iPath® S&P 500 VIX ST Futures™ ETN

Latest iPath® S&P 500 VIX ST Futures™ ETN News and Updates

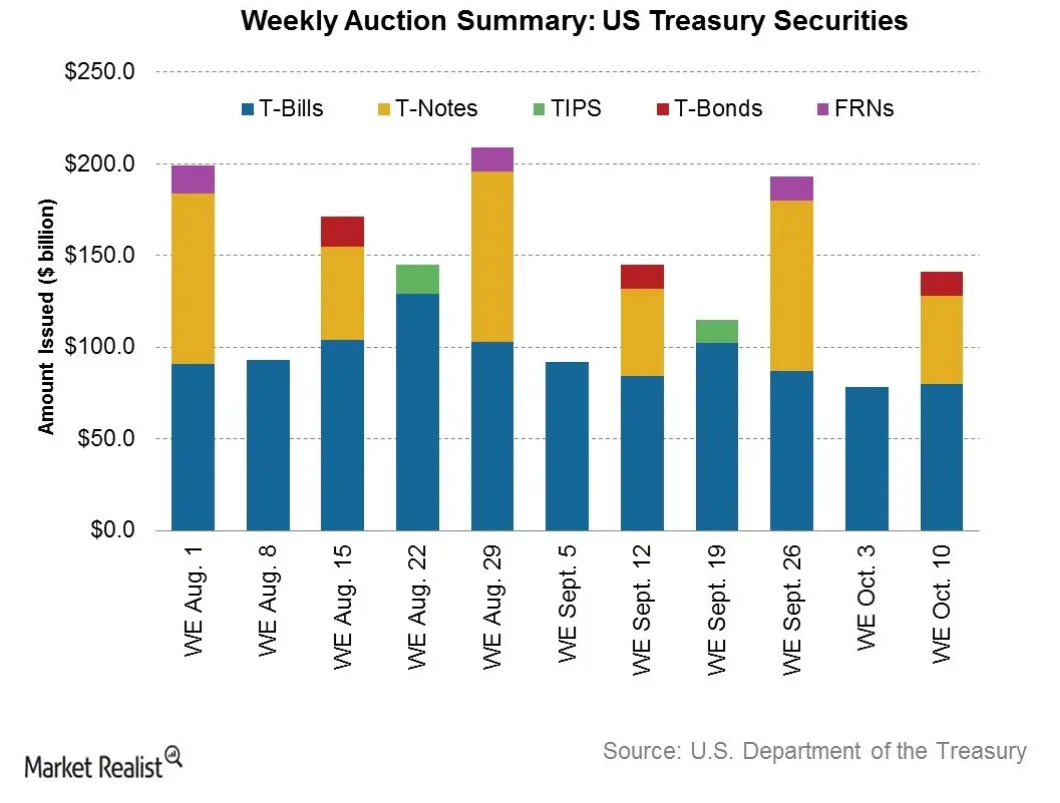

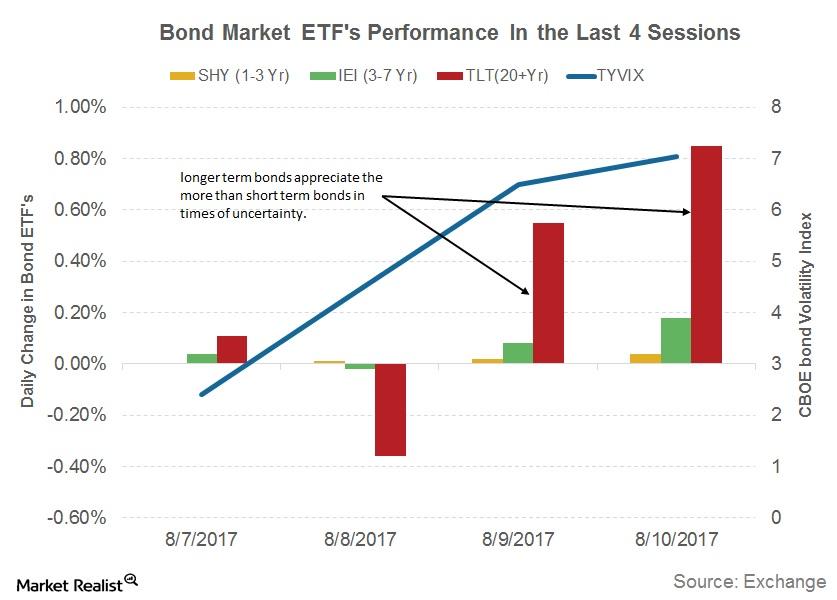

Why investors are preferring high-quality debt

High-quality bonds can be an investor refuge when there’s market volatility. These securities provide relatively stable cash flows. The default probability is low.Financials Financial intermediation, systemic risks, and “too big to fail”

When financial intermediaries allocate funds, they assess the risks and returns that come from various risky claims. Intermediaries help allocate resources and risks throughout the economy. Financial intermediation can result in concentrated risks. The risks increase the financial system’s fragile state. These risks are called systemic risks.

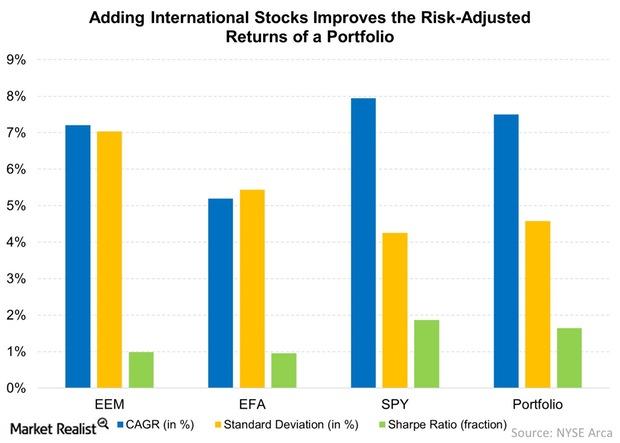

Why Diversification Is More than Just a Buzzword

Diversification is important because a diversified portfolio has higher risk-adjusted returns than a portfolio exposed to only one security.

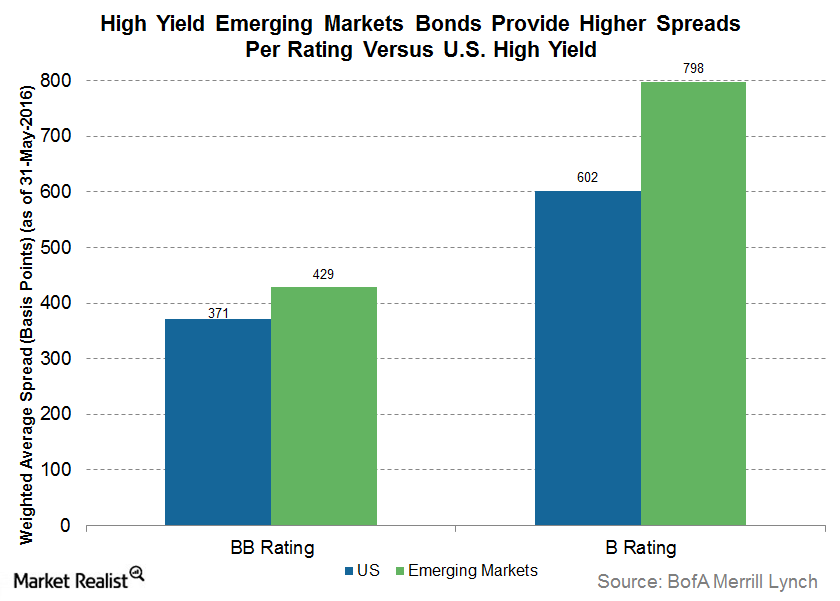

What Are the Attractive Characteristics of High Yield EM Bonds?

Investors are flocking to government bonds (BND) of developed markets, which is causing downward pressure on interest rates.

