Vanguard Dividend Appreciation ETF

Latest Vanguard Dividend Appreciation ETF News and Updates

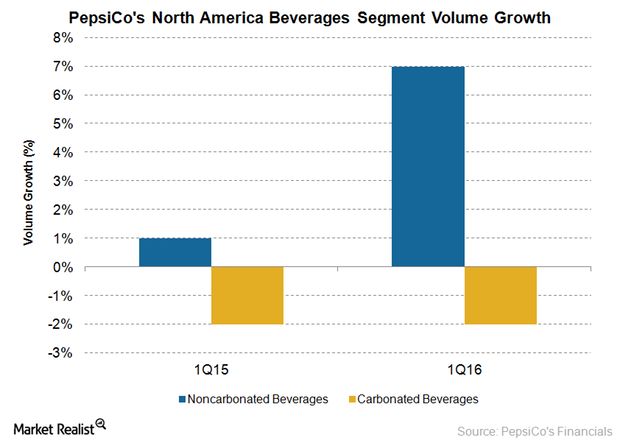

PepsiCo Aims to Revive Soda Volumes with Crystal Pepsi

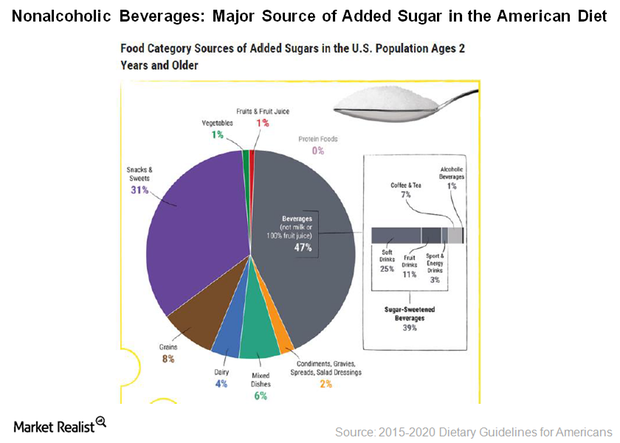

Carbonated soft drinks have been losing their fizz as more and more consumers are opting for healthier beverage options.

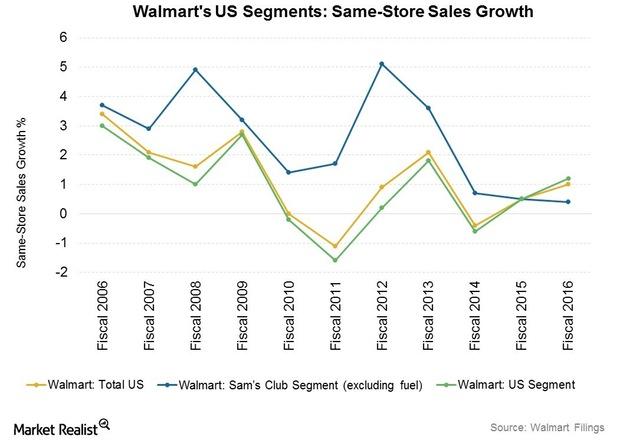

What’s Shaping Consumer Spending Trends at Walmart Stores?

The average store-only shopper spends ~$1,400 per year at Walmart, while the online-only shopper spends ~$200.

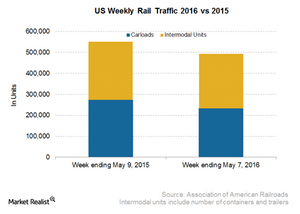

US and Canadian Rail Traffic Fell

In the week ended May 7, 2016, total US railcars went down by ~233,000, a double-digit fall of 15%.

Can Nike Regain Footing with Its Adaptive Lacing Footwear?

In early March, Nike showcased its new self-lacing footwear. Also known as “HyperAdapt 1.0,” the shoes tighten up when the foot is placed inside them.

