Brent Nyitray, CFA, MBA

Brent Nyitray has 18+ years of experience in the investment industry, primarily focused on the Real Estate Sector at a variety of hedge funds, including Elliot Management and Dellacamera Capital Management. Until 2004, Brent was a Managing Director at Bear Stearns, responsible for the European Risk Arbitrage trading desk in London. Brent earned an MBA in 1994 from the Simon Graduate School of Business with a 3.9 GPA. He was formerly a US Naval Officer.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Brent Nyitray, CFA, MBA

Why Is the Median Income to Median Home Price Ratio Elevated?

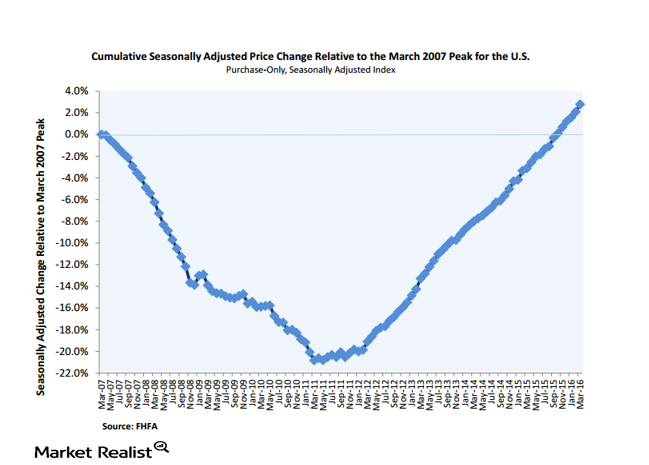

The recent 5.5% year-over-year gain for home prices has put the FHFA House Price Index about 3% above its April 2007 level.

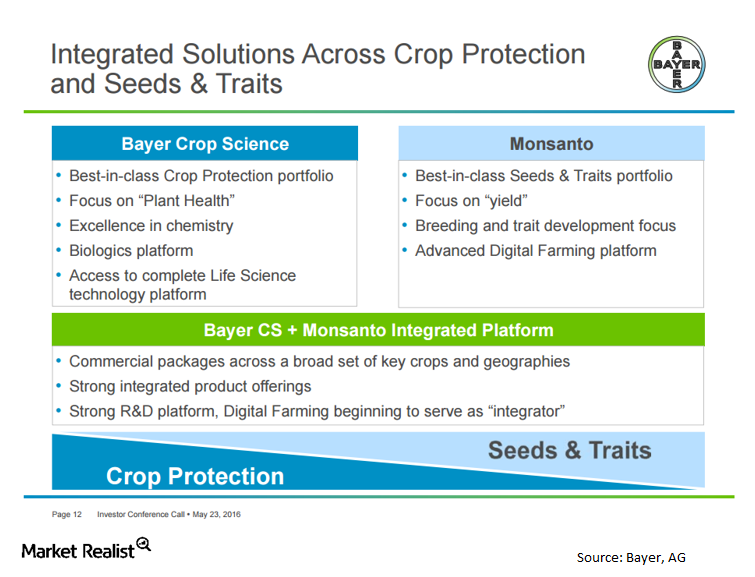

What’s the Rationale for the Bayer-Monsanto Deal?

In the Monsanto-Bayer deal, Bayer’s shareholders should expect to see mid-single-digit accretion to core EPS (earnings per share) in the first year and double-digit accretion thereafter.

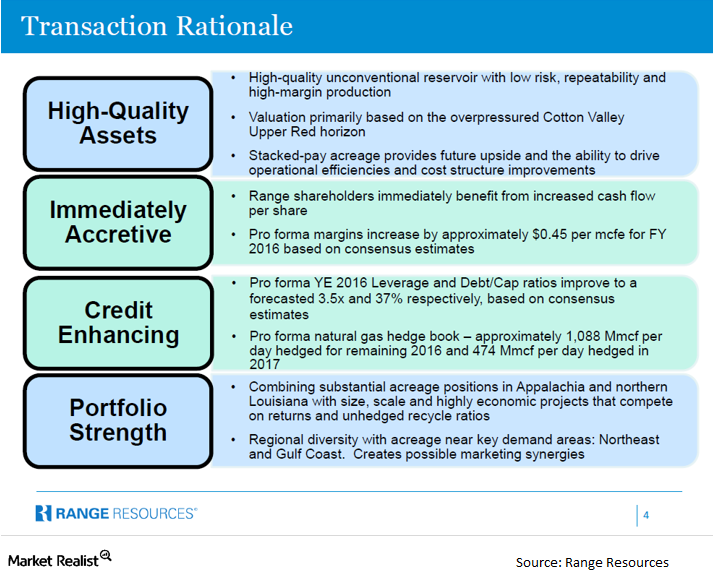

Rationale for the Memorial Resource-Range Resources Transaction

Range Resources is growing its portfolio in the Southeast US. Natural gas exports seem to be a promising growth area. The deal will enhance its credit profile.

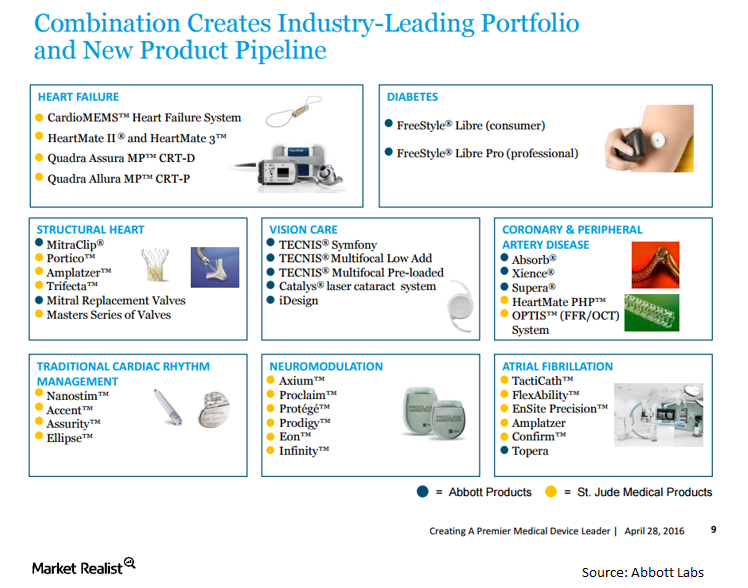

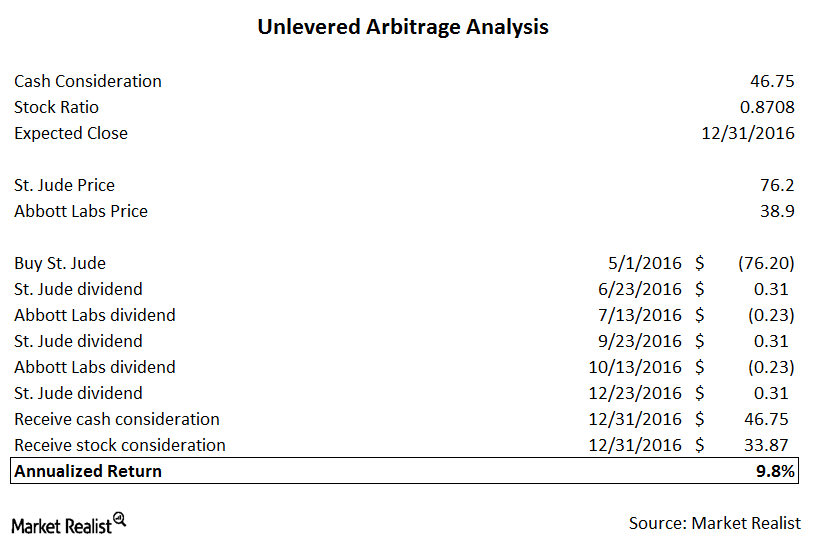

Rationale for the St. Jude Medical-Abbott Merger Transaction

Abbott Labs is buying St. Jude Medical for about $30 billion in cash, stock, and assumed debt to become a dominant player in the cardiovascular health space.