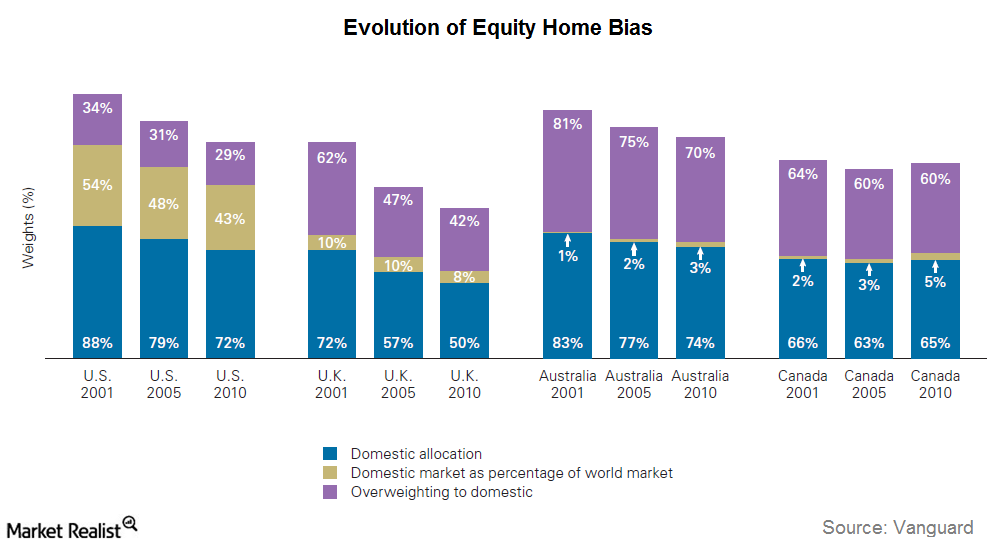

The Equity Home Bias Puzzle

In this series, we’ll look at the prevalence of home bias, the disadvantages of favoring home bias, and the benefits of international diversification.

What Are the Implications of Iran Nuclear Deal Exit?

In this series, we’ll analyze how the US exit from the Iran deal has affected markets and how recent developments could affect oil prices and volatility.

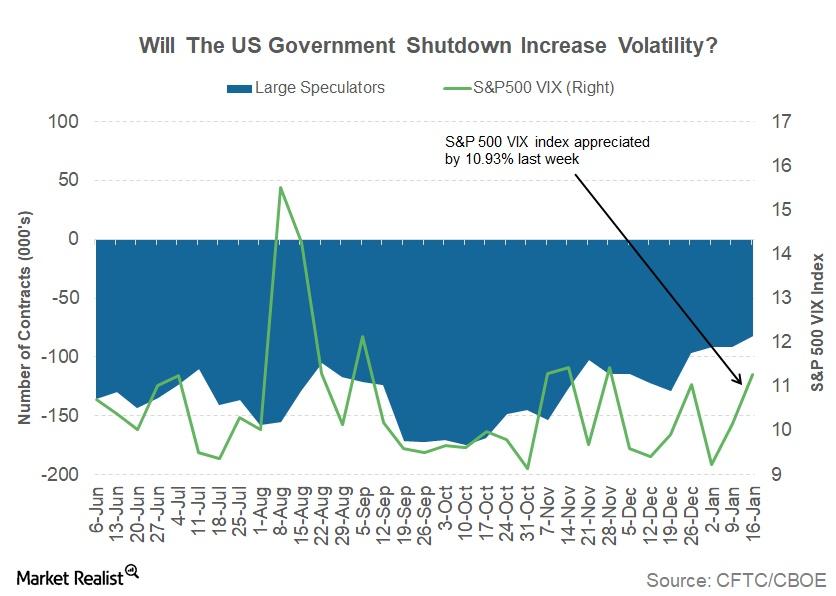

Could the US Government Shutdown Impact Market Volatility?

During the week ended January 19, 2018, global markets trended higher despite the possibility of a US government shutdown. The potential shutdown pushed volatility up.

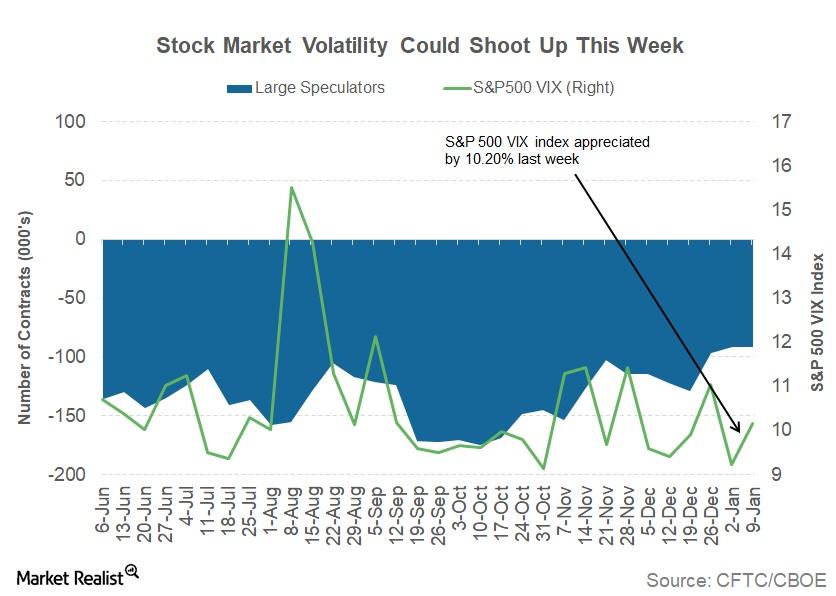

Could the Threat of a US Government Shutdown Spike Volatility?

The Dow Jones Industrial Average appreciated ~1.6% for the week ended January 12, 2018, while the S&P 500 (SPY) returned ~1.3%. The tech-heavy NASDAQ (QQQ) posted a weekly gain of ~1.4%.

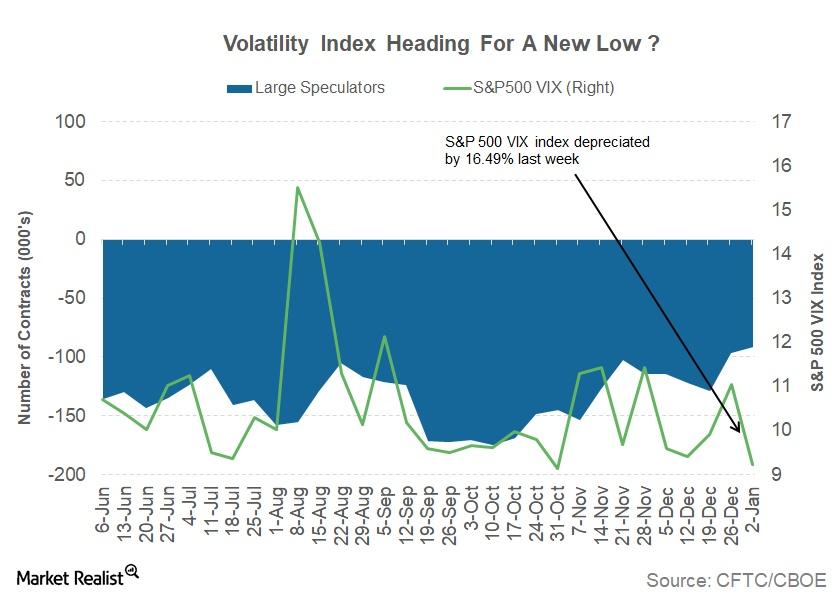

Why Volatility Fell 16% in Week 1 of 2018

Every segment of the global financial markets began 2018 on a positive note. The global equity rally extended in the first week of the year.

