Wendy's Co

Latest Wendy's Co News and Updates

Is Wendy's Going Private? Potential Deal Could Change WEN Stock’s Fate

The largest shareholder of Wendy's fast food chain is exploring a potential merger or acquisition. Will WEN stock go private as a result?

Wendy’s Is Rolling Out New French Fries Nationwide

Who supplies Wendy’s fries? Learn more about the fast-food chain’s fries—and the new french fry recipe the company is rolling out in September.

WallStreetBets Is Behind the Movement in Wendy's (WEN) Stock

Investors want to know if Reddit’s WallStreetBets community will target Wendy's (WEN) stock next. Is WEN stock a good buy now?

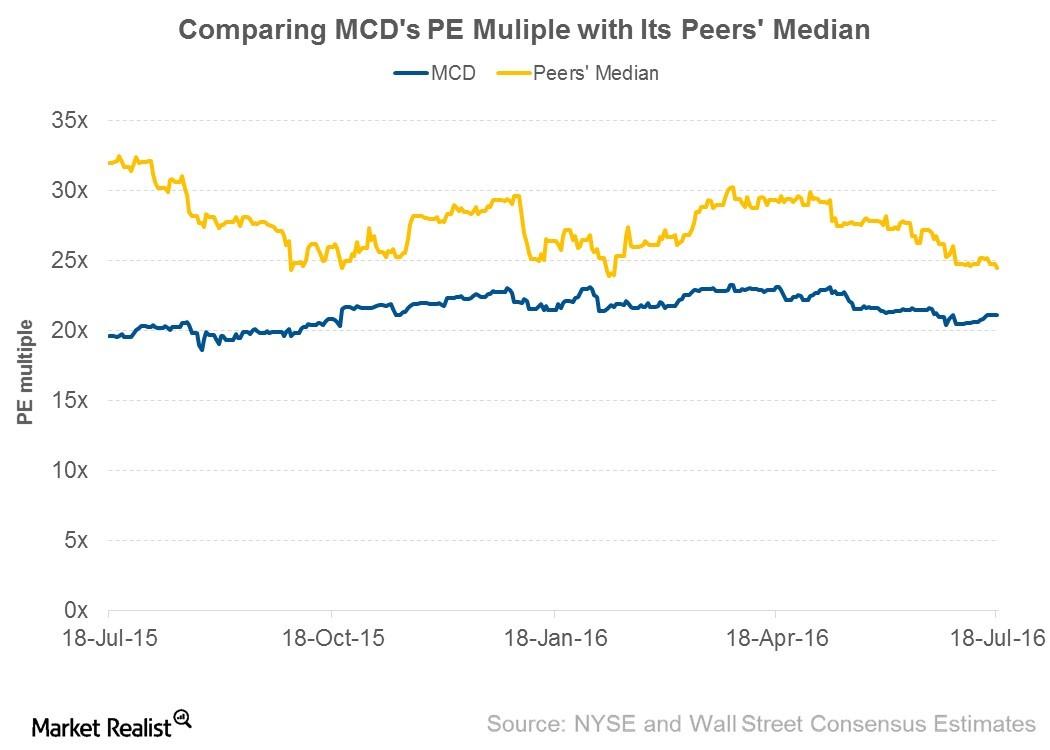

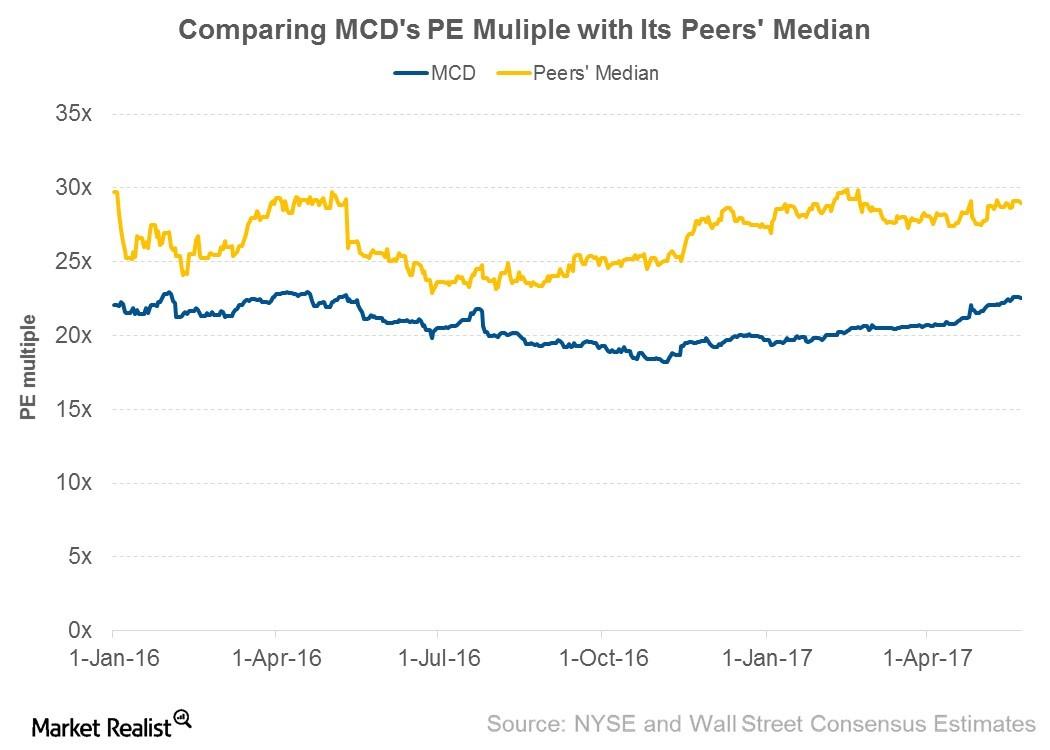

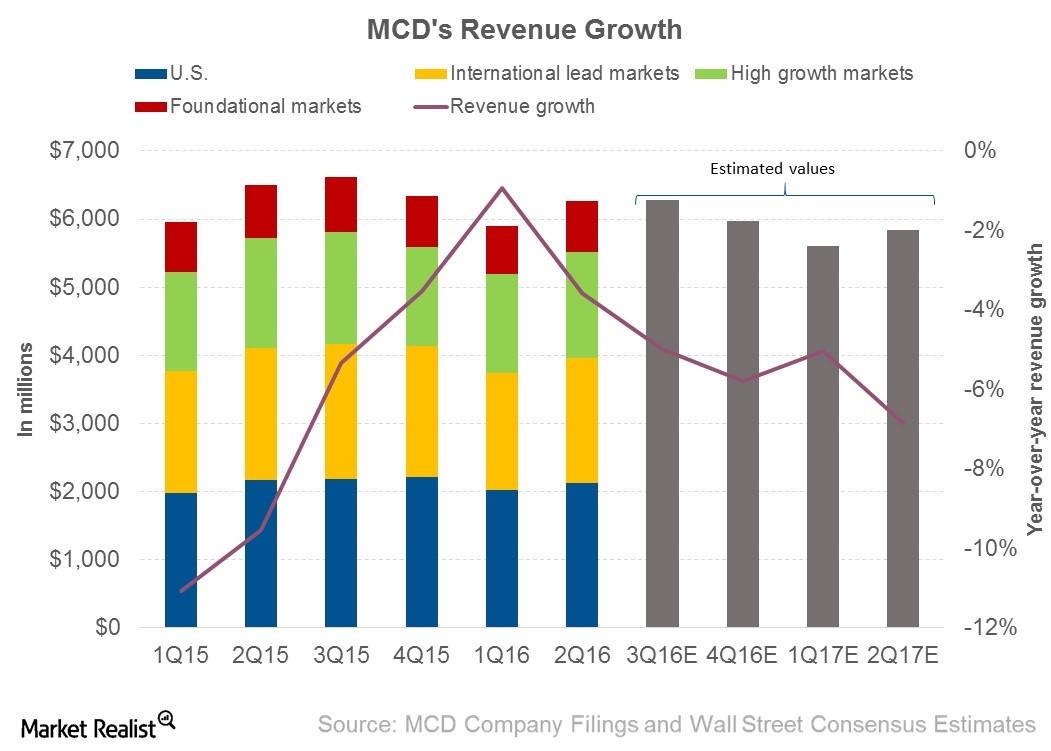

Can 2Q16 Results Drive McDonald’s Valuation Multiple Up?

Valuation multiple Investors should look at valuation multiples when deciding whether to enter or exit a stock. Valuation multiples are driven by perceived growth, risk and uncertainties, and investors’ willingness to pay for a stock. There are various multiples to evaluate a stock. In this article, we’ll use the PE (price-to-earnings) ratio due to its […]

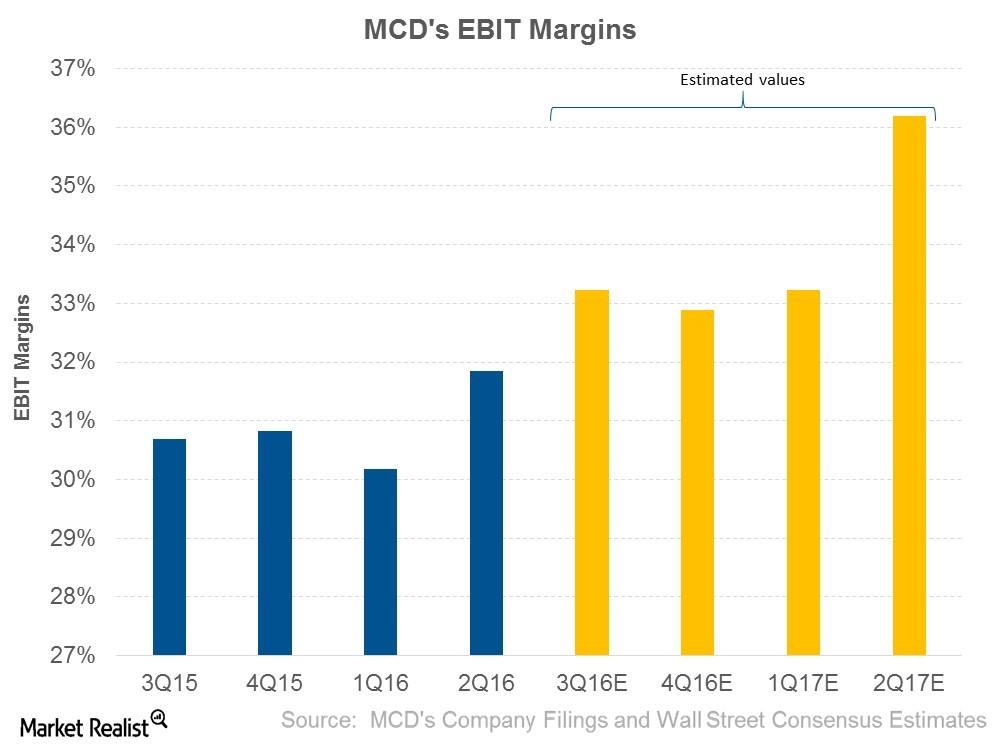

How Will McDonald’s Expand Its EBIT Margins?