Abbott Buys St. Jude Medical for $85 per Share in Cash and Stock

On April 28, Abbott Labs and St. Jude Medical announced an agreement where Abbott will buy St. Jude for $30 billion in cash, stock, and assumed debt.

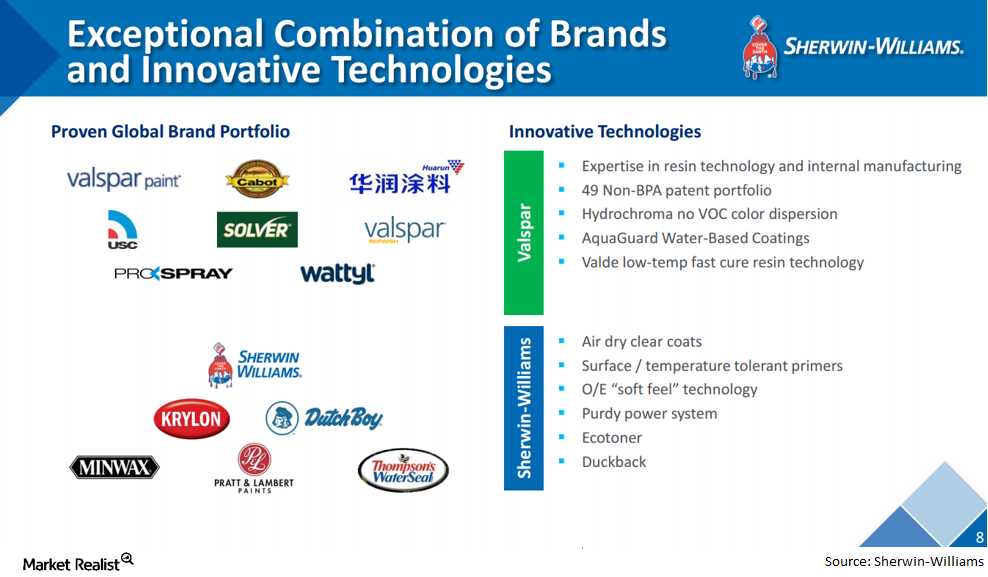

What’s the Rationale for the Valspar and Sherwin-Williams Merger?

Sherwin-Williams is buying coatings manufacturer Valspar in a $11.3 billion cash transaction. The companies stress that this is a complementary transaction.

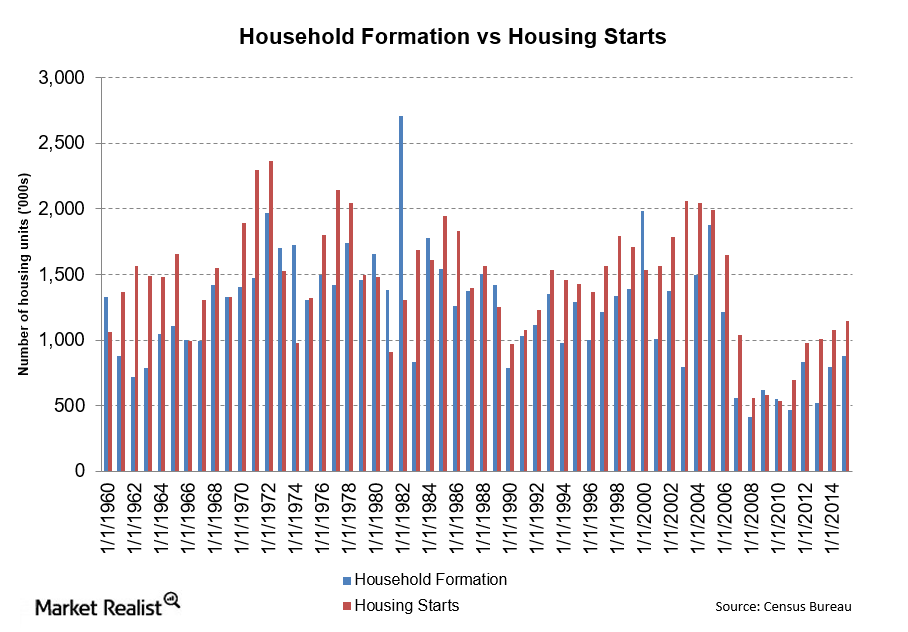

Limited Supply: Analyzing Housing Starts and Household Formations

There was a big fall in household formation in 2008. In 2005, household formation peaked at 1.9 million. By 2008, that number was just over 400 million.

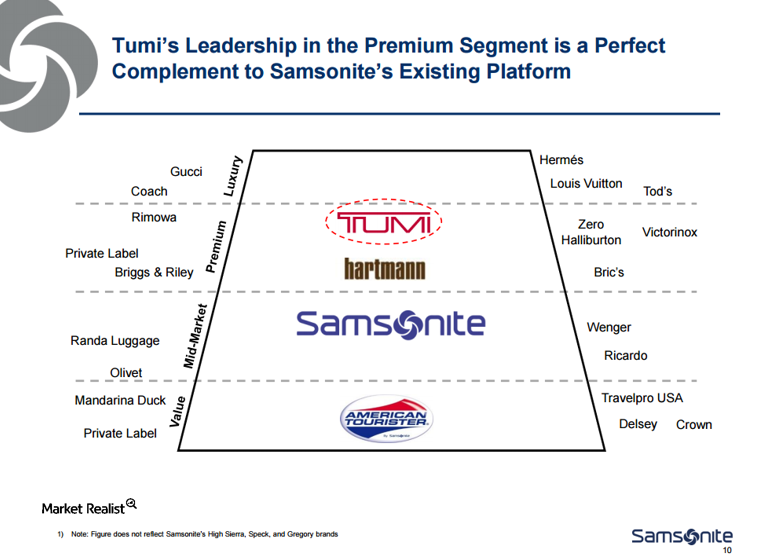

Can the Samsonite-Tumi Merger Get Antitrust Approval?

Samsonite will need to file for merger approval under the Hart-Scott-Rodino Antitrust Improvements Act. The companies will need to file for Canadian antitrust approval.

What’s the Rationale for the Samsonite-Tumi Transaction?

Hong Kong-based Samsonite is buying luxury brand Tumi (TUMI) in a $1.8 billion deal. Samsonite is mainly known as a utilitarian luggage company.

The Baxalta–Shire merger: Basics of Shire Pharmaceuticals

Shire is a biopharmaceutical company that focuses on rare diseases. Shire is best known for its treatments in ADHD, and the market here is quite large.

