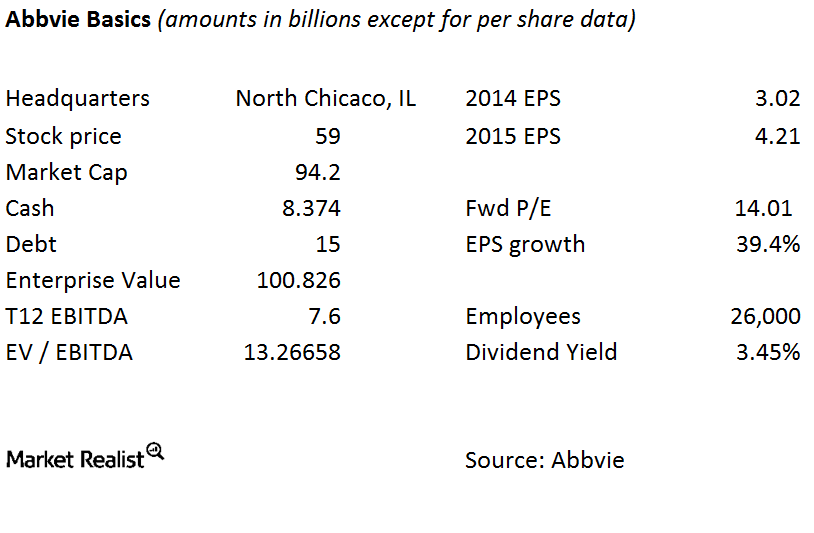

The Pharmacyclics–AbbVie Merger: The Basics of AbbVie

A major reason for the Pharmacyclics–AbbVie merger is to diversify AbbVie away from its reliance on a single product, Humira, and boost its pipeline.

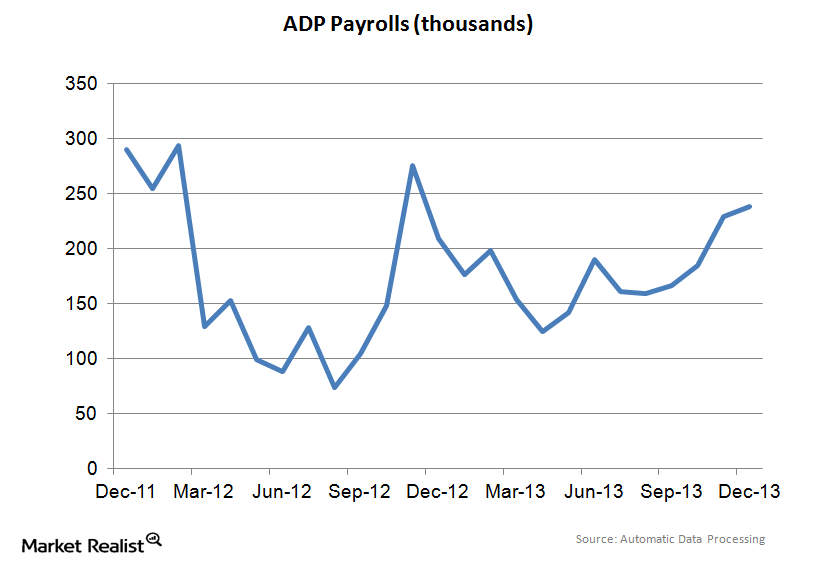

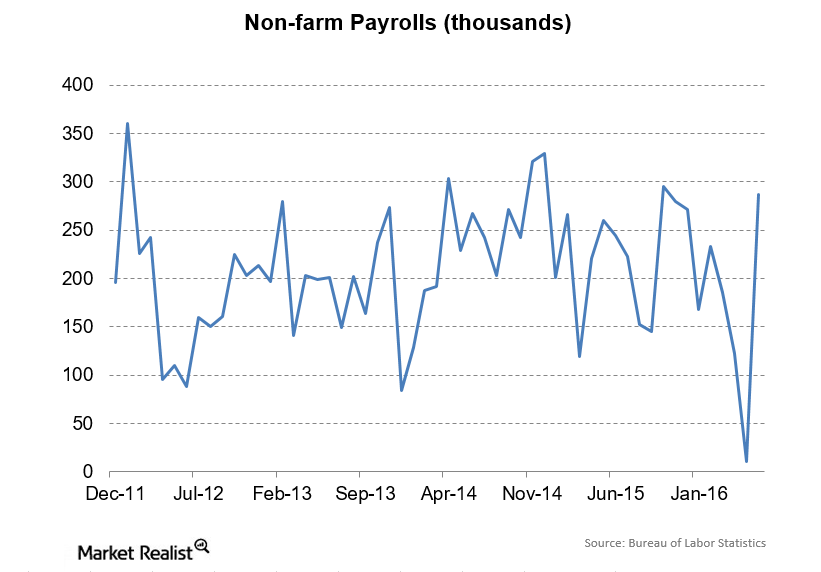

Jobs report shows hiring is picking up—good for commercial REITs

Private sector employment increased by 238,000 in December, while November’s numbers were revised upward from 215,000 to 229,000.