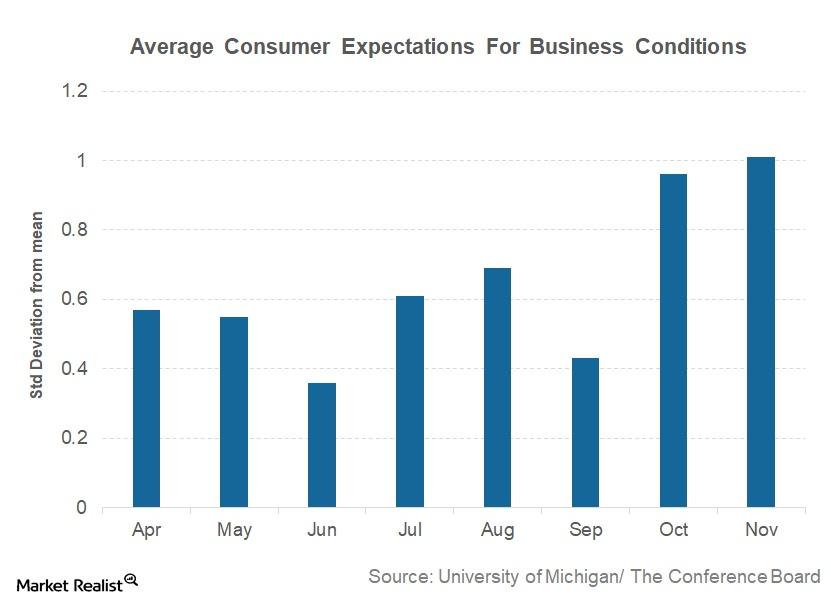

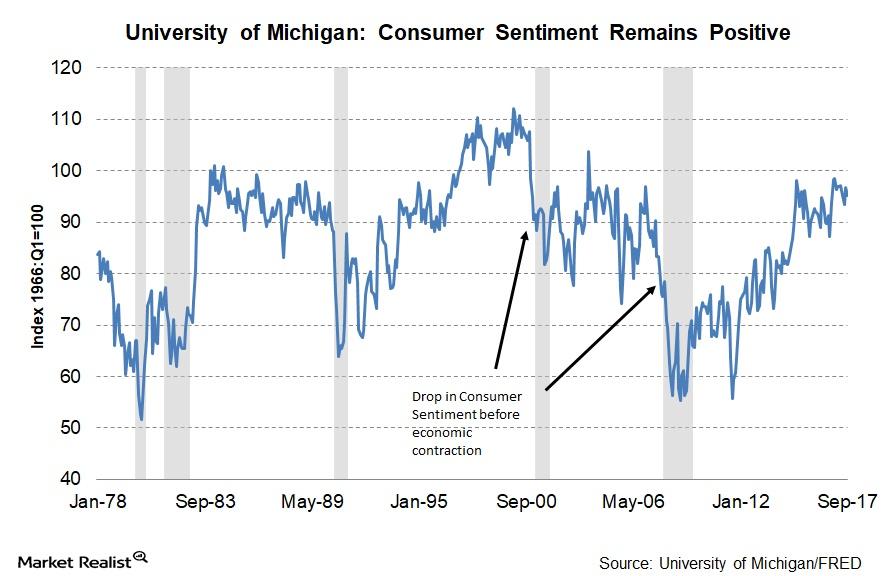

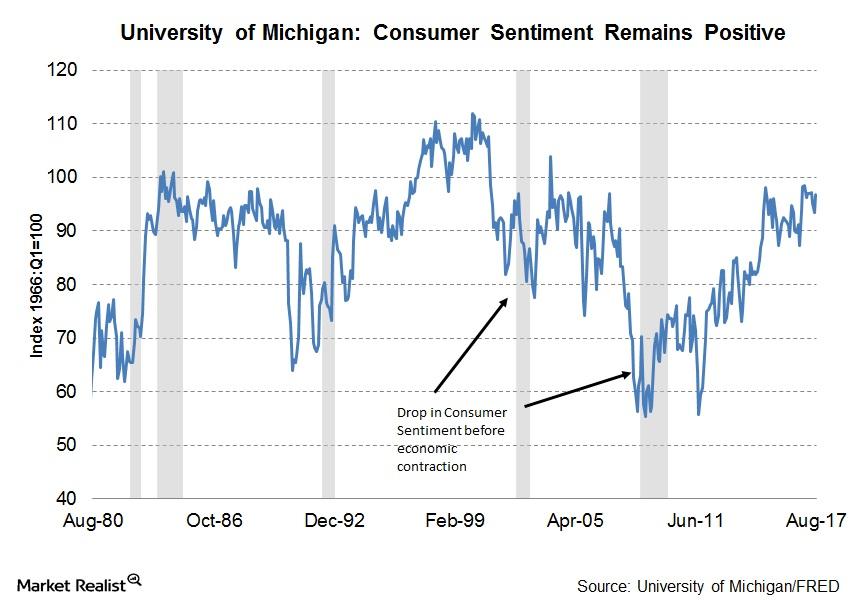

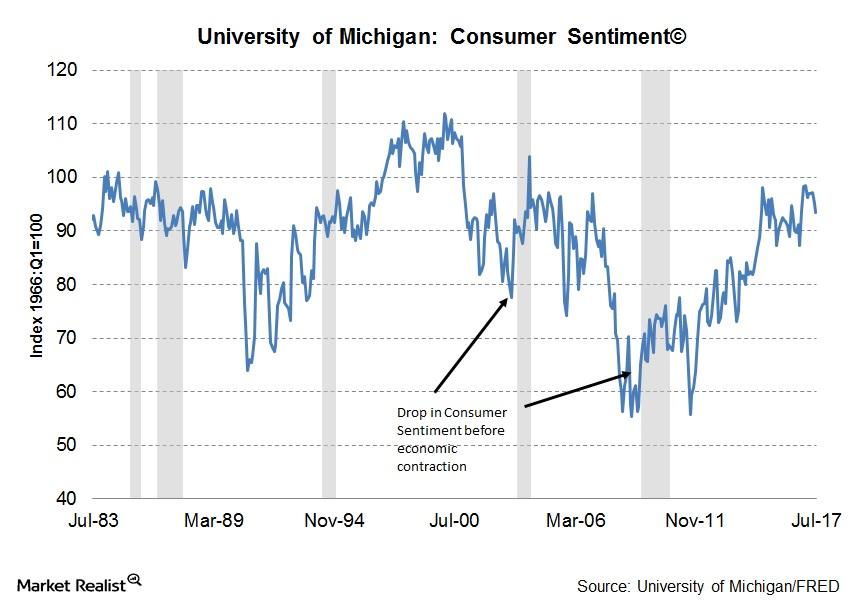

Why Consumer Expectations Continued to Increase in November

Consumer expectations for business conditions Average consumer expectations for business conditions form the only component of the Conference Board LEI (Leading Economic Index) that is not a leading indicator. Consumer expectations are based on two separate surveys. One survey is conducted by the University of Michigan and Reuters, while the second survey is conducted by […]

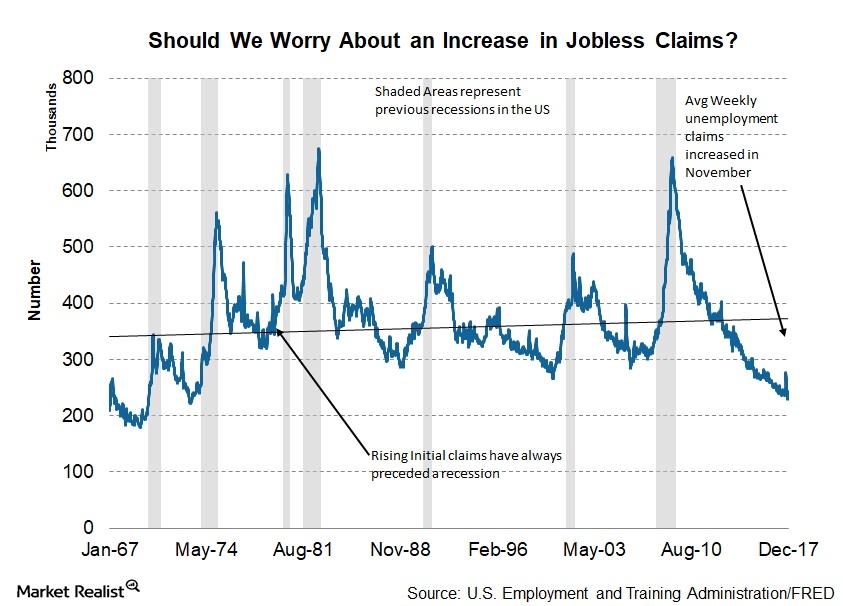

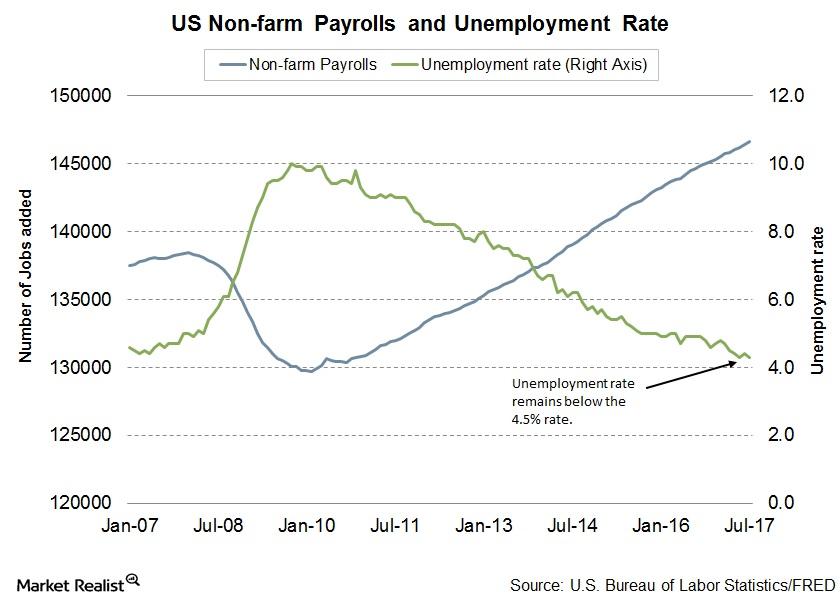

Should We Worry about Rising Unemployment Claims?