Growth and Synergies Drive the Baxalta–Shire Merger

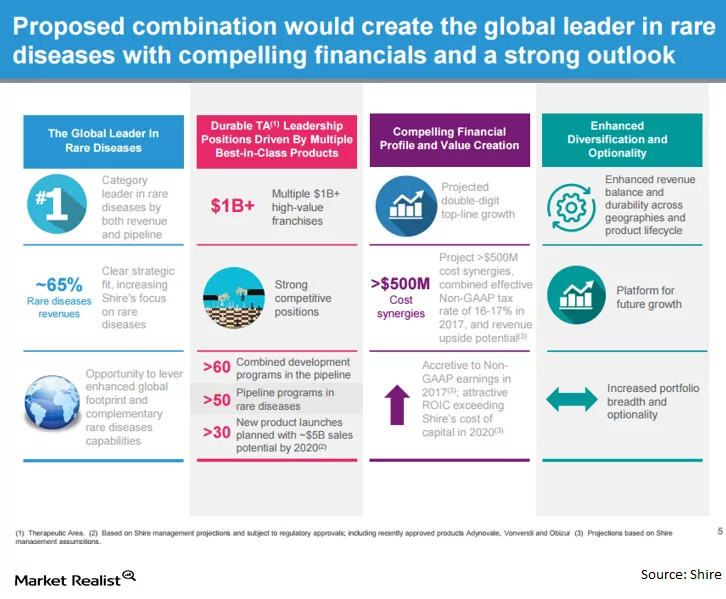

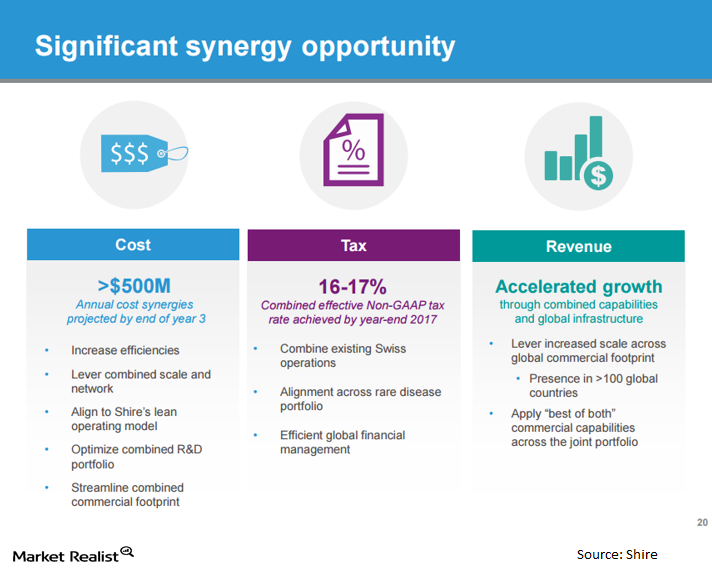

The Baxalta–Shire merger could create the top platform for rare diseases in the world. Baxalta brings Advate, a treatment for hemophilia, a rare blood disease.

Why Home Price Appreciation Differs from State to State

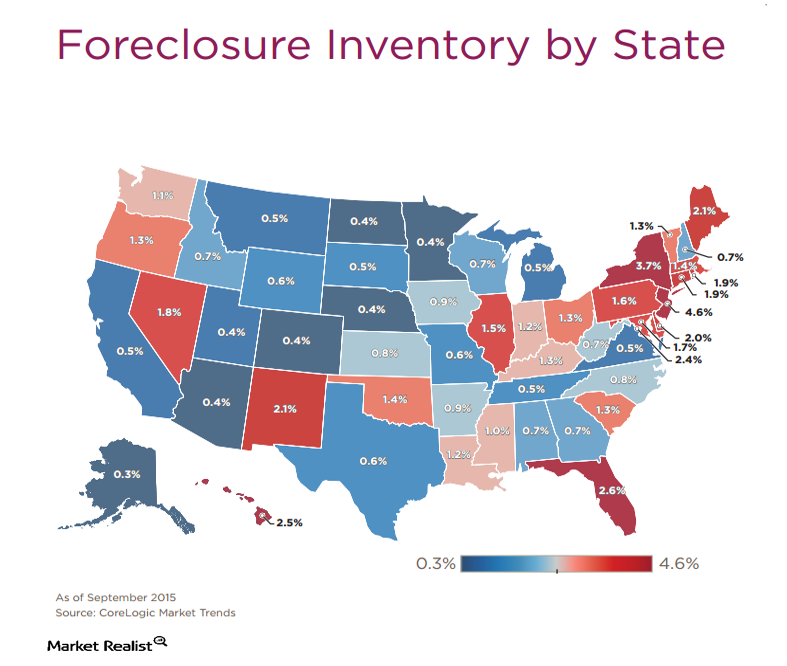

In the judicial states, particularly New York, New Jersey, and Connecticut, we’re seeing much lower home price appreciation.

The Lam Research-KLA-Tencor Merger—Semiconductor Consolidation

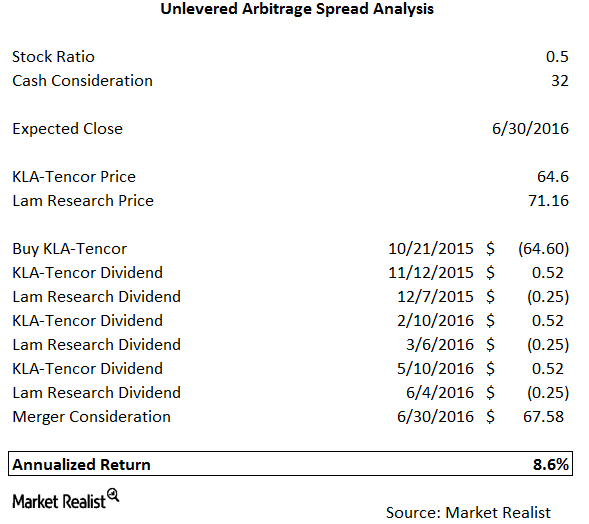

On Wednesday, October 21, Lam Research announced its merger with KLA-Tencor in yet another big deal in the semiconductor space.

Basics of the EMC-Dell Merger

Dell is buying EMC (EMC) for a combination of cash and stock. The total transaction value of the EMC-Dell merger is close to $67 billion if you include cash and assumed debt. Shareholders will receive $24.05 in cash and 0.111 shares of newly-issued VMWare (VMW) tracking stock.

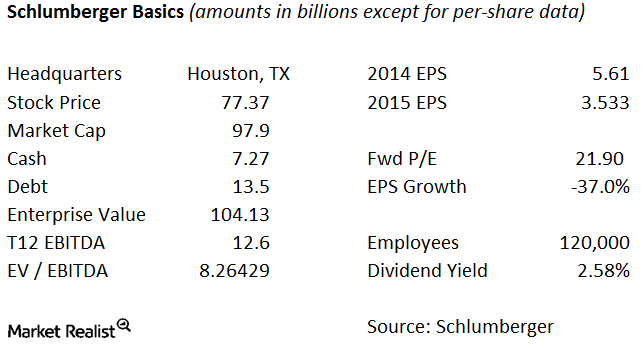

Basics of Schlumberger

Schlumberger (SLB) provides technology, project management, and information technology services to the oil and natural gas exploration and production industry.