Wall Street analysts are expecting McDonald’s (MCD) to post EBIT of $2.1 billion in 3Q16. This represents an EBIT margin of 33.2% compared to 30.7% in 3Q15.

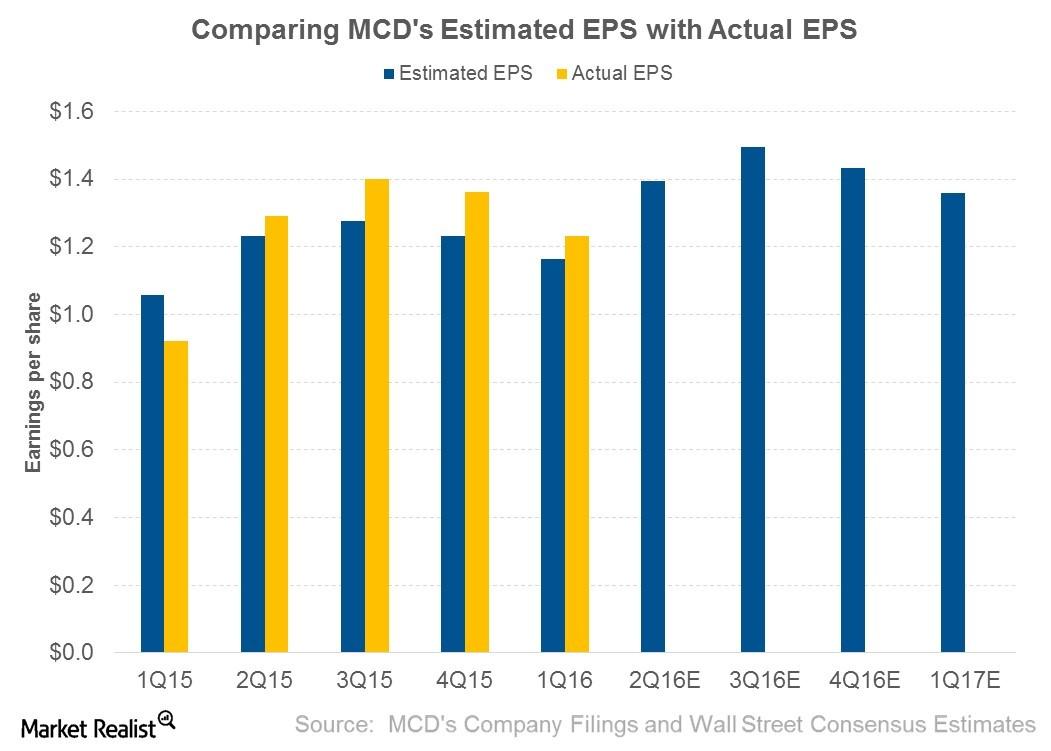

Will McDonald’s 2Q16 Earnings Beat Analysts’ Estimates?

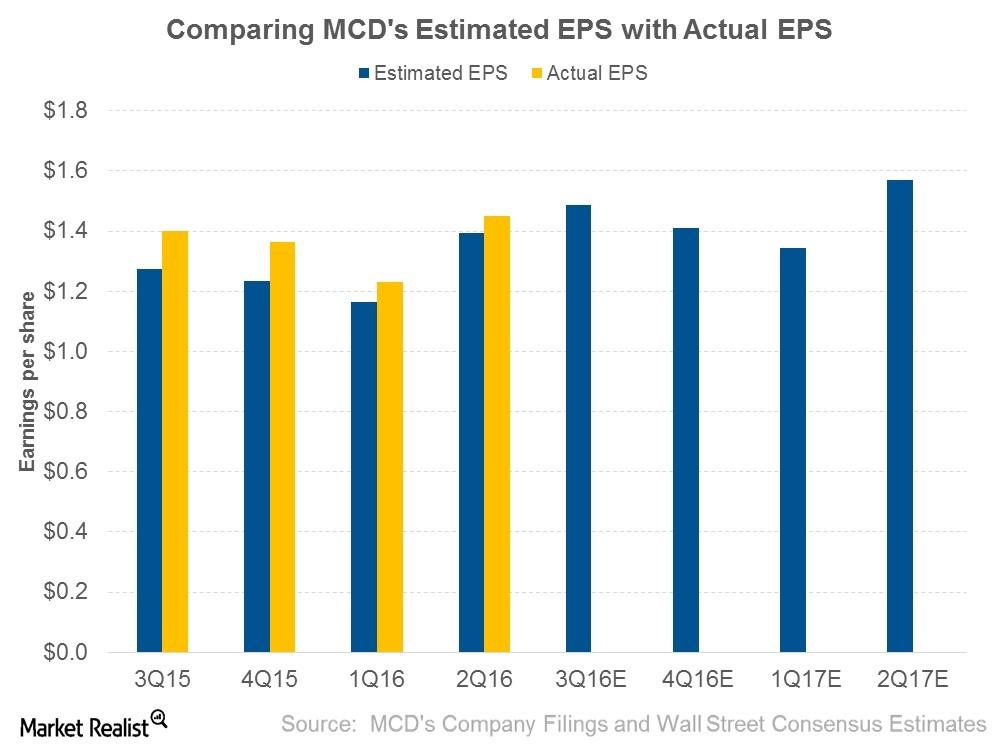

So far in this series, we’ve discussed McDonald’s (MCD) estimated revenue, sources of revenue, and estimated EBIT (earnings before interest and tax) margins.

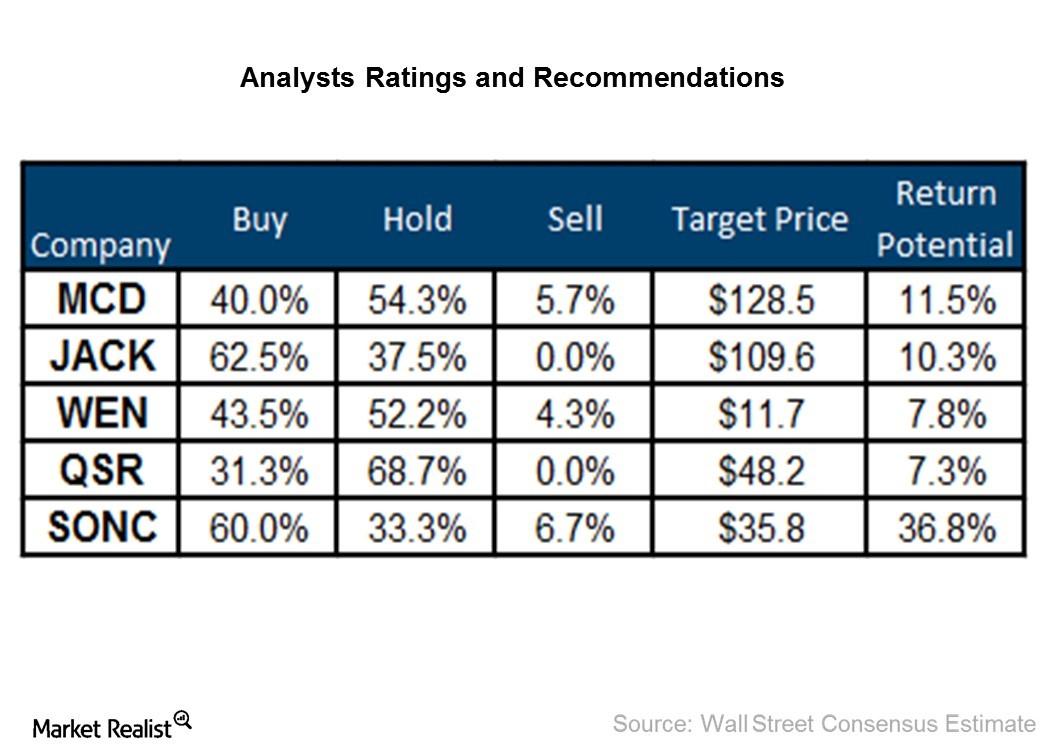

Which Fast Food Restaurants Do Analysts Favor?

