Maxim Integrated Products Inc

Latest Maxim Integrated Products Inc News and Updates

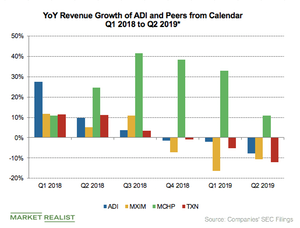

US-China Trade War Impacts Analog Chipmakers’ Guidance

Analog chipmakers have exposure to almost all end markets including industrial, automotive, communications, and consumer markets.

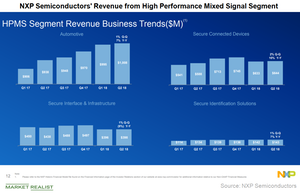

Automotive and Connected Devices: NXP’s Key Growth Drivers

NXP Semiconductors (NXPI), a leader in the automotive chip market, provides HPMS (high-performance mixed-signal) analog, MCU (microcontroller), and sensor solutions.

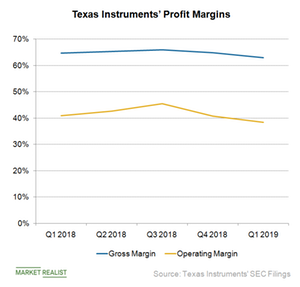

Texas Instruments’ Profit Margins Continue to Beat Peers

Texas Instruments (TXN) manufactures analog chips that are built on old technology nodes that have already been paid off.

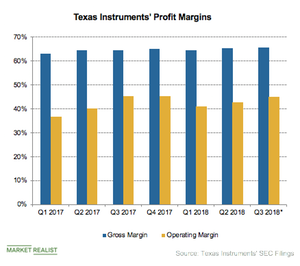

A Look at Texas Instruments’ Strategy to Improve Profitability

Texas Instruments (TXN) has improved its revenue by diversifying into various end markets.

Why Maxim Integrated Stock Tanked after Its Q4 Results

Maxim Integrated (MXIM) announced its fiscal 2019 fourth-quarter results (for the year that ended in June) on July 30.

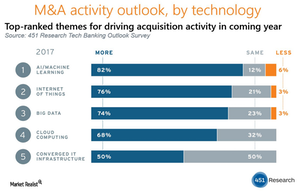

Which Semiconductor Companies Are Potential Acquisition Targets in 2018?

Analysts at Morgan Stanley and KeyBanc Capital Markets have listed Cypress Semiconductor (CY) as a potential acquisition target.

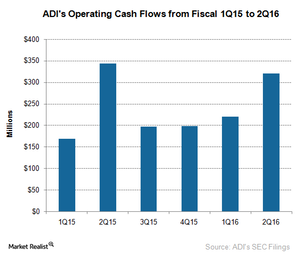

What Is Analog Devices’ Acquisition Strategy?

Analog Devices (ADI) has been using M&A (mergers and acquisitions) to rapidly expand its technology offerings and boost its revenue.