Ginnie Mae Securities Buck The Recent Trend And Rally

Ginnie Mae and the to-be-announced market The Fannie Mae to-be-announced (or TBA) market represents the usual conforming loan—the plain Fannie Mae 30-year mortgage. Meanwhile, Ginnie Mae TBAs are where government loans go—such as the federal housing administration (or FHA) and veterans affairs (or VA) loans. The biggest difference between a Fannie Mae mortgage-backed security (or […]

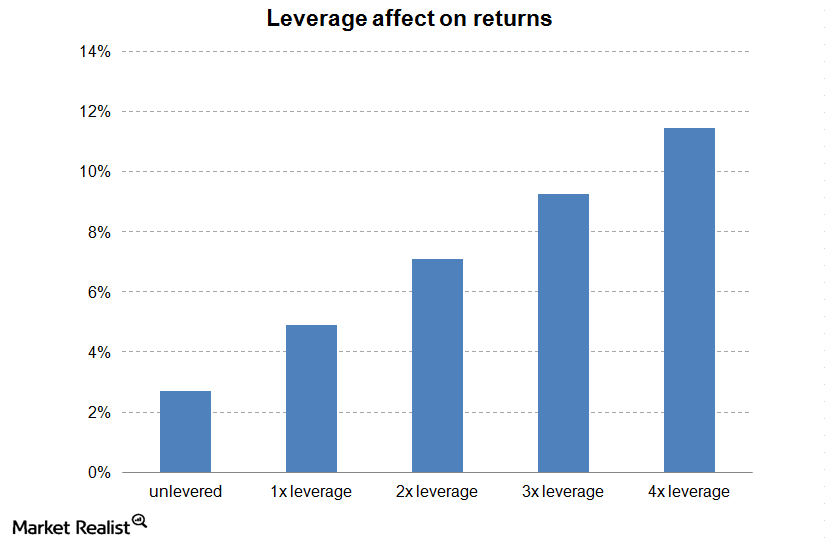

Leverage and mortgage REITs – Part 2

Leverage and Mortgage REITs – Part 1 How a mortgage REIT typically does it Most mortgage REITs use repurchase agreements to fund their balance sheet. A repurchase agreement (repo) is basically a secured loan. The REIT will pledge the mortgage backed securities they just bought as collateral for a loan. It is actually an agreement […]

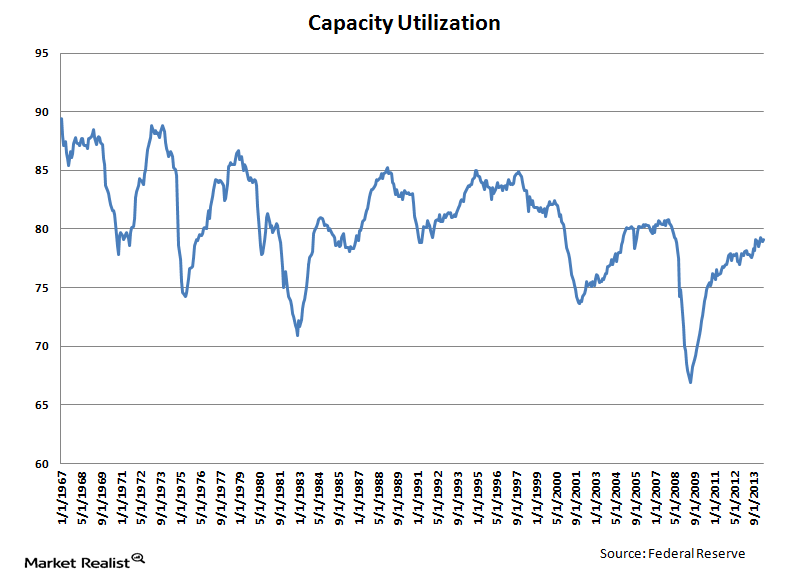

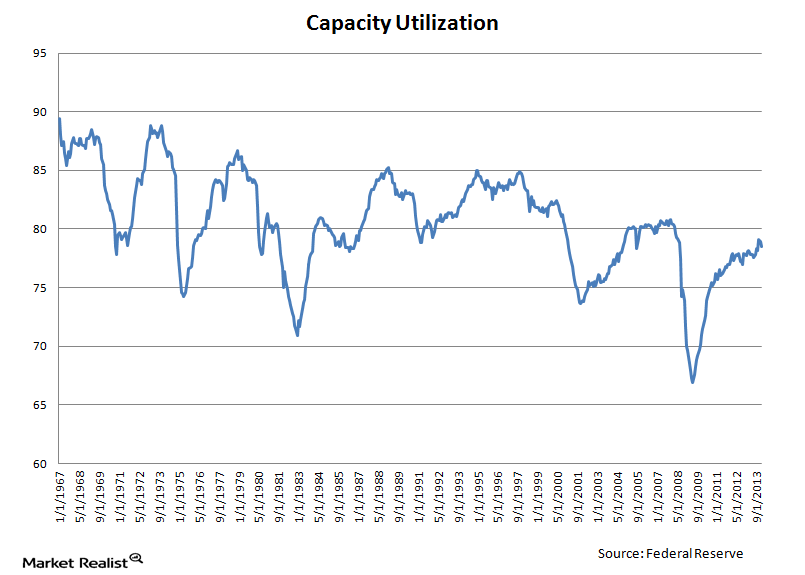

Why capacity utilization is an important economic indicator

Capacity utilization rates are approaching long-term historical averages.