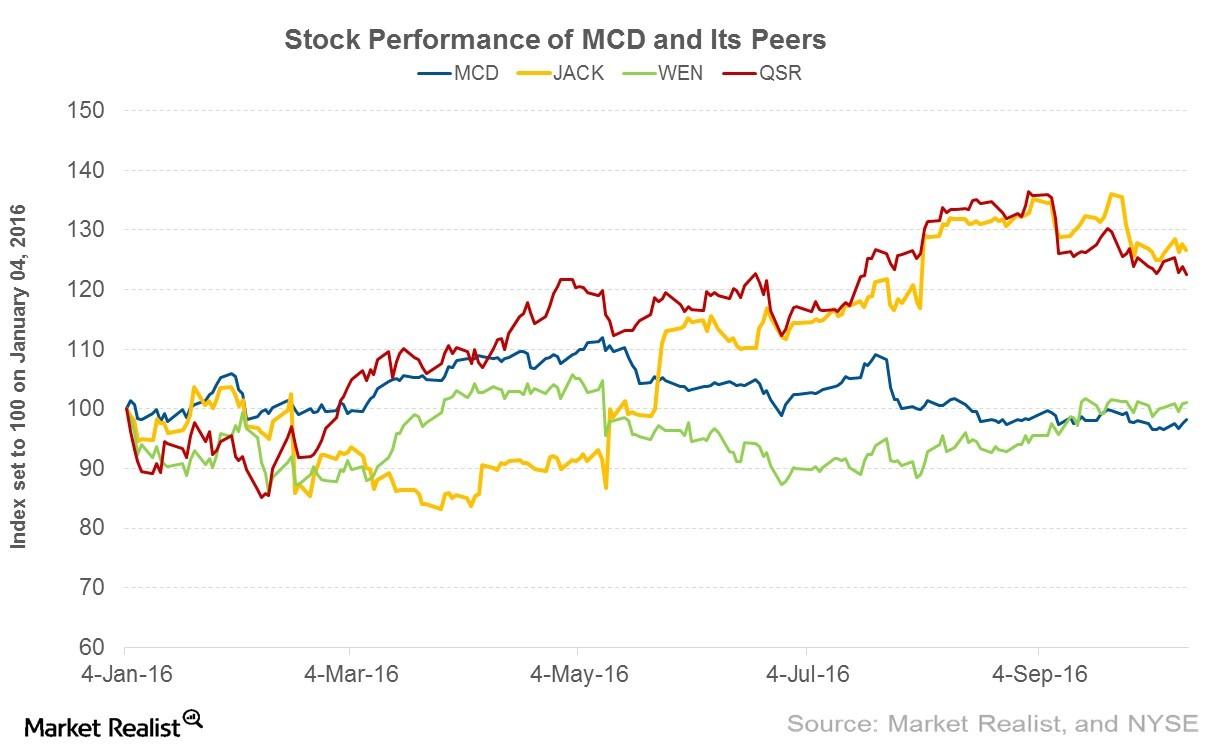

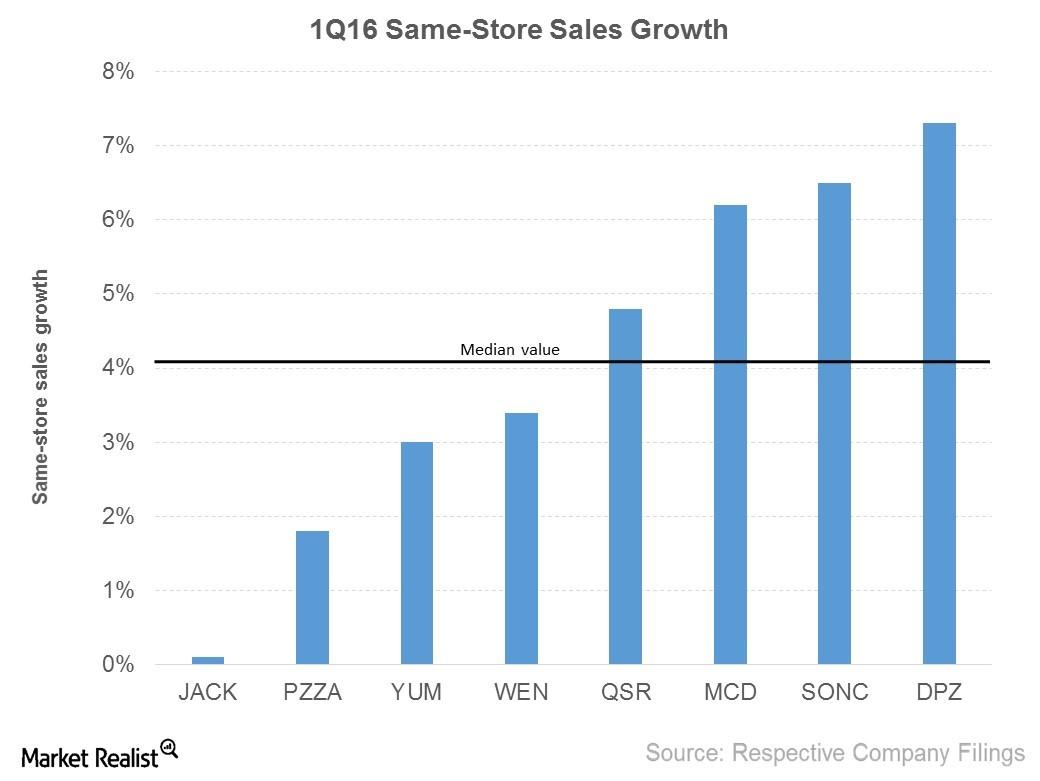

Jack in the Box (JACK) and Restaurant Brands International (QSR) are analysts’ favorites among the companies we’ve reviewed in this series.

Can Investors Expect Momentum from McDonald’s 3Q16 Earnings?

McDonald’s (MCD) is scheduled to announce its 3Q16 results on October 21, 2016. As of October 13, 2016, it was trading at $115.40, a fall of 9.4% from July 25.

Can McDonald’s Beat Analysts’ Earnings Estimates Again in 3Q16?

In the last four quarters, McDonald’s has beaten analysts’ estimates. In 3Q16, analysts are expecting the company to post EPS of $1.48, a year-over-year rise of 6.1%.

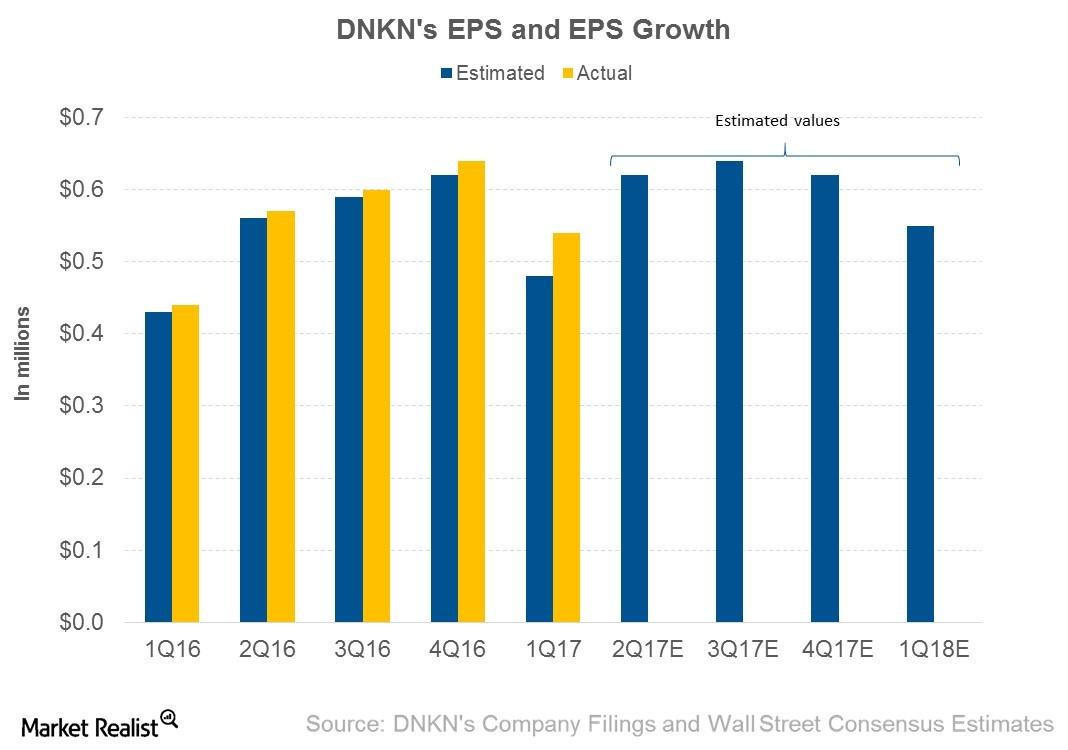

What Will Drive Dunkin’ Brands’ 2Q17 Earnings?

In 2Q17, analysts expect Dunkin’ Brands (DNKN) to post EPS (earnings per share) of $0.62, which represents a rise of 8.8% from its EPS of $0.57 in 2Q16.

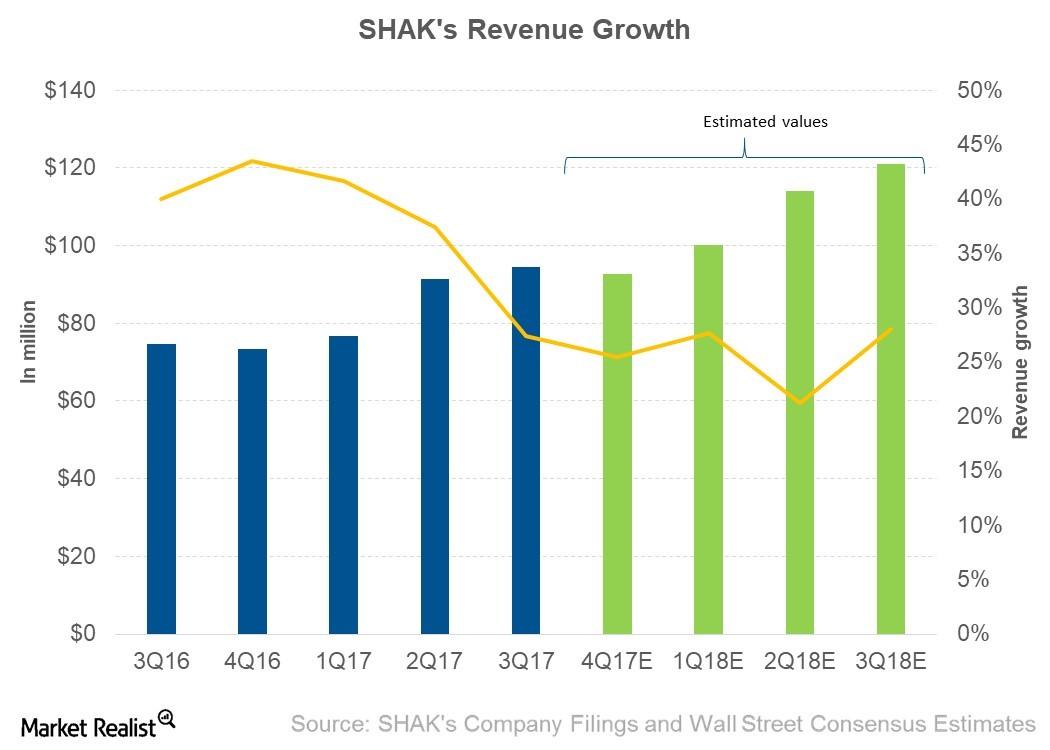

Why Analysts Are Expecting Shake Shack to Rise over the Next 4 Quarters

For the next four quarters, analysts are expecting Shake Shack (SHAK) to post revenues of $427.9 million, which would be a 27.4% YoY (year-over-year) rise.

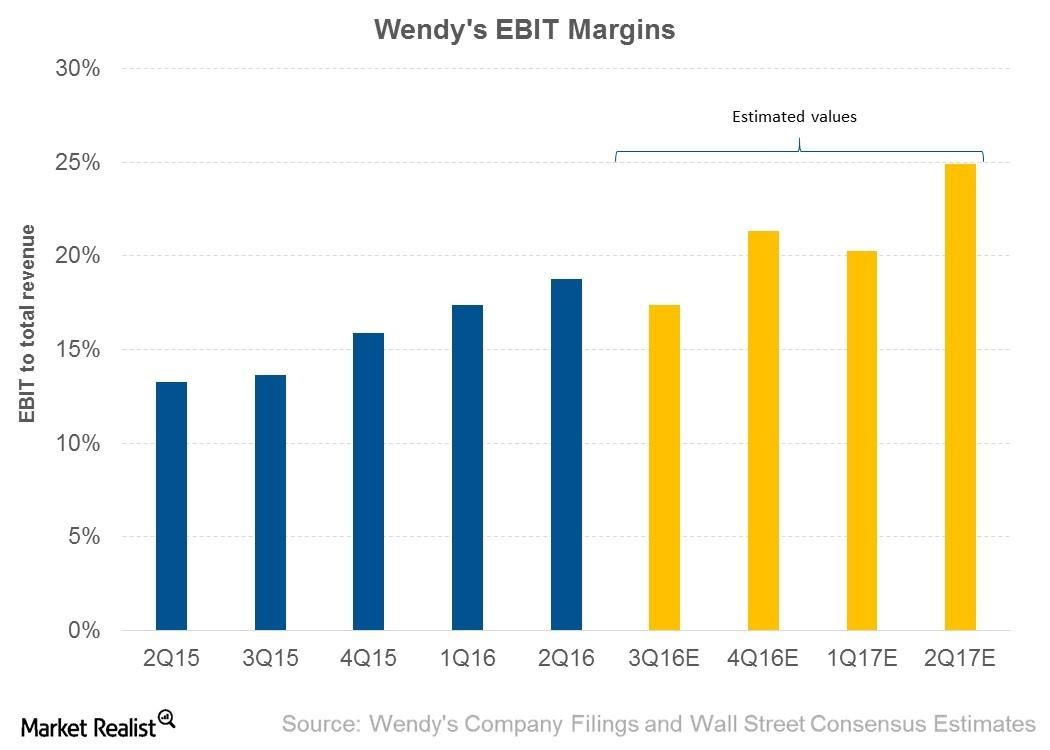

Why Did Wendy’s EBIT Margins Expand in 2Q16?