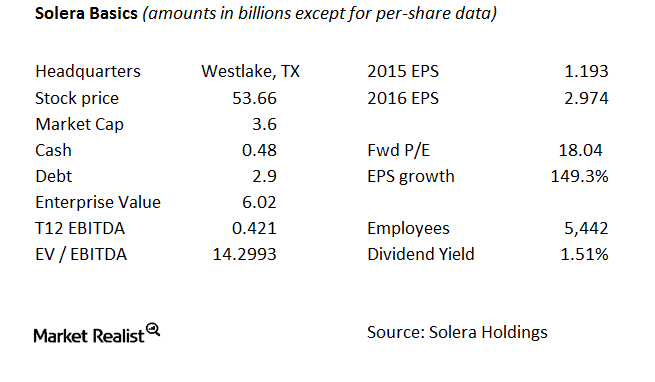

The Basics of Solera

Solera connects insurers and auto service providers. Its software is used by auto insurance companies, auto dealers, collision repair facilities, assessors, auto recyclers, and various other entities.

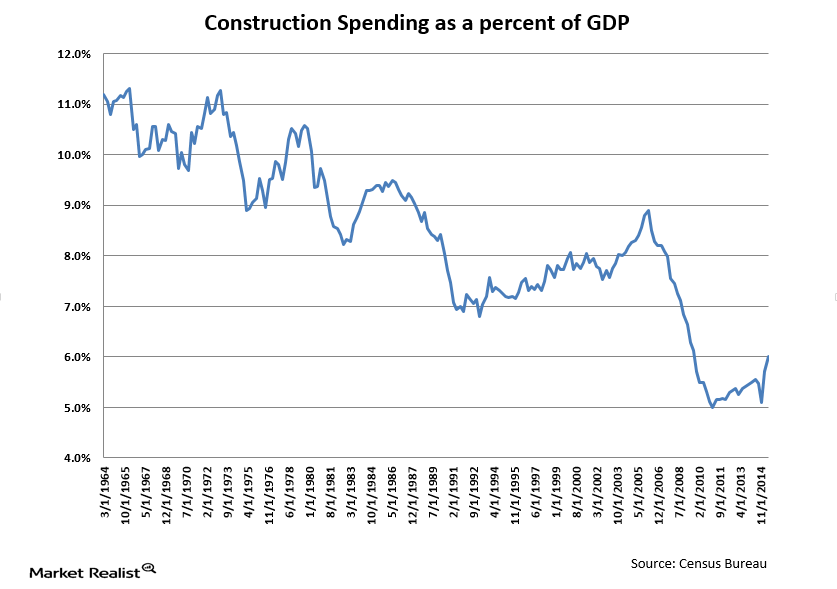

The Importance of Construction Spending to GDP

Historically, construction spending has led economies out of recessions. This didn’t happen in the most recent recession, however, because of the overhang from the real estate bubble.

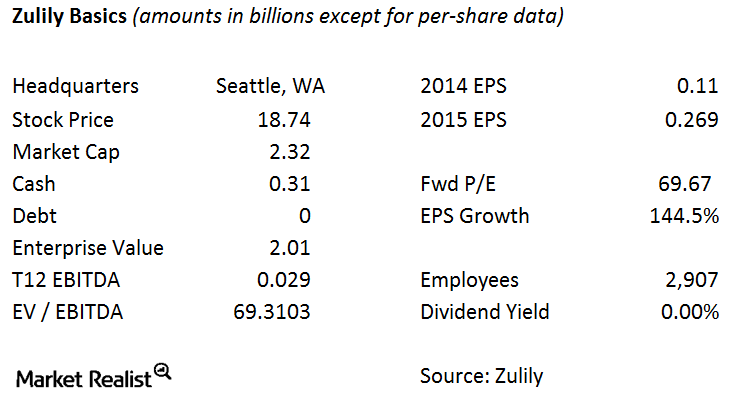

Basics of Zulily

With relationships with emerging and boutique designers, online retailer Zulily uses proprietary technology to match its customers with vendors. This technology is a major reason why Liberty Interactive is buying Zulily.

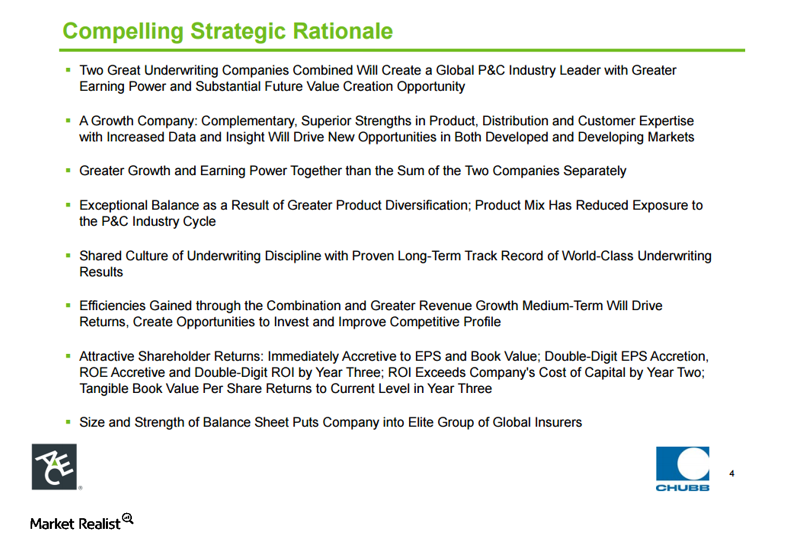

What Is the Rationale for the ACE–Chubb Merger?

The biggest rationale for the ACE–Chubb merger is the potential for cost-cutting. By combining with Chubb, ACE Limited is creating a leading player in property and casualty insurance.

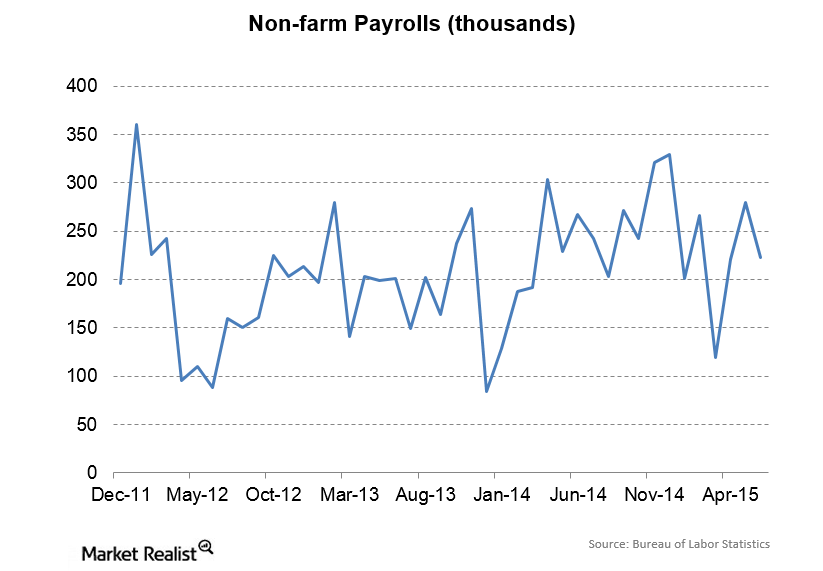

June Payrolls Increase

Private payrolls increased by 223,000 in June, while government jobs growth was flat and manufacturing employment barely increased.