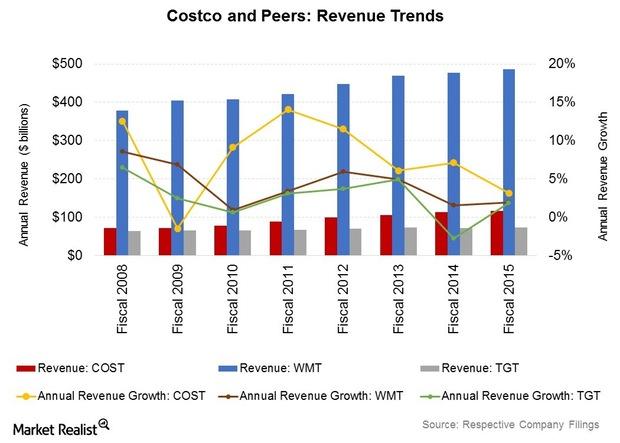

Costco’s Revenue Growth Likely to Moderate in Fiscal 2Q16

Costco posted record results for fiscal 2015. Revenue grew by 3.2% to $116.2 billion, and net income rose by 15.5% to $2.4 billion.

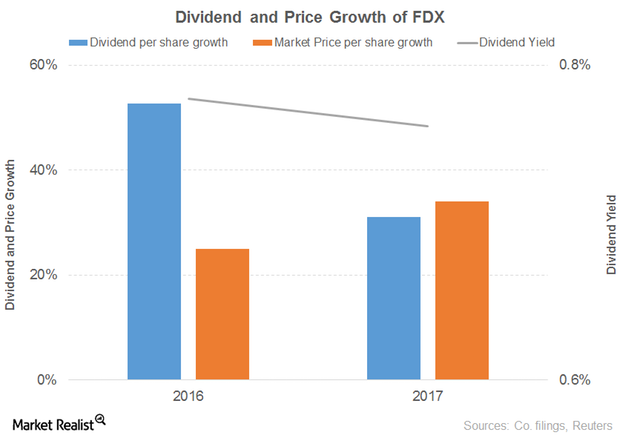

How FedEx’s Performance Influenced Its Outlook

FedEx’s (FDX) revenue grew 6% and 20% in 2016 and 2017, respectively. The FedEx Ground, FedEx Freight, and FedEx Services segments drove the 2016 growth, offset by the FedEx Express segment.

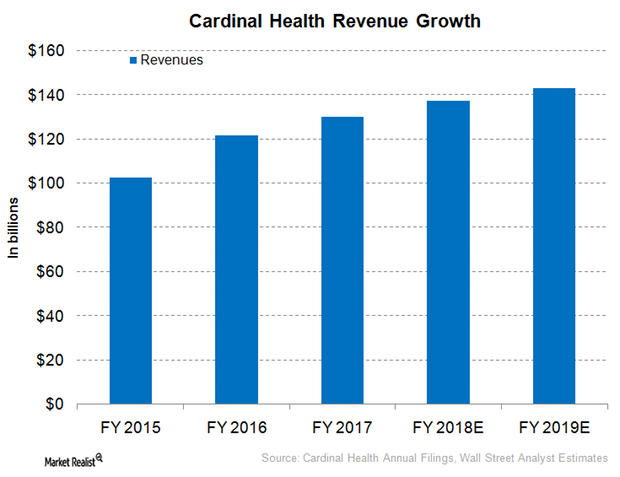

Cardinal Health Expected to Report Modest Revenue Growth

For fiscal 2018, Cardinal Health (CAH) has projected mid-single-digit revenue growth on a YoY basis, partially driven by the company’s high customer retention rates.