In 2Q16, Wendy’s posted EBIT of $71.7 million—an EBIT margin of 18.7% compared to 13.3% in 2Q15. Analysts expected the EBIT margin to be 16.7%.Consumer Must-know: Chipotle Mexican Grill’s food costs

CMG reported $372 million in food costs in 3Q14. Food costs accounted for 34.3% of the revenue. It was an increase of 70 basis points year-over-year (or YoY).Consumer Analyzing Burger King’s shifting business model focus in 2Q14

Franchise revenues include royalties and franchise fees. Royalties are calculated as a percentage of franchise restaurant revenues, which are driven by same-store sales.

McDonald’s Risks, Strengths, and Weaknesses

The restaurant industry is susceptible to a wide array of risks of macro and micro factors. As a huge global brand, McDonald’s faces several risks.

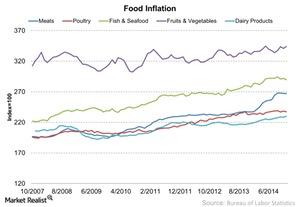

How Food Inflation Impacts The Restaurant Industry

Food inflation can squeeze a restaurant’s operating margins, but a restaurant can adjust the menu pricing and pass the cost on to customers.

McDonald’s Global Presence and the Three-Legged Stool

McDonald’s, the world’s largest fast food chain, has over 38,000 restaurants across 120 countries. In 2018, it had approximately $21.0 billion in sales.

Can Starbucks Deliver Double-Digit EPS Growth in Q1?

Starbucks will report its first-quarter earnings after the market closes on Tuesday. Analysts expect the company to report double-digit EPS growth.

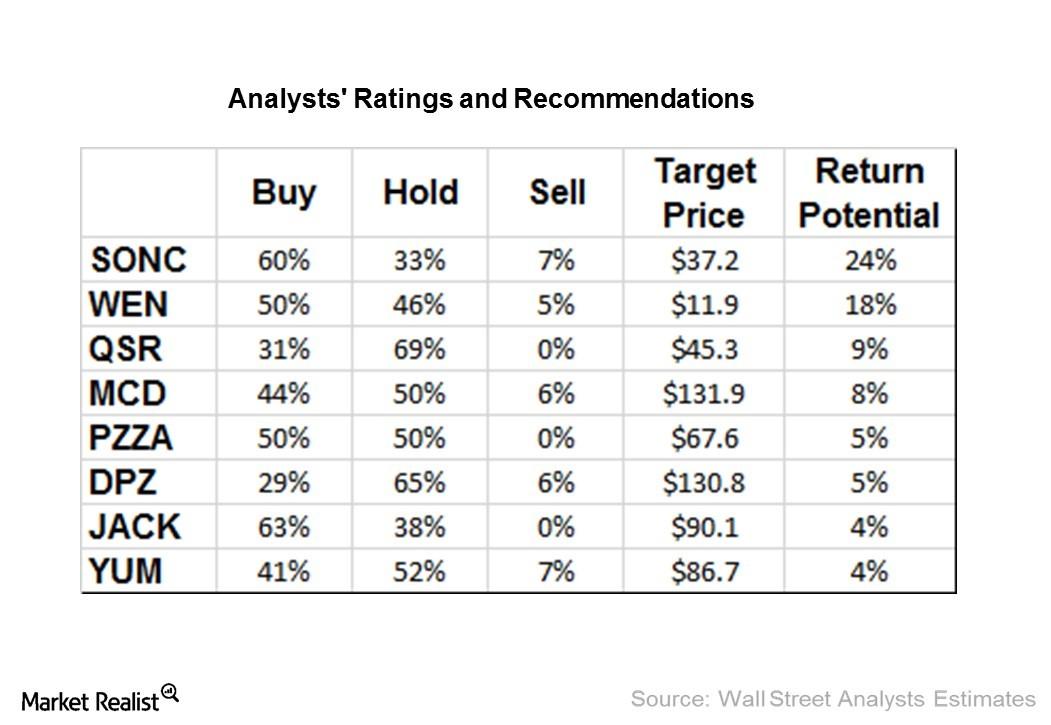

The Word on the Street: What Analysts Are Recommending for Fast-Food and Pizza Companies after 1Q16

JACK, PZZA, and QSR are the most favored stocks in our group of eight fast-food restaurants, with no analyst recommending a “sell” for their stocks.

Must-Know: McDonald’s Has Got Tough Competition

McDonald’s (MCD) competition includes large international and national food chains as well as regional and local retailers of food products.

How McDonald’s Wages and Major Costs Stack Up

McDonald’s performance is sensitive to any changes in price levels—be it food, labor, or rent. So how much does it cost for McDonald’s to generate revenue?

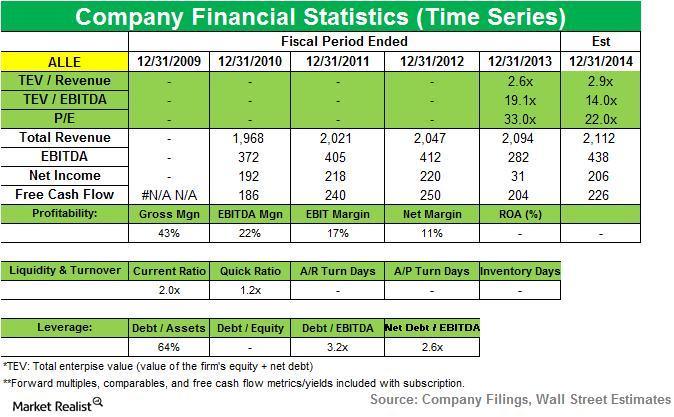

Trian Fund lowers its position in Allegion

Allegion provides security solutions for homes and businesses, employing more than 8,000 people and selling products in more than 120 countries across the world. Allegion reported third-quarter 2014 net revenues of $546.7 million, up 3.3% compared to the previous year.

Is McDonald’s a ‘Buy’ Ahead of Its Q2 Earnings?

McDonald’s is set to report its second-quarter earnings before the market opens on July 28. Let’s look at analysts’ expectations for the quarter.

What to Expect from Jack in the Box’s Q2 Earnings

For the second quarter, analysts expect Jack in the Box to report revenue of $211.1 million—a fall of 2.1% from the second quarter of 2019.

What Does Wendy’s Future Look Like?

Innovation, consumer-facing technological development, and brand building with its franchisees are going to be the three crucial aspects of Wendy’s future.Consumer Why fuel prices affect restaurants

Higher fuel costs put pressure on operating costs, and can squeeze profit margins. The demand side also takes a hit. When gas prices are high, consumers tend to economize on transit by eliminating unnecessary trips.

McDonald’s Menu Struggles to Shed Its Junk Food Rep

Despite health-related controversies, fast food companies such as McDonald’s maintain that they provide consumers with choice and convenience.

The Restaurant Industry: An Overview

More Americans are eating out, and they’re eating out more often. The restaurant industry’s share of the food dollar is 51%, up from 25% in 1955.

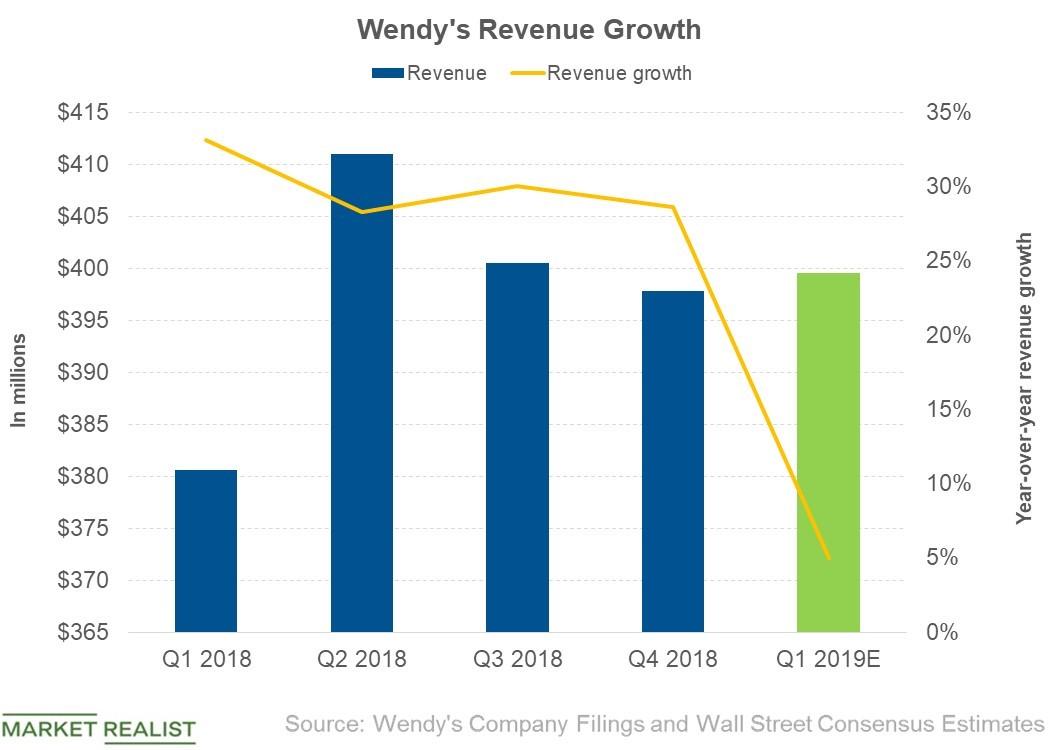

What Will Drive Wendy’s Revenue in Q1 2019?

Analysts expect Wendy’s (WEN) to post adjusted EPS of $399.5 million in the first quarter of 2019, a rise of 5.0% from its $380.6 million in the first quarter of 2018.