Average weekly claims and the economy Average weekly unemployment claims are a constituent of the Conference Board LEI (Leading Economic Index). Claims have a 3% weight in the LEI. Weekly unemployment claims, if adjusted for seasonality, give investors a clear understanding of changes in the employment market. Though the Bureau of Labor Statistics releases a monthly […]

Understanding the Sharp Rise in Consumer Expectations in October

The November Conference Board LEI reported the average consumer expectations for business conditions for October at 0.96, a sharp increase from the September reading of 0.43.

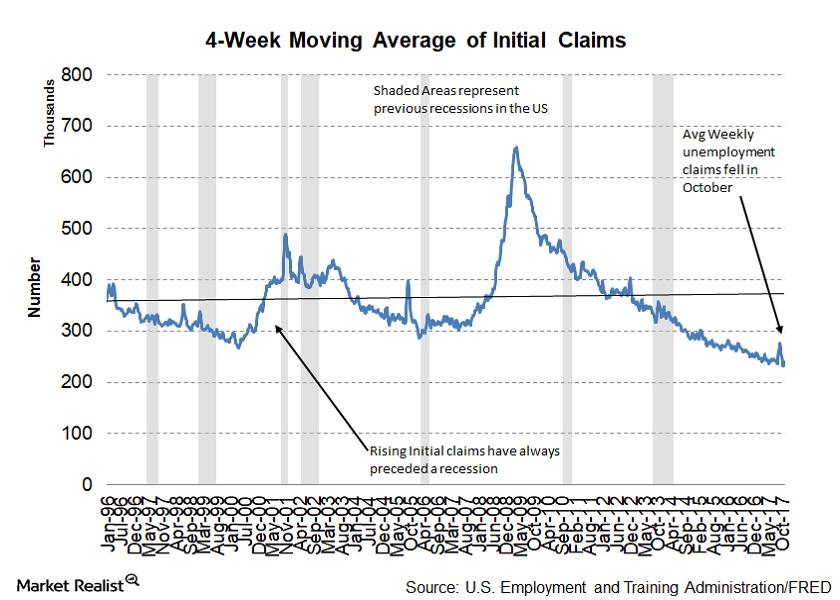

What Decreasing Weekly Unemployment Claims Say about the US Economy

In the Conference Board Leading Economic Index, the average weekly unemployment claims have 3.0% weight.

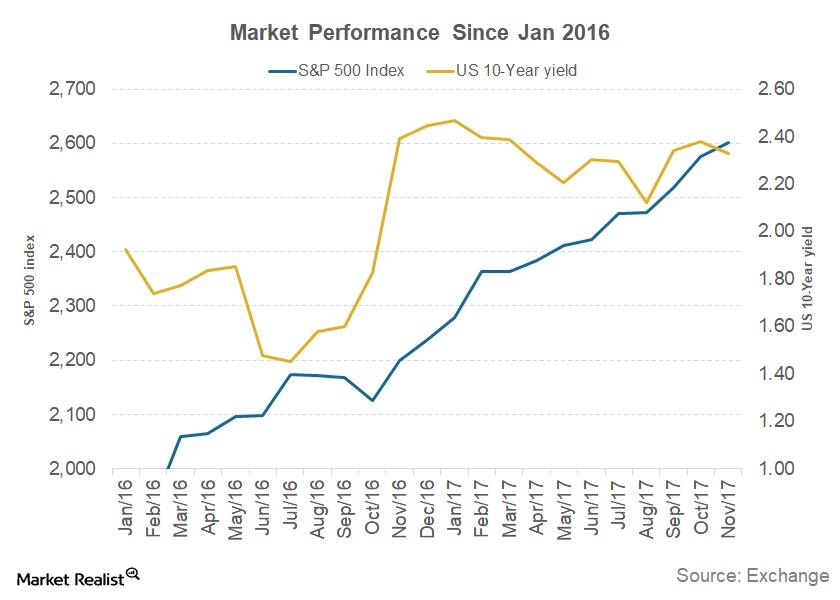

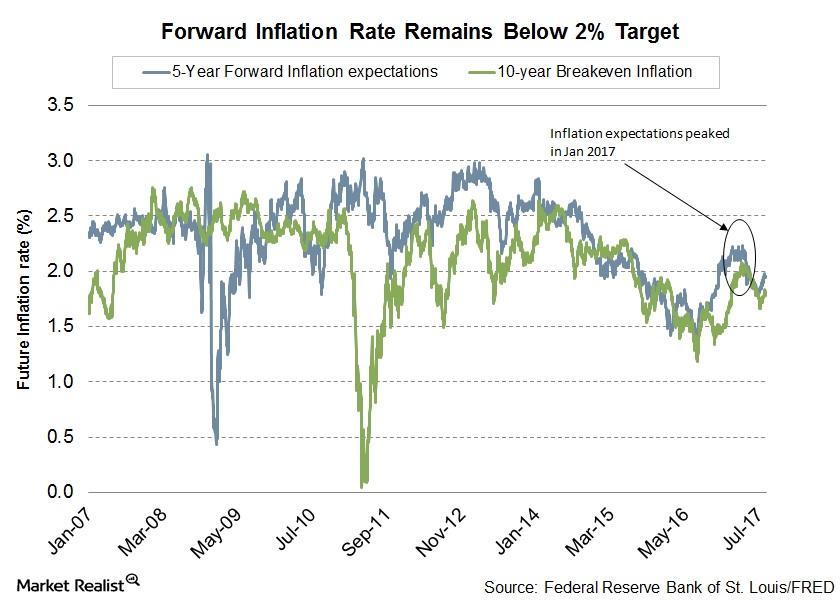

The FOMC’s View of the Equity and Bond Markets

The FOMC’s November meeting minutes deemed the bond market’s yield curve to be flattening between meetings. The report indicated that bond yields have risen since the September FOMC meeting for multiple reasons.

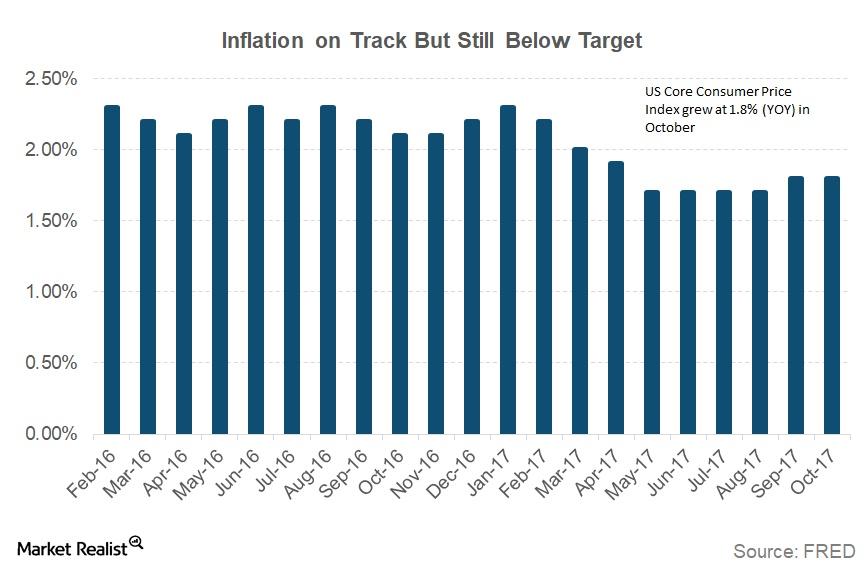

Chart in Focus: The Consumer Price Index Rose in October

The Fed is expected to increase the target funds rate by 0.25% at its December meeting.

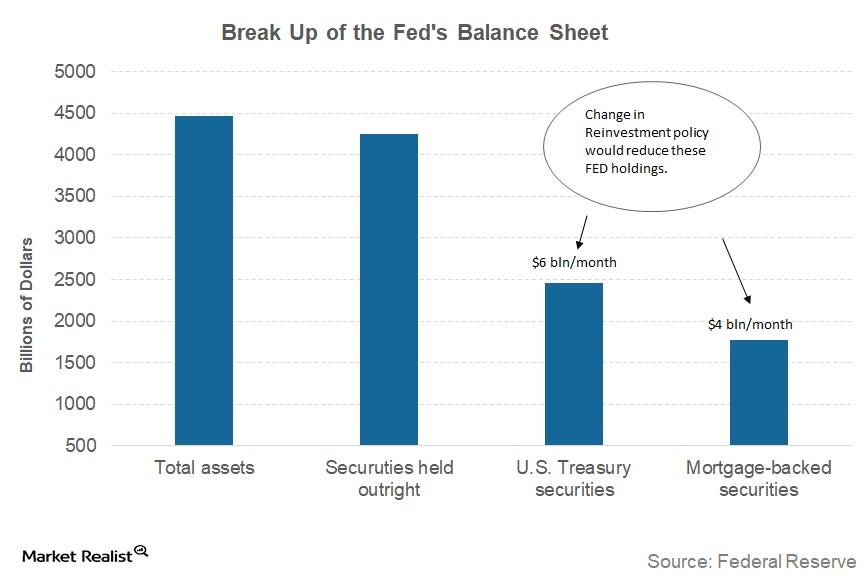

Janet Yellen Balance Sheet Strategy a Closer Look

Fed Chair Janet Yellen, in her speech at the 2017 Herbert Stein Memorial Lecture, offered some more insight into the Fed’s balance sheet reducing strategy.

