Texas Instruments Inc

Latest Texas Instruments Inc News and Updates

Key strategies applied by Texas Instruments to achieve growth

Texas Instruments Incorporated (TXN) planned its strategic exit from it back in September 2012. It instead dedicated its strategic and R&D investments toward becoming a pure analog and embedded processing company.

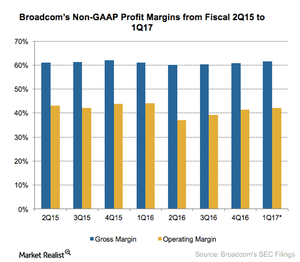

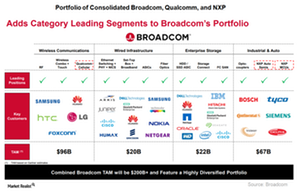

How Broadcom’s Acquisitions Could Improve Its Profitability

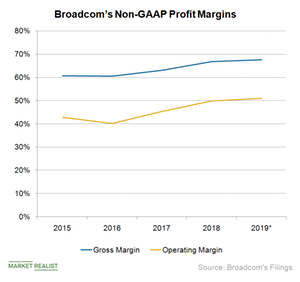

Broadcom’s profitability In the previous part of this series, we saw that Broadcom (AVGO) is likely to witness seasonal revenue decline as demand in its wireless segment, its second largest, falls. While revenue depends significantly on external factors such as customer demand, the pricing environment, and competition, profitability depends on internal factors such as cost control and product […]

Industrial and Auto: Texas Instruments’ Future Growth Drivers

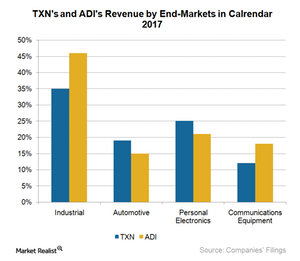

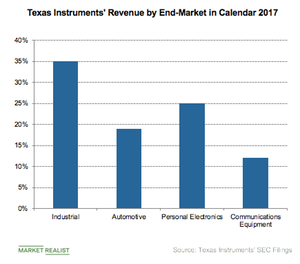

Texas Instruments (TXN) is the bellwether of the economy since it caters to most major end markets.

These Are Texas Instruments’ Future Growth Drivers

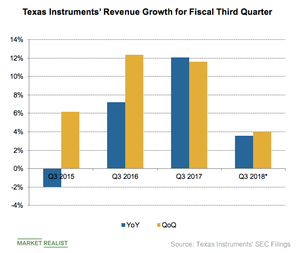

Texas Instruments (TXN) reported strong fiscal Q2 2018 revenue, and forecast slower-than-usual revenue growth for the third quarter as it increases its exposure to the more stable industrial and automotive markets.

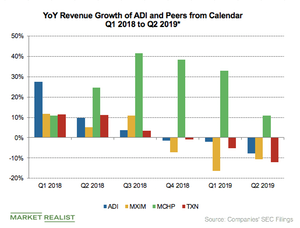

US-China Trade War Impacts Analog Chipmakers’ Guidance

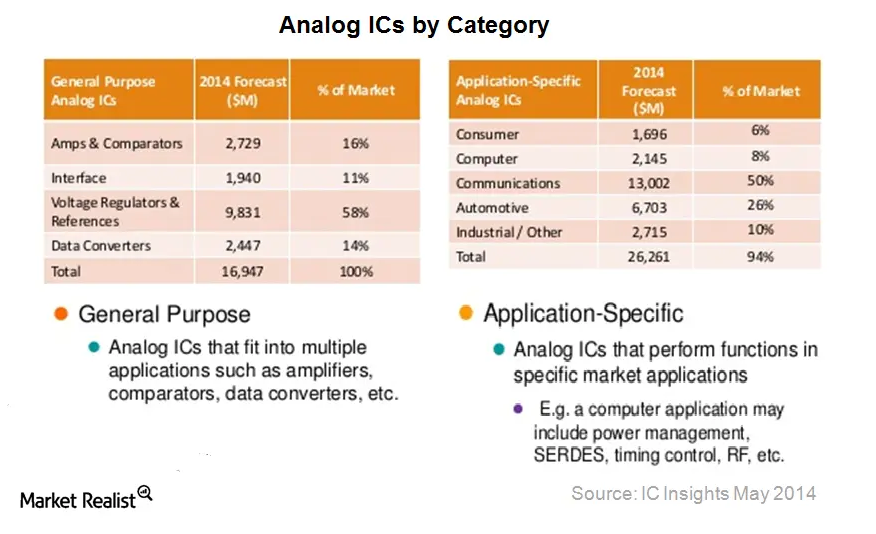

Analog chipmakers have exposure to almost all end markets including industrial, automotive, communications, and consumer markets.