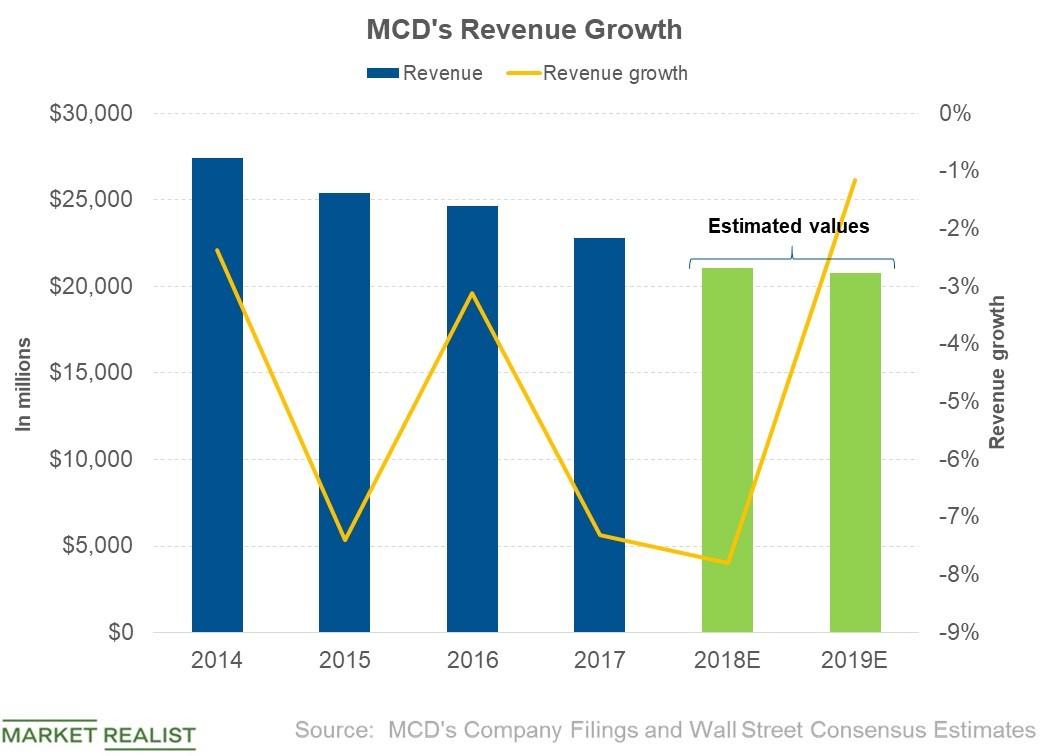

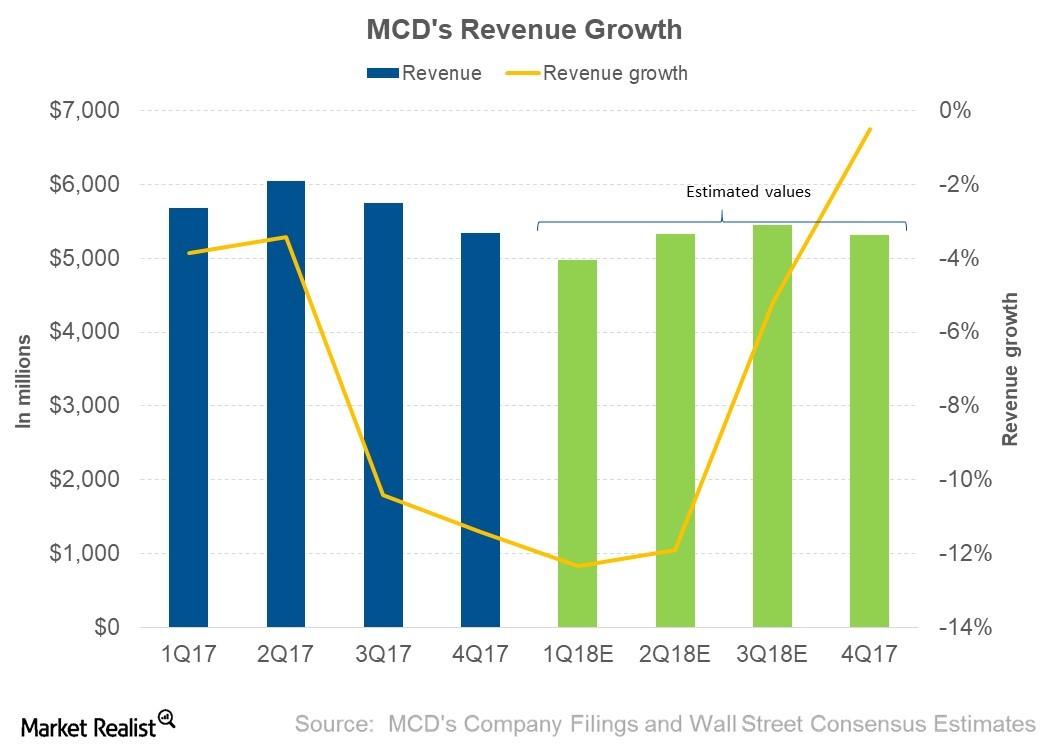

Analysts Expect McDonald’s Revenue to Fall in Q1 2019

In the first quarter of 2019, analysts expect McDonald’s (MCD) revenue to fall 4.1% YoY (year-over-year) to $4.93 billion from $5.14 billion, likely due to its company-owned restaurant count falling.

What Analysts Expect from McDonald’s Revenue in 2019

In the first three quarters of 2018, McDonald’s (MCD) revenue fell 9.3% to $15.86 billion.

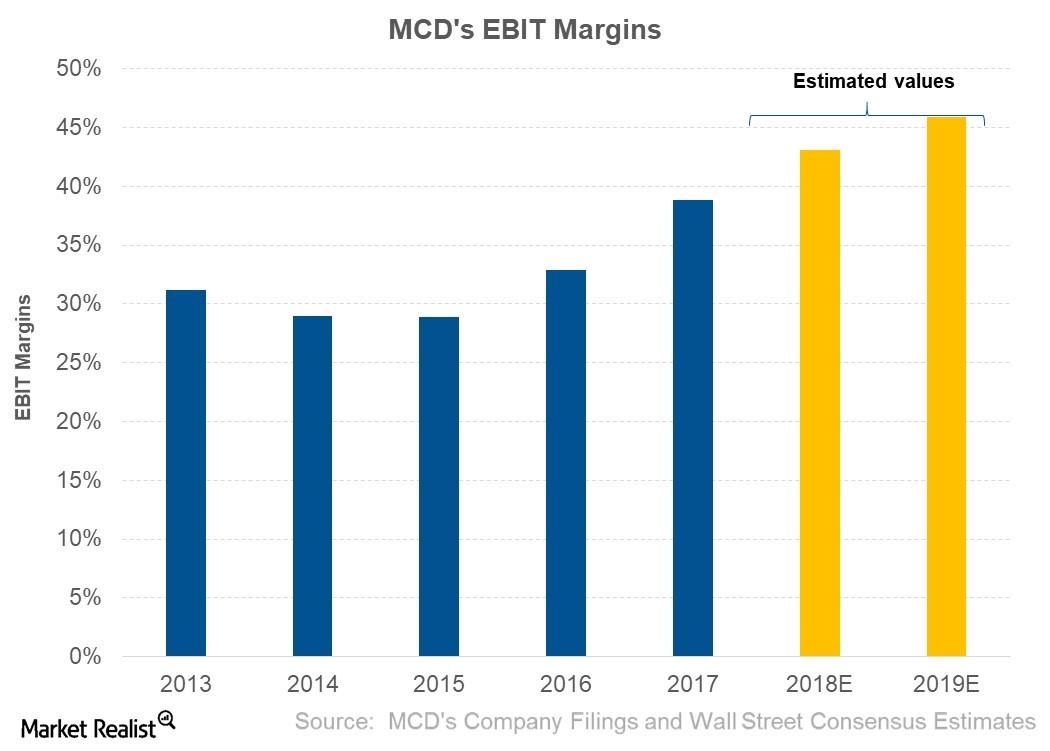

Why McDonald’s EBIT Margin Expanded in 2018

McDonald’s (MCD) has posted EBIT (earnings before interest and tax) of ~$8.9 billion, which represents an EBIT margin of 38.8%.

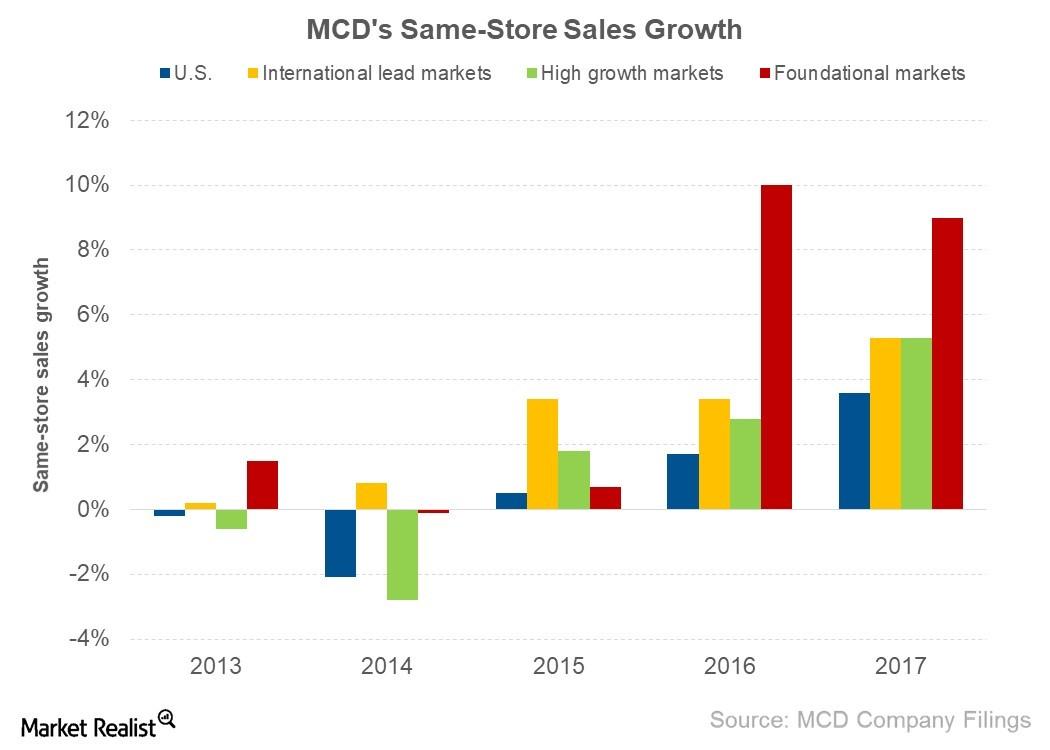

McDonald’s Posts Strong Same-Store Sales Growth in 2017

MCD posted SSSG of 3.8%, 1.5%, -1.0%, and 0.2% in 2016, 2015, 2014, and 2013, respectively.