University of Michigan Consumer Confidence Index dips in August

The Thomson Reuters/University of Michigan Consumer Confidence Index is a leading indicator for the U.S. economy The Thomson Reuters/University of Michigan Consumer Confidence Index is an important indicator of the consumer’s perception of the U.S. economy. Similar to other consumer confidence measures, it asks consumers about their views on the current economic conditions and their […]

Primer on mortgage backed securities, Part 5

Continued from Primer on mortgage backed securities, Part 4. Prepayment risk Prepayment risk and interest rate risk go hand-in-hand. The main difference between a mortgage backed security and a government bond is that with a government bond, you know exactly when you will get your principal and interest payments. If you purchase a 7-year Treasury […]

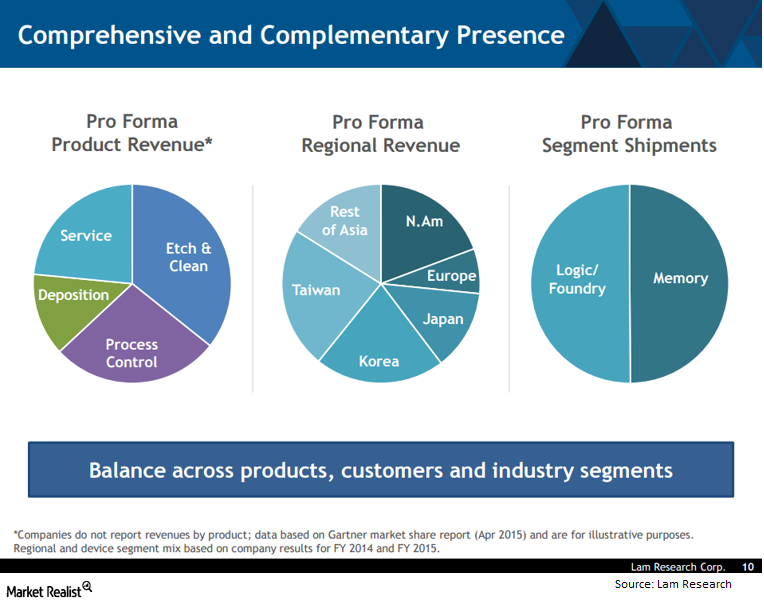

Regulatory Path for the Lam Research-KLA-Tencor Merger

In the press release announcing the Lam Research-KLA-Tencor merger, the companies mention they will serve approximately 42% of the wafer fabrication equipment market immediately upon closing.

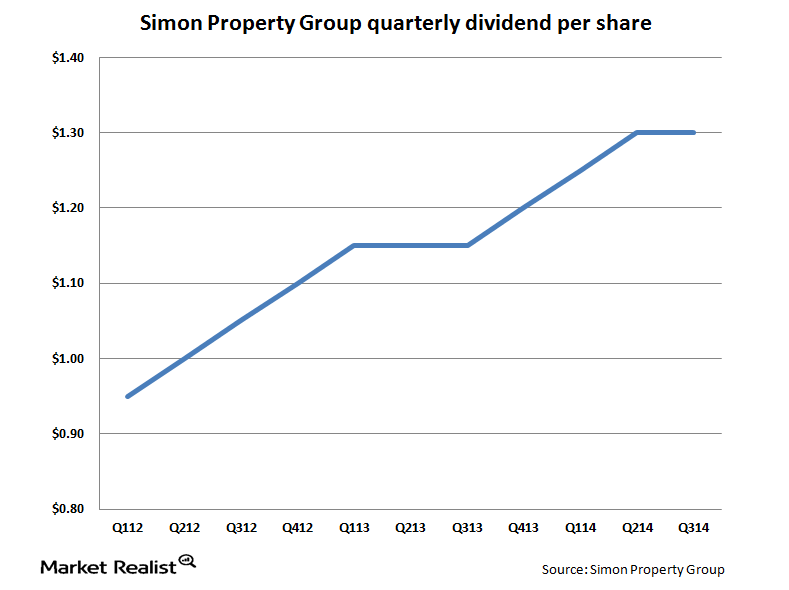

Simon Property Group faces competition from online retailers

Simon Property Group is by far the biggest shopping center REIT in the U.S., with a market capitalization of $53 billion. The next biggest REITs are less than half Simon’s size.

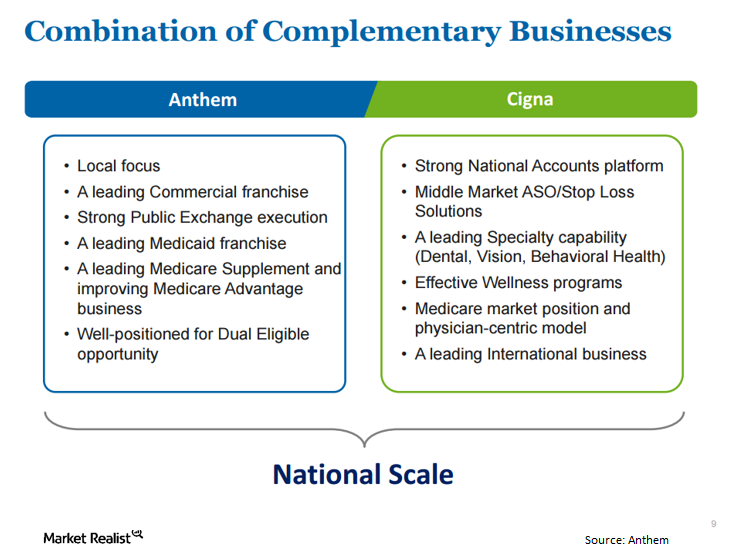

Anthem Files Bear Hug Letter for Cigna on June 21

On June 21, Anthem (ANTM) filed a bear hug letter for Cigna (CI). A bear hug letter is a formal press release in which an acquiring company discloses its interest in a target company.