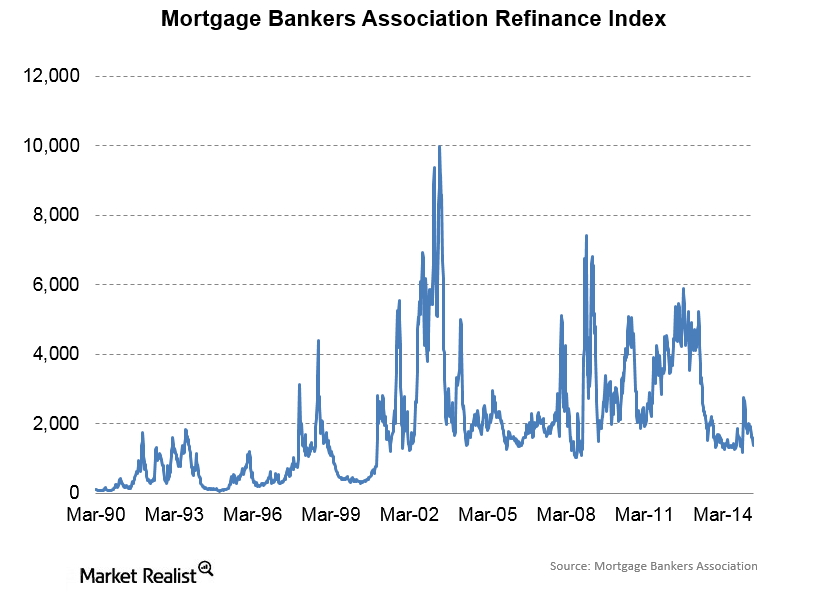

Mortgage Refinances Are Hit by Prepayment Burnout

Refinancing activity affects prepayment speeds. Prepayment speeds occur because homeowners are allowed to pay off their mortgages early and without penalty.

What’s the Rationale for the Broadcom-Avago Merger?

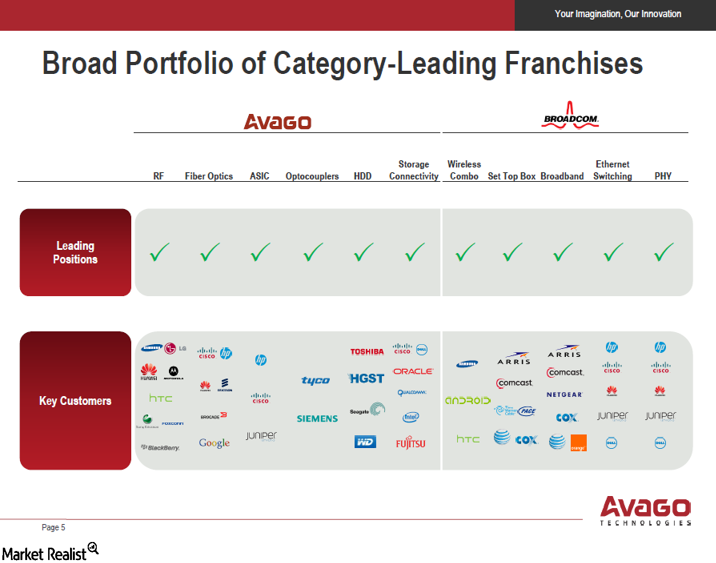

The Broadcom-Avago merger is expected to deliver $750 million in annual synergies within about 18 months of completion of the deal.

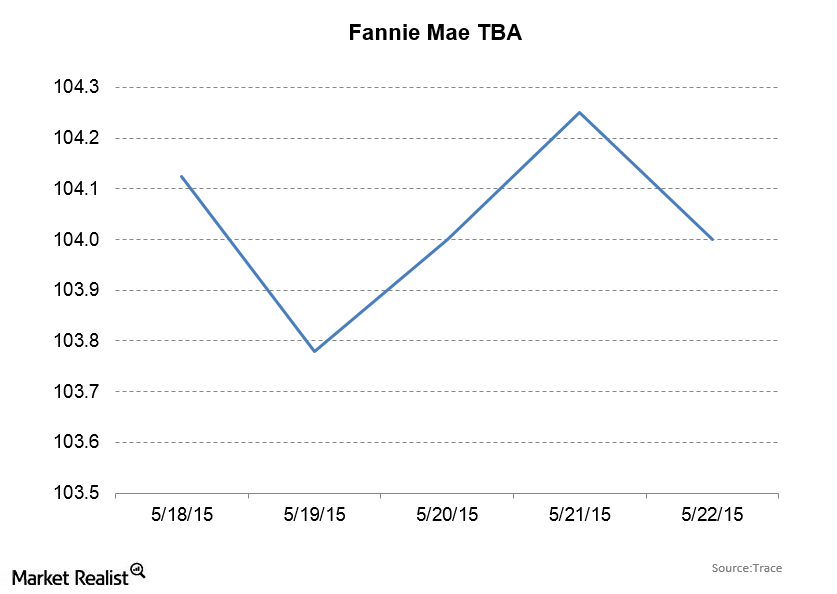

REIT Outlook: Fannie Mae Securities Close at 104 1/32

Fannie Mae TBAs started the week at 104 15/32 and gave up 7/16 to close at 104 1/32. The ten-year bond yield increased by 7 basis points.

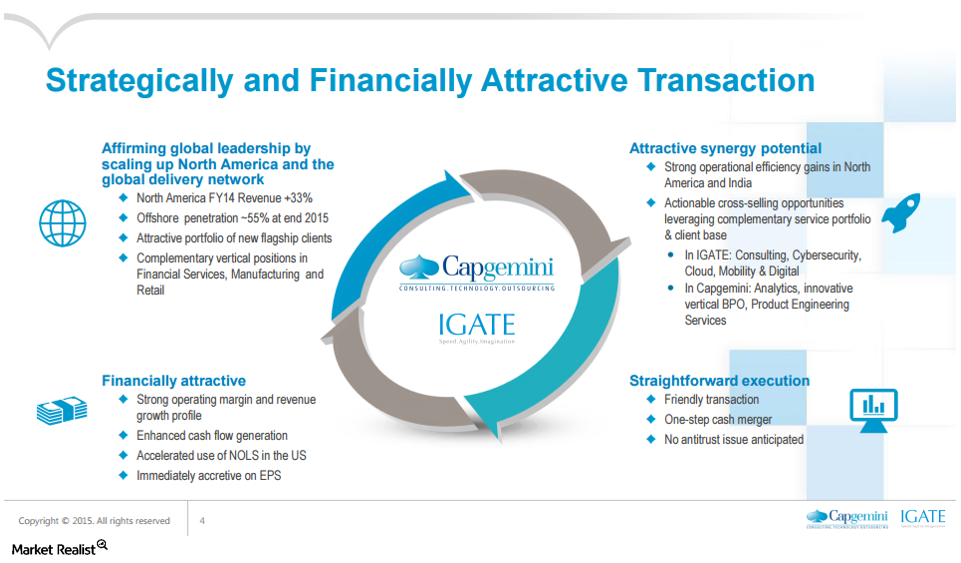

Rationale for Capgemini’s Acquisition of IGATE

The acquisition bolsters Capgemini’s exposure in the financial verticals—where IGATE is particularly strong—as well as manufacturing, retail, and healthcare.