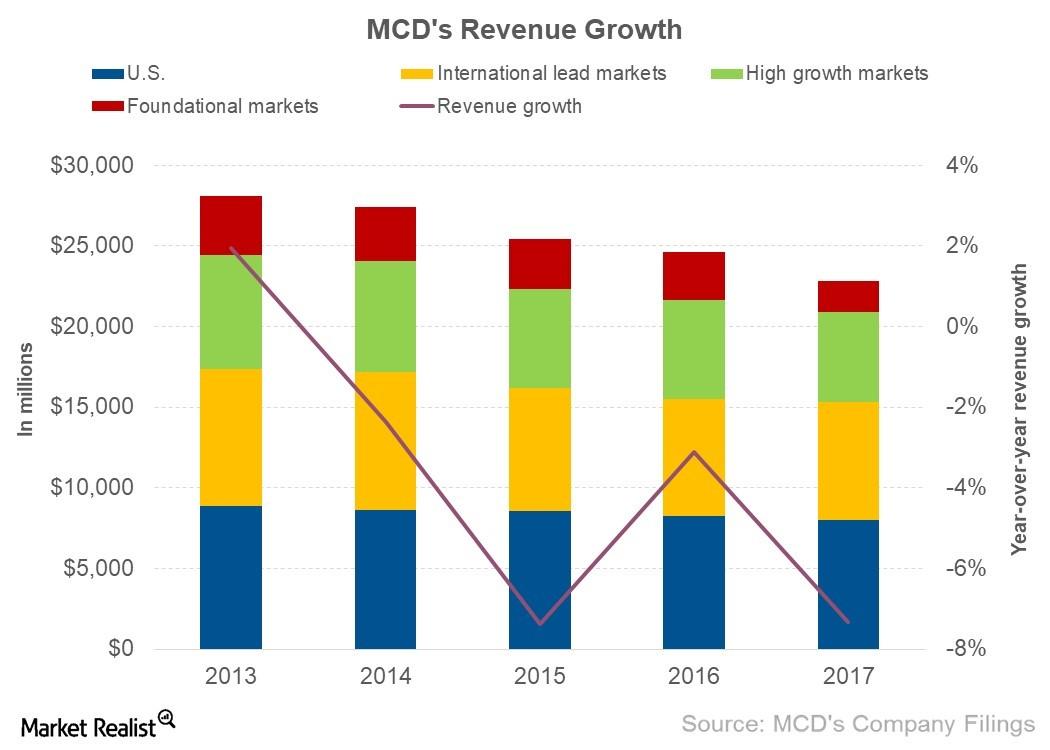

Why McDonald’s Revenues Declined in 2017

In 2017, McDonald’s (MCD) posted revenues of ~$22.8 billion, which represents a fall of 7.3% from ~$24.6 billion in 2016.

What Analysts Expect for McDonald’s Revenue in 2018

Revenue expectations In 2018, analysts expect McDonald’s (MCD) to post revenue of $21.1 billion, which represents a fall of 7.7% from its revenue of $22.8 billion in 2017. As part of its optimizing strategy, McDonald’s has been refranchising its company-owned restaurants. The refranchising is expected to lower the company’s revenue in 2018. However, some of […]

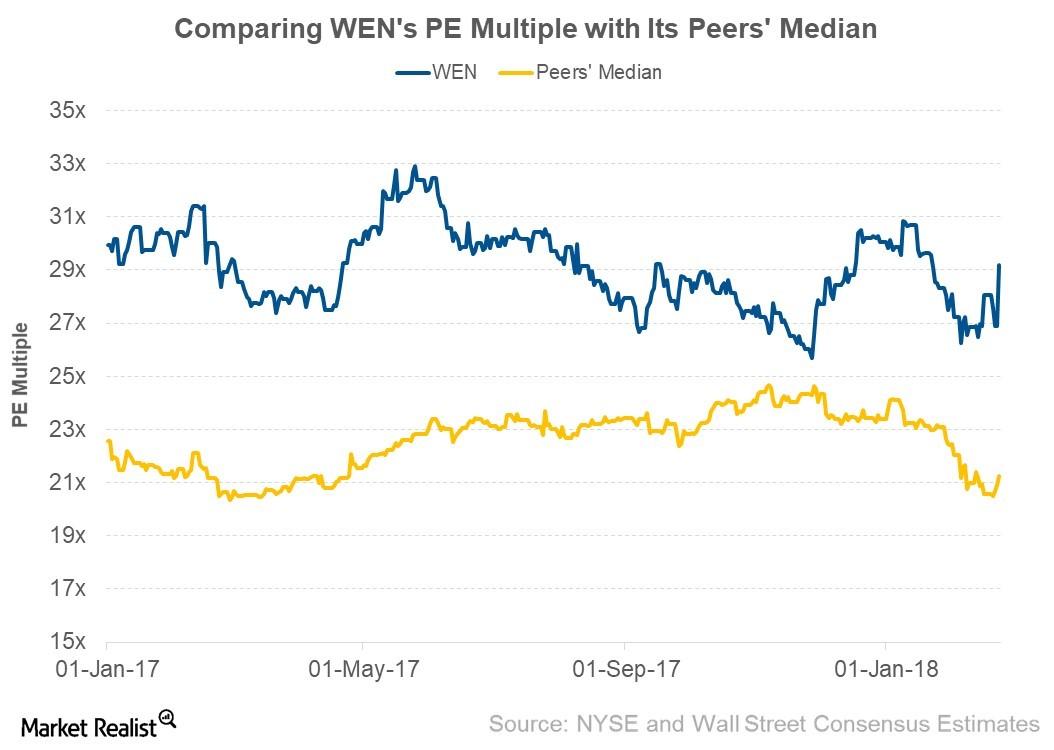

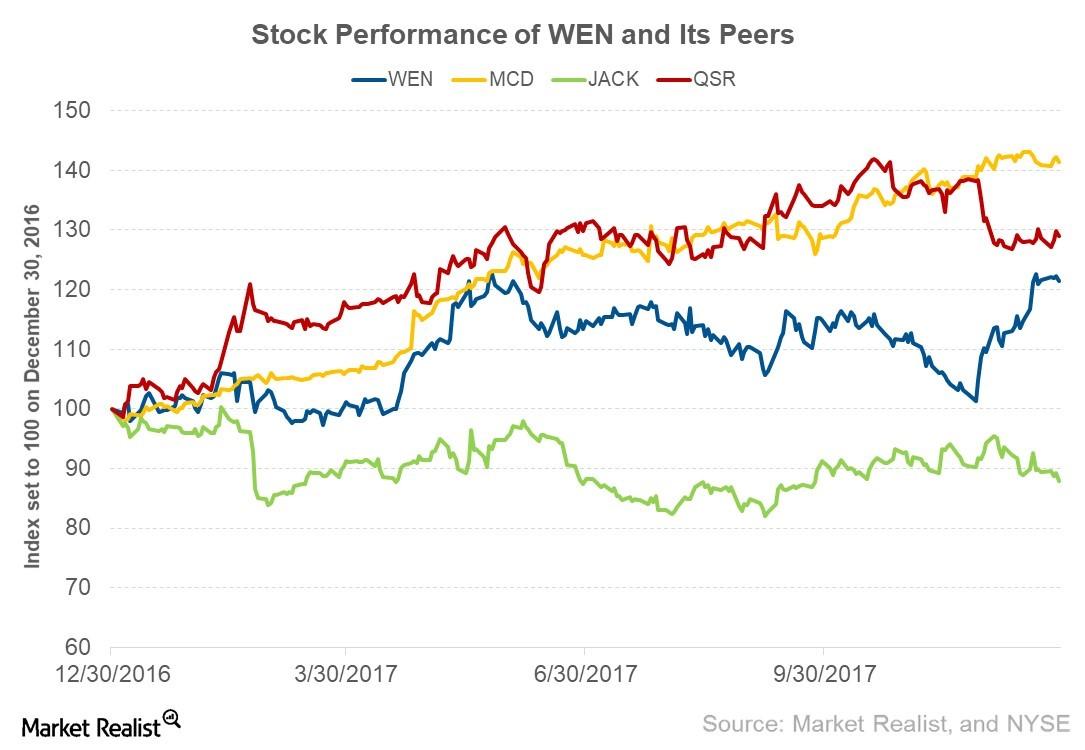

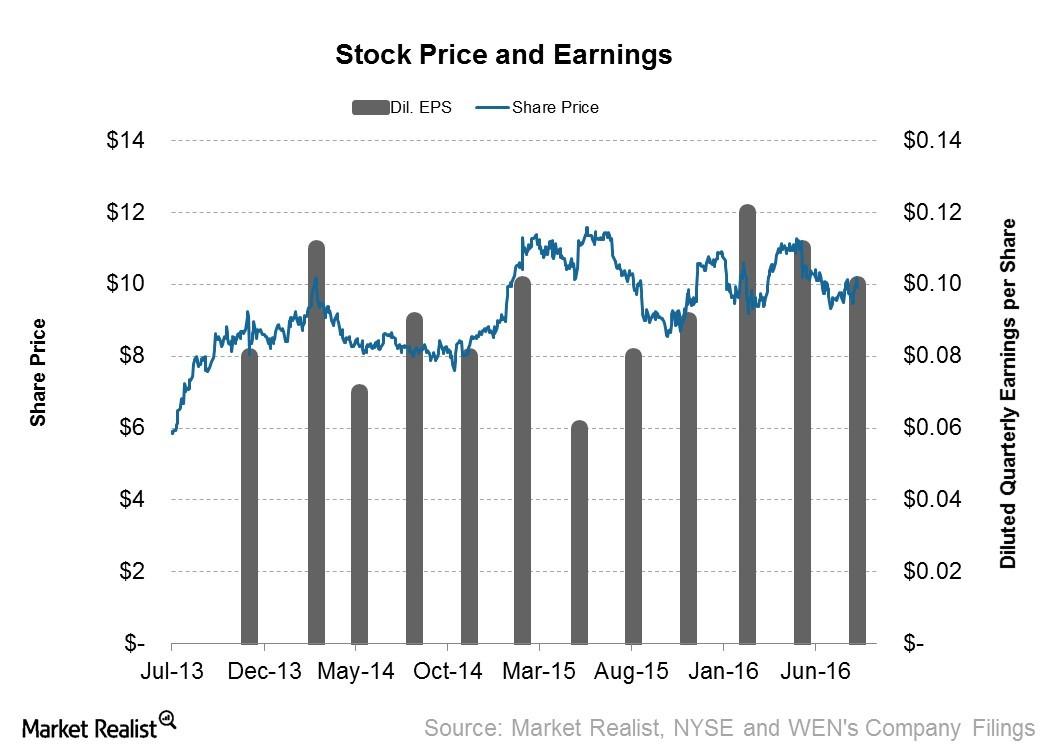

How Wendy’s Valuation Multiple Compares to Its Peers

The initiatives taken by Wendy’s management to drive SSSG appear to have led to a rise in WEN stock and a higher valuation multiple.

What Analysts Expect for Wendy’s Revenue in 2018

For 2018, analysts are expecting Wendy’s (WEN) to post revenue of $1.3 billion, which represents a growth of 2.6%.

