US-China Trade War Impacts Analog Chipmakers’ Guidance

Analog chipmakers have exposure to almost all end markets including industrial, automotive, communications, and consumer markets.

Nov. 20 2020, Updated 4:59 p.m. ET

Analog chipmakers’ June 2019 quarter guidance

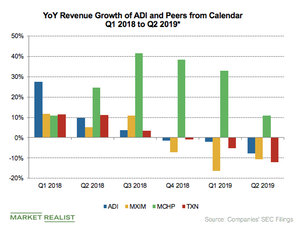

Analog chipmakers have exposure to almost all end markets including industrial, automotive, communications, and consumer markets, and their earnings are influenced by the macroeconomic environment. The US-China trade war has reduced car and smartphone sales and slowed industrial activity, which caused Maxim Integrated (MXIM) and Texas Instruments (TXN) to report second-quarter revenue guidance of double-digit YoY declines. Their guidance excludes the impact of new developments in the trade war.

The United States has increased its tariffs on $200 billion worth of Chinese imports from 10% to 25%, and China has retaliated with 5%–25% tariffs on $60 billion worth of US imports. The United States also made it difficult for American firms to sell products to China’s Huawei. As a result, Analog Devices (ADI) and other US analog chipmakers have halted shipments to Huawei until further notice.

ADI’s Q3 2019 guidance

The impact of the above developments was reflected in ADI’s fiscal 2019 third-quarter guidance. The company expects its revenue to fall 7.6% YoY and 5.6% sequentially to a two-year low of $1.45 billion. Rivals TXN and MXIM also expect their June 2019 quarter revenue to fall to more than a two-year low, but their guidance excludes the impact of the above developments in the trade war. ADI expects adjusted EPS to fall 20% YoY and 10.3% sequentially to $1.22.

Even though ADI’s guidance reported YoY declines, its stock is rising, as investors had already priced in the worst outcome amid demand uncertainty. ADI stock fell 16% in May to $97.5 on May 20, reaching close to its 200-day moving average of $96.96. This guidance sheds some light on the possible impact of the trade war on ADI’s earnings, thereby increasing the stock price.

Check out all the data we have added to our quote pages. Now you can get a valuation snapshot, earnings and revenue estimates, and historical data as well as dividend info. Take a look!