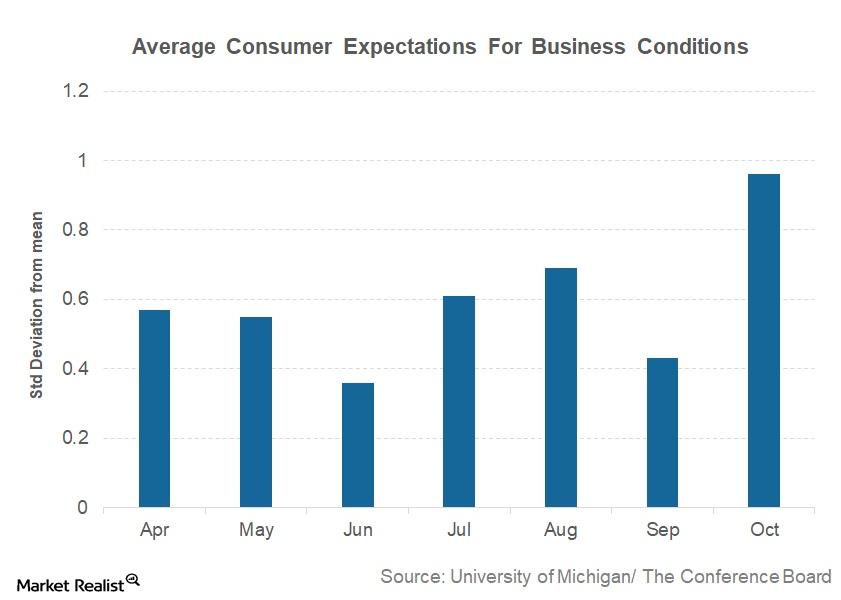

Why Expectations for Business Conditions Fell 50% in September

The October Conference Board LEI reported that average consumer expectations for business conditions for September are 0.37 above the mean.

Are Global Fears Controlling Precious Metals?

Ongoing worries in North Korea and political chaos in Washington have been crucial in boosting the prices of precious metals.

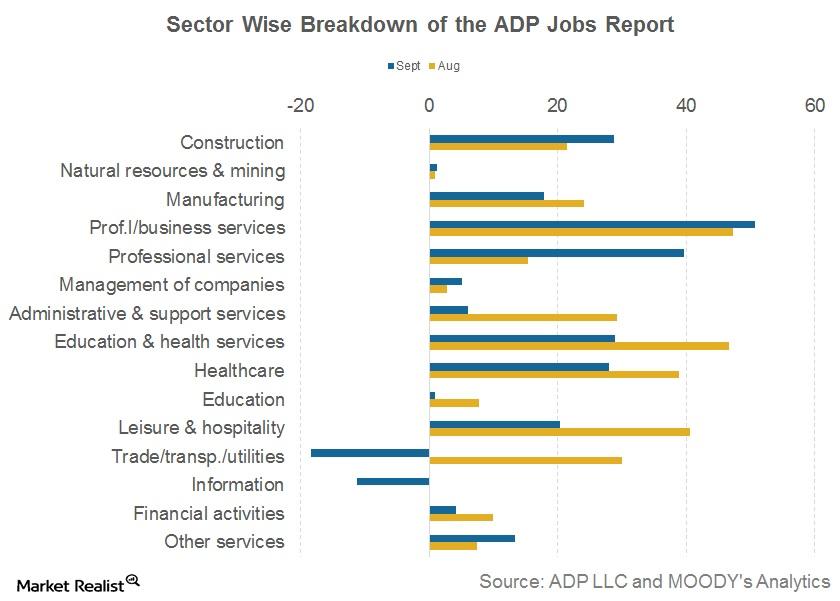

Which Job Sectors Saw the Most Impact from Hurricanes Last Month?

As per the September ADP Employment Report, there was a major drop in the number of jobs created in the trade, transport, and utility sector.

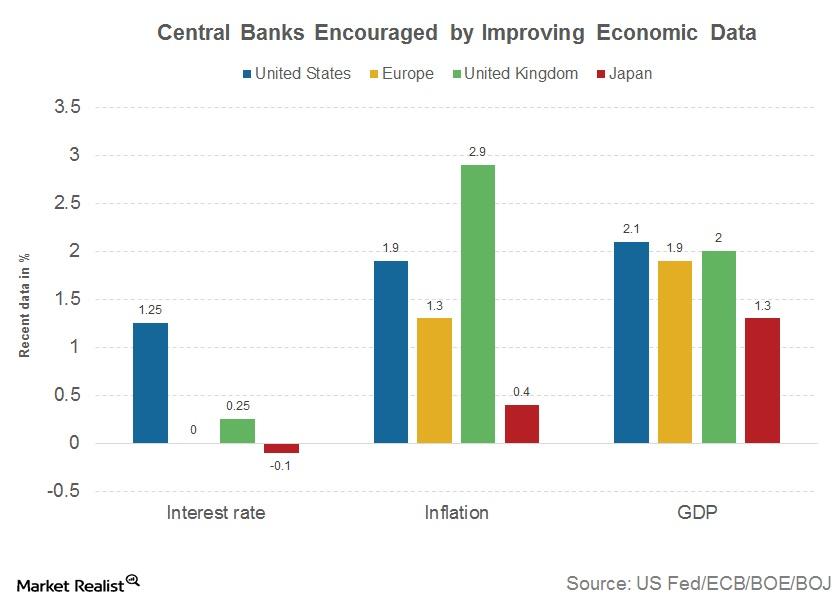

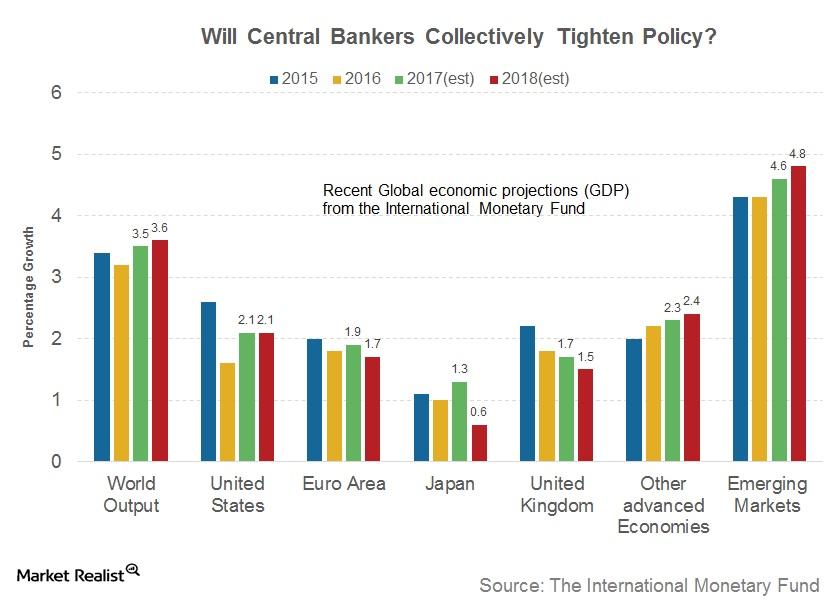

Would Markets Be Prepared for a Central Bank Surprise?

Three central banks on a path to tightening After years of ultra-loose monetary policy, global markets are beginning to realize they may have to wave goodbye to easy money. In their efforts to save the global system from the 2007 financial crisis, and to revive economic growth, US, EU, UK, and Japanese central banks resorted […]

Consumers’ Business Condition Expectations Continue to Improve

Consumer expectations for business conditions Consumer expectations data, which forms the only non-leading component of the Conference Board Leading Economic Index (or LEI), is collected through two different surveys. One of these surveys is conducted by the University of Michigan and Reuters, where consumer expectations for economic conditions in the next 12 months are collected, […]

More Temporary Relief from North Korea Tensions?