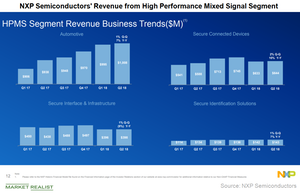

Automotive and Connected Devices: NXP’s Key Growth Drivers

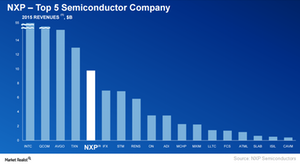

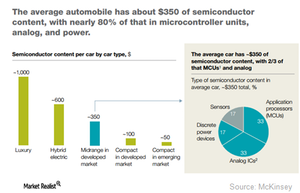

NXP Semiconductors (NXPI), a leader in the automotive chip market, provides HPMS (high-performance mixed-signal) analog, MCU (microcontroller), and sensor solutions.

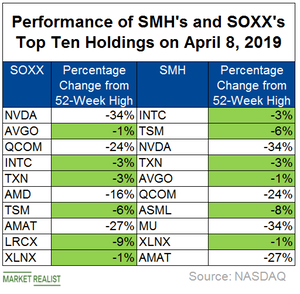

What Pushed SOXX and SMH to New Highs?

The semiconductor sector is set to report its weakest earnings in more than two years.

S&P 500 Index Nears Record High amid Earnings Season

The S&P 500 Index, represented by the SPDR S&P 500 ETF (SPY), rose 0.3% on October 23, nearing the all-time high it saw in July.

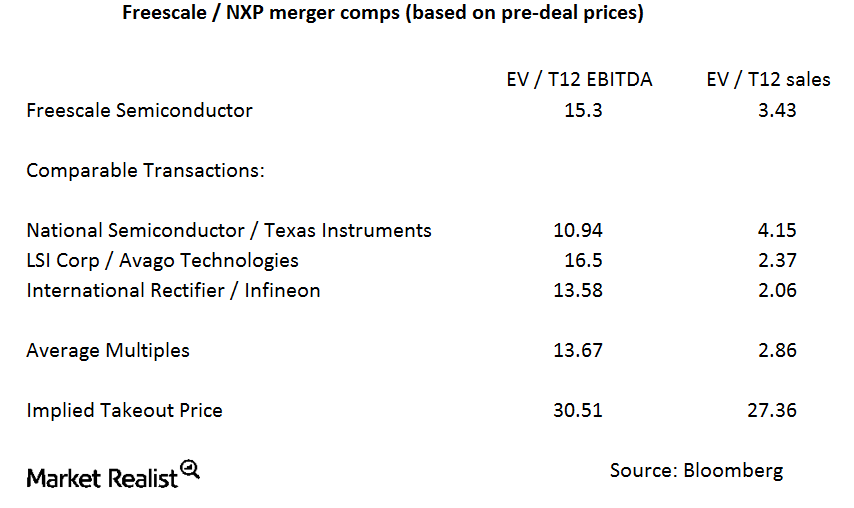

Why is the Freescale–NXP merger premium so low?

The companies were asked about the takeover premium and the background to the transaction on the conference call, but they refused to comment.

Texas Instruments Diversification Strategy Starts to Pay Off

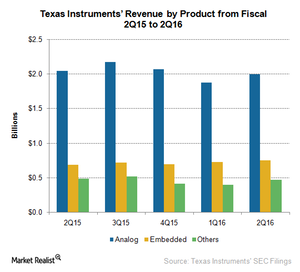

Texas Instruments (TXN) has been reducing its exposure in the declining smartphone market and increasing its exposure in the growing automotive and industrial markets to reduce its seasonality.

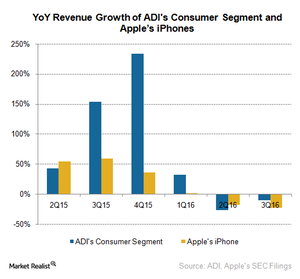

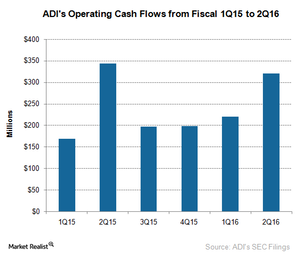

How Related Are ADI’s Consumer Revenues and Apple’s iPhone Sales?

ADI’s Consumer segment is made up of its computing and mobile businesses, and Apple (AAPL) is its biggest customer.

What’s behind Semiconductor Stocks’ Rise?

Most semiconductors stocks had risen more than 2% as of midday today, with several factors having raised investors’ optimism about the sector’s growth.

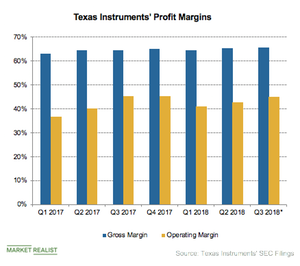

Texas Instruments’ Profit Margins Continue to Beat Peers

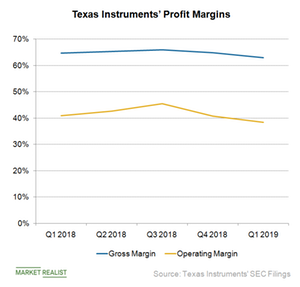

Texas Instruments (TXN) manufactures analog chips that are built on old technology nodes that have already been paid off.