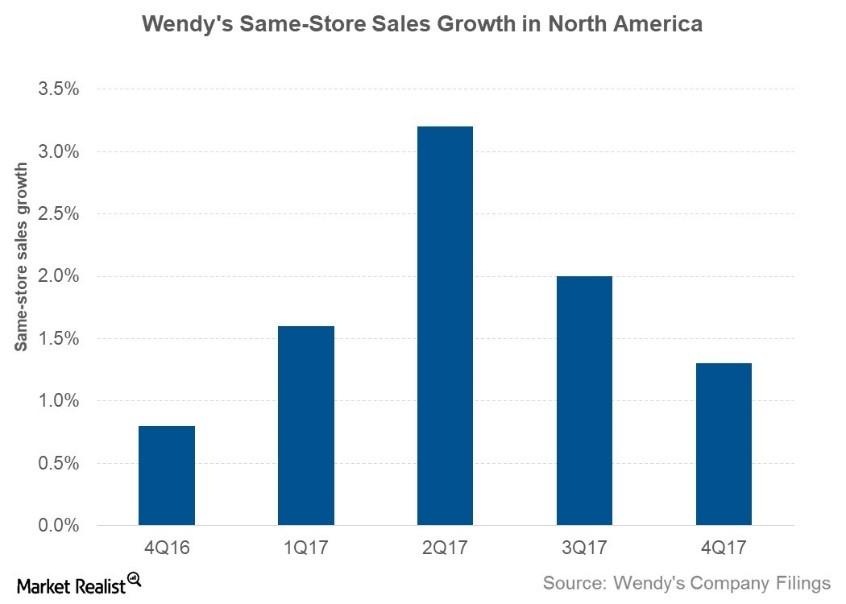

What Drove Wendy’s Same-Store Sales Growth in 4Q17?

Wendy’s (WEN) posted SSSG (same-store sales growth) of 1.3% in the North American region compared to 0.8% in 4Q16.

What’s Driving Wendy’s Stock Price

In this series, we’ll look at analysts’ earnings and revenue estimates for the next four quarters. We’ll also review Wendy’s valuation and analysts’ recommendations.

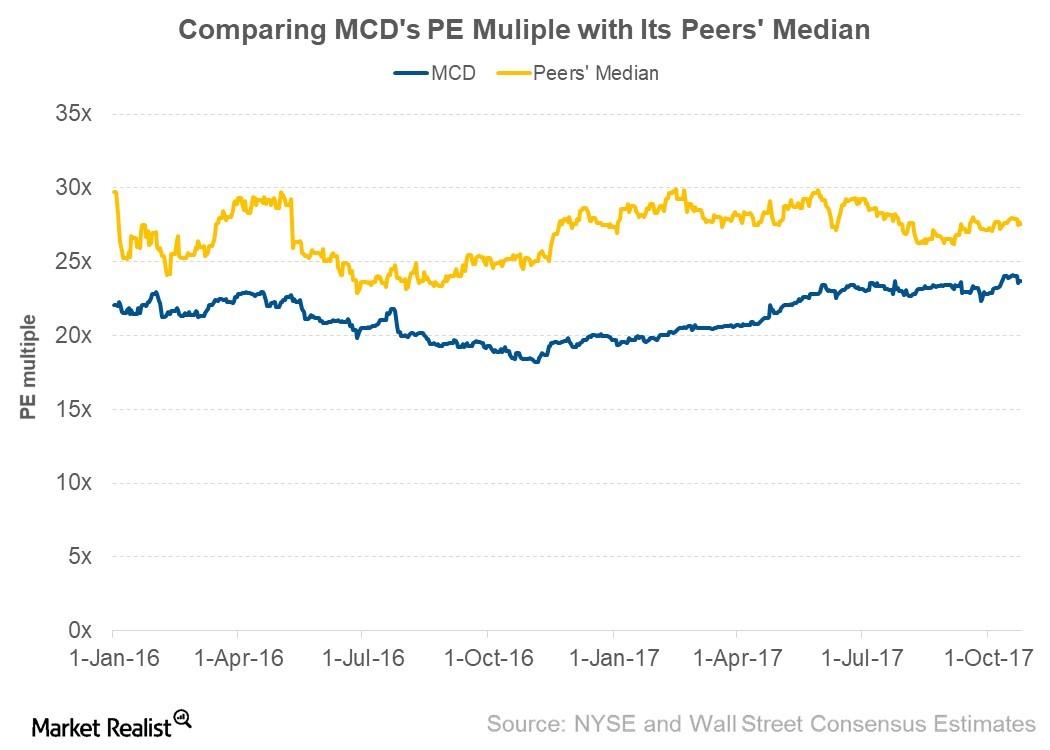

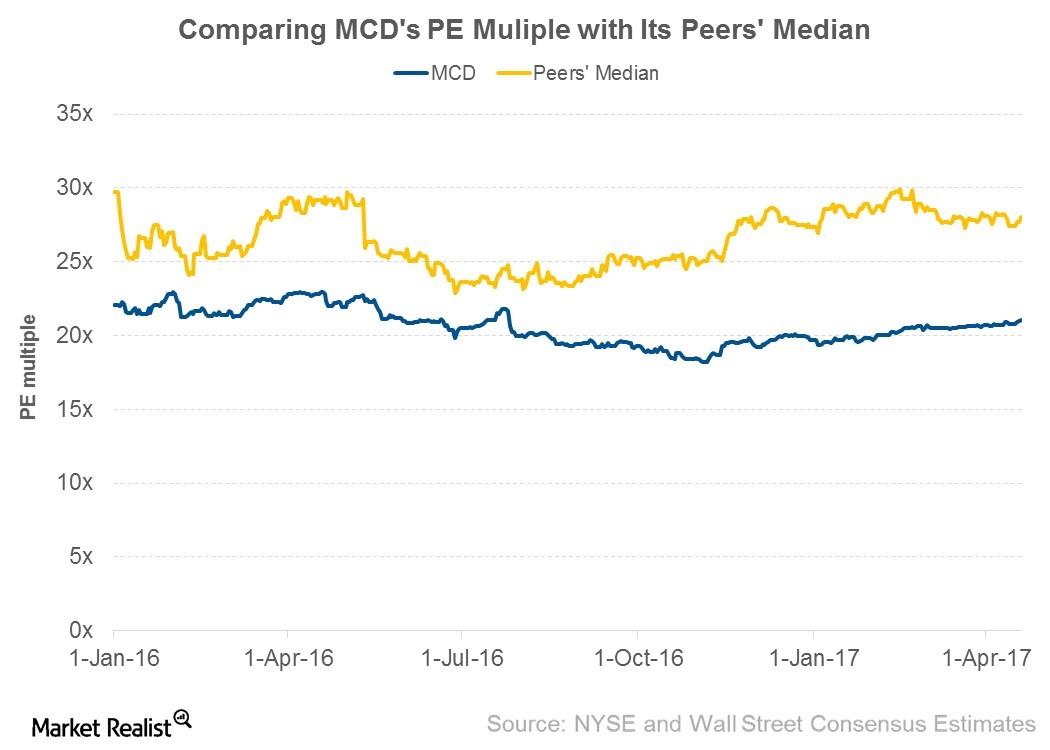

McDonald’s Valuation Multiple Compared to Its Peers

As of October 25, 2017, McDonald’s was trading at a forward PE multiple of 23.66x compared to 23.57x before the announcement of 3Q17 earnings.

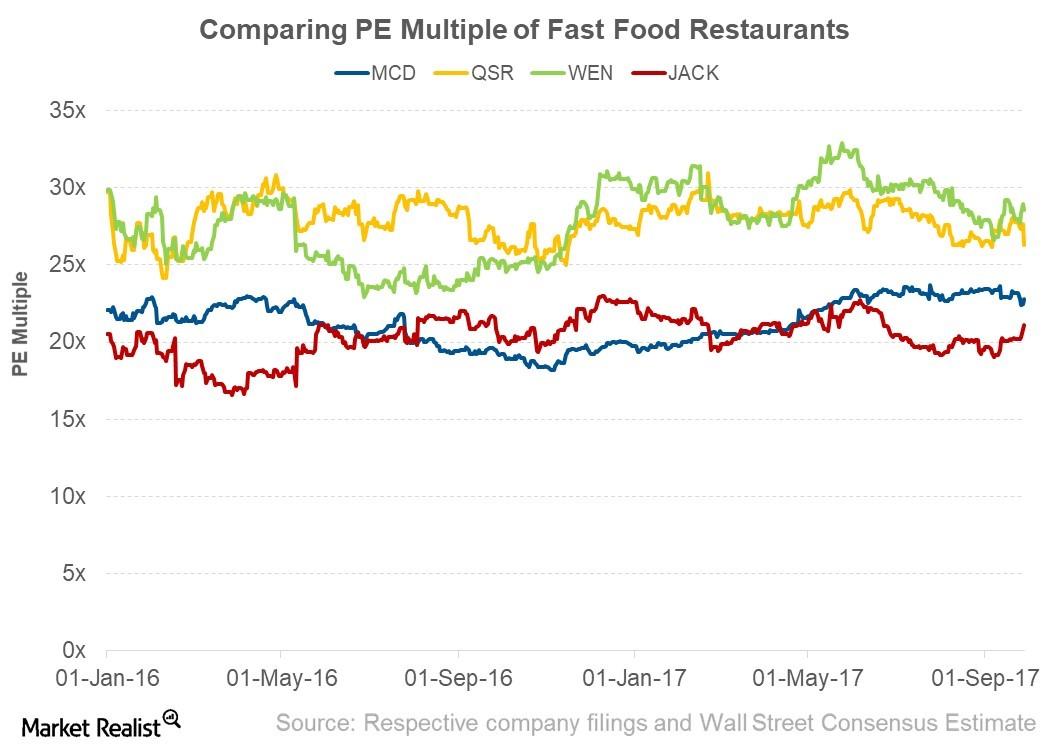

How Fast Food Restaurants’ Valuation Multiples Stack Up

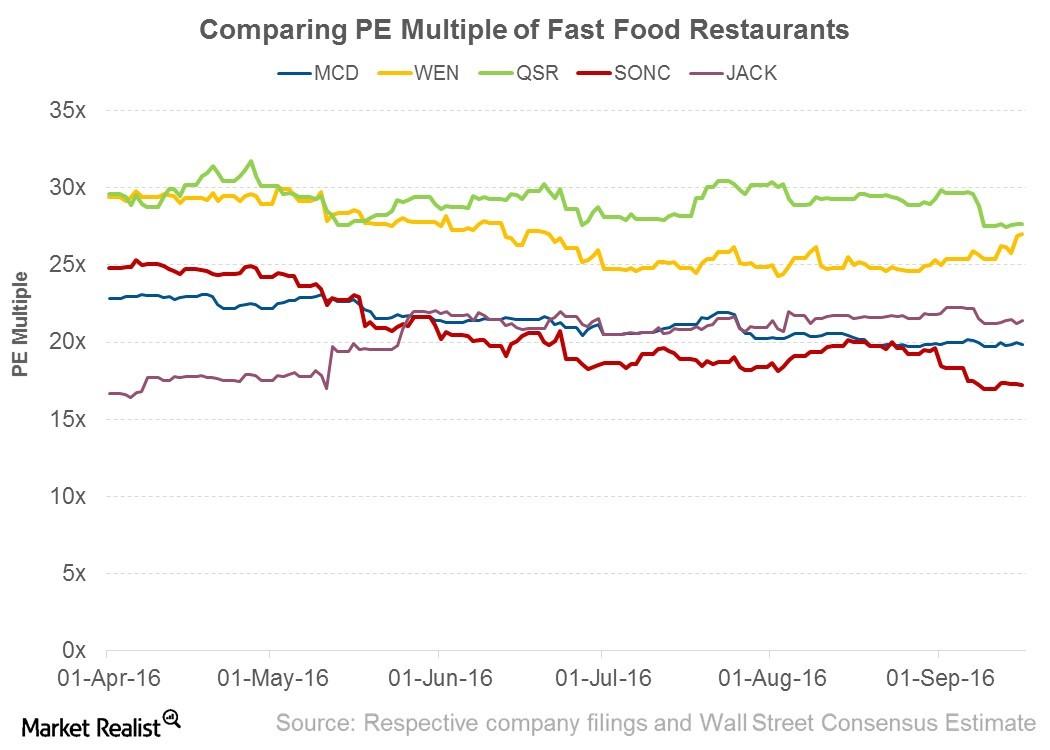

Wendy’s (WEN) has been trading above its peers’ valuation multiple.