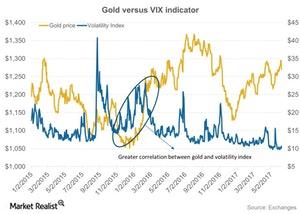

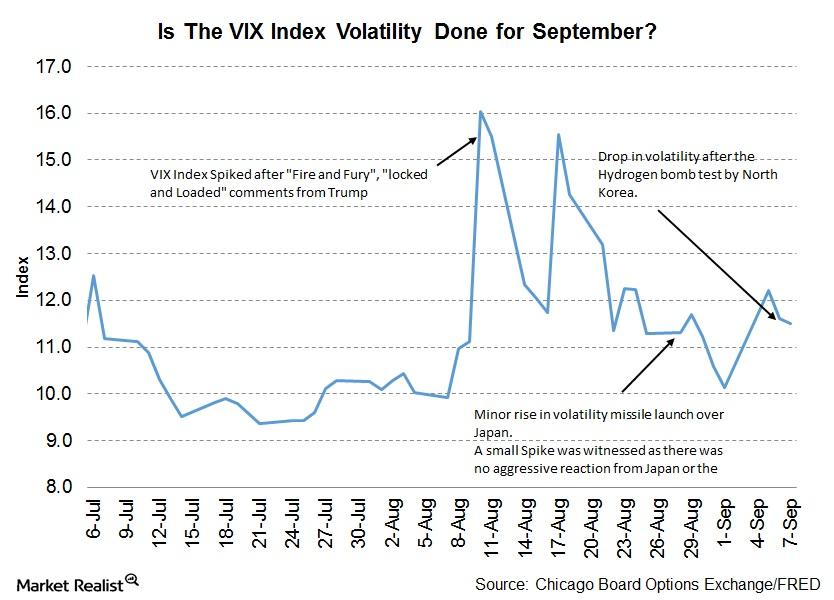

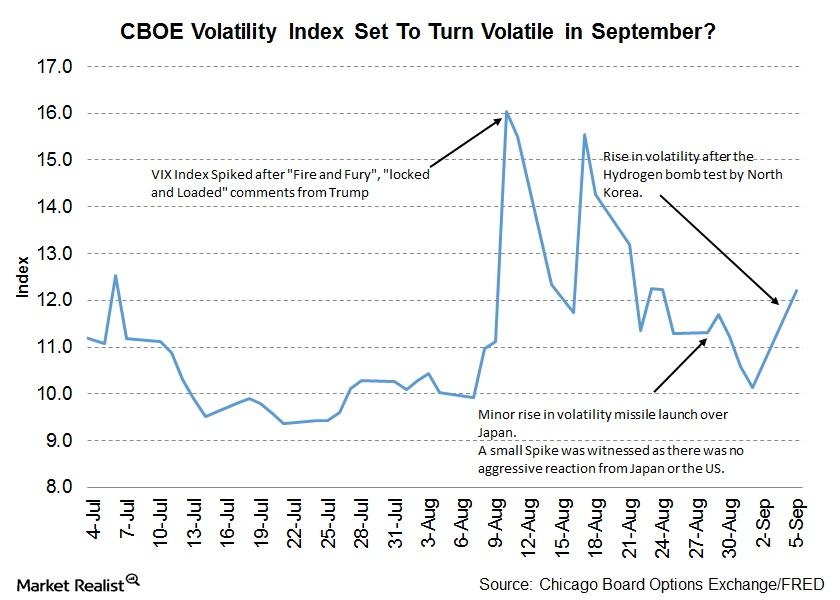

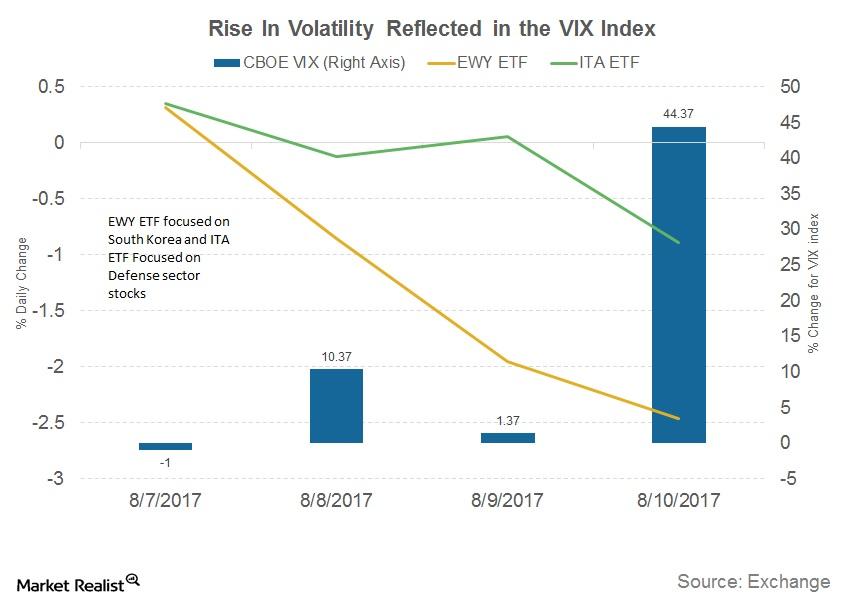

This week volatility (VXX) has continued to stick to its trend of sudden spikes and then dropping immediately.

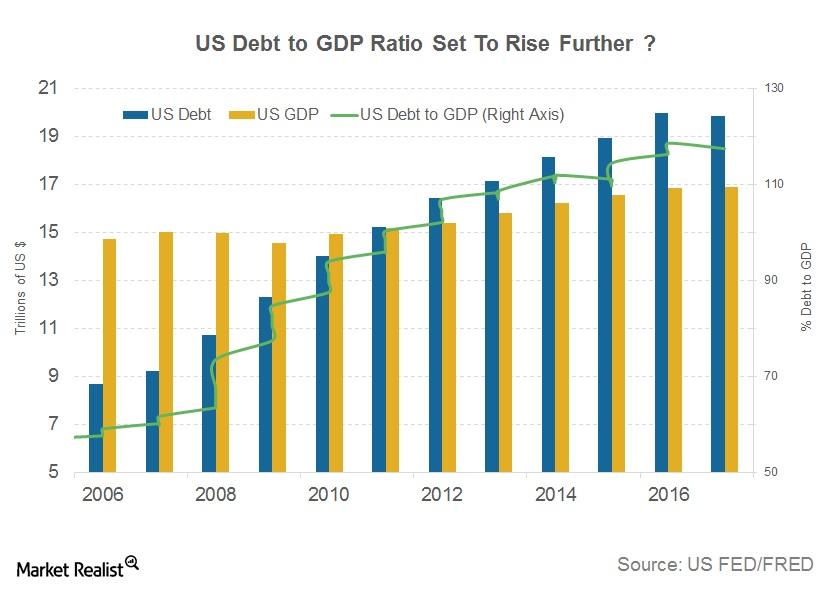

Why the US Debt Ceiling Fight Has Been Postponed

The key reason for the debt ceiling deal was to approve aid to Hurricane Harvey victims. A US government shutdown could have adversely impacted relief operations.

Why September Could Be Volatile for Financial Markets

August was a volatile month, filled with economic, political, and geopolitical uncertainty. September could turn out to be another nail-biter for the financial markets.

What Stocks Should Be on Your Radar amid Geopolitical Tensions

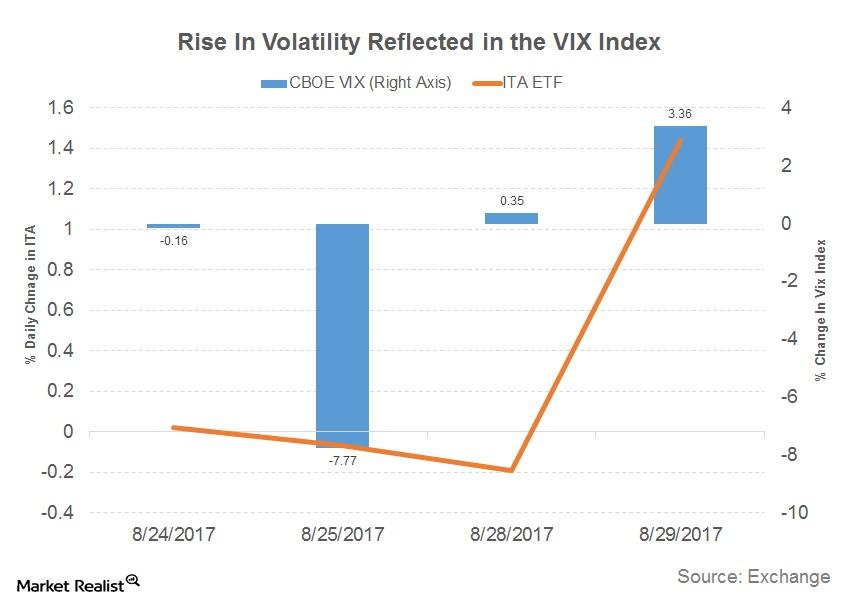

Renewed tensions arising out of North Korea’s missile launch on Tuesday had a major impact on volatility. Asian markets have declined more than 1% as risk aversion dominated markets.