Why Broadcom Is One of the Most Profitable Semiconductor Companies

Until now, Broadcom’s profits were a product of a favorable product mix, low costs, and high volumes.

A Look at Texas Instruments’ Strategy to Improve Profitability

Texas Instruments (TXN) has improved its revenue by diversifying into various end markets.

Why Is Microchip Stock Rising Today?

Microchip stock rose in pre-market trading today after the company updated its financial guidance for the third quarter of fiscal 2020.

What Mergers and Acquisitions Could Open Up for Qualcomm

Qualcomm is looking to venture into automotive, servers, IoT (Internet of Things), and laptops.

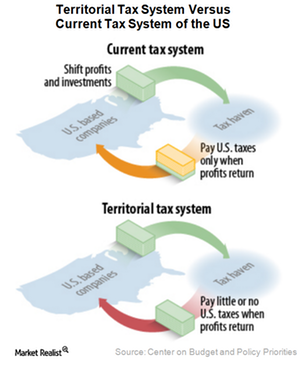

Territorial Tax System: Important for US Semiconductor Companies?

The semiconductor industry welcomed the Tax Cuts and Jobs Act that President Trump signed into law on December 22, 2017.

Reading the Most Profitable Semiconductor Companies

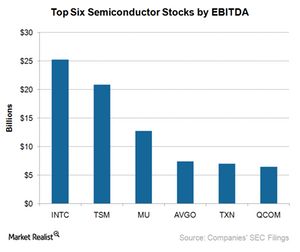

In calendar 3Q17, Intel (INTC) was the most profitable semiconductor company, with a last-12-month EBITDA of $25.3 billion.

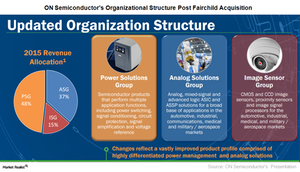

ON Semiconductor’s Revised Organizational Structure

The Power Solutions Group’s revenues rose 34.3% sequentially to $620.3 million in 4Q16. More than $200 million in revenues came from the Fairchild Semiconductor integration.

NXP Semiconductors Benefiting from Freescale Merger Synergies

Many Apple (AAPL) suppliers who diversified their revenue streams, especially in the automotive sector, reported strong growth in 2Q16, and NXP Semiconductors (NXPI) was no exception.

Which Segment Is Most Profitable for Texas Instruments?

Texas Instruments’ Analog segment contributes 62% to the company’s total revenue and is made up of high volume analog and other products.

Britain Contributes Little to the Global Semiconductor Industry

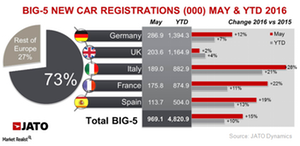

Europe accounted for only 10% of global semiconductor sales in April 2016, according to World Semiconductor Trade Statistics.

What Is Analog Devices’ Acquisition Strategy?

Analog Devices (ADI) has been using M&A (mergers and acquisitions) to rapidly expand its technology offerings and boost its revenue.

Automotive: The Next Big Thing for Texas Instruments

Texas Instruments (TXN) has increased its exposure in the automotive, industrial, and communications segments, which accounted for 64% of the company’s revenue in fiscal 1Q16.

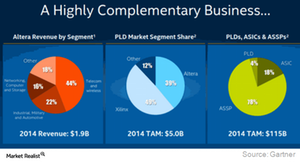

Intel Finalizes Altera Acquisition, Right on Schedule

Intel (INTC) completed its acquisition of Altera on December 28, 2015, for $16.7 billion. The Altera acquisition will make Intel the second largest semiconductor supplier after Texas Instruments.

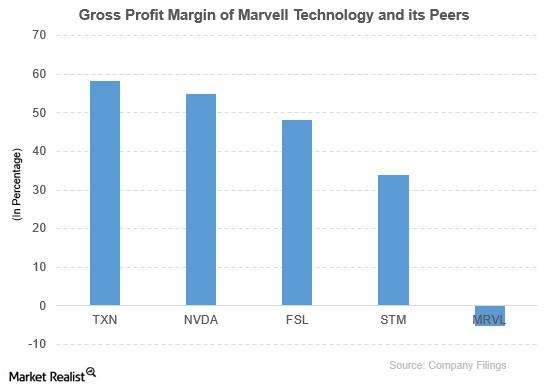

How Did Marvell Technology Compare to Its Peers?

Marvell Technology was outperformed by its peers based on the gross profit margin and PBV ratio. ETFs outperformed it based on the price movement and PBV ratio.Earnings Report The main challenges facing Texas instruments

Consumer demand for the latest features and applications is huge. Endless technological innovation addresses that demand to a point, but has led to consistently shorter product life cycles.