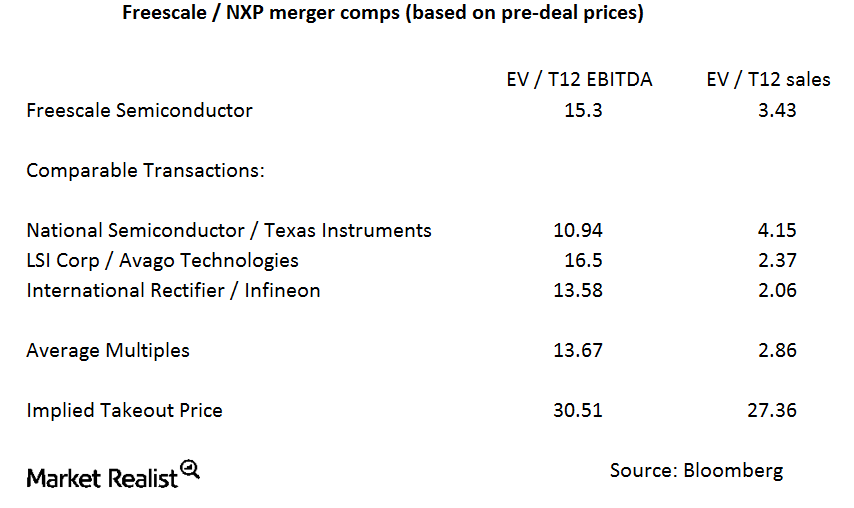

Why is the Freescale–NXP merger premium so low?

The companies were asked about the takeover premium and the background to the transaction on the conference call, but they refused to comment.

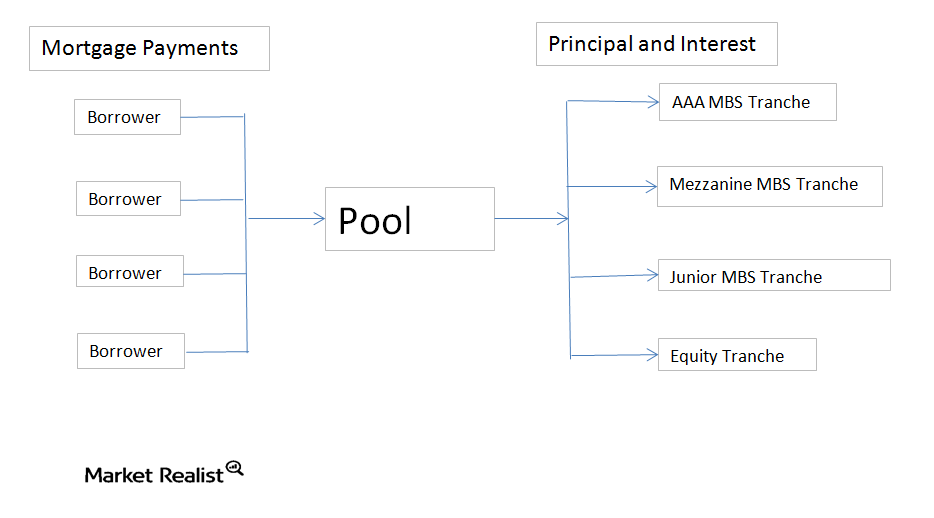

Primer on mortgage backed securities, Part 1

What are mortgage backed securities? Mortgage backed securities are pools of individual mortgages that have similar characteristics. They allow a relatively illiquid asset (an individual home mortgage) to be converted into a very liquid asset that can be traded with relative ease. They also allow an issuer to divide up the cash flows in order […]

Fannie Mae TBA securities shrug off the March FOMC meeting

Given that another $10 billion in tapering was already priced in, TBAs didn’t react to the FOMC meeting. MBS spreads tightened as MBS rallied in the face of a bond market sell-off.

The US witnesses an unexpected drop in capacity utilization

From 1972 to 2012, capacity utilization averaged 80.2% and bottomed at 66.9% in 2009 suggesting there’s a lot of room for production to expand before we start feeling inflationary pressures.

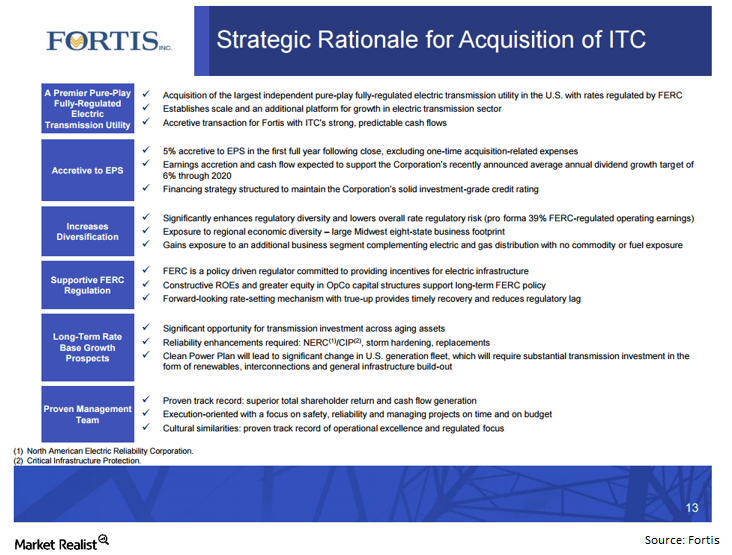

What’s the Rationale for the ITC-Fortis Merger?

Fortis (FRTSF) is buying ITC (ITC) in the largest Canadian purchase of a US utility. Fortis intends to sell a 19% stake in order to help finance the transaction.

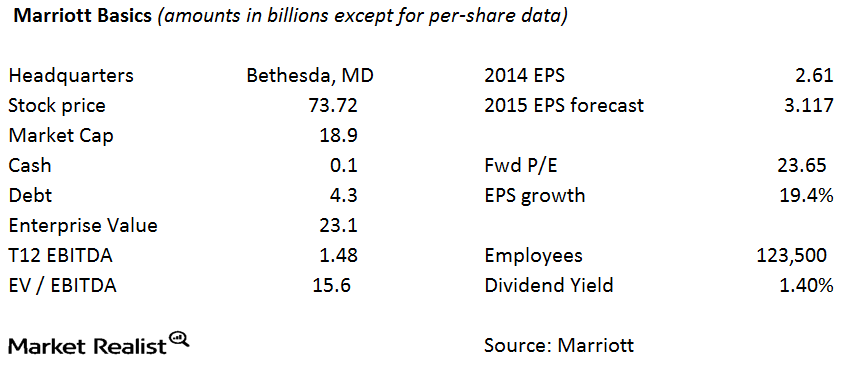

Rationale for the Starwood-Marriott Merger

With the Starwood-Marriott merger, the companies expect to generate at least $200 million in annual cost savings beginning in the second year after the deal closes.