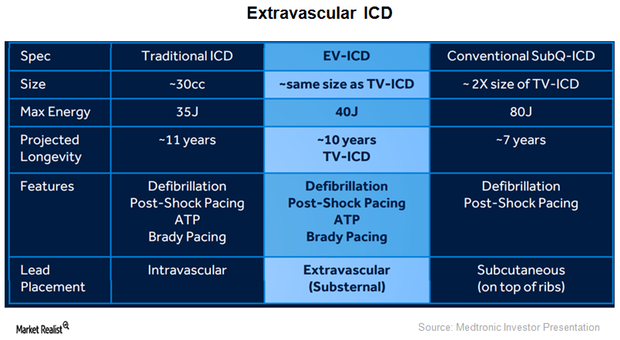

Medtronic Expands Capabilities of Implantable Cardioverter Defibrillators

On May 2, 2016, the FDA approved Medtronic’s (MDT) Visia AF and Visia AF MRI Surescan. These devices are single-chamber implantable cardioverter defibrillators (or ICDs) capable of detecting asymptomatic and undiagnosed atrial fibrillation.

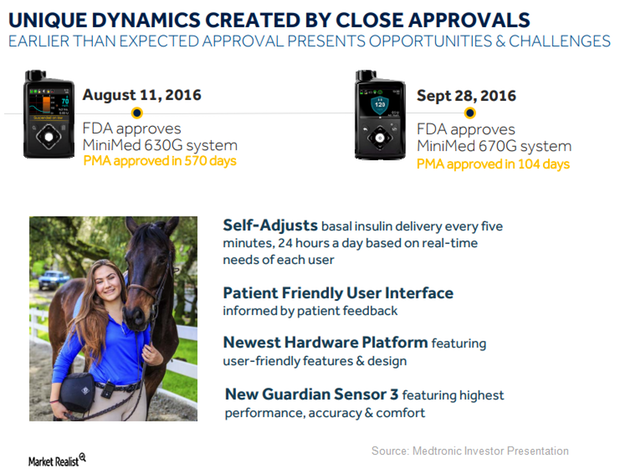

Medtronic Saw Several Challenges during Launch of MiniMed 670G

In fiscal 2H17, Medtronic launched the priority access program to first target those patients who were interested in purchasing MiniMed 670G.

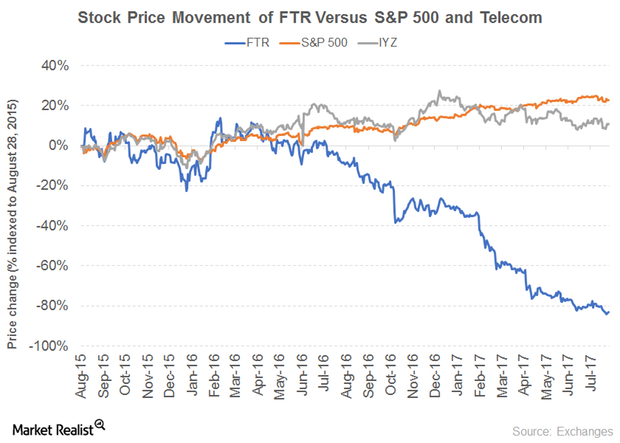

Frontier Communications: High Dividend Yield despite Dividend Cut

In this series, we’ll look some small-cap stocks with high dividend yields.