A Look at Consumer Expectations amid Risk Aversion

Consumer expectations for business conditions Consumer expectations form the only component of the Conference Board Leading Economic Index (or LEI) based on business expectations. Referring to consumer expectations regarding future economic conditions, their measurement is an average of two surveys. One survey, conducted by the Conference Board, records consumer expectations for business conditions six months […]

Tax Reforms and Jobs Could Drive the Last Week of Summer

Any negative news from the jobs report will be foreshadowed by the tax reform news. It’s the last jobs report before the September FOMC meeting.

Will Jackson Hole in 2017 Be the Beginning of the End of Monetary Accommodation?

This year’s theme for the annual Jackson Hole Symposium is “Fostering a Dynamic Global Economy.”

Will the Fed Repeat Its Taper Tantrum Mistakes?

In this cycle of expansion after the great recession, the Fed has started the process of monetary tightening.

Washington or Wyoming: What Will Drive Markets This Week?

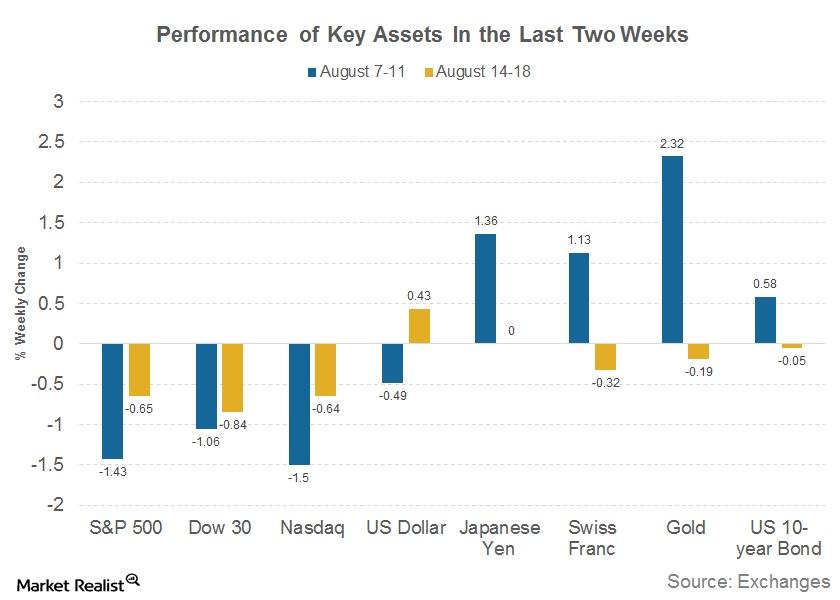

The last two weeks have been eventful for financial markets (SPY).

Do Financial Markets Have Another Tense Week Ahead?

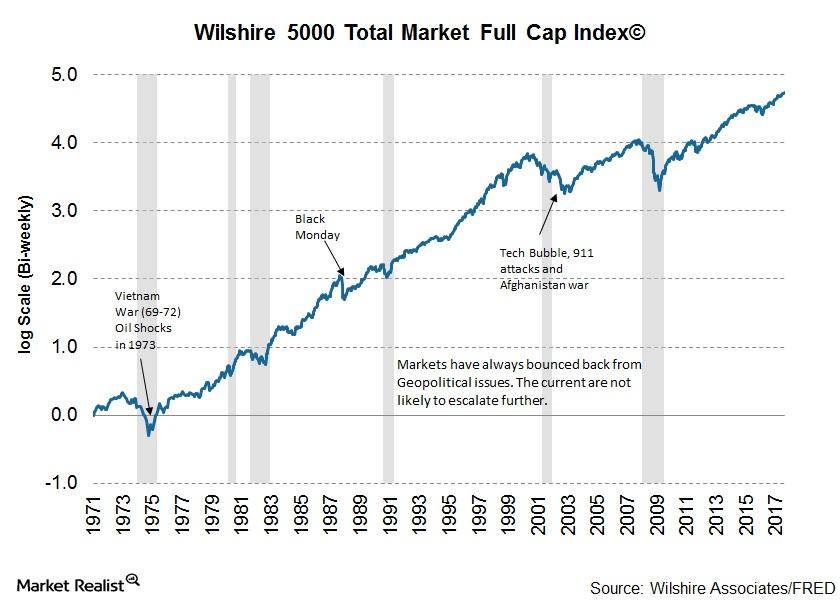

Equity markets in the US and across the globe reported heavy losses as risk aversion set in.

Will Bond Yields Continue to Fall amid Geopolitical Tensions?

Bonds, especially U.S. Treasuries (GOVT), are considered one of the safest assets in which to park your funds in times of uncertainty.

Which Stocks Will Benefit the Most from US-Korea Tensions?

Some companies benefit in times of uncertainty, and some sectors provide cover for investors.

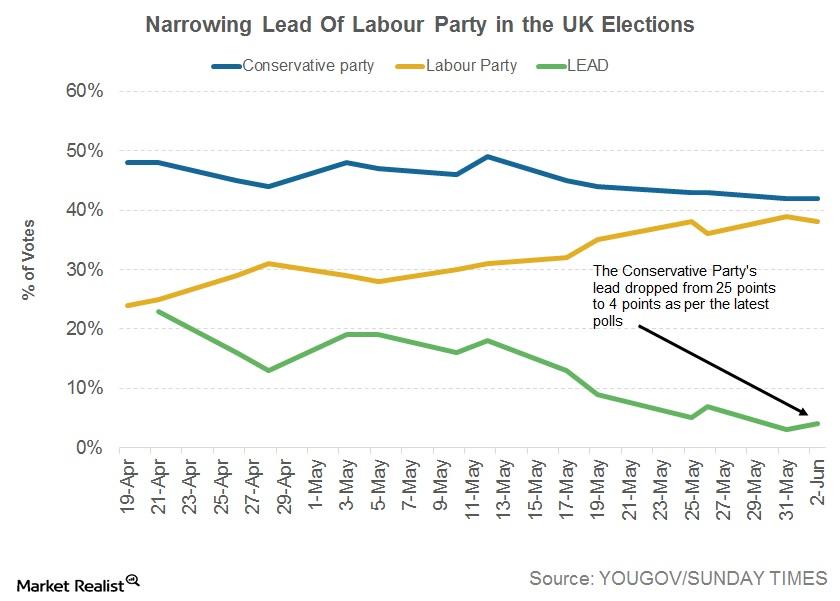

Will UK Elections Give the Markets Another Shock?

After the surprising Brexit vote, the United Kingdom is bracing for another possible election surprise on Thursday, June 8.

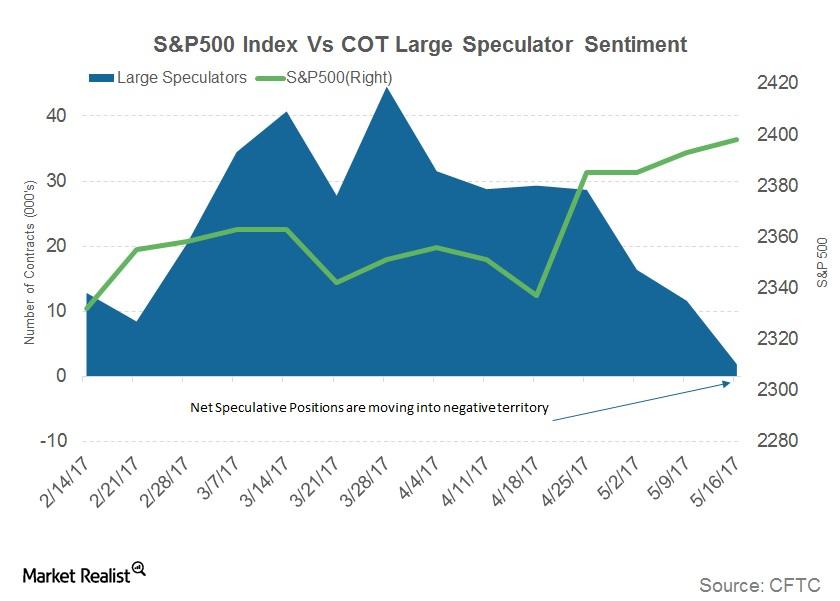

Why S&P 500 Speculative Bets Are off the Table

CFTC data released on Friday indicated that commercial traders maintained a net position of 5,756 contracts in the previous week.