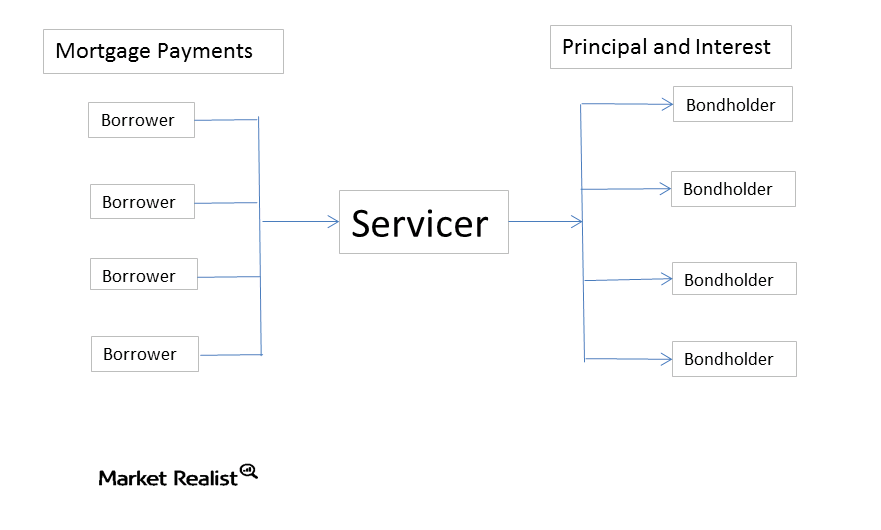

Why mortgage servicing rights imply risks for servicers

Risks of being a servicer Generally, servicing seems like an easy job. Collect the payment, give the government its take, pass the (smaller) payment to the bondholders, and keep the rest. What could go wrong? There’s just one catch. What happens if you miss your mortgage payment? The U.S. government guarantees Ginnie Mae securities. When […]

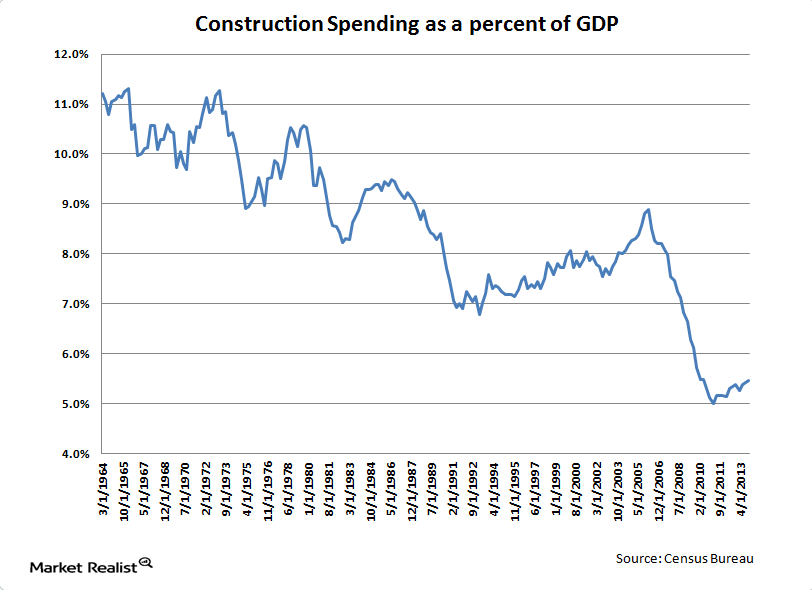

Construction Spending is a key driver for the US economy

Construction spending is a major driver of job growth in the U.S. economy The Construction Put in Place Survey is released monthly by the Census Bureau and it measures the total dollar value of construction work in the United States. It covers both the public and private sectors and includes new structures as well as […]

Jobs Report: Why It’s the Highlight of the Week

There isn’t much real estate–related economic data this week. There are some important macro reports as well as the jobs report on Friday.

Ginnie Mae TBAs Rise with the Bond Market

The ten-year bond yield fell by 8 basis points to 1.51% for the week ending August 12, 2016. Ginnie Mae TBAs rose by 4 ticks and closed at 104 28/32.