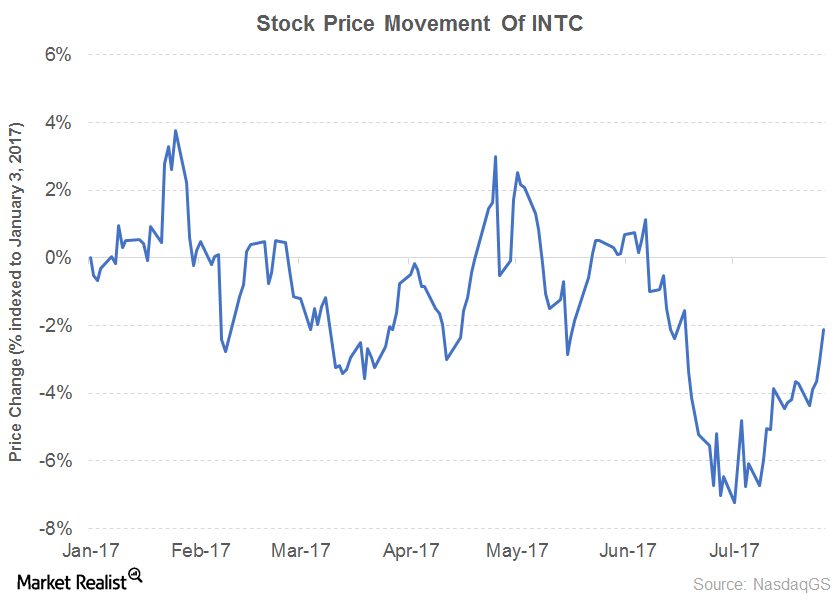

Have Intel and Procter & Gamble Been Able to Increase Dividends?

Intel (INTC) released its 2Q17 results on July 27, 2017. The company’s revenue and EPS for the first half of 2017 rose 8.5% and 72.0%, respectively.

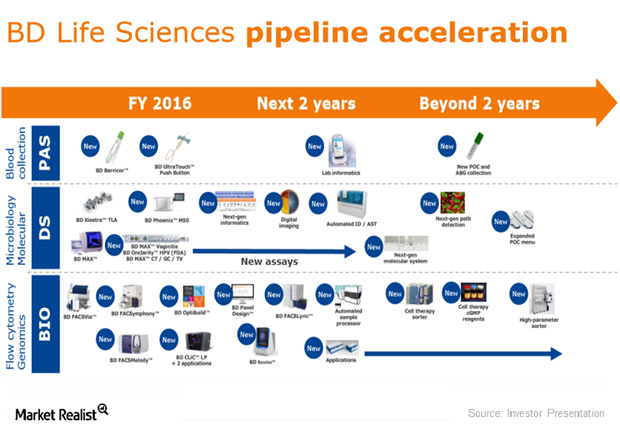

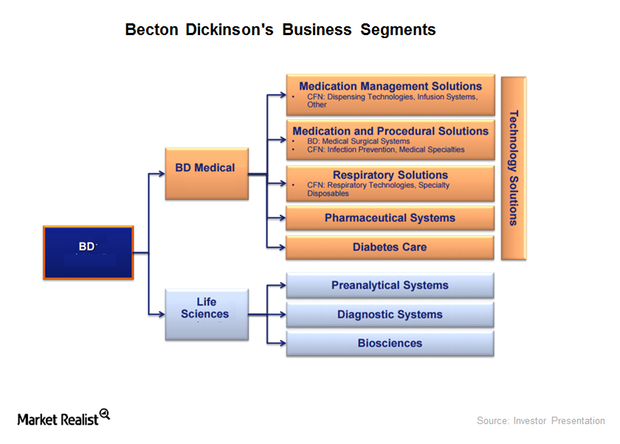

BD Lifesciences’s Product Pipeline Could Boost Its Fiscal 2017 Growth

Becton, Dickinson and Company (BDX) recently launched BD Barricor and BD Ultra Touch Push Button under its Pre-Analytical Systems division.