Analyzing McDonald’s Valuation Multiple

As of May 24, 2017, McDonald’s was trading at a PE multiple of 22.6x—compared to 21.3x before the announcement of its 1Q17 earnings.

Where McDonald’s Valuation Multiple Stands Next to Peers

As of April 19, 2017, McDonald’s was trading at a PE multiple of 21.1x, as compared to 19.9x before the announcement of its 4Q16 earnings.

Behind the Valuation Multiples of Fast Food Restaurants

As of September 16, 2016, these five fast food restaurants were trading at a median PE multiple of 21.4x.

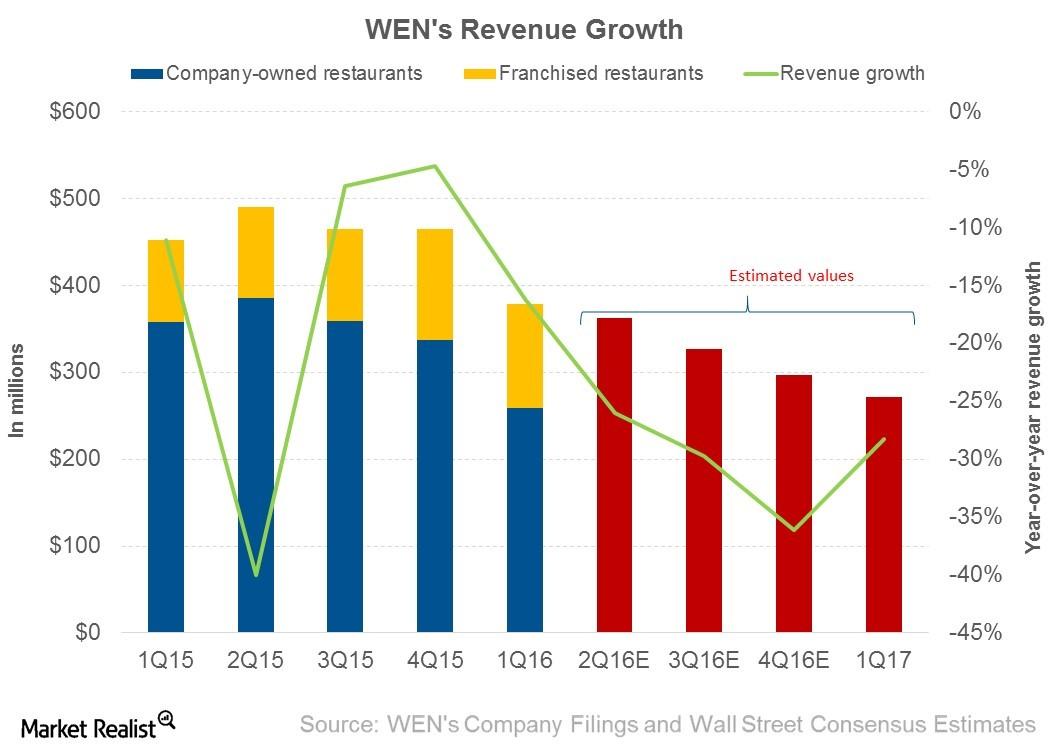

Wendy’s Stock Fell Due to Declining Sales

Wendy’s (WEN) posted its 2Q16 results on August 10, 2016. The company posted adjusted EPS (earnings per share) of $0.11 on revenue of $382.7 million.

Why Did McDonald’s Revenue Decline in 2Q16?

In 2Q16, McDonald’s revenue declined by 3.6% from $6.5 billion to $6.3 billion.

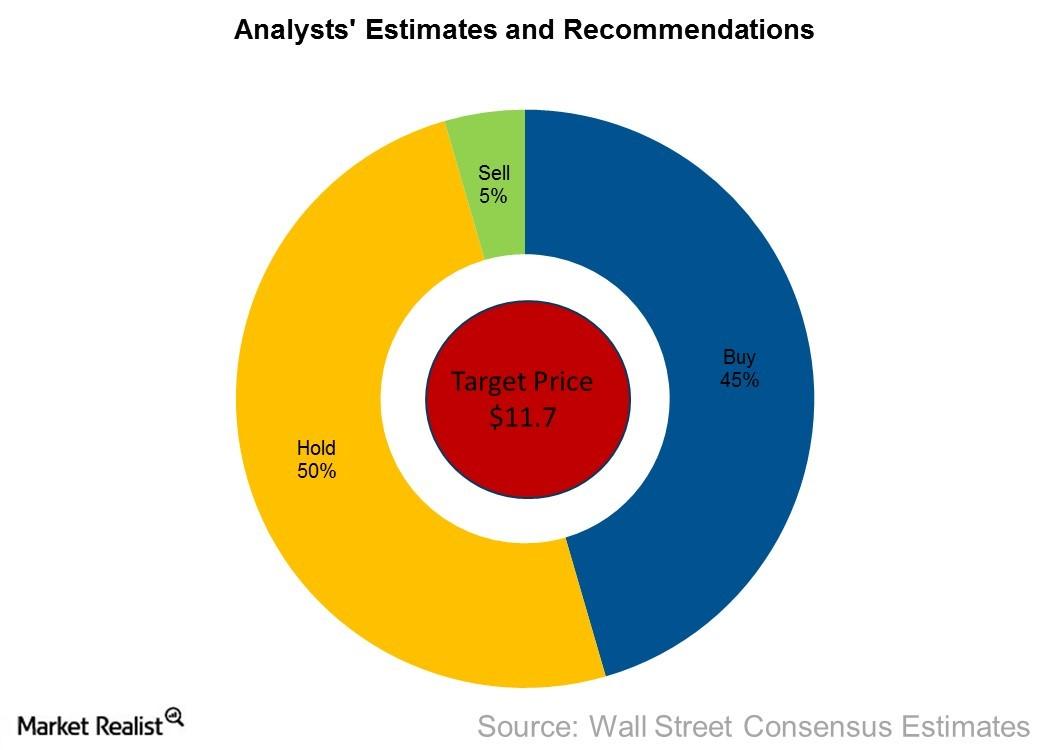

The Word on the Street: What Analysts Are Saying about Wendy’s

According to Bloomberg, of the ten analysts surveyed, 45.5% have issued “buy” recommendations for Wendy’s, while 50% have issued “hold” recommendations.

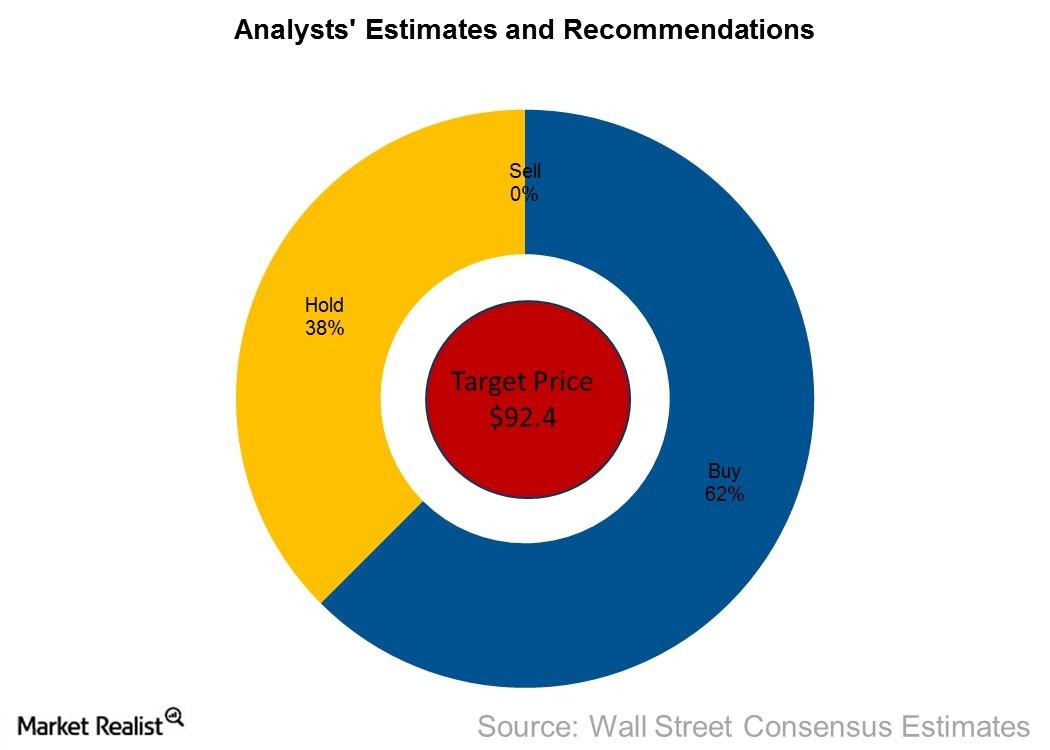

The Word on the Street: How Analysts See JACK

According to a Bloomberg survey of 16 analysts, 62.5% have given “buy” recommendations for JACK, and 37.5% have given “hold” recommendations.

Why Domino’s Outperformed Other Fast-Food and Pizza Companies in Same-Store Sales Growth in 1Q16

SSSG is an important metric for investors to monitor because it increases a fast-food company’s revenue without increasing capital investment.

Why Did Wendy’s Revenue Fall in 1Q16?

Wendy’s Company (WEN) generates its revenue through company-owned restaurant sales, franchisee fees, rental income, and royalty collected from franchisees.