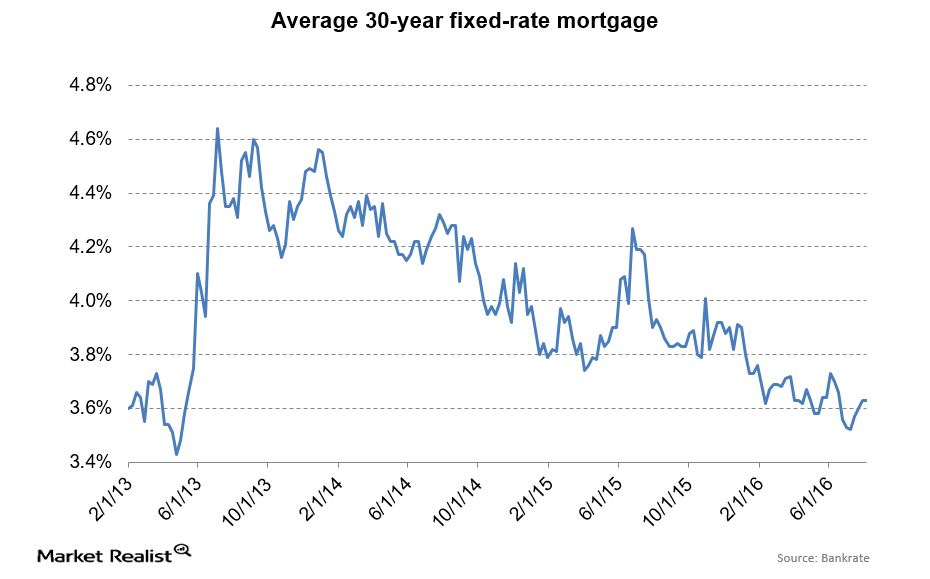

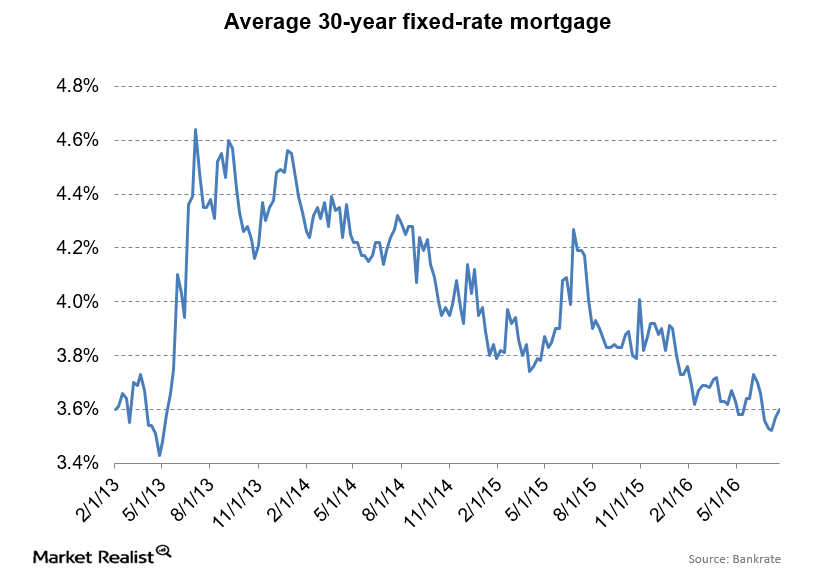

Mortgage Rates Didn’t Move despite a Volatile Bond Market

Lately, mortgage rates and bond yields have shown a weak correlation. Treasury yields have fallen in the past month, while mortgage rates have been steady.

What’s Annaly Capital’s Take on the Bond Market’s Volatility?

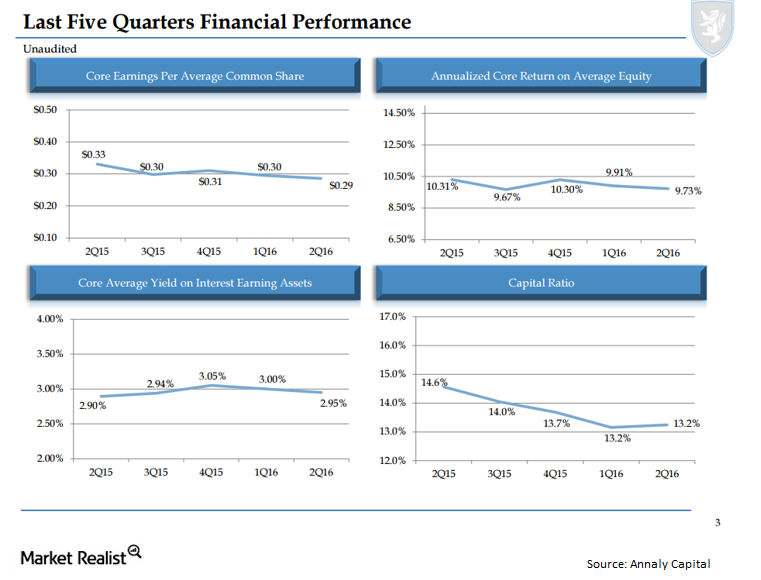

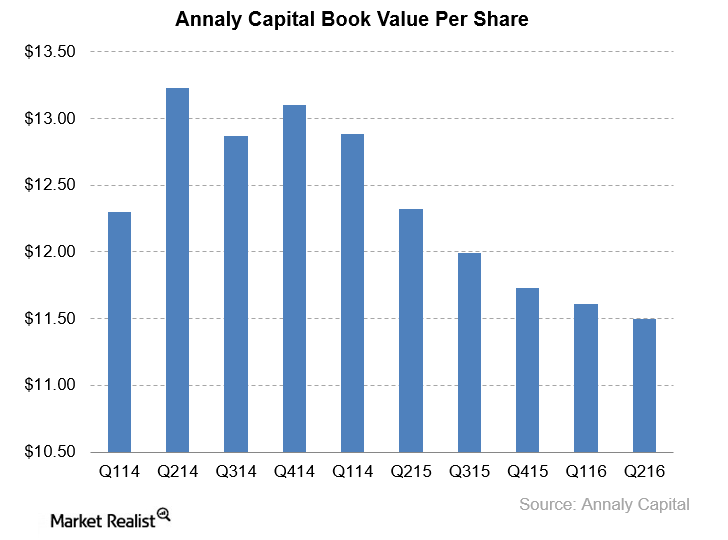

Annaly positioned itself to reduce its interest rate risk and increase its credit risk. Since 2009, global bond markets have risen in value by about $17 trillion.

How’s Annaly Capitalizing on Commercial Real Estate?