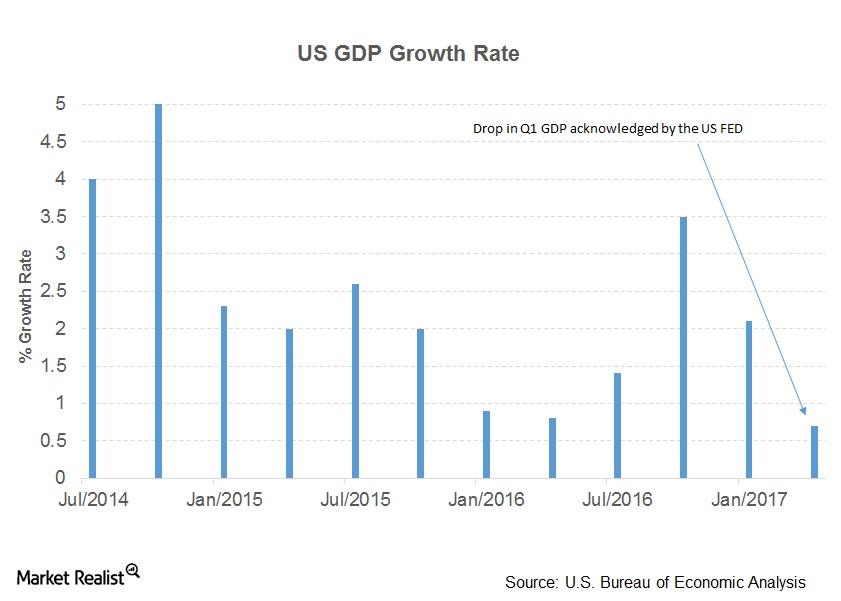

Unpacking the Fed’s Outlook on the US Market

In its May statement, the Fed seems to have gone the extra mile to explain the slowdown in the first quarter.

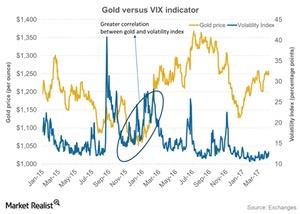

Upcoming French Elections Could Impact Gold

Since the French elections are right around the corner, investors might start parking their money in safe-haven assets like gold.

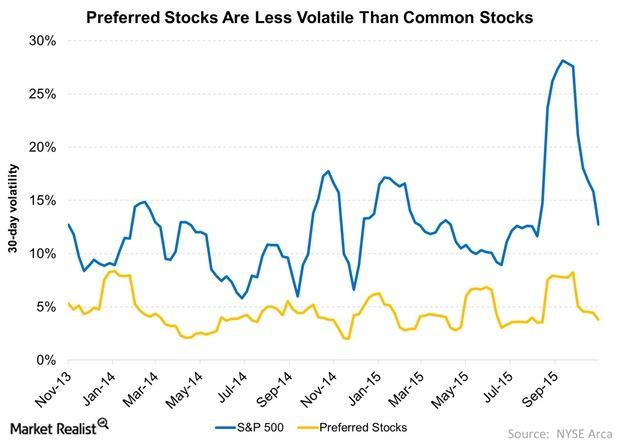

Why Preferred Stocks Are Less Volatile than Common Equities

Preferred stocks are less volatile compared to common equities. This is mainly because a larger portion of the returns comes from dividends, which tend to be stable.

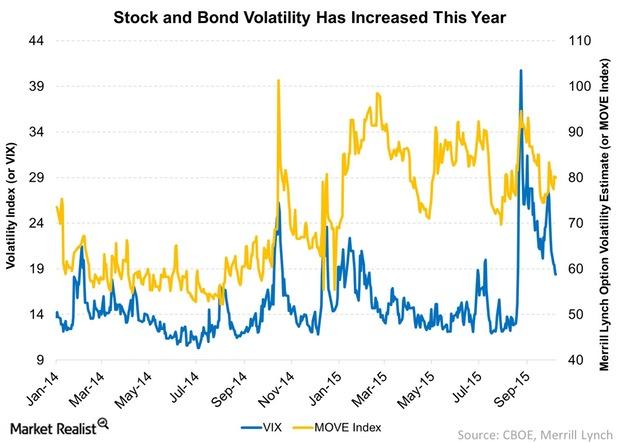

Higher Volatility: You Need to Rethink Your Portfolio Strategy

Higher volatility calls for you to rethink your strategy. After being calm for most of 2014, both bonds (AGG)(BND) and stocks have experienced volatility this year.

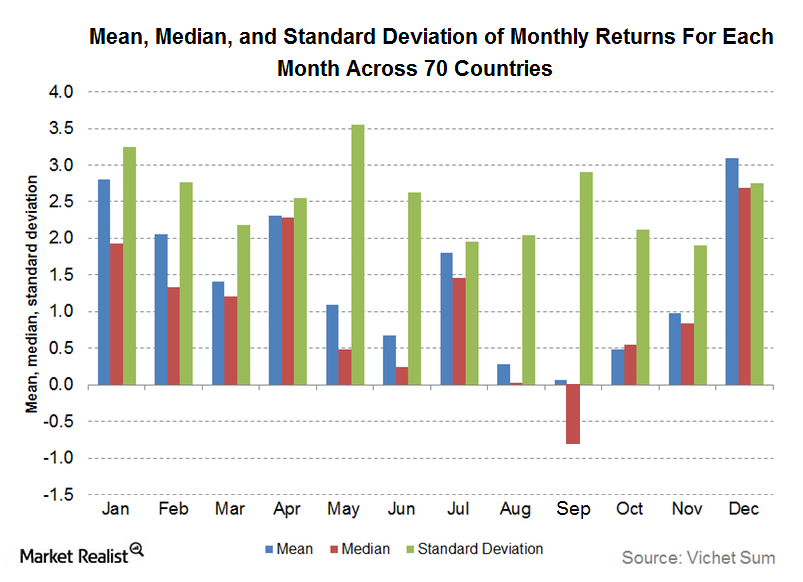

Making Sense of the ‘September Effect’ on Equities

The dreaded September effect is not limited to US stocks (SPY). It’s relevant to markets around the globe (ACWI).

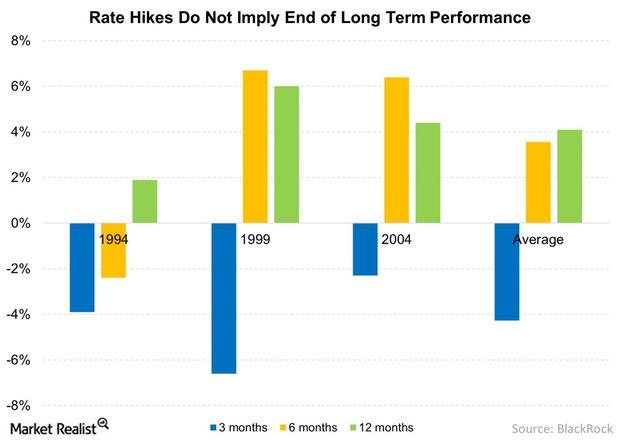

Rate Hikes Historically Lead to Muted Stock Returns

The last three rate hikes have seen negative three-month returns following the initial tightening period. Yet in the subsequent months, the S&P 500 Index rebounded.

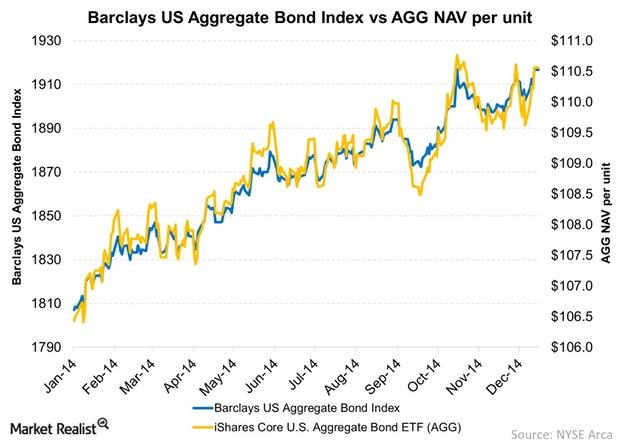

Calculating A Bond ETF’s Underlying Value

The calculation of a bond ETF’s underlying value is going to be less precise than a stock ETF’s underlying value.