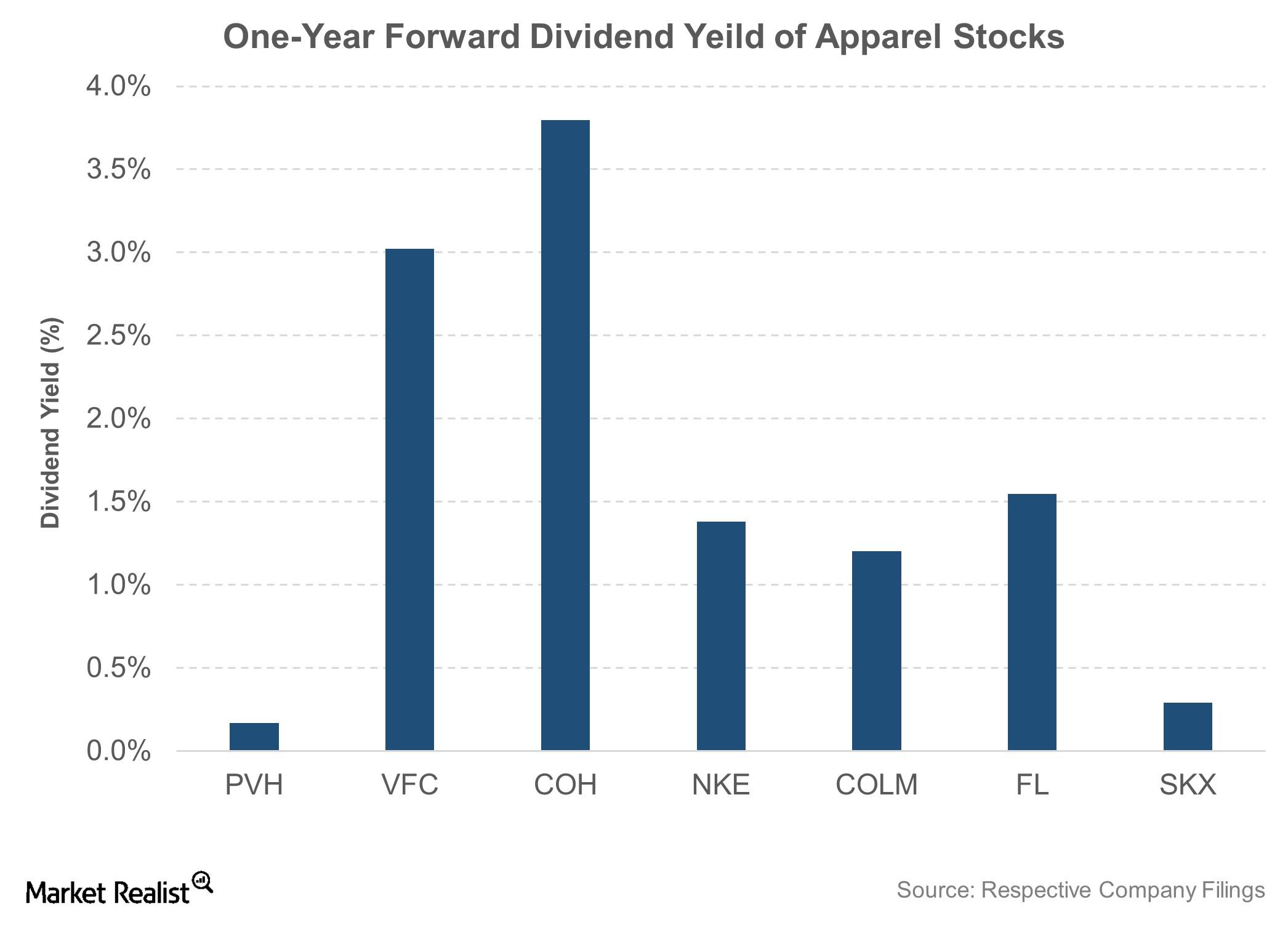

What’s Nike’s Dividend Policy?

Nike (NKE) is a consistent dividend payer and has increased dividends over the last 14 years.

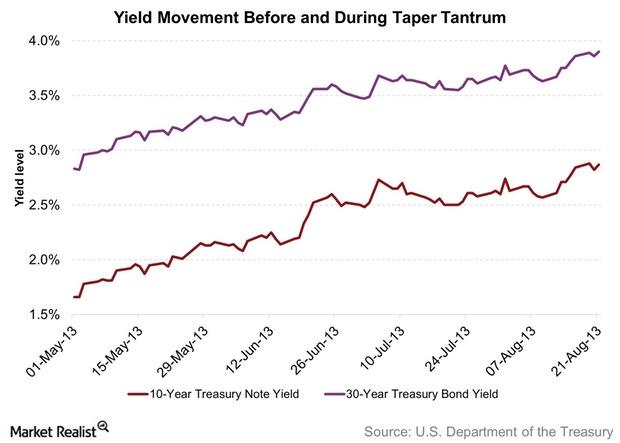

Why Were Fed Policymakers Worried about Clear Communication?