By investing in commercial real estate, Annaly Capital is increasing its returns. At the same time, it’s taking on credit risk.

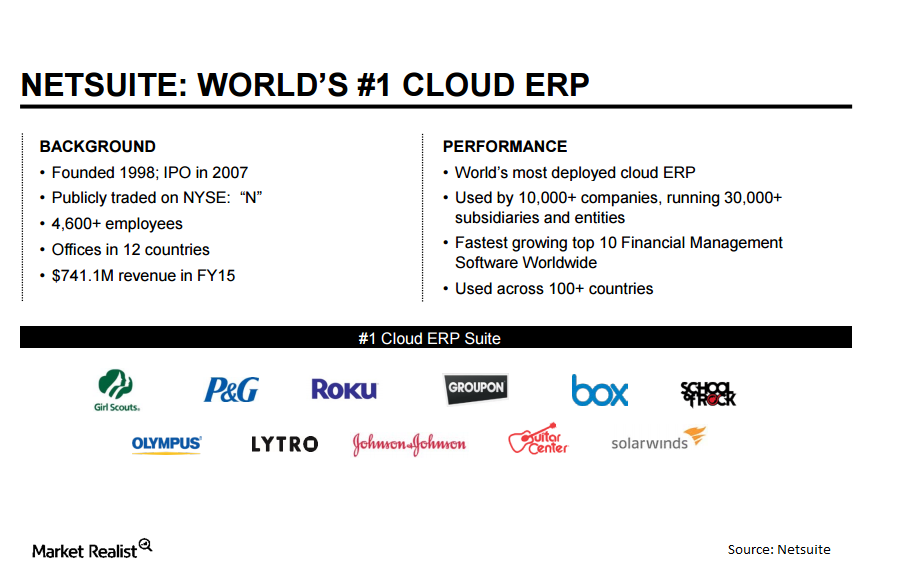

The Oracle-NetSuite Merger: What’s the Rationale?

The relationship between Oracle and NetSuite goes back a long way. Oracle co-founder Larry Ellison and his family own almost half of NetSuite stock.

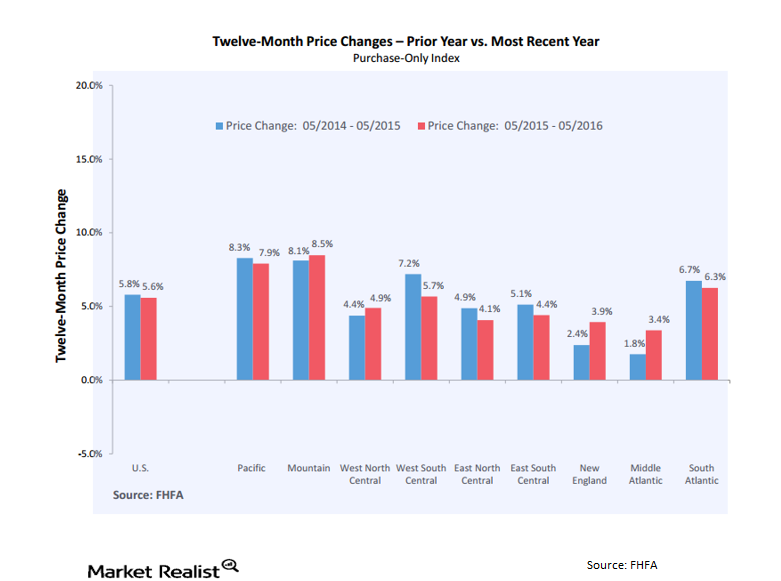

Real Estate Market Hot in the West, Cold in the Northeast

Home prices in the Pacific and Mountain states have outperformed prices in the rest of the country over the past two years.

Mortgage Rates Rise with the Bond Market

Lately, mortgage rates and bond yields have shown a weak correlation. Treasury yields have fallen over the past month, while mortgage rates have been steady.

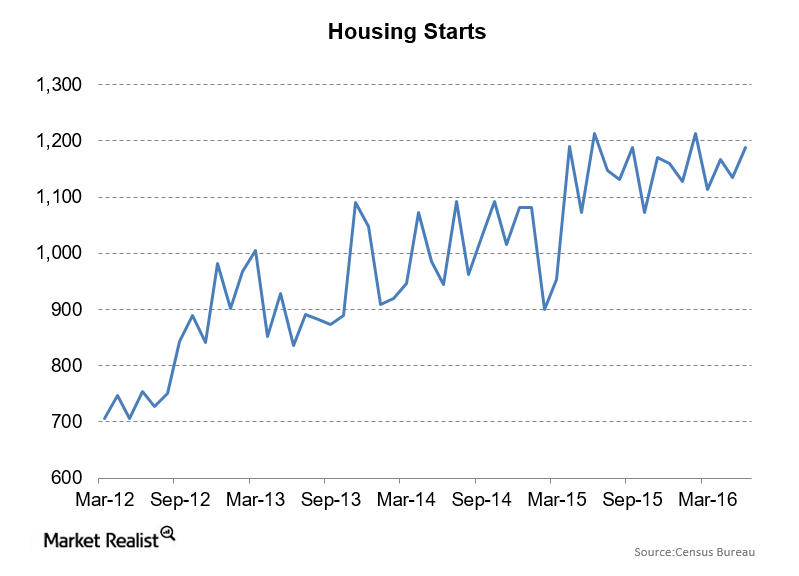

Why Do Housing Starts Remain Muted?

Housing starts and building permits came in around 1.2 million—towards the top end of a narrow range over the past year.