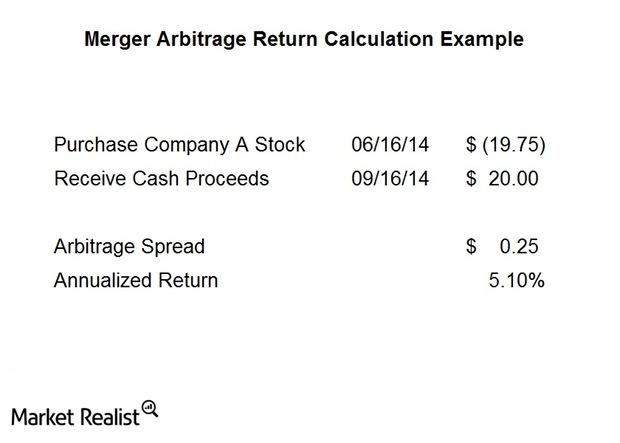

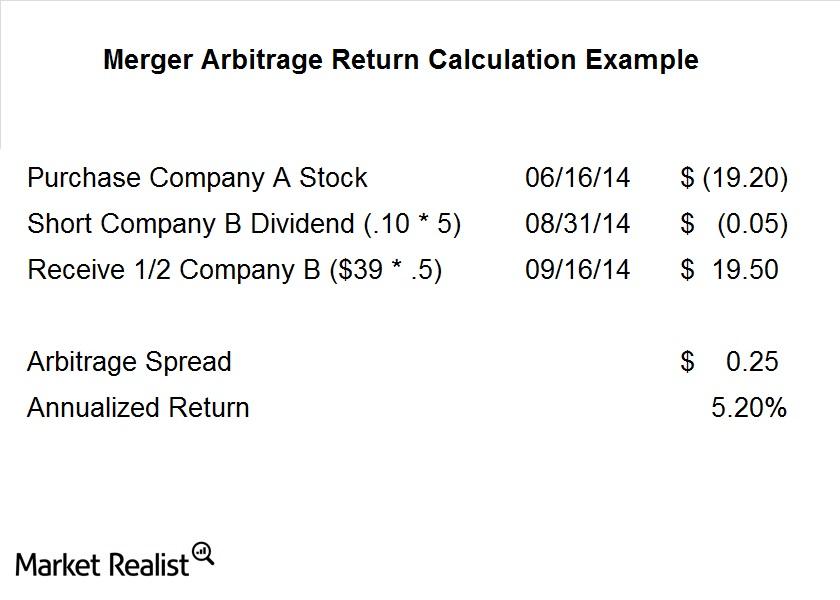

Identifying and analyzing a typical cash merger arbitrage spread

What are the components of a risk arbitrage spread? There are a number of factors that figure into a trade. Let’s look at a typical cash deal first.

Merger arbitrage must-knows: A typical stock merger spread

Not all deals are cash deals, however. Often companies will issue stock in lieu of giving cash for a deal. This adds a layer of complication to the process and also some risk factors we need to consider.

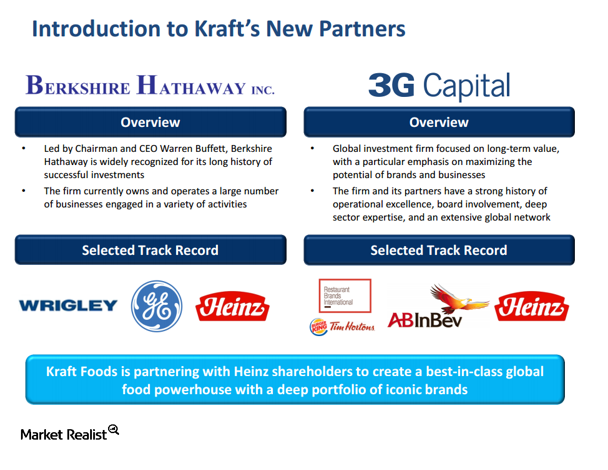

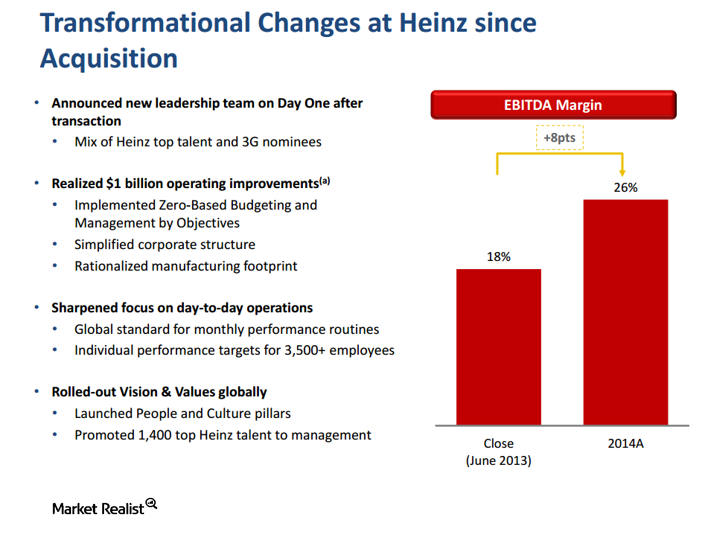

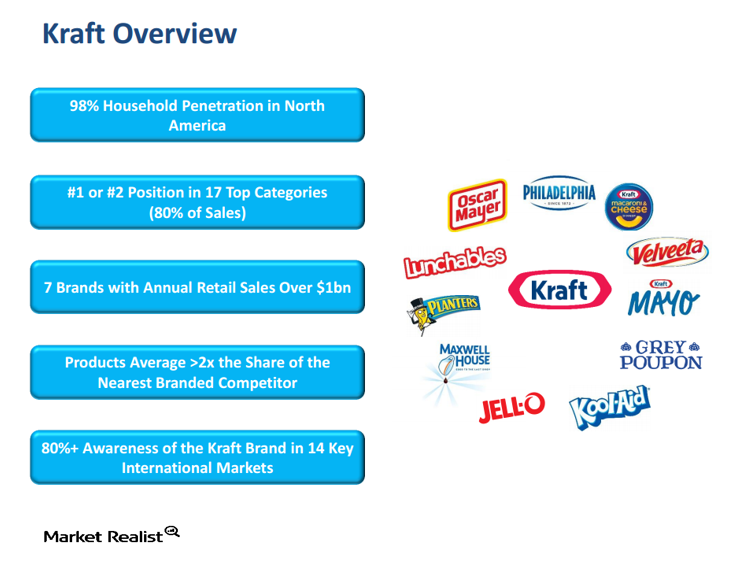

The Kraft–Heinz merger: Overview of Heinz

Kraft’s (KRFT) and Heinz’s portfolio of brands are highly complementary, which is a big reason for the Kraft–Heinz merger.

The Kraft–Heinz Merger: What If the Deal Breaks?

The Kraft–Heinz merger isn’t a typical risk arbitrage deal because you can’t arbitrage a spread. Before the deal, Kraft was trading at $62.40 a share.

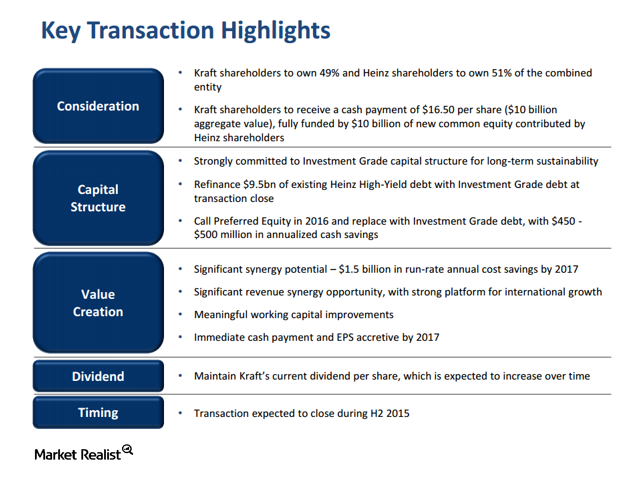

The Kraft–Heinz Merger: Transaction Rationale

The Kraft–Heinz merger entity will maintain Kraft’s current dividend, and management anticipates it will grow.