The credibility of the Federal Reserve was a concern raised by some policymakers at the September FOMC (Federal Open Market Committee) meeting.

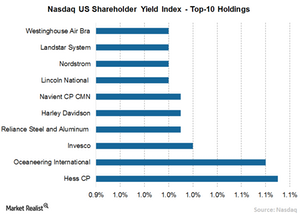

Shareholder Buyback: A Powerful Tool to Achieve Higher Income

What products single out specifically the share buyback companies?

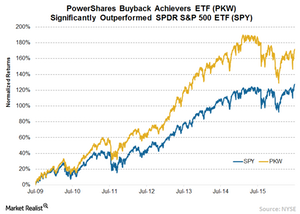

Buyback Achievers Strategy Significantly Outperforms Benchmark

Historically, we have seen Buyback does perform very well across all interest rate environments. Looking at the data back to the mid-80s, it does well.

AGCO Acquires Cimbria, Expands in Seed and Grain Handling

On June 29, AGCO (AGCO) announced that it acquired Cimbria Holdings from Silverfleet Capital for 310 million euros ($340 million).

What’s the Verdict on Becton Dickinson’s Strategic Portfolio Review?

Becton Dickinson (BDX) completed its annual strategic review of its portfolio, which was initiated after the acquisition of CareFusion.

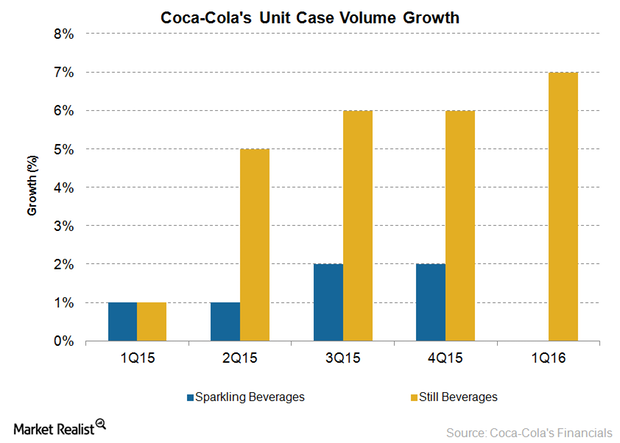

Why Coca-Cola Is Focusing on Still Beverages

In January 2016, Coca-Cola announced the acquisition of a minority stake in Chi Limited, Nigeria’s leading dairy, juice, and snacks company.

An Insight into Sport Drinks’ Positioning in the US Beverage Market

Sports drinks are considered a healthier choice than traditional soda beverages, and they contain less sugar than traditional soda beverages.