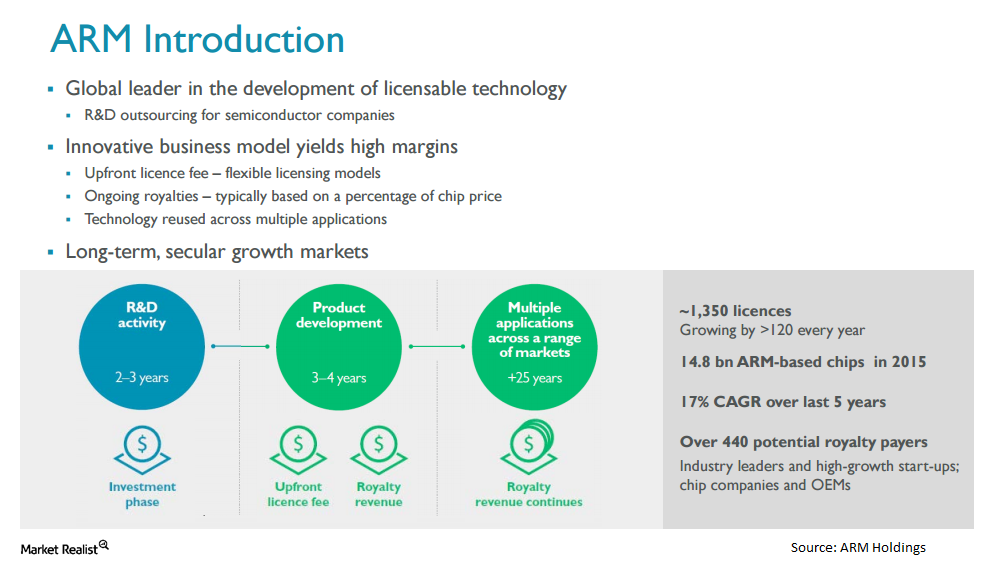

What Are the Conditions for the ARM Holdings-Softbank Merger?

ARM Holdings and Softbank are merging in a cash transaction. In an unusual step, there aren’t regulatory or antitrust conditions to the transaction.

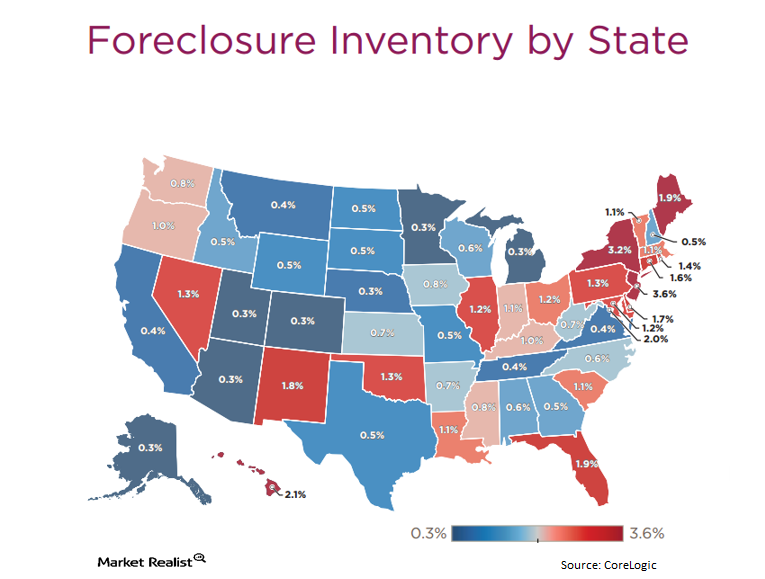

Why Are State Foreclosure Laws Important?

There are two basic types of state foreclosure laws—judicial and non-judicial. In non-judicial states, foreclosures are handled through a streamlined process.

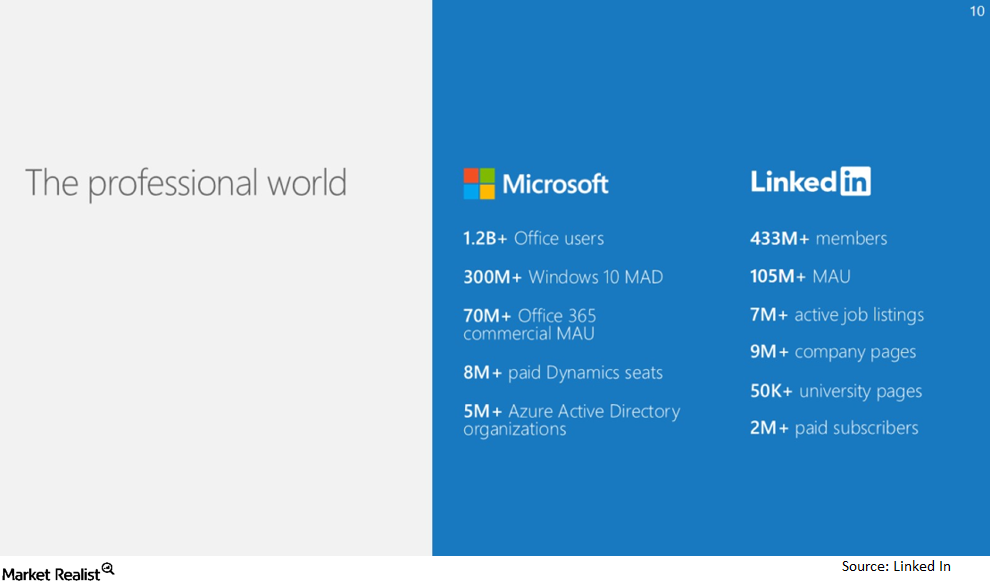

What’s the Rationale for the Microsoft-LinkedIn Merger?

LinkedIn will be a standalone entity within Microsoft. This transaction is part of Microsoft’s plan to focus on cloud-based offerings. It wants to rely less on PCs.