Is Antitrust an Issue in the Kraft–Heinz Merger?

The first place arbitrageurs look to get a handle on antitrust risk is the 10-K, where companies often disclose the names of competitors.

The Kraft–Heinz Merger and Material Adverse Change, Part 3

Other important merger spreads include the deal between Time Warner Cable and Comcast as well as the merger between Pharmacyclics and AbbVie.

The Kraft–Heinz Merger: Transaction Benefits for Kraft Investors

Kraft has a non-solicitation agreement with a fiduciary out. This means that Kraft could discuss another merger if approached by another suitor.

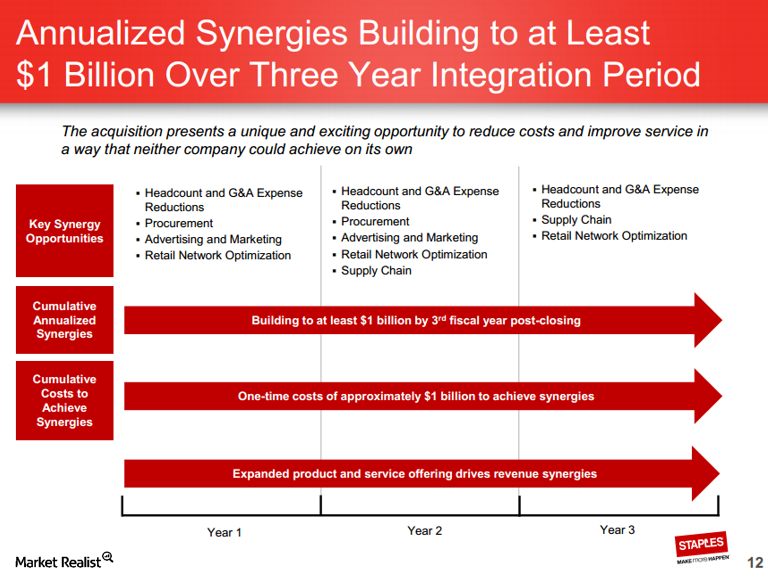

The Office Depot–Staples merger is about cost savings

Staples expects to spend $1 billion up front in order to achieve $1 billion in annual synergies—usually meaning reducing workforce—beginning in year three.

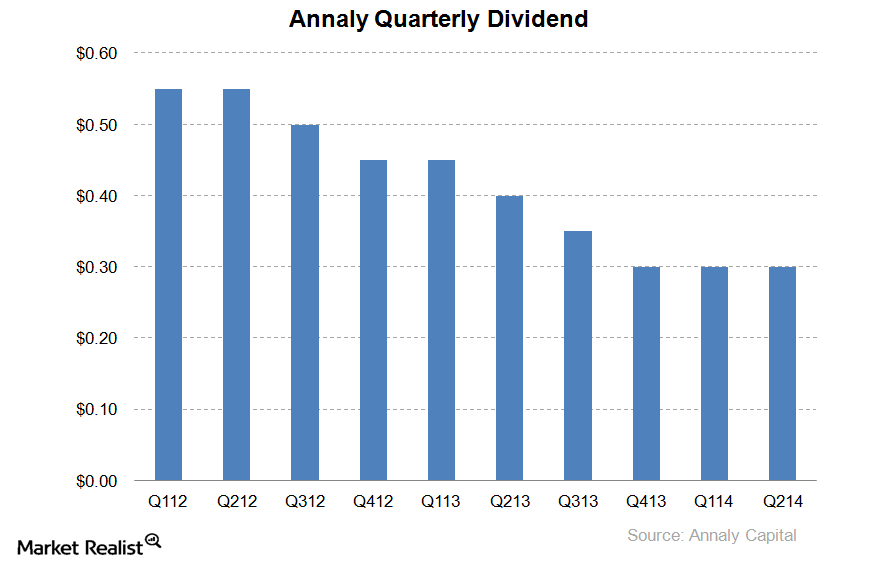

Annaly CEO Wellington Denahan shares her vision for the future

On the company’s conference call to analysts and investors, Annaly CEO Wellington Denahan addressed the current interest rate environment and where she saw the company heading in the future.

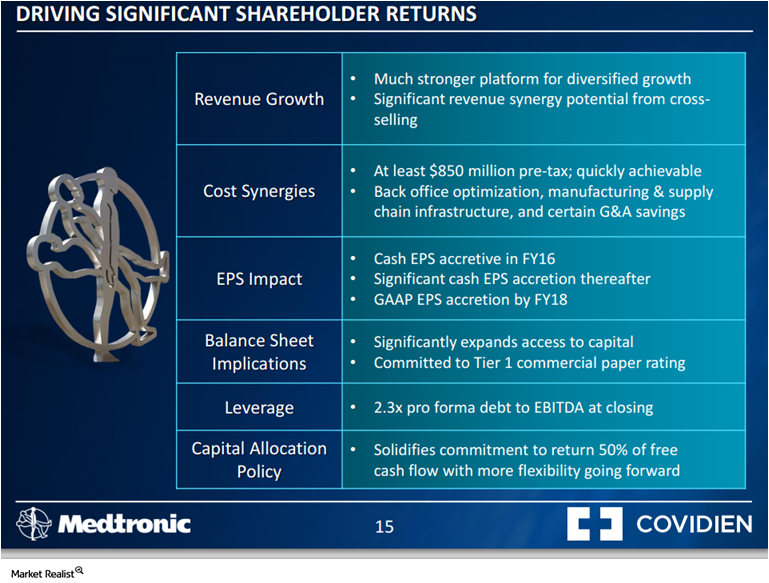

Understanding the rationale for the Covidien-Medtronic transaction

On June 15, 2014, Medtronic (MDT) and Covidien (COV) reached an agreement to merge via a scheme of arrangement. The two companies more or less offer complementary goods.

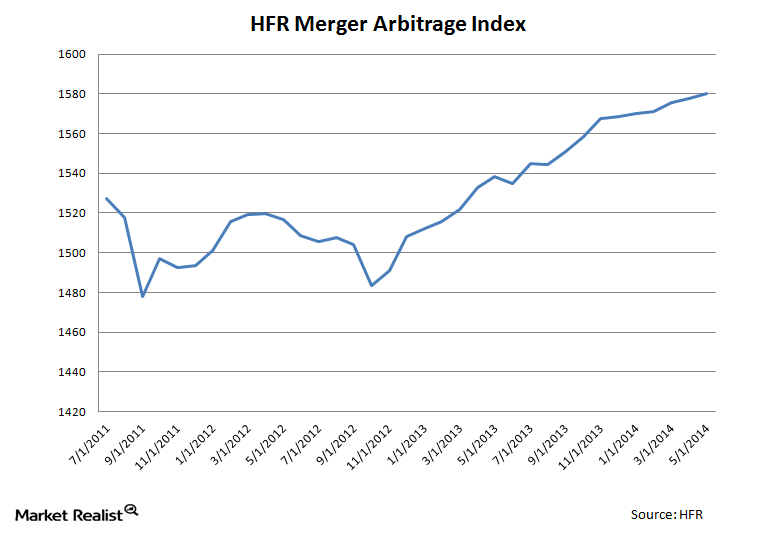

Merger arbitrage must-knows: A key guide for investors

Merger arbitrage, otherwise known as “risk arbitrage,” is an investment strategy that primarily focuses on mergers and capturing the spreads on announced deals.

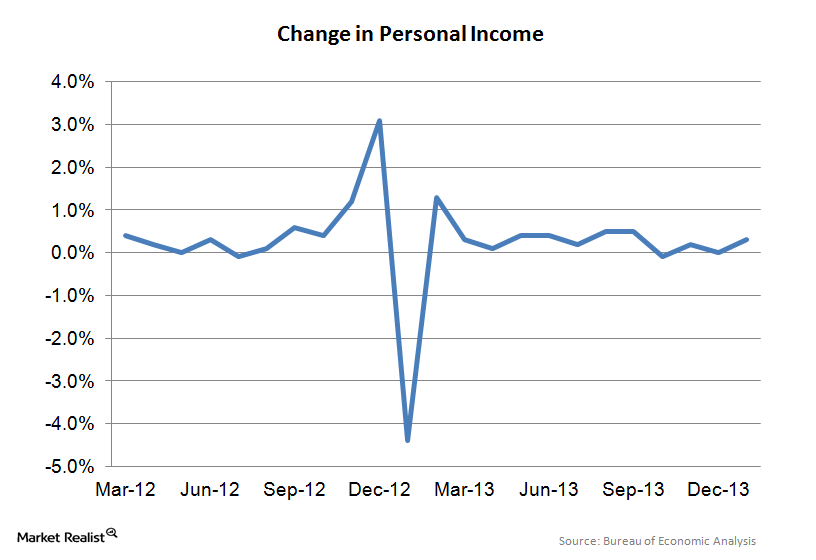

Important releases for homebuilder and REIT investors this week

While last week was a huge one for the builders, we still have a lot of important data this week, with the Case-Shiller Real Estate Index, New Home Sales, as well as the Personal Spending and Income data.

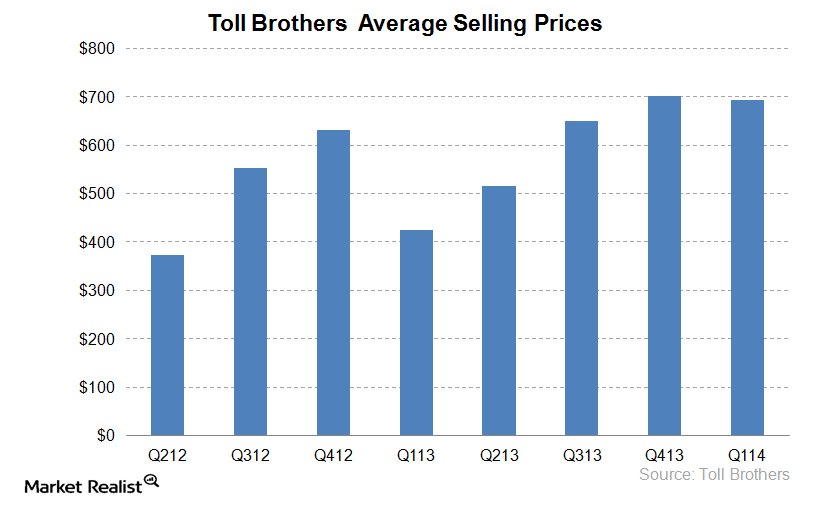

Why Toll Brothers differs from other builders: An investor’s guide

Toll Brothers caters to move-up, empty-nest, active-adult, age-qualified, and second-home buyers in the United States. It currently operates in 19 states.

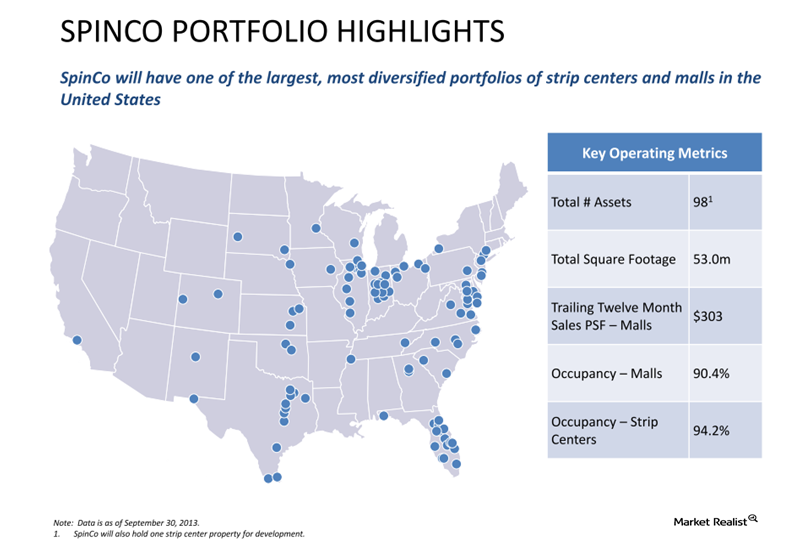

Must-know basics of Simon Property Group’s spinoff REIT, Spinco

Spinco will have one of the largest, most diversified portfolios of strip centers and malls in the United States. It will hold a total of 98 assets.

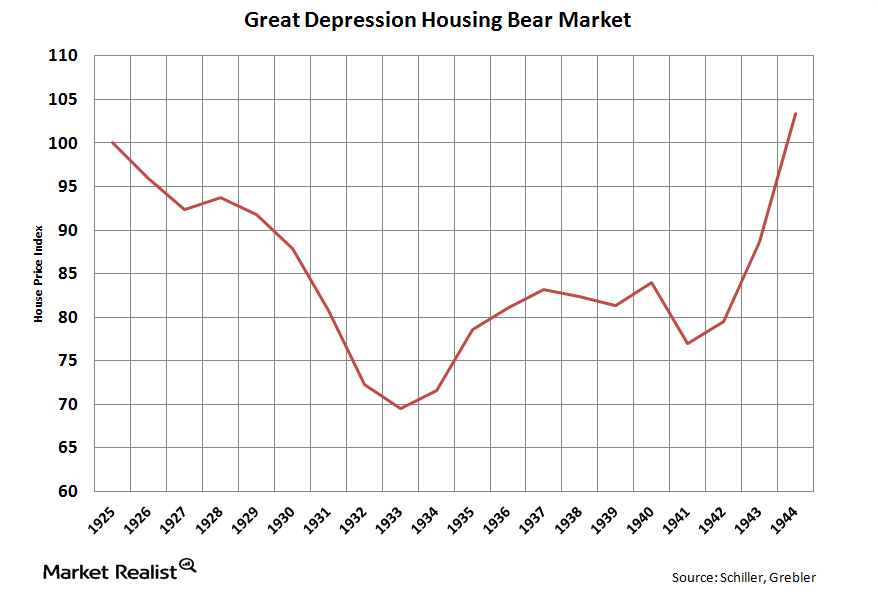

Comparing the Great Depression’s housing bear market with today’s

The real estate bubble of the 2000s was bigger than the real estate bubble of the 1920s In many ways, the dual stock market and real estate bubbles of the 1920s were a mirror image of the 2000s market collapse. The 1920s real estate boom peaked in 1925, and the stock market collapsed four years […]