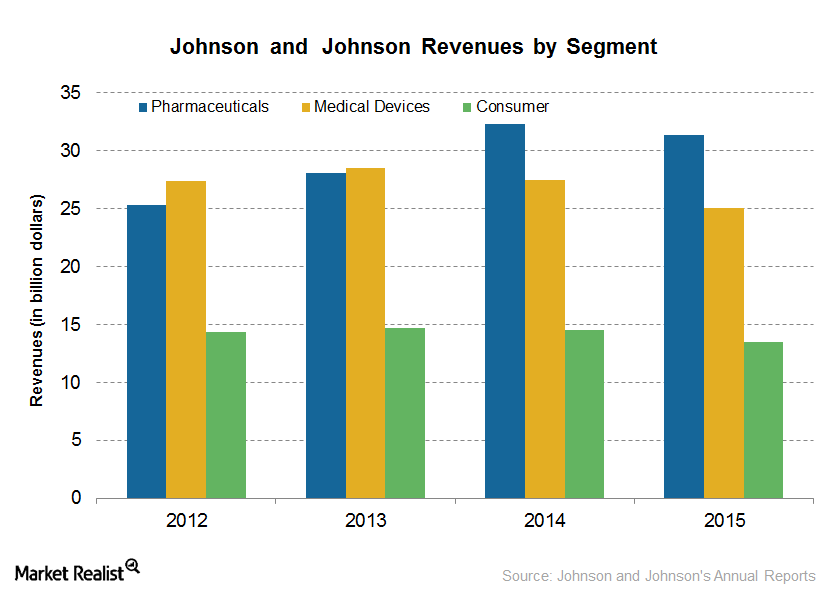

How Johnson & Johnson Hopes to Boost Its Medical Device Segment

Johnson and Johnson’s (JNJ) medical device business segment comprises of cardiovascular, diabetes care, orthopedics, surgery, and vision care divisions.

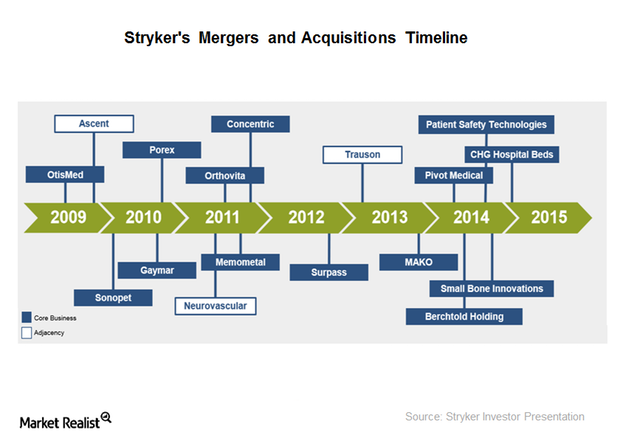

Growth and Profitability: How Does Stryker Do It?

Between 2012 and 2014, Stryker (SYK) entered into a number of mergers and acquisition deals, investing ~$3.4 billion.

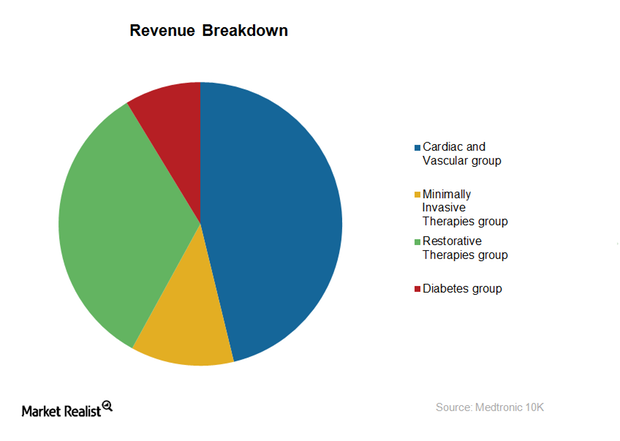

A Key Breakdown of Medtronic’s Business Model

Medtronic generates revenue through four segments: Cardiac and Vascular Group, Minimally Invasive Therapies, Restorative Therapies, and the Diabetes Group.

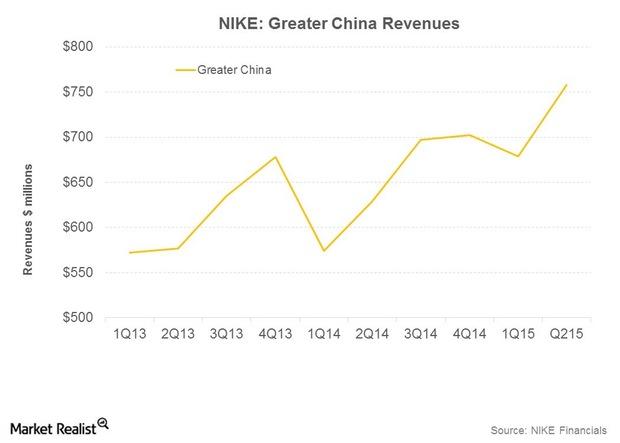

NIKE in Greater China: Strategies That Work

NIKE holds the #1 position for both apparel and footwear in China among sportswear rivals. It plans to leverage the value of its